ENERGY GL BAL

SPRING 2023

34. A digital game-changer for LCOE reduction

Miguel Ángel Torrero, VP Power & Renewables, Enverus, and Co-Founder, Rated Power.

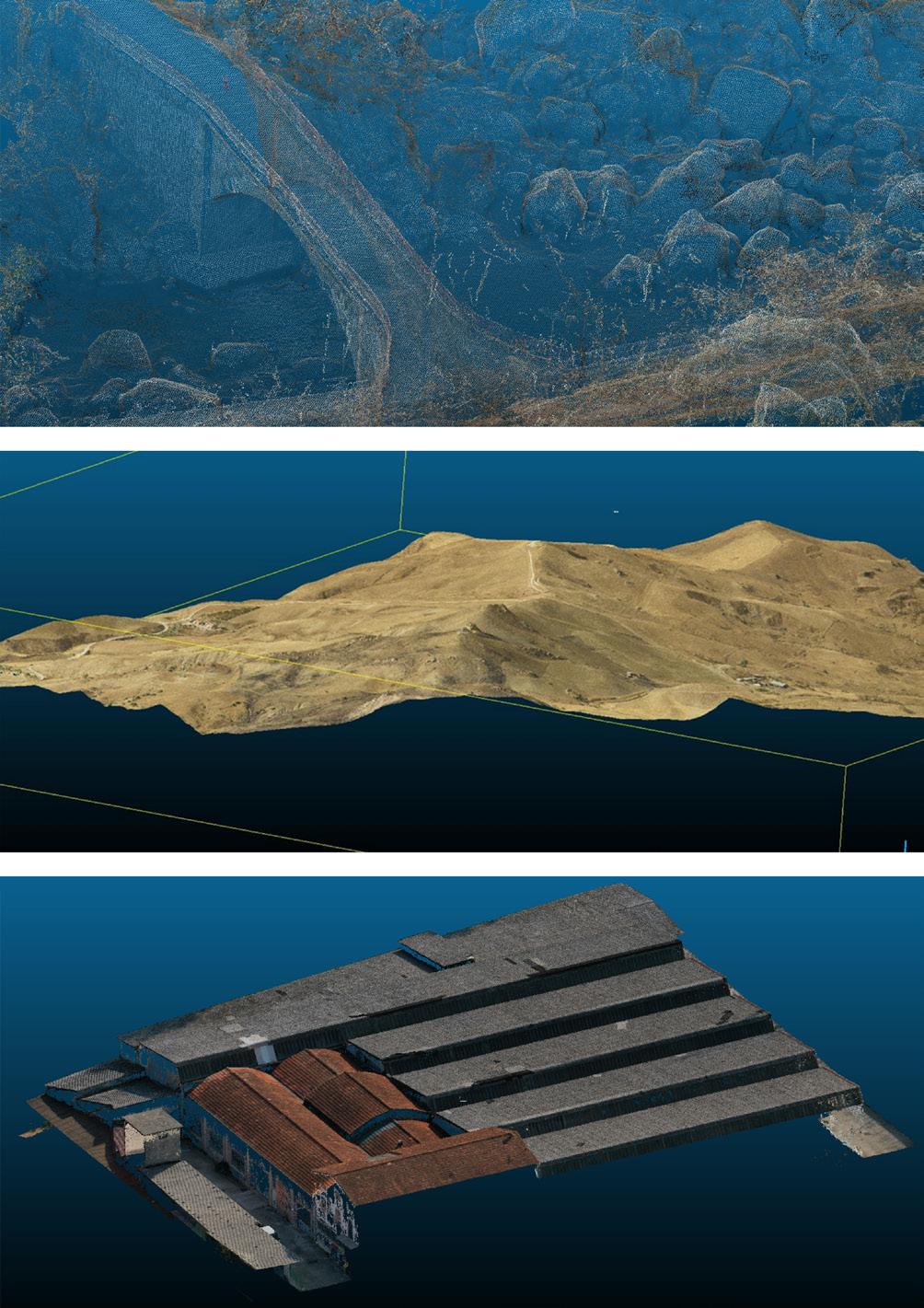

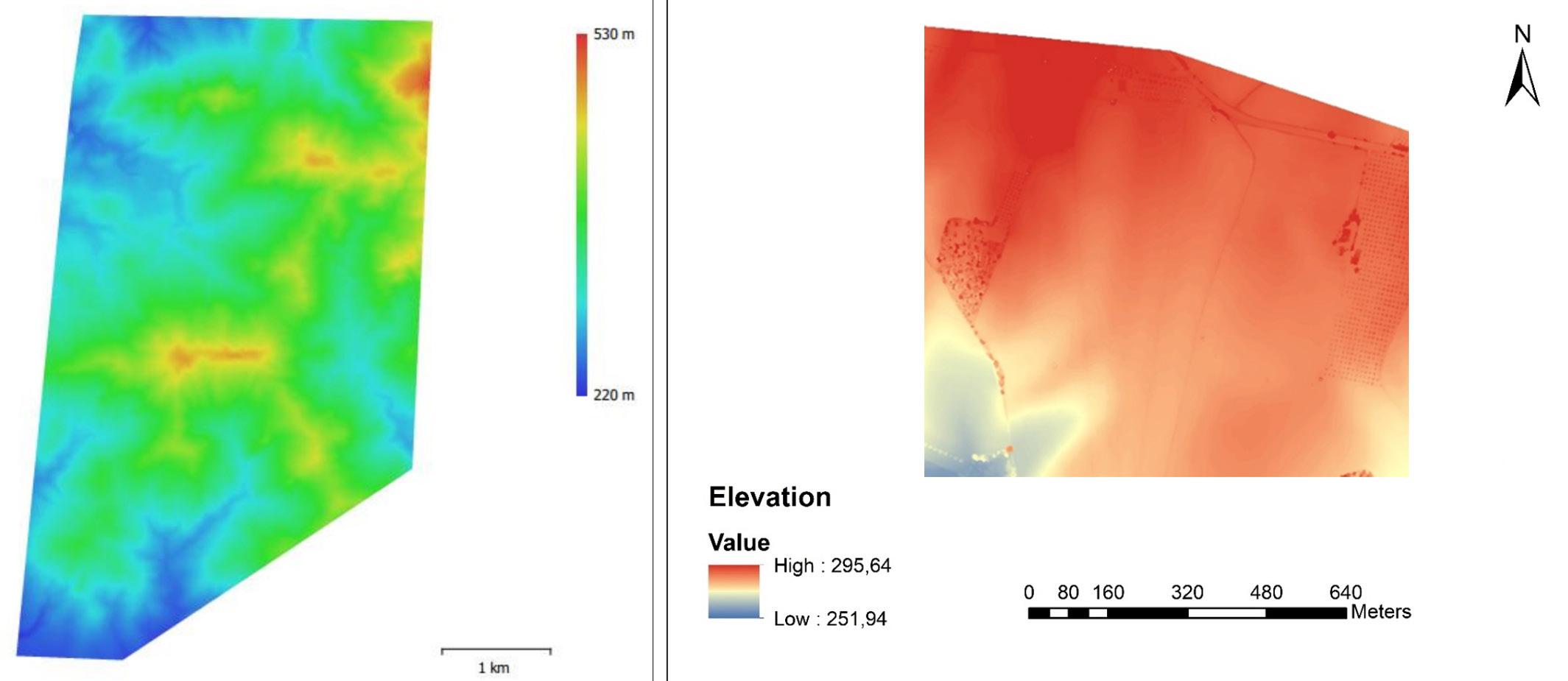

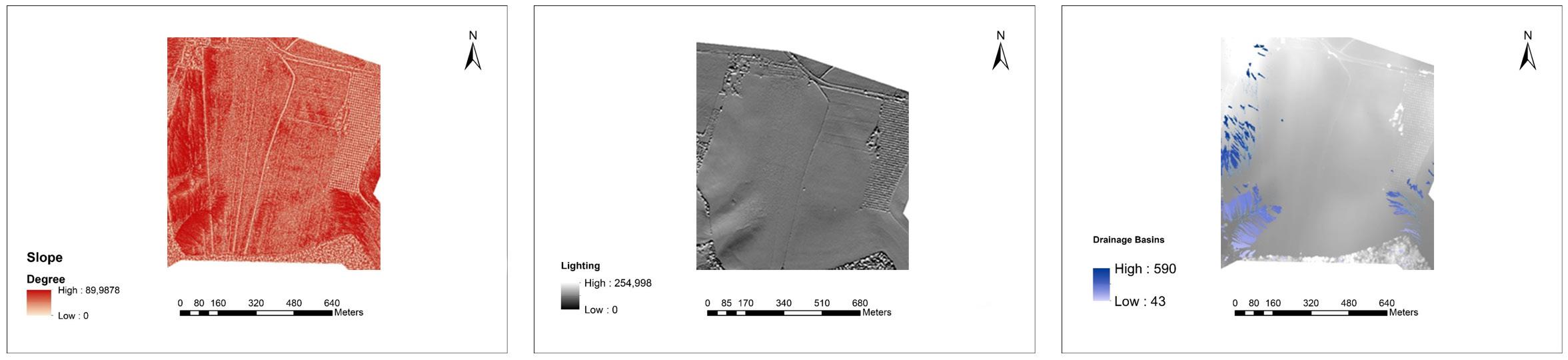

38. Surveying for site suitability Wesii, Italy.

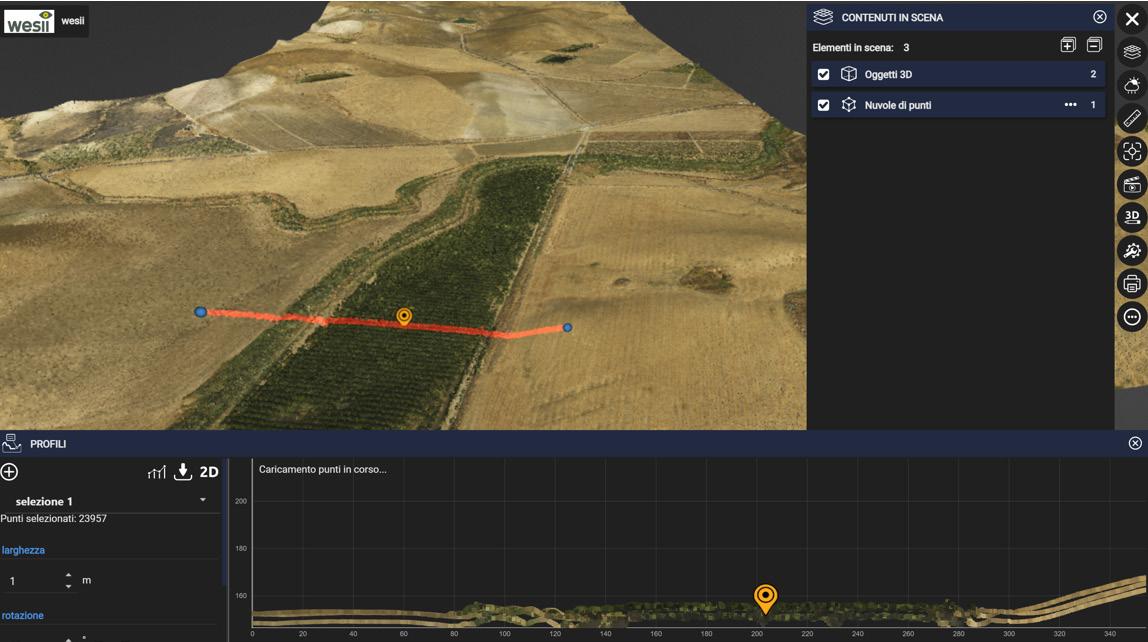

44. The rise of energy storage

Sonia Quiterio, Conrad Energy, UK.

48. Making the UK green Eric Adams, Hydrogen Projects Director, Carlton Power, UK.

54. Giving the green light to hydrogen

Afkenel Schipstra, First Hydrogen, the Netherlands.

58. Building the energy future

Gerhard Lohe and Dr Thorsten Becker, Doosan Lentjes, Germany.

