Rising Star: Shannon McInnis

Partner Spotlight: Brian Mahoney, Salem Five Mortgage

Rising Star: Shannon McInnis

Partner Spotlight: Brian Mahoney, Salem Five Mortgage

FLIPPING LOSSES INTO LEGACY

Working with Dave has taken all of the guess work out of determining insurance coverage and needs for our family—we had previously enrolled in a corporate option, thinking that our best interests were protected; however, Dave’s analysis and insights not only saved us on premiums, but offered us more coverage. He holds the insurance for our home and our vehicles, continually updating us on policies and rates …without hesitation, I would recommend Dave for his knowledge, response rate and genuine customer service.

- Maureen Marblehead, MA

We have worked with Dave Bruett for only a few years and can confidently say we would never change. Dave's professionalism and responsiveness sets him apart from the other agents we have worked with. His expertise and thorough guidance provides us the confidence that we are making the right decisions for all our insurance needs. He is our 'go to!'

- Nora Marblehead, MA

Dave is so customer focused he makes things easy when it comes to insurance. Whether it is setting up a new policy, answering my questions promptly, helping get a claim filed or any other insurance related issue he is always right on top of it. I do all my personal insurance with him and when I started my own business a few years ago he set all that insurance up for me as well. Dave is the best!

- Sam Salem, MA

David Bruett President

ALL OF YOUR INSURANCE NEEDS MET WITH ONE AGENT

Put David's 19 years of experience to work and protect yourself, your clients, and your business!

This section has been created to give you easier access when searching for a trusted real estate affiliate. Take a minute to familiarize yourself with the businesses sponsoring your magazine. These local businesses are proud to partner with you and make this magazine possible. Please support these businesses and thank them for supporting the REALTOR® community.

ATTORNEY

Capano & McGloin, LLP

Lisa J. McGloin (781) 599-1010 CapanoMcGloin.com

Dalton & Finegold, LLP

Christina Petrucci (978) 783-3038 dfllp.com

Gilmore & Gilmore, Attorneys at Law

Rick Gilmore (978) 777-3480 GilmoreGilmore.com

BANKING & MORTGAGE SERVICES

Salem Five Mortgage

Brian Mahoney (978) 720-5322 www.salemfive.com

HEATING, AC & INDOOR AIR QUALITY

Preferred Air

Tom Favazza (978) 750-8282 PreferredAir.com

HOME INSPECTION

R.J. Home Inspection

Adam Wright (800) 253-4402 rjhomeinspection.com

HOME/MOLD INSPECTION

Pillar To Post

Arthur Staffiere (781) 488-8650 arthurstaffiere.pillartopost.com

INSURANCE SERVICES

David Bruett Insurance Services

David Bruett (978) 594-5308 davebruettinsurance.com

INTERIOR DESIGN/ HOME STAGING

I Got a Guy, LLC (978) 476-2671

Tasteful Interiors

Brodie Curtis (978) 476-2671

JUNK REMOVAL & MOVING SERVICES

Ace Cleanouts, LLC

Joe Manzi (844) 223-7781 acecleanouts.com

MOLD REMEDIATION & INSPECTION

Premier Restoration

Jake Turner (339) 235-4278

MORTGAGE / BANKING

Leader Bank

Sherry Burke (617) 293-5098 LeaderBank.com

MORTGAGE LENDER

Edge Home Finance Corp

Karina Garcia (617) 334-2390

Guaranteed Rate - Liz Ryan

Liz Ryan (978) 237-4431 ccm.com/liz-ryan

MOVING / STORAGE

Barnaby’s Moving & Storage

Robert Barnaby (603) 425-4579

Isaac’s Moving & Storage

Jon Dalzell (781) 436-4727 isaacsmoving.com

PHOTOGRAPHY / MULTIMEDIA Lightshed Photography Studio

Dan St. John (978) 854-5348 lightshedphoto.com

TRANSACTION COORDINATOR

Real Estate TC Services

Jessica Martinez (978) 770-2964

Do you know of a great business that would love to connect with Top Real Estate Agents on the North Shore? Contact me!.

Buyers typically take 30 seconds when making a decision on how they feel about your property.

make sure EVERY SECOND

Tasteful Interiors is a full service home design company specializing in Home Staging and Interior Design Planning. With a collective experience of 20 years in the industry, we take pride in our diligence, quality of services & creative outlook on the market as a whole. Located in Andover, MA our team has serviced hundreds of vacant and occupied properties in the Greater Boston, North Shore, South Shore & Metro West regions.

