OCTOBER 2024

VOLUME 7 ISSUE 9

OCTOBER 2024

VOLUME 7 ISSUE 9

10 The Future Of Mining In Asia

Olga Savina of BMI, a Fitch Solutions company, provides an outlook for the mining industry in Asia and evaluates the future opportunities and obstacles it may face.

16 Transforming Mining Operations With Multi-Orbit Satellites

Todd Cotts, Intelsat, outlines how multi-orbit satellite connectivity can accelerate digitalisation and optimise performance in the mining industry.

21 The Future Of Optimised Performance

Petro-Canada Lubricants explores the benefits of ultra-low zinc additives in transmission drivetrain oils.

24 Embrace Change Welcome Progress

Jevons Robotics, Australia, presents insights into the development process and benefits of a new battery electric, payload agnostic, autonomous vehicle for the mining industry.

27 Mind The Gap Part 2: Looking For Innovation In All The Right Places

Zach Savit, Stratom, USA, in the second of two articles, considers how sometimes innovation grows in the open, and sometimes you have to look for it.

30 Bringing Drones To Underground Surveying

Eloise McMinn Mitchell, Flyability, Switzerland, describes how the use of drones in underground surveys can improve safety protocols and the efficiency of data collection.

35 The Ongoing Journey To Minimise Unscheduled GMD Downtime

Maarten van de Vijfeijken, ABB, considers the benefits of remote monitoring platforms in decreasing the unscheduled downtime of gearless mill drives.

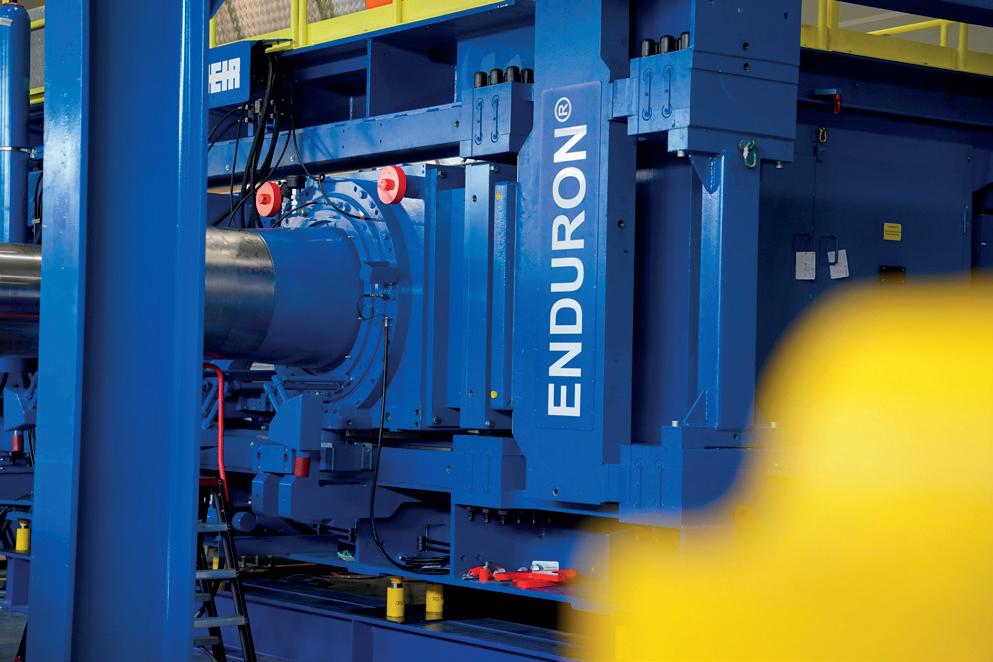

39 Rethinking Conventional Comminution

Bjorn Dierx, Weir, highlights the importance of adapting new, energy-efficient grinding technologies in order to improve the sustainability and cost-effectiveness of mining operations.

43 Real Time Quality Control

Henry Kurth, Scantech International Pty Ltd, addresses the rise of online analysers over traditional sampling in bulk material handling.

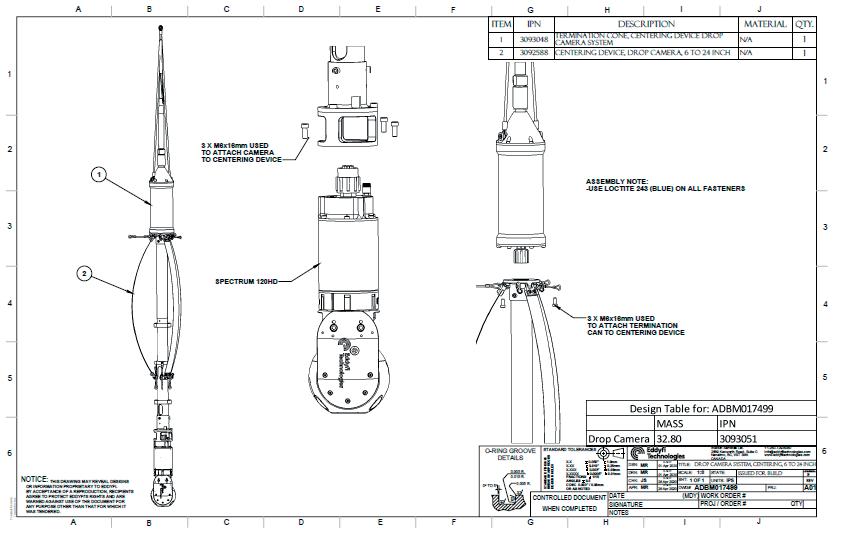

47 Tried And Tested

Philippe Cyr, Eddyfi Technologies, Canada, evaluates the advancements in non-destructive testing for mining applications.

50 Human Rights And Emerging Legal Risk In The Critical Minerals Sector

Peter Hood, King & Spalding, examines how new EU sustainability rules create unseen legal risk for non-EU companies in the mining sector.

53 From Drill And Blast To Surface Miners

Maggie Moller, Vermeer Corp., USA, and Alseny Conte, Compagnie des Bauxites de Guinée, Republic of Guinea, discuss how the implementation of surface miners can help mining operations become more efficient and less disruptive to neighbouring communities.

To address key industry challenges, mining equipment manufacturers are embedding fleet connectivity capabilities into heavy mining equipment to support telematics, vehicle monitoring, IoT strategies, automation processes, and remote-control operations. Intelsat’s portfolio of FlexMove services stands out in meeting the unique and evolving needs of the mining industry with its multi-orbit fleet connectivity solutions to ensure heavy equipment fleets remain connected everywhere, all the time.

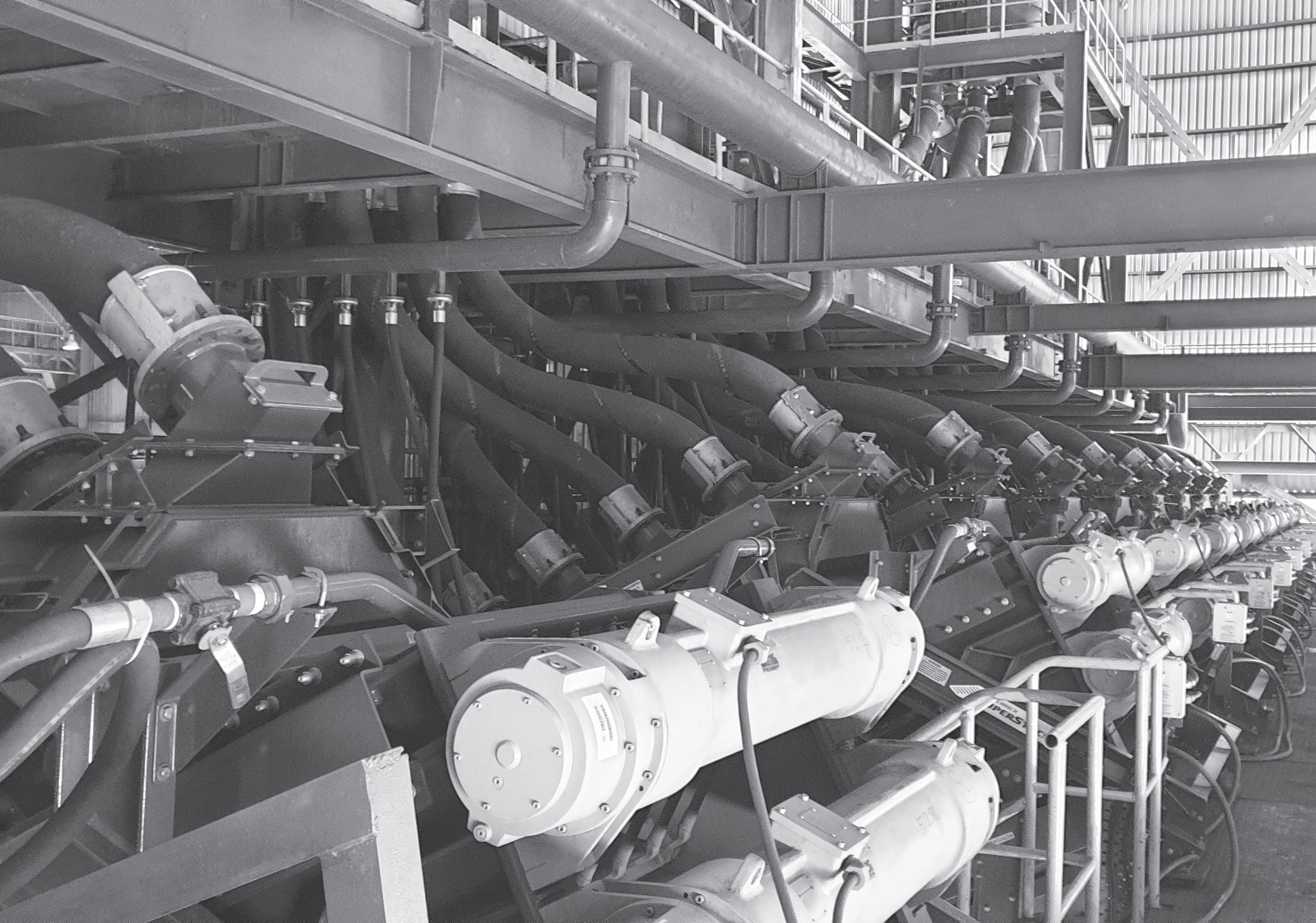

Derrick ® equipment is achieving higher quality product grades in Iron Ore, Gold, and Industrial Mineral operations around the world, saving on maintenance and infrastructure costs

MANAGING EDITOR

James Little james.little@globalminingreview.com

SENIOR EDITOR

Callum O’Reilly callum.oreilly@globalminingreview.com

EDITOR Will Owen will.owen@globalminingreview.com

ASSISTANT EDITOR

Jane Bentham jane.bentham@globalminingreview.com

SALES DIRECTOR

Rod Hardy rod.hardy@globalminingreview.com

SALES MANAGER

Ryan Freeman ryan.freeman@globalminingreview.com

PRODUCTION MANAGER

Kyla Waller kyla.waller@globalminingreview.com

ADMINISTRATION MANAGER

Laura White laura.white@globalminingreview.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@globalminingreview.com

DIGITAL CONTENT ASSISTANT

Kristian Ilasko kristian.ilasko@globalminingreview.com

DIGITAL EVENTS COORDINATOR

Merili Jurivete merili.jurivete@globalminingreview.com

HEAD OF EVENTS

Louise Cameron louise.cameron@globalminingreview.com

Global Mining Review (ISSN No: 2515-2777, USPS No: PENDING) is published 10 times per year by Palladian Publications Ltd., and distributed in the USA by Asendia USA, 701 Ashland Ave, Folcroft, PA. Application to Mail at Periodicals Postage Prices is pending at Philadelphia, PA, and additional mailing offices. POSTMASTER: send address changes to Global Mining Review, 701 Ashland Ave, Folcroft, PA. 19032.

Annual subscription (10 issues) £50 UK including postage, £60 overseas (airmail). Claims for non-receipt must be made within four months of publication of the issue or they will not honoured without charge.

SENIOR GLOBAL INDUSTRY LEAD, METALS & MINING, ASPENTECH

The mining sector has undergone a profound transformation over the past few decades. This shift from labour-intensive manual processes to technologically sophisticated operations has not only increased productivity, but has also enhanced safety and sustainability across the entire industry. The advent of geological modelling software, automated drones, and advanced fleet management systems has mitigated risks and boosted operational efficiencies, ushering in a new era marked by unprecedented advancements in mining technology.

Historically, mining was a gruelling process fraught with danger and inefficiency. Geologists and mining engineers spent countless hours manually drawing detailed maps and designs for mine development. Any unexpected changes in geological conditions required revisions that added significantly to their already-painstaking efforts. Moreover, the physical extraction of minerals involved laborious work in harsh and potentially dangerous conditions, often with limited regard for environmental consequences.

Today, the picture is strikingly different. Modern technology enables small teams of specialists to design, operate, and maintain mining operations with an unprecedented level of precision and safety. Advanced software not only models, but also simulates and optimises mining processes, reducing the time required to plan operations from months to mere days.

Despite these advancements, the integration of technology within the mining industry remains a significant challenge. The vast amount of data generated by disparate systems offers the potential for deep insights and operational efficiencies – if it can be effectively integrated and leveraged. However, the lack of interoperability among systems from various vendors and the fragmentation of data across platforms often hinder this potential.

This is where the importance of seamless integration comes into play. By facilitating effective communication between different technological systems, integrated solutions enable mining companies to optimise their operations, meet production targets, and maintain investor confidence. Such systems are not merely beneficial; they are essential for the continued growth and competitiveness of the mining industry in the global market.

In line with this, centralised data management solutions are critical. These systems exemplify the future of mining operations by enhancing real-time decision-making and operational transparency. With technologies that allow for the rapid analysis and application of data, companies in this space can more effectively manage modern mining challenges.

