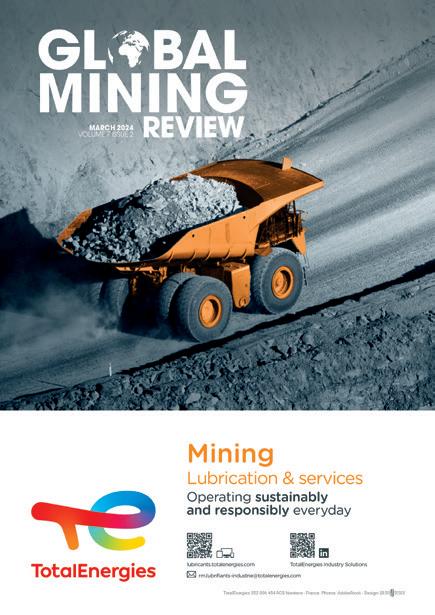

TotalEnergies 552 006 454 RCS Nanterre - France. Photos: AdobeStock - Design: rm.lubrifiants-industrie@totalenergies.com lubricants.totalenergies.com TotalEnergies Industry Solutions Mining Lubrication & services Operating sustainably and responsibly everyday MARCH 2024 VOLUME 7 ISSUE 2

The development of every Cat® mining truck is driven by a commitment to delivering what you require: highly reliable and durable machines, technology and autonomy solutions that boost efficiency and safety, features to reduce environmental impact, and services that improve your overall hauling operation. Our efforts are driven by your results.

With a focus on continuous improvement and an innovative mindset, we’re committed to your operation today and in the future.

TOGETHER WITH CAT DEALERS, WE’RE YOUR PARTNER FOR THE LONG HAUL.

Discover new ways to improve your hauling operation today: CAT.COM/MININGTRUCKS

CAT® MINING TRUCKS DRIVEN FOR RESULTS ©2024 Caterpillar. All Rights Reserved. CAT, CATERPILLAR, LET’S DO THE WORK, their respective logos, “Caterpillar Corporate Yellow”, the “Power Edge” and Cat “Modern Hex” trade dress as well as corporate and product identity used herein, are trademarks of Caterpillar and may not be used without permission.

CONTENTS

03 Editor’s Comment

05 Guest Comment

07 Industry News

10 Navigating Nickel

Luc Lachance, ION Commodities, Canada, discusses nickel’s performance in 2023 and explores how operational excellence can ensure sustained business success.

13 In Tune With Nature

Paul Kos and Chris Jaros, Stantec, USA, consider the advantages of implementing nature-based stream restoration methods in mine closure.

17 The Evolution Of A Workhorse

Gordon Wilkin, Caterpillar, Inc., reviews the evolution of the CAT® R2900: an LHD on the verge of celebrating 30 years since its first introduction to the mining industry.

21 Around Tyres And Beyond

Caroline Wies, Michelin Group, France, examines how data mining can be pushed to the next level for safer, smarter, and more sustainable mining operations.

24 An Ecosystem For All

Komatsu USA presents a framework for what an open, democratic, and interoperable ecosystem for the mining industry – that leverages technology – might look like.

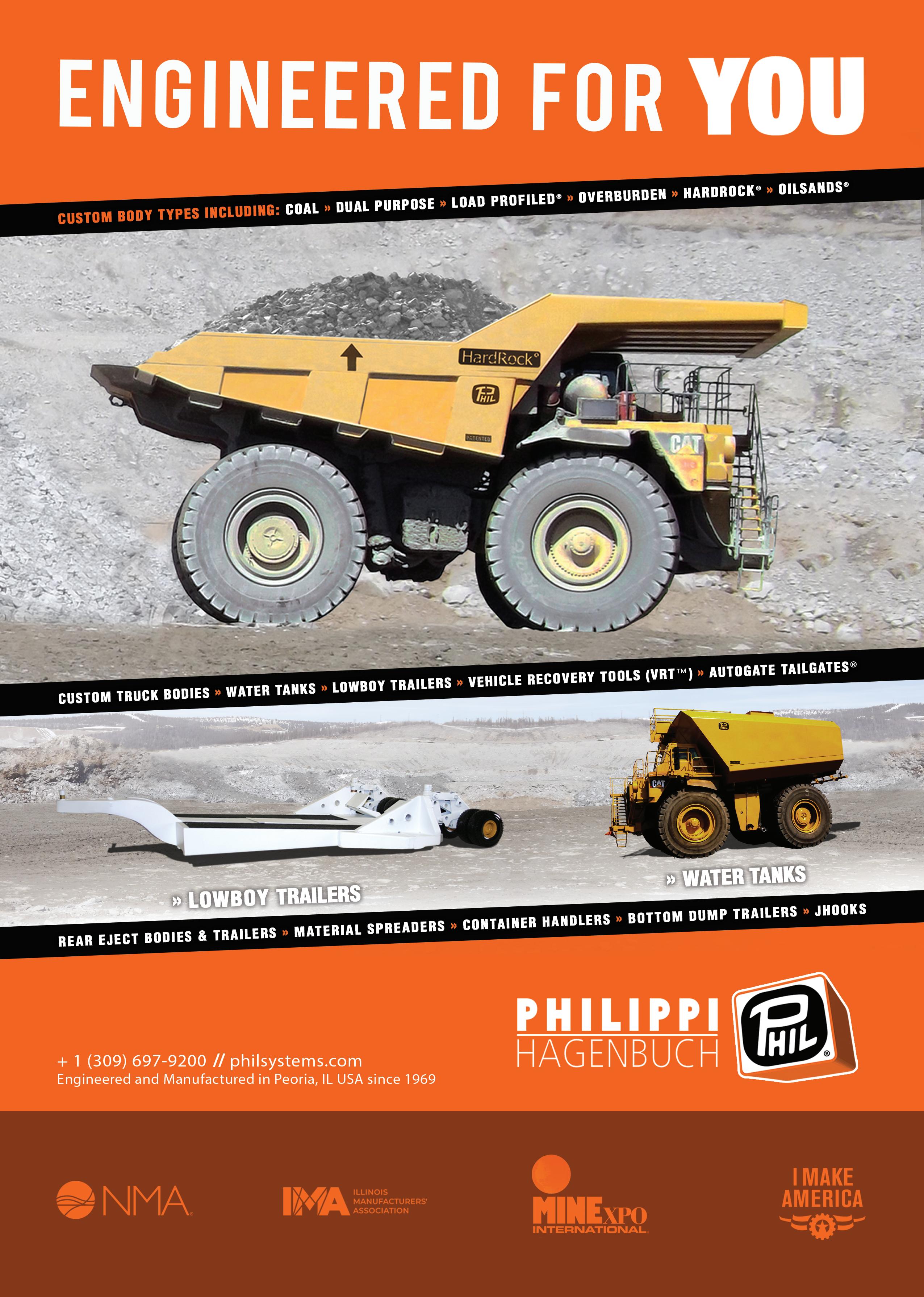

29 Lighten The Weight, Maximise The Payload

Josh Swank, Philippi-Hagenbuch, USA, describes the importance of choosing a lightweight truck body that offers all of the benefits, without the sacrifice of short wear life.

32 Paving The Way For Sustainable Mining

Luiz Sampaio, TotalEnergies Lubrifiants, France, highlights the critical role of lubricants in reducing the ecological footprint of mining activities.

37 Breaking New Ground

Elitza Terzova, Shell Lubricant Solutions, outlines the four factors that could shape the future of mining and the importance of collaboration in addressing key challenges.

41 Crushing Downtime With New Oil

Jim Thomas, Lubrication Engineers, USA, addresses how the right choice of lubricant can boost operational efficiency and prevent costly failures.

