As yet another shopkeeper dies, and just one in four assault and abuse reports ends up in court, stores demand changes to tackle growing distrust of retail policing

Trade bodies call for funding to prevent independents being cut out

Retailers urged to be vigilant against e-liquids posing as Ribena brand

Retailers share tips on making the most of medicines during the colder months

NEW

BOT TLE

STOCK

NOW ENJOY RESPONSIBLY.

EDITION

STEFFLON DON CHIVAS REGAL D ON

UP

P4 P30

DEPOSIT RETURN SCHEME

P2 VAPING

5-18 SEPTEMBER 2023 STRICTLY FORTRADEUSERSONLY

WINTER REMEDIES

P3

‘WE WANT JUSTICE’

The leading magazine for retailers selling vape products

CHARGE YOUR VAPE SALES WITH VAPE RETAILER

COMING UP IN THE OCTOBER ISSUE OF VAPE RETAILER

• What to stock: the most sought-after products in next-gen nicotine and the functions they serve

• Nicotine pouches: how retailers can grow their nicotine pouch customer base through education, information and guidance

• What’s new in open systems: getting to grips with the latest tech in open-system vapes, and how to manage a successful category

PLUS

Regional trends: the bestselling e-liquid pods across the UK

Quick guide: CBD e-liquids

And much more!

Order your copy from your magazine wholesaler today or contact Marketing on 020 7689 3363

To advertise in Vape Retailer, please contact Natalie Reeve on 020 7689 3372

Follow us on Twitter: @Vape_Retailer

ON SALE

9 OCTOBER

HALLOWEEN & BONFIRE NIGHT How to boost confectionery and alcohol sales during this seasonal period CATEGORY ADVICE HALLOWEEN & BONFIRE NIGHT 24 SEPTEMBER betterretailing.com bene seasonal and holidays, Halloween Night bigger range portunities reboost sales range categories. years, Halloween gained the UK. Although took pandemic, search demonstrates 2021, spending for Halloween products the increased to According consumer on Halproducts reach £777m alone. THE OPPORTUNITYHALLOWEEN GENERATE SALES THIS SPOOKY SEASON PRIYA KHAIRA nds out how retailers can boost sales over the Halloween and Bon re Night period P24 DEPOSIT RETURN SCHEME P4 P30 Retailers share tips on making the most of medicines during the colder months P2 VAPING Retailers urged to be vigilant against e-liquids posing as Ribena brand WINTER REMEDIES 5-18 SEPTEMBER 2023 STRICTLY FORTRADEUSERSONLY Trade bodies call for funding to prevent independents being cut out P3

As yet another shopkeeper dies, and just one in four assault and abuse reports

ends

up in court, stores demand changes to tackle growing

distrust

of retail policing ‘WE WANT JUSTICE’

Alex Yau, acting editor

in

demand

A RECENT trip to my hometown had me visit the newsagent on the street where I grew up for the rst time in 16 years. The previous owner, Mr Singh, no longer runs the business, and it has since been refurbished from an una liated store to a Family Shopper.

Heading inside gave a clear image of how customer demand and convenience stores have changed in nearly two decades. An extensive magazine section where I remember browsing titles such as the O cial PlayStation Magazine and WWE Sticker Collection has been reduced and replaced with impulse products.

The back of the shop had a deli counter, where I would get freshly made sandwiches or ask for a Pot Noodle to be lled with boiling water during my school lunch hour. This was mostly unchanged, with a fresh bakery remaining. It appears Mr Singh could see into the future, predicting the eventual growth of food to go in local shops.

Despite not stepping into the shop for 16 years, I still had clear pictures in my head of what the shop was like. This nostalgic trip also highlights the impact local shops have and the impression they make on their communities, even on residents who have long since le .

The ve biggest

SUNTORY Beverage & Food GB&I (SBF GB&I) has threatened to crack down on retailers found selling dodgy ‘Rybena’ e-liquids.

Messages sent to retailers by the soft drinks supplier, seen by Retail Express, said it had joined forces with trading standards after �inding an “increasing volume of blackcurrant-

THE TRIP HIGHLIGHTS THE IMPACT LOCAL SHOPS HAVE ON COMMUNITIES

This issue marks the end of my stint as acting editor, as my colleague Megan Humphrey has returned from her sabbatical. Although Retail Express returns to her more-than-capable hands, my involvement doesn’t end here, and I will continue ghting the corner of independent retailers.

@retailexpress

�lavoured vaping” products imitating its popular Ribena brand.

It said: “As you will understand and appreciate, these are not of�icial Ribena products, and have no connection to [SBF GB&I].

“We are now working with trading standards to take enforcement action against retailers selling such vaping products.

“As well as infringing on

Allwyn contract

Ribena’s intellectual property rights, in many instances, the vaping products do not comply with the UK legal regulations and therefore pose a risk to users’ health.”

SBF GB&I demanded that any retailer selling the copycat product to stop immediately, and for store owners to report others they know to

be selling it.

An SBF GB&I spokesperson said: “We will pursue all possible action to protect independent retailers and consumers from unsafe and counterfeit products.”

ce service

Editor Megan Humphrey @MeganHumphrey 020 7689 3357 Editor – news Jack Courtez @JackCourtez 020 7689 3371 Editor in chief Louise Banham @LouiseBanham Features writer Priya Khaira 020 7689 3379 Features editor Charles Whitting @CharlieWhittin1 020 7689 3350 Production editor Ryan Cooper 020 7689 3354 Sub editor Jim Findlay 020 7689 3373 Sub editor Robin Jarossi Head of design Anne-Claire Pickard 020 7689 3391 Senior designer Jody Cooke 020 7689 3380 Junior designer Lauren Jackson Production coordinator Chris Gardner 020 7689 3368 Head of marketing Kate Daw 020 7689 3363 Head of commercial Natalie Reeve 020 7689 3367 Senior account director Charlotte Jesson 020 7689 3389 Commercial project manager I y Afzal 020 7689 3382 Account director Lindsay Hudson 020 7689 3366 Account manager Megan Byrne 020 7689 3364 Management accountant Abigayle Sylvane 020 7689 3383 Managing director Parin Gohil 020 7689 3388 Head of digital Luthfa Begum 07909 254 949 our say

Features writer Jasper Hart 020 7689 3384 @JasperAHHart 41,206 Audit Bureau of Circulations July 2021 to June 2022 average net circulation per issue Retail Express is printed and distributed by News UK at Broxbourne and delivered to news retailers free by their newspaper wholesaler. Published by: Newtrade Media Limited, 11 Angel Gate, City Road, London, EC1V 2SD; Phone: 020 7689 0600 Reproduction or transmission in part or whole of any item from Retail Express may only be undertaken with the prior written agreement of the Editor. Contributions are welcome and are included in part or whole at the sole discretion of the editor. Newtrade Media Limited accepts no responsibility for submitted material. Every possible care is taken to ensure the accuracy of information. No warranty for goods or services described is implied. Subscribe online at newtrade.co.uk/our-products/ print/retail-express. 1 year subscription: UK £65; overseas (EU) £75; overseas (non-EU) £85 Retail Express’ publisher, Newtrade Media, cares about the environment.

NATIONAL Lottery products sold online by retailers will be restricted to either 10 games or a total sales value of up to £50 per customer.

Specialist reporter Dia Stronach 020 7689 3375

The terms were highlighted in Allwyn’s new retailer agreement, which independ-

For the full story, go to betterretailing.com and search ‘Allwyn’

government consultation launched on 14 August also recommended including ad-

For the full story, go to betterretailing.com and search ‘Tobacco’

THE Post Of�ice (PO) has promised to pay all subpostmasters a share of pro�its from its new online parcel sales service.

uk allows customers to pur-

chase Evri and DPD parcel services directly from the company, for drop off at branches. Despite the pledge, PO warned that the system may not make “signi�icant” pro�its in its �irst year and will require more promotion.

Several retailers reported the issues to Retail Express, claiming the more

environmentally friendly vehicles were unable to navigate through restricted roads, bridges and country lanes. They added they were unable to get alternative supply, due to other wholesalers experiencing “capacity issues”.

ALEX YAU

betterretailing.com facebook.com/betterretailing

stories

01 02 03 04 05

Retailers warned about rise in dodgy ‘Rybena’ e-liquids Post O

this fortnight

Delivery strain

SOME rural store owners have had deliveries from Booker cut off, due to the wholesaler’s switch to larger and more sustainable lorries.

ent store owners welcomed as a way of levelling the playing �ield against the multiples. Stores are also forbidden from offering customers substitute scratchcards, and must display legal warnings on sales pages.

Trip to old newsagent showed change

Tobacco legislation

STORES could lose out on £2.25m in pro�it every year, if proposals to include antismoking messages in cigarette packets go ahead. Acting editor Alex Yau @AlexYau_ 020 7689 3358

A

vice in packaging. According to estimates from the Department of Health, stores would lose £2.25m each year for the �irst 10 years, dropping to £900,000 if the restrictions are forced only on rolling tobacco.