10. Protecting the energy mix

Somaieh Salehpour, VP of Strategic Marketing and Technology, Seal for Life, USA.

14. Invest in wind

Mark Goalen, Houlder, UK.

18. Raising the voltage

Luiza Ferreira and Alex Rimmer, 2H Offshore Engineering, UK.

26. Making solar shine

Christian Hürlimann, MET Group, Switzerland.

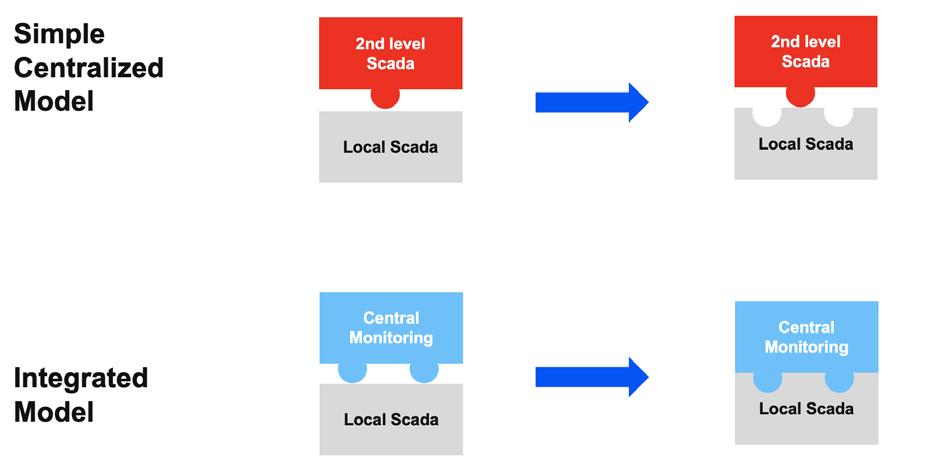

30. Setting up software architecture for an integrated platform

Christos Georgopoulos, Power Factors, Greece.

Reader enquiries [enquiries@energyglobal.com]

62. The future of biogas energy in North America

Mariane Ferencevic, Director of Business Operations, Fitec Environmental Technologies, Canada.

66. Securing a green world

Bernard Montel, EMEA Technical Director and Security Strategist, Tenable, France.

70. Global news

With more than 60 years of experience, Seal For Life Industries offers the most diversified coating solutions in the market for superior infrastructure protection. In the rapidly growing sector of renewable energy, Seal For Life are primed to provide the vital protection the industry infrastructure needs with a wide range of brands and products.

The company's goal: To make renewable energy truly sustainable. To learn more, visit: www.sealforlife.com

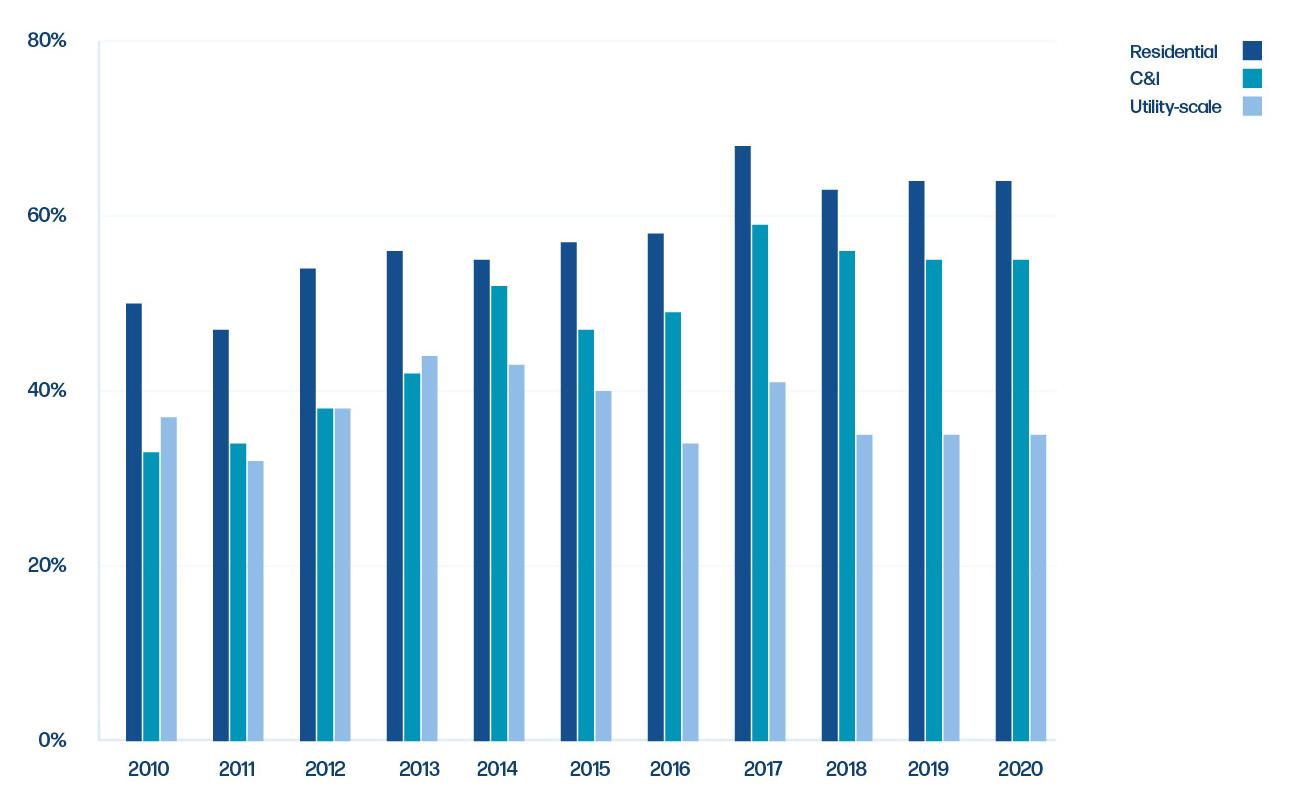

rivate capital has played a critical role in financing the growth of renewable energy over the last two decades. According to the International Energy Agency, more than 80% of total power sector investment globally is focused on renewables, grid integration, and storage. Furthermore, solar makes up almost half of this new investment, split between utility scale and distributed systems. Unsurprisingly, this has resulted in an influx of private capital into the space, with S&P Global reporting over US$21.5 billion invested in the US alone during 2021.

Much of this investment has traditionally been focused on asset owners, with pension funds and long-term capital managers investing in utility scale power plants. However, Clairvest’s activity in the renewables space over the past few years has supported an important shift towards investment in companies that enable the energy transition and support assets during and after their construction and commissioning period. Understanding this shift and the role of private equity outside of asset ownership is vital for leaders in the space.

The transition towards renewables has been a long-term secular trend in response to the fundamental need for reductions in carbon emissions and domestic energy security. Traditionally, this transition was supported by government incentives but, over the past several years, the declining capital cost of renewable energy has accelerated this transition.

Government action is again set to pour more fuel on the fire with the passage of the Inflation Reduction Act, which underscores governmental support for all forms of renewable power. Similar legislation is being passed globally, with a focus on reducing carbon emissions and empowering renewable businesses.

These new policies and continued declines in the capital cost of renewable power plants will enable continued growth for businesses in the sector. As rapid demand

Pgrowth occurs, it typically drives a need for capital and expertise to support businesses as they scale. Private equity can assist companies in navigating rapid growth transitions by providing a stable balance sheet, a long-term outlook for success, and expertise in navigating the common pitfalls of a scaling business.

Private equity can provide tangible benefits, including access to equity and debt capital, strategic planning, support with mergers and acquisitions, and bolstering the team as the company grows. In addition, private equity firms typically have experience growing and scaling businesses, which allows management to better play to their strengths as industry experts.

However, there are several private equity investment styles, and it is important to choose a partner that aligns well with the business’ goals and aspirations. One of the most important factors to consider is whether or not a company is comfortable giving up control to a private equity firm, or if they would prefer a minority investment. Each has their advantages, but results in vastly different partnership structures. With minority partnerships, existing management is in control of the business and drives the business’s strategy. Conversely, majority partnerships provide private equity firms with a greater say in the day-to-day operations and business’s overall direction.

In contrast to asset ownership, which is typically long-term, private equity investment periods commonly range from 3 – 7 years, and investors are typically looking to realise a return by year five. Management should carefully analyse the average hold period of a private equity firm to ensure it is aligned with their business plan; if management has a 7 – 10 year plan to fully realise the potential of a company, but a private equity firm has a 3 – 5 year time horizon, there could be a potential misalignment of interests.

Through partnerships with NovaSource Power Services and ALSO Energy, Clairvest has witnessed the value that is created through an aligned partnership between the right investor and companies that service the renewable energy sector. Ultimately, this leads to the creation of strategically significant businesses – ones that are vital to the future of renewable energy.

he world is attempting to shift away from a fossil fuel energy system to a materials-intensive renewable energy system, but the raw material markets which are vital for mass deployment of renewables face a range of challenges. The coming decades will see vastly more competition for the materials needed for the green transition, and Asia will be at the centre of this.

Electricity systems are where the most rapid change is expected, as the technologies needed to decarbonise the grid are available; and electricity is the lynchpin of a green economy. Decarbonising other sectors often relies on the electrification of fossil fuel processes or electrolytically produced feedstocks, such as hydrogen. Mass decarbonisation, which is needed to hit Paris Agreement targets, cannot happen unless there is investment in grids and renewable generation.

Energy systems across Asia will rapidly change over the coming decades, with the transformation being at a pace not previously seen in human history. This will be led by huge growth in solar and wind capacity – by 2050, CRU expects 55% of all solar and wind installations will have taken place in Asia.

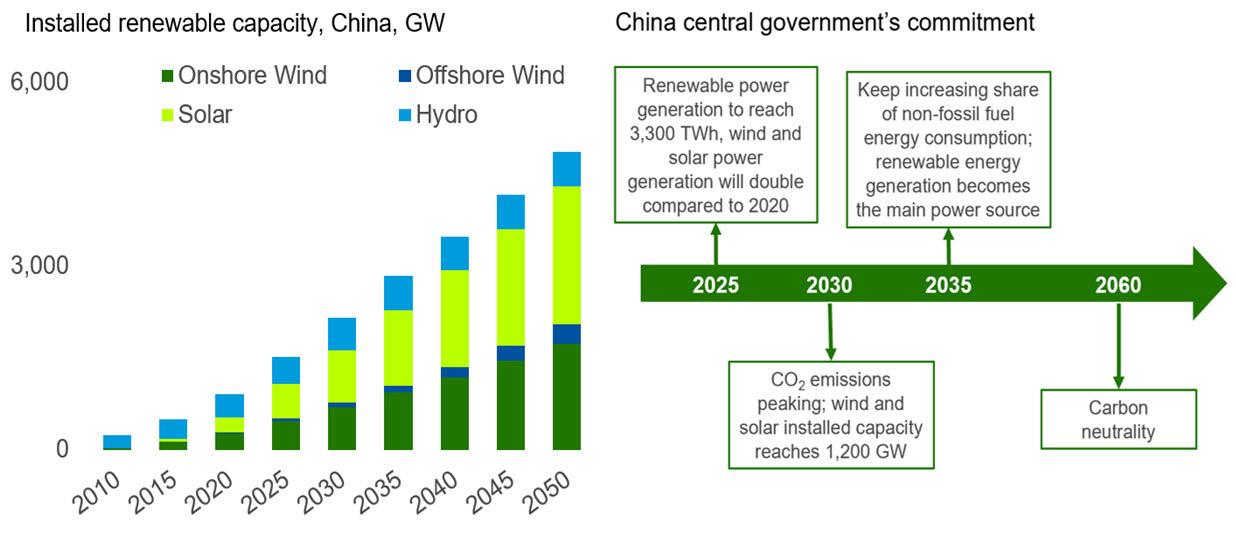

China is central to this story, both because of its huge domestic power requirement and vast manufacturing base. China has already installed approximately 750 GW of solar and wind (n.b. approximately 40% of the cumulative

global total), as well as over 400 GW of hydro capacity. Indeed, CRU forecasts Chinese renewable installations will surpass the government’s commitments and, by 2030, expects Chinese installed capacity of wind and solar will reach approximately 1650 GW – approximately one-third above the government target.

