9-22 APRIL 2024

STRICTLY FORTRADEUSERSONLY

NATIONAL LOTTERY

Job adverts and reps working for Allwyn reveal new strategy for small shops

POST OFFICE

Postmasters to receive a combined £30m pay increase in latest remuneration review

PLUG PULLED ON SMALL SHOPS

• Retailers le ‘blindsided’ by Cashzone as it terminates ‘unpro table’ ATMs with little warning

P3

• Operator blames rising interest rates as it begins ripping out machines

NEW PRODUCTS FOR YOUR SHOP

P8 Müller Yogurt & Desserts launches take-home cartons to meet demand

P2

P4

CATEGORY ADVICE VAPE RESTRICTIONS 26 government nounced its ban vapes January 2024 new restrict egoryandcrack then, the government will come ect by the end The Scottishthat tish April 2025, alongside statement ing has “worked together to agree come provideconsumers”. has start from any government as However, the rmed will month allowing businessesto new regulations. this has prompted suppliers, custo andcome the saw the number for vapes’ since cords began, SkoGoSmokeFree. co.uk predicts disposable stockpile plies their prodflavours approaches.exactly what occurredwhen force, the selling and EU marsays. AN OVERVIEW A BREAKDOWN ON THE DISPOSABLES BAN PRIYA KHAIRA explains everything retailers need to know ahead of the upcoming ban in April 2025 A BREAKDOWN OF THE DISPOSABLES BAN Get yourself up to speed with the upcoming legislation and how it will impact you P26 9-22 APRIL 2024 STRICTLY FORTRADEUSERSONLY • Retailers le ‘blindsided’ by Cashzone as it terminates ‘unpro table’ ATMs with little warning • Operator blames rising interest rates as it begins ripping out machines P3 PLUG PULLED ON SMALL SHOPS NATIONAL LOTTERY P2 P8 Müller Yogurt & Desserts launches take-home cartons to meet demand P4 POST OFFICE Postmasters to receive a combined £30m pay increase in latest remuneration review NEW PRODUCTS FOR YOUR SHOP Job adverts and reps working for Allwyn reveal new strategy for small shops

Although the drop is only 0.8%, it’s still a slowdown. There is truth in numbers, but on this occasion, I want to talk about the importance of not getting too bogged down by them. There are inevitable struggles right now, a lot of which I don’t need to go into because you are facing them on a daily basis.

Instead, I want to turn your attention to the opportunities within your reach, and the reasons why independent retailers are best placed to take advantage of them.

More than supermarkets, you have the power to know what your customers want, and how they want it. We know that households are nancially struggling right now, so why not ask shoppers when they are at your counter – what they’d like to see more of in your store.

Who knows, their answers might surprise you. They might want to see more own-label products, or they might want more promotional o ers. But if you don’t know, how can you be expected to turn those negative numbers into positive ones?

YOU HAVE THE POWER TO KNOW WHAT YOUR CUSTOMERS WANT

A simple conversation could make the world of di erence. Plus, whatever they want, you have the power to give them it. You don’t have to jump through any hoops, you hold the magic.

So, if I can leave you with one thing, it’s don’t assume, and instead ask the important questions today.

The ve biggest stories this fortnight

01

New National Lottery strategy for small shops revealed

JACK COURTEZ

JOB adverts and reps working for Allwyn have revealed major upcoming changes to the National Lottery.

A recently advertised retail analyst role describes a new retailer incentive scheme as a “strategic initiative”, which will replace the current rewards where stores can earn

£10 and win up to £10,000 by uploading �ixture photos.

A new senior brand manager for scratchcards also con�irmed the operator is set to make scratchcards “available in brand-new places”.

Although no formal announcement has been made on the future of current drawbased games, a senior product manager role for the category

02

suggests changes are likely.

The job adverts also indicated that new “instant win” games printed on store terminals could be part of Allwyn’s plans.

Last week, new kit rolled out to selected stores as part of a trial as Allwyn ramps up retail investment, including

an illuminated scratchcard dispenser and a new Playstation with double-sided graphics.

The �irm expects 40 stores to have the new equipment by the end of May, with another 10,000 later in the year, and a full rollout throughout autumn and into 2025.

03

Failure to check ID Summer crime spike

AN investigation has revealed Deliveroo and Uber Eats drivers are refusing to conduct checks that prevent sales of age-restricted goods to minors.

More than 100

04

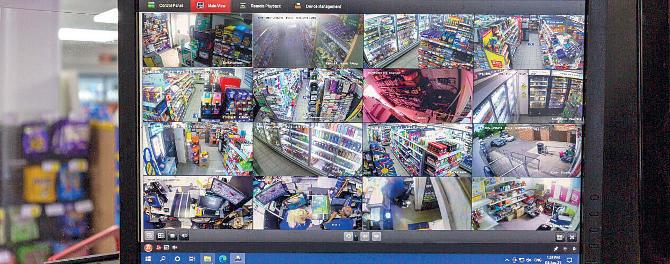

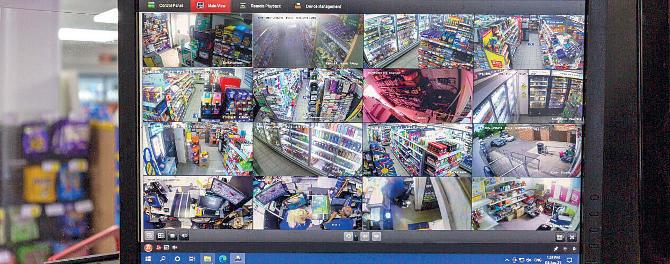

STORES located in tourist destinations are being warned to stay vigilant as shoplifting is expected to spike during the summer.

A security-industry boss, who asked not be named, told Retail Express they had examined convenience stores where their equipment was installed, noticing an increase in the systems being triggered from June to September.

Vince Malone, owner of Tenby Stores & Post Of�ice, said incidents in his store “double between June and September”.

05 Indie sales fall

SYMBOLS and independents are experiencing a 0.8% sales drop year on year.

According to Kantar’s latest statistics, the two were the only category to see a fall, despite grocery price in�lation standing at the lowest level

since February 2022.

The �igures also revealed that 23% of households surveyed identi�ied themselves as struggling �inancially. Kantar added retailers are putting an emphasis on discounts and price-match schemes.

@retailexpress betterretailing.com facebook.com/betterretailing

UK drivers across both �irms were identi�ied boasting of exploiting �laws to avoid checking IDs and committing other licensing breaches.

investigation also uncovered evidence that Uber Eats’ support centre had instructed drivers to hand over alcohol even when customers had failed doorstep ID checks. Editor Megan Humphrey @MeganHumphrey 020 7689 3357 Editor – news Jack Courtez @JackCourtez 020 7689 3371 Editor in chief Louise Banham @LouiseBanham Features editor Charles Whitting @CharlieWhittin1 020 7689 3350 Production editor Ryan Cooper 020 7689 3354 Sub editors Jim Findlay 020 7689 3373 Robin Jarossi Head of design Anne-Claire Pickard 020 7689 3391 Senior designer Jody Cooke 020 7689 3380 Junior designer Lauren Jackson Production coordinator (parental cover) Bod Adegboyega 020 7689 3368 Head of marketing Kate Daw 020 7689 3363 Head of commercial Natalie Reeve 07856 475 788 Associate director Charlotte Jesson 07807 287 607 Commercial project manager I y Afzal 07538 299 205 Account director Lindsay Hudson 07749 416 544 Account managers Megan Byrne 07530 834 009 Lisa Martin 07951 461 146 Finance manager (maternity cover) Isuri Abeykoon 020 7689 3383 Managing director Parin Gohil 020 7689 3388 Head of digital Luthfa Begum 07909 254 949 our say Take action now –you won’t regret it Shop vape blame BRITISH American Tobacco (BAT) is blaming retailers for playing a role in underage vaping after a mystery shopping exercise claimed nine out of 10 stores were not enforcing Challenge 25. When asked by Retail Express, BAT declined to provide the methodology for the exercise. In addition, asurvey of 2,000 parents conducted by BAT found that 89% support a licensing regime for vape sales. Features writer Jasper Hart @JasperAHHart 020 7689 3384 40,152 Audit Bureau of Circulations July 2022 to June 2023 average net circulation per issue Retail Express is printed and distributed by News UK at Broxbourne and delivered to news retailers free by their newspaper wholesaler. Published by: Newtrade Media Limited, 11 Angel Gate, City Road, London, EC1V 2SD; Phone: 020 7689 0600 Reproduction or transmission in part or whole of any item from Retail Express may only be undertaken with the prior written agreement of the Editor. Contributions are welcome and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. No warranty for goods or services described is implied. Subscribe online at newtrade.co.uk/our-products/ print/retail-express. 1 year subscription: UK £65; overseas (EU) £75; overseas (non-EU) £85 Retail Express’ publisher, Newtrade Media, cares about the environment. Megan Humphrey, editor News editor Alex Yau @AlexYau_ 020 7689 3358 STATISTICS can be quite scaremongering. On this page, you’ll see that Kantar revealed

independ-

The

symbols and

ents as the only grocery category to see a sales slump year on year in its latest results.

