Mega-scale, low-carbon hydrogen has arrived

Spring 2024

precision, high-pressure Coriolis dispensing solutions reduce safety concerns without compromising capacity. Harness the power of alternative fuels to drive efficiency as you take your business to new distances. Learn more at www.emerson.com/micromotionhighpressure

Emerson’s

Go Hydrogen.

03 Comment

04 Asia’s hydrogen landscape: is the region slipping behind?

Flor De la Cruz, Wood Mackenzie, discusses the state of the hydrogen market in Asia and how the region can catch up with developments in Europe and the US.

10 Adapting in a new era

Conrad Purcell, Haynes and Boone LLP, UK, provides a review of the issues arising from adapting existing hydrocarbon infrastructure for use with hydrogen.

13 Hy standards – part one

In the first part of a two part article, Justin Distler and Vince Mazzoni, Black & Veatch, discuss the ongoing development of safety codes and standards to mitigate the unique risks associated with hydrogen and its production systems.

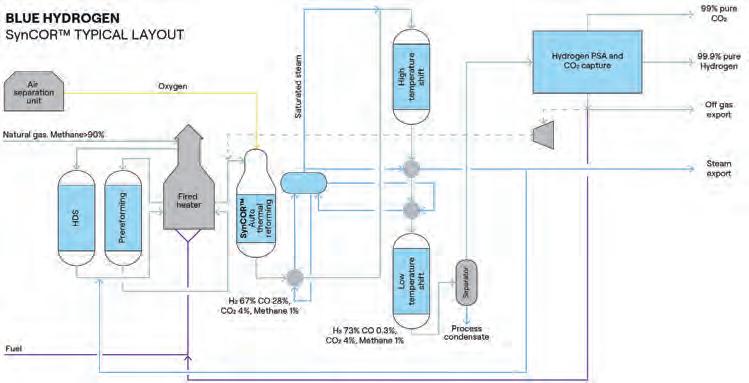

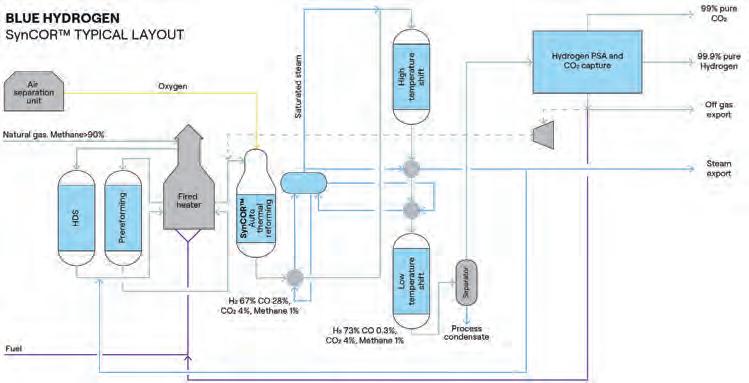

29 Mega-scale hydrogen decarbonisation is in reach

Adam Samir Kadhim and Nitesh Bansal, Topsoe, consider the possibilities for mega-scale decarbonisation via diverse low-carbon hydrogen methods.

35 A smooth transition

Raj Melkote, Bayotech, explains how utilising renewable natural gas as feedstock in steam methane reforming (SMR) can enable the production of net-zero carbon hydrogen.

40 Powering the CO2 countdown

Yanling Wu, Ganesh Venimadhavan and Bhargav Sharma, Honeywell Connected Enterprise, alongside Tim Ballai, Honeywell UOP, explain how simulation tools can help to accelerate innovation in clean hydrogen project development.

45 Scaling up to meet anticipated demand

17

Financing a hydrogen future – the good, the bad and the ugly

With only around 9% of new green hydrogen projects under construction or having reached final investment decision (FID) stage, Nadim Chaudhry, World Hydrogen Leaders, takes a look at the challenges and likely pathways to drive the industry forward.

21

Building investor trust in hydrogen projects

Lauren Davies, Andrew Nealon, Alistair Wishart and Garrett Finch, Vinson and Elkins, explain the role of project financing in the development of low-carbon hydrogen projects.

25 Changing the game for decarbonised hydrogen projects

Justin Schaeffer and Mario Graca, Shell Catalysts & Technologies, discuss how new legislation that incentivises lowering the carbon intensity of produced hydrogen may warrant a reassessment of projects.

Todd Cartwright, Nel Hydrogen, discusses why electrolyser equipment needs to range from small containerised systems to large capacity plants in order to meet varying market needs.

51 Revolutionising PEM electrolysers

Magnus Thomassen, Hystar, Norway, highlights the importance of innovation in scaling green hydrogen production.

55 The impor tance of decentralisation

Andrea Pusceddu, IMI Critical Engineering, outlines why decentralised hydrogen production will be key in decarbonising the transport and logistics sector.

59 Fulfilling the promise of green hydrogen

Soufien Taamallah, Electric Hydrogen, and Luiz Soriano, Neuman & Esser, explain the importance of collaboration between electrolyser OEMs and compressor OEMs in driving industrial scale decarbonisation.

63 Under pressure

Derrick Bauer, Ebara Elliott Energy, considers the challenges associated with the compression and transportation of high-pressure hydrogen through existing pipelines.

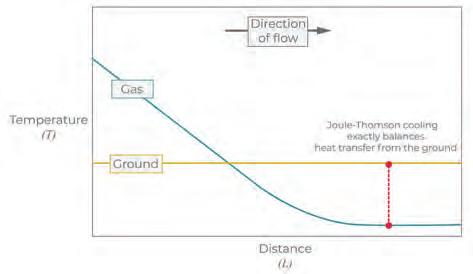

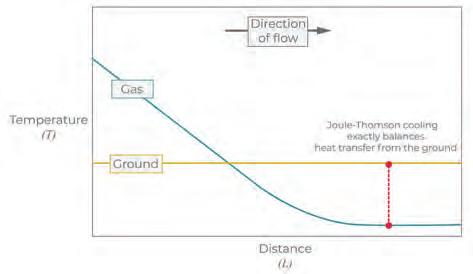

69 The move to blue

John Anderton, Atmos International, discusses the rise of blue hydrogen and the important role of pipeline simulation.

Topsoe provides leading technology, catalysts and solutions to customers producing hydrogen from natural gas, alternative feedstocks including waste and biomaterials, or via electrolysis. Topsoe’s solutions can be tailor-made to allow feedstock flexibility. They help ensure customers can reliably produce high-quality, high-purity hydrogen, whether the final product is low-carbon blue, green or traditional hydrogen.

Copyright© Palladian Publications Ltd 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, recording or otherwise, without the prior permission of the copyright owner. All views expressed in this journal are those of the respective contributors and are not necessarily the opinions of the publisher, neither do the publishers endorse any of the claims made in the articles or the advertisements. Printed in the UK.

Join the conversation @HydrogenReview like join Global Hydrogen Review @Hydrogen_Review follow Spring 2024 Volume 3 Number 8 ISSN 2977-1927 CBP019982

Scaling the Hydrogen Ecosystem

Forging a more efficient path to net zero and energy security

Yokogawa offers a comprehensive range of sensor-to-enterprise solutions to support the hydrogen ecosystem. Our business solutions help scale the entire hydrogen value chain. Together we can create a prosperous low carbon hydrogen economy on the path to net zero.

Callum O'Reilly Senior Editor

Managing Editor James Little james.little@palladianpublications.com

Senior Editor Callum O'Reilly callum.oreilly@palladianpublications.com

Editorial Assistant Poppy Clements poppy.clements@palladianpublications.com

Sales Director Rod Hardy rod.hardy@palladianpublications.com

Sales Manager Chris Atkin chris.atkin@palladianpublications.com

Sales Executive Sophie Birss sophie.birss@palladianpublications.com

Production Manager Kyla Waller kyla.waller@palladianpublications.com

Events Manager Louise Cameron louise.cameron@palladianpublications.com

Digital Events Coordinator Merili Jurivete merili.jurivete@palladianpublications.com

Digital Content Assistant Kristian Ilasko kristian.ilasko@palladianpublications.com

Digital Administrator Nicole Harman-Smith nicole.harman-smith@palladianpublications.com

Admin Manager Laura White laura.white@palladianpublications.com

Data from a NASA-funded study has found that the Moon is slowly shrinking. As its molten core cools, the Moon is gradually contracting and shrivelling, like a grape drying out to a raisin. As this happens, faults along the Moon’s surface have appeared. These faults − along with moonquakes that can last for hours − mean that the Moon is vulnerable to landslides. And although researchers are quick to reassure us that this does not affect us back on Earth, they do have concerns about the safety implications of such landslides for future lunar visitors.

