03 Guest Comment

05 World News

12 Optimisation: The Key To Successful Mining

Wesley Taylor, Komatsu, discusses the benefits and prospects of a new payload management solution in a Q&A with Will Owen, Editor of Global Mining Review

17 Operating Like A Well-Oiled Machine

Robert Dura, Jennifer Clark, and Gareth Fish, Lubrizol, USA, consider how choosing the right lubrication technology can prevent unnecessary downtime and component failure in open gear systems.

22 Invest In Uptime

Eric Matson, The Goodyear Tire & Rubber Company, USA, examines how a smart investment in tyres and tyre maintenance can be crucial in maximising uptime.

27 Brushing Up On Dust Control

Greg Bierie, Benetech Inc., USA, explores various technological and innovative solutions that can be used to improve dust control within conveying operations.

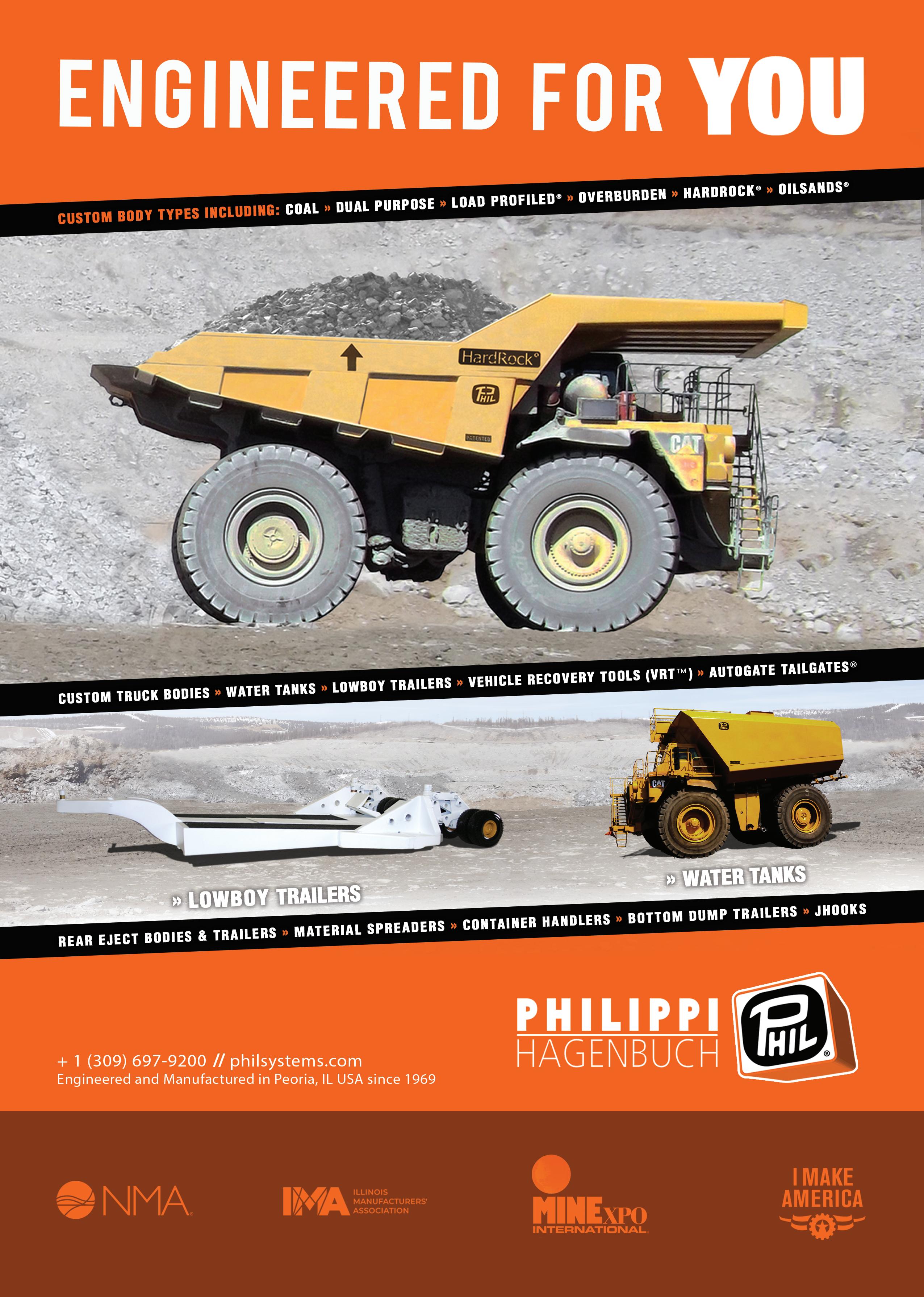

31 Overhauling Haul Road Maintenance

Josh Swank, Philippi-Hagenbuch Inc., USA, illustrates some new ways to increase efficiency and safety through haul truck customisations.

35 The Electric Path To Sustainable Mining

Atilson Neto, Vale, Brazil, analyses how the latest innovations in autonomous and electric truck fleets can help decrease emissions and increase efficiency and safety in mine operations.

40 Ensuring The Success Of Mining 4.0

Nathan Stenson, Nokia, UK, highlights the importance of leveraging partnerships - and private wireless - to ensure the success of the next generation of mining.

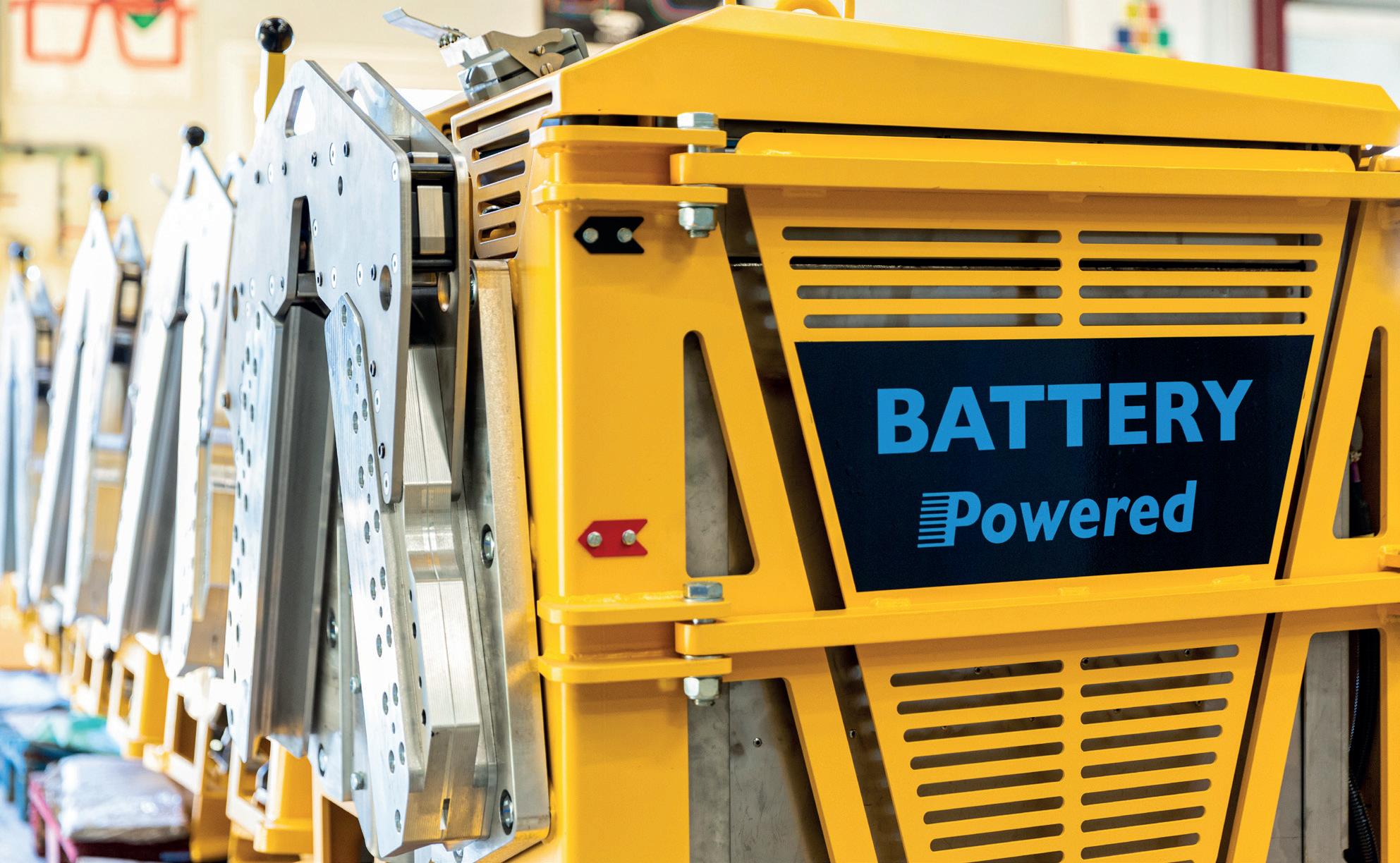

44 Crafting Clean Mining Technologies

Audrey Beurnier and Bryan Pons, Aramine, France, review the various keys to manufacturing a battery powered machine which prioritises energy efficiency, reliability, and safety.

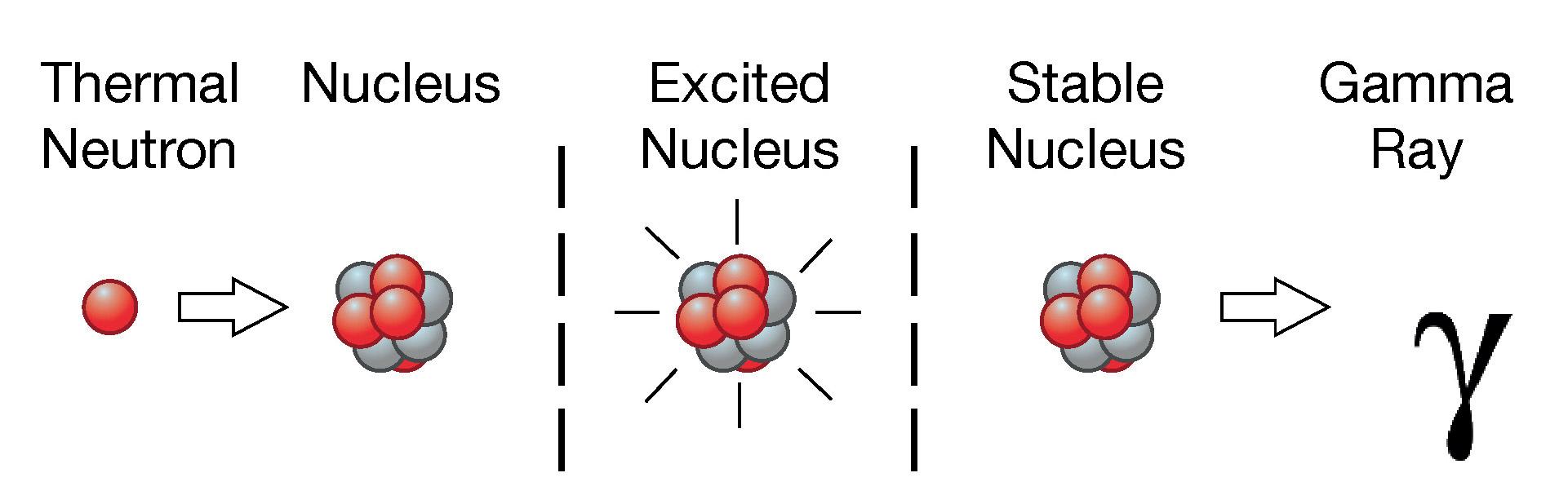

49 NAA In Copper Mining

Gary Noble, Thermo Fisher Scientific, Australia, explains how neutron activation analysis can be used to revolutionise copper mining operations.