Specialist reporter Dia Stronach 020 7689 3375

News reporter Alice Brooker @alice_brooker 07597 588955

For the full story, go to betterretailing.com and search ‘ID checks’

Cover image: Getty Images/DGLimages

ALICE BROOKER

ALICE BROOKER

INDEPENDENT retailers have been left ‘blindsided’ by Cashzone as it pulled out out “unsustainable”

ATMs with less than two months’ notice.

Retail Express understands the operator began issuing letters at the start of the year to stores that “consistently fail to meet volumes required”. The �irm blamed a “continuing rise in interest rates” putting “unprecedented pressure on ATM deployers”.

Cashzone went on to explain that it had attempted negotiations with Link, “to increase the fees the banks pay us when their customers use our machines to access their cash to re�lect this increased cost”.

“This has meant many of our machines have become unsustainable,” it said. “The situation has been exacerbated by the decline in transaction volumes experienced across the UK ATM network.”

Affected sites are being told that they will be contacted by Cashzone to organise a suitable date and time to collect the ATM.

Umesh Bathia, owner of U&S Food & Wine in Farnham, Surrey, told Retail Express he had his machine removed in February, despite attempting to negotiate with Cashzone.

“I asked them if we could reduce the rate to get more customers,” he said. “Over

Cashzone terminates ‘unsustainable’ ATMs

eight years ago, it was a free-to-use ATM and it was booming, but as time went on, Cashzone imposed charges. When they applied a £1.50 charge to each transaction, the usage really slowed down.

“I understand if they aren’t making money, they need to make changes, but I wish they’d spoken to us to see if there was a way we can work together to �ind a �inancially viable solution.”

When asked what impact losing the ATM has had on his store, Bathia explained: “We are de�initely worse off. Although the usage slowed down, people still used it, especially the elderly who

express yourself the column where you can make your voice heard

“CONFECTIONERY on the whole is up. Our sales are up by 14% year on year. But that doesn’t translate to 14% growth in pro ts. The margin on confectionery is 18-19% for us now and it used to be more than 30%. There’s nothing we can do. Everything goes up 25p here and there. Sometimes we eat the cost to keep that product on the shelf because we have regular customers buying it.”

Meten Lakhani, St Mary’s Supermarket, Southampton

want to be able to balance cheques and don’t rely on their smartphones to do this.

“Having an ATM also helps us compete, and without it, people just go elsewhere.”

It’s not the �irst time Cashzone has come under �ire by independent retailers. In recent years, the �irm has been criticised for cutting commission rates by 65%, after a slowdown in withdrawals during the Covid-19 pandemic.

Other store owners who’ve recently had a Cashzone ATM installed have expressed concern after learning of the raft of terminations.

Nathalie Fullerton, of One

Stop Partick in Glasgow, said: “I only had a Cashzone ATM installed last month. To hear they are getting rid of ones with relatively no notice is quite alarming and not very fair. You adapt your property and hope it bene�its you, and when this doesn’t happen, it’s stressful.”

Retail Express approached Cashzone, asking them to clarify what volume requirements stores needed to meet to avoid losing their ATM, and it failed to provide an answer.

However, a spokesperson for NCR Atleos, owner of Cashzone, said: “As a nonbank for-pro�it independent owner of the world’s

What are you doing to grow your confectionery sales?

“WE try to get hold of new products as soon as possible to give ourselves a point of di erence. We have built up a strong range of American confectionery and our category sales have grown 15% since we started this. We were also one of the rst ones to jump on freezedried sweets. I thought they would be a fly-by, but I am onto my sixth order now and I’m getting referrals. It’s great for sales.”

Nishi Patel, Londis Bexley Park, Dartford, Kent

Do you have an issue to discuss with other retailers? Call 020 7689 3357 or email

largest retail ATM network, NCR Atleos regularly monitors operational costs and interchange fees across our Cashzone ATM network in the UK and makes necessary adjustments.”

A spokesperson for Link added: “We do receive regular requests from members to change the fees [both up and down] and Link always considers these carefully. The fees are reviewed at least annually to take account of a number of factors, including an assessment of the costs of ATM operators and the maintenance of a satisfactory geographical spread of free-to-use ATMs across the country.”

“CONTACT your networks. Keeping your eyes on social media is so important. I’m with Women in Convenience, the Fed, the ACS and Women in Retail. We have WhatsApp groups talking about the latest trends and sharing advice on what they’re doing in their shops. If you’re not in a network, join one because they can o er advice. It’s incredibly useful”

Fiona Malone, Tenby Post O ce & Stores, Pembrokeshire

megan.humphrey@newtrade.co.uk

BUBBLE TEA: The rst self-serve table-top bubble-tea machine is now available in convenience.

Drinks from Blue Ice Machines, which has three flavours, generate nearly £5 in pro t per cup sold. The machine costs £2,620 plus VAT, or can be leased for £98 a month, plus VAT. This includes a holder for cups and straws.

For the full story, go to betterretailing.com and search ‘bubble tea’

PAYPOINT: The rm has struck a new deal with Lloyds Bank, helping to “streamline card payments”, by o ering stores a 12-month fee-free Lloyds business account and giving a “competitive commercial card o ering”. Lloyds Bank Merchant Services’ managing director said the deal would enable the rm “to support even more UK smalland medium-sized businesses”.

For the full story, go to betterretailing.com and search ‘Lloyds’

GOOD WEEK BAD WEEK

EAT 17: The retailer has been forced to close its wholesale business and Hammersmith store due to a poor nancial performance. Founder James Brundle said: “Our primary focus has been on streamlining our business operations to maximise pro tability.”

For the full story, go to betterretailing.com and search ‘Eat 17’

SMITHS NEWS: Thieves are targeting Smiths News-supplied stores in Sussex, snatching tote boxes and collectables. Retail Express understands that a number of retailers have had their deliveries targeted over multiple days.

For the full story, go to betterretailing.com and search ‘Smiths News’

03 betterretailing.com

9-22 APRIL 2024

Malone @retailexpress facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972

Fiona

POs to receive £30m pay bump

POST Office (PO) retailers are to receive a combined £30m pay increase, due to changes announced in the firm’s annual remuneration review.

Confirmed on 27 March, measures include a one-off payment equal to 15% of each branch’s March variable remuneration. The figure is attributed to a profit-share from the

PO’s online sales, including its online parcels arm launched last year.

The rise will be paid out this month and is worth nearly £5m for all affiliated stores.

Around £12m of the pay rise comes from an increase in Royal Mail tariffs on 2 April and inflation-linked 4% remuneration rate increases on handling pre-paid parcels and returns.

Elsewhere, there’s a 21%

increase in remuneration on DVLA transactions and a 9.4% rise in postmasters operating outreach PO vans to “take into account the national living wage increase and changes in fuel prices”.

The 2,800 largest banking branches are also to receive complementary high-grade note counters worth £3.5m.

The remuneration for MoneyGram and Western Union ‘Cash to Account’ services

will also increase to the same level as the Send product.

Assessing the wider impact of the recently announced changes, and based on 11,500 branches, the £30m increase is equivalent to an average remuneration increase of £2,600 per year, per store.

However, with services offered differing by branch, the levels for many retailers will be significantly above or below the average.

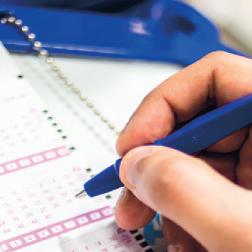

The National Lottery Mystery Shopper & Knowledge Check Programme Operation Guardian

Operation Guardian store visits help support National Lottery retailers to maintain high responsible retailing standards.

To prepare for these visits, please make sure staff are fully trained.

1 2 3

Underage Play Mystery Shop

(formerly known as Operation 18)

Remember the Stop, Look, Check steps when assessing a customer’s age and asking for ID

Excessive Play Mystery Shop

Remember to print GamCare details via the terminal if a customer needs help with their play, or on behalf of someone else

Mace fascia expansion

THE Mace fascia is making a resurgence, as buying group PGMA has taken on its expansion and development.

Already responsible for giving smaller shops across Scotland access to benefits of the Costcutter supply chain, commercial director Martin

Devlin said: “The Mace fascia gives members another revenue and it builds up the benefits of PGMA. If a retailer wants a brand, they can have it.

“If not, that’s fine. There’s also an option to have a hybrid of both.”

THE UK’s deposit return scheme (DRS) is unlikely to be introduced in 2025, with reports suggesting a 2027 launch “would be more likely”.

The Department for Environment, Food & Rural Affairs’ (Defra) secretary of state, MP Steve Barclay, stressed the interoperability is crucial for businesses, and indicated that he would use

New Healthy Play Knowledge Check

Ensure staff are fully trained on a regular basis.

Material can be found in your Retailer Organiser and on the new Retail Training Centre* website

Have you completed your Healthy Play training modules yet?

Scan the QR code to visit the Retail Training Centre today!

Digital ID for alcohol

STORES could soon be able to accept digital age verification, rather than a physical ID, for alcohol sales, with a government consultation on the change due to close at the end of March.

The consultation was launched to examine wheth-

er technology has a place in age-restricted sales of alcohol in retail and hospitality.

Last month, experts and suppliers met for a conference organised by Westminster, discussing the use of digital IDs, such as smartphone apps.

