April 2023

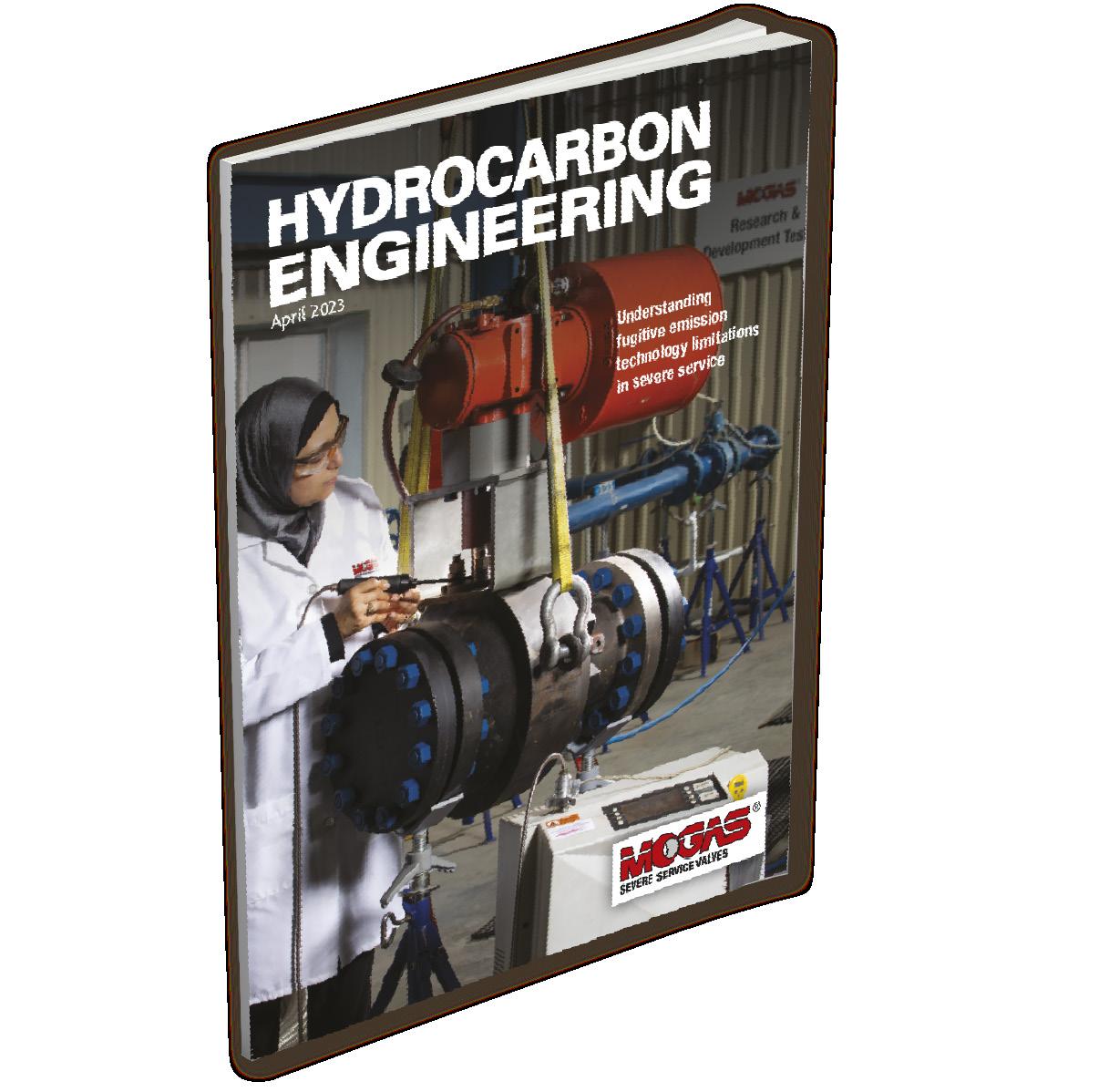

Understanding fugitive emission technology limitations in severe service

Dr. José-Francisco

(CCUS).

34 Know your limitations

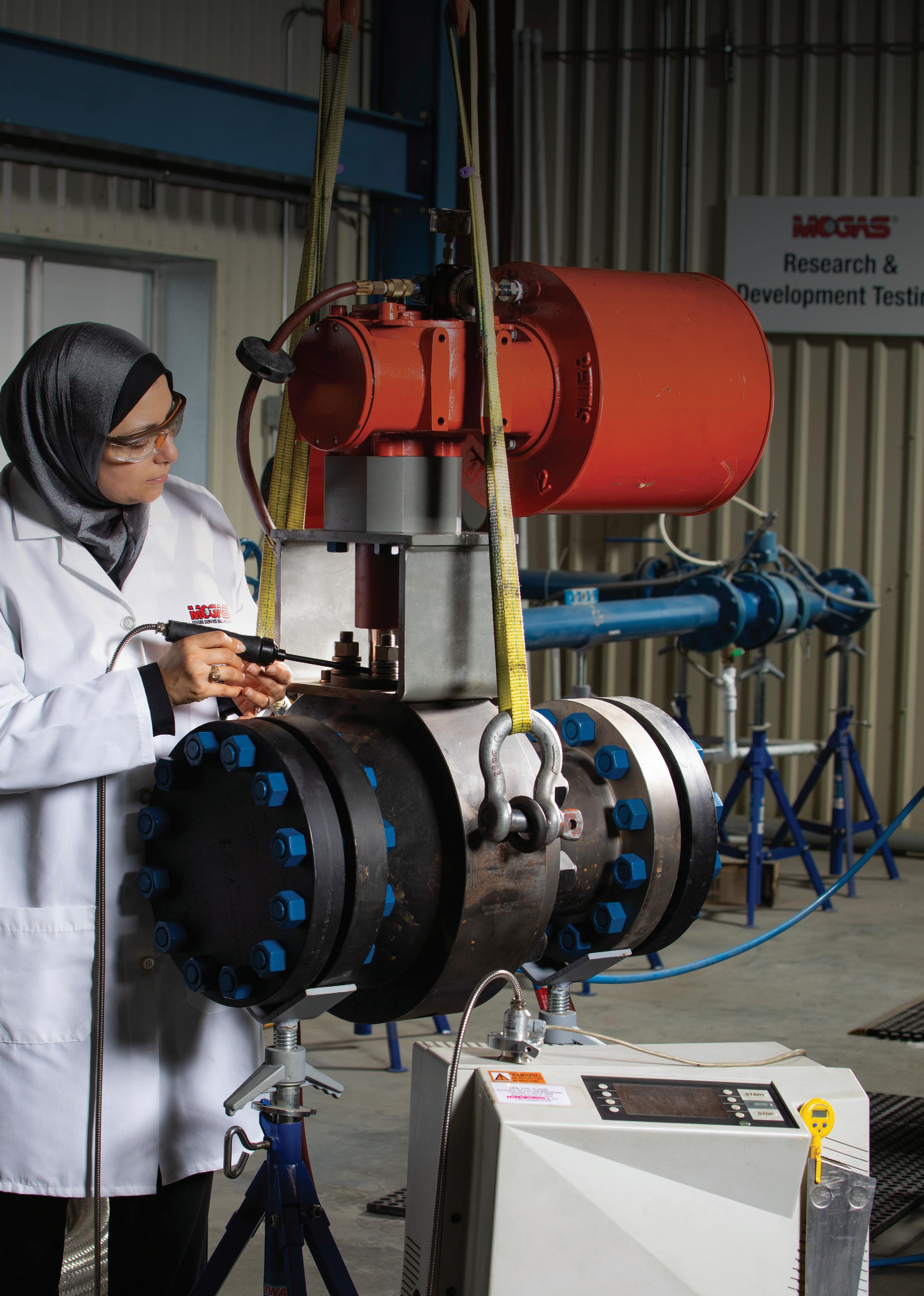

Asmaa Kassab and David Ashwill, MOGAS Industries Inc., USA, discuss fugitive emission technology limitations in severe service valves.

41 Reliable valve operation

Dhanesh Bhaskaran, Valmet, India, details the valve-related challenges and solutions associated with molsieve dryer processes.

45 Performance under pressure

Eric Sallee and Laura Ball, OsecoElfab, USA, explain how to minimise over-pressure risks and maximise performance with rupture discs in a refining or chemical processing facility.

49 Reaping the benefits of optimisation

Andrew

Technip Energies,

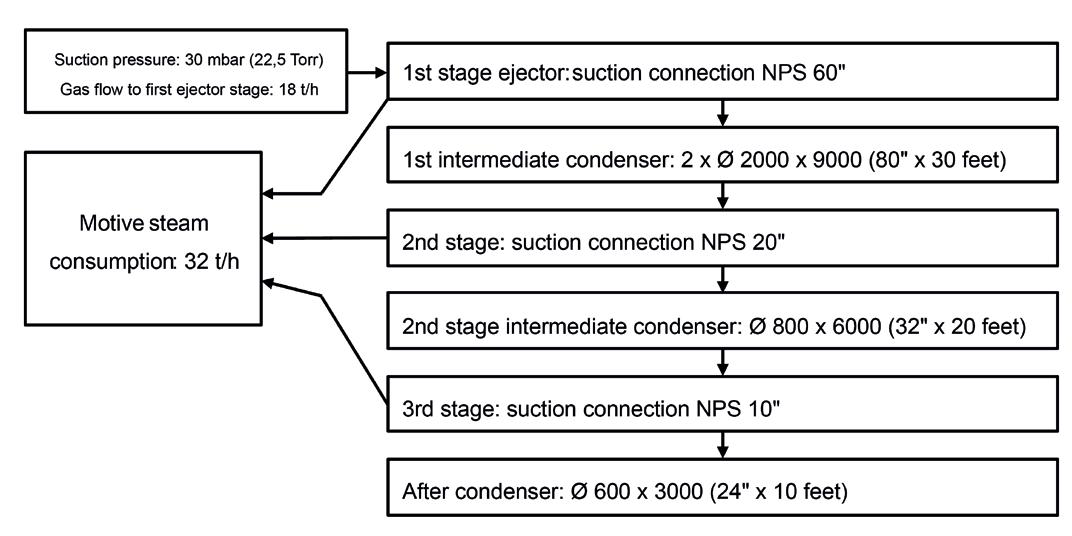

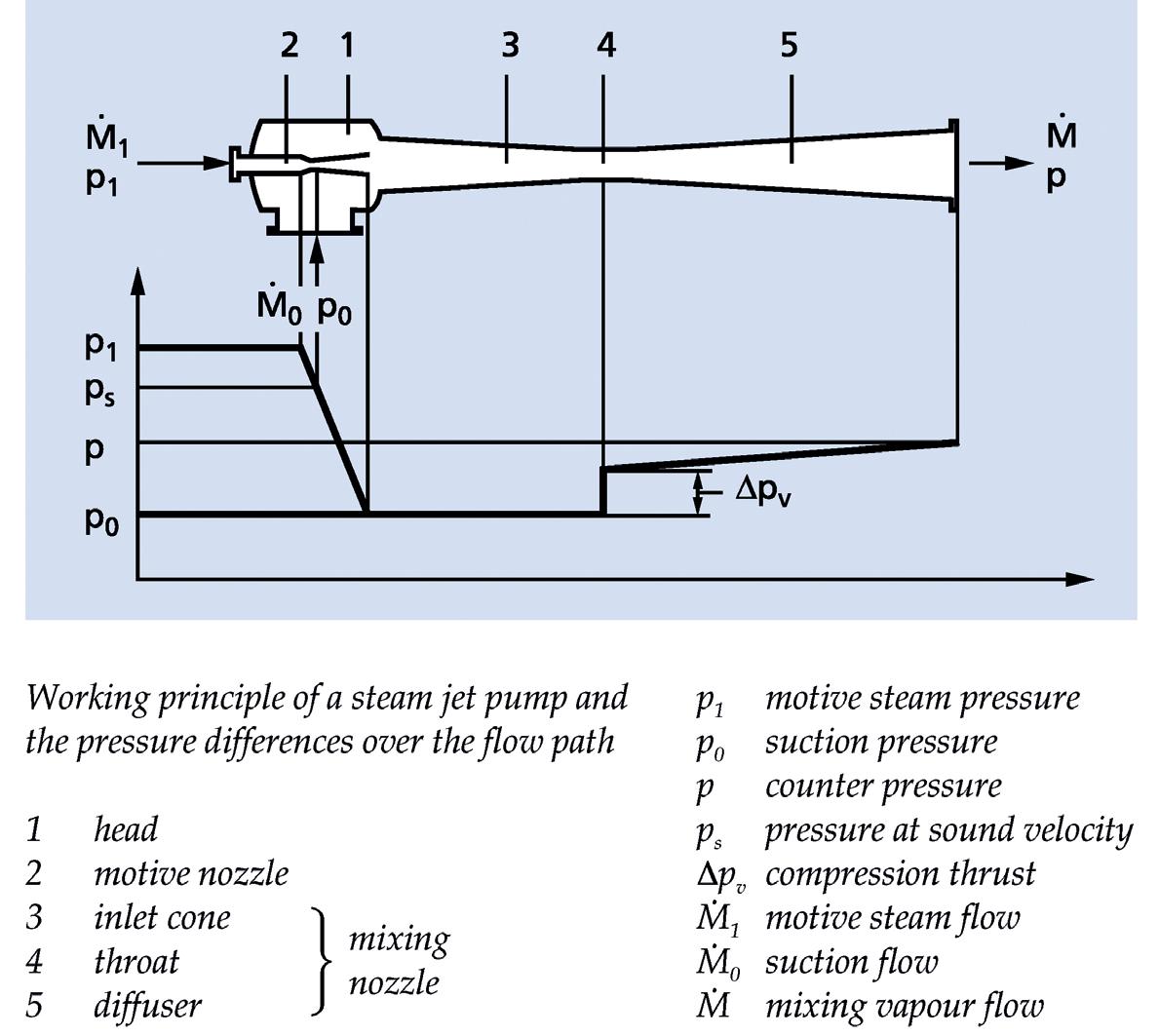

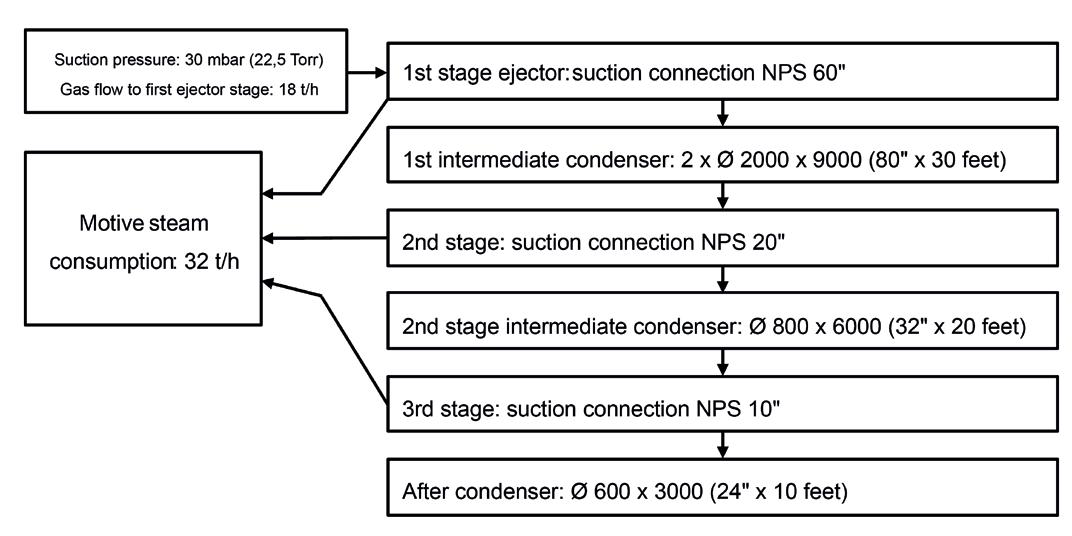

Peter Trefzer, Dr. Laurent Solliec and Norbert Strieder, GEA Wiegand, explore how to reduce a refinery’s operating costs by way of optimising vacuum systems.

55 Minor improvements for significant savings

Dr. Sander Willems, Antonio Batistini, Andrea Angeletti and Barbara Morico, Maire Tecnimont Group, Italy, discuss the company’s circular recycling model that is aimed at maximising the valorisation of plastic waste.

29 Know thyself, know thy enemy

Duncan Mitchell, KBC (A Yokogawa company), explains how integrated process and energy models are capable of providing critical insight in the battle against emissions reduction.

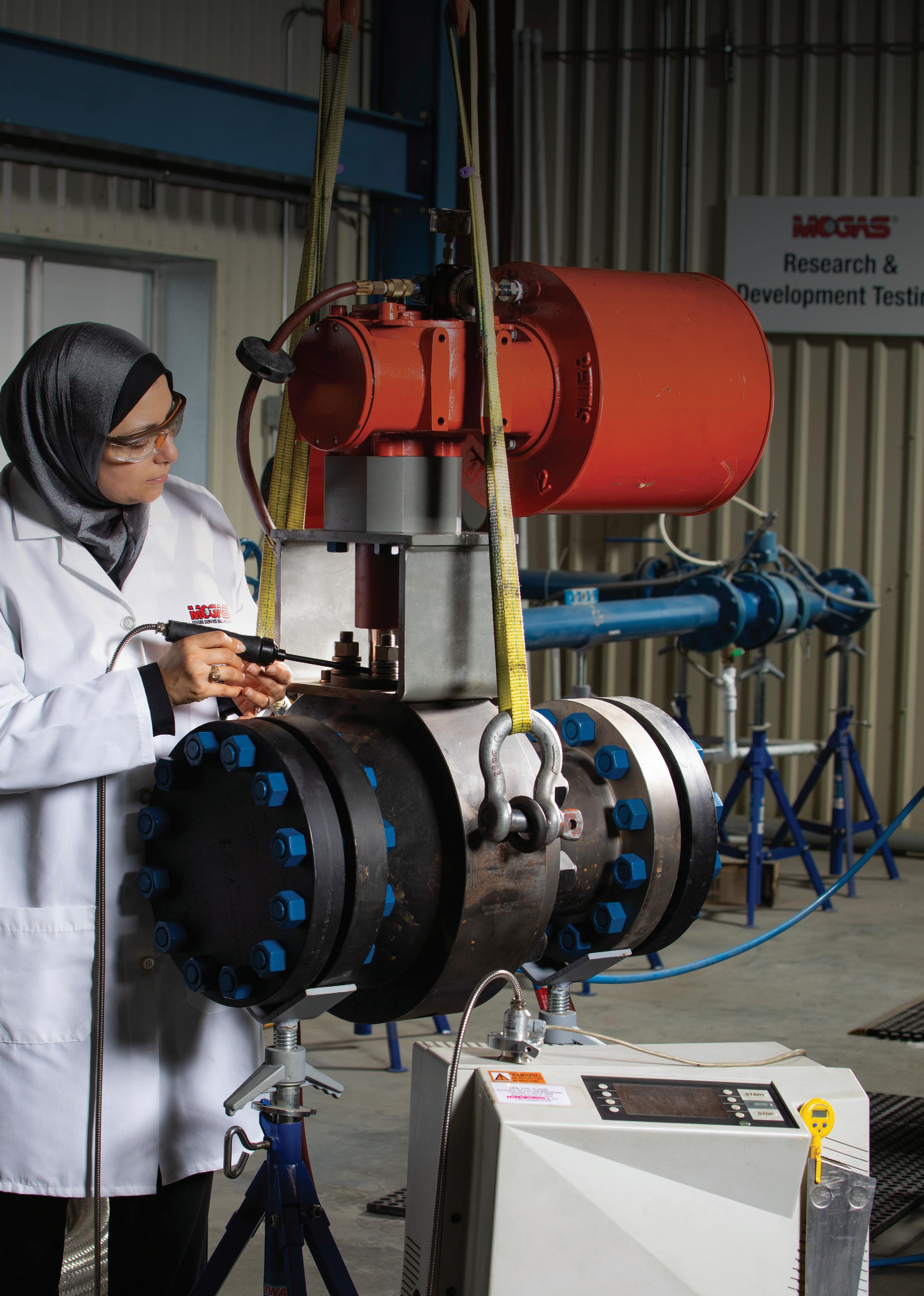

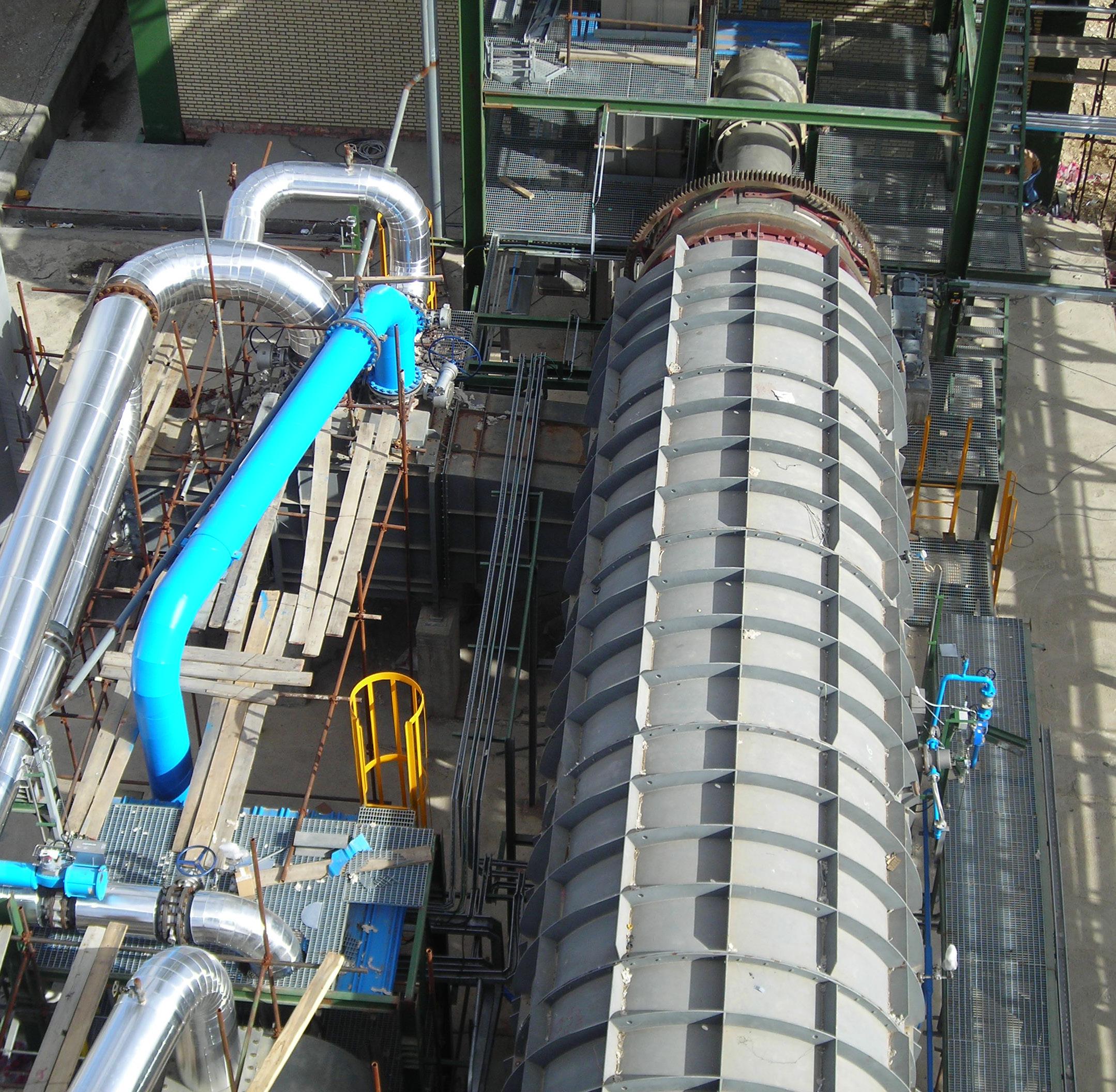

THIS MONTH'S FRONT COVER

Johannes Poth, Integrated Global Services, introduces a technology for reducing fuel consumption and carbon dioxide (CO2) emissions in fired heaters.

61 Delivering a greener product

Michael F. Ray and Michael J. Ray, ThioSolv, USA, discuss the use of refinery sulfur processing in anaerobic digester gas clean-up.

65 Sulfur Review

In this year’s annual Sulfur Review, Hydrocarbon Engineering presents a selection of sulfur services and technologies that are available and in use within the downstream oil and gas sector.