53 Sustainable Water Use

Eric Wasmund and Jose Concha, Eriez, Canada and Peru, weigh the growing importance of technologies in water management, and how it is crucial to achieving sustainable operations.

56 Mine Management From Above

Christopher Thomson, AgEagle, Switzerland, examines how fixed-wing drones can be used as a multi-purpose tool to optimise mine management and safety.

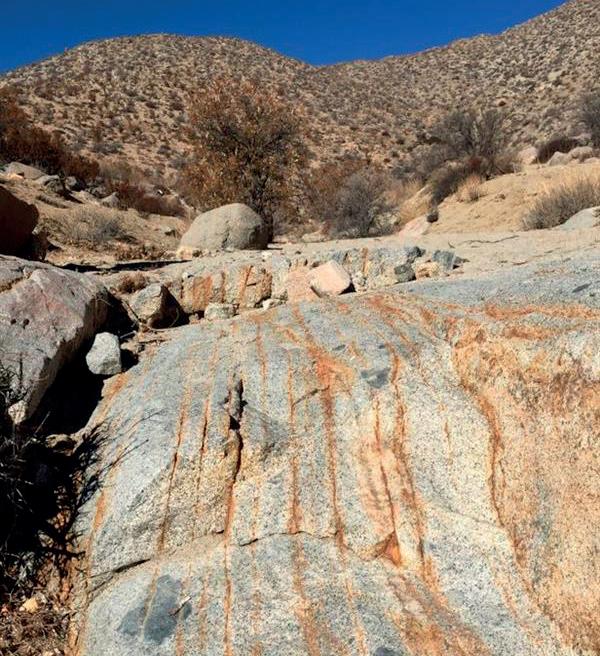

60 Establishing Exploration Excellence

American Pacific Mining Corp. profiles its recent experiences in becoming an established junior miner, and reviews some of the precious and base metals opportunities that are currently being explored in the Western US.

65 Driving The Green Transition With Chilean Copper

Sam Garrett, Great Southern Copper, Chile, provides an overview of Chile’s copper industry and how it is paving the way for a green energy future.

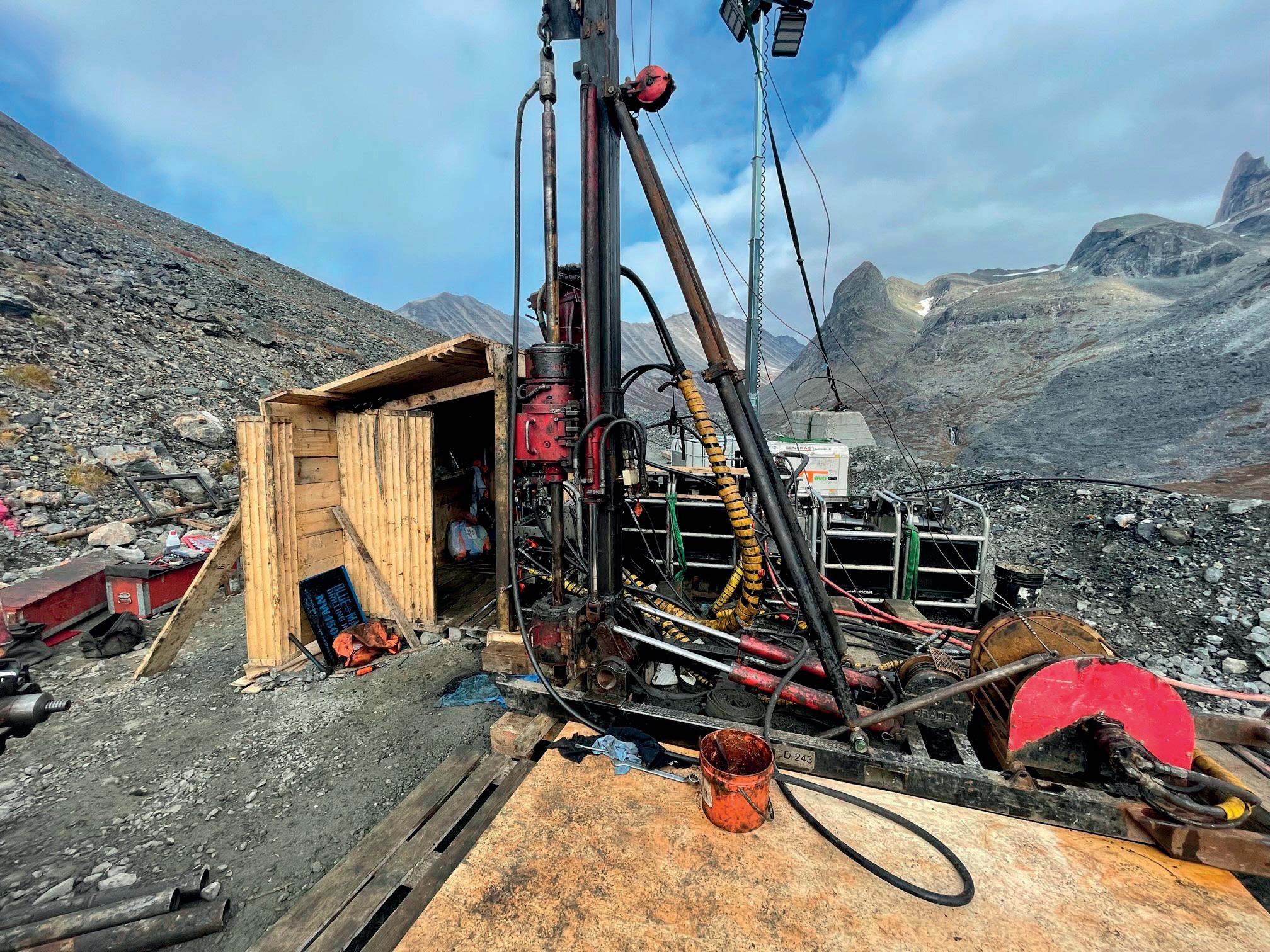

69

Eldur Olafsson and James Gilbertson, Amaroq Minerals, Greenland, evaluate the development of the Nalunaq gold project in south Greenland as it approaches production.

Lindsay Robertson, McCrometer, USA, outlines how choosing the correct flow meter can optimise slurry and tailings management.

dual 1675 hp Tier 4 engines, big 38 m³ shovel size and the Argus Payload Monitoring System, the Komatsu PC7000-11 surface mining excavator is a rare combination of power and precision. Operators can efficiently dig up and load 240 – 290 trucks with intelligent payload measuring technology, visible from the Argus display.

Amplified by COP27, the volume continues to increase on the importance of moving away from fossil fuels towards sustainable sources of energy. In turn, this movement fuels the need for critical minerals to support the burgeoning battery electric vehicles (EV) market.

Demand for these critical minerals is set to soar, with the International Energy Association forecasting that EV demand will require 50 new lithium projects, 60 new nickel mines, and 17 cobalt mines by 2030. The need for robust supply chains, highlighted by the COVID-19 pandemic, is coupled with the desire to unlock China’s grip on the sector, where 90% of rare earths and 60% of lithium are processed. China has been pursuing a critical minerals strategy for many years, but what are the governments of other countries actually doing to catch-up with China and support the requirements of the EV industry?

MANAGING EDITOR

James Little james.little@globalminingreview.com

SENIOR EDITOR

Callum O’Reilly callum.oreilly@globalminingreview.com

EDITOR

Will Owen will.owen@globalminingreview.com

EDITORIAL ASSISTANT

Isabelle Keltie isabelle.keltie@globalminingreview.com

SALES DIRECTOR

Rod Hardy rod.hardy@globalminingreview.com

SALES MANAGER

Ryan Freeman ryan.freeman@globalminingreview.com

PRODUCTION MANAGER

Kyla Waller kyla.waller@globalminingreview.com

ADMINISTRATION MANAGER

Laura White laura.white@globalminingreview.com

EVENTS MANAGER

Louise Cameron louise.cameron@globalminingreview.com

EVENTS COORDINATOR

Stirling Viljoen stirling.viljoen@globalminingreview.com

DIGITAL ADMINISTRATOR

Leah Jones leah.jones@globalminingreview.com

DIGITAL

The loudly trumpeted US Inflation Reduction Act in 2022 has seen the US Government pledge to provide US$7.5 billion in tax credits for EV buyers if their battery uses raw material extracted or processed from the US, from trade partner countries, or through recycling. This has caused a virtual stampede to relocate supply chains to the US, with companies committing over US$13.5 billion worth of investment since it was enacted (more than double the investment in the previous three months).1 This Act also promises to accelerate the long-awaited streamlining of the ‘permitting’ of new US mines.

In Canada, the Government has now launched its critical minerals strategy, which aims to boost the extraction, processing, manufacturing, and recycling of critical minerals.2 The Canadian strategy again recognises the need to streamline the regulatory approval process for new mines and fast-track environmental approvals, combined with investment in new infrastructure (i.e. roads, rail, and ports) to unlock new mineral projects. This boost to the domestic sector has been coupled with an announcement that the federal government would prevent foreign state-owned enterprises from owning and participating in Canada’s critical mineral sector, which was quickly followed by ordering three Chinese groups to divest their stakes in Canadian critical minerals companies, on the basis that these investments posed a threat to national security.

Australia, likewise, updated its critical minerals strategy in 2022, which includes substantial subsidies.3 The strategy also recognises the need to strengthen international partnerships and proposes various initiative in this regard.

The UK Government is not in a position to pledge much to the sector, but instead the UK’s critical minerals strategy focuses on relieving the bottle necks in the supply chain by accelerating what the UK can produce domestically, as well as collaborating with its allies in order to diversify supply.4

Most recently, the European Commission has proposed the European Critical Raw Material Act, which aims to help boost supplies of minerals such as lithium and rare earths – by identifying potential projects along the supply chain, from extraction to refining and processing to recycling – as well as build up reserves.5

The various governments seem to have adopted a common approach: to focus on supporting their own domestic sectors, but also to collaborate with ‘friendly’ jurisdictions to develop and strengthen the much needed critical minerals supply chain. However, given the significant head start that China have gained in the race to secure critical minerals, time will tell whether the profusion of strategies from western governments is too little too late.