A new website called parcelsonline.postof�ice.co.

For the full story, go to betterretailing.com and search ‘Booker’

For the full story, go to betterretailing.com and search ‘Post O ce’

For the full story, go to betterretailing.com and search ‘vaping’

GOOD WEEK

More action demanded to tackle rising shop crime

ALEX YAU

RETAILERS have called for changes to the justice system, following the death of a store owner and new �igures that reveal only a quarter of reported shop crimes were prosecuted.

Last month, Police Scotland con�irmed Best-one retailer Bashir Ahmed passed away following a shoplifting incident and assault at his store in Newtongrange, Midlothian. Emergency services arrived at the shop at around 7pm on 18 August, where he was pronounced dead at the scene upon their arrival.

Sources close to the family alleged he suffered a suspected heart attack after an assault in an attempt to prevent shoplifting.

Police Scotland told Retail Express a “female youth” had been reported to Scottish prosecutions body the Procurator Fiscal (PF) for shoplifting and assault. The individual is under 18 and has not been arrested. The police are treating the incident as unrelated.

“The death is being treated as unexplained, and enquiries into the circumstances remain ongoing,” a police spokesperson added.

A week before Ahmed’s death, Dan Brown, of Pinkie Farm Convenience Store in Musselburgh, was the victim of an assault and received stabbing threats during a shoplifting incident. Brown said the police were

unable to attend the incident and asked him to book an appointment instead. Posting about his experience on social media, Brown wrote: “Will I be booking my appoint from hospital next time?”

Speaking to Retail Express, Brown had criticised the criminal justice system as a deterrent. He said: “I have 15-to-25 incidents of store crime a day, and the reality is that nothing will happen. I try to keep staff out of it and not confront shoplifters because it puts us in danger. There’s more at risk than just stolen goods.”

“There have been situations where I’ve been called to court as a witness and have seen people on the dock come to my store later in the same day. I’ve been to court on 30 occasions, but there have been times where I’ve never seen the court room because I’ve been told to go home. Retail crime is massively underreported.

“There’s not really any deterrent out there, but I also see the challenges the police have in lack of resources. I used to have �ive community of�icers and a community watch group, but there’s just one community of�icer now.

I’m disappointed in the response times we get, but I also understand the police are struggling and it’s part of a larger issue. The government and justice systems need to do more.”

Brown’s experiences with shop crime come as more than 7,000 cases of abuse and assaults were reported to Police Scotland under the Protection of Workers Act, which came into force in August 2021.

A similar law was introduced in England in June last year, meaning common assault against anyone working in a retail environment is classed as an aggravated offence, carrying harsher penalties.

The Scottish Grocers Federation’s (SGF) head of policy and public affairs, Luke

McGarty, told Retail Express that 1,904 shop crime incidents out of the 7,000 had gone to court during the two-year period, meaning around one in four reported crimes led to prosecution.

He said: “The SGF will be pushing to �ind out what the conviction rates of those prosecutions are. Retailers will only want to report crime if they are con�ident there will be a followthrough. Shop crime has a huge impact on retailers, and the reality is that it has a human cost.”

Meanwhile, in England,

SYMBOLS: Lioncroft Wholesale is to oversee the development and rollout of the Lifestyle Express fascia throughout England. The rm’s chief executive, Jason Wouhra, told Retail Express the “tired” brand would receive a refresh as part of a new retail club, hinting at investment in areas such as food to go.

For the full story, go to betterretailing.com and search ‘Lifestyle Express’

READY MEALS: Retailers have an opportunity to take £100 of additional weekly sales by partnering with renowned restaurateur Praveen Kumar. The chef is looking to partner with thousands of local shops for a frozen meal concession of his award-winning Indian cuisine, similar to Cook’s o ering.

For the full story, go to betterretailing.com and search ‘Praveen Kumar’

BAD WEEK

home secretary Suella Braverman pledged to have every theft investigated. However, retailers and the National Police Chief’s Council were all skeptical about the promise due to already overstretched resources.

Terence Ford, of One Stop St Johns Road in Cambridgeshire, welcomed Braverman’s pledge, but stressed there was concern that police wouldn’t be able to follow through with the home secretary’s demands, due to “budget cuts across the board”.

BUSINESS RATES: Retailers in England will face a nancial penalty, unless they notify the Valuation O ce Agency of alterations to their store’s physical property or lease within 60 days. The changes will impact all store owners, including those who get rates relief or exemption on their property.

For the full story, go to betterretailing.com and search ‘business rates’

VAPING: The ACS has warned of an increase in customers asking legitimate retailers for illicit products over the legal 2ml e-liquid limit. The body’s chief executive, James Lowman, said: “We have materials available for retailers to communicate the rules to customers.”

For the full story, go to betterretailing.com and search ‘vaping’

03 betterretailing.com @retailexpress facebook.com/betterretailing alex.yau@newtrade.co.uk 020 7689 3358

5-18 SEPTEMBER 2023

Become a PayPoint Park Super Agent! Sign up today! Scan here or visit paypoint.com/parksavings Exclusive opportunity in partnership with the Fed for members only! Potential earnings in excess of £1,000* per year!* Bundle deal includes PayPoint Services, Park Savings and Collect+ Service. Extensive marketing support * Terms and conditions apply. Visit paypoint.com/parksavings

DRS funding urged for small shops

ALICE BROOKER

SMALL shops will be “out of pocket” unless they are given grant funding to support the estimated £1.8bn required to roll out the UK’s deposit return scheme (DRS), the Fed has warned.

The £1.8bn figure, estimated by the British Retail Consortium, covers the cost of reverse vending machines (RVMs), labour costs, staff hours run-

ning the scheme, store modifications and lost sales due to store space being taken up.

According to Fed national vice president Mo Razzaq, the estimated figure favours supermarkets, which have more resources to support DRS on its expected implementation date of October 2025.

He said that although the trade body supports the upcoming legislation, he added that it has also “consistently

refused to accept that retailers should be out of pocket for implementing it”.

“Grants must be made available for the purchase of expensive equipment and any changes to the layout of shops that are forced to become return points for the scheme,” he said.

Razzaq called for a system reflecting the Republic of Ireland’s, where local shops are to receive grants of €6,000 to help fund the installation of

RVMs. UK grants could also help retailers shoulder the initial startup costs.

He added: “As we have seen in Scotland, unless a wellthought-out, workable scheme is brought forward, with meaningful consultation and financial support for retailers, any proposed DRS will fall at the first hurdle.”

The £1.8bn estimate does not include the cost of setting up a body to run the scheme.

Costco expansion

COSTCO plans to open 14 depots, making it one of the UK’s biggest cash-and-carry companies.

The plans, announced by The Sun, would give Costco 44 depots, 13 shy of Bestway’s.

Targeted locations for the

sites are Chelmsford, Colchester, Exeter, Oxford, Cambridge, Maidstone, Brighton, Portsmouth, Bournemouth/Poole, Preston, South Glasgow, southeast London, Wolverhampton/north-west Birmingham and south-west Birmingham.

RETAILERS have been warned not to sell slush drinks to children under four, after a chemical in the product has led to several being hospitalised.

The Food Standards Agency issued advice last month urging that slush drinks containing glycerol should be agerestricted.

The ingredient has been linked to intoxication, dangerously low blood sugar and loss of consciousness when overconsumed.

Confectionery import

RETAILERS will soon get access to hundreds of confectionery lines imported from North America and Europe at “competitive prices”.

Confectionery retailer SoSweet is to open a wholesale arm, following the success

of its retail business. Stores will get access to more than 250 lines, with products imported from the USA, Mexico, Spain and Turkey. Director George Robinson said the stock would be priced competitively.

NEWS 04 5-18 SEPTEMBER 2023 betterretailing.com

SLUSH WARNING FOR UNDER-FOURS For the full story, go to betterretailing.com and search ‘DRS’ For the full story, go to betterretailing.com and

‘Costco’ For the full story, go to betterretailing.com and search ‘slush’ For the full story, go to betterretailing.com and search ‘SoSweet’ Subject to Availability. Non PMP Available.Retailers are free to set their prices. UK/ ROI, 18+. 10:00 07/08/23 – 16:59 27/10/23. Match & minute randomly allocated. Purchase necessary (NPN for ROI). Visit matchtheminute.cadburyfc.com for full T&Cs. Prizes subject to clubs and/or COVID-19 guidance. UNLOCK SALES WITH CADBURY’S BIGGEST FOOTBALL TICKET GIVEAWAY EVER STOCK THE RANGE TODAY! FOR MORE INFORMATION GO TO SNACKDISPLAY.CO.UK

search

DEPOT TO SHELF

When launching new products and promotions on big brands, getting wholesale and retail joined up is crucial to ensure success.