The Chinese government has committed to carbon neutrality by 2060, which will require huge additional solar and wind installations, and CRU forecasts capacity will hit over 4300 GW by 2050. This will take a monumental quantity of raw materials and will test supply chains globally. However, China’s ability to deploy at scale should no longer be a surprise.

Yet, risks remain. The Chinese central government released a raft of financial support and obligatory targets to drive renewable energy, but it also removed many subsidies in 2021. Moreover, coal has seen a recent resurgence and will remain vital in China’s energy mix for at least the next two decades.

Japan is aiming for carbon neutrality by 2050. By 2030, the Japanese government has previously pledged to increase the share of solar power to 14 – 16% from 2.7% today, and wind power to 5% from 0.8% today.

South Korea has made pledges to increase renewable generation to 20% of the power mix by 2030, with offshore wind being a focus. While these targets are modest, the country is also increasing nuclear output.

India is a market with huge potential, a vast population, and pent-up demand. The government has pledged to take non-fossil energy capacity to 500 GW,

CharlieDurant,CRU,UK,

providesinsightintosomeofthechallengesAsiawillfaceinitsenergytransitionto renewables.

and for 50% of its electricity requirements to come from renewables by 2030. However, given current rates of change, India’s pledges are challenging.

Elsewhere in Asia, the lack of carbon prices/costs will keep fossil fuels competitive with renewables. However, there will be regional variation and subsidies will play a role. For example, Vietnam has driven large solar capacity additions through feed-in tariff schemes and, across Asia, ‘Just Energy Transition Partnerships’ and financial support are building momentum. Yet, installing so much capacity, not just in Asia but globally, in such a short time will be challenging for the region and commodity markets will be tested.

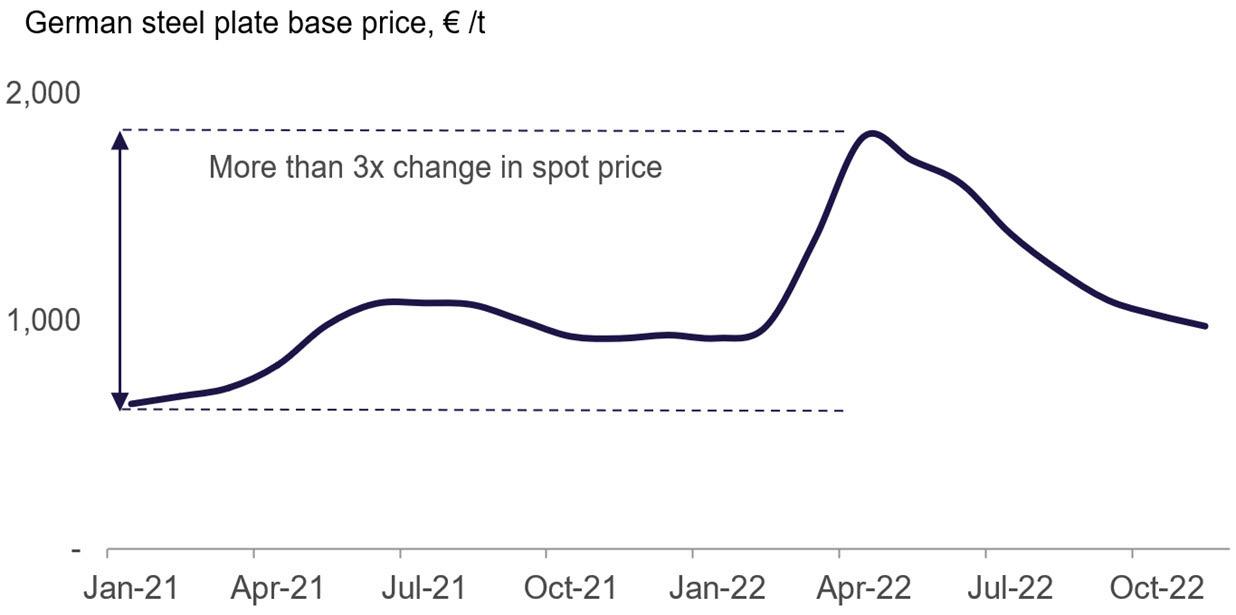

Metals demand will be shaped by the energy transition, but applications will also be shaped by materials pricing. Historically, metal costs accounted for 7 – 15% of upfront CAPEX costs, but this will be higher in the future.

Commodity prices rose to very high levels in 2022 and, even though some have seen substantial declines, they remain high. Many commodities are likely to remain elevated into the medium term due to increased

demand pressures. These will directly feed into higher costs for renewables.

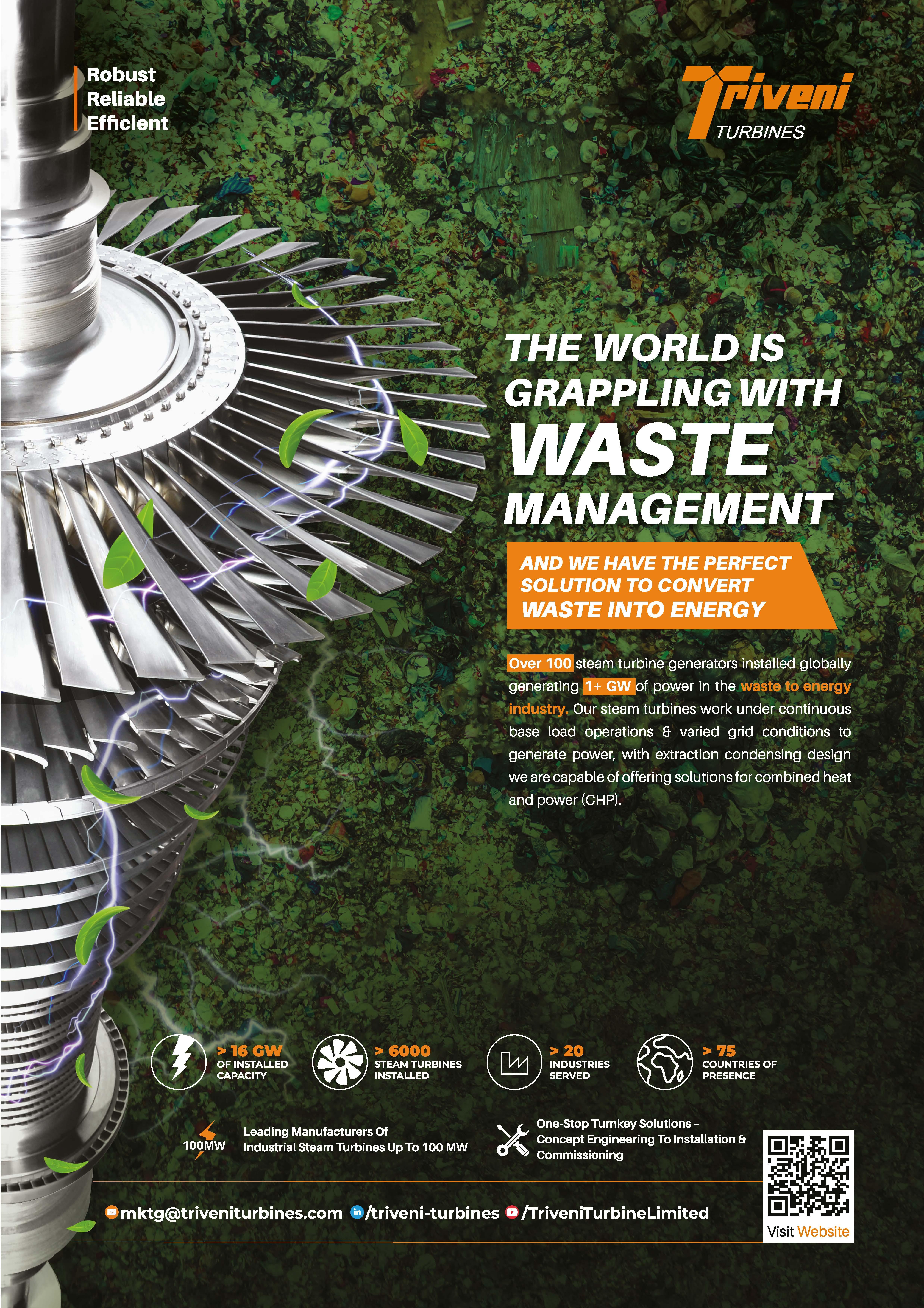

Managing price risk in volatile markets will be vital. A good example is offshore wind, which requires large volumes of steel over long build periods. Steel is used for the tower, transition piece, offshore substation and, most importantly, the foundation. A monopile foundation is essentially a large steel tube driven into the seabed. Supporting a large turbine out at sea presents a challenge for material strength and durability – and steel plates provide an excellent solution to that challenge.

Steel prices are volatile and purchasing teams in offshore wind companies face the challenge of market timing or require complex risk management. CRU discovers plate prices globally, including across Asia, but Figure 3 shows a cautionary example of the volatility European plate consumers faced between 2021 and 2022.

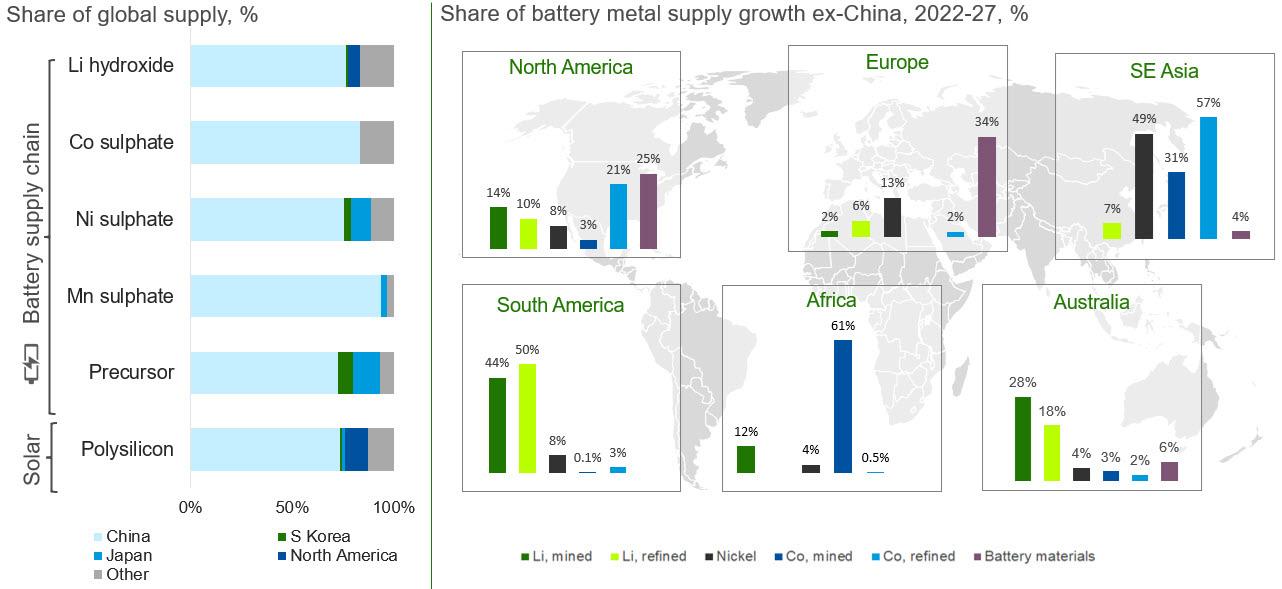

Almost all polysilicon for solar production is in China, and – along with silver-paste, glass, and frames – it is a key input cost for solar cells. Prices of polysilicon have increased hugely over the last two years, but prices are likely to come down, at least in the short term. However, this supply chain is becoming increasingly politicised, attracting the interest of policy makers globally, which will have implications for solar module costs. Affordable solar photovoltaics will be crucial if Asian countries are to achieve their decarbonisation goals.