NEWS 04 9-22 APRIL 2024 betterretailing.com

JACK COURTEZ

UK DRS FACES FURTHER DELAY For the full list of changes, go to betterretailing.com and search ‘Post Office’ For the full story, go to betterretailing.com and search ‘digital age verification’ For the full story, go to betterretailing.com and search ‘Mace’

the same Internal Market Act as Defra did in Scotland to remove glass from the scope in Wales.

*Not applicable in all stores. Refer to your in store procedures where relevant

1028651 TNL Op March Guardian Trade Press Ad Retail Express AW1.indd 1 27/03/2024 16:50

RIO brand in double digit growth +41%*

40% of Fruit Carbonated shoppers buy 1.5Ltr/ 2Ltr bo le once a week or more**

Rio has the #3 fastest selling SKU***

Search Rio Soft Drink *Circana GB Symbols & Independents, Value Sales Growth 52 w/e 30 DEC 2023 vs 52 w/e 02 JAN 2021; **VYPR 09 FEB 2023; ***Circana GB Symbols & Independents, Fruit Carbonate Branded SKU, Units Per Store Per Week, Distribution >10%, 52 w/e 30 DEC 2023

SUNSHINE SELLS NEW 1.5L

NEWSTOCKUP NOW To find out more, request POS kits and download digital assets email connect@ccep.com, call 0808 1 000 000 or visit my.ccep.com ALC. VOL 5.0% PLEASE DRINK RESPONSIBLY SCAN TO VISIT 1. Kantar Penetration 52w 24-Dec-23 vs. Previous Year 2. IWSR RTDs Strategic Study 2022 – United Kingdom ©2024 THE ABSOLUT COMPANY AB ©2024 THE COCA-COLA COMPANY

PLANNED FORUNPLANNED MOMENTS

1in3

1in3consumers purchasealcohol ready-to-drink(ARTD) optionsinGB 1

NO.1

Refreshmentisthe consumersno.1preferenceforwhenmakinganARTDchoice2

EASY

Consistentquality, convenientand portable

PRODUCTS 08 Müller adds take-home formats

PRIYA KHAIRA

MÜLLER Yogurt & Desserts has launched 950ml take-home cartons for Frijj �lavoured milk.

The new format is available in Müller Frijj Fudge Brownie and Strawberry varieties.

Its launch comes after research indicates that the overall �lavoured milk category is growing by 3% year on year, with larger take-home formats contributing to over 40% of the milkshake market.

While smaller on-the-go formats are the most prominent in this sector, accounting for 55% of �lavoured milk drinks' total market

value, larger take-home sizes still account for over 40% of the total sector, according to Circana data.

The brand hopes that its new launch will strengthen its portfolio and enable category growth, the supplier said.

The Müller Frijj rollout will be supported by a TV campaign.

From May, the brand is also reintroducing its ‘Feel the Urjj’ marketing campaign to further support the launch, spanning across radio, out-of-home and social media activations.

Becky Spellman, associate marketing manager at Müller Yogurt & Desserts, said: “We think there is a huge

SBF GB&I invests in greener caps

SUNTORY Beverage & Food GB&I (SBF GB&I) is introducing tethered caps to its soft drinks range in the UK and Ireland in a bid to reduce littering. Bottle caps are often discarded, whereas tethered caps are easier to recycle.

Lucozade Energy, Lucozade Sport, Ribena, Fit Water and Orangina will have all transitioned to the new format by June.

Coca-Cola Europaci�ic Partners is another major soft drinks supplier to have made a transition to tethered bottle caps across select 1.5l and 500ml lines.

SBF GB&I’s head of external affairs and sustainability, Fraser McIntosh, said: “By attaching them, we are reducing the potential for them to be littered and making sure they are sorted during recycling.”

opportunity for category growth in milk drinks.

“They are already purchased by 33% of households, but if we can offer the right pack sizes and �la-

vours to ful�il the needs of both on-the-go and at-home shoppers, we can really fuel growth in this sector.”

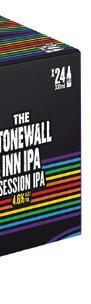

Nisa stocks Stonewall Inn IPA

CARLSBERG Marston’s Brewing Company is launching Stonewall Inn IPA from Brooklyn Brewery in the UK.

Nisa has been con�irmed as a stockist for the new launch, which is available in 4x330ml packs with an RRP of £6.50.

The new IPA has an ABV of 4.3%, containing a blend of grapefruit and citrus peel notes.

It was �irst brewed in the supplier’s New Yorkbased brewery in 2017 for the owners of the Stonewall Inn.

To support the launch, the supplier is running a social media campaign, including a giveaway of

tickets to a launch event taking place this month in Shoreditch, east London, which the owners of the Stonewall Inn will be attending.

tickets to a launch event taking place this month in Shoreditch, east London, which the owners of the Stonewall Inn will be attending.

Bzzd Energy unveils pink-lemonade tonic

BZZD Energy has introduced a pink lemonade �lavour to its energy tonicwater range.

The new launch comes after the brand won six product innovation awards including a commendation at the Grocer Awards.

The tonic water range contains plant-based caffeine. Bzzd Energy Pink Lemonade contains hints of

raspberry and is sweetened using blossom honey and plant-based Stevia.

It is available in cases of eight units with an RRP of £5.50. It is currently available on Amazon and is set to roll out into retail channels later this year.

The drinks are made using 100% recyclable materials along and ethically sourced ingredients.

Cadbury adds Dairy Milk & More

MONDELEZ International has unveiled Cadbury Dairy Milk & More, which boasts bigger chunks and more �lavour combinations per bite than other Cadbury varieties.

Cadbury Dairy Milk

Nutty Praline Crisp (180g, RRP £2.75) and Cadbury Dairy Milk Caramel Nut Crunch (200g, £2.75) both contain 70% bigger chunks compared with Dairy Milk 180g.

Cadbury Nutty Praline

Pladis goes retro with new edition

PLADIS has unveiled a limited-edition collection, inspired by nostalgic �lavours.

McVitie’s has introduced Eton Mess and Lemon Meringue to its Cake Bars line-up. Both have an RRP of £1.25 for a pack of �ive.

McVitie’s is also launching a limited-edition Candy Floss �lavour for its Iced Gems range. The new variety has an RRP of £1.25.

The limited-edition launches come in time

for summer, as the brand hopes to tap into on-the-go snacking occasions.

Crisp contains almond and hazelnut praline and a wafer base, while the Caramel Nut Crunch variety contains layers of toffee, hazelnut and caramel. The bars were initially available in Tesco and are now available to convenience and wholesale channels.

Ranging and merchandising advice for the products is available via Mondelez International’s Snack Display website.

Adam Woolf, marketing director of McVitie’s at Pladis UK&I, said: “Alongside a surge in on-thego snacking occasions, Cake Bars are gaining in popularity.

“Our latest additions are placed to help busy Brits indulge in the �lavours of their favourite desserts, now in a portable, handheld format.”

Bobby’s Mega Sour Spray Can

BOBBY’S Foods has expanded its confectionery range with the addition of its Mega Sour Spray Can.

The new variety contains a Blue Razz �lavour spray combined with purple blackcurrant-�lavoured gumballs to provide a fusion of �lavours. Each can has an RRP of £1.29.

A marketing campaign ran for the �irst two weeks of its launch to help boost customer engagement.

The Mega Sour Spray Can emits a spray-can sound when used and is decorated with graf�iti-themed packaging.

The brand hopes that its playful packaging will attract a younger audience.

Carmelina

marketing manager at Bobby's Foods, said: "Its novel design and unique �lavour combination are sure to resonate with consumers, driving incremental sales for our customers."

Mancini,

09

9-22 APRIL 2024 betterretailing.com

Mancini,

09

9-22 APRIL 2024 betterretailing.com

In partnership with

Assistant manager, Premier Broadway, Edinburgh, and Women in Convenience ambassador Sophie Williams

Focus on… Improving your con dence

THE biggest challenge I have had is people underestimating me, not only because I am a woman, but also because of my age.

I have been lucky to have such great support from my parents and my colleagues. My manager, Colleen, has been such a role model to me. She’s a bit older, and a mother gure. It’s not easy, but putting myself out there and going to events has helped. I o en have to take a moment to reflect on what I have achieved at just 24 years old, and this helps me remember how well I am doing.

It doesn’t even need to be a big milestone – even going to work every day and doing your best is enough, so remember to give yourself a pat on the back. I nd saying a rmations to myself really useful. It can feel embarrassing, but it really works.

If I’m giving a talk, or going to an event, and I’m nervous, I say to myself: “I am worthy, I am good at what I do and I deserve to be here.” The feeling you get a er doing something scary is so electric.

At the end of last year, I had a terrible, misogynistic experience, which knocked my con dence. I was so upset, but I leaned on my team.

They gave me validation and I felt heard. It’s because of them I remembered why I love what I do and am feeling the best I ever have right now. I know how intimidating it can be to take the rst steps, but I want to reassure you that you will be welcomed into the industry by your female peers with open arms. There is a supportive and very caring community of women waiting to meet you.

Headline partner Supporting partner Collaborators

Headline partner Supporting partner Collaborators

Walkers unveils spooky collab

PRIYA KHAIRA

FOLLOWING a collaboration with Ghostbusters: Afterlife in 2021, Walkers is now partnering with Sony in celebration of the release of Ghostbusters: Frozen Empire via an onpack promotion.