Carolyn Thomson from Suntory Beverage and Food GB&I (SBF GB&I) recently visited Chris Gallacher from United Wholesale (Scotland) and Navid Amjed from Day Today Elite in Glasgow. We followed the journey of Ribena’s on pack promotion in partnership with Hasbro from depot to shelf, to help retailers unlock more sales opportunities.

WHOLESALE

Carolyn Thomson, Regional Account Manager, SBF GB&I explains: “It's key for wholesalers to engage with partnerships like the one between Ribena and Hasbro, as it helps retailers get excited about brands. They can then pass that excitement onto the consumer, which means they are more likely to pick up the drink.

Promotions drive sales

720,000 Ribena shoppers entered the Hasbro competition in 2022

Back big brands! Ribena is worth almost £120M

So we know this promotion starts from a strong position

shows the retailer how much we believe in the promotion

“If something is promoted strongly in wholesale it shows the retailer how much we believe in the promotion and the product – and then gives them clear guidance on how they should then show their customers what it is all about”.

Chris Gallacher, Managing Director, United Wholesale (Scotland) adds: “Our job is about getting that product from the depot to the shopper. We need to educate the retailer about on-pack promotions and use PoS to create some theatre in stores – to show retailers how big these promotions can be.

“We’ve got numerous different platforms for communicating with retailers – our weekly newsletters, WhatsApp broadcasts, push notifications through our apps, and banners on our websites. We use all of these, along with strong in-depot communication, to help create excitement.

“Partnerships like this show retailers the brand cares. They want to get added value onto their packs, and we have a great platform to make that come alive.”

Carolyn Thomson said:

“Retailers can take advantage of promotions like these by making sure they highlight the offer to the consumers. This involves creating a journey from the front of the shop, right the way through the store, that is disrupted by the news of the on-pack offer.

“With strong promotion, shoppers will see it on the bottle on shelf, then by the time they get to the check out, they will have clocked the PoS, shelf-barkers, standing units and more. There’s no reason for them to miss the offer and unlock the opportunity to win one of our games.

Chris Gallacher summarises: “Today we’ve learned how we can get the product from the wholesaler to the consumer and get everyone engaged on that journey.”

TO SEE THE FULL VIDEO OF SBF GB&I’S DEPOT-TO-SHELF JOURNEY, SCAN THE QR CODE, OR FOLLOW @SUNTORYBF_GBI ON TWITTER AND LINKEDIN

RETAIL

RETAIL

PRODUCTS

McVitie’s launches Xmas range

JASPER HART

PLADIS has unveiled its sweet biscuit range for Christmas 2023, featuring new launches from McVitie’s alongside returning popular lines.

Among the launches for this year is the McVitie’s Jaffa Tree (RRP £3), a tree-shaped carton with a selection of Jaffa Cakes treats.

Also new for 2023 is the McVitie’s Penguin Cracker. This stocking �iller is available in three unique pack designs, in cases of 12, which include Penguin bars, Mini Penguins Pack and a festive party hat, at an RRP of £1.25.

Returning lines include McVitie’s Victoria Chocolate

Creations, which has been given a packaging refresh to feel like consumers are opening a present. It is available in a 340g box (RRP £6.75) which contains eight biscuit varieties across milk, white and dark chocolate.

Also making a return is the McVitie’s Victoria premium biscuit assortment, available in fully recyclable 275g (RRP £5) and 550g (RRP £7) boxes.

McVitie’s Family Circle is also available in a 400g seasonally-themed box at an RRP of £2.50.

The Jaffa Cakes Christmas Pole is also making a return after being the fourth-bestselling novelty product last year, in a pack of 40 Original Jaffa Cakes with a ‘Santa

O -trade launch for Cruzcampo lager

HEINEKEN UK has launched leading Spanish lager Cruzcampo in the off-trade, following an on-trade launch earlier this year.

Cruzcampo (4.4% ABV), which is the number-one draught lager in Spain, according to Nielsen �igures, is available via Booker and One Stop. It has initially launched in 4x440ml and 10x440ml multipacks, with respective

RRPs of £6.25 and £12.50.

Additional formats will be launching this month, including a 660ml bottle (RRP £2.75) and a 12x330ml bottle multipack (RRP £12.50).

The supplier says the beer offers consumers a premium beer at an affordable price point, in the wake of a survey in which 29% of UK consumers said they’ve reduced their spend on alcohol.

Ginsters updates pack designs

GINSTERS has launched an updated pack design across its entire range.

The new design is more colourful, to make each individual line stand out, and also highlight the brand’s taste, provenance and ingredients.

Design agency Bloom, which created the new design, said it “deliberately evokes more emotion and wholesomeness of the delicious product inside”.

The decision to update the design comes in the wake of Ginsters having achieved �ive consecutive years of value sales growth, according to IRI �igures. The brand is aiming to cement its position as a “beacon” for the chilled food

stop here’ crafting activity (RRP £3.75).

Finally, McVitie’s Santa Snacks Chocolate Cake Bars is

Christmas savoury snacks from Pladis

returning for the fourth year running, in packs of seven individually wrapped bars, at an RRP of £1.50.

Ca einated Hooch range is Soopa

GLOBAL Brands has launched Soopa Hooch, a new range of its Hooch ready-to-drink (RTD) brand.

Soopa Hooch is a caffeinated beverage with an 8% ABV, available in Electric Lemonade, Darkest Berry and Twisted Tropical varieties.

Each variety contains 32mg of caffeine per 100ml, as well as taurine and guarana, and comes in a 440ml can at an RRP of

£2.89. Wholesale stockists at launch include United Wholesale Grocers, United Wholesale Scotland and Soho Cash & Carry.

The launch comes as the enhanced RTD category is in growth, having grown by 25.5% year on year. Consumers are also shopping in convenience for RTDs more often, increasing their frequency of purchase by 27.7%.

Compact cigarettes from Imperial

to go category. Emma Stowers, Ginsters marketing director, said: “The new design delivers standout and visibility, which, in turn, will bene�it the category by attracting more shoppers to the �ixture, while also making the portfolio easier to shop, which will aid conversion – a win-win situation for all.”

IMPERIAL Tobacco has launched a Compact range across its Richmond and Players cigarette brands for added on-the-go convenience.

The new cigarette sticks are 13% slimmer in size and come in a modern roundedcorner pack that �its easily into bags and pockets. They carry RRPs of £10.99 (Richmond) and £11.60

PLADIS has also unveiled its 2023 savoury biscuits Christmas range, with new packaging across its returning bestsellers from Jacob’s and Carr’s.

Among the range are Jacob’s Christmas Caddies, in Mini Cheddars, Treeselets, Mini Cheddars Chorizo & Smoked Paprika and Mini Twiglets varieties, each at an RRP of £2.50.

Jacob’s The Festive Selection is also back, this time in an updated fully recyclable cardboard box across 300g, 450g and 800g sizes, with respective RRPs of £4, £4.50 and £7.

Meanwhile, Jacob’s Savours

Selection is returning with a limited-edition Paprika & Cheese biscuit. The Savours Selection comes in a 250g box at an RRP of £4. Carr’s Seasonal Selection is also returning in 200g (RRP £3.50) and 400g (RRP £4.50) formats.

Dr Pepper’s rebrand and new campaign

COCA-COLA Europaci�ic Partners GB (CCEP GB) has relaunched Dr Pepper in Great Britain with a new pack design and its �irst campaign in more than a decade, ‘Try more weird’.

The redesign features contrasting swirls of burgundy and pink, and the Zero Sugar variant has been renamed Dr Pepper Zerooo.

Meanwhile, the ‘Try more weird’ campaign encourages people to embrace their quirks. It includes sponsorship, experiential activations and in�luencer marketing.

Martin Attock, vice-president of commercial development at CCEP GB, said: “With its unique �lavour and brand personality, Dr Pepper has

an incredibly loyal fanbase. The brand is worth £167m – retaining its position as number two in the �lavoured carbonates segment – and is outperforming the segment with 18.2% value growth and 12.1% volume growth.”

Lipton debuts Ice Tea can multipacks

(Players).

Tom Gully, head of consumer marketing UK&I at Imperial, said: “With cigarettes in the lowest price sector seeing substantial growth year on year, our new Compact variants from two of our leading cigarette brands, Players and Richmond, will help retailers tap into shopper demand for value.”

LIPTON has launched 330ml can multipacks of its Peach and Lemon Ice Teas, as it seeks to grow sales of formats for at-home consumption.

The supplier has identi�ied the at-home occasion as a growth area, as hybrid working continues and multipacks are the fastest-growing format within the deferred consumption occasion. Lipton’s multipacks are packs of six with an RRP of £4.

This is partly because more than half of customers see cans providing advantages on speci�ic occasions over bottles, such as keeping drinks colder for longer, and being easier to carry on some occasions.

Lipton’s expansion into cans comes as it is the number-one ready-to-drink tea brand in Great Britain, worth £58m. It is currently growing 46% faster than the market by value.