Our team caters to the needs and expectations of home owners & their respective real estate experts. By working hand-in-hand with clients through this process, we aim to accentuate the most crucial & unique aspects of every listing. Providing experience, perspective & professionalism in order to exceed any goals set forth for the project; As we dedicate ourselves to your success in the market to maximize every home’s selling potential.

"When getting ready to list a home for sale, It's vital to complete the necessary prep work to make a favorable and lasting first impression”

NAR President Kenny Parcell (National Association of Realtors)

Source: https://www.nar.realtor/research-and-statistics/research-reports/pro le-of-home-staging

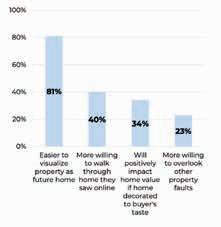

• 89% of Buyers’ Agents cited that Home Staging has an e ect on buyers’ view of homes.

• 81% of Buyers’ Agents claim that staging a home made it easier for buyers to visual a property as their future home.

• According to buyers, Living Rooms (39%), Primary Bedroom (36%), and Kitchens (30%) are the main selling points when referencing how Home Staging played a role in their decision making.

• Nearly half of Seller’s Agents (48%) report that staging a home decreased its time on market.

• On Average, every $400 spent on staging results in atleast $1,000 ROI.

First, Happy Father’s Day to all my fellow dads out there!

My oldest daughter graduated from high school last month and while exciting for her, it felt like someone kicked me in the chest. Yes, this is just one of many milestones our kids hit on their way to adulthood and some form of freedom, but this one hit me hard.

I woke up, looked around and realized that my daughter’s childhood days are literally over. I keep asking myself where the past almost 19 years of my life went. When she was born, a good friend said, the days are long but the years go by fast, so enjoy it while it’s happening.

No truer words have been spoken. My daughter’s childhood literally went by in a flash...and I have thousands of pictures and videos to prove it. A lot has happened over the course of those 18 plus years. We added a second child just two years after our first, bought a new house (now currently on the market), got through three different schools, attended more basketball and soccer games than you can even imagine, lot’s of travel and on and on. Living life as much as possible.

But then my thoughts go to “what’s next?” My daughter is going away to college and my youngest is moving to Phildelphia with her mother. My hope is that she has a great time at school, gets

whatever degree she chooses to earn, graduates and gets a terrific job or starts whatever career path she desires.

Yes, one era ends yet another begins and it’s somewhat exciting to see how it all unfolds. I’m sure many of you have been down this road prior to me, and there are also many just at the beginning stages of it. Whatever the case, love your kids, support them, and do all you can to help them along the way.

The past is hard to let go of, however, new beginning’s are like a roller coaster ride...up, down, twisting and turning... and the cycle continues. As Joni Mitchell sang in her song The Circle Game...

And the seasons go round and round, and the painted ponies go up and down. We’re captive on the carousel of time. We can’t return, we can only look behind.

Thanks for reading and Happy Selling!

Talman Hauch Publisher North Shore Real Producers talman.hauch@n2co.com

BY PATRICK MAGUIRE, CEO, NORTH SHORE REALTORS

Shore REALTORS® Advocacy

Stay up to date on local zoning proposals, legislation, and REALTOR® advocacy efforts by staying in touch with North Shore REALTORS® (NSR). With over 250 blog posts, dozens of Town Monitors, and an active government affairs program, NSR is your go to resource on the key issues affecting homeownership and private property rights here on the North Shore.

Around 100-150 years ago, multifamily construction of 2-3 family buildings would have been quite common. It was a practical solution to house working class employees near their place of employment. Community centers like in Ipswich and Salem saw a large amount of these smaller multi-families in their downtown areas.

It would be unusual to see a 2-3 family building being built today. Some communities, like Haverhill, have an inventory of new duplexes but otherwise you’re more likely to see a single family or 5+ unit multifamily being constructed. Without new construction, conversion of these properties into condominiums leads to a dwindling number of 2-3 families on the North Shore.

In response to this trend, Salem Mayor Pangallo has put forward a Condo Conversion

Ordinance that would affect all multifamily conversions of 2-3 family buildings. There are state regulations for 4+ unit buildings but nothing was in place for 2-3 families. The ordinance is being described by the city as a

tenant protection measure. Salem is a community that is majority renters.

Upon initial review of the submitted ordinance:

• Tenants have at least a 120 day right of first refusal to purchase the unit they occupy or had occupied within 1 year prior to notice

• Tenants receive at least a 2-year period from notice before being required to vacate (this obligation could be transferred to a new owner if the unit is sold during this period)

• If notice of conversion has been given, rental increases are capped

• Tenants receive relocation assistance of at least $6,000 per unit

This will have a dramatic effect on Salem property owners that wish to convert to condominiums. As of the time of writing, the ordinance is before the City Council. NSR will be watching progress closely.