The new promotion gives shoppers a chance to win prizes every hour between 6am and midnight.

Until 5 May, shoppers have an opportunity to win prizes including cinema tickets, private VIP screenings of Ghostbusters: Frozen Empire, Sony store vouchers or a trip to New York for a Ghostbusters-themed adventure holiday including

a movie location tour.

The promotion is available across Walkers’ portfolio, including Monster Munch, Wotsits, Squares and Quavers lines, in a range of formats including price-marked packs, sharing bags, grab bags and multipacks.

To enter, shoppers will need to scan the QR code presented on one of the participating packs or enter their details on the Walkers website along with a unique on-pack code to �ind out if they have won any of the instant-win prizes.

Josephine Taylor, senior brand marketing manager at PepsiCo, said: “Our previous on-pack promotion for Ghostbusters: Afterlife cre-

New media campaign for Richmond

RICHMOND has announced that it has invested £2.6m into its ‘Good times’ marketing campaign.

The campaign will span TV, social media and out-of-home launches along with consumer giveaways and in-store promotions.

The advert celebrates the brand’s heritage and provides a look into its future.

The ‘Good times’ campaign

aims to highlight its Pork and Meat-Free Sausages.

Across the entire Richmond range, its Meat-Free range is the third-biggest meat-free brand in the category, displaying growth of £113.4m in 2019 to £190.1m in 2024.

Chris Doe, marketing and innovation director at Pilgrim’s Food Masters, said the ad aims to highlight the brand’s inclusive range.

Higgidy reveals spring campaign

HIGGIDY has released its latest ‘Higgidy Helping of Scrumptious quiche’ campaign.

It is set to launch from May and supports the British Hen Welfare Trust.

The new campaign will run across in-store, out-ofhome, PR and social media activations.

As part of the campaign, Higgidy is launching a new Garlic Roasted Broccoli & Vintage Cheddar Quiche with Emmental crumb (RRP £4.59).

Pro�its made on this new variety will be given to the British Hen Welfare Trust. The Trust’s mission is to help rehome ex-commercial hens and encourage food suppli-

ated a buzz for �ilm fanatics and shoppers alike.

“We’re pleased to be in partnership with Sony again to build on this, in honour of its Ghostbusters: Frozen

ers to use free-range eggs.

Along with this new variety, Higgidy’s Spinach, Greek Feta & Roasted Red Pepper Quiche will feature in the brand’s new May campaign.

Empire launch.”

The brand is amplifying awareness of the campaign via digital, in-store, in�luencer and social media activations.

BROOKFIELD Drinks has launched Neo Wtr, a 100% recycled ocean-bound plastic bottle with a recyclable cap and label, a �irst for the category.

Neo Wtr has an RRP of £1.25 for a 500ml bottle. It will roll out to wholesalers across the country from the beginning of June.

The development of this bottle came about after research showed that by 2050, oceans could contain more plastic than �ish. Each 500ml bottle is made using discarded plastic that has been col-

Neo Wtr helps tackle ocean pollution

lected along coastlines that are at-risk of ocean plastic pollution.

Neo Wtr managing director Nigel McNally said: “The pressure is mounting on soft drinks manufacturers to provide solutions to prevent a global disaster.”

A new look for Quality Street lines

NESTLÉ has made alterations to two of its Quality Street �lavours this year.

The Purple One and Orange Crunch have taken on a new shape to match Caramel Swirl. The Orange Crunch has also transitioned from foil to a paper wrapper. Both �lavours will, however, keep their coloured wrapping and �lavours.

The change has come after

Nestlé underwent a trial at the end of last year and introduced the new formats in a number of Quality Street tubs and cartons on the lead up to Christmas.

Jemma Handley, senior brand manager for Quality Street, said: “After a successful trial at Christmas, we’ll be permanently rolling out new shapes for two of our muchloved sweets.”

PRODUCTS 10

Global Brands taps into tequila market

GLOBAL Brands has added new tequila range Take to its portfolio.

The Take range comprises a 100% Blue Weber agave blanco Tequila (38% ABV), and three Tequila-based liqueurs: pineapple, jalapeño and pink grapefruit. The liqueurs have a 34% ABV.

The new line was released to target the UK tequila market, which grew by 478% in the on-trade in 2023, according to data cited by Global Brands.

Take’s packaging is inspired by traditional Huichol artwork and Mexican culture.

Matt Bulcroft, marketing director at Global Brands,

said: “We’ve developed a brand that challenges perceptions of tequila, with a fresh take on the category. Our new liqueurs offer a base for Margaritas, as well as tasting shots, without the need for salt and lime.”

Müller enters out-of-home sector

MÜLLER Vitality plant-based is being made available to the out-of-home sector, with the brand offering the product in a 3kg bulk pouch format with separate mixable sauce.

Data shows that bulk packs currently account for 40% of the out-of-home yogurt market, with it seeing year-on-year value growth of 30%.

Müller has stated that it had identi�ied a gap in the market for its products.

Empire rebrands three lines

EMPIRE Bespoke Foods has rebranded three of its products including its Goose Fat, Duck Fat and Quail Eggs lines.

The redesign aims to highlight what each product can be used for. The front label on its Goose Fat and Duck Fat jars now reads ‘perfect for roasties and chips,’ while the Quail Eggs feature recipe imagery on the front of the jar alongside a ‘ready to eat’ roundel.

The rebranded range will be available as part of Empire Bespoke Food’s 2024 festive range, which is now available to be ordered.

“We are seeing a trend for cooking with duck and goose fat through the year, so this

rebrand will enable us to broaden out the usage occasions,” said Benjamin Moody, brand manager at Empire Bespoke Foods.

New Fruittella Berries & Cherry

PERFETTI Van Melle has expanded its Fruittella range with the addition of a Berries & Cherries �lavour.

The new line is made with real fruit juice, natural colouring and is vegan.

Fruittella Berries & Cherries Stick has an RRP of 65p for a single 41g stick.

The new launch aims to tap into on-the-go snacking occasions and target children and families.

Lauren Potter, senior brand manager at Fruittella, said: “Made with only natural �lavours and colourings, Berries & Cherry single stick chews allow children to enjoy our bestselling chews’ natural fruity taste.

“The vegan and free-from formula makes the brand’s Berries & Cherry Stick an accessible treat for all the family.”

are vegan, gluten-free and made with real fruit.

Müller Vitality PlantBased Thick & Creamy and Müller Vitality PlantBased Healthy Balance

Plain yogurt will be available in plain �lavour, while the Müller Mixables Sauce range will be available in Strawberry, Toffee and Peach varieties.

The Müller Mixables Sauce range will be available in 1kg pouch formats. They

World of Sweets adds Clif products

WORLD of Sweets is growing its healthier snack range by partnering with Mondelez International to become the of�icial UK distributor for Clif products.

The bar was �irst launched in America in 1992. It is now the number-one energy bar in the US, worth £1.2bn globally.

Clif Bar is available in Chocolate Chip, White Chocolate Macadamia Nut, Crunchy Peanut Butter, Blueberry Almond Crisp, Peanut Butter Banana with Dark Chocolate and Chocolate Almond Fudge varieties.

Clif Nut Butter Bars are available in Chocolate Chip & Peanut

Butter, Chocolate & Peanut Butter and Peanut Butter.

Meanwhile, Clif Bloks Energy Chews, which are designed for athletes, are available in caffeinated and non-caffeinated Strawberry, Mountain Berry, Tropical Punch and Black Cherry varieties.

Mix it up with new Mixtons RTD trio

READY-TO-DRINK cocktail brand Mixtons has added a new trio of canned cocktails to its portfolio.

The new drinks come in Dragon Mojo, Forbidden Zest and Spicy Melons varieties.

Dragon Moji contains rum, mint, kiwi and dragonfruit, while Forbidden Zest features gin, blood orange, pink grapefruit and yuzu. Spicy Melons is crafted with tequila, lime, watermelon and chilli �lavours.

The new launch aims to explore new �lavour combinations, in response to growing consumer demand for unconventional cocktail �lavours, with spicy cocktails

rising in popularity, according to BinWise data.

All Mixton cocktails have an 8% ABV and are available from the brand’s online website. The cans have an RRP of £22.50 for a pack of six.

11 9-22 APRIL 2024 betterretailing.com

WIN! FESTIVAL ticket festival tickets Visit boardmasters.winwithrubiconraw.co.uk/terms for full T&Cs & Prize details.

HELL BEVERAGES drinks are available in over 50 countries, and are brand leaders in 11 of these markets1. All products are produced in a state-of-the-art, fully automated warehouse that is one of the most modern factories in the world

HELL Beverages is one of the biggest energy drinks producers in the world1, and with a new team in place, it is changing how the brand is represented in the UK.

Hell’s range consists of Hell Energy and Hell Ice Co ee, and in the past few months it has appointed Barry Wilson as national sales manager, and Andy Pheasant as head of eld sales. Along with this is the appointment of a UK-based marketing agency to support its global campaigns.