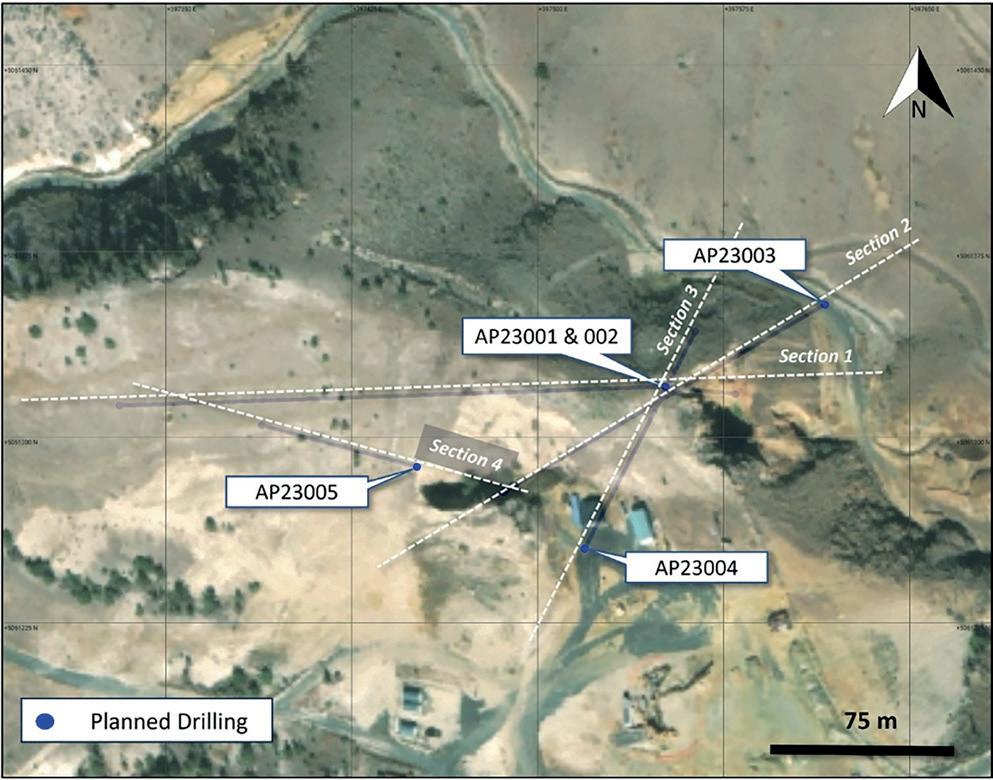

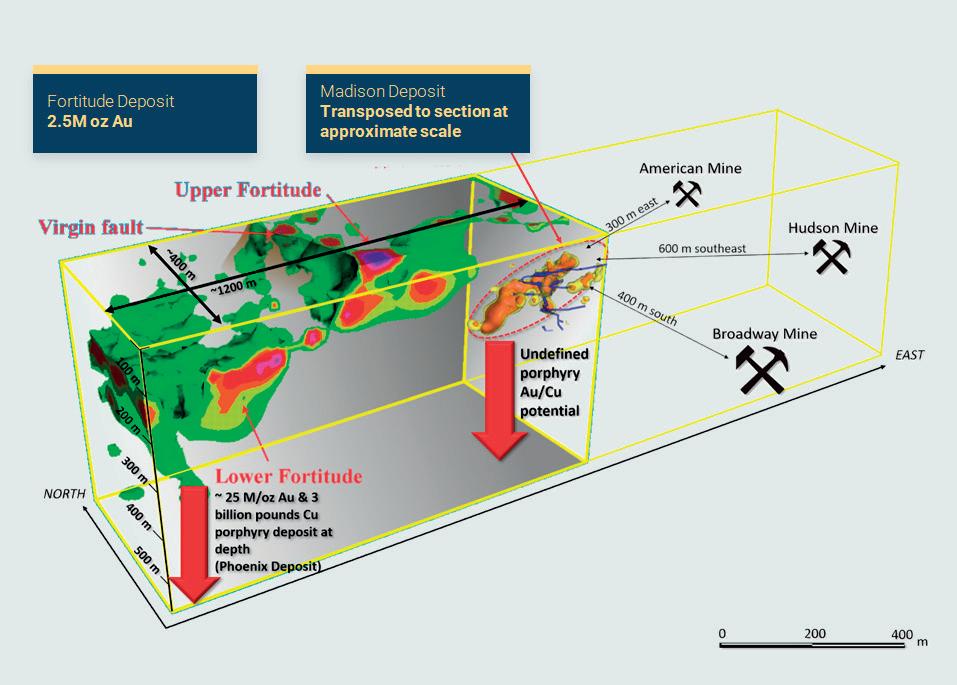

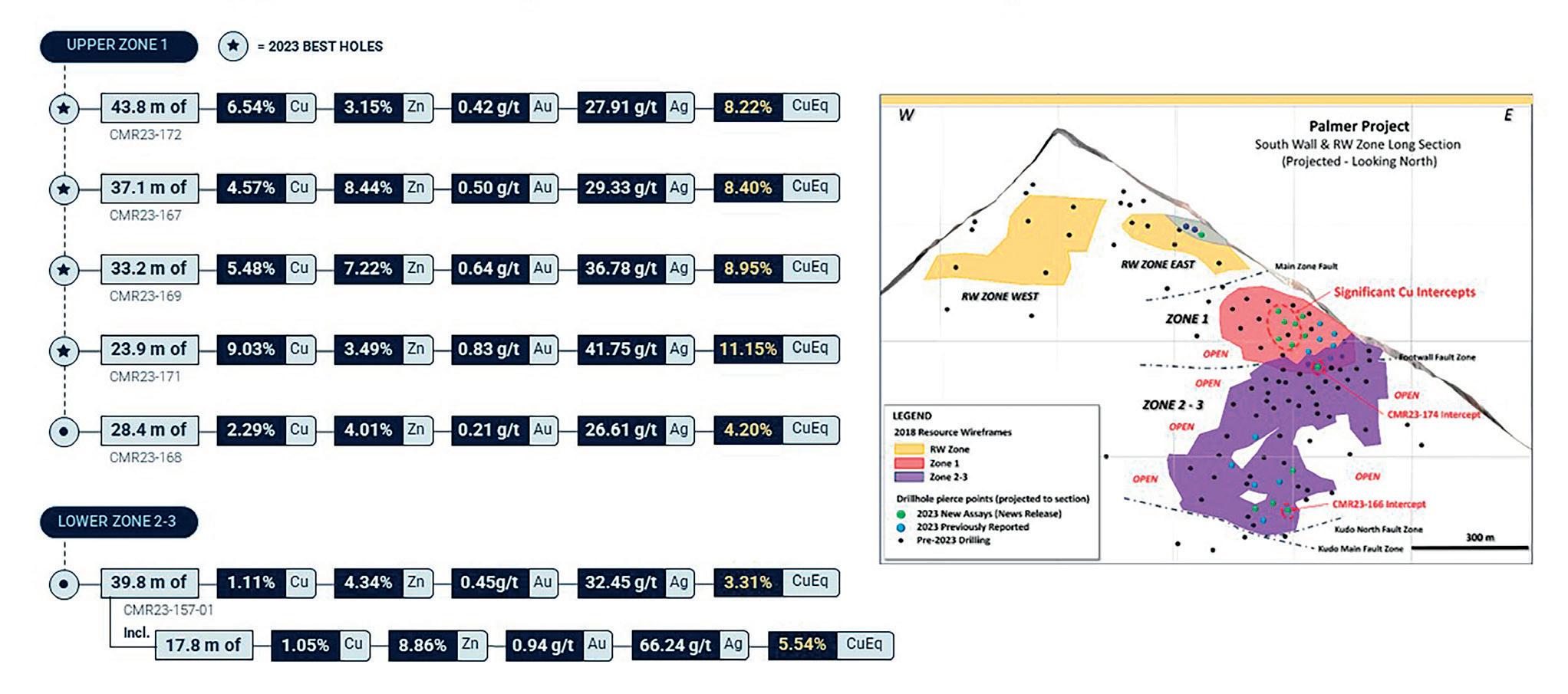

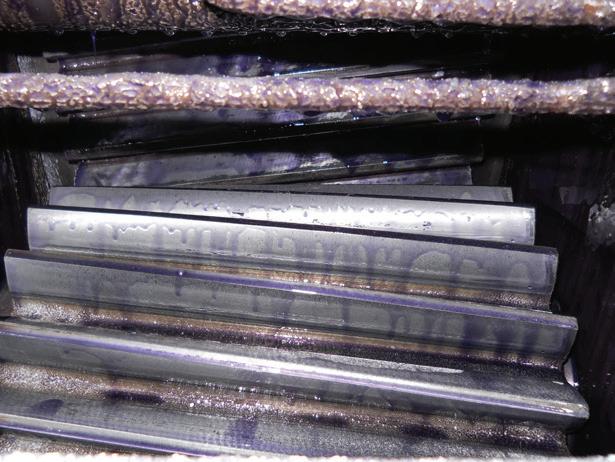

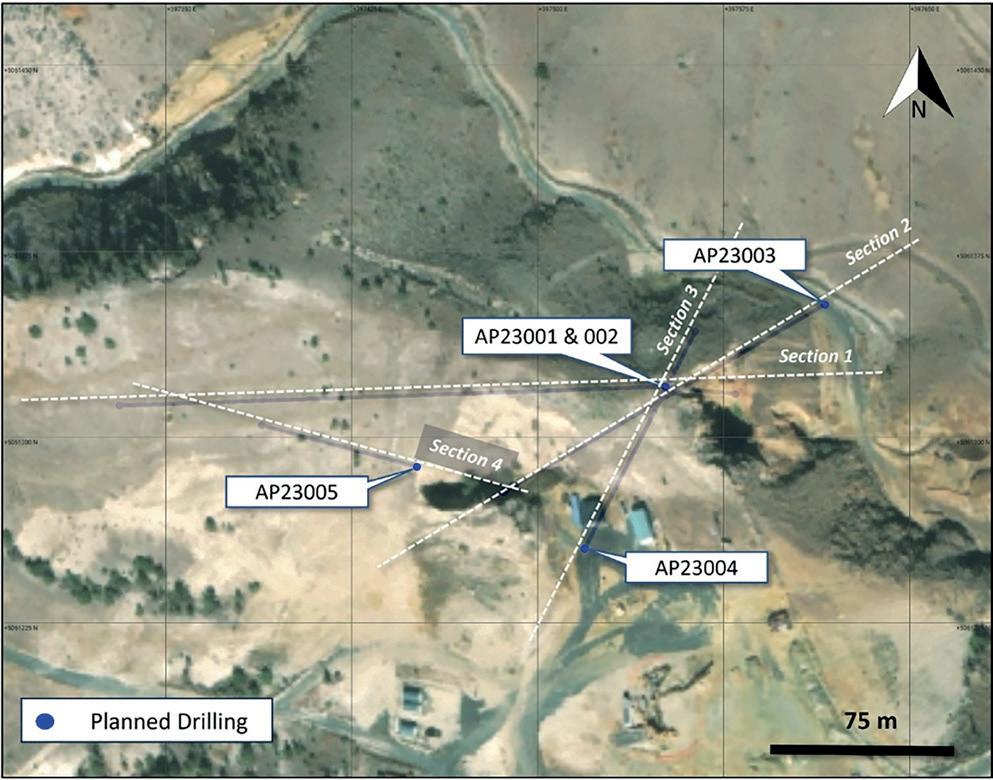

45 Expanding Exploration Across The Western US

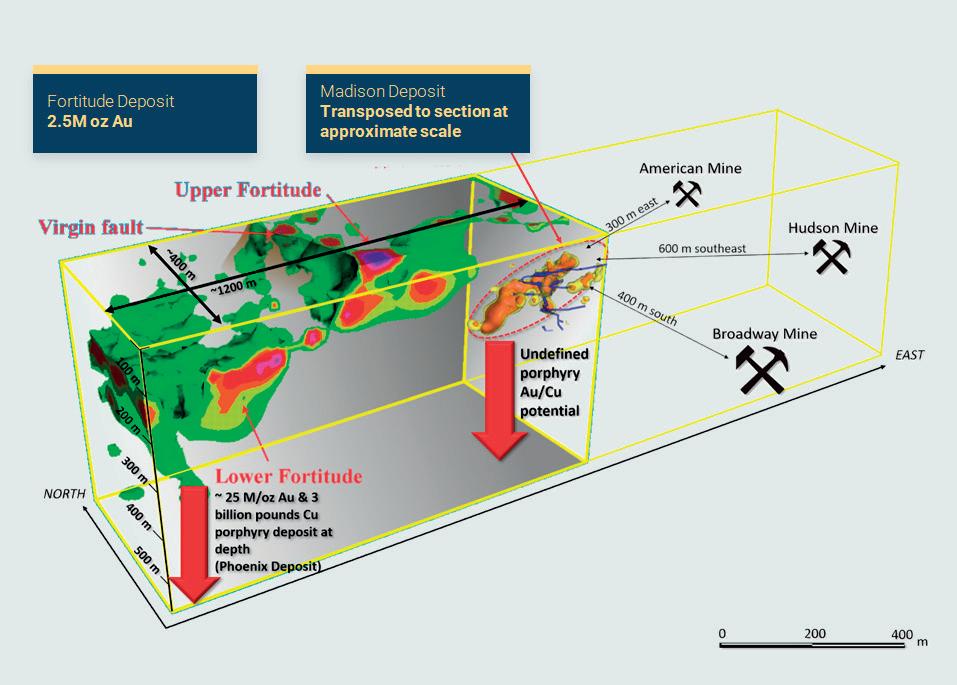

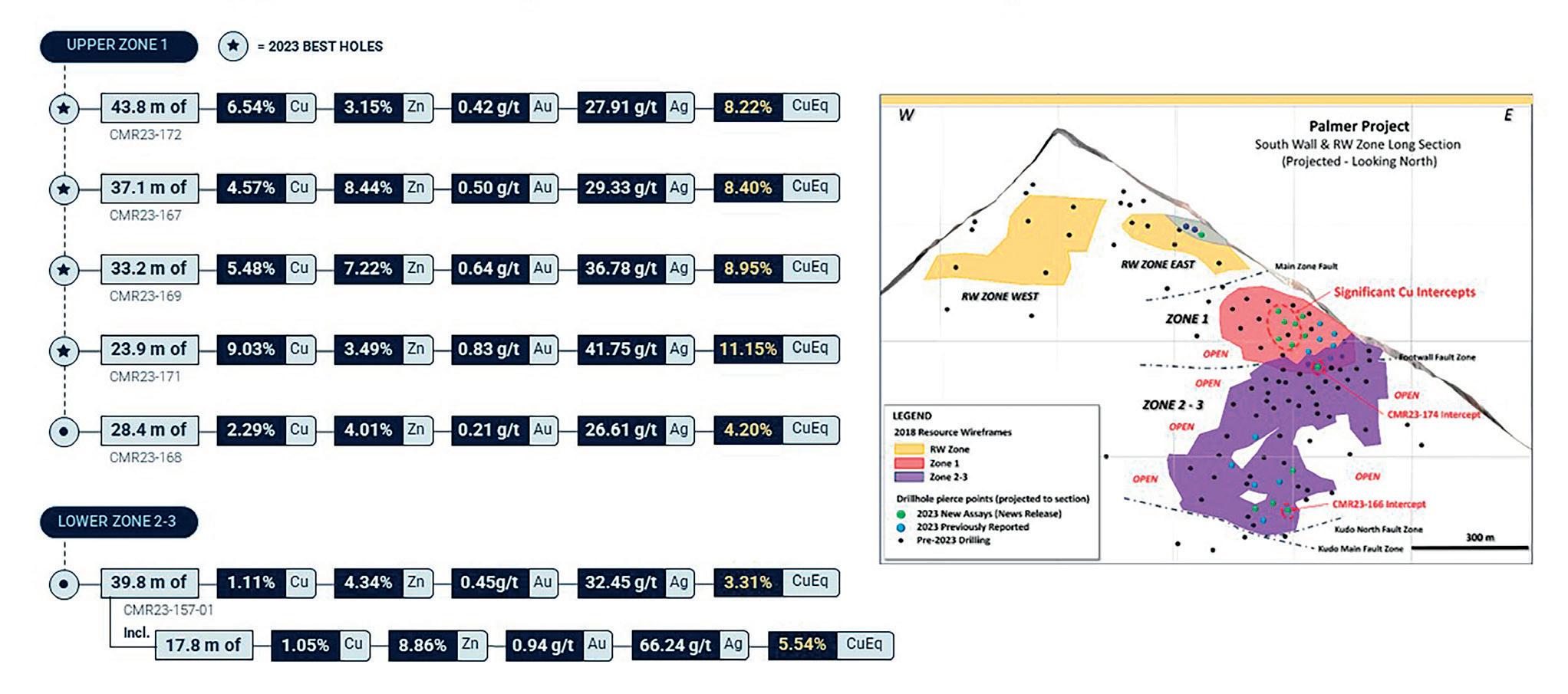

American Pacific Mining Corp. provides an update on its portfolio growth in the western US; with joint venture partnerships with industry majors in Alaska and Nevada, the Canadian junior miner has expansion plans for precious and base metals opportunities.