1. Reported by Benchmark Mineral Intelligence.

2. ‘The Canadian Critical Minerals Strategy’, Natural Resources Canada, (2022).

3. ‘Critical Minerals Strategy’, Australian Government: Department of Industry, Science & Resources, (16 March 2022).

4. ‘Resilience for the Future: The UK’s critical minerals strategy’, UK Government: Department for Business, Energy & Industrial Strategy, (22 July 2022).

5. ‘Critical Raw Materials Act: securing the new gas & oil at the heart of our economy I Blog of Commissioner Thierry Breton’, European Commission, (14 September 2022).

15 South Street, Farnham, Surrey, GU9 7QU, UK t: +44 (0)1252 718999 // w: www.globalminingreview.com

To support growing demand, Komatsu has begun producing the company’s HM400-5 articulated haul trucks at its factory in Chattanooga, Tennessee. While the trucks were produced in Chattanooga in the mid-2000s, in 2009 production shifted to the company’s plant in Ibaraki, Japan, where it has remained until now.

Used primarily in construction, quarry and mining applications, the 473-HP HM400-5 is designed to move material across challenging terrain while delivering productive, consistent performance for operators of all experience levels.

To celebrate the new production line, Komatsu and the Association of Equipment Manufacturers (AEM) hosted US Represetative, Chuck Fleischmann, along with other local and state officials for a launch event at the company’s Chattanooga plant.

Fleischmann sated: “For years, Komatsu has been a proud member of our Chattanooga-area community, providing hundreds of good-paying jobs and generating a massive economic impact for Chattanooga and Tennessee. Bringing back production of Komatsu’s HM400-5 trucks is another sign of

our strong local workforce, and shows the confidence business leaders have in Chattanooga’s economy and our values of hard work, low taxes, and free enterprise. I am excited that Komatsu is expanding their operations here in Chattanooga and investing in our community.”

Production of the truck has already driven an increase in Komatsu’s spend with local and regional suppliers. Additionally, the new line will offer more opportunities for area students to gain experience in manufacturing. Komatsu’s Chattanooga plant currently has a pre-apprenticeship programme that employs high school seniors part-time, allowing them to earn credits toward a full apprenticeship certification through Chattanooga State Community College.

Rod Schrader, Chairman and CEO, Komatsu North America, said: “We have seen the demand for our HM400-5 trucks grow significantly in both the US and Canada, which is why we began producing the trucks here in the US. The domestic production of this popular truck supports Komatsu’s commitment to jobs and manufacturing in the US, and also enables us to contribute far more to the local Chattanooga economy.”

Barrick Gold Corporation grew attributable proven and probable gold mineral reserves by 6.7 million oz net of depletion in 2022, while maintaining grade despite an increase in the reserve price assumption. Reported at US$1300/oz, attributable proven and probable mineral reserves now stand at 76 million oz at 1.67 g/t, increasing from 69 million oz at 1.71 g/t reported at US$1200/oz in 2021.

Led by Pueblo Viejo and the Africa & Middle East region, Barrick has now delivered a second consecutive year of gold reserve growth over and above annual depletion, with nearly 12 million oz of attributable proven and probable reserve gains in 2022 before depletion.

Successful exploration at both the Lumwana and Jabal Sayid mines has driven the growth of attributable proven and probable copper reserves by 640 million lb, notwithstanding an increase in the annual reserve price assumption to US$3.00/lb. As a result, Barrick replaced 103% of annual global depletion at consistent quality, effectively maintaining attributable proven

and probable copper mineral reserves of 12 billion lb at 0.38% in 2022.

Total attributable gold mineral resources grew by nearly 10% relative to 2021, and total attributable copper mineral resources more than doubled, growing by 124% y/y, both net of annual depletion. This growth was driven by the successful completion of a preliminary economic assessment supporting the Lumwana Super Pit expansion, and the incorporation of Reko Diq following the reconstitution of the project in December 2022.

Attributable measured and indicated gold resources for 2022 stand at 180 million oz at 1.07 g/t, with a further 42 million oz at 0.8 g/t of inferred resources. Attributable measured and indicated copper resources for 2022 stand at 44 billion lb at 0.39%, with a further 15 billion lb at 0.4% of inferred resources.

Mineral resources are reported inclusive of reserves and for 2022, are based on a gold price of US$1700/oz and a copper price of US$3.75/lb.

PDAC 2023

05 – 08 March 2023

Toronto, Canada

www.pdac.ca/convention

CONEXPO-CON/AGG 2023

14 – 18 March 2023

Las Vegas, USA

www.conexpoconagg.com/conexpo-conagg-construction-trade-show

Expomin

24 – 27 April 2023

Santiago, Chile www.expomin.cl

Mines and Money Connect: London 2023

25 – 26 April 2023

London, UK

https://minesandmoney.com/connect

CIMTL23 Convention and EXPO

30 April – 03 May 2023

Montreal, Canada

https://convention.cim.org

Discoveries 2023 Mining Conference

30 May – 01 June 2023

Mazatlán, Mexico

www.discoveriesconference.com

China Coal & Mining Expo 2023

25 – 28 October 2023

Beijing, China www.chinaminingcoal.com

To stay informed about upcoming industry events, visit Global Mining Review’s events page: www.globalminingreview.com/events

Mine Vision Systems (MVS) has entered into a multi-year agreement with Hecla Mining Co. to introduce the FaceCaptureTM mapping system into two of its mines in North America.

As the largest silver producer in the US, Hecla’s rich history includes a consistent focus on applying innovative new practices. FaceCapture will enable Hecla to map and georeference the mine face in real-time, reduce production downtime, and bring higher quality information to its geologists at the moment they need it most.

“Our production, productivity, and safety objectives are directly affected by multiple decisions we make at the mine face every day,” said Matt Blattman, Corporate Director of Technical Services, Hecla Mining. “FaceCapture will allow us to process high quality 3D mine face data in real time, permitting our team to make critical production decisions and with reduced exposure at the mine face.”

“Hecla has over 130 years of experience driving and embracing new and innovative methods to achieve company objectives,” said Mike Smocer, MVS CEO. “We are proud to support Hecla’s culture of innovation and desire to provide better data to key employees when they need it.”

Rana Gruber has selected Sandvik Mining and Rock Solutions to supply a fleet of 19 battery-electric vehicles (BEVs), including trucks, loaders and drills, for its iron ore operations in Storforshei in northern Norway. The agreement underpins Rana Gruber’s aim to operate the world’s first carbon-free iron ore mine by the end of 2025.

Sandvik’s second-largest battery-electric mining fleet to date will include six Sandvik TH550B trucks, five Sandvik LH518B loaders, four Sandvik DL422iE longhole drills, two Sandvik DS412iE mechanical bolters and two Sandvik DD422iE jumbos. Delivery of the equipment will begin during 1Q23 and is planned to continue through 2024. Sandvik will also provide on-site service support and batteries.

Gunnar Moe, CEO of Rana Gruber, said: “We’re proud that our mining operations already have among the industry’s lowest CO2 footprints, but we have even higher ambitions to completely eliminate our carbon emissions. We have a crystal-clear decarbonisation strategy. When we announced our 2025 goal in 2020, many did not believe it would be possible, but we’re taking another major step forward partnering with Sandvik to implement a battery-electric fleet that will improve our work environment and reduce our operational costs. Most importantly, BEVs will help us achieve our ambitious goals for carbon-free mining.”

Moe said Sandvik’s philosophy around batteries and approach to battery safety was an important factor in Rana Gruber’s selection process.

“This is a new world for us but Sandvik has extensive battery-electrification expertise,” he said. “We are already very pleased with our cooperation with Sandvik and their commitment to support our BEV transition, not as a supplier but as a true partner wanting to take the journey with us.”

Anglo American has agreed to acquire a 9.9% minority interest in Canada Nickel Company Inc., which owns the Crawford nickel project in Ontario, Canada.

Anglo American will also provide technology expertise to the Crawford project and has the exclusive right to purchase up to 10% of recoveries of nickel concentrate, iron and chromium contained in the magnetite concentrates and any corresponding carbon credits from the Crawford project. Anglo American’s equity funding will support Canada Nickel’s work to complete the necessary permitting requirements to proceed with development of the project.

The investment is part of Anglo American’s approach to expand its nickel product offering with additional battery-grade nickel for use in electric vehicles, complementing nickel production from Anglo American’s PGMs mines in South Africa, as well as ferronickel from its nickel assets in Brazil, which is mostly destined for the global stainless-steel industry.

Peter Whitcutt, CEO of Anglo American’s Marketing business, said: “As a responsible provider of future-enabling metals and minerals to our customers, we are committed to supporting our

industry in increasing the availability of critical materials that will underpin the success of the energy transition, and to do so sustainably.”

Anglo American will apply its FutureSmart MiningTM technologies to ore samples from Canada Nickel, with the aim of assessing opportunities to improve processing recoveries and reduce the project’s overall energy, emissions and water footprint.

“Our in-depth product knowledge and portfolio of innovative technologies has the potential to provide a value-enhancing contribution to the development of the Crawford project, with the objective of unlocking additional supply of nickel to meet the world’s growing demand for battery technology for electric transport,” Whitcutt added.

Located in a tier-one mining jurisdiction in Ontario, Canada, with optimal support infrastructure, the Crawford project is one of the largest undeveloped, bulk tonnage nickel sulfide resources in the world. If brought into production, the project is expected to play an important role in expanding the available supply of battery-grade nickel.

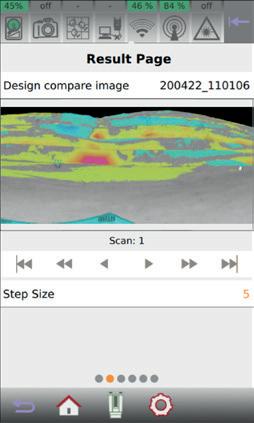

Hexagon’s Mining division has been awarded an eight-year fleet management project by PT Bukit Makmur Mandiri Utama (BUMA). As part of this project, Hexagon successfully deployed 150 units of HxGN MineOperate OP Pro to BUMA’s IPR site operation in Indonesia with the system optimally running within three months.

The phased deployment covers Hexagon’s fleet management, asset health and enterprise analytics solutions implemented by the Hexagon team on-site from June to September 2022. BUMA was established in 1998 as a family business and is currently the second largest independent coal mining contractor in Indonesia.

Delta Dunia Makmur acquired BUMA in 2009 and has been overhauling it into a more streamlined corporation since. It holds approximately 20% of the market share and provides coal mining services to many of Indonesia’s largest and longest-running names in the coal industry.