Copper is used more intensively in renewables than in conventional generation, and so solar and wind are vital for copper demand growth – although they are a relatively small part of today’s markets. CRU forecasts global copper consumption in solar and wind installations will double from 2020 to 2030, hitting 1.5 million t. Huge grid enhancements are also needed, which will further boost copper demand. Along with demand growth from electric vehicles, growth of the global copper market is almost entirely contingent on a green transition.

The copper industry is heading for a significant structural imbalance, causing a supply gap from the middle of this decade that will impact prices. CRU forecasts over 6 million t of mine production will need to be added to the copper market to meet projected demand in 10 years. Much of this is needed to power green technologies.

Figure 1 . The world is not on track to limit temperature increases to 1.5˚C. Source: Climate Watch.■ Many companies rely on Boehlerit‘s innovative technology to manufacture their products. The Styrian carbide specialist Boehlerit is guaranteed to be behind many everyday products.

To incentivise new production coming online, copper prices will need to lift to levels where opening a new mine can be profitable. This price will need to cover more than just the cash operating costs if sufficient supply can be found. Copper mine constructions are large and complicated investments, and higher prices may be needed if the market is to meet the needs of the energy transition.

A rising share of renewables will cause more variability in electricity supply, and grid balancing will become more complex. In addition to improved grids, power storage

systems will be needed to ensure the dispatch of electricity even when wind or solar generation is low. The true cost of renewables, therefore, needs to take account of power storage in the system.

With technological improvements, CRU believes variability can be managed and will not stop a significant roll out of new renewables capacity in the coming years. But the need for mass deployment of batteries for grid storage creates new supply chain risks.

China currently plays an outsized role in raw material markets vital to wind and solar production. Chinese companies are even more dominant in battery material supply chains.

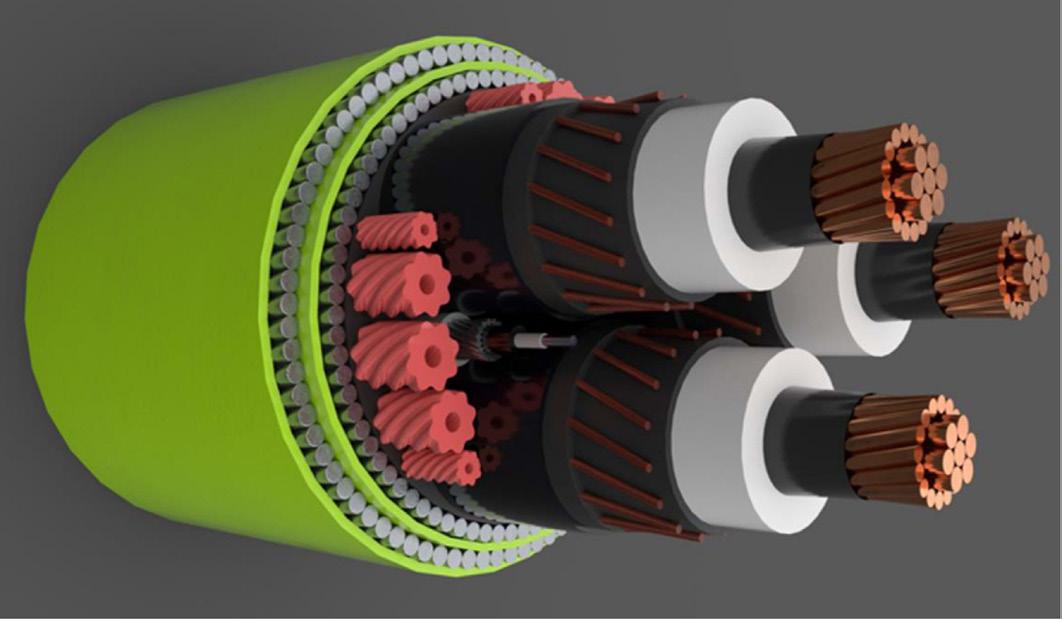

Concentrated supply chains can exist at a corporate, as well as national, level. Out of thousands of cable factories worldwide, only around 30 sites can currently produce subsea cables due to relatively high technical and capital entry barriers. For offshore wind, when including installation costs, wire and cables can account for approximately 17% of the total project cost. This is due to the extensive usage of high-value subsea export and array cables, in addition to the sophisticated cable-laying works required by specialist vessels. Moreover, CRU foresees a clear challenge for subsea cable producers to meet such exceptional demand.

Beyond economic and market considerations, geopolitics and trade rules pose additional risks. For example, there are significant anti-dumping duties on Chinese products in the solar value chain in many global markets and countries. Moreover, the US has brought in a raft of measures to boost domestic manufacturing and could remove China from the US solar supply chain altogether. Similar legislation could follow from other markets, such as the EU.

Trade measures are also evident in Asia. India introduced import duties of 40% on solar modules and 25% on solar cells in April 2022. With approximately 80% of solar panels imported (mainly from China), this has led to higher costs and more limited availability of solar panels, with at least one large solar project having been put on hold. In addition, the new policy only allows procurement of

Figure 3 Chinese renewable power generation will expand massively. Figure 4 Managing commodity price volatility will be a challenge. Note: Carbon fibre and glass prices not included.solar panels for government-funded projects from the approved list of mainly domestic suppliers, which have limited capacity. India is forecast to start polysilicon production in 2025.

Despite these policies, by 2026, CRU forecasts that China will still account for approximately 87% of polysilicon capacity, with the rest coming from North America, Europe, North Asia, and India.

Renewable developers looking to lower Scope 3 emissions need to source low-carbon dioxide (CO 2 ) commodities. However, decarbonising many commodity markets will be a huge task, requiring massive CAPEX, process flowsheet change, and sufficient supply of energy, as well as raw materials. Understanding the nuances of emissions produced in commodity markets requires good data.

The roll out of electric vehicles, as well as wind and solar power generation capacity, will add over 10 million t of aluminium consumption by the 2040s. Solar panels often use aluminium in installation brackets, although steel is mostly used for utility installations. Moreover, nearly all bare overhead cables are aluminium. Yet, aluminium is notoriously electricity-intensive, requiring an average of 14.2 MWh/t. To add to this complexity, CRU’s models show emissions from smelters can range from 2 – 20 tCO 2 e/t on a Scope 1 and 2 basis.

Producing steel can also be CO 2 -intensive. CRU data shows that making steel plates – typically used for monopile construction – using a blast furnace emits a global median of approximately 2.4 tCO 2 /t. Polysilicon and silicon metal production can be highly emission-intensive processes.

Despite the high emissions from these inputs, the lifecycle emissions of renewable power are, even today,

still significantly lower than for fossil fuel power. But emission targets will tighten, and commodity markets will need to decarbonise also. This will be a huge challenge and consumers of commodity-intensive products will likely face higher prices as a result.

The mutual dependency between commodity and energy markets is increasing and is expected to continue as the global economy transitions to a low-carbon economy. The world is shifting from a fossil fuel- to a materials-intensive energy system, and the needed rate of change is unlike anything that has been seen before. The transition will also require a transformation across economies, which will influence transport, industry, agriculture, and building sectors, as well as societies, on a similar scale. Decarbonising the world will therefore require vast CAPEX over the coming decades.

Commodity markets are complex, ever changing, and subject to multiple forces – and a deep understanding is vital when analysing the impacts of the transition. Historically, commodity markets have adapted and many could – at least theoretically – be significantly scaled up and decarbonised. The real question is how best to do this, and having a good understanding of costs will be key to achieving this.

Hitting many of the decarbonisation and renewable installation targets across Asia will be extremely challenging. Despite large scale promises and aspirations, supply chains will be stretched and trading relationships are being tested.

Having the necessary business intelligence in this space will therefore be needed to successfully navigate these challenges.

Somaieh Salehpour, VP of Strategic Marketing and Technology, Seal for Life, USA, highlights the various ways that coating technologies are able to protect the renewable energy infrastructure.

sustainable future is ahead of us, and the wind industry is proof of that – it has been rapidly expanding over the past couple of years, with over 93 GW of wind energy installed globally in 2021. Solar energy generation also increased by a record 179 TWh (up 22%) in the same year. These are both vital parts of the future mix, but other technologies will be needed to reach the challenging goals set.

The UK has made major commitments into offshore wind with over £900 million invested in offshore wind manufacturing plants in 2021, the highest on record since the industry arrived in the UK in 2000. The UK offshore wind industry is committed to creating tens of thousands of jobs, with 26 000 already working in the sector and this set to increase to 69 000 in the next five years.

The US has conducted offshore wind lease sales off the coast of New York, fetching over US$4 billion, a major step in the US’ push to renewable energy. Plans have been announced for areas in the Gulf of Mexico and the Central Atlantic to be made available for auction, and they are in the process of analysing suitable sites off Oregon and in the Gulf of Maine. Asia-Pacific region’s wind energy sector could soon account for approximately a quarter of their power this decade, with China set to be the largest market by 2030. And India is expected to install approximately 20.2 GW of wind power capacity

between 2021 – 2025, a growth of nearly 50% compared to the 39.2 GW currently installed in the country.

Easy-Qote has been making great strides in protecting this all-important infrastructure to the sustainable future. A brand on a mission to change the way corrosion prevention is viewed, and conducted, with it being applied simply as a patch.

In the case of Easy-Qote, one individual or small team is armed with a wire brush and a roll of patches. Simply brush loose corrosion away, apply the patch, and return to base. No blasting is required, avoiding the all-important issue of environmental contaminants. Overhead costs will be greatly reduced, with transportation and manpower costs down. Instead, protection is immediate and with a service lifetime of 25 – 30 years, the asset can now reach its full potential with long-term protection.

Geothermal energy is like an Earth-driven radiator, with no harsh chemicals, instead just using the Earth’s heat to provide energy. To do so, it is necessary to drill deep, but to drill this deep, company’s need to provide insulation protection to the drill pipe/equipment, as well as extreme temperature, abrasion, and pressure challenges to both the internal and external coatings.

Team Highland/Seal For Life have been hard at work the past two years, coming up with an exterior and interior coating solution for deep well drilling for thermal wells with Eavor and putting them into action.

Incorporating both Highland and US coating technologies and the company’s internal R&D expertise, the project has identified over 82 drill sites so far, with the first deep well tested early in 2022.

Products that went out to the first well drilled in early 2022 include Highland 74-INS-AR, Novolac Liner technology for the internal pipe joints with added abrasion resistance, and Highland 6521-INS, 100% solids Novolac technology with insulation package for the outside of the pipe joints, offering insulation and abrasion resistance (this is a combination of Highland and US coatings technologies).

At the end of 2022, the deep well depths have reached 3 miles/4 km with success, nearly three times the depth that are typically used for standard oil drilling operations and supports clean energy options. These depths also equate to higher performance requirements for heat, insulation, and abrasion resistance.

Hydrogen has the potential to be a game-changer for the future of energy, as it offers a clean, renewable, and versatile fuel source. However, widespread adoption of hydrogen will require significant investment in infrastructure and technology development. Retrofitting existing pipelines for hydrogen is crucial in order to take advantage of the potential benefits of hydrogen as a clean energy source. By repurposing existing pipelines, governments and operators can avoid the high costs and environmental impacts associated with building new infrastructure from scratch. Additionally, retrofitting can accelerate the adoption of hydrogen as a fuel source by enabling faster deployment and reducing barriers to entry for hydrogen producers and users.

At present, the development of internal coatings for retrofitting existing pipelines is a hot topic in the coating and energy industries. With the possibility for hydrogen to greatly contribute to the future energy-mix, there is significant interest and investment in developing coatings that can ensure the safe and efficient transport of hydrogen gas.

Seal for Life has been actively working on creating a coating solution for the hydrogen transport market, and also developing test methods to evaluate the solutions. The company has developed interesting prototypes that are currently being tested according to field conditions.