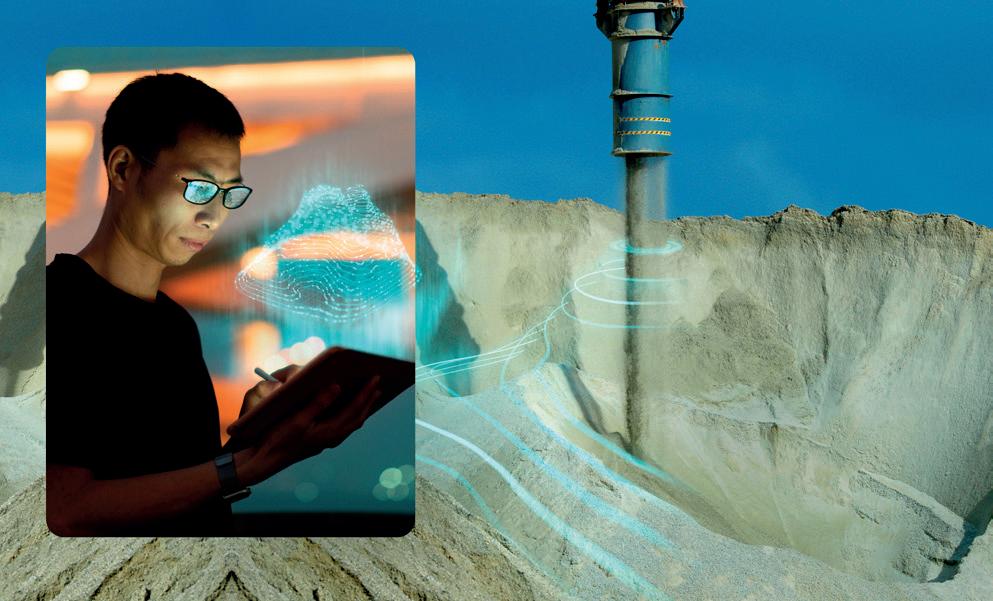

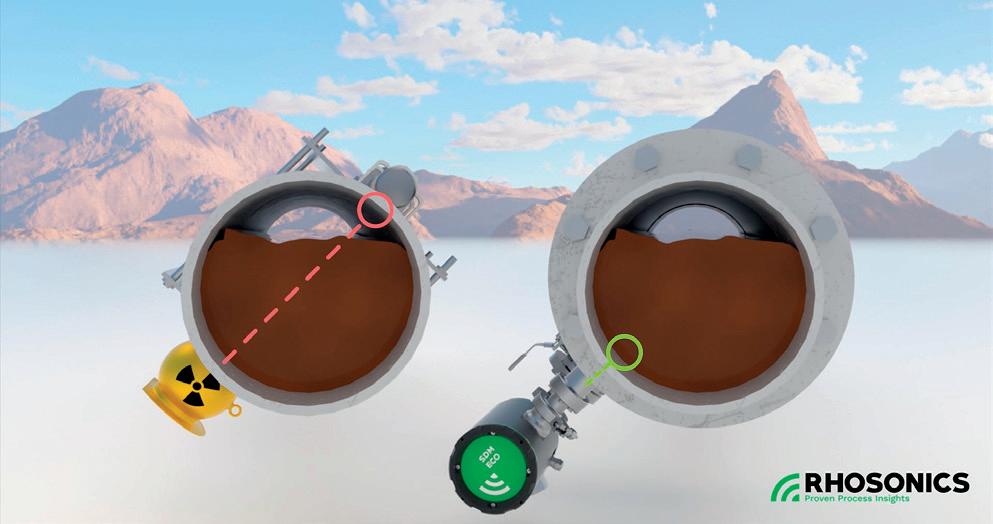

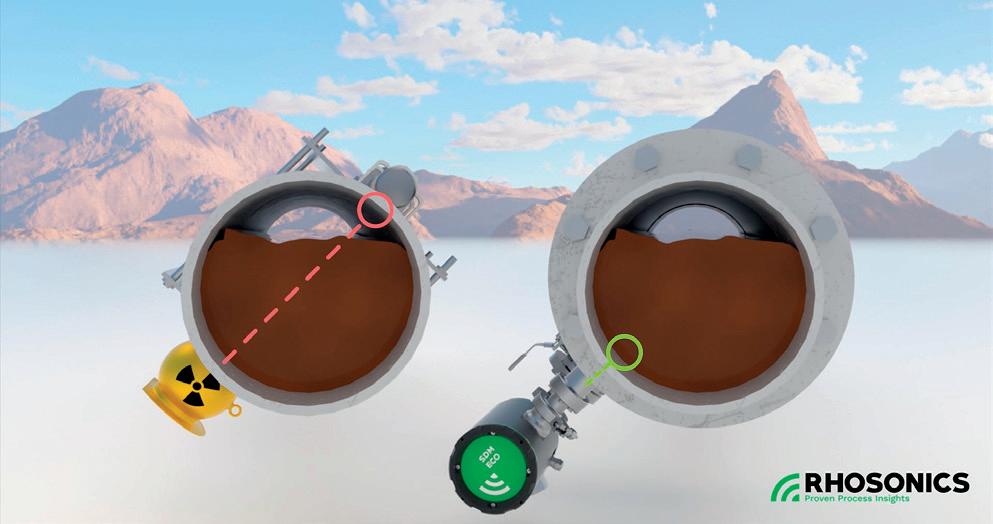

49 Revamping Slurry Management

Frank Termeulen, Rhosonics, the Netherlands, explains how technological advancements can make slurry density measurement safer, greener, and more cost-effective.

53 The Future Is Digital

Tibor Nemes, Nokia, Hungary, assesses the benefits of utilising digitalisation to drive sustainable mining practices.

57 Drive System Overdimensioning: Still A Necessity?

Eric Åström, Hägglunds, Sweden, evaluates the pitfalls of overdimensioning and considers how electrohydraulic direct drives can provide a more efficient solution in the management of peak demand.

61 Driving Towards Sustainability

Giancarlo Scaturchio, Rockwell Automation, Italy, explores how variable frequency drives can deliver improved sustainability for mining operations through a collaborative business model.

ON THE COVER

Lubrifiants is a leading global manufacturer and marketer of lubricants, with 42 production sites around the world and a direct presence in 160 countries, delivering to more than 600 mines per day.

Lubricants division offers innovative, high-performance, and environmentally friendly products and services to help mining customers reduce their carbon footprint and ensure lowest total cost of ownership. Copyright © Palladian Publications Ltd 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither does the publisher endorse any of the claims made in the advertisements. Printed in the UK. MiningReview like join Global Mining Review @Mining_review follow CBP019982

TotalEnergies

TotalEnergies’

Premium multi-purpose synthetic all weather transmission, drive train, hydraulic and wet brake fluid for heavy-duty mobile equipment. Trademarks are owned or used under license EXTREME MINING CONDITIONS? CONSIDER THEM CONQUERED GAME CHANGING ASSET PROTECTION VISIT US AT CIM, BOOTH #504. VANCOUVER, MAY 12-15, 2024

Editor’s Comment

MANAGING EDITOR James Little james.little@globalminingreview.com

SENIOR EDITOR Callum O’Reilly callum.oreilly@globalminingreview.com

EDITOR

Will Owen will.owen@globalminingreview.com

EDITORIAL ASSISTANT

Jane Bentham jane.bentham@globalminingreview.com

SALES DIRECTOR

Rod Hardy rod.hardy@globalminingreview.com

SALES MANAGER

Ryan Freeman ryan.freeman@globalminingreview.com

PRODUCTION MANAGER

Kyla Waller kyla.waller@globalminingreview.com

ADMINISTRATION MANAGER

Laura White laura.white@globalminingreview.com

DIGITAL ADMINISTRATOR

Nicole Harman-Smith nicole.harman-smith@globalminingreview.com

DIGITAL CONTENT ASSISTANT

Kristian Ilasko kristian.ilasko@globalminingreview.com

DIGITAL

Merili Jurivete merili.jurivete@globalminingreview.com

EVENTS MANAGER Louise Cameron louise.cameron@globalminingreview.com

EDITORIAL ASSISTANT, GLOBAL MINING REVIEW

As spring arrives, groundbreaking ideas and initiatives within the mining industry continue to bloom. Only three months old, 2024 is already proving to be a remarkable year for innovation and transformation across all aspects of mining operations.

I, along with the rest of the Global Mining Review team, had the privilege of attending SME MINEXCHANGE in Phoenix, USA, at the end of February, to meet industry leaders and witness their new technologies and programmes in action. This was an excellent opportunity to observe how much mining has developed in the past year, with the adoption of sustainability initiatives increasingly becoming a key point of discussion.

From electrifying vehicle fleets to improving energy efficiency through the use of artificial intelligence, the vast range of sustainable approaches promoted at the conference was impressive and encouraging. Undoubtedly, the next generation of mining leaders and engineers must adapt to increasing demand, not only for critical minerals across the world, but also for green technology that aids the decarbonisation of the industry as a whole.

By 2030, only half of the cobalt and lithium required for the green energy transition, and 80% of copper, will be produced by mines.1 With mining so crucial to the progress of this transition, and consequently, to the future of our planet, it is clear that a unified, holistic approach to boosting production, while keeping emissions low, is required.

The need for investment in the net zero transition seems even more acute approaching the summer months. Scientists at the EU’s climate service recently raised alarm bells by confirming that 2023 was the warmest year since 1850, and they have warned that 2024 could be even hotter.2

Everyone within the industry must therefore strive to work together, as minimising the impact of mining operations on the environment and surrounding communities is paramount. The safety and protection of the environment are at stake, not to mention the financial impacts and damage to the reputation of companies.

Electrification has become a hot topic across the mining industry as it searches for ways to reduce its emissions. This entails not only implementing battery electric vehicles (BEVs) in the mining process, but also using green energy to power every element of an operation. While the rise in electricity costs may pose an obstacle, companies have managed to develop automation and digitalisation solutions to improve energy efficiency and optimise the decarbonisation process.

Recognising the importance of electrification, GMR has launched its first virtual conference, titled ‘Electrification in Mining’. Taking place on 16 April, the event will feature a range of presentations from mining leaders and industry experts exploring the evolution of technologies and initiatives to promote the future of sustainable mining. Register for free on our website now: www.bit.ly/49ytkos

This March issue of Global Mining Review also delves into other ways sustainability initiatives are implemented in all stages of the mining process. For example, TotalEnergies’ article on page 32 highlights how lubricants can play a crucial role in reducing the ecological footprint of mining activities. Meanwhile, on page 13, Stantec considers the advantages of implementing nature-based stream restoration methods in mine closure.

With the climate crisis looming over everyone’s lives, effective collaboration and cooperation between companies and countries are essential. The adoption of sustainable technologies and innovations across mining operations is not a matter of if, but when.

References

2.

1. SOBOTKA, B., ‘The mining industry must be ambitious in its support of the net zero transition’, World Economic Forum, (12 February 2024).

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK t: +44 (0)1252 718999 // w: www.globalminingreview.com

SEABROOK, V., ‘2023 was world’s hottest year on record – and 2024 could be worse’, Sky News, (9 January 2024).

EVENTS COORDINATOR

Global Mining Review (ISSN No: 2515-2777, USPS No: PENDING) is published 10 times per year by Palladian Publications Ltd., and distributed in the USA by Asendia USA, 701 Ashland Ave, Folcroft, PA. Application to Mail at Periodicals Postage Prices is pending at Philadelphia, PA, and additional mailing offices. POSTMASTER: send address changes to Global Mining Review, 701 Ashland Ave, Folcroft, PA. 19032. Annual subscription (10 issues) £50 UK including postage, £60 overseas (airmail). Claims for non-receipt must be made within four months of publication of the issue or they will not honoured without charge.

JANE BENTHAM

Truck Trakka technology Identify haul truck fleet to optimize individual vehicle payloads Empowering the next era of real-time payload management crmining.com Titan 3330™ is the most advanced real-time payload management system for mining operations, able to track and automatically report on all material movements. With its high-precision GPS offering 10cm accuracy to the bucket teeth via a user-friendly interface, operators can benefit from knowing where they need Start the conversation Globalsales@crmining.com 1300 33 8482 crmining.com/digital

3330 real-time payload management Load & haul maximized High-precision GPS, providing 10cm accuracy to the bucket teeth

Titan

NGuest Comment

GREGORY BEISCHER CEO, ALASKA ENERGY METALS

ickel activity is rising to accommodate multi-sector demand. Its importance as a transition metal has grown, but today’s production of critical clean energy inputs, from batteries to solar panels to critical materials, is concentrated in only a handful of countries, which is an issue.

Nickel will be required to support global population growth, which is anticipated to hit 8 billion in the next six years. At the same time, the world’s largest producer of nickel – Indonesia – may experience a change in its laterite nickel supply. Last year, the Indonesian Nickel Miners Association revealed the country’s reserves of high-grade nickel ore may be depleted by 2030, due to high annual production and increased demand from smelting facilities. If Indonesia exhausts its existing reserves without further exploration, this would mark a significant turning point for the global nickel supply chain.