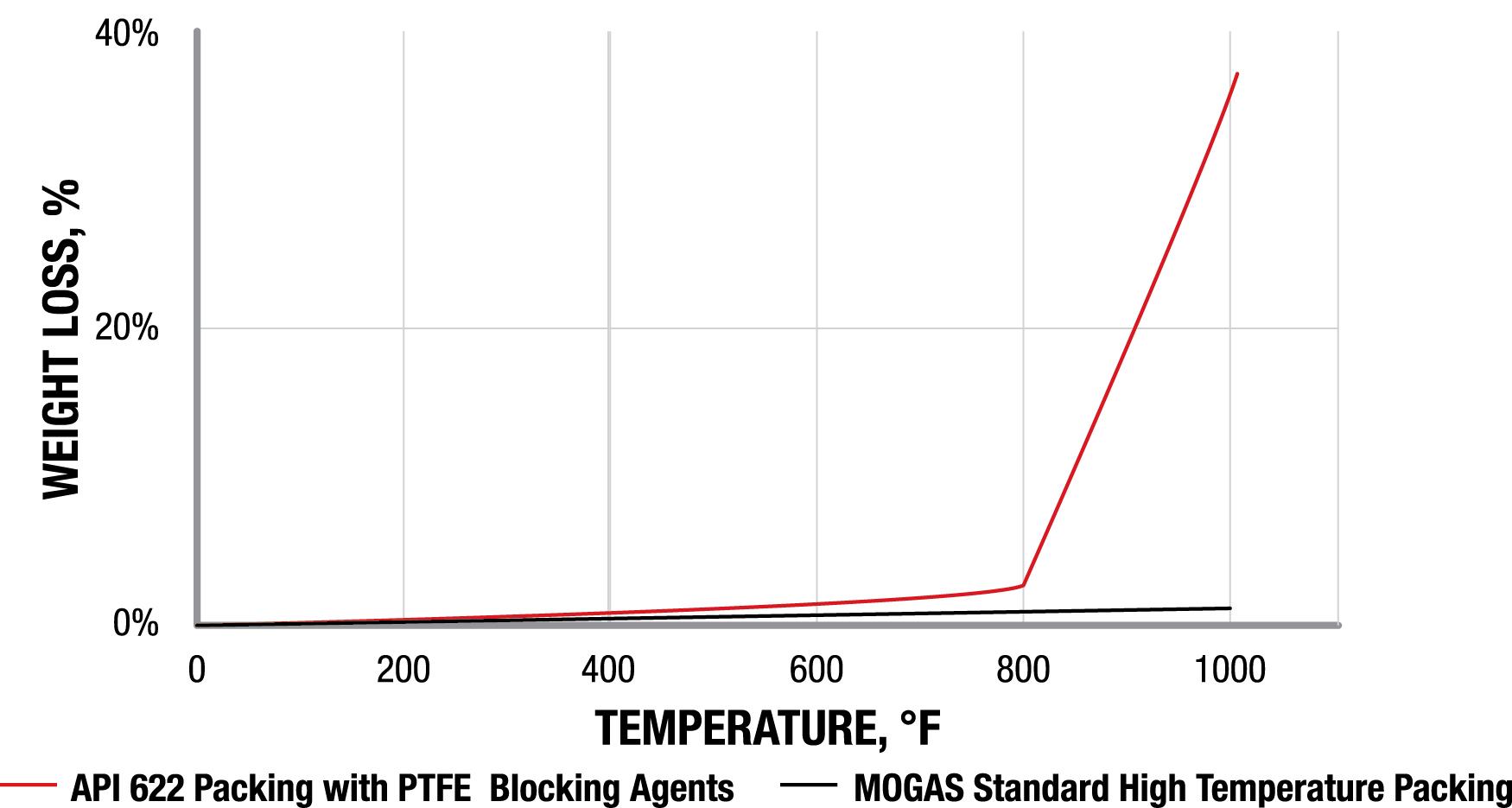

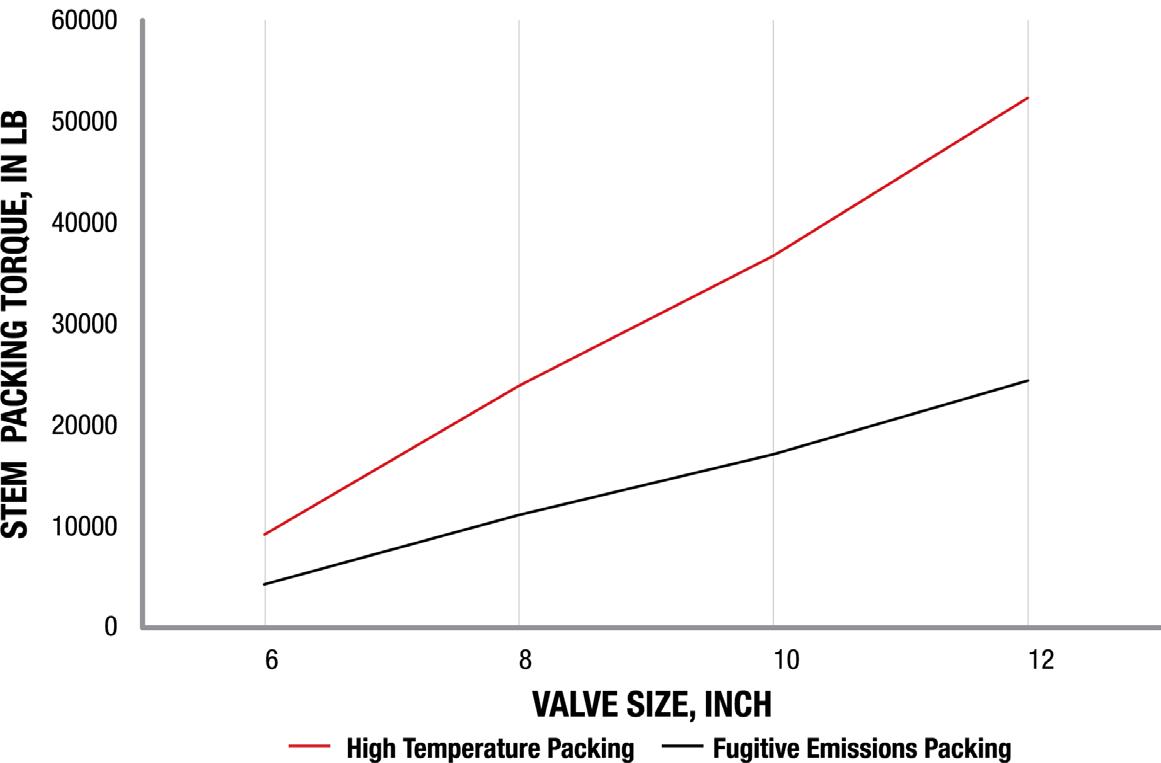

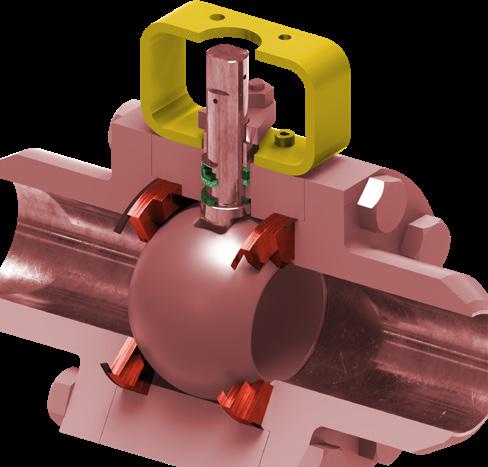

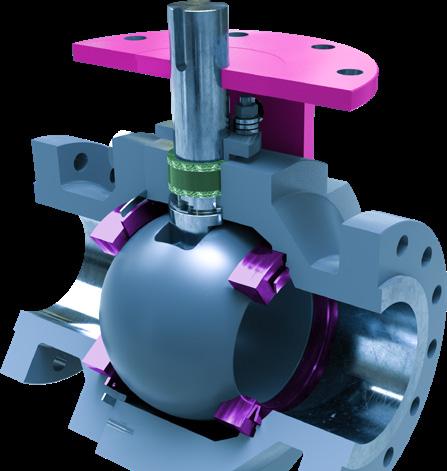

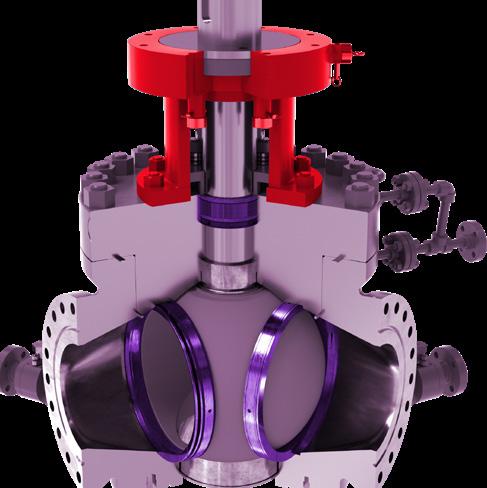

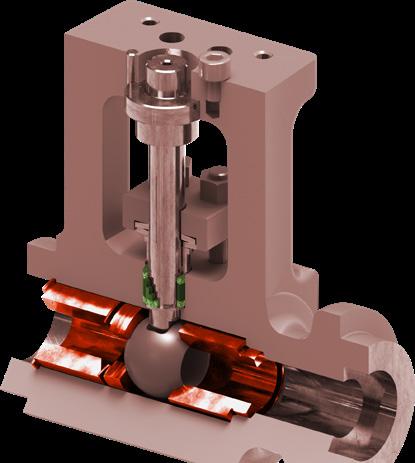

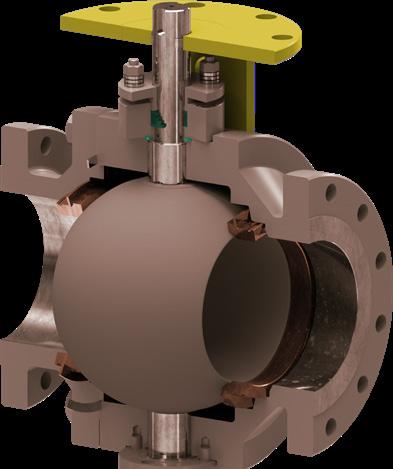

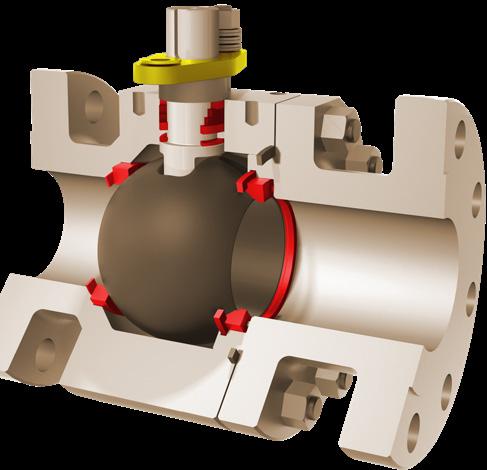

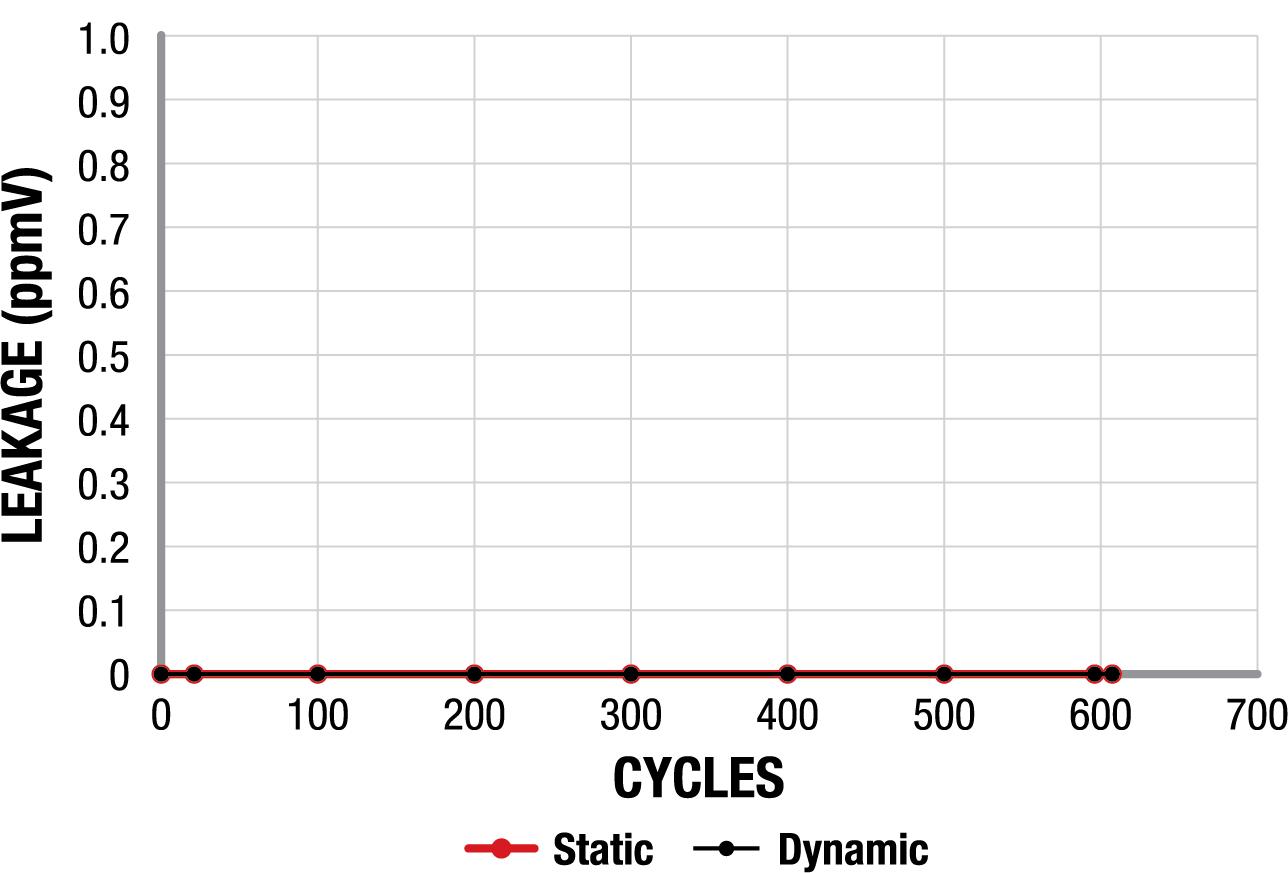

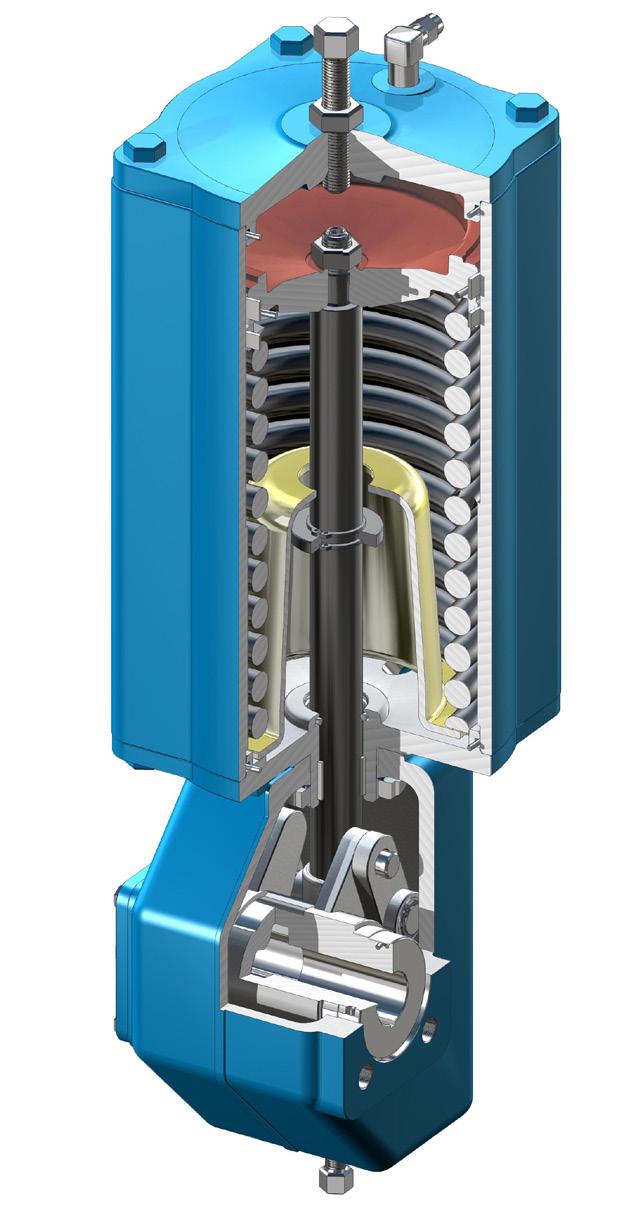

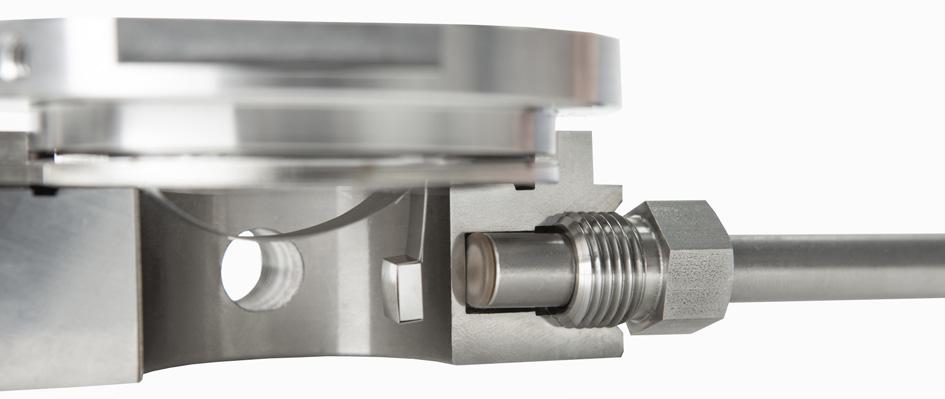

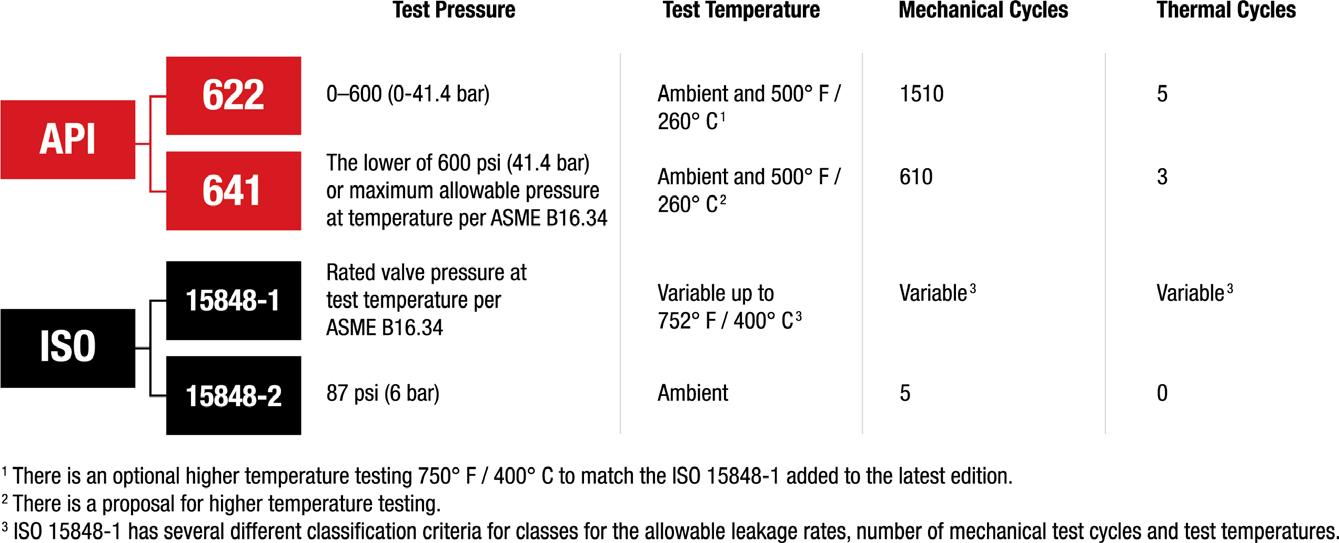

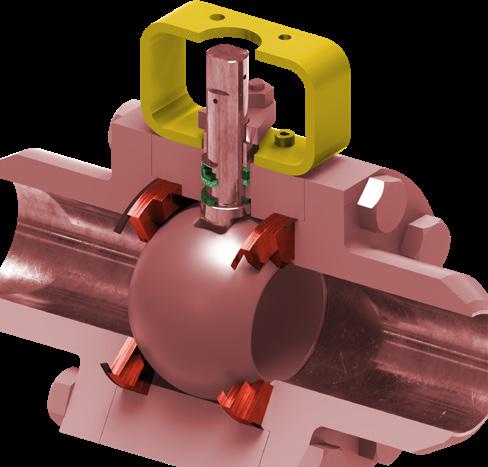

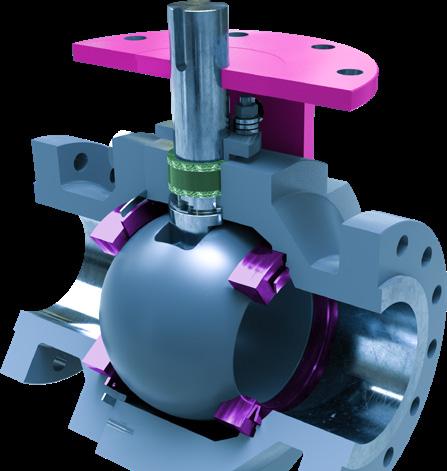

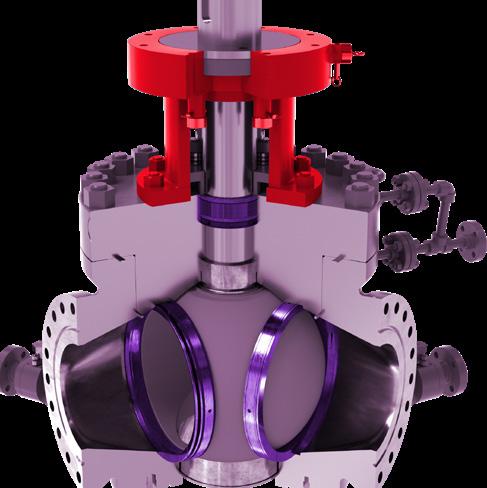

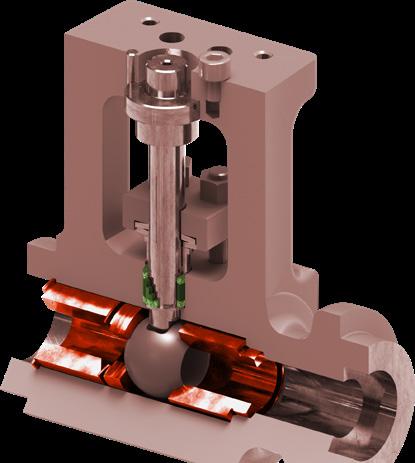

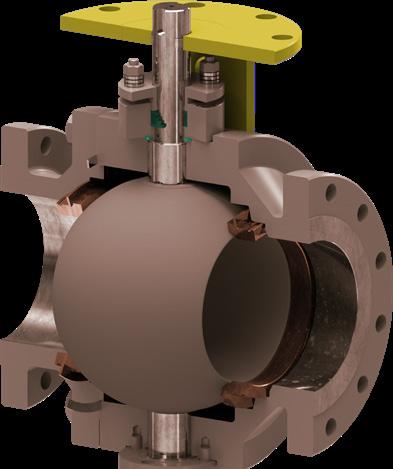

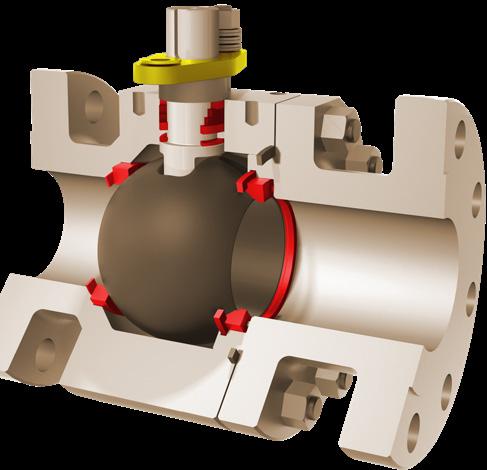

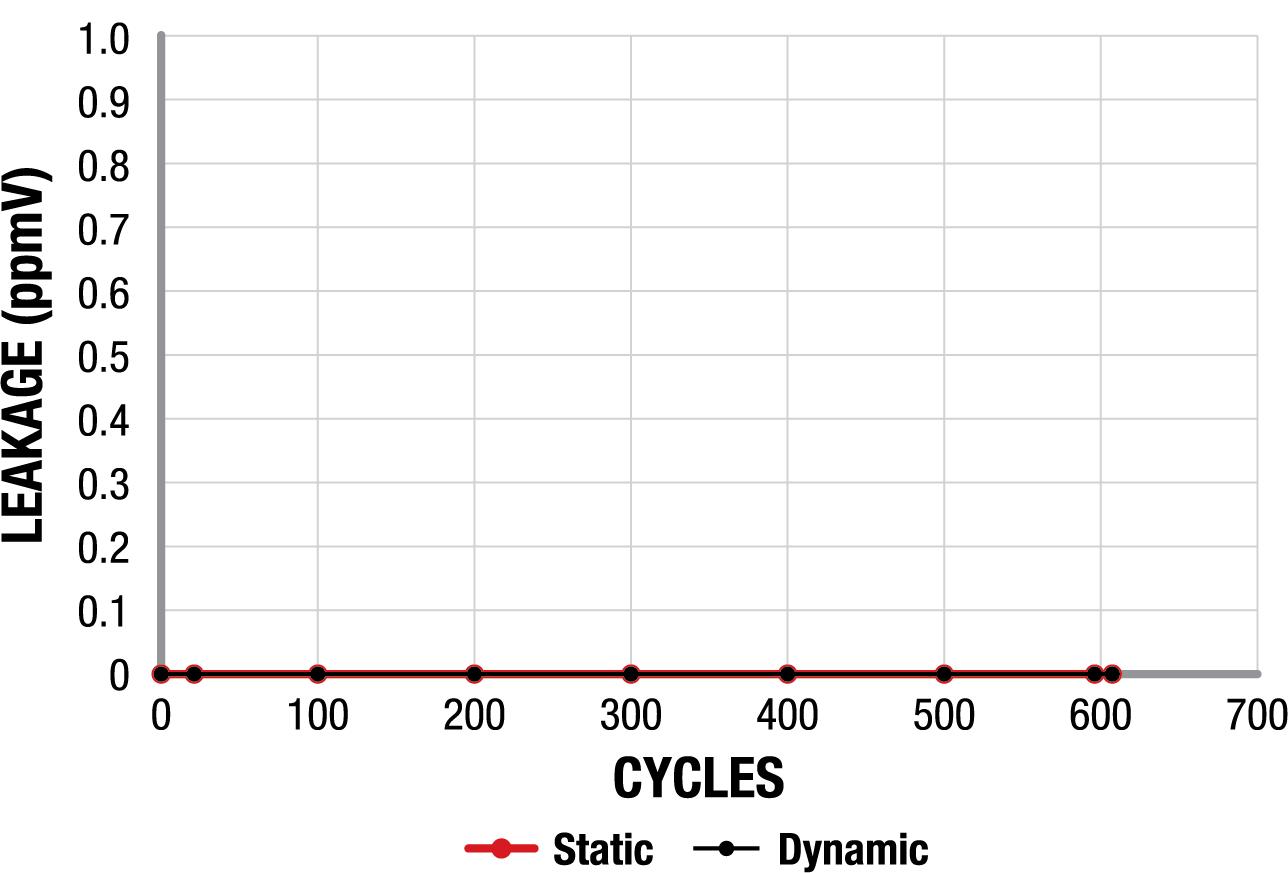

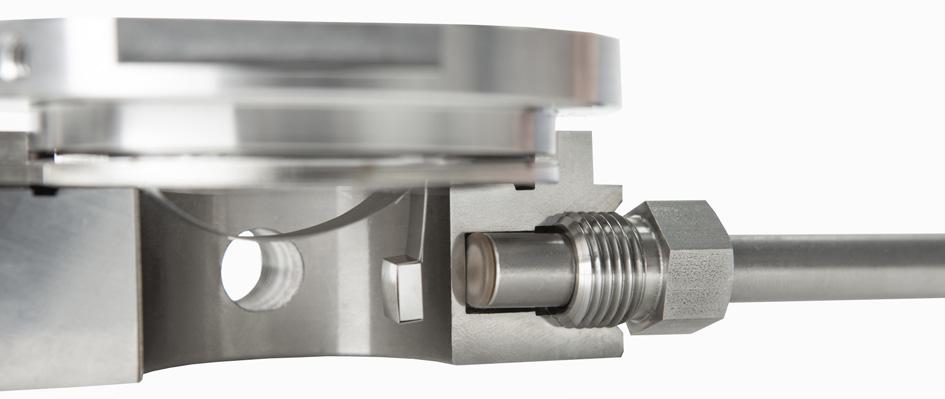

Sustainable low emission valves installed in high temperature severe service applications are a standard offering from MOGAS. The valve pictured is a 6 in. MOGAS ISOLATOR 2.0, ASME 600 Class, that was API 607 fire tested with low FE packing, then FE tested to API 641. Both passed.

CONTENTS Hydrocarbon Engineering Like Join Hydrocarbon Engineering @HydrocarbonEng Follow CONVERSATION JOIN THE 2023 Member of ABC Audit Bureau of Circulations Copyright© Palladian Publications Ltd 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. CBP006075 April 2023 Volume 28 Number 04 ISSN 1468-9340 03 Comment 05 World news 08 Local market growth in MENA Nancy Yamaguchi, Contributing Editor, discusses the trends in production and petroleum product

in the MENA region, and unpacks the knock-on effects of the

15 Capturing

demand

COVID-19 pandemic.

the right opportunities

Pérez-Calvo,

facilities

in carbon capture, utilisation

19 Sustainable chemicals

Sulzer Chemtech, outlines what hydrocarbon processing

should consider when investing

and storage

enabled by circularity

consider ways in which

order to meet the net zero challenge. 23 Plastic waste: the crude oil of the third millennium

Reynolds and Andreas Bormann,

the chemical industry is adapting in

Cut your CO2 emissions in half with ET Black™ Carbon Black Technology

ET Black™ is a state-ofthe-art technology that complies with the most stringent environmental regulations now and in the future.

Plus, the flexibility to produce all ASTM grades, and specialty grades, in a single plant. ET Black™, the technology of reference for producing carbon black obtained by thermal decomposition of highly aromatic oils.

Find out more at: www.igoforETBlack.com

CONTACT INFO

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O'Reilly callum.oreilly@palladianpublications.com

ASSISTANT EDITOR Bella Weetch bella.weetch@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Sophie Birss sophie.birss@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

EVENTS MANAGER Louise Cameron louise.cameron@palladianpublications.com

EVENTS COORDINATOR Stirling Viljoen stirling.viljoen@palladianpublications.com

DIGITAL CONTENT ASSISTANT Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR Leah Jones leah.jones@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITOR

Nancy Yamaguchi Gordon Cope

SUBSCRIPTION RATES

Annual subscription £110 UK including postage /£125 overseas (postage airmail).

Two year discounted rate £176 UK including postage/£200 overseas (postage airmail).

SUBSCRIPTION CLAIMS

Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

APPLICABLE ONLY TO USA & CANADA

Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032.

15 South Street, Farnham, Surrey

GU9 7QU, UK Tel: +44 (0) 1252 718 999

COM MENT

CALLUM O'REILLY SENIOR EDITOR

Back in November, I commented on the wave of discontent spreading across Europe as workers from various industries downed tools over pay and working conditions. Although some of these disputes have now been resolved, many strikes are still ongoing. As I write this, Germany’s transport sector is at a near standstill as the country experiences a ‘mega strike’ (as it has been dubbed by the German media) with staff at airports, ports, railways, buses and subways all walking out. Meanwhile, in France, national strikes over the government’s proposed pension reforms are causing chaos, particularly for the country’s oil processing industry, which is running at a fraction of normal capacity. Bloomberg reports that four of the country’s six refineries are barely operating after ExxonMobil started taking its largest facility out of service due to the fact that it cannot get crude into the site.1 This, of course, has repercussions for the global oil market.

At a time when worker unrest is widespread, Airswift’s latest ‘Global Energy Talent Index’ report makes for particularly interesting reading. The annual energy workforce trends report suggests that job satisfaction in both the oil and gas and petrochemicals sectors is high. The petrochemicals sector, in particular, records a very settled workforce, with 57% of respondents not considering a move outside of the sector. Perhaps unsurprisingly, given the global cost of living crisis, remuneration was listed as having the most positive impact on job satisfaction, followed by factors including benefits, job excitement and flexible working conditions.

However, there are some red flags within the report. Airswift warns that the oil and gas sector risks losing its multi-skilled, mobile workforce to other industries. Ilda Andaluz, Executive Vice President of Global Human Resources at Varel Energy Solutions, notes: “The digitalisation and diversification of industry portfolios means the workforce increasingly has skills synergies with other sectors, such as technology, that make them appealing.” 80% of respondents have been approached about another job in the past year, and 85% are considering switching to another role, with renewables (49%) top of the wish list. Career progression is the main driver for a change of jobs, while interest in the wider industry and ESG are also key factors. And on the topic of the environment, 21% of oil and gas workers say their employers are not doing enough to enable the energy transition, which could impact efforts to attract and retain an ESG-conscious workforce. The majority of respondents welcomed changes as a result of the energy transition, with 38% noting that they enjoy their role more as a result. Interestingly, responses in the petrochemical sector were a little more split, with 37% of respondents enjoying their role more as a result of changes brought about by the energy transition, and 20% enjoying it less.

There is also a warning that recruitment and retention have been casualties of recent inflation and supply chain costs, while investments in technology and digitalisation have also been negatively impacted, particularly in the petrochemicals sector. And there are some concerning statistics about the gender divide within the report. In the oil and gas sector, 36% of female respondents said that their views are listened to and have an impact on company policy (vs 46% of men), and in the petrochemicals sector 42% of men feel comfortable expressing their values and views at work compared to just 16% of women. These are statistics that obviously need immediate attention as the energy sector seeks to expand its recruitment and retention efforts to improve gender equality.

1. GRAHAM, R., ‘French Refining Is Barely Running as Strikes Enter Week Four’, Bloomberg UK, (27 March 2023).

1. GRAHAM, R., ‘French Refining Is Barely Running as Strikes Enter Week Four’, Bloomberg UK, (27 March 2023).

-------END TO END SULPHUR PROCESSING AND HANDLING SOLUTIONS

We are a world leading manufacturer of sulphur processing equipment as well as solutions for downstream silo/stockpile storage and reclamation, and bulk loading systems for truck, rail and ships.