Despite the risks involved, the scientific discoveries that can be gained from lunar exploration are enormous. In fact, rock samples from the Apollo missions are still revealing their secrets to this day. Scientists at the US Naval Research Laboratory (NRL) recently discovered solar-wind hydrogen in a lunar soil sample. It is the first time that scientists have demonstrated detection of hydrogen-bearing species within vesicles in lunar samples. The discovery could revolutionise space travel, enabling future astronauts to one day use water on the Moon for life support and rocket fuel. “Hydrogen has the potential to be a resource that can be used directly on the lunar surface when there are regular or permanent installations there,” said Dr Katherine D. Burgess, Geologist in NRL’s Materials Science Technology Division. “Locating resources and understanding how to collect them prior to getting to the Moon is going to be incredibly valuable for space exploration.”

A number of initiatives aimed at exploring and developing the Moon are already underway, such as the US-led Artemis III project, which is the first Artemis mission that plans to have a crewed lunar landing. The Japanese Aerospace Exploration Agency (JAXA) is also considering a concept for a plant that will utilise water resources on the Moon to produce hydrogen and oxygen for use by spacecraft and manned facilities. JAXA plans to study the concept of the entire system of a lunar in-situ resource utilisation (ISRU) plant and conduct ground demonstration this decade, with the aim to construct a demonstration plant in the 2030s and launch full-scale operation by 2040.

At the end of last year, JGC Corp. was selected by JAXA for the conceptual study of the ISRU plant. JGC will carry out demonstration planning as well as a study of a pilot plant concept. And in anticipation of the fact that such a plant may be built on the Moon, JGC also announced that it has teamed up with Yokogawa Electric Corp. to develop a control system that will support the ultra-remote communications required for the operation of plants on the lunar surface. Such a system, which will be located at a ground station, would need to take into account constraints such as the communication delay between the Earth and the Moon. By the end of this year, the two companies plan to complete a study that will identify an optimal solution for a control system that will be able to handle ultra-remote communications.

Editorial/advertisement offices:

Palladian Publications 15 South Street, Farnham, Surrey

GU9 7QU, UK

Tel: +44 (0) 1252 718 999 www.globalhydrogenreview.com

Back on Earth, there are a number of other exciting developments underway to ensure that hydrogen plays a key role in decarbonising our energy systems. You can find out more about a range of innovative solutions and exciting projects within the pages of this issue. And if you are picking up a copy of this magazine at the World Hydrogen Summit in Rotterdam, I’d like to encourage you to sign up for a free subscription to Global Hydrogen Review by scanning this QR code.

Flor De la Cruz, Wood Mackenzie, discusses the state of the hydrogen market in Asia and how the region can catch up with developments in Europe and the US.

4

The low-carbon hydrogen market kicked off in Asia in 2020 and now accounts for more than 27 million tpy (or 23%) of global project announcements. Australia announced several giga-scale projects between 2020 and 2021, leveraging its excellent renewable resources and ample land availability to produce low-cost electrolytic hydrogen. India quickly followed with a host of project announcements of its own. Both markets are targeting hydrogen-as-ammonia exports to Japan, South Korea and Singapore.

After the US announced a US$3/kg H2 production tax credit (PtC), the country’s low-carbon hydrogen became the most competitive this decade. Capital and developers began to flock to the world’s biggest economy. As a result, project announcements in Asia almost came to a halt and existing projects’ development slowed down.

With over 14 exporters worldwide targeting only two major import centres, the EU and Northeast Asia, Asian markets need robust strategies to capture demand.

Key markets like India and Australia retain a favourable position to become hydrogen exporters to Northeast Asia but challenges around costs, supply chains, hydrogen emissions and subsidies are starting to mount.

Markets that can respond swiftly with a combination of subsidies, domestic targets and simplified regulatory processes to offer the most competitive hydrogen costs will have the upper hand in ensuring Asia does not lose its advantage: proximity to key import markets.

Electrolytic hydrogen costs in Asia

Australia’s renewable resources and ample land availability propelled it to the forefront of global electrolytic hydrogen project announcements, totalling over 13 million tpy and 89 gigawatt electrolysis (GWe) at the end of 2023. However, Australian projects have stalled, with nearly 80% still in early development.

Despite boasting excellent renewable resources, EPC and labour costs have driven up the levelised cost of hydrogen (LCOH) in Australia. The LCOH of electrolytic hydrogen in Australia is over US$10/kgH2 today. India and China’s lower labour and EPC costs give them a competitive edge in the region, but the LCOH is still above US$7/kgH2

By 2030, Wood Mackenzie forecasts a 40% decrease in electrolytic hydrogen costs. But this will not be enough to make electrolytic hydrogen competitive this decade. Governments are working to bridge this gap through hydrogen subsidy schemes.

In 2023, the Australian federal government allocated US$1.4 billion (AU$2 billion) to the ‘Hydrogen HeadStart’ programme, offering a 10-year credit to large-scale projects. Wood Mackenzie estimates the tax credit will ease the burden by around US$1.2 - 2/kgH2, but it will only support two to three projects, which would be less than 1% of Australia’s announced project capacity.

The Indian national government also announced a subsidy scheme, the Strategic Interventions for Green Hydrogen Transition (SIGHT) programme. It aims to give out incentives worth US$2 billion to manufacture electrolysers and electrolytic hydrogen. Under the scheme, electrolytic hydrogen producers can receive a maximum payout per kg of hydrogen of 50 rupees (US$0.60) in the first year, 40 rupees (US$0.48) in the second and 30 rupees (US$0.36) in the third.

Lastly, Japan allocated US$20 billion for its Contracts for Difference (CfD) subsidy scheme to support low-carbon hydrogen and ammonia over a 15-year period. The CfD covers the landed price gap between low-carbon hydrogen and the price of the fuel it will displace, primarily coal and LNG, or the price of grey hydrogen. Wood Mackenzie estimates that this will amount to US$1 - 3.5/kgH2 with the subsidy decreasing over time as the cost of low-carbon hydrogen comes down.

5

Although governments are developing subsidy schemes, more is needed to bring down costs. For the LCOH of electrolytic hydrogen to slip under US$2/kgH2, or on parity with grey hydrogen, it will require a combination of cost reduction strategies. Total investment costs (TIC) must decrease by at least 80% and electrolyser system efficiency needs to reach 80% from 70% currently. Electricity costs also need to drop below US$40/MWh with capacity factors above 80%.

Electrolyser stack costs will come down as OEMs continue to automate and scale manufacturing. OEMs are working to improve electrolyser efficiency, with technologies such as solid oxide electrolyser cell (SOEC) already approaching 80% efficiency. Developers are pursuing giga-scale electrolysis projects that

Assumptions: off-grid power source: onshore wind, hydrogen technology: alkaline (pressurised), capacity: 200 MW, load factor: 26 - 37%, system efficiency: 60%, lifetime: 20 years, FID 2023 and 2030. Source: Wood Mackenzie Lens Hydrogen and Ammonia service.

can offer significantly lower TICs by leveraging industrial-sized equipment and giga-scale hybrid renewable projects. Onshore wind and solar projects can potentially offer electricity costs below US$40/MWh with capacity factors above 80% in specific locations in Australia and China.

Although costs will be a determining factor for developers trying to secure offtake agreements, carbon intensity will also play a major role. Developers must understand how project design can impact their expenses and carbon intensity. Failing to do so can cost them lucrative subsidies that can make or break project economics.

Forget colours, it’s time to look at carbon intensity

In Asia, several countries have established carbon intensity thresholds for low-carbon hydrogen. South Korea offers the most lenient standard, defining low-carbon hydrogen as having a well-to-gate emissions of 4 kg of CO2e/kgH2. India is the most restrictive, setting the average annual threshold at 2 kg of CO2e/kgH2

However, most standards in the region lack rules on additionality; that is, adding new renewable capacity alongside hydrogen production. Electrolyser demand for clean power could inadvertently lead to additional fossil-based generation to meet other demands on the grid, increasing overall emissions.

The bulk of operational and announced low-carbon hydrogen projects in Asia are electrolytic hydrogen projects, with China leading the way on projects in operation. But most projects there are grid-connected, raising concerns about their actual ‘greenness’.