On one hand, this would be the most ideal scenario for our environment. Indonesia and Chinese companies operating nickel mines, smelters, and refineries do not share the West’s standards for environmental protection. However, on the other, it could cause serious disruption, which is why long-standing dependence on Indonesia’s nickel supply is becoming highly unfavourable to activists and governments alike.

A new focus: Disseminated sulfide ores

While the West is far behind compared to where it needs to be to support demand and avoid an industrial bottleneck and supply chokehold, it has revived nickel exploration with a strong focus on the delineation and discovery of disseminated sulfide ores.

Sulfide deposits, which are typically formed in igneous or volcanic environments, contain higher concentrations of nickel and are generally easier to mine. Several decades ago, explorers overlooked this grade of nickel, but today it has gained favour, most notably in the electric vehicle sector, because it aids in the development of EV batteries. In order to keep pace with production expectations and keep

decarbonisation goals on track, nickel exploration in the West must continue. In the US, for example, a sudden supply halt would be detrimental to various groups, including the country’s national defence.

Nickel exploration in the US

The US Geological Survey includes nickel on its list of fifty minerals critical to the country’s economy and national security. As of now, the US has only one existing nickel mine, and, while it is operational, the country imports 100% of the nickel it actually uses. This mine is anticipated to reach its end of life by 2027.

New federal legislation like the Inflation Reduction Act and the bipartisan infrastructure law have worked to encourage and create big incentives for domestic production, but mining operators in the US continue to be met with challenges. In the US today, there are only a few states in which nickel can be found. These include Michigan, Minnesota, Alaska, and a few others, but proposals for mining operations have not exactly been met with open arms. Alaska is particularly important because it is a pro-mining state with the gold standard environmental and regulatory regime to support truly responsible mining.

The hard truth

While the above is an ideal scenario, at the present time, Indonesian nickel production is up by one quarter from 2018 and currently accounts for half of the world’s nickel supply. Indonesia’s ministry is also working to attract more investment for exploration projects, but the Indonesian Institute has warned that if further exploration continues, it will not come without potential consequences, some of which we have already seen.

If Indonesia overbuilds nickel processing facilities, nickel reserves will decline due to over-mining and environmental risks will intensify – something we simply cannot afford if, globally, we are to meet our ambitious climate goals and protect the environment.

Palladian Publications Ltd, 15 South Street, Farnham, Surrey, GU9 7QU, UK t: +44 (0)1252 718999 // w: www.globalminingreview.com

Innovative solutions. Positive transformation.

You need a partner that can meet your needs and embrace the future. One with new solutions for a changing world. Together, we can work toward a better future. komatsu.com/hardrock

© 2024 Komatsu Ltd. or one of its subsidiaries. All rights reserved.

WX07 LHD

World NEWS

SOUTH AMERICA Metso opens slurry pump hubs in Peru and Brazil

Metso has established pump assembly and competence centres in Peru and Brazil, investing in its slurry pump capabilities in South America.

These regional Metso Pump hubs serve mining customers by offering a full range of slurry handling solutions and shorter lead times with reduced transport-related CO 2 emissions.

“Our investments in our regional pump hubs have paid off. Our customers get fast access to our experts and the whole breadth of our pumps offering. As examples of some of the latest orders, I’d like to mention this quarter’s record-breaking order of nearly 100 pumps for an iron ore mine and another major order for a copper mine in 2023, including a significant number of horizontal and vertical slurry pumps. A key enabler of these sales has been our comprehensive technical and service support, as well

as our quick delivery times, effective collaboration, and competitive prices,” said Eduado Orsi, Manager, Pump Application and Sales at Metso in Brazil.

“Slurry handling is vital in maximising productivity and efficiency of minerals processing plants. Our offering has been designed to serve our customers’ needs for effective slurry handling. In addition to the major growth in new pump equipment orders in South America, customers are increasingly interested in our aftermarket offering, including our agreement-based services. To support our customers, we have strengthened our regional supply chain and assembly capacity, as well as application and engineering resources. Metso will continue to invest in slurry handling capabilities in South America and other key market areas,” added Kalle Sipilä, Vice President, Pumps Business at Metso.

CANADA Rio Tinto to decarbonise iron ore processing

The Government of Canada has awarded CAN$18.1 million from its Low Carbon Economy Fund to Rio Tinto’s Iron Ore Company of Canada (IOC) to support the decarbonisation of iron ore processing at its operations in Labrador West.

The funding will enable IOC to reduce the amount of heavy fuel oil that is consumed in the production of iron ore pellets and concentrate. The company will install an electric boiler to displace emissions from the usage of the heavy fuel oil boilers, as well as instrumentation and fuel-efficient burners to further reduce heavy fuel oil consumption from induration machines.

Over the lifetime of this project, IOC will see a cumulative reduction of about 2.2 million t of greenhouse gas emissions.

Installation of the new equipment will begin in 2Q24 and is expected to be completed in 1H25. The project will create more than 100 jobs during the construction and implementation stages in Labrador West.

IOC President and Chief Executive Officer, Mike McCann, said: “Rio Tinto IOC has a plan to decarbonise and continue producing some of the lowest carbon-intensity high-grade iron ore products in the world, right here in Canada. This project alone will eliminate approximately 9% of IOC’s greenhouse gas emissions. We look forward to collaborating with the Government of Canada and other partners towards our goal of achieving net zero emissions by 2050.”

Labrador Member of Parliament, Yvonne Jones, added: “By working with organisations across Canada, such as IOC, we can help the community save money on monthly operating costs and grow the economy, all while fighting climate change. Through the Low Carbon Economy Fund, the Government of Canada is partnering with climate leaders nationwide to cut emissions. I applaud the leadership shown by IOC for helping to keep our air clean and build resilient communities in Newfoundland and Labrador.”

7 global mining review // March 2024

World NEWS

Diary Dates

Electrification in Mining

16 April 2024

Online Conference www.globalminingreview.com/ events/electrification-in-miningvirtual-conference

CIM Connect Convention & Expo

12 – 15 May 2024

Vancouver, Canada www.cim.org/events

Discoveries Mining Conference

21 – 23 May 2024

Mazatlán, Mexico www.discoveriesconference.com

Euro Mine Expo

28 – 30 May 2024

Skellefteå, Sweden www.euromineexpo.com

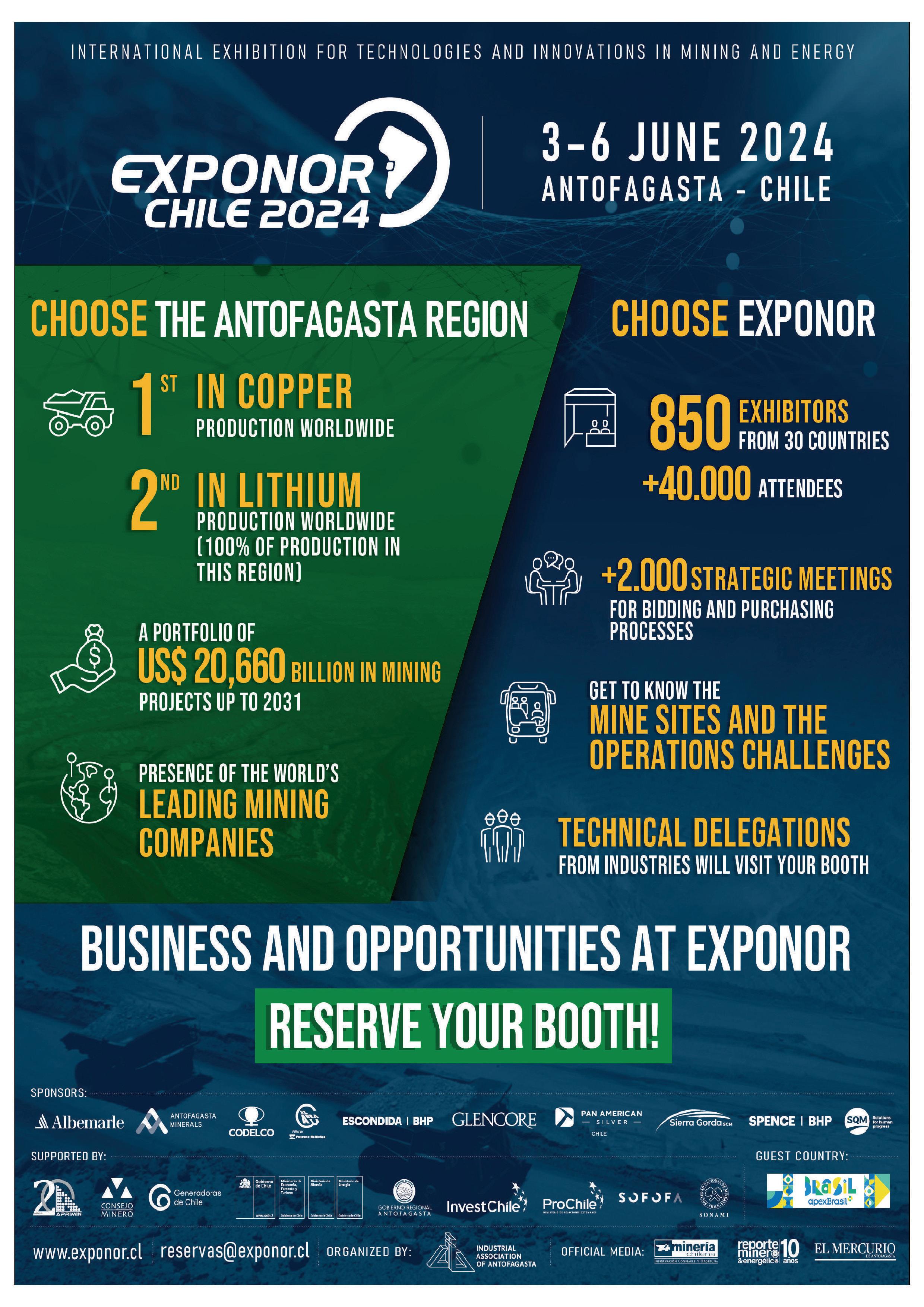

Exponor Chile

03 – 06 June 2024

Antofagasta, Chile www.exponor.cl

Elko Mining Expo

06 – 07 June 2024

Elko, USA

www.exploreelko.com/top-events/ elko-mining-expo

International Fairs EXPO KATOWICE

04 – 06 September 2024

Katowice, Poland www.expo-katowice.com

MINExpo INTERNATIONAL®

24 – 26 September 2024

Las Vegas, USA

www.minexpo.com

To stay informed about upcoming industry events, visit Global Mining Review’s events page: www.globalminingreview.com/events

SWEDEN Boliden partners with Hypex Bio for environmentally-friendly explosives

Boliden has signed an agreement with the Swedish explosives supplier Hypex Bio regarding the production and delivery of nitrate-free and environmentally-friendly explosives to Kankbergsgruvan, Boliden.

The agreement means that Boliden and Hypex will cooperate on the production and delivery of nitrate-free and environmentally-friendly explosives to the Kankberg mine, which includes the establishment of a production facility at the mine, as well as a delivery and service agreement.

The supply and service agreement for Hypex’s explosives solution spans five years starting in 2024. The production quantity is expected to amount to 400 – 450 t and thus largely meet the Kankberg mine’s annual needs. In addition to the fact that the explosive drastically reduces the need for nitrogen treatment of water, the climate impact is reduced by approximately 400 t of CO2 per year (Scope 3).

“For us, it is important to be part of technology development in many areas and when it is successful, we also want to be early with implementation. Together with the electrification of transport and other machines, this means another important step towards being able to conduct mining operations that are, in principle, fossil-free,” said Peter Bergman, General Manager of the Boliden area.

GLOBAL Komatsu adds new LHD to underground hard rock line-up

Komatsu has introduced to the global market the new WX11 LHD, an 11 t machine that offers optimum breakout force and payload, helping to maximise productivity and provide a lower total cost of ownership.

The WX11 showcases Komatsu’s commitment to providing underground hard rock miners with a load, haul, and dump solution, integrating next-generation data management capabilities, operator ergonomics, intuitive controls, and compliance with EU Stage V emission requirements. As a new model within the Komatsu hard rock family of products, the WX11 is designed to be a leading LHD for all underground mine operators and contractors. With ease of operability, optimal performance, and ground-level maintenance position, the WX11 has several competitive edges in the 10 t LHD class.

“The WX11 is a game changer for hard rock miners. Developed through a close partnership between our experienced team and our longtime customers, this product reflects a shared commitment to design excellence,” said Ryan Karns, Director of LHD and Truck Products at Komatsu. “The WX11 is the LHD every miner will want to have in their operation.”

8 March 2024 // global mining review

PROdUCT NEWS

Many mining companies around the world suffer from water stress and, although mine managers understand that evaporation may be reducing their available water, most do not understand its full impact.