From obtaining charitable grants to hosting fundraising drives to rallying volunteers, North Shore REALTORS® is proud to support housing charities across the North Shore.

For World Down Syndrome Day and in celebration of their wonderful son Jaxson, Michelle and Rob D’Amico, of Century 21 North East and NewFed Mortgage respectively, took to their community for pictures of crazy socks. For each submission, they would donate a dollar to the Massachusetts Down Syndrome Congress (MDSC).

Pictures came in from across the country, from Massachusetts to Florida to California and even outside the US in Aruba. In all, there were 250 photos submitted and with additional

funds raised by the Saugus Sachems Girls Softball Team and American Gas Product, a total donation of $500 was made to MDSC.

Of MDSC, Michelle posted that: “The MDSC is a key factor in helping families in Massachusetts who have someone in their family with Down Syndrome. From planning fun outings and introducing families to each other, to holding learning sessions for the individuals with Down Syndrome, to help them succeed in life. The MDSC has been there for us literally since the day Jaxson was born, and we are grateful for all they have offered us.”

Thank you to Michelle and Rob for all you do for this important cause and thank you Jaxson for being the amazing person you are. Michelle said of Jaxson that “he’s going to change the world’s perception of Down Syndrome”, and we at NSR believe her wholeheartedly.

•

•

BY SHERRY KEENAN BURKE, SALES MANAGER, RESIDENTIAL LENDING, LEADER BANK

Cómo Proteger a sus Clientes de Ofertas Preseleccionadas

¿Sus clientes han solicitado una hipoteca y posteriormente han recibido ofertas de otros prestamistas o incluso de empresas de tarjetas de crédito? Aunque su frustración puede dirigirse inicialmente a su prestamista, en realidad no es éste quien tiene la culpa de las ofertas no solicitadas que reciben durante el proceso hipotecario.

Estas ofertas, también llamadas pistas de activación u ofertas preseleccionadas, pueden resultar especialmente molestas a la hora de comprar una vivienda y muchos compradores quieren saber si hay alguna forma de evitar recibirlas.

¿Qué es una Oferta Preseleccionada o un Trigger Lead (Pistas de Activación)?

Las pistas de activación se atribuyen principalmente a las agencias nacionales de informes de crédito al consumo y se generan cuando se elabora un informe de crédito a su nombre. Esta es la razón por la que muchos posibles compradores de vivienda reciben estas ofertas de crédito no deseadas y solicitudes de otros prestamistas cuando solicitan un préstamo hipotecario: cuando usted solicita un préstamo hipotecario, parte de la diligencia debida que realiza su prestamista consiste en elaborar un informe de crédito y comprobar su puntuación crediticia.

La oficina de crédito puede entonces vender su información a otros prestamistas, lo que a su vez podría dar lugar a que usted reciba ofertas de otros acreedores y prestamistas.

¿Son Legales las Ofertas de Crédito Preseleccionadas?

Las pistas de activación, aunque son frustrantes, son legales. A los ojos de la ley, ofrecen a los futuros compradores de vivienda acceso a un abanico más amplio de opciones a la hora de elegir un prestamista, de modo que pueden estar seguros de obtener un interés competitivo. La buena noticia es que hay formas de evitar este tipo de ofertas preseleccionadas.

¿Están Seguros Mis Datos Si Se Han Utilizado Para Enviarme Una Oferta Preseleccionada?

Los problemas de privacidad de los datos asociados a estas ofertas de los acreedores, aunque no son habituales, son un riesgo. Si su información privada está en una lista que se mantiene y comparte entre las agencias de crédito, tiene el potencial de ser hackeada o robada, como ocurrió en 2017 con la filtración de datos de Equifax, donde los registros privados de cientos de millones de estadounidenses se vieron comprometidos en uno de los mayores delitos cibernéticos de la historia.

La Ley de Informes de Crediticios Justos (Fair Credit Reporting Act) promueve la exactitud, imparcialidad y privacidad de la información de los consumidores en poder de las agencias de informes de los consumidores y protege específicamente a los consumidores de la inclusión negligente de datos erróneos en los informes crediticios.

Cómo Excluirse de las Ofertas Preseleccionadas Hay dos formas sencillas de que su cliente proteja su información y evite que las empresas de crédito la utilicen para enviar ofertas no deseadas:

1. Añada su nombre al Registro Nacional No Llamar. A los 31 días de añadir su nombre a la lista, debería empezar a ver una disminución de las solicitudes no deseadas.