06

New Maltesers lines in Mars Wrigley’s Christmas range

MARS Wrigley has unveiled its 2023 Christmas range, with three new Maltesers launches for convenience retailers.

Among the new products for this year are Maltesers Assorted Truf�les, available in a 200g pack at an RRP of £5.50; Maltesers Christmas Mix, a 240g sharing bag of mini Maltesers Reindeers and Teasers (RRP £5.85);

and Maltesers Reindeers in 29g single packs in Milk Chocolate and Mint varieties (RRP 75p).

Returning lines include the Celebrations Advent Calendar (£11.80) and the M&M’s Santa (£2.99).

Cybi Capaldi, senior brand manager, Christmas at Mars Wrigley, said: “Tapping into Mars Wrigley’s blockbuster brands and fan-favourite

Wall’s relaunches top vegan seller

WALL’S Pastry has relaunched its Vegan Jumbo Roll with a new recipe to cater to the increasing number of shoppers describing themselves as �lexitarian.

The reformulated roll is available now at an RRP of £1.25. Its new recipe comes following a year-long project to make it feel like an authentically meat sausage roll. It is made from a combination of textured pea protein

and cooked giant couscous. Other ingredients include sautéed onions, and a blend of herbs and spices.

According to independent research carried out for the supplier, consumers rated the new recipe higher in categories of appearance, �illing, texture and �lavour.

The Vegan Jumbo Roll packaging has also been given a new design to enhance standout on shelf.

Shaken Udder expands ambient range with strawberry flavour

formats, we have curated a Christmas confectionery range to surprise and delight shoppers.”

SHAKEN Udder has expanded its ambient milkshake range with the launch of a Strawberry Dream variety.

The new �lavour is available in a 330ml bottle.

Convenience suppliers include AF Blakemore, CJ Lang, Nisa, Costcutter and JW Filshill.

Since launching its ambient range, Shaken Udder is now worth £1.75m in

COMBO FROM

convenience, seeing 66.7% growth year on year. This is outpacing its overall annual growth of £15.3%.

The brand hopes Strawberry Dream will help maintain this growth, as strawberry is the second-largest milk �lavour in convenience.

To accompany the launch, Shaken Udder’s �irst TV advertising campaign, ‘Do what makes you happy’, will

return to ITV in September, having launched initially this spring.

Cadbury FC’s latest on-pack promo

‘MATCH the minute to win it’ is the latest on-pack promotion from Mondelez International through its Cadbury FC initiative, offering shoppers the chance to win various football-related prizes.

To enter, shoppers buy a participating pack and enter its barcode and batch code at matchtheminute.CadburyFC. com. They will then be designated a football match from the ongoing UK football

season, and a minute within that match.

If a goal is scored in their given minute, they win a prize. Prizes range from stadium hospitality experiences to retail gift vouchers and match tickets.

The promotion is running until late October 2023 on a wide range of Cadbury products, including but not limited to Diary Milk, Wispa, Twirl, Double Decker and Crunchie.

5-18 SEPTEMBER 2023 07 betterretailing.com

* ITUK EPOS, volume share growth January 2023 vs February 2022 *

Rizla Trade Ad 2023 Q4 Mini Page (172x240).indd 1 14/06/2023 07:35

THE UK’S No1 FASTEST GROWING SUPER

Monster launches sugar-free version of Original flavour

JASPER HART

COCA-COLA Europaci�ic Partners (CCEP) has added Monster Zero Sugar, a sugar-free version of the brand’s Original variety, to its range.

The supplier said the new drink, which has already proved popular in the US, can help retailers capitalise on the continued demand for traditional energy drinks, which have a 55% market share, as well as the popularity of zero-sugar options.

Monster Zero Sugar’s can

design pays homage to the original �lavour to drive engagement with core Monster fans. It is available as a single can and in a four-pack.

Currently, Monster is worth £545m, having added £92m in sales in the past year, while maintaining 20% volume growth.

According to Nielsen �igures, this makes Monster the fastest-growing major energy drinks brand in Great Britain.

“Monster Original has been a �irm favourite and standout sales driver for retailers

since it �irst launched over 20 years ago,” said Pippa Collins, associate director commercial development at CCEP GB.

“With continued consumer desire for zero-sugar energy drinks and the strong performance of our Ultra range as the number-one zero-sugar energy range in GB, we wanted to create a zero-sugar energy drink that matches the iconic taste of Monster Original.

“Monster Zero Sugar has already proven to be incredibly popular in the US, so

Stowford Press’ on-pack promo

we’re con�ident its arrival in GB will bring excitement to the energy �ixture and help retailers drive further sales.”

Dole launches mixed fruit in jelly range

THE Dole Sunshine Company has launched a range of mixed fruit in jelly targeted at kids.

The range is available in Orange Jelly with Mixed Fruit and Strawberry Jelly with Mixed Fruit varieties. Both varieties will launch in packs of four at an RRP of £1.79.

Neither line contains any arti�icial colours, �lavours or sweeteners, while both are

high in vitamin C. The �lavours were chosen by year two and year three students at a primary school, who voted on the best �lavours.

According to research by Dole, parents view jelly with fruit as an appealing option for their children. The supplier will support the launch with a marketing campaign across in-store activations and social media.

AN on-pack promotion from Westons Cider is now running across Stowford Press multipacks, offering shoppers the chance to win a big-night-in bundle.

The ‘Stowford Press big night in’ promotion will run across Apple 10-packs and four-packs, as well as the recently launched Low Alcohol cans, until March 2024.

Shoppers have the chance to win a grand prize worth

£2,000 by scanning the code on promotional packs on the Westons website.

This prize includes a Smart TV, speaker bar, a PlayStation 5 console and game, wireless speaker, a £250 supermarket or takeaway voucher, a 12-month TV streaming subscription and branded pint glasses.

There are also 10 extra vouchers worth £100 up for grabsfor runners-up.

PRODUCTS 08

M2015 MZS GB Trade RN 540x150 SUT v3 HR copy.pdf 1 24/08/2023 12:31

SBF donates Ribena to local causes

SUNTORY Beverage & Food GB&I (SBF GB&I) has partnered with various independent convenience retailers to help them donate stock to local charities and community groups.

The partnership has seen 50 retailers across England, Scotland and Wales donate more than 90 pallets of Ribena, Ribena Sparkling and Orangina to various causes that are important to their local communities, equivalent to around 9,000 cases of stock.

This follows from the partnership’s �irst iteration in December 2020, when 40

retailers took part during the winter lockdown.

Wholesale partners this year included Parfetts, United Wholesale Scotland, Splendour Wholesale and

Bottlegreen launches cobranded liqueur

BOTTLEGREEN has teamed up with potato vodka brand Edwards 1902 to launch Edwards Bottlegreen Elder�lower Liqueur.

The premium drink is available in a 50cl bottle with a wax-covered closure at an RRP of £26 and is the �irst all-British cobranded elder�lower liqueur, the suppliers said.

It is also Bottlegreen’s �irst

alcoholic product.

Emma Hamilton, cofounder of Edwards vodka, said: “Both companies have a shared objective and, as importantly, a shared approach: Edwards 1902 places quality at the very heart of everything it does, and the same can be said of Bottlegreen, and both brands strive to help make great-tasting, �irst-rate cocktails.”

Amrit Singh Pahal of H & Jodie’s Nisa. These wholesalers acted as distribution and collection points for participating retailers.

Epicurium expands energy and co ee

EPICURIUM has expanded its soft drinks range with lines from big can energy brand C4 Energy and Jimmy’s Iced Coffee.

The wholesaler is now stocking C4’s Cosmic Rainbow, Frozen Bombsicle, Twisted Limeade, Orange Slice and Pineapple Head varieties in cases of 12 500ml cans. Each can has a £1.99 RRP.

C4 drinks contain zero sugars or carbohydrates and contain vitamins that help reduce fatigue and aid

concentration.

Additionally, Epicurium is now stocking Jimmy’s Iced Coffee’s Original, Caramel, Oat and Mocha varieties in cases of 12 275ml fully reusable and recyclable ‘bottlecans’. Each variety is non-HFSS and carries an RRP of £2.25.

Koko updates coconut milk range with new pack design

KOKO Dairy Free has relaunched its plant-based milk and yogurt range with new packaging and recipes. The supplier’s Original M!lk and Unsweetened M!lk varieties have been given a pack redesign to better communicate their coconutbased origins.

Meanwhile, new recipes have made Original high in protein and low in sugar,

and Unsweetened high in protein and low in fat. They carry a £1.80 RRP for a 1l carton.

Koko products are free from major allergens including dairy, soya and oats, and are enriched with calcium and vitamins D2 and B12.

Wholesale stockists include Suma, In�inity, CLF, SOS Wholesale, Green City, Dundeis and IA Distribution.