Table 1 shows a few examples of evaporation losses from water storages of various sizes, based on an average daily evaporation rate of 12 mm. This is a typical figure in hot climates, but it can vary according to ambient temperature, humidity, wind speed, and other factors.

To address these water losses, Aquatain Products Pty Ltd – an Australian company which has been pioneering its water-saving technologies since 2006 – has developed a unique product called WaterGuard GOLD. The product is a liquid which self-spreads across the surface of water storages, forming a very thin ‘liquid lid’ on the surface.

Danny Bryan, Special Projects Consultant with Aquatain Products Pty Ltd, says: “The principle is simple, but the impact can be huge. Trials have shown evaporation reductions of 50% or more. As you can see from Table 1, a one-hectare dam can lose more than 800 000 litres of valuable water each week. Evaporation is really a silent assassin, as you can stand beside a dam all day and not realise that the water is disappearing in front of you. WaterGuard GOLD is very easy to apply. For most dams, it can be simply poured on from the edge and it will self-spread to cover the surface. For larger storages, it can be applied directly from a boat or barge.”

The product is economical to use. In a harsh environment, for example, an application of 3 litres will protect 1000 m2 of water surface for up to three weeks. A lower rate can be used in less-severe conditions.

The components of WaterGuard GOLD are safe chemicals, and are used in many food and pharmaceutical applications.

In addition to WaterGuard GOLD for evaporation control, the company has another flagship product called Aquatain AMF for mosquito control. Like WaterGuard GOLD, it spreads across the water surface to form a very thin film. However, its action is slightly different: the Aquatain AMF film reduces the surface tension of the water, preventing mosquito larvae from attaching at the surface to breathe and causing them to drown. The product involves an entirely physical action without any toxic chemicals. It is highly effective in breaking the mosquito breeding cycle, is approved for sale

in nearly 70 countries, and has been prequalified by the World Health Organisation, which ensures users that it has been extensively assessed for its efficacy, safety, and quality.

Malaria and dengue fever are endemic to multiple countries around the world (malaria kills more than 700 000 people in Africa each year), and mining companies are affected severely in many cases. In addition to recognising its responsibility to protect its employees and families from disease, there is clearly a benefit to a mining company’s bottom line if absenteeism can be minimised by reducing the incidence of mosquito-borne disease.

Figure 1. WaterGuard GOLD is available in several sizes, up to 1000 litre IBCs.

Figure 1. WaterGuard GOLD is available in several sizes, up to 1000 litre IBCs.

Surface area of dam (m 2 ) Evaporation losses (litres) Daily Weekly 500 6000 42 000 1000 12 000 84 000 5000 60 000 420 000 10 000 120 000 840 000 9 global mining review // March 2024

Table 1.

Luc Lachance, ION Commodities, Canada, discusses nickel’s performance in 2023 and explores how operational excellence can ensure sustained business success.

The demand for nickel – all over the world – has undergone considerable growth over the past two decades, with the market evolving from 1.12 million t in 2000 to 3.42 million t in 2020.1 However, 2023 posed fresh challenges to the industry, marked by volatile pricing dynamics, oversupply concerns, and uncertainties surrounding demand from China’s struggling property sector.2 Under these challenging conditions, nickel emerged as the weakest performer among LME base metals in 2023, with prices down by around 45% according to ING.3

In response to this turbulent market environment, nickel producers – from the C-Suite to process professionals and plant superintendents – should focus on what they can most readily control: operational excellence. While financial derivatives offer a hedging option to navigate fluctuating supply and demand dynamics, operational excellence stands out as the single most important tool at the disposal of nickel producers for gaining a competitive advantage and ensuring sustained business success amidst persistent market volatility.

Nickel overview

Nickel, the fifth most abundant element on Earth, plays a key role in various industries ranging from stainless steel production to electric vehicle (EV) lithium-ion batteries. Although reserves available for economically viable mining are limited, the current land resource base is estimated to endure for over 100 years at the present mining rate, according to the International Nickel Study Group (INSG).4 Geographically, Asia dominates the nickel market, with China alone representing nearly 60% of the world demand in 2020 (up from 39% in 2010).5

The primary application for new nickel remains stainless steel production, with this market experiencing a growth rate of approximately 5.8% per annum, driven by demand across the automotive, consumer goods, and construction industries.6 However, nickel’s usage extends to alloyed steels, high nickel alloys, castings, electro-plating, catalysts, and chemicals.

10 March 2024 // global mining review

What changed in 2023?

Supply and demand dynamics

The demand for nickel witnessed substantial growth in 2023 and is projected to further increase by 9% in 2024.7 However, this surge in demand has also been met with a simultaneous rise in production, presenting a challenge for balancing the market. Consequently, the global nickel market experienced a surplus of 223 000 t in 2023, over double the 104 000 t surplus in 2022. This surplus is particularly noteworthy given that the total global nickel output reached approximately 3.42 million t in 2023.3 Projections from the INSG indicate that this surplus is poised to expand to 239 000 t in 2024, marking the third consecutive year of excess supply.1

The surge in supply stands out as one of the key drivers for nickel’s relative underperformance in 2023, which can be mainly attributed to class II and nickel chemicals – particularly nickel sulfate, rather than the historical association with LME deliverable/class I nickel. Indonesia has played a pivotal role in this supply surge, particularly in nickel pig iron (NPI) and nickel mesh. To position itself as a significant raw materials supplier to EV battery manufacturers, Indonesia has substantially increased its mined nickel production in 2023. Holding the largest nickel reserves, Indonesia produced an estimated 1.6 million t in 2023, constituting nearly half of the global nickel production.8

China’s influence

In China, the second-largest producer of nickel, class I output rose by over 36% y/y in the first three quarters of 2023, responding to historically high LME prices.

However, the Chinese housing market, which was marked by a considerable slowdown in the latter half of 2023, has added complexities to nickel pricing dynamics. In July, new home prices fell by 0.23% in 70 cities, a slide that continued into December when they fell by 0.45%, as reported by the South China Morning Post.9 This downturn has strained the cash flows of real estate developers, leading to project delays and a diminishing trust in the property market.

Whilst there was initial optimism regarding Chinese stimulus measures to bolster metal prices in 2023, this enthusiasm is now waning, given the absence of a substantial stimulus package comparable to measures implemented during the 2008 financial crisis. Speculation is now growing that the economic slowdown in China might endure longer than initially anticipated, prompting financial institutions to downgrade their price outlooks for nickel.

Energy transition

Amidst the transition to cleaner energy sources, nickel has emerged as a key strategic metal due to its unique properties. The green transition, necessitating an investment of nearly US$200 trillion through 2050, particularly targets EVs, upgraded power grids, and low-carbon power, with nickel playing a central role.10 Offshore wind turbines, for example, are contributing to heightened nickel demand, as these technologies are mineral-intensive, requiring approximately 15 times more nickel compared to traditional wind turbine installations.11

Moreover, with major carmakers heavily investing in EV manufacturing, the surge in nickel demand for lithium-ion batteries – known for their higher energy density,

extended lifespan, and increased driving range – is expected to strongly impact the global nickel market in the coming years. McKinsey projects that by 2030, EVs and associated infrastructure will consume more than a third of global nickel production, a substantial increase from the current 17% demand attributed to EVs.11

However, in the short term, the path forward for EVs is uncertain, given that the market observed a notable slowdown in the latter half of 2023, particularly in the US. Several factors contributed to the smaller-than-expected appetite in 2023, including a consumer hesitancy to pay a premium for EVs, especially when faced with financing such premiums at high interest rates, as well as the comparative cost between electricity prices and fuel prices throughout the year. While it is yet to be determined whether this is a temporary occurrence or more of an enduring trend, there is notable uncertainty surrounding the trajectory of EV adoption, creating a volatile and unpredictable environment for the nickel industry.

Key to understanding the significance of these 2023 trends lies in the fact that pricing volatility already compounds enduring and widely acknowledged technical challenges. Nickel deposits are increasingly characterised by lower ore grades, needing more complex extraction processes, especially for laterite projects. Additionally, the energy required for metal extraction increases with decreasing ore grades, resulting in surging extraction costs which could potentially render mining financially unsustainable if prices stay low.12

What can we expect in 2024?

Ongoing volatility in industrial metals is expected to persist in 2024, influenced by factors such as a robust US dollar and weakened demand amid slow global manufacturing activity. Uncertainties in the metals markets – driven by economic growth concerns, geopolitical tensions, and strict monetary policies –continue to affect stainless steel and EV demand in particular.

Geographically, Indonesia’s NPI production is expected to rise, while China may witness a decrease in NPI production coupled with an increase in nickel cathode and nickel sulfate production. The uncertainty surrounding China’s recovery, especially in its troubled property sector, poses a significant challenge, restraining gains for industrial metals and sustaining volatility in the near term.

Despite a potential recovery in demand from the stainless steel sector and EV batteries, forecasted nickel prices indicate short-term pressure, averaging US$16 600/t in 1Q24 and gradually rising to US$17 000/t.13

Achieving (and sustaining) operational excellence

2024 is likely to witness volatile pricing in an already prevalent background of diminishing metal grades and increasing orebody complexity. To navigate this challenging market, nickel producers must prioritise operational efficiency to ensure competitive advantage and long-term success. Businesses must make every dollar count, and operational excellence ensures that mining companies can extract maximum value from their mineral deposits.

Achieving and sustaining such operational excellence is a gradual process that hinges on creating a culture where all teams invest in constantly improving business outcomes. Undoubtedly,

11 global mining review // March 2024

what lacks measurement cannot be managed effectively, and what is not precisely measured cannot be precisely controlled. First achieving compliance and excellence in metallurgical accounting practice, encompassing the representative and timely measurement of all significant metal movements and inventories in metallurgical operations, therefore appears as a necessary condition for meeting higher operational standards.

The data problem

Miners face challenges in transforming the abundance of data available at their operations and within the industry into valuable operational insights. A predominant root cause for this is the presence of data silos between departments, along with the widespread usage of spreadsheets for operational accounting and management across the metal value chain. This practice exacerbates integration issues as these homegrown systems struggle to present a unified source of truth.

Furthermore, poor representativeness and availability of certain data also preclude the ability to unlock valuable operational insights. This leads to inconsistent estimates for key performance indicators and operational models, affecting both analyses and predictions. Achieving operational excellence across the nickel value chain necessitates improving the representativeness of these estimates, which can be done through a combination of measurement retrofit and data reconciliation.

What are the consequences of relying on poorly representative data?

Firstly, poor estimates of metal movements and inventories inside and around mineral and metal processing plants pose huge risks of undetected material losses and lower-than-expected recoveries, which ultimately lead to lost profits when some revenues are not realised.

Secondly, poorly representative data from pit to port poses the risk of not shipping the right quantity and quality of metal concentrate at the right time. Shipping a lower quantity/quality of metal concentrate than the requirements may result in penalties and a loss of trust, while shipping a higher quantity/quality than required can lead to receiving insufficient payment in view of the actual production. This delicate balance highlights the importance of representative data in ensuring fair transactions and maintaining strong relationships with customers.

Finally, poorly representative data across the metal value chain may also lead to a lack of market responsiveness, resulting in lost profits when opportunities are not seized. Such low market responsiveness can be improved by extending the spatial scope and improving the timeliness of the metallurgical accounting system to produce representative valuation reports of a given metallurgical operation at a higher frequency. This is easier said than done, however, as doing so will require a higher measurement rate. This can be challenging, particularly for the inventories, let alone the pressure on the metallurgical lab throughput, which is more than often very limited. Importantly, this improvement path must be first implemented at each mineral or metal processing site and then fully integrated among a mining company for maximum operational and financial effectiveness, rather than being solely a corporate-level formality.

Overall, these risks and consequences could extend beyond immediate financial concerns to include reputational damages. Instances where companies are compelled to restate their financial statements not only create delays, but also sow distrust, triggering stock drops and other adverse consequences.

To mitigate these risks, the metallurgical accounting system must be compliant with industry-acknowledged standards, such as the AMIRA P754 Code of Practice for Metal Accounting. Such compliance requires, in a non-exhaustive manner, an adequate amount of data redundancy provided through a well-designed measurement system that has a fit-for-purpose measurement representativeness.

The importance of automation

To unlock the representative and timely information that operational excellence requires, an automated and systematic approach is essential. To this end, a focus on enhancing visibility across the entire metal value chain, connecting the front, middle, and back offices for greater transparency, is essential. Proprietary mathematical algorithms can be employed to create centralised dashboards serving as a ‘single source of truth’ to address operational challenges.

