Founded in 1949, the Francis Ouimet Scholarship Fund awards significant need-based college scholarships each year to deserving students who have worked at Massachusetts golf courses. For 75 years, thousands of young men and women have had their lives changed by working in golf and earning the Ouimet Scholarship.

Dedicated individuals in the golf community have had a hand in carrying Francis Ouimet’s legacy forward by investing in today’s youth and are proud to support them on their path to college graduation. These supporters have done so knowing this competitive Scholarship is an honor reserved for hard-working, high-performing students with financial need.

We are proud of the positive impact we’ve had on so many lives. Currently, we’re meeting 60% of Scholar families’ financial need. However, with the ongoing rise in college tuition and housing expenses, we’ve seen a 30% increase in new scholarship applicants. In light of this, we’ve established a new objective. Our goal is to boost our support for the new Scholars in the 2024/2025 academic year, striving to cover 75% of their financial need by the time they graduate. The Ouimet Fund community has accomplished so much, and with your support, we can reach new heights.

The Ouimet Fund is currently meeting of

The Ouimet Fund has set a new goal to meet of

With this support level, Lifetime Members are taking the next step with their personal generosity. These gifts will assist in increasing awards for Ouimet Scholars across the state. Being part of this special group means donors are not only supporting The Fund during the initial pledge period, but they will continue to make an impact as a donor throughout their lifetime.

Single Membership Couples Membership

$12,000 $15,000

• Pledge can be paid over one to four years.

• Lifetime Members make an annual donation of any amount after the membership pledge is completed.

Lifetime Memberships Provide:

• A personally engraved bag tag signifying your support level

• The opportunity to increase your business contacts and forge lifelong friends at Ouimet golf outings

• Exclusive invitations to annual Ouimet events

• Recognition of your commitment in the Ouimet Fund Annual Impact Report, on the website, and in other marketing materials

Sustaining Lifetime Members have grown from the original 22 members to over 350.

Establishing an endowed scholarship in the name of a family member, friend, or organization is a profound way to honor them and celebrate their legacy in a meaningful and lasting manner. Named endowed scholarships are permanently restricted funds invested to ensure the existence of the scholarship in perpetuity.

Endowed Scholarship Program

$50,000 minimum gift

• Endowment can be paid over one to five years.

The Named Endowed Scholarship Program offers a distinctive connection between the donor, honoree, or sponsoring organization and golf, Francis Ouimet, youth, and education. Donors often share with us the sense of fulfillment they experience, knowing they’ve contributed significantly to shaping a young student’s future.

The Ouimet Fund’s Named Endowed Scholarship Program has become the cornerstone for our growth. Since 1991, the number of endowed scholarships invested with The Fund has grown from 5 to 200. This program offers robust security for The Fund, reassuring donors of our steadfast commitment for the long term.

• A permanent scholarship for your family and loved ones which can be tailored to meet your preferences and goals

• Annual communication and connection with the recipient of your scholarship, including meeting your recipient at the yearly Investing in Lifetimes reception

Named Endowed Scholarships fund 40% of the total

• Personalized annual financial reports on your fund’s performance and impact

• A personally engraved bag tag signifying your support level

• Exclusive invitations to Ouimet events and golf outings

• Recognition of the scholarship in the Ouimet Fund Annual Endowed Scholarship Brochure, Annual Impact Report, on the website, and in other marketing materials

Members of the Eddie Lowery Planned Giving Program will make a great impact through commitments offering immediate or delayed benefits to themselves and the Ouimet Fund.

In addition to the impactful benefits to Ouimet Scholars, planned giving strategies listed here provide donors with tax benefits and income generating transactions.

Many of these options are simple and flexible, and we can help. While we offer the opportunity to become more publicly engaged with our Scholars and friends, we can also work with you to ensure your preferred level of privacy.

Your gift will support the Francis Ouimet Scholarship Fund and your personal philanthropic goals. Speaking with your attorney and financial advisor helps ensure that your gift is best for you and your family.

• Will or Trust Provisions: When you make or update your will or trust, you may gift a specific amount or leave a percentage of your estate. We would be happy to provide suggested bequest language as you work with your attorney.

• Gifts of Appreciated Securities: Stocks, bonds, and mutual funds that have increased in value and have been held for more than one year are one of the most popular assets our donors use when making a gift to the Ouimet Fund.

• IRA Required Minimum Distributions: If you are 70½ years of age or older, you can give directly to the Ouimet Fund from a traditional IRA completely free of federal income tax (up to $100,000 per person per year).

• Other Retirement Plan Assets: By making the Ouimet Fund the beneficiary of your IRA or 401(k), you may reduce or eliminate federal estate and income taxes related to your retirement account at your passing, all without a requirement to change your will.

• Insurance Policies: You may have purchased a policy that is no longer needed for its original purpose, such as for the payment of estate taxes that may no longer be due, to protect children who are now grown, or to fund now-completed educational plans. The Ouimet Fund may benefit from these policies if adjusted.

• Charitable Remainder Trusts: A charitable remainder trust provides an immediate income tax deduction. It also provides you or other named individuals income each year from assets you give to the trust. The remainder is distributed to the Ouimet Fund at the end of the income period.