09 5-18 SEPTEMBER 2023 betterretailing.com

THE

SEPTEMBER ISSUE OF RN

OPINION

RETAILER OPINION ON THIS FORTNIGHT’S HOT TOPICS

What do you think? Call Retail Express on 020 7689 3357 for the chance to be featured

CRIME: Are you seeing more incidents at your cash and carry?

“ORGANISED crime is on the up. For example, bulk cigarette theft is one of the incidents increasing. One of my wholesaler’s depots now has a permanent member of security. They have security in their car park.”

Gaurave Sood, Neelam Post Office, Uxbridge , west London

I do a lot of walking outside

CASH: Has the number of banks near you reduced?

“YES, and it’s forced me to hire Lumis to collect my cash. My local HSBC closed down recently. Looking at it positively, it means I no longer have to worry about the risk of carrying large amounts of cash to the bank. It’s probably much cheaper as well.”

Lewis, Spar Minster Lovell, Oxfordshire

“WE’VE got a post office, so the closures of nearby banks have had a positive impact. People who would use the banks five miles away are now using us for their everyday banking. It’s created more work for us, but we’re getting the footfall as a result.”

Joe Williams, The Village Store, Hook Norton, Oxfordshire

“RETAIL crime is a huge problem, especially since the pandemic. The Crown Prosecution Service is backlogged with incidents and people are not getting prosecuted in a timely manner.”

People are not prosecuted in a timely manner

WELL-BEING: How are you managing your mental health?

“I DO a lot of walking outside, whether that’s on my own or with a family member. There are many other activities I use to make me feel good. I also have a good network of female retailers as part of the Women in Convenience WhatsApp group. I can call upon them if I need help.”

“I HAVE music on in the store. This includes anything, such as what’s currently in the pop charts. People who follow me also know that I listen to a lot of Prince and Punjabi music. Having something on in the background in the shop keeps you going and helps you stay motivated.”

Serge Notay, Notay’s Premier, Batley, West Yorkshire

It’s had a positive impact

DEVELOPMENT: How has a previous career helped you in convenience?

“I USED to work at Currys, and I gained skills such as learning how to close at the end of a day, and auditing stock, which has transferred to running my convenience store. My parents ran the store previously, so I’ve always been around retail.”

Ken Singh, BB Nevison Superstore, Pontefract , West Yorkshire

“I’VE always been a retailer, running the shop since I was 18. I’m now 33 years old. As a student, I held a part-time job and this provided me with skills in the early days. Experience like this gave me ideas and I met fellow retailers who were able to share their experiences with me.”

Kiru Nadarajah, Everydays, Hampton, west London

10

5-18 SEPTEMBER 2023 betterretailing.com

Trudy Davies, Woosnam & Davies News, Llanidloes, Powys

The skills transferred into retailing

Ferhan Ashiq, Levenhall Village Store, Musselburgh , East Lothian

UP IN

8

Pricewatch: see what other retailers are charging for Christmas confectionery and boost your own profits + Exclusive Wholesale Pricewatch on beer multipacks Christmas confectionery: how to get your store set up for sweet sales Home delivery and click & collect: what you need to run a modern and successful service + STAY INFORMED AND GET AHEAD WITH RN betterretailing.com/subscribe To ADVERTISE IN RN please contact Natalie Reeve on 07824 058172 3,451 retailers’ sales data analysed for every issue 69+ unique retailers spoken to every month 71% of RN’s news stories are exclusive At RN, our content is data-led and informed by those on the shopfloor ORDER YOUR COPY from your magazine wholesaler today or contact Kate Daw on 020 7689 3363

Ian

COMING

850896 TNL L4 Trade Ad RE 339x260mm AW1.indd 2 18/08/2023 13:08

‘Police and crime commissioner needs to take crime more seriously’

LAST month, the Of�ice for National Statistics (ONS) released its latest crime �igures.

However, the Leicestershire police and crime commissioner, Rupert Matthews, appeared to gloat over the results of the survey, which suggested the East Midlands had fewer reported sex and weapon offences.

Matthews attributed the ONS �igures to good policing.

His view is not representative of reality. Incidents do not get reported by the public in the knowledge that crime will not get investigated.

The negativity starts with the call handler.

The reason why the ONS �igures claim that Leicestershire has the lowest rate of shoplifting is because retailers are discouraged from reporting shop theft.

COMMUNITY RETAILER OF THE WEEK

The police trivialise shoplifting as a low-level and victimless crime. How can that be?

Shoplifting is a blight on the lives of retailers and their employees.

A shrinking retail sector is the evidence of this impact. You can see this on the nearby Narborough Road. Retail crime is brazen and anarchy is at the doorstop. The police need to be

COMMUNITY

more proactive in tackling the issue.

Mr Matthews needs to step outside his La La Land and join me at my shop for just half an hour, any day of the week, to see the reality.

Subhash Varambhia, Snutch Newsagents, Leicester Matthews failed to comment as Retail Express went to print

OF THE WEEK

Alan Mannings Shop on the Green, Chartham, Canterbury

Keep trying new things

OUR customer demographic ranges from young people to 94-year-olds, and we have, by and large, settled into a range of products that works for them. Elderly customers come in for their ready meals, which are nice and easy for them to put in the microwave that evening, and the youngsters are coming in for Prime energy drinks and similar products.

RISING

STAR

One of two leading retailers shares his thoughts on the challenges in retail

Most of our sales come from snacking and alcohol products, with only 14% coming from grocery. It’s about knowing what people want and looking out for changes.

You’ve got to look at the demographics in your local area. You can look at the census to see how many people are in the area, what they earn and what other shops are nearby that might be your competition. You need to work on the area you’re within rst.

We’re no longer a part of Londis, and this means that we’re no longer getting the allocations every month. These are basically promotions on a range of products, but they were o en things our customers didn’t want. We’d get thousands of pounds-worth of stu that just sat on our shelves. We know our customers and we know they don’t want promotions, they want accessible products they can pick up at the last minute.

We know that because we look at our sales data and manage it.

Some of our customers’ purchasing habits never change, so we end up keeping things to a basic level for them, which is a bit sad, because you want to move on and get people to try di erent things. We know our customers don’t like Au Vodka, so even if a new one comes out, we don’t get it in because it won’t sell.

That said, we still put new things out to test them because it’s so important to try new things, and it does pay o . We’re putting out Herr’s Crisps at the moment. They’re jalapeno-flavoured and cost around £2, and they are selling week in, week out. We’ve got another new supplier from which we buy Brett’s Crisps, and again, despite the high price of more than £2, people come in and buy them because they love them.

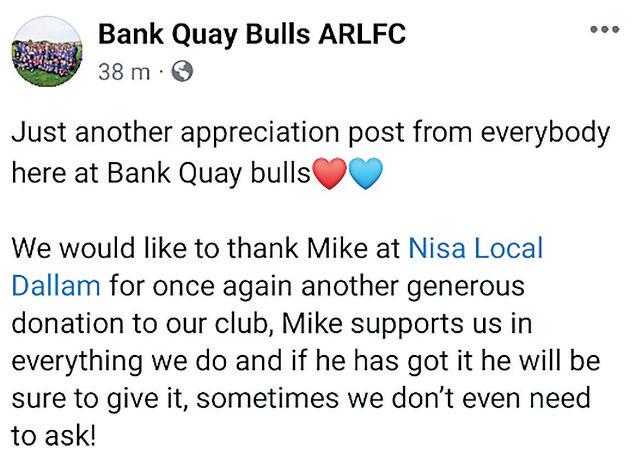

“WE have donated £1,000 towards 20 families, so each family gets a £50 voucher towards a school uniform. We wanted to support people who were struggling in the current climate. One lady said she didn’t know what she would have done without it, she had recently lost her job and she was struggling. We sponsor the girls’ rugby team and other teams within the rugby club – they highlight the work I do within my local community. It’s the time of the year where families need to buy school uniforms for the next school year. I see a lot of struggle out there.”

“MY parents have owned this shop for 40 years, and they’ve given me and my brother a really strong sense of equality. We began stocking collectable stickers for the Women’s World Cup, which ended last month. Little girls started to collect them and we put loads of flags up in the windows and around the shop. My mum in particular wanted to do this, and we all got dressed up outside the shop. She isn’t into football at all, but she was adamant we should play our part in promoting the sporting event in the community. We did our bit to promote fairness and equality.”

13 betterretailing.com 5-18 SEPTEMBER 2023 Letters may be edited LETTERS

Meet Patel, Meet & Deep News, Twickenham

RETAILER

‘We did our bit to promote equality’

Mike Sohal, Dallam Stores, Warrington –Mikesohal07

Get in touch @retailexpress betterretailing.com facebook.com/betterretailing alex.yau@newtrade.co.uk 020 7689 3358

‘I see a lot of struggle out there’

SWEETEN THE CHRISTMAS SPIRIT

WHEN TO GET STARTED

WHILE Christmas is a winter festival, independent retailers should be thinking about its opportunities before the end of summer.