A seamlessly integrated data management system across the entire metal value chain minimises manual interventions and ensures a smooth flow of data from pit to port. This enables representative estimates of all significant metal movements and inventories, provided it is supported by regular equipment monitoring and system audits. Adopting a compliant and automated metallurgical accounting system should not only facilitate timely operational and financial reporting, but also maintain detailed records for critical processes like audits, enhancing the overall transparency for mining companies.

While technology adoption varies among miners due to the industry culture of fearing the ‘first mover’ reputation, champions of new technology at an operational level consistently yield the best outcome, and EY predicts that there will be a surge in data and technology adoption among miners in 2024.14

Conclusion

As the nickel market continues to face complex pricing dynamics and oversupply uncertainty, companies must prioritise optimising their operations to effectively secure profits and manage risks.

Operational excellence, a key differentiator for mining companies thriving in challenging environments, is unachievable, let alone sustainable, without first reaching compliance and excellence in metallurgical accounting. Mining companies that achieve and sustain such excellence will not only generate more profits from current deposits than competitors, but also opportunistically capitalise on upcoming deposits having declining metal grades and increasing orebody complexity. Those who do not embrace operational excellence risk falling behind in both current and future operations, potentially facing acquisition by competitors who have adopted and sustained operational excellence.

References

Available on request.

12 March 2024 // global mining review

Paul Kos and Chris Jaros, Stantec, USA, consider the advantages of implementing nature-based stream restoration methods in mine closure.

The mining industry can show sustainable water management by restoring streams, wetlands, and woodlands to natural ecosystems. Restoring a natural water system using Nature-based Solutions (NbS) provides a critical habitat for creatures living on land and in the water. It also supports the United Nations Sustainable Development Goals.

13 global mining review // March 2024

Reclamation promotes biodiversity, and helps mining companies get regulatory and social approval.

Historically, in the US, mine closure and water management regulations prioritised preventing erosion. Because of this, many mine water management methods included waterways made of hard armouring. The hard armour would be riprap or gabion baskets (a layered rock wall held together with metal wiring). Thankfully, today’s policies allow some erosion in stream restoration projects. This is a positive development, because erosion is a key principle of natural stream behaviour. Now, a more modern approach to mine closure and water management means restoring waterways to mimic the surrounding undisturbed areas.

Components of a restored stream

Stream restoration does not require a major effort beyond reclamation and monitoring. The initial water treatment and grading is the same for both nature-based and traditional methods. The main difference lies in recreating a more natural ecosystem using the six components outlined below.

Low-flow channel

A low-flow channel is key to concentrate seasonal flow fluctuations, providing a continuous water path. This channel usually meanders through the floodplain to limit channel gradient.

Riffle-pool sequence

Riffle-pool sequences create varied aquatic habitats. They have riffles on straight segments of the stream and allow for pools at the bends. Both habitat types are necessary for fish and insects to propagate. Riffle-pool sequences are also important from a structural perspective – as they provide gradient control on slopes up to 5%.

Floodplains

When there is more water than the stream can hold, it enters the floodplain. Even higher flows may reach overflow areas above the floodplain. Planning for large influxes of water is a key component of a resilient riparian ecosystem. The greater flow area and vegetation help decrease flow velocities and limits erosion.

Boulder walls or vegetated soil lifts

Sometimes, the site topography dictates the need for small sections of armouring along the streambank or channel, but the choices extend beyond the traditional riprap. More natural boulder walls or vegetated soil lifts can provide support, decrease erosion, and integrate with the natural landscape.

Vegetation

Proper revegetation of an area is critical to the success of a nature-based stream restoration project. A well-vegetated stream bank can resist erosive storm flows and help further strengthen armoured banks. It is best to choose a diverse seed and plant mixture that mimics the nearby natural stream setting. Riparian plant species thrive where water is present. They flourish on floodplains, tolerate high water tables, and provide erosion resistance. Plants create shade and help control stream temperatures. They also promote biodiversity by providing habitat for both land and aquatic animals and insects.

Fish passage

Fish ladders are sections of stream built to help fish navigate upstream where there are steep slopes and high velocities. Without help, those fish may not have access to important breeding habitat. The fish passage enhancements can take many forms, depending on the swimming ability of the native fish. It is anticipated that this will become more of a focus in future water management projects. In many parts of the US, new and current restoration projects include a fish and aquatic life component, with more regulations around fish passage. 1

Case studies in Colorado’s watershed

The riparian ecosystem of the Alamosa River in Colorado had been damaged by previous mining activity. When it came time to restore the watershed, the focus was on managing erosion and sediment deposition. Stantec restored more than 12 000 ft of the river. As with so many water projects, this was a section of river that served many stakeholders. The reservoir upstream regularly releases high volumes of water to accommodate agricultural needs downstream. Stantec installed boulder weirs along the riverbanks to better regulate the unnaturally high flow in the channel. The structures directed water back into the historic channel flow area, so the heavily vegetated inner banks could manage higher flow. This resulted in

14 March 2024 // global mining review

Figure 1. Natural restoration work on the Alamosa River included installing hydraulic structures to better manage erosion and sediment deposition.

reduced sediment loading and a stabilised channel. This restoration project also helped recharge groundwater nearby and safeguard natural infrastructure. The Alamosa River Restoration was good for the environment, promoted healthier communities, and achieved regulatory compliance, improving the larger watershed beyond the Alamosa River.

Another example in Colorado is Four Mile Creek. It supplies water to a few small towns near Boulder, and the watershed had been impacted by previous mining activity.

When Stantec’s team started work here, the amount of arsenic in the water was over the drinking water standard. Stantec environmental engineers tested waste rock piles to determine what metals were present and removed waste rock from the channel. The channels were restored using the principles discussed above, and the design included a low-flow channel, rifle-pool sequences, boulder walls, vegetated soil lifts, and floodplain areas. The team also capped remaining waste rock with an evapotranspiration cover to reduce leaching. Finally, they planted vegetation consistent with the surrounding forest and native stream channel.

After the restoration of the main channel and side tributaries, water quality in the area has greatly improved. Now, arsenic levels are below detection limits, and the surrounding landscape is regrowing.

Beyond environmental benefits –social acceptance and carbon

Support and buy-in is a very real component of today’s mining landscape. A mining company that has shown attention, care, and funding focused on environmental remediation is more attractive in the eyes of investors and the public. Plus, a proven record of responsible mining and environmental care promotes trust in communities who are often quick to oppose nearby mining activity. Changes in both legislation and reporting capabilities mean independent reviews can verify environmental stewardship successes.

Another benefit that is getting a lot of attention lately is the potential for riparian and wetland areas to sequester carbon. Large swathes of land – especially forested riparian ecosystems – can become carbon sinks as part of a carbon offset programme. This is evident in many industrial site closure plans. 2 It is anticipated that carbon sequestration opportunities will gain popularity, as more companies look to secure carbon credits and carbon offsets.

Cost of nature-based stream restoration

Regardless of the channel type, water management is typically a small percentage of the total reclamation costs at a mine. The greatest costs are usually slope grading, topsoiling, and vegetation. This means that adjusting the channel construction costs from hard armour to a natural system has a small impact on the final cost.

When restoring a stream, Stantec uses geometry and vegetation for erosion protection. As such, any additional excavation and vegetation may cost less than buying and placing rocks. Maintenance costs are also generally less. This is because a natural stream is a resilient ecosystem. It maintains balance through erosion and sediment deposition. Flooding is mitigated by building a grassy marsh area rather than riprap armouring.

In both the US and Canada, many mining projects may qualify for state and federal tax incentives and low-interest loans to support restoration work. 3 This is especially true for historic or abandoned mine sites that do not have an active supply of funding.

A duty to care for land and water

Nature-based water management can be part of every future mine closure plan. It is encouraging to see so many successful projects that have restored landscapes that were damaged due to mining impacts. Choosing to naturally restore stream channels and the surrounding landscape truly is the right thing to do. However, beyond a moral obligation, it can also make it easier to obtain permits, funding, and community support for future projects. Using a nature-based stream restoration approach is a winning solution for mining companies, communities, and the environment.

References

1. DANIS, N., NIGHTENGALE, T., and RYHERD, J., ‘Fish passage: Fixing culverts is key to better stream habitat for salmon, other species’, Stantec, (23 April 2023), https://www.stantec.com/en/ ideas/service/ecosystem-restoration/fish-passage-fixing-culvertsis-key-to-better-stream-habitat-for-salmon-other-species

2. WISEMAN, G., and PLAYER, B., ‘Measuring trees and tracking carbon sequestration from the sky’, Stantec, (30 August 2022), https://www.stantec.com/en/ideas/content/blog/2022/ measuring-trees-and-tracking-carbon-sequestrationfrom-the-sky

3. RYCKMAN, C., and MCCULLOCH, A., ‘Finding funding: New opportunities abound for the mining industry’, Stantec, (7 March 2023), https://www.stantec.com/en/ideas/content/ blog/2023/finding-funding-new-opportunities-abound-for-themining-industry

16 March 2024 // global mining review

Figure 2. Stantec worked with a local ranching community along the Alamosa River in southern Colorado to restore a vital water source that was once suffering from pollution.

Gordon Wilkin, Caterpillar, Inc., reviews the evolution of the CAT® R2900: an LHD on the verge of celebrating 30 years since its first introduction to the mining industry.

Replacing the originally designed large load-haul-dump (LHD) 2600 machine, which was closely followed by the successful R2800, the Cat® R2900 model series was first produced in December 1994 and made its debut at the 1995 AIMEX mining show in Sydney, Australia. It has enjoyed a rich history of efficient production spanning nearly three decades. The largest of the four LHD models, the R2900, increased rated payload to 17.2 t, 1 t higher than the R2800. At the time, this met mining operations’ needs for increased productivity to reduce the cost per tonne of ore mined. At mine sites in Australia, initial machines impressed operators with improved visibility that addressed left-hand-side blind spot issues common with other models.

Throughout the years, the R2900 series has remained the workhorse of the Caterpillar LHD line, with design updates making only minor changes to many of the productivity

specifications such as payload, bucket size options, and breakout force. Much of the effort focused on reducing exhaust emissions to improve underground air quality. Roughly a decade after the series introduction, the R2900G model was introduced in 2005 with both ventilation reduction (VR) system and EU Stage IIIA/US EPA Tier 3 engine packages. The former offered the optional use of flow through or highly efficient wall flow diesel particulate filters to improve underground air quality.

With commercial availability of the new Cat R2900 model in 2019, Caterpillar added an EU Stage V/US EPA Tier 4 Final engine option for markets adhering to higher emissions regulation standards. It introduced the Cat Clean Emissions Module to the LHD for limiting both particulate matter and NOx to near zero. Technology also played an integral role in machine design with Product Link™ Elite enabling machine

17 global mining review // March 2024

Figure 1. The R2900 XE’s switch reluctance electric drive system with continuously variable speed control provides 52% quicker acceleration and improved machine response over the R2900G.

health monitoring through the in-cab display and making it easier to share data across multiple destinations.

Remote machine operation was also introduced with the early R2900’s to increase operator safety. The scalable remote technology includes the Cat line-of-sight console with other

Cat MineStar™ Command technology options to make it possible for tele-remote and semi-autonomous operation from a distant operator station.

Sea change with the R2900 XE

With a markedly different design, the new Cat R2900 XE, introduced mid-year 2023, serves as Caterpillar’s next evolutionary step in pushing the boundaries of loader performance and efficiency. The company’s first diesel electric LHD model meets today’s mining industry’s needs for bigger payloads, faster loading, and reduced emissions. It features optimised lift arm and component geometry, plus load-sensing hydraulics to elevate lift breakout force to 32 500 kg and calculated tilt breakout force to 42 000 kg, an overall 35% improvement in breakout force from the R2900G.

Moreover, the new LHD includes many operator and technician enhancements designed to improve safety and productivity. Its field-proven switch reluctance (SR) electric drive system with continuously variable speed control provides 52% quicker acceleration and improved machine response over the R2900G. With no driveline or powertrain shock loads, it offers smooth directional changes and increased power train component life. Automatic retarding controls maintain speed on grade, and the anti-rollback feature also prevents coasting in neutral.

With no transmission or torque converter, the R2900 XE features lower hydrocarbon emissions and offers a reduction in fluids that require regular servicing. Service intervals for the Cat C15 engine have been increased to 500 hours. Together with lower heat generation, there is a reduction in service parts required and stoppages for servicing.

At 18.5 t payload, the R2900 XE’s 1.3 t higher payload than the R2900G delivers faster load cycle times and provides a three to four-pass match to the 63 t Cat AD63 underground mining truck. Both models offer a variety of capacity options to match mine site conditions. Productivity for the R2900 XE averages in excess of 20% higher compared to its predecessor.

The new Cat underground LHD model comes from the factory equipped ready for a broader range of Cat MineStar solutions than the R2900G. Mine sites can now choose from a wide array of technologies like Detect, Fleet, Health, and Command for underground that enable remote operation ranging from line-of-sight to full autonomy. Additionally, new Autodig technology optimises loading by automating crucial parts of the digging cycle.

The R2900 XE shares parts and components with the previous R2900G model and the industry proven Cat 988 XE large wheel loader. Many of the safety and technology advancements are also shared with many other models from the broad range of Cat equipment, allowing the local dealer to continue to provide support, service, and parts to the new R2900 XE.

Proving the claims

A six-month, Caterpillar-conducted study of the new R2900 XE followed the unit more than 1500 operating hours to compare its performance to that of the mine site’s existing fleet of five R2900G units. The R2900 XE was equipped with an 18.5 t rated bucket, and the R2900Gs were equipped with 17.2 t rated buckets.

18 March 2024 // global mining review

Figure 2. First produced in 1994, the Cat® R2900 has enjoyed a rich history of efficient production for nearly three decades.

34 % average fuel consumption 101.6 % tonnes / hour 20 % lift capacity 54.9 % CO emissions at high idle Compared with the Cat ® R2900G

Figure 3. Introduced mid-year 2023, the diesel electric Cat R2900 XE meets the mining industry’s needs for bigger payloads, faster loading, and reduced emissions.

Figure 4. Compared to the Cat R2900G, the new R2900 XE increases productivity and lift capacity and reduces fuel consumption and CO emissions.

WIRTGEN GmbH · Reinhard-Wirtgen-Str. 2 D-53578 Windhagen T: +49 26 45 / 131 0 A WIRTGEN GROUP COMPANY

SM(i): Surface Mining combines safe mining operations with modern cost-effectiveness: the 280

replaces

otherwise needed for

drilling and pre-crushing. It cuts costs, delivers mined raw materials of higher quality, and ensures more efficient exploitation of the deposits. Take advantage of innovative solutions from the technology leader. www.wirtgen.com www.wirtgen.com/mining Blasting? No! Safety? Yes!

280

SM(i)

the entire equipment

blasting,

Field follow data showed a 34% average fuel consumption reduction with the R2900 XE, primarily due to its SR electric drive system and hydraulic piston pumps. The new R2900 XE also offered 54.9% lower CO emissions at high idle, while NOx emissions were 34% and 42.1% lower at idle and high idle, respectively. Diesel particulate matter was lowered by 99.99%, comparing the R2900 XE EU Stage V/US EPA Tier 4 Final engine to the Tier 2 of the R2900G.

Lower CO and NOx emissions data demonstrated an improved working environment for personnel at the mine using the R2900 XE. Beyond reduced exhaust emissions, a 7 – 11°C reduction in working area temperatures were recorded. At the same time, the R2900 XE operates quieter and reduces exposure to vibration levels compared to its predecessor.

The new R2900 XE offers an impressive reduction in tyre wear, which Caterpillar attributes to the new traction control system design. Traction control reduces tyre spin in difficult underfoot conditions to improve productivity, increase tyre life, and reduce consumable costs.

The R2900 XE, with its higher bucket capacity, provided a 101.6% increase in tonne-per-hour productivity on a duty cycle pulling material from the same loading source to destination. The field follow results also demonstrated a 20% increase in lift

capacity over the mine’s current LHD models, and the R2900 XE delivered three-pass loading – compared to the R2900G’s four passes – of the mine’s AD60 and AD63 trucks, equipped with the mine’s preferred body size.

Compared to the R3000H

At another Australian underground mine, Caterpillar evaluated the performance of the R2900 XE against the Cat R3000H. The performance and payload study included the same draw points measured in the field follow for each loader, and material was dumped at the same tipping location at the mine’s underground crusher.

The R3000H offers a rated payload of 20 t, today the largest LHD in the Cat line, and was equipped with a 10.5 m3 bucket. The smaller R2900 XE’s rating is 18.5 t, and it was fitted with a Cat 9.2 m3 bucket for the study. Even with the smaller bucket and rated payload, the R2900 XE outperformed the larger loader as anticipated by Caterpillar.

The reasoning behind its higher productivity was in part due to the R2900 XE filling its bucket 15% faster, in just 11 seconds. Additionally, the new LHD clocked a much faster fully loaded acceleration speed with its electric drive system compared to the R3000H, delivering faster cycle times.

On top of offering higher productivity, the R2900 XE burned 13% less fuel than the R3000H over the same application. This equated to a 12% better t/l of fuel productivity result.

The mine site plans to equip its future R2900 XEs with a 9.8 m3 bucket. Using the larger bucket, the mine could realise a potential extra 6% increase in productivity gains compared to using the 9.2 m3 bucket.

Against competitive LHDs

A third Australian study pitted the R2900 XE against a competitive LHD model with a published rated payload just over 17 t. The study’s objective was to clear the same amount of material from the same specified area.

The R2900 XE cleared the area in 20 buckets compared to the competitive LHD’s 24 buckets, was 17% faster in clearing the development, and loaded the haul trucks faster. Plus, the measured operating heat generated by the R2900 XE was 7.1°C lower on level ground and 11°C lower on the decline than the competitive LHD.

In comparative working conditions, the R2900 XE had an 8% lower fuel burn rate than the competitive LHD, saving on fuel costs. The R2900 XE also delivered a 20% faster average cycle time on level ground and a 23% average cycle time advantage when travelling down the decline, compared with the competitive model.

Conclusion

Caterpillar acknowledges that the performance statistics documented can vary over applications. However, these studies show the R2900 XE has exceeded its design targets and is proving those results in the field against its R2900G predecessor, larger LHD models, and other OEMs. The Caterpillar designed, integrated, validated, and supported SR electric drive system not only offers a significant improvement in performance and productivity, but also advancements in safety, improved greenhouse gas emissions, carbon footprint reduction, and other emissions reductions.

20 March 2024 // global mining review

Figure 6. A high-resolution display gives operators real-time system information in 11 languages, while all controls, levers, switches, and gauges are positioned to maximise productivity.

Figure 5. With its 18.5 t payload, the R2900 XE provides a three to four pass match to the 63 t Cat AD63 underground mining truck.

Caroline Wies, Michelin Group, France, examines how data mining can be pushed to the next level for safer, smarter, and more sustainable mining operations.

As organisations strive to reach net zero emissions and transition to renewable energy sources, the global demand for essential metals and minerals is set to increase in the coming years. In its report ‘Minerals for Climate Action – The Mineral Intensity of the Clean Energy Transition1’, The World Bank shows that the overall demand for critical minerals such as iron, aluminium, copper, and zinc, essential to manufacture sustainable energy sources, will increase until 2050, after which annual demand will remain superior to current levels.

Mining industries across the globe are facing the challenge to respond to these increasing demands, while also trying to reduce their own environmental impact. As such, they are striving towards innovative products and solutions designed to reduce energy consumption and environmental impact in the entire mining process: from rock to metal.

Smart mines and their partners

The search to reduce their environmental impact and improve efficiencies has led mining companies to look for global partners, such as the Michelin Group, to bring evolving technologies to the mining process. This has contributed to the development of a highly connected, digital mine which includes everything from wearables on staff, in-pit equipment, monitoring devices, drone and GPS utilisation, and –increasingly – automation.

The global mining industry was one of the first sectors to recognise the value of data collection and analysis to improve safety and reach net zero emission targets. Data collection and analysis has evolved throughout the years and continues to contribute to the development of smart mines. There are many definitions of smart mines, but RWTH Aachen University’s Institute for Advanced Mining Technologies (AMT) describes

21 global mining review // March 2024

Figure 1. The Michelin Group strives to empower mining companies worldwide by developing data-driven and digitalised solutions to make their operations safer, smarter, and more sustainable.

‘smart mining’ as the intelligent connection and integration of mining machines (physical components) using information and communication technologies (cyber-systems) to form so-called cyber-physical systems, where the exchange and transmission of data and information takes place via a platform.2 This definition is in line with the different technologies developed by the Michelin group around and beyond tyres.

As an example, the Tyre Pressure Monitoring System (TPMS) MICHELIN MEMS 4, designed for >51 in. mining tyres, monitors the temperature and pressure of mining tyres remotely and in real time, allowing mines to gain better fleet management performance since 2006. This fourth generation user-friendly TPMS tracks tyres but also goes beyond, providing fleet data for mines worldwide. As the only monitoring system on the market that, by design, retains historical tyre pressure and GPS tracking by tyre for detailed analysis of potential site risk factors, it offers a comprehensive and evolutive suite of over 30 reports. These can be customised, sending automatic email reporting at scheduled times to create actionable reports, as well as trending analysis.

The integration of MICHELIN MEMS 4 with autonomous truck systems offers mines unified maintenance planning and productivity optimisation. An in-depth analysis of the available data coming from the tyres and from the fleets allows for customised recommendations to improve the safety and productivity of the mine, as well as to reduce its environmental impact. With this information, mines are able to quickly react to potential issues and better keep their employees safe. Real-time monitoring also decreases unscheduled downtime and extends tyre life, meaning less raw materials are consumed. Moreover, better pressure management leads to higher fuel efficiency across a mine’s fleet.

Next level data mining for improved decision-making

Data collection and analysis are part of daily operations and are changing decision-making within mine sites. The Internet of Things (IoT) and digitisation of mines are creating quick response times, which enable operational parameters to be changed according to what is happening on site. Any deviation from a target can be quickly identified, allowing for safety, productivity, and cost efficiencies to be improved.

At Michelin, the Consulting & Services Department leverages this gathered data to answer specific questions of mines sites around and beyond tyres; such as fleet productivity, tyre management, and safety issues, based on large historical quantities of data from different sources. The consulting study output will deliver actionable advice to the mine site: short-term steps to take, essential training, KPIs to implement, and measures to consider when the mine plan changes. The knowledge, methodology, and experience of the Michelin Consulting & Services team have proven their worth for mine sites worldwide.

Case studies

Examples of consulting studies include tyre compound and tyre rotation policy recommendations and weight and volume studies, but also fleet cycle optimisation – enabling mines to take full advantage of their fleet equipment and reduce their environmental impact.

22 March 2024 // global mining review

Figure 2. The Michelin Consulting & Services team leverages gathered data to answer specific questions around and beyond tyres.

Figure 3. In-depth analysis from tyre and fleet data results in customised recommendations, no matter what brand.

Figure 4. Among many outputs, weight and volumetric studies help validate the accuracy of the loading unit onboard.

One of the mine sites that hired Michelin Consulting & Services had observed a decrease of the average tyre life over the period that it wanted to study. At the same time, the mine wanted to quantify the impact on the productivity of their rigid dump trucks after changing the vehicle body. Four different scenarios according to tyre compound and vehicle body were studied, staying within tyre load and speed limits. Analysis of up to five years of tyre monitoring and fleet management data, as well as the future mine plan, showed which specific tyre compound to use and which tyre rotation policy to implement to obtain the best results in productivity and tyre life. These actionable insights allowed the mine site to increase productivity by up to 8% and tyre life by up to 10%.

The Michelin Consulting & Services teams also regularly conduct weight and volumetric studies to validate the accuracy of the truck fleet and loading unit onboard payload measurement systems. They proceed by examining related factors that may impact a truck’s payload and productivity.

This type of study includes validating the accuracy of the mine site’s onboard payload measurement system with an acceptable tolerance of ± 5%. In one example, analysis showed contributing factors to maximising payload, including payload positioning which aids in tyre longevity and maintenance prevention, as well as axle distribution that helps avoid premature wear and endurance damage to tyres and components. This study uncovered discrepancies between the site payload target and calculated nominal target for the truck fleets.3

After analysis, it was revealed that the truck fleet had a forward loading bias in payload positioning. This type of loading contributes to premature tyre and component wear and endurance, as well as posing a safety risk, since the vehicle headboard is not structurally designed to carry payload. Most of the truck fleet and loading unit onboard systems were accurate and within tolerance. However, the study revealed a large swing in individual loads, with several trucks well above tolerance – an indicator that the mine site should investigate further to achieve greater productivity.

Conclusion

Building on its experience in the field and its innovative power, the Michelin Group, in its partnership with mining industries, continues to push forward in the coming years by developing data-driven and digitalised solutions to make operations safer, smarter, and more sustainable. The company strives to implement their Michelin Better Mining approach across the globe to help the mining industry meet the global demands for metal and minerals, reach net zero emissions, and transition to renewable energy sources.

References

1. The World Bank, ‘Minerals for Climate Action – The Mineral Intensity of the Clean Energy Transition’, The World Bank Publications, (2020), pp. 71 – 72.