The transition to integrated technological solutions represents more than just an operational upgrade; it reflects a broader shift towards a more sustainable and responsible mining industry. By reducing the reliance on manual labour and increasing the use of data-driven strategies, mining can continue to meet the world’s resource needs without sacrificing safety or environmental integrity – all while delivering insights into higher levels of mining companies’ organisational structures.

Moreover, the integration of technology facilitates a better understanding of the mining process from start to finish, enabling companies to anticipate and respond to potential challenges with greater precision and in time frames that lead. This enhances operational efficiency, improves material recovery rates, reduces waste, and minimises environmental impact.

As we stand on the brink of a technological renaissance in mining, the industry must embrace the integration of these advanced systems across all aspects of the value chain. The journey towards fully integrated mining operations may be complex, but the rewards – increased efficiency, enhanced safety, and improved sustainability – are too significant to ignore.

In conclusion, the future of mining depends not just on individual technological advancements, but on our ability to integrate these technologies into a cohesive, efficient system and to generate insights from that data in meaningful actionable time frames. As mining operations become more complex and the demand for resources continues to grow, the successful integration of cutting-edge technologies will be crucial for the industry’s evolution. The time to invest in these technologies is now, to ensure a profitable, safe, and sustainable future for mining worldwide.

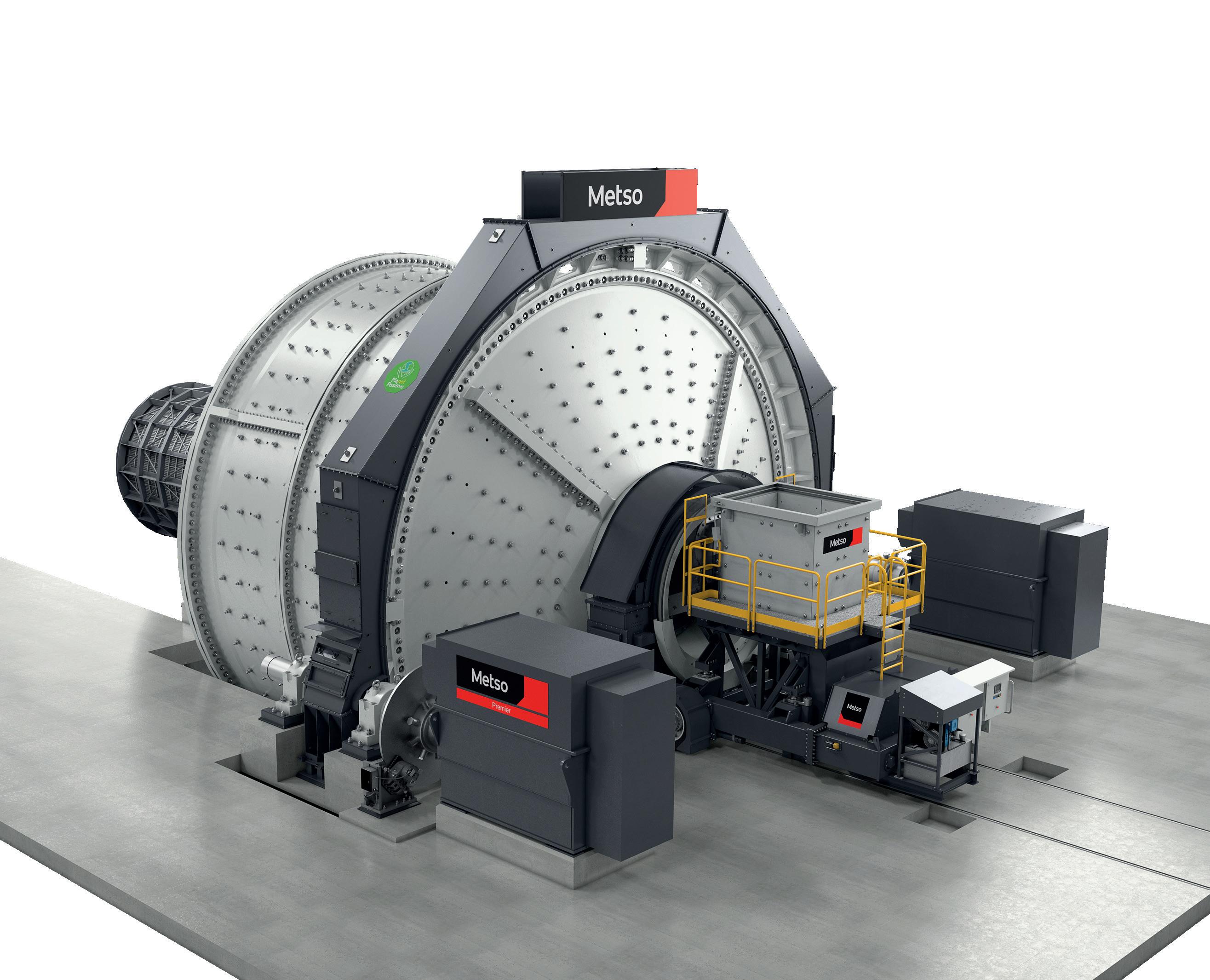

Grinding operations are unique and require expertise to find an optimal solution. Metso Premier™ horizontal grinding mills bring together limitless possibilities in design and unmatched performance to exceed your operational goals.

Epiroc and Fortescue have announced the handover of Australia’s first Pit Viper 271 E (PV271E) electric-driven blasthole drill rig at MINExpo in Las Vegas.

Marking a key milestone in Fortescue’s decarbonisation journey, the PV271E will soon be deployed at Fortescue’s Pilbara iron ore operations, making it the first electric PV271 in Australia to operate on a mine site.

This versatile drill rig is designed to enhance productivity while eliminating the need to operate on diesel. With the ability to drill single-pass holes up to 18 m deep and 270 mm in diameter, the drill rig has a 34 t bit load capacity, ensuring reliable operation across diverse mining conditions. Enhanced automation features also maximise safety and productivity, making the PV271 a crucial step forward for reducing emissions in mining practices.

President of Epiroc’s Surface Division, José Manuel Sánchez, said, “For Epiroc, partnering with Fortescue to deliver Australia’s first electric-driven autonomous Pit Viper drill is a milestone achievement in our shared pursuit of a zero emissions, sustainable mining industry. The electric-driven Pit Viper 271E, equipped with advanced automation features, will play a vital role in making mining more sustainable while ensuring safety and productivity.”

Fortescue Metals CEO, Dino Otranto, added, “At Fortescue, we’re moving at speed to decarbonise our iron ore operations by deploying a green mining fleet and locomotives. The deployment of the electric Pit Viper marks another milestone in our decarbonisation journey, and the first step in our ability to deploy zero emissions blasthole drill rigs across our sites.

By acquiring the Epiroc PV271 we’re proving that the technology for zero emissions mining is here, now.”

Liebherr and BHP have announced a Global Framework Agreement (GFA). This agreement further cements their long-standing partnership, uniting both companies in their shared pursuit of cutting-edge mining solutions.

Building on a history of successful collaboration, the GFA merges BHP’s drive for responsible resource extraction with Liebherr’s technological expertise in heavy machinery. Together, they aim to continue pushing the boundaries of operational efficiency while enabling greenhouse gas emission reductions for BHP’s operations.

“This extension is a testament to the strength of Liebherr’s relationship with BHP and our shared vision for the future of mining”, said Dr Jörg Lukowski, Executive Vice President, Sales and Marketing, Liebherr-Mining Equipment SAS. “Over the years, we’ve worked closely with

BHP to develop solutions that not only improve operational efficiency, but also drive more sustainable outcomes. We are excited to continue this journey and deliver the latest advancements in automation, digitalisation, and electrification to their operations globally.”

Under this agreement, Liebherr and BHP will collaborate closely on delivering world-class machine performance and integrating the latest advancements in safety, automation, digitalisation, and electrification across BHP’s global mining operations.

BHP’s Chief Commercial Officer, Ragnar Udd, added, “This renewed agreement between BHP and Liebherr not only reaffirms our trusted partnership over the years, but also signals our collective ambition towards helping to influence the future of mining.”

China Mining Expo

23 – 25 October 2024

Xi’an, China www.chinaminingexpo.com

Mining, Metals, and the Circular Economy

29 – 30 October 2024

Sydney, Australia www.imarcglobal.com/miningcircular

IMARC

29 – 31 October 2024

Sydney, Australia www.imarcglobal.com

The Mining Show

26 – 27 November 2024

Dubai, UAE www.terrapinn.com/exhibition/ mining-show/

Resourcing Tomorrow

03 – 05 December 2024

London, UK www.resourcingtomorrow.com

Investing In Africa Mining Indaba

03 – 06 February 2025

Cape Town, South Africa www.miningindaba.com

SME MINEXCHANGE

23 – 26 February 2025

Denver, USA www.smeannualconference.org

PDAC

02 – 05 March 2025

Toronto, Canada www.pdac.ca/convention

GRX25

20 – 22 May 2025

Brisbane, Australia www.grx.au

To stay informed about upcoming industry events, visit Global Mining Review’s events page: www.globalminingreview.com/events

To expand its artificial intelligence (AI) capabilities and help customers optimise their mining operations, Komatsu has announced its intent to acquire Octodots Analytics, a Chile-based digital solutions provider.

The announcement comes as the company debuted its new Modular ecosystem, a bold vision for the future of mine site optimisation and data sharing, at MINExpo 2024 in Las Vegas. Building upon Komatsu’s DISPATCH fleet management system, the Modular ecosystem is a set of interconnected platforms and products designed to simplify existing workflows.

“Our ecosystem is designed to empower customers to optimise decision making at the machine, mine site, and enterprise levels,” said Jason Fletcher, SVP Mining Technology Solutions, Komatsu. “Octodots’ expertise and solutions map perfectly to what we’ve created and we are excited about the opportunities to incorporate their products and capabilities into our offering.”

Since 2017, Octodots Analytics has been developing and commercialising advanced digital solutions for industries including mining, construction, forestry, transportation, and more. The company’s multidisciplinary team has particular expertise in three key areas: mining engineering, transportation, and data science.

Barrick Gold Corporation has awarded Metso a major order for the supply of copper concentrator plant equipment to their Lumwana expansion project in North-Western Province in Zambia.

Metso’s scope of delivery includes key equipment for grinding, flotation, thickening, feeding, and filtration. The value of the order is approximately €70 million, and it is booked in the Minerals segment’s 3Q24 order intake.

“We are honoured to have been selected by Barrick as the strategic partner for this project. The copper concentrate production process in Lumwana has been designed with sustainability and production efficiency in mind, with most of the equipment selected from our Planet Positive offering,” said Markku Teräsvasara, President of the Minerals business area and Deputy CEO of Metso.

Lumwana is a significant contributor in Barrick’s expanding copper portfolio, catering to the rapidly increasing demand for copper required for the energy transition. The project is also elemental in reviving Zambia’s copper industry and contributing to the local economy. The expansion will turn Lumwana into one of the world’s major copper mines, with projected annual production of 240 000 tpy of copper.

Thiess and FLANDERS have signed an agreement to collaborate on bringing fleet decarbonisation options to mine owners in North America and a Letter of Intent (LOI) for Australia and Asia, reducing emissions and improving efficiencies of mining operations.

Up to 80% of direct greenhouse gas emissions at a mine site originate from fossil-fuelled mining vehicles, making mining fleet decarbonisation a key priority for mine owners targeting net zero carbon emissions by 2050.

Thiess Group Executive Chair and CEO Michael Wright said: “This collaboration will bring together Thiess’ 90 years of mining and asset management experience with FLANDERS’ innovative FREEDOM® hybrid haul truck solutions – designed to deliver up to 30% fuel savings, reducing greenhouse gas emissions and enhancing productivity.”

FLANDERS Chief Commercial Officer, Wayne Chmiel, added: “Recognising both the need and opportunity in the global mining marketplace for retrofittable agnostic technology solutions and services, FLANDERS is proud to work with Thiess to combine Thiess’ world-class expertise in running multi-brand fleets at the lowest cost per tonne for loading and hauling, with FLANDERS world-class expertise in retrofittable agnostic mining technology solutions.

“This collaboration will help miners ‘dCarbonise and dCost’, allowing customers to reduce their carbon emissions while reducing overall cost per tonne.”

In addition to the technological innovations outlined above, Thiess and FLANDERS will work together to ensure Thiess’ highly skilled maintenance workforce is equipped with the latest expertise to diagnose, troubleshoot, and innovate electrical systems and emerging technologies in the mining sector.

Nouveau Monde Graphite has awarded ABB a contract to supply, construct and commission the 120 kV substation for its Phase-2 Matawinie Mine in the province of Quebec, Canada, as part of the construction preparation for the establishment of a 103 000 tpy graphite mining and concentrator complex.

Located 120 km north of Montreal, the Matawinie Mine will be connected to the provincial hydropower network, enabling the access to clean energy to support mining activities and concentrator production of carbon-neutral graphite concentrate destined for the lithium-ion battery market. Nouveau Monde Graphite is set to equip the Matawinie Mine with a zero-emission mining fleet and associated charging infrastructure, which would make it the world’s first all-electric opencast mine when it starts operating.

“We are excited to move one step closer to building the mine of the future, powered by clean energy to responsibly extract and produce a critical mineral for global decarbonisation”, said Eric Desaulniers, Founder, President, and CEO of Nouveau Monde Graphite. “Our environmental stewardship and innovative mindset have been matched by the team at ABB, from the commencement of our electrification journey, to translate our vision into reality.”

A recognised global leader in mine electrification with its ABB eMine™ portfolio of solutions, ABB will lead construction of the substation as the primary connection point between the mine site and Hydro-Québec’s hydropower generation facility, enabling full electrification of the Matawinie Mine using clean energy.