Most symbol groups, wholesalers and suppliers get their o ers and pre-order options in place before August and September, so this means that retailers need to be thinking about what they want to have in store very early.

“Make sure to stock up on festive confectionery products from as early as October,

when sales start to spike, and ensure they remain available until Christmas,” says Andy Mutton, managing director at Storck UK. However, deciding when to start putting products on the shelves can be tricky.

For some, it’s worth putting them in front of customers early so their stores remain at the forefront of people’s minds as the season approaches. Others prefer to wait to make a bigger impact.

“We had some Christmas

confectionery come in this week and we’ve already got them up on the shelves,” says Peter Juty, from Costcutter Culvestone in Kent.

“I saw them in the multiples a few weeks ago. Even if we’re not selling them for Christmas, we can still use them for Halloween sales.

“It’s good for customers to know we’ve got them and it means it’s always in the back of their minds where they can go and get it from.”

However, Juty says Christ-

mas sales don’t start to pick up until closer to Christmas Day, as the multiples run out of stock and their cheaper options are no longer available.

With this in mind, Vijay Aanasane, from Foxhole Store in St Austell, Cornwall, waits far longer before putting his products on the shelves.

CHARLES WHITTING nds out what this year’s festive season o ers the confectionery category and what retailers need to do to maximise sales opthis Aanasane, from Foxhole Store says. “That’s when people ac-

“We put them out in the fourth week of November,” he says. “That’s when people actually start buying it. If we do it too early, then it’s just wasting space in our shop.”

CATEGORY ADVICE CHRISTMAS CONFECTIONERY 14 5-18 SEPTEMBER 2023 betterretailing.com

Image credit: Getty Images/studiodr

o ns , t e d k o o e! © 2023 Mars or Aff il iates. *Niels en IQ Scantrak data to 21 WE 24.12.22

CATEGORY ADVICE CHRISTMAS CONFECTIONERY

WHAT TO STOCK

CONFECTIONERY sales at Christmas di er compared to the rest of the year as people opt for sharing and gifting options within the category.

Whether it’s tins of Roses, Celebrations and Miniature Heroes, a selection of smaller stocking llers or a high-end premium chocolate product, most retailers will be stocking up on more than just a few extra single bars of chocolate.

“Retailers should tap into the ‘big night in’ occasion at this point of the season, as shoppers will begin to favour sharing formats, multipacks and tablets.

“They can make the most of Cadbury’s range of sharing products by stocking products such as Roses, Heroes and Dairy Milk tablets,” a spokesperson for Mondelez International says.

On top of sharing options, retailers should nd fun additions to their ranges, from chocolate coins and other stocking llers to advent calendars and unusual gifts.

“Chocolate continues to dominate confectionery sales in the run-up to the big day, and is worth more than £1.65bn – growing 4.8% on last year. Sharing and gifting chocolate products, such

as boxed chocolates and seasonal novelty formats including gurines, advert calendars and selection packs, continue to be hugely popular at Christmas and should be a focal point of festive displays,” says Mutton. “Sugar confectionery still has a major part to play and was worth more than £400m over Christmas 2022, growing faster than chocolate, at 6.8% year on year.”

16 5-18 SEPTEMBER 2023 betterretailing.com

Crispy. Creamy. Dreamy. New from the No.1 premium boxed chocolate manufacturer Lindt* *Source: IRI Circana Total Market 52we 22/07/2023 StockupNOW & Hazelnut 30g Milk Chocolate & Hazelnut 138g Assorted 135g Price-marked pack

REDUCING LOSSES AND IMPROVING EFFICIENCIES INALSOTHIS ISSUE September 2023 A MUST-READ FOR PROFIT-DRIVEN INDEPENDENT RETAILERS The resources every independent retailer needs to boost margins, stay competitive and satisfy customer needs HOW TO CUT COSTS AND MAKE BETTER MARGINS EFFICIENCIES ALSO IN THIS ISSUE September 2023 A MUST-READ FOR PROFIT-DRIVEN INDEPENDENT RETAILERS The resources every independent retailer needs to boost margins, stay competitive and satisfy customer needs HOW TO CUT COSTS AND MAKE BETTER MARGINS LOSSES AND IMPROVING REDUCING LOSSES AND IMPROVING EFFICIENCIES ALSO IN THIS ISSUE September 2023 A MUST-READ FOR PROFIT-DRIVEN INDEPENDENT RETAILERS The resources every independent retailer needs to boost margins, stay competitive and satisfy customer needs HOW TO CUT COSTS AND MAKE BETTER MARGINS Spotlight on ranging and merchandising advice for evolving consumer behaviours Marketing techniques and strategies for growing basket spend Margin-boosting opportunities, including premium lines and supplier resources Reducing losses through sustainability, energy efficiency and staff productivity INCLUDING: Order your copy from your magazine wholesaler today or contact us on 020 3871 6490 On sale 26 September Only £4.99 How to Cut Costs and Make Better Margins is your in-depth, expert guide that will help you make the best decisions to ensure the continued success of your store

Margins Boost your margins, stay competitive and satisfy your customers’ needs!

How to Cut Costs and Make Better

CATEGORY ADVICE CHRISTMAS CONFECTIONERY

THE IMPACT OF VALUE

THIS year, the continuing cost-of-living crisis is having a signi cant impact on what customers are willing to spend their money on.

This has meant retailers have had to deal with reduced sales in certain categories, but Christmas confectionery isn’t expected to be one, particularly from a gifting perspective.

SUPPLIER

SUPPLIER

VIEW

Cybi Capaldi, senior brand manager for Christmas, Mars Wrigley

Cybi Capaldi, senior brand manager for Christmas, Mars Wrigley

“LAST year was a record-breaking 12 months for total grocery Christmas sales, with December passing the £12bn mark for the rst time (up 9% year on year) a er a unique year of retraction in 2021. Within this, chocolate and biscuits saw signi cant growth in spend (9.3%) and volume (3.4%) as pre-Covid-19 habits started to return, with customers shopping more freely across ranges and retailers with cost-saving aims.

“There are four key factors to consider when merchandising Christmas o erings to shoppers: visibility, new products, PoS and pack sizes.

“Place popular Christmas lines just below eye level, at ‘buy level’, to take advantage of incremental sales. Champion new products to raise sales and capitalise on early consumer demand. A secondary sitting of Christmas confectionery by the till can boost both awareness and sales alongside displaying PoS materials that highlight new products.

“Retailers can increase awareness of seasonal campaigns and new products by making use of point of sale in store. Consumers will be intrigued by what catches their eye.

“Retailers should consider stocking a range of di erent product sizes to capture the attention of all shoppers, catering to a range of wants and needs.”

“A lot of people aren’t doing what they used to two or three years back,” says Shumaila Malik, from Costcutter Heathside Road in Manchester.

“People are more likely to be looking for smaller and less expensive gifts this Christmas, and chocolate is a great, affordable gift.”

Malik also predicts conveni-

ence stores will bene t from more sales this year as people avoid potential big shops at multiples and instead opt for smaller shops at local stores. She also thinks customers will look to purchase products like chocolate closer to the big day rather than making big preparatory shops in September or October.

“In September, people will have spent money on the summer holidays and getting their kids ready for school,” she says. “The last thing they’ll want to see is Christmas items. It’s when Halloween starts kicking in that people start thinking about Christmas, and now people are far happier buying nearer the time.”

19 5-18 SEPTEMBER 2023 betterretailing.com

19

CATEGORY ADVICE CHRISTMAS CONFECTIONERY

THE USEFULNESS OF PMPS

ANOTHER way for retailers to highlight their confectionery range this Christmas and generate impulse as well as planned sales in the lead up to December is to introduce price-marked packs (PMPs) into their ranges, particularly for smaller, impulsive stocking llers.

“PMPs are increasingly im-

portant and account for more than two-thirds of category sales in some wholesalers, and 63% of shoppers think PMPs mean they are not being overcharged, which gives shoppers transparency and helps store owners overcome the notion they are pricier than grocers,” says a spokesperson for Lindt & Sprüngli.

new products

Mondelez’s new Christmas lines

Mondelez International has launched eight lines for its 2023 Christmas range, including Cadbury Mini Snowballs Family Pack (RRP £4.50), Cadbury Dairy Milk Advent Calander (RRP £10), Cadbury Chunk Collection (£6), Cadbury Buttons Selection Box (RRP £6.50), Cadbury Dairy Milk Winter Orange Crisp (RRP £3.50), Cadbury Dairy Milk Coins (RRP £1.99), Cadbury Dairy Milk Money Box Tin (RRP £6) and Toblerone Tru les (RRP £6.09).

Lindt Choco Wafer

Lindt has launched new Choco Wafers, which became available to independent stores in August. There are four new Lindt Choco Wafer products. The Milk Hazelnut Box and Assorted Box have an RRP of £5.50 and are designed for sharing. The Milk Hazelnut 30g Countline Bar has an RRP of £1, while there is also a 95p price-marked version.

