95

Canada Canada’s economy has largely recovered from the COVID-19 crisis. Domestic demand is picking up following the easing of containment measures. Exports are expected to strengthen, demand for commodities buoying trade amid shocks to world growth. Limited trade ties to economies hard-hit by the war in Ukraine, and income from high resources prices, shield Canada from larger economic impacts. Real GDP is projected to grow by 3.8% in 2022 and 2.6% in 2023. Unemployment will remain low as output rises slightly above potential. Global supply tensions will keep price growth high this year, compounding underlying inflationary pressures. The Bank of Canada should continue raising its policy rate and shrinking its balance sheet to return inflation to target and contain financial imbalances. Signs that resurgent demand is straining domestic productive capacity could require faster policy tightening. To avoid fuelling excess demand, federal and provincial governments should channel strong resources revenues to public-debt reduction while targeting temporary income support to households facing living-cost pressures. Greater support for green technologies, including clean electricity, would advance Canada’s climate policy goals and free up energy for export. Price pressures have increased in a strong economy The Omicron wave only briefly slowed growth in economic activity. Real GDP grew by 0.8% (non-annualised) in the first quarter of 2022. Large output gains in contact-intensive services followed the relaxation of containment measures from late January. Solid growth in recent months also reflects contributions from resources sectors, construction and manufacturing. Higher energy prices are boosting merchandise export values, which are also benefiting from increased demand for metals and fertilisers. Slowing home sales and price growth suggest housing-market activity is cooling in the wake of interest rate rises. Housing-related spending continues, however, to buoy core retail sales. Recent data

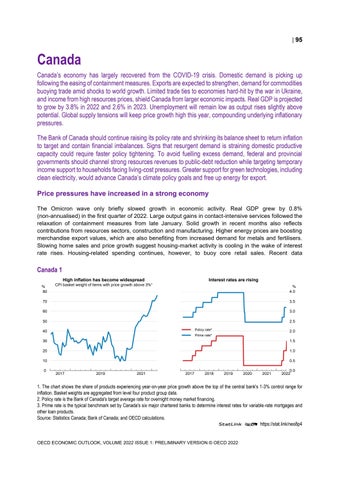

Canada 1 High inflation has become widespread % 80

Interest rates are rising

CPI basket weight of items with price growth above 3%¹

% 4.0

70

3.5

60

3.0

50

2.5 Policy rate²

40

2.0

Prime rate³

30

1.5

20

1.0

10

0.5

0

2017

2019

2021

0

0

2017

2018

2019

2020

2021

0.0 2022

1. The chart shows the share of products experiencing year-on-year price growth above the top of the central bank's 1-3% control range for inflation. Basket weights are aggregated from level four product group data. 2. Policy rate is the Bank of Canada's target average rate for overnight money market financing. 3. Prime rate is the typical benchmark set by Canada's six major chartered banks to determine interest rates for variable-rate mortgages and other loan products. Source: Statistics Canada; Bank of Canada; and OECD calculations. StatLink 2 https://stat.link/neo8p4

OECD ECONOMIC OUTLOOK, VOLUME 2022 ISSUE 1: PRELIMINARY VERSION © OECD 2022