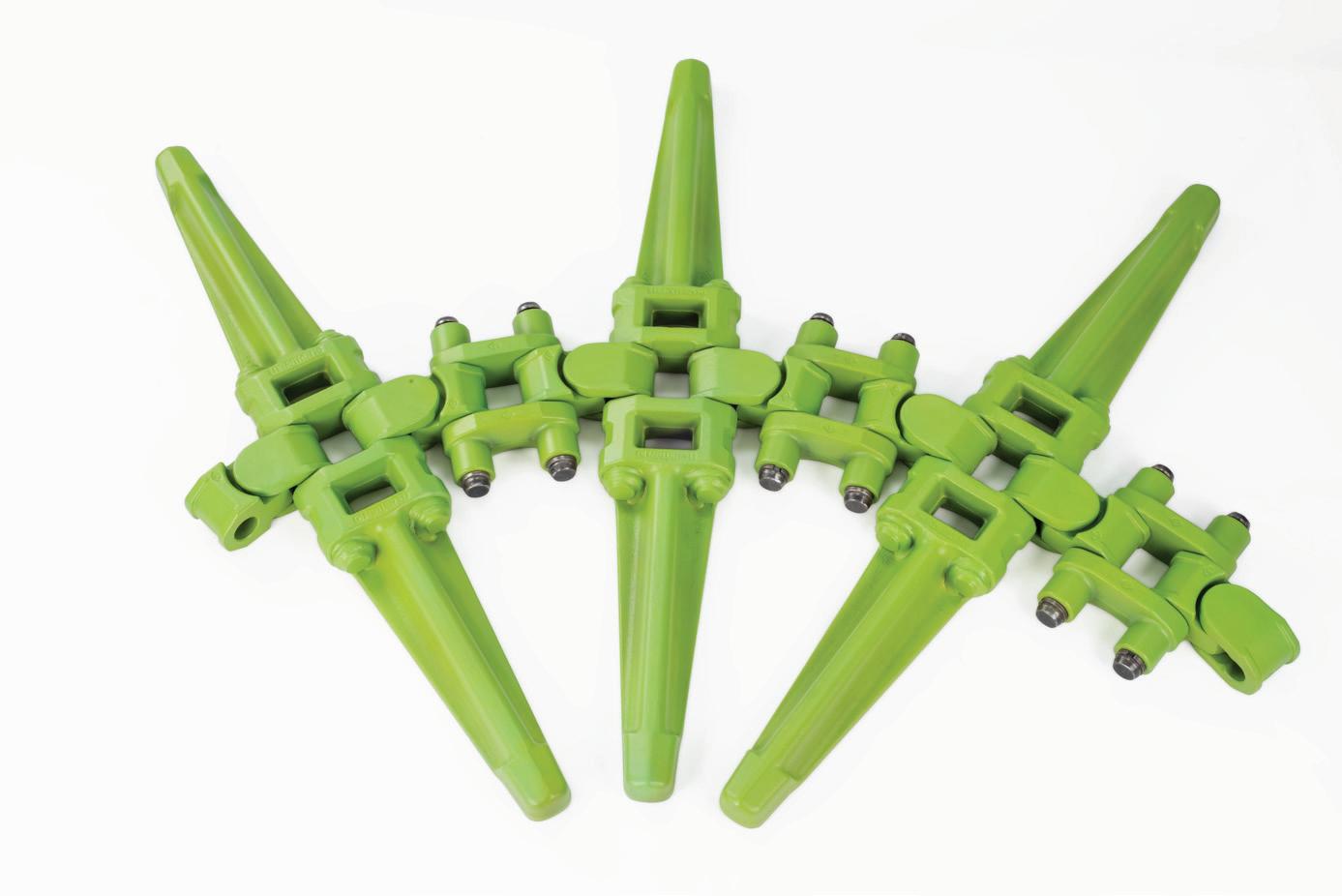

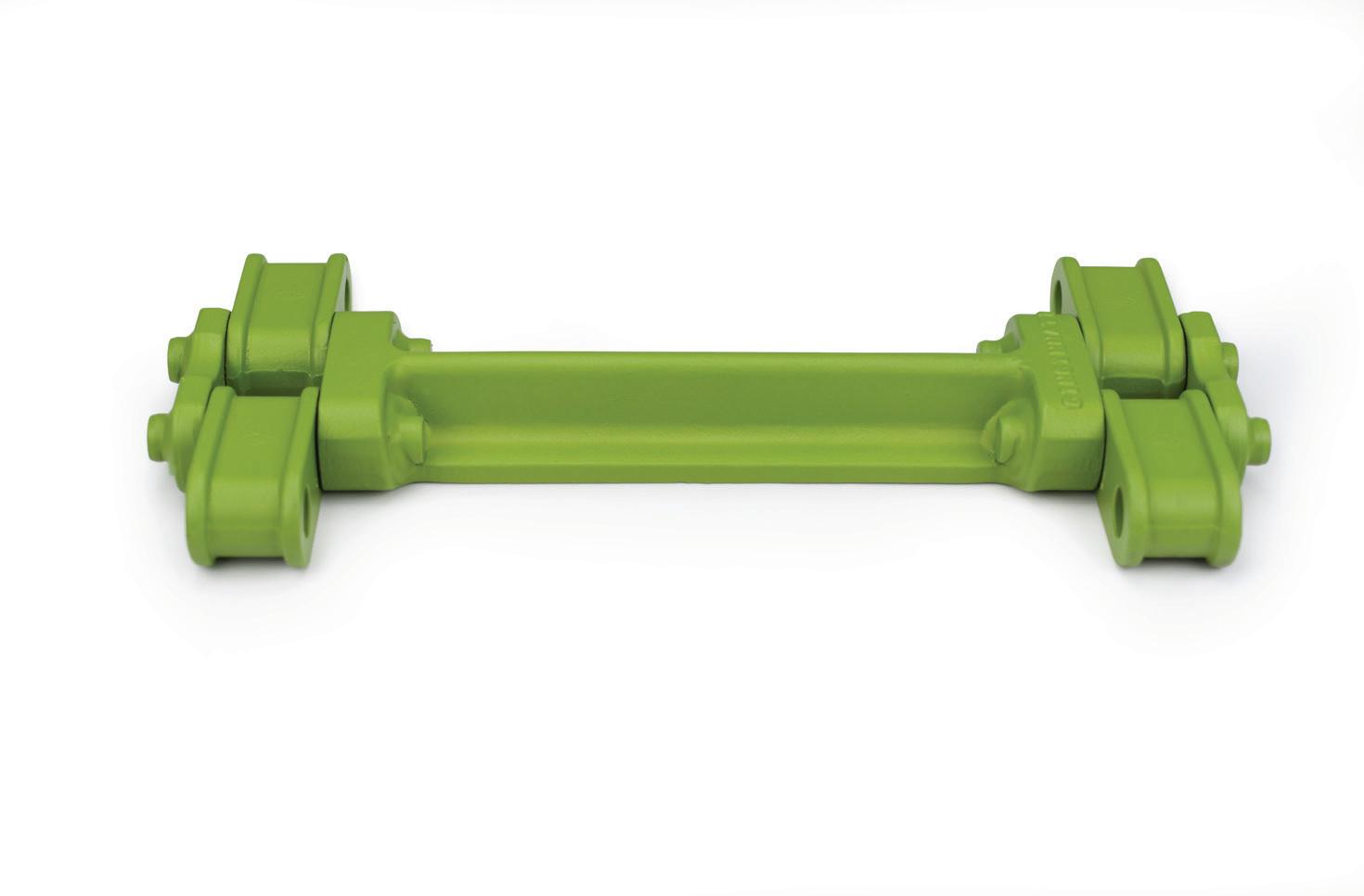

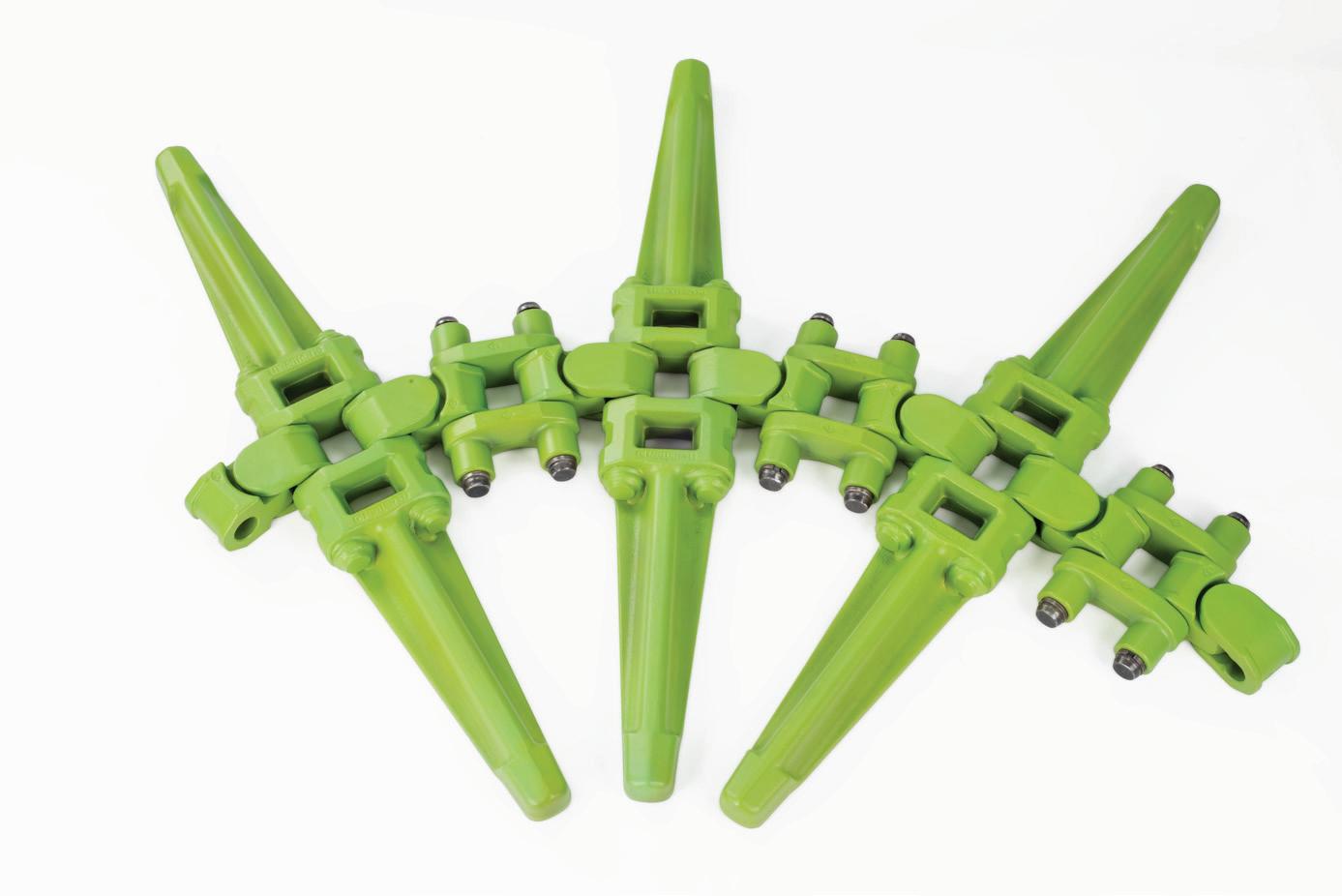

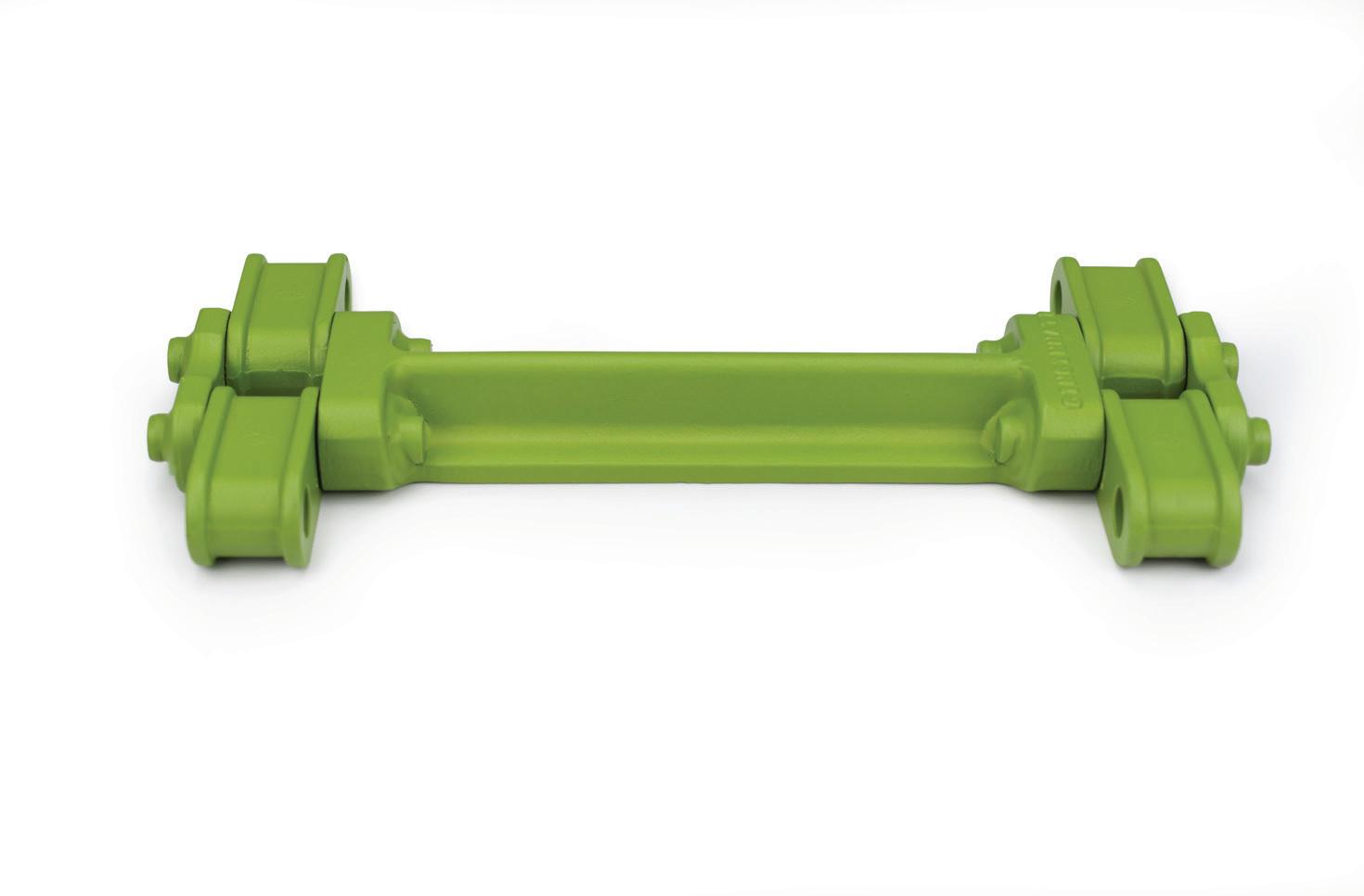

ADVANCING SIZER TECHNOLOGY FOR A MORE SUSTAINABLE MINE

More than four decades ago, we innovated the Mineral Sizer™ to help underground coal mines break coal more efficiently and effectively whilst also increasing productivity.