“We will be massively upweighting our visibility in the UK, both within the trade and with consumers,” says Pheasant. “It’s a really exciting time for retailers to come and work with us with a ra of NPD and new initiatives coming quickly, the rst of which will be the world’s rst energy drink entirely created by arti cial intelligence, including the design, recipe and taste.”

Why stock it?

HELL Energy will attract new shoppers with its strong flavour range and great shelf standout, and appeal to retailers with its high PoR. It contains the usual 32mg/100ml ca eine, plus ve types of vitamin B, no preservatives and real sugar content. It is also non-HFSS, and in a 79p price-marked pack (PMP), it o ers a ordable premium quality.

Hell is tailoring its marketing to broaden appeal to UK consumers. This will include new social channels and digital assets for retailers. RTD co ee is growing in convenience ahead of the total market2, so a quality product at an a ordable price is a must-stock. Hell Ice Co ee is made from Arabica and Robusta co ee, with 75% UHT Milk, and is available in a £1.25 PMP can. A new Mocha variety will launch in the UK this month, bringing in shoppers a er a more chocolatey flavour pro le.

RETAIL BRAND SPOTLIGHT IN ACTION 12

bestsellers

is

123 Hell Energy Classic RRP: 79p PMP Hell Energy Black Cherry RRP: 79p PMP Hell Ice Co ee Latte RRP: £1.25 PMP

HELL ENERGY FOCUS ON: Three

What

Hell Energy?

What to know

HELL Energy should be merchandised in the energy drinks section of your soft drinks chiller. A good range of flavours helps to overcome barriers to consumption while o ering a broader appeal.

HELL Ice Co ee can be located with other RTD co ee and tea SKUs, but is also e ective next to self-service machines for impulse purchases. Range diversi cation can help to sustain growth.

BRAND blocking helps shoppers to identify what they need quicker. Free-to-hire branded chiller equipment is available to keep your range together and boost soft drinks sales.

Luke Singh Mander, The Three Singhs, Selby, West Yorkshire

“SINCE we introduced the Hell range we have seen really strong sales across both the Energy and Ice Co ee SKUs. We have installed a Hell-branded fridge and our customers love the colours and lighting on it, and they o en spend 30 seconds to one minute looking at the full range before making their choice. Hell has supported us with a branded giveaway that we put on Facebook to grow awareness of the range and drive interest in the brand. We have also dual-sited the core range in our main so drinks xture.”

9-22 APRIL 2024 betterretailing.com 13 In partnership with

RETAILER What’s new? 1 Bálint Fabók (27.06.21). “Hatalmasat nőtt, már harmadik a világpiacon a borsodi energiaital-gyártó” (in Hungarian). g7.hu. Retrieved 28.06.21 2 Nielsen Total GB incl. discounters vs Total Impulse, MAT val w/e 25.03.23 Please contact andrew.pheasant@hellenergy.com for more details and to see how the Hell team can power your sales, support you with PoS and o er ranging advice

MODEL and lm star Michele Morrone is the new face of Hell, with a ra of online adverts having hit the market this February.

Discover the food- and drinks-to-go offers that work for your store

How to make the most of spirits, RTDs and seltzers this summer

Pricewatch: see what other retailers are charging for chilled coffee, and boost your own profits

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

The aisles are wide enough for wheelchairs

CRIME: What impact are ongoing incidents having on your livelihoods?

“ONE of our supervisors got abused when she asked someone to leave the shop. She asked to take the day off because it was impacting her mental health, and you can’t say no. You’ve got to ask how they feel and whether they feel safe coming into work.”

Umar Majid, Baba’s Kitchen, North Lanarkshire

Listening to customers is key

DISPOSABLES: What’s your focus following the ban?

“WE are devastated about disposables. They are a huge part of our business. It’s created more questions than answers.

Trading standards and the police are underfunded, so this will open the path for illicit and counterfeits to grow.”

“THE challenge is our range is 100% disposables. We delisted all the refills. People weren’t asking for them. If they’re removing disposables, that’ll free up space and we’ll transition to refills.”

It will free up space and we’ll transition to refills

LAYOUT: How are you improving your customers’ journey in your store?

“THE first thing customers see is that our store is laid out nicely. There’s no mess on the floor, and we have music on so there’s a good ambience. The aisles are wide enough for wheelchairs and prams –people don’t feel like it’s tight and they have to rush around or get out of the way.”

Jag Singh, Premier Horsley Hill, South Shields, Tyne and Wear

“OUR customers see our vaping cabinet on the left and beer cave straight ahead, with the till sandwiched in between the two points of interest. One of our tills is selfcheckout, which has freed up a member of staff to walk the shop floor and make sure the everything is in good nick.”

Girish Jeeva, Girish’s Premier, Glasgow

My fiancée was involved in an armed robbery

COMMUNITY: How are you going above and beyond?

“WE deliver orders locally and we accept mail and deliveries from online stores for the villagers. We know everyone in the village and many in the surrounding ones. Village shops need to offer customers more than basic goods. Listening to customers is key.”

Camille Ortega McLean, Bulwick Village Store, Northamptonshire

“WE have a ‘Don’t suppose’ corner. As in, ‘I don’t suppose you sell fuses or plugs?’ We stock hardware and stationery products that people might need and not think we’ve got. Like an Aldi central aisle. We have fishing nets for the kids in the summer because they go tadpoling.”

Alison Thompson, Carlton Village Shop, Bedfordshire

14

OPINION

Trudy Davies, Woosnam & Davies News, Powys, Llanidloes

ing whether we want to

in

is the safety of myself

colleagues.

fiancée was

in an armed robbery. A previous knife incident took an officer four days to come out.”

Musselburgh COMING UP IN THE 12 APRIL ISSUE OF RN

Anita Nye, Premier Eldred Drive Stores, Orpington, south-east London

“IT certainly has us question-

work

retail. My biggest concern

and

My

involved

Dan Brown, Lothian Stores,

+

Wholesale Pricewatch: cider

STAY

GET AHEAD WITH RN betterretailing.com/subscribe To ADVERTISE IN RN please contact Natalie Reeve on 07824 058172

RN’s

At RN, our content is data-led and informed by those on the shop floor ORDER YOUR COPY from your magazine wholesaler today or contact Kate Daw on 020 7689 3363

+

INFORMED AND

3,451 retailers’ sales data analysed for every issue 69+ unique retailers spoken to every month 71% of

news stories are exclusive

‘Look regularly at your data, and trust it’

RETAIL is changing fast, trends come and go, but I think some, including Prime, are here to stay. In 1998, tentative steps were being made to sell hot food in shops that sold newspapers all day long. Fast forward to now and the food potential is huge, while newspapers are in decline. So, how do we prioritise

what we do?

Everyone will say look at your demographic. However, we have two very different stores, one af�luent and on the edge of the city centre, and the other near social housing and de�initely disadvantaged.

Why, if we redact the amount sold, are the top 20 lines virtually the same? This

COMMUNITY RETAILER OF THE WEEK

‘Ant and Dec recognised our work’

“MY parents, Sashi and Pallu Patel, have managed the store for 40 years and they got surprised on Ant & Dec’s Saturday Night Takeaway for their community work. The producers found us through our social media, and they managed to win themselves a holiday for all their e orts. My parents are always helping their community and host an annual Christmas party for those that don’t have plans. They are so grateful for being recognised in this way; it was such a great surprise.”

How to know when the time is right to sell up

I’VE now sold my Morrisons Daily store in Mickleton, Gloucestershire.

begs the question – are we overthinking what we do.

In an ideal world, everyone would be eating healthily and fresh produce would not sit on the shelves as gap �illers. A lot of grocery lines sell well until the date tells us otherwise.

The solution, I feel, is to look regularly at your data, invest in the pro�itable or

fast-moving lines and trust as much as possible what it is telling you.

Keep an eye on addedvalue services to your store, such as the parcel services, driving footfall and, last but not least, spend quality time on your social media.

Judith Smitham, The Old Dairy-Pydar Stores, Truro

COMMUNITY RETAILER OF THE WEEK

Richard Johnson, Premier – Peppers Family Convenience, Hucknall, Nottingham

‘Our new promo video has gone viral’

“WE had a re t done recently and we got Reel Productions involved to lm a fun video to promote the changes. The pair are known in the local area, and have done it for a few other businesses. They did a cover of Rick Astley’s popular song ‘Never Gonna Give You Up’, and changed the lyrics to t the theme of the store. It highlighted everything we now have, including our beer cave and food to go. We also got sta involved. You can watch it on our Facebook page.”

Each issue, one of seven top retailers shares advice to make your store magni cent

I had been there for 16 years and in that time I had got it to a place where it needed to be and I couldn’t see any more room for expansion and improvement. I had brought it to its peak and now it needed new energy, new ideas and a new trader. I’ve always preferred new ideas and things like that, and I found I was no longer excited by the store. I’ve got a young family and I want to spend more time with them, go on holiday without too much hassle and spend Christmas at home instead of in the shop. I still have Wilmcote Village Stores, where I’ve been for three years. There’s plenty more potential and growth opportunities in there. It will be a great project and I’ll be taking the lessons I’ve learned in Mickleton to Wilmcote.

It’s always an important question retailers should ask themselves: when is the time right to step back and move on? There are a lot of older retailers in our industry, but there’s so much good talent coming through and you have to ask yourself what your aspirations are for the future. It’s so important to talk to other retailers who’ve sold up. Their advice was invaluable for me.

