May 2023

API INSPECTION TRAINING

Petroleum and petrochemical inspection personnel gain practical knowledge and earn Continuing Professional Development (CPD) hours through API live and on-demand inspection training courses.

PERFORMANCE, ENGINEERED.

Our pumps and valves are meticulously designed and field-tested, ensuring optimal reliability to maintain seamless operational efficiency.

SARASIN-RSBD® 78 Series Pilot Operated Pressure Relief Valve

BLAKEBOROUGH® BV500 & BV501 Cage Trim Valves up to Class 600lb Rating ROTO-JET® RO-FT API 610

SARASIN-RSBD® 78 Series Pilot Operated Pressure Relief Valve

BLAKEBOROUGH® BV500 & BV501 Cage Trim Valves up to Class 600lb Rating ROTO-JET® RO-FT API 610

Cyndie Fredrick, Richard Stambaugh, Mark Knobloch, Kathy Young, Emma Chan and Jessica Parsa, Merichem Company, explore

prioritising the safe

37 Bridging the LNG and energy transition gap

Magnus Ulseth, Quorum Software, explains how cloud-based software can help LNG fulfil its potential as a transition fuel.

39 Expectations from simulation: part two –case studies

As a follow-up to part one of this article, Prashanth Chandran, Nathan Hatcher and Ralph Weiland, Optimized Gas Treating, Inc., USA, present a series of case studies whereby simulators have been used across a range of treating applications.

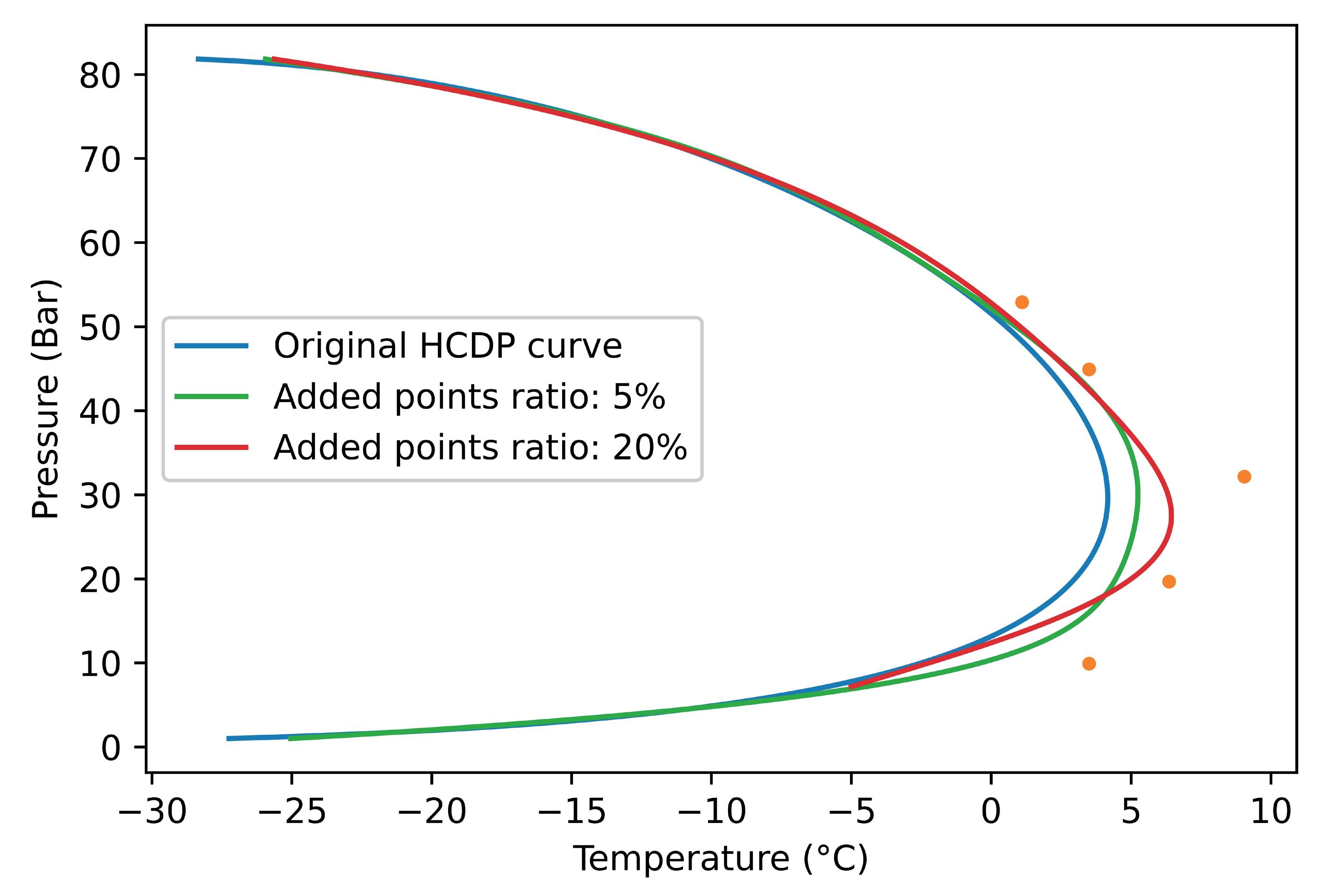

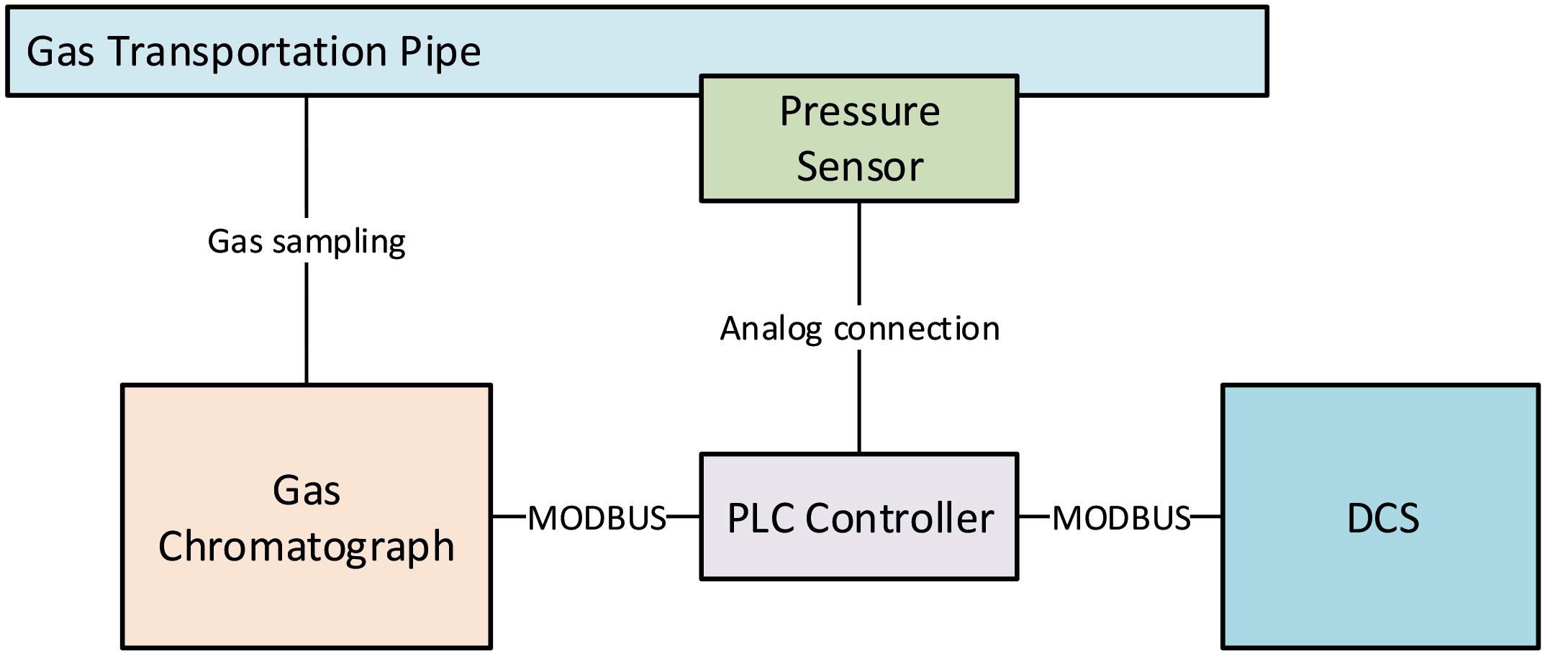

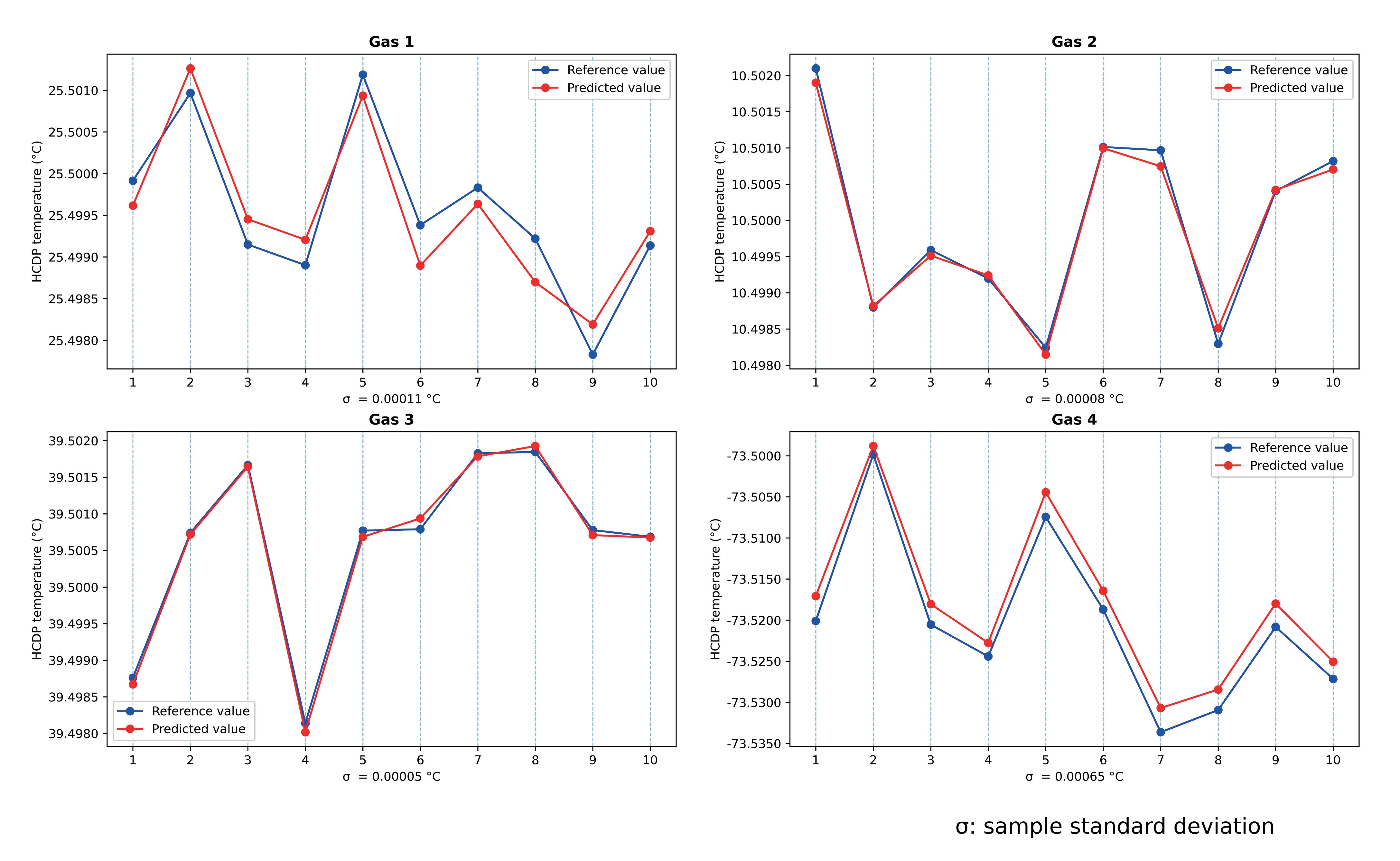

45 The importance of accurate analysis

Gadi Briskman and Tom Rosenwasser, Modcon Systems Ltd, introduce a method that enables accurate prediction of the hydrocarbon dew point using machine learning (ML).

Artem

process behind selecting

Dr Roland Emmrich and Olga Alhaj-Hohenstein, MAN Energy Solutions, Germany, reflect on the most recent developments in axial compressors, and provide an overview of new solutions available to aid decarbonisation efforts. 29

Enhanced design to enhance operations

Prof. Dr. Klaus Hoff and Jens Wulff, NEUMAN & ESSER, Germany, detail how a compressor design program can be used to reduce a plant’s CAPEX, OPEX and greenhouse gas emissions.

33

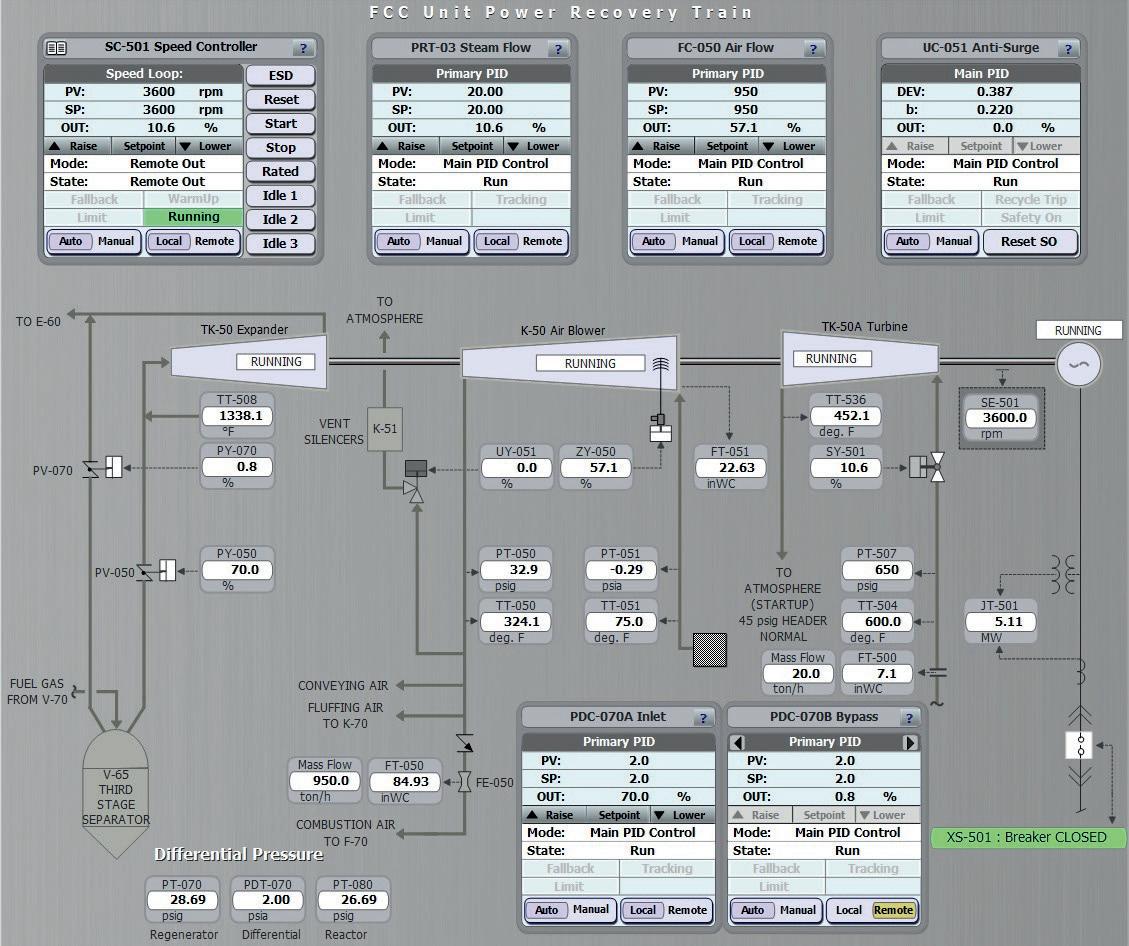

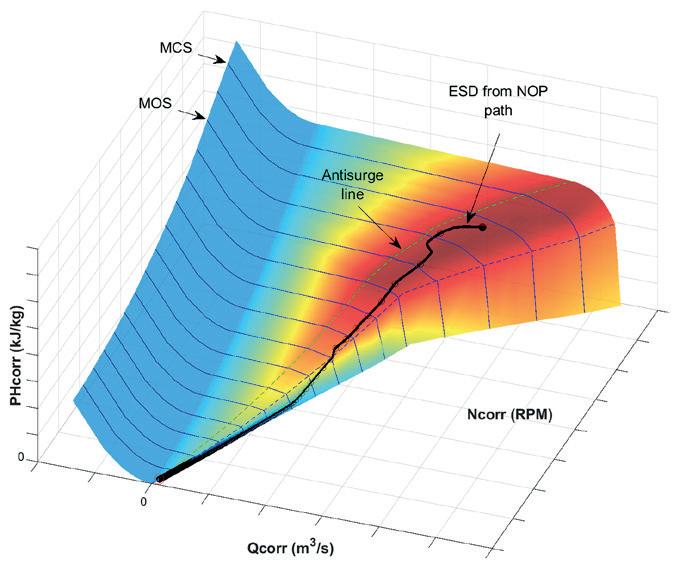

Taking control of a system

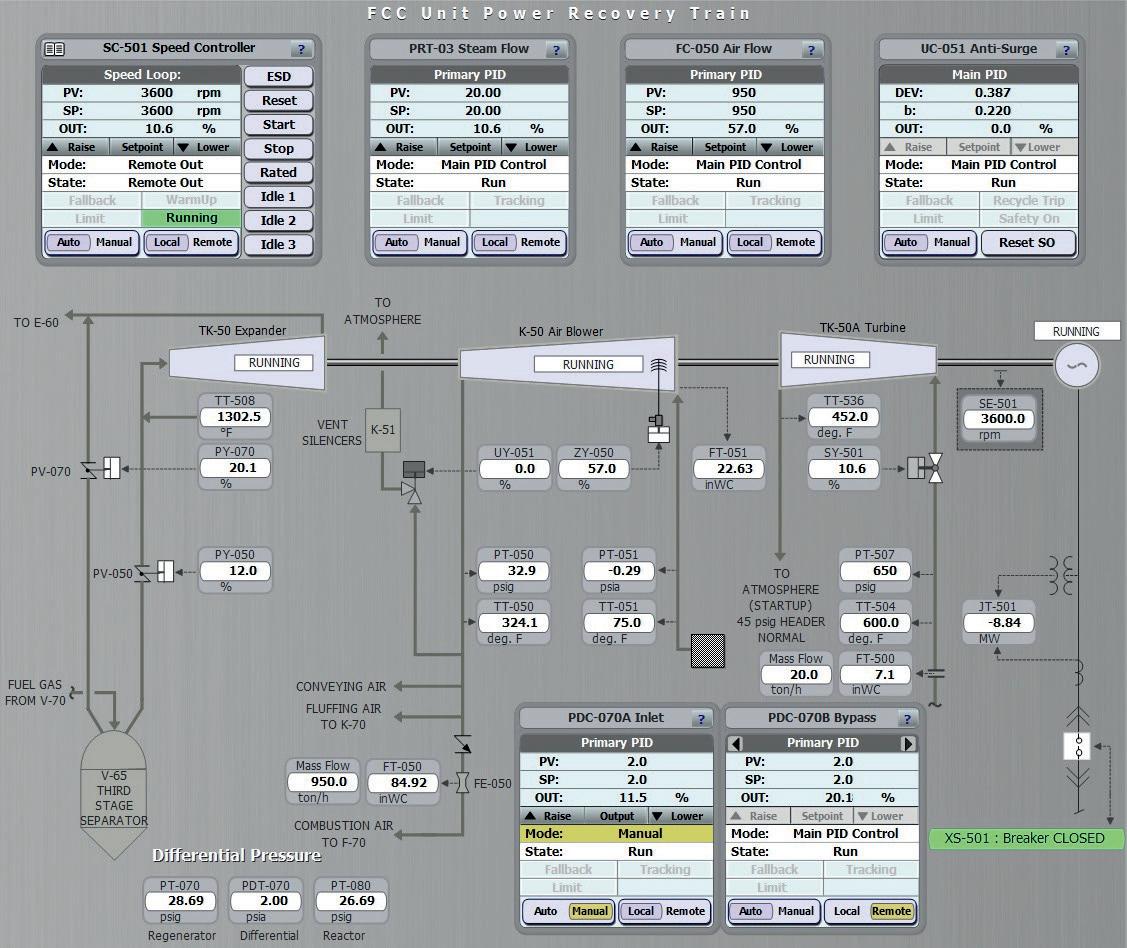

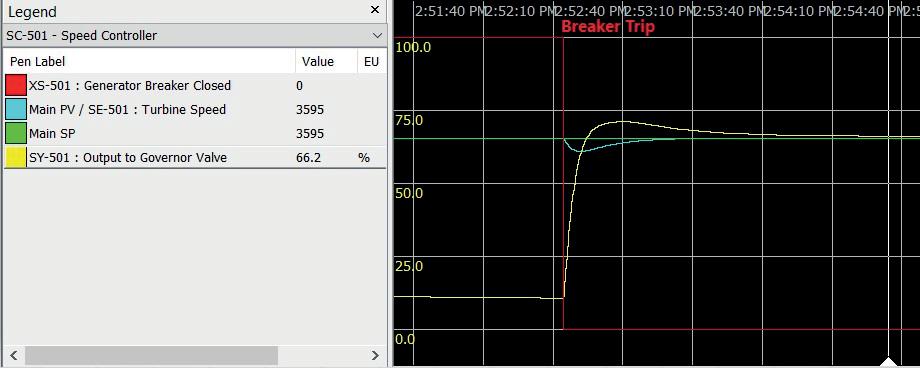

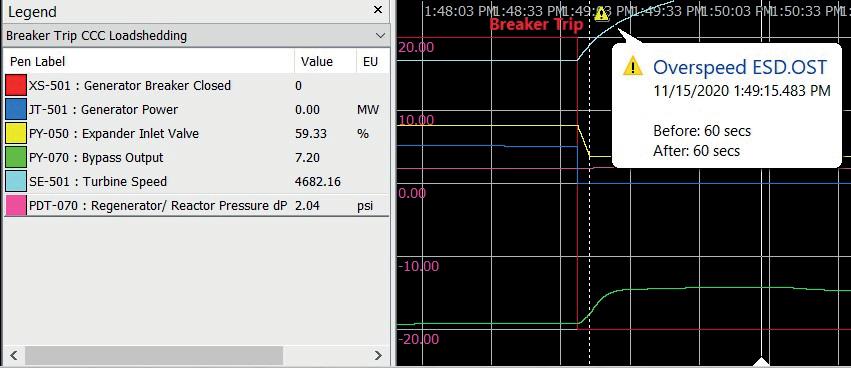

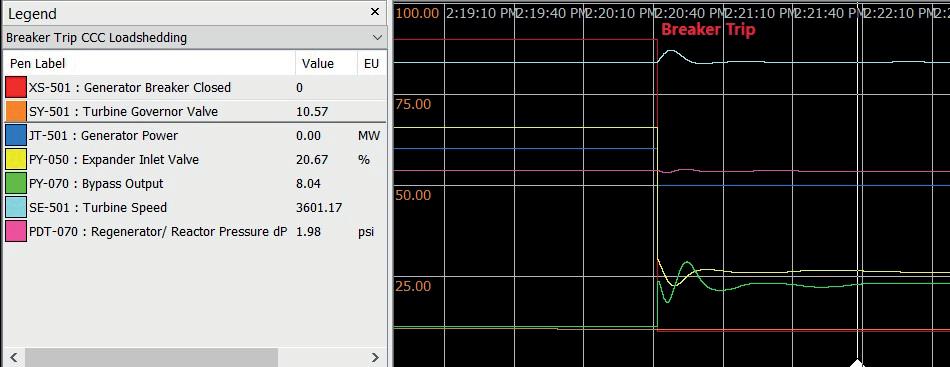

Nabil Abu-Khader, Compressor Controls Corp. (CCC), UAE, presents a number of operation scenarios for power recovery trains (PRTs).

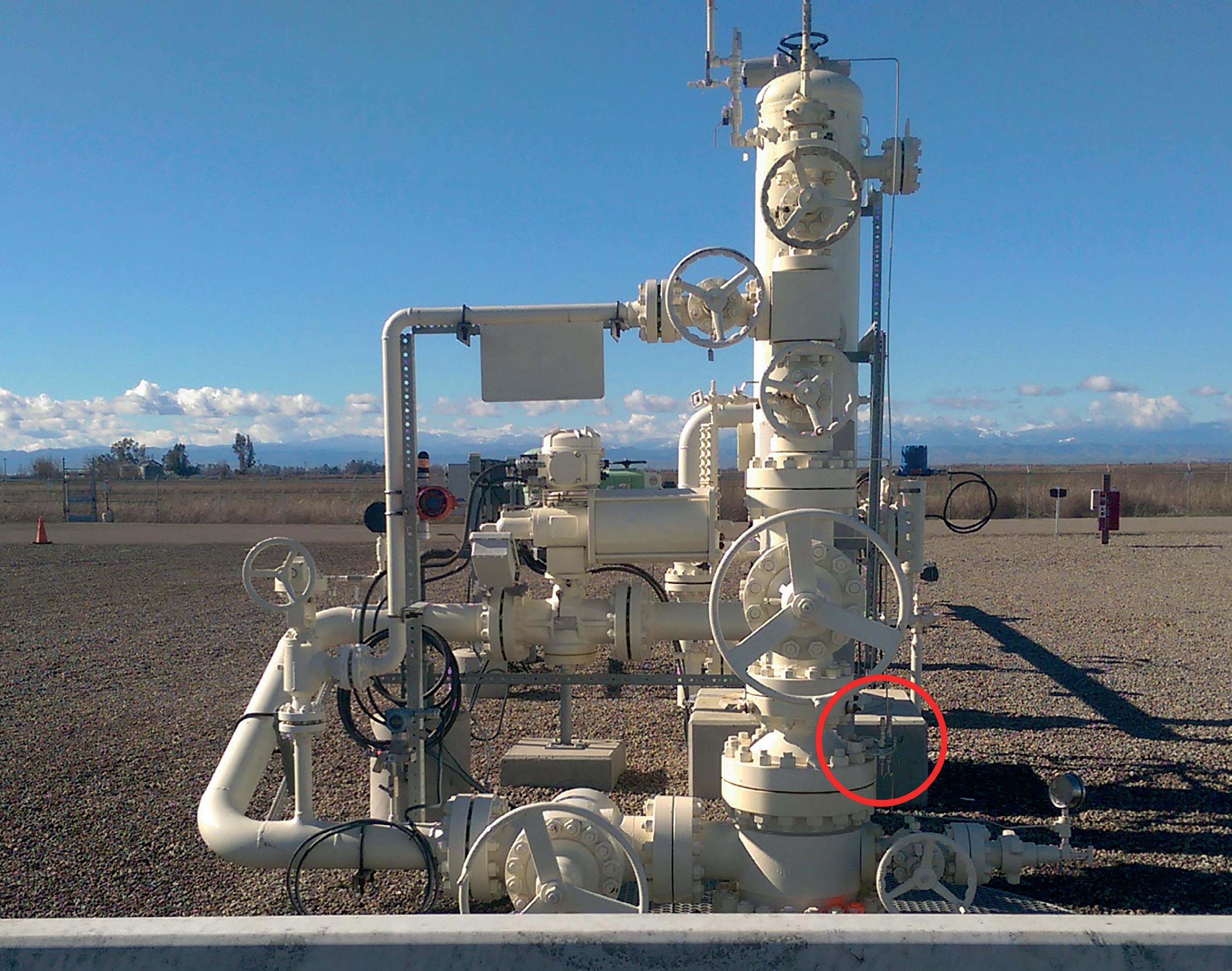

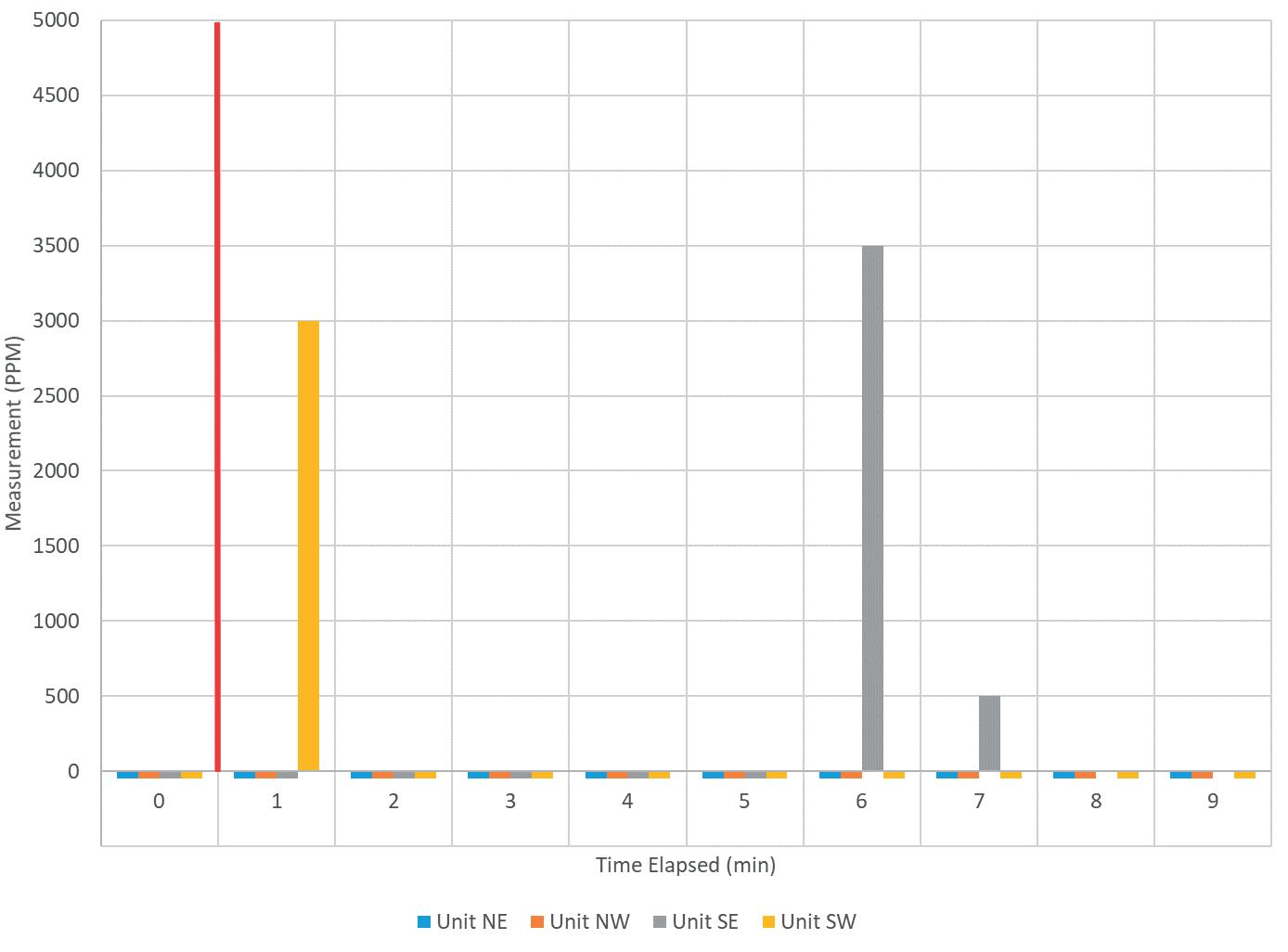

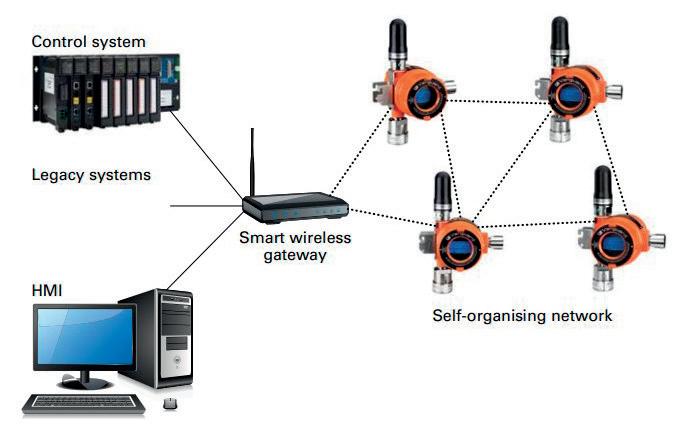

49 Efficient detection capabilities

Julian Yeo, United Electric Controls, USA, discusses how wireless gas leak detection can improve monitoring efficiency and regulatory compliance.

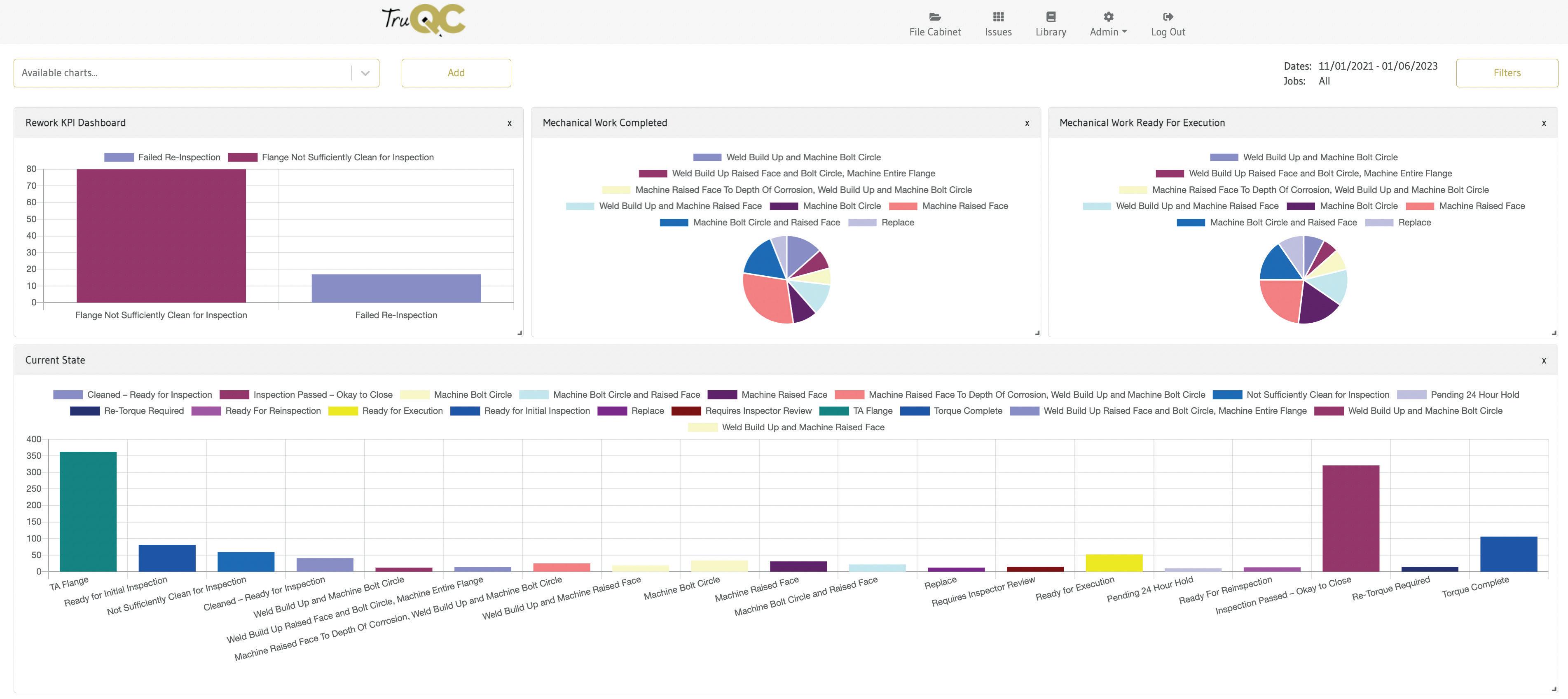

52 The time for digitalisation is now

Ross Boyd, TRU, USA, explains how digitalisation can be implemented at the operational level to assist turnarounds, inspections and maintenance at refineries.

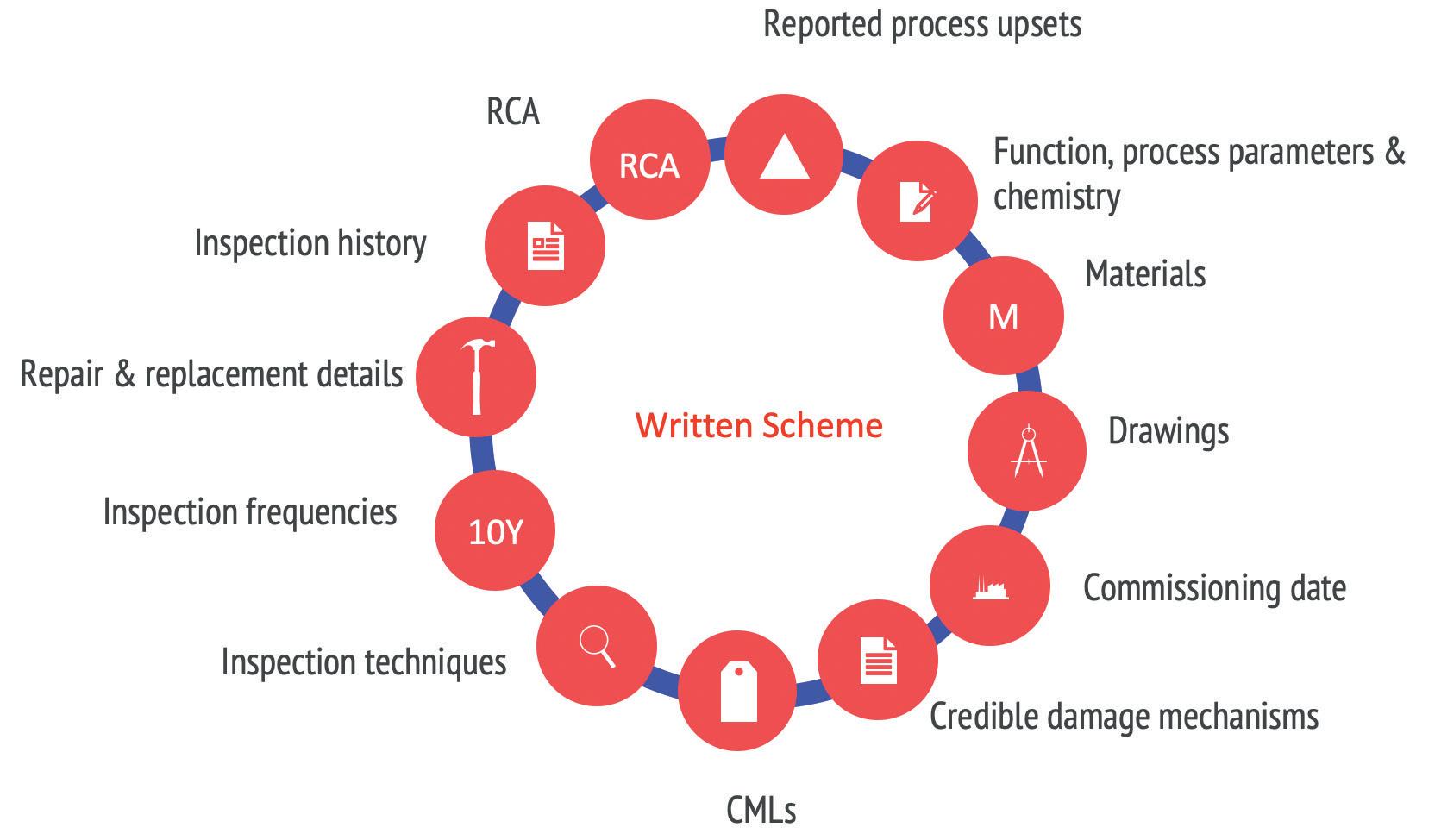

57 Tracking changes

Ashfaq Anwer, UAE, discusses the development and management of written inspection schemes, and explores how they can help to ensure equipment reliability in process plants.

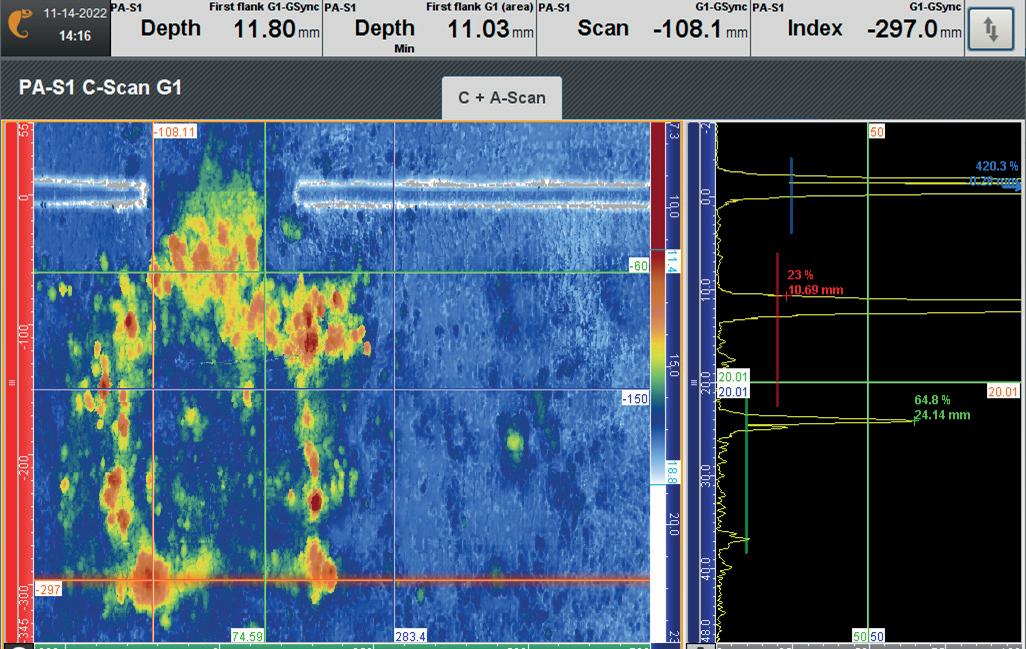

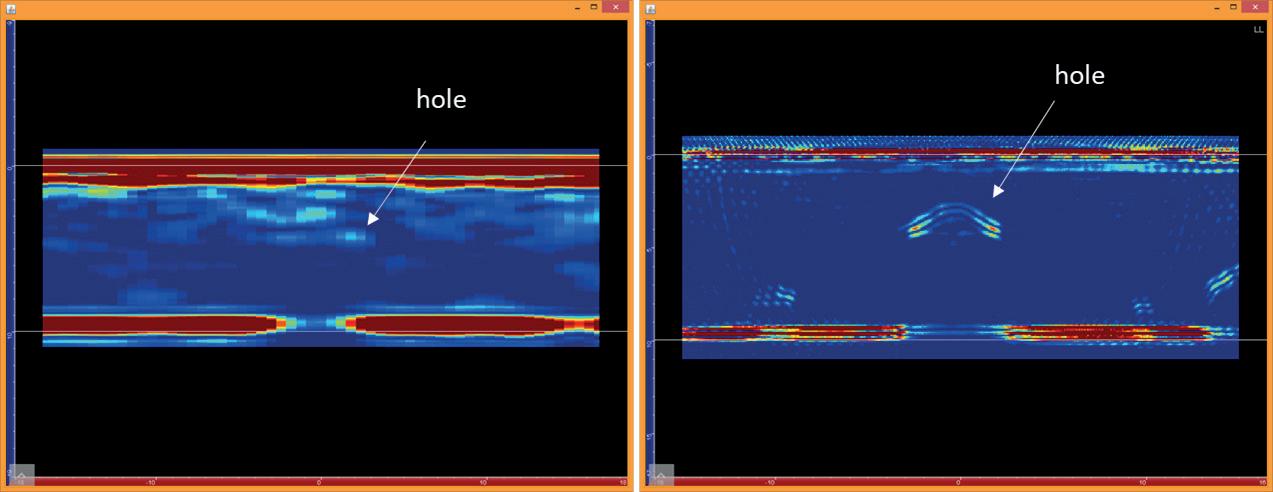

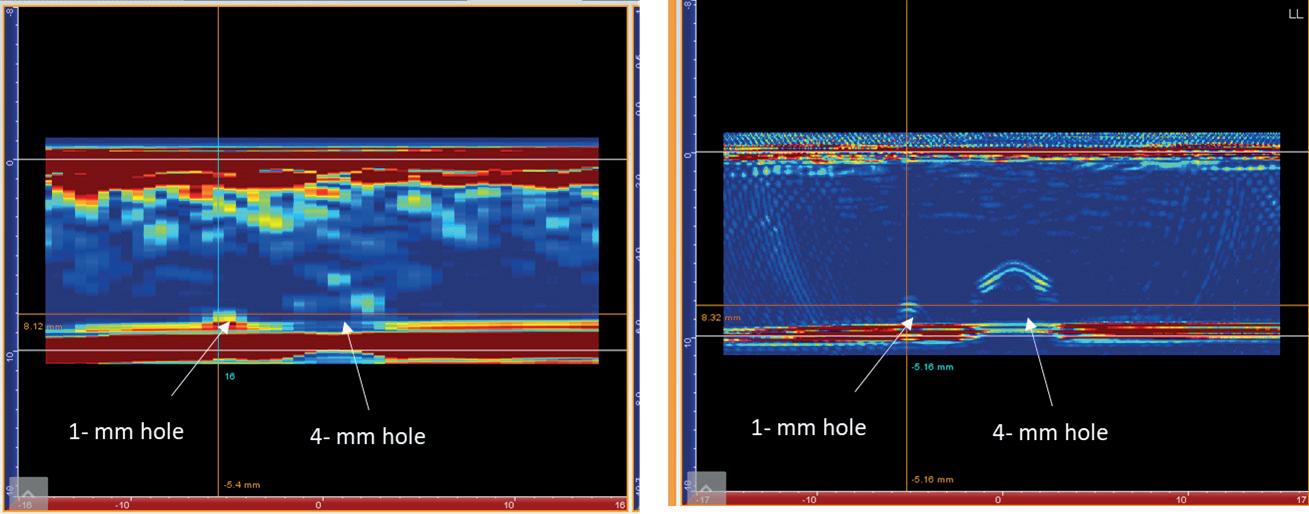

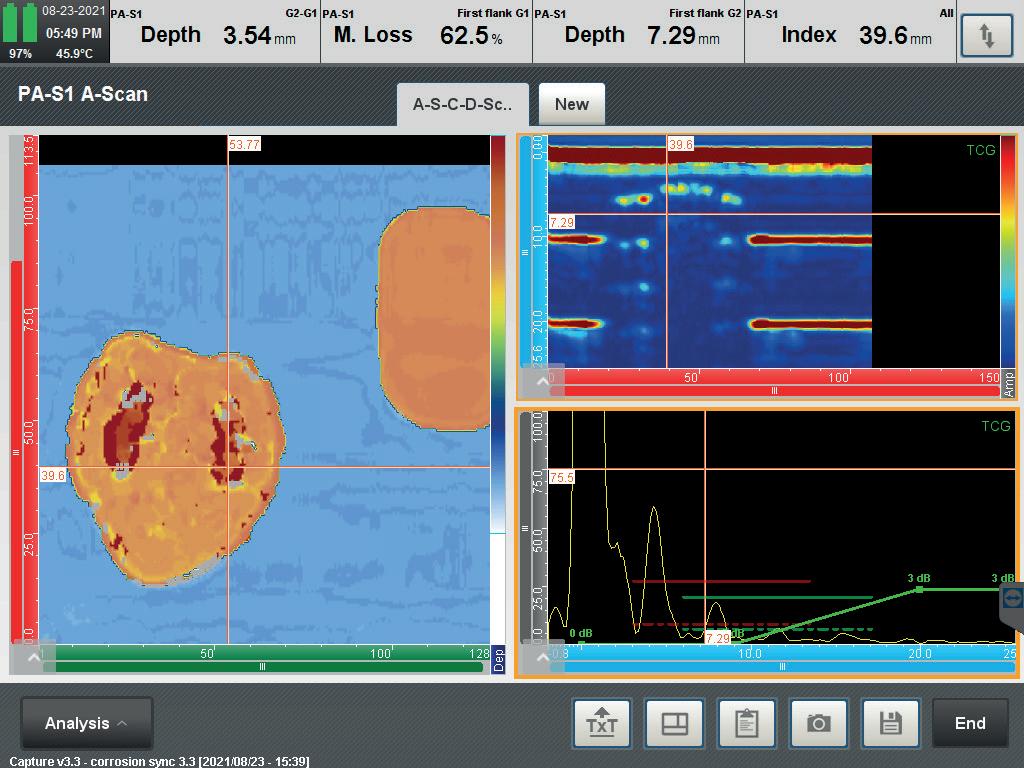

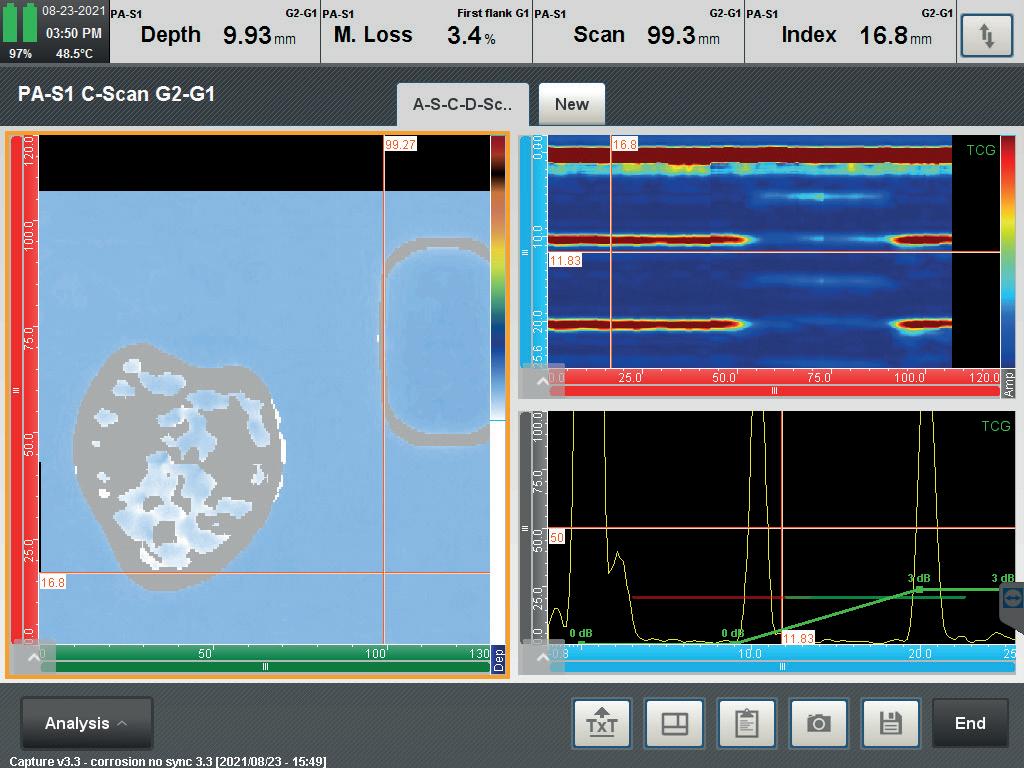

61 Advanced mapping solutions

Frederic Reverdy, Eddyfi Technologies, France, explains how best to perform corrosion mapping with ultrasonic techniques.

THIS MONTH'S FRONT COVER

API Training builds a more knowledgeable and skilled natural gas and oil industry workforce through educational programmes designed to help ensure improved productivity, safety and sustainability in industry operations. Inspection personnel can continue their professional development on their own schedule through on-demand eLearning training or instructor-led courses offered in-person and virtually.

CONTACT INFO

MANAGING EDITOR James Little james.little@palladianpublications.com

SENIOR EDITOR Callum O'Reilly callum.oreilly@palladianpublications.com

ASSISTANT EDITOR Bella Weetch bella.weetch@palladianpublications.com

SALES DIRECTOR Rod Hardy rod.hardy@palladianpublications.com

SALES MANAGER Chris Atkin chris.atkin@palladianpublications.com

SALES EXECUTIVE Sophie Birss sophie.birss@palladianpublications.com

PRODUCTION MANAGER Calli Fabian calli.fabian@palladianpublications.com

EVENTS MANAGER Louise Cameron louise.cameron@palladianpublications.com

EVENTS COORDINATOR Stirling Viljoen stirling.viljoen@palladianpublications.com

DIGITAL CONTENT ASSISTANT Merili Jurivete merili.jurivete@palladianpublications.com

DIGITAL ADMINISTRATOR Leah Jones leah.jones@palladianpublications.com

ADMIN MANAGER Laura White laura.white@palladianpublications.com

CONTRIBUTING EDITOR

Nancy Yamaguchi Gordon Cope

SUBSCRIPTION RATES

Annual subscription £110 UK including postage /£125 overseas (postage airmail).

Two year discounted rate £176 UK including postage/£200 overseas (postage airmail).

SUBSCRIPTION CLAIMS

Claims for non receipt of issues must be made within 3 months of publication of the issue or they will not be honoured without charge.

APPLICABLE ONLY TO USA & CANADA

Hydrocarbon Engineering (ISSN No: 1468-9340, USPS No: 020-998) is published monthly by Palladian Publications Ltd GBR and distributed in the USA by Asendia USA, 17B S Middlesex Ave, Monroe NJ 08831. Periodicals postage paid New Brunswick, NJ and additional mailing offices. POSTMASTER: send address changes to HYDROCARBON ENGINEERING, 701C Ashland Ave, Folcroft PA 19032.

15 South Street, Farnham, Surrey

GU9 7QU, UK

Tel: +44 (0) 1252 718 999

COM MENT

CALLUM O'REILLY SENIOR EDITOR

In recent weeks, artificial intelligence (AI) has been hitting the headlines following a string of controversies. A song that used AI to clone the voices of musicians Drake and The Weeknd was recently removed from streaming services after it went viral and drew strong criticism from publishers Universal Music Group, which claimed that the song violated copyright law. German artist Boris Eldagsen refused his prize for winning the creative open category at the Sony World Photography Awards, revealing that his work was created using AI. And the family of Michael Schumacher announced that they are planning legal action against a German magazine which published an AI-generated ‘interview’ with the former Formula 1 world champion, who suffered severe head injuries following a skiing accident in 2013.

There is growing concern about the power that AI has to change the way we live. Key figures in the sector, including Elon Musk, recently signed an open letter warning of the potential risks of the technology, and urging that training of powerful AI systems should be suspended amid fears of a threat to humanity.

Of course, there are two sides to the coin, and AI has enormous capacity to make a positive impact on society and revolutionise industries such as ours. For example, Yokogawa Electric Corp. recently announced that its reinforcement learning-based AI algorithm will be officially adopted for use at an ENEOS Materials chemical plant, following a successful field test in which the autonomous control AI demonstrated a high level of performance while controlling a distillation column at the plant for almost a year. During the field test, the AI is reported to have shown year-round stability, reduced environmental impacts, lightened workloads, and improved safety, all while achieving stable performance and optimising operations. This is the first example in the world of reinforcement learning AI being adopted for direct control of a plant.

The integration of AI in the downstream oil and gas sector holds great promise for increased efficiency, cost savings, and improved safety. AI can optimise production, streamline supply chains, and enable predictive maintenance, reducing downtime and increasing overall performance.

However, the adoption of AI in the downstream oil and gas sector is not without risks. One major concern is cybersecurity, as AI systems depend on vast amounts of data that need to be kept secure. Another risk is the need for a skilled workforce to operate and maintain the system, and the possibility of unexpected outcomes that could have serious consequences for human safety and the environment.

It is important for industry players to work together to mitigate these risks and ensure responsible use of AI in the downstream oil and gas sector. This includes carefully considering the ethical implications of AI implementation, engaging with regulatory bodies and industry partners, and investing in education and training programmes to build a skilled workforce that can operate and maintain these systems safely and effectively. Used carefully, AI has enormous potential to change the way that we live our lives for the better. And it can also make a number of our everyday tasks that little bit easier. Take writing an ‘Editor’s Comment’ for a magazine dedicated to the downstream oil and gas industry, as an example. Did any of you suspect that the previous three paragraphs above were created (in approximately 10 seconds) using Chat GPT, an AI language model developed by OpenAI?

Just don’t tell my boss…

WORLD NEWS

USA | Beaumont refinery expansion boosts US Gulf Coast capacity

ExxonMobil has announced the beginning of operations at its Beaumont refinery expansion, adding 250 000 bpd of capacity and making the refinery one of the largest in the US (measured by crude oil distillation capacity). According to ExxonMobil, the total capacity of the Beaumont facility is now 630 000 bpd.

This is the first major refinery capacity expansion to come online since the COVID-19 pandemic, which led to several refinery capacity closures over the course of 2020 and

2021. Total US refinery distillation capacity decreased from 19 million bpd at the start of 2020 to 17.9 million bpd at the start of 2022. Increased US Gulf Coast refinery capacity should grow gross refinery inputs and production of refined products such as gasoline and distillate fuel oil (usually sold as diesel). Since mid-March 2023, total crude oil inputs at refineries on the US Gulf Coast have increased, reflecting the growing capacity of the Beaumont refinery.

Japan & South Korea | JERA signs LNG MoU with KOGAS

JERA Co. Inc. has announced that it has entered into a Memorandum of Understanding (MoU) with Korea Gas Corp. (KOGAS) regarding cooperation in the LNG sector.

Under this MoU, JERA and KOGAS have agreed to discuss opportunities for mutual collaboration in the LNG industry including LNG swaps, trading, ship optimisation, and market view exchange.

JERA and KOGAS will strengthen their strategic relationship and consider developing schemes of cooperation regarding their LNG supply and demand in order to enhance stable energy supply in Japan and South Korea.

In a statement, JERA said that it will continue to work together with LNG buyers and other companies to enhance procurement capabilities.

USA | AFPM honours facilities with outstanding safety practices

The American Fuel & Petrochemical Manufacturers (AFPM) has announced the winners of the 2022 Annual Safety Awards. The awards are part of a comprehensive programme developed by the AFPM Safety and Health Committee to promote safe operations in the refining and petrochemical industries. They also recognise facilities that have outstanding occupational and process safety performance.

The industries’ commitment to safety is reflected in their records, where they have consistently ranked as one of the safest of more than 500 manufacturing industries tracked by the US government over the last decade.

The highest honour, the ‘Distinguished Safety Award’, is awarded to the top sites with outstanding safety performance, programme innovation and safety leadership. This honour was awarded to three facilities this year for achieving a sustained, exemplary level of safety performance: ExxonMobil Chemical Co.’s Beaumont Chemical Plant, LyondellBasell Industries’ Bayport Complex, and Phillips 66’s Sweeny Refinery.

China | Technip Energies awarded contract for Juhua’s chemical complex

Technip Energies has been awarded a contract by Ningbo Juhua Chemical & Science Co. Ltd (Juhua) for a 1,3-propanediol (PDO) plant with a capacity of 72 000 tpy, as well as a 150 000 tpy polytrimethylene terephthalate (PTT) plant, in Ningbo, China.

These two products are based on Technip Energies’ proprietary Zimmer® PDO and PTT technologies, which will

strengthen and expand Juhua’s petrochemical new materials business, while improving its competitiveness. Technip Energies will provide the licenses, basic design packages, and proprietary equipment for both technologies, as well as detail design services. The PDO technology was originally developed by Shell, and Shell Catalysts & Technologies will be the catalyst supplier for the PDO plant.

Bhaskar Patel, SVP Sustainable Fuels, Chemicals and Circularity, Technip Energies, stated: “We are very pleased that Juhua has selected two of our polymer technologies for the expansion of their facility in Ningbo. This is the first commercial-scale application of our PDO technology, which produces a high-quality monomer with excellent raw material utilisation as feedstock for our PTT technology.”

DIARY DATES

08 - 12 May 2023

RefComm

Galveston, Texas, USA events.crugroup.com/refcomm

22 - 24 May 2023

ILTA 2023 International Operating Conference and Trade Show

Houston, Texas, USA ilta2023.ilta.org

07 - 08 June 2023

Downstream USA 2023

Galveston, Texas, USA events.reutersevents.com/petchem/downstream-usa

07 - 08 June 2023

Valve World Americas Expo & Conference Houston, Texas, USA valveworldexpoamericas.com

13 - 15 June 2023

Global Energy Show Calgary, Alberta, Canada www.globalenergyshow.com

10 - 13 July 2023

LNG2023

Vancouver, British Columbia, Canada www.lng2023.org

05 - 08 September 2023

Gastech Singapore www.gastechevent.com

26 - 28 September 2023

Turbomachinery & Pump Symposia Houston, Texas, USA tps.tamu.edu

02 - 05 October 2023

ADIPEC

Abu Dhabi, UAE www.adipec.com

03 - 05 October 2023

AFPM Summit

Grapevine, Texas, USA summit.afpm.org

13 - 16 November 2023

ERTC

Lake Maggiore, Italy worldrefiningassociation.com/event-events/ertc

USA | Chart expands MoU with Wolf Carbon Solutions

Chart Industries Inc. has announced the expansion of its existing Memorandum of Understanding (MoU) with Wolf Carbon Solutions U.S. LLC. Wolf is an affiliate of Wolf Midstream, a US$4 billion multi-asset energy infrastructure organisation based in Calgary, Alberta, Canada.

Through the cooperation agreement, both companies will jointly identify, develop, pursue and execute projects using Chart’s Sustainable Energy Solutions (SES) Cryogenic Carbon

Capture (CCC) technology at mutually agreed upon host sites located along Wolf’s recently announced Mt. Simon Hub carbon pipeline system. The proposed Mt. Simon Hub will run from Cedar Rapids, Iowa, to central Illinois, US. Carbon that would otherwise be emitted into the atmosphere will be captured via Chart CCCTM technology and transported, stored, and permanently sequestered in the proposed Mt. Simon Hub carbon capture, transport, and sequestration system.

China | Lummus announces start-up of world’s largest double reslurry paraxylene crystallisation unit

Lummus Technology has announced the start-up of Shenghong Refining & Chemical (Lianyungang) Co. Ltd’s paraxylene unit.

The grassroots unit, which is the world’s largest double reslurry paraxylene crystallisation unit, is part of Shenghong’s refining and petrochemical integrated project in Lianyungang, Jiangsu Province, China.

In 2017, Lummus executed an agreement with Lianyungang Co. to provide the paraxylene technology license, process design services and operator training and start-up services. In addition, Chevron Lummus Global (CLG) has provided multiple hydrocracking technologies, as well as hydrotreating and delayed coking technologies for Shenghong at the same complex.

France | Axens acquires shares in the BioTJet project

Axens has acquired stakes in the BioTJet project, the aim of which is to build and operate the largest European sustainable aviation fuel (SAF) production unit using the Fischer-Tropsch process, relying on the BioTfueL® technology. This unit will be built in France, and started up by 2027. BioTfueL is an advanced biofuel production technology, developed and proven within the framework of the eponymous project from

2010 to 2021. The process includes Gasel® – a technology suite licensed by Axens used to produce high-quality renewable fuels by the Fischer-Tropsch process.

Within the framework of the BioTJet project, Axens is surrounded by its partners, and is part of the European energy transition strategy in line with the ambitious decarbonisation objectives of the aviation sector.

EXPECT THE ABSOLUTE BEST.

Servicing your facility's burners has never been easier. Zeeco offers on-site and off-site burner services designed to optimize burner performance and reduce downtime. Whether you need a simple cleaning, repair work, or a complete burner retrofit, Zeeco can get the job done right, on time, and on budget. Don' t have ZEECO Burners? No problem. Don' t waste money waiting for burner service.

Call the experts redefining what it means to be the world's foremost fired equipment authority. Zeeco - Redefining Combustion.

Ng Weng Hoong, Contributing Editor, discusses the ways in which geopolitics are set to rule Asia’s oil markets in 2023.

Asia’s energy planners will have to consult political scientists as much as traders in order to navigate an increasingly conflict-driven global oil market in 2023. The markets appear to have adjusted to the unprecedented amount of international trade sanctions imposed on Russia over the course of 2022. Crude oil initially surged to US$140/bbl as a result of panic buying, but has since fallen by half to the US$70/bbl range. However, Asia is not taking the current lull for granted, with China and India leading the region’s rush to build oil stockpiles.

In 2023, China’s oil consumption will rise by 4.8% to reach another record high of 15.85 million bpd, according to the US Energy Information Administration (EIA)’s latest forecast. Asia’s other developing economies, led by India, will boost their combined consumption by nearly 2.6% to 14.06 million bpd. By comparison, the EIA predicts that the world’s oil appetite will edge up by a mere 1.1% this year.

These forecasts are made on the key assumptions that the global economy will not slump into recession, and that the war in Ukraine will not escalate. Both assumptions could prove optimistic. For Asia, energy disruption is a huge worry, as the energy-deficit region would be directly impacted if a shooting war broke out between China and the US.

Will Saudi Arabia buy Xi Jinping’s petroyuan pitch?

Emerging from three years of a self-imposed COVID-19 lockdown, China was widely expected to lead the surge in the world’s oil consumption growth in 2023. Instead, the markets responded with a collective yawn. In the weeks that

followed Beijing’s lifting of anti-pandemic restrictions on 8 January 2023, the benchmark Brent crude price held within a range of US$75 – 85/bbl. For now, Brent looks unlikely to reclaim the US$100/bbl level last seen in mid-August 2022.

China’s projected oil demand may not be the energy markets’ biggest concern this year. Last December, President Xi Jinping travelled to Saudi Arabia to personally push for a weakening of the US’s grip on the world’s financial system. He wants Saudi Arabia and other Middle Eastern countries to price their oil exports to China in the Chinese currency, the yuan.

At the inaugural China-Gulf Cooperation Council (GCC) Summit, Xi personally appealed to the Arab world to use the yuan at the expense of the dollar to price oil exports. This is emerging as one of the most intriguing ideas in financial circles. Following the first oil shock in 1974, Saudi Arabia acceded to the US demand that oil revenues be used to purchase US Treasuries and assets. Oil was to be priced and traded exclusively in the dollar, where previously it could also be pegged to the British pound. In return, the US would guarantee the security of the ruling Saudi family and the Kingdom. Saudi Arabia and OPEC members complied by recycling their enormous oil windfall into the US assets and debts. This provided the US with a constant long-term infusion of funds to cover its mounting budget deficit caused mostly by the Vietnam War, and costly domestic welfare programmes.

The deal worked so well that other countries joined in, thus entrenching the petrodollar’s status as the world’s first truly global currency. OPEC’s revenues helped finance US

debt spending, which became free to grow virtually without limits. The dollar’s position as the world’s reserve currency became key to the global infrastructure of payments to support world trade, further enhancing the US as a superpower.

In recent years, the system has been challenged by China, Russia, India and other developing countries wary of the US’s ability to impose unilateral trade sanctions on others.

In pitching the petroyuan, China has taken the boldest gamble by any country so far to undermine the dollar’s position. At the China-GCC Summit, Xi officially presented the idea to de facto Saudi Arabian ruler, Crown Prince Mohamed Bin Salman, and the other GCC leaders from Kuwait, the UAE, Qatar, Bahrain and Oman. Xi tabled five proposals, starting with the petroyuan. In exchange, China promised to increase the import of Middle East energy, and expand investment in the region. While the petroyuan idea has been around for years, this was the first time that China had formally proposed it at an international event.

Why the urgency?

Beijing has identified the petrodollar as a pillar of US global power that it believes it can weaken. If Saudi Arabia were to price even a portion of its oil sales in yuan, it could set an example for other countries that would kickstart a chain reaction. By using its own currency, China, the world’s largest oil importer, could reduce global demand for the dollar. It would weaken the future sting of US financial and trade sanctions, which were unleashed on the Russian economy in response to the war on Ukraine.

For its part, Saudi Arabia could be tempted given its growing self-confidence and increasing alienation from the US, as Prince Salman has a testy relationship with the US government under President Joe Biden. The Saudi government also worries about the possibility of facing US financial and economic sanctions in the future.

Saudi Arabia is also eager to protect its long-term share in the Chinese market against the growing competition of cheaper oil supplies from Russia and Iran. Furthermore, Prince Salman sees China as an important bulwark against Iran, the biggest rival to his kingdom in the Middle East.

Salman is clearly betting on China, especially after it emerged that Xi had facilitated the resumption of diplomatic ties between Saudi Arabia and Iran. On 10 March 2023, the three countries issued a joint statement in Beijing that Saudi Arabia and Iran would restore ties after a seven-year break.

Hong Kong courts Saudi Aramco’s listing on stock exchange

Building on Xi’s December 2022 visit, Hong Kong has made it a top priority to secure the listing of Saudi Arabia’s largest company, Aramco, on its stock exchange. Aramco’s listing would greatly boost Hong Kong’s recently flagging fortune, and support Beijing’s plans to expand China’s business and energy ties with the Middle East.

In February 2023, Hong Kong’s Chief Executive, John Lee, pitched Aramco, now trading on the Saudi Stock Exchange, or

Tadawul, to take up a secondary listing on the Hong Kong Stock Exchange. Lee led a delegation of more than 30 senior business people on an unprecedented campaign to drum up business and technology deals with the Kingdom and neighbouring UAE.

State-owned Aramco opted against listing a portion of its equity on an international bourse when it went public in 2019. Although there was strong interest from global exchanges in New York, London, Singapore and Hong Kong, the company was concerned that international investors would not pay for its lofty targeted valuation of US$2 trillion.

Demands by foreign stock exchanges for full disclosure of the company’s tightly-guarded financial and oil reserves data may also have contributed to Aramco’s decision to restrict its public offering to the Tadawul in Riyadh, Saudi Arabia. The Saudi government accepted the scaled-back plan, including the company’s reduced valuation of US$1.7 trillion when its stock began trading on 11 December 2019.

This time around, Hong Kong stands a better chance to snare the coveted secondary listing. In recent years, China’s government under Xi has moved to impose full political, legal and administrative control over the former British colony which reverted to Chinese rule in 1997. Beijing is unlikely to object to Aramco’s demand for absolute secrecy over its oil and gas reserves and production data as a condition for the secondary listing. As the sole guardian of Saudi Arabia’s energy industry, Aramco is entrusted to protect the Kingdom’s enormous oil and gas wealth, which includes its data.

Saudi Arabia’s growing importance to China

Saudi Arabia’s growing importance to China’s geopolitical strategy was underlined by President Xi’s meeting with GCC leaders last December. The China-GCC summit marked a high point in Saudi-China relations, highlighted by Aramco signing multi-billion-dollar deals with Chinese state-owned energy firms in 2022. The Saudi firm announced two agreements with Sinopec and Shandong Energy Group, worth a total of at least US$30 billion.

Aramco and Sinopec announced that they will be expanding their joint refining and petrochemical complex in China’s southeastern Fujian province. The partners will be adding a 16 million tpy (320 000 bpd) refinery linked to a 1.5 million tpy ethylene unit to start up in late 2025.

With Shandong Energy, Aramco has said that it is looking to develop a downstream presence in China’s northeastern province of Shandong. The Saudi firm will supply the crude feedstock and purchase the processed chemical products that will “expand its liquids-to-chemicals capacity (in China) to up to 4 million bpd by 2030.”1

Earlier last year, Aramco formed a joint venture (JV) with North Huajin Chemical Industries Group Corp. and Panjin Xincheng Industrial Group, to develop a liquids-to-chemicals complex in Panjin City in Liaoning province, China.

Huajin Aramco Petrochemical Co. (HAPCO) will build an integrated refinery-petrochemical complex worth more than US$10 billion. The 300 000 bpd refinery and ethylene-based steam cracker are expected to start operations in 2024.

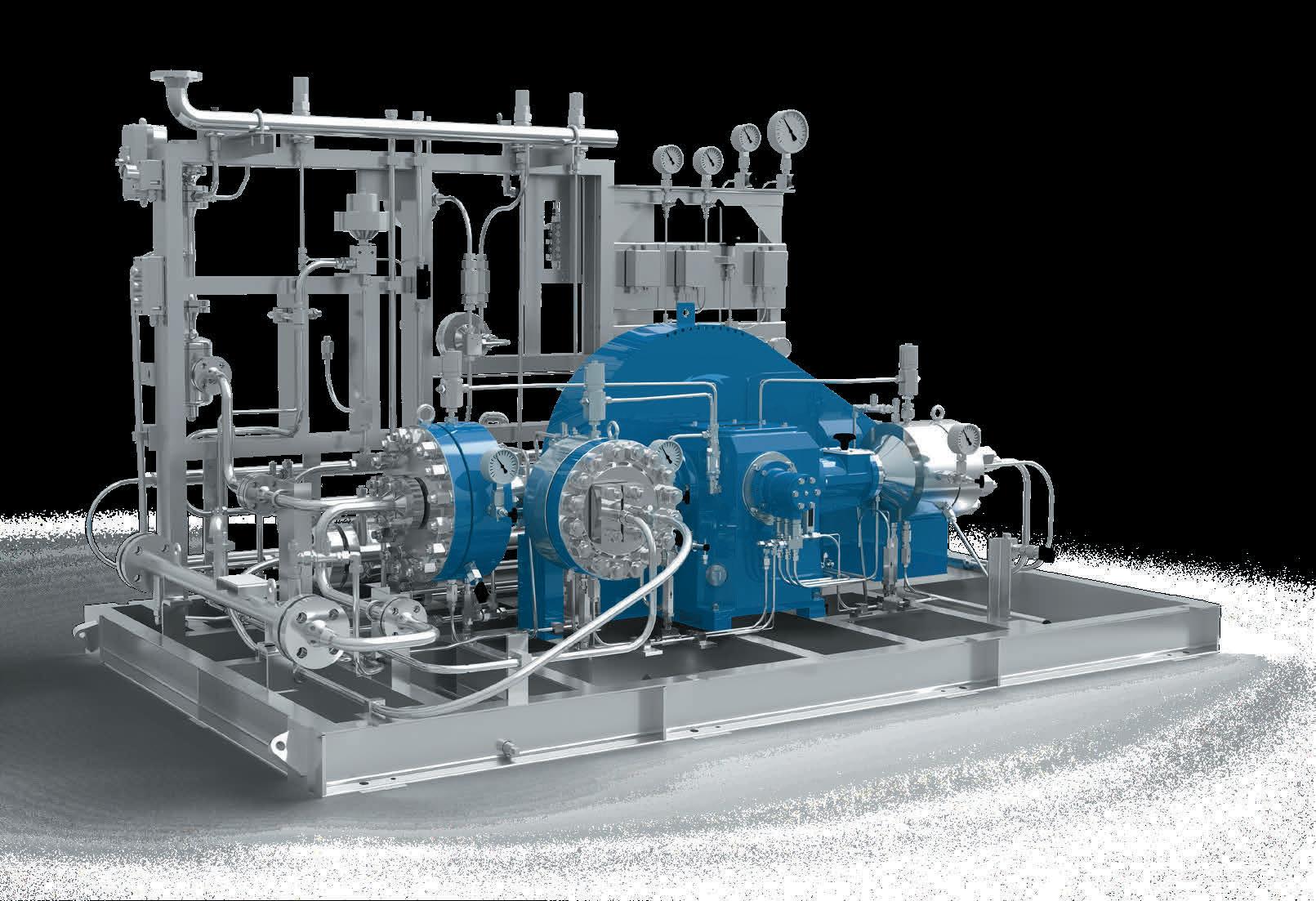

Hydrogen Compression

Turn to Elliott Group for operational flexibility in hydrogen applications.

Elliott’s Flex-Op® Hydrogen Compressor features flexible, configurable, and economical compression options for hydrogen applications. Designed with proven Elliott compressor technology, the Flex-Op’s compact arrangement of four compressors on a single gearbox maximizes compression capability with enough flexibility to run in series, in parallel, or both. Who will you turn to?

n Learn more at www.elliott-turbo.com

The World Turns to Elliott COMPRESSORS | TURBINES |

|

Asia: refiners gain from cheap Russian crude and renewed Chinese demand

Asia’s oil refiners and traders are expecting another bumper year on the back of heavily discounted Russian crude supply and renewed Chinese demand.

The oil industry had a blockbuster 2022, led by the western majors ExxonMobil, Shell, Chevron and BP reporting record profits. Crude prices surged to a 13-year high, with Brent nearly touching US$140/bbl shortly after the Russian army began attacking Ukraine on 24 February 2022.

World markets plunged into chaos when international sanctions, organised by the US, stopped most countries from buying Russian commodities. The disruptions created opportunities for nimble traders who realigned global oil supply chains with China, India and other Asian countries playing key roles.

While the sanctions targeted Russia’s crude oil, refined products proved much harder to monitor. By 2H22, the US was forced to accept that Asia was openly importing Russian crude for refining into finished products for export to the rest of the world, including the West. A complete ban on Russian crude sales would have devastated the world economy still struggling to recover from recession, inflation, and over two years of COVID-19 lockdowns.

Asia’s expanded refining capacity

China and India led the purchase of up to 1 million bpd of Russian crude for supply to refiners in Asia and the Middle East. Russia’s fire-sale of its crude at hefty discounts of between 30 – 40% proved too good to pass up.

India was particularly defiant with External Affairs Minister, S. Jaishankar, fiercely rebuking the West for trying to shame his country into joining the sanctions.

Speaking at various public forums last year, he accused the West of hypocrisy for allowing Europe to continue buying Russian oil, gas and coal while demanding developing countries forego the offer of cheap energy. “Our purchases for the month would be less than what Europe does in an afternoon,” he told an influential US audience at the US-India ministerial dialogue in Washington D.C., US, last April.

On the issue of Russian oil sales, Jaishankar told his audience, including US Secretary of State, Anthony Blinken, and Defense Secretary, Lloyd J. Austin: “Your attention should be focused on Europe.”

There is another reason for China and India to lap up cheap Russian crude. When COVID-19 broke in 2020, both countries were faced with surplus refining capacities and slowing oil demand growth. In 2020, Asia’s oil consumption fell 5.6%, according to BP2, dragged down by the region’s deep economic slump. Although consumption partly rebounded by nearly 5% in 2021, the refining industry remained under pressure as product prices were still weak compared with crude.

Adding to the industry’s misery, the growth in refining capacities in both China and India did not slow down the legacy of past decisions by the two countries to expand their downstream oil sectors. Over the past decade, China’s refining capacity has expanded by an annual average of 2.7% to a new high of 17 million bpd, while India’s recently reached a record of well over 5 million bpd. The deluge of discounted Russian crude feedstock, along with record high product prices, have

delivered a much-needed windfall for the two countries’ refiners. They will be hoping for this scenario to continue in the coming years.

According to consultant GlobalData, Asia will add 10.2 million bpd of crude distillation capacity by 2027.3 This includes 7.3 million bpd of new construction and 2.9 million bpd from the expansion of existing refineries. According to BP, Asia had 36.5 million bpd of refining capacity at the end of 2021, implying the region will be boosting capacity by 28% by the end of 2027.2

Bhargavi Gandham, GlobalData’s Oil and Gas Analyst, said: “The refinery capacity additions in Asia will be primarily driven by China and India. Economic growth, the ever-growing demand for petroleum products, especially from the transportation sector, and expanding petrochemicals sector are driving capacity additions in these countries.”

GlobalData expects Sri Lanka to build Asia’s biggest standalone refinery over the next five years. It expects the proposed Hambantota III refinery to start up in 2027 with a total capacity of 420 000 bpd.

The US Energy Information Administration (EIA) reported a significant increase in China’s refinery capacity in 2022. The 320 000 bpd Shenghong petrochemical plant in Lianyungang in Jiangsu province began trial processing in May 2022, while PetroChina started up its 400 000 bpd Jieyang refinery in Guangdong province in late 2022. Zhejiang Petrochemical Corp. (ZPC) completed a 400 000 bpd expansion of its Rongsheng plant earlier in the year.

In Malaysia, the 300 000 bpd RAPID Pengerang refinery in Johor state is fully operational after a prolonged shutdown caused by a fire in March 2020.

In India, the EIA has reported that Hindustan Petroleum is currently expanding its 170 000 bpd Visakhapatnam refinery to over 300 000 bpd by 2023.

China targeted by new US laws to ‘protect’ oil reserves

With China in mind, the US House of Representatives passed two new laws in January 2023 to limit the president’s ability to release stockpiles from the nation’s Strategic Petroleum Reserves (SPR).

The Republican Party, which controls the House, passed the Strategic Production Response Act (SPRA) on 27 January 2023, and the ‘Protecting America’s Strategic Petroleum Reserve from China’ act on 12 January 2023.

Led by senior members, the Republican Party has been protesting for months that President Joe Biden’s recent releases of SPR stocks have benefitted Chinese rather than American consumers.

The SPRA will “help ensure the Strategic Petroleum Reserve is available during a true energy emergency and not abused for non-emergency, political purposes,” said Cathy McMorris Rodgers, who chairs the House’s energy and commerce committee.4

In a statement, she described the SPR as “vital and central [...] to provide the oil supplies Americans need during true emergencies, not drain them away for non-emergency, political purposes.”

Earlier, the House had passed a law specifically designed to stop the sale of SPR stocks to China. Rodgers said that the

‘Protecting America’s Strategic Petroleum Reserve from China’ act was needed to stop the president from “draining our strategic reserves” and “selling it to China”.

“Millions more barrels went to overseas traders who eventually sent it to China. We also know that China is ramping up its purchases of crude oil from Russia and the US to boost its own reserves,” she said.

“China now likely controls the world’s largest government-controlled stockpile of oil, with almost a billion barrels, at the expense of American taxpayers and our energy security.”

Rodgers described the sales to China as “a significant threat to our national and energy security.”

In 2022, Republican Party leaders called for the president to be impeached for selling 950 000 bbl of crude oil from the SPR to a subsidiary of China’s state-owned Sinopec.

Unipec America was among 12 companies that won bids to buy SPR crude at market prices, said the US Department of Energy (DOE). The sale from the nation’s reserves was part of the Biden administration’s efforts to combat rising oil prices that it has blamed on Russia’s invasion of Ukraine.

References

1. ‘Aramco and Shandong Energy collaborate on downstream projects in China’, Aramco, (9 December 2022), https://www.aramco.com/en/newsmedia/news/2022/aramco-andshandong-energy-collaborate-ondownstream-projects-in-china

2. ‘Statistical Review of World Energy’, BP, https://www.bp.com/en/global/ corporate/energy-economics/ statistical-review-of-world-energy. html

3. ‘Asia to account for over half of global refinery CDU capacity additions by 2027, says GlobalData’, GlobalData, (8 February 2023), https://www. globaldata.com/media/oil-gas/ asia-account-half-global-refinerycdu-capacity-additions-2027-saysglobaldata/

4. ‘Chair Rodgers Applauds Passage of H.R. 21 to Protect the SPR’, Energy & Commerce Committee, (27 January 2023), https:// energycommerce.house.gov/posts/ chair-rodgers-applauds-passage-of-hr-21-to-protect-the-spr

Bibliography

• ‘President Xi Jinping Attends First China-GCC Summit and Delivers Keynote Speech’, Ministry of Foreign Affairs, the People’s Republic of China, (10 December 2022), https://www.fmprc.gov.cn/ mfa_eng/zxxx_662805/202212/ t20221210_10988406.html

• ‘The Rise of the Petroyuan and the Slow Erosion of Dollar Hegemony’, The World Financial Review, (28 July 2014),

https://worldfinancialreview.com/the-rise-of-the-petroyuan-and-theslow-erosion-of-dollar-hegemony/

• ‘Exxon smashes Western oil majors’ earnings record with $56 billion profit for 2022’, CNBC, (31 January 2023), https://www.cnbc. com/2023/01/31/exxon-smashes-western-oil-majors-earnings-recordwith-56-billion-profit-for-2022.html

• ‘Oil giant Shell posts highest-ever annual profit of $40 billion’, CNBC, (2 February 2023), https://www.cnbc.com/2023/02/02/shell-earningsoil-giant-reports-record-annual-profits.html

• ‘Chevron annual profit doubles to record $36.5 billion, but fourth-quarter miss hits shares’, Markets Insider, (27 January 2023), https://markets.businessinsider.com/news/stocks/chevron-annualprofit-doubles-to-record-$36-5-billion--but-fourth-quarter-miss-hitsshares-12108651

• ‘BP posts record 2022 earnings to join Big Oil profit bonanza’, CNBC, (7 February 2023), https://www.cnbc.com/2023/02/07/bp-earnings-q4and-fy-2022.html

• ‘Price Cap on Russian Oil: Running to Stand Still’, CSIS, (28 November 2022), https://www.csis.org/analysis/price-cap-russianoil-running-stand-still

Your operations prosper

Process Industry solutions expertise

Spent caustic liquors are considered some of the most foul forms of wastewater produced by industry. They are malodorous and may contain other constituents such as sodium sulfides, sodium mercaptides, sodium naphthenates, phenolic salts, amines, and potentially emulsified hydrocarbons. Whether a result of ethylene production from scrubbing cracked gas with aqueous sodium hydroxide, or hydrocarbon refining where the liquors emanate from caustic washing to remove contaminants, the caustic liquors do not easily respond to conventional biological processes. They may be harmful to human health and the environment, and challenging to treat.

Traditionally, spent caustic has been disposed of by deep well injection or incineration, or transported to offsite industrial sites for treatment and disposal. Health, safety and environmental (HSE) concerns have prompted regulatory guidelines and requirements for handling spent caustics, which often vary by city, state, country or geographic region.

The US Environmental Protection Agency (EPA) categorises spent caustic as hazardous and deleterious waste, and its safe removal and disposal has been a requirement since 1997. The Occupational Safety and Health Administration (OSHA), a department of the US Department of Labor, requires chemical manufacturers,

distributors or importers to provide applicable Safety Data Sheets to communicate information and risks on hazardous materials. Refineries and petrochemical complexes were mandated to treat spent caustic to prevent adverse environmental impacts and meet environmental regulations.

The EU developed a chemicals policy in the late 1960s that was regulated at the organisational level rather than within its 27 individual countries. The policy was overhauled in 2007 with the launch of the Registration, Evaluation, and Authorization of Chemicals (REACH), which united chemicals regulation in Europe into a single system.

Canadian provincial governments play a role in the country’s environmental regulation, with the province of Ontario leading in toxics reduction legislation. Its Toxics Reduction Strategy helps protect the health and environment by reducing toxic substances in air, land, water, and consumer products. In 2009, the Ontario Legislature passed the Toxics Reduction Act, the cornerstone of the Toxics Reduction Strategy, which requires regulated facilities to track and quantify toxic substances that they produce, and develop plans to reduce the use and creation of them.

Although less advanced than the US, EU and Canada, several other nations, including Australia, China, Japan, New Zealand and

Cyndie Fredrick, Richard Stambaugh, Mark Knobloch, Kathy Young, Emma Chan and Jessica Parsa, Merichem Company, explore how the oil and gas industry is prioritising the safe treatment and/or reuse of its waste materials.

Singapore, are instituting programmes and processes that ensure proper compliance with safety and environmental policies.

There is also an extensive history of international collaboration on chemicals assessment and management, resulting in binding conventions, such as the Stockholm Convention, mandatory classification and labelling standards, and global chemicals institutions. Most notable is the Inter-Organization Programme for the Sound Management of Chemicals (IOMC), an international coordinating group that promotes sound chemical management worldwide following the recommendations of the 1992 UN Conference on Environment and Development (UNCED).

It is recognised across the globe that the treatment and removal of spent caustic is not a nicety; it is a necessity. Spent caustic must be handled for its final disposition in a thoughtful and careful manner to ensure the safety of workers, society and the environment, and to guarantee a refinery’s final wastewater product quality.

Spent caustic treatment

Spent caustic treatment is deployed onsite, eliminating the need to haul the spent caustic offsite as waste to a treatment or disposal or recycling facility. It utilises items that are readily available at most sites, including sulfuric acid, atmospheric oxygen, nitrogen, fuel gas, electricity, steam, and cooling water. Rather than relying on hazardous and expensive liquid oxidisers, it produces a safe, saltwater effluent that is not harmful once it is neutralised. And because there are no foul odours and no health and safety issues, it is simple for wastewater treatment plants to manage.

The goal of onsite treatment is to ensure that the caustic is neutralised, impurities are removed, and chemical oxygen demand (COD) and biochemical oxygen demand (BOD) are greatly reduced so that the treated brine can be sent to a wastewater treatment facility for final polishing before release to the environment. The most frequently used technologies include simple neutralisation, deep neutralisation, wet air oxidation (WAO), and incineration.

Caustic neutralisation and oxidation systems have been in use for many decades. Although seemingly simple processes, there are surprising complexities to consider. There are a variety of temperatures and pressures to think about, as well as a range of impurities that may need to be handled – some requiring additional treatment steps. Proper mixing and residence times are needed for the reaction and separation steps. Selection of the proper metallurgy is also extremely important, as corrosion can quickly disable a unit, requiring expensive repairs.

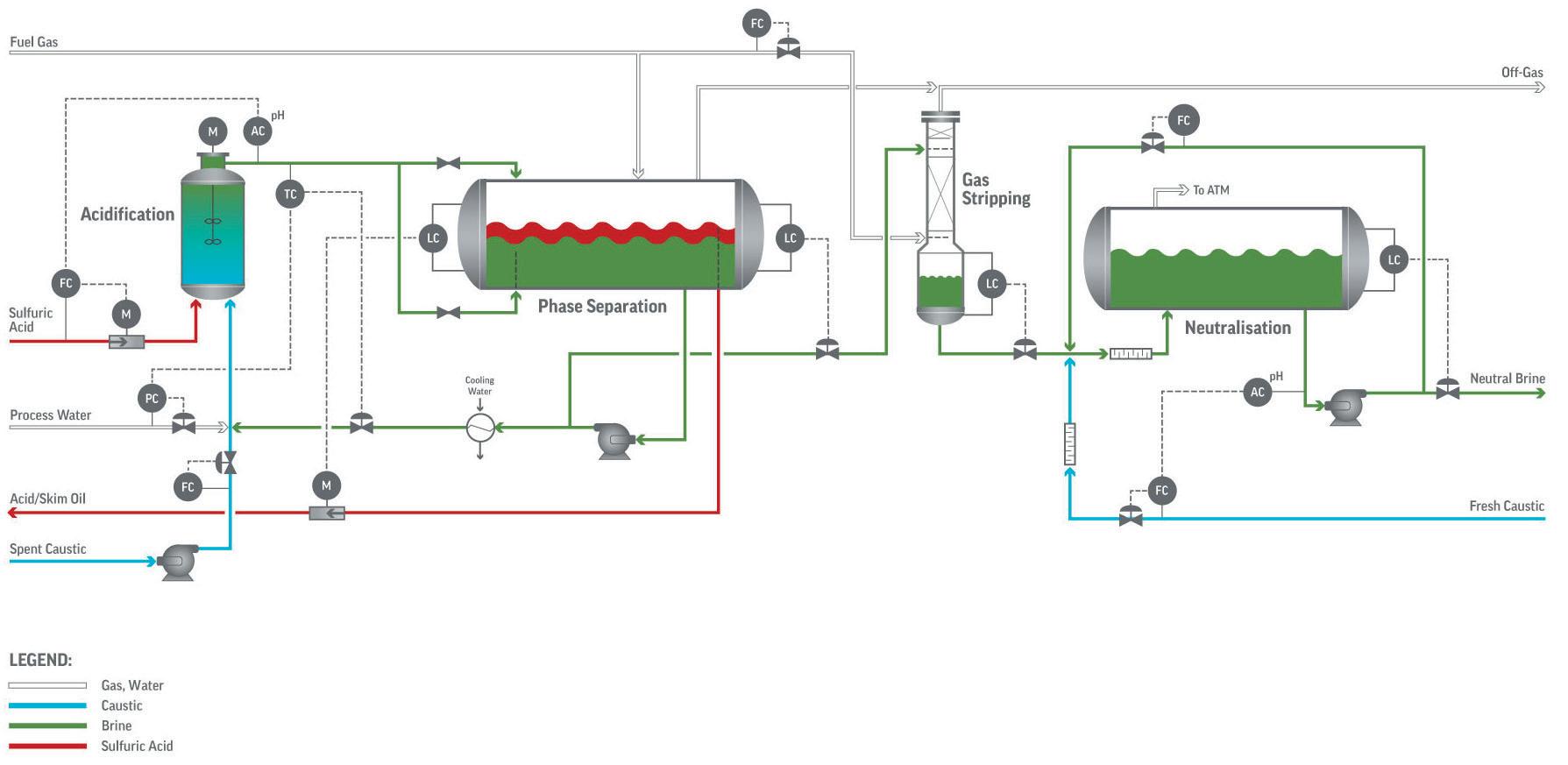

Simple neutralisation

Where brine product specifications are lenient, and a small volume of spent caustic will be diluted into a large wastewater stream, simple neutralisation offers the simplest and least expensive treating option. A simple, low-cost acid, such as sulfuric or hydrochloric acid, is added to the spent caustic to neutralise any free sodium hydroxide (NaOH) remaining, and drops the pH to an acceptable discharge range, usually 6 – 8. The acids are readily available and add no COD to the treated brine.

If sulfate or chloride levels are deemed too high with the acids, simple organic acids, such as formic or acetic acid, can also be used.

This option is best used for treating sulfidic or regenerated sulfidic caustic streams coming from light hydrocarbon streams such as LPG, where most of the toxicity and COD result from easy-to-remove sulfide and mercaptide salts.

The process operates simply. Spent caustic and the acid of choice are injected continuously, mixed, and then enter a three-phase separator. The acid flow is regulated via pH sensing of the released brine. If acid gases or oils are generated by the reaction, they are allowed to separate. If needed, nitrogen or fuel gas can be added to strip away dissolved acid gases further, lowering the odour and COD.

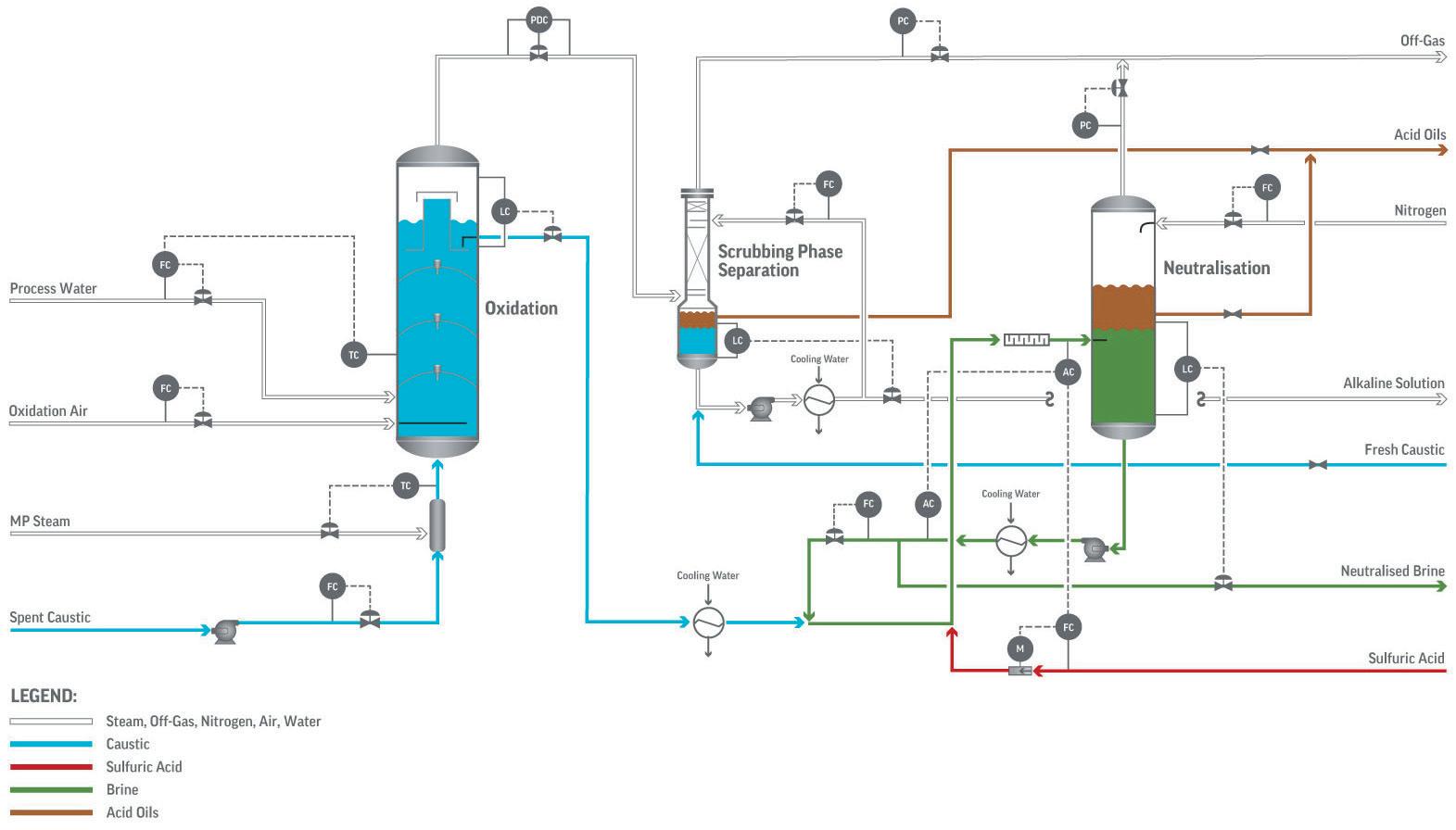

Deep neutralisation

When the spent caustic contains high concentrations of organic compounds, or the brine product specifications are more demanding, deep neutralisation offers enhanced removal of impurities for most spent caustic types – sulfidic, phenolic and naphthenic. ‘Deep’ refers to acidification of the spent caustic to a low pH, followed by reneutralisation with caustic. This allows organic compounds such as phenolics, cresylics and naphthenics to be reconstituted as an oil phase that then separates from the brine. The oil phase can be decanted for recovery if valuable, or reblended with another hydrocarbon stream. Low temperature and pressure operation coupled with recovery of the organics gives deep neutralisation distinct advantages when treating spent caustics containing high concentrations of impurities – especially sulfides and organics.

The deep neutralisation treating system typically consists of a low pH reactor, a three-phase separator, acid gas stripping, and reneutralisation. As with simple neutralisation, sulfuric acid is typically used in excess to drive the pH to a low value for liberation of the original impurities. Any acid gases or oils generated by the acidification are then allowed to separate in a three-phase separation drum. Nitrogen or fuel is used if needed to strip away any remaining dissolved acid gases to very low ppm levels. The acidic brine is then reneutralised back to a neutral pH with fresh caustic.

The typical effluent streams are neutralised brine, a phenolic or naphthenic oil phase, and an acid gas stream containing hydrogen sulfide (H2S) and mercaptans. When there is a significant acid gas stream, proximity to an amine treater or Claus unit is advantageous to process the H2S.

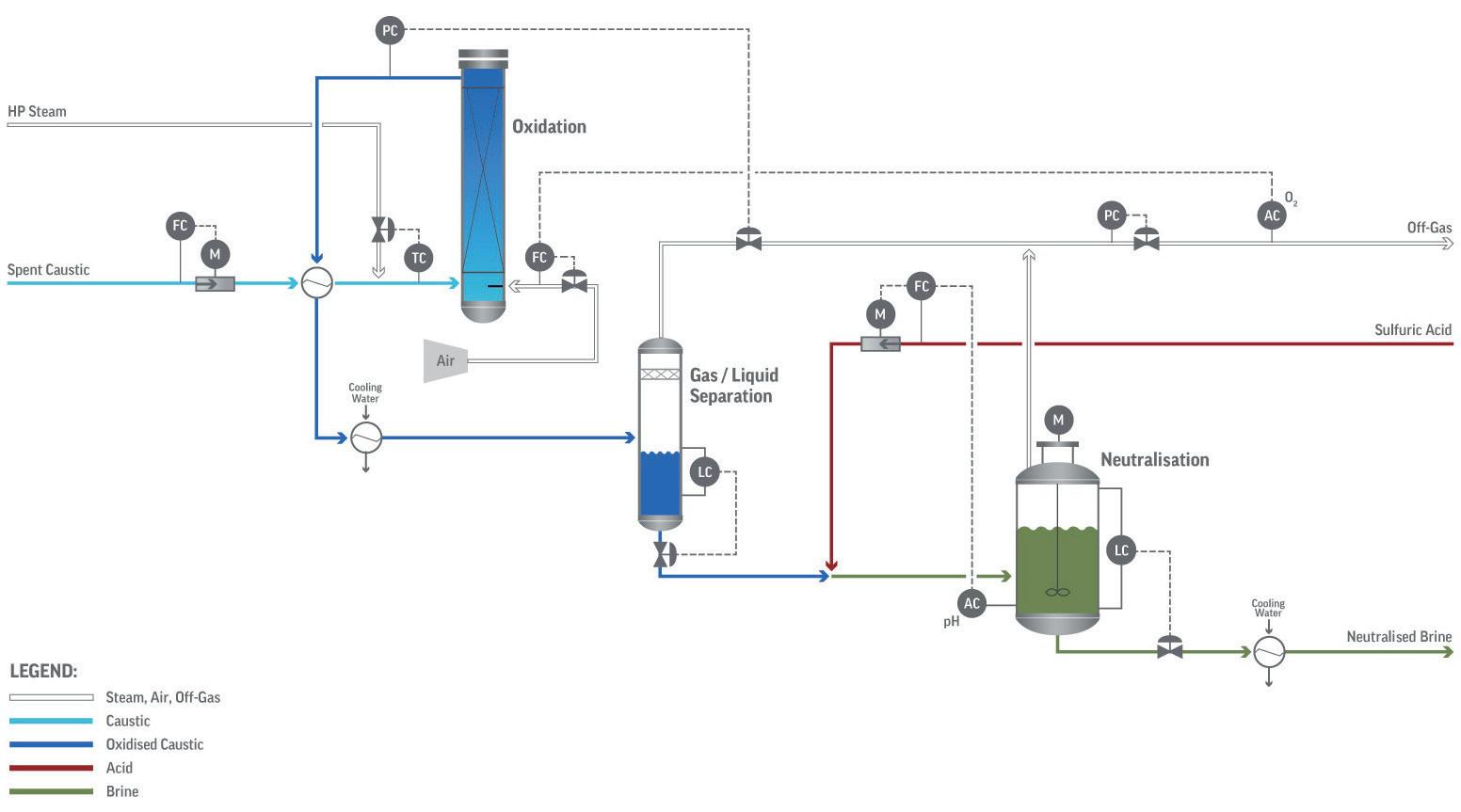

WAO

WAO is now a widely used technology to treat all spent caustic types – especially for high flow rate sulfidic caustic streams from ethylene production plants. As opposed to neutralisation, which separates the impurities intact from the spent caustic, WAO destroys the impurities via oxidation, converting sulfides to sulfate, and organic compounds to carbonate and low-molecular weight carboxylic acids. Oxidation also means that no acid gas is released, so the off gas stream only contains traces of VOCs. Highly coloured, odorous liquors treated with WAO become water-clear and can be managed efficiently by a biological wastewater treatment system.

WAO brings hot caustic containing suspended or dissolved pollutants into contact with air in a reactor at elevated temperatures and pressures. The molecular oxygen dissolved in the caustic becomes an oxidising agent that causes a chain reaction of radicals formed from organic and inorganic compounds in the reaction mixture. The organic pollutants are mineralised or converted into biodegradable substances, and the inorganic compounds are degraded.

The degree of oxidation depends on the compound, the reactor residence time, and the selected temperature and pressure. After exiting the reactor, the off gas is separated from the oxidised caustic and typically exits to a downstream incinerator. The oxidised caustic then flows to a neutralisation system where sulfuric acid is added on pH control to meet the desired final pH. The only effluent streams are an oxidised, neutralised brine, and off gas.

A very small number of providers offer WAO with varying techniques and efficacy, with temperature being the most critical variable in WAO system design. As temperatures are increased, there is a higher degree of oxidation. WAO reactor temperatures range from as low as 100°C to as high as 320°C, with pressures ranging from 5 barg up to 120 barg. The temperature and pressure selected depends on the feed type and the product specifications required. Most sulfidic systems operate in the middle of the range at 200°C and 30 barg, where all sulfides are fully oxidised to sulfate. High-temperature systems (260 – 320°C) are applied where organics such as phenolics, naphthenic acids and amines are prevalent. Although amines are difficult to oxidise, at 290°C and higher they may be partially destroyed –depending on the amine type.

Pop-A-Plug ® Tube Plugs

ASME PCC-2 Compliant Heat Exchanger Tube Plugging System

Trusted by plants around the world as their go-to tube leak solution, Pop-A-Plug Tube Plugs from Curtiss-Wright are engineered for optimal performance throughout the life cycle of heat exchanger equipment. Controlled hydraulic installation eliminates welding and time-consuming pre-/post-weld heat treatments that can cause damage to tubes, tube sheet ligaments, and joints.

• No Welding Required

• Pressure Ratings Up to 7,000 PsiG (483 BarG)

• Simple Hydraulic Installation

• Helium Leak Tight Seal to 1x10 -10 cc/sec

• 100% Lot Tested to Ensure Unmatched Quality

• Wide Range of Sizes& ASME/ASTM Certified Materials Available

877.383.1029 l est-sales@curtisswright.com l cw-estgroup.com/he-23

Incineration

When complete destruction of all impurities is needed, including the most difficult elements such as amines and heat-resistant hydrocarbons, direct incineration is usually required. In such situations, only a flame temperature can catalyse the oxidation of the most resistant compounds. Incineration comes with a very high operating cost, as fuel gas or natural gas are typically used to maintain the flame as atomised caustic is injected. Because of the high consumption of fuel gas, incineration is usually reserved for small streams, or where fuel gas is available at low cost.

Beneficial reuse

Treatment is but one option for managing spent caustic resulting from the production of petroleum products. As an alternative to treatment, beneficial reuse of spent caustic is also an environmentally-friendly and sustainable option, and replaces the need for disposal. Under the EPA’s beneficial reuse regulations, spent caustics may be reused as feedstock for new products or as substitutes for commercially-available products, if certain regulatory requirements are met. When such conditions are satisfied, beneficially reused spent caustic is excluded from the EPA’s solid waste definition, thereby reducing the producer’s waste generation statistics or reporting. Beneficial reuse has long been a priority method of handling spent caustic by some producers, and is gaining recognition as more refinery, petrochemical, and other manufacturers integrate ESG into their decision making.

Beneficial reuse extends the life cycle of the caustic and creates an asset from what may otherwise be perceived as a liability. It prevents pollution by reducing the need to harvest new feedstock, which saves money and reduces carbon dioxide (CO2) emissions and carbon footprints, for some, by more than 50% relative to the complete product life cycle.

Conclusion

In response to scientific evidence and mounting public concerns about the harmful effects of spent caustic, the oil and gas industry is instituting more vigorous efforts to prioritise the safe treatment and/or reuse of its waste materials. It is moving chemical management away from being a compulsion that is followed because of regulatory pressures and fear of fines and reputational damage, and towards oil and gas companies considering it their duty to protect the planet and its resources from short- and long-term harmful chemical effects. As more companies measure their environmental criteria, including resource usage and waste-related practices, they can respond to global concerns about how they handle waste products and their impact on the environment, society and economies. The result is a reduction in operational footprints, which spans the entirety of an organisation’s value chain and increases societal trust in the industry overall.

The intricacies of processes and interactions of spent caustic make partnering with a company that understands the complexities and challenges associated with treatments and beneficial reuse crucial to success.

COMPACT SIZE BIG PERFORMANCE

Laser 3 Plus Series

Delivering all the benefits of Servomex’s Tunable Diode Laser (TDL) technology in a light, compact unit, the Laser 3 Plus provides fast, accurate and responsive gas measurements for combustion and process control, making it a must for safety applications.

Artem

Compressed air is an important utility in the refining and chemical industries, widely used to drive pneumatic equipment and machinery. Air is also utilised as an oxygen/nitrogen source in manufacturing processes.

Drying of compressed air upstream of process equipment is crucial to avoid moisture condensation in downstream piping and to satisfy moisture specifications if air is used as the process gas. Among the available technologies, desiccant drying has been recognised as one of the most cost-efficient and versatile options, permitting water dew points of as low as -70°C.

The desiccants that are conventionally offered into this service include activated alumina, molecular sieves, and silica gels. Although these materials have been well established in industry over the years, there are often misconceptions about

some of the benefits that they offer in compressed air plants. This is especially pronounced for silica gels, as there are a variety of grades offered in a market, with substantial variability in properties and performance characteristics in compressed air applications. This article will briefly review the relevant benefits and challenges associated with using the most common desiccants, and discuss the use of Sorbead® Air – an adsorbent for high energy efficiency air dehydration.

Adsorbents

Activated alumina is one of the most established adsorbents used in the compressed air industry. It offers high surface area and a high porosity matrix with good affinity towards polar compounds – especially water. The highly hydrophilic nature of the alumina surface makes it a sound choice for

adsorbing moisture. Dew points of down to -50°C are achievable with activated alumina, and regeneration temperatures are normally within the 200 – 250°C range. Advantages of activated alumina include fairly high ‘in service’ robustness and high stability towards alkaline components, such as ammonia, amines or alkali hydroxides. Combined with wide availability and comparably low cost, this makes activated alumina a suitable adsorbent for heatless dryers, and a good conventional choice for heat-regenerated dryers.

Molecular sieves are crystalline aluminosilicates with frameworks stabilised by monovalent or multivalent cations from the alkali or alkaline earth group, as well as water in its as-synthesised form. This crystal water is removed by thermal treatment without damaging the crystalline structure to create the conditions for a reversible water adsorption/desorption. The microporous and highly ordered structure of molecular sieves ensures very high surface areas in such materials, often in a 700 – 900 m2/g range. Molecular sieves are normally used for applications where very low dew points down to -100°C are required, or the compressed air needs to be dried at higher temperatures. The steep shape of the isotherm allows for low moisture content in the product gas to be reached. However, the downside of such high affinity to moisture is the need to heat up molecular sieve beds to high temperatures to drive the water off. Regeneration temperatures in the 240 – 290°C range are often used for efficient reactivation.

Silica gel is an amorphous and highly porous form of silicon dioxide (SiO2), exhibiting high surface areas and favourable water adsorption properties. Silica gel is commercially available as a granular and spherical bead material of various size ranges, and has been widely used in the compressed air industry for more than 50 years. Despite its long commercial history, users are often challenged when selecting the proper silica gel desiccant for the dehydration of compressed air. This is mostly due to the abundance of various silica gel grades and types on the market, as well as poor understanding of the difference in properties and performance between these materials. These factors often result in the unfavourable decision being made towards a lower cost but less efficient product.

Highly efficient adsorbents

Unlike standard market silica gels, Sorbead Air is an alumino-silicate gel produced using a unique proprietary manufacturing process. The patented technology is a line of highly efficient adsorbents optimised for energy efficient drying.

Some of the key factors that are normally considered when selecting the adsorbent include equilibrium and dynamic water capacities, regeneration temperature related to heat of moisture adsorption on the desiccant, and durability and hydrothermal stability of the adsorbent in service. Benefits of the technology include high dynamic water uptake combined with comparatively low moisture desorption temperatures as well as hydrothermal resistance.

Desiccant selection for a compressed air plant is of crucial importance. The proper adsorbent not only warrants steady and reliable operation of the dryer, but it also saves costs for the user. As adsorbent replacement terms are often advised by the dryer manufacturer, the changeouts are conducted in accordance with these guidelines. The desiccant selection and service periods are normally not challenged by users, and the associated costs are taken as granted. Part of this is due to the

adsorbent being viewed as a commodity, and the poor differentiation between products offered on the market. It is especially relevant to silica gels, which are available in various grades, shapes, compositions and colours. The fundamental misconception is equating Sorbead Air adsorbents to conventional silica gels or alumina promoted silica gels.

The data provided in Table 1 compares the properties and performance of Sorbead Air against some of the most common silica gels offered on the market, and underlines the importance and necessity of comparing adsorbents in order to select the proper product. Performance is compared with conventional and alumina promoted silica gels that are widely offered. To make this comparison meaningful, the desiccants were divided into two types – regular grade, which is compared with Sorbead Air R in Table 1, and water stable grades, which are compared with Sorbead Air WS in Table 2.

Regular grade silica gels are normally characterised by high surface area and pore volume. The products A and B in Table 1 exhibit high surface area pore volumes, which point to similarities with Sorbead Air at first glance. However, closer inspection shows that high values of these commonly-recognised parameters are not sufficient to derive performance features. Product A is a conventional, pure SiO2-based adsorbent, and was shown to exhibit inferior mechanical properties: on average, a higher attrition rate and more pronounced ageing under thermal swing cycling. It is important to highlight that lower mechanical strength and enhanced fines generation are among the common features exhibited by pure silica gel desiccants.

Another meaningful disadvantage of SiO2 adsorbents is comparatively low hydrothermal stability. As desiccant is subject to multiple thermal regeneration cycles in commercial service, hydrothermal ageing plays a role. While equilibrium moisture uptake on ‘fresh’ Product A was measured as reasonably high, there was a pronounced decline in moisture pick-up when the sample was exposed to prolonged thermal regeneration

cycles. The precise effect is highly dependent on the specific operating conditions of the machine.

Alumina is often added to the formulation to enhance the hydrothermal stability of silica gel adsorbents and modify some of the adsorbent properties. Product B contains approximately 20 wt% aluminium oxide (Al2O3). While silica gel desiccants promoted with a certain amount of alumina could feature enhanced stability towards liquid water, the exact response is highly dependent on manufacturing process and the amount of alumina added in a composition. An important aspect to consider when selecting SiO2-Al2O3 desiccants with high Al2O3 content is the altered shape of the water adsorption isotherm as compared to pure silica gels. As alumina content increases, water adsorption isotherm deviates from the isotherm typically observed for pure SiO2, and shows features more typical for alumina. Without elaborating on the fundamental scientific nature of this phenomena, the direct consequence of this – relevant to operations of industrial dryer – is reduced water dynamic capacity of the desiccant at humidities and pressures normally used for commercial compressed air dryers. While heat of adsorption and moisture uptake properties are normally not substantially affected at alumina levels of 1 – 5 wt%, higher content often results in lower moisture pick-up as compared to pure SiO2 adsorbents.

Product B with Al2O3 content of 20 wt% reports equilibrium uptake much lower than normally observed for Sorbead Air products. As a result, more adsorbent would be required, and therefore a larger vessel size, to achieve similar

performance. Another consideration not to be neglected when comparing SiO2 adsorbents promoted with alumina is water desorption temperature. Desiccants promoted with high amounts of alumina often exhibit higher heat of moisture adsorption and require somewhat higher regeneration temperatures. Since an increase in moisture heat of adsorption is almost directly proportional to alumina content, higher alumina content in silica gels often translates into an increase in nominal regeneration temperature. A temperature of approximately 140°C is sufficient for regenerating Sorbead Air R, and Product B needs approximately 160°C for reactivation, on average. Although some manufacturers do claim regeneration temperatures of as low as 160°C for high-alumina-containing SiO2-based desiccants, users and dryer OEMs always need to execute caution when using or designing dryers with these adsorbents.

Properties of some of the market-available water stable desiccants are shown in Table 2, compared against Sorbead Air WS. This type of adsorbent is resistant to liquid water and often used as protective layers on top of regular grade desiccants. Product D is 99.8 wt% SiO2 pure silica gel with a surface area of 240 m2/g. Comparably low surface area is in agreement with reduced equilibrium moisture uptake, which is almost 30% lower than what Sorbead Air WS offers. As a result, Product D would have limited contribution to the overall desiccant bed moisture removal performance, so a larger vessel size would be needed for newly designed dryers which use this adsorbent. Another related disadvantage is lower achievable

dew point temperatures for a fixed volume of adsorbent, even for configurations where water stable grade is used as the layer protecting regular grade adsorbent.

Product E is alumina promoted silica gel with reported 16 wt% Al2O3 content with a surface area of approximately 450 m2/g. It features somewhat higher equilibrium moisture uptake as compared to Product D, but still less than Sorbead Air WS, which offers approximately 20% higher loading. An important aspect to consider when selecting a high alumina promoted silica gel based desiccant as a protective layer is long-term hydrothermal stability. Activated alumina is known to undergo partial rehydration in the presence of liquid moisture at elevated temperatures upon extensive thermal swing cycling – conditions typical for the front section of the adsorbent in heat-reactivated dryers. Sorbead Air WS is designed to deliver excellent performance under severe hydrothermal conditions due to its proprietary manufacturing process, with compositional alumina of about 3 wt%.

Conclusion

Selecting an adsorbent for a compressed air dryer is important, and could be very challenging if a user or OEM is not well educated on the properties of common desiccant grades offered on the market. This is especially pronounced for silica gels, with abundant product selection across applications in dryer plants. Sorbead Air adsorbents from BASF are high-performance desiccants optimised for air drying, with a very clear value proposition.

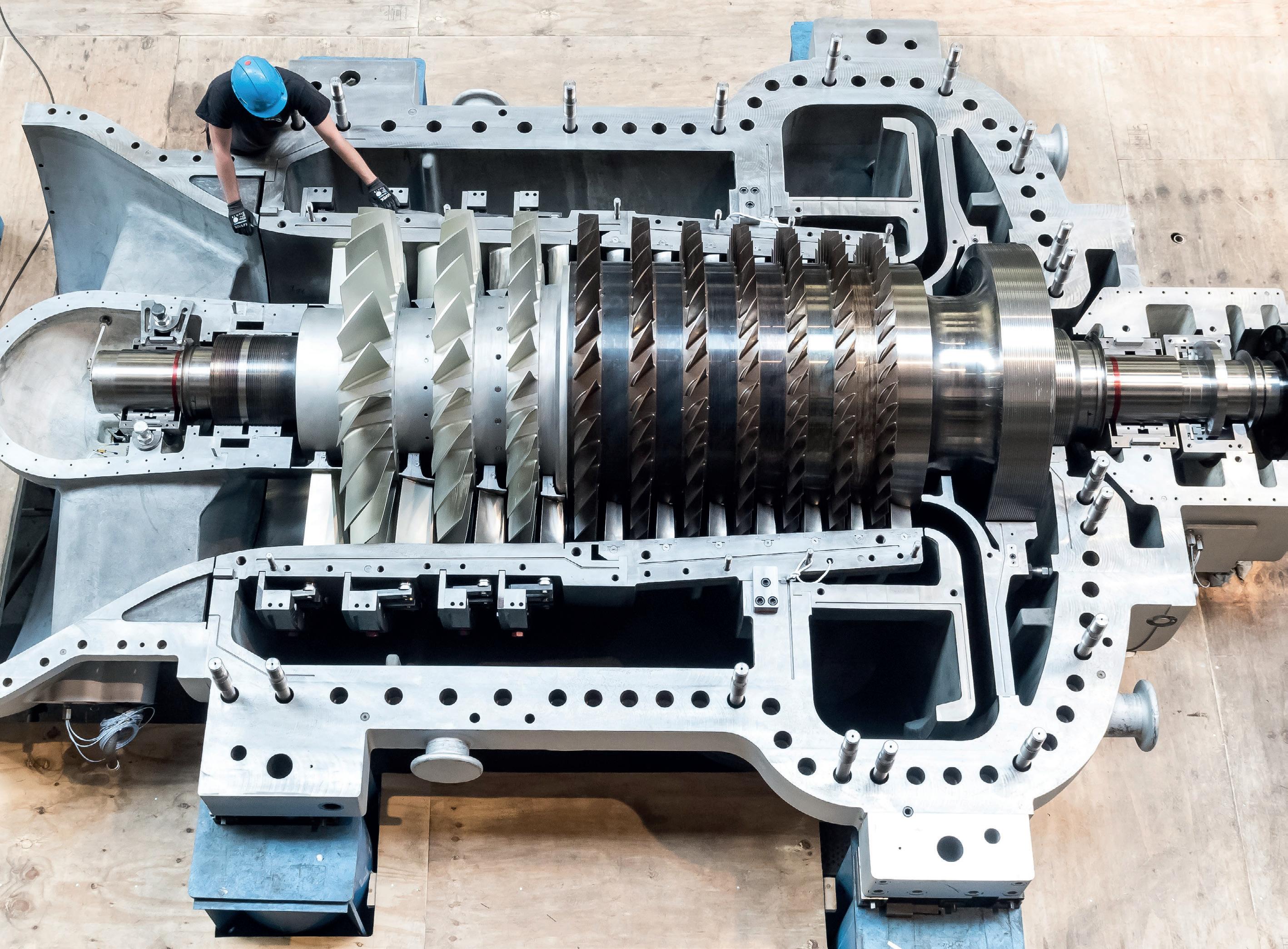

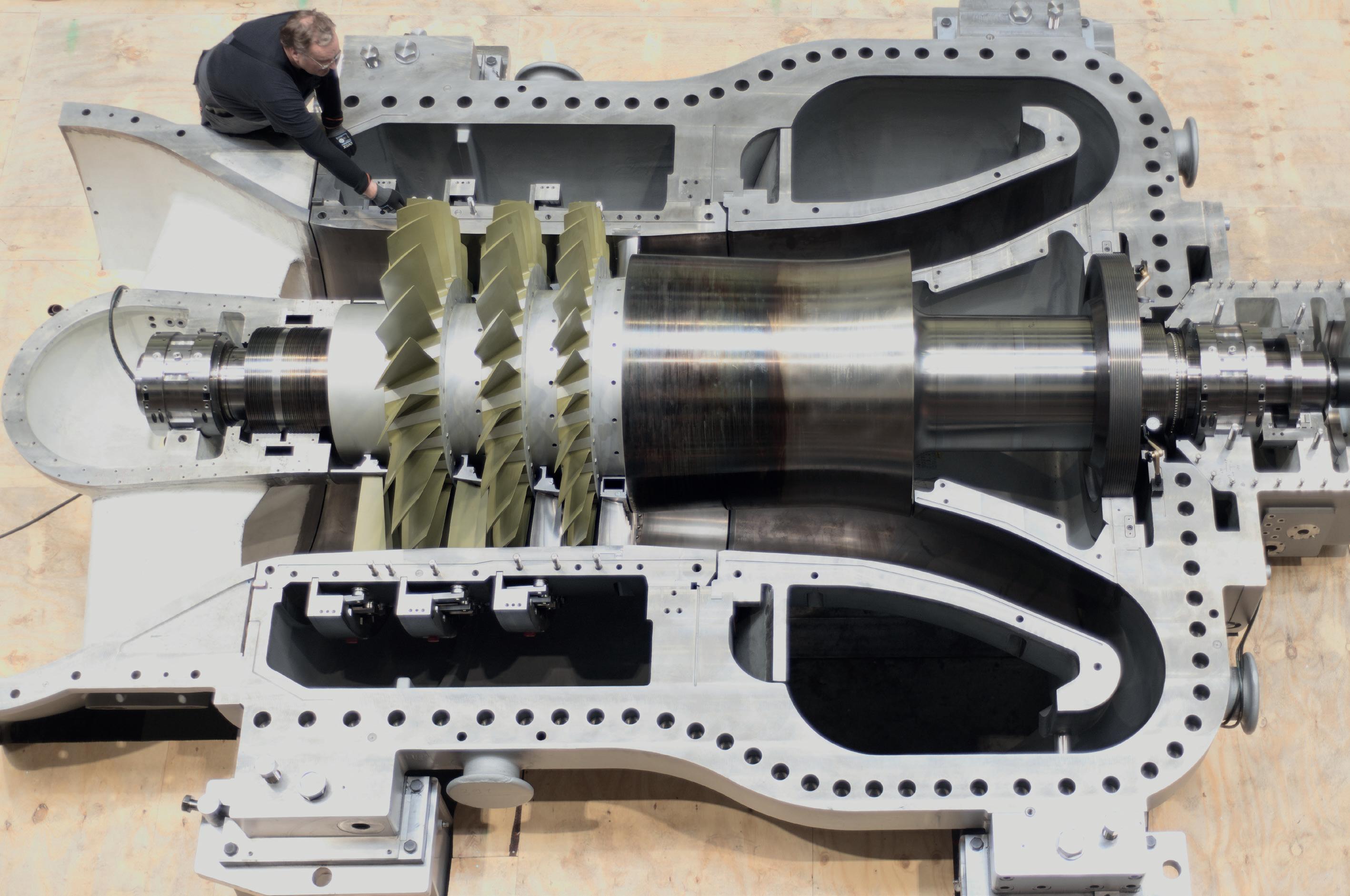

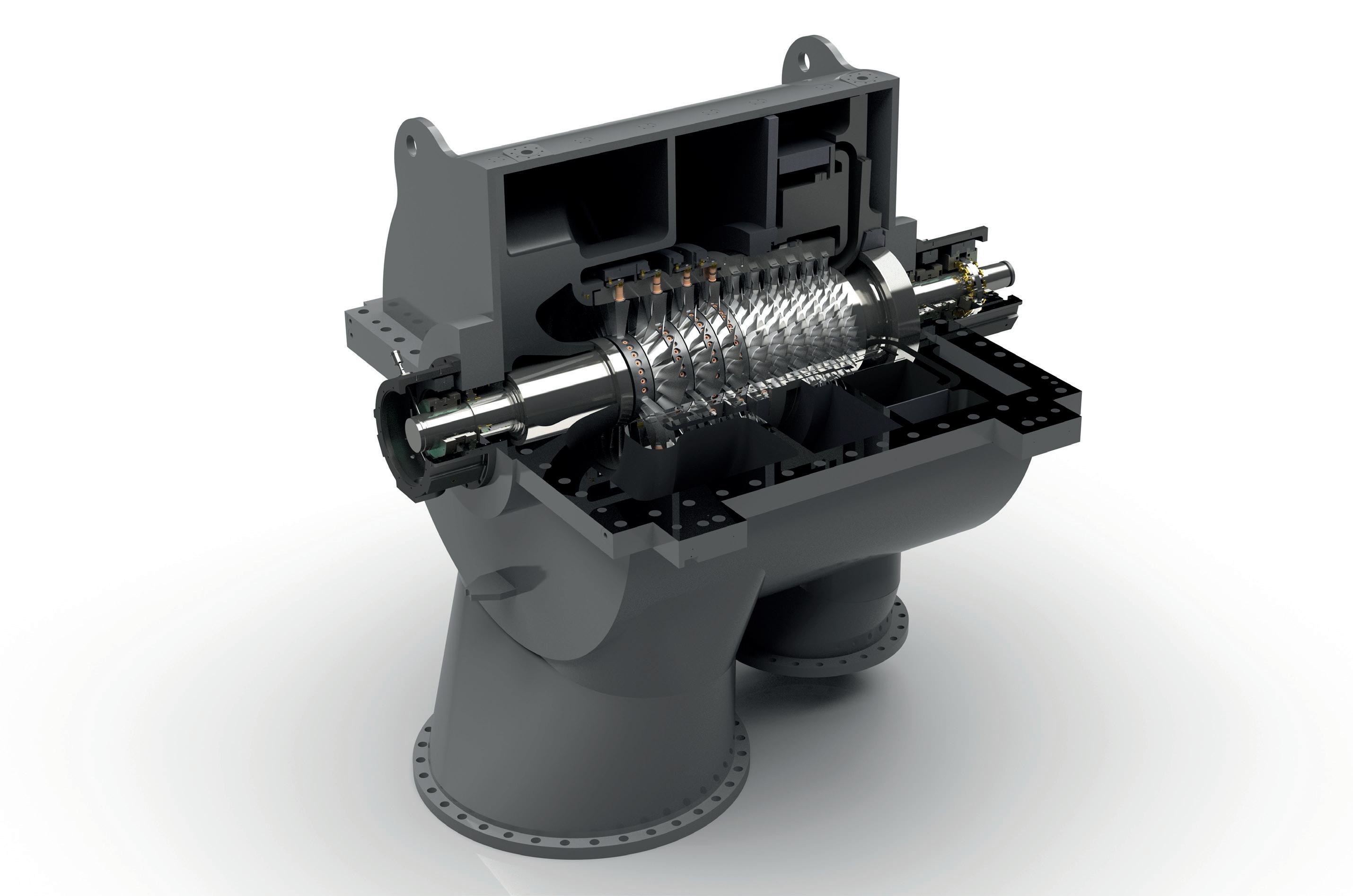

Dr Roland Emmrich and Olga Alhaj-Hohenstein, MAN Energy Solutions, Germany, reflect on the most recent developments in axial compressors, and provide an overview of new solutions available to aid decarbonisation efforts.

Large axial compressors have been deployed in various industrial applications for decades. Not only do they operate as air compressors, but they are also used with other process gases with large volume flows that need to be compressed. Typical applications are blast furnace blowers, main air blowers for fluid catalytic cracking (FCC), nitric acid (HNO3) production, air separation units, wind tunnels, propane dehydrogenation (PDH), or LNG plants. The majority of these applications use axial compressors for air compression, but also compress other gases such as natural gas or PDH gas, which is a mixture of hydrocarbons and hydrogen.

MAN Energy Solutions (MAN ES) is a supplier of industrial axial compressors, and is continuously developing

its machine and blading technology to meet the technical and operational challenges of modern industrial applications. The MAX1 axial compressor blading, whose basic technology was developed between 2007 – 2015, is an important part of this in-house R&D process.

The blading is a hybrid concept based on proven industrial design and gas turbine technology, using a multi-objective optimisation design approach across the disciplines of aerodynamics, structure mechanics, rotor dynamics and design. It is a good solution with respect to efficiency, performance range, power density and robustness, and its features make it a good match for a number of different applications and gases. For more details, see the article entitled ‘Next steps in axial

compression’, which appeared in the August 2019 issue of Hydrocarbon Engineering 1

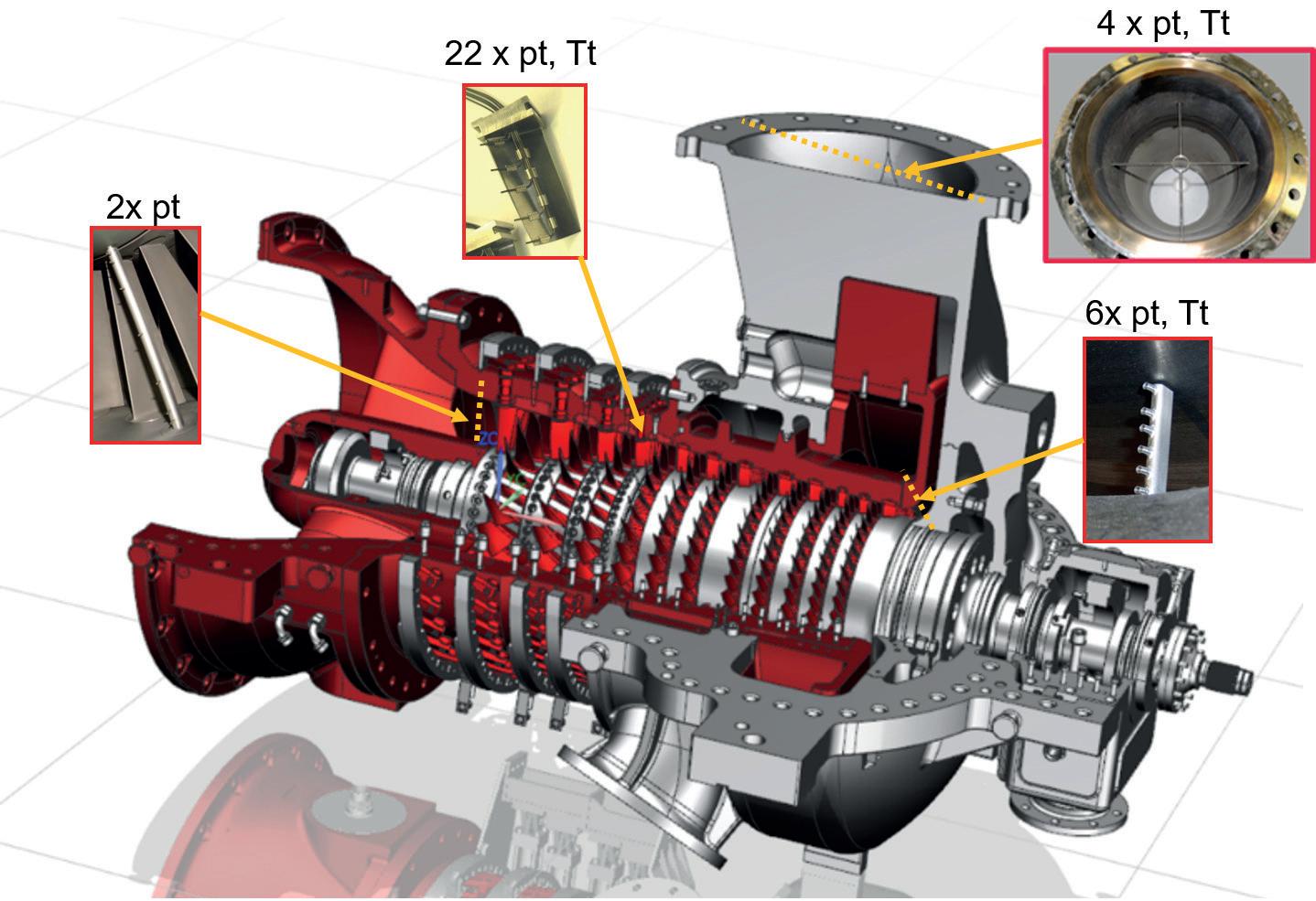

New technology and rig test verification

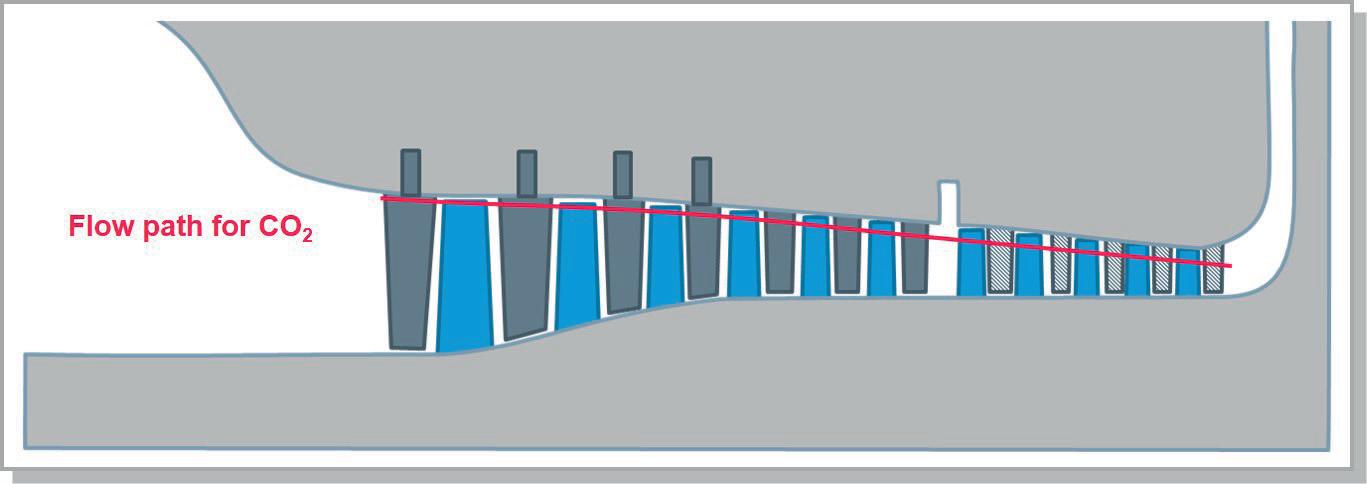

The latest development step, verified in 2020, was the so-called ‘Flow Cut’ technology, which enables the use of the MAX1 blading for compressing gases in large-scale production plants. Each gas differs in its properties, molecular weight, molar heat capacity and polytropic exponents. These parameters influence the pressure and temperature rise in the compressor and therefore require an individual design of the flow channel in order to keep the

flow angles in the inlet and outlet planes of the various stages as similar as possible. The underlying Flow Cut procedure is performed with a calibrated in-house S2 streamline curvature programme. When the flow path is adapted, the blades need to be shortened or extended (see Figure 1). The basic design of the MAX1 blading supports such adaptations.

MAN ES internally tested all development steps in a rig test compressor configuration. The Flow Cut technology was therefore verified in an 11-stage test rig with a nominal volume flow of approximately 90 000 m³/hr, and a pressure ratio of 8. The design flow and the machine Mach number were changed in such a way that the resulting flow path is similar to a carbon dioxide (CO2) compressor for carbon capture and storage (CCS) applications. The test rig was heavily instrumented with thermocouples and pressure probes, strain gauges, tip-timing probes and fast pressure transducers, as well as inlet and outlet flange-to-flange instrumentation to collect performance data under a variety of operating conditions (see Figure 2).

During the design stages, special care was taken with regards to structural integrity, to ensure sufficient robustness against all possible blade excitations, which was again proven by way of Flow Cut test rig measurements. All of the neatly collected data, which verified the robustness and high performance of the blading, will function as the basis for all future machines that are customised with the Flow Cut technology.

Entering the refining sector

Following a number of customer orders in air separation, blast furnace and nitric acid applications, MAN ES’ axial compressor technology made an entrance into the fluid catalytic cracking (FCC) market in 2021. FCC main air blowers are deployed in refineries and supply compressed air at 3 – 5 bar to the regenerators in order to reactivate the catalyst by burning off the coke deposits. Volume flows in this application range from 200 000 to 780 000 m³/hr, resulting in a range of compressor frame sizes, from AG060 up to AG120. Typically, these machines consist of seven to nine stages. The driver defines the suitable flow control mechanism: either speed control for steam turbine drive, or a pure vane control for electric motor driven trains. The AG-MAX1 features four variable guide vanes for a fixed speed flow control. Figure 3 is an example of a 10-stage AG-MAX1 compressor from the modular design system.

Entering the PDH market

The AG-MAX1 axial compressor design is now also integrated in one of the biggest propylene production sites worldwide. The new production site has a yearly output of approximately 850 000 t of propylene granules. By means of PDH, the versatile feedstock polypropylene, which is used in plastics production, for example, is made from propane.

Due to the increasing demand for propylene, MAN ES decided to develop an efficient compressor solution for the PDH market based on the MAX1 technology. The basic requirements of this application were a volume flow of up

to 1.7 million m³/hr, and a rather low pressure ratio of approximately 2. The maximum flow capacity of the AG-MAX1 modular system is limited to the frame size AG170 with a volume flow of roughly 1.6 million m³/hr. This resulted in a ‘two times 50%’ solution for the project. Each machine still delivers approximately 850 000 m³/hr in the frame size AG115.

Typically, only three or four axial stages are needed to supply the defined pressure level for this application. For this reason, the exit volume flow is much larger than that of other high pressure ratio compressors, resulting in large exit casings and thus large bearing spans. In order to maximise the performance of the compressor, the free space is used to further increase the exit pressure level behind the blading with a diagonal diffuser. This design feature gives the AG-MAX1 for PDH air applications its typical shape, shown in Figure 4.

A second customer order is currently being prepared at MAN ES’ production site in Oberhausen, Germany. This AG120 with four axial stages will be able to deliver a maximum volume flow of approximately 950 000 m³/hr, and, as a first, will be integrated into the PDH customer process as a 100% solution for the regeneration air compressor.

The first PDH air machines tested in Oberhausen achieved excellent operational results, demonstrating smooth rotordynamic behaviour and performance, which

surpassed the customer’s requirements. Further benefits are its robustness and highest machine availability amongst MAN ES’ axial compressors.

New technology on the horizon

MAN ES plans to introduce MAX1 blading to the PDH gas compressor (see Figure 5) in order to improve robustness and reduce the overall power consumption of the machine train.

Today, blading is no longer the focus of the company’s R&D investigations. MAN ES is instead working on finding the most beneficial machine train solution for individual customer projects, with a focus on reducing both OPEX and CAPEX as much as possible.

Technology solutions for decarbonisation

The switch to using renewable energy sources will greatly reduce the world’s carbon footprint. However, renewable power production usually relies on the weather, and can be very volatile. Production and demand times do not necessarily match, and so storing surplus power for later use improves both the overall efficiency and stability of these renewable energy systems.

MAN ES can provide key equipment for a wide range of storage technologies, such as liquid air energy storage (LAES) or compressed air energy storage (CAES). CAES uses geological reservoirs to store large amounts of energy for long periods of time – a very economical and effective solution for large-scale applications.

The company offers a wide range of air compressors, including combined axial and radial compressors for large units that are ideal for large-scale applications. Here, the MAX1 technology, with a history of use in combined axial and radial compressors for air separation units (ASU), offers a solution for large volume flow. In this case, the combined axial and radial compressor AR-MAX1 is built without intercooling, because the exit temperature is meant to be high in order to be stored and reused in the energy storage process.

The world’s industrial production processes need to decarbonise quickly. Avoidance, balancing and capture are the three main carbon-reduction tactics. Nevertheless, not all three approaches are viable for all industrial producers. Carbon capture, utilisation, and storage (CCUS) provides a proven and practical way of reducing emissions for large industrial plants that emit huge amounts of CO2 in flue gases. In some processes, the CO2 can be removed before combustion. Compression technology plays a key part in CCUS, as it is necessary for the various CO2 gas streams within the capture process. For large volumes of CO2, MAX1 is again a good solution, due to the economy of scales, and the company’s experts are currently in close cooperation with customers, working on machine solutions for all decarbonisation applications in the near future.

Reference

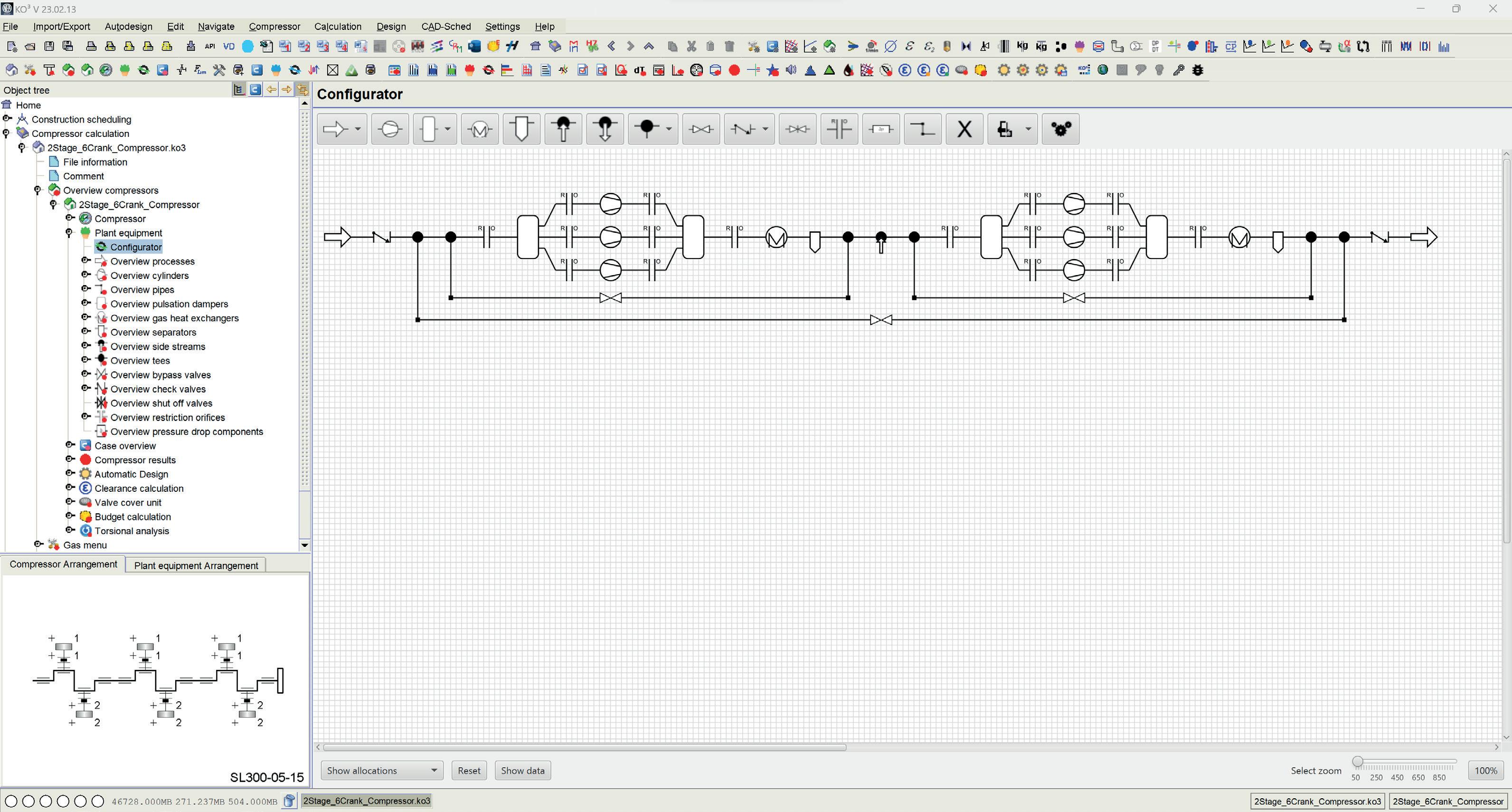

As pressure and temperature are the key parameters in most hydrocarbon processes, compressors play a key role in the process design. Therefore, an accurate design program that can be used over the entire product life cycle is highly desirable. In the early sales stage, most engineering, procurement and construction (EPC) companies and licensors require basic technical information, such as the number of machines and compression stages needed, power consumption, cooling demand, and a preliminary mass force calculation. A rough commercial budget quote is then added to these datasheets. Often, clients want to weigh up the consequences of different variants, and so a quick answer is therefore advantageous.

As the project matures, an increasing number of specifications and engineering details are added, leading to a design that is ready for ordering. Here, the prediction quality of the machine behaviour and design data is of the highest importance in order to reliably design the units so that they are competitive when it comes to CAPEX and OPEX. When building the units, the design data has to flow into the compressor manufacturing process, as well as the design of the auxiliary equipment – such as pulsation dampeners, coolers, separators, piping and driver.

Being able to create an ‘as built’ design file in combination with a remote monitoring system forms the basis of coming closer to a digital twin. This allows for process optimisation, improved on demand maintenance scheduling, and faster troubleshooting. It is very helpful to be able to read measured data from a site and to compare it against the predicted data with the same process inputs, particularly when it comes to troubleshooting.

As compressor units have a lifespan of several decades, the ability to adapt them to changing process conditions is also very helpful. With the right design program, these new requirements can be added into the software, and the technical and commercial consequences can be evaluated objectively.

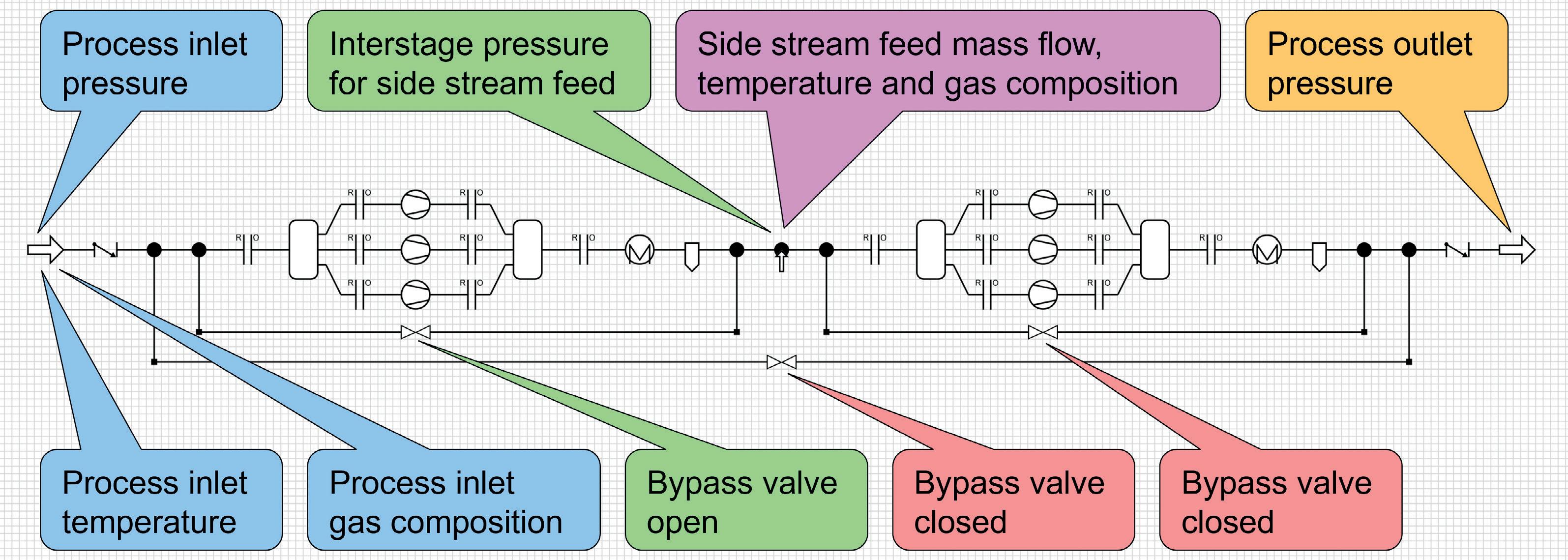

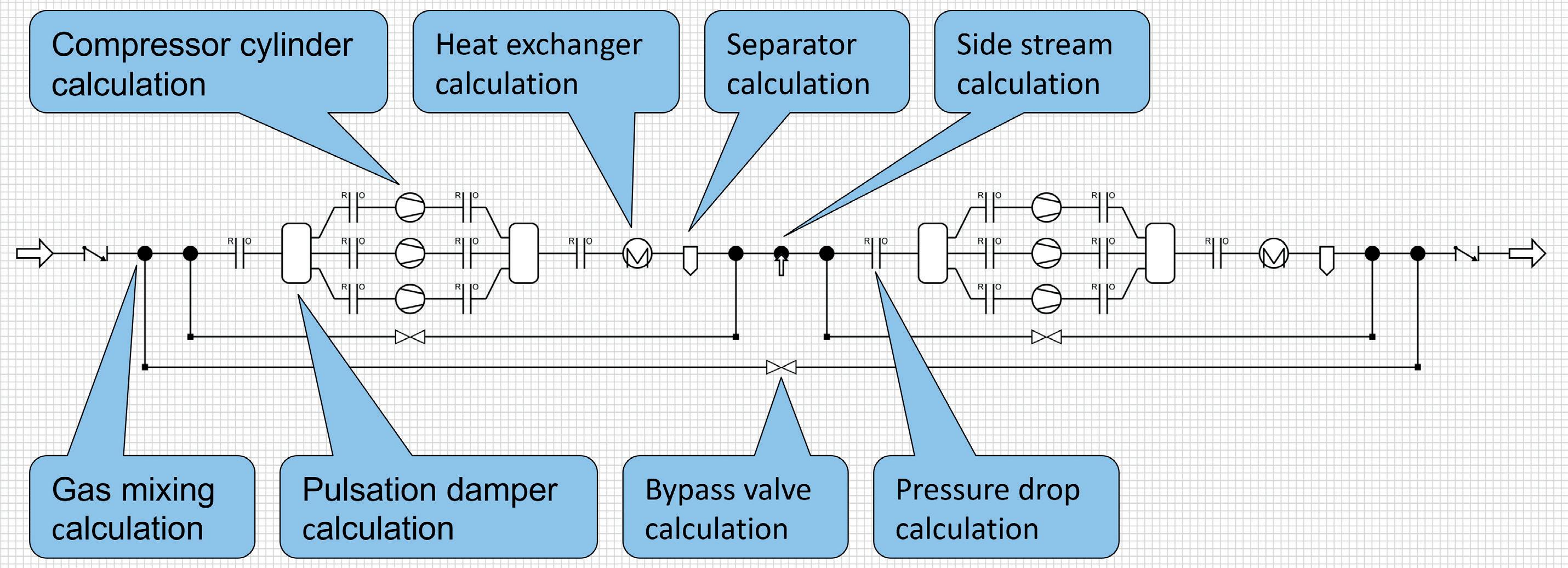

Most of the aforementioned tasks could be fulfilled by NEUMAN & ESSER’s reciprocating compressor design program, KO³. In the past, the program was limited to the design and recalculation of the compressor and the corresponding process data. On the plant side, only the pulsation vessels were dimensioned in the so-called damper check. Now, the entire compressor system can be both recalculated and designed. The calculations include all piping, coolers, vessels, separators, throttle valves, orifices and bypass valves.

Figure 1 shows an example of the system configuration of a 2-stage, 6-crank piston compressor. The input interface of the KO³ design program of the system configurator is shown. The compressor configuration can be viewed schematically at the bottom left of the figure. The main view shows the system configurator. With the icons in the toolbar, operators can

put together the desired system configuration. This can be done relatively quickly, by simply clicking on the icons and placing them on the configurator interface. As particular emphasis was placed on user friendliness and acceptance during the development of the new plant tool, the configurator contains automatic configuration creation. With a single click, a system with standard components is configured on the basis of the configured compressor. Figure 1 illustrates an example of an automatic configuration. It contains one suction and one discharge pulsation vessel per stage. The three cylinders of each stage are identified by the compressor symbol. An orifice is provided in front of and behind each vessel, as orifices are usually placed at these points as a result of the pulsation study. A cooler and a separator are provided behind each stage. In addition, bypasses are provided around each individual stage and around both stages. This is not provided for in every plant. However, this can be changed quickly by simply deleting the elements. In the system shown, a feed gas stream between the two stages has been inserted.

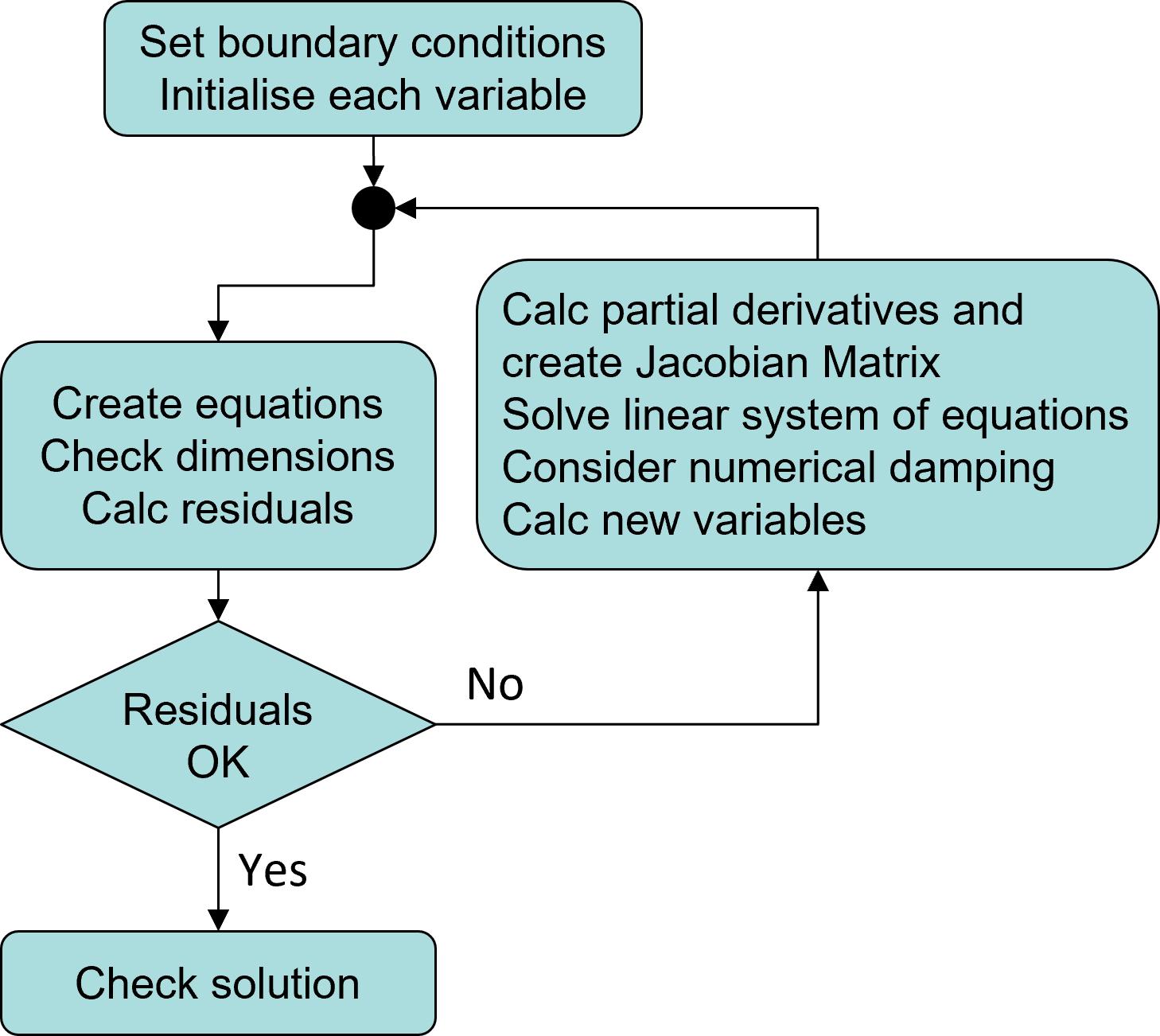

After the system has been configured, the necessary boundary conditions must be entered so that all thermodynamic quantities can be determined together. In the example used in Figure 1, the necessary boundary conditions are defined in Figure 2. With this information, the system of equations can be solved on the basis of the defined compressor (stroke, speed, cylinder diameter, damage chamber), provided that the boundary conditions allow a solution at all. If a solution does not physically exist due to boundary conditions, the program aborts with a qualified error message. Due to the fact that the compressor has already been configured before the system configuration, the mass flow is a result of the calculation and not a boundary condition.