Through continuous innovation, the MMD Mineral Sizer has evolved into a unique range of dependable solutions and systems, capable of efficiently processing any combination of wet, sticky, hard, dry and abrasive material.

Whether its a Sizer or complete Sizer Station, each machine is optimised to suit your exact requirements. Our experienced teams of professionals work closely with customers to provide an efficient solution that offers low total cost of ownership and contributes towards wider net carbon zero targets.

Discover our Sizer solutions +

Olga Savina of BMI, a Fitch Solutions company, provides an outlook for the mining industry in Asia and evaluates the future opportunities and obstacles it may face.

This article will discuss five key themes set to shape the mining industry across the Asia-Pacific region in the coming years.

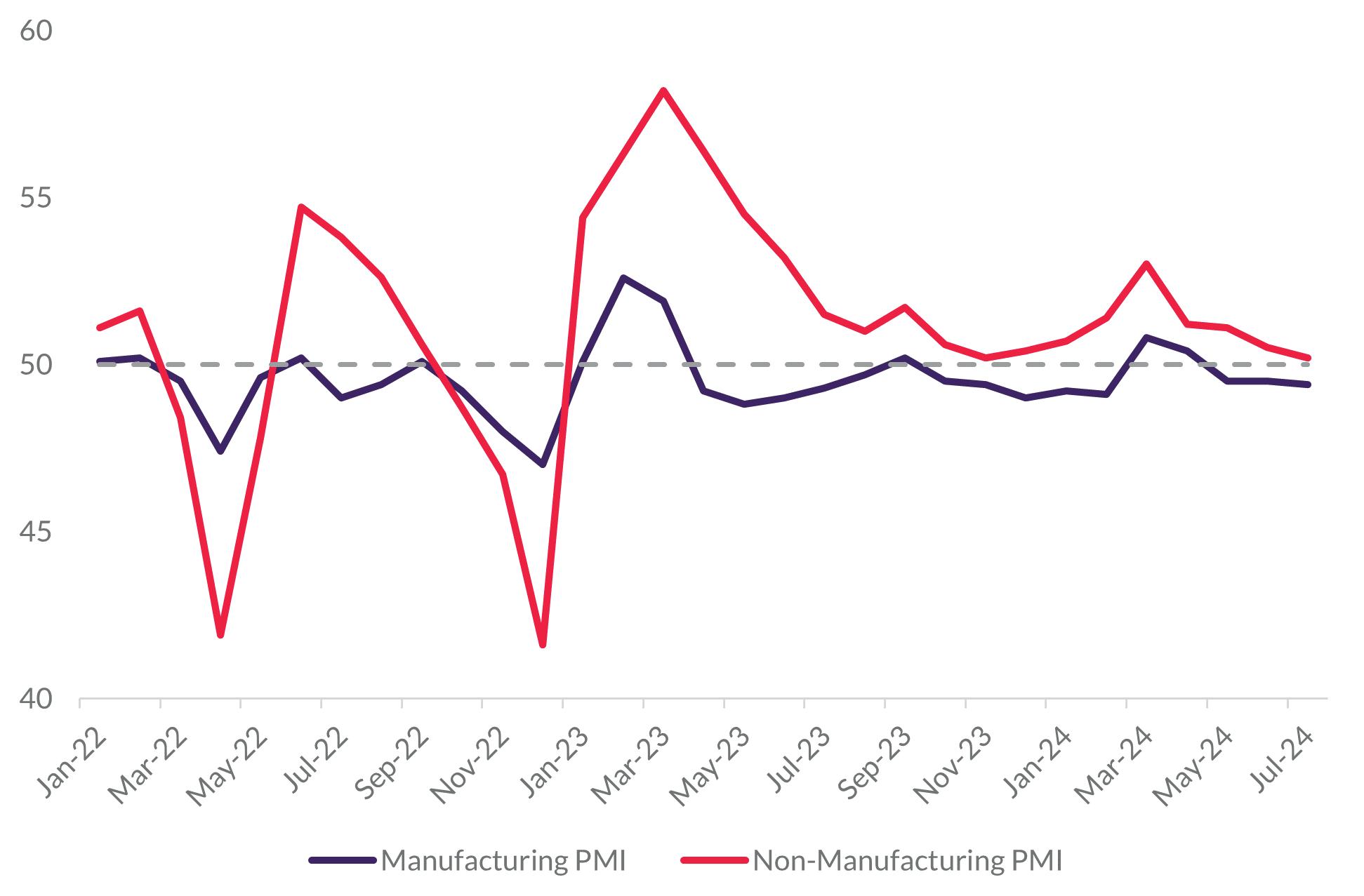

In 2024, it is expected that Mainland China’s mining industry value will decline by 16.7% y/y due to weak

industrial growth for the main sectors, as well as a relatively lower price outlook for major commodities, including coal. The Chinese economy continues to face a number of downside risks, with its struggling real estate sector front and centre. In 2Q24, real GDP growth fell to 4.7% y/y, down from 5.3% in the previous quarter, underperforming nearly all analyst forecasts. BMI’s Country Risk team expects China’s GDP growth to slow down in 2024 to 4.7% y/y, with the economy missing the

government’s growth target of around 5.0%. It is also evident that the country’s recent official manufacturing PMI remained in contractionary territory for the third consecutive month in July, with a reading of 49.4 (June: 49.5), highlighting the potential for weaker metals demand in the leading consumer globally. At the same time, continued weakness in the Chinese property sector, which has been weighing on overall economic growth, has significant implications for the

metals market. China is the world’s largest consumer (as well as producer) of industrial metals and coal, with the property sector being a major source of demand across a broad spectrum of the metals market, including steel, iron ore, coking coal, and more. BMI’s Country Risk team believes that China’s housing downturn is likely to last for years, driven by an oversupply amid waning speculative demand. Meanwhile, developers face a credit crunch and repairing the sector’s balance sheet is

expected to take years. Additionally, homebuyers are likely to stay away due to falling prices, stretched valuations, and the risk that developers may not complete their homes. On 17 May 2024, authorities in Mainland China announced more measures aimed at shoring up the housing market, including lowering mortgage rates and down-payment ratios. The most notable of these was the CNY300 billion in central bank funding to support state firms in purchasing completed but unsold houses from developers. That said, BMI’s Country Risk team maintains scepticism about whether this will drastically change household perception of the property market outlook, which is crucial for improving consumer confidence, highlighting that the end of China’s housing crisis is not yet in sight. As of July 2024, the ongoing property downturn still shows little sign of reversing, with investment in the real estate sector

declining by 10.1% y/y over January – June 2024. BMI also highlights that the outcome of China’s Third Plenum at the end of July did little to alleviate concerns.

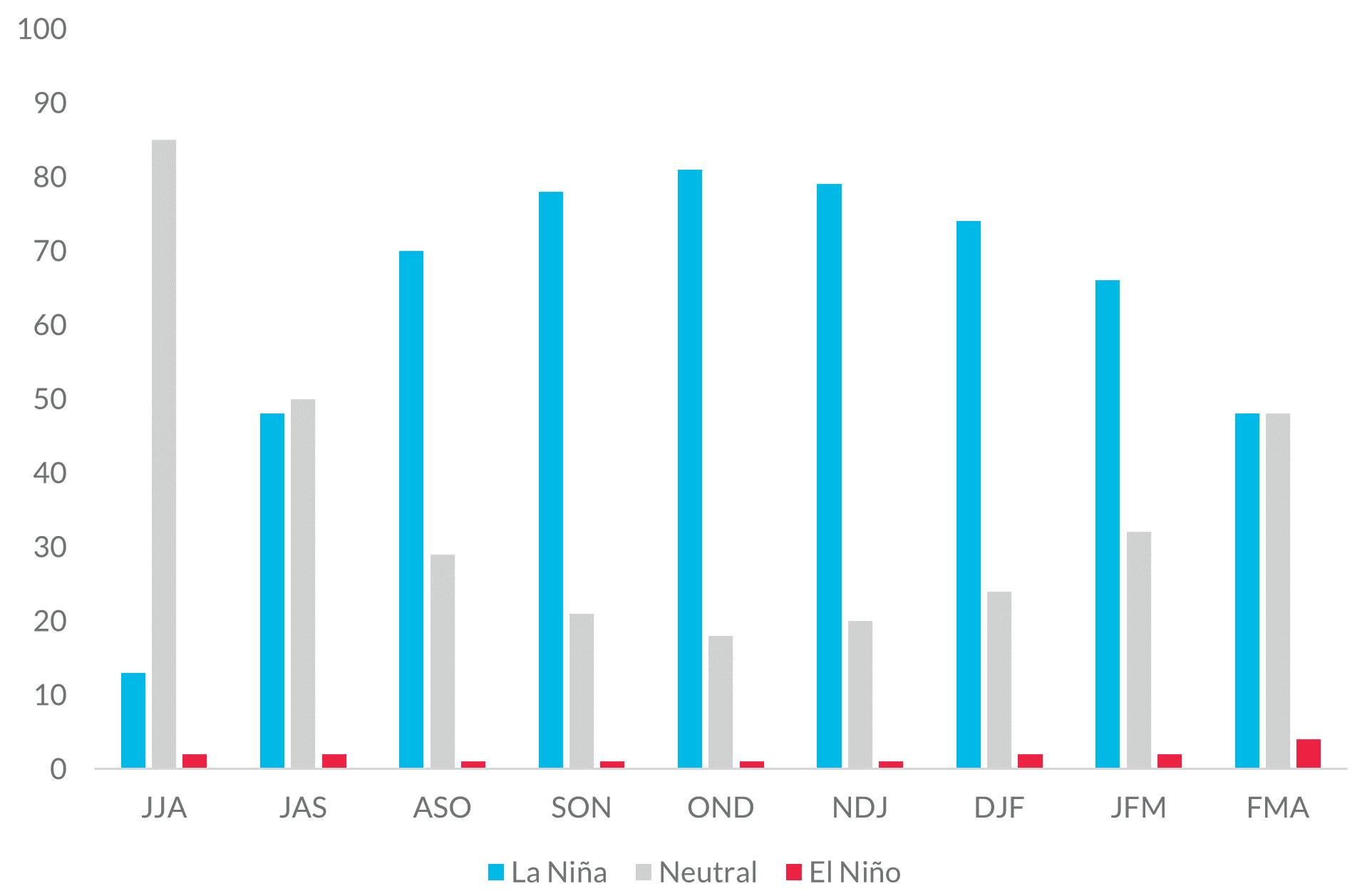

According to the July 2024 update from the US Climate Prediction Center, La Niña is expected to develop during August – October 2024, with a 70% likelihood, and persist into the Northern Hemisphere winter into the end of 2024 and the beginning of 2025, with forecasts indicating a 79% chance of continuation through November –January. While the exact impact of La Niña remains uncertain and subject to its intensity and duration later in 2024, the potential negative effects serve as downside risk to BMI’s regional outlook.

As opposite to El Niño, La Niña is characterised by cooler-than-usual sea surface temperature in the equatorial Pacific, caused by the strengthening of trade winds that increase the upwelling of cold water. This phenomenon typically leads to above-average rainfall in Southeast Asia and Australia. La Niña is usually defined by the Oceanic Niño Index (ONI) as a sustained cooling of the sea surface temperatures in the Niño 3.4 region, with values less than -0.5°C. As a rule, La Niña events occur every 2 – 7 years and typically last for 9 – 12 months, though they can occasionally extend over several years.

Should La Niña materialise in the second half of 2024, mining companies in the region could face heavy rainfall and flooding, potentially disrupting mine operations and logistical infrastructure. In Australia, the previous 2020 – 2023 ‘Triple-Dip’ La Niña episode and associated heavy rainfall and flooding disrupted coal mines in New South Wales and Queensland. Wet weather conditions boosted by the 2020 – 2023 La Niña episode also wreaked havoc in Indonesia, bringing flooding and landslides and affecting mine sites.

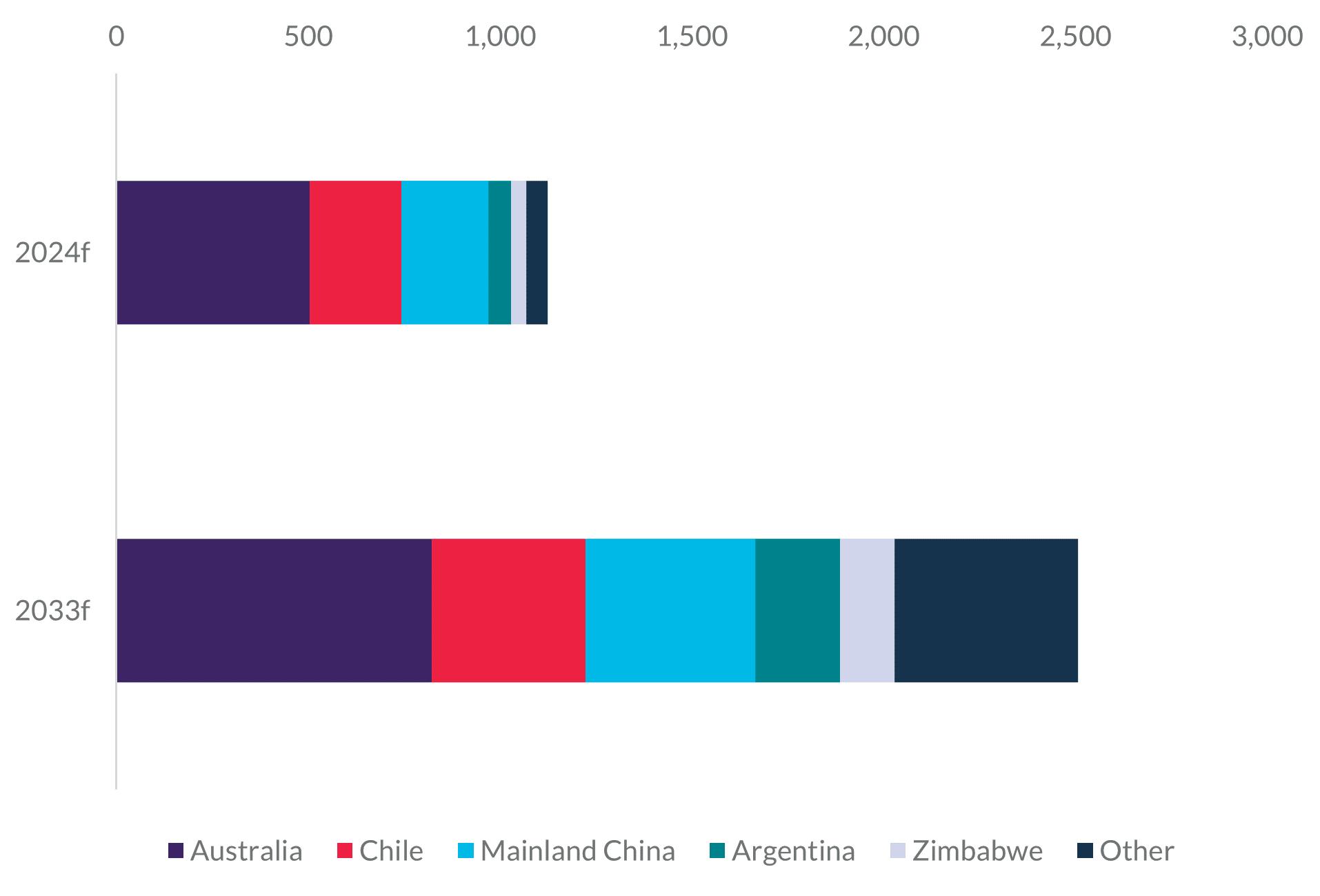

Asia will maintain its leading role in the absolute production of lithium concentrates through Australia,

which is expected to remain the world’s top producer, bolstered by its strong projects pipeline. Mainland China will continue to import lithium concentrates for its battery industry while investing to expand its domestic production capacity and securing the lithium supplies by developing projects overseas.

According to the USGS, in 2022, out of 777 kt lithium carbonate equivalent (LCE) produced globally, 518 kt LCE was produced in Asia, with Australia accounting for 398 kt LCE and Mainland China the remaining 120 kt LCE. Australia is by far the world’s top producer of lithium, accounting for more than 51% of global lithium production in 2022, and with a strong project pipeline, it is expected that the country will maintain its dominant position in the global lithium market for years to come. Lithium production in Australia is dominated by hard rock spodumene, with Western Australia providing almost all of the country’s lithium production, mainly due to its attractive export infrastructure and geographical proximity to Asian markets. Globally, Mainland China is the largest consumer of lithium, due to the size of its battery manufacturing industry for electric vehicles (EVs), renewable energy systems, and consumer electronics, and the market is expected to continue investing in lithium projects worldwide, as well as in research and development to increase extraction domestically.

As for the lithium refining market, Asia-Pacific is also expected to remain among the dominant forces behind the supply of lithium chemicals. Notably, Mainland China dominates both lithium carbonate and lithium hydroxide production, and Australia has been also actively seeking to gain a bigger share of lithium processing and refining capacity. As Western markets seek to reduce a keyman risk in China’s supply of refined lithium, Australia stands to benefit by introducing domestic refineries and processing plants close to its lithium mines.

Australia is expected to outperform other markets in the Asia-Pacific region in terms of growth and investment in the mining industry. Specifically, Australia is well-positioned to benefit from the battery revolution, with strong cobalt and lithium projects. Additionally, the Australian government is strongly focused on critical minerals, aiming to enhance the attractiveness of Australia’s mining regulatory environment. In June 2023, Australia released its new Critical Minerals Strategy 2023 – 2030, focusing on seizing its critical minerals opportunity.

Moreover, Australia is poised to be the global and Asian mining industry leader in the adoption of technology to reduce costs, improve efficiency, and enhance mine safety. This advantage is attributed to the country’s strong network connectivity, reliable power supply, highly skilled labour force, and government support. The mining landscape is currently experiencing a technological disruption, where companies are at a crossroads between the traditional practices of the past and a transformative, sustainable future. State-of-the-art mines incorporate cutting-edge technological innovations such as cloud computing, advanced sensors, drones, increased automation, and the integration of machine learning and artificial intelligence. Decarbonisation efforts will also be increasingly relevant for the mining sector as firms seek to reduce emissions across their supply chains.

Carbon emission reduction and environmental concerns are expected to be at the forefront of priorities for mining companies in the region over the coming years. The shift towards a low-carbon economy will incorporate changes to regulatory frameworks, becoming less favourable to highly pollutive mining operations. Notably, China is expected to continue ramping up environmental regulations. Since its 2020 pledge to reach carbon neutrality by 2060 and its plan to achieve peak carbon emissions before 2030, China has made notable steps to reduce its carbon intensity. China emits the largest amount of emissions in the world, with its mining industries contributing significantly to the country’s pollutive nature.

As for Australia, miners in the country are likely to face growing pressures to reduce their environmental impact by incorporating cleaner power sources into mining operations and shifting away from coal. Expanding mining operations could face greater scrutiny, require more regulatory approval, or even encounter community and political pushback.

Todd Cotts, Intelsat, outlines how multi-orbit satellite connectivity can accelerate digitalisation and optimise performance in the mining industry.

The mining industry remains in the throes of a digital transformation. With increased frequency, mining owners and operators continue to adopt and deploy new technologies and connected applications to enhance productivity, reduce costs, improve workplace safety, comply with always-emerging regulatory requirements, and overcome rampant labour shortages using remote control and autonomous operations.

Mining organisations are turning to technology and connectivity solutions to address and overcome several key industry challenges, which include the following:

The global need for the earth minerals extracted by mining companies continues to rise. Benchmark Mineral Intelligence projects that 384 new mines will be needed just to meet demand for materials to manufacture batteries for electric vehicles, smartphones, solar panels, and wind turbines. To meet expanding demand, existing mines will need to operate with maximum productivity and efficiency, while new mine site exploration will need to happen with greater speed and expediency.

A wide range of heavy industries continue to struggle with labour shortages, and mining is no exception. According to the Society for Mining, Metallurgy & Exploration, more than half of the US mining workforce is ageing and expected to retire by 2029. 1 Candidates for replacements are in short supply, with mining employment having fallen by more than 20% over the past decade in the US. 2 The lack of talent and migration of workers to new industries have dramatically impacted the ability of mining companies to recruit and retain talent, making the need to leverage autonomous and remote control solutions all the more urgent.

The World Economic Forum estimates that heavy industries are responsible for nearly one-third of the world’s carbon emissions. 3 The mining industry alone is believed to be responsible for nearly 10% of global greenhouse gas emissions. 4 As governments and regulatory bodies continue introducing additional

requirements to curb environmentally harmful practices across all industries, mining owners and operators are challenged to achieve compliance and avoid costly financial penalties.

Worker safety is always a pervasive and dominant issue in an inherently dangerous business. According to UN reports, heavy industries like mining, construction, and transportation account for a high percentage of the 2.78 million occupational deaths each year. The US Bureau of Labor Statistics reports that mining ranks highest in fatal work injury rates. Despite advances in technology and workplace practices and training, mining fatalities still saw a 31% increase in 2023. 5

In response to these and other challenges, and in an effort to remain competitive, mining companies are turning to digital technologies and solutions that can connect people and assets, capture and transmit data, and improve the sustainability and safety of operations. At the same time, mining equipment manufacturers are embedding fleet connectivity capabilities into heavy mining equipment to support telematics, vehicle monitoring, IoT strategies, automation processes, and remote-control operations.

The increased presence of digital applications and connected solutions, as well as the requirements to capture and transit data in real time, are driving demand for robust, ubiquitous connectivity at all times and in all locations.

According to ABI Research, heavy industries that leverage 5G for connectivity solutions in their workplace environments experience a significant lift in operational performance, worker productivity, reductions in costs, and enhanced efficiencies across all aspects of the business. As the era of digitalisation progresses in the mining industry, the significance of having access to reliable connectivity will become a critical, non-negotiable requirement.

However, 5G coverage is typically only available in populated urban and suburban areas, where mines are rarely to be found. To ensure mining operators can enjoy these same benefits of connectivity in rural and remote locations, addressing and closing gaps in terrestrial coverage is vital. Reliable connectivity must be available in the remote locations where many mines are typically situated, often outside the footprint of terrestrial and cellular reach. For this reason, satellite-powered communications must be part of any mining operators’ communications solution suite.

Satellite-powered connectivity solutions are more powerful, resilient, reliable, cost-effective, and accessible than ever before, offering mine owners and operators an ever-broadening range of benefits and value that include the following:

Satellite network solutions offer a degree of flexibility unmatched by cellular, fibre, or the low power wide area network technologies that have typically powered connectivity at mining sites. Maintenance of these legacy networks is complex, requiring ongoing investments in new infrastructure as connectivity needs and locations change. With an expansive and unhindered view of the planet, satellites can provide the expanded coverage mining companies need to power mobile applications and connected equipment as conditions change on the ground, new applications are introduced, and communications requirements emerge.

Satellite solutions can serve as either a primary or redundant source of connectivity for mining users. They can play a critical role in delivering enhanced communication redundancy and expanding the reach of terrestrial networks to ensure that cellular-connected heavy equipment is able to continue operating anywhere on the worksite that might be situated outside the wireless network coverage footprint.

When connectivity-on-the-move is needed to power the critical mobile applications that enable miners to have the situational awareness they crave, the capabilities of satellites to provide coverage across the vastness of the

Earth make it the ideal connectivity solution. It is the continuous coverage by satellites, accessible simply by having line of sight to the sky, that makes telematics and predictive maintenance – as well as autonomous and remote operations – possible.

The advent of multi-orbit satellite connectivity is poised to further deepen the inherent value of satellite connectivity for mining owners and operators. By combining the breadth, reliability, and global coverage offered by geostationary satellite constellations with the low latency capabilities of low-Earth orbit (LEO) constellations, satellite solutions can meet the performance standards demanded by data-hungry applications in use across the mining industry. Multi-orbit high-throughput connectivity solutions ultimately deliver the speed, coverage, and latency that allow mining companies to maximise investments in connected equipment and real-time data applications.

Satellite-connected solutions once suffered from negative perceptions related to cost and complexity, some of which were justified. Today, mining operators and heavy equipment manufacturers can leverage the power of satellites to digitally transform their operations and generate new streams of revenue from machinery-as-a-service models at highly competitive cost points. Furthermore, the costs of deploying satellite solutions are now favourable compared to 5G, which requires significant capital investment for small cell base stations, spectrum licences, terminals, fibre connections, and a range of other fees that drive OPEX. ABI Research estimates that, over a five-year period, the costs for deploying a multi-orbit HTS satellite solution at a mining site would be lower by 67%.

As mining companies continue to face increased pressure to meet carbon neutrality goals, satellite-powered connectivity solutions can power the applications that help mining operators decarbonise, reduce greenhouse gas emissions, achieve sustainability goals, and remain in compliance with the always-emerging regulations that vary by country, state, county, and province. Satellite connectivity powers applications that can be used to optimise routing and travel of heavy vehicle equipment, reducing idle times, fuel consumption, and energy usage. Miners can more easily access real-time telematics data to monitor performance of equipment, all of which can lead to more efficient operations that dramatically reduce carbon and greenhouse gas outputs.

Among today’s satellite connectivity solutions available to mining owners and operators, Intelsat’s portfolio of FlexMove services is able to meet the unique and evolving needs of the mining industry.

FlexMove, Intelsat’s flagship managed service for high-throughput connectivity for communications-onthe-move (COTM) and communications-on-the-pause (COTP) applications, delivers flexible, enterprise-grade satellite connectivity that keeps crews reliably connected to company networks and the cloud anywhere, even in the most remote locations. FlexMove powers COTM connectivity for trains transporting mining product from the site to the next destination and within on-site offices, and provides portable, backpack-friendly COTP solutions for temporary fixed use in remote field operations.