2. Regístrese en OptOutPrescreen, una herramienta de la Industria de Informes de Crédito al Consumidor que permite a los consumidores optar por recibir o no ofertas de compañías de tarjetas de crédito y seguros.

Si sus clientes necesitan ayuda para comprar una vivienda, no dude en ponerse en contacto con el equipo de expertos Agentes de Préstamos de Leader Bank!

“As a home care nurse, I would often sit at a patient’s kitchen table and talk with them at great length about their health goals,” Shannon McInnis recalls.

“I see the amazing parallels to what I do now, speaking to someone at their kitchen table while learning their real estate goals.”

A savvy real estate investor and devoted nurse for nearly two decades, Shannon admits she had no clue what she was signing up for when she decided to obtain her license to list her own properties in June of 2023.

But there’s no halfway in Shannon’s world. In just two years, she has become one of the most recognized new names in North Shore real estate. With nearly $20 million in closed volume in 2024 alone, Shannon not only earned a slate of Rookie of the Year awards but also launched North Shore Living Real Estate Group, a handpicked team of driven agents who share her community-minded, fullthrottle approach to the business at Keller Williams Realty Evolution.

Raised in Peabody and steeped in sports from an early age, Shannon is a proud product of her environment. Her father, Paul, a longtime small business owner, instilled a relentless work ethic in his daughter.

“My dad pushed me a lot growing up playing sports and academically,” Shannon chuckles. “I think that influenced my thinking because I am very growth minded and don’t ever want to become complacent.”

Shannon attended Bishop Fenwick High School, where she was a three-season

athlete on multiple state championship teams. That competitive streak followed her to Northeastern University, where she majored in Biology and cheered for Division 1 co-ed.

After earning her RN from Simmons College, Shannon spent 17 years as a home care nurse and high-risk case manager, while also quietly building an impressive real estate investment portfolio.

“I retired from nursing when my daughter was one, so I could focus on her and my investment properties,” she shares.

But one thing was certain: Shannon was not good at sitting still. She got her real estate license “somewhat by accident,” intending only to represent herself in her transaction.

But when her Keller Williams office asked if she’d be working full or parttime, Shannon paused — and then hit the ground sprinting.

In less than two years, Shannon has built a high-achieving business rooted in hustle and purpose. Her efforts have earned her a string of impressive accolades: KW Evolution Rookie of the Year, KW New England Region Rookie of the Year, North Shore Realtors Association Rising Star, and a top 10% ranking among solo agents in the KW New England Region.

Shannon is quick to give credit where it’s due for her early rise though.

“I had the opportunity to have my former agent, Lauren Consolazio, and Kathy Brogan, who is one of the best in the business, as my mentors,” she acknowledges. “Every day I would go into the office and meet with them and pick their brains on the things I should be doing to better myself and grow my business.”

After a standout year, Shannon founded her own team, North Shore Living Real Estate Group. The team currently includes four agents and a recently hired operations manager.

“I am a lifelong North Shore resident and absolutely love this area,” she elaborates. “So I thought it was a fitting name to show my deep connection to the area while paying it forward in mentoring new agents on my team.”

When it comes to recruiting, Shannon looks for people who are willing to show up, no excuses.

“Potential candidates need to have the desire to work relentlessly towards their own goals as well as the team’s vision,” she notes. “I am willing to coach and mentor if someone is willing to put in the work with time, effort and consistency.”

Shannon says she doesn’t mind the long hours because she enjoys solving problems, building futures, and showing up with empathy to help clients reach their goals. Whether helping seniors transition to their next chapter or guiding buyers through a big leap, Shannon brings her nurse’s compassion and an investor’s practical know-how.

“I take what I have learned over many years about investing, renovating, and design and put it to good use in helping my seller clients prepare their homes to get top dollar,” she says. “I also bring a lot of value to buyer clients in helping them envision the potential a home has.”

Shannon’s toolbox includes a deep network of vendors, while her heart stays rooted in her hometown.

“I’m also growing my social media presence and doing a lot of local business spotlights to shine a light on businesses that make this community a great place to live,” she elaborates.

Outside of work, Shannon’s world revolves around her loved ones — her fiancé Brandon, her four-year-old daughter Audrina (nicknamed “Drina”), and her big, tight-knit crew that includes her parents, and her sister and her family who live close by in Peabody. Her mom and dad, now retired, help by picking Drina up from school every day, a gesture that gives Shannon space to pour into her business, while her brother-in-law is a member of her team.

I am willing to coach and mentor if someone is willing to put in the work with time, effort and consistency.”