Simon Stone, Vice President of APAC, Hexagon’s Mining division, said: “We are looking forward to strengthening

our relationship with BUMA and accelerating their digital transformation journey. Like BUMA, Hexagon firmly believes in safety and efficiency, which makes this partnership and collaboration highly valuable to both parties.”

HxGN MineOperate OP Pro offers opencast mines high-precision guidance for dozers, drills, and loading equipment. The solution improves bench elevations, reduces dilution and decreases rework to improve site safety, efficiency, and profitability. Hexagon’s enterprise integration enables BUMA a single source for reporting and support across their fleet.

BUMA President Director, Pak Sorimuda Pulungan said: “In following management’s Technology Transformation project outline, Hexagon’s suite of integrated products and industry proven technology solutions played a major role in the decision-making process. Hexagon has set the new standard of being a reliable technology partner supported by an expert local team.”

Reducing the number of on-site accidents in a mine is crucial; ensuring that personnel remain safe in both in underground and surface settings is necessary. Becker Mining Systems developed both the PDS4.0 and the smartdetect system with safety and proximity awareness in mind.

Level 9 compliant, and with a full range of attachments, PDS4.0 and smartdetect

have been designed to offer V2V, V2P, and V2X detection solution in one comprehensive and robust package, allowing for upgrades, and simple system modifications, based on the needs of the customer.

With smartdetect and PDS4.0 enabled vehicles; you will never again have to wonder “how close is too close”

Freeport-McMoRan has achieved the Copper Mark at all 12 of its copper producing operations globally. Freeport’s most recent copper operation to receive the copper mark is PT Freeport Indonesia (PT-FI) Grasberg – one of the world’s largest copper and gold mines. In addition, Freeport’s two primary molybdenum sites, the Climax and Henderson operations, were awarded the Molybdenum Mark.

The Copper Mark is the assurance framework to promote responsible production practices for copper, built on the vision of improving practices across the whole industry over time. Its participants commit to fully meet the Copper Mark’s standards within two years of signing up to the assurance process and to continuously strengthen practices as these standards continue to be updated to align with increasing stakeholder expectations on ESG. The Copper Mark seeks to promote transparency and accountability of its participants in general and especially in the case where a participating site manages complex issues that have significant environmental or social impacts. PT-FI Grasberg operates a riverine tailings management system which the Copper Mark recognises as one such issue.

As a matter of principle, the Copper Mark expects participants to manage tailings with the goal of causing zero harm to people and the environment. It requires all participants to review all possible tailings systems alternatives and to implement the

system that is the most aligned with the overall objective to cause zero harm.

In addition, following extensive consultation in 2021, the Copper Mark adopted its interim guidance for tailings management. The interim tailings guidance requires all participants to implement the global industry standard for tailings management, where applicable, and also specifies the expectations for riverine, ocean and lake tailings systems.

The extensive, independent onsite assessment of PT-FI Grasberg confirmed the site’s conformance with the current Copper Mark expectations and standards, including the interim tailings guidance.

The Copper Mark is also developing additional guidance for any participating sites that are identified as having significant long term environmental or social impact issues. Once finalised, PT-FI Grasberg will be required to demonstrate conformance with these additional requirements through on-site third-party assurance.

Executive Director of the Copper Mark, Michèle Brülhart said: “We congratulate Freeport-McMoRan for achieving the Copper Mark at all of its copper operations globally and we are thrilled to see the company continue its commitment to demonstrating its responsible production practices with its two primary molybdenum sites to receiving the Molybdenum Mark.

TrajectorE Engineering has announced the commencement of a new project with Saskatchewan Copper developer, Foran Mining Corp., to support the development of Canada’s first carbon-neutral copper mine located in McIlvenna Bay, Saskatchewan.

McIlvenna Bay is a copper-zinc-gold-silver rich deposit intended to be the centre of a new mining camp and is part of the prolific Flin Flon Greenstone Belt that extends from Snow Lake, Manitoba, through Flin Flon to Foran’s ground in eastern Saskatchewan, over a distance of 225 km. McIlvenna Bay is the largest undeveloped VHMS deposit in the region and has a goal to become a fully carbon-neutral mining producer,

by utilising renewable power sources, battery electric vehicle fleet, and other first-in-kind initiatives.

trajectorE will be leveraging their history of hands-on experience in the mining and mineral processing sector to support Foran in the areas of Operational Readiness and Commissioning.

“We’re very excited to be partnering with the Foran Mining team to help develop what will be a leading example of what sustainable mining looks like in Canada. This project is perfectly aligned with our mission of partnering with Operators to realise sustainable productions,” says trajectorE CEO, Andrew Sinclair.

TotalEnergies Lubrifiants is a leading global manufacturer and marketer of lubricants, with 42 production sites around the world and direct presence 160 countries, delivering more than 600 mines per day. TotalEnergies’ Lubricants division offers innovative, high-performance and environmentally friendly products and services to help mining customers reduce carbon footprint and ensure lowest TCO.

In mining operations today, several buzzwords are frequently mentioned – electrification, sustainability, and decarbonisation – and yet the central theme that ties these factors together is optimisation. The fact is, every facet of mining operations is driven by optimisation, which ultimately affects sustainability and profitability.

Automating everyday operations, such as payload management, can play a big role in advancing optimisation at mine sites. Getting instantaneous, real-time visibility into the amount of material being loaded and moved can help increase operational efficiency, productivity, and utilisation. Miners can gain even more value from payload technology if they are able to integrate it with disparate systems.

The Argus Payload Management system by Modular Mining – a Komatsu technology brand – is a solution that can help optimise efficiency through automation. To learn more, Will Owen (WO), Editor of Global Mining Review, sat down with Wesley Taylor (WT), Automation and Surface Mining Product Manager at Komatsu.

Modular Mining and its suite of mining technology products, such as Argus, have been around since 1979. Aside from its notable track record, what differentiates Argus from other technologies in payload management?

One of the most notable things that Argus does is use a common strategy for all types of loading equipment. We talk about the importance of capability, user interfaces, features, etc. – with Argus these all can be shared across different loading tools. This allows operators to transition from one piece of equipment to another while retaining a very comfortable, easy-to-use interface with the same amount of information and knowledge.

Being a Komatsu brand and company, Modular Mining works with the factory teams that design some of our loading equipment – such as our electric wheel loaders and electric rope shovels. This collaboration enhances Argus’ accuracy and features when used with Komatsu equipment. It combines the feel of working with a third party with the strength of a true OEM backing.

Additionally, a software package is available with the Argus suite called mRoc. mRoc can add an immense amount of value, even outside of the operator in the chair. mRoc enables production and maintenance managers to evaluate the efficiency and operation of the loading equipment in action.

Thus, mRoc provides two significant capabilities, both in the operating chair and in the back office, all from one Argus product.

What are the unique ways in which Argus offers solutions to some of the day-to-day challenges of payload management at mine sites?

Load and haul optimisation is a pretty big buzzword in the industry right now, and this remains true for Komatsu’s big mining customers. One of the biggest challenges is also an opportunity: the wealth of data that can be generated from loading equipment haulage, especially in mixed-fleet operations.

Taylor, Komatsu, discusses the benefits and prospects of a new payload management solution in a Q&A with Will Owen, Editor of Global Mining Review.

It can take a great deal of workforce effort to consolidate, analyse, understand and verify this data, prior to implementing optimisation or process changes.

The exercise of checks and data analysis could require the attention of an entire team or department. However, this is one of the exceptional things that the mRoc software can handle. mRoc takes all of the rich loading and cycle data, organises it, analyses it and saves it all in one place in micro and macro level data sets, making it easy for the customer to evaluate the operational efficiency of their machine now and in the past.

Again, it is worth noting that it does not matter if it is a Komatsu loading tool or CAT – the same metrics and KPIs are generated by Argus. This results in a streamlined process and a large portion of the legwork being completed automatically for the customer, without the need for a large data-management infrastructure.

What are the current trends in payload compliance? How is it changing? How does the Argus solution enhance payload compliance?

Payload compliance can be split into two critical factors. One is loading optimisation – i.e. making sure that the maximum possible number of tonnes are being moved –and the other is ensuring that equipment safety and reliability thresholds are not exceeded.

Overloading a loading or haulage tool can lead to repair costs and other factors that could affect a customer’s profitability. You want to load as much as possible without loading too much. On the other hand, you do not want to underload either. Efficiency and optimisation are key when it comes to payload compliance, and this is what that the Argus solution does very well.

Argus’ ease of use really helps in this situation. Again, the commonality of the user interface, in addition to the alert operators receive when they are close to overloading, helps operations run as close to the optimal efficiency and capacity of their machines as possible.

Are there technologies available that can benchmark and help make continuous improvements in productivity? How does Argus promote payload performance for each operator?

Argus is a foundational technology that benchmarks what a customer could do when it comes to optimising their load and haul processes. It tracks all the relevant data – from the equipment loading a truck to the truck being loaded – and consolidates it into the mRoc platform, which then contextualises it for the operator in the chair.

When customers begin to integrate automation into their operations, they will not always know exactly how many tonnes per hour a machine is moving or how efficiently their fleet is being loaded. Adding technology, such as adaptive controls, can increase customers’ operational awareness and help them understand the level of productivity that could be achieved.

How flexible and scalable is Argus to meet the needs of operations of different sizes?

If you have aging equipment or trucks and new trucks coming in, the Argus’ truck-tracking modules can fit onto both without issue. The module (through mRoc) is also flexible through the use of its truck grouping function. Grouping is via make/model/tray size. Each truck KPI can be individually set if required – i.e. two haul trucks of the same make and model, but with different tray capacities, can be set. This is left in the capable hands of Modular Mining’s customer support team, allowing customers to flex the system out as far as they want it.

Argus’ easy installation is another big factor when it comes to utilising it on equipment and maintaining it. Modular Mining has ability to do remote maintenance. From that standpoint, we work with our customers to make sure that no matter how big their fleet, how large their potential market or where they are located, we can provide global installation support and knowledge. With this in mind, I do not really see a limit.

Can you outline some specific examples of where Argus has optimised overall payload management?

MDG finds the best technological solutions for Customers specific needs, proposing itself as “one source solution”, while offering Engineering, high-quality Manufacturing and mechanical handling Services

We have a couple of case studies available on our website, most notably an oil sands mine in Canada.

In this case, the mine sought to move more material while increasing payload compliance on its fleet of three CAT 495 electric shovels. The payload system it previously used relied on truck onboard scales to relay information to their fleet management system. These scales were often inaccurate – due to re-weighing the truck after it had left the pit (resulting in unexpected payload increases or decreases post load), difficult scale maintenance schedules, etc. – or often did not function at all.

In addition, the majority of the mine’s fleet of CAT 797 trucks are leased. As part of the leasing agreement, the mine is fined any time a truck weighs in over 120% of payload capacity. Given the inaccuracies mentioned above, the mine was experiencing > 120% payload events on a regular basis. It was threatened with millions of dollars in fines, as there were no other payload measurements to refute the scales.

Within a few weeks of Argus being implemented, operators became more aware of how their load distribution looked in terms of the shovel productivity and haulage. One of the biggest improvements to result was a 6% increase in productivity. Argus helped tighten payload distribution and minimise excessive overloads. Within this, some of the tails, the underloads, became more efficient as well. These performance improvements are a clear example of greater optimisation bringing about improved efficiency.

There is also a safety and a sustainability aspect to this case. Fewer overloads lead to less equipment damage. This leads to fewer repairs which, importantly, reduces the time people spend carrying out maintenance and repairs. Fuel and emissions savings can also be achieved when loading is completed with greater accuracy. When operators are better at hitting optimal loading targets, trucks can be sent on their way more quickly without needing to make additional, unnecessary passes.

Are there any other examples you can cite where Argus has improved payload management?

We have another case study from a coal mine in North America. One of the most unique aspects of this mine was its mixed fleet of four P&H4100 overburden shovels and a mixed haulage fleet of Liebherr T282s, Komatsu 960s, and Komatsu 930s. The mine sought to optimise the load and haul operations of its fleet of shovels after payload performance plummeted, with only 40% of loads falling within the acceptable payload range. Operator performance issues, ineffective payload management tools, and costly delays in payload feedback to operators contributed to this result. The mine wanted to optimise its load and haul operations by improving operator performance, truck compliance, and production – all while reducing costs.

The Argus kit’s mixed fleet tracking capabilities were essential in this scenario. Not only can Argus work with mixed fleets in terms of loading tools, but it can track mixed truck fleets as well. The benefits of Argus in this case became apparent quickly. Shovel operator performance improved after four weeks by 6.5%, delivering impressive advantages in productivity and haul fleet efficiency. The site increased its average truck loads per hour and moved more tonnes per day, resulting in a production increase equivalent to gaining two entire trucks. In other words, if the site removed two of its existing trucks it would maintain current production output while saving approximately US$3 million/yr based on current commodity pricing.

What does the future hold for Argus?

WT

Argus is a foundational technology for future-generation optimisation: increasing productivity, safety, sustainability, automation, etc. With the growing ease of collecting data from equipment, we are seeing increased opportunity for Modular Mining to help analyse data and produce reports that our customers can use at an enterprise level. Machine data will continue to help workers on the ground understand how their equipment is performing, but with Argus, management in local or global offices can see it as well.

Implementing Argus helps the full command of mining operations to better use and leverage site data to improve the wider enterprise. To me, that is the exciting thing, seeing what customers can do when they have access to this level of detail from their equipment. This insight can quickly lead to the promotion of better optimisation and efficiency across operations. I am excited to see what the future holds for Argus and what technology it will help benchmark next.

Robert Dura, Jennifer Clark, and Gareth Fish, Lubrizol, USA, consider how choosing the right lubrication technology can prevent unnecessary downtime and component failure in open gear systems.

Mining operations around the world depend on complex systems working in harmony to deliver maximum efficiency and profitability. Within the mining industry, many applications depend on open gear configurations due to the significant stress and harsh working conditions they experience. Mining draglines, rope shovels, and grinding mills are just a few examples that rely on properly maintained and safely operating open gear systems to ensure effectiveness.

As important as the open gear system is itself, the lubrication used is equally critical to the system. Open gear systems must contend with a wide variety of harsh operating and environmental conditions, necessitating high-performing lubrication that enables long-term reliability and performance. Open gear systems vary in size and can be up to 90 ft (27 m) in diameter. Gear systems this large typically take up to 12 months to manufacture, and, due to the increased cost of most metals today, can easily cost over

US$1 million to produce. Thus, extending the life of and reducing the damage done to these gears is extremely important for the continued function and life of the system.

Insufficient or improper lubrication can result in machine downtime, requiring costly maintenance and lost production. For example, replacing the swing rack on a mining rope shovel and returning it to full production after gear failure takes between 100 – 150 hr on average. And, since lost production time has the potential to cost a mining operation as much as US$175 000/hr, using the wrong lubricant simply is not worth the risk.

Given the cost associated with equipment failure, it is imperative that mining professionals make the right choice when selecting a lubricant for open gear systems. Recent advances in open gear lubricants (OGLs) help ensure even higher performance for increasingly reliable, long-term operations. To provide high-performing lubricants, new unique performance polymers (UPP) have been developed to solve many of the challenges inherent in today’s open gear systems, which directly translates to benefits in the field.

UPPs comprise a versatile class of compounds with unique architectures that offer thickening efficiencies, low-traction

coefficients, and high shear stability. UPPs can be used to optimise the lubricant depending on what types of performance attributes are required in the end-use application. They also exhibit excellent temperature and thermal stability — ideally suiting them for the rigorous demands of the mining industry.

Through testing, it has been found that UPPs can enhance the performance of finished fluids by lowering the traction coefficient and operating temperature, while increasing overall efficiency. These advantages have been demonstrated in extensive laboratory testing, and translated well to studies in the field.

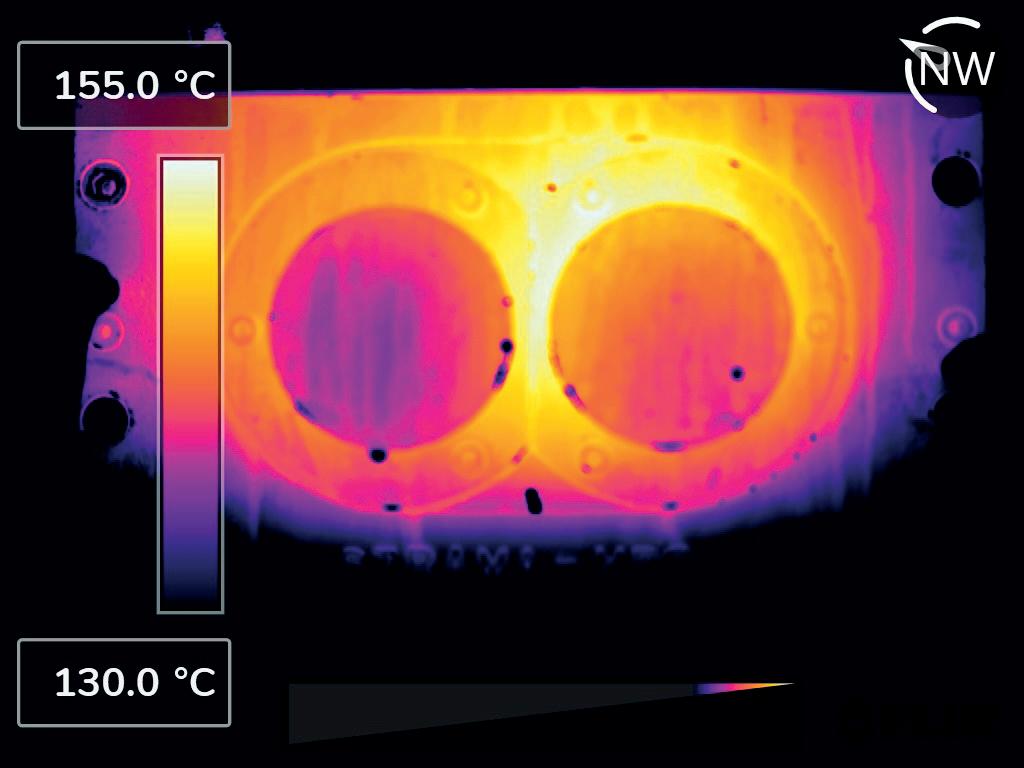

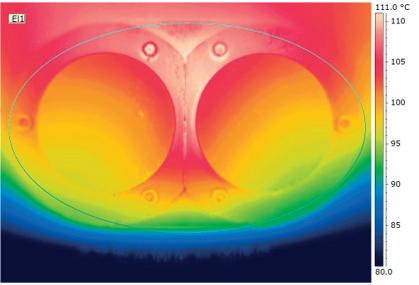

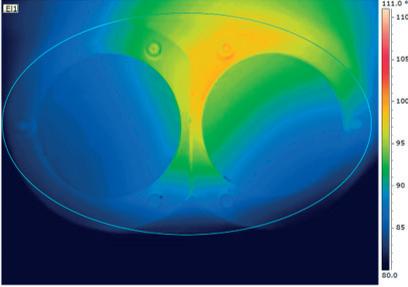

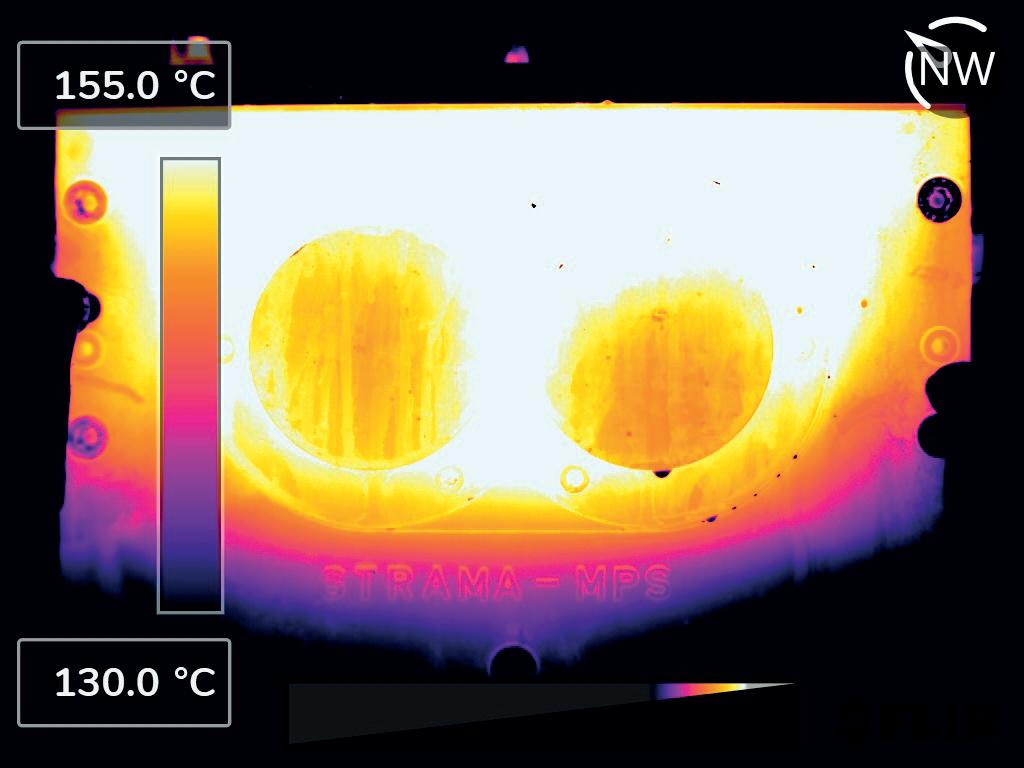

The cooler industrial gears are when they operate, the longer their life spans will be. OGLs formulated with select UPPs can effectively reduce operational temperatures of the open gear systems, which contributes to longer-term reliability in the field.