China, India and Australia still rely heavily on fossil fuels, primarily coal, to meet power demand. With average power grid intensity above 0.5 kg of CO2e/kWh, this would mean hydrogen emissions from a grid-connected electrolyser would surpass brown hydrogen in all three markets.

Crucially, developers in these markets are targeting exports to Japan, South Korea and the EU. The EU has the strictest rules on grid-connected electrolysers which may pose a challenge for developers. While Japan and South Korea have less stringent rules on grid-connected electrolysers, they still require developers to have a green power purchase agreement (PPA) in place.

In economies such as India and China, the rapid roll-out of renewables is struggling to keep pace with growing power demand, limiting green PPA availability for electrolytic hydrogen. In addition, grid congestion could add hurdles in delivering green power, despite developers having signed a PPA. In these markets, the availability and deliverability of a truly green PPA remains challenging, even for the most willing developers.

It looks inevitable that project developers will require detailed certification across the value chain to sell their delivered product into key import markets. This will not come cheap. Several bodies have emerged that are willing to certify entire hydrogen value chains for a hefty fee. And without a global agreement on carbon-intensity measurements, emissions scopes, methodology and rules, developers may require multiple certificates to access different markets.

The role of China

China’s position on electrolytic hydrogen production will be critical. The country already has 0.3 million tpy of grid-connected

6 Spring 2024 GlobalHydrogenReview.com

Figure 1. Asia’s low-carbon hydrogen project announcements. Source: Wood Mackenzie Lens Hydrogen and Ammonia service.

Figure 2. Cost of electrolytic hydrogen by start-up year.

Accelerating decarbonised hydrogen together

The world’s energy systems are changing. Hydrogen is becoming a key part of the future energy mix, with a need for very large volumes of hydrogen on the horizon. Decarbonised (blue) hydrogen can help meet that need, and Shell Catalysts & Technologies has developed a low cost, high capacity way to match those production requirements through the Shell Blue Hydrogen Process. This brings together several proven technologies to deliver 1,000 te/day of hydrogen from a single train with up to 99% CO2 capture rate at a very competitive Levelized Cost of Hydrogen (LCOH). It is a hydrogen solution designed to help decarbonise hard-to-abate industries, lower the CO2 footprint of heavy transport, and reduce home heating emissions.

Learn more at catalysts.shell.com/bluehydrogen.

electrolysers in operation, largely based on Chinese alkaline technology. Chinese alkaline electrolysers have lower limits of 20 - 50% to operate safely, meaning they require some continual electrical load. Proton exchange membrane (PEM) technology, more commercialised by western OEMs, can operate at lower limits and be closer to 0%. This allows developers to mirror hydrogen production to renewable generation. But it comes at a higher cost.

China accounts for 57% of the current 45 GW of global electrolyser manufacturing capacity. An additional 15 GW is planned in 2024.

With China’s highly competitive electrolyser OEMs seeking to dominate the global market like the country’s renewables and battery manufacturers already do, China’s low-cost and slightly more efficient alkaline electrolysers could proliferate. This could have consequences for both technology choices and emissions. A significant expansion of grid-powered hydrogen projects operating on China’s alkaline technology across price-sensitive emerging economies could result in a two-tiered hydrogen market.

However, permitting some grid supply can be seen as the pragmatic approach to kickstart the hydrogen economy in Asia.

Where will demand come from?

In Asia, three countries – Japan, South Korea and Singapore –drive the bulk of the demand. As per Wood Mackenzie’s latest supply and demand outlook, these markets will need to import at least 2.3 million tpy of low-carbon hydrogen by the turn of the decade to meet domestic demand. Both hydrogen and ammonia will be key to achieving decarbonisation targets in the power and transport sectors. Hydrogen gas co-firing and ammonia coal co-firing to decarbonise power will constitute around half of overall hydrogen demand this decade. Many Japanese or South Korean firms are beginning to trial this technology ahead of commercial adoption, which will ramp up in the early 2030s.

PEMWE: proton exchange membrane water electrolysis. AEM: anion exchange membrane electrolysis. SOEC: Solid oxide electrolyser cell. Source: Wood Mackenzie Lens Hydrogen

These markets are supportive of blue ammonia imports in the near term to offer scale at a lower cost. A landed cost of US$600/t for blue ammonia into Northeast Asia looks achievable this decade, which is roughly half the cost of importing electrolytic (green) ammonia in the same timeframe. However, energy security plays a key role, and Japan and South Korea will continue to pursue electrolytic hydrogen projects that can offer diversity of supply in the next decade.

Japanese and Korean companies have been actively developing projects overseas, and this trend will continue. As these companies negotiate hydrogen-as-ammonia offtake agreements, project developers are willing to offer equity to Japanese and Korean companies or projects where Japanese or Korean companies are already partners.

Conclusion

Despite Australia and India establishing subsidy schemes – these will hardly move the needle. The two countries currently do not have the capital to support subsidy programmes on par with those announced in the US and EU. Japan’s CfD scheme can help Australian and Indian projects get off the ground. But again, subsidies alone will not be enough, electrolytic hydrogen projects need to scale.

Scale can deliver additional cost savings and make electrolytic hydrogen projects competitive with programmes in markets such as the US. In Asia, over 100 GWe of the 127 GWe in announced projects are giga-scale electrolytic hydrogen projects with capacities above 1 GW of electrolysis. Giga-scale projects require more complex supply chains and will take longer to be developed, pushing timelines into the 2030s. So, although it may seem Asia is slipping behind, Asian giga-scale projects just need more time to develop.

8 Spring 2024 GlobalHydrogenReview.com

Figure 4. Chinese electrolyser manufacturing capacity by technology. (P)AWE: pressurised alkaline water electrolysis.

and Ammonia service.

Figure 3. Grid-connected electrolytic hydrogen emissions.

Assumptions: power intensity is taking the average grid intensity in each market. Electricity consumption is assumed to be 47 kWh/kgH2 for the electrolyser system. Electrolyser efficiency is assumed to improve over time. Source: Wood Mackenzie Lens Hydrogen and Ammonia service.

Elliott’s Flex-Op® Hydrogen Compressor features flexible, configurable, and economical compression options for hydrogen applications. Designed with proven Elliott compressor technology, the Flex-Op’s compact arrangement of four compressors on a single gearbox maximizes compression capability with enough flexibility to run in series, in parallel, or both. Who will you turn to? n

The World Turns to Elliott COMPRESSORS | TURBINES | CRYODYNAMICS® | GLOBAL SERVICE

Learn more at

Turn to Elliott Group for operational flexibility in hydrogen applications.

www.elliott-turbo.com

Hydrogen Compression

Conrad

Purcell, Haynes and Boone LLP, UK, provides a review of the issues arising from adapting existing hydrocarbon infrastructure for use with hydrogen.

The electrification of transport, heating and industry, using power generated from renewables, is the basis on which many governments hope to reduce greenhouse gas (GHG) emissions and thereby arrest climate change. Inevitably there will be certain sectors in which GHG emissions are hard to abate, such as shipping, aviation, steel and cement production and petrochemicals. In order to reduce GHG emissions from these sectors, governments are supporting industry to find solutions based on the use of hydrogen and its derivatives. If a substantial part of the economy is to be powered by hydrogen, then the existing hydrocarbon infrastructure will need to be adapted to work with alternative fuels.

Pipelines

Whether hydrogen production takes place at large scale centralised production facilities or at a more local decentralised scale, it is likely that end users will in future be reliant upon at least some transportation infrastructure if hydrogen is to be used as a feedstock for industry, as well as potentially as a fuel for power generation. The allocation of risk between hydrogen producers, pipeline owners and buyers of hydrogen will need to be carefully managed to ensure that a commercially robust contractual and regulatory framework is in place. In the UK, the Energy Act 2023 has extended the provisions contained in the Gas Act 1986 to cover the licensing of pipelines for the transport of hydrogen. Many of the risks associated with hydrogen gas are similar to the risks associated with natural gas (which is mostly made up of methane), but there are some differences. Some of the key issues that will need to be addressed include the corrosive effect of hydrogen on steel – which is used in the construction of many pipelines – and the risk of hydrogen gas escaping through gaps in the pipeline due to the very small size of hydrogen molecules. This may be addressed either by modifying pipelines or by using a blend of hydrogen and natural gas that is sufficiently chemically similar to the original design parameters of the pipeline to avoid any negative impact. Blending a small quantity of hydrogen into the natural gas system (between 5 - 15%) is currently considered to be safe in Europe and may help to facilitate the energy transition. However, this is not a complete solution where the ambition is to move away from fossil fuels altogether.