The coating industry is also collaborating with the energy industry to advance the development of hydrogen transport coatings. For example, the Association of Materials Protection and Performance (AMPP) has established a working group to address the challenges associated with the transportation of hydrogen through existing pipelines and requirements for internal coatings.

Seal for Life is very involved in technical committees such as this one, where working groups bring together experts from the coating, energy, and pipeline industries to share knowledge and to develop solutions for the safe and efficient transport of hydrogen gas. The company strongly believe that collaborative efforts between the coating and energy industries are essential to advance the development of these coatings and support the transition to a low-carbon future, and is proud to be an active part of the energy transition.

Figure 1 Easy-Qote installation requires minimal manpower.

Figure 2 EQ applied simply as a patch.

Figure 4 Hydrogen will soon be a key part of the energy mix.

Figure 1 Easy-Qote installation requires minimal manpower.

Figure 2 EQ applied simply as a patch.

Figure 4 Hydrogen will soon be a key part of the energy mix.

We have checked the operation behaviour, scheduled maintenance and installed updates. As your service partners, we keep your business running smoothly, securing availability and efficiency 24/7, around the world, on-site and digital. We’re there – so you can be away from time to time. Get support at www.man-es.com/primeserv

Mark Goalen, Houlder, UK, outlines the barriers to floating offshore wind commercialisation.

While the offshore wind market enjoyed its best year ever in 2021, with 21.1 GW of capacity commissioned, only 57 MW of that was floating wind – as reported by the Global Wind Energy Council (GWEC).1 It is clear that, as with most nascent technologies, barriers to full commercialisation exist.

One of the barriers to full floating offshore wind commercialisation is developers selecting the best floating foundation type for each offshore site and its unique conditions. There are many floating foundations to choose from, but they can typically be categorised in four main structure types: spar buoy, tension leg platform, semi-submersible platform, and barge.

One of the key technical factors that will influence the floating foundation choice is its motion response to environmental conditions. Understanding the effect of these motions is fundamental as it impacts everything from mooring design, the dynamic cable, the tower and, arguably most critically, the nacelles which have limitations that must be factored in. Each of the floating foundation types has other varying characteristics which effect how it responds to the marine environment.

To date, most projects using these foundations can be seen as demonstrators, which have been driven by the floating structure designers themselves to prove

their technology, rather than to provide developers with an objective demonstration of each technology for a given site and environmental conditions. As such, there is still a fundamental need to identify the best technical solutions for each planned floating site that will minimise costs, risk, and inefficiency for developers.

These demonstrators have also used conventional wind turbine generators, which were originally designed for onshore or fixed wind. Given the number of known challenges associated with operating and maintaining these conventional turbines in a dynamic environment, it is expected that over time, disruptive technology (such as X1 Wind’s weathervaning downwind concept, SEATWIRL’s vertical axis turbine, and SENSEWind’s self-erecting nacelle system), or other technology innovations will gain traction and direct the evolution of the industry.

Ultimately, there will not be a single definitive foundation type as there are lots of additional variables that will impact the decision, including a technologies’ operability, reliability, practicality, readiness, CAPEX, OPEX, and potential longevity, to name a few. A developer will select a foundation most suitable for the wind farm they are developing and, especially given that many developers’ portfolios are global, this will vary from site to site. Therefore, advanced floating foundation selection involves collaborating with the right partners to analyse a combination of technical and operational factors and, arguably, the latter may have a bigger impact throughout the asset’s lifecycle.

One such operational factor, and indeed one of the most significant barriers to rapid floating offshore wind commercialisation, is supply chains. Port infrastructure, site capabilities, logistics, and operations and maintenance (O&M) access are all vital supply chain considerations. It is essential that developers and other stakeholders have a holistic understanding of site selection criteria and processes, equipment, vessels, and crews involved from the very start to optimise their floating wind projects.

In November 2022, the news broke that Shell had cancelled the construction of a demonstrator floating wind farm off

the shore of France. Shell cited supply chain issues among the key reasons for abandoning the project. Just a few months before, Equinor announced delays to the roll-out of its floating Hywind Tampen project, also citing supply chain issues.

Despite floating wind successes and high ambitions, as Shell and Equinor have proven, supply chain constraints remain a key barrier and, again, collaboration will be required to realise the full potential as the industry moves forward.

Currently, there are 14 floating ScotWind projects, and these are likely to face supply chain challenges as well. ScotWind is assuming to mostly use 18 – 20 MW turbines. However, these are not actually available yet, so it is a bold assumption on the developers’ part. For a 10-year period (2029 – 2039) for manufacturing and installations, achieving ScotWind’s ambitious goals would require approximately 125 units to be made per year.

Critically, many Scottish ports do not have the required areas to deliver commercial scale floating offshore wind without significant investment and infrastructure development. Decisions on floating foundation type are yet to be made. Until that is known, the supply chain cannot form, and investment cannot be made in port infrastructure.

For ports that will support a new development: location, infrastructure, water depth, available space for fabrication, and storage are all key. Taking the UK as an example, current options are limited. Individual ports do have plans to invest, but none will be sufficient to cover all options, and there is therefore a chance that significant parts of the manufacture could go to Europe or Asia.

Up to now, this lack of port infrastructure has been driving the choice of concrete over steel foundation. It would appear easier to manufacture concrete structures because it requires a less skilled workforce. These structures only require the moulds and raw materials, not the specialised welding equipment or qualified welders. Steel can be prefabricated elsewhere and assembled, but that builds in additional fabrication risk and requires additional transport of large components, increasing costs and carbon footprint.

Interestingly, there is one possible solution being used by Copenhagen Offshore Partners on the Pentland development. The company has selected the Stiesdal TetraSub for the site. The philosophy of the Tetra concept is such that the parts can be fabricated in existing fabrication facilities. The completed parts are then delivered to site for assembly. They do not need welding and it is expected that two full units per site per week can be assembled. This kind of system looks very attractive from the supply chain perspective as it overcomes a lot of the existing barriers. All eyes will be on the performance of the units in Pentland, ahead of developers selecting floating foundations for ScotWind.

O&M is an even bigger challenge facing the industry. Floating foundations are currently towed back to port for maintenance and repairs. However, this will not remain viable or economical as wind farms are located further offshore and the distance to O&M ports increases. The ability to conduct O&M on location must be developed, because the risk and costs associated with connection and disconnection and transportation of the wind turbines will prove too high over time. A combination of modifying the turbine, as well as developing the tools and vessels required to support this O&M phase, will be crucial to the success of floating wind.

Having the right expert advice available on everything from motion response to supply chains and from port infrastructure to O&M, from the outset of the project, ensures that developers gain a holistic understanding of the processes, equipment, vessels, and operations involved throughout. Independent marine and offshore design and engineering specialists can provide consultancy on the costs, timeframes, emissions, and risks of each floating wind technology – supported by technical analysis.

With the right collaboration and investment, the supply chain challenges in Scotland, and globally, can and will be overcome to ensure the floating offshore wind industry becomes a pillar stone of the global energy transition.

1. ‘Wind industry enjoyed its second-best year but scaling-up for Net Zero requires policy breakthrough’, Global Wind Energy Counci, (4 April 2022), https://gwec.net/wind-industryenjoyed-its-second-best-year-but-scaling-up-for-net-zero-requires-policy-breakthrough/.

Figure 2 Rampion offshore wind farm, the UK. Source: Unsplash.Adjusting existing units to new feedstocks is challenging and uncertain. As you transform your operations to meet new market demands, Sulzer Chemtech brings expertise to help operators efficiently process pyrolysis oils from waste plastics and biofuels with innovative licensing technologies and purification systems.

Contact us for more information chemtech@sulzer.com

Sulzer Chemtech – We make chemistry happen!

Floating offshore wind is emerging as the solution for wind energy in water depths where fixed foundations become unfeasible (>60 m). Market projections indicate that up to 46 GW of floating wind will commence installation globally by 2035.1 Given that in 2022, only 60 MW of the global installed offshore wind capacity came from floating wind, this represents a massive growth in a short timeframe.

A significant part of the technology proposed for offshore floating wind projects is able to come from similar oil and gas energy technologies. For example, the main floating substructure designs (spar, semi-submersible, barge) and mooring line and anchor configurations (catenary, taut, semi-taut) are all based on oil and gas technologies that are widely used. Although the principles remain similar to oil and gas, the design will need to be

Luiza Ferreira and Alex Rimmer, 2H Offshore Engineering, UK, explain the need for, challenges associated with, qualification of dynamic high-voltage power cables for floating wind farms.

adapted to the operating conditions, specifications, scale, cost, and volume for deployment in floating offshore wind.

The inter-array dynamic high-voltage (HV) power cables are, however, an area where technology from other similar applications is not directly applicable due to the unique combination of HV and large dynamic motions under environmental loads (sea waves, wind, and subsea ocean currents). This presents a significant challenge to developing and qualifying new HV power cable technology for dynamic inter-array cables, and also to ensure that the designs can be configured and applied to each project in an efficient and cost-effective way.

This article will explain some of these challenges, and dive into some of the areas which are supporting the development of workable power cable configuration for the next offshore floating wind farms throughout the world.

It will also look at how this can be done without the need to conduct expensive qualification testing each time a new wind farm is installed.

The inter-array dynamic HV power cables (Figure 1) will be used in all floating offshore wind farms to connect the individual wind turbines to their neighbours and to the offshore substation so that the power can be transmitted to where it is needed. They are an area where technology from other similar applications is not directly applicable.

For example, low- or medium-voltage umbilicals and cables (and associated unbonded flexible pipes) already used in floating oil and gas facilities to transmit power are not fully applicable. Although they are designed to accommodate dynamic motions reliably over long periods, they are not suitable for the higher voltages required for floating offshore wind. Similarly, although static cables in fixed wind farms are specifically developed for high voltage, these are only designed for use in static applications and not to accommodate the large dynamic motions associated with floating wind. Thus, although some of the lessons learned and parts of the designs may be transferrable, overall new power cable technology is required for floating wind applications. This is technology that a range of experienced cable vendors have been developing and testing.

A key challenge is that the new inter-array dynamic HV power cable technologies will need to operate reliably over long periods without failures to minimise the costs over lifetime. Based on insurance claims from fixed wind developments, damage to power cables represent 80% of all claimed costs and inter array cable damages range from US$1.8 million – US$12 million. 2 As such, achieving this reliability is already something the offshore wind industry has found challenging when designing power cables. The floating wind industry must avoid similar significant costs to be incurred due to down time or to repair or replace damaged power cables. Therefore, qualification and testing of the inter-array dynamic HV power cable technology is going to be essential to confirm that the level of reliability

can be achieved within each design of power cable and to ensure possible failure modes are captured and designed out before power cables are installed commercially for long periods and in high numbers. However, the key question is how this qualification will be done in a consistent, standardised way that minimises the amount of qualification testing and hence cost.

The demand for qualification of inter-array dynamic HV power cables is quite recent given the technology is relatively new, and for the reasons outlined in the previous section. The qualification of these power cables is, however, complicated as it includes both electrical (e.g. HV transmission) and mechanical aspects (e.g. fatigue life), which co-exist and influence each other (e.g. thermal effects). But until recently, there has been no single industry code or guideline that describes the process to design and qualify an inter-array dynamic HV power cable from start to finish.

There are a range of industry codes from certification bodies (e.g. American Bureau of Shipping, Bureau Veritas, DNV, Lloyd’s Register, etc.), which describe the qualification process at a high level. Each of these uses similar approaches to describe the steps to achieve qualification to different technology readiness levels (TRL). However, all have differences in their approaches and definitions, only describe the general processes, and are not adapted to any specific components.

This high-level guidance must be supplemented with more specific industry codes to define the steps and processes to design and conduct qualification testing for a specific component, e.g. power cable. However, even where these codes exist, the pace of development in floating wind power cables exceeds the scope of the existing codes. For example, wind turbine generators (WTGs) have now evolved to beyond 14 MW (e.g. 20 MW is planned) and it consequently becomes more efficient to increase the size of the power cable beyond the current 66 kV commonly used so as not to limit the overall potential output of the wind farm. The current existing industry standards and guidelines (such as IEC 63026, 4 as well as Cigre TB 722 5) only cover type tests for qualification of subsea HV power cables up to 66 kV. With current technologies using 66 kV and expected to head towards 132 kV, the standards will need to be revised or new ones released to follow the industry trends for future developments.