Weekends are packed with pool days, cheering on the Celtics, trips to Lincoln, New Hampshire, and a shared love of cribbage — Brandon and Shannon even play in local tournaments at Granite Coast Brewery.

“Growing up, I played cribbage with my grandfather for coins,” she remembers with a smile.

Shannon is also deeply involved in giving back to the community she loves. She chairs two local committees: the North Shore Realtors Community Investment and Involvement Committee and KW Evolution’s Professional Development Committee. She often hosts block parties where guests are encouraged to bring donations for local animal shelters or No Child Goes Hungry in Peabody.

Looking ahead, Shannon has her sights set on expanding her team and getting her broker’s license.

I’m committed to sharpening our systems, expanding our reach, and helping more families love where they live.”

“My mission over the next year is to focus on growing with purpose — building a team that shares my passion for client care, increasing our impact across the North Shore, and continuing to lead with integrity and heart. I’m committed to sharpening our systems, expanding our reach, and helping more families love where they live.

“When I was a young girl in highly competitive sports, my dad used to always tell me, ‘If it were easy, everyone would do it,’” Shannon concludes. “In the moments that I can feel the growing pains, I think of this and remind myself that the work is worth it.”

“I wish all of our customers could sit in one of our meetings so they could hear the way our upper management speaks and treats our employees. Very loyal and hard work is rewarded. We want to be looked at in the highest regard in the community.”

That kind of admiration for a business’s leadership is rare. But as Brian Mahoney, Senior VP and Director of Sales at Salem Five Mortgage Company readily points out, it’s also exactly why Salem Five has stood the test of time while helping build the North Shore communities it serves.

Headquartered in historic Salem, Salem Five Bank just celebrated its 170th anniversary this year. Their mortgage branch, formed as a wholly owned subsidiary nearly four decades ago, is deeply embedded in the fabric of New England real estate, with a solid reputation earned through consistent performance, a standout culture, and high-caliber people that stick around.

Salem Five Mortgage Company is far from your average lender. For starters, they are the largest mutual bank in Massachusetts, a distinction that speaks volumes about how they operate.

“We’re a culture-first organization,” Brian explains. “As a community bank, we make sure our customers and employees come first.” And it’s not just lip service. “Over a third of our loan officers and managers have been here for more than a decade. The very first loan officer ever hired still works here almost 40 years later,” he elaborates.

In a business known for turnover, that kind of longevity is almost unheard of. It also explains how the bank has managed to thrive year in and year out, even in the toughest of markets.

Built Like a Battleship to Last

Five Mortgage Company

“Believe it or not, we’ve been running in the black the last three years, which is not easy in this environment. But we have the kind of loan officers here who know how to get it done, the right way,” Brian notes with pride.

And it’s not just the employees though; Brian notes it’s the way Salem Five views the mortgage business itself.

“Most banks treat their mortgage arm as a necessary evil,” Brian points out. “Not Salem Five! Our bank loves the mortgage business! That’s why we’re the varsity team of mortgage companies.”

Brian admits he didn’t grow up dreaming about mortgages. He attended UMass Lowell and obtained his English degree while getting his entrepreneurial feet wet.

“In my youthful exuberance, I started a chimney sweeping business that I ran while I was still in college,” he recalls with a chuckle. “But after a few years, I felt beaten down by the work — chimney sweeping is profitable for a reason! I knew it wasn’t for me long-term.”

After selling the business, Brian thought he’d go back to school with the funds and become a lawyer. But fate had other plans.

“Not long after I sold my business, I was at Bleachers in Salem watching a friend’s band play,” he remembers.

“That night, a buddy introduced me to the mortgage business and next thing you know, I’m still in it 28 years later!”

Today, Brian oversees a team of 46 brilliant loan officers spread across 30+ retail branches, operating with the kind

of consistency and compassion that only comes from being part of something bigger than yourself.

“As a mutual bank, the depositors as a whole own the organization,” he explains. “That means something.”

At Salem Five Mortgage Company, everything revolves around serving the client and making the process seamless for their Realtor partners.

“We have portfolio products that are proprietary to the organization,” Brian explains. “Our bridge loans, competitive pricing, and our ability to get creative with borrowers … These are things you simply can’t find at other banks.”

As for customer service expectations and communication, Brian absolutely lights up when the subject is broached.

“Every week, I have a focus meeting with my team to reinforce the fact that we keep our pre-approved buyers and our agent partners apprised of everything going on in this everchanging market. I take care of agent partners’ clients like they’re my baby.”