• Charitable Lead Trusts: Works in reverse fashion from CRT above, where the Ouimet Fund receives a fixed amount of income from the trust, and at the end of the income period the remainder is distributed to your estate or individuals named.

We invite you to establish a closer connection with the Ouimet Fund and the Scholars who receive this need-based financial assistance.

Please reach out to us to discuss any of the enclosed programs.

Colin McGuire, Executive Director

774-430-9097, colinm@ouimet.org

Kellie Costa, Director, Development & Donor Relations

774-430-9094, kelliec@ouimet.org

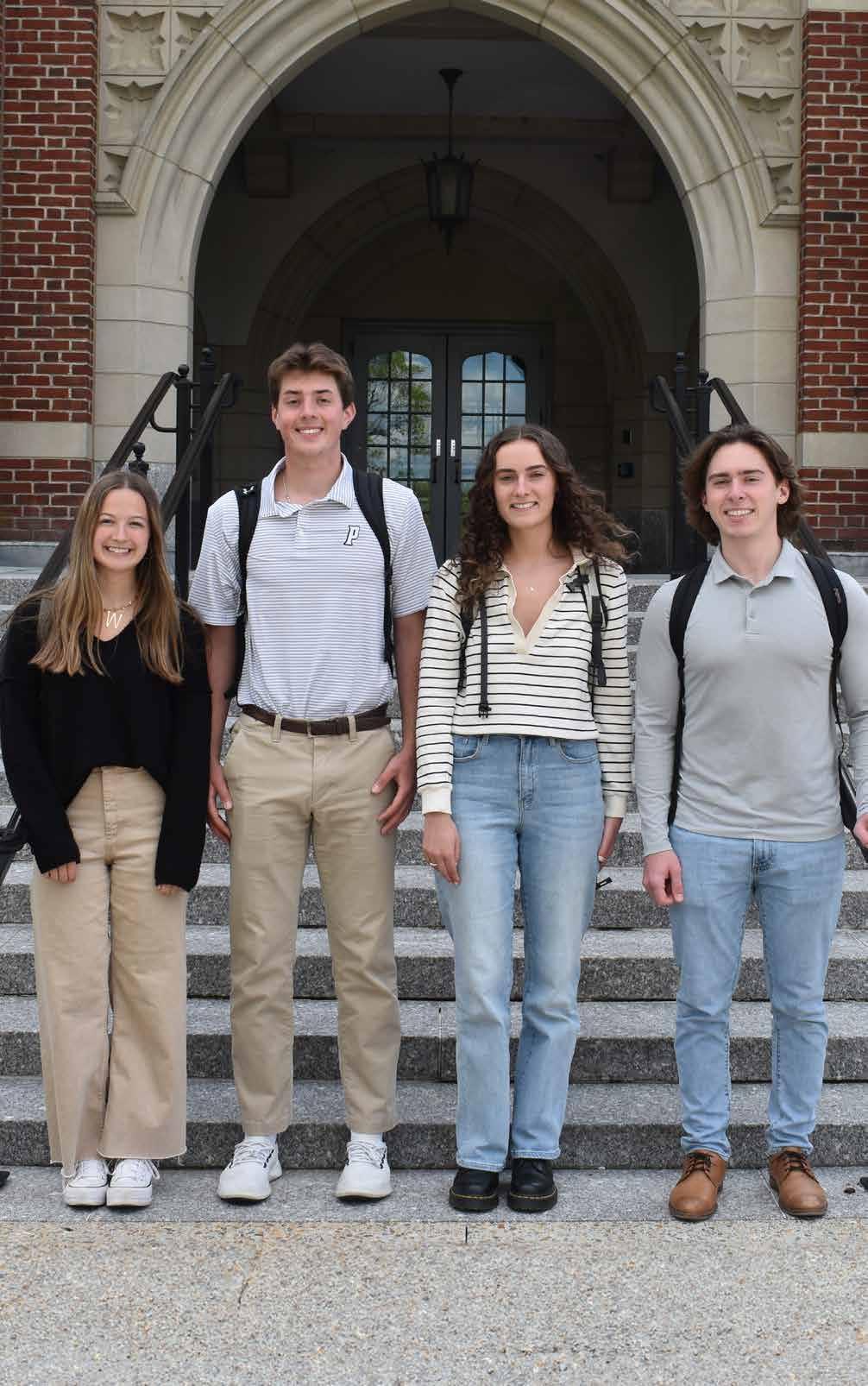

Jayna Byrne

Bear Hill Golf Club

Emmanuel College ‘26

“The Ouimet Scholarship has positively impacted my life in many ways, combining financial support with networking and career opportunities. The financial impact of the Ouimet Scholarship has been transformative, enabling me to pursue higher education by not only relieving some financial burden but also allowing me to fully engage in academic and extracurricular activities that enrich my overall college experience.”

Pericles Flagg

Worcester Country Club

Worcester Polytechnic Institute ‘28

“I feel incredibly grateful and appreciative to receive a Ouimet Scholarship. This support has enabled me to concentrate on my studies, maintaining a 4.0 grade point average. The Ouimet Fund’s investment in my education motivates me to work hard to achieve my goals and future success. I will always remember the kindness of donors of the Ouimet Fund and share it by giving back to others in the future.”