Higher operating temperatures are known to cause issues for lubricants formulated with lower-quality oils, as it subjects them to oxidative degradation, which often leads to film durability issues. Since a lubricant’s primary objective is

Make sure your next mining body delivers extraordinary productivity and service life. Hardox ® 500 Tuf combines the hardness of Hardox ® 500 with the toughness of Hardox ® 450. This wear resistant steel is also tough enough to perform as a structural steel, allowing for stronger and lighter mining dump bodies.

15%

LONGER WEAR LIFE

Hardox ® 500 Tuf wear steel delivers a 30% longer service life than an ordinary AR450 steel or…

30% LIGHTER …save 15% or more weight in a mining dump body to reduce fuel consumption and CO2 emissions.

100%

GUARANTEED

Guaranteed flatness, thickness, and bending performance, making fabrication more reliable and minimizing waste in production.

Learn why Hardox ® 500 Tuf makes extraordinary mining equipment.

www.hardox.com

to provide protection, and elevated temperatures typically compromise that ability, the right chemistry must be carefully selected. With the appropriate chemical formulation, the lubricant is better able to resist heat-related breakdown, ultimately preserving its protective capabilities over extended run intervals.

As mentioned previously, a lubricant that runs cool lasts longer. Testing performed by Lubrizol (as detailed later in this article) has shown that if an OGL can reduce an open gear system’s working temperature by just 10˚F (6˚C), it can help reduce total lubricant consumption by approximately 30%, helping operators not only protect their equipment, but also reduce their environmental impact through reduced water consumption for cooling.

Remember, gear failure resulting from a degraded lubricant can cost significant time, money, and labour to rectify before the machine can be made fully operational again. Enhanced temperature control can help extend equipment life beyond ordinary expectations in harsh mining environments.

With a keen understanding of the threat that high heat can pose to open gear systems, Lubrizol set forth to design and validate a lubricant formulated with a UPP, in order to reduce operating temperatures and better protect bearings, while also improving overall operational performance.

In a controlled laboratory setting, a series of different OGL formulations were tested to compare performance and draw conclusions about the capabilities of UPPs. In both grease and fluid formulations, conventional mineral-based oils, synthetic oils using polyalphaolefin (PAO)-based formulations, and formulations enhanced with a specifically designed UPP were compared.

The results were as follows:

To simulate gear performance, an FZG test machine was used. Specially designed gears were loaded against each other under a series of stages and run for 21 700 revolutions or until scuffing occurred. In this study, the following were used:

n Conditions: FZG A/2.8/50.

n Gear type: FZG A = A.

n Pitch line velocity: 2.8 m/s (550 ft/min.).

n Starting temperature: 120˚F (49˚C).

Initially, the primary objective was to evaluate through FZG testing to see if there was an operational temperature difference among the product types and identify which sample consumed the least amount of energy. The conventional mineral-oil-based sample was used as a baseline.

After FZG evaluation, solid evidence was found that OGLs formulated with UPPs achieved the goal of reducing operational temperatures:

n UPP OGL ran 38˚F (21˚C) cooler than the baseline mineral OGL.

n UPP OGL ran 27˚F (15˚C) cooler than the PAO OGL.

n PAO OGL ran 10˚F (6˚C) cooler than the baseline mineral OGL.

The testing protocols for fluid formulations were very similar to the grease tests. An FZG A/8.3/90 study (8.3 m/s [1630 ft/min.]) pitch line velocity and 194˚F (90˚C) starting temperature was executed to examine a mineral OGL, a PAO OGL, and a UPP OGL over 12 load stages using the same samples. Once again, the objective of this testing was to evaluate if there was an operational temperature difference among products, and which sample consumed the least amount of energy. The mineral OGL was used as a baseline material.

Again, evidence was found that the UPP OGL offered significant temperature reductions. Here, the PAO-based OGL offered good temperature reduction versus the mineral-oil-based OGL. However, the UPP OGL ran 27˚F (15˚C) cooler than both the mineral and PAO OGLs. In addition to the temperature reduction, employing a UPP has also been shown to provide significant energy savings compared to PAO and mineral-oil-based formulations (Figure 3).

Research has shown that OGLs formulated with specifically designed UPPs can offer reduced operating temperatures and efficiency gains. These attributes make lubricants formulated with UPPs ideal for the demanding nature of open gear systems that major mining operations around the world depend on.

In order to achieve new operational benefits, operators should work with lubricant suppliers to investigate modern OGL formulations with UPP technology. In critical mining applications, it can mean the difference between success and failure.

Mines generate loads of digital information, and smart miners are using it to make better sense of their operations. It all starts with connectivity provided by IWT’s SENTINELTM System, an integrated communications solution that improves miner safety, enhances e ciencies and transforms job site data into actionable intelligence.

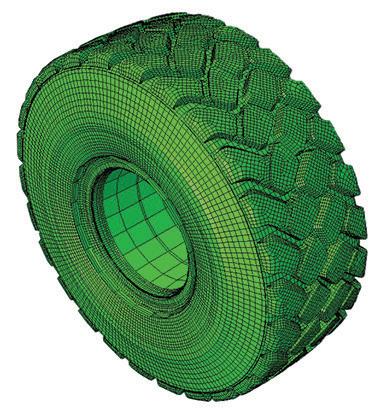

The search for uptime inevitably leads to a focus on tyres, because nothing rolls in business without them. As such, the investment in tyres is substantial enough that long-gone are the days of just ‘letting it ride.’ Today, companies are investing in technology that makes tyres perform better and building the service and support structure to help maintain their tyre investment. The opportunity to increase uptime can maximise benefits for a business, but means it needs the right partners to keep up with industry improvements and future developments. The mining industry has been an early adopter of impactful, innovative technology, and it continues to be the workshop for further development in key trend areas that will improve the longevity and impact of the mining industry for years to come.

For many in the mining industry, tyres are essential to the operation of the vehicles used on the job. Tyres also represent a substantial investment, in both up-front capital and ongoing maintenance. Evolving technology is improving performance of today’s OTR mining tyres in meaningful ways.

Today’s modern mining tyres are made of components that use advanced technology. The combination of components are selected to achieve the desired performance at a particular site. A tyre fit-for-purpose will use the right components, working as a holistic system to deliver what Goodyear calls ‘performance power’. The blending of technology in the tyre components is what makes today’s mining tyres unique. At Goodyear, the most important components of a tyre are broken down into three main areas: tread design, compounding, and sidewall construction. Here is brief look at each component:

To the untrained eye, most tread designs look similar, and many might assume they all perform in similar fashion. The truth, however, is far more complex and current tyre technology plays a big role in the performance of a selected tyre, especially in the mining industry. To understand the impact of a modern

Eric Matson, The Goodyear Tire & Rubber Company, USA, examines how a smart investment in tyres and tyre maintenance can be crucial in maximising uptime.

tread design, a fleet manager should first take a close look at what will be underneath the tyre.

A tyre’s underfoot condition will help determine the tread design that should be used. If the underfoot condition is soft, a tyre with a shallow tread depth might be in order. If the underfoot condition is rocky, a tyre that has deeper tread depth might be preferable. When evaluating underfoot conditions, the job site should be searched. Are other areas free of debris that can cut into tyres? How are surfaces manicured? Are there things that can be done to boost traction? Are machines required to navigate curves or steep inclines and declines? If in doubt about any of these factors, a qualified tyre technician should be consulted.

Although not visible to the naked eye, rubber compounds are a foundation of good tyre performance. Compounds comprise various formulary ingredients that can be adjusted to provide

certain performance benefits. Many compounds are found in a standard mining tyre, from the crown of the tread to its casing, and they interact with one another while the tyre is in operation. Like tread designs, rubber compounds – and their unique technology – can help meet performance requirements presented by different underfoot conditions. For example, machines that operate in severe service conditions can benefit from tyres that offer enhanced cut resistance. To achieve the desired feature, certain additives can enhance tread compounds, thus increasing a tyre’s ability to defend against cuts and improve scrub resistance.

Sidewalls are where the tyre gets its strength and today’s tyres use a mix of technologies to ensure a tyre can deliver performance when on the job. The sidewalls help support the tyre so it can carry the vehicle’s load and can play an important role in maintaining equipment stability. However, heavy loads

can cause sidewalls to bend. This can expose more of a sidewall’s surface area to rocks and other debris. Sidewalls that feature increased thickness, special compound technology, and/or added reinforcements can help reduce sidewall bending or deflection, which can cut down on a tyre’s exposure to potentially damaging objects on the ground. As electric vehicles begin to play an important role in the mining industry, sidewalls play an important role in managing the extra weight of batteries and absorbing the stress of additional torque. Sidewalls are also an important part of the tyre’s casing and should be built with longevity in mind, so retreading is an option to maximise the investment in a tyre and lengthen its overall service life.

The benefits provided by tread designs, compounding, and sidewall construction can be quickly negated by poor

tyre maintenance. Because tyres are a significant investment, it makes sense to take steps to optimise their performance and longevity. Since needs vary from customer to customer and site to site, Goodyear recommends a tailored tyre maintenance programme to help maximise tyre investment. A balanced maintenance program should include tyre inspection, performance tracking, and data analysis for actionable insights and reporting.

Daily inspection of tyre inflation and wear should be cornerstone of any maintenance programme. Maintaining proper inflation levels is one of the most effective practices that a mining operation can employ to help achieve enhanced tyre performance and longer service life. Correct, consistent inflation can positively impact tyre wear rates and help reduce the amount of fuel mining machines consume. Inflation checks are recommended as part of every pre-shift inspection, or typically, at least once a day. Goodyear offers a solution for mining applications that delivers up-to-the-minute information regarding key metrics on a fleet’s tyres. Goodyear TPMS Heavy Duty (HD) is designed for both fleet managers and operators ensuring that service needs can be addressed in near real time to keep business running. The TPMS HD predictive algorithm allows for fleets to be proactive and plan for upkeep and replacement. Regular monitoring and data collection can help avoid common over and under-inflation of a fleet’s tyres. Over-inflation can lead to premature and/or uneven wear. Under-inflation can cause tyres to flex more and forces engines to work harder. Overloading is another condition that can have a detrimental impact on sidewall durability and impact tyre performance.

In addition, a tyre maintenance programme should ensure tyres are not mismatched around the vehicle. For improved performance, it is best to stick with very similar diameters, tread patterns, tread depth, and tyre construction – whether radial or bias, but never mixed – regardless of application or axle. This practice can help reduce the incidence and rate of tyre wear.

It is also recommended that mining operations work closely with a qualified tyre dealer to implement a comprehensive OTR tyre management programme. A qualified dealer can evaluate existing maintenance programmes and offer suggestions for improvement, including the deployment of specific tyre management solutions, such as Goodyear’s EMTrack OTR tyre performance monitoring programme. The Goodyear EMTrack system enables faster, more accurate data collection of critical tyre data, including tread depth and inflation levels, via a special scanning tool; automatic uploading of captured tyre information to a secure, cloud-based storage platform; as well as downloading into customisable reports for real-time, on-site viewing.