When it comes to selling, you’ve got to make sure you give the symbol group the appropriate amount of notice – Morrisons required six months – and that you’ve got your bills and everything correct and in order. But, most importantly, you’ve got to have an idea of what your next step is. Don’t sell without having a plan and something to go onto.

We got a good price for the store, but we also wanted to make sure we were selling to the right people. So, I went and took a look around some of their other stores to look at their operations. I was looking at their store standards and how they interact with the community. But the most important thing was seeing how happy their sta were. A lot of my team are staying in Mickleton, so I wanted to look a er them.

15 betterretailing.com 9-22 APRIL 2024 Letters may be edited

LETTERS

Harj Dhasee Mickleton Village Stores, Gloucestershire

Deep Patel, Meet & Deep News, Twickenham, Greater London –@MeetAndDeep

Get in touch @retailexpress betterretailing.com facebook.com/betterretailing megan.humphrey@newtrade.co.uk 07597 588972

GET THE BEERS IN THIS SUMMER

CHARLES WHITTING nds out where the points of di erence can be found within a retailer’s beer and cider range

GETTING READY FOR SUMMER

BEER and cider are year-round mainstays for stores with alcohol licences, but it is in the summer months when the category really comes into its own. And retailers need to be getting their preparation work in now if they are to have the range and availability ready in time for customers.

“When thinking about what to stock over the warmer months, we recommend retailers stock around 70% apple and 30% fruit cider to get the balance right,” says Jonathan

Nixon, commercial director at Thatchers Cider. “You also want to think about giving customers a range of options so you have something for all cider drinkers.”

This summer brings plenty of opportunities and challenges. The Men’s Euros will see a huge surge in demand for beer and cider as people gather to watch England and Scotland compete for the biggest prize in Europe. And the longer these teams stay in the competition, the greater the demand will be

for sharing multipacks as people get excited and continue to gather to watch the matches.

“At the moment, it’s the mainstream brands,” says Anita Nye, from Premier Eldred Stores in Orpington, southeast London. “We sell 18-, 12- and 10-packs. And we do four-packs and singles of some of the more popular brands like Foster’s, Stella, Strongbow and Desperado. When it comes to cider, we sell the big bottles of Strongbow and Frosty Jack’s.”

The cost-of-living crisis will

impact beer and cider spend in stores. People are likely to choose drinking and socialising at home instead of the pub, particularly around the Euros, making sharing packs an even greater necessity.

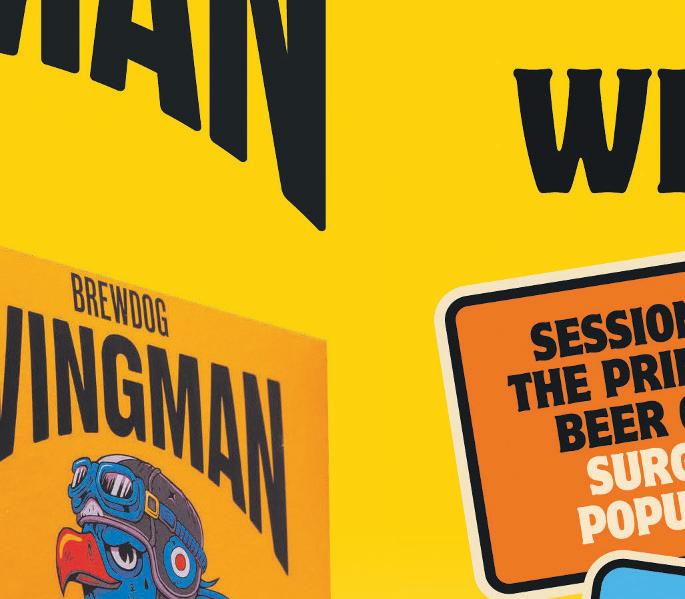

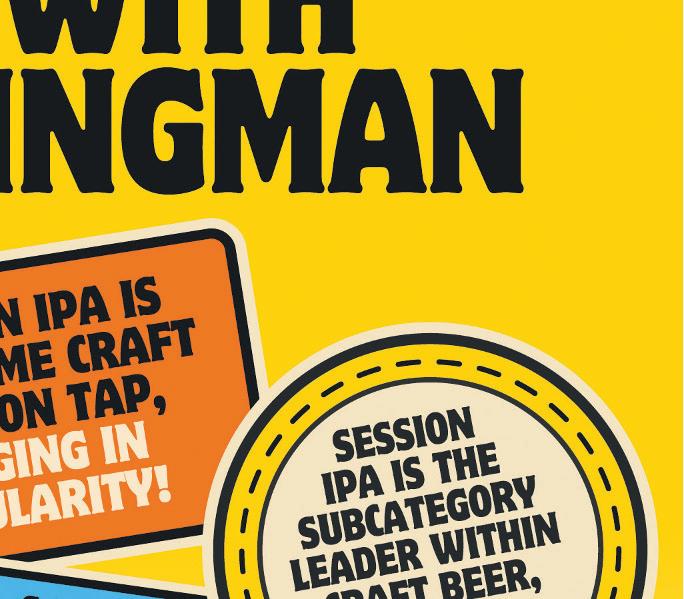

“Multipacks are a key growth driver for the category,” says Caitlin Brown, category executive at BrewDog. “We’ve placed our focus on mid-size multipacks, as they become more commonplace within the consumer repertoire, particularly for socialising.”

CATEGORY ADVICE BEER & CIDER 16 9-22 APRIL 2024 betterretailing.com

NEW a F ruity ADDITION TO OUR GROWING Cider FAMILY

A rich, refreshingly fruity cider created with the sweetest dessert apples, a fresh berry aroma and bold blackcurrant flavour. the

SUPPLIER

VIEW

John Price, head of marketing, KBE Drinks

“PAIRING beers and ciders with food is still an underexplored opportunity for retailers to consider when trying to drive incremental sales.

“With an increasing number of consumers making fewer visits to pubs, bars and restaurants at the moment due to ongoing nancial pressures, this almost certainly means more eating and drinking at home, where they will still want to make home meals as authentic as possible, which means matching their beer choice to cuisine. So, for example, if they are eating Indian food, then pairing it with authentic Indian beer brand King sher is a great idea.

“Retailers should respond to this trend with clearly sign-posted meal deals and inspirational ideas for pairing beers with food.”

TAKING THINGS A STEP FURTHER

WHILE mainstream brands are an essential cornerstone to a store’s overall o er, some retailers have taken things further, broadening their range to incorporate craft beers and brews from local breweries and cideries.

“We just put some new chillers into the shop, which has allowed us to widen our craft beer selection,” says Hardev Ruprai, from Ruprai Food & Wines in Birmingham. “We’ve

been doing it for ve years and we saw the market for it. We’ve got local beers, Belgian beers, US beers, the full range. We source them from independent and mainstream wholesalers.”

Joe Williams, from The Village Shop in Hook Norton, Oxfordshire, has a 175-year-old brewery in his village and is in a real ale area, which makes local and craft options a key part of his o er.

“We have three shelves of

craft beer and we use a local supplier called the Craft Drink Company based in Bourtonon-the-Water,” he says. “They do small, independent, local breweries, along with craft drinks across other alcoholic and soft drinks. Because we’re dealing with that one company, it’s easy to hit a minimum order rather than dealing with individual brewers.

“It tends to be amber ales and pale ales that people have

as a treat because the cost of everything has gone up. It’s little and often, a single beer mid-week rather than lling the basket.”

Williams hosts a beer festival every July which features more than 100 di erent beers and has boosted his store’s reputation, but he accepts that it wouldn’t work for every store.

“It very much depends on your area more than anything,” he says.

GOING LOW AND NO

THE increased demand for no- and low-alcohol beers has extended beyond Dry January and Sober October. Brands have responded and there are low-alcohol versions of most of the popular brands out there. For retailers, the increased normality of low- and no-alcohol options means hav-

ing a few lines available is no longer a point of di erence, but an essential part of your core range.

“Two- fths (40%) of adults say they are looking to moderate their drinking, therefore it’s more important than ever for retailers to consider stocking alcohol-free options,” says

Lauren Priestley, head of category development o -trade at Diageo. “With this in mind, we recommend stocking a few high-quality alcohol-free beer options. Research has shown that the alcohol-free beer category is currently worth £118m, so stocking a few alcohol-free beers is a must.”

Thatchers Apple & Blackcurrant

Thatchers has expanded its fruit cider range with the addition of an Apple & Blackcurrant variety. The new flavour has a 4% ABV and is available in 4x440ml (plain with a £5.89 RRP and £6.69 pricemarked) and 10x330ml can packs, and a single 500ml glass bottle (£12 and £2.25, respectively).

Strongbow Zest

Heineken UK has launched Strongbow Zest, blending the apple cider with lime, lemon and orange flavours. Available in 4x400ml, 500ml and 10x330ml formats, it has a 4% ABV.

BrewDog Wingman

BrewDog has launched a new session IPA. Wingman has a 4.3% ABV. Formats available include single 440ml can (RRP £2.50), 4x 330ml can multipack (RRP £6.25) and 12x330ml can (RRP £16.50).

Foster’s Proper Shandy

Heineken has launched a new Foster’s variety with a lower 3% ABV. Foster’s Proper Shandy is available in 440ml cans in packs of four and 10, with respective RRPs of £3.75 and £9.25. The lower ABV caters to the 40% of adults who say they want to moderate their drinking, according to Kantar.

CATEGORY

18 9-22 APRIL 2024 betterretailing.com

ADVICE BEER & CIDER

new products

NEWBRAND 2024!FOR

your store have stand-

eye-catching displays to clear labelling and clever crosspromotions, effective merchandising and display is about helping your shoppers make quick and easy buying decisions and encouraging them to try new products.

SOME HELP? Contact: marketing@newtrade.co.uk or call Kate Daw on 07886 784465 Not sure about Merchandising & In-store Display

have seven other exciting categories to enter, from Retail Innovation to being a Community Hero and everything inbetween. Find the full list at betterretailing.com/ Awards-2024 or scan below: MERCHANDISING & IN-STORE DISPLAY AWARD AWARDS PARTNERS Sponsored by Mondelez International

Does

out displays and first-class merchandising? If the answer is YES, enter the Better Retailing Merchandising & In-store Display Award and gain the recognition you, your store and your team deserve. From

NEED

We

MAKE YOUR STORE A SWEET SPOT

CHARLES SMITH

CHARLES SMITH

Retailers of all sizes can make their store a ‘go-to’ for chocolate all year round, writes

THE CHOCOLATE OPPORTUNITY

CHOCOLATE is the ultimate affordable feelgood treat, bought by all demographics. Whatever size your store, it’s possible to make it a chocolate go-to by creating a highly visible range of impulse lines, single bars, sharing bags, tubs and gifting boxes, featuring old favourites and new products, with di erent price points.

Chocolate confectionery makes up two- fths of the

£13.3bn treating and snacking category, and it’s driving total confectionery growth. Data from NIO, formerly Nielsen, shows singles took 30% of chocolate in 2023, and are growing at 9%. Sharing products are growing, too, with multipacks up 12%. The leading sharing tubs are Celebrations, Cadbury Heroes and After Eight.

Parental concern about

their kids’ sugar consumption is reportedly a ecting sugar confectionery purchases. Kantar’s research shows one in ve people don’t buy chocolate due to a perceived lack of healthier options, but reduced sugar and free-from products are winning fans.

Vegan Society-approved products don’t just attract lactose-intolerant chocolate lovers, they’re trending with

vegans, vegetarians and flexitarians. Free-from chocolate grew nearly 50% in 20202022, albeit from a low start. Meanwhile, Rainforest Certied cocoa claims and environmentally friendly packaging attract rising numbers of shoppers concerned about provenance and sustainability. That said, the bulk of purchases in independent retailers are still ‘mainstream’ chocolate.

“CHECK you have the core range for your store size and listen to reps and wholesalers’ recommendations. Sweat the space, and make sure everything’s current, with new brands and products, and keep shelves rammed with stock. Look at it from the customer’s point of view, and make the decision process easy. These are fast-moving lines, so ensure the layout is conducive to the customer journey.

“Optimise shoppability and make things easy to nd. Block brand families together. With single bars, put the bestsellers at eye-level and kids’ products towards the bottom. Multi-bars are moving to a range from £1.35£1.99, so o er these at di erent price points, and keep them with crisps.

“To get extra sales, highlight new products and seasonal sellers with secondary sitings and dump bins. Include chocolate in your delivered range, and promote it online.”

CATEGORY ADVICE CHOCOLATE 20 9-22 APRIL 2024 betterretailing.com

Sid Sidhu, St John’s Budgens, Kenilworth, Warwickshire RETAILER VIEW

Have you been affected by the recent Floods? Are you struggling to stay warm and cover your heating bills during the colder weather? For more information visit www.newstraid.org.uk call us FREE on 0800 917 8616 or email mail@newstraid.org.uk NewstrAid is here to help and can provide FINANCIAL, EMOTIONAL and PRACTICAL support to retailers and their staff this winter.

CATEGORY ADVICE CHOCOLATE

WHERE TO STOCK YOUR CHOC

IN smaller shops, it’s best to keep chocolate at the till, with another station in a separate bay with sugar confectionery. Core chocolate sales are likely to be impulse buys of singles and duos in the daytime, with bigger options such as Celebrations, Lindor, Dairy Milk, Ferrero Rocher and Thorntons bought in the evening.

“Consumers want ever more convenient ways to shop, and ‘at my convenience, not yours’

is a trend we’re increasingly seeing,” says Matt Boulter, Mars Wrigley’s UK sales director.

Sid Sidhu, from Budgens St John’s in Kenilworth, Warwickshire, has created separate areas for di erent chocolate formats.

“We have sharing bags by the checkout, single bars in the next aisle and gifting in the back by the cards, toys and fresh flowers,” he says. “We’re

not a ected by HFSS, but we don’t have kids’ products by the till.”

Sidhu also has a dedicated gifting section to drive further sales, with a range of premium brands including Green & Black’s, Lindt, Ferrero, Guylian, and a carousel with personalised Toblerones.

“We also have Rainforest Alliance-certi ed products and a range of ‘friendly’ and freefrom ones, including Moo Free

and one from a specialist supplier,” he says. “We have some reduced-sugar options, too, but they’re slow sellers.”

Kam Nijjer, whose Budgens Meriden in Coventry is 1,400sq ft, has a three-metre bay by the door, and impulse lines on the counter.

He says: “Shoppers are always looking for new things. They’re price-conscious, but want the quality to stay the same.”

RETAILER VIEW

Matt Boulter, UK sales director, Mars Wrigley

Address the di erent ‘need states’ in your range. Singles are strong impulse on-the-go items, so secondary-site them with other food to go or nightsin treats.

Place core sellers in the main xtures. Nearly half (45%) of confectionery products are picked up from there. Eighty-one per cent of chocolate consumers would like to see all chocolate products grouped in the chocolate aisle.

Placing bestsellers at eye-level has been shown to boost sales by up to 20%, while use of engaging PoS plays a large role in increasing basket spend.

THE IMPORTANCE OF VALUE

SELF-TREATING often brings people in, while many others will buy chocolate on impulse while shopping for other essentials. Sharing and gifting are major purchase drivers, with products linked to Easter, Christmas and other occasions. In the cost-of-living crisis, entertaining at home has driven sales of sharing packs and tubs year-round. However, when it comes to sharing bags or single bars, price is becoming even more

important. Sharing bag sales are growing in part because customers want to get better value for money by buying in bulk. PMPs account for 96% of treat bag sales, with a spokesperson from Lindt & Sprungli saying 63% of consumers believe PMPs suggest they’re not being overcharged. “PMPs are important,” says Sidhu. “You need a mix across the sectors – single bars, duo bars, sharing bags and multi-bars, which are

moving to a price range from £1.35-£1.99.”

Hitesh Modi, from Londis BWS in Chesham, Buckinghamshire, agrees, stating that PMPs are selling better than standard packs, with the big brands still dominating sales.

“Our chocolate sales have stayed consistent over the past few years,” he says. “We make less on PMPs, but consumers want to feel they’re not being cheated, so we focus on those.”

Secondary siting by the till and PoS boosts awareness and sales of new products.

Cross-merchandise linked products by the chocolate xture, like Baker & Baker and Cadbury fresh cookies in-store bakery range, including new Mini Eggs cookies.

Stay up to date with manufacturers and wholesalers’ planograms and ranging advice, and refresh xtures at the end of major seasons such as Christmas and Easter.

22

WHILE shoppers tend to go for mainstream impulse products, it’s important to have a choice of di erent flavours as well to keep people interested. While customers will be focused on price when it comes to known quantities, new releases and products they’ve not been able to get elsewhere can often justify a higher price and margin.

“The biggest flavour for us recently is caramel,

especially Galaxy Caramel,” says Modi.

In addition, Modi says KitKat White Bisco is selling well, and so is McVitie’s Gold Billion Bar, which comes in a 60p PMP. Modi mixes this array of new launches with products you can’t nd everywhere else.

“We have US chocolates like Hershey’s bars from time to time, along with other US soft drinks,” he says.

WHAT’S

Cadbury Dairy Milk & More

Mondelez’s Cadbury’s latest launch, Cadbury Dairy Milk & More, has larger chunks than standard Cadbury Dairy Milk 180g, and comes in two flavours: Nutty Praline Crisp and Caramel Nut Crunch. They have an RRP of £2.75 for a 180g pack.

Limited-edition Dairy Milk

Mondelez is also marking Cadbury’s 200th anniversary with limited-edition Dairy Milk bars with retro packaging in seven collectable designs. They come in 200g packs with an RRP of £2, and 95g PMPs with an RRP of £1.35.

Aero Choco-hazelnut

Nestlé Confectionery has launched a new Aero Choco-hazelnut flavoured bar. It is 90g and has an RRP of £1.35. Nestlé has also launched a 145g Aero Peppermint sharing bar, and is introducing Kitkat White four- nger and Chunky variants.