Maltesers Assorted Tru les

Mars Wrigley is adding to its Tru les range with the launch of Maltesers Assorted Tru les. It is aimed at a more a luent shopper than other Maltesers Tru le lines and £700,000 will be invested in promoting it. Also new for 2023 is the Maltesers Christmas Mix, which includes a selection of Maltesers Reindeers in both milk chocolate and mint flavours, and Maltesers Teasers.

Very Berry chew bars

Swizzels has announced the launch of Very Berry chew bars. Featuring two new flavours – Strawberry & Blueberry and Raspberry & Blackcurrant – the veganfriendly chew bars are presented in vibrant packaging that features a di erent Minion on each product – with Christmassy colours to add even more to its festive aesthetic. They have an RRP of £1.

Anthon Berg advent calendars

Anthon Berg, a Danish brand distributed in the UK by World of Sweets, has launched two Anthon Berg advent calendars, one with chocolate liqueurs and one with marzipan. The calendars have an RRP of £21.99 and feature 24 windows.

Swizzels gift drums

Swizzels is launching two gift drums for Christmas 2023. They have an MRSP of £2.99 and are packed with Swizzels sweets including Love Hearts and Drumsticks.

20

Back this year

Returning Christmas essentials

Swizzels’ Sweet Shop Favourites Tubs are returning this year as a product to share with family, friends and colleagues on an occasion like Christmas and the weeks leading up to it. Sweet Shop Favourites Tub is the number-one tub at Christmas and sees a 105% uplift at Christmas. The tubs have an MRSP of £5.

Mr Swizzels Sweet Shop Advent Calendars are back this Christmas. With a RRP of £5, they come with 24 doors lled with Swizzels favourites including Refreshers, Drumstick, Love Hearts and Squashies.

The Celebrations portfolio has six lines that are designed to tap into key sharing occasions across Christmas. It includes a tub, a pouch, a pop, a flip, a centrepiece and an advent calendar.

RETAILER VIEW

Peter Juty, Costcutter Culverstone, Kent

Peter Juty, Costcutter Culverstone, Kent

“I’M expecting more from Christmas confectionery sales this year. Last year, we spent £8,500 on stock, and this year we’ve spent £12,500. Last year, we ran out of products early and the multiples were cutting back as well, so this year we’ve bought early and more to compensate for that.

“Have a good range and do it big. If you’ve just got one or two products on the shelves, then people won’t come in. But if you’ve got lots of products on o er then they’ll remember the store and keep it in their heads for when they’re looking for somewhere to buy their Christmas chocolate. It’s the same concept as with Easter and we sell a phenomenal amount.

“We space them all around the store and when they’re selling out at one section, we move the rest of the front of the store. As we get closer to Christmas, more products go to the front of the store and the front bays, but we keep things moving around to keep it fresh.”

21 5-18 SEPTEMBER 2023 betterretailing.com

SNACKDISPLAY.CO.UK GET A FAST START TO YOUR CHRISTMAS SUB BRAND IN SHARING NOVELTIES* GREW BY 5.4% IN 22 #1 FOR GREAT SEASONAL ADVICE GO TO SNACKDISPLAY.CO.UK *Nielsen Xmas Tracker, including discounters WE 10.09.22 TO 24.12.22 NEW TO ‘23 STOCK OUR RANGE GROW YOUR SALES WITH

CATEGORY ADVICE CHRISTMAS CONFECTIONERY

MAKING YOUR OFFER STAND OUT

WHILE retailers should look to include the kind of established favourites that customers will be looking for at Christmas. It is also important to get hold of any new products.

At a time when people are looking to treat themselves and their friends, having something new and interesting for them to gift or enjoy can help to bolster basket spend throughout the season, particularly if they are smaller, more affordable and impulsive options.

“Introduction of new prod-

ucts with innovative flavours and healthier ingredients, increase in gifting trends and growth in retail market are expected to drive the demand this Christmas,” says Clare Newton, trade marketing manager at Swizzels.

Beyond this, it is important to position and promote your Christmas confectionery range in as prominent a position as possible.

“In store, retailers can expect to have access to a host of shopper touchpoints such as branded shippers and front-

of-store displays. These will help retailers invite customers further into the store, away from non-HFSS-only zones and to the destination that is the confectionery aisle,” says Cybi Capaldi, senior brand manager for Christmas at Mars Wrigley.

Not only will these themed chocolatey treats lend a more festive feeling to the entranceway to your store, but they will also draw sales from customers at all stages of their shopper journey.

“We try to make one space dedicated to confectionery and

then get a massive stand,” says retailer Vijay Aanasane. “Londis often provides us with cardboard stands. The big boxes – Celebrations and Quality Street – are our bestsellers.

“This year, we’ll be doing promotions as we’ll be getting stuff from Londis under offer, which is something they do well. Last year, we offered two tubs for £10 or one for £5.50 or £6, and we sold a lot.

“The promotions are really important. As long as we get promotions at Christmas, we’ll do well.”

22

DRIVE YOUR SALES WITH

NUTELLA BISCUITS

Ferrero UK launched Nutella Biscuits in spring 2022. RETAIL EXPRESS’ NEWTRADE INSIGHT service partnered with them to help two retailers trial the range in store to boost biscuit sales and bring new customers to the category

PAID FEATURE NEWTRADE INSIGHT VISIBILITY IS VITAL

THE two retailers stocked the 41.4g three-pack (RRP 75p) and 166g tube 12-pack (RRP £1.99) to test where best to place them in store.

In trialling their products, both retailers bene ted from the use of a countertop unit and a free-standing display unit (FSDU). They combined this point of sale (PoS) with positioning that was prominent, encouraged an impulse buy and was linked with relevant products.

Placing the products by the entrance, till areas and hot co ee machines drove incremental purchases.

“We utilised the PoS and put the products by the till area before we repositioned them closer to the biscuit aisle,” says Scott Graham, of McLeish in Inverurie, Aberdeenshire. “The PoS has

DIFFERENT FORMATS

been a great visual.”

“We had them three feet away from the co ee machine,” says Goran Raven, of Raven’s Budgens in Abridge, Essex. “The increase came by moving the FSDU so customers walked past it on the way to the till.”

The variety of positioning in the store meant the products were popular with residential and transient customers, both of whom are well represented in Graham’s and Raven’s stores.

Customers also told both retailers the products brought innovation to their biscuit and on-the-go o erings.

“At the beginning, the feedback was ‘I haven’t seen this sort of product before’, and customers were trading up from the three-pack to the tube format,” says Graham.

HAVING the smaller 41.4g Nutella Biscuits snack pack and the larger 166g tube meant shoppers had an option depending on how much they wanted to spend and their purchasing occasion, as both retailers discovered.

“The snack pack sold, but the tube is the big winner,” says Raven. “We found that

people trade up once they have tried both.”

Meanwhile, Graham’s tube sales slowed down after a few weeks, but this decrease was softened by the snack packs. “The tube format slowed down, but this is because customers moved over to the three-pack, so the sales balanced out,” he says.

ABOUT NUTELLA BISCUITS

crunchy biscuit, enclosing a creamy Nutella centre, offers consumers a new way to enjoy the signature taste of Nutella, which is the UK’s favourite chocolate hazelnut spread2.

CROSS-MERCHANDISING

THE novelty of the Nutella Biscuits products also played a role in driving sales. “Sales have been doing very well on their own, and we haven’t had to do much apart from put them by our co ee machine as we believe they will go well together,” said Raven, four

weeks into the trial.

The ability to stock two di erent formats in di erent parts of the store in both retailers’ cases meant the products were popular with all sorts of customers in Raven’s and Graham’s stores, whether they were local or

passing trade.

Having them stand out in areas where shoppers were looking for other products also meant they garnered enough impulse interest that both retailers wanted to see how well they kept selling without giving them an additional

push on social media. “We’re letting the product speak for itself, but the price and FSDU have been the important factors,” says Graham. “It’s all about the location and the appeal of the product in the PoS. We get a lot of repeat customers.”

Nutella biscuits T3 and T12 are in full distribution in Bestway, Dhamecha and Parfetts, plus all key Unitas members

insight in action

“SALES have gone brilliantly. This is solely down to their quality and positioning – we made a large display with PoS and positioned it right by the entrance. We haven’t done much direct promotion on the stock because we haven’t needed to as sales have been so strong, and the products have been so popular. We found that both formats went really well with our food-to-go o erings and our co ee, and would absolutely want them to be part of our permanent range. Nutella is a trusted brand and has combined two really good products –Nutella and biscuits – that customers love. All our customers have been asking about them.”

Scott Graham, McLeish, Inverurie, Aberdeenshire

“ WE let the products speak for themselves. We wanted to see how they would perform on their own, so we’ve not pushed them on social media and we haven’t needed to. A large variety of customers were buying them, and the impulse, onthe-go element de nitely helped. The biggest challenge was displaying the three-pack. It worked well on the till, where we put all new products, and by the co ee machine, but it couldn’t be there forever as there is no room. The tube format is clearly a biscuits product, so it sits really well and has a clear purpose. I would keep both lines, but would prefer the tube format if I had to choose.”