2. SÖRENSON, A., and CLAUSEN, E., ‘The Future of Mining is Smart’, RWTHAachenUniversity’sInstituteforAdvancedMining Technologies, (2021), p. 1.

2. Michelin’s recommendations should be confirmed with original equipment manufacturers in all instances.

beumer.com SOME THINK THAT RAW MATERIALS TRANSPORT REQUIRES TRUCKING. WE THINK DIFFERENT. Visit us! CIM, Vancouver, Canada May 12– 15, 2024

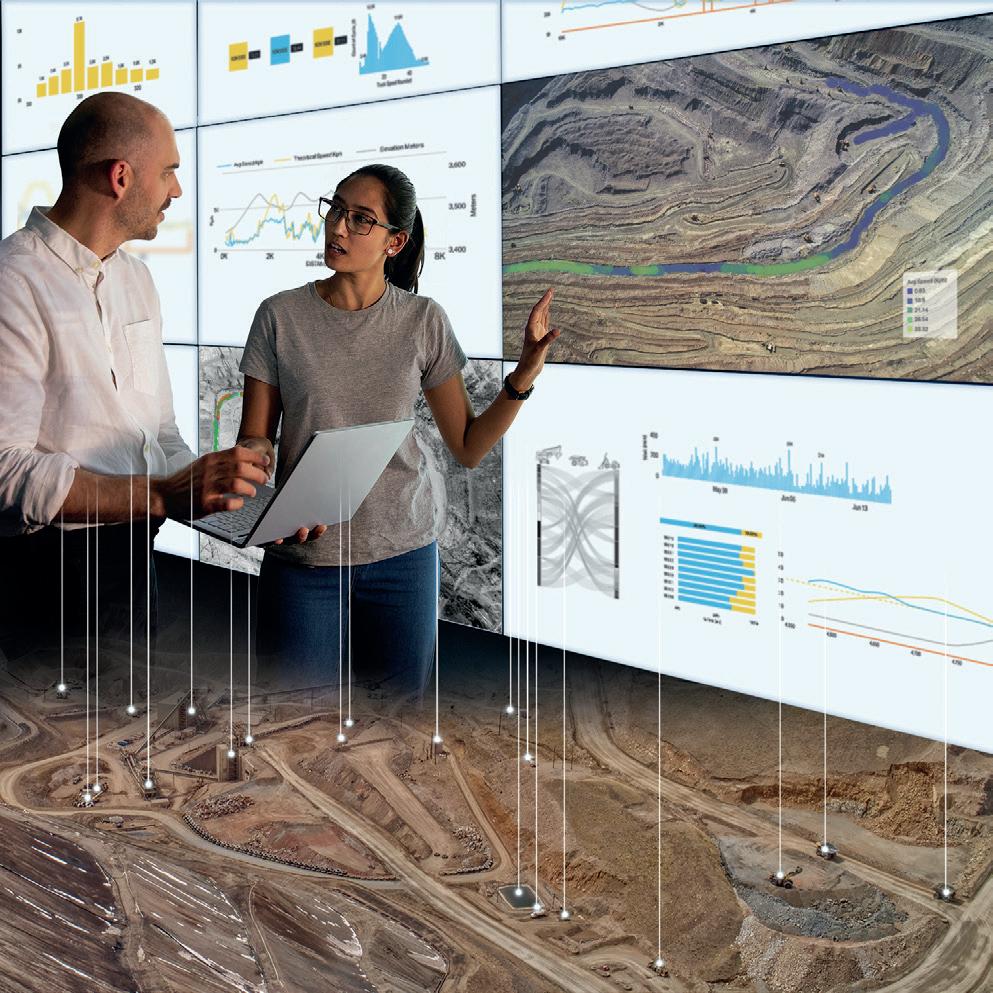

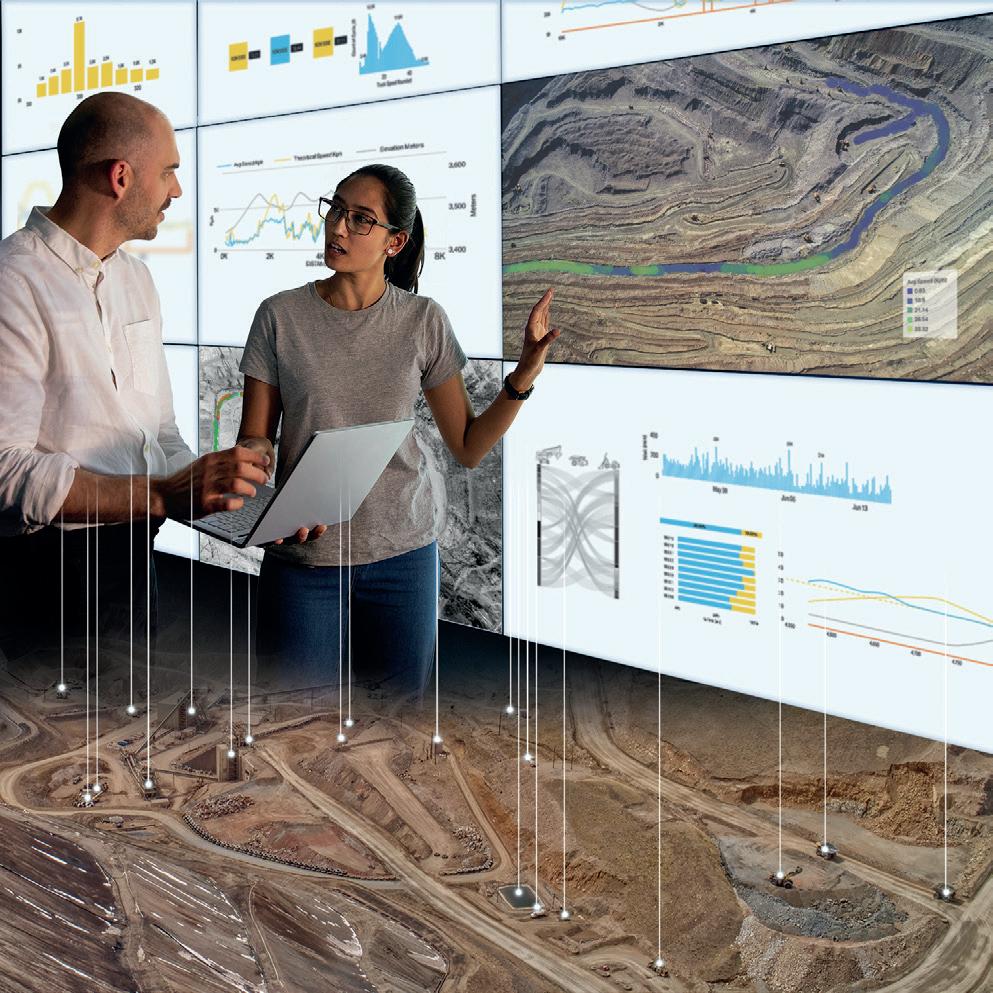

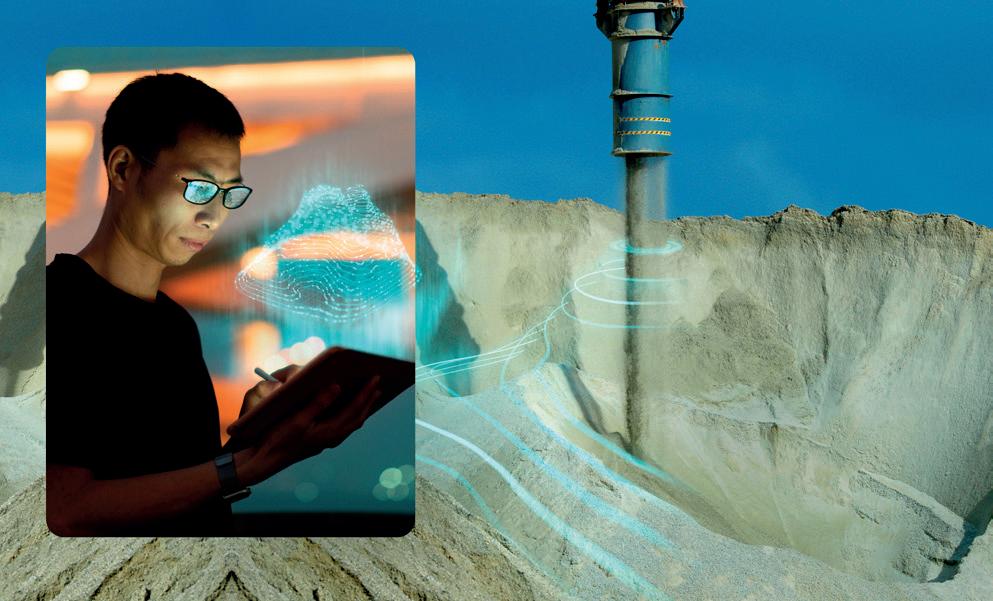

Komatsu USA presents a framework for what an open, democratic, and interoperable ecosystem for the mining industry – that leverages technology – might look like.

Virtually every mining operation is grappling with having to drive greater value amid dwindling resources, while facing the ongoing challenges of sustainability, interoperability, productivity, reliability, and safety.

As mine operations become more complex – and the challenges and opportunities to drive greater productivity become more pronounced – no one solution provider can deliver all of the answers. To compound the situation, cycle times for developing new products, especially from a single-source provider, are long and are not keeping pace with customer demand. Moreover, operators at every level face multiple

challenges of both optimising functions and reducing the carbon footprint.

Every facet of mine planning, operations, and maintenance must be able to achieve still greater levels of performance, as measured in key performance indicators (KPIs). With this backdrop, consistency and predictability, therefore, play a major role in maintaining and achieving greater insights into productivity that can meet business forecasts around mine operations at every level – be it equipment, process, or enterprise.

Mining operations and the solutions that enhance them must be highly scalable and adaptable in order to respond to the ever-changing needs and variables on

24 March 2024 // global mining review

the ground, as well as command centres for enterprise operations. Driving optimum value by hitting variable targets, including dispatcher and operator expertise, equipment reliability, and responding to ground conditions, will ultimately impact both the top and bottom lines.

Who would benefit?

Every mining operation starts out with a plan. While smaller operations may not need automation, they still need to execute a plan that maximises functions common to all operations such as maintenance, refueling, safety, and sustainability.

As mining operations grow, things become incrementally more complex, and variables at the mine site become even more critical, requiring enhanced technology solutions. Hitting KPIs depends on multiple variables, including the skills and experience of dispatchers, equipment operators, the accuracy of road maps, weather conditions, and other factors. When bottlenecks occur, productivity can plummet, putting the best laid plans at risk.

This is where operators can benefit from an industry ecosystem that can develop agnostic solutions and tools that would optimise mining operations; automate and integrate the functions involving mixed fleet operations

25 global mining review // March 2024

(all makes and models), harness data, analytics, and hardware to realise greater performance; and act as an incubator to accelerate the deployment of advanced mining applications across an entire industry.

As all mining operations evolve, the key to their continued growth and survival will lie in having access to

the right tools, at the right time, that an entire industry – not just one company – has to offer.

A unified user experience

A better and more evolved ecosystem is one where all companies, developers, partners, and suppliers are working together to benefit the customer; an agnostic, interoperable and open ecosystem platform that is focused on, not just on one company’s technology, but the innovation and best practices of an entire industry – while allowing individual companies to profit within this environment.

Leveraging the data, products, services, solutions, applications, and hardware of an entire industry must result in a unified user experience (UX). Instead of having multiple screens for mine planning, situational solutions, and equipment tools, each user should have a unified, simplified UX that empowers the user with one screen.

By creating a secure, open, interoperable platform where all vendors and solutions can exchange data to automate operations and share insights, an agnostic ecosystem would allow mining companies to make the most of their investments in equipment, technology, and personnel to deliver the most sustainable, predictive results.

n Equipment/task: At the task or equipment level, the ecosystem would enable third-party software and automation providers to develop applications that can share a single screen from any manufacturer.

n Mine/process: At the process or mine level, the ecosystem would populate a mine plan and apply predictive intelligence that transforms a mine plan into action, implementing several variables to a road network – for example, to align the operation with targeted KPIs.

n Enterprise: In order to deliver predictability, scalability, and sustainability across all mining operations, the ecosystem should be able to monitor all mine sites from a single location; share data and insights; and be secured by a trust framework that provides complete secure control over customer data.

n Towards a democratic ecosystem: The ecosystem needs to be entirely democratic. That is, the ecosystem should not be limited, closed off, or dedicated to one company’s brand of equipment, hardware system, or technology in order to participate. The example most often used to support this rationale is that smaller operations with a mixed fleet operation should be able to access the same level of technology and automation that enterprise operations do. Essentially, everyone is welcome and invited to have a seat at the table.

Benefits of an interoperable ecosystem