23 9-22 APRIL 2024 betterretailing.com

NEW IN CHOCOLATE Keep shoppers happy by featuring the latest innovations USE NOVELTY TO DRIVE SALES

SCAN HERE TO ENTER *18+ UK. Open between 13:30 BST 1st February 2024 – 23:59 BST 30th June 2024 to Independently owned convenience stores and forecourts (unaffiliated or affiliated to a symbol group) only. Excludes centrally managed and owned convenience stores and forecourts (‘Partcipants’). Go to Snackdisplay.co.uk and fill out the entry form, describing your retailing idea in no more than 300 words. Additional documentation of upto 5MB and/ or a photograph of up to 5MB may also be uploaded (optional). It is the Participants responsibility to ensure ideas can be made public and shared publicly. All ideas submitted may be made public and available for other Participants to use. Participants can enter more than one idea, only one prize per store. Ideas will be judged based on the following criteria: Scalability and Adaptability, Impact, Ingenuity and Clarity. A panel of judges will select the winning ideas, awarding one top winning idea, cash prize of £5000 and 10 runner up ideas, cash prize of £1000. The judging panel will consist of an independent judge. The judge’s decision is final. No dialogue will be entered into. Where ideas are duplicated the first application received will be viewed by the judges and duplicate ideas will be entered into the random draw. All other entries will be placed into a random prize draw for 20 prizes of £500 cash each. Mondelez reserve the right to indefinitely use and publicise the ideas entered submitted in the competition from the time of receiving the entry forms. Winners will be contacted for promotional and PR purposes subject to agreement. Winners will be contacted by the Promoter by email within 14 days of the judging day and will have 14 days to formally accept the prize. Delivery of the prize will take place within 28 days of prize acceptance. For full terms and conditions go to snackdisplay.co.uk. Promoter: Mondelez Europe Services GmBH- UK Branch, Uxbridge Business Park, Sanderson Road, Uxbridge, UB81DH. ANITA has introduced a loyalty card where shoppers earn a stamp for every £10 they spend in-store Simply share your great retailing idea – however big or small it may be – via the QR code below to be in with a chance of winning

PREPPING FOR THE SUMMER SEASON

TAMARA BIRCH talks to retailers about getting the right summer remedies in store for their customers

WHAT SUMMER REMEDIES SHOULD YOU FOCUS ON IN 2024?

THE UK summer is hard to predict. In 2022, the UK experienced highs of 40oC in the height of summer, but in 2023, this was largely replaced by rain. This makes preparing for summer remedies quite the challenge for convenience retailers.

However, there are shopper missions that remain the same, no matter the weather, like remedies for allergies and hay fever. Visits to the hay

fever NHS website tripled in 2023, reaching 27,834 visits in 24 hours. According to Matt Stanton, head of insight at DCS Group, allergy and hay fever remedies are currently worth £4.5m and are growing by 8% year on year.

“There are two clear allergy peaks: tree pollen in April and grass pollen in June,” he says.

“Seventy-four per cent of allergy remedy sales are between March and August.”

With more people travelling than ever before, retailers should make sure to have travel essentials available – especially if they are near a train station or an airport. These include travel sickness remedies, anti-diarrhoea tablets and eye drops.

“Anti-diarrhoea remedies, such as Imodium, increase in summer as many Brits go abroad on holiday,” adds Stanton. “The barbecue season

also drives an increase, too, with people eating and drinking a little too much. Indigestion remedies are important for these shoppers, too, so make sure you’re stocking Gaviscon and Rennie.”

Retailers also have an opportunity to drive sales and meet summer shopping missions by stocking suncream, and sting and bite remedies, as these distress purchases grow signi cantly in summer.

SUPPLIER VIEW

Matt Stanton, head of insight, DCS Group

Key Dates

31 March –27 October

British summer time

“THE availability of GP appointments is under pressure, so people are opting to self-treat with over-the-counter remedies, which is leading to overall category growth. Allergy is in long-term growth, and in recent years the hay fever season has lasted 10 days longer than average and dealt us 21% more pollen. Urbanisation is increasing our likelihood of developing atopic conditioners, such as hay fever and asthma. The growth is expected to continue into the 2024 season.”

CATEGORY ADVICE SUMMER REMEDIES 24

WHAT ARE THE KEY PRODUCTS TO STOCK?

“THE most important products to have on shelf are onea-day anti-allergy tablets, ‘instant’ anti-allergy tablets, a decongestant nasal spray, decongestant tablets and eye drops,” says Matt Stanton. Becoming a one-stop shop for hay fever relief will help grow repeat visits from customers, and ensuring they are all merchandised together makes for an easier shopping experience. Nishi Patel, owner of Londis Bexley Park in Dartford, Kent, has also included hay fever wipes in his range.

“Hay fever wipes are a growing product for us,” Patel says. “I su ered for the rst time last year, as did many others, and I tried the wipes and they were really refreshing.”

Patel also recommends putting some in the fridge to make them even more refreshing. Patel also stocked a range of sprays, tablets and cream for your nose to ensure there’s something for everyone. A range of tissues encourages link spending.

The season brings more social occasions, so demand

for convenient and on-the-go solutions will increase. Products such as lozenges can be stocked on clip strips to minimise space and enable you to stock more.

Paresh Vyas, owner of Jack Lane Convenience in Manchester, has started to stock natural honey due to its natural health bene ts.

Claire Campbell, senior brand manager, Olbas

Vyas advertises the honey pots in store through posters, but also on Facebook and in the local area.

THE BATTLE BETWEEN BRANDED VS OWN LABEL

WITHIN summer remedies, branded tends to be a bigger seller for convenience retailers. Patel utilises pre-sales from Londis to get the best price possible, o ering his customers a choice between an own label and a more premium, branded option.

“Some shoppers have better relief from di erent options,” he explains. “We stock Clarityn, and some will only buy this. However, other custom-

ers have said own label is exactly the same.”

Vyas also stocks a selection of branded and own label, and tells customers they can save money by buying an ownlabel option.

“Most of the ingredients are the same and customers appreciate it if we tell them there’s a cheaper option available. They are also more likely to come back.”

Both retailers say custom-

“Menthol lozenges – such as Jakemans – are a vital product to stock to soothe the symptoms of a sore or tickly throat and to help keep airways clear,” says Elizabeth HughesGapper, senior brand manager at Jakemans. “Consumers hold expertise, trust and reputation highly when it comes to choosing their brand.”

ers prefer branded options over own label for allergy relief, but Vyas adds that own label is a stronger seller for cold and flu remedies.

“The RRP on branded cold and flu products, like Lemsip, is quite high and customers don’t want to pay that. We advise them that both products will have the same e ect,” he says. “Some will still buy Lemsip, though, because they trust the brand.”

“WHILE many of us automatically associate cold and flu with colder weather, there are some viruses that do the rounds in the summer, along with the added complication of hay fever. Brits are always keen to make the most of their summer time, so a quick remedy to the summer sni les is really important.

“I reached out to our local garden centre, who have al- garden centre, who have allowed us to trial some of their honey in our store. We bought them on a sale-or-return basis, so there’s no risk for us.”

“Making sure one’s range of summer remedies is all-encompassing and covers most symptoms will stand retailers in good stead as they head towards the summer months. Preparing to address the common complaints that come with seasonal allergies and summer colds will make sure consumers can nd what they’re looking for.

“It is important to make the products that alleviate congestion associated with seasonal allergies readily accessible for consumers. They are looking for a quick solution, so making sure they are standing out is important.”

KEEP YOUR REMEDIES SAFE

THERE’S long been a debate around where to stock your summer range – behind the till, where it’s safe, or on the shop floor, where people can see it. Most retailers have moved their range onto the shop floor, as it helps sales, but close by to keep it secure.

“We moved it to the shop floor when I took over the store from my dad and sales increased signi cantly,” Patel explains. “It has to be in the right location, so you can

see what’s going on.”

Vyas moves his summer remedies range to the shop floor just for the summer season, using a gondola end to help it stand out.

“Outside of the hay fever season, it’s behind the till. It’s not just for security, but also to be a responsible retailer.

“We have a lot of school children and don’t want one of them getting their hands on paracetamol or ibuprofen,” he says.

25 9-22 APRIL 2024 betterretailing.com

SUPPLIER VIEW

A BREAKDOWN ON THE DISPOSABLES BAN

PRIYA KHAIRA explains everything retailers need to know ahead of the upcoming ban in April 2025

AN OVERVIEW

THE UK government rst announced its plans to ban disposable vapes on 29 January 2024 as part of new measures to restrict the category and crack down on youth vaping. Since then, the UK government has stated that a disposable ban will come into e ect by the end of April 2025 at the latest.

The Scottish government has con rmed that a ban will come into e ect for Scottish retailers on 1 April 2025, alongside a statement claiming that the UK has “worked

together to agree on a date for when the ban will come into force, to provide certainty for businesses and consumers”.

There has not, however, been an announcement to conrm a start date for the ban from any other government as of yet. However, the UK government has con rmed that businesses will receive a sixmonth grace period, allowing time for businesses to adapt to new regulations. All of this has prompted suppliers, retailers and customers alike to seek answers

and come up with plans for the future. 2023 saw the highest number of Google searches for ‘disposable vapes’ since records began, while David Skopinski, from GoSmokeFree. co.uk predicts that disposable vape users will stockpile supplies of their favourite products and flavours as the ban date approaches.