That “overcommunication” approach is a core differentiator to build trust. And once a loan closes? Salem Five Mortgage

Company doesn’t disappear like many other lenders tend to do.

It’s also part of why Salem Five Mortgage Company is the largest servicer of Fannie Mae loans in New England.

“We service the majority of the loans we write ourselves,” Brian emphasizes. “That may sound uninteresting — until the servicer has a question and has to call the bank. With us, they’re calling the same people who wrote the loan. That’s a big deal.”

The mortgage industry has seen its fair share of turbulence in recent years. But Brian sees opportunity on the other side.

“Further contraction with automation and AI is streamlining the business,” he offers. “But we’ve stayed in business long enough that our P&L is a battleship. We’ll be left standing and outlast the rest. The good, solid players last through the ups and downs by running a business with frugality and efficiency.”

Outside of work, Brian is a proud husband to his wife, Cheryl, of 22 years, and a

devoted dad to twin daughters Grace and Emily — both headed to college this fall — and his son Brian Jr., a senior at Merrimack College. The Mahoneys enjoy skiing, boating, and anything that keeps them outdoors together.

After losing their beloved French bulldog just before Christmas last year, the family made an impromptu trip to the breeder.

“I lasted one day in the house without a dog,” Brian shares. “Now we have two platinum Frenchies. I only intended to pick out one, but I can’t say no to my girls!”

In addition to their solid reputation as a stalwart community bank, Brian is proud Salem Five Mortgage Company can also give back to the local areas it serves through Salem Five’s Charitable Foundation. The foundation allows employees to nominate local charities that are near to their heart for financial support. But Brian’s personal favorite initiative is his company’s annual toy drive with the Salvation Army.

“I love to see children smile and can’t imagine a child not having gifts to open during the holidays,” he shares. “It’s something I really look forward to every year.”

Eyeing the future, Brian’s industry has seen plenty of contraction lately but he isn’t in the least bit concerned; Salem Five Mortgage Company has built something lasting on values, not volume.

“We’re still standing because we believe in treating our people, our clients and our agent partners the right way,” Brian concludes.

To learn more, visit www.salemfive.com or call 978-720-5200 to connect with an expert Salem Five loan officer today.

BY ADAM WRIGHT, OWNER, R. J. HOME INSPECTIONS

Summer is finally here and finally time for warm outdoor active living here in new England! With this transition of the weather comes the heat, increased humidity, heightened pest activity, and of course the joys of grilling season. As a home inspector, I’ve seen firsthand how vital proper upkeep is during the summer months and I do not want to see you as a real estate professional have your home fall victim to summer conditions. To help keep your home in peak condition, here are my top 4 key tips to guide you through this month and prepare for summer.

1. Optimize Your Air Conditioning System The hot summer months make air conditioning systems indispensable. Before temperatures rise further, ensure that your AC is in excellent condition for maximum cooling efficiency:

• Professional Inspection: Have an HVAC professional perform an inspection and routine maintenance, checking refrigerant levels, tightening connections, and cleaning the coils.

• Replace Filters: Dirty filters restrict airflow, causing your AC to work harder and consume more energy. Replace filters regularly, particularly at the start of summer.

• Thermostat Check: Verify that your thermostat is functioning properly, and consider upgrading to a programmable or smart thermostat for better energy management.

2. Prepare Dehumidifiers for Basement Use Basements tend to be humid in the summer, which can lead to mold growth and structural issues. If you don’t have a dehumidifier, it’s time to get one! If you already do have a dehumidifier in place, follow these steps to maximize its performance:

• Clean and Test: Clean the water collection bucket and ensure that the filter is clean. Run a test cycle to confirm the unit is functioning well.

• Monitor Settings: Set your dehumidifier to maintain an optimal humidity level, ideally between 30% and 50%.

• Position Wisely: Place the dehumidifier centrally within the basement for even air circulation and ensure the drainage hose is properly connected for continuous operation.

3. Proactive Pest Control June is prime time for pest activity, and New England homeowners should remain vigilant, especially for carpenter ants and mosquitoes:

• Spray for Carpenter Ants: These ants can be highly destructive if they establish a nest inside your home.

Inspect areas prone to moisture and wood decay, and apply pest control spray around the perimeter. On home inspections I always remind people that everyone in new England gets carpenter ants so its nothing to be scared of, just make sure you stay on top of the maintenance.

• Mosquito Prevention: Mosquitoes can be a nuisance and carry diseases. Eliminate standing water in gutters, buckets, and bird baths to reduce breeding grounds. Consider installing mosquito-repelling lanterns or nets in outdoor living spaces. Or even higher a professional to spray your property to reduce mosquitos.