FlexMove Fleet is Intelsat’s advanced high-throughput fleet connectivity solution for heavy equipment, as well as on and off-road mining transport vehicles. Accessible via a lightweight, flat-panel, all-in-one antenna that affixes quickly to mining vehicles, FlexMove Fleet gives mining companies the ability to remotely monitor and manage heavy equipment fleets in a single or across multiple locations, no matter how remote.

FlexMove LEO leverages the OneWeb LEO network and LEO-only and multi-orbit antenna systems to provide mining companies an additional end-to-end solution for COTM and COTP applications requiring higher speeds up to 100 Mbps download and latency of 70 milliseconds or lower. The combination of Intelsat’s own geostationary orbit (GEO) satellites and LEO network technologies from Intelsat’s strategic partner, Eutelsat OneWeb, powers the autonomous and remote-control applications that require higher speeds and low latency.

Mining companies face a multitude of challenges today, from overwhelming demand and widespread labour shortages, to expanding regulatory pressures and pervasive safety concerns. Together with Intelsat, mining companies can successfully surmount these challenges by accessing enterprise-grade satellite connectivity to power effective remote operations, ensuring crews are always connected to company networks and one another, even when and where terrestrial-based connectivity is unreliable or unavailable.

1. BALDWIN, S., ‘Why the U.S. has a serious mining worker shortage’, CNBC, (8 December 2023), www.cnbc.com/2023/12/08/why-the-ushas-a-serious-mining-worker-shortage.html

2. MILLS, R., ‘Mining industry dogged by retirements and lack of new recruits’, Mining.com, (7 February 2024), www.mining.com/web/ mining-industry-dogged-by-retirements-and-lack-of-new-recruits/

3. GHONEIM R., and MORRIS, D., ‘Decarbonizing heavy industry is possible. Here's how we set off a green chain reaction’, World Economic Forum, (23 November 2023), www.weforum.org/ agenda/2023/11/decarbonizing-heavy-industry-is-possible-hereshow-we-set-off-a-green-chain-reaction

4. DWYER, A., ‘Can mining ever be sustainable?’, Think Landscape, (6 May 2024), www.thinklandscape.globallandscapesforum. org/68092/can-mining-ever-be-sustainable/

5. ROLFSEN, B., ‘Mining Accidents Lead to ‘Troubling’ 31% Jump in Worker Deaths’, Bloomberg Law, (8 November 2023), www.news.bloomberglaw.com/safety/mining-accidents-lead-totroubling-31-jump-in-worker-deaths

Petro-Canada Lubricants explores the benefits of ultra-low zinc additives in transmission drivetrain oils.

As industries around the world strive for regulatory compliance, sustainability, and environmental responsibility, efforts to reduce their ecological impact have intensified. Nowhere is this more prevalent than in the mining industry. Lubricants are the lifeblood of machinery and equipment, reducing friction, wear, and energy usage. However, conventional lubricants often include additives like zinc which create a protective coating on the metal surfaces of internal components, but which can also carry stringent regulatory limitations and be harmful to the environment. This has led to the emergence of a new generation of ultra-low zinc lubricants – an alternative that is set to transform industrial maintenance practices.

This article outlines the advantages to the mining industry of using ultra-low zinc additive technology in transmission drivetrain oils. But first, it is necessary to explore zinc’s usage a little more and address a major misconception that keeps the industry wedded to lubricants that may not be performing as effectively as they could.

Zinc-based additives have traditionally been popular in transmission drivetrain oils due to their exceptional anti-wear and high-pressure capabilities. These additives create a protective barrier on metal surfaces, minimising friction and enhancing the longevity of machinery.

However, while zinc-based additives can offer clear benefits for equipment performance, they can, as previously alluded to, also carry very stringent regulatory classifications.

There are a few different types of zinc anti-wear utilised in additive technology for transmission drive-train oils. One has recently been classified by ECHA (European Chemicals Agency) as a reproductive toxicant, Category 1B, and there are additional concerns that the other types may follow suit. The mining industry is under heavy scrutiny, and the health and safety of personnel, customers, and the environment is a top priority for all mining companies. These regulatory classifications make the presence of zinc a concern for mine owners and operators alike.

In addition to regulatory concerns, the presence of zinc can raise significant concerns relating to environmental impact. When lubricants containing zinc enter the environment through leaks, spills, or improper disposal, they can pose serious risks. Zinc can build up in soil and water, potentially harming aquatic life and disturbing ecosystems. Additionally, in industrial environments, zinc emissions can lead to air pollution, affecting both human health and the environment.

Beyond the negative environmental implications, there is another problem. Oils with certain types of zinc anti-wear may have a decomposition pathway that can cause them to release too much sulfur, leading to copper corrosion and copper on steel wear.

Considering regulatory and environmental concerns, perhaps the most compelling argument in support of an

ultra-low zinc transmission drivetrain oil is simply that, as a lubricant component, zinc is not doing the anti-wear job that many believe it is doing. Both traditional and next-generation transmission drive train oils involve the formation of a polyphosphate film on the metal surfaces, and it is this film that does the wear protection job. The reality is that zinc atoms are just the carriers, dispersing back into fluid as the polyphosphate film is formed.

What if it was possible to eradicate the carrier, but still generate a similar polyphosphate film and create a more sustainable alternative, without compromising performance?

Mining projects have always been complex, with significant delays between discovering a deposit and beginning production, which can become challenging as ore quality diminishes and market demand accelerates. Switching to ultra-low zinc lubricants helps mine operators stay compliant with evolving standards, and demonstrates to partners, investors, and the local communities a commitment to sustainability and best practice.

When combined with the appropriate additive chemistries and high-quality base oils, premium ultra-low zinc transmission drivetrain oils have been shown to offer superior and more durable performance compared to zinc-based alternatives. This can result in extended drain intervals and lower maintenance costs, ultimately benefitting both the company and the environment. In addition, ultra-low zinc transmission drivetrain oils are better equipped to manage common contaminants like water, and the absence of zinc reduces the detrimental impact to certain friction materials, where the zinc atoms can get clogged within the pores.

Overall, the benefits these next-gen, ultra-low zinc lubricants provide is cause for the industry to re-evaluate their current use of zinc-based transmission drivetrain oils.

Manufacturers, lubricant suppliers, and end-users are increasingly recognising the numerous benefits of using next-gen alternatives in their operations. As awareness grows, stakeholders are gradually incorporating these next-gen lubricants into their maintenance practices – contributing to both a reduction in their ecological footprint and an increase in the efficiency and longevity of their equipment.

Not only do ultra-low zinc lubricants mark a pivotal advancement in the ongoing quest for more sustainable industrial practices, they do it without compromising on performance. It is early days, but already there is plenty of evidence to support the claim that ultra-low zinc transmission drivetrain oils can actually outperform more traditional products.

It is proof that best practice and cutting-edge performance are not mutually exclusive. By adopting ultra-low zinc lubricant technology, mining companies are actively supporting the preservation of natural resources, showing their commitment to optimised operations, meeting all of their regulatory obligations, and promoting a sustainable future for generations to come.

A multi-orbit, enterprise-grade network solution

Intelsat’s portfolio of FlexMove services meets the unique and evolving needs of the mining industry with its multi-orbit connectivity solutions ensuring heavy equipment fleets remain connected everywhere, all the time.

Mining Operators Can:

• Support Telematics

• Monitor Vehicles

• Automate Processes

• Perform Remote Control Operations

Discover how at intelsat.com/land-mobility

Jevons Robotics, Australia, presents insights into the development process and benefits of a new battery electric, payload agnostic, autonomous vehicle for the mining industry.

In the constantly evolving global mining industry, there is a strong emphasis on adopting advanced technologies to maintain competitiveness. Mining companies are publishing roadmaps around automation and decarbonisation as a core value proposition for their investors and internal teams. This trend is mirrored by global OEMs who are prioritising automation initiatives for haul trucks, drills, and shovels.

Jevons Robotics has recently entered the mobile equipment market, marking a significant advancement with its industry-first, battery electric, payload agnostic, autonomous machine capable of operating in the harshest of mining operating environments: the ARTEV™6000, an automated remote terrain electric vehicle rated to carry a payload up to 6000 kg.

The ARTEV6000 represents a rover-type 6 t vehicle, engineered for continuous day or night shift operations. It boasts a battery life of 6 hours per charge, with a rapid swapping system designed to maximise availability in the field. Equipped with capabilities, the ARTEV6000 can effectively navigate slopes of up to 15° and 12° cross slopes, while ensuring a stable chassis for payload deployment. Its dual and four-wheel driving functionality offers unparalleled flexibility for manoeuvring when navigating the bench environment.

Historically, leaders have relentlessly pursued the elimination of risks associated with executing the drill and blast cycle. From operating near high walls, to working over cavities and uneven or hot ground, interactions between mobile equipment and people all combine to make this one of the key risks for leaders in mining.

Jevon Robotics has unveiled the ARTEV6000 platform, configured for the drill and blast sector, to solve this problem. This innovative platform features a unique self-levelling chassis on grade technology, a vision system with automated hole detection capabilities, and software integration to streamline operations. These features not only optimise operations, but also simplify the number of machines needed to operate in the explosives and stemming process.

By leveraging advanced vision and hole detection technology, the ARTEV6000 vehicle can accurately position itself over blastholes, offering a comprehensive solution for deploying explosives and stemming material. Forward-thinking mining managers are cognisant of the inherent physical, biological, ergonomic, and environmental risks involved. Thus, prioritising the reduction of exposure hours to critical hazards is imperative for enhancing safety and risk mitigation in the workplace.

Manufactured in Western Australia, the vehicle is equipped with a comprehensive array of sensors dedicated to the management of the mission, machine performance, and the visibility for the operator from the comfort of the remote-control room. Its autonomy capabilities span from line-of-site to Level 4 autonomous control room operations, empowering operators to input QA activity with real-time reporting. The Jevons solution demonstrates superior performance in executing repetitive tasks such as blast QA/QC, stemming, and ANFO loading with precision, thereby enhancing productivity while concurrently lowering operating risks, carbon emissions, and costs.

The vehicle’s payload agnostic feature facilitates seamless interchangeability of payloads on a single chassis, offering versatility beyond the conventional loading of bulk explosives and stemming material. This mobility platform can be reconfigured based on customer needs to accommodate a range of alternative payloads – including drilling fluids, dewatering equipment, sensors and monitoring equipment, and geophysical sensors. The platform can even manage the increasing number of electric cables in a pit as customers progress to electrifying drills and shovels.

With a plethora of asset choices, forward-thinking mining managers can leverage a single chassis with diverse payload options to provide standardisation of asset selection for supporting mining operations. This approach provides customers with increased visibility and enhanced control over autonomous operations, fostering the harmonisation of battery charging infrastructure, simplification in maintenance, and interoperability of interchangeable payload systems. These initiatives facilitate centralised coordination back to the control room that will become more complex as auxiliary mobile assets are required to be automated.

The ARTEV6000 has undergone extensive testing and has completed a number of commercial trials with global leading brands. It is presently deployed in the Pilbara region of Australia.

Jevons Robotics recently concluded a trial with one of the world’s leading explosive companies, during which the ARTEV6000 demonstrated:

n Zero safety breaches.

n Sustained productivity of over 260 holes in a 12-hour shift.

n Precision measurement of blasthole depths compared to manual measurements.

n Accurate backfilling with stemming to the required depth.

n Accurate detection and recording of water within a blasthole.

n Machine availability exceeding 90%.

n Execution of a 12-hour shift using two batteries.

n Safe and productive operations during a day or night shift – using a combination of an infrared camera and under carriage lighting allowed the operator to enable all QC activity to be conducted on a night shift.

Conventional methods have traditionally entailed personnel driving a mobile processing unit (MPU) or stemming truck to deliver explosives or stemming, supported by a large auxiliary crew of operators and equipment. This conventional solution works relatively efficiently on flat benches, however, given the irregular topography of some opencast mines, teams of individuals are often tasked with manually passing buckets along a human conveyor belt to access steep and challenging

blastholes, elevating the risk of incidents associated with rock falls, open voids, and muscular skeletal or general fatigue.

The inception of the Jevons solution followed an unforeseen incident leading to the tragic death of an employee at a mine site in the Pilbara in September 2021, where the ground collapsed beneath an operator undertaking blasting activities. The founders of Jevons were driven by the ability to completely remove that risk from operations and developed the patented ARTEV6000 as a direct result.

The ARTEV6000 has attracted significant attention from the industry. Notable global mining industry leaders are pioneering with early adaptation. As a result, the test vehicle is fully booked until the end of 2024, and there are only a limited number of 2025 on-site trials available across Australia.

Jevons has commenced work on its smaller ARTEV1000 variant that will include the ability to deliver blast QA/QC activity within the quarry and construction segments. This will be available in 2025 and promises to bring the same safety and productivity improvements to this market.

The speed and efficiency demonstrated by Jevons can be attributed to a combination of key factors. Firstly, the founder possesses unique insight into the operating environment. Secondly, there was a critical customer need that leaders were eager to address to keep their people safe. Additionally, a diverse team of technical experts and subject matter experts collaborated to solve a real problem. This shared dynamic fostered a clear mission focus and a sense of urgency within the organisation.

Jevons also benefits from a robust local ecosystem of suppliers who contributed to the development of this solution, making it a world leader in its field.

In March 2024, Jevons Robotics received the National CORE Innovation Hub’s Hot 30 award, acknowledging its contributions to the industry. Co-founder Todd Peate expressed gratitude towards Development WA for their support of the Australian Automation and Robotics Precinct (AARP) in the Wanneroo region of Perth, Western Australia. This facility enables innovators to conduct product testing before deployment on-site. Additionally, Jevons Robotics received an Innovation Commercialisation Acceleration Grant in 2023 to facilitate the commercialisation of their solution.