Information captured through a tyre performance management system can enable better decisions to be made about the tyres currently being used and help predict future tyre requirements more accurately. By tracking performance and other indicators over time, it enables the ability to be able to predict when tyres

JENNMAR has been the innovative leader in ground control for the mining industry for more than forty years. Over the past decade, our growth has led us to structural support in tunneling and civil construction projects, implementing the same vigor and detailed processes. Because we understand the ever changing and demanding conditions above and below ground we have built the richest portfolio of diverse and complementary brands.

JENNMAR sets the bar in every industry we serve and as we continue to grow, our focus will always be on the customer. Our products are made in the U.S.A. and backed by experienced engineers and technicians who are with you every step of the way, from initial consultation to qualified instruction and on-going technical support. We support and are dedicated to rebuilding America’s infrastructure.

will need to be replaced. In today’s budget-conscious operating environment, efficient tyre forecasting and ordering can help with more effective tyre inventory management.

Once out of service, a post-mortem analysis of the tyres can yield valuable information about how the tyre was maintained while it was running. An out-of-service tyre that exhibits unusual wear patterns could, for example, have been operated in an under-inflated state for an extended period. Findings of this nature can prompt mining operations to re-examine their tyre maintenance practices and programmes. Information gleaned from scrap tyre analysis can help mining operations make better-informed decisions about their tyre assets.

Choosing proper tyres from the best available options and maintaining them with fleet solutions will help increase uptime, but there are industry changes and important trends that should be considered when planning long-term tyre needs. Goodyear’s forward-looking approach to market trends and innovations is called FACES, and it stands for fleets, autonomous, connected, electric, and sustainability. The FACES approach highlights where the company is investing today to be an impactful partner for its customers in the future. Many of these trends already have root in the mining industry, but Goodyear believes they will continue to shape the products and services that support the OTR industry for many years.

The importance of OTR fleets only continues to grow in importance. Industry consolidation and greater world demand

are making large fleets of heavy-haul trucks or dozens of port vehicles an important part of growth in the industry. As fleets grow in size and technological complexity, there is even more need to focus on maintenance and inventory to protect the investment in the collected or even individual assets.

The OTR industry has been in the autonomous vehicle space for many years with some of the largest mining and port customers having been in the space for more than five years. It is possible to observe fleets of 80 – 100 large earthmoving vehicles all operating without drivers. Those drivers used to be frontline defense to check inflation and defend against tyre wear. Now, with more autonomous vehicles, the need for complementary automated solutions for tyre maintenance is becoming a big focus. Finding partners to manage those automated solutions will keep fleets moving into the future.

With larger fleets running more complex tyre solutions, there is an opportunity to connect all of a fleet’s vehicles and collect data – often in real-time – and use it to make decisions about assets like tyres. Services and features available today mean mining companies have access to real-time data and can understand fleet and vehicle needs at any given moment. They can also plan ahead for just-in-time service or replacement to maximise investment.

As in other industries, there is a big movement toward electric vehicles in the mining space. OEMs are developing and rolling out large earth movers that run on electricity with more new advancements just around the corner. Electric vehicles have new needs and require new tyres. The added weight and increased torque on the tyres mean the tyres are under different types of stress and need new technology to ensure they can keep fleets moving.

More than just a buzz word, sustainability in the mining industry is changing how Goodyear thinks about tyres and solutions. Using tools and services today to make sure that tyres are properly inflated is a sustainable step almost all companies can take. A properly inflated tyre has less rolling resistance and needs less fuel to move, so it has a positive impact toward many company sustainability goals. From sourcing to technological advancements, sustainability is coming to life in many ways across the industry.

With the average time to change an OTR tyre around four hours, that means a very valuable asset is out of commission and that can have a big impact on efficiency and growth. Eliminating that stoppage through the right mix of products and services means increases in uptime, resulting in more OTR partners delivering on their promises to customers and stakeholders. As the industry continues to grow, innovative products and tailored solutions should be implemented to maintain a fleet’s tyre investment today, and maximise uptime in the future.

Greg Bierie, Benetech Inc., USA, explores various technological and innovative solutions that can be used to improve dust control within conveying operations.

Although the importance of a well maintained and fully operational conveyor system is critical, the belt is often viewed as nominal and insignificant when it comes to perceived importance and its contribution to the bottom line. There are, however, innovative technologies which now make it considerably easier to maintain conveyors, and eliminate many problems at the source.

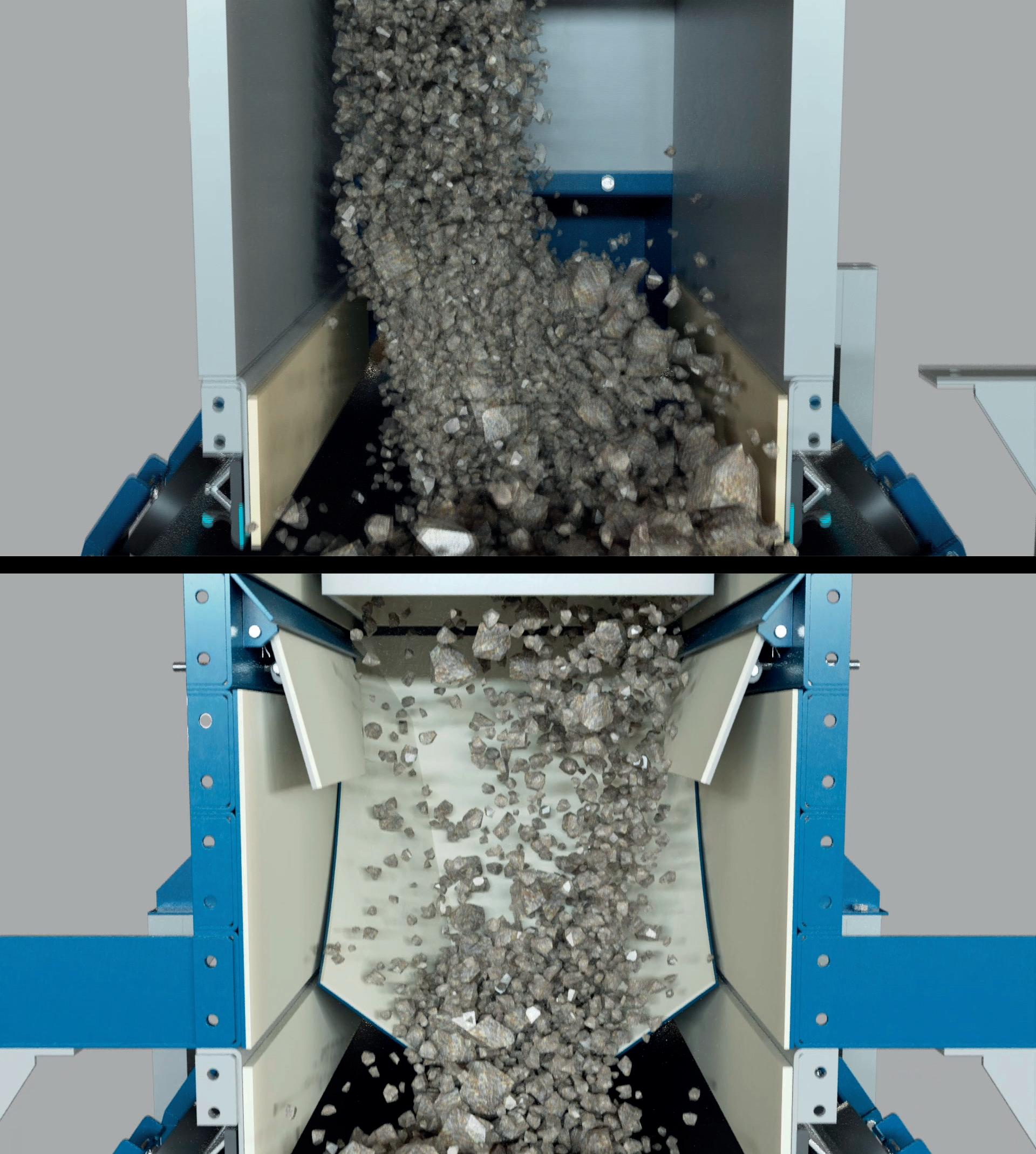

Part of the problem with conveyor belts is that there are multiple moving parts and various transfer operations that require attention. Fugitive dust is one of the primary problems that results from bulk material cargo moving from initial loading points to final discharge points throughout the system (Figure 1). It is estimated that approximately 85% of the fugitive dust and spillage issues occur at the transfer points between conveyors.

When material leaves the head pulley of the feed conveyor, it is not uncommon for the material stream to spread out, and launch with seemingly a ‘mind of its own’. As the material spreads out and gains surface area, it also induces air into the material stream. As a result, multiple problems are caused further down the material handling system.

In addition to induced air, the velocity of the material stream itself generates an air velocity which further captures the dust released by the turbulent material. Dust generation at the transfer point is increased even further when the material is allowed to impact the receiving conveyor, and is not properly contained.

These issues can become quite severe over time if the problems are not resolved quickly and effectively.

Today, however, plant managers and operators have a variety of innovative options to choose from, and can implement newer, highly effective technological solutions that actually eliminate the source of the problem, not just try to clean up the mess.

A properly-engineered transfer chute is one solution that can eradicate problems at the source, by forming a homogenous material stream as it transfers onto the receiving belt (Figure 2). Proper design incorporates both centre-loading of material onto the receiving conveyor, while soft-loading the material at approximately the same speed as the receiving belt. These systems are most common in retrofit applications and utilise laser point cloud scanning, as well as DEM modelling, to analyse flow through the existing geometry. That information is incorporated into the design of the new chute and containment structure. In many cases, properly-engineered designs operate without the need for additional dust control measures.

A lower cost, more budget-friendly solution involves simply correcting material loading at the point where it is deposited onto the receiving belt (Figure 3). This method combines containment areas with internal parts that can be maintained externally, in order to eliminate confined space issues and drastically reduce downtime when service or inspection is required. This technology uses a fully-adjustable loading spoon, as well as adjustable loading plates, to ensure centre-loading and soft-loading of the material onto the receiving belt. Due to the modular construction of the components, the need for hot work during installation, service, or repair is practically eliminated.

Another highly effective method is the use of modular components, particularly externally-adjustable wear liners. Modular components make replacement less difficult, and also enhance safety by reducing the need for housekeeping around and near rolling components. In most cases, maintenance can be performed by fewer people, due to ergonomic design and simplicity in repair and replacement requirements – without the need for confined space entry permitting. The wear liners can be replaced as needed from the outside of the containment zone in minutes, instead of hours, when full production is critical and downtime comes at a premium.