10

11

Shipping

If hydrogen production takes place at an industrial scale using renewable energy to make ‘green hydrogen’ in parts of the world where the conditions are best suited to its production, such as parts of South America or Australia, then it will need to be transported to the places where it will be used. Historically, natural gas has been transported over long distances as LNG and it is possible for hydrogen to be liquified and transported as LH2, although the costs of doing so are high. This is partly because of the very low temperature required for LH2 and partly because of the volumetric energy density of LH2. Although long distance pipelines may be a solution to the problems associated with shipping hydrogen, another alternative is to convert hydrogen to ammonia, which is cheaper and easier to transport by ship than hydrogen. Ammonia can be used as a replacement for hydrocarbons in a number of currently high GHG emission areas, such as the manufacture of fertilizers for food production and as fuel. However, there are some drawbacks to the use of ammonia as it is a toxic chemical and the risks associated with handling it and the possibility of environmental damage resulting from spillages reduce its attractiveness as an energy carrier. There are some industrial processes where pure hydrogen will be required and it does not make sense to convert hydrogen to ammonia, transport it to another location, and then crack it to get back to hydrogen. In such cases, it may be that the most economically viable solution is to move the industrial activity for which pure hydrogen is required to a part of the world where hydrogen is available locally.

Storage

Production of hydrogen using renewable energy powered hydrolysis depends upon a supply of renewable energy that may be intermittent. As a consequence, there is likely to be a seasonal storage requirement for hydrogen in an economy that is more reliant upon hydrogen as a fuel or feedstock. Natural gas is commonly stored underground in salt caverns and the physical conditions within salt caverns are also suitable for storage of hydrogen. Depleted oil and gas fields may also be used to store hydrogen, although the risk of a chemical reaction with hydrogen is greater in these, making them less desirable. Another advantage of using salt caverns that historically stored natural gas for hydrogen storage is the cost saving from reusing natural gas facilities, such as the operation and control systems which can be converted to be used for hydrogen.

Boilers

If hydrogen is to be burned in boilers as a fuel instead of natural gas, there are some specific risks that need to be considered and planned for. Hydrogen produced in a way that avoids GHG emissions, e.g. from electrolysis using renewable electricity or with carbon capture and storage, may be a suitable fuel for heating water in a sustainable way that helps to mitigate climate change. The fact that hydrogen gas is non-toxic to humans is also a positive factor in favour of its use in residential settings. Notwithstanding the transportation issues associated with pumping hydrogen through pipelines, it is likely that where hydrogen is used in remote locations, because electrification is deemed to be impractical, that it will need to be stored on site in high pressure storage tanks due to hydrogen’s low ambient temperature energy density. The risk of a high-pressure hydrogen tank exploding and causing injury and

property damage may be mitigated by the lack of neighbouring properties in a remote location, but it would be more difficult to manage in a populous area. There are also practical issues associated with the combustion of hydrogen (e.g. hydrogen burns with a clear flame that cannot be detected in the same way as a natural gas flame) that will impact the safety equipment used in existing infrastructure as part of the adaptation to using hydrogen as a fuel.

Long-haul aviation

Electrification of short-haul passenger fights may become possible in the future, but long-haul flights are unlikely to ever be powered by electricity. As such, alternative sources of aviation fuel with lower or net zero GHG emissions will be required. One exciting development in this space is the production of sustainable aviation fuel (SAF) using solar power. Using a concentrated solar power plant, solar energy is captured from heliostats and transferred by heat transfer fluid to a molten salt thermal energy storage system. The heat can then be used to generate steam to drive a turbine generating electricity to power an electrolyser for hydrogen production. Residual heat from the plant can also be used to facilitate the combination of the hydrogen and carbon monoxide through the Fischer-Tropsch process to produce a liquid hydrocarbon that can be used to power aircraft. The advantage of using SAF, rather than converting aircraft to use hydrogen as a fuel, is that SAF works as a direct replacement for fossil fuel derived aviation fuel, which means that existing aircraft propulsion systems, refuelling infrastructure and airport designs can be used without needing to be redesigned or replaced. The only carbon that is emitted from burning the SAF is that which was input during the production process, meaning that SAF could be effectively net GHG neutral.

The case for SAF has been extended by some car manufacturers and classic car enthusiasts to allow for the continued production of internal combustion engine powered vehicles, as well as for the continued use of vintage and classic cars which would otherwise likely be prohibited from using fossil fuels at some point in the future.

Conclusion

There is growing momentum in the development of the hydrogen industry. In the UK, the government announced 11 major projects to produce green hydrogen in December 2023, backed by £2 billion of government funding. Some of the potential uses for hydrogen will evolve as the difficulties associated with its low energy density and corrosive effect result in adaptation. The use of green hydrogen as a fuel to be blended into the natural gas network for combustion may ultimately be uneconomic if electrification turns out to be a more economical way of generating heat. This is especially true if green hydrogen turns out to be more valuable as a feedstock for fertilizer production or SAF than as a fuel in its own right. The use of existing infrastructure, especially in areas such as hydrogen storage in salt caverns, will give the transition away from fossil fuels to a more hydrogen-based economy a boost. It remains to be seen what impact the production of hydrogen in parts of the world that have not traditionally been energy exporters will have on the location of global manufacturing centres, but it is likely that exporting energy in the form of manufactured goods may be more economical than exporting it in the form of hydrogen on ships.

12 Spring 2024 GlobalHydrogenReview.com

In the first part of a two part article, Justin Distler and Vince Mazzoni, Black & Veatch, discuss the ongoing development of safety codes and standards to mitigate the unique risks associated with hydrogen and its production systems.

Increased public and industry awareness of hydrogen and hydrogen systems safety is important as the industry advances the use of hydrogen as a fuel. The safe use of hydrogen begins with the understanding that it has some different properties to most hydrocarbon fuels used today, but also some similar safety hazards. Hydrogen is a colourless, odourless, tasteless, and non-toxic gas. It is 14 times lighter

than air and dissipates rapidly in an open space. It has a low ignition energy and a wide range of flammability (4 - 75%, by volume, in air) in addition to its higher flame temperature, higher flame speed, and low visibility in daylight relative to natural gas. These properties of hydrogen, among others, result in unique safety considerations that must be properly managed.

13

Key hazards with gaseous hydrogen typically include major leaks, fires, explosions, high pressures, and material embrittlement. For enclosed hydrogen systems, deflagration and detonation should be factored in the design of the building or enclosure. High pressure systems can result in high velocity leaks and also pose risks for high pressure ruptures, so proper safety distances and inherently safe design should be implemented to minimise risks.

Embrittlement is also an important design consideration with any piping or storage system that interacts with hydrogen. Depending on the pressure, temperature, cycling, and environment, proper materials of construction are selected to avoid hydrogen embrittlement, thereby avoiding circumstances that could lead to a major leak or failure. Additionally, liquid hydrogen has hazards including cryogenic temperatures that can liquefy air and cause oxygen enrichment, which increases the risk of combustion of certain materials, such as asphalt.

Best practices for handling hydrogen systems need to be planned, developed, communicated, and implemented in any project across all stakeholders from initial planning, through to operations and maintenance.1 It is important to establish a strong corporate safety culture, be open to feedback and concerns from various stakeholders, and educate relevant staff on the hazards of hydrogen systems, including local authorities having jurisdiction (AHJs) and first responders.

Facility design

Inherently safe design principles are important for any project, including hydrogen projects due to the hazards previously mentioned. Proper facility design should consider and address appropriate indoor and outdoor design criteria,

including but not limited to: ventilation, venting/flaring, electrical hazardous area classification, leak/flame detection, deflagration, detonation, safety distances from exposures, and isolation. In addition to manually-activated shutdowns, emergency shutdown should be automated through hydrogen leak/flame detection and process upsets. All gaseous hydrogen will be vented safely during shutdown. Figure 1 summarises key facility design criteria to be considered for a hydrogen project.