ROTOFORM PASTILLATION

With 700+ systems in use by the sulphur industry, Rotoform is the world’s most widely used process for small to mid-capacity production of premium quality pastilles and offers unrivalled product uniformity and environmentally friendly operation.

SG DRUM GRANULATION

Where higher capacity is required, our SG rotating drum system is a fully automated, ‘once through’, sulphur granulation process based on a size enlargement process by continued coating of seed material.

KEY FEATURES

Solidification capacity up to 280 mtpd.

Duplex steel belts alloyed for maximum lifetime.

Pastilles according to SUDIC premium quality spec.

KEY FEATURES

Capacity up to 2,000 mtpd.

Single pass, no need for screens.

Process simulation to suit all conditions.

Simple operation, precise control.

ipco.com/sulphur

Pastilles Steel belt Rotating shell Heating channel Heating channel Cooling spray Sulphur nuclei particles Sulphur granules Sulphur spray Rotating drum Flights

WORLD NEWS

China | Aramco JV HAPCO to commence construction of refinery and petrochemical complex

Aramco and joint venture (JV) partners NORINCO Group and Panjin Xincheng Industrial Group plan to start construction of a major integrated refinery and petrochemical complex in northeast China.

Huajin Aramco Petrochemical Co. (HAPCO), a JV between Aramco (30%), NORINCO Group (51%) and Panjin Xincheng Industrial Group (19%), is developing the complex that will combine a 300 000 bpd refinery and a petrochemical plant with a

production capacity of 1.65 million tpy of ethylene and 2 million tpy of paraxylene.

Construction is due to start in 2Q23 after the project secures the required administrative approvals. It is expected to be fully operational by 2026.

Aramco will supply up to 210 000 bpd of crude oil feedstock to the complex, which is being built in the city of Panjin, in China’s Liaoning province.

India | Chevron Lummus Global technology chosen for Mumbai Refinery

Chevron Lummus Global LLC (CLG) has announced that Bharat Petroleum Corp. Ltd (BPCL) has selected its ISOFINISHING technology for a catalytic processing unit at the Mumbai Refinery in Mumbai, India.

Once complete, the unit will have a capacity of 200 000 tpy and will be the first catalytic process unit to manufacture de-aromatised

solvents and white oil in India. These specialty products will meet India’s domestic standards and international standards, and will serve as a substitute for these types of products that are currently being imported into India.

CLG’s project scope includes the technology license, engineering services, proprietary equipment, and catalyst supply.

USA | Sempra launches Port Arthur LNG project

Sempra has announced that its 70%-owned subsidiary, Sempra Infrastructure Partners LP, has reached a positive final investment decision (FID) for the development, construction and operation of the Port Arthur LNG Phase 1 project in Jefferson County, Texas, US.

Sempra Infrastructure closed its joint venture (JV) with an affiliate of ConocoPhillips, and announced an agreement to sell an indirect, non-controlling interest in the project to an infrastructure fund managed by KKR. Additionally, Sempra Infrastructure announced the closing of the project’s US$6.8 billion non-recourse debt financing and the issuance of the final notice to proceed under the project’s engineering, procurement and construction (EPC) agreement.

The Port Arthur LNG Phase 1 project is fully permitted and is designed to include two natural gas liquefaction trains, two LNG storage tanks and associated facilities with a nameplate capacity of approximately 13 million tpy. Total CAPEX for the Port Arthur Phase 1 project is estimated at US$13 billion.

USA | Technip Energies commences study for Texas Green Fuels export complex

Technip Energies has been selected by Texas Green Fuels (TGF) to commence pre-FEED for the TGF Galveston Bay clean fuels export project.

TGF’s export complex will produce industrial-scale, cost-effective, and sustainable fuels such as clean ammonia, hydrogen, and methanol for both domestic and export markets.

Technip Energies will perform pre-FEED, which will enable TGF to confirm the technical and economic feasibility of the project.

The partnership will leverage Technip Energies’ global expertise to extend through engineering, procurement and construction (EPC) of the TGF complex.

TGF’s mission is to support global net zero objectives that mitigate the

adverse impacts of climate change by developing projects that convert the world’s abundant, low-cost renewable electricity into clean fuels. These clean products are produced using renewable electricity for all electricity requirements.

Final investment decision (FID) on the TGF export complex is expected in 2025, with commercial operations commencing in 2028.

April 2023 HYDROCARBON ENGINEERING 5

DIARY DATES

12 - 14 April 2023

25th International Aboveground Storage Tank Conference & Trade Show

Orlando, Florida, USA www.nistm.org

20 April 2023

Global Hydrogen Conference

Online

www.globalhydrogenreview.com/events/globalhydrogen-conference-2023/

25 - 27 April 2023

Sulphur World Symposium

Edinburgh, Scotland www.sulphurinstitute.org/symposium-2023

08 - 12 May 2023

RefComm

Galveston, Texas, USA events.crugroup.com/refcomm

22 - 24 May 2023

ILTA 2023 International Operating Conference and Trade Show

Houston, Texas, USA ilta2023.ilta.org

07 - 08 June 2023

Downstream USA 2023

Galveston, Texas, USA events.reutersevents.com/petchem/downstream-usa

07 - 08 June 2023

Valve World Americas Expo & Conference Houston, Texas, USA www.valveworldexpoamericas.com

13 - 15 June 2023

Global Energy Show Calgary, Alberta, Canada www.globalenergyshow.com

10 - 13 July 2023

LNG2023

Vancouver, British Columbia, Canada www.lng2023.org

05 - 08 September 2023

Gastech Singapore www.gastechevent.com

26 - 28 September 2023

Turbomachinery & Pump Symposia Houston, Texas, USA tps.tamu.edu

USA | Europe became primary destination for US LNG exports in 2022

US exports of LNG averaged 10.6 billion ft3/d in 2022, increasing by 9% (0.8 billion ft3/d) compared with 2021, according to the latest ‘Natural Gas Monthly’ report from the US Energy Information Administration (EIA).

The increase in US LNG exports was driven by strong LNG demand in Europe, high international natural gas prices, and expanded US liquefaction capacity. US LNG exports to Europe increased 141%, or 4 billion ft3/d, compared with 2021.

US LNG exports to Europe increased as a result of both natural gas supply challenges in Europe after Russia’s pipeline exports to the region declined to 40-year lows, and higher prices at Europe’s natural gas trading hubs relative to other LNG markets.

Europe became the primary destination for US LNG exports in 2022, accounting for 64% (6.8 billion ft3/d) of total exports. France, the UK, Spain, and the Netherlands accounted for a combined 74% (5 billion ft3/d) of US LNG exports to the region.

UK | Shell Blue Hydrogen Process selected

Uniper and Shell UK Ltd have awarded Shell Catalysts & Technologies a contract to deliver a process design package for the Humber H2ub® project, using the Shell Blue Hydrogen Process (SBHP).

The deal could see the technology deployed at Uniper and Shell UK’s proposed project in the Humber, UK, which aims to produce low-carbon hydrogen.

Two other companies are also working on plant design proposals for the project, and the one that is selected will become the project’s preferred low-carbon hydrogen

production technology provider. That company will also support the project’s FEED and EPC stages, ahead of the final investment decision (FID), which is expected by around 2025.

The proposals involve building a blue hydrogen production unit at Uniper’s Killingholme site in the UK, which will be capable of generating 720 MW of low-carbon hydrogen from natural gas. The carbon dioxide (CO2) produced as a result of this process, estimated to be 1.6 million tpy, would be captured and stored permanently in a geological formation in the North Sea.

USA | Chart Industries completes acquisition of Howden

Chart Industries Inc. has completed its acquisition of Howden from affiliates of KPS Capital Partners LP (KPS).

The strategic combination of Chart and Howden expands the company’s offering of products and solutions across clean power, clean water, clean food and clean industrials. The combination also provides access to new specialty

products and ESG-linked end markets such as nuclear, energy recovery and electrification.

In a statement, Chart said that the complementary nature of the equipment and solution portfolios results in a differentiated offering across stationary and rotating equipment.

Chart paid a purchase price of approximately US$4.4 billion in cash.

April 2023 HYDROCARBON

WORLD NEWS

ENGINEERING 6

MAKE EVERY MOLECULE MATTER

At Shell Catalysts & Technologies, we understand how small, unseen chemical reactions can affect the health of our loved ones, neighbours, and the planet at large. That’s what motivates us in our mission to Make Every Molecule Matter. Every member of our team is focused on the same goal — developing cleaner energy solutions that enable industries to tackle global climate challenges starting at the molecular level. Together, our experienced scientists and expert engineers put our diverse, unique owneroperator expertise to work — collaborating with you to create solutions that can solve your specific emissions and energy efficiency challenges.

Learn more at catalysts.shell.com/MEMM

8 April 2023 HYDROCARBON ENGINEERING

The Middle East and North Africa (MENA) region, encompasses the Middle Eastern countries of Bahrain, Iran, Iraq, Kuwait, Israel, Jordan, Kuwait, Lebanon, Oman, Palestine, Qatar, Saudi Arabia, Syria, the UAE and Yemen; and North African countries of Algeria, Egypt, Libya, Morocco and Tunisia. MENA is home to the key OPEC members that are collectively responsible for the bulk of OPEC crude production, plus some significant non-OPEC oil producers, such as Bahrain, Egypt, Oman and Qatar. Qatar left OPEC effective January 2019, citing its decision to focus on natural gas development rather than petroleum. Qatar remains a member of the Organization of Arab Petroleum Exporting Countries (OAPEC) which includes all of MENA’s oil exporters save Iran, as Persians are not Arabs. While most of the MENA countries possess oil resources, some produce little or no oil, and are import-dependent. These include Morocco, Tunisia, Jordan, Lebanon, Israel, Palestine, Syria and Yemen. OAPEC tracks fuel consumption data for MENA countries excluding Israel and Palestine.

This article will provide an update on MENA’s petroleum sector, chiefly trends in production and petroleum product demand, and the recent dip-recovery cycle caused by the COVID-19 pandemic. Data quality and timelines vary significantly among these 19 countries. Most data series on consumption extend only to 2020 or 2021, though data on crude production among OPEC countries is available through to January 2023. The discussion and graphics in this article rely on the most recent series that can be completed for all 19 MENA countries.

Oil export revenues rebound

The COVID-19 pandemic cut global oil demand, and as oil prices fell, so did net export revenues for MENA oil producers. As demand recovered, oil prices began to climb. Russia’s invasion of Ukraine led to a price spike in the summer of 2022, with Brent crude spot prices averaging US$122.71/bbl in June 2022. Prices have retreated from this peak, and Brent spot prices averaged US$82.50/bbl in January 2023. These remain strong prices, however, when

April 2023 9 HYDROCARBON ENGINEERING

Nancy Yamaguchi, Contributing Editor, discusses the trends in production and petroleum product demand in the MENA region, and unpacks the knock-on effects of the COVID-19 pandemic.

recalling that in late 2019, before the pandemic hit in force, Brent spot prices were in the range of US$55 – 70/bbl.

The strength of oil prices is creating a resurgence in oil export revenues. This favours the OPEC countries, and in many ways acts against the interests of OPEC’s neighbours, as it widens the gap between the oil ‘haves and have-nots’. Replenishing government coffers with oil revenues is supporting energy sector investments once again, but new projects cannot be built overnight, and many MENA countries struggle to maintain the energy infrastructure that they already possess.

Civil conflict has hindered development in many areas over the years. Libya offers perhaps the most famous example, with its staggering fluctuations in crude production, refinery utilisation, exports and demand. Syria has also been plagued with civil conflict since 2011, which caused a collapse in its oil output. In 2010, the country produced approximately 383 300 bpd of oil. This plunged to 70 800 bpd in 2021. Sadly, the region is now suffering a severe humanitarian crisis in the aftermath of the 2023 Turkey-Syria earthquakes. In early

February 2023, an extreme 7.8 magnitude quake hit south-central Turkey and northwestern Syria, followed by a 7.5 magnitude quake, and then followed by a 6.3 magnitude aftershock. At the time of writing, over 51 000 deaths have been confirmed, approximately 44 300 in Turkey and 6700 in Syria. Dealing with this disaster will be at the forefront of regional priorities in 2023.

The COVID-19 pandemic caused a sharp contraction in OPEC oil export revenues. The US Energy Information Administration (EIA) calculated that OPEC net oil export revenues dropped from US$595 billion in 2019 to US$320 billion in 2020. In 2021, revenues recovered to US$570 billion. In 2022, the EIA estimates that revenues jumped to US$907 billion, propelled upward by demand growth and Russia’s invasion of Ukraine. The EIA forecasts that OPEC revenues will decline from this peak in 2023, though at a hefty US$835 billion this level will remain comfortably above pre-pandemic levels.

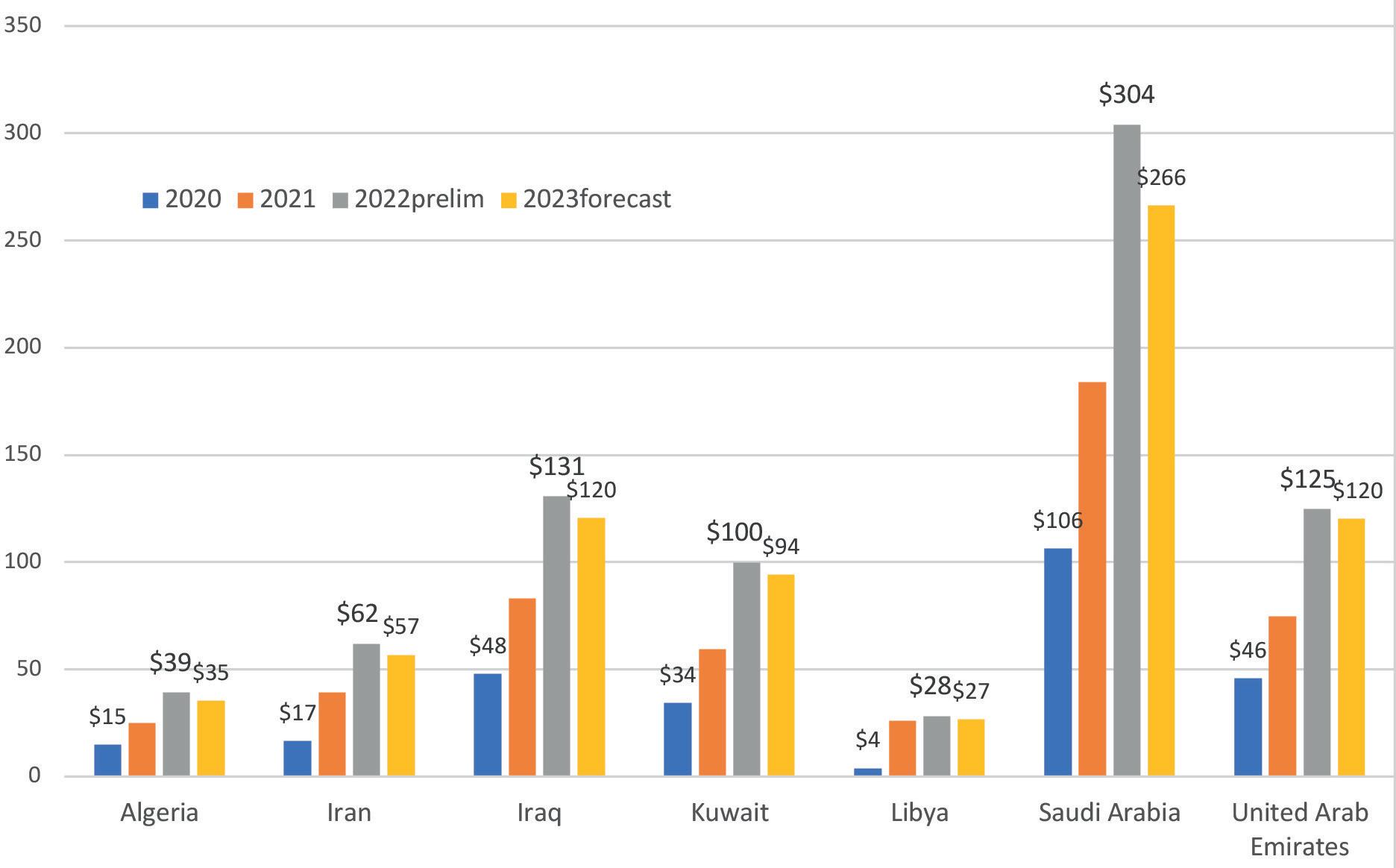

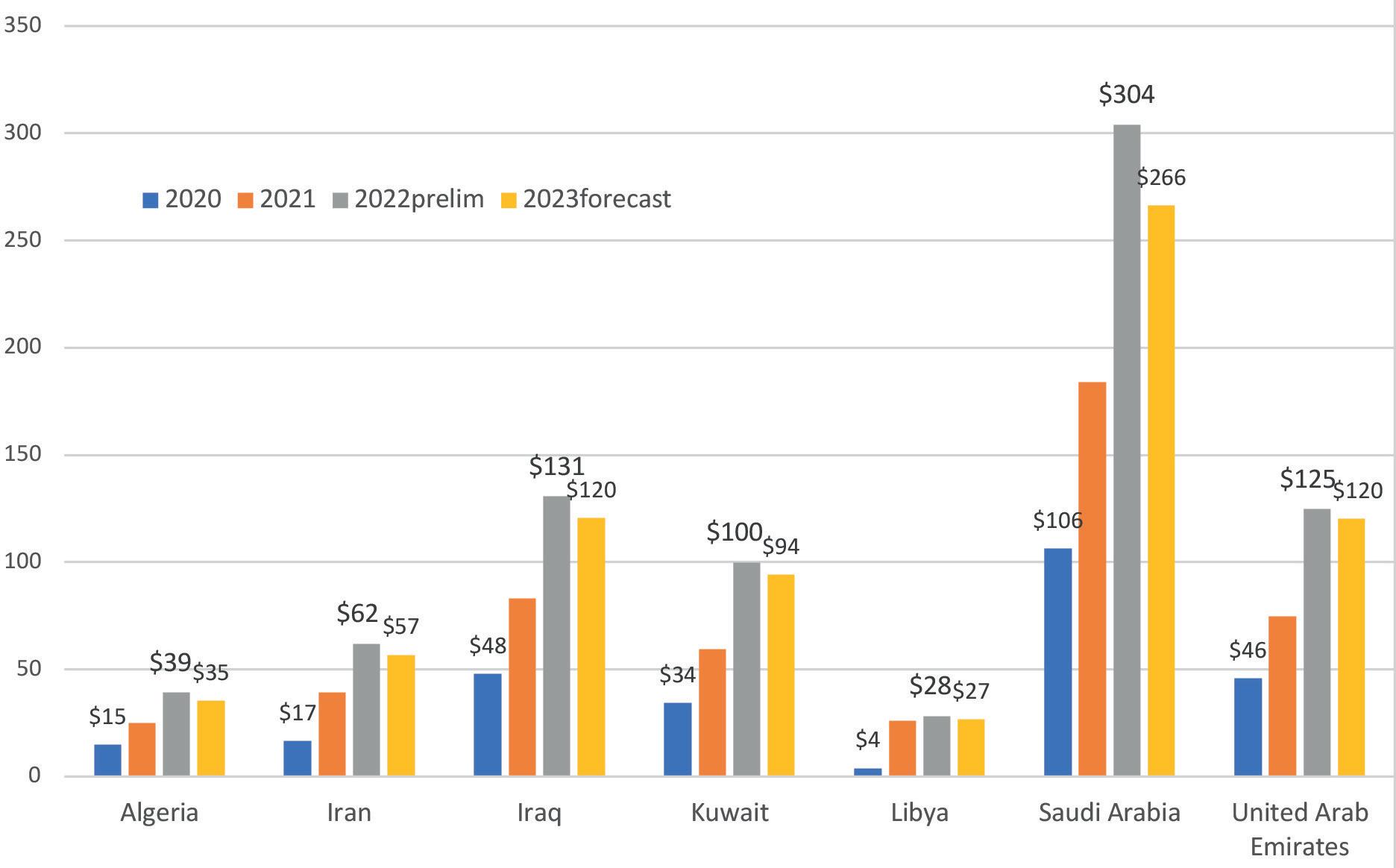

Figure 1 presents details of oil export revenues in the MENA OPEC countries. Saudi Arabia is the largest earner by far, followed by Iraq and the UAE. Saudi Arabian revenues jumped back nearly threefold from US$106 billion in 2020 to US$304 billion in 2022. Revenues are forecast to decline to US$266 billion in 2023. In Iraq, revenues recovered from US$48 billion in 2020 to US$131 billion in 2022, with a forecast US$120 billion in 2023. UAE revenues of US$46 billion in 2020 rebounded to US$125 billion in 2022, and they are forecast to be US$120 billion in 2023. MENA OPEC revenues dropped to US$270 billion in total in 2020, recovered to US$491 billion in 2021, soared to US$789 billion in 2022, and are forecast to retreat slightly to US$720 billion in 2023. These seven MENA countries accounted for 87% of total OPEC net oil export revenue in 2022, the non-MENA OPEC countries being Angola, Nigeria, Congo, Equatorial Guinea, Gabon and Venezuela.

Recovery in MENA oil production

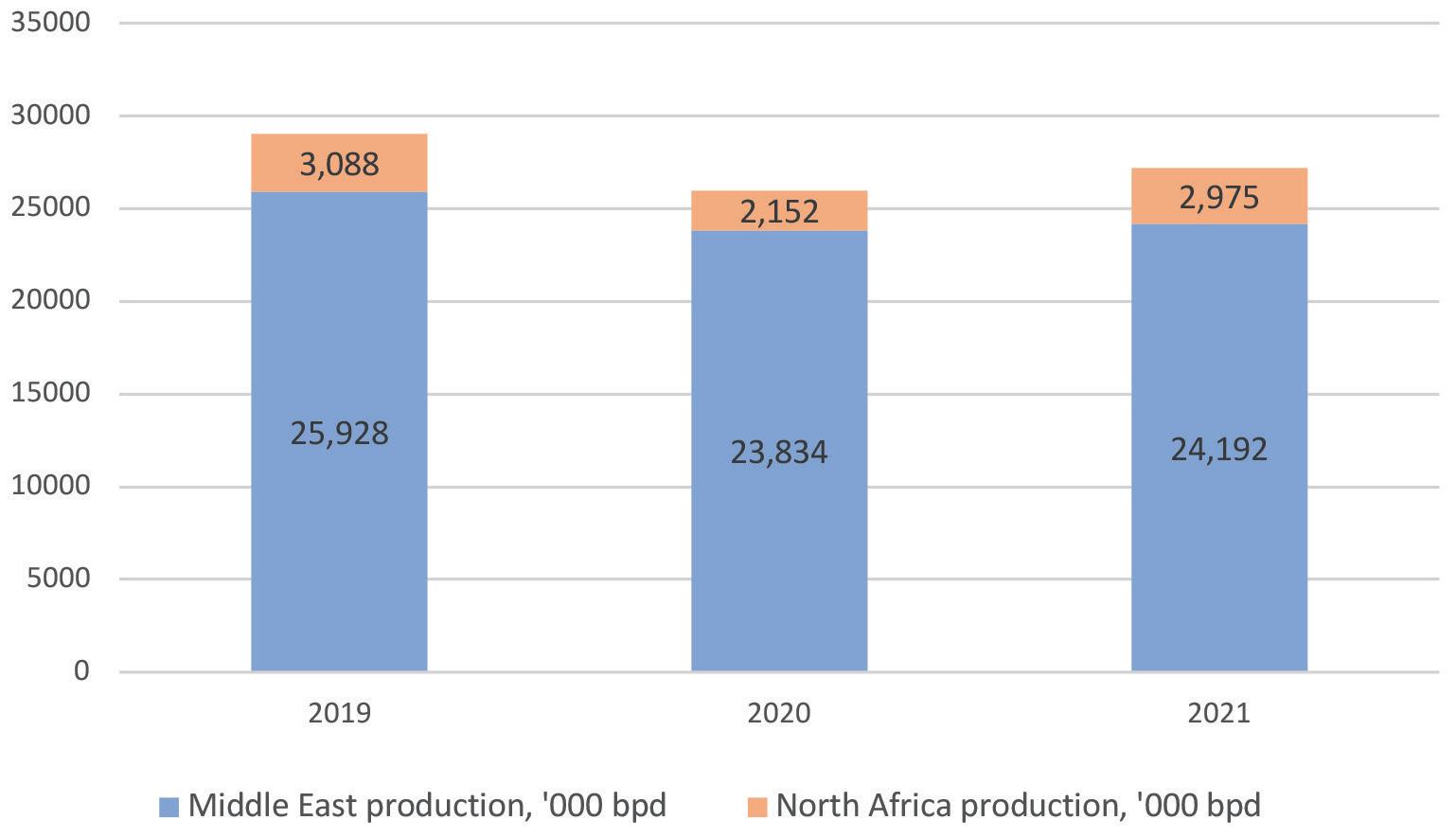

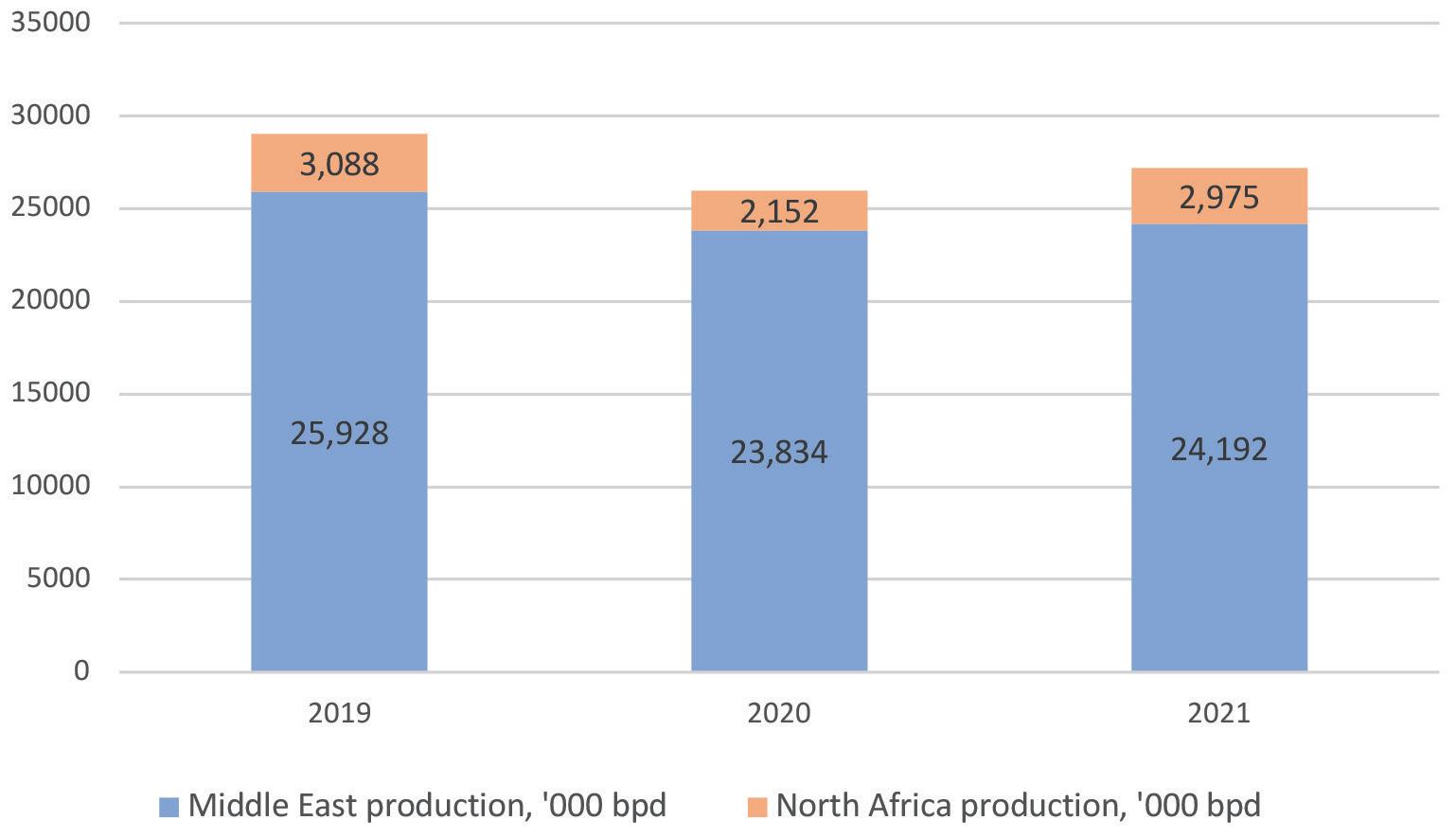

From 2019 to 2020, MENA crude and condensate production fell by 3.03 million bpd. Middle Eastern production fell by 2.09 million bpd while North African production fell 0.93 million bpd. In 2021, Middle Eastern production regained 0.359 million bpd, and North African production recovered by 0.823 million bpd, for a total of 1.18 million bpd. This pattern is depicted in Figure 2. Production continued to rebound in 2022 for most of the MENA countries. However, according to OPEC, North African crude production declined slightly in 2022 because of a production decrease in Libya. OPEC reported that all Middle Eastern OPEC countries saw

April 2023 HYDROCARBON ENGINEERING 10

Figure 1. MENA OPEC net oil export revenues pre-and post-pandemic, US$ billion (source: EIA).

Figure 2. Decline and recovery of MENA crude and condensate production 2019 – 2021, ‘000 bpd (source: EIA).

License to thrill Process alternative feedstock with confidence

Adjusting existing units to new feedstocks is challenging and uncertain. As you transform your operations to meet new market demands, Sulzer Chemtech brings expertise to help operators efficiently process pyrolysis oils from waste plastics and biofuels with innovative licensing technologies and purification systems.