As mentioned previously, approximately 85% of the dust and spillage is created at transfer points; however, the remaining 15% can also be reduced by looking at another

potential problem: improper belt cleaning. Belt cleaning and the elimination of carryback on the bottom (dirty) side of the conveyor belt becomes a common culprit in this area. To simplify maintenance and service for proper tensioning of belt cleaners, an air tensioning system can be utilised. Secondary overlapping cleaning blades, made of tungsten carbide or ceramic, utilise dual tension relief for better pressure distribution, and can also be used to clean belts requiring belt clips or fasteners without damage to the cleaner blades (Figure 4).

A clean belt is much more likely to track properly and eliminate buildup from carryback materials which can build up on idlers, pulleys, and adjacent structures. Improper belt tracking also contributes to dust and spillage issues, as well as damage to the single most expensive item on a conveyor system; the conveyor belt. It is estimated that the conveyor belt can amount to

35% of the cost of the entire system, so it is important to avoid issues such as delamination from rubbing against structure, impact damage, and impingement issues arising from improper material loading.

It should also be noted that the belt has very little chance of containment for fugitive dust and materials at the load point if it is not centred under the load point at the load zone. Along with this, proper belt support is also very important for material containment and the elimination of dust and spillage in that area.

Another technology which introduces belt support with rolling components – as well as ease of service in areas where structural interference are common place – is a ‘drop and slide-in’ idler. Due to a narrower foot pattern, these idlers can be placed very close together in the impact zone, in order to provide under belt support to eliminate belt sag between rolls, and does so without friction due to the use of rolling components.

A benefit to this technology is that there is no friction and horsepower loss, which is common with alternative slider beds. This can be important to users that have the desire or need to reduce horsepower consumption without sacrificing sealing and performance. Slider beds are also subject to uneven wear and sealing difficulties after prolonged use, which contributes to fugitive dust and materials escaping at the load point. The service aspect and sealing advantage of a slide-in idler is enhanced by the ability to service and replace the idlers from one side of the conveyor. The idler allows tight spacing and removal of a single idler at a time. This also minimises difficulties in areas where structural interferences are present.

Last but not least, a recent particularly serious dust control issue is respirable crystalline silica. Both MSHA and OSHA are currently tightening compliance regulations and enforcement efforts. Preliminary testing of new technologies are achieving very positive results that can bring mining quarry operation into compliance. The system utilises a combination of dust collection and dust suppression. The dust collection filtration system – which purges on 20-minute cycles – is combined with a chemical binder for 20 sec. upon each purge cycle. The chemical binder agglomerates fine particulates into the material stream, and prevents re-release due to idler turbulence or subsequent transfer points.

This approach is used in respirable crystalline silica applications, where the very fine (1 – 5 µm) dust particles have caused serious concerns for personnel safety. To reduce exposure and health risks in areas where crushing and conveying creates respirable crystalline silica dust issues, those issues can be mitigated using this new development in engineering controls, for the reduction of respirable crystalline silica dust concerns in mining conveyor operations.

An apple a day keeps the doctor away. This phrase, while overused, offers an interesting point. There is something to be said about a person who looks at their current situation and makes choices that decrease future risk or increase the potential for prospective payoff. Now of course, this article is not about eating enough fruits and vegetables, but the true sentiment of the advice applies to a broad range of topics – including haul road maintenance.

Haul road maintenance can easily be categorised as just an unavoidable expense. While it is a fact that haul roads must be maintained, there are ways to decrease ongoing costs with preventative maintenance and boost efficiency in

the process – kind of like a person who eats an apple occasionally or lives a generally healthy lifestyle to lower their medical bills. Through preventative maintenance, operations can address areas that may seem small in the present moment, but reduce risk of more significant downtime and headaches in the future. The key is to incorporate equipment that helps operations realise the long-term benefits.

Every minute an operation spends on active haul road maintenance, such as clearing debris or bringing in additional material to repair the effects of wash boarding,

Josh Swank, Philippi-Hagenbuch Inc., USA, illustrates some new ways to increase efficiency and safety through haul truck customisations.

takes a minute away from producing and generating revenue. This expense significantly compounds over time. Consider also the cost of damaged tyres, and the financial benefit of proper haul road maintenance quickly adds up.

Mining operations can shell out over US$25 000 to replace just one tyre on a haul truck – not a cheap endeavour. Poorly maintained roads are harder on tyres, which causes them to wear out faster. Not only does this force more frequent replacement, which subsequently increases costs, but damaged tyres also impact operator safety, since a haul truck operating on even one problematic tyre can easily go out of control without warning.

Adopting preventative haul road maintenance practices that keep roads in good condition significantly reduces these costly risks. Additionally, it offers greater capacity for operations to focus on production and profit, rather than diverting resources to repairing roads and replacing tyres. Tailgates and custom truck bodies are two custom haul truck solutions that offer a significant benefit to tyre life, while addressing numerous other avoidable risks.

Good haul road health starts with prevention. Many haul roads contain an incline, so naturally gravity pushes the material to the back of the truck beds. When operations use standard off-the-shelf truck bodies, whether driving on the steep part of the haul road or not, material spillage is common because the truck body is not optimised for the material it is hauling and the open back allows gravity and bumps to slide material off the back onto the haul road. Haul truck customisations can address this issue and significantly reduce spillage.

Tailgates added to a standard haul truck allow operations to maximise capacity without risking material spillage. Without a tailgate, operators tend to adjust their loading strategy to decrease the amount of material they place in the truck, while also moving the loading target to the front of the body to prevent spillage. Because of this, trucks often carry 10 – 20% less than their rated capacity, and the additional weight in front leads to faster front tyre wear. This is simply not affordable. For example, consider a haul truck rated for 70 t that carries an average of three loads per hour. If that truck is hauling 12% less than its rated capacity, it can haul more than 200 t of additional sellable material over the course of an eight-hour day with the simple addition of a tailgate. While tailgates provide an excellent option to address spillage, mines can fully maximise hauling capabilities by replacing the OEM’s standard haul truck body with a custom-engineered body designed to fit the specific needs of the operation. Standard haul trucks are built with the premise of all materials possessing the same material density, resulting in a ‘one-size-fits-all’ approach. Alternatively, custom truck bodies take all aspects of the operation into account, recognising that properties of iron ore differ from those of overburden, coal, or fly ash. Custom bodies, optimised specifically for the properties of the material to be hauled, ensure maximum payload capacity. In mining, density varies significantly depending on the material being extracted. Custom truck bodies prevent hauling below capacity level, simply because space in a standard design is too limited to reach the gross vehicle weight with lightweight material.

Custom truck bodies are also designed to address spillage and ensure that the material stays in the truck and does not spill out the back or sides onto the haul road. They are engineered to match the body shape to the mine’s material, loading equipment and haul road inclines, in order to ensure the truck body is optimal for all aspects of the operation. Some manufacturers also add a liner to protect against abrasive or sticky materials that could cause extreme wear or carryback. Custom haul truck solutions – although more of an initial investment than generic, off-the-shelf options – benefit productivity by maximising the payload, decreasing costs related to haul road maintenance and reducing the carryback with each haul.

For smaller haul trucks, such as those used in quarries, gold mines and environments that use haul trucks in areas with

low overhead clearances, operations should consider a custom rear eject truck body. Like their counterparts, rear eject bodies are fully customised for the operation and designed to keep material in the truck and off the haul road. Rear ejects offer additional benefits for efficiency and operator safety. Rear eject bodies provide an ideal solution for constructing haul roads because they operate by pushing the material out the back of the truck body in a controlled fashion. This prevents the need to stop and raise the truck bed to dump material, and allows for a more even spread of the material along the haul road’s path. Additionally, rear ejects provide greater stability and the option to operate safely in low-clearance areas.

Once the initial phase of building the haul road is complete, operations can pair their rear eject with a material spreader attachment for finishing touches and ongoing maintenance. Material spreader attachments round out the haul road building process, as they fine-tune and place any additional material needed for a smooth surface. Later, material spreaders fill in maintenance gaps – both literally and figuratively – to maintain a good base layer of material, effectively addressing the washboard effects common on gravel roads. Some material spreaders handle aggregate material from very fine up to 2 in., with a spread width adjustable between approximately 5 – 60 ft or more (1.2 – 18.2 m).

The spreader attachment also increases haul road maintenance efficiency when dealing with the effects of winter weather. When snow and ice lead to dangerous haul road conditions, the traditional action is to dedicate crews of up to four people to spend a whole day spreading sand for safety. This reallocation of labour and resources negatively affects the mine’s overall efficiency. With a rear eject body and material spreader, a single operator can effectively distribute sand, grit or other crushed aggregate from the comfort of the vehicle’s cab, resulting in better workforce utilisation and increased productivity for the mining operation.

Another integral product for haul road maintenance is a water tank. Often overlooked in importance, the water truck serves as an important tool for meeting EPA dust restrictions and extending the life of the haul road. However, in order to maximise safety and efficiency, a customised solution offers the best option. By incorporating a custom water tank design, mines can convert an older haul truck into a water truck, extending the life of the truck and maximising its equipment investment. Properly spraying down haul roads prevents dust from migrating from the haul roads, thereby reducing the need to add more material as time goes on.

When looking for a water tank, the shape of the tank should not be overlooked. While it may seem insignificant, square tanks haul approximately 20% more water than round tanks with the same basic exterior dimensions. They also improve safety by creating a lower centre of gravity. The tank’s baffling system should also be designed to prevent water from churning and surging to improve stability and overall safety.

Additionally, it is important to look for a water tank that provides drivers with precise control of the tank’s water output. Individually controlled spray heads make it easier for drivers to optimise water use, while reducing the risk of oversaturating haul roads. With some systems, operators can turn on the individual spray heads and programme a spraying interval. By boosting precision in water output, operations can increase safety and efficiency.

When a mining operation sends a maintenance person or crew to clean and maintain a haul road, they give up the time that would otherwise be spent maintaining equipment. This impacts both productivity and the bottom line – 10 hr of haul road maintenance could equate to US$500 in labour expense – not to mention the additional expense in downtime and equipment utilisation.

It is a simple fact that risks such as these are a part of business. However, just as an apple may help decrease the risks that lead to a doctor appointment, certain preventative maintenance practices in mines offer the potential to decrease the risk of future challenges. Haul road maintenance is one of those practices that offers operations a way to minimise future risks simply by planning ahead.

Atilson Neto, Vale, Brazil, analyses how the latest innovations in autonomous and electric truck fleets can help decrease emissions and increase efficiency and safety in mine operations.

In the mining industry, the impact of climate change and how the industry can respond to it has increasingly been a topic of discussion over the past decade. While all business sectors feel the effect of climate change, mining companies often operate in inhospitable conditions and feel the immediate effect of heavy precipitation, drought, and other physical or climatic challenges to mining operations. However, many mining operations, such as Vale, also see the bigger picture, and are alligning with the

2015 Paris Agreement to limit global warming to 1.5˚C above pre-industrial levels.