The key facility design considerations depicted in Figure 1 are dependent on the system, application, and operating pressure/temperature, and expound on these additional criteria.2

Venting/flaring

Hydrogen release from pressure relief devices and equipment purges need to be routed to a vent that discharges to a safe location. The Compressed Gas Association G-5.5 Standard for Hydrogen Vent Systems indicates that a flare is not required on hydrogen vents. The National Aeronautics and Space Administration indicates that hydrogen has been safely vented with flows less than 0.5 lb/s, however meteorological conditions, other site-specific factors, and vent stack discharge velocities should be considered when deciding between venting or flaring.3 While industry guidance lacks prescriptive requirements for the use of hydrogen flares, best practices and project specific considerations need to be applied on a project-by-project basis.4 Hydrogen vents are prone to ignite because of hydrogen’s low autoignition energy, so vents will still need to consider a thermal radiation exclusion zone around a vent, as well as consider any resulting thrust and extinguishing methods for an ignited vent or flare. For large-scale hydrogen projects with common vents, it may be prudent to include a flare to provide a controlled burn of vented hydrogen, assuming any unsteady flow operational risks can be properly understood and controlled. The ignition of a hydrogen plume formed out of a vent without a flare can cause significant acoustic emissions, which could startle plant personnel or the public if the project is sited near a community. Another important consideration is the ventilation of oxygen. Hydrogen production using electrolysis processes will generate large amounts of oxygen. Proper placement of oxygen vents is critical since placement of oxygen vents too close to hydrogen vents can result in an even more dangerous gas mixture than the hydrogen alone. During detailed design, a dispersion analysis should be performed on the hydrogen vents/flares to ensure the design is sufficient. American Petroleum Institute (API) 521 recommends a dispersion analysis, even for flares in case of a flame out of the flare.

Electrical hazardous areas

Electrical equipment located near hydrogen equipment or piping should be rated for the appropriate hazardous area classification. For example, hydrogen areas may be rated for Class 1 Division 1 or 2 Group B, per the National Electric Code (NEC). Depending on jurisdictional rules, equivalent international or region-specific codes and standards addressing electrical hazardous area classification can be used.

14 Spring 2024 GlobalHydrogenReview.com

Figure 1. Hydrogen facility design criteria.

The flow control partner for all your PtX processes

For all things hydrogen

Valve solutions for green and blue hydrogen manufacturing, processing and transportation

Creating a greener way forward with reliable, superior performance and a comprehensive service offering

– built on extensive industry experience and proven performance in all key applications.

For more information, visit valmet.com/flowcontrol

Deflagration and detonation

Proper deflagration design should be considered for any enclosures containing hydrogen systems. National Fire Protection Association (NFPA) 68 provides guidance on deflagration venting design and NFPA 2 provides further guidance on using barricade construction in conjunction with deflagration minimisation techniques. In the event that detonation is possible, NFPA 69 provides additional guidance to manage the explosion after it occurs. NFPA 67 also provides guidance on explosion protection for gaseous mixtures in pipe systems to prevent air ingress to piping during venting and flaring events.

Ventilation

Proper ventilation of any enclosed hydrogen systems is important to keep hydrogen volumes below an explosive mixture. The ventilation quantity can vary depending on the applicable code. The typical six air changes per hour used for other hazardous gases may not be sufficient for hydrogen applications. Manufacturer’s guidance should be followed. Ventilation of the enclosed space should have any air inlets located at the lowest point, while any outlets are located at the highest point, where hydrogen can accumulate. Forced draft ventilation should use non-sparking fans and electronics to mitigate ignition sources. In some instances, active ventilation can be used to reduce the hazardous area classification.5,6 Failure or shutdown of ventilation systems typically results in the shutdown of hydrogen production equipment.

Leak/flame detection

There are a variety of technologies to detect hydrogen leaks including conventional cathodic bead, thermal, acoustic, hydrogen leak detection tape, fibre optic, or palladium film. Infrared style detectors are not effective for hydrogen. Hydrogen leak and flame detection is critical in determining if a system needs to be shut down on an emergency or maintenance basis. A combination of fixed and mobile detection equipment should be used to protect operators throughout the project lifecycle. Oxygen detection is also a good idea in occupied areas. Oxygen leaks can produce enriched areas with a very high fire danger. Nitrogen leaks can produce oxygen lean areas that can pose suffocation hazards. Detection of leak or flame typically includes audible and visual annunciation to plant personnel, in addition to alarming at the equipment control location.

Isolation

Isolation of hydrogen systems after leak detection is critical to mitigate the formation of an explosive mixture or to accommodate a shutdown for routine maintenance. A combination of automated block valves and shutdown controls, in addition to easy-access and emergency shutdown procedures, are important to consider in the design.

Process hazard analysis

Identification and mitigation of safety hazards should begin during project planning and should continue as the project progresses through design. In many instances, jurisdictions (e.g., US Occupational Safety and Health Administration)

include specific legal requirements around hazard identification and mitigation. Safety hazards can be identified and mitigated through formal hazard and risk assessments. Some examples include failure modes and effects analysis, hazard identification analysis (HAZID), hazard and operability analysis (HAZOP), and probabilistic risk assessment. Because there are multiple types of hazard and risk assessments, the appropriate method should be selected based on the level of detail required for the stage of the project and agreed upon as the appropriate method by the project owner or key project stakeholders. For example, a pre-feasibility stage project might perform a HAZID, which could be performed with minimal level of process definition. A HAZID typically uses a ‘what if’ type method to identify potential hazards, which are ranked based on probability and consequence, and after which a hazard rating would be assigned and methods for mitigating the hazard would be reviewed. Insufficiently mitigated hazards would be flagged for immediate follow-up, or for follow-up during future projects stages when there is greater level of process definition.

During front end engineering or detailed design, the project team often performs a HAZOP, which involves a detailed review of the process design, typically when there is piping and instrumentation diagram level of process definition. The goal of the HAZOP analysis is to identify any deviations from the intended function of the system design that could result in a hazard. All credible deviations are then evaluated to understand causes and consequences, after which follow-up actions are assigned to ensure the necessary safeguards are incorporated in the system operation and design.

Making safety a priority

To help generate new ideas and facilitate knowledge transfer, there are a variety of organisations that bring together industry members for education and training, including the Center for Hydrogen Safety (CHS). Black & Veatch is an executive member of the CHS, bringing experience and insights on diverse fuel sources and technologies. Education, training, and adherence to codes and standards, and best practices is critical to safe design, operation, and wide-spread adoption of hydrogen.

In part two of this article, Black & Veatch will explore the safety implications of hydrogen’s use as a fuel in combined power generation.

References

1. CHS: Center for Hydrogen Safety, AIChE, (5 July 2023), https://www.aiche.org/chs

2. ‘Best practices overview’, Hydrogen Tools, (n.d.), https://h2tools.org/ bestpractices/best-practices-overview

3. GREGORY, F. D, ‘Safety standard for hydrogen and hydrogen systems’, Office of Safety and Mission Assurance, (1997).

4. ‘ Venting’, Hydrogen Tools, (n.d.), https://h2tools.org/bestpractices/venting

5. IEC 60079-10-1, Explosive Atmospheres – Part 10-1: Classification of areas – Explosive gas atmospheres.

6. ISO 22734, Hydrogen generators using water electrolysis – Industrial, commercial, and residential applications.

Acknowledgements

Additional Black & Veatch contributors: Kevin Chael, Allan Gilson, Michael Goff, Donovan Mumm, Derek Ogg and Carina Winters.

16 Spring 2024 GlobalHydrogenReview.com

With only around 9% of new green hydrogen projects under construction or having reached final investment decision (FID) stage, Nadim Chaudhry, World Hydrogen Leaders, takes a look at the challenges and likely pathways to drive the industry forward.

Hydrogen – particularly green hydrogen – is now recognised as a vital zero-emissions energy source that is instrumental in the fight against climate change.

It can be transported over long distances, stored for lengthy periods, and certain existing fossil fuel infrastructure, such as gas pipelines, can be adapted to handle hydrogen supply. It is also a clean energy and feedstock source for

17

hard-to-abate industries which rely on high temperatures for key parts of their process.

Despite these attributes, the promise of a new hydrogen economy is facing multiple financial hurdles including capital still not flowing in at the scale needed: inflation (with costs of projects having increased considerably over the last year compared to when budgets were decided), slowness to implement policy around regulation and subsidies, and technology and infrastructure issues.