23 5-18 SEPTEMBER 2023 betterretailing.com

This feature was created by Newtrade Insight. Data is gratefully received from the two retailers who participated in a 12-week trial of Nutella Biscuits. Any data from other sources is cited.

1IT IRI 52 w/e 01.11.2020, 2Nielsen Scantrack 4wks to 20.02.2021 vs. PCD YA

Goran Raven, Raven’s Budgens, Abridge, Essex

NUTELLA Biscuits rst launched in the UK in March 2022, following success in European markets including France and Italy, where it was the biggest biscuit launch of the year1. The baked In partnership with

GENERATE SALES THIS SPOOKY SEASON

PRIYA KHAIRA nds out how retailers can boost sales over the Halloween and Bon re Night period

THE HALLOWEEN OPPORTUNITY

IT is bene cial for retailers to accommodate seasonal trends and holidays, and Halloween and Bon re Night present a bigger range of opportunities than most for retailers to boost sales across a range of categories.

Over the years, Halloween has gained a large amount of traction and popularity in

the UK. Although sales took a hit amid the pandemic, research demonstrates that by 2021, consumer spending for Halloween products across the UK rapidly increased to £600m. According to Statista, consumer spending on Halloween products is predicted to reach a signi cant £777m this year alone.

WHAT TO STOCK: CONFECTIONERY

CONFECTIONERY is a staple category that thrives during Halloween and Bon re Night. Customers looking for a ordable trick-or-treat goodies will likely pay a visit to your store, along with Bon re Night

shoppers in search of sharing packs of sweets or marshmallows to roast.

“I nd that shoppers go for multipacks of cheaper sweets, things like Haribo or lollipops.

We o er chocolate and to ee

coated apples on a stick during this time, which fly o the shelves. It’s something very on trend for Halloween that people like to try,” says Enya McAteer, from Mulkerns Spar Jonesborough in County Armagh.

“Halloween is the UK’s third-biggest retail event in the confectionery calendar, and retailers can maximise sales uplift by ensuring they stock a ordable products suitable for both parties and

trick-or-treat occasions. Creating themed displays and in-store theatre help to drive additional footfall to confectionery areas,” says Phil Hulme, commercial director for Kervan Gida UK Ltd.

“Retailers can make Halloween a focus in the aisles by decorating them to draw shopper attention, and they can make sure shoppers know where they can buy their Halloween treats,” Hulme adds.

CATEGORY ADVICE HALLOWEEN & BONFIRE NIGHT 24 5-18 SEPTEMBER 2023 betterretailing.com

GIVEYOURCUSTOMERSACHANCETO WIN EPIC PRIZES (OR SCARY SURPRISES) Source: *Nielsen Scantrack Data Value w/e 051122, Halloween = latest 4 weeks, Total GB © 2023 The Coca-Cola Company. 1 IN 4 FLAVOURED CARBS PURCHASED WAS A FANTA!* FANTA GREW BY 19.1% DURINGHALLOWEEN2022 TO FIND OUT MORE EMAIL CONNECT@CCEP.COM, CALL 0808 1 000 000 OR VISIT MY.CCEP.COM SOFT DRINKS SPEND INCREASED AND GREW FASTER THAN 3 OF THE 4 TRADITIONAL HALLOWEEN CATEGORIES* SCAN TO REQUEST YOUR FANTAHALLOWEENPOS NOW AT MY.CCEP.COM COC1669_Fanta Halloween Trade Ad_RE_AW2.indd 1 23/08/2023 11:34

CATEGORY ADVICE HALLOWEEN & BONFIRE NIGHT

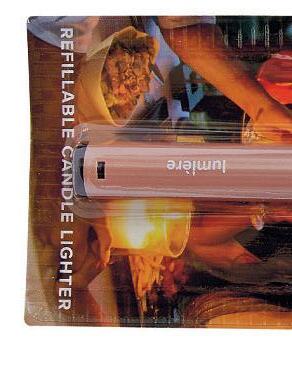

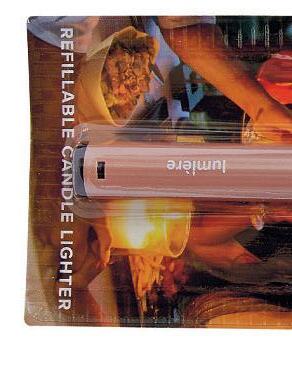

WHAT TO STOCK: LIGHTERS AND MATCHES

THE demand for lighters and matches is forecast to reach a high seasonal peak this year.

With Bon re Night and Diwali in close proximity to each other, retailers should expect a rise in matches and lighters sales throughout the end of October and early November.

“Halloween leads the way for increased use of matches and lighters – not surprising, as spending on pumpkins alone is estimated to have reached almost £30m last year. Against the backdrop of a tough economic climate, people really want to make the most of family-focused celebrations such as these. As matches and lighters take up

limited shelf space, retailers can really boost seasonal sales of these highly a ordable, but high-margin products,” says Gavin Anderson, sales and marketing director at Republic Technologies (UK) Ltd.

While reworks are popular items that are commonly associated with the celebration of Halloween and Bon re Night, there have been many people who have called for a halt in rework sales.

Across social media, some communities have shown resistance to the sales of reworks in local convenience stores due to the environmental impact of them and distress that the products can cause

to wildlife and domestic animals.

If you are looking into gaining a permit to sell reworks, then it is important to think about your demographic and whether people in your local area are likely to support and purchase these items.

For Pramit Patel, from Epping Stores in Essex, reworks have been sought after by customers for years.

“We have a licence and have been selling reworks every year for more than 10 years now,” he says. Patel explains that reworks have consistently sold well each year and are good additions for the Halloween and Bon re Night period.

26

WHAT TO STOCK: DRINKS

HALLOWEEN and Bon re Night are both popular times for parties and group celebrations. This means that customers can be expected to drop by your store in search of various soft and alcoholic drinks and multipack options during the lead up to the holidays.

“By reviewing their ranges ahead of the season, and en-

suring they are stocked up on consumer favourites such as Captain Morgan, Smirno , Gordon’s, Tanqueray and Johnnie Walker, retailers can ensure they meet the needs of these shoppers,” says Lauren Priestley, head of category development at o -trade at Diageo. Soft drinks is also one of the

fastest-growing categories at Halloween. Low- and no-alcohol options along with soft drinks are popular options among Gen Z and millennials, who are the top two demographic groups most likely to spend money on Halloween products. With many suppliers releasing themed varieties of existing favourites, this is another

opportunity to create a talking point in your store.

“Retailers can maximise Halloween and Bon re Night sales by utilising seasonal PoS materials, increasing the number of facings on shelves for relevant products, and putting up themed decorations to bring the occasions to life for shoppers in store. By introduc-

ing cross-category promotions, which include beers, wines, spirits, alcohol-free spirits, decorations and snacks, retailers can encourage incremental purchases,” says Priestley.

What to stock

Products and promotions

Bebeto o ers a range of small bags for trick-ortreating along with larger 150g bags that can work well for customers shopping for parties. Bebeto also o ers Bebeto gummies and Gummy Party Tubs along with a Pick & Mix Party Tub as part of the brand’s Halloween o er.

This year, Swizzels is o ering a Mummy Mix, Trick Or Treat Lolly Mix and Monster Treats packed full of sweets like Drumstick Lollies, Refreshers Chews, Mini Love Hearts Rolls, Fizzers, Fruity Pops, Double Lollies and Parma Violets.

The Oetker Group has added to its range with Dr Oetker The Spooks of Halloween Baking Cases, The Spooks of Halloween Decorating Icing, The Spooks of Halloween Sprinkles and the Spooktacular Science Bake & Learn Glow in the Dark Icing Cupcake Mix. The launches also feature Dr Oetker’s rst-ever seasonal cake mix, the Spooktacular Science Bake & Learn Glow in the Dark Icing Cupcake Mix (RRP £2.75).

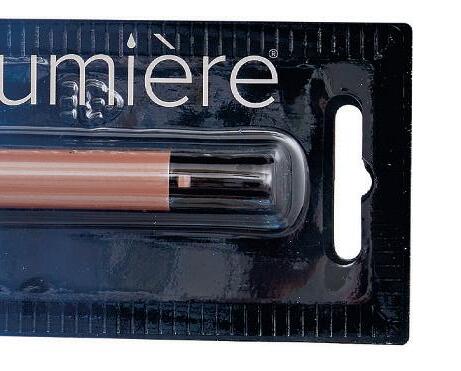

For retailers interested in stocking up on lighters or matches, Republic Technologies brands hold a 86% share of the UKs Utility Lighters market. Popular brands include Zig-Zag, Cook’s, Swan, Bryant & May, Poppell, Cricket, Lