August 2023

www.mercuryadsorbents.com Optimized Mercury Removal With MERSORB® mercury adsorbent pellets MERSORB® mercury adsorbent pellets – a Trademark of Nucon International, Inc. (NUCON®) • PROVEN RELIABLE – EVEN IN CRACKED GAS • HIGH MERCURY CAPACITY – HOT, COLD, WET or DRY • MORE PELLET SIZES – MORE PROCESS DESIGN FLEXIBILITY • LOW MOISTURE – FAST START-UP • 40 YEARS EXPERIENCE – ADSORPTION PROCESS DESIGN Your Experts for Mercury Removal – in Ethylene Plants PROVEN PROCESS – PROVEN PRODUCTS AntiMercure® is a Registered Trademark of Selective Adsorption Associates, Inc. for its Process Engineering Services MERSORB® is a Registered Trademark of NUCON International, Inc. for its mercury adsorbent pallets • Cracked Gas • Ethane Feed Gas • LPG, Naphtha, & Light Condensate Feed Liquid • Regen. Gas from Cracked Gas Driers • Light Olefin Gas from FCC Units • AntiMercure® Process Engineering • MERSORB® mercury adsorbent pellets

27 Gas analysis for process control

Australia: beyond coal

Klaus Brun, Elliott Group, and Timothy C. Allison and Natalie R. Smith, Southwest Research

Setting up for success

Joseph Doerfler, FS-Elliott, USA, reviews the development and design of an API 672-compliant centrifugal compressor for one of the world’s largest single-site ethylene facilities, and details the steps taken to reduce overall costs while increasing system efficiency.

THIS MONTH'S FRONT COVER

Rhys Jenkins and Maria-Katharina Mokosch, Servomex, look at the role of gas analysis in ethylene dichloride (EDC) and vinyl chloride monomer (VCM) production for polyvinyl chloride (PVC) manufacturing.

31 Answering the burning question of our time

Mark Naples, Umicore Coating Services Ltd, discusses the urgency of climate change, and suggests gas detection measurement as one way to reduce emissions from the oil and gas industry.

37 Safe combustion

Stuart Rye, NEO Monitors AS, Norway, considers whether methane can safely exist in a hot-fired process heater during normal operation.

43 Finding a fix

Johannes Poth, Integrated Global Services (IGS), Germany, explores five common causes of refractory failure, and outlines how to fix them.

49 Control valve selection for SAF production

Increasingly, refineries are starting to retool their infrastructure to produce sustainable aviation fuel (SAF). However, new processes are required, creating challenges for control valve selection. Scot Bauder and Janelle Prusha, Emerson, discuss.

55 Changing expectations

Fabrizio Delledone and Mike Semens-Flanagan, IMI Critical Engineering, examine various emerging valve designs to support the growing number of LNG applications.

59 The value of effective flow control

Dave Godfrey, Rotork, UK, discusses the importance of accurate and effective flow management within the growing LNG industry.

64 Q&A with...

Hydrocarbon Engineering talks to David Walsh, Product Director, Screw Compressor Products, Howden, a Chart Industries Company.

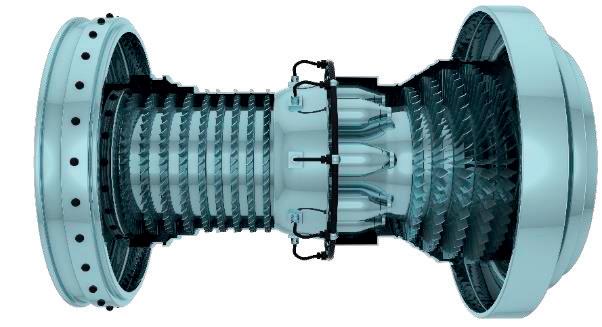

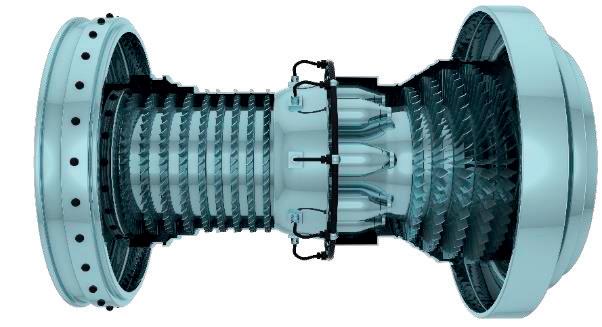

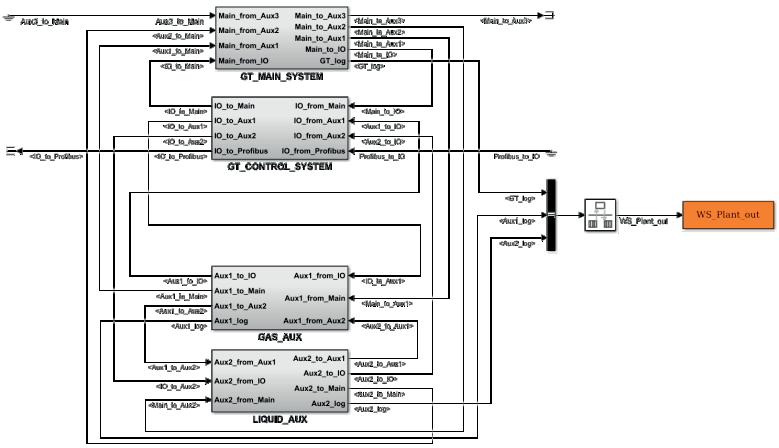

Elliott Group discusses on p. 16 how advancements in turbomachinery design will significantly improve performance of various energy storage systems through increased efficiency, operating range, and application-specific design for each system. Improvements in efficiency, transient response, and operating range can significantly enhance the commercial viability of both standalone energy storage systems and systems coupled synergistically with other industrial thermal/electrical processes. Visit elliott-turbo.com

CONTENTS Hydrocarbon Engineering Like Join Hydrocarbon Engineering @HydrocarbonEng Follow CONVERSATION JOIN THE 2023 Member of ABC Audit Bureau of Circulations Copyright© Palladian Publications Ltd 2023. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK. CBP019982 August 2023 Volume 28 Number 08 ISSN 1468-9340 03 Comment 05 World news 08

Nancy Yamaguchi, Contributing Editor, discusses the

of

energy market, and

the

are changing in line with carbon-neutrality

times

current state

Australia’s

how

fuel types

goals. 16 Adapting to the changing

discuss

advancements can improve the performance of various energy storage systems, including

22

Institute,

how turbomachinery

hydrogen.

Cut your CO2 emissions in half with ET Black™ Carbon Black Technology

ET Black™ is a state-ofthe-art technology that complies with the most stringent environmental regulations now and in the future.

Plus, the flexibility to produce all ASTM grades, and specialty grades, in a single plant. ET Black™, the technology of reference for producing carbon black obtained by thermal decomposition of highly aromatic oils.

Find out more at: www.igoforETBlack.com

CONTACT INFO

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O'Reilly callum.oreilly@palladianpublications.com

ASSISTANT EDITOR Bella Weetch bella.weetch@palladianpublications.com

EDITORIAL ASSISTANT Poppy Clements poppy.clements@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Sophie Birss sophie.birss@palladianpublications.com

PRODUCTION MANAGER Kyla Waller kyla.waller@palladianpublications.com

EVENTS MANAGER Louise Cameron louise.cameron@palladianpublications.com

EVENTS COORDINATOR Stirling Viljoen stirling.viljoen@palladianpublications.com

DIGITAL CONTENT ASSISTANT Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR Leah Jones leah.jones@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITOR

Nancy Yamaguchi Gordon Cope

SUBSCRIPTION RATES

Annual subscription £110 UK including postage /£125 overseas (postage airmail).

Two year discounted rate £176 UK including postage/£200 overseas (postage airmail).

SUBSCRIPTION CLAIMS

Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

APPLICABLE ONLY TO USA & CANADA

Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032.

15 South Street, Farnham, Surrey

GU9 7QU, UK

Tel: +44 (0) 1252 718 999

COM MENT

CALLUM O'REILLY SENIOR EDITOR

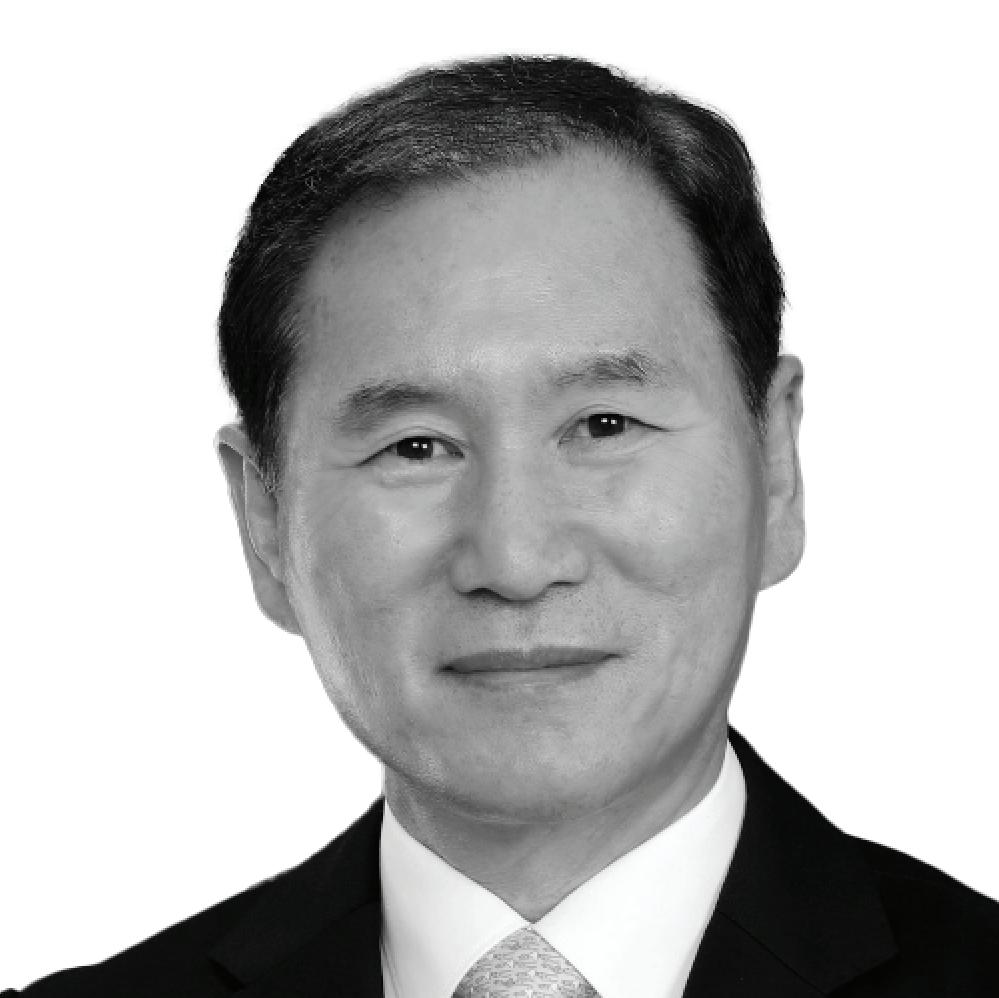

Last winter, LNG played a starring role in keeping Europe’s lights switched on following the start of the Russia-Ukraine conflict.

The International Gas Union (IGU)’s latest ‘World LNG Report’ outlines how LNG demonstrated its essential value as a flexible, reliable and available energy resource during the most turbulent year in the history of gas markets. 1

Europe imported 66% more LNG in 2022, with 44% of the continent’s total imports coming from the US. Despite the Freeport LNG terminal being taken offline following an accident in June 2022, US producers exported 55.2 million t of LNG to Europe last year, a 148% increase compared to the previous year. This accounted for 69% of the country’s LNG exports in 2022.

Throughout the last year, record new regasification capacity was approved, with some projects fast-tracked. The IGU reports that more than 10 European markets have initiated the construction of new infrastructure since the outbreak of the war in Ukraine, including 26 projects with a combined regasification capacity of 104.5 million tpy. Of these projects, six have been commissioned, and four terminals have taken final investment decisions (FIDs) and are under construction. The IGU also notes that approximately 70% of this new capacity will come from floating terminals.

The fact that Europe could turn to LNG in its moment of need illustrates the fuel’s essential role in assisting with global energy security. The IGU’s report states that, as of April 2023, “the global LNG trade connected 20 exporting markets with 48 markets with importing infrastructure, and an increasingly globalised LNG market made it possible to re-route massive volumes of energy in a matter of months.”

But LNG’s special quality extends beyond its flexibility, which ultimately improves energy security worldwide. It also has a key role to play as a transition fuel in the push for cleaner energy. It can replace oil and coal, and accelerate the integration of renewables. The IGU also points out that there is a significant opportunity to minimise the lifecycle emissions of LNG today by decarbonising the liquefaction segment of the value chain. And, looking to the future, the sector is developing its decarbonisation pathways, with examples including renewable natural gas or biomethane, blue and green hydrogen, ammonia, e-methane, and carbon capture, utilisation and storage (CCUS).

However, a lack of investment is impacting both producers and consumers, and this needs to be addressed to ensure that LNG can continue to play its important dual role. The IGU’s President, Li Yalan, explains that a lack of sufficient supply drove the world spot prices to record highs last year, which resulted in many consumers choosing dirtier fuels or even shutting down operations altogether. Strategies to future-proof investments in gas infrastructure are key to ensuring that LNG can help the world securely continue on its path to net zero.

1. ‘World LNG Report’, International Gas Union (IGU), (2023).

Delivering sulphur and sulphuric acid solutions for a more sustainable world Improve uptime Decrease CAPEX & OPEX Optimize capacity Energy efficiency SO2 Contact our experts to learn more: sulphursolutions@worley.com Reduce emissions Everything sulphur and so much more Through our in-depth experience and complete lifecycle engineering capabilities, we find ways to make plants and processes more reliable and profitable. With our large technology portfolio, we deliver the right solutions for any challenge. worley.com/comprimo worley.com/chemetics Worley Group

WORLD NEWS

Saudi Arabia | TotalEnergies, Aramco and SABIC successfully process oil from plastic waste

For the first time in the MENA region, TotalEnergies, Aramco and SABIC have successfully converted oil derived from plastic waste into ISCC+ certified circular polymers.

The plastic pyrolysis oil was processed at the SATORP refinery, jointly owned by Aramco and TotalEnergies, in Jubail, Saudi Arabia. It was then used as a feedstock by Petrokemya, a SABIC affiliate, to produce certified circular polymers.

The project aims to pave the way for the creation of a domestic value

chain for the advanced recycling of plastics to circular polymers in Saudi Arabia. The process supports the use of non-sorted plastics, which can be difficult to recycle mechanically, and consequently contributes to solving the challenge of end-of-life plastics.

Sami Al-Osaimi, SABIC EVP Petrochemicals, said: “This project shows collaboration across the petrochemical value chain to overcome upstream and downstream challenges in circular plastics.”

Egypt | Studies underway for biofuel project

Within the framework of their strategy to provide practical solutions for cleaner energy, ECARU, Qalaa Holdings and Axens have signed a cooperation protocol in the presence of H.E. French Ambassador to Egypt, Marc Barety, to carry out technical and economic studies for a project to support the production of second-generation biofuel (advanced bioethanol) and sustainable aviation fuel (SAF).

The project will be carried out in two phases, the first of which will be the production of advanced bioethanol while the second will be the production of SAF. The project’s studies will take approximately seven months. The aim is to export production of second-generation biofuel, in line with Egypt’s strategy to maximise the use of various waste types and contribute to sustainability and waste recycling.

Global | The energy crisis has reshaped natural gas markets

The global energy crisis has transformed the structure of natural gas markets, requiring closer dialogue between producers and consumers looking to ensure both short and longer term security of supply, and reduce emissions.

According to the latest edition of the International Energy Agency (IEA)’s ‘Global Gas Security Review’, tensions in gas markets have eased significantly since the beginning of 2023. Yet the new analysis notes that deeper coordination among market participants remains essential.

The security of global gas supplies remains at the forefront of energy policy making, with growing complexity for both the short- and long-term. LNG has become a baseload source of supply for Europe, with its share in total EU demand rising from an average of 12% over the 2010s to close to 35% in 2022 – similar to the contribution from Russia’s piped gas before the invasion of Ukraine. Meanwhile, China’s balancing role in global gas markets is set to increase.

USA | NextDecade reaches FID for Rio Grande LNG

NextDecade Corp. has announced that it has made a positive final investment decision (FID) to construct the first three liquefaction trains (Phase 1) at the company’s 27 million tpy Rio Grande LNG (RGLNG) export facility in Brownsville, Texas, US.

The company has executed and closed a joint venture (JV) agreement for Phase 1, which included approximately US$5.9 billion of financial

commitments from Global Infrastructure Partners (GIP), GIC, Mubadala Investment Co., and TotalEnergies.

NextDecade has committed to invest approximately US$283 million in Phase 1, including US$125 million of pre-FID capital investments into Phase 1.

The US$18.4 billion project financing for RGLNG Phase 1 is some of the largest greenfield energy project financing in US history.

In conjunction with making a positive FID, RGLNG issued the notice to proceed (NTP) to Bechtel Energy Inc. to begin construction of Phase 1 under its lump-sum turnkey engineering, procurement, and construction contracts (EPC).

Phase 1, with nameplate liquefaction capacity of 17.6 million tpy, has 16.2 million tpy of long-term binding LNG sales and purchase agreements (SPAs).

August 2023 HYDROCARBON ENGINEERING 5

WORLD NEWS

DIARY DATES

05 - 08 September 2023

Gastech Singapore www.gastechevent.com

17 - 20 September 2023

GPA Midstream Convention San Antonio, Texas, USA www.gpamidstreamconvention.org

17 - 21 September 2023

World Petroleum Congress Calgary, Alberta, Canada www.24wpc.com

26 - 28 September 2023

Turbomachinery & Pump Symposia Houston, Texas, USA tps.tamu.edu

02 - 05 October 2023

ADIPEC

Abu Dhabi, UAE www.adipec.com

03 - 05 October 2023

AFPM Summit Grapevine, Texas, USA summit.afpm.org

09 - 12 October 2023

2023 API Storage Tank Conference & Expo Denver, Colorado, USA events.api.org/2023-api-storage-tank-conference-expo

06 - 08 November 2023

Sulphur + Sulphuric Acid 2023 New Orleans, Louisiana, USA www.sulphurconference.com

13 - 16 November 2023

ERTC

Lake Maggiore, Italy worldrefiningassociation.com/event-events/ertc

05 - 07 December 2023

16th Annual National Aboveground Storage Tank Conference & Trade Show

The Woodlands, Texas, US www.nistm.org

30 - 31 January 2024

NARTC

Houston, Texas, USA www.worldrefiningassociation.com/event-events/ nartc

USA | Refinery capacity increased at the start of 2023 for the first time since COVID-19

According to the annual ‘Refinery Capacity Report’ by the US Energy Information Administration (EIA), US refining capacity increased by 0.6% at the start of 2023, compared to the start of 2022. US operable atmospheric crude oil distillation capacity, the primary measure of refinery capacity, totalled 18.1 million barrels per calendar day (bpd) at the start of 2023, up by 117 000 bpd from 17.9 million bpd at the start of 2022.

The number of operable refineries in the US, including both idle and operating refineries, decreased to 129 refineries at the beginning of 2023, down from 130 refineries at the beginning of 2022. The single refinery closure reflects the loss of a small facility in Santa Maria, California, US. Despite the loss of this plant, overall capacity increased because PBF Energy reactivated a previously retired crude oil distillation unit at its refinery in Paulsboro, New Jersey, US.

UAE | Masdar, Mitsubishi Chemical Group and INPEX explore polypropylene production

Masdar, Mitsubishi and INPEX have signed an agreement to explore production of a commercial-scale polypropylene produced from carbon dioxide (CO2) and green hydrogen, in Abu Dhabi, UAE.

The green hydrogen and CO2 will be converted into e-methanol, which will subsequently be converted to propylene and polypropylene.

Mitsubishi Chemical Group’s CEO, Jean-Marc Gilson, said: “The chemical

industry is now faced with the dual challenge of reducing its greenhouse gas (GHG) emissions, while actively participating and leading the transition to a carbon-neutral economy. With that focus in mind, our ambition to use CO2 as a key starting raw material is a very important stepping stone towards a sustainable future and we are looking forward to using our expertise to contribute to the success of this project.”

North America | Wood Mackenzie reports growth in RNG market

According to a new report from Wood Mackenzie, the renewable natural gas (RNG) market saw huge growth in 2022. 60 million ft3/d of new production capacity was added, and 66 future projects were announced, confirming that the number of RNG projects has doubled in the last five years.

Activity has been spurred by mandates and incentives aimed at lowering greenhouse gas (GHG) emissions, such as investment tax

credits (ITC) in the Inflation Reduction Act (IRA) for RNG development, and low-carbon fuel programmes in the US Environmental Protection Agency (EPA)’s Renewable Fuel Standard programme.

Despite recent growth, RNG only makes up 0.5% of the natural gas market in North America. Nevertheless, with continued support, Wood Mackenzie projects it will grow to 3% of the market by 2050.