In 2022, at COP27, there were several significant announcements around new initiatives and projects to move the clean hydrogen industry forward. However, despite some progress, the economic challenges around the future of hydrogen remain, ultimately resulting in few low-carbon hydrogen project financing deals being closed. While some in the industry argue that the small number of final investment decisions (FID) is normal for such a nascent industry, others are concerned that only around 4% of potential clean hydrogen projects have reached FID stage. 1

What is holding the industry back?

The International Energy Agency (IEA) points to a combination of policy and regulatory uncertainty, high costs, lack of infrastructure and uncertain demand for the final product. To keep climate goals on track, it estimates that 70 million tpy of clean hydrogen will need to be produced by 2030, with only 1 million being produced today. But at the current rate of around 1000 announced projects to date globally, this means we are looking at only 30 million tpy by 2030. 2 And of those that actually have investment locked in, the figure falls to less than 2 million tpy. 2 According to the Hydrogen Council, a total investment of US$320 billion is needed for those anticipated 1000 projects, but with only US$29 billion committed so far. 2

From a geographic standpoint, Europe leads the way, accounting for 117 investments in green hydrogen projects in comparison to 46 in North America, 21 in the Middle East and 18 in China. However, across all new financing, less

than 10% actually accounts for committed capital, with the US accounting for a significant 70%. 2

Currently, green hydrogen has less energy per unit volume than fossil fuels, contributing to its higher price. Unlike grey hydrogen, which is extracted from natural gases in a carbon-intensive process, green hydrogen relies on electrolysis powered by renewable energy, such as solar or wind power, to split water into hydrogen and oxygen. However, renewable energy facilities are not being built at the rate needed to decarbonise the new sustainable electricity demand. Added to this, the few hydrogen projects that are operational are relatively small-scale, representing less than 1% of total hydrogen production over the last three years ² – and typically, green hydrogen infrastructure mainly becomes economically feasible when bigger facilities can meet higher demand.

Inflation matters

Following the supply chain disruptions and political tensions emerging from the Russia-Ukraine war, inflation has become a major concern for many industries. With more nations reducing their reliance on Russian gas and looking towards energy self-sufficiency, there has been an increased demand for raw resources (particularly steel and copper) for renewable development, which has also been exacerbated by logistics issues. While these higher costs of construction have not had much impact on assets already in operation (as costs are typically hedged at the time of FID), inflation risk remains in the growth pipeline, where tariffs have been approved but the project itself has not been confirmed and costs not yet locked in.

As an example, according to S&P Global Commodity Insights, the cost of electrolytic hydrogen from renewable energy rocketed to US$16.80/kg in July 2022, three times the normal price in recent times. 3

Inflation predictions for the foreseeable future are likely to mean that future projects become more expensive, particularly those with multiyear construction periods, where assets are valued at the start of the construction period. While developers will no doubt factor this in, they are likely to be confronted with increased insurance premiums.

The need for policy

Many believe that without strong government policy support, green hydrogen development will not scale up in the timescale required.

Director of Infrastructure Investments at Igneo Infrastructure Partners, Devina Parasurama, suggests that “investors require a degree of certainty, more financial support and scale, which can be done through effective policies at various levels. At the national level, strategies with timelines and targets are the first step to creating a stable planning horizon and certainty for stakeholders.

“Supply-side policies are required to advance technologies from early R&D to scale up stage. Similarly, demand-side policies, such as assisting consumers with conversion costs reduces the investors’ constant worry about where the demand will come from, at what level,

18 Spring 2024 GlobalHydrogenReview.com

Figure 1. Hydrogen used in ammonia production has proved itself at scale.

chartindustries.com howden.com Decarbonization Solutions for the Full Supply Chain

and crucially, when. Fiscal policies, such as carbon pricing and CFDs, will encourage the use of low- or zero-carbon hydrogen – this will help lower operational costs and provide predictable terms for both producers and end users. Finally, certification and standards provide clarity and harmonisation, which will be key in scaling hydrogen and fostering international trade.”

Grey hydrogen, which uses highly-polluting steam methane reformation (SMR), has long been the cheapest production method, trading at around US$1.50 - 2/kg in the US. In comparison, green electrolysed hydrogen costs aproximately US$4 - 8/kg. 4 While some have debated whether the real goal of the 2022 US Inflation Reduction Act (IRA) was solely environmentally-focused, or aimed more at keeping manufacturing stateside, the US$3/kg subsidy incentive for green hydrogen is likely to stimulate increased demand and an electrolyser boom. The subsidy – which acts as a tax credit – will mean that although green hydrogen is still a bit more expensive than natural gas, it will be much closer in price to grey hydrogen.

The main shortcoming of the IRA is that the production credits only last for 10 years, meaning that developers and investors might still find market confidence challenging in the longer-term. This could particularly be the case for certain industries phasing out fossil fuels – such as steel production – which will need to construct new plants to support hydrogen.

The EU, on the other hand, is taking a different, more regulatory approach. Rather than financial incentives, it is making mandatory that 42% of hydrogen used in industry should be renewable by 2030. The issue here is that such an obligation will result in additional costs on industry by compelling them to switch from cheaper natural gas to more expensive hydrogen. Additionally, the EU has applied a tight definition of what constitutes renewable hydrogen, which could increase costs further. To ensure the hydrogen is genuinely ‘green’, it needs to be produced off-grid during the limited periods when there is an excess of renewable electricity. Only allowing production within limited operating hours will raise the cost of hydrogen, particularly at the beginning of its development.

However, the EU is seeking to cover at least part of the cost gap through its own subsidies and has recently

launched a new European Hydrogen Bank which will run auctions to finance the most competitive hydrogen production.

While many investors will no doubt appreciate government intervention, there are others that take a bolder approach. Speaking at World Hydrogen Week, Peter Van Ees, Sector Banker, New Energies and Hydrogen at ABN Amro, commented: “From my viewpoint, it is too easy to simply ask governments and tax payers to fix this issue. We make sure all our customers understand that uncertainty is part of the opportunity. If all this was low risk and predictable, everybody would be doing it. We can discuss what is needed from others, but the main kickstarter is entrepreneurship and just getting going with what we have. And actually, we already have quite a lot!”

Trading vs fading

As there is currently a very limited merchant market for trading hydrogen or hydrogen derivatives, producers are facing a significant challenge when seeking to take out futures contracts to guarantee a price for their hydrogen. Banks remain skittish around the potential size of future revenue and in order to resolve this, projects requiring financing need to have ‘bankable’ offtake schemes in place, often with offtake agreements in other market sectors where hydrogen – such as petroleum refining or ammonia production – has proved itself at scale. Continued success in these industries would also go a considerable way to proving that clean hydrogen is genuinely viable and encouraging the scale-up and adoption of electrolyser technology.

In addition to offtake security, financiers have to account for technology risks, major infrastructure challenges – such as storage facilities, delivery pipelines and liquefaction plants – as well as sufficient sources of water and renewable energy as feedstock. These risks also need to be allocated in a way that project financiers understand. Financial institutions need to be confident of loan repayments which can take the form of predicted revenue streams, along with other vehicles such as collateral asset packages serving as security, insurance backing, and ‘on-time’ delivery contract agreements.

Conclusion

While from an economic viewpoint, the immediate future of clean hydrogen might have an uncertain pathway and not insignificant financial challenges to overcome, progress is still being made. Having been largely dismissed in the early stages, it is now widely accepted that it will have a major role in the energy transition.

References

1. https://www.iea.org/reports/global-hydrogen-review-2023/ executive-summary

2. ‘Hydrogen Insights 2023’, Hydrogen Council and McKinsey & Co., (May 2023).

3. PENROD., E., ‘Green hydrogen prices have nearly tripled as energy costs climb: S&P’, Utility Drive, (21 July 2022).

4. ESPOSITO, D. and TALLACKSON, H., ‘The Inflation Reduction Act upends hydrogen economics with opportunities, pitfalls’, Utility Drive, (30 September 2022).

20 Spring 2024 GlobalHydrogenReview.com

Figure 2. Financiers have to account for infrastructure challenges.

Lauren Davies, Andrew Nealon, Alistair Wishart and Garrett Finch, Vinson and Elkins, explain the role of project financing in the development of low-carbon hydrogen projects.

The finance sector has a significant role to play in the global transition to net zero, with project financing being a customary means of raising funds in the energy and infrastructure sectors. This article will examine some of the key challenges associated with using a ‘traditional’ project finance model in the development of low-carbon hydrogen projects and will also consider some potential solutions.

What is a ‘traditional’ project finance model?

Project financing is a well-established method of raising long-term debt for major energy and infrastructure projects.

21

As a financing structure, it has been central to the development of energy and power infrastructure globally as it has certain benefits over other financing structures. Project-financed projects are structured with special purpose vehicles as borrowers, and financiers look to the cash-flow generated by the project for the repayment of their loans. From the perspective of a project’s sponsors and equity investors, financial indebtedness incurred by a project company will customarily be off-balance sheet for a project’s equity holders, subject to the terms of any agreed sponsor guarantees or support, and therefore may be preferable to raising debt at the corporate level. Moreover, due to the broad range of potential financiers involved in the project finance market, a project may be able to attract a higher level of debt, on longer tenors and offering more competitive (and therefore favourable) financial terms than would be the case with other forms of financing. Because project assets are ring-fenced and there is limited or no recourse to the assets of the sponsors and equity investors, it is necessary to structure any project financing in a manner that mitigates (to the extent possible) the level of risk that a project company is exposed to. The level of willingness of prospective financiers to lend to a project (known as ‘bankability’), is closely aligned with the risk profile of the project.

Challenges

Technology/technical

Project finance tends to gravitate towards projects where risks can be identified, mitigated and allocated in a manner that is acceptable to both lenders and the key project participants. Proven technology is particularly desirable to a project financing; if something goes wrong with the project and lenders are not able to rely on any revenue stream or a strong sponsor paying back the debt, they might not have any way of getting their loans repaid. As a result, project financing in an established sector is generally more attractive to potential financiers and equity investors because well-tested and proven technology decreases project and operational (and therefore overall transactional) risks.

Because large-scale clean hydrogen production currently relies on technologies that are still evolving and rapidly scaling up in size and complexity, project financiers will focus on mitigating technological risk. For example, the durability and degradation of electrolyser cells and their components will be a key consideration for financiers of green hydrogen projects (or hydrogen made using electricity produced from renewable or other low-carbon sources, such as nuclear) given, amongst other things, the limited track-record of electrolyser deployment at this scale. Optimising electrolyser efficiency can help push down the cost of hydrogen production. However, large improvements in efficiency will entail a trade-off with electrolyser cost. Blue hydrogen projects (when natural gas is split into hydrogen and CO 2 and the CO 2 is captured and permanently sequestered underground) are typically more expensive than grey hydrogen projects,

with significant upfront CAPEX required due to the added expense of CO 2 capture and sequestration. In order for blue hydrogen projects to progress, it is critical to scale up investment in developing and deploying carbon capture, utilisation and storage (CCUS) technology to show both its effectiveness and that the risk of CO 2 leakage from geologic sequestration is negligible. As this technology matures, more projects will come to match the risk profile that banks are looking for due to the decreased technological risk and accepted mitigants of CO 2 leakage risk through perhaps contractual indemnities or insurance. For now, banks that are willing to be flexible with their project finance risk criteria may benefit from a substantial early-mover advantage.

While the total number of announced projects for clean hydrogen production is rapidly growing (annual production of clean hydrogen could reach 38 million t in 2030 if all announced projects are realised), only 4% of potential production developers have taken a final investment decision (FID). Banks have thus far not been able to provide the debt financing necessary for these two technologies to significantly scale up and, as a result, many projects are simply not going ahead.

Financiers can, however, better understand technology risk by performing a more robust diligence exercise, focusing on the adequacy and scope of construction contractor/manufacturer performance warranties and how they respond to the underperformance of electrolysers. As technology proves itself, the associated risks will diminish, and production costs will decrease accordingly. In fact, green hydrogen is currently projected to become cost competitive with grey hydrogen (or hydrogen produced by natural gas) by 2050. This downward trend of production costs, coupled with expected production increases from 0.2 million tpy in 2022 to 25 million tpy in 2030, and electrolyser capacity expected to swell from 2 GW to 242 GW in the same period, suggests a market ripe for growth.

In the meantime, many projects in this sector will require some form of support. This may take the form of sponsor support to provide additional equity in the project in limited circumstances (such as cost overruns, construction delays or underperformance) or to guarantee the repayment of the debt until completion of the project. The level of support a sponsor is able to offer will depend on the specific circumstances of the project under consideration.

Hydrogen lacks an established market

In order to secure project financing, sponsors generally need an established customer base, or creditworthy offtaker, that can demonstrate a certain revenue stream. Low-carbon hydrogen lacks a standardised market and therefore long-term offtake contracts are typically required to make projects viable. Ultimately, market and offtake risk are assessed on a project-by-project basis, but it may be easier to satisfy lender bankability requirements where a project can demonstrate that green or blue hydrogen will replace an existing supply of grey hydrogen

22 Spring 2024 GlobalHydrogenReview.com

MOBILITY SAF E-FUELS HYDROGENATION DEHYDROGENATION STEAM REFORMER INDUSTRIAL EMITTERS CARBON CAPTURE H2 PURIFICATION H2 PURIFICATION CO2 PURIFICATION H2 H2 UNDERGROUND STORAGE POWER GENERATION LOHC (TOLUENE) LOHC (MCH) ELECTROLYZER DAM CO2 CO2 CO2 CO2 H2 H2 H2 H2 H2 CO2 STORAGE CO₂ INDUSTRY CHEMICALS FEEDSTOCK SUPPLY Click here Your roadmap to Low Carbon H2 Discover Axens Solutions for the Production, Transport & Storage and Purification of Hydrogen

for which there are long-term, creditworthy consumers and sufficient demand, as well as demonstrating that the required offtake infrastructure is in place. While the costs of green hydrogen are higher than other hydrogen sources, government support may be required to make these projects economical. Similarly, lenders may take more comfort from arrangements entered into with offtakers in industrial markets in which hydrogen demand already exists on a continuing and long-term basis. Expanding demand in other sectors (such as transport) may lead to other opportunities for sales, resulting in project lenders becoming even more comfortable with offtake risk.

Recent commentary on the state of the offtake market indicates that only a very low portion of the clean hydrogen production capacity planned by 2030 has identified offtakers, with potential offtakers reluctant to commit to long-term contracts in the face of higher than expected clean hydrogen prices and the uncertainty surrounding them. Without secure long-term offtake contracts, hydrogen project developers that nevertheless push ahead face the risk of developing an asset that ends up as a liability before the end of its anticipated economic lifetime (or ‘stranded assets’), preventing the hydrogen market from gaining faster momentum. As with technological risks, project financiers who accept the risks associated with the still-developing hydrogen market and become involved at this earlier stage will be better placed to take advantage of the market in the future by developing strong industry knowledge and relationships in a market poised for growth.

Government support

Ultimately, however, the high capital requirements of hydrogen projects mean that, at least in the short-term, most are unlikely to be bankable without some form of government support. This might be a ‘top-up’ to revenues from the sale of hydrogen at a market price competitive with cheaper hydrogen sources or natural gas, which has been adopted in the EU, with the European Hydrogen Bank auction, and is likely to be adopted in the UK under the Low Cost Hydrogen Agreement model. Alternatively this could be a tax credit, as has been adopted under the Inflation Reduction Act in the US, which enhances return on investment for the investor by reducing tax expenses.

Many governments have announced programmes to this effect. Notably, the Japanese government released a revised Hydrogen Basic Strategy in June 2023. The strategy has four key goals:

y To generate public and private sector investment in hydrogen worth 15 trillion yen over the next 15 years.

y To increase the supply of hydrogen and ammonia in Japan from 2 million t to 3 million t by 2030, then to 20 million t by 2050.

y To expand the amount of Japanese-made water electrolysis equipment to 15 GW by 2030.

y To reduce the cost of hydrogen supply. Overall, this strategic policy is emblematic of the Kishida administration’s wider attempts to promote the establishment of international hydrogen supply chains.

The EU aims to reach 10 million t of domestic renewable hydrogen production and an additional 10 million t of imported renewable hydrogen by 2030 as part of the REPowerEU Plan, and there have been substantial recent steps by the EU to make this a reality. On 20 June 2023, the European Commission (EC) published two delegated acts outlining detailed rules on the EU definition of renewable hydrogen. The acts define the production requirements for ‘renewable fuels of non-biological origin’ (RFNBO) (i.e., green hydrogen and derivative fuels, such as e-ammonia, e-methanol, e-kerosene and e-natural gas). They apply equally to production projects located in the EU, as well as export projects selling to the EU. Both acts are necessary for the fuels to be counted towards EU countries’ renewable energy targets, and will provide regulatory certainty to investors as to what format of project will be able to produce ‘RFNBO compliant’ green hydrogen. Some regulatory uncertainties still remain under the delegated acts, particularly the eligibility of renewable power projects which have received operating aid or investment aid to supply power to an ‘RFNBO compliant’ green hydrogen project. As well as regulation, the EU is providing funding support to hydrogen projects. In November 2023, the European Hydrogen Bank launched an €800 million pilot auction of renewable hydrogen price subsidies, with an additional €2.2 billion auction planned in early 2024.

To support first movers, governments will need to keep moving forward with clear regulations and associated certification schemes. International cooperation needs to be reinforced to prevent lack of alignment between these efforts, which could lead to market fragmentation. This is even more important given that the international trade of hydrogen and hydrogen-based fuels is crucial to a net zero future. As part of its net zero emissions by 2050 goal, it is envisaged by the International Energy Agency (IEA) that more than 20% of demand for merchant hydrogen and hydrogen-based fuels will be internationally traded by 2030. Although momentum is strong, much more needs to be done. By 2030, the Hydrogen Council estimates that committed capital must increase more than twenty-fold to achieve emissions reductions necessary to meet the IEA’s net zero target.

Conclusion

Low-carbon hydrogen projects have a significant role to play in the transition to net zero, and project financiers will continue to maintain a crucial role in the provision of funding for the capital costs of such projects. While the market remains under development, there may be significant opportunities available to banks that are willing to be more flexible with their risk criteria. As hydrogen and CCUS technologies continue to mature and governments continue to implement policies to facilitate the development of a merchant market for hydrogen, the project finance structure will continue as an invaluable tool in the financing of these low-carbon hydrogen projects.

24 Spring 2024 GlobalHydrogenReview.com

Justin

Schaeffer and Mario Graca, Shell Catalysts & Technologies, discuss how new legislation

that incentivises lowering the carbon intensity of produced hydrogen may warrant a reassessment of projects.

Right now, there are scores of decarbonised (blue) hydrogen projects under evaluation in the US. And, in response to the Inflation Reduction Act, which incentivises lowering the carbon intensity (CI) of the produced hydrogen, these projects are likely to be tasking their technical teams with exploration of methods to further reduce this CI. The act has fundamentally altered the landscape, and this may warrant a reassessment of projects to align with the newly prioritised CI reduction goals.

Fortunately, there are a number of ways in which this can be achieved. While this article highlights the opportunities offered by the Inflation Reduction Act for projects in the US, the rationale applies more widely: when legislation encourages reducing hydrogen CI in other regions, the concepts discussed here could enhance those project economics too.

The Inflation Reduction Act

The Inflation Reduction Act has been described as one of the most significant pieces of climate legislation in US history and one of its goals is to accelerate the country’s use of low-carbon hydrogen.

To achieve this, it features a wide range of measures that include the extension of solar and wind power incentives, the expansion of tax credits for carbon capture, utilisation, and storage (CCUS), and – most notably for those developing decarbonised hydrogen projects – the introduction of a tax credit for hydrogen production.

This Section 45V Clean Hydrogen Production Tax Credit

(45V) calculates the amount of credit according to the CI of the hydrogen produced. As shown in Table 1, there are five different brackets, ranging from zero subsidy for hydrogen of more than

25

4 kg carbon dioxide (CO2) emitted per kg of hydrogen (H2) produced (kgCO2/kgH2), through to the highest tier which provides a subsidy of US$3/kg for hydrogen that emits less than 0.45 kgCO2/kgH2

Key qualification criteria for 45V include that a project must be based in the US, be put into service before 2033, and not also claim 45Q (a tax incentive in the US that provides monetary credits for capturing and storing CO2) or clean fuel tax credits.

The GREET model

The recently proposed regulations by the US Department of Treasury and Internal Revenue Service regarding 45V make use of the greenhouse gases, regulated emissions, and energy use in technologies (GREET) model, an established tool for evaluating the well-to-gate lifecycle emissions of hydrogen production processes.

A special version of GREET has been released, 45VH2-GREET, which contains many parameters that are fixed and unalterable, known as ‘background’ data. Notably, the emission factors for natural gas feedstock, including methane leakage, falls into this category, making it non-adjustable for project developers.

On the other hand, 45VH2-GREET allows flexibility in adjusting ‘foreground data’, specifically related to the hydrogen production facility. This crucial distinction implies that projects aiming to reduce lifecycle emissions must focus on factors they can control, such as lowering feedstock consumption (because the feedstock emission factor is fixed), reducing power consumption, and lowering direct emissions from the facility and its products.

In essence, projects that select hydrogen producing technologies that are advantaged on CI – that is, they have ways of addressing these adjustable factors – have a higher chance of qualifying for a higher 45V bracket. It should be noted that the 45V legislation is continuously evolving, and this article refrains from making specific assertions about how the CI of the Shell Blue Hydrogen Process (SBHP) will perform under 45V.

Moving projects into higher subsidy brackets

Decarbonised hydrogen project developers will typically select from three technology options. One such option is the SBHP, which is proven and has all of its elements in operation in multiple locations, including at the Pearl GTL facility in Qatar (Figure 1).

The two other main technologies are autothermal reforming (ATR) and steam methane reforming (SMR). While the 45VH2-GREET model includes only ATR and SMR technologies for producing hydrogen from natural gas, projects can petition for a provisional emission rate (PER) to qualify for 45V with the SBHP (although currently the SBHP and several reduction levers are not integrated into 45VH2-GREET). This is key because the SBHP has numerous features that can enable it to outperform these, both in terms of CI – which is crucial given the Inflation Reduction Act’s incentives for producing low-CI hydrogen – and in terms of levelised cost of hydrogen (LCOH). This is consistent with a recent report by the International Energy Agency (IEA),1 which concluded that the SBHP has the lowest carbon footprint and LCOH when compared with other decarbonised hydrogen production methods for a specific scenario in the Netherlands.

There are multiple reasons for these advantages. For example, the SBHP has a self-sufficient steam balance and has excess steam co-product available, whereas the other technologies require ‘on purpose’ steam generation, which either consumes fossil fuel or part of the hydrogen product.

Furthermore, it is possible to increase the amount of the SBHP steam co-product through heat integration without compromising on hydrogen yield. The steam co-product can displace the use of steam produced using conventional methods from fossil-based feedstock, and potentially make a boiler redundant, or be used for internal power generation. While the current 45V regulations exclude co-product in CCS based hydrogen production, the co-product can help to reduce CO2 emissions, CAPEX and OPEX.

1.5 - 2.5

2.5 - 4

>

In addition, ATR and SMR processes yield a higher methane (CH4) slip from the reforming process, and require external firing and often include a pre-reformer step to improve the efficiency of the process, all of which contribute to increased CO2 emissions. These processes also often require higher compression duties than the SBHP because of lower operating pressures and as they are catalytic processes, they require deep desulfurisation with expensive adsorbent.

In contrast, the SBHP has no direct CO2 emissions from the process and, because it operates at higher pressure, it also provides hydrogen at higher pressure which results in significant energy savings relating to hydrogen compression. This contributes to a reduction in CO2 emissions, CAPEX and OPEX, as well as equipment count and complexity.

SBHP also contains less CH4 in the syngas, and it achieves a high carbon capture rate because most of the carbon is in the form of carbon monoxide which is converted to CO2 and captured by the ADIP ULTRA solvent.

Customising the default line-up to enhance the CI

Crucially, there are a number of levers that engineering teams can pull to further enhance the CI of the hydrogen produced by a SBHP unit and, because it is customisable, these levers only require minor additional investment. Some of these levers would directly play into the facility factors that are adjustable within the

26 Spring 2024 GlobalHydrogenReview.com

Figure 1. The Pearl GTL facility in Qatar.

kgCO2/kgH2 US$/kg H2

100%

33.40%

Table 1. Inflation Reduction Act Section 45V hydrogen production tax credit

< 0.45

(US$3.00) 0.45 - 1.5

(US$1.00)

25.00%

(US$0.75)

20%

(US$0.60)

4 0%

WE’RE COMMITTED TO A BETTER FUTURE

WE’RE COMMITTED TO A BETTER FUTURE

Optimizing combustion for a greener tomorrow