The offshore floating wind community has therefore sought to find ways to consolidate the range of codes and guidance available into a single framework to support the qualification of dynamic HV power cables. There were two key advances in 2022:

> Firstly, CIGRE TB 862 guidance, released in January 2022, is the first code that addresses the design and qualification of HV power cables in a single document. 6 It gives a general overview of the steps required and the range of other design codes and guidance to develop

these cables. It outlines the complexity of the high voltage dynamic inter array cables and highlights how a combination of design, finite element analysis (FEA) and testing is required throughout the development, and qualification testing of these power cables.

> Secondly, ORE Catapult and 2H released a qualification framework for dynamic HV power cables to provide guidance on developing a standardised qualification programme for these dynamic cables and outline which tests have to be performed in each stage of the process, the order of the tests, as well as providing clear direction on which codes to follow, pointing out any gaps that may still exist.7 Standardisation is key to guarantee all cables, independent on the vendor, are qualified to the same level.

The most mature technology readiness level (TRL 9) is only reached once a HV power cable has been operating in the field for two years and has achieved all qualifications requirements. To reach this stage, there are a number of steps to be fulfilled, as outlined in CIGRE TB 862 and the ORE Catapult and 2H framework. 6,7 This is a long, complex process which integrates the design and qualification tests. In order to progress through each technology readiness level, there are a range of requirements that must be fulfilled to differing degrees at each stage, which are namely:

> Structural analysis.

> Thermal-electrical analysis.

> Component electrical and mechanical tests.

> Reduced scale electrical and mechanical tests.

> Full scale electrical and mechanical tests (including full scale fatigue testing).

> Project specific tests.

> Commissioning tests.

> Performance monitoring.

The floating offshore wind farms to be installed around the world can be located in shallow water depths (60 m – >200 m), such as the North Sea, or in deeper

water depths (500 m – >1000 m), such as the West Coast of the US and the Mediterranean Sea. They can also be installed in a range of environments and utilising a range of different floating substructures and mooring systems. Offshore floating wind farms will also typically have different sizes of cables, defined by the cross-section of their electrical conductor e.g. 240 mm 2 , 500 mm 2 , 800 mm 2 , and 1000 mm 2 . The biggest cables are closer to the offshore substation and the smaller cables are further from the substation, connecting a fewer number of turbines.

The process to qualify power cables therefore not only has to address the range of code requirements in the qualification process, but must allow for the qualification testing to be applicable across a wide range of scenarios, e.g. shallower and deeper water depths, high levels of dynamic motion, and for different electrical conductor sizes. In practice it will not be possible or commercially effective to develop one power cable design that is suitable for all situations, but instead a family of products that cover different ranges of applicability.

As experience within floating wind develops, the qualification of new dynamic HV power cable cross-sections will be able to use learnings from previously qualified designs, similar to what happened to flexible pipes in oil and gas. But, while the floating wind industry matures and earns this practical and technical knowledge, a large number of qualification tests will have to be performed.

The question is where to begin this journey, and will the first floating wind projects provide a suitable starting point to qualify the technology?

Contrary to what many may think, developing an inter-array dynamic HV power cable in shallower waters is more challenging than in deeper water depths.

The simplest and cheapest configuration for a dynamic HV power cable connected to a floating platform is a free-hanging catenary, as shown in Figure 2. However, the combination of floater dynamic motions in medium to harsh environments and large floater excursions produce excessive loads where:

> The catenary power cable touches the seabed at the touchdown point (TDP).

> The catenary power cable interfaces to the floating hull (hang-off).

The loads are proportional in magnitude to the ratio between the length of power cable and level of motion at the top of the power cable. Therefore, the shorter a power cable is, the less capable it is of absorbing the motions occurring at the floater and the higher the loads are. In the case of a catenary, the length of the power cable is also dependent on the water depth it is installed in. Therefore, as the water depth reduces, the length of the power cable reduces, and it is subsequently less able to accommodate floater motions, resulting in higher loads.

This has typically made the catenary concept unfeasible for floating offshore wind farms in shallow waters (<150 m) and it is only exasperated where larger and stiffer power cable sizes are used.

This is where experience in similar systems in oil and gas applications (e.g., umbilicals, low voltage power cables, and non-bonded flexible pipes) is relevant. Oil and gas has had exactly the same challenges in shallow water depths and in order to address them, a range of alternative configurations have been installed to increase the length of the line so it is better at absorbing the floater motions and consequently reducing loads to manageable levels. Examples of the range of alternatives used in oil and gas are also shown in Figure 2. However, although these provide greater ability to absorb motions, they also come with a disadvantage of higher costs and complexity (e.g. installation of mid water arches). Thus, most of the popular configurations from oil and gas shallow water are not ideal for floating offshore wind.

The tethered lazy wave configuration is currently the go-to configuration for inter-array dynamic HV power cables. It has been selected for the first pilot projects including the Hywind Demo, offshore Scotland. 8 However, the clamps used to connect the tether to the power cable can be a high-risk component and therefore future commercial projects are trying to avoid the use of tethers. The WindFloat Atlantic project is an example where tethers were not installed for the three wind turbines of 8.4 MW installed.9

Although there are caveats, shallow water therefore presents one of the most challenging areas to begin the development of floating wind from the perspective of the inter-array HV power cables. This is not to say that deeper waters will not have different challenges (e.g. due to higher cable weight and/or platform excursions), but, at a general level, if inter-array dynamic HV power cables can be designed and qualified for shallow water then extending the design and qualification to deeper water depth can be readily achieved.

A key aspect will be qualifying the inter-array dynamic HV power cables (and ancillary equipment) to cover a sufficiently broad range of application, e.g., shallower and deeper water depths, with a high level of dynamic motion tolerance. There will not be one power cable design that is suitable for all situations; however, it is anticipated that shallow water development provides the opportunity to develop and qualify the technology that will underpin future deeper floating wind developments.

As discussed in the previous section, the loading on the inter-array dynamic HV power cable is highly dependent on its shape configuration, which can be dependent on the size of cable, water depth, the level of motion at the floating substructure (e.g., the influence of the substructure type and its mooring), and local environment conditions. The loading on the power cable is therefore

also very dependent on all of these parameters. Given the huge areas globally over which floating wind farms could be developed, there is in effect a never-ending number of possible combinations of these parameters to design for and to qualify a power cable for. However, it will not be cost effective or practical to test power cables separately in every single new application. It is also not practical or possible to wait for a power cable to be installed in each location to understand the loading or configuration required.

This is where structural analysis with a virtual simulation model of the system comes in, and, in particular, structural analysis to:

> Define the loading range for which the power cable must be qualified to operate.

> Confirm that the loading in the power cable remains within the level with which the power cable has previously been qualified.

The structural analysis is now sufficiently advanced that it can accurately estimate the loading on the power cables and the behaviour of the power cable cross-section to this loading. Structural analysis is therefore able to accurately determine for the given range of application that the power cable has sufficient strength and fatigue resistance for all phases of installation and operation.

This means that the structural analysis is essential in conjunction with the qualification testing to both define requirements for qualification testing, but also as a key tool to minimise the level of qualification testing required moving forward. But the next question is how is this achieved in practice?

To avoid the need to requalify a HV power cable each time, it is necessary to show that the existing qualification remains valid. This is a complex process that extends into a range of areas and one which the ORE Catapult and 2H qualification framework discusses in more detail.7 One key aspect to minimise any requalification test will be to ensure that, when applied to a different situation, the power cable design stays within the loading limits previously established for a qualified product.

One way to achieve this is through developing the configuration of the floating wind system to ensure the power cable remains within the same load limits. This could mean through the design of the floating substructure, mooring configuration, or the power cable configuration itself. This is done performing fully coupled structural analysis, including the wind turbine, floating substructure, power cable, and mooring lines to the simulation, so that the global response of the system is captured. This reduces conservatism associated with looking at components individually, but also ensures that the trade-offs between components are understood. For example, the design of the mooring system may need to be made stiffer to reduce the loading on the power cable

to stay within qualifications, but there may be a cost optimisation that says the configuration of the power cable must be improved instead.

As previously discussed, a key tool is to adjust the configuration of the power cable. The shape of the lazy wave can be optimised by a range of parameters, such as top angle; buoyancy module quantity, distribution, and elevation; and use of tethers at touchdown point, as given in Figure 3. The design of power cables in shallow water depths is significantly more challenging since there is a trade-off between the parameters. For example, if the number of buoyancy modules is increased, the hog bend might touch the surface, affecting vessel access. Reduced buoyancy on the other hand may cause excessive compression at the TDP.

However, as discussed, in a typical wind farm there may be different sizes of cables based on distance of each wind turbine from the substation, and cables can be installed in a range of water depths and soil profiles. Therefore, the cross-section of each power cable and their global configuration is likely to differ across a floating wind farm. For the best performance of the cable, each scenario has to be optimised individually and collectively. Experience and engineering judgement are crucial to reduce the number of configurations and maximise standardisation across a wind farm to reduce overall costs and stay within the previously qualified limits.

Floating wind is growing worldwide to deliver clean energy and make a key contribution to the energy transition with a huge increase in capacity expected in the coming years. Inter-array dynamic HV power cables are a key part of the system to carry the power from the turbines to the offshore substation, but also an area with high risk due to new technologies. A robust and reliable design of these power cables will be essential to minimise cost and guarantee the integrity of the wind farms. Qualification testing will be needed to ensure the right level of reliability to minimise undesirable downtime or repair costs. However, equally, the qualification testing must be done in a way that supports the objective to reduce costs by ensuring power cables are developed and qualified for a wide range of applicability, but also that new wind farm developments look to ensure their cable configurations stay within these qualified limits.

There are similarities between oil and gas and renewables but also new challenges to overcome, such as the complex design of the power cable cross-sections and the impact that temperature makes on the cable’s physical characteristics. But with the right approach, as outlined in the latest qualification framework from ORE Catapult and 2H, 6 programmes can be optimised through combining the design, analysis, and qualification processes and standardising the range of tests.

1. ‘Floating Wind Progress Update: H2 2022’, 4C Offshore, (November 2022).

2. ‘Lloyd Warwick International Offshore Wind Loss Adjusters Perspective’, ORE Catapult, (28 April 2021).

3. ‘2015 Deepwater Production Riser Systems & Components’, Offshore Magazine, (April 2015).

4. ‘Submarine Power cables with extruded insulation and their accessories for rated voltages from 6 kV (Um = 7.2 kV) up to 60 kV (Um = 72.5 kV) – Test methods and requirements’, IEC 63026, (December 2019).

5. ‘Recommendations for additional testing for submarine cables’, CIGRE TB 722, Working Group B1.55, (April 2018).

6. ‘Recommendations for mechanical testing of submarine cables for dynamic applications’, CIGRE, TB 862, (January 2022).

7. ‘FOW CoE: Dynamic Cable Technoloy Qualification Framework and Case Studies’, ORE Catapult in partnership with 2H Offshore, (29 September 2022).

8. ‘D3.1 Review of the state of the art of dynamic cable system design’, Corewind, (February 2020).

9. ‘WindFloat Atlantic Project - A step change towards commercial Floating Wind’, Ocean Winds, (6 April 2021).

Figure 3 Lazy wave HV power cable optimisation in deepwater depths.Christian Hürlimann, MET Group, Switzerland, identifies the technological advancements in the solar industry which companies need to embrace in order to optimise their photovoltaic portfolio.