August 2023 HYDROCARBON ENGINEERING 6

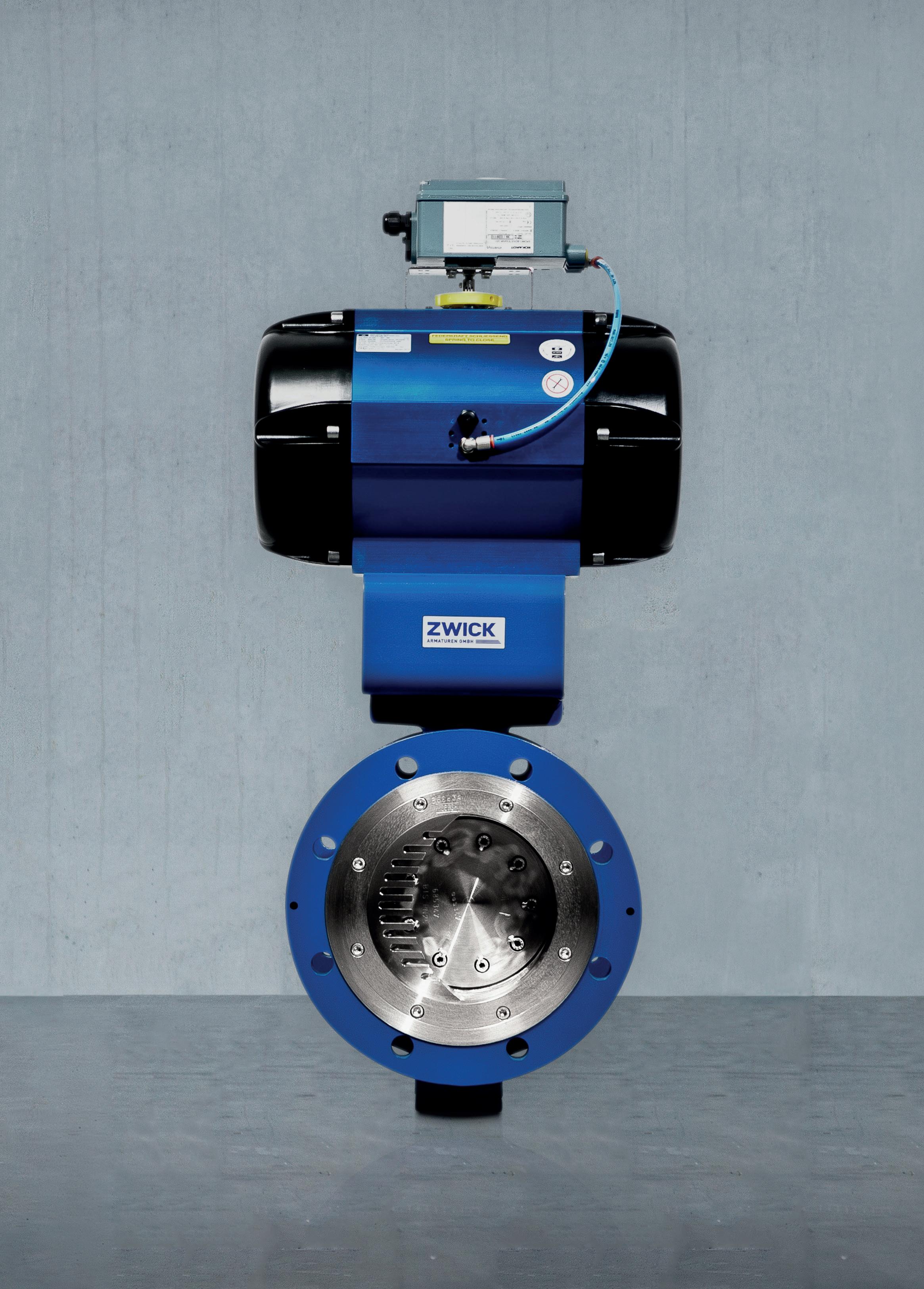

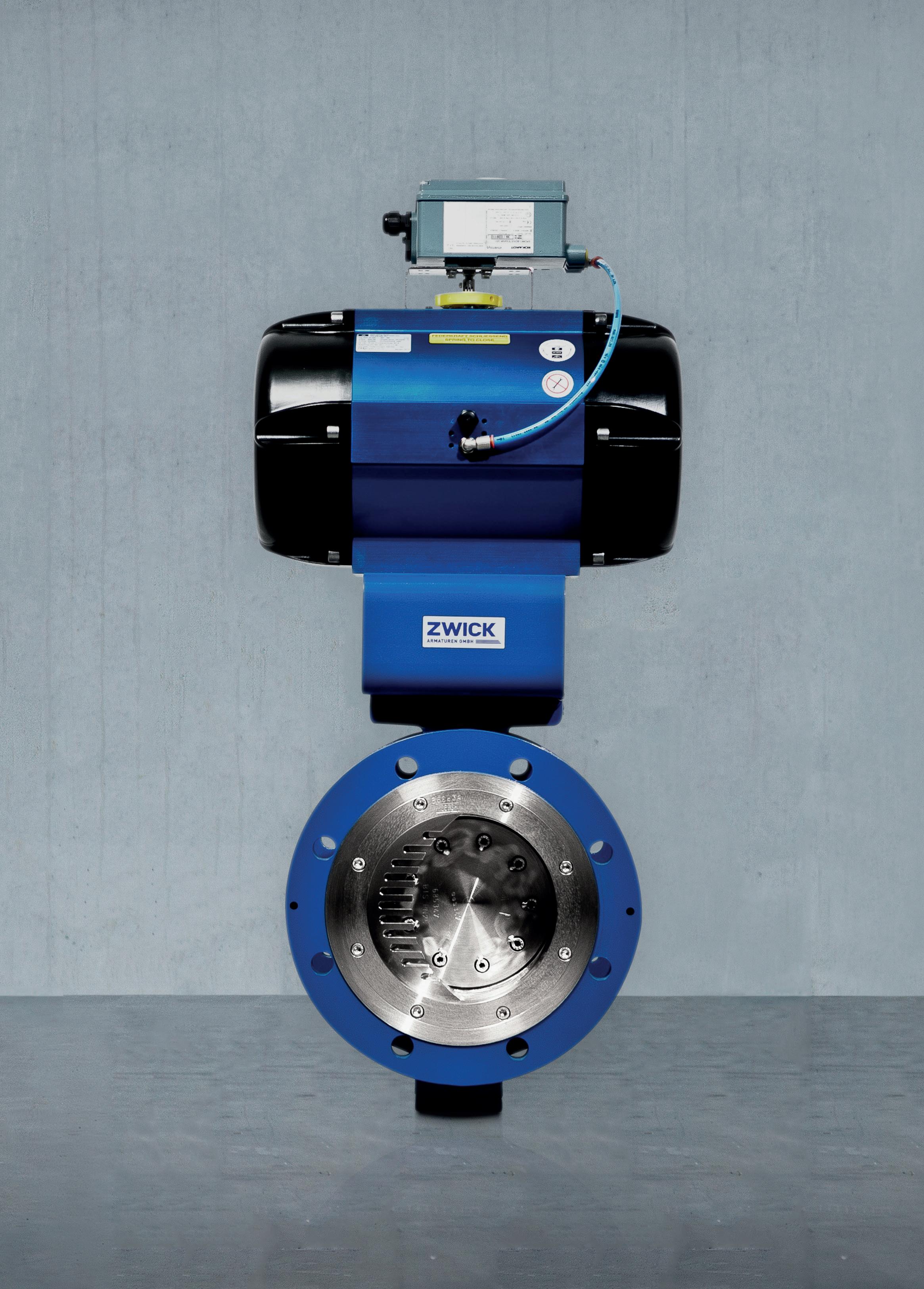

Visit us at Offshore Europe in Aberdeen 5 - 8 September, stand 1R41 to see this next generation valve

8 August 2023 HYDROCARBON ENGINEERING

Within the Organisation for Economic Co-operation and Development (OECD), Australia stands apart – not only because of its distance from most of its fellow countries, but because of its abundant energy resources and its high per-capita emissions of carbon. Australia has significant fossil energy reserves (coal, natural gas and petroleum), as well as renewable energy (biomass, solar energy, wind and hydropower). The country also possesses the world’s largest reserves of uranium, but does not have any nuclear power plants, and exports its uranium.

Australia’s energy wealth could be considered an embarrassment of riches, except that so much of the riches are the wrong type: coal. The country is finding it impossible to abruptly stop using a fuel source that is so

plentiful and is so much a part of the existing energy infrastructure. If there was a sport called ‘The OECD Clean Energy Games’, Australia would be in the penalty box, holding hands with the US and Canada. These three countries possess abundant fossil energy reserves. They share a goal of carbon-neutrality by 2050, and they have a major fight ahead to transition to a clean energy economy. Among these three, Australia has the highest per-capita carbon dioxide equivalent (CO2e) emissions: approximately 16.46 CO2e/capita in 2022, relative to 15.82 CO2e/capita in the US and 14.77 CO2e/capita in Canada.1

Globally, critics are sceptical that Australia will be able to make the drastic cuts in fossil energy production and use that are needed. Recently, however, discussions between Australia and the US revealed potential to expand investment in renewable and clean energy.

August 2023 9 HYDROCARBON ENGINEERING

Nancy Yamaguchi, Contributing Editor, discusses the current state of Australia’s energy market, and how the fuel types are changing in line with carbon-neutrality goals.

Australian Prime Minister, Anthony Albanese, and US President, Joe Biden, met and agreed upon a new pact on clean energy policy and investment. The Biden Administration is devoting billions of dollars to clean energy development, and it is possible that Australia will be designated a ‘domestic supplier’ to the US, potentially allowing Australian companies to benefit from the huge investments being made in the US. Indeed, many Australians believe that the investments earmarked for natural gas would be better spent on strategic minerals, green hydrogen, solar energy, and wind turbines. In the near- and mid-term, however, it is more likely that Australia will continue to pursue success in natural gas production and LNG exports. According to the ‘Statistical Review of World Energy’, the industry standard long-published by BP and now produced by the Energy Institute (EI), in 2021, Australia gained the number one spot in global LNG exports, surpassing Qatar. In 2022, Qatar reclaimed the number one spot.

Australia has mineral wealth that is vital to the energy industry, including lithium, vanadium, cobalt, and rare earth metals. These strategic minerals are essential for batteries, turbines, solar panels, and computers that help make renewable energy technologies viable. Mining and processing are energy intensive, but channelling natural gas and ultra-low-sulfur petroleum fuels to these ventures may hasten a phase-out of coal. Australia is the world’s largest exporter of lithium, but it has yet to capture the value-added of processing its mineral wealth into finished batteries.

This article will explore Australia’s energy market, how the fuel types are changing, and how the oil industry is adapting.

Australian primary energy

Australia has faced international criticism over its dependence on fossil energy, yet in fairness this is a

herculean task given its vast fossil energy reserves and their contribution to national wealth. Historically, fossil energy contributed approximately 95 – 96% to Australia’s primary energy mix. According to BP and the EI, fossil energy accounted for 96.3% of Australia’s energy mix in 2008, and the country cut this to 85.6% in 2022. This has been achieved primarily by cutting coal use by an average of 3.2%/yr during the 2008 – 2022 period. In 2022, oil provided 34.6% of Australian primary energy, followed by coal at 25.9% and natural gas at 25.1%. Oil demand growth has been moderated in recent years, although part of this was caused by the COVID-19 pandemic. Demand has been recovering, but at a slower pace than that seen pre-pandemic.

During the decade 2012 – 2022, the Statistical Review of World Energy reported primary energy demand growth rates of:

n Coal: -2.5%/yr.

n Oil: -0.5%/yr.

n Natural gas: 2.3%/yr.

n Hydroelectricity: -0.5%/yr.

n Renewables: 17.0%/yr.

In 2021, The Australian Department of Climate Change, Energy, the Environment, and Water provided additional details on renewables growth rates of: 2

n Biofuels: -6.9%/yr.

n Hydropower: -1.0%/yr.

n Biomass: 0.2%/yr.

n Biogas: 2.5%/yr.

n Solar hot water: 5.4%/yr.

n Wind: 15.0%/yr.

n Solar PV: 33.6%/yr.

Coal remains relevant in Australia because of its vast reserves (the reserves-to-production ratio is over 300 years), and the fact that coal resources are located close to existing population centres and feed directly into the power sector. Australia has the world’s third-largest coal reserves, following the US and Russia, and it is the second-largest coal exporter, after Indonesia. Australia is successfully producing syngas from coal at its Leigh Creek project. There are plans to expand coal syngas production for power generation and fertilizer manufacture.

Natural gas consumption and export continue to grow, though production gains recently have slowed, causing concern to LNG exporters. Australia surpassed Qatar to become the world’s largest LNG exporter in 2021. According to BP, Australia exported 108.1 billion m 3 of LNG in 2021, vs Qatar’s exports of 106.8 billion m 3 . The EI reported that in 2022, Qatar reclaimed the top

August 2023 HYDROCARBON ENGINEERING 10

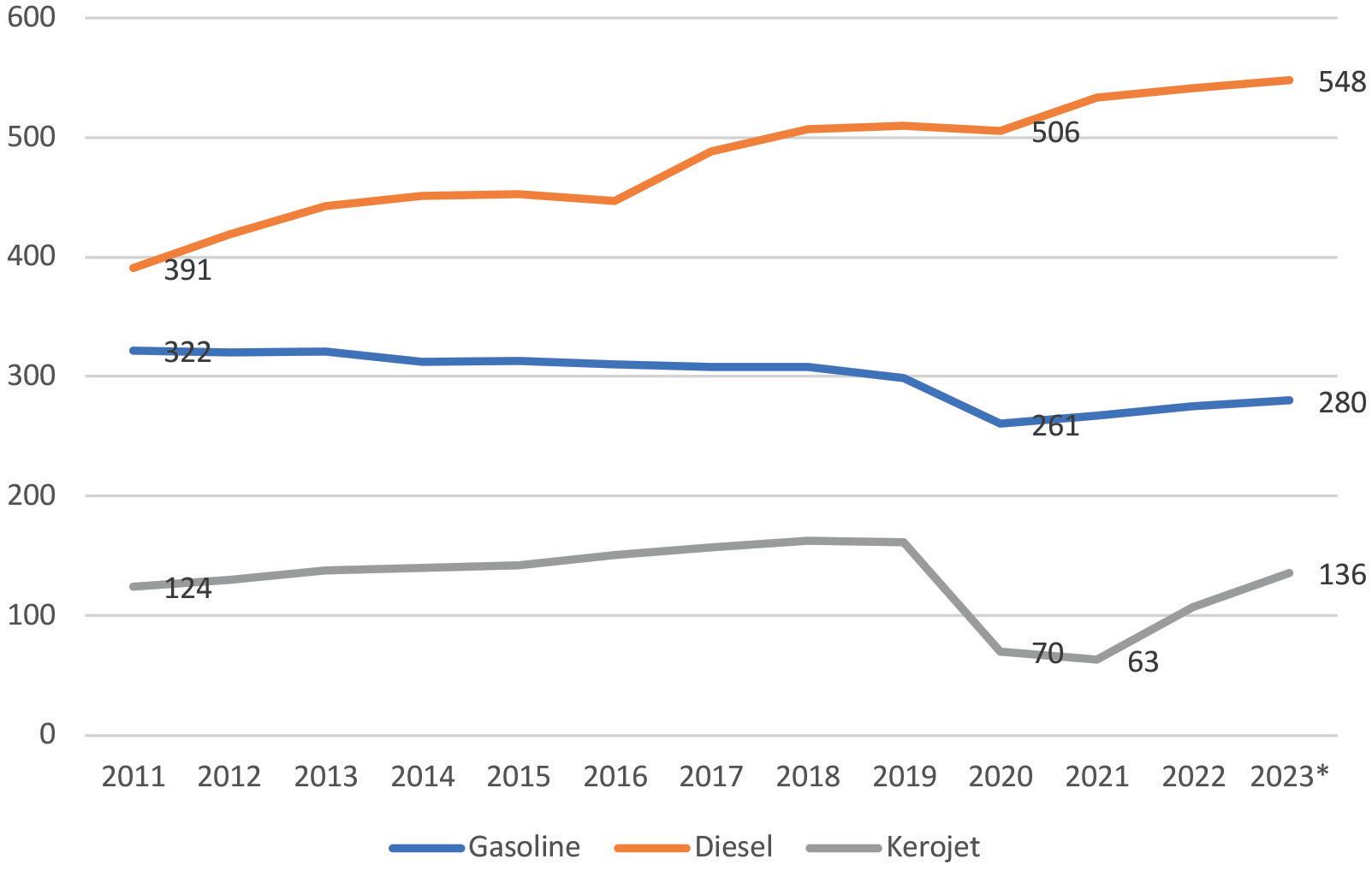

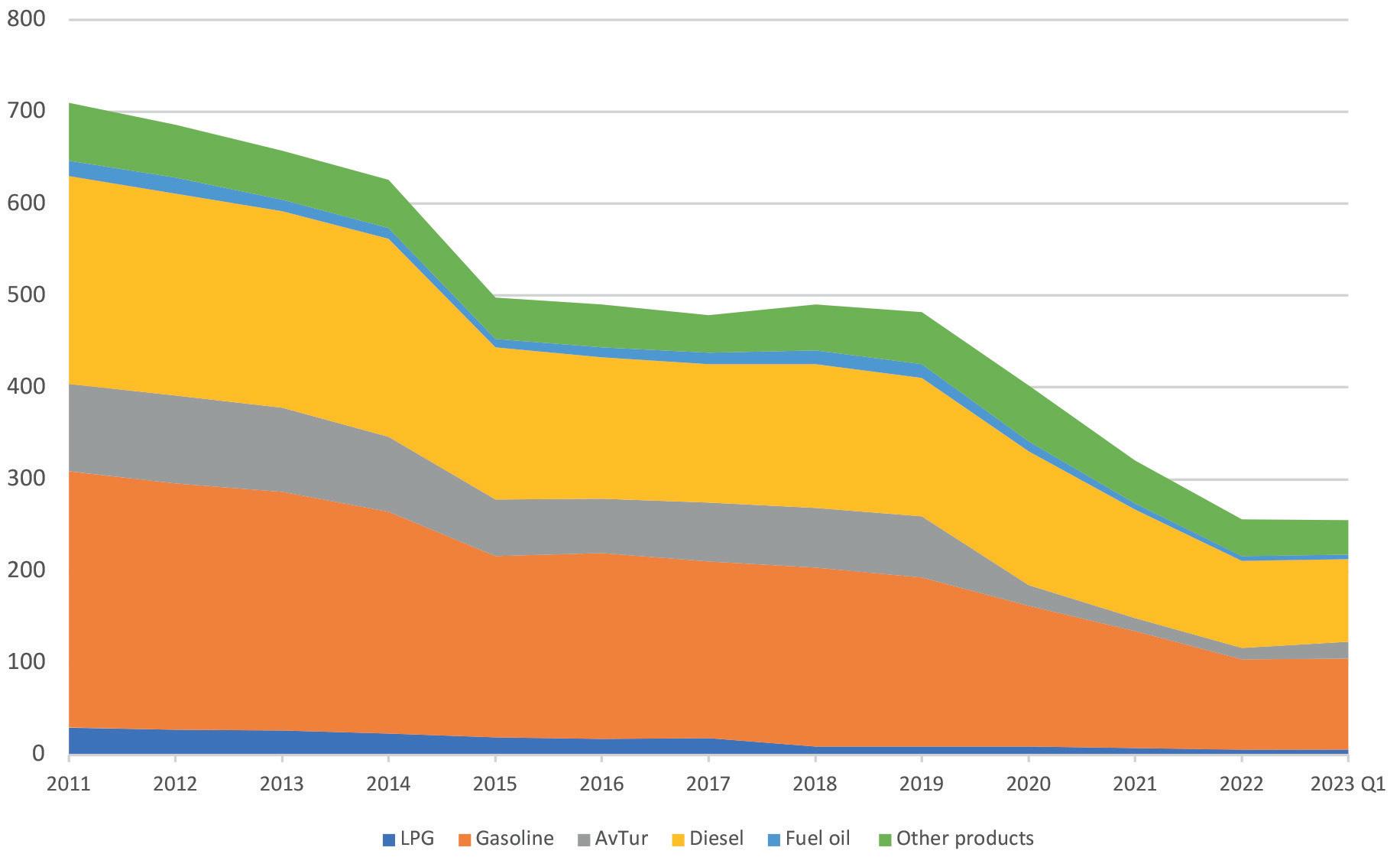

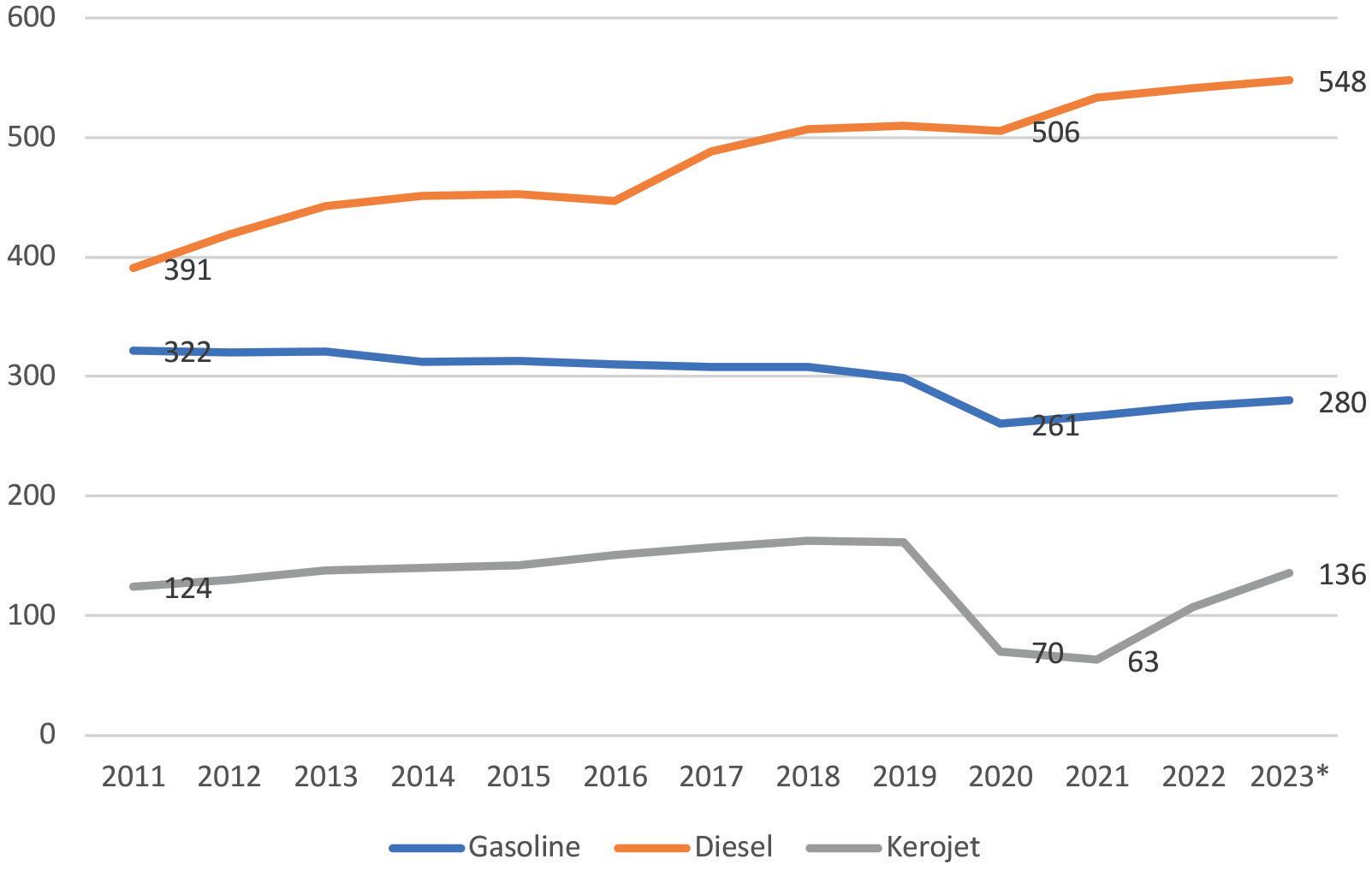

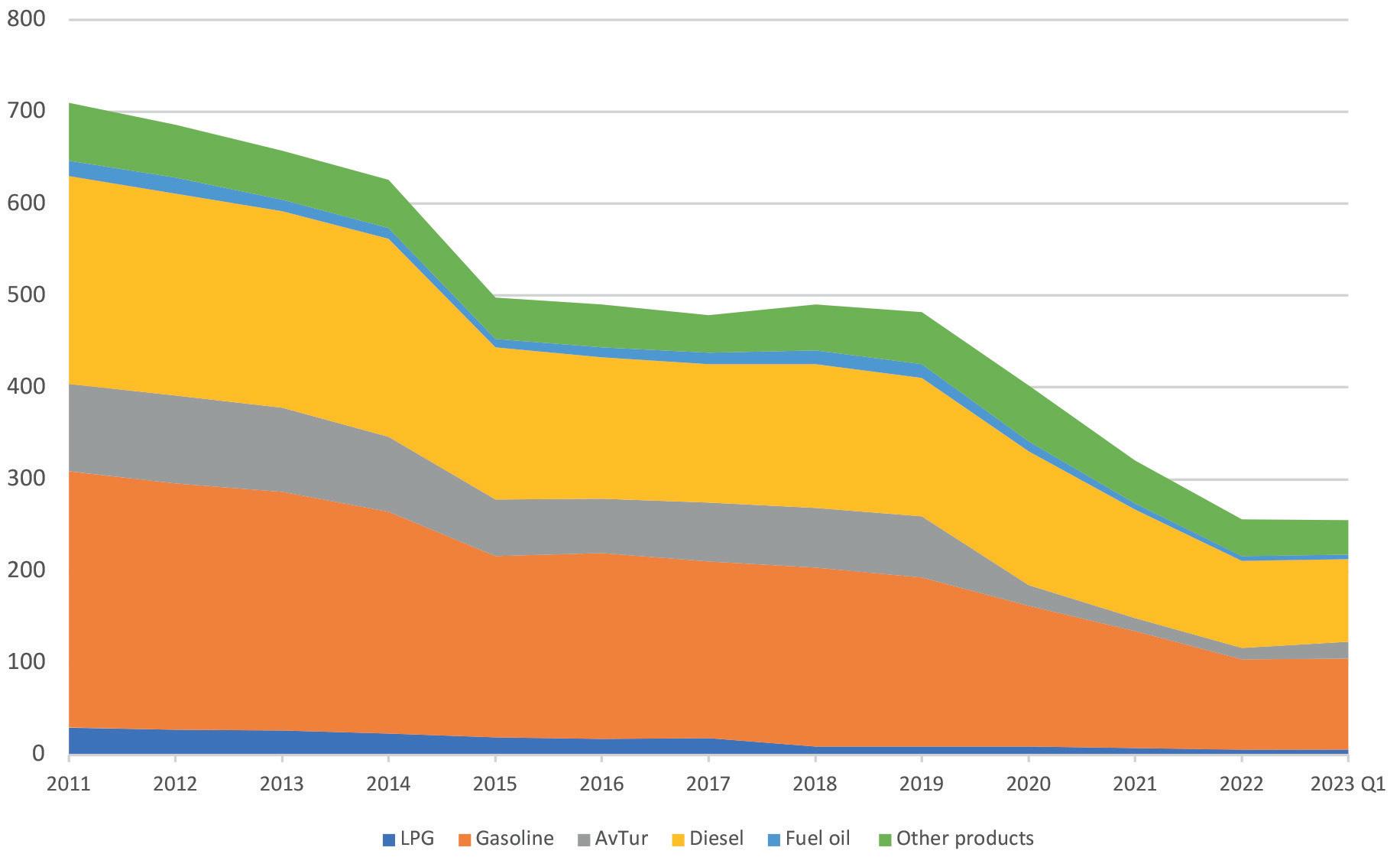

Figure 1. Australia key petroleum product sales, 2011 – 1Q23, ‘000 bpd (source: Australian Department of Climate Change, Energy, the Environment and Water).

We make chemistry happen

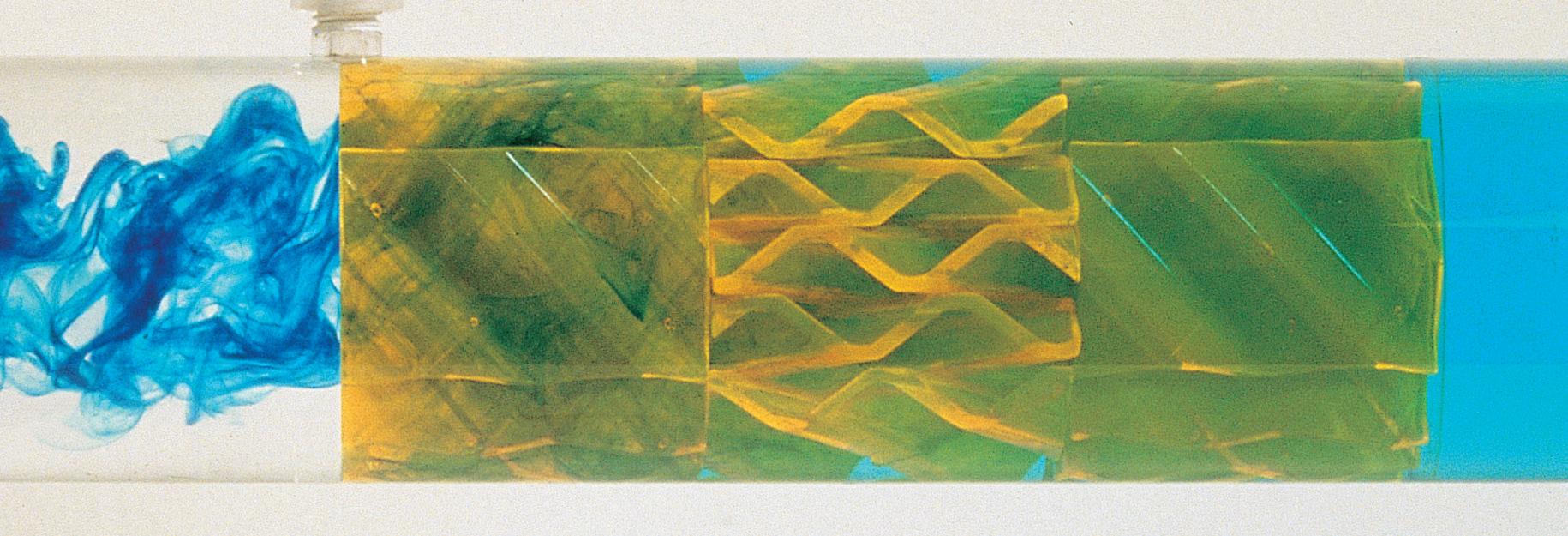

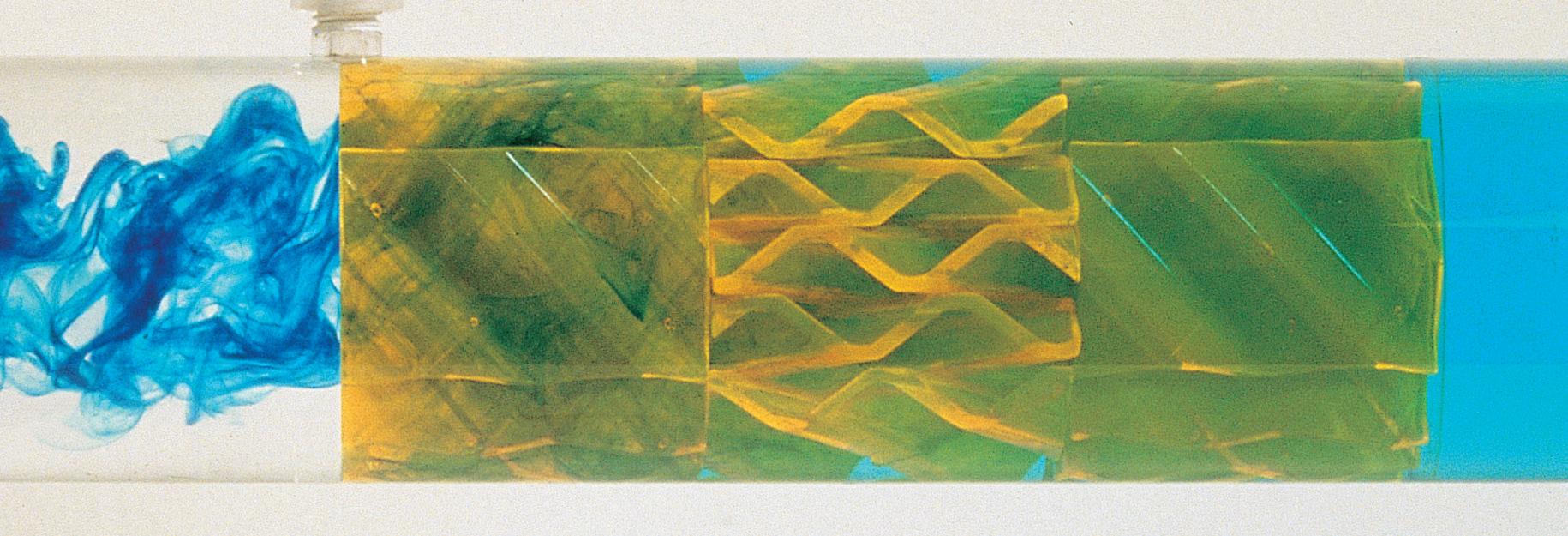

Sulzer Chemtech is the global market leader in innovative mass transfer, static mixing and polymer solutions for chemicals, petrochemicals and refining. We are steering the way in ecological solutions such as bio-based chemicals, polymers and fuels, recycling technologies for textiles and plastic as well as carbon capture and utilization/storage, contributing to a circular and sustainable economy.

We are solution provider for mass transfer equipment, its installation and upgrade, with solutions for all types of separation, from distillation and absorption to phase separation and liquidliquid extraction. In order to benefit from the high performance capabilities of the column internals, it is important that they are installed in the proper manner. Sulzer Chemtech can also assist you in installing the internals on site with our team of field services professionals.

For more information, please visit sulzer.com/chemtech

spot, exporting 114.1 billion m 3 of LNG vs Australia’s 112.3 billion m 3 . Australian LNG exports flow mainly to Japan, China, South Korea and Taiwan. There are plans to build new LNG capacity, including the Scarborough project scheduled for 2026. However, new projects may be delayed because of concerns over stagnating natural gas production. Without additional upstream natural gas development, the priority is to supply existing LNG plants rather than to build new ones.

Unlike coal, most of Australia’s natural gas reserves are in the northwest part of the country, while the population is centred in New South Wales (NSW) and Victoria. The government forecasts shortages of natural gas in NSW, and it is actively working to control domestic prices and supply. Australia’s first LNG import terminal, Port Kembla in NSW, is expected to open by the end of 2023, with the goal of bringing Queensland LNG to NSW – potentially supplying as much as 75% of the state’s demand.

Australian oil sector

Oil demand in recovery

Australia’s oil sector has changed dramatically. During the Asian Boom, Australian demand growth mirrored its neighbours far more than it did its OECD contemporaries. Prior to the COVID-19 pandemic, oil demand was still growing at a robust 1.3%/yr on average from 2011 to 2019, whereas OECD oil demand was shrinking by -1.9%/yr. Australia’s oil demand has remained strong in comparison to other OECD countries, although the pandemic hit the travel industry and transport fuel demand particularly hard. Figure 1 shows the pandemic’s impact on sales of key transport fuels. Jet fuel sales dropped from approximately 161 400 bpd in 2019 to 70 100 bpd in 2020, fell again to 63 500 bpd in 2021, and

began to climb back to 107 300 bpd in 2022. Data for 1Q23 shows demand continuing to recover, averaging 135 900 bpd.

Gasoline sales fell from 299 000 bpd in 2019 to 260 800 bpd in 2020. Demand rose modestly to 267 100 bpd in 2021, continued to recover to 275 300 bpd in 2022, and rose again to average 280 100 bpd during 1Q23.

Diesel sales were the least affected by the pandemic, declining slightly from 509 700 bpd in 2019 to 505 800 bpd in 2020, then resuming strong growth to 533 300 bpd in 2021, 541 600 bpd in 2022, and 548 000 bpd during 1Q23.

Total product sales in 2022 amounted to 985 200 bpd, rising to 1 022 500 bpd during 1Q23.

As Figure 1 illustrates, gasoline sales had been falling even before the COVID-19 pandemic hit, and this trend is expected to continue.

Drastic cuts in refinery capacity and output

The past decade has brought enormous upheaval to Australia’s refining industry. Refining companies had long foreseen a future of declining demand and tighter environmental regulations, including requirements for ultra-low-sulfur fuels, which would require significant investment. Australia’s refineries were typically mid-sized and gasoline-oriented, and they were becoming antiquated when compared to some of the giant new refineries in Asia and the Middle East. Yet the decision to close a refinery is a difficult one, and most companies held on for years despite low margins.

Over the past decade, however, refiners have been forced to cut capacity ruthlessly, often converting former refinery facilities to product import terminals and supplying their networks with fuel from refineries in Asia and beyond. Shell converted its Clyde refinery to a product terminal in 2013, and it sold its Geelong refinery to Vitol in 2014. In 2014, Caltex closed its Kurnell refinery. BP closed its Bulwer Island refinery in 2015 and converted its Kwinana refinery to a product terminal in 2021. BP plans to build renewable diesel and sustainable aviation fuel (SAF) production at the Kwinana site, with current plans to produce 10 000 bpd of these renewable fuels. ExxonMobil closed its Altona refinery in 2021.

Currently, only two refineries remain in Australia: Ampol’s Lytton refinery (formerly Caltex) and Vitol Viva’s Geelong refinery (formerly owned by Shell).

Even with this downsize, there are concerns about future

August 2023 HYDROCARBON ENGINEERING 12

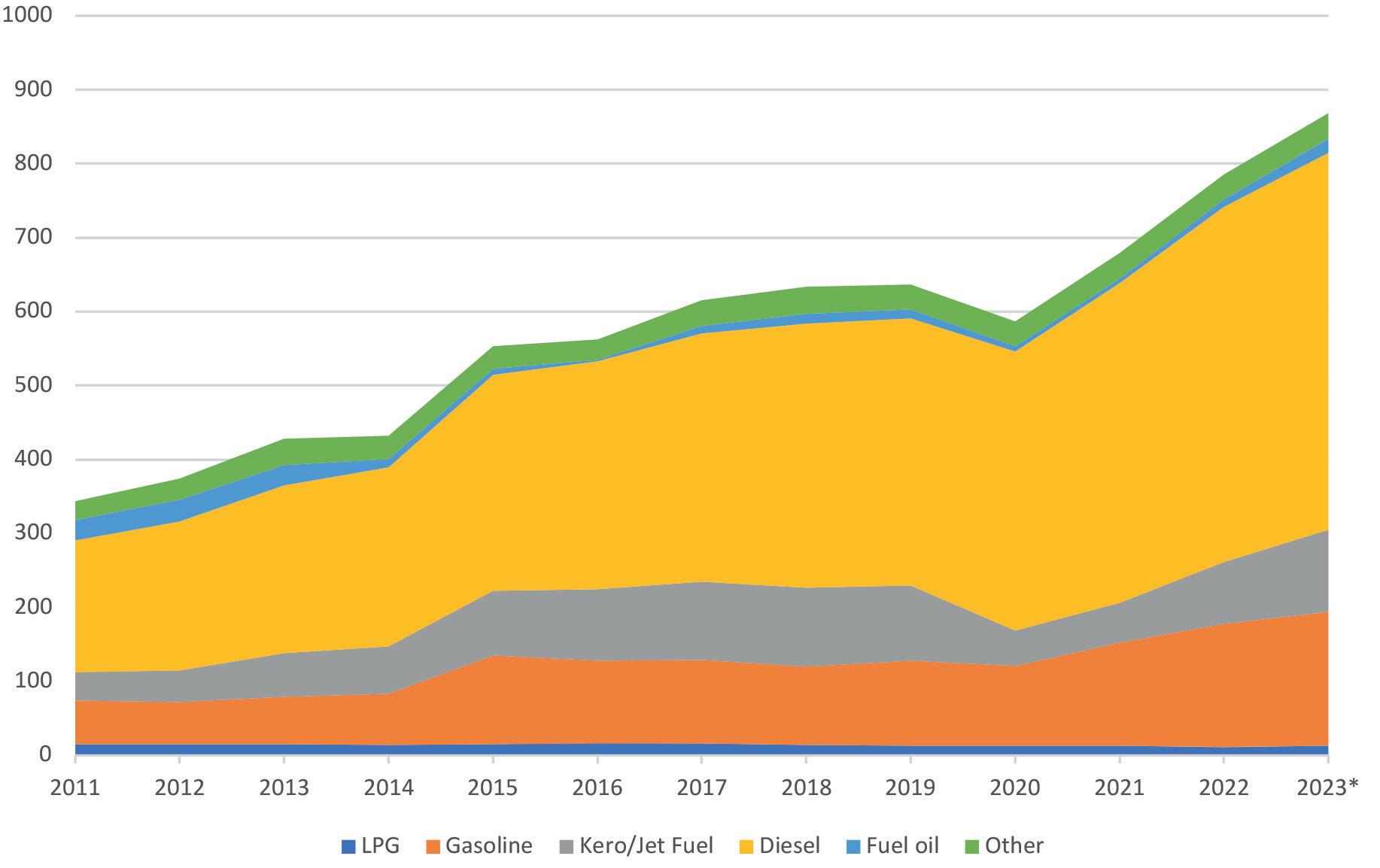

Figure 2. Dramatic downturn in Australian refined product output, 2011– 1Q23, ‘000 bpd (source: Australian Department of Climate Change, Energy, the Environment and Water).

Invisible. Invaluable.

Effective asset management is more than digital tools and data. It requires the behind-the-scenes use of best practices and a deep understanding of heavy industry infrastructure.

When decades of EPC experience meets data analytics, our clients have an integrated solution for the reliability they require.

Let

find ways to help you.

’s

• Fu l l -s e r v i ce s o l u ti o n s f r o m d e si g n an d c o n s t r u c ti o n t o o p e r a ti o n s & m a i n te n a n c e • E n h a n c e d d ia g n o s ti c s t o r a pi d ly a c h i eve yo u r g o a l s • D a t a - d r i ve n o p e r a ti o n s & m a i n te n a n c e f o r m a x i m ize d R O I

profitability. Australia’s two remaining refineries received government subsidies to remain in operation, lest the country be left without any refining capability. The government decided that the country needed a ‘sovereign fuel supply’. It passed the Fuel Security Bill in 2021, providing approximately AU$2.3 billion (US$1.8 billion) in subsidies to Ampol and Viva Energy to remain open until 30 June 2027, with a possible extension to 2030. The regulations call for minimum stockholding obligations (MSO) for gasoline, jet fuel and diesel. When margins are low, the government may provide a subsidy of up to AU$0.18/l to the refiners. The government is providing each refinery with up to AU$125 million to upgrade their facilities to produce ultra-low-sulfur gasoline (maximum 10 ppm sulfur) by the end of 2024.

Australia’s crude refining capacity is currently 236 000 bpd, down from its height of 829 000 bpd in 2002. The government reported total refinery input of 261 600 bpd in 2022, 26.8% of which was indigenous. Figure 2 displays the dramatic downturn in refinery production, which dropped from 710 000 bpd in 2011 to 256 000 bpd in 2022. In 2022, output was:

n LPG: 2.2%.

n Gasoline: 38.4%.

n Aviation turbine fuel: 4.8%.

n Diesel: 37%.

n Fuel oil: 2.0%.

n Other products: 15.6%.

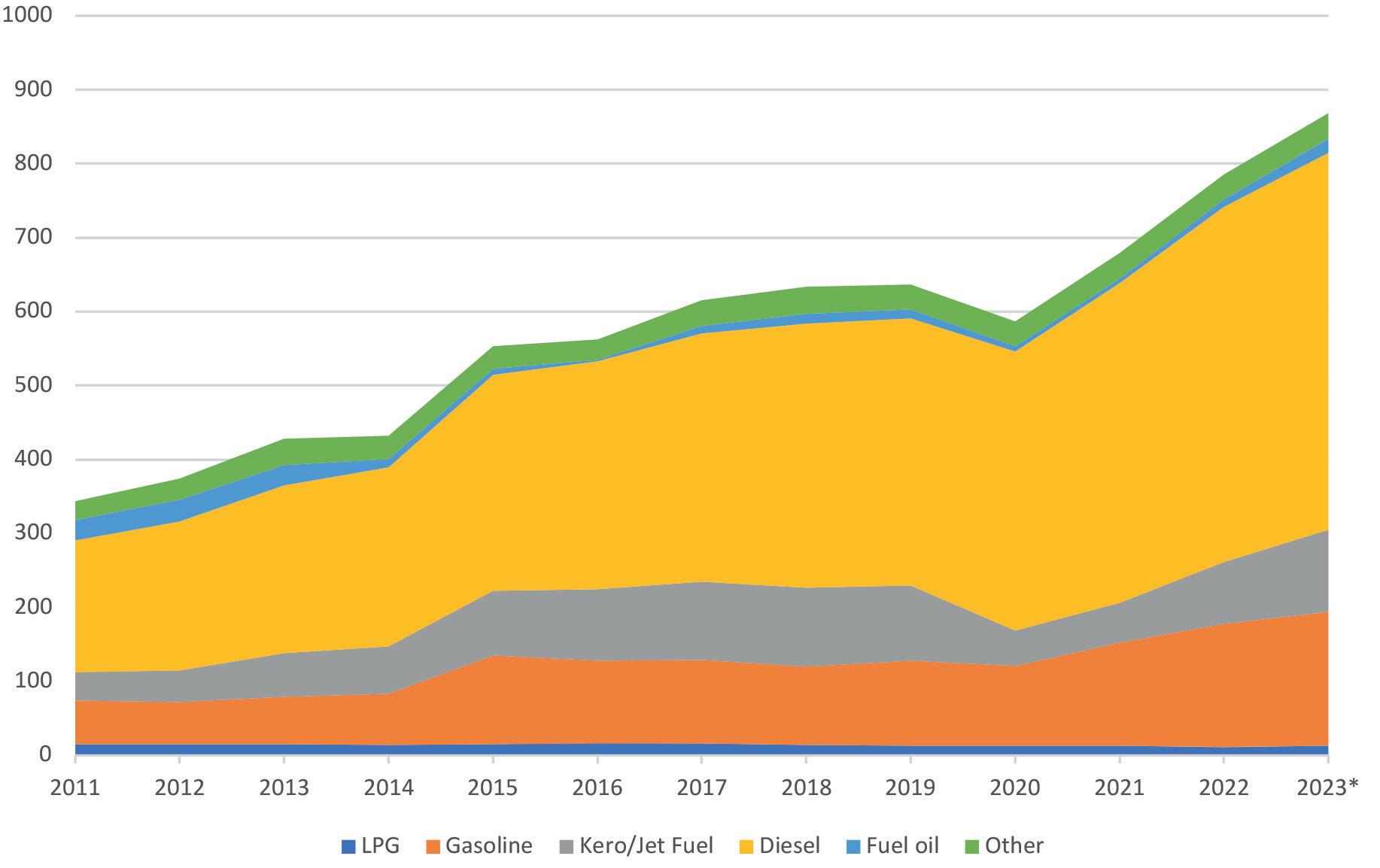

Refined products imports balloon; exports vanish

Australia is becoming hugely dependent on imported fuels, as shown in Figure 3. In 2011, the country imported 343 000 bpd of refined products, juxtaposed against market sales of 941 500 bpd. Product imports grew to 868 000 bpd during 1Q23, vs demand of 1 022 500 bpd. In 2011, imports accounted for approximately 36% of

Australia’s demand. By 1Q23, this share had surged to 85%. Australia’s dependence on imported diesel is staggering, with domestic refining supplying less than 10% of market sales. During 1Q23, domestic sales of diesel averaged 548 000 bpd, and diesel imports were 510 000 bpd – 93% of demand. Diesel imports are sourced mainly from the Asia-Pacific region, including Singapore, South Korea, India, Malaysia, Taiwan, Thailand and China. Gasoline imports also come chiefly from Asia-Pacific refining centres, but cargoes have also arrived from more distant sources in Europe, the US, and the Middle East. During 1Q23, domestic sales of gasoline averaged 280 100 bpd, while imports averaged 181 000 bpd – approximately 64% of demand.

Australia’s shrunken refining capability has caused imports to soar and exports to dwindle. The demand collapse as a result of the COVID-19 pandemic caused a brief jump in product exports, which rose from 66 200 bpd in 2018 to 107 500 bpd in 2020, but exports retreated to 86 800 bpd in 2022. Of this, however, 80 200 bpd was LPG. Exports of higher-value gasoline, diesel and jet fuel have essentially vanished.

Conclusion

Australia’s energy markets continue to change and evolve. It is a complex process, but the presence of so many choices is more a blessing than a curse; a country with few choices is likely a country with few resources and capabilities. Australia has both the resource base and the capability to use it. With the benefit of hindsight, however, it is easy to say that devotion to coal eclipsed other development, and phasing out coal is now extremely difficult. Coal use has been shrinking at -2.5%/yr, but it still represented a hefty 25.9% of Australia’s primary energy in 2022. Given the technology of today, it is not possible for Australia to maintain this dependence on coal and still achieve its goal of carbon-neutrality by 2050.

During the decade from 2012 through to 2022, the EU managed to cut its CO 2 e emissions by an average of -1.6%/yr. 3 Australia is lagging far behind. The country achieved an emissions reduction of only -0.2%/yr during the decade. Efforts to reduce coal use are focused on expansion of natural gas use, government support for a slimmed-down oil refining industry, and a host of alternative and renewable energy developments which now appear to be gaining traction.

Natural gas and LNG continue to be viewed as the best near-term tactic to replace coal. The government recently unveiled its ambitious National Gas Infrastructure Plan (NGIP), designed to secure natural gas supplies over a 20-year time horizon.

August 2023 HYDROCARBON ENGINEERING 14

Figure 3. Australia’s rising dependence on imported fuel, 2011 – 1Q23, ‘000 bpd (source: Australian Department of Climate Change, Energy, the Environment and Water).

The government is also actively controlling price and supply, which is a comfort to consumers but worrisome to private companies. The government set a cap on natural gas prices to shield consumers from high prices, and it has established a ‘code of conduct’ intended to protect consumers while still providing what it considers certainty to producers. The government is also seeking to expand its ability to control LNG exports from east coast producers when supply shortfalls are foreseen. Australia’s first LNG import terminal is scheduled to open within the year, bringing supply to NSW.

Oil use is declining modestly, although diesel demand remains very strong. The market may be viewed as stabilising into a gentle downward trend. After the dramatic closure of five Australian refineries, the two remaining refineries must make the investments necessary to comply with government regulations, but they are considered vital to supply security. The government is subsidising its operations at least through to 2027, extendable to 2030. Although the government relies on imported feedstocks for 70 – 75% of refinery inputs, it has a slight advantage because the incremental barrel of refined fuel supply is an imported barrel. When margins drop below a specified level, the government will pay a direct per-litre subsidy. Most of the former refining companies are adept product traders, and they continue to compete at the retail level. Consumers will expect high-quality fuel and ample choice.

The largest potential for change in Australia’s energy economy is likely to be in strategic minerals that are vital to new energy technologies. Years ago, before the huge advances made in batteries and electric vehicles (EVs), Australia sold off vast amounts of its lithium. It remains the world’s largest exporter of lithium, but there is great potential to capture value-added by processing its own lithium and other vital minerals rather than relying on simple resource extraction. In February 2023, the government released a brief ‘National Battery Strategy’, championing the idea of developing a globally competitive battery industry. 4 Energy storage will be vital to Australia’s clean energy future. With Australia’s abundant sunshine, it is a natural site for virtual power plants. Australia could also become a major player in the global export market, diversifying the sources of supply to countries including the US.

Finally, a new agent of change is emerging in Australia: high-tech titans impatient with the slow pace of change. Of these, Mike Cannon-Brookes of software company Atlassian hit the headlines when he led a boardroom coup against AGL Energy Ltd, Australia’s largest electricity generator and its largest carbon emitter. Shareholders stunned the company by rejecting company board picks and voting in four new ‘green’ board members. Consequently, AGL is now closing a coal-fired power plant and conducting a feasibility study into converting the site into a clean energy hub.

Australia is resource-rich, and it is working to cut its fossil energy use. Will Australia’s approach mirror that of BP’s? As noted, BP’s Statistical Review of World Energy has been transferred to the EI, in partnership with KPMG, Kearney, and Heriot Watt University. BP continues to support the effort, which it launched in 1952. BP was one of the first to start publishing data on global CO2 emissions, which it added in 2010. The company is transitioning to a wider-ranging energy company, going ‘beyond petroleum’. Can Australia go ‘beyond coal’, and find the optimal use of its resources to ensure an ecologically and economically sound energy future?

References

1. Author’s calculation using CO2e data from the EI, and population data from the individual countries.

2. For more information on the Australia Department of Climate Change, Energy, the Environment, and Water, see: www.energy.gov.au/data/renewables.

3. CO2e are defined as “the sum of CO2 emissions from energy, CO2 emissions from flaring, methane emissions in CO2e and CO2 emissions from industrial processes.” The early years were calculated by BP, and this data is now tracked by the EI.

4. ‘National Battery Strategy’, Australian Department of Industry, Science and Resources, (February 2023).

capture.

Let´s get the future started today.

→ compressors e.g. for electrolyser projects, hydrogen, CO 2 and process gases

→ membrane systems for hydrogen separation and carbon capture

→ ball valves for midstream and downstream applications

→ heat transfer systems for hydrogen and syngas projects.

We look forward to welcoming you at our booths: Hydrogen Technology & Carbon Capture Expo, GASTECH and ADIPEC 2023.

www.borsig.de

BORSIG

Think. Create. Change.

Hydrogen and carbon

solutions for your processes.

Klaus Brun, Elliott Group, and Timothy C. Allison and Natalie R. Smith, Southwest Research Institute, discuss how turbomachinery advancements can improve the performance of various energy storage systems, including hydrogen.

16 August 2023 HYDROCARBON ENGINEERING

Global integration of renewable energy sources (with high variability) into the power generation mix requires the development of cost-effective, efficient and reliable grid-scale energy storage technologies. A number of energy storage technologies are being developed that can store energy when excess renewable power is available, and discharge the stored energy to meet power demand when renewable generation drops off, assisting or even displacing conventional fossil- or nuclear-fuelled power plants. The development and commercialisation of these technologies is a critical step for enabling high penetration of renewable energy sources.

Energy storage demands are complex, and the corresponding solutions may vary significantly with required storage duration, charge/discharge duty cycle, geography, daily/annual ambient conditions, and integration with other power or heat producers and consumers. Typically, commercial viability of an energy storage system is a function of both performance and cost.

Many mature and emerging energy storage technologies use combinations of thermal, mechanical and chemical energy to meet storage demands over a variety of conditions. These systems offer the potential for better scalability than electrochemical batteries. While recognising that a broad variety of machinery-based energy storage systems either exist or are under development to address the need for low-cost, long-duration storage, this article will focus primarily on hydrogen, including an overview of how hydrogen impacts compression and combustion in machinery, for both pure hydrogen and blended hydrogen applications.

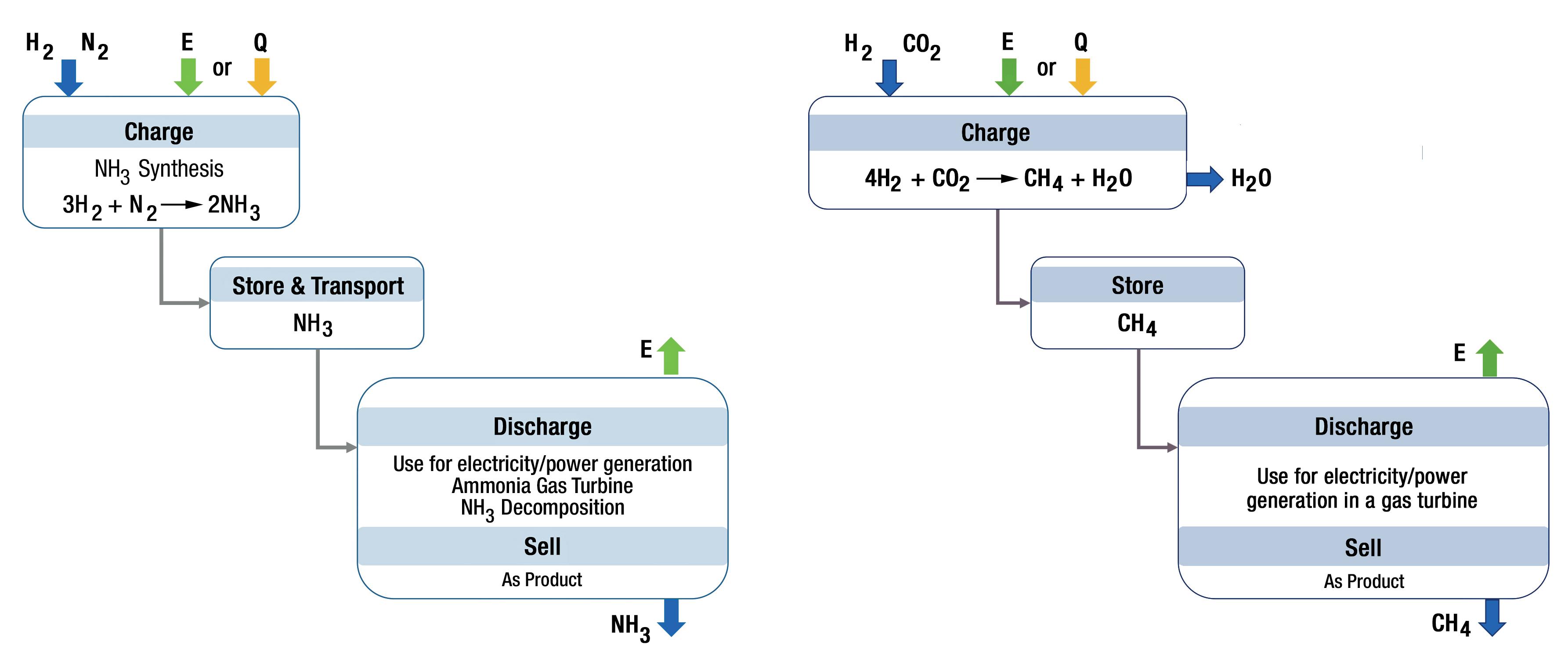

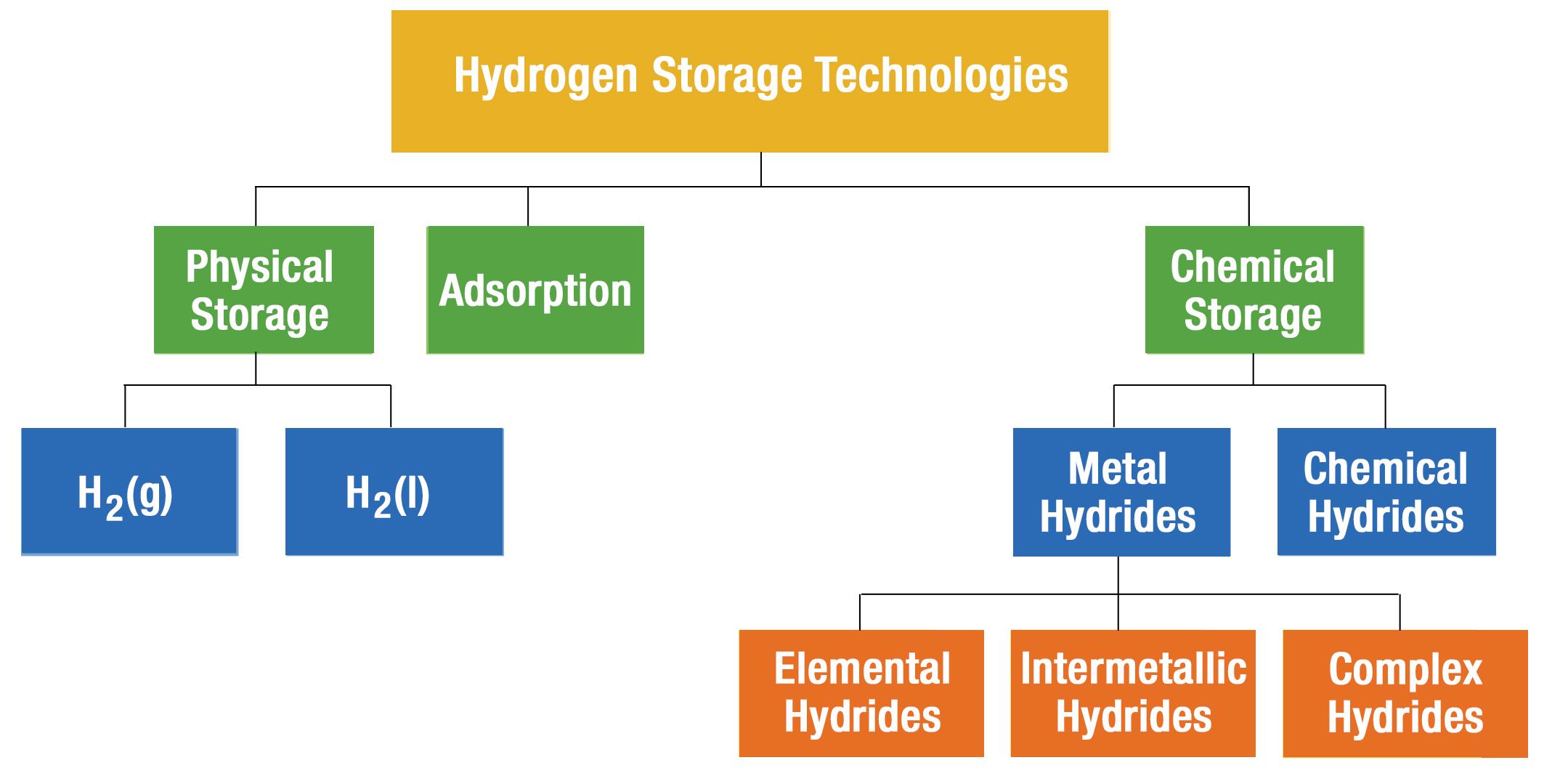

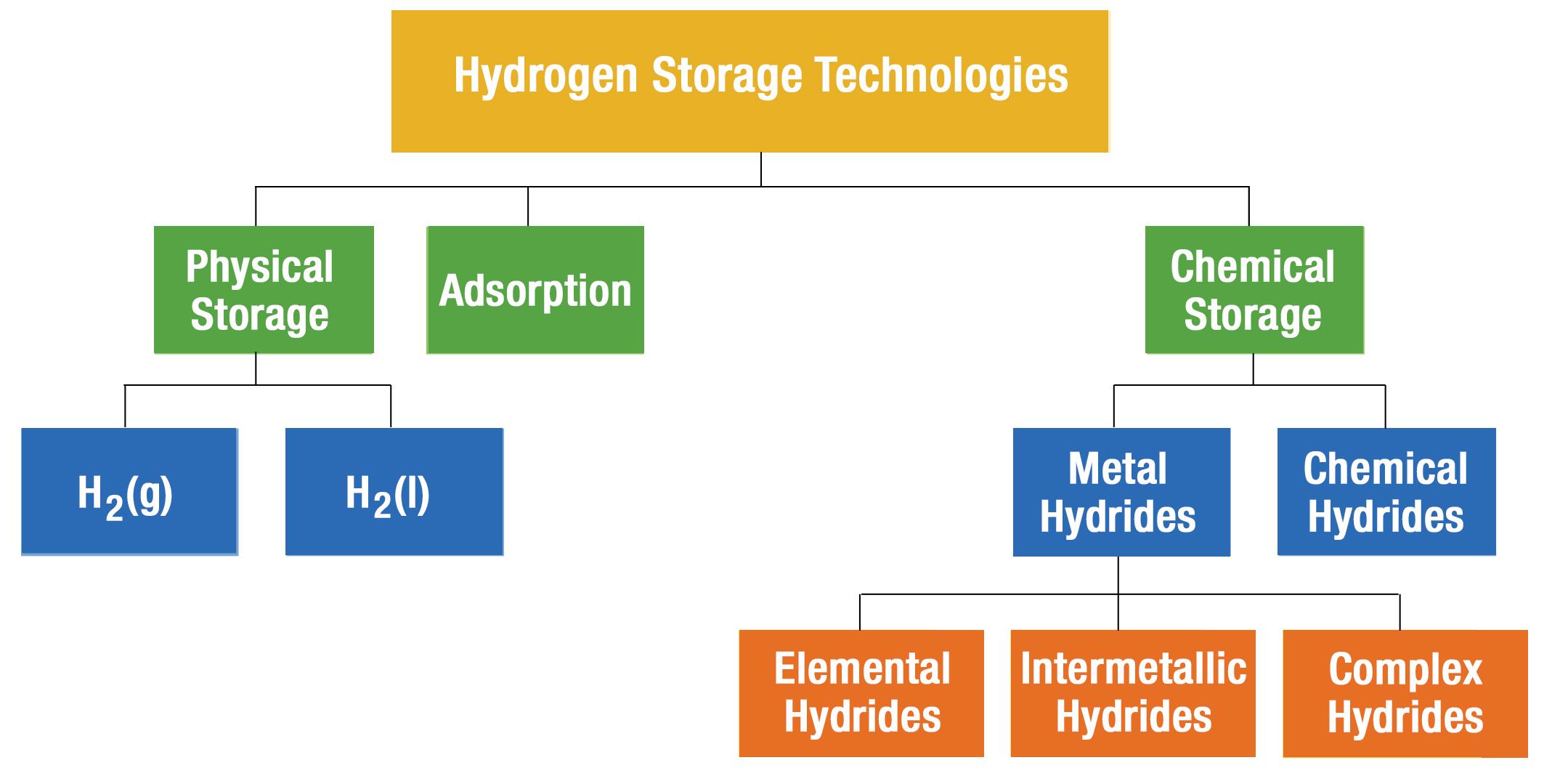

Hydrogen energy storage

Hydrogen technologies are among the most well-known thermochemical storage options, and include a wide range of generation, storage, transmission, and electrical conversion systems. Thermochemical storage is an attractive storage medium due to its zero-carbon formulation and long-term stability, enabling seasonal storage. Most existing hydrogen is formed by steam reforming using coal or natural gas, although electrolysis of water via renewable or nuclear power is being developed for a carbon-free solution. Hydrogen is already stored in large volumes in underground salt caverns, but poses compression and transportation challenges due to its low mole weight, meaning that it requires significant compression power and lower heating value than methane. Various hydrogen carriers have been considered, including ammonia, metal hydrides, sorbents, formic acid and methane (see Figure 1). Power conversion with hydrogen and hydrogen products can be accomplished via combustion in a gas turbine or other process, or electrochemically via fuel cells.

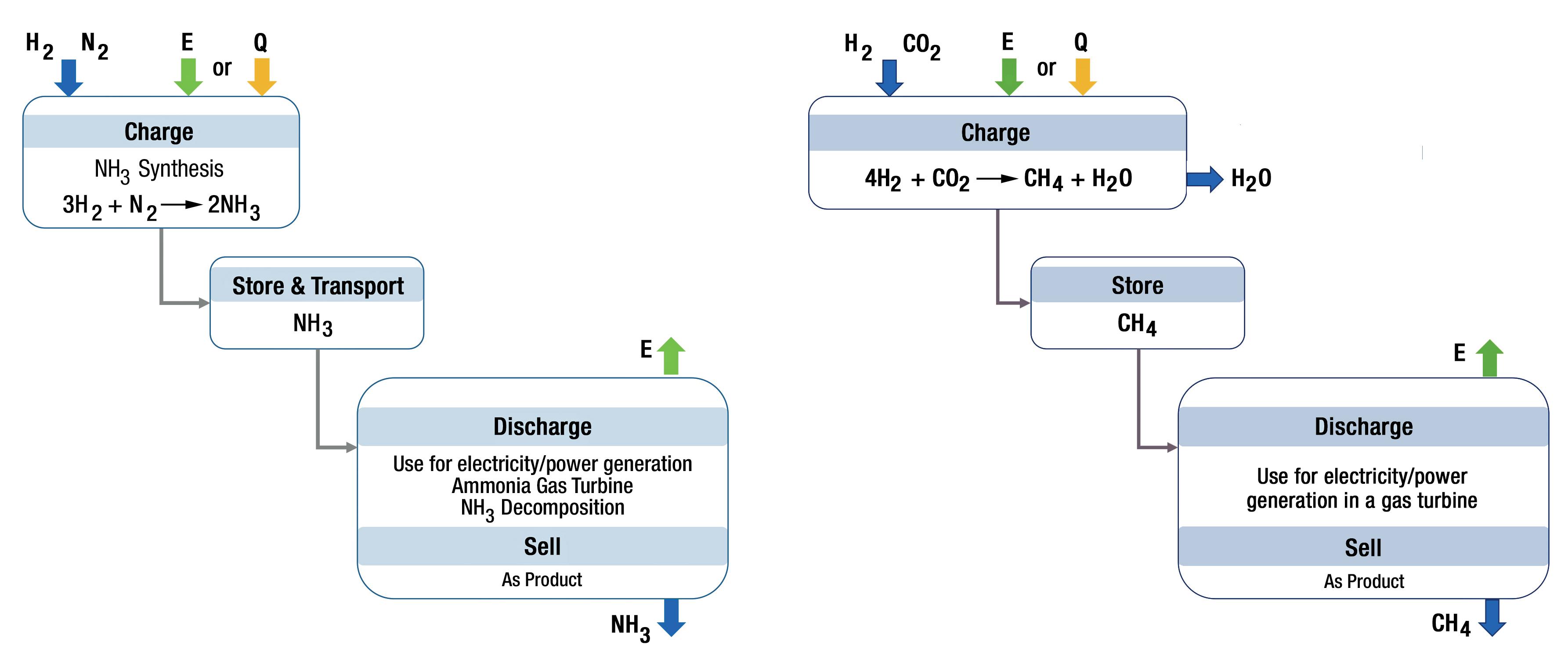

Hydrogen can be stored in many forms, including as a high-pressure gas, liquid, adsorption with various materials, and metal (many materials including magnesium and aluminium) or chemical hydrides (formic acid, ammonia, methane, methanol, or liquid organic hydrides). Two carrier synthesis methodologies are shown in Figure 2: ammonia synthesis and natural gas synthesis.

August 2023 17 HYDROCARBON ENGINEERING

Ammonia is transportable as a liquid and has been explored as a gas turbine fuel, but is also valuable for fertilizer use in its own right. There is broad experience with methane transportation (carbon dioxide [CO2]-to-fuel or power-to-gas), which effectively uses the natural gas pipeline infrastructure as a storage system. Many challenges are linked to these approaches, including nitrogen oxide (NOx) formation associated with ammonia combustion, and the low efficiencies of the synthesis processes, coupled with the low efficiency of a hydrolysis or methane reformation process.

Many thermal-mechanical energy storage systems can use adaptations of relatively conventional turbomachinery. However, hydrogen energy storage is generally more complex for various reasons. Using centrifugal compressors to compress hydrogen or process gases with high hydrogen content poses special technical challenges because of the physical properties and flammability of hydrogen. Although hydrogen is processed in a variety of industrial applications, most hydrogen compressors are found in refineries for hydrotreating; hydrogen plants; and hydrocracker applications. Within these refinery applications, feed gas, recycle, net gas, and booster compressors are used to compress hydrogen over a wide range of pressures and flows. Other hydrogen compressors are found in gasification, electrolysis, and many chemical and petrochemical plants.

Hydrogen compression is challenging for the following three reasons:

n It is an extremely light gas.

n It can cause hydrogen embrittlement in ferrous alloys.

n It has a low auto-ignition temperature in the presence of oxygen.

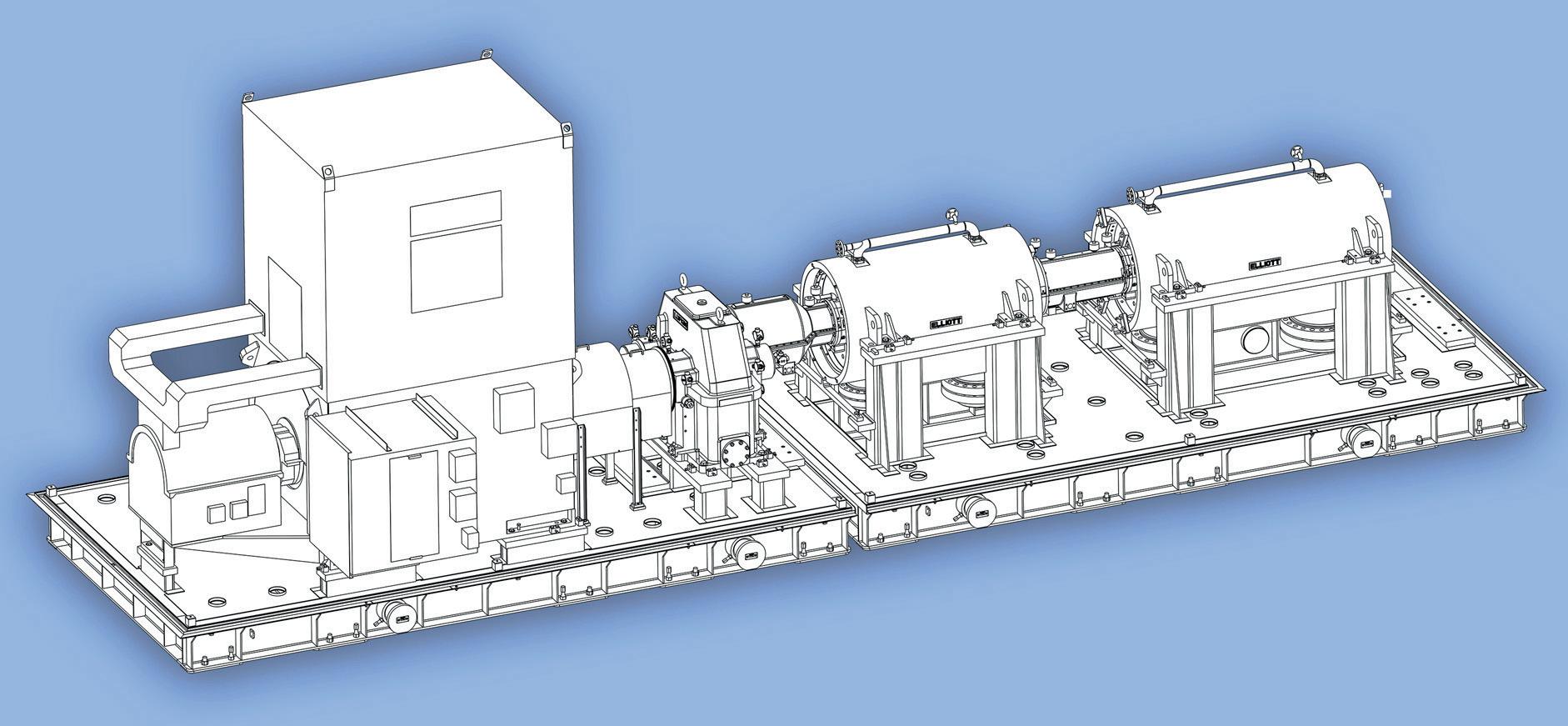

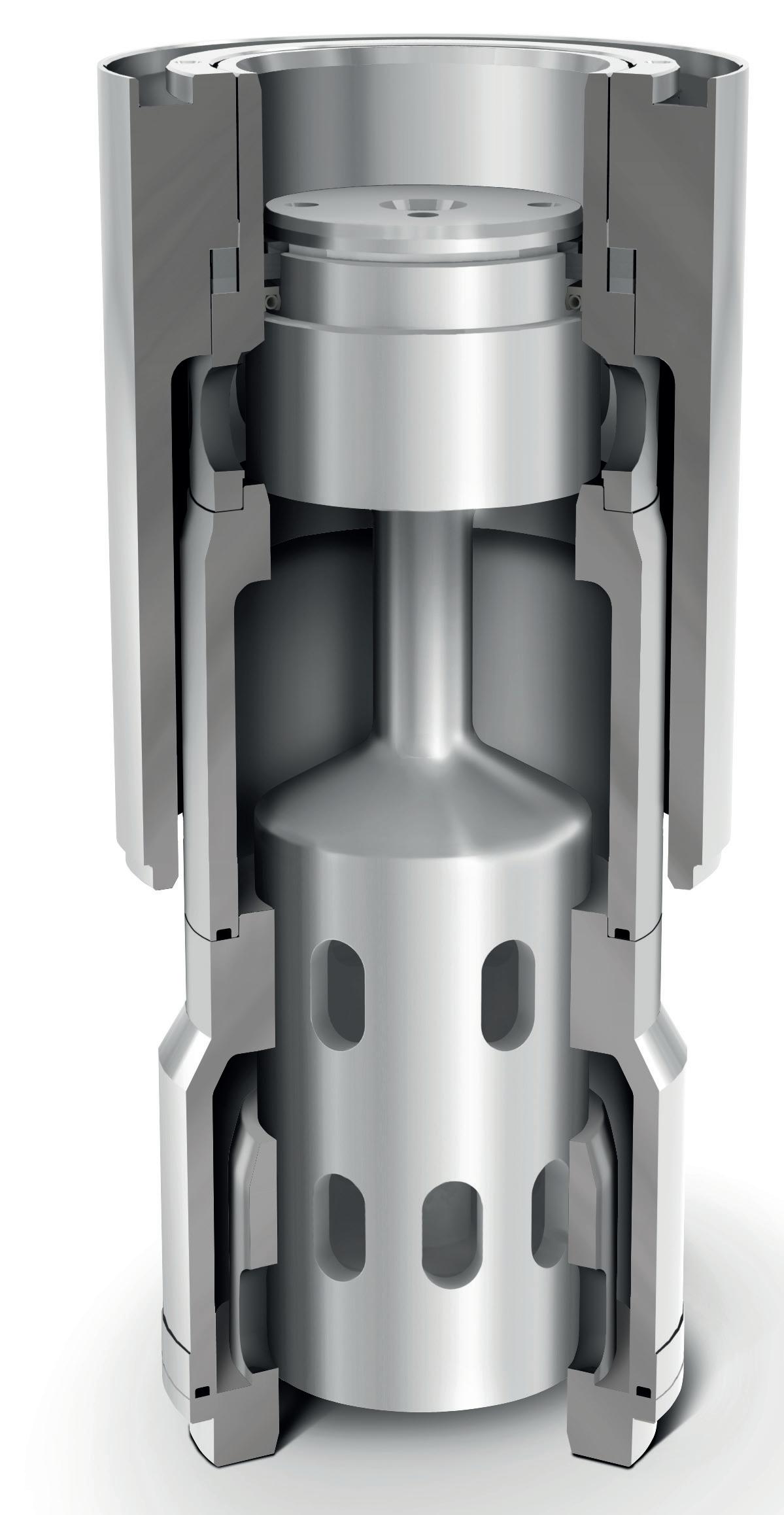

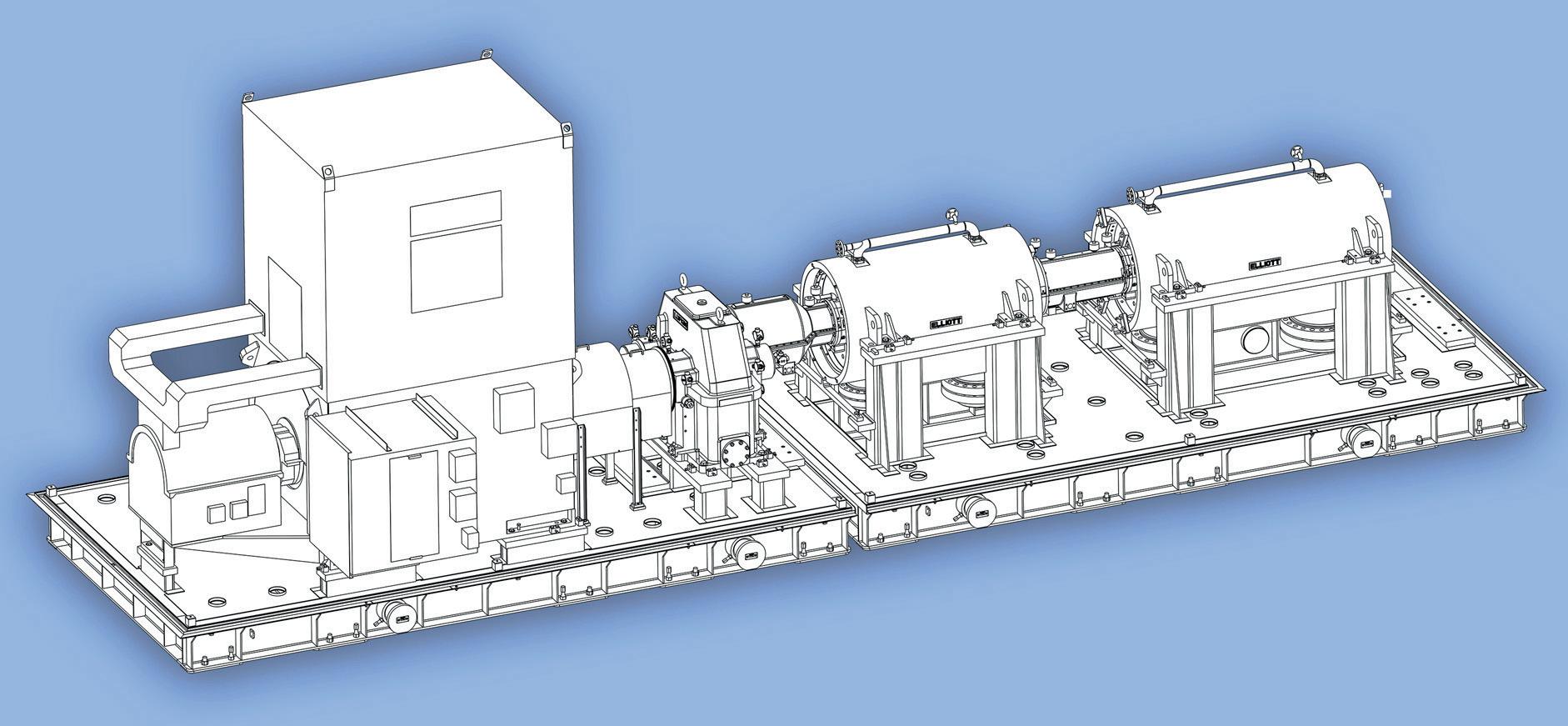

Light or low molecular weight gases are difficult to compress, resulting in a low head rise per centrifugal stage in the compressor. Even at relatively high impeller tip speeds of 350 m/sec., typical pressure ratios per stage seldom exceed 1.1. This means that long compression trains with many stages per barrel are required if a significant pressure rise is desired. For example, Figure 3 shows a compression train for a refinery net gas application. Here, each of the compressor barrels operating in series has eight centrifugal impeller stages, which results in a total pressure rise from 7 bara to 18 bara. To achieve higher pressure ratios, either higher impeller tip speeds or longer compression trains with increased compression power are required.

Another centrifugal compressor prototype designed for hydrogen service required six stages, with tip speeds exceeding 700 m/sec. in order to achieve a 3:1 pressure ratio. 2 Kurz et al explored the effect of mixing up to 20% hydrogen into natural gas pipelines, noting a significant increase of up to almost 60% in power consumed vs transported due to the increased compression power and lower energy density, and also a requirement to add compression stages and/or units. 3

Hydrogen embrittlement is a metallurgical interaction between ferrous metals and hydrogen gas at certain pressures and temperatures that can lead to rapid yield strength deterioration of the base metal in the compressor. Special surface coatings are available to minimise exposure and direct penetration of hydrogen into the metal. However, as a safety precaution, the design yield strength of the exposed alloys must be limited to below 827 MPa. This further limits the operating speed of the compressor and its pressure rise per stage. Hydrogen molecules are small compared to most hydrocarbon gases, which makes case-end and inter-stage sealing challenging. Most hydrogen compressors use tandem dynamic dry gas seals and multiple static O-rings to minimise leakage flows. Nonetheless, hydrogen detection and scavenging is often required to minimise the risk of hydrogen exposure to the atmosphere and the associated explosive hazards.

Hydrogen combustion in gas turbines is an area that has been widely

August 2023 HYDROCARBON ENGINEERING 18

Figure 1. Hydrogen storage technologies.1

Figure 2. Ammonia (left) or methane (right) as hydrogen carriers.

Hydrogen Compression

Turn to Elliott Group for operational flexibility in hydrogen applications.

Elliott’s Flex-Op® Hydrogen Compressor features flexible, configurable, and economical compression options for hydrogen applications. Designed with proven Elliott compressor technology, the Flex-Op’s compact arrangement of four compressors on a single gearbox maximizes compression capability with enough flexibility to run in series, in parallel, or both. Who will you turn to?

n Learn more at www.elliott-turbo.com

The World Turns to Elliott COMPRESSORS |

|

CRYODYNAMICS®

GLOBAL

TURBINES |

SERVICE

explored and demonstrated by many original equipment manufacturers (OEMs), yet challenges remain. This topic is broadly covered in other literature, but in general the challenges associated with hydrogen combustion stem from its high flame speed and very broad flammability limit compared to methane.4 Hydrogen has a safely high autoignition temperature, but very low ignition energy, thus requiring significant safety precautions. The high flame speed and high combustion temperatures create combustor design challenges to avoid flashback, combustor instabilities, and NOx formation.

There is significant experience with hydrogen combustion in diffusion flame combustors, with good results, although NOx emissions increase to almost twice the levels experienced with pipeline natural gas combustion due to higher flame front temperatures. There is less experience with lean premixed combustion systems. The general consensus among OEMs is that existing lean premixed combustion systems can operate with 5 – 15% hydrogen mixed into natural gas, requiring no significant modifications. Commercial operating experience with lean premixed combustors has been documented, ranging from 5 to 33% hydrogen (by volume). Higher concentrations of hydrogen require more advanced combustor architectures, including multi-tube, multi-cluster or micromix designs that

can perform at concentrations of up to 50 – 65% hydrogen by volume, and in some cases have been tested with up to 100% hydrogen.

Machinery developments for energy storage systems

Turbomachinery for energy storage applications has to satisfy a number of operational and performance requirements. These are primarily driven by the type of energy application, the service duty, and the plant’s commercial and operational design requirements. Fundamentally, most energy storage applications aim for high round trip efficiency, low capital cost, wide operating range, frequent starts and stops, and very high availability. Some of these requirements are inherently contradictory and require compromised design decisions. For example, while it is desirable to keep the stage count in a compressor for Compressed Air Energy Storage (CAES) or Pumped Hydroelectric Energy Storage (PHES) to a minimum, in order to reduce capital costs, the resulting high stage loading will often lead to lower efficiency and limited operating range. Similarly, advanced technologies such as magnetic or gas bearings can help to reduce parasitic losses, but often have an impact on the reliability of the plant. Finally, the frequent starts and stops required for almost all energy storage applications can have a significant life-reducing impact on the turbomachinery, as a result of thermal-mechanical stresses.

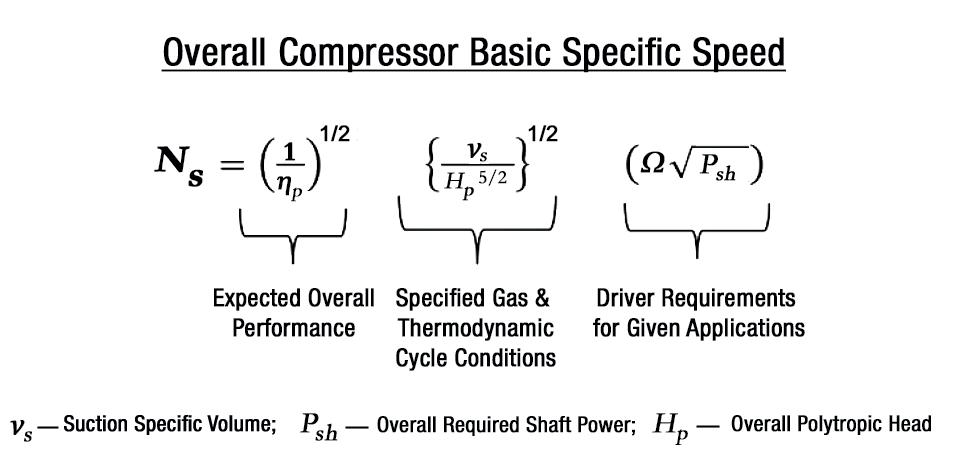

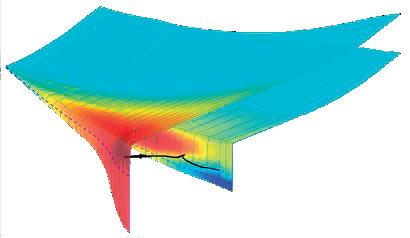

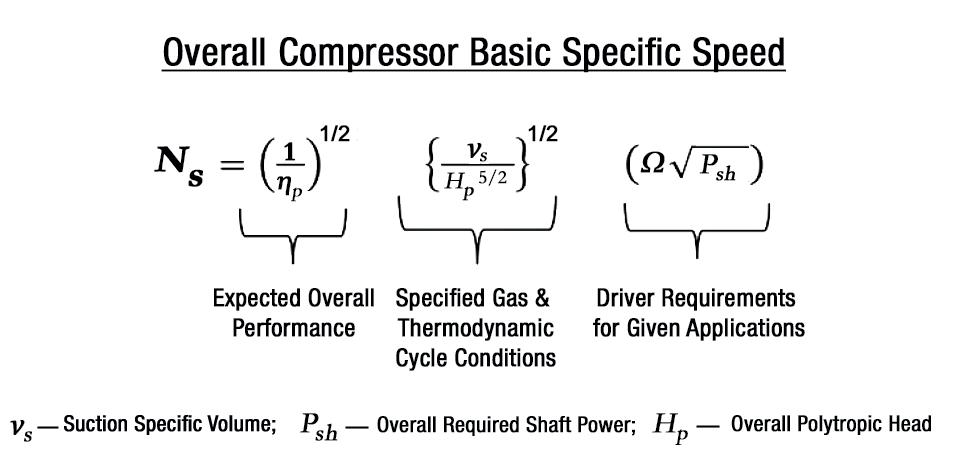

The objective for a thermal-mechanical energy storage scheme is not to isolate the design of turbomachinery components from the thermodynamic cycle, but to design them as an integrated system so as to increase the efficiency of the entire process rather than just the machine. This requires some customised solutions that are often not commonly available with off-the-shelf or turbomachinery products. Specific speed is a well-known design parameter that helps to determine the shape and size of turbomachinery for a given duty.

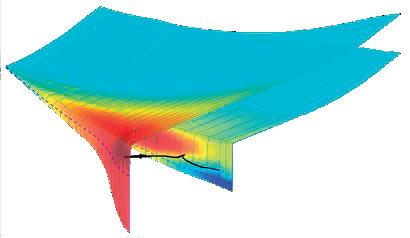

Figure 4 shows how the overall expected turbomachinery performance can be combined with the thermodynamic cycle to determine the overall specific speed of the system. In turn, this can be used for turbomachinery specific speed that works synergistically with the cycle to enhance overall efficiency. The specific speed can be effectively used to create a novel turbomachinery architecture that is highly customised to the chosen thermodynamic cycle.

August 2023 HYDROCARBON ENGINEERING 20

Figure 3. Two barrel tandem net gas hydrogen compressors driven by an electric motor (source: Elliott Group).

Figure 4. Connecting turbomachinery’s overall performance with thermodynamic cycle design.

The success of machinery-based energy storage systems requires the development of application-specific machinery in order to meet fast transient response requirements with high round trip efficiency, at low cost. The following list of design challenges that turbomachinery OEMs must consider clearly shows that some of these requirements are contradictory, and a fine balance is required for an optimal solution:

n System performance (efficiency) and operability (variability):

§ Efficient and flexible architectures, including blading shape.

§ Off-design performance matching, and flow range (surge).

n Cyclic operation:

§ Frequent start-ups and shutdowns at potentially high ramp rates.

§ Fatigue life.

§ Rotary inertia.

n High pressures and temperatures:

§ Materials.

§ Clearances, seals and bearings.

§ Thrust management.

§ Rotor assembly.

§ Equipment protection in hostile environments.

n Hostile environment:

§ Internal.

§ External.

§ Freezing concerns in expander.

Conclusion

Advancements in turbomachinery design will significantly improve the performance of various energy storage systems through increased efficiency, operating range, and application-specific design for each system. Improvements in efficiency, transient response, and operating range can significantly enhance the commercial viability of both standalone energy storage systems and systems that are coupled synergistically with other industrial thermal/electrical processes.

Note

• This article has been based on information from a short course given at the 2022 Asia Turbomachinery & Pump Symposium.5

References

1. DENNIS, R., ‘Hydrogen Storage: A Brief Overview of Hydrogen Storage Options’, Thermal-Mechanical-Chemical Energy Storage Workshop, (February 2020).

2. DI BELLA, F.A., and FAIRMAN, K.D., ‘Development of a 240,000 kg/Day Hydrogen Pipeline Centrifugal Compressor for the Department of Energy’s Hydrogen Delivery and Production Program’, Proceedings of ASME International Mechanical Engineering Congress and Exposition (IMECE), (2012).

3. KURZ, R., LUBOMIRSKY, M., and BAINIER, F., ‘Hydrogen in Pipelines: Impact of Hydrogen Transport in Natural Gas Pipelines’, Proceedings of ASME Turbo Expo 2020, Paper GT2020-14040.

4. KURZ, R., MILLER M., GOLDMEER, J., and MOORE, J., ‘Hydrogen Storage. In K. Brun, T. Allison, and R. Dennis, Thermal, Mechanical and Hybrid Chemical Energy Storage’, Unpublished manuscript, (2020).

5. ALLISON, T., TIMOTHY, C., BRUN, K., RIMPEL, A. M., and SMITH, N. R., ‘An Overview of Machinery in Energy Storage and Hydrogen Applications’, Short Course, Asia Turbomachinery & Pump Symposium, (2022).

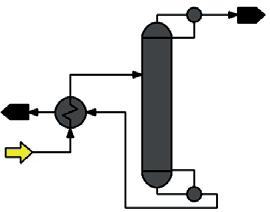

Contact us for a free trial Optimized Gas Treating, Inc www.ogtrt.com +1 512 312 9424 CAPE-OPEN What it is What it can do for you Interface to combine & operate 2+ compliant software packages as one Keep using your favorite general purpose process simulator while integrating ProTreat® and SulphurPro ® the ultimate CAPE-OPEN compliant tools for simulating carbon capture, gas treating & SRUs Scan the QR code to view a demo of the wizardry https:// vimeo.com/826278213

Your Favorite Process Simulator

ProTreat®

SulphurPro®

August 2023 22 HYDROCARBON ENGINEERING

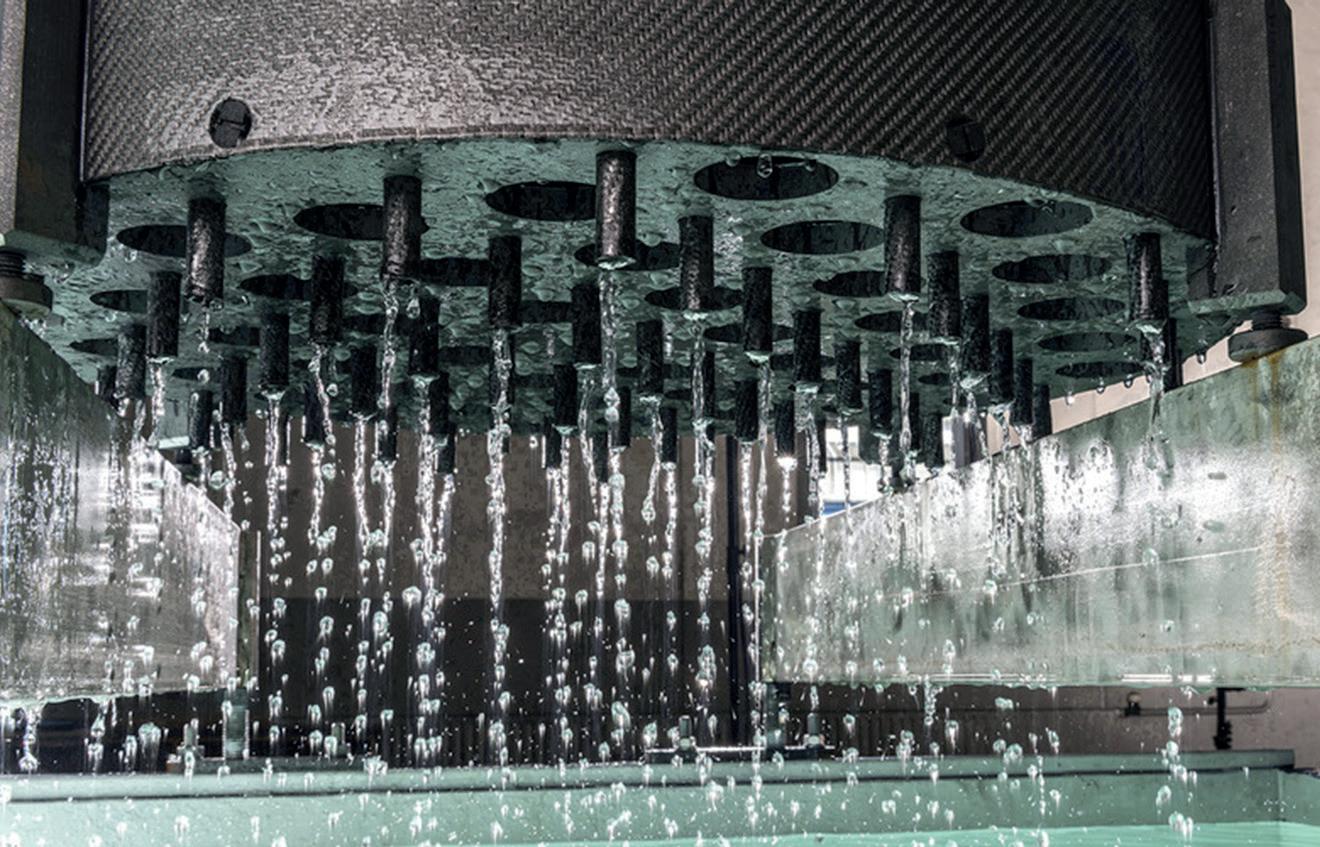

Ethylene is vital to the manufacturing industry as it is used in plastics, vinyl, rubber, and other common consumer products. Both US and global demand for ethylene has been growing steadily, and is expected to rise by over 5% annually up until 2030, at least. As a result, petrochemical companies have been investing in capacity expansions of ethylene crackers.

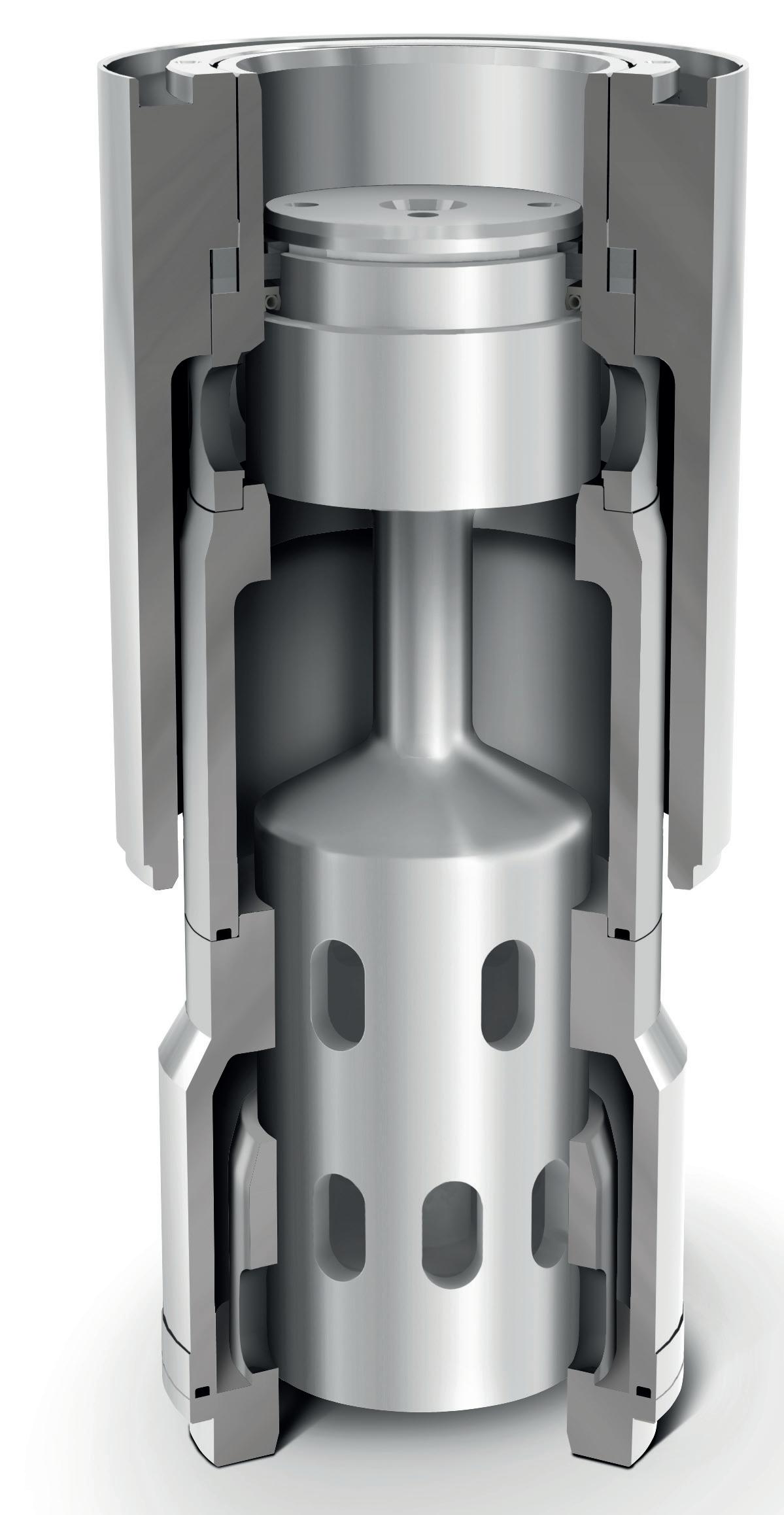

To keep up with increasing demand, one of the world’s largest single-site ethylene plants needed to increase air demand for the ethylene process. At this plant, compressed air is responsible for decoking the furnaces in the process of providing ethylene downstream of the chemical processing, supplying a rapidly growing demand for high-value polyethylene products. An important factor in determining the best solution was the customer’s desire to keep the existing foundation and reduce the civil engineering work that was required to upgrade the air system. However, the customer did not want to sacrifice key features required by API 672 that ensure the long-term reliability of the compressor package.

Project overview

The engineering and procurement team at the ethylene plant reached out to FS-Elliott in order to determine the best solution for their site. The customer wanted to save costs by using the existing layout, demanding minimal civil changes and avoiding the disturbance of key plant components. In addition to increasing air demand, the customer noted that the existing compressors were unreliable as they kept surging and shutting down as a result of high-temperature alarms on water coolers. The obsolete pneumatic control system was also unrepairable, and there were not enough instruments to monitor what was happening with the compressor during normal operation.

To gather a better understanding of what the customer wanted, FS-Elliott sent a sales engineer, who was the main point of contact, to visit the site and understand where the compressors would be placed. The sales engineer discovered that the customer’s current solution to increase air capacity was to rent diesel-driven screw compressors to keep up with the air demand. However, the diesel-driven

August 2023 23 HYDROCARBON ENGINEERING

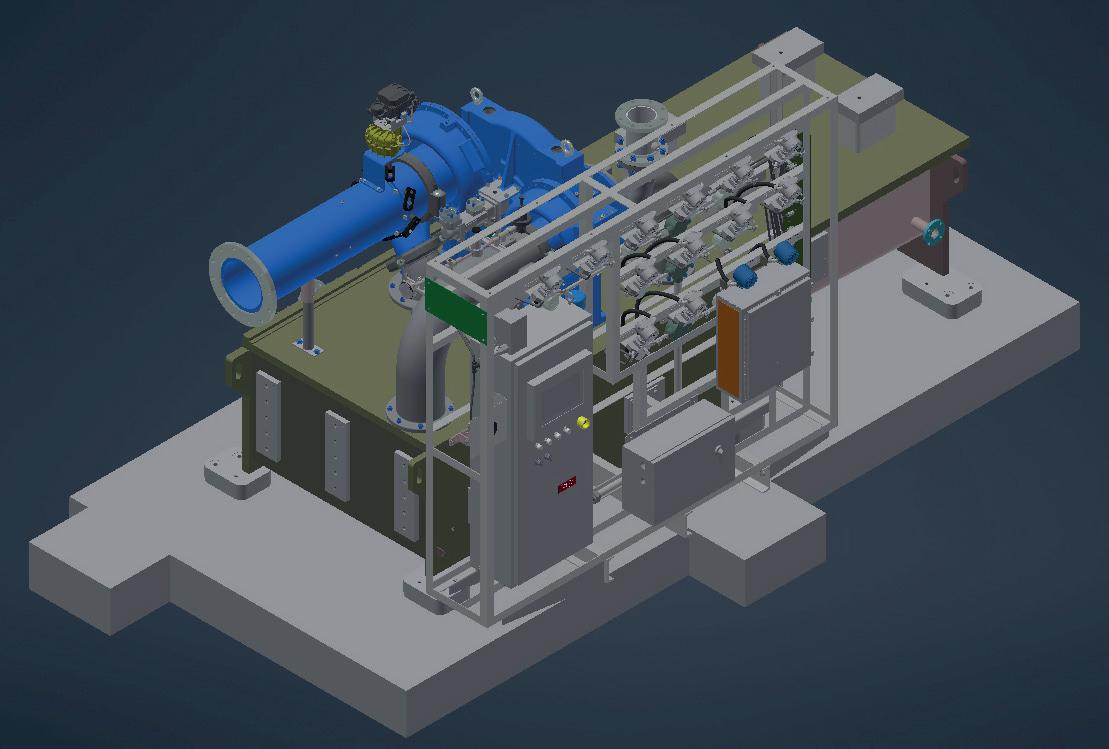

Joseph Doerfler, FS-Elliott, USA, reviews the development and design of an API 672-compliant centrifugal compressor for one of the world’s largest single-site ethylene facilities, and details the steps taken to reduce overall costs while increasing system efficiency.

compressors were costly to operate and had limited daily runtime due to local regulations.

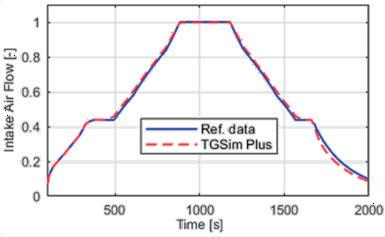

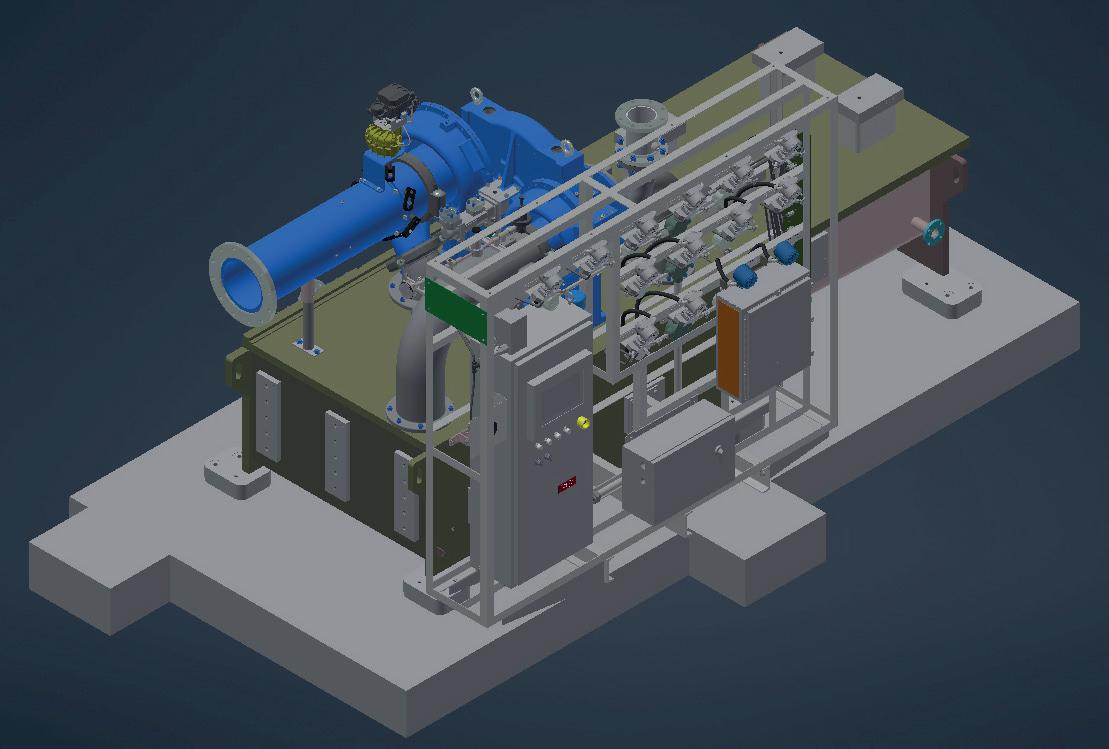

After completing the initial inspection, FS-Elliott reviewed the scope and provided a proposal for two 100% capacity PAP Plus compressors, highlighting the reduced operating costs of running a more efficient and reliable compressor package and the ability to install the new compressor on the existing foundation. Once the customer awarded the contract to FS-Elliott, initial meetings were scheduled to review preliminary drawings and unit outlines. These drawings outlined the custom designs of two separate, three-stage centrifugal compressors that would each provide a flow rate of 5000 ft3/m, a 10% increase over the existing units, and pressure of up to 125 psia. Both units were designed with NEMA 4X enclosures for the compressor control panel, junction boxes, and other instrumentation. The unit was also provided with additional features to increase reliability, including a dual oil filter, dual oil coolers, and SMART transmitters mounted in an instrument rack mounted to the compressor (see Figure 1).

Lower operating costs and reduce carbon footprint

The customer was not only excited about upgrading the air system, but was also looking forward to the opportunity to

significantly reduce operating costs. Being able to reuse the existing layout helped the customer make minimal civil changes, and limited any disruption to the process.

Not only would the customer save money by not significantly changing the layout in their plant, but they would also do so by returning the rented diesel-driven screw compressors. The replacement system would also help to reduce the customer’s carbon footprint, as diesel-driven units are harmful to the environment.

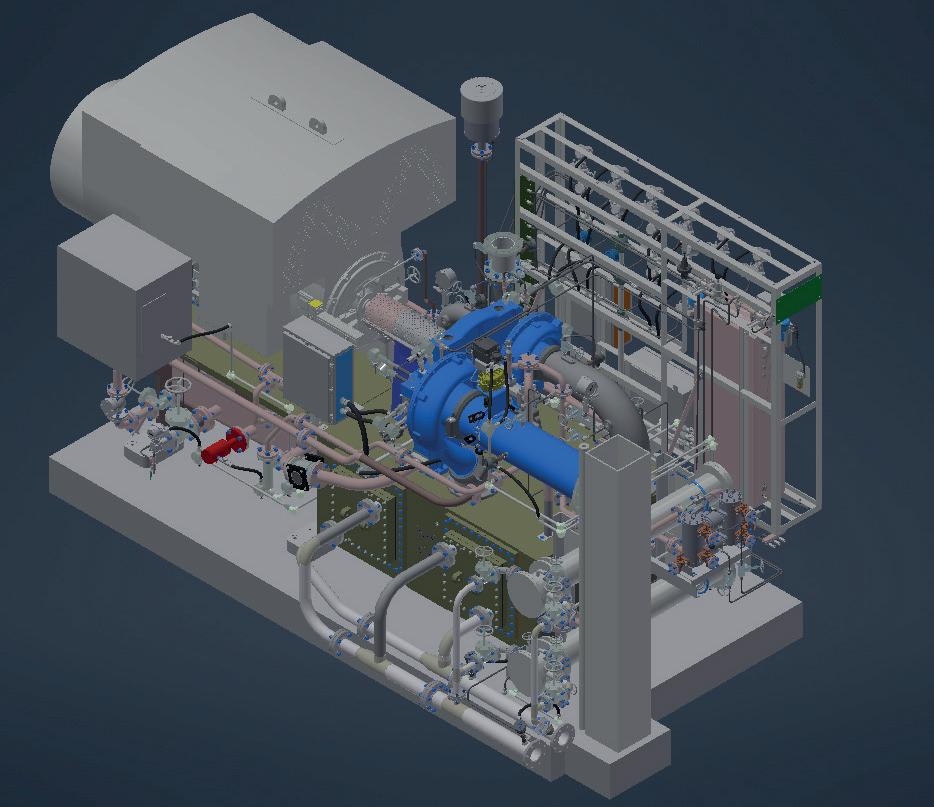

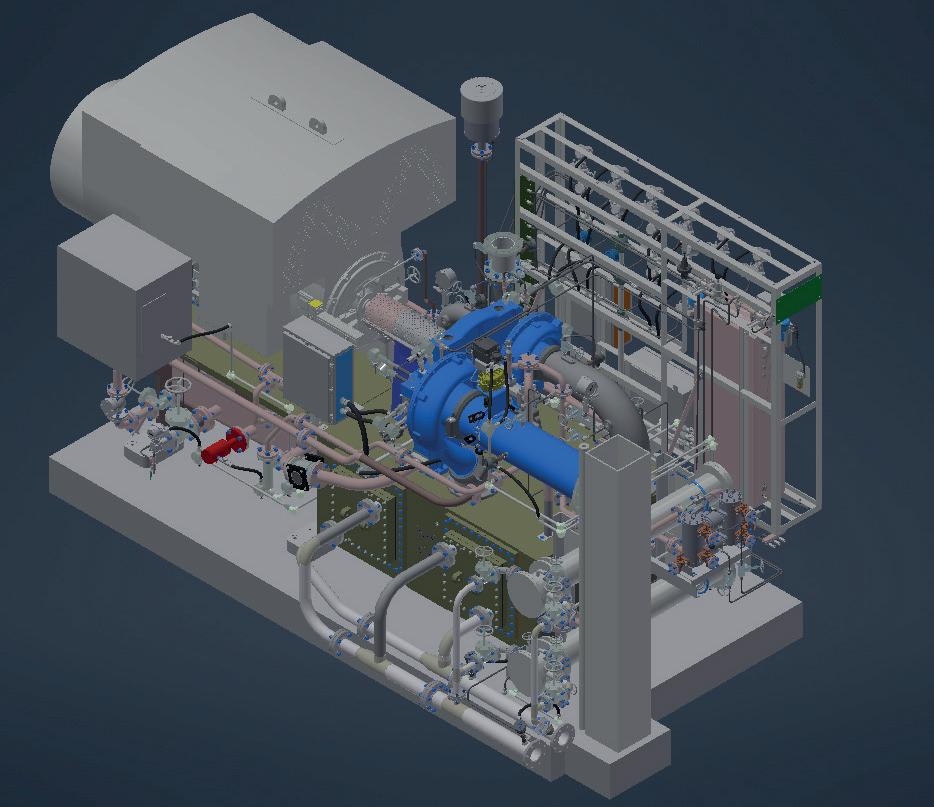

However, there were some challenges during the detailed engineering phase of the project, as the replacement compressors had to be designed as such that they would fit the existing plant layout. Since the foundation size could not be increased, FS-Elliott needed to shorten its standard baseplate design. To accommodate the existing foundation anchor locations, the baseplate mounting feet were increased in size to eliminate the need for drilling new holes in the foundation, as seen in Figure 2.

Redesigning the baseplate was the plan of action; but one major roadblock was that there was an existing piping support for the ethylene process that was located in front of the compressor. This had to be avoided so that the existing layout was not disrupted. Initially, there were two piping supports; FS-Elliott knew this might cause some creative layout problems on the PAP Plus package. The existing support ended up being unproblematic, as seen in Figure 3, as the compressor was placed as close as possible to save space for both units.

The other challenge was attempting to keep the existing piping that was provided by the general outline presented by the customer. The required connections were reviewed, and the necessary dimensions were taken into consideration to reduce the risk of complications onsite.

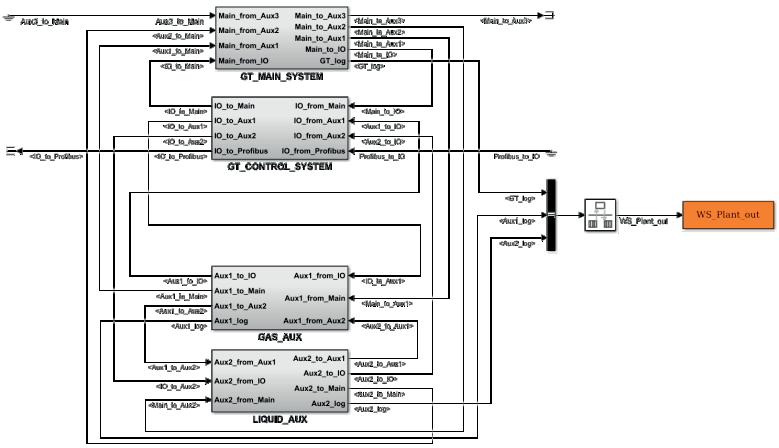

Customised control panel technology

To meet the customer’s scope of supply for its control system, FS-Elliott’s R2000 control panel was offered. This offered the plant the latest technology while including FS-Elliott’s Energy Advisor and maintenance notification system, ensuring that the compressor operated to its full potential without any unnecessary downtime. The Energy Advisor allows the customer to monitor the efficiency level of both PAP Plus compressors and provide recommendations for improved efficiency when required. As the reliability of the compressor was paramount to continuing operations of the ethylene plant, the maintenance notification system could provide proactive alerts for routine compressor maintenance. Additional options were added, including an NEMA 4X enclosure, 12 in. Allen-Bradley HMI, Simplex Power Supply and Allen Bradly Control Logix, and RS-422 Serial Modbus.

Project schedule

During the project, one of the end user’s project engineers served as the single point of contact, keeping communication open among all parties involved to ensure that the project was on schedule and within budget, avoiding miscommunication along the way. FS-Elliott and the customer’s engineering department worked hand-in-hand to ensure that the process was smooth.

August 2023 HYDROCARBON ENGINEERING 24

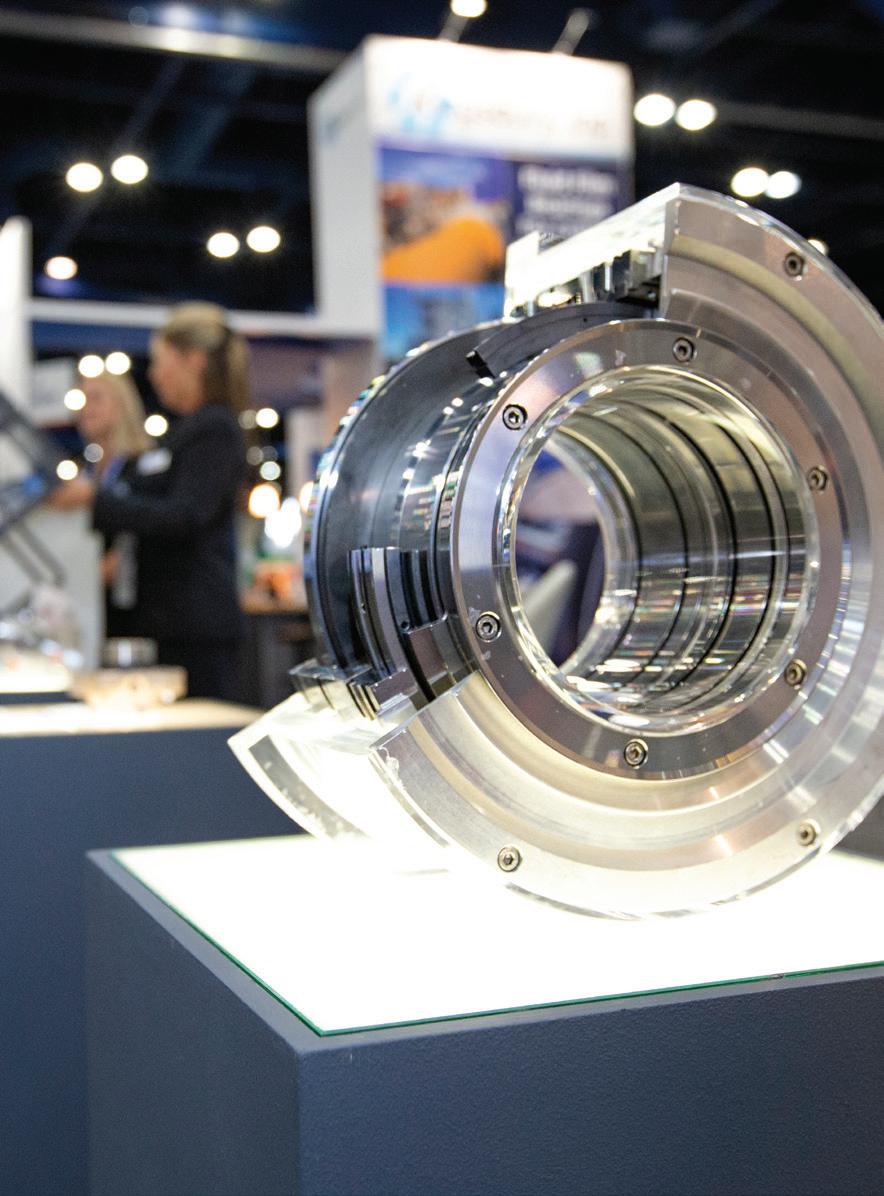

Figure 1. New FS-Elliott PAP Plus compressor.

Figure 2. 3D model of the FS-Elliott PAP Plus compressor with larger mounting feet to accommodate existing foundation holes.

Throughout the project, the customer wanted to ensure accessibility to key components in the compressor package, and requested that junction boxes be located on the right side of the main driver, and that the inlet air filter be bolted to the existing connection, amongst other specific details. 3D drawings were produced and inspected by the project

angle of the compressed air system allowed for the identification of areas that might have been overlooked in the project scope to be corrected before shipment. The customer experienced a slight delay onsite with regards to ensuring that the area was ready, so FS-Elliott held the PAP Plus compressors back at its warehouse until requested.

Testing and installation

FS-Elliott knew the requirements of the user’s industry and followed the API 672 standard to perform the full-speed, full-load mechanical tests. After completing the mechanical running test and sufficient cooling down, key parts, including bearings, seals and rotors, were visually inspected to identify possible quality issues. Testing on both units went smoothly, and there were no mechanical concerns. In order to minimise labour costs, the end user handled the entire installation process using its internal resources. Both units arrived at different staggered dates, to avoid space restrictions.

Conclusion

The PAP Plus centrifugal compressors that were deployed in this project have now been installed since early 2022. Since installation, the new units have helped the plant produce its product and provide the necessary air needed for the ethylene process. The close partnership between the customer and FS-Elliott resulted in a solution that delivered lower operating costs and a reduced carbon footprint, while

RUGGED, RELIABLE GAS ANALYSIS SERVOTOUGH SPECTRAEXACT 2500

• Flexible analysis for demanding process applications

• Accurate and stable real-time photometric sensing

• Designed for ease of use and low maintenance operation Learn

Figure 3. A 3D model of an FS-Elliott PAP Plus compressor, including customer foundation and pipe support to prevent interference onsite.

Figure 3. A 3D model of an FS-Elliott PAP Plus compressor, including customer foundation and pipe support to prevent interference onsite.

more: servomex.com

Rhys

analysis in ethylene dichloride (EDC) and vinyl chloride monomer (VCM) production for polyvinyl chloride (PVC) manufacturing.

at the role of

One of the most widely produced polymers in the world, polyvinyl chloride (PVC), is a highly versatile material used in a wide range of applications. Its properties of chemical resistance and mechanical strength place it in high demand globally, and it is the third most produced polymer after polyethylene and polypropylene, being manufactured in both rigid and flexible forms for use in construction, electronics, transport, and healthcare products.

August 2023 27 HYDROCARBON ENGINEERING

Jenkins and Maria-Katharina Mokosch, Servomex, look

gas

Two routes exist for the industrial manufacture of PVC. The predominant manufacturing route involves the production of ethylene dichloride (EDC) and vinyl chloride monomer (VCM); these are intermediates with no direct applications themselves.

An alternative, acetylene-based route also exists, and is particularly popular in markets where there is a shortage of ethylene cracker feedstock, such as China, which is where more than half of VCM production capacity is acetylene-based.

Regardless of the method used to create it, the VCM is then mixed with water in the presence of polyvinyl alcohol, lauryl peroxide, or isopropyl percarbonate, where a catalytic reaction takes place. After a few hours, this produces PVC granules, which can be moulded to form a number of commercial products.

Gas analysis plays a vital role throughout these processes, helping to address the application challenges that arise. Effective gas and liquid phase measurements can assist operators to achieve precise control, ensure efficiency and safety, and maintain the quality of products.

Ethylene-based EDC-VCM production

EDC production begins with a direct chlorination process, with ethylene and chlorine being reacted together in a chlorination reactor. This typically involves a ferric chloride catalyst, used because of its high selectivity.

Ethylene is the controlling factor in the chlorination process, so it is important to measure its concentration levels for process control.

The reaction can be performed either at low (20 – 70˚C) or high (100 – 150˚C) temperatures. The low-temperature process results in the formation of fewer byproducts, but requires more energy to recover EDC. While the high-temperature process creates more byproducts, it utilises the heat of the reaction in EDC distillation, leading to considerable energy savings.

For safety reasons, oxygen must be monitored before the chlorination step in order to raise an alarm before any explosive conditions occur.

Another method of producing EDC is through oxychlorination. Later in the process, when EDC is converted to VCM, hydrogen chloride is also generated, and this can be utilised to produce more EDC by oxychlorination with ethylene and air (or oxygen).

Typically, the oxychlorination reactor is a fixed-bed reactor with cupric chloride catalyst packed in tubes while cooling water flows on the shell side for temperature control (a fluidised bed reactor can be used instead, but these do not offer heat recovery).

Temperatures above the optimum (around 300˚C) can lead to the formation of more byproducts, due to the increased oxidation of ethylene to carbon oxide, and cracking of EDC.

The crude EDC, whether it comes from direct chlorination, oxychlorination, or the recycle stream, must be purified to 99.5 wt% before pyrolysis. Purification includes washing with water or scrubbing with caustic soda to remove hydrogen chloride; drying to remove water; and removal of light ends and heavy ends by distillation.

The drying process is essential, as any trace of water in EDC is extremely corrosive and can damage plant equipment. To prevent this, the water level in the purified liquid EDC needs to be accurately monitored.

Next, the purified EDC is thermally cracked into VCM and hydrogen chloride in the pyrolysis furnace in the presence of a catalyst – usually charcoal pellets impregnated with iron oxide – under conditions of approximately 500˚C and 50 psig. At this temperature, purified EDC splits into VCM and hydrogen chloride, with conversion rates of between 50 – 65%.

Rapid cooling of the pyrolysis gases helps to reduce the formation of tar and heavy byproducts. The extremely high purity of the EDC feed – which, as mentioned, needs to be at least 99.5 wt% – reduces coke formation and fouling of the pyrolysis reactor.

Finally, the VCM produced through pyrolysis is purified. Quenching, splitting of hydrogen chloride, and fractionation are all used to separate the VCM from unreacted EDC, hydrogen chloride, and the remaining byproducts.

Quenching removes EDC from the stream and recycles it back into the EDC purification process. Hydrogen chloride is separated from the pure overhead product in the hydrogen chloride splitter, and then sent via the recycling stream to the ongoing oxychlorination reaction. The overhead product of the VCM fractionator is 99.9% VCM, which is transported to storage, while the bottom products of the VCM fractionator are recycled.

The oxygen concentration within the purified VCM product is measured to ensure product quality, and for safety.

Acetylene-based VCM production

An alternative route for VCM production is by reacting acetylene with hydrogen chloride. In this process, brine is first produced by mixing sodium chloride with water. The electrolysis of brine produces caustic soda, chlorine and hydrogen. Hydrogen chloride is then produced from hydrogen and chloride in the synthesis furnace. At this stage, it is necessary to monitor the purity of the hydrogen chloride and the unreacted chlorine.

Acetylene – produced from calcium carbide – and hydrogen chloride are mixed and fed into a catalytic reactor, where VCM is synthesised over a catalyst. The resulting VCM is purified, dried, and sent to storage or polymerisation.

As with the ethylene-based route, oxygen concentration is measured in the VCM product to ensure product quality, and for safety.

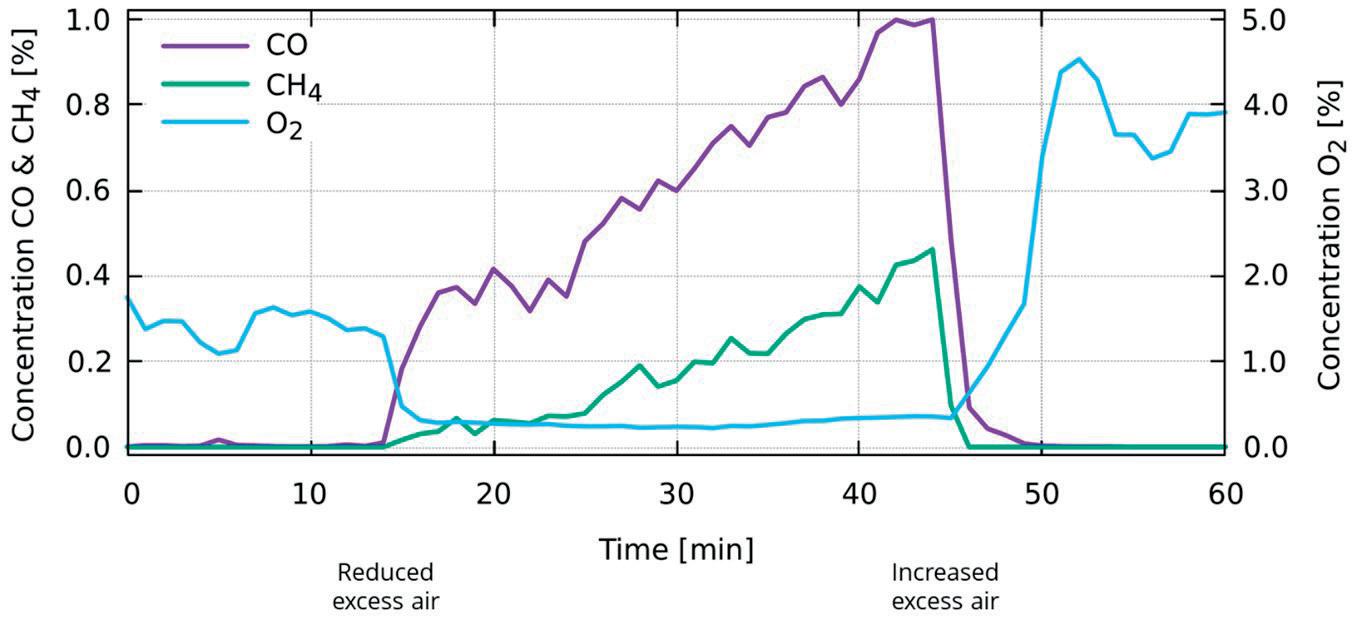

Gas analysis for process control

The ethylene concentration in the chlorination process is typically measured using an infrared analyser with a range of 0 – 100% in the feed and 0 – 40% in the crude EDC. The sampled gas is very corrosive and can contain significant levels of hydrogen chloride, chlorinated hydrocarbons, and water.

For this reason, nickel-based corrosion-resistant alloys, such as Hastelloy or Monel, are usually specified for the measurement cell and for the pipework used in the sample conditioning system.

The pressure and temperature of the process at the measurement point are usually above ambient, so the gas needs to be cooled before analysis. This allows any vapours that are present to condense and be removed. Drying the process gas also helps to reduce corrosion.

The measurement of liquid phase water in EDC is of critical importance, as the thermal cracking process produces

August 2023 HYDROCARBON ENGINEERING 28

BEST IN THE INDUSTRIAL

LNG application field

Gas pipeline feeding. Gas power generation stations. Gas peak shaving plants and LNG transfer in small to medium size shore terminals.

The experience acquired through the complete pumping systems supply launched Vanzetti Engineering in the development of systems and components dedicated to any type of LNG and LBG applications.

VANZETTI ENGINEERING. Widening the horizons of LNG sustainability.

www.vanzettiengineering.com

substantial amounts of hydrogen chloride and EDC, so any residual water will increase the corrosive nature of the process stream.

This will lead to damage of plant equipment, so minimising trace amounts of water in EDC is critical to the operation of any VCM plant. A specially configured infrared analyser can be used for this application.

Crude EDC from the oxychlorination reactor can contain a reasonable amount of hydrogen chloride and chlorine. As mentioned, a caustic scrubber, such as sodium hydroxide, is used to remove these from the process. Again, infrared analysis provides a solution, measuring the strength of sodium hydroxide both at the caustic scrubber inlet and after the acidic gas absorption.

The corrosive nature of the sample means that corrosive-resistant materials such as Monel, Hastelloy, PVDF and PTFE should be used. As the sample is in the liquid phase, temperature compensation is required on the infrared analyser. Temperature control of the sample may also be recommended in order to minimise errors due to sample temperature variations.

Additionally, any hydrogen chloride recycled from the stripper to the oxychlorination reactor must be clean and of high purity. Infrared analysis of this stream, in the range of 0 – 100% hydrogen chloride, is required to effectively optimise the reactor process control.

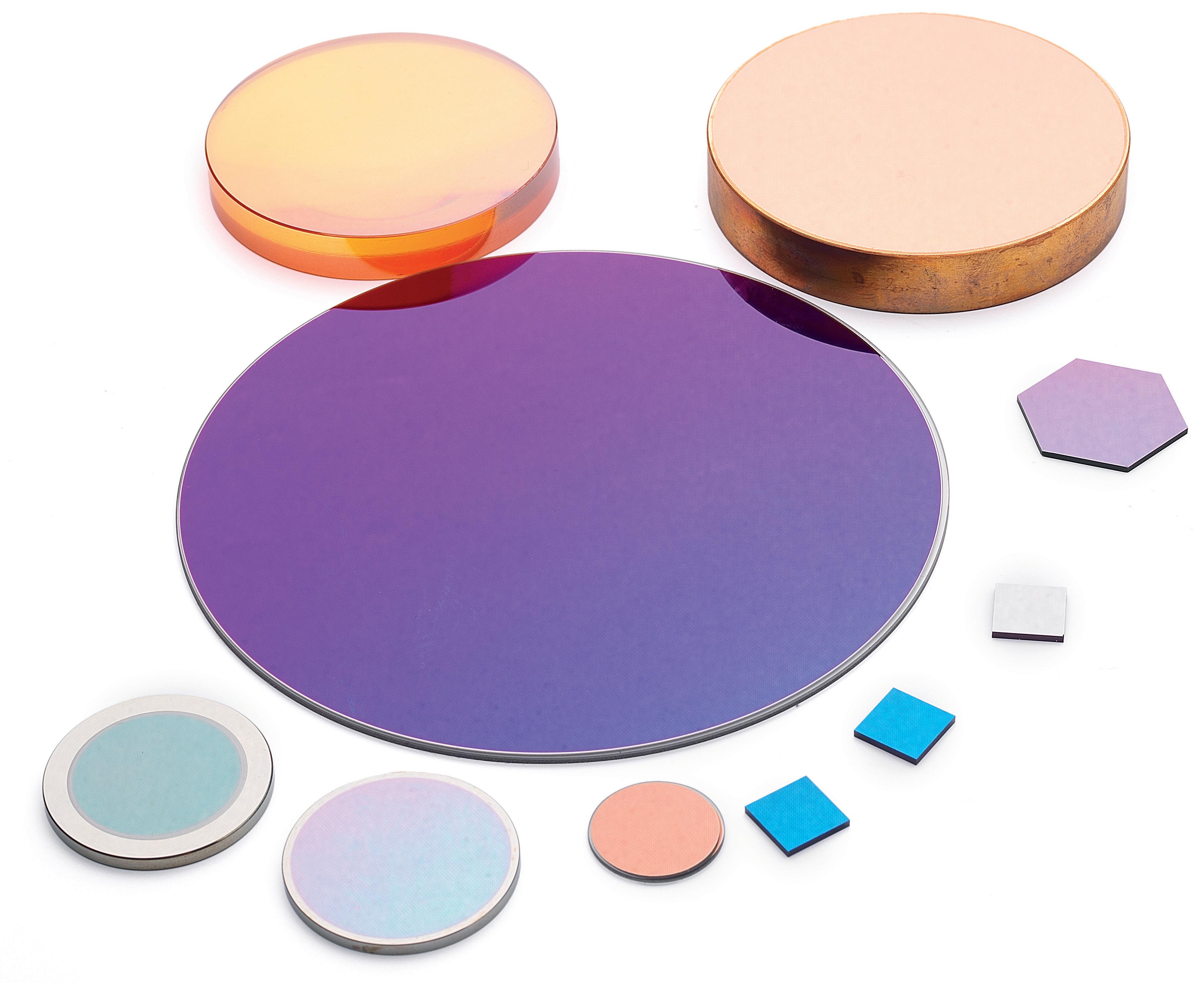

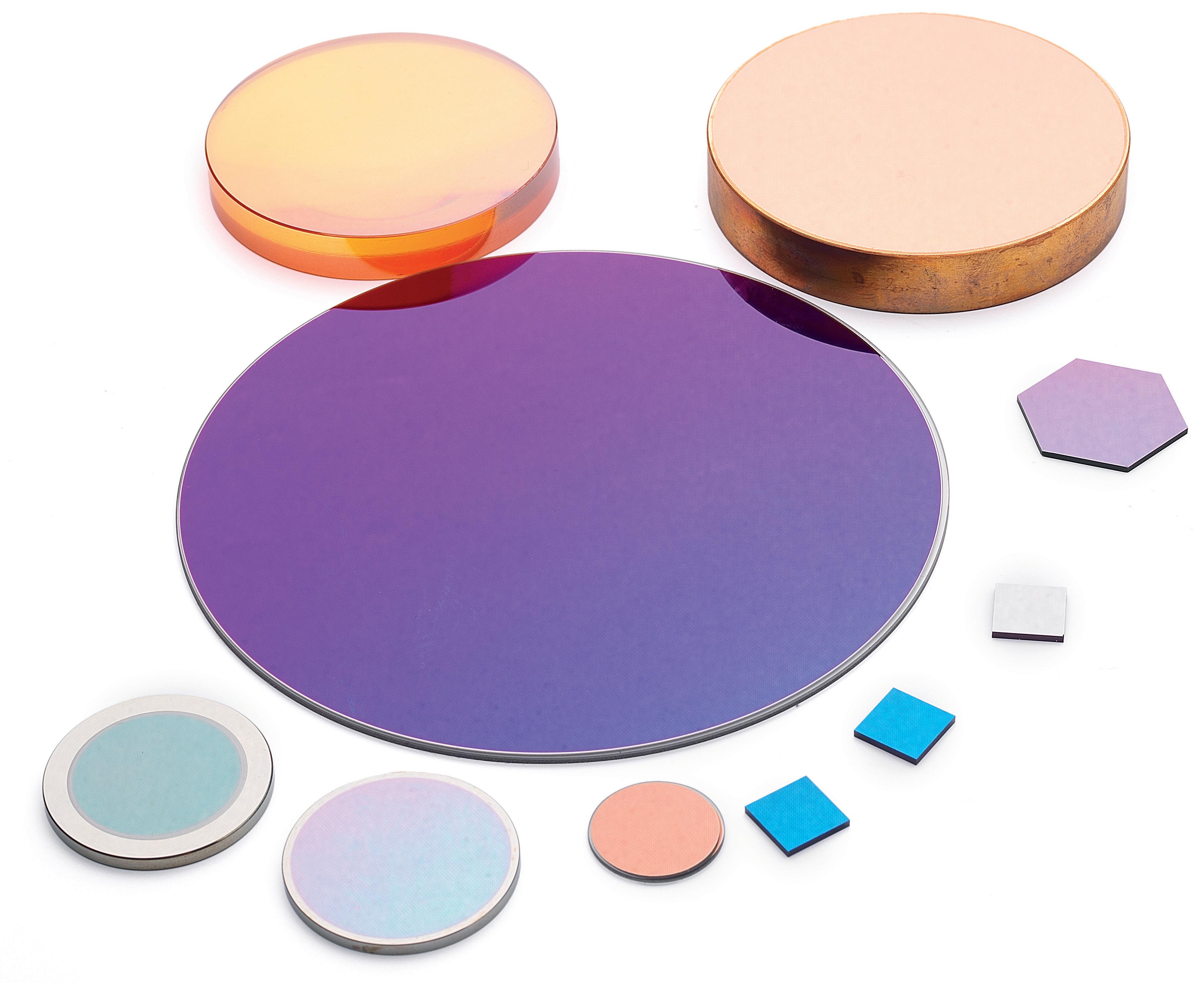

Infrared analysis for process control

Infrared sensing is a flexible measurement technology based on the unique light-absorbing properties of some gases. It delivers a non-contact, real-time detection of the selected gas’ concentration in a mixture, and is ideal for gas analysis for process control applications in EDC and VCM production.

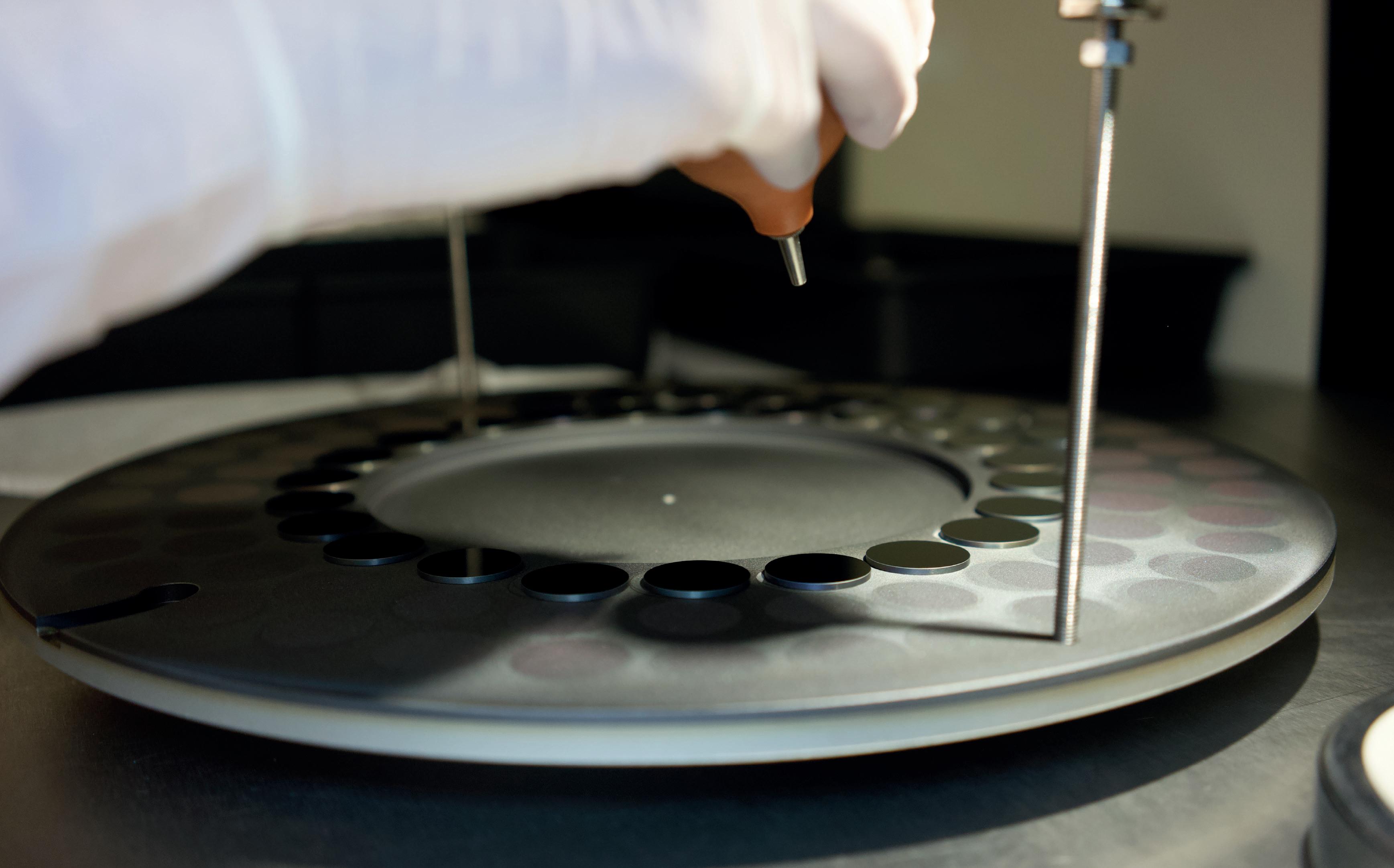

The single-beam, dual-wavelength sensing technology uses a pair of optical filters mounted on a rotating disc, which pass through a beam of IR light alternately. The measure filter is chosen to pass light only at a wavelength that the gas to be measured absorbs, while the reference filter has a light passed through it at a wavelength that is unaffected by the gas to be measured. The difference in absorbance is measured by the detector and provides a direct output of the gas concentration.

This technique is virtually unaffected by common mode effects, such as contamination on the sample cell windows, as it influences both measure and reference signals equally.

An industry standard in infrared sensing for EDC and VCM is Servomex’s SERVOTOUGH SpectraExact 2500 gas analyser, which has recently been updated with new electronics and ease-of-use features, meeting the latest European certifications and international safety approvals.

The analyser can also be configured for trace water measurements with a measurement cell designed for liquid samples. Typically, measurement ranges down to 0 – 50 ppm water in EDC are achieved. The instrument is calibrated using the Karl-Fischer titration method, a standard laboratory technique for trace water determination.

A special requirement in trace water measurement is the use of sample temperature compensation. Without compensation, sample temperature fluctuations will produce errors in the measurements.

As process uptime is of primary importance for plant operators, the ability to plan when to conduct analyser maintenance – and to increase the intervals between servicing points – is vital.

The SpectraExact 2500 typifies the latest developments in gas analysis, with a simplified user interface and increased focus on reliability and predictive maintenance, with built-in diagnostics.

Oxygen analysis for safety and optimisation

Oxygen measurement at the oxychlorination reactor is critical to the safety and efficiency of the reaction. Too little oxygen reduces efficiency, but too much can lead to the development of an explosive mixture in the reactor. VCM is a flammable gas, so it is also important to monitor any oxygen incursion into the VCM product as it is transported to storage and PVC manufacture.

A paramagnetic analyser is recommended to measure the oxygen concentration, typically in the range of 0 – 10%. For safety reasons, it is often necessary to install multiple analysers reporting to a voting system, prior to the chlorination stage, to ensure that the plant is fully protected in the event of an analyser failure.

Paramagnetic sensing is a well-proven oxygen measurement technology that offers an accurate and fast response. It is a physical measurement technique, with no chemicals or electrolyte to replace, and maintenance requirements are low.

Examples of paramagnetic oxygen analysers include Servomex’s SERVOTOUGH Oxy 1900 and OxyExact 2200 analysers. The Oxy 1900 is suitable for process gases with a dew point temperature of 10°C below ambient temperature, and can be used for measurements in the VCM gas line where the sample has a low hydrogen chloride level and dew point.

The OxyExact 2200 high-temperature model is suitable for process gases with a dew point of up to 105°C without removal of condensable vapours; therefore, it can measure oxygen in the process stream prior to chlorination. It also offers the capability to connect up to six transmitter units to a single control unit, and can be used to create a voting system.

The sample at this part of the process contains high levels of hydrogen chloride (about 30%) and water vapour (with a dew point of approximately 80°C). To prevent condensation, the sample line is maintained at 95 – 105°C, preventing corrosion and enabling a true reading of oxygen concentration to be obtained.

Conclusion

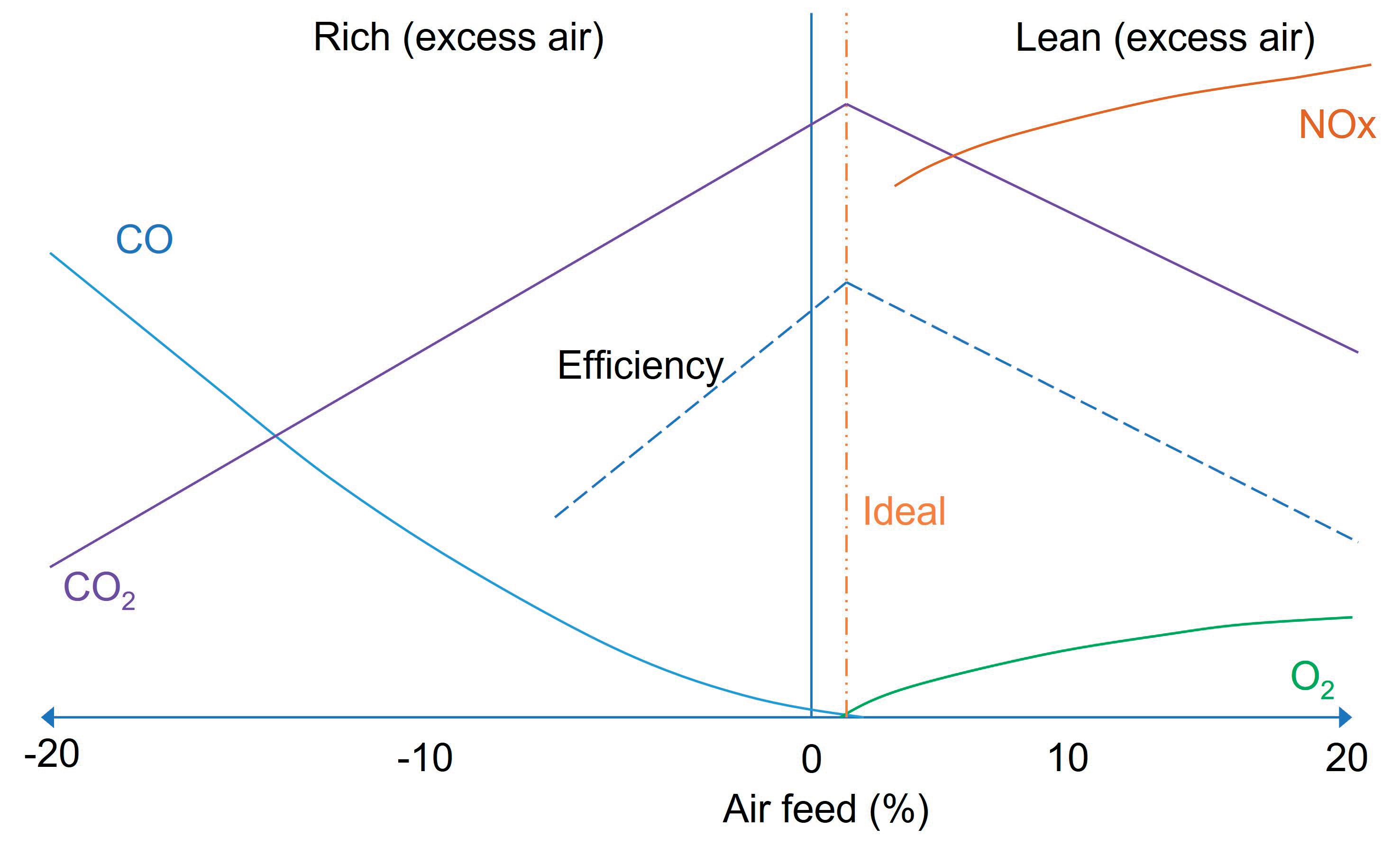

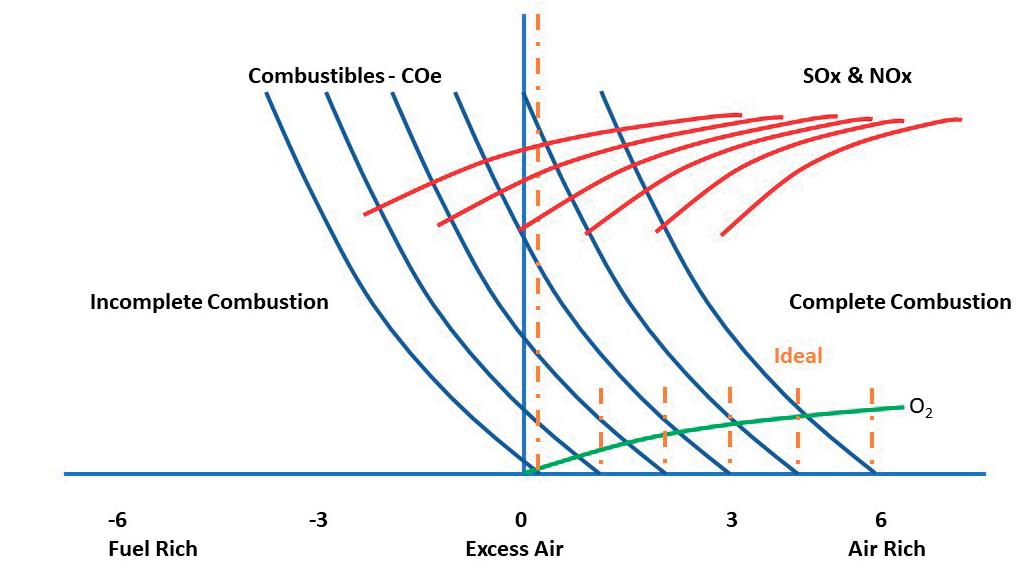

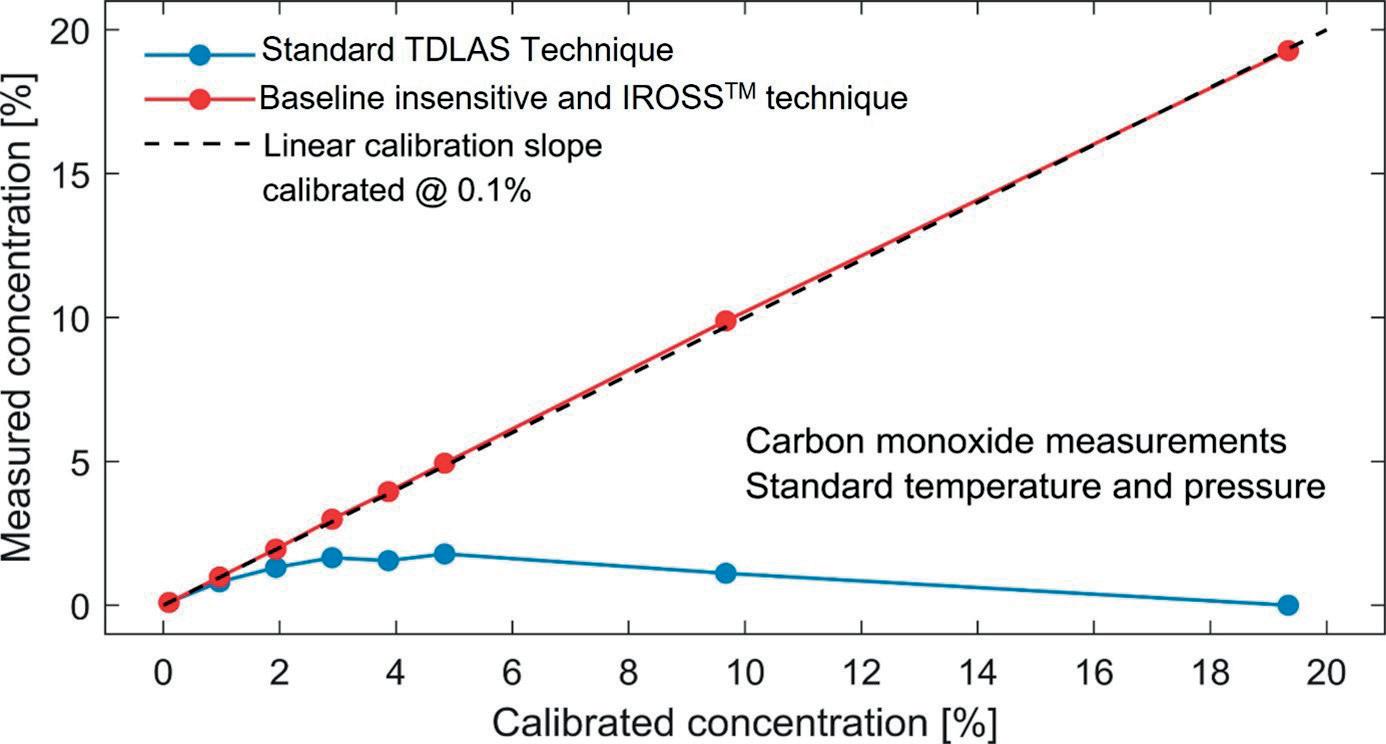

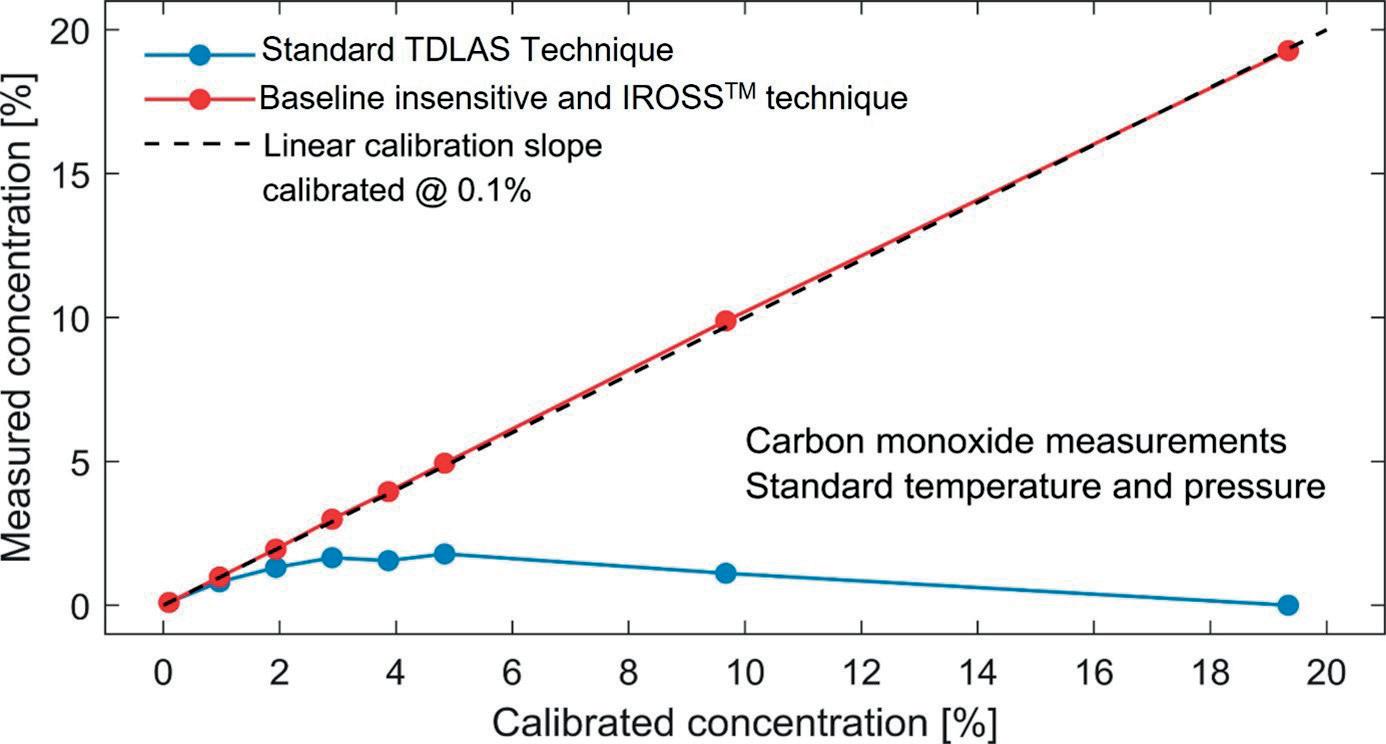

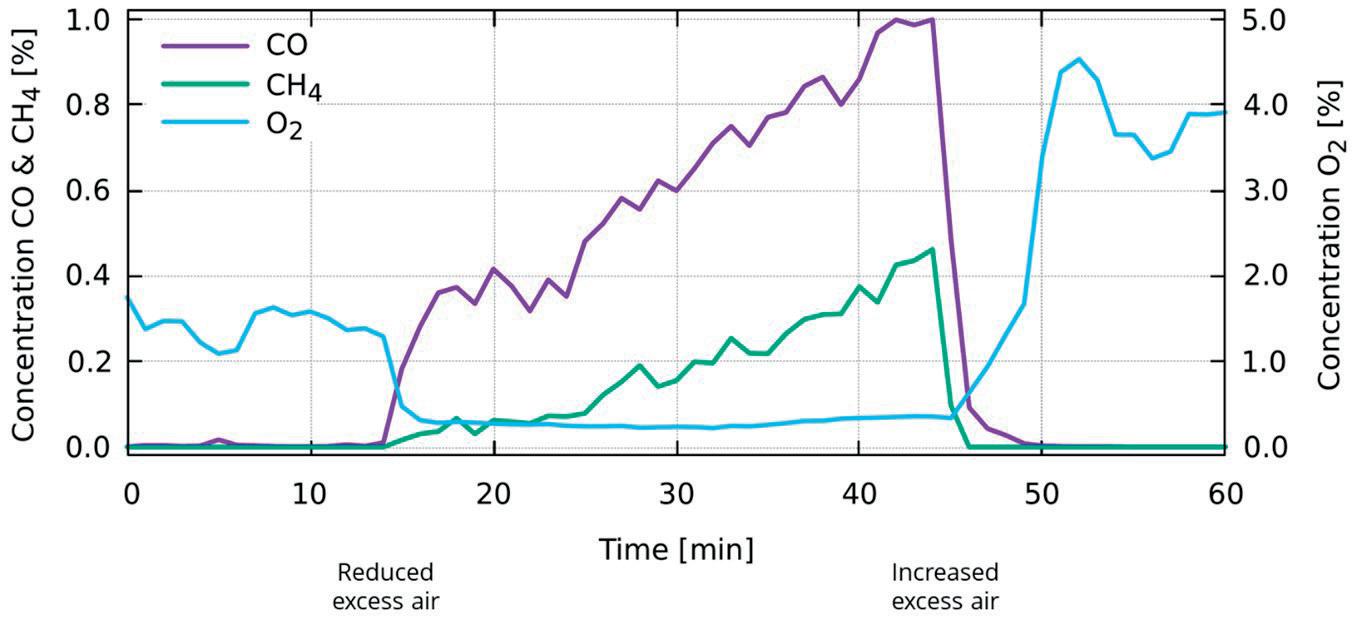

Process efficiency, product quality, and safety are all key considerations for plant operators manufacturing EDC and VCM for PVC production. Gas and liquid analysis solutions can help meet the challenges of these applications, delivering the accurate and reliable measurements required.