Contact us for more information chemtech@sulzer.com

Sulzer Chemtech – We make chemistry happen!

production continue to rise, with 2022 crude production rising by 2.587 million bpd above 2021 levels.

As prices have recovered and revenue has risen, oil rigs have been returning to active status. According to the Baker Hughes Rig Count, active rigs in the Middle East fell from 414 in 2019 to 265 in 2021, but 2022 brought a recovery to 308 rigs. In Africa, the rig count fell from 117 in 2019 to 69 in 2021, then recovered to 82 in 2022.1

MENA fuel demand

Fuel demand is often difficult to measure precisely and to report quickly. This section focuses on country-level and fuel level MENA demand through the year 2021. It relies mainly on the work of the EIA, supplemented by OAPEC data. These organisations make data available to the public, and they cover each country individually.

The fact that the table and figures within this article appear crowded is part of what defines the region. MENA countries cover a large geographic area, composed of numerous markets – many of which are quite small. Yet taken as a whole, MENA constitutes a significant and growing market. According to BP, during the decade 2011 – 2021, Middle Eastern oil demand grew at 0.6%/yr on average, and African demand grew at 1.4%/yr on average.2 Only the Asia Pacific market grew more swiftly, averaging growth of 2.3%/yr, led by giants China and India. Demand in the CIS region expanded by 0.9%/yr. In contrast, North American demand declined by -0.1%/yr, whilst demand in South and Central America fell by -0.8%/yr. European demand declined by -1.0%/yr.

OPEC forecasts that Middle Eastern oil demand rose by approximately 46 000 bpd in 2022, and that another 33 000 bpd of demand will be added in 2023. African demand rose by 16 000 bpd in 2022, and another 19 000 bpd of demand will be added in 2023.

Table 1 presents country-level demand for the MENA countries, ranging from small markets of under 100 000 bpd (Bahrain, Jordan, Palestine, Yemen and Tunisia) to large markets

of 500 000 bpd and above (Iran, Iraq, Saudi Arabia, the UAE and Egypt).

At the fuel level, MENA’s demand barrel is weighted toward diesel. In 2021, North Africa consumed approximately 768 000 bpd of diesel, while the Middle East consumed approximately 1 876 000 bpd, for a MENA total of 2 644 000 bpd. This may not seem large by European standards, but according to BP, it exceeded diesel demand in South and Central America, which was 2 220 000 bpd in 2021.2 MENA’s largest diesel markets are Iran, Saudi Arabia and Iraq.

Gasoline demand in 2021 averaged approximately 405 000 bpd in North Africa and 1 681 000 bpd in the Middle East, for a MENA total of 2 086 000 bpd. The largest gasoline consumers in MENA are Iran, Saudi Arabia, the UAE and Iraq. MENA’s gasoline market is significantly larger than the EU market, where BP reported that 2021 market demand was 1 465 000 bpd.2

MENA internal product trade

Refinery utilisation and domestic markets

The COVID-19 pandemic caused MENA refinery utilisation rates to drop significantly in 2020. According to BP, Middle Eastern utilisation rates fell from 87.2% in 2018, to 83.9% in 2019, then to 76.5% in 2020. African utilisation fell from 62.3% in 2018, to 61.4% in 2019, then to 54% in 2020. BP reported that Middle Eastern utilisation rates improved to 79.2% in 2021, while African utilisation rates rose to 56%. These rates are well below what most refineries require to be considered profitable.2

Although some of the MENA countries are small markets, together they make a sizeable market that is still desirous of growth and development. This contrasts with many larger markets, where growth rates are slow or perhaps already in negative territory. In the 1980s and 1990s, Saudi Arabia led the region by becoming the first major export-oriented refining centre. The goal was to capture the value-added of processing domestic crude oils and gaining market share in Europe, Asia and the Americas. Other countries followed suit, and MENA refinery capacity expanded dramatically. As time passed, local demand began to absorb more refined product output, and some of the focus on exports transitioned into satisfying domestic markets. The investments made to produce ultra-low-sulfur fuels and EURO standard fuels also helped domestic markets to switch to higher-quality fuels. MENA market demand tended to grow more rapidly than demand in European markets, which helped keep local refineries running even when global overcapacity pressured margins.

Growth in internal trade

MENA is not monolithic, and some countries are so distant from one another that they can scarcely be called neighbours. Google Maps calculates that the journey from Muscat, Oman, to Casablanca, Morocco is 8007 km. A glance at the map shows that Morocco is more likely to import fuel from Europe, the Mediterranean, or West Africa than from Oman and its Persian Gulf neighbours. National borders also may stymie trade when the countries involved have poor relations, or when one or the other faces internal unrest that jeopardises oil infrastructure. Nonetheless, many MENA demand centres are relatively close to MENA refiners, and proximity has encouraged trade.

April 2023 HYDROCARBON ENGINEERING 12

Middle Eastern countries Demand North African countries Demand Bahrain 61 Algeria 439 Iran 1989 Egypt 816 Iraq 853 Libya 223 Israel 219 Morocco 310 Jordan 90 Tunisia 99 Kuwait 346 Total North Africa 1887 Lebanon 166 Oman 206 Palestine 24 Qatar 275 Saudi Arabia 3351 Syria 132 UAE 855 Yemen 62 Total Middle East 8630 Total MENA 10 517

Table 1. MENA oil demand by country, 2021, (‘000 bpd)

Gain a better perspective on hydroprocessing solutions. ART catalyst systems are designed to outperform and outlast the competition. Turn flexibility into opportunity. Learn more at arthydroprocessing.com

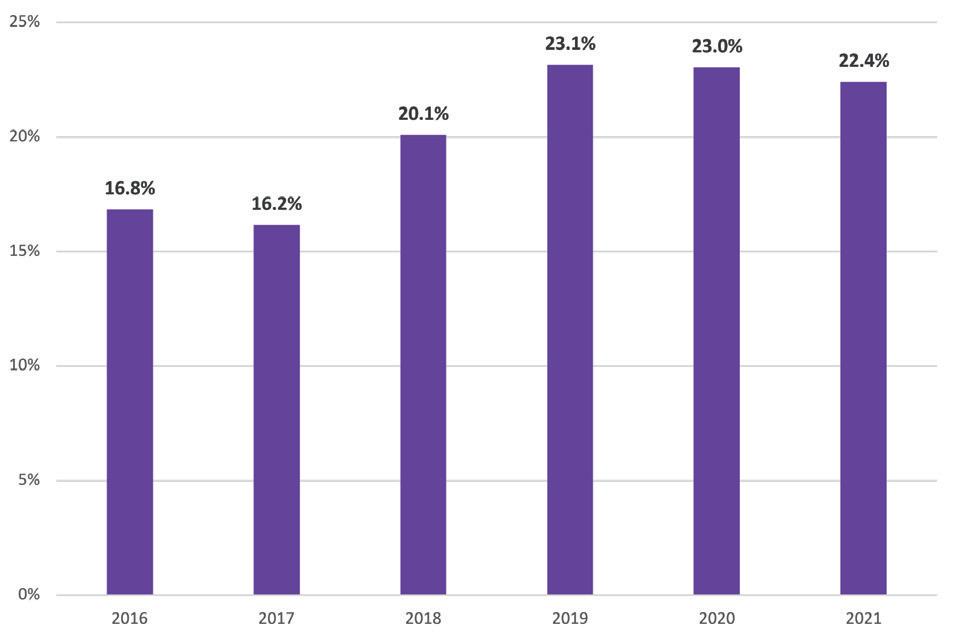

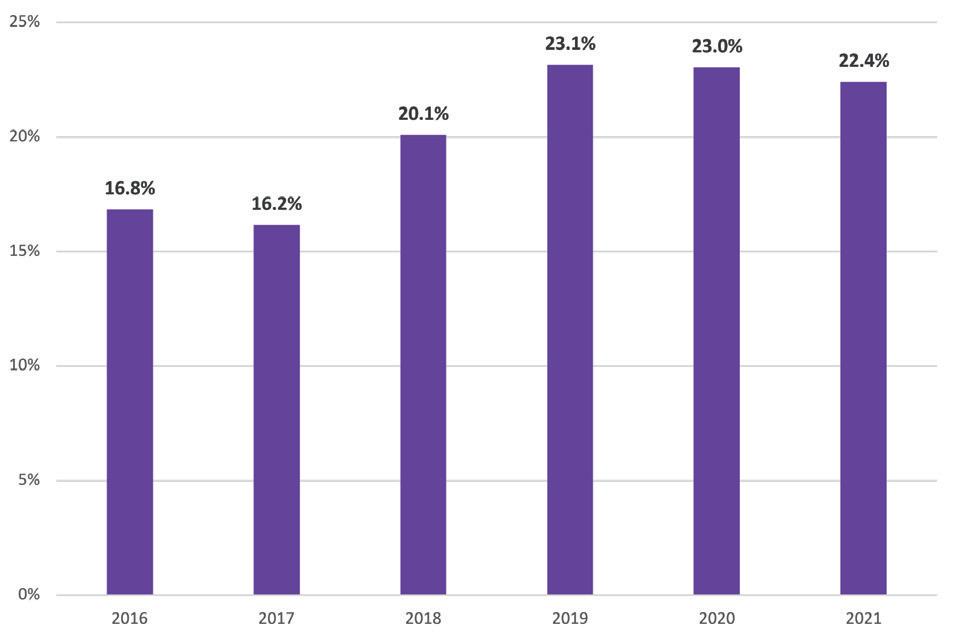

Figure 3 illustrates the growing importance of internal product trade in MENA. According to BP’s data on product trade, 16.8% of MENA fuel exports went to the region in 2016.2 After declining to 16.2% in 2017, this grew to 23.1% in 2019. The COVID-19 pandemic caused a slight retreat thereafter. Nonetheless, in 2021, 22.4% of MENA product exports remained in the region’s markets – a significant share relative to the 16.8% and 16.2% seen in 2016 and 2017.

Conclusion

MENA is composed of 19 countries with widely varying levels of petroleum sector development. It is home to some of OPEC’s largest oil producers, as well as several key non-OPEC producers. It also includes countries that produce little or no petroleum, relying on imports – often from their neighbours. When oil demand and prices rose in the post-COVID-19 world, the gap between the oil ‘haves and have-nots’ widened. Russia’s invasion of Ukraine has had a mixed impact on MENA. The import-dependent countries

are facing higher prices and inflationary pressures, while the exporters are reaping higher revenues. On the other hand, sanctions on Russia are raising interest in oil and gas investments, including European interest in Algeria’s gas resources as an alternative to pipeline gas from Russia. Additionally, market tightness caused by reductions in Russian oil exports has prompted Kuwait to start ramping up production from its giant Al Zour refinery. The refinery is anticipating significant growth in middle distillate exports to Europe, naphtha and very low sulfur fuel oil (VLSFO) exports to Asia, plus increased use of VLSFO in Persian Gulf bunkering. Other MENA refineries are also expanding product exports to Europe. The EIA reported that Russia provided 53% of Northwest Europe’s seaborne diesel imports between October 2021 and September 2022. In February 2023, however, sanctions took effect, and these diesel imports fell to a mere 2%. They were replaced mainly by imports from the Middle East and Asia.

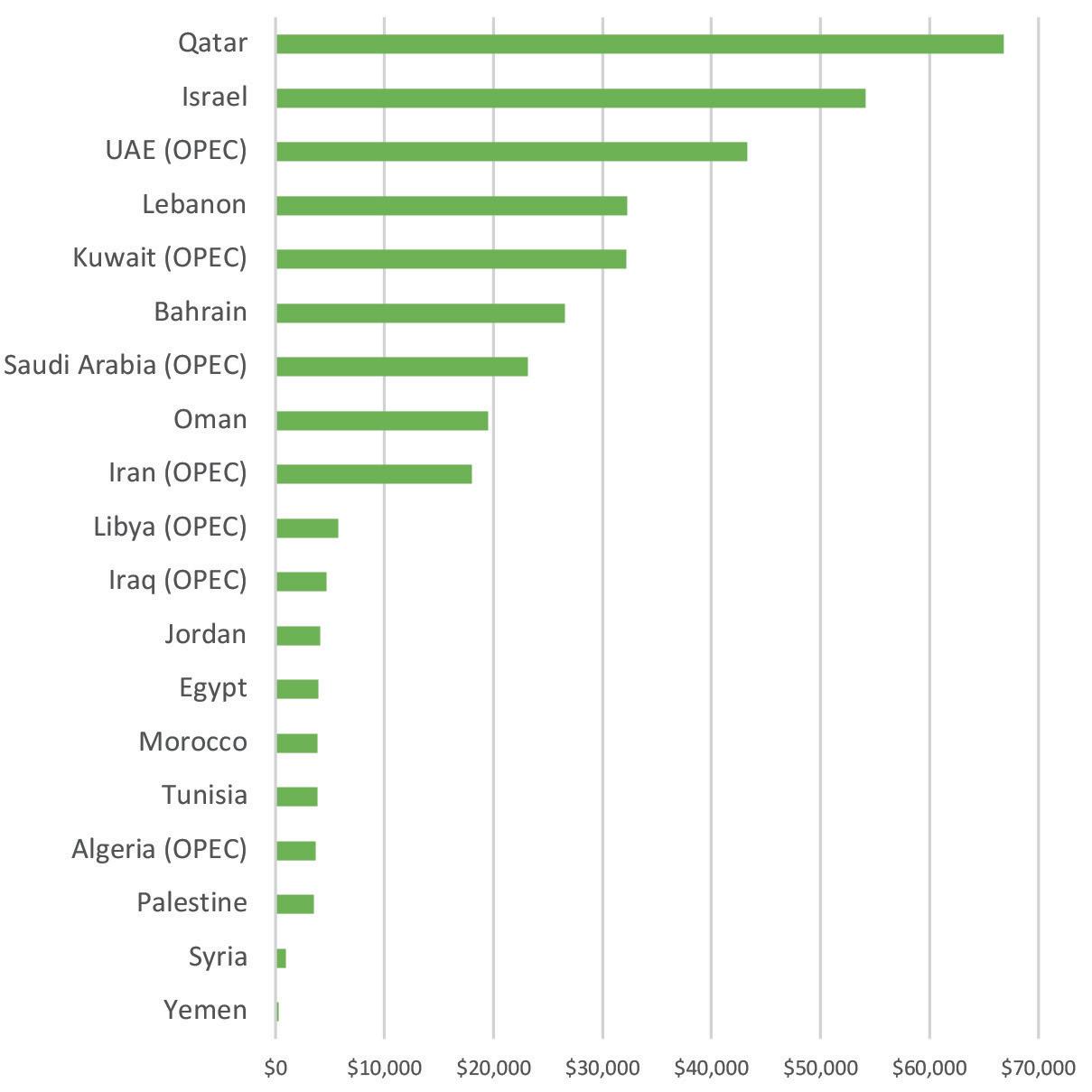

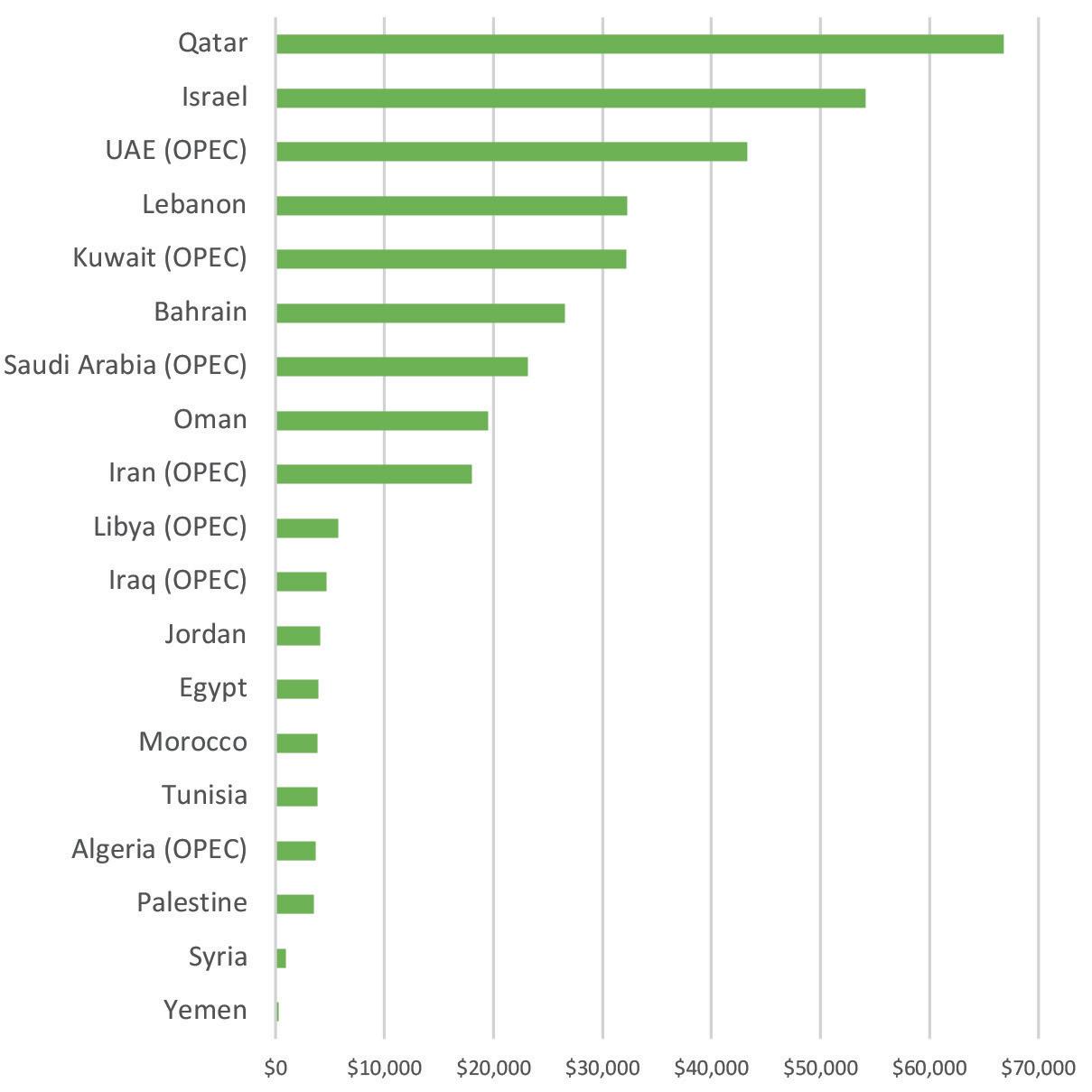

The presence of an active hydrocarbon industry may not be definitive of a successful economy, but in MENA it certainly helps. Figure 4 ranks the 19 MENA countries according to GDP per capita in 2021, as reported by the UN. The OPEC countries clearly dominate the top half. A former OPEC member, Qatar, is at the top, with a GDP per capita figure of US$66 799. The country is the world’s foremost exporter of LNG. Bahrain and Oman are also in the top half. They are not OPEC members, but they are significant oil producers with established refining industries. Iran’s oil production has been constrained for years by sanctions, and progress on this front could allow Iranian production to increase by 1 million bpd or more, greatly increasing its ability to pay for additional development. Oil wealth in the region also has allowed for the diversification of economies, and many oil producers are already planning for a future when oil demand and prices decline. The UAE, for example, has emerged as a major financial centre and a hub of international trade.

Finally, political stability and peace may not be definitive of a successful economy either, but this clearly helps. The bottom half of Figure 4 is populated by countries that have contended with civil strife and outright war – sometimes for years, if not decades. Developing energy resources and infrastructure relies on stable markets that attract both domestic and foreign investors, and upon agreeable international relations. These things have eluded some MENA members. Still, most of the members cooperate in regional groups or accords, such as OPEC, the OPEC+ Group and OAPEC, and there are signs that intraregional trade is growing. In the petroleum sector, there are multiple opportunities for mutually-beneficial development and trade within the MENA region.

References

1. ‘International Rig Count’, Baker Hughes, https://rigcount. bakerhughes.com/intl-rig-count

2. ‘Statistical Review of World Energy’, BP, https://www.bp.com/en/ global/corporate/energy-economics/statistical-review-of-worldenergy.html

Bibliography

• EIA, https://www.eia.gov/

• OPEC, https://www.opec.org/opec_web/en/

• OAPEC, http://www.oapecorg.org/Home

April 2023 HYDROCARBON ENGINEERING 14

Figure 4. MENA GDP per capita, 2021, US$ (source: UN).

Figure 3. MENA fuel exports to other MENA destinations, % of exports (source: BP).

Dr. José-Francisco Pérez-Calvo, Sulzer Chemtech, outlines what hydrocarbon processing facilities should consider when investing in carbon capture, utilisation and storage (CCUS).

Global climate policies are driving the decarbonisation of the energy, manufacturing and processing sectors, setting them on a path towards net zero. While carbon capture and storage/utilisation (CCS/CCUS) technologies are considered crucial to slashing emissions, the available solutions can differ greatly in terms of performance, cost and profitability. It is therefore important for hydrocarbon processors to identify the set-ups that are best suited to supporting specific operations and maximising carbon dioxide (CO2) capture, as well as energy and cost-efficiency.

Due to the fact that they sequester large volumes of CO2 from flue gases before they are released into the atmosphere, post-combustion CCS and CCUS facilities are regarded as one of the enabling technologies to achieve carbon-neutrality by 2050. To address this ambitious goal, the global capacity of CCS is expected to increase more than sixfold in less than a decade, from 43 million t in 2022 to 279 million t by 2030.1

While the vast majority of current and past CCS and CCUS projects are being used or built in order to decarbonise power plants, it is important to drive adoption

April 2023 15 HYDROCARBON ENGINEERING

by industrial point sources, which are estimated to be among the top capturers by 2030.1 As the oil refining industry is the world’s third-largest emitter of greenhouse gases (GHG), with 4% of the total global CO2 output in 2018 coming from this sector2, hydrocarbon processors implementing carbon sequestration solutions can play a key role in abatement efforts.

Additionally, this action can help companies to reduce costs from ever-increasing carbon taxes, with the highest rates currently at US$129.89/t of CO2 emitted.3 These charges are already a reality in the EU, Canada, Japan,

South Africa and various countries in Latin America, and they are being scheduled or considered in a number of other regions. At the same time, it is necessary to lower the CAPEX and OPEX of CCS and CCUS plants to ensure that refineries and petrochemical complexes can remain profitable.

Defining operations and processing conditions

As the flue gases and carbon emissions from these facilities substantially differ from power plants, adopting process conditions and solutions for the energy sector, even if proven, is not necessarily ideal for maximising profitability. For example, power stations often use mega-columns to reduce the vast majority of their emissions, whereas smaller units are generally sufficient for industrial emitters, including hydrocarbon processing facilities. In addition to this, while the concentrations of CO2 in flue gas from gas- and coal-fired power plants are typically 4% and 13.5% by volume, respectively,4 the composition in refineries is estimated to be between 8 – 20% by volume.5

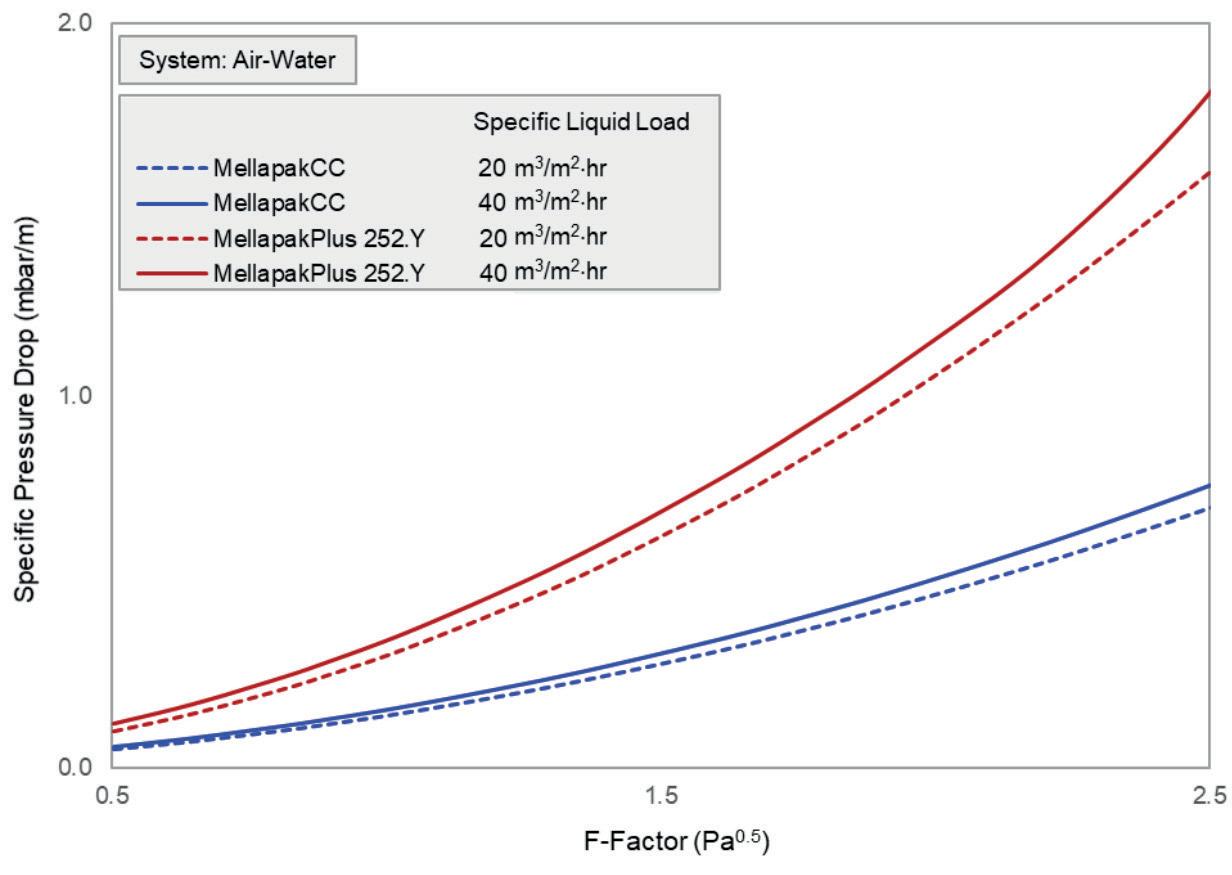

A recent study analysed the financial performance of CCS for industrial emitters by means of in silico models.6 The study concluded that well-designed absorption-based CO2 capture systems that leverage Sulzer Chemtech’s structured packing, MellapakPlusTM, are expected to annually cost below €45 (US$46)/t of CO2 captured for plants treating 1000+ tpd of flue gas, with concentrations ranging from 20% to 12% by volume. These values combine both CAPEX and OPEX. According to the simulation, the optimum capture efficiency of the set-up to benefit from minimal costs is around 90%. However, more effective sequestration,

April 2023 HYDROCARBON ENGINEERING 16

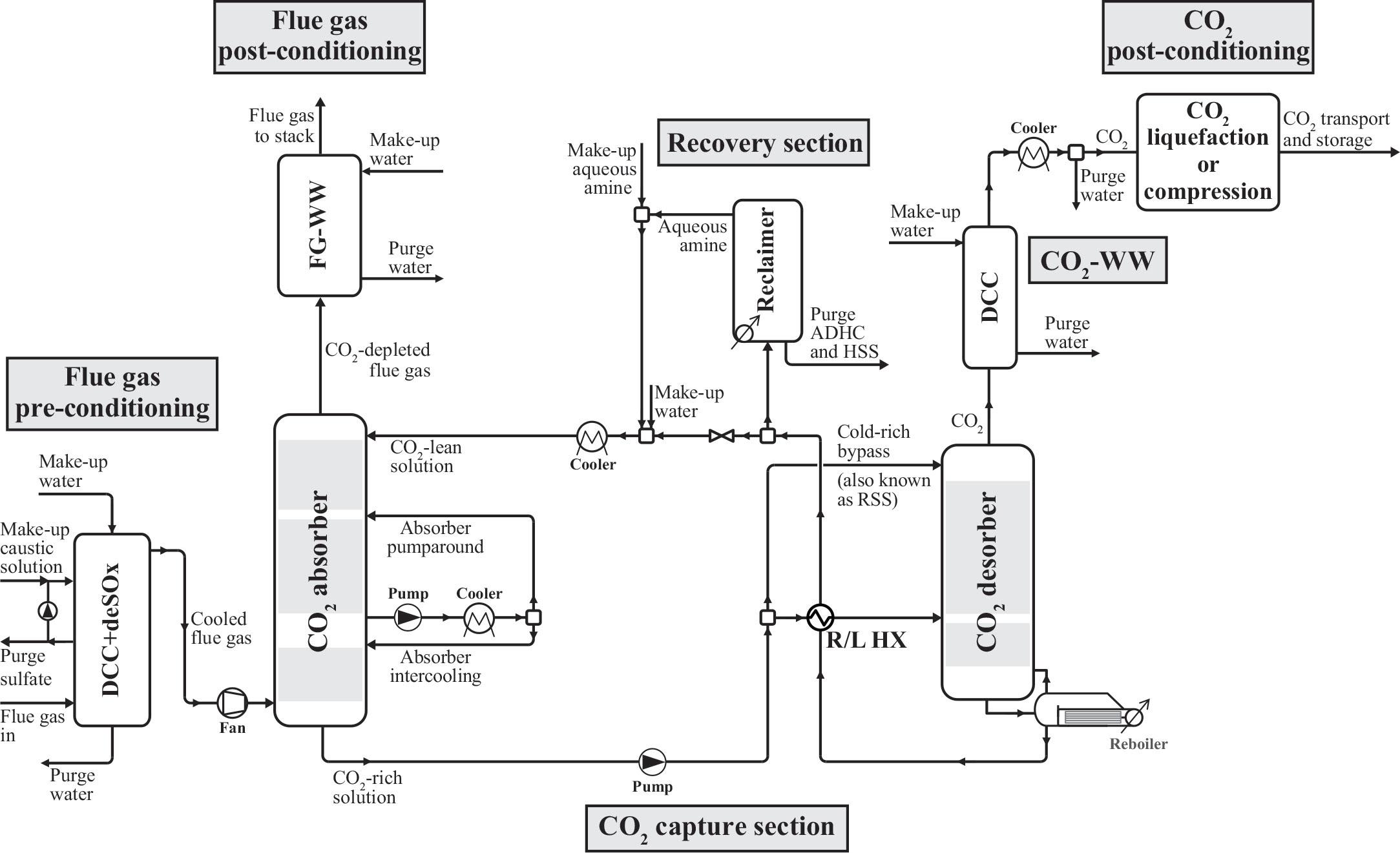

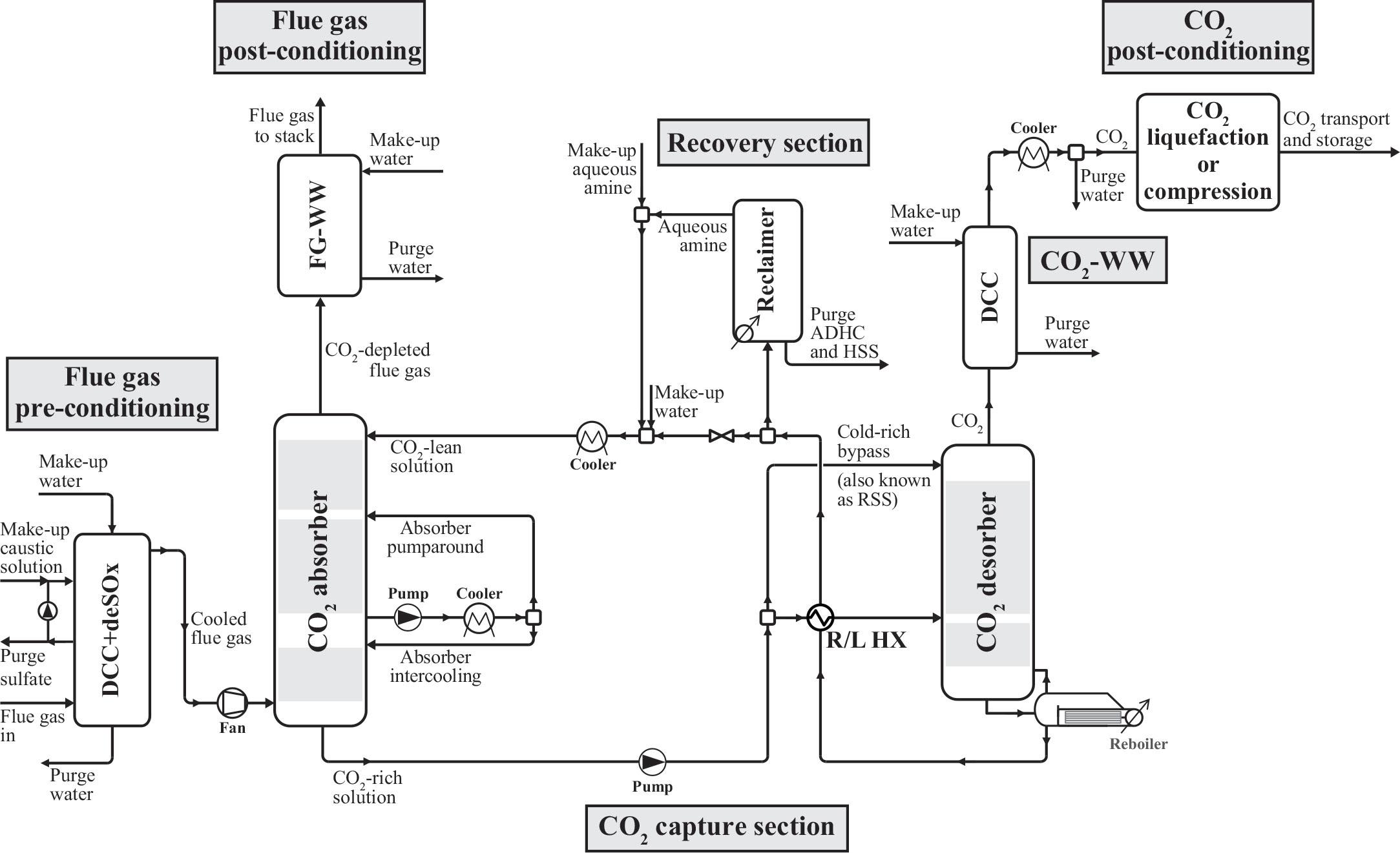

Figure 1. Typical flow scheme of absorption-based post-combustion CO2 capture processes (source: ETH Zurich7, and reproduced with author’s permission).

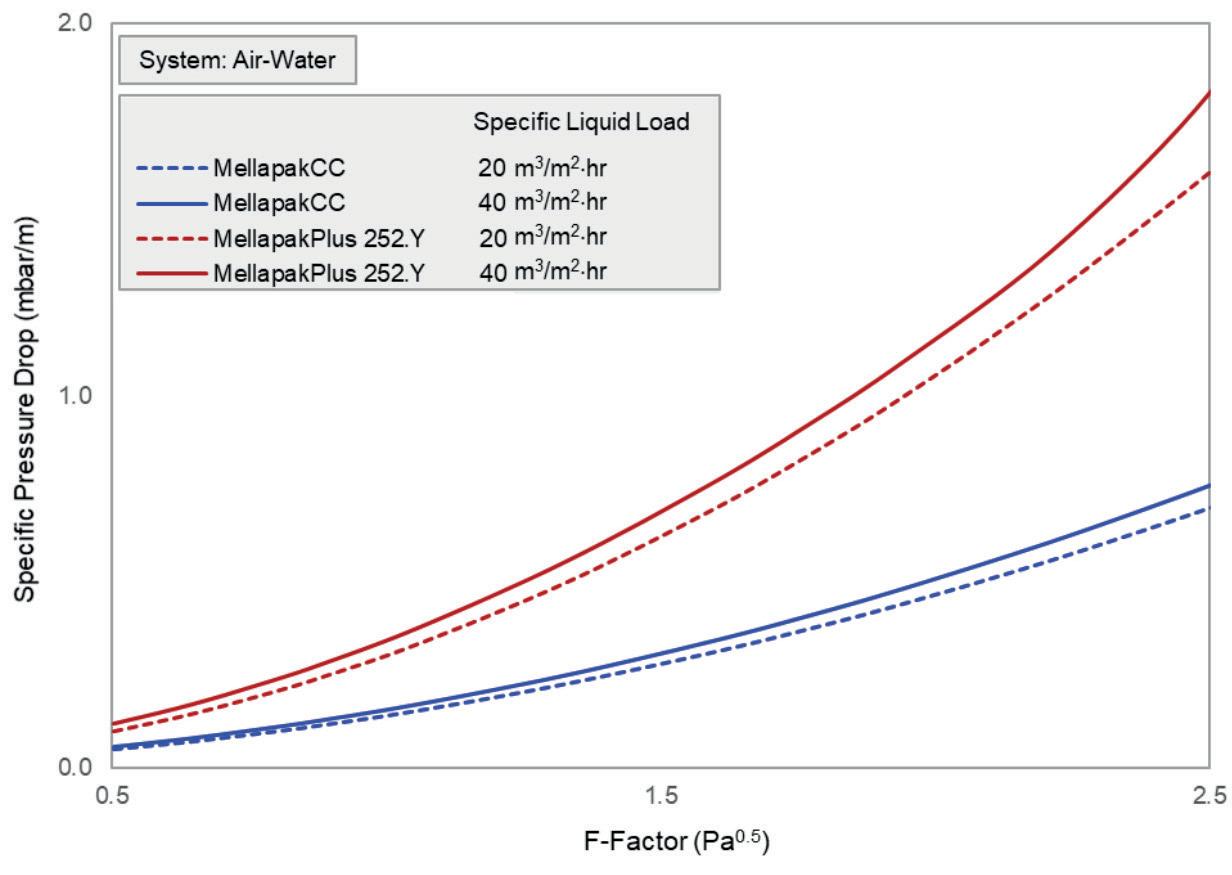

Figure 2. Comparison of the specific pressure drop trends of MellapakCC and MellapakPlus 252.Y, at two specific liquid loads.

D o n’ t M i s s t h e B o a t

G e t o n b o a r d w i t h a s u p p l i e r w h o w i l l g e t y o u w h a t y o u n e e d o n t i m e

W i t h m a n u f a c t u r i n g p l a n t s i n t h e N o r t h A m e r i c a , Eu ro p e a n d A s i a , y o u g e t t h e c e ra m i c c a t a l y s t b e d s u p p o r t y o u n e e d , w h e n y o u n e e d i t G e t t i n g D e n s to n e ® m e d i a s u p p l i e d f ro m o u r r e g i o n a l p l a n t s r e d u c e s h e a d a c h e s o n f r e i g h t a n d s u p p l y c h a i n i s s u e s A n d , s i n c e y o u ’ r e p u rc h a s i n g c l o s e r to y o u r o p e ra t i o n s , i t ’s a m o r e s u s t a i n a b l e s h i p p i n g p ro c e s s

D e n s to n e ® s t a n d s a p a r t i n s u p p o r t m e d i a f o r f i x e d c a t a l y s t c e ra m i c b e d a p p l i c a t i o n s b y d e l i v e r i n g e xc e p t i o n a l q u a l i t y a n d c o n s i s t e n t r e l i a b i l i t y , ev e n i n t h e m o s t s ev e r e p ro c e s s e s

M a k e s o m e w av e s w i t h D e n s to n e ® s u p p o r t m e d i a , i n c l u d i n g D e n s to n e ® 5 7 , 9 9 , 2 0 0 0 a n d t h e r evo l u t i o n a r y D e n s to n e ® d e l t a P ® m e d i a b e d s u p p o r t t e c h n o l o g y

Reliability. Delivered. w w w d e n s to n e c o m

NORPRO

reaching as high as 99%, is possible without incurring significant cost increases. The flow scheme of absorption-based post-combustion CO 2 capture processes considered in this study 6 is shown in Figure 1.

Sulzer Chemtech has recently developed a new type of structured packing, MellapakCCTM, which is specifically designed to support CCS and CCUS processes and is already installed at sites around the world. This packing offers enhanced overall efficiency by minimising pressure drop and column size requirements (see Figure 2). This means that total annualised costs for refineries are likely to be lower, when a suitable set-up is selected, making decarbonisation even more commercially-attractive for industry players.

Strategic investments

Another key aspect to consider is the scale of the emissions generated by the hydrocarbon processing plant, combined with the capacity of the CCS unit. More precisely, the latest research indicates that for large facilities emitting more than 1000 tpd of flue gases, running costs are typically higher than CAPEX.6 As such, it is more important than ever to optimise the process parameters in these set-ups in order to improve operations and their efficiency. Conversely, CAPEX represents the larger portion of the total cost of ownership for infrastructures treating lower masses.

Furthermore, as the costs and features of the different types of energy available at a given CO2 point source greatly influence OPEX, the optimal CO2 capture plant design

should be able to integrate low-cost excess heat for solvent regeneration as much as possible.6

By considering all of these aspects, companies can define strategic plans to improve their return on investment (ROI).

Identifying the right technology partner

Partnering with a CCS/CCUS technology specialist that can support facilities with complete processing solutions and plants, in addition to providing individual pieces of equipment, can help companies optimise CAPEX and OPEX. Experts with a proven track record can help determine the strategies that are most effective for addressing specific requirements and the scale of the intended project by engaging in technical discussions and identifying the most suitable technologies.

For large infrastructures with capacities of above 1000 tpd, a skilled full-service provider can deliver fully-integrated licensed processing technologies that are designed and proven to operate with high efficiency in order to minimise running costs. When supporting smaller facilities, such a partner can drive lean strategies, reducing the expenses and logistics issues associated with dealing with multiple contractors.

By working with an expert in CCS/CCUS technology, it is possible to take advantage of all of these benefits. As an example, Sulzer Chemtech has a portfolio of mass transfer components and internals for absorption applications, such as MellapakCC and AYPlusTM DC. Its teams also have extensive know-how in CO2 capture technologies and solvents, as well as process optimisation and system integration. Additionally, the company has experience in delivering complete processing plants on a modular scale, and can offer modules for carbon removal with a capture rate of up to approximately 100 000 tpy.

With the right support, refineries and petrochemical complexes that are interested in reducing their environmental footprint can leverage effective CCS/CCUS solutions that can help to ensure optimal profitability.

References

1. ‘Global Carbon Capture Capacity Due to Rise Sixfold by 2030’, BloombergNEF, (18 October 2022), https://about.bnef.com/blog/ global-carbon-capture-capacity-due-to-rise-sixfold-by-2030/

2. LEI, T., GUAN, D., SHAN, Y., ZHENG, B., LIANG, X., MENG, J., and TAO, S., ‘Adaptive CO2 emissions mitigation strategies of global oil refineries in all age groups’. One Earth, vol. 4, no. 8, (2021), pp. 1114 - 1126.

3. The World Bank, Carbon Pricing Dashboard, last updated on 1 April 2022, https://carbonpricingdashboard.worldbank.org/ map_data

4. ABU-ZAHARA, M. R. M., EL NASR, A. S., Al HAJAJ, A., and GOETHEER, E. L. V., ‘Techno-economics of liquid absorbent-based post-combustion CO2 processes’, Absorption-Based Post-combustion Capture of Carbon Dioxide, Woodhead Publishing, (2016), pp. 685 - 710.

5. ‘Understanding the Cost of Retrofitting CO2 capture in an Integrated Oil Refinery’, IEAGHG, (August 2017).

6. PÉREZ-CALVO, J. F., and MAZZOTTI, M., ‘Techno-economic assessment of post-combustion CO2 capture using aqueous piperazine at different flue gas compositions and flowrates via a general optimization methodology’, International Journal of Greenhouse Gas Control, (2022).

7. ‘Process Development and Optimization of Absorption-Based Post-Combustion CO2 Capture Technologies Applied to Industrial Point Sources’, ETH Zurich, (2021), https://www.researchcollection.ethz.ch/handle/20.500.11850/530962

April 2023 HYDROCARBON ENGINEERING 18

Figure 3. Example of Sulzer’s skid-mounted solution: modular process plants are predestined for decentralised applications such as carbon capture from hydrocarbon processing facilities.

Limiting global warming to acceptable levels, whilst still maintaining our current lifestyles and continuing to produce and use carbon-containing products such as plastics or fuels, is the major challenge of the energy transition. The only solution to this challenge is a net zero emission scenario where carbon dioxide (CO2) levels in the atmosphere are kept at least constant. In other words, the carbon offtake, mainly through biomass generation (short regenerative carbon cycle), must match CO2 emissions.

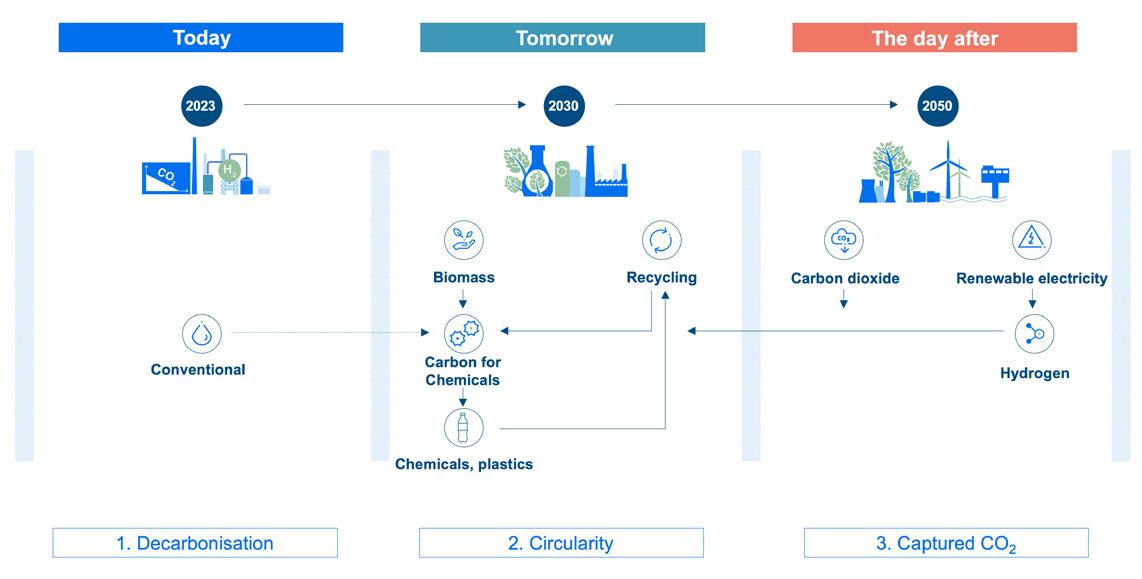

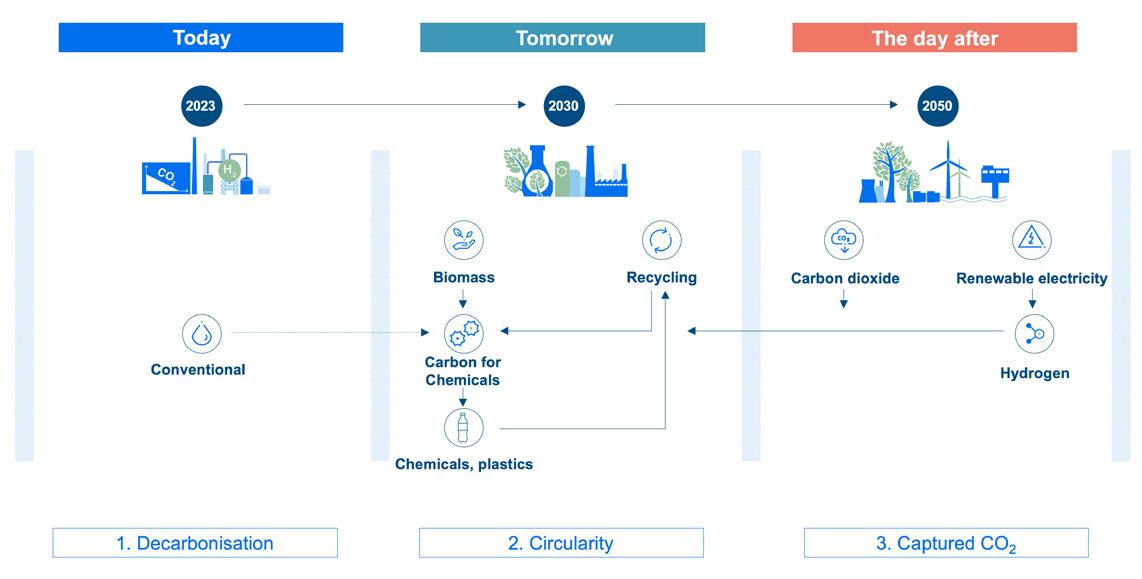

Consequently, this means that fossil carbon emissions need to be either completely avoided via decarbonisation, which is not always practical or economically-feasible, or that fossil carbon emissions are replaced by biogenic (derived from biomass) carbon emissions over time. Such a transition will take time, as it involves the adaption of many industries, but the good news is that the journey has started and that the principles of circularity and sustainable chemistry will help to achieve the target (Figure 1).

The beginning of the journey to decarbonise the manufacturing base was the introduction of more carbon-efficient catalytic processes, the use of renewable electricity as a source of energy instead of fossil fuels, and a more intimate and optimised integration between the monomer production facilities and their derivative units.

In addition to these decarbonisation methods, circularity principles offer further reduction of the CO2 footprint to achieve the chemical industry’s emission targets

April 2023 19 HYDROCARBON ENGINEERING

Andrew Reynolds and Andreas Bormann, Technip Energies, consider ways in which the chemical industry is adapting in order to meet the net zero challenge.

via a shift to circular feedstocks. The replacement of fossil-based carbon feedstocks by circular feedstocks with increasing amounts of recycled end-of-life plastic resin is an accessible and short-term solution that has started with mechanical and chemical recycling (thermal pyrolysis route). These recycling techniques will soon be followed by even more carbon-efficient chemical recycling solutions, at least for functional polymers, that render high-purity recycled monomers.

The second big driver towards a zero-emission target is via sustainable chemicals. CO2, captured during photosynthesis and converted naturally to carbohydrates where it is then stored in plants, is an ideal certifiable source of sustainable, biogenic carbon. The incorporation of biogenic carbon into the materials’ value chain reduces the carbon footprint to net zero, unlocks the use of agricultural waste streams, and has a direct impact on the reduction of fossil feedstocks.

A truly sustainable solution can therefore be obtained when end-of-life plastics recycling is combined with the introduction of biogenic carbon feedstock co-processing.

Thinking one step further, besides using biomass and recycled wastes as a major feedstock source for sustainable carbon, usage of captured CO2 from the air or from sustainable chemistry processes will provide another source of sustainable carbon, consequently enhancing sustainability.

While most of the technologies required for circularity and sustainable chemistry are already available, or at least in their advanced development stages, and despite increasing prices of oil and CO2, there will still be a need for a more eco-oriented legislation and consumer awareness to bring these new value chains to fruition.

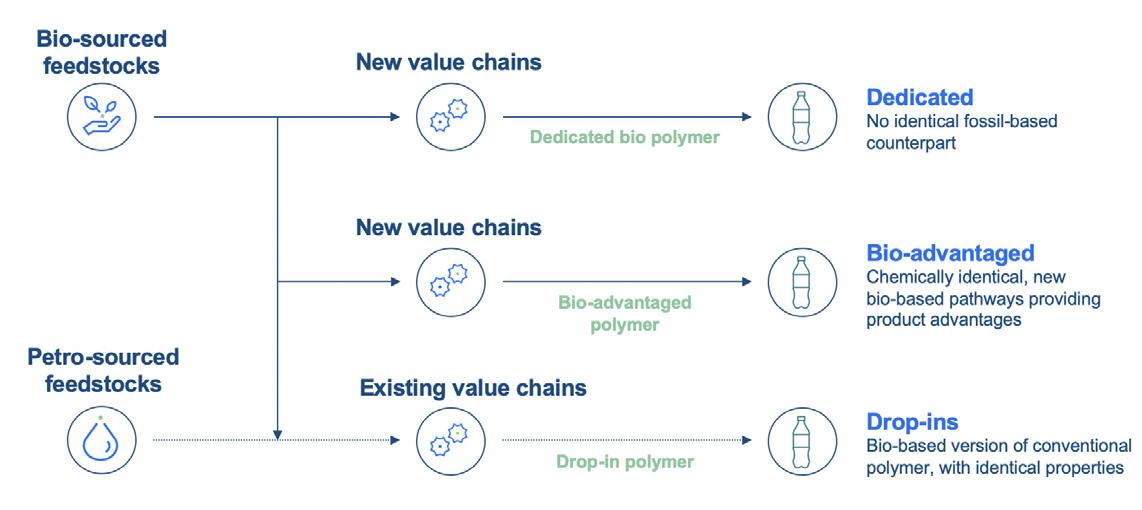

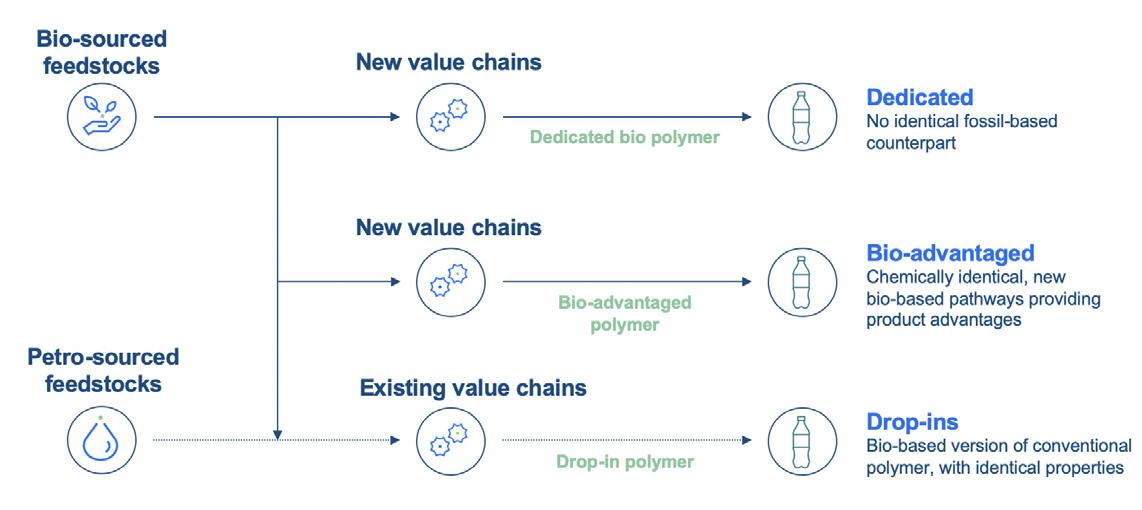

Biopolymers

Although advanced recycling techniques are starting to be deployed on a wide-scale in Europe, pulled by favourable legislation, we are seeing a more focused introduction of biodegradable polymers in Southeast Asia – and more specifically, in China. The introduction of bio-sourced polymers is yet to be seen on a large-scale (Figure 2).

High-volume polyolefin resins that are essentially polyethylene and polypropylene are intrinsically difficult to recycle due to the strong intra-molecular

April 2023 HYDROCARBON ENGINEERING 20

Figure 1. The path to sustainability.

Figure 2. Biopolymer routes.

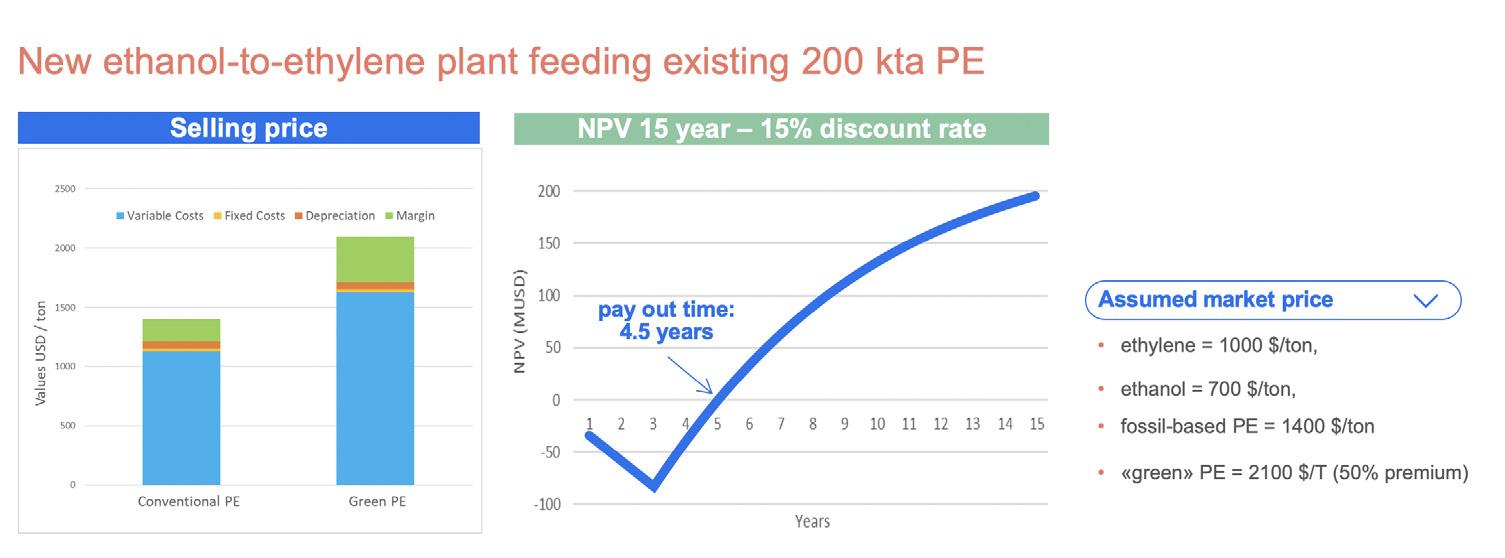

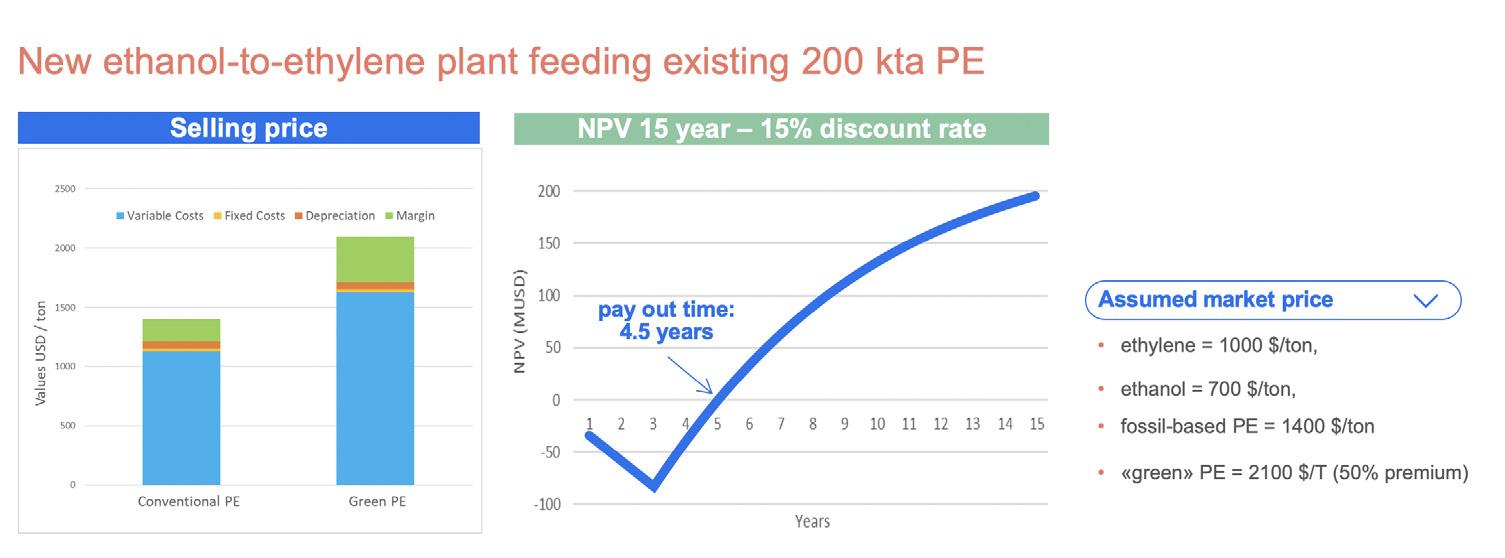

Figure 4. Economics of bio-PE production from ethanol.