• Screens!: Window screens and screen doors are essential barriers against bugs while allowing airflow through the home. These screens need to be intact, especially if you have an eclosed screen porch where you plan on spending those warm summer nights. Repair any holes or gaps to prevent bugs from entering. Minor holes can even be fixed with a simple patch kit. Replace larger sections of torn screening material entirely.

4. Grill Maintenance for Fire Safety Grilling season is in full swing now (although for some of us grilling season never ends), but it’s crucial to perform regular maintenance to prevent fires or other hazards:

• Deep Cleaning: Scrub off grease buildup from the grill grates and interior surfaces. Check the grease tray and empty it if necessary.

• Check for Gas Leaks: If using a gas grill, inspect hoses for cracks or leaks. A great tip is to apply soapy water to the connections and look for bubbles as an indicator of leakage.

• Test Ignition System: Ensure that burners ignite quickly and that the flame is consistent across the grill surface.

• Safe Placement: Ideally we want you to position your grill at least 10 feet away from your home and other flammable structures, such as wooden decks or fences. I hear about fires caused from grills all the time and we don’t want you being a victim of this. Another thing we see ALL the time on home inspections is melted siding from grills being too close.

A comprehensive home maintenance plan for June will help you enjoy the summer comfortably and safely. We all know that home constantly requires upkeep so staying ahead on maintenance is huge. By following these tips and conducting regular inspections and repairs, you can keep your home efficient, pest-free, and ready for the joys of summer while preventing costly damage.

BY

When Mike Quail decided to walk away from a lucrative marketing firm career to become a full-time real estate investor in 2006, people thought he was crazy. And they had good reason to be skeptical — at first.

When Mike Quail decided to walk away from a lucrative marketing firm career to become a full-time real estate investor in 2006, people thought he was crazy. And they had good reason to be skeptical — at first.

“I had started doing real estate investing and flipping on the side,” Mike explains. “So I lost some serious money for a few years during the 2007-2008 market crash; but after a few years of grinding away, I eventually hit my stride.”

Today, Mike is the team leader of The Mike Quail Team at eXp Realty Luxury, based in Danvers. He’s served more than 800 happy clients over the past two decades and closed $42 million in volume over the past two years alone. He’s also a four-time eXp Realty ICON Award winner, a RE/MAX Hall of Famer, and a past #1 producer at Keller Williams Beverly. Clearly, Mike’s no longer just surviving in the market — he’s mastered it.

After graduating from Babson College in 2001 with a degree in entrepreneurship and a concentration in marketing, Mike dove headfirst into a marketing career, representing powerhouse clients like Dunkin Donuts, Coors Brewing Company, Miller, and Corona Beer Company. Still, something was missing. He read “Rich Dad, Poor Dad,” attended plenty of real estate seminars and the entrepreneurial wheels began to turn.

“I wanted to renovate houses and resell them for a profit and also buy and hold rental properties,” he recalls. “It was hard to buy homes at a low enough price where it would be a win for the home seller and a win for my business during that time.”

Like many investors during that era, Mike learned the hard way that timing is everything as the market collapsed. But what separated him from the crowd was what came next.

“What I noticed is that a week or two later, I would see a real estate agent sign in front of that same house and it would

sell shortly after,” he recalls. “That’s when I realized if I became a Realtor, I could help a lot more people.”

Mike initially got licensed to use the MLS for his own investing, but quickly realized the value of being able to offer clients more than one solution: “I then began to offer clients the cash offer option or the listing option,” he notes. “Things really took off from there.”

He hired his first assistant, then grew a team of 5-10 agents and admin, which he led for over a decade. Today, he’s pared down to what he calls a “small

My heart [is] to do the right thing in the eyes of God and then to be a great listener to my clients’ goals, and then be a great strategist to help them achieve their goals.”

power team” of himself, agent partner Christine Willard, two remote assistants, and his wife, Anny, has recently joined as a part-time admin.

While many team leads focus on scaling up, Mike’s eyes are on a different prize: impact over headcount. He intends to keep his team boutique and nimble as he prepares to launch his own online real estate coaching company this month.

Still, he’s open to bringing on one more person — if they’re the right fit. “I’m looking for someone that is what I like to call ‘P-squared;’ that is, a pleasure to be around and productive in their role,” he emphasizes.

Mike’s outlook on real estate is grounded in both strategy and something deeper. “Love God, Love Others, Serve Big!” is more than a mantra — it’s how he defines success.

“My heart [is] to do the right thing in the eyes of God and then to be a great listener to my clients’ goals, and then be a great strategist to help them achieve their goals,” he states.

It’s also why he gives back so enthusiastically to his loyal client base.

“We’ve held Thanksgiving pie giveaways for over a decade with our annual pie party. This past February, we had a Date Night Valentine’s giveaway where we gave everybody pizzas paired with soda or a bottle of wine,” Mike laughs. “And this summer, we’re doing a nice S’mores packet gift bag. Our team loves to give back to our clients while building relationships.”

Outside of work, Mike’s a devoted dad to three daughters — Samantha (17), Alexandra (14), and Emma (7) — and loving husband to Anny, his wife of 19 years. They are the reason he continues to greet each new day with the same gusto he felt when he started in real estate 20 years ago and he absolutely relishes the role of being a proud ‘Girl Dad.’

Have the right heart posture to serve and the money will follow.”

“My family and faith keep me motivated, pure and simple,” he shares. “Of course, there is the economic driver, but there is also the spiritual driver,” he continues. “I am driven to succeed for myself and my clients, but along that journey, I have been humbled in my relationship with God through my Christian faith. Trying to be more like Christ in my personal and professional life has caused me to grow and learn to serve others first, and the fruit will come from that.”

In an effort to assist others, Mike volunteers at Trinity Evangelical Church in North Reading, serves in the kids’ ministry and summer camp, and coaches JV boys basketball at Covenant Christian Academy, a role he’s held for two years and loves.

“It’s so life-giving, and brings me so much joy. I also realized how much I had

missed having a big team to coach and watching people get better at something and grow,” he reflects.

Mike’s also rediscovered a passion for running, something he did back on his high-school cross-country team.

“I started running again during COVID; and every Saturday, I would go to the track here in Danvers and run one mile as fast as I possibly could. I started out at 9 minutes and got my time down to 5:47.” That’s only five seconds off his high school PR.

Since then, Mike’s run eight marathons — most recently finishing the Boston Marathon.

“I raised $10,000 to support the Boston Children’s Hospital in honor of my daughter’s friend, Tyler, who passed away,” he shares.

Looking ahead, Mike is focused on continuing to serve clients at a high level, mentoring his teammate to become a top producer, and officially launching his online coaching business to teach other agents the systems that helped him build an amazing career.

“I’m excited to share all I have learned over the years and pass along my knowledge to more people than I ever could coach on one team,” he affirms.

His parting advice to aspiring agents looking to leave their own legacy someday?

“Have the right heart posture to serve and the money will follow,” he concludes. “And practically, pick a type of lead generation that fits your personality… and then go do it well!”

None of the agents in our magazine paid to be featured. They were either nominated by fellow Top 300 Agents, or industry colleagues in the community and featured FREE of charge.

Real Producers magazine started in Indianapolis in 2015 and is now in over 130 markets across the nation and continues to spread rapidly.

We often get a lot of compliments about North Shore Real Producers content, our quality of photography, professional design appearance, and overall, the positive nature and influence that our publication has brought to the real estate community here in Essex County and the North Shore.

But like anything, not everyone agrees. We also get notes and calls about why we decided to feature some of the people who we’ve featured.

How did they get in the magazine, and oftentimes, how can I be included in your pages? These are fair questions which warrant some discussion, so let me offer explanation into some of the frequently asked questions.

Who receives North Shore Real Producers?

The top 300 agents/teams in Essex and Northeast Middlesex Counties. This is based on total MLS Sales Production from 2024.

What is the process for being featured in the magazine?

Almost every feature you see has been nominated by peers. You can nominate other agents, affiliates, brokers, owners or even yourself. We will consider anyone brought to our attention because we don’t know everyone’s story.

We spent a lot of time getting to know the North Shore and Essex County agent community during my ramp-up period in 2020.

What does it cost a agent or team to be featured?

The answer is simple... NOTHING. None of the agents in our magazine paid to be featured. They were either nominated by fellow top 300 agents or industry colleagues in the community and featured FREE of charge.

Who are the Preferred Vendor Partners?

Anyone listed as a Preferred Vendor Partner in our Partner Index in the front of every publication is an integral part of this community. Our Preferred Vendor Partners pay for their presence in our publication and will have an ad in every issue, attend our private events and be a part of our online presence. We don’t just find these businesses randomly, nor do we work with all businesses that approach us. Many of you have recommended every single Preferred Vendor Partner you see in our publication.

Our goal is to create a powerhouse network, not only for the best agents in the area but the best affiliates as well, so that we can grow stronger together: Connecting. Elevating. Inspiring. If you have questions, suggestions or nominations, please feel free to send me an email at talman.hauch@ realproducersmag.com or call me at 617-921-7033.