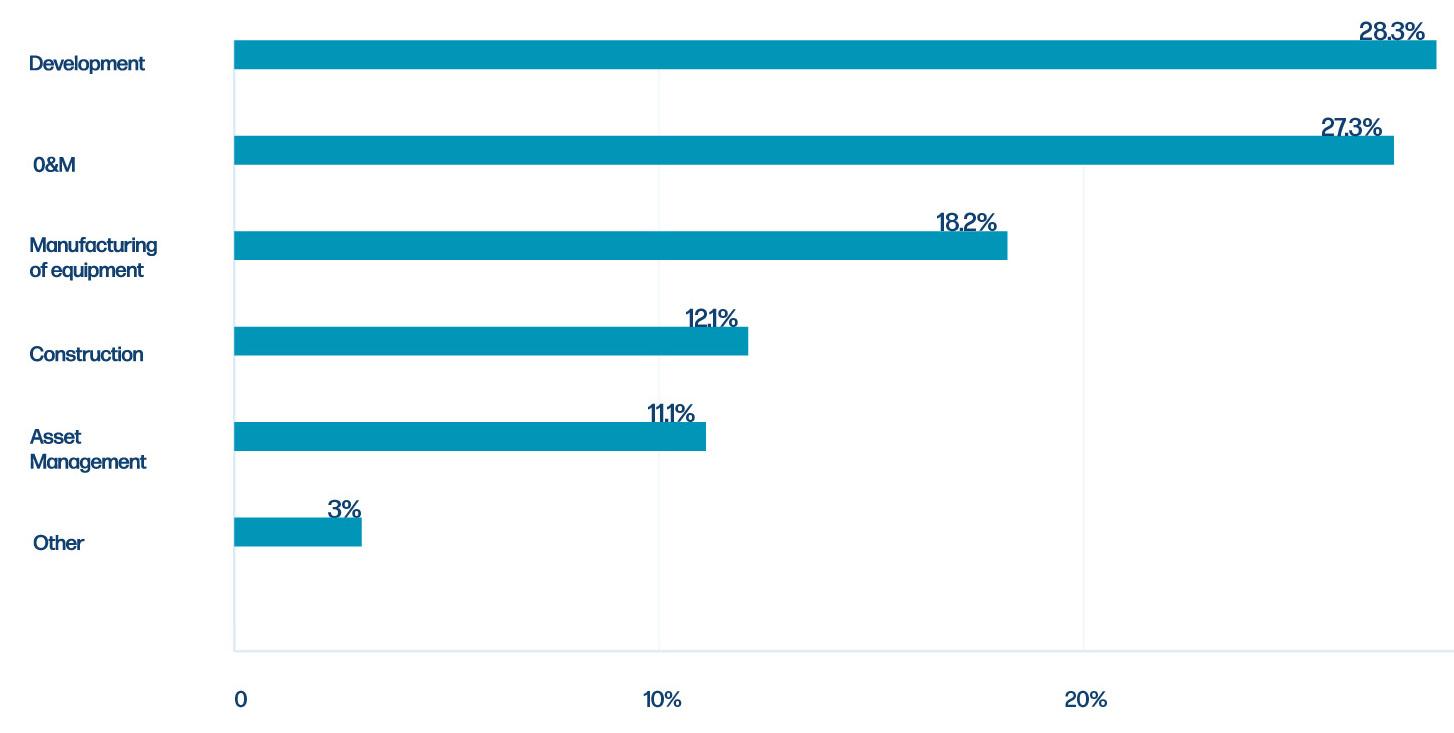

The relentless advance of technology presents countless opportunities for businesses to optimise efficiency and operations. At the same time, ongoing technological developments force companies to try and identify future scenarios and possibilities to make their business as future-proof as possible. MET Group pursues a strategy of incorporating the latest commercially-viable technological solutions in the development and operation of its renewables portfolio.

Long gone are the days when artificial intelligence (AI) and machine learning were a favourite of sci-fi scriptwriters in Hollywood. The business community is relying increasingly on AI-driven solutions not only to get a tech edge, but also to stay in the game. The energy industry and renewables are no exception to the rule. The sector is embracing digitalisation and technological developments to spur the energy transition.

MET Group, an integrated energy company headquartered in Switzerland, seeks to establish a pure-play renewables portfolio in Europe diversified along all key dimensions: technology, geography, revenue model, size, and lifecycle stage. With a strategic aim of reaching a capacity of 2 GW in renewable capacity by 2026, MET leverages the latest

technological solutions along the entire value chain of renewables projects (development, construction, operation and maintenance, and asset management) with a special focus on photovoltaics (PV). At its core, successfully developing and operating a power plant hinges on presenting a viable business case to investors while reaching the lowest levelized cost of energy (LCOE). The goal is to attain the lowest generation cost for injecting power into the grid, utilising the available technology in the market.

The renewable sector abounds in digitised solutions and products designed to aid companies in developing PV projects. From cloud-based software that finds suitable surfaces for solar parks by analysing a range of factors, such as the distance to the grid or substations, topography, soil depth, and solar radiation, to ultra-efficient solar cells, solar panel integration in roof tiles, facade elements, and transparent glass windows, or solar panels that collect energy at night through thermoelectric generation, the advance in solar energy development seems unstoppable. High-powered panels and new plant designs are contributing to drastically increasing capacity at PV projects as the evolution of solar modules leads to higher outputs.

To keep pace with the drive within the renewables sector of boosting project yields wherever possible based

on topographical and cost-efficiency considerations, the company has opted to install single-axis solar trackers that follow the sun’s position by adjusting the position of the panels on the axis. In addition, bifacial solar modules are applied to benefit from the reflected surface solar radiation, known also as albedo effect, using the solar panel’s backside, and increasing the yield even more.

Thanks to technological development, agriculture and solar projects are no longer mutually exclusive. Scientific research published by Germany’s Fraunhofer Institute for Solar Energy Systems proves that combining solar generation with agricultural activity is now not only viable at lower costs, but it significantly raises land use efficiency and may be particularly suitable for arid regions. While higher sunlight radiation leads to an increase in solar power production, solar irradiation under the PV panels can be significantly lower, thus certain cultivation can benefit from greater yields due to reduced dryness and reduced solar irradiation in case of shade-loving cultures and contributing to an uptick in land use efficiency.

Combining agriculture and solar energy production is the natural next step for the industry. In addition to allowing and aiding agriculture production, this technology can also protect the water supply and guard arable areas from wind erosion with solar fences. Several countries have recognised the added benefits of agrivoltaics and some national regulators have even made the model compulsory. By making the land dual-purpose, developers can also secure land for such projects more easily, removing considerable barriers to their expansion. In addition, these installations can be decommissioned after their lifetime expires without leaving any environmental impact. Having recognised the environmental and business benefits of the agro PV model, MET has partnered with agrivoltaic experts in project development and technology providers to evaluate and integrate agrivoltaic characteristics into future PV project developments.

The development phase of a PV project requires businesses to thoroughly map the landscape and identify commercially available technologies to put forward a compelling business case. Short of looking into their crystal ball, those in the PV business need to gauge the possible direction and outcome of technological developments and align their projects accordingly. Even though certain technologies may not yet be commercially viable at the time a project is in the development phase, they also need to be considered, as they may become mainstream by the time the project becomes operational. Once a project is developed and authorised, it reaches a point of no return and large scale modifications become nearly impossible to implement. The course is set for the next 25 years.

The second phase of the value chain, namely construction, also comes with its own set of considerations and requires

identifying the latest technological developments. Advancements in robotics allow novel solutions to become widespread in the construction of solar installations. Developments, such as AI-based robots developed by specialised companies, can meaningfully accelerate solar installations as a complement to existing construction programmes. Robots can now perform the ‘heavy lifting’, including the placing and attachment of solar panels, leading to more rapid, precise, and cheaper installation, as well as the ability to install larger panels, along with increased worker safety. Robots can complement members of the current solar workforce, easing the strain of labour shortages worldwide as the number of solar projects predicted to come online is set to rise steeply. Other innovations to enhance solar system construction, operations, and maintenance are also in the pipeline. Prefabricated modular systems are being developed that can be shipped to sites ready for rapid deployment with very minimal labour requirements.

Even when a PV project reaches the operational phase, there are multiple options to optimise the plant for higher efficiency. Operators can rely on digital solutions to manage operation and maintenance, and power dispatching into the grid in an increasingly cost-effective manner. Supported by machine learning and AI, these solutions make faster and more reliable decisions to help operate such assets. Ranging from maintenance scheduling to making sure that the modules are aligned or precisely predicting the expected amount of energy that can be injected into the grid, as well as intelligent diagnostics of performance degradation in solar plants, the possibilities are almost endless for optimisation. There are considerable advances in developing drone solutions for solar panel cleaning, anti-soiling solutions, and coating for solar modules which can considerably improve power yield.

MET is currently working on a software solution for energy aggregators, which will allow the commercial and operational optimisation of the group’s asset portfolio. The goal is to tackle the challenge posed by intermittent power generation via data-driven, digital tools.

Given that PV projects are highly standardised, AI-driven solutions can help operators benchmark the different projects within the portfolio with respect to operational efficiency and optimise the entire fleet of power plants. MET experts and consortium partners are working on training an algorithm to learn what the company considers to be a healthy operational state of a given power plant, and the next phase is to have the algorithm learn by itself to identify what the healthy status is and compare it to actual operations.

As technological advancement constantly reshapes the renewables industry, MET seeks to constantly optimise and even refurbish existing projects to bolster efficiency or potentially replace existing project components with more efficient ones by applying the latest technology with the aim of reaching and maintaining the lowest LCOE. Long-term cost predictability is the key to a higher level of stability and an unbeatable value proposition for commercial partners. As regulatory support becomes less substantial for renewable projects, monitoring and optimising the efficiency of assets throughout their lifetime has become indispensable.

With a growing portfolio of high performance products, Seal For Life offers innovative corrosion prevention and thermal insulation technologies for infrastructure protection.

A track record of more than 60 years, always pushing the boundaries to develop new solutions for the challenges of tomorrow.

sealforlife.com

ar too often, renewable energy asset managers, operators, and field technicians find themselves working at cross-purposes. Why? Many times, it is because asset performance management (APM) platforms are not fully integrated with the on-site plant data (SCADA, DAS, power plant controller [PPC]) acquisition systems. And this lack of integration leads to everything from miscommunication to lost production.

To scale successfully — and to take advantage of new revenue opportunities, such as ancillary services — the renewable energy industry must prioritse standardisation and the full integration of real-time monitoring and control systems with sophisticated, purpose-built APM platforms.

Consider this common scenario: An asset manager is logged into the organisation’s APM platform. The platform, which consolidates data from plants spread over a wide geographic region into one place, alerts the asset manager that inverter 5 at Plant B is out of communication. A local field technician is tasked with checking it out.

However, when the technician arrives at Plant B, there does not appear to be a problem with inverter 5. Instead, it is inverter 7 that is out of communication. But, because of a difference between naming conventions used for inverters in the SCADA system vs in the APM, the technician initially was directed to the wrong inverter, wasting precious time and money.

This is an overly simplified example, but it shows how a lack of alignment between remote and on-site systems can make asset management and operations and maintenance (O&M) much harder than they have to be. Not only that, but it also often causes costly oversights and delays.

But there is a better way. This article looks at:

> Why fully integrating SCADA and PPC systems with an APM platform is crucial to the efficient management of renewable energy assets.

> How technology has evolved in recent years to make this not just a possibility, but a necessity.

> The steps renewable energy owners, operators, and asset managers can take to work toward better integration now.

When owning, operating, or managing renewable energy plants, the chances are that one set of systems are relied upon to monitor and control local aspects of a project – e.g., SCADA and PPC systems – and a different set of centralised tools for technical and commercial asset management.

While these local and centralised systems may be linked, they are often not fully integrated. This can result in a mismatch between the day-to-day operational

Power Factors, Greece, discusses how a fully integrated asset management platform helps boost project returns.

management of projects that is carried out by technicians at the local level, and longer-term asset management work that is managed at a central level.

To enable teams to work together more effectively, the local and central systems must be integrated, offering a single source of truth when it comes to information about how assets are performing — and what can be done to ensure optimal performance in the future.

But what does a fully integrated local and centralised system look like?