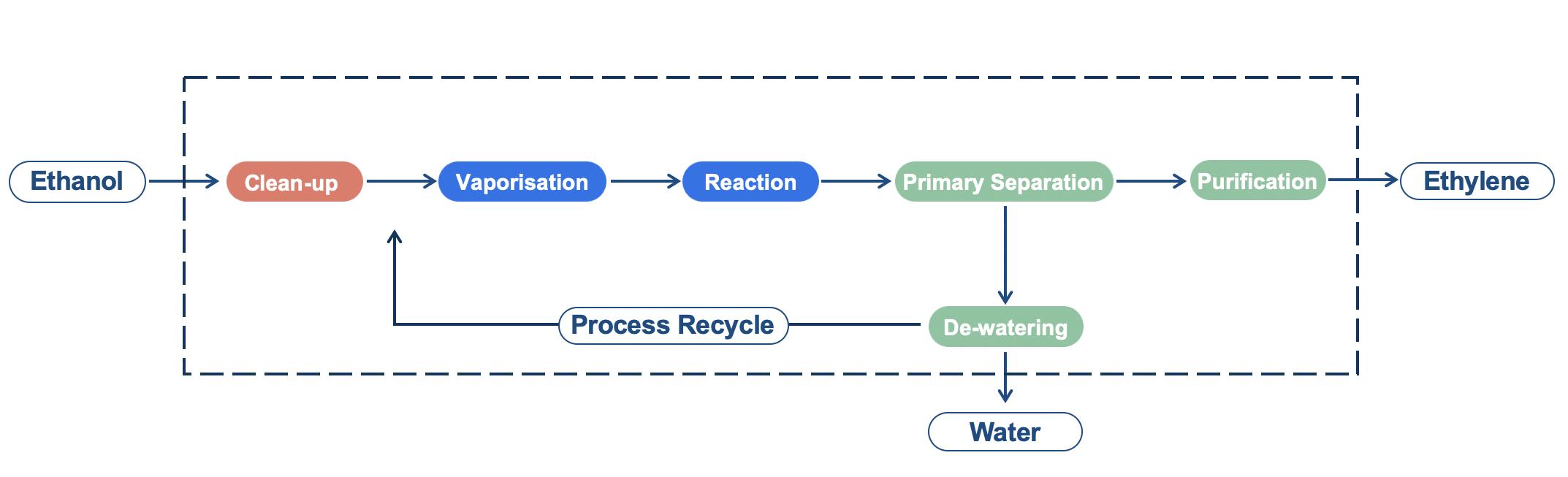

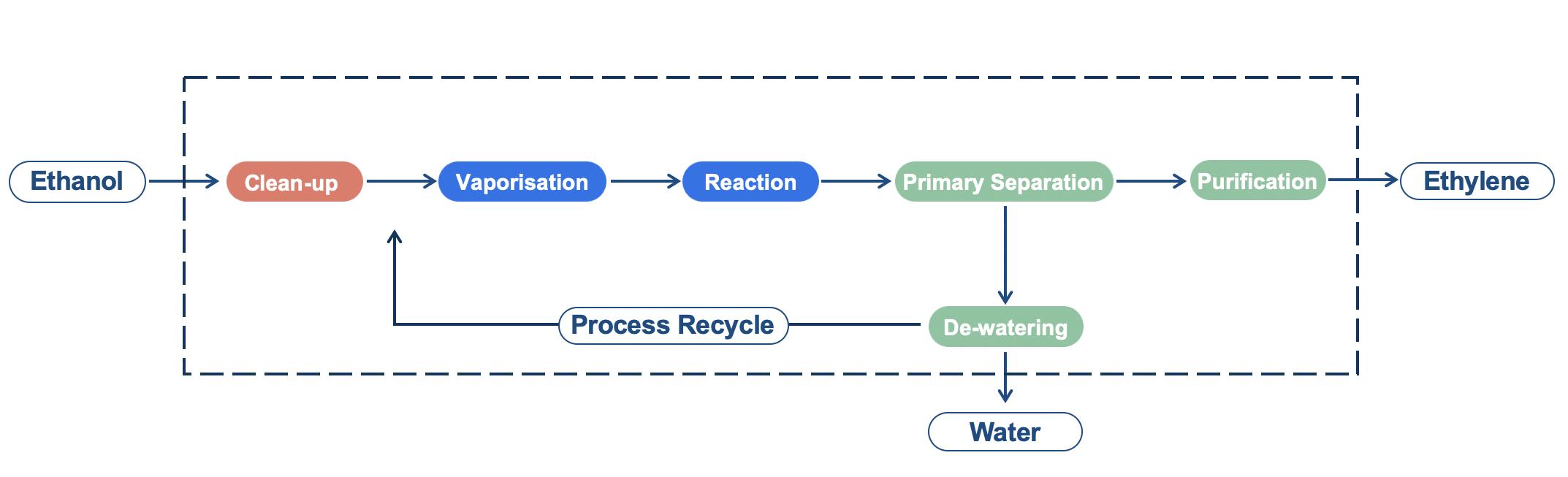

Figure 3. Ethanol-to-ethylene preparation unit.

bonding, and are currently at best valorised by pyrolysis. In the future, and to avoid a wide-scale ban, the industry must find a sustainable solution for these resins. A few alternative solutions are presented in the following case studies.

Case study: retro-feeding a bio-sourced feedstock to an existing European polyethylene unit

Industry cannot rely entirely on favourable legislation and carbon credits to move forward towards a cleaner environment. The introduction of climate-friendly solutions that are economically-justifiable is a low-hanging fruit solution that should be adopted quickly.

Figure 3 is an example of a drop-in polymer solution for polyethylene that may provide favourable economics by way of customer proximity and acceptable green premiums on the products. From a technology point of view, ethylene produced from ethanol is chemically-identical to conventional sources, and may be used as a drop-in substitute. Ethanol is a liquid that is freely traded and transportable, thus easily accessible. Specifically, Figure 3 shows a typical block flow diagram of an ethanol-to-ethylene plant that uses Technip Energies’ Hummingbird® technology.

Commercially, ethanol-derived ethylene would face difficulties when competing with its fossil-based cousin, if it were traded at the same market prices. The key to achieving competitiveness is via premiums associated to the green polymer. Price premiums for this bio-sourced, green polyethylene can be more than 100% above conventional resins. As the contribution of the resin price to the overall cost of the consumer goods is small, the incremental cost burden may be easily absorbed by the retailer and maintained in the long-term. As an example, a typical running shoe weighs less than 300 g, so material cost for the polymer sole material lies in the range of €3 or less.

Production of sustainable ethylene should ideally be close to polyethylene polymerisation plants with smaller capacities to allow for full captive offtake of the sustainable ethylene produced, and should be close to consumer markets that accept green premiums.

Both of these boundary conditions are a given in Europe. The production base in Europe is composed of ageing and smaller naphtha-based units that are often stranded with fourth-quartile production costs. These units face head-on competition from the new integrated, gas-fed mega complexes in the Middle East, and will not survive global competition without a shift in strategic positioning.

withHybrid

The contribution of feedstock price to the cost of production of a polymer is preponderant, and represents more than 90%. Processing plants located in regions close to cheap feedstocks are truly advantaged. The remaining production costs are often optimised through economies of scale, with new polymer units being larger than 500 000 tpy in capacity. Smaller units have inherent economic challenges to overcome.

European polymerisation units with a newly set up ethanol-to-ethylene plant can be a good solution for rendering these plants profitable, while increasing sustainability of the product.

The return on investment (ROI) associated with building a new ethanol-to-ethylene conversion unit is attractive (Figure 4).

Optimized Gas Treating, Inc 212 Cimarron Park Loop, Buda, TX 78610 www.ogtrt.com +1 512 312 9424 Now

Solvents N o withHybridSol S me Proven Technol OGT | ProTreat® Process Simulation

The unit is simple, with low operating costs and capital expenditure (CAPEX). Marginal additional capital is required for modifying the existing polyethylene unit. The price premium of green polyethylene more than compensates for the higher feedstock price of ethylene produced from ethanol. Furthermore, product differentiation avoids head-on competition based on cost only. It is of note that no carbon credits are required to ensure profitability.

The use of bio-sourced feedstocks has a direct impact on reducing carbon footprint. The use of cellulosic feedstocks may also be envisaged to produce 2G ethanol, further enhancing the carbon balance.

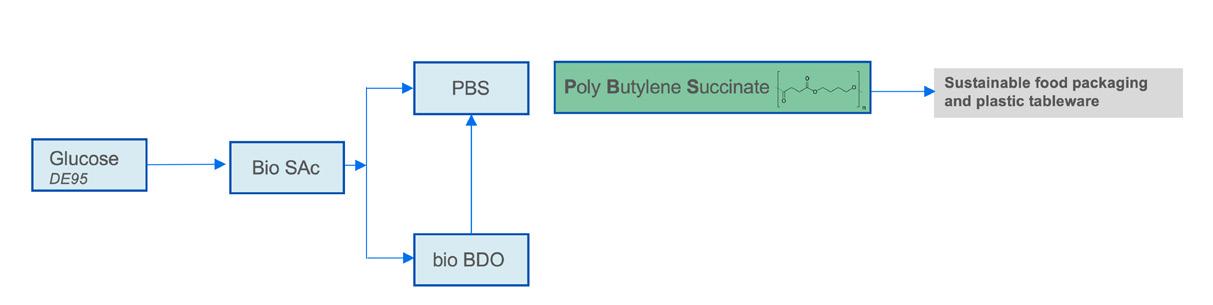

Case study: a bio-sourced feedstock to produce a biodegradable polymer

Biodegradability of polymers can help to solve the problem of plastic waste in the environment, and if combined with bio-sourced feedstocks, will add additional carbon benefits to achieve the net zero emission target. It should be noted that not all bio-sourced polymers are biodegradable.

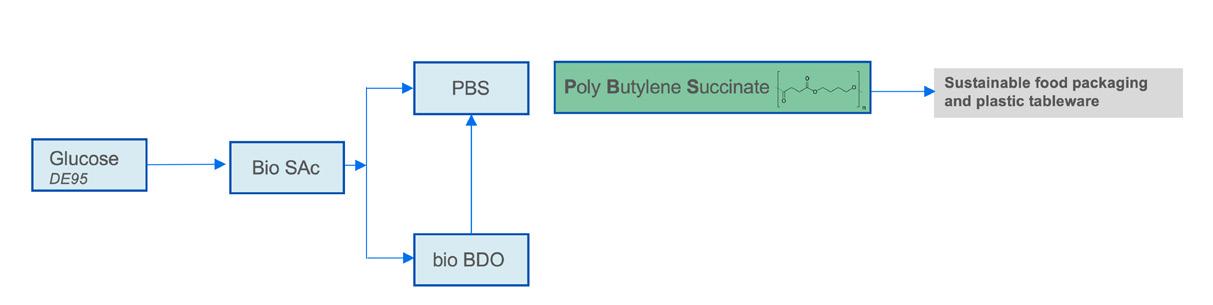

This case study takes the example of such a biodegradable, potentially bio-based polymer, polybutylene succinate (PBS),

which is a polyester with interesting intrinsic mechanical properties that can be degraded under natural environmental conditions by bacteria and fungi, according to the EN 13432. PBS is an ideal replacement for polypropylene for packaging applications, with excellent processing qualities.

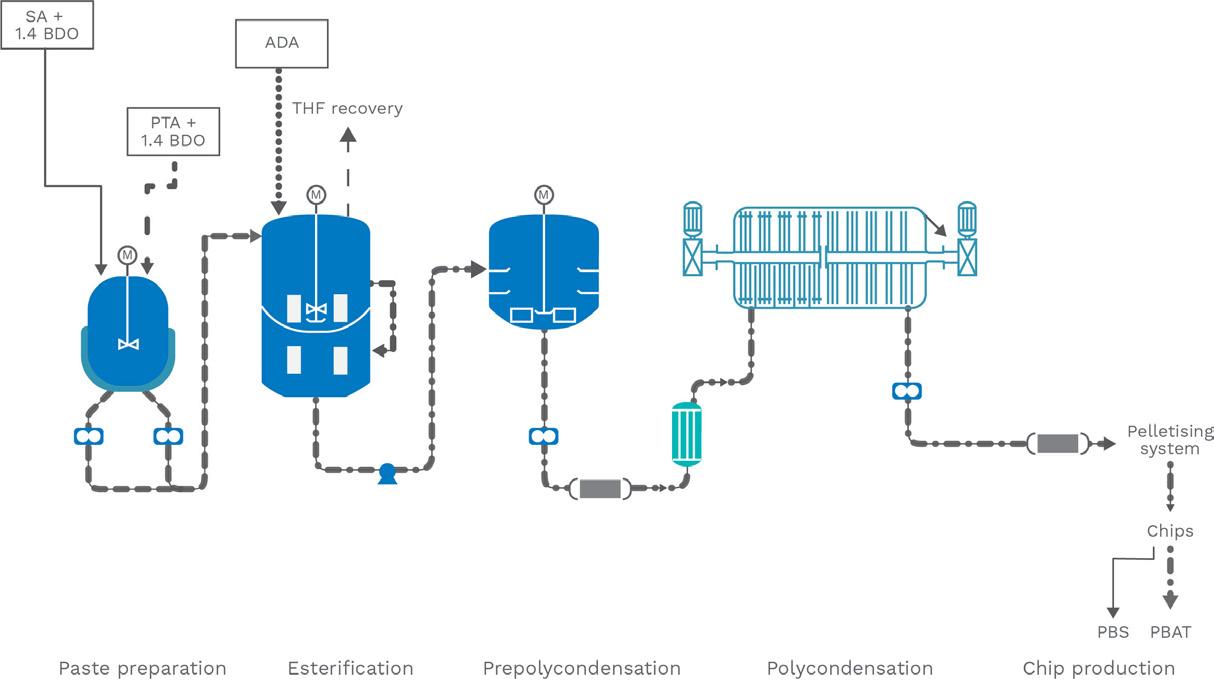

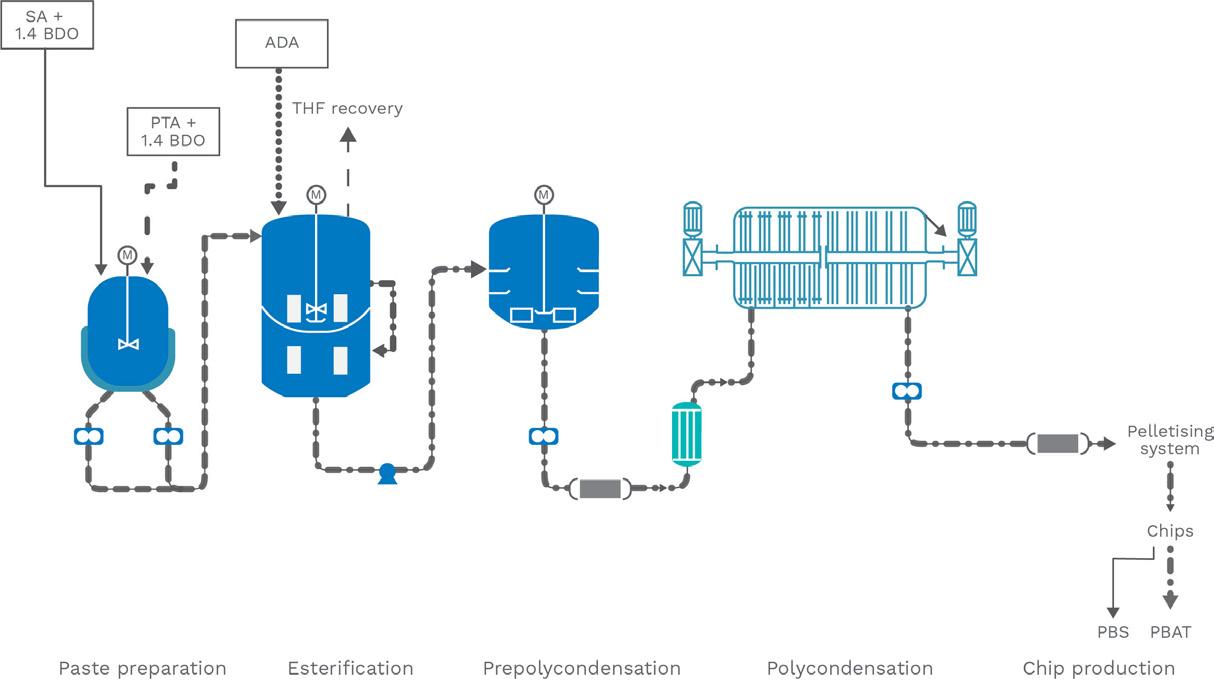

Today, PBS is mainly manufactured from the synthesis of fossil-feedstock-derived succinic acid (SA) and butanediol (BDO) via maleic anhydride routes, making it biodegradable but not bio-based.

On the other hand, PBS can be produced with 100% bio-based monomers. With the introduction of a novel technology to produce SA from glucose by fermentation, bio-based SA is available as both a monomer and a base chemical to produce BDO (Figure 5).

Using this bio-based SA, BDO can be synthesised by esterification and hydrogenation, thus yielding the two required monomers for PBS from a single feedstock: glucose. By combining these two bio-monomers, PBS can be produced – as depicted in Figures 6 and 7.

Life cycle analysis studies suggest that the use of low pH yeast fermentation with direct crystallisation is the most beneficial process to SA from an environmental perspective, with more than 50% reduction in greenhouse gas emissions.

From a carbon perspective, and specifically useful to the packaging industry, the triple advantage of reducing the cost of waste collection, reducing the carbon footprint due to the absence of energy required to incinerate waste plastics, and reducing waste plastics pollution is of interest.

Biosuccinium® is a novel technology for bio-succinic acid production with referenced full-scale production facilities ready for license. Zimmer® licenses its commercialised swing technology for PBAT/PBS bio-polyester production.

Conclusion

The challenge of sustainability will rely on a concerted effort by consumers, governments and the industry. The challenge will be difficult but necessary with a continued focus on the optimal use of carbon applying multiple but complementary solutions.

Bibliography

• International Energy Agency, https://www.iea.org/

• Ellen MacArthur Foundation, https://ellenmacarthurfoundation.org/

• Boston Consulting Group, https://www.bcg.com/

• Renewable Carbon Initiative, https://renewable-carbon-initiative.com/

• COK, B., et al., ‘Succinic acid production derived from carbohydrates: an energy and greenhouse gas assessment of a platform chemical toward a bio-based economy’, (2 August 2013), https://onlinelibrary.wiley.com/ doi/full/10.1002/bbb.1427

• ‘Technip Energies Process Technology Handbook’, Technip Energies, (January 2023), https://edition.pagesuite.com/html5/reader/ production/default.aspx?pubname=&pubid=9f345b4c-683a-40dcb3b4-dbb8fce57a5b

April 2023 HYDROCARBON ENGINEERING 22

Figure 5. Bio PBS value chain.

Figure 7. Fabrication scheme of PBS from bio-SA and BDO.

Figure 6. PBS chemistry from bio-SA and BDO.

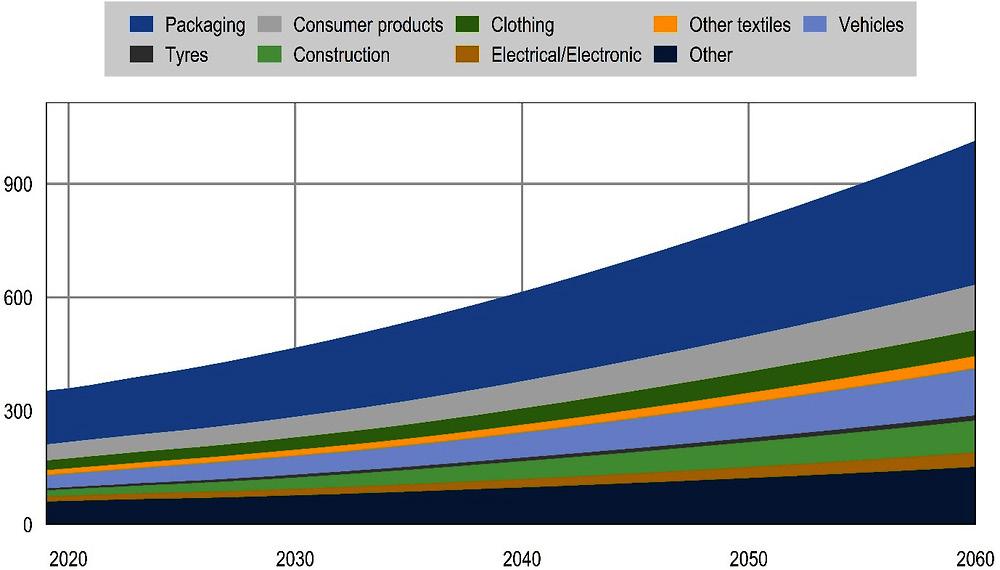

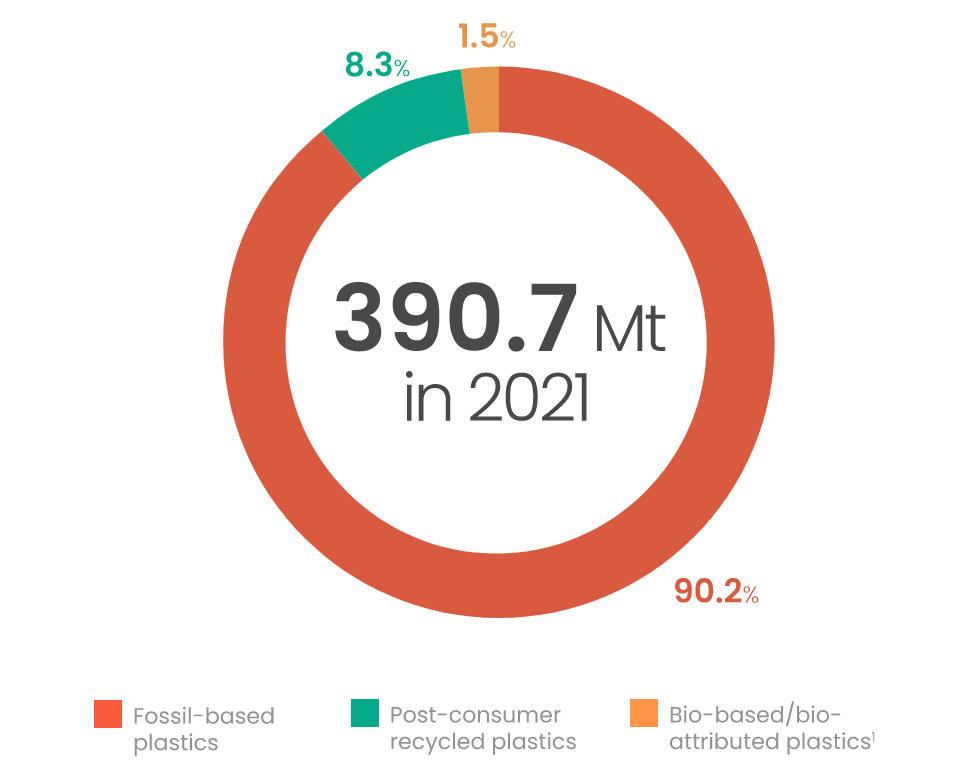

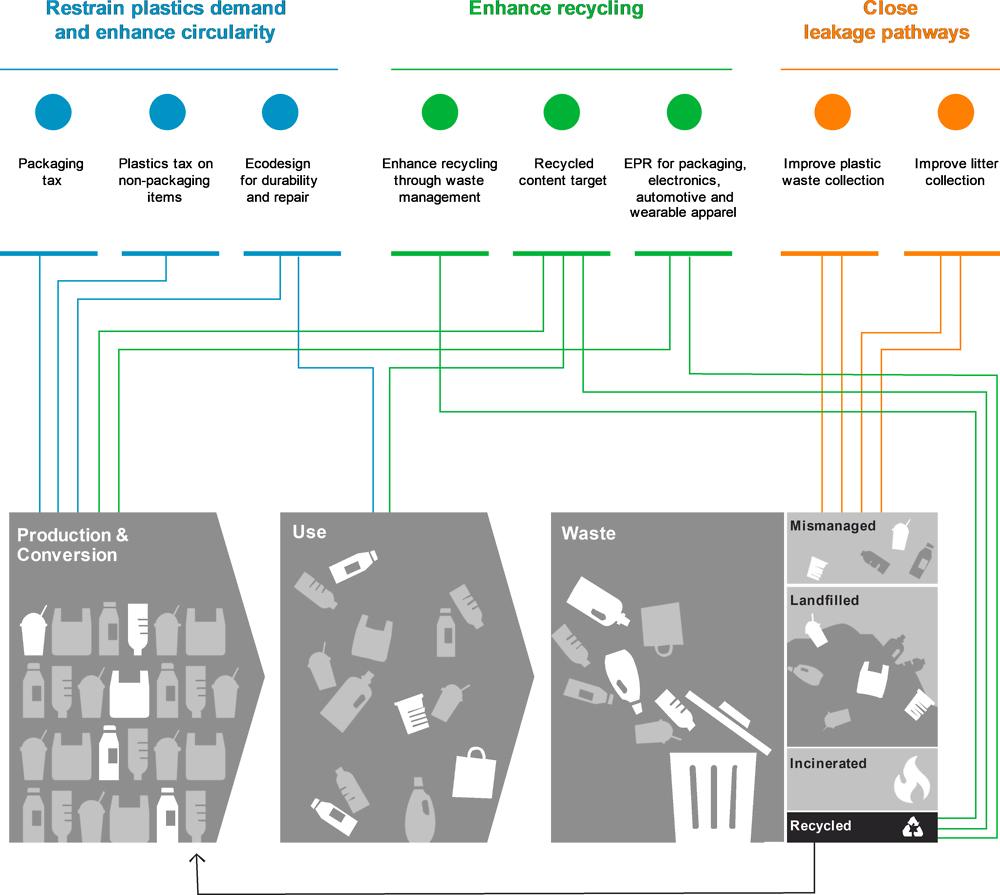

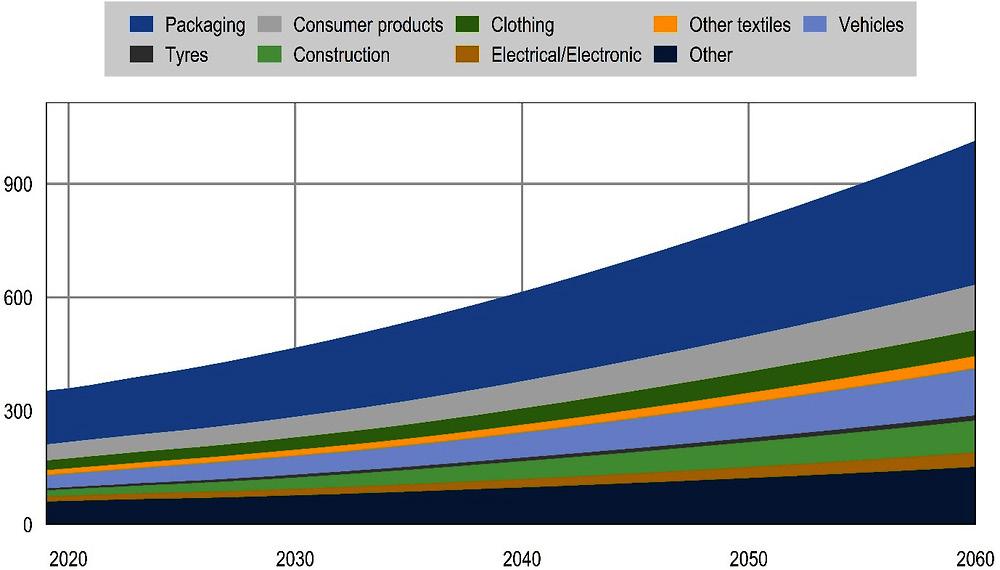

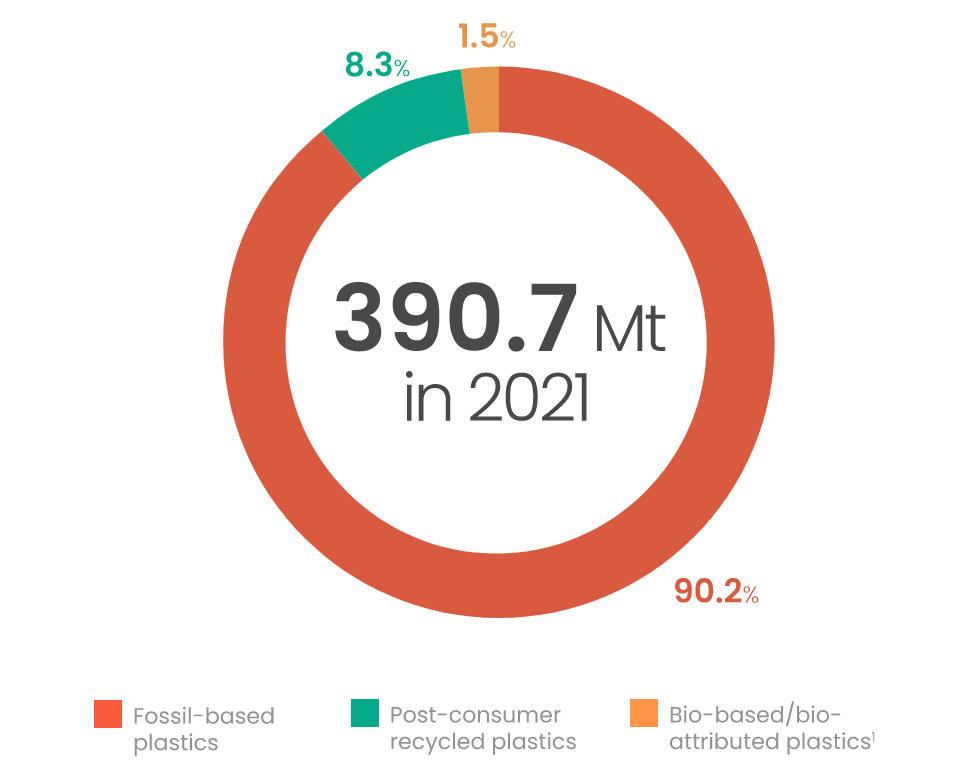

According to the Organization for Economic Cooperation and Development (OECD)’s ‘Global Plastics Outlook’, published in February 2022, global plastics production has doubled from 234 million t in the year 2000 to 460 million t in 2019, outpacing economic growth in this period by almost 40%.1 In the same timespan, global annual plastic waste has more than doubled to 353 million t in 2019 (from 126 million t in 2000). The OECD report concludes that humanity’s current use of plastics is far from circular, with only 55 million t (out of 353 million t) of plastic waste being collected for recycling – half of which is disposed of in sanitary landfills, whereas 19% is incinerated and only 9% (33 million t)

ultimately recycled. This leaves 22% of plastic waste that is disposed of in uncontrolled dump sites, burned in open pits, or leaked into the environment.

Beyond being a hazard to the marine and terrestrial environment, as well as to humans, the report also identifies plastics as a substantial contributor to greenhouse gas (GHG) emissions (approximately 3.4% [1.8 Gt] of emissions globally). 90% of these GHGs come from their production and conversion from fossil fuels, so closing material loops could lower the carbon footprint of plastics substantially.

With global plastic waste on track to almost triple by 2060 (see Figure 1), radical global action will be needed to curb demand, increase

April 2023 23 HYDROCARBON ENGINEERING

Dr. Sander Willems, Antonio Batistini, Andrea Angeletti and Barbara Morico, Maire Tecnimont Group, Italy, discuss the company’s circular recycling model that is aimed at maximising the valorisation of plastic waste.

product lifespans, and improve waste management and recyclability of plastics in order to achieve a world free of plastic pollution, according to the ambitions of the United Nations Environment Assembly.2

Today, most plastics are still produced from fossil-based feedstock. Transitioning to a circular, climate-neutral economy calls for investments and innovation from the entire plastics value chain to develop new business models for reuse, produce more recycled plastics, and generate new feedstocks that are less dependent on fossil-based oil and gas.3

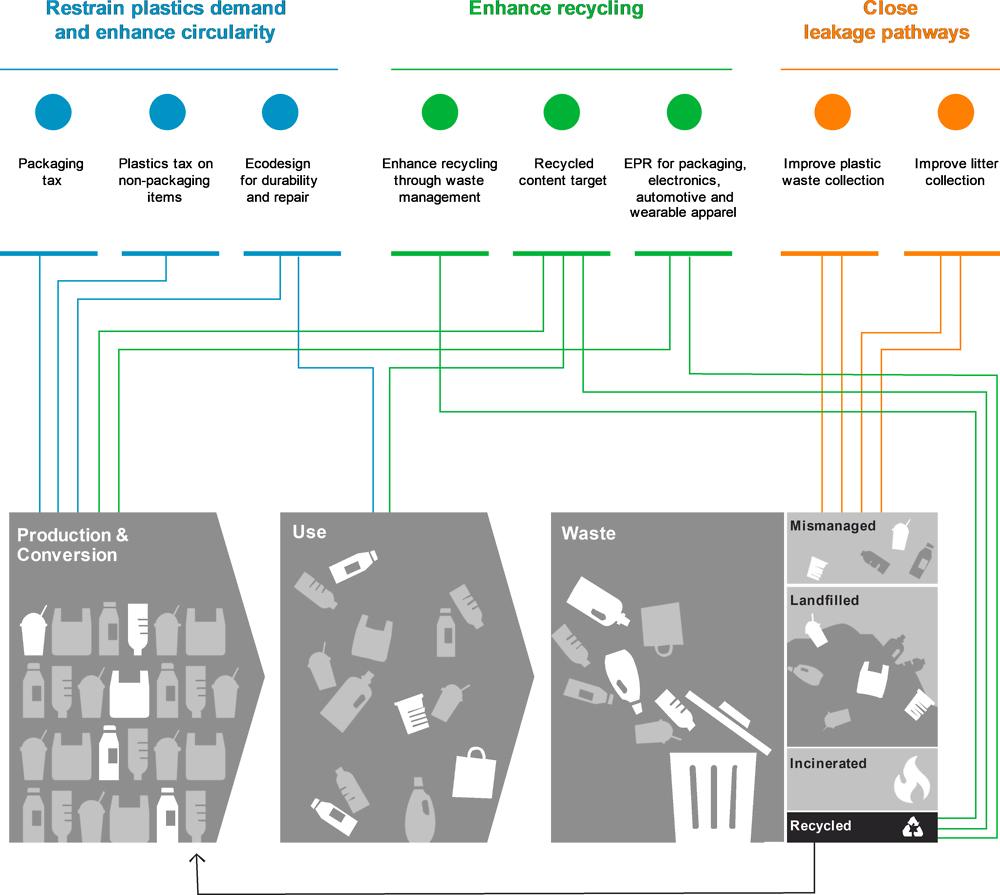

The OECD categorises the policies required into three main pillars (see Figure 2), each of them spanning multiple available technologies or instruments.2

While there are significant opportunities to reduce, redesign or, in some cases, substitute plastic in the system, these are

expected to tackle waste disposal and GHG emissions only partially, even if solutions are scaled up drastically. Similarly, downstream solutions are essential but limited by economic-viability, speed of infrastructure development, and feedstock tolerances and quality. Relying only on an ambitious scale-up of mechanical and chemical recycling also leaves substantial waste disposal and GHG emissions in the system. According to an independent study commissioned by Plastics Europe, all of these solutions have an important role to play in the future plastics system, and only a combination of all available solutions and technologies will facilitate the achievement of the challenging but necessary targets.4

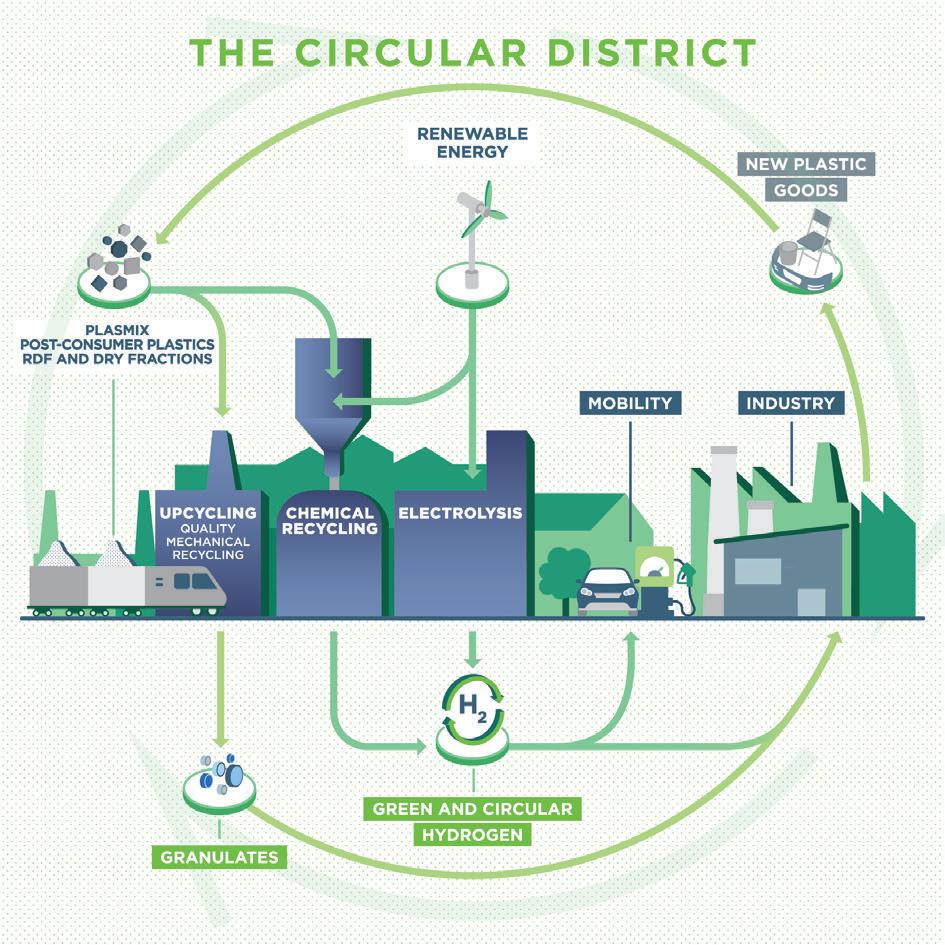

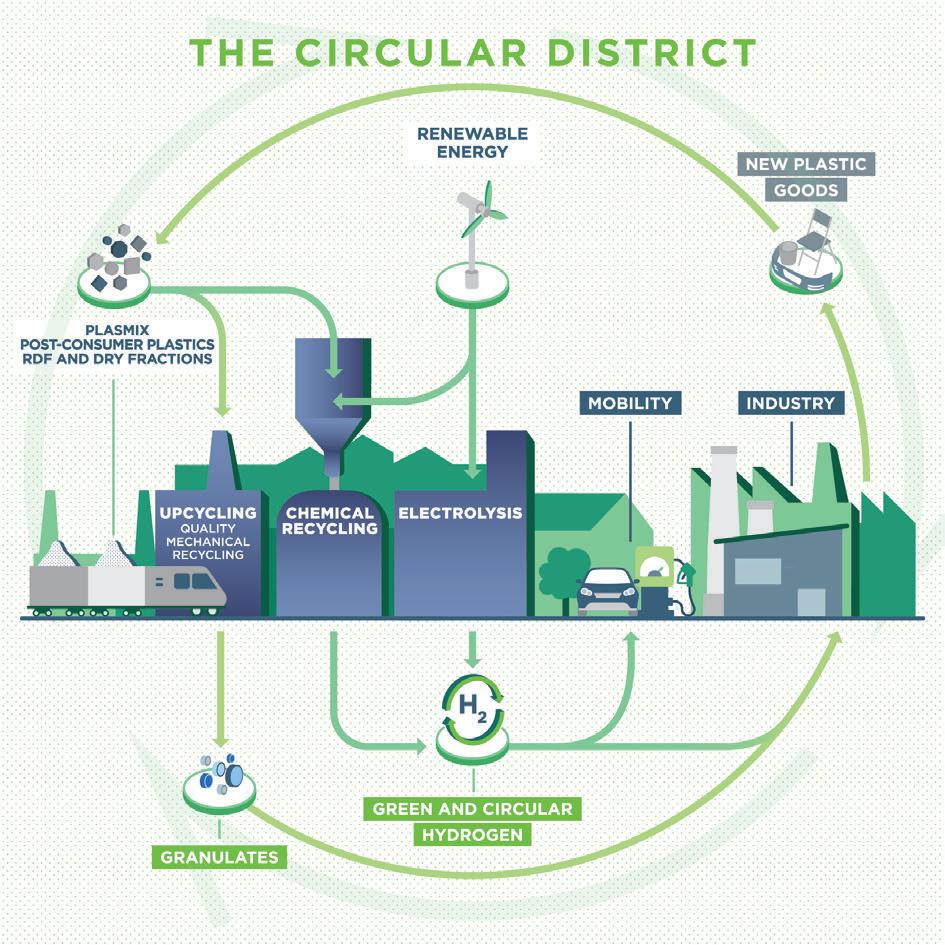

For this purpose, Maire Tecnimont Group, through its subsidiary NextChem, has developed its Green Circular Districts model (Figure 3).5 This model integrates various green chemistry technologies, including plastic and other waste recovery technologies, in order to support a circular economy, as well as decarbonisation in general.

The future of plastics recycling

Even if reduced drastically, the plastic waste that humanity is likely to continue producing for decades to come, along with the plastic waste currently at large in the world, will still need to be managed and preferably recycled (as opposed to incinerated or disposed of otherwise) according to the circularity principle. In addition to this, a switch to renewable feedstocks for plastics, which is highly desirable from a carbon footprint point of view, would not render the recycling step obsolete, as the derived plastics still need to be managed, making recycling a key step in the circular pathway.

The current low share of plastic recycling (see Figure 4) implicates significant losses for the economy and the environment. Almost two-thirds of plastic waste results from relatively short-lived products (e.g. packaging, consumer goods, textiles)1 and it is estimated that 95% of the value of plastic packaging material alone is lost to the economy after a short first-use cycle.6 To be able to extract the value from the vast pool of post-consumer feedstock currently not made available for recycling, large investments in waste collection capacity and logistics, as well as in existing mechanical and chemical recycling capacities and technologies, are needed.

The available technologies for producing recycled plastics can be divided into mechanical recycling or upcycling and chemical recycling, the latter also being referred to as advanced recycling (enhanced recycling in the US), or feedstock recycling.

By combining various technologies in the Green Circular District, synergies can be achieved, such as the dedication of part of the mechanical recycling process (pre-treatment and possibly some separation and decontamination steps) to the preparation of feedstock for downstream recycling technologies.

April 2023 HYDROCARBON ENGINEERING 24

Figure 1. Plastic waste by application (million t), OECD baseline scenario 2020 – 2060 (source: OECD).

Figure 2. Circularity policies along the entire plastics life cycle (source: OECD).

Mechanical recycling

The term mechanical recycling refers to a combination of treatment steps and technologies in which the molecular structure of the original polymer is not altered. A mechanical recycling process typically starts with a sequence of pre-treatment steps, followed by a separation and decontamination phase. The mechanical recycling process can then be concluded with a granulation step to achieve what NextChem calls ‘upcycling’. Through upcycling, a process applied at NextChem’s MyReplast Industries plant (see Figure 5), the properties of recycled plastics can be modified and improved to achieve properties similar to those of the virgin plastics that they replace.

Pre-treatment

n Manual selection.

n Ballistic separation (2D vs 3D fraction).

n Size reduction (pre-grinding and post grinding).

n Dry cleaning: dust and light fraction removal through air-sifting or aspiration.

n De-metallisation: ferrous (e.g., magnetic belt) and non-ferrous (eddy current).

Separation and decontamination

n Washing: cold or hot wash, friction wash.

n De-inking.

n Flotation separation: gravimetric separation in water or in multiple density-adjusted solutions.

n Tribo-electric (electrostatic) separation.

n Optical selection (detection combined with air-jet expulsion):

§ Laser scanning – shape recognition.

§ Visible light – colour selection.

§ Infra-red recognition – near-infrared (NIR) or mid-infrared (MIR) sensors.

Pelletisation (upcycling)

n Melt filtering (removes inclusions as small as 80 �m).

n Melt degassing and deodorisation (removal of volatile components).

n Extrusion and pellet cutting.

n Deodorisation of pellets (additional removal of low boiling volatile components).

During pelletisation, several types of plastic flakes can be compounded with other types of flakes or pellets, mineral fillers, and impact modifiers to obtain upcycled products with improved performance (see Figure 6).

As the separation and decontamination steps are based on different principles, the configuration of a mechanical recycling process strongly depends on the feedstock composition and targeted output and purity.

Solvent-based recycling

The European Coalition for Chemical Recycling defines chemical recycling as “[a process] that converts polymeric waste by changing its chemical structure to produce substances that are used as products or as raw materials for the manufacturing of products. Products exclude those used as fuels or means to generate energy”.7 Going strictly by the definition of chemical recycling, the recycling processes using solvents for decontamination falls under mechanical recycling, as the structure of the original polymer is largely preserved and only contaminants and additives are removed. Through solvent recycling, high-purity recycled polymers with natural colour can be obtained. Solvent recycling does require a relatively pure input stream in terms of polymer composition, to be efficient.

Chemical recycling

As opposed to mechanical recycling, in chemical recycling the chemical structure of the polymers in the plastic waste is modified. More specifically, the polymer chains are partially or completely broken down into their constituting monomers, into heavy and/or light hydrocarbon fractions similar to crude oil fractions, or into syngas.

April 2023 HYDROCARBON ENGINEERING 26

Figure 3. Maire Tecnimont’s Green Circular District model.

Figure 4. World plastics production in 2021 (source: Plastics Europe).

Chemical recycling is generally divided into three main categories: depolymerisation, pyrolysis and gasification.

Depolymerisation

The depolymerisation process – often referred to as chemolysis or solvolysis – uses different combinations of solvents and heat to break down polymers into their monomers or into intermediates for polymerisation. Depending on the polymer and the related chemistry, depolymerisation is achieved by water (hydrolysis), methanol (methanolysis) or other alcohols (ethanolysis, glycolysis, etc, or more generally ‘alcoholysis’), usually in combination with heat and in some cases with the help of a catalyst.

Polycondensation polymers such as PET and nylon (PA) and polyurethanes (PUR) are suitable for depolymerisation, whereas poly-addition polymers tend to break up into fragments in a less specific manner, not yielding the original monomers in a selective way but randomly, typically requiring more downstream refining.

Depolymerisation processes require a highly pure plastic waste fraction, in terms of polymer composition, to be efficient. Such fractions can either be obtained through closed-loop recycling schemes (e.g., an EPR scheme) or through a pre-treatment and separation process similar to that applied in mechanical recycling.

NextChem is a development partner in the EU-funded DEMETO project for the high-performance microwave technology for PET depolymerisation. In such a technology, coloured or highly-contaminated PET from food packaging and polyesters from textile waste that cannot be mechanically recycled are depolymerised using an alkaline hydrolysis process, assisted by microwaves. The downstream processing allows for the purification of the monomers that can be used to produce a new virgin polymer, closing the loop between PET and polyester materials.8

Pyrolysis

Pyrolysis is a thermal degradation process performed at temperatures of over 400°C in an inert (oxygen-free) atmosphere. Mixed plastic waste fractions that are not suitable for mechanical or solvent recycling can be recycled through this thermal degradation process into a mixture of gaseous and liquid hydrocarbons. After a hydrogenation step, these can then be employed as fuels or as feedstock for traditional petrochemical refining and cracking processes to produce, among other things, new monomers for polymerisation. Pyrolysis technology is especially suitable for multi-layer plastics that cannot be separated mechanically or by selective dissolution.

Although pyrolysis processes perform well with mixed plastics, pre-selection and pre-treatment is required to reduce the amount of inerts and undesired polymers that can generate unwanted or harmful byproducts (e.g., chlorine content due to presence of PVC) or reduce the yield (e.g., due to the presence of oxygen-rich polymers such as polycarbonate or PET).

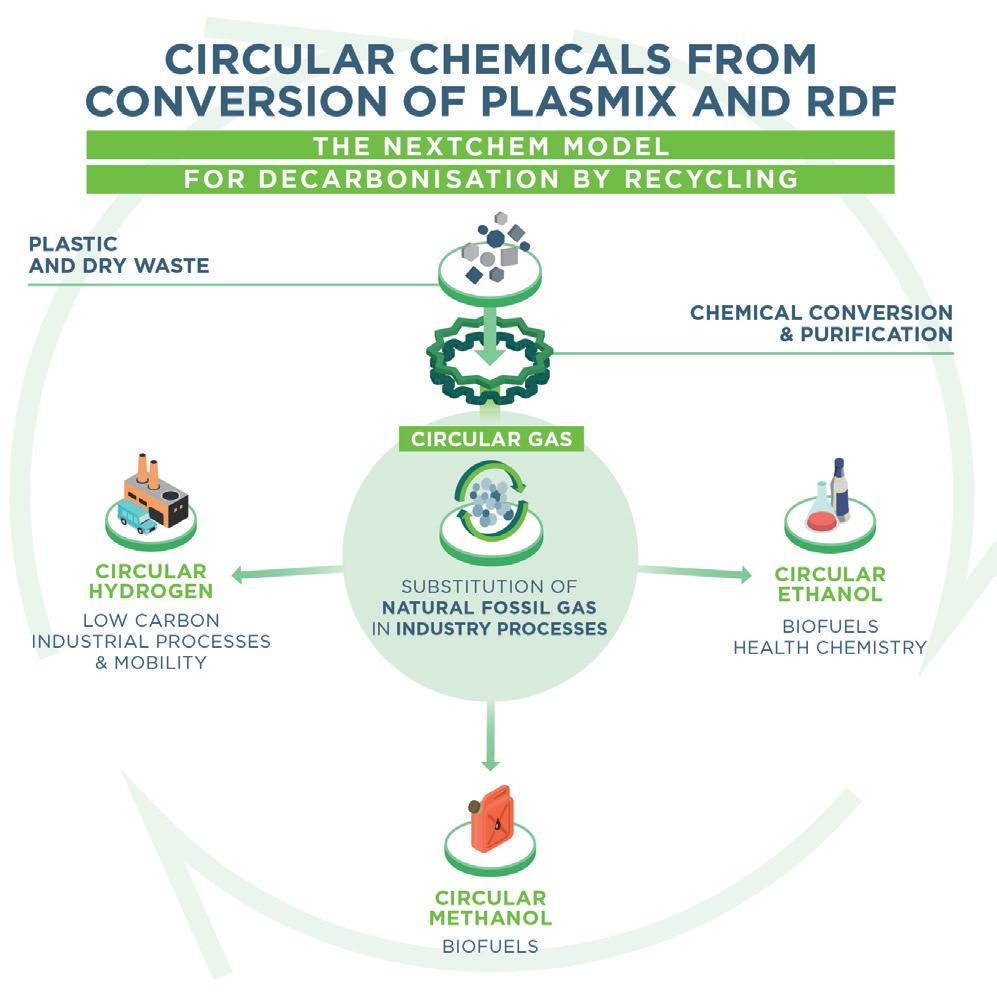

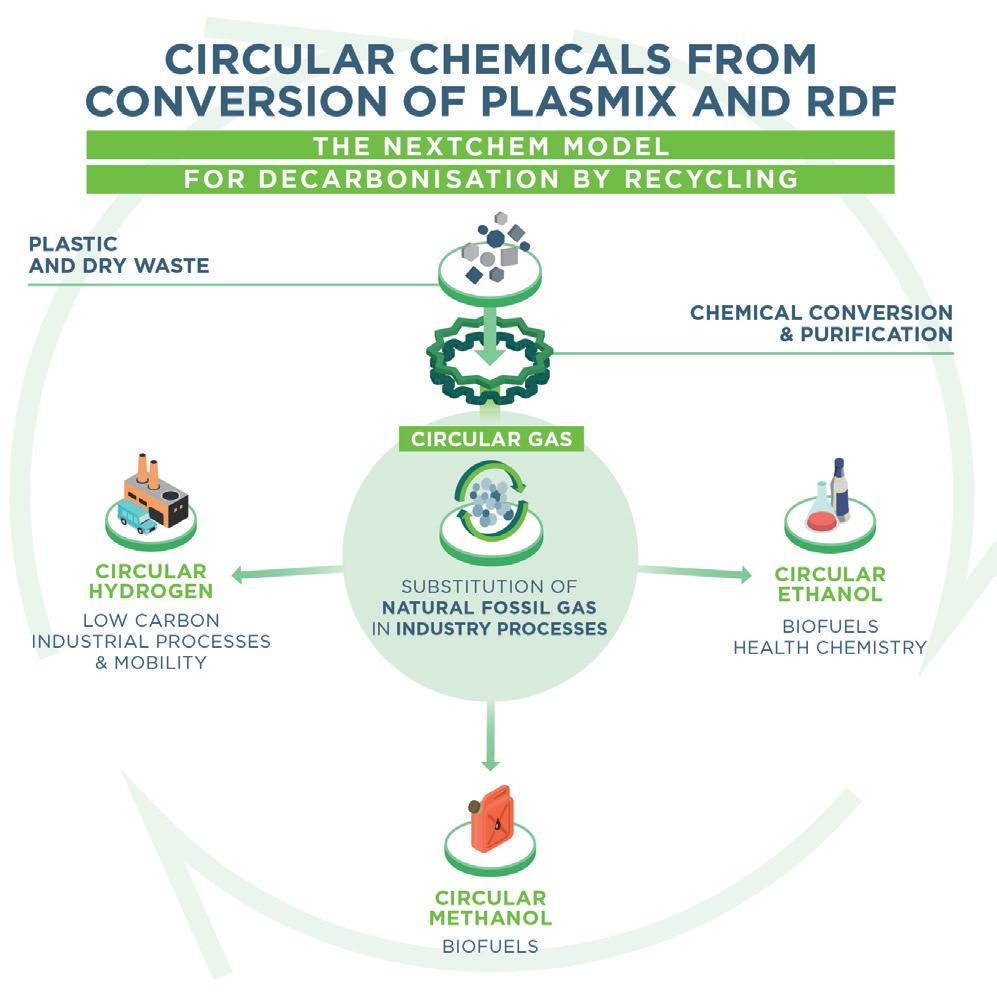

Waste-to-chemicals

Through the waste-to-chemicals process, a thermal partial oxidation process, a Circular Gas® (mixture of hydrogen and

carbon monoxide[CO]) is obtained that can be used as substitution for syngas, as fuel, or as feedstock for producing several molecules such as Circular Hydrogen®, Circular MethanolTM, Circular EthanolTM, Circular Ammonia, and combinations thereof (e.g., co-production of Circular Hydrogen and Circular Methanol). From these products,

April 2023 HYDROCARBON ENGINEERING 27

Figure 6. MyReplast granules.

Figure 7. NextChem’s waste-to-chemical technology concept.

Figure 5. MyReplast plant in Bedizzole, Italy.

a range of other chemicals can be synthesised, including monomers for polymerisation (e.g., polyethylene and polypropylene) and fuels such as sustainable aviation fuel (SAF). The waste-to-chemicals process can be combined with green hydrogen to enhance the overall yield while reducing CO2 emissions to zero.

Waste-to-chemicals processes, such as those offered by NextChem’s subsidiary MyRechemical, require high temperatures for thermal oxidation (1000 – 1800°C) while using pure oxygen as a gasifying agent, and need to be operated at a scale above 50 000 tpy in order to be economically-viable. They are able to process difficult-to-recycle mixed waste streams that can include non-plastic impurities, such as organic waste, requiring less pre-treatment and less pre-selection in terms of inerts and undesired polymers (e.g., chlorinated plastics).

Conclusion

To achieve the targets for recycling and recycled content, large recycling capacities need to be developed, leveraging all available recycling technologies – from mechanical to chemical recycling.

Full potential can only be reached if a level playing field is created for all recycling, collection and sorting technologies to develop and attract investments. This requires science-based material and technology-neutral regulations that consider the environmental impact of the recycling process, as well as the complete life cycle impact of recycled plastics.9

On Demand Webinars

Especially when it comes to sensitive plastic packaging, chemical recycling is expected to help fill the gap between the current mechanical recycling capacities and to overcome some of its shortcomings while addressing the large gap in supply and demand for recycled content. To stimulate investments in chemical recycling, end-of-waste criteria for its outputs need to be harmonised globally, and at the same time the mass balance approach to tracing and certifying recycled content needs to be clarified and embedded in legislation. In summary, through the application of a Green Circular District approach, plastic waste is poised to become the crude oil of the third millennium.

References

1. ‘Global Plastics Outlook: Economic Drivers, Environmental Impacts and Policy Options’, OECD, (2022), https://doi.org/10.1787/ de747aef-en

2. ‘Global Plastics Outlook: Policy Scenarios to 2060’, OECD, (2022), https://doi.org/10.1787/aa1edf33-en.

3. ‘Plastics - The Facts 2022’, Plastics Europe, (October 2022), https:// plasticseurope.org/knowledge-hub/plastics-the-facts-2022/)

4. ‘ReShaping Plastics: Pathways to a Circular, Climate Neutral Plastics System in Europe’, SYSTEMIQ, (April 2022).

5. ‘Environmental sustainability’, Maire Tecnimont, https://www.mairetecnimont.com/en/sustainability/energytransition/green-circular-districts

6. ‘Plastic waste and recycling in the EU: facts and figures’, European Parliament, (2023), https://www.europarl.europa.eu/news/ en/headlines/society/20181212STO21610/plastic-waste-andrecycling-in-the-eu-facts-and-figures

7. European Coalition for Chemical Recycling, https://www.coalitionchemical-recycling.eu/#chemicalrecycling

8. DEMETO, https://www.demeto.eu/

9. Plastics Europe, https://plasticseurope.org/

Explore our library of free-to-access On Demand Webinars, covering a range of topics in the downstream sector Visit: www.hydrocarbonengineering.com/webinars

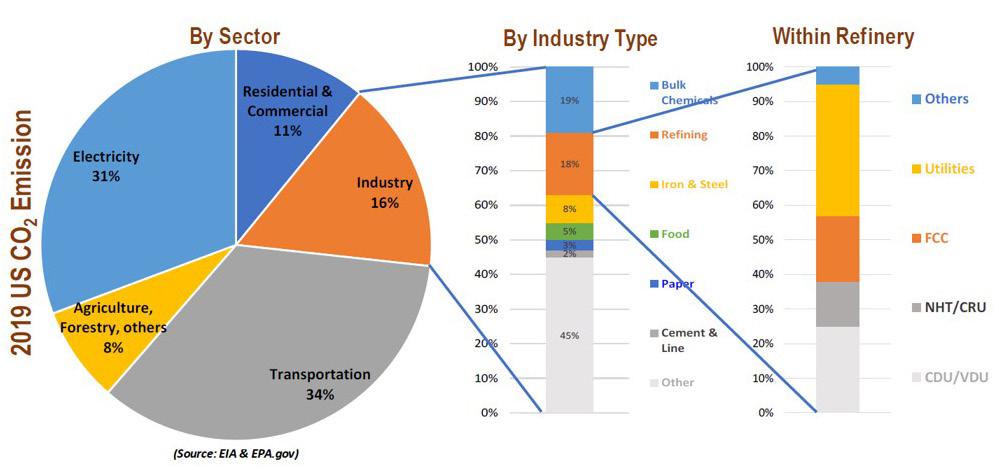

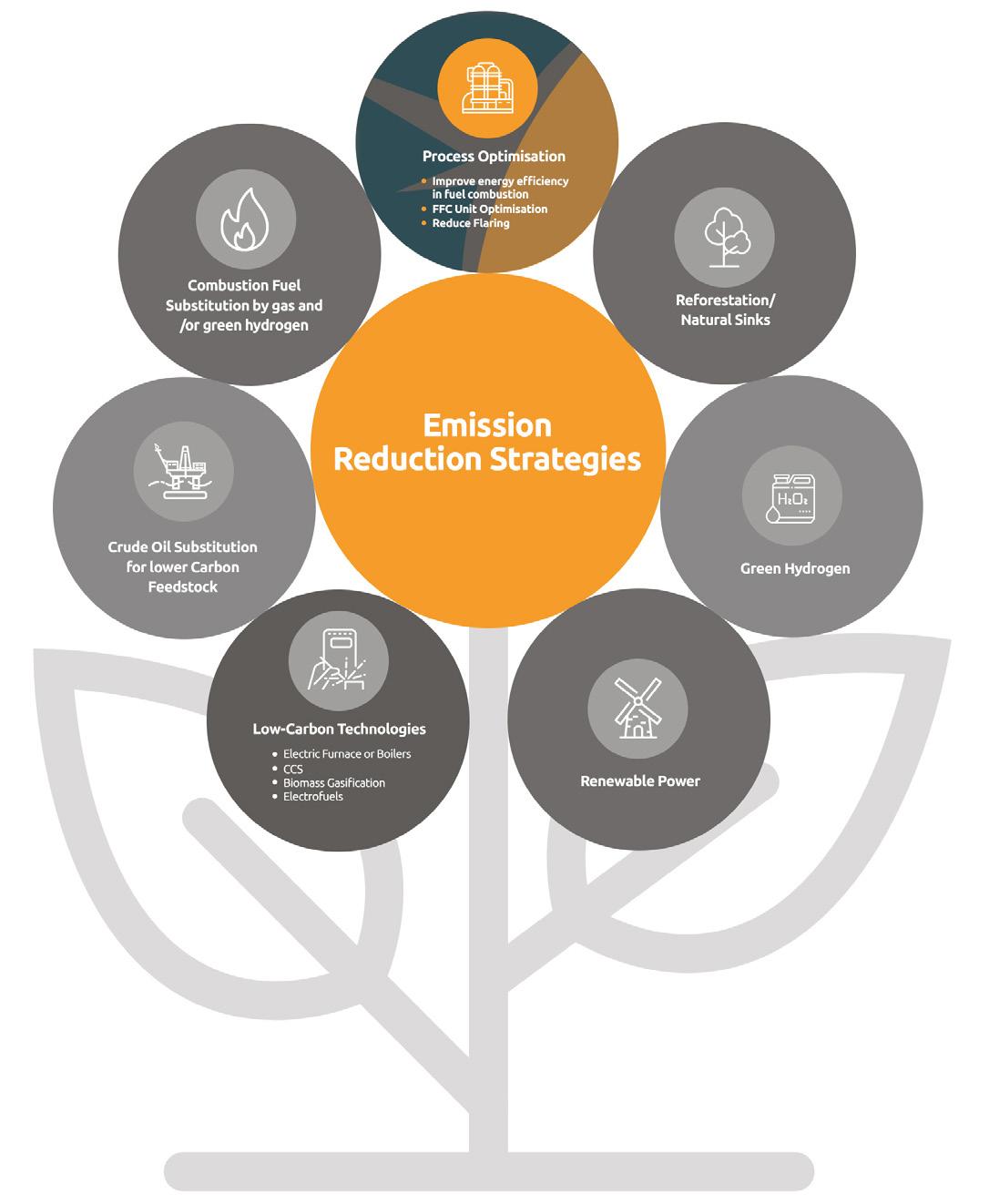

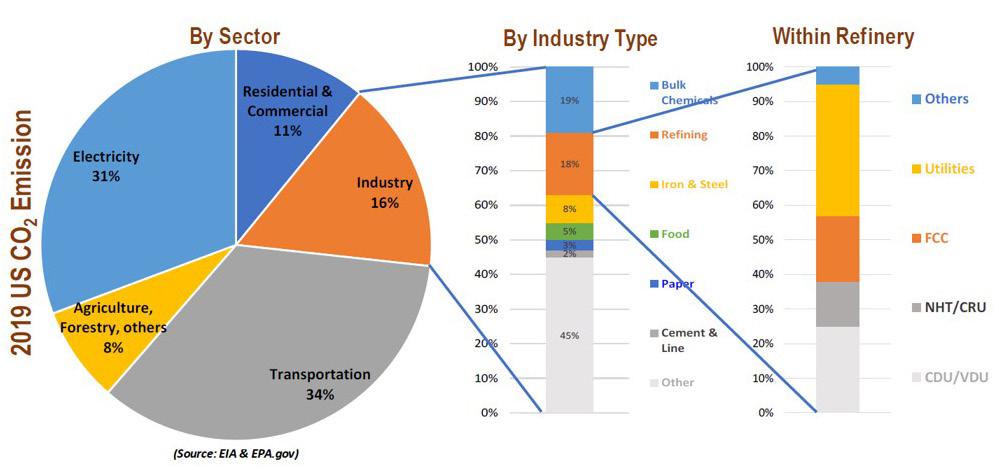

Globally, refiners are facing the challenge of reaching net zero emissions – and this is daunting. According to the 2018 Conservation of Clean Air and Water in Europe (CONCAWE) report, the EU has clear ambitions to significantly reduce carbon dioxide (CO2) across its economy and society.1 Currently, the EU aims to reduce greenhouse gas (GHG) emissions by 40% by 2030 and 80 – 95% compared with 1990 by 2050, with industry-specific targets of 83 – 87%. Meeting these targets will require significant change; the ambitious goals will demand an adaptation of the entire EU energy system and consumer behaviour, as well as the development of innovative solutions, which will demand both funding and technological expertise.

As shown in Figure 1, US oil refineries are the second largest emitters of GHG in industry, ranking only behind the

April 2023 HYDROCARBON ENGINEERING 29

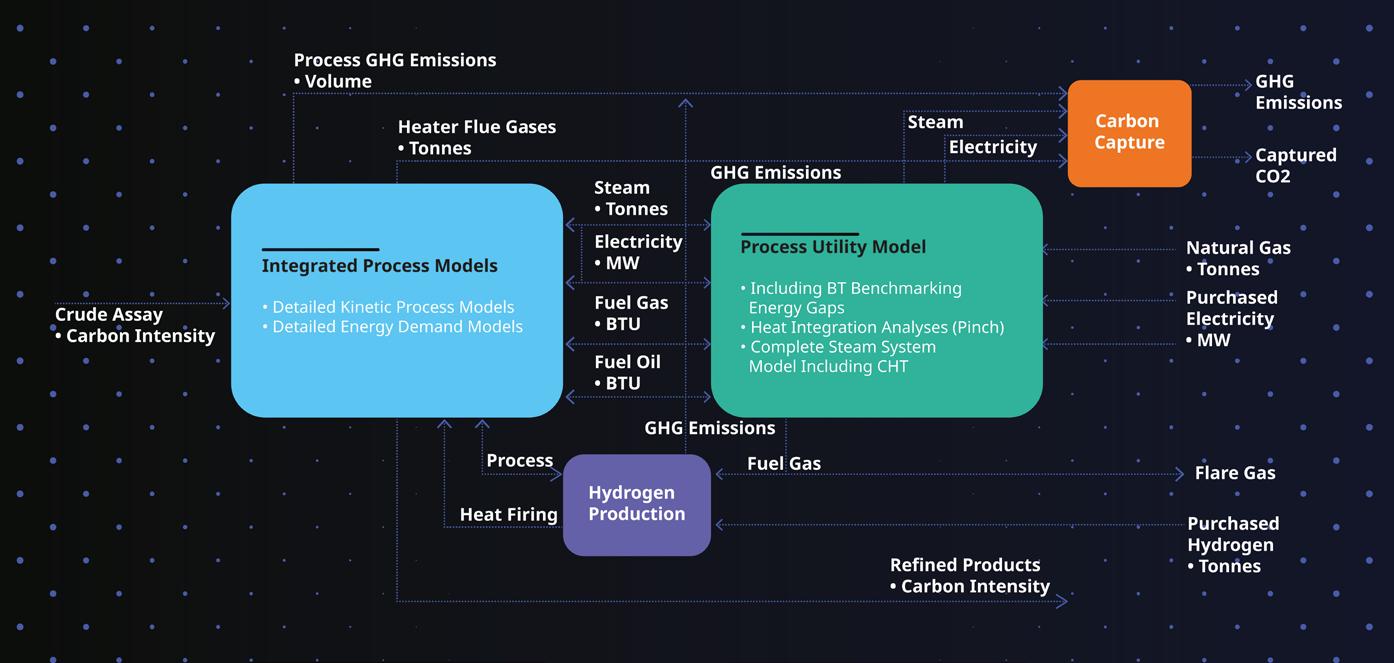

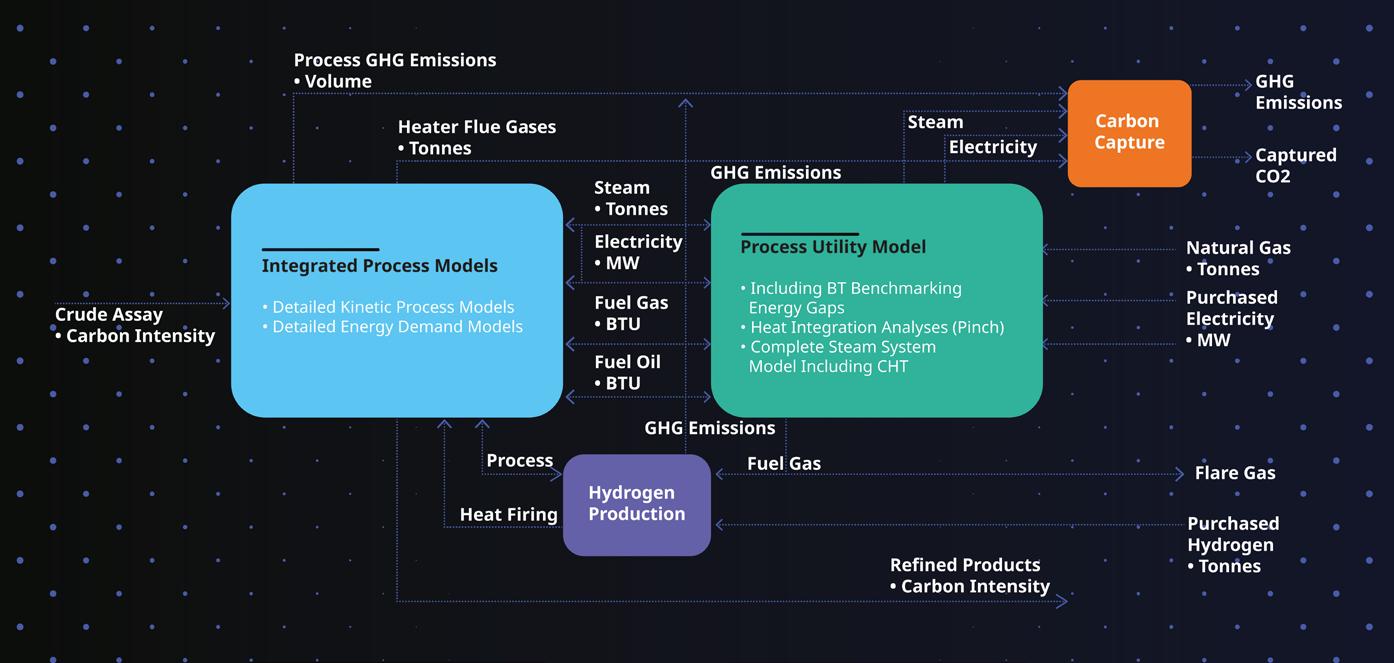

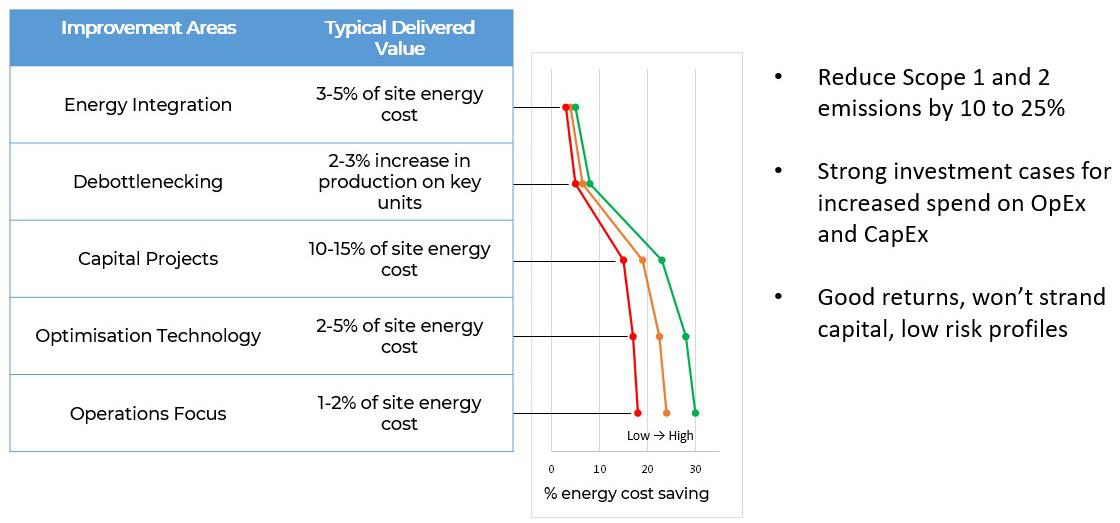

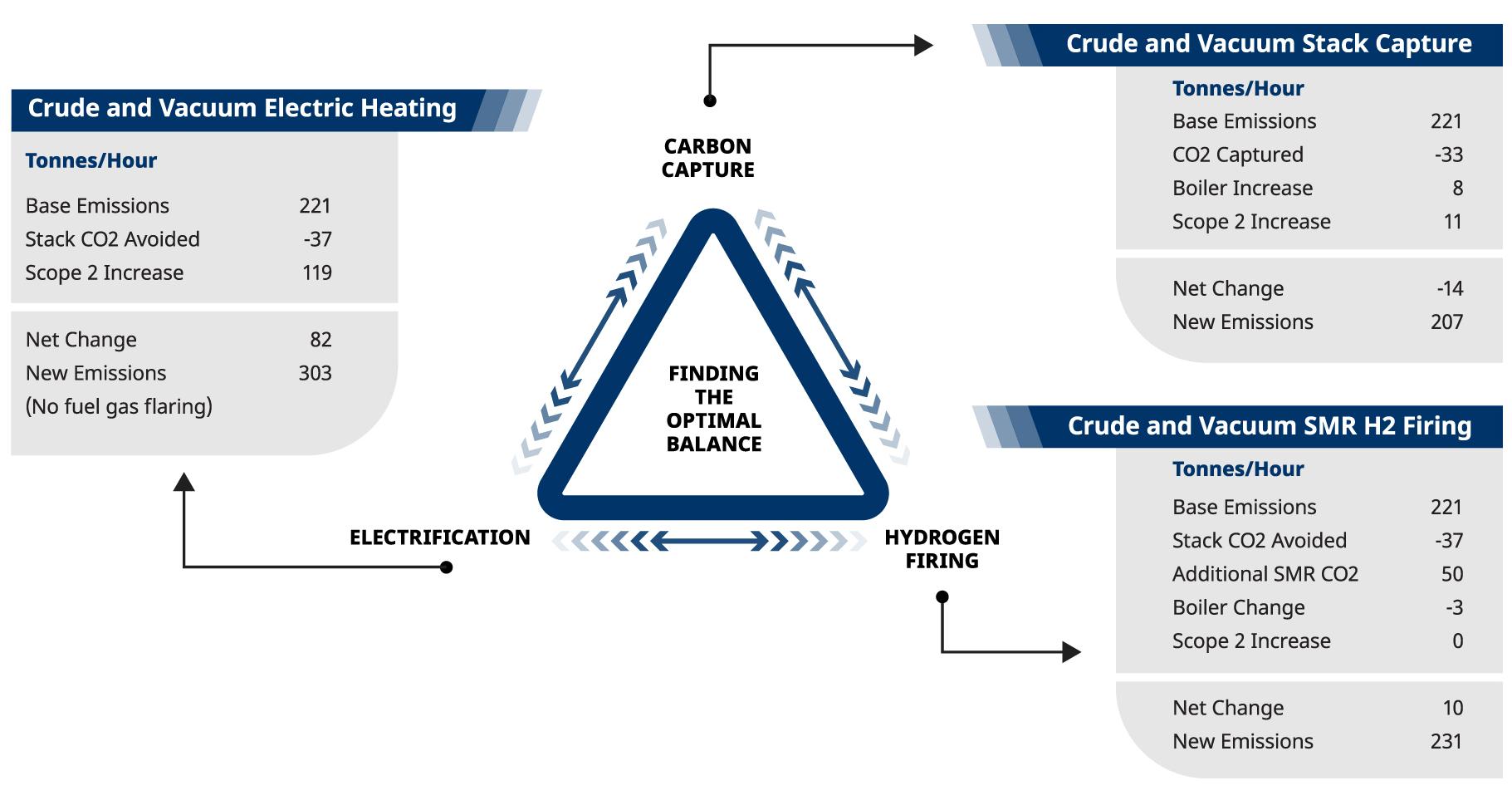

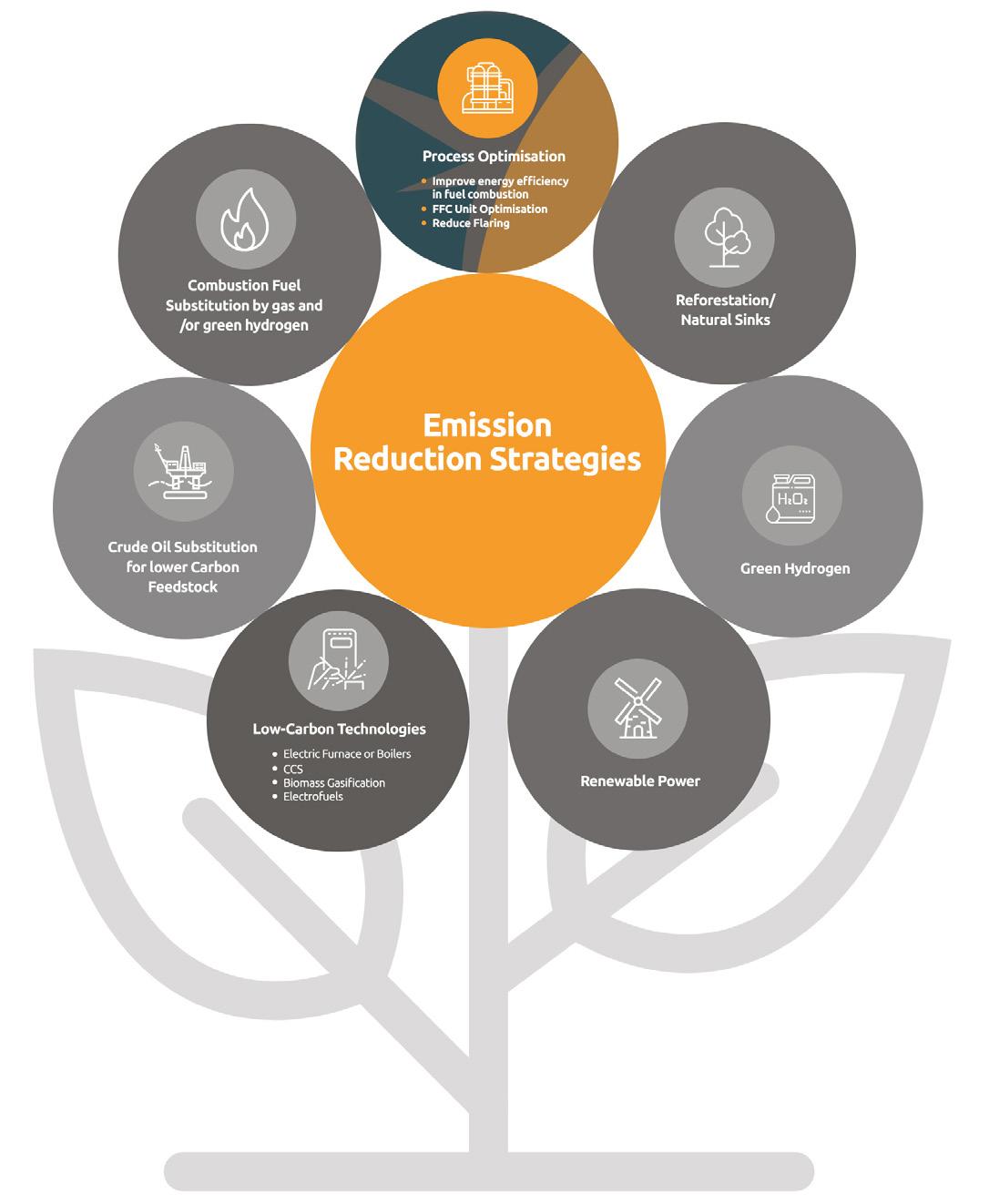

Duncan Mitchell, KBC (A Yokogawa company), explains how integrated process and energy models are capable of providing critical insight in the battle against emissions reduction.

bulk chemicals industry in terms of annual tonnes of CO2 emissions. If all existing and proposed refineries operate as usual, without the adoption of any carbon emissions abatement measures, they will emit up to 16.5 Gt of CO2 from 2020 to 2030, up from 1.3 Gt in 2018.2

Many refiners such as ExxonMobil, Shell, Total and Valero, to name a few, have committed to significantly reducing their direct GHG emissions (Scope 1) and indirect emissions (Scope 2), as depicted in Table 1.

The response required to meet the goals of the global energy transition has been likened by some to fighting a war, such is the intense and prolonged focus on understanding and overcoming the challenge. Sun Tzu famously wrote in ‘The Art of War’: “know thyself, know thy enemy,” and this provides insight that is helpful to develop

and execute a roadmap of short- and medium-term projects (battles, if you will) in the ‘war’ against Scope 1 and 2 emissions.

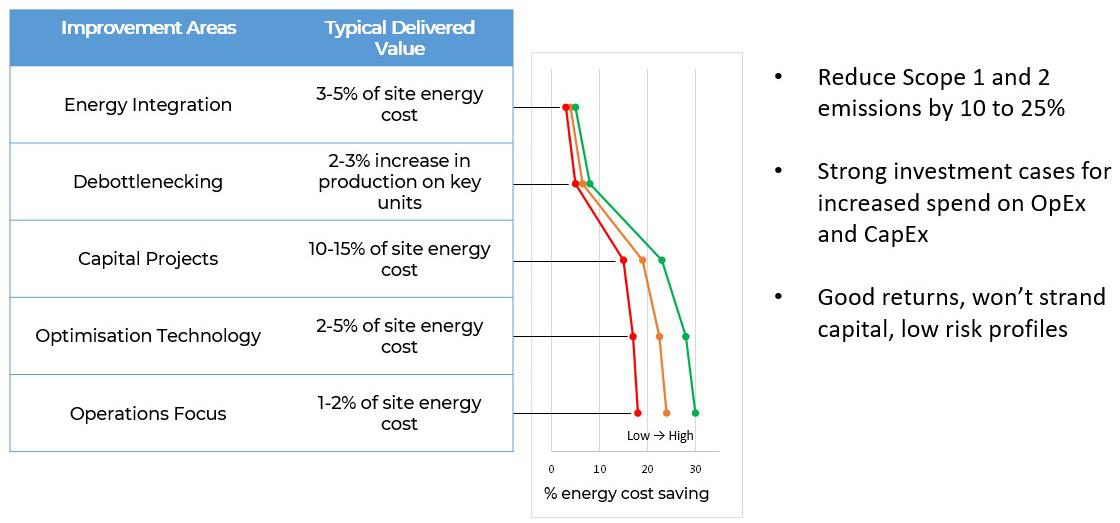

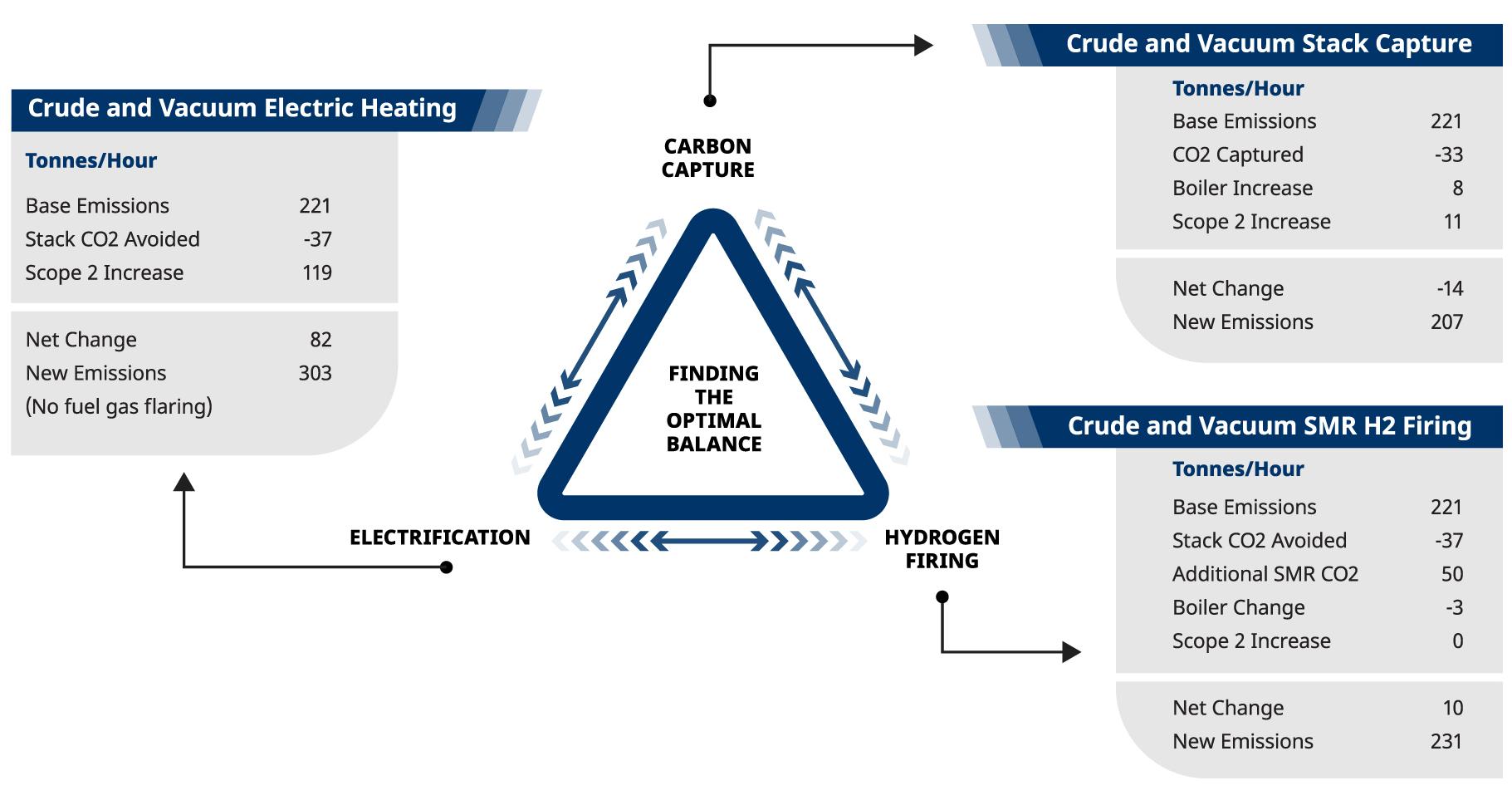

Attack by stratagem

Using a two-pronged strategic approach, ‘know thyself’ refers to the refinery’s configuration, its unit operations, its energy demand and use, and its GHG emissions.

‘Know thy enemy’ refers to the old battles familiar to all refineries; those of energy integration, efficiency, yield maximisation, and cost control.

The point here is that these two aspects are linked for success. How a refinery is configured, what it processes and produces, and how it provides the energy needed by those processes is critical to understanding how much and where GHG emissions are derived. Then, based on that information, determining which carbon emissions and mitigation strategies are necessary to meeting reduction targets is also important. This is where the full value of integrated modelling of the processes and energy systems becomes clear. Modelling provides a comprehensive tool that can be used to analyse the current situation and, most importantly, identify the adjustable mechanisms to improve the situation in one area without causing negative consequences in another. Consider, for example, the impact on the fuel gas balance from continuously replacing fuel gas in a fired heater with hydrogen, without flaring any excess.