Jevons Robotics is currently engaged in discussions with key players in the mining services sector. Beyond mining, the company is exploring partnerships with agricultural, industrial, and defence sectors. By addressing unmet needs that traditional equipment manufacturers may overlook, Jevons aims to provide further specialised solutions tailored to diverse industry requirements.

Leaders recognise that stagnation poses a significant threat to operational efficiency. Embracing change, albeit challenging, is essential for progress. Engaging with industry trailblazers, such as Jevons Robotics, can offer valuable insights into leveraging innovative applications to effectively address challenges and mitigate risks.

Zach Savit, Stratom, USA, in the second of two articles, considers how sometimes innovation grows in the open, and sometimes you have to look for it.

Welcome back. Many of you (44 000 or so) may be just recovering from the euphoria induced by MINExpo. It is a bastion of innovative thinking and hope that quadrennially inspires new projects, purchases, and potential.

There were nearly 2000 exhibitors at the show –thousands of companies trying to get in front of decision-makers and keep their fingers on the pulse of

what the industry needs. From a technology producer or vendor perspective, this is the widest their nets can get.

While the excitement of MINExpo’s innovative showcase lingers, the industry must look beyond the dazzling technological displays and delve into the practical challenges that lie ahead.

In the September issue of Global Mining Review, the first part of this article, ‘Mind The Gap: Part 1 – Finding The Next Innovations In Mining’, focused on some of the gaps in both processes and technologies that mining could adapt to improve operations through adoption and testing of new tools. This article highlights a wider chasm: that which exists between the invention source and operational deployment.

‘Incremental’ is not a bad word. Incremental change is why drill bits last longer and work better than they used to. Established companies invest through research and development to improve offerings, and these innovations are often built on the shoulders of established technologies. MINExpo is a massive display of these gains.

The major OEMs definitely make a splash with over 5000 t of equipment on the floor, exhibiting important advances in their product lines. Applications of autonomy, electrification, greater capacity, or greater efficiency critically advance the equipment that defines

the mining industry – and can all be viewed as incremental advances.

While crucial, these advances focus on improving existing technology and equipment rather than replacing it. Applying new tech to existing equipment and processes is one of the essential pathways through which mining realises technological gains.

Incremental gains can be seen in consumables, equipment, material handling, and software across many legacy providers. Driven by direct customer feedback, these advances quickly add value to operational needs with minimal risk involved.

New equipment capitalisation requires calculating the return on investment, but these enhancements face greater internal testing by vendors before being vetted operationally, minimising uncertainties associated with new technology adoption.

Due to the recent increased frequency of mergers and acquisitions, it needs to be mentioned that these moves can significantly aid technological growth. Buying a company that has put in much of the foundational work for a new technology allows the buyer to pair that technology with existing solutions, grow revenue streams, and keep unique solutions out of the hands of competitors. This kind of collaboration aids incremental technology growth, but does not eliminate some of the industry’s broader technology adoption challenges outlined below.

Intelligence

– *It should be noted here that the autonomous vehicles referenced here are focused on ‘over the road’ vehicles. Gartner mentions closed road system autonomy specifically in a podcast (September 2023) as doing better than those operating in open environments.

“If at first the idea is not absurd, then there is no hope for it” –Albert Einstein

The problem with Einstein’s quote on an idea’s absurdity is twofold when applied to new mining technologies. First, there is no qualification for if an idea actually works. Second, this only guarantees hope, not value. Across all industries, nearly 90% of all technology startups fail within the first five years – and mining is not a major exception. 1

But, if an idea works well, and if it survives past ‘hope’, it still has to challenge the existing standards.

The first person or company to think of a new way is frequently lambasted by those

adhering to the status quo. Mining is no different. ‘The way we’ve always done it’ is a blatant lie told by those comfortable with things as they are. It cannot be true, or the industry would be using steam hoists, pick axes, and donkeys. Sometimes, things do, in fact, change. By their nature, these new ideas tend towards less capital-forward ventures. Software and small-scale technologies are easier to showcase without larger investment. Many of these ideas succeed through solving problems within small, connected networks where the inventor knows that the problem exists and can be solved with the new tool.

Trialling specific innovations through existing connections in a tight-knit industry like mining increases the survival rate of these ideas. Technology trials can also proceed with more significant ideas or at larger operations through greater risk/reward tolerance.

Complicating the issue, operations take on more risk here than just new technology. The support structure and reliability of these new ideas are not always in the initially deployed minimum viable product. These hurdles compound with standard technology adoption pitfalls to limit these ideas’ ability to make a lasting impact on the industry. Consequently, the great ideas that have stood the test of time are even more impressive.

Mining frequently adopts technology designed with other uses in mind and conforms it to operational requirements. One of the best, most recent examples of this adoption style is drones.

Although proven and adopted outside of the industry, even many early adopters in mining waited to try unmanned aerial vehicles (UAVs). Adoption was higher outside of restrictive regulatory frameworks, but UAV tech has now been fully integrated into mining operations around the globe. Measuring underground voids, conducting surface scans, and prospecting for new deposits are now recognised value centres for these versatile drones.

The innovation models used in many of these outside cases do not conform to the mining mindset. While some new technologies – lidar scanners, network infrastructure, process automation, etc. – incorporate more easily, mining can look to several other sectors as new technology is tested.

Construction, agriculture, and oil and gas all offer some similarities. Operational pace, remote locations, and dirty environments provide a quality testing ground. If new solutions thrive in these areas, applications may exist within mining, but looking in these industries may miss the nearest analogue.

Two primary career groups get to play in the dirt, play with big equipment, and blow stuff up: mining and the military. When you think about it, the major difference between mining and much of the defence sector is that fewer people shoot at you in mining.

Global navigation systems, radios, autonomy, and many other technologies on which the industry currently relies were created for or improved in military applications. The real trick in adapting military technology for mining use is understanding the aspects directly applicable to mining operations. Identifying what configuration changes must happen to unleash the real value of potentially overruggedised solutions will allow mine operators to tailor cutting-edge solutions to their operations.

Because these new solutions stem from different sources, each of them requires nurturing adoption in different ways. The onus is on operational leadership to deploy and nurture these tools accordingly, which requires an approach defined by the maturity of the technology.

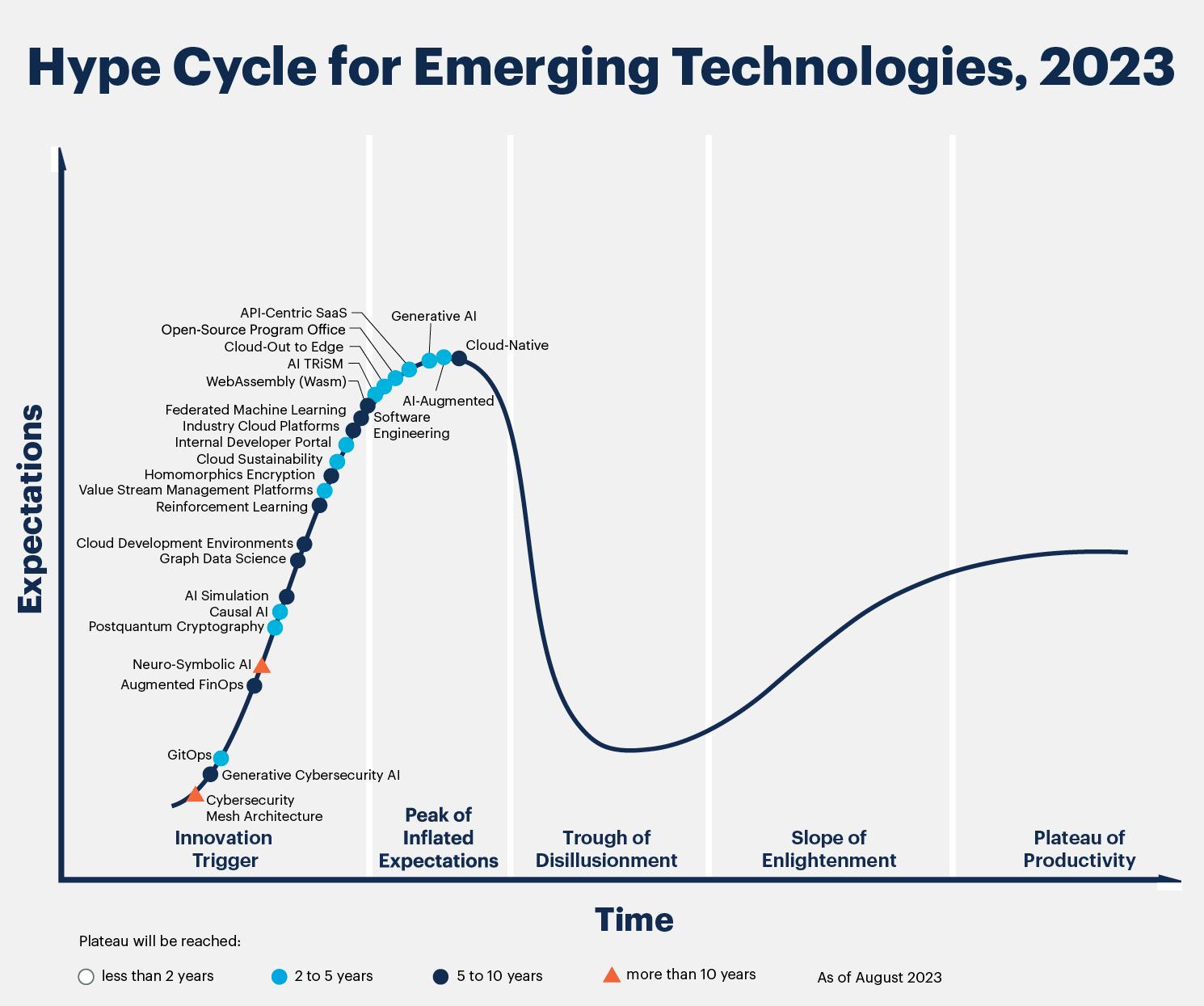

Remember, not all new technologies are at the same stage. For those outside the direct technology evaluation world, this is a brief reminder of one interpretation of how technology matures.

Gartner’s hype cycle, developed in 1995, illustrates how many innovative technologies progress from inception to widespread adoption (Figure 1). 2 While the research and consulting giant offers insight into the maturity of the product, mining operations can optimise their trial and deployment of emerging technologies using this model’s framework.

While a new adaptation to existing technology may be instantly deployable, something early in development may require more monitoring. Additionally, understanding how to ensure new technologies do not suffer poor user acceptance may mean more training or testing time.

If you did not do it this year, go to more than just the eye-catching booths at MINExpo or the companies you know. Seek out the smaller, unique solutions too. You may not find exactly what you are looking for, but you might get exposed to new technologies you had not seen or thought about before.

Mining innovation is not about choosing the path to find the right new technology. Every path should be explored. The more you know, the better equipped you are to make the best decisions when your operation hits a new snag or finds a new way to fowl things up. Knowing what tech is out there will help you find the right one when you need it.

1. PATEL, N., ‘90% Of Startups Fail: Here's What You Need To Know About The 10%’, Forbes, (14 April 2022), www.forbes.com/sites/ neilpatel/2015/01/16/90-of-startups-will-fail-heres-what-youneed-to-know-about-the-10/

2. ‘Podcast: The AI Hype Cycle 2023: Autonomous Vehicles Sit in the Trough of Disillusionment’, Gartner, (5 September 2023), www.gartner.com/en/podcasts/thinkcast/the-ai-hype-cycle2023-autonomous-vehicles-sit-in-the-trough-of-disillusionment

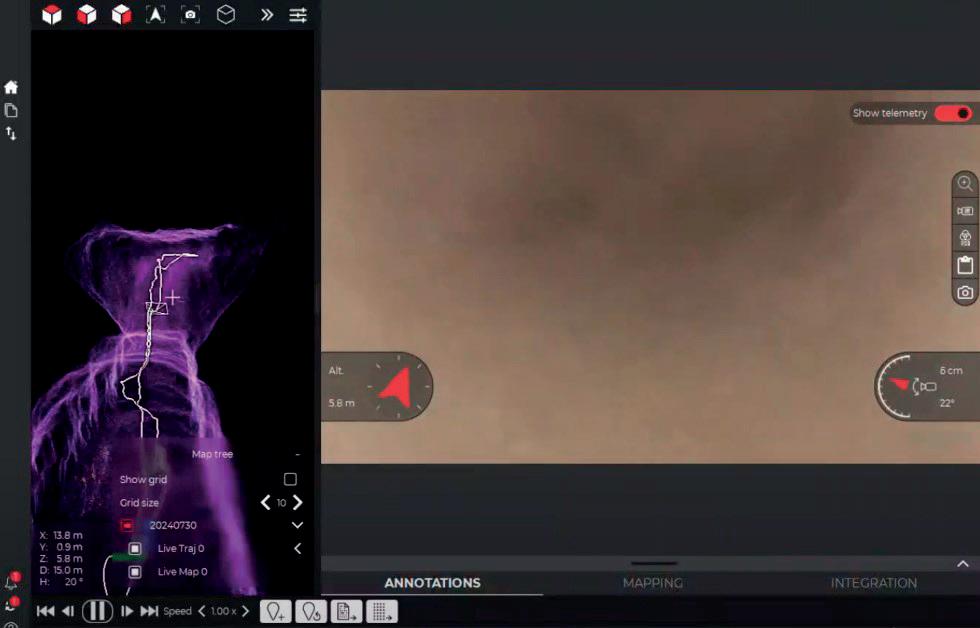

Eloise McMinn Mitchell, Flyability, Switzerland, describes how the use of drones in underground surveys can improve safety protocols and the efficiency of data collection.