A fully integrated asset management solution is more than simply pulling data from local SCADA systems into one place. Why? Because information such as fault codes and asset hierarchies often differs from plant to plant. On top of that, SCADA and OEM data likely does not align with the data frameworks and asset hierarchies in the central system.

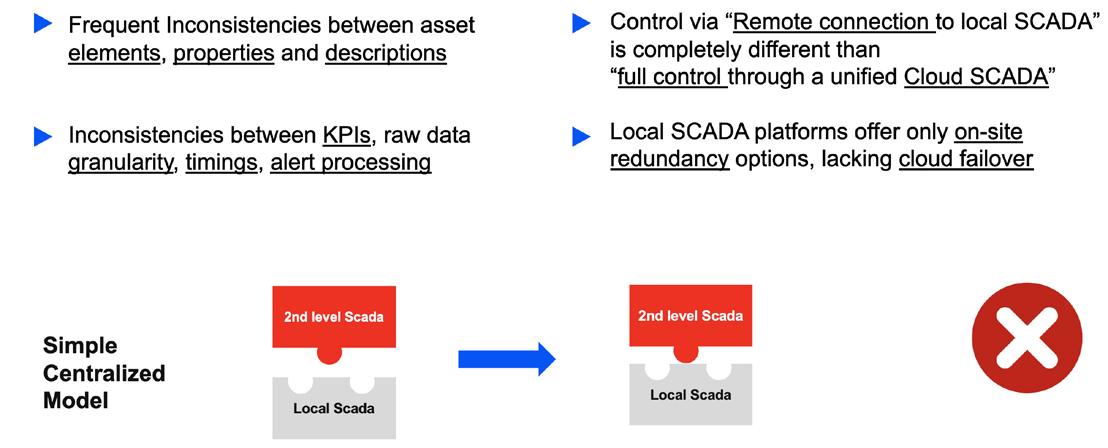

There are four main drawbacks to just centrally replicating information from local systems into the central system:

1. Inconsistencies between asset elements, properties, and descriptions: As discussed, differences in how sites or assets are organised (from naming conventions to asset hierarchies) in the local systems vs the central system can cause confusion. Simply pulling data from local systems into the central system does not address that challenge.

2. Inconsistencies between key performance indicators (KPIs), data granularity, raw data, and alerts: Inconsistencies in how the physical assets are organised gives rise to inconsistencies in how KPIs, data, and alerts are managed between the systems. Companies will face problems if data is not consistent and clean.

3. Control via remote connection to local SCADA is completely different from full control through a unified cloud SCADA:

Operators need to ensure the local SCADA data is fully integrated, rather than only accessed sporadically by a remote connection. Full integration is needed in a large, diverse portfolio.

4 Local SCADA platforms offer only on-site redundancy operations but lack cloud failover: If the local SCADA systems are not integrated with a central system, it limits what operators can do to restart an asset in the case of failure. It means they have to interact with local contractors rather than acting themselves — and with this comes all the issues and potential costs of unplanned downtime.

A fully integrated system is a system where the same software is running locally on site and centrally in the cloud, so that people at all levels can refer to the same information on the same platform. The tight configuration between hardware and software in this system means that it can be configured for maximum security and redundancy options. This enables operators to work smoothly to protect their assets and restore them later.

A fully integrated system also enables remote control of assets, should an operator need, for example, to act quickly to put trackers into the stow position due to an incoming hailstorm. If operators can control their assets from local and central control rooms, it gives them greater flexibility to act efficiently and effectively in all situations.

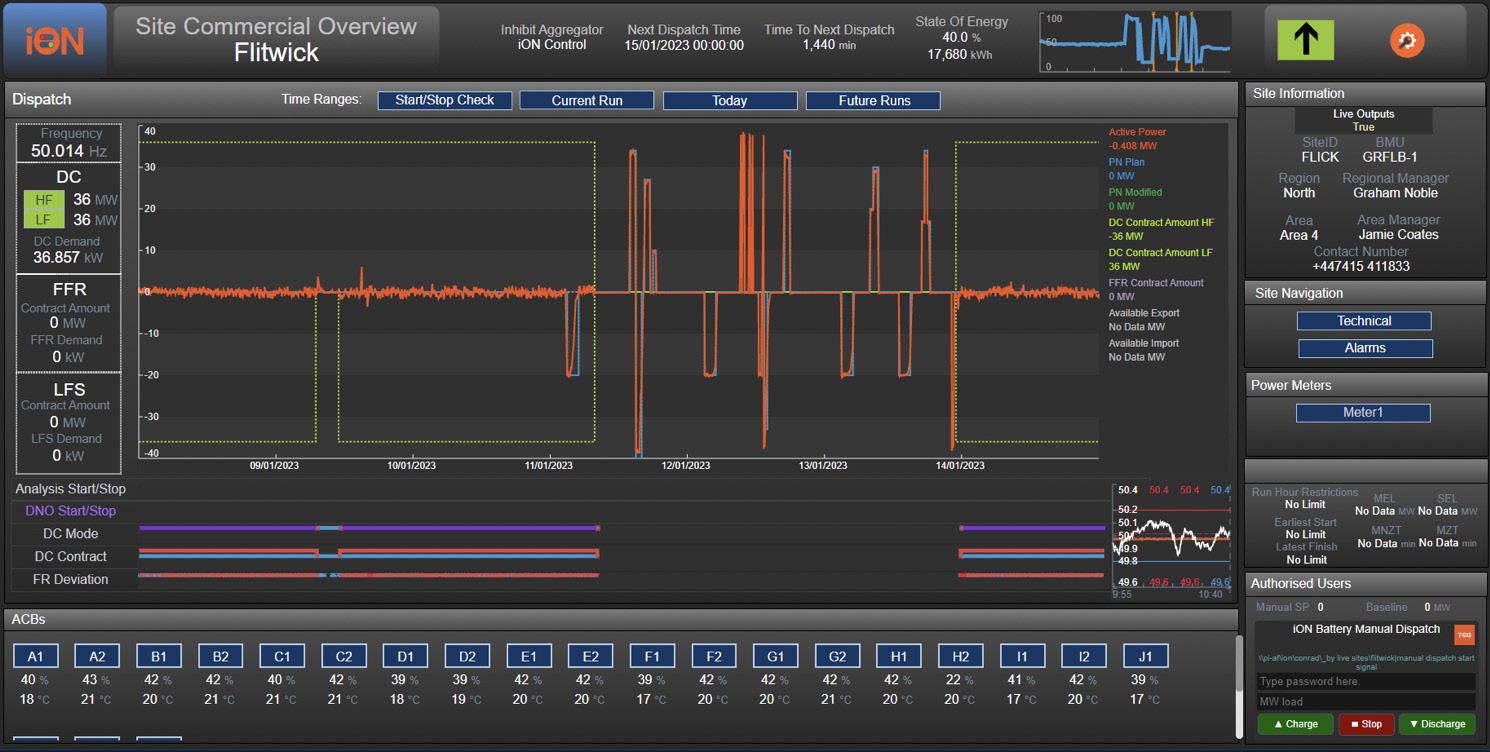

Finally, an integrated system can involve closer links between the operational side of an asset and signals coming from the power market. The emergence of batteries in the renewable energy sector has opened up the potential for asset operators to profit by providing ancillary services to grid operators and/or participating in the balancing market. However, they can only take full advantage of this if they can see what is happening in the market in real time and respond quickly to tell their assets where to dispatch the electricity.

A fully integrated system delivers five main benefits for asset owners:

1. Solving inefficiencies: Unified software helps solve inefficiencies between asset managers and O&M contractors. This is particularly true where performance KPIs are involved.

2. Bi-directional, super-fast control and monitoring: A fully integrated system means that companies are not simply able to retrieve information from their local SCADA systems, but can address issues and control assets centrally.

3. Structured connections and processes to aid compliance: An integrated system can boost security and help an owner demonstrate compliance much more easily than if they are dealing with a host of local data systems.

4. Sub-second data granularity: This is now a viable option for on-site and central data, which is important given the growth of real-time data needed to help operators provide ancillary services from their assets.

5. Flexible fast vs low-cost storage options for real-time vs archival data: An integrated system can help companies to standardise the accessibility and storage of their performance data – which is important for operators required to keep high-frequency data for a few years to provide

Figure 1 . Centralising third-party SCADAs only do part of the job.documentation if there is a conflict with a battery vendor. Such data can also help with troubleshooting.

Companies — from asset owners and managers to O&M companies to market operators — need a centralised platform that provides relevant insights and information to their teams. It should be provided both remotely in the cloud and fully integrated into local systems, providing a single source of truth for both the plant-level and portfolio views.

For O&M companies, a central monitoring and asset management platform helps streamline and improve communication with asset managers and owners. And it supports their work of analysing the causes of problems and fixing them — using site data to solve problems in real time.

For asset managers, the focus is on analytics and reporting. An integrated platform must provide high-quality data, energy monitoring, and analysis of physical assets compared to performance KPIs. This builds on the predictive maintenance focus of historic asset monitoring systems to introduce smarter forecasts and real-time data.

And for market operators, a fully integrated system helps provide information that allows them to operate in the power market. Capabilities such as real-time forecasting, reporting, and insights that support the physical optimisation of their assets are crucial.

Power Factors is providing SCADA and PPC for the 150 MWdc Aurora project in Minnesota, the US. The project belongs to a renowned global utility and consists of 16 solar plants with single axis trackers, expected to be delivering over 210 million kWh/y to Xcel Energy.

Following the owner’s requirements, each solar plant has its own control room, hosting a local plant server. In addition to the automated control functionality provided through the PPC, full inverter and tracker control is granted locally or remotely to the operators through the integrated plant schematics HMI.

The benefits of a centralised and integrated system have been discussed, but why is it the right time for asset owners to put one in place? To put it simply, it makes good business sense and it is now technically viable. There are seven main reasons to do this now:

1. The world has moved on: Asset monitoring and control technology are now powerful enough that cloud-based SCADA systems are no longer regarded as second-class citizens compared to their local cousins. Systems exist that can operate central monitoring in tandem with local controllers, so it makes sense for asset owners to take advantage of these to operate growing portfolios.

2. Standardisation is mandatory: Owners and operators are more focused on the standardisation of their data systems because

they want to unify the way that they manage hybrid portfolios in different nations and markets. Standardisation of systems and harmonisation of data is seen as mandatory.

3. Pressure from the secondary market: More reliable data is important when owners are looking to sell assets on the secondary market. Investors are very educated and have a long list of demands related to projects they invest in. As a result, owners need access to the relevant data to fulfil those requests — and do not want their lives made more difficult with unwieldy data platforms.

4. More stakeholders to keep happy: A wide range of stakeholders are asking for access to data, both inside and outside the owner’s team. These include asset managers, O&M specialists, owners, analysts, investors, and vendors. These stakeholders need access to information based on the same data set.

5. Growth of merchant solar: Owners are increasingly interested in selling the power from their renewable energy plants on the open market, rather than longer-term and more passive structures such as feed-in tariffs. This means there is increased pressure to analyse assets and power markets quickly so owners can benefit from new opportunities and respond quickly to address issues at their plants. The need to be flexible day in and day out requires up-to-date systems.

6. Opportunities for grid balancing: This increased flexibility is also needed in the energy storage market, where owners of storage assets such as batteries need to dispatch power almost instantly. As more owners add storage to their portfolios, they need the right software if they are to provide the ancillary services needed in the grid balancing markets. It is essential if companies are going to successfully stack asset income streams.

7. Hybrid plants are becoming more common: As well as standalone assets, more owners are embracing the opportunity to attach storage capacity to their generation assets. Centralised and integrated solutions help to manage them.

Taking steps towards an integrated monitoring and control systems is crucial for renewable energy stakeholders looking to stay competitive – and it starts with putting in place a software architecture that supports the entire portfolio and project pipeline, both now and in the future.

he world’s energy mix is still heavily dependent on fossil fuels, which account for 81% of global energy consumption. Energy production and consumption are responsible for two-thirds of greenhouse gas emissions. Transitioning to a clean, sustainable, and affordable energy system is essential for combating climate change and ensuring global security.