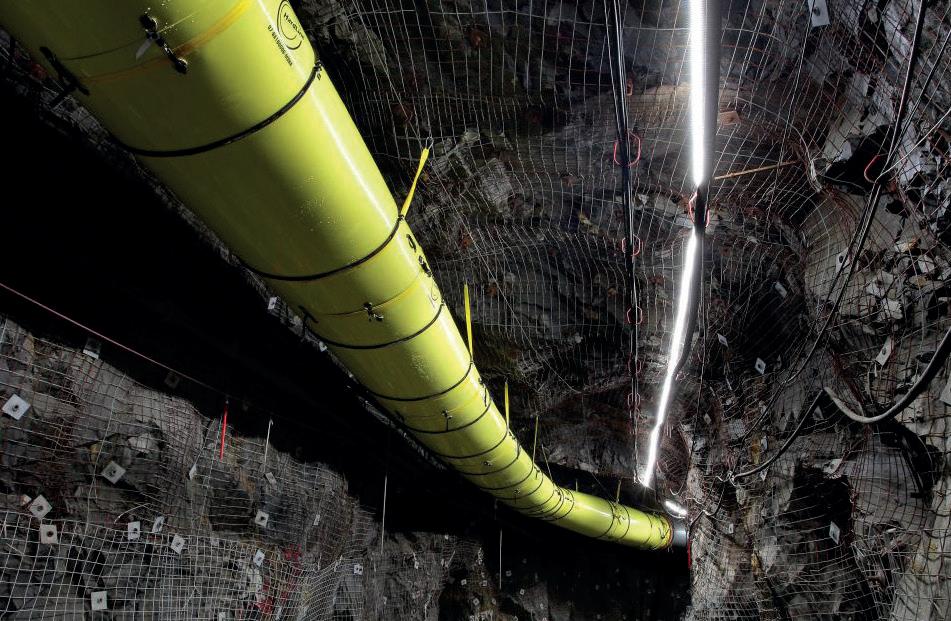

Not all mines are created equal – and certainly not copper mines. Located in the Limpopo province of South Africa, the Palabora copper mine is managed by Palabora Mining Company. Ground was broken at the site in 1956, and nearly 70 years later, it is still one of the largest producers of copper in South Africa, alongside producing nickel sulfate, magnetite, vermiculite, and more. The mine was initially opencast, but has expanded to include underground operations too.

The underground section of the mine relies on block caving to extract minerals. This hard-rock mining technique involves excavating underneath an ore body before allowing it to collapse into the space underneath. The collapse is usually triggered by explosives. As the broken ore drops into the caverns underneath, access tunnels are used to gather material that has fallen into the void. As a result of the large volumes of ore that can be moved without too much difficulty, the block caving method is effective and used at several mines around the world. In fact, in some cases this method has been seen to achieve production rates that match surface mining.1

At the Palabora Mine, this method of controlled collapse has been in use for over a decade and is well-established, with an average of 700 000 tpy of copper produced and tunnels that extend 1600 m underground. However, block caving can be a challenging means of mining. When the ore collapse is triggered by explosives, it can be difficult to assess the best means of access into the space afterwards. This is important for ensuring the safety of mineworkers and requires some form of surveying or scouting to determine the condition of the fallen ore and the best way to approach the void safely. Due to the nature of this form of mining, it may not be possible to see the entirety of the void from an access passage. This can mean there is a risk of moving or unstable rocks or material that could shift unexpectedly. Without prior knowledge of this, mineworkers must spend a long time planning the best way to safely approach the void. Situational awareness from a scan or survey could improve the speed of operations and keep staff safe.

For this reason, the team at Palabora, as part of a commitment to continuous improvement, wanted to develop ways to gather this information remotely, as this would prevent staff from being near the void opening until an all clear is provided. This task fell to the technical service department, which provides information to the mining team and is in charge of technical assessments on geological and geometrical challenges. Initially, they started using laser scanners to gather surveying information about the state of a void after an explosion. This enabled a surveyor to stand several metres away from the void opening. However, there was still a concern that employees could be within range of rocks rolling from the muck piles, dislodging from the hanging wall, as well as the accumulated dust or heat exertion. A more distanced and safe solution was required to improve on operational efficiency with more accuracy in the assessment.

The surveying team, with encouragement from Executive Manager, Sam Ngidi, researched alternative surveying methods that could be used in an underground mine. When the surveying team introduced the idea of drones, Ngidi helped them purchase an Elios 3 drone. The survey team that is focused on undercutting is led by Superintendent Surveyor, Marlon Cloete, and their entire unit has been trained to use the drone in order to ensure everyone is equipped with the knowledge to use this exciting new tool.

The Elios 3, built by Swiss brand Flyability, is a rugged drone. It has a protective cage around it that enables it to fly in difficult environments without fear of collision. When it makes an impact, the drone has built-in firmware that helps it to stabilise and recover. This is crucial for the Palabora team’s project, as the drone would be flying beyond the line of visual sight and thus, needs to be capable of surviving unexpected impact. In addition, the drone has a powerful, 4K camera, as well as a laser scanner from Ouster. The LiDAR payload on the drone has two purposes: the first is to gather detailed laser scans for analysis with centimetre accuracy and the second is to provide situational awareness. As the drone flies, it produces a live scan of its surroundings. This means that should the pilot be flying in dusty environments, they can swap from guiding the drone with the camera to the LiDAR point cloud. This gives a clear 3D view to the pilot and helps them to operate even in the most challenging scenarios. Finally, the drone has a return-to-signal feature, which means that should it have signal disruption or loss, it will automatically fly back along its flight path to reconnect to the controller. Overall, the unique capabilities of this drone made it the best option for surveying the voids underground.

When Palabora brought the Elios 3 underground, they immediately found that they could triple the distance between the pilot and the void opening; where fixed scanners required surveyors to stand much closer to the space, the Elios 3 meant pilots could stand up to 100 m from the opening. This eliminated most if not all the risks associated with this type of work.

The scanning process with a drone looks like this:

1. The pilot identifies a safe take-off space that is up to 100 m away from the void opening. From this location, they prepare the drone for take-off and begin the flight.

2. The flight takes place, with the pilot capturing both photos and laser scans of the void. Due to the drone’s visual payload, the pilot does not need a line of sight to monitor the drone, but can instead rely on the drone’s remote control with its live feed and live point cloud to guide the flight.

3. After the drone has finished data collection and has safely landed, the results are imported to Inspector 5, the custom software used with the drone. The analysis can then be done to assess the location of ore deposits after the controlled cave-in, as well as help assess the efficacy of the blast.

As a result of using this technology, the Palabora team has felt that they have elevated safety protocols in their mine without compromising on data – in fact, they now have greater access than ever before.

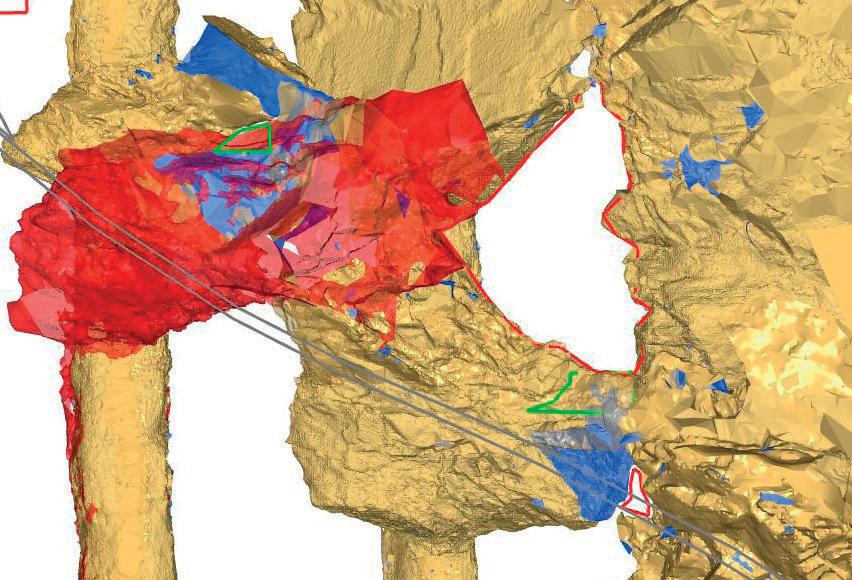

With the introduction of the Elios 3 to Palabora’s mine, they have begun to develop other use cases for the drone. The 3D point clouds are used to analyse the surfaces of rock formations after a blast. That data and video footage are now being used by the surveying team at Palabora to identify pillars created from the blast, as well as to analyse the geological structure, structural support compliance, and the quality of the blast. In addition, the data helps teams to understand how the rock fragmented.

Analysing the pillars is an important part of surveying at this mine. These pillars represent a hazard as without careful maintenance, these pillars can be dangerous if they fall. Each pillar is carefully assessed to determine its structure and monitor it for convergence or change. In some cases, the pillars need to be demolished, and in others they are treated and used as support. The data from the drone is used to create a survey report that is shared with the mining department on the quality of the blast, as well as the position and size of the pillars left in the undercut. The pillars are recorded and added to a catalogue monitored by Palabora to determine how they should best be treated/removed to enable continued operations.

An additional use of the drone has been in part of a massive excavation project to create an underground crusher. Palabora is excavating an immense underground void to construct the crusher, with the excavation reaching 50 x 11.3 x 27 m. The drone has been used to measure excavations that would not be accessible otherwise, including at height. As a result of using a drone to survey the space, nearby activities do not have to stop during data capture, which streamlines overall efficiency. The drill and blast activities are scanned with the drone to detect errors in the blast compared to the design (over and underbreak), which can help catch errors early and avoid delays. Quality checks are also carried out later on, in order to ensure the excavation meets safety standards, such as using the drone to measure shotcrete thickness by comparing data sets from multiple flights. With the video footage as well, project managers can remotely analyse progress during the mining process from the comfort of their office, rather than having to make visits underground.

A further application for using a drone with a laser scanner has been to monitor the extent of caving in the walls of tipping silos. This is because should a tipping silo wall cave, it would disrupt the stability of the tipping area and its storage capacity. This would in turn halt operations

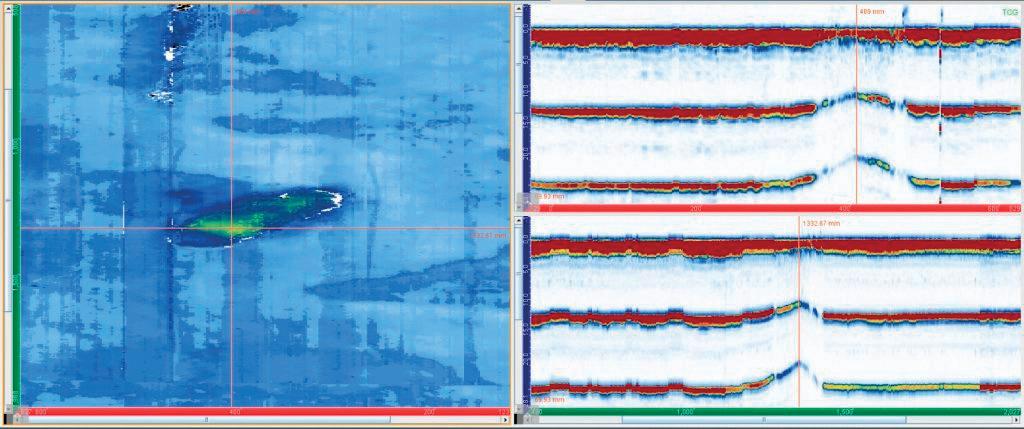

Figure 3. Laser scans from the Elios 3 are used for analysis and pillar management, as shown here where green represents treated pillars, yellow is previous scans, and red is the latest scan data from an undercut area.

Figure 4. The Elios 3 in flight underground. The lighting rig on the camera has a capacity of 16 000 lumens, helping pilots get a clear visual feed when flying beyond the line of visual sight.

and affect the mine’s productivity and financial efforts. In the past, it was not possible to monitor these silos safely from the inside, however, with the drone measuring just 50 x 50 cm, it can fly into small access hatches and safely complete an inspection without anyone having to enter the confined space. The drone’s data is then used to analyse the walls and determine if there are any changes to the structure, compared to previous point cloud data. This can easily be done on-site with a computer, making the inspection process quick and efficient. In addition, the level

of detail from the drone exceeds the needs of the project and thus the high accuracy surpasses expectations.

overground site. With additional applications including stockpile measurements and equipment inspections, they hope to use this technology in new ways soon.

The driving factor that brought the drone to this site was a need to innovate safety protocols and improve the data collection efficiency. As mining is an industry that can be slow to adopt new technology, the increasing prevalence of drones points to them being a reliable tool for mines, with a particular value in underground surveying. This is because remote surveys with a drone can be used for hazardous locations (such as unknown voids or old workings), alongside routine surveys and inspections. Their fast deployment also points to them being used for emergency response or urgent scenarios where situational awareness is needed, but the safety of mineworkers could be at risk. Other case studies with the Elios 3 for mining have seen the drone surpass traditional surveying methods, such as mapping a 340 m tunnel in 9 minutes or locating an ore pass hang up in 10 minutes. The speed, safety, and accuracy of using drones make them an attractive addition to surveying workflows and the results from Palabora make one thing clear: it is not a question of ‘if’ drones are coming to mines – but when.

HIGMAN, B., MATTOX, A., HOAGLAND, N., and COIL, D., Ground Truth Alaska, (12 August 2019), www.groundtruthalaska.org/articles/block-caving-underground-

Maarten van de Vijfeijken, ABB, considers the benefits of remote monitoring platforms in decreasing the unscheduled downtime of gearless mill drives.

As a market leader in gearless mill drives (GMD), ABB is often looked at by the industry for the latest developments. It is a well-known fact that the GMD offers the highest possible mill drive system efficiency, combined with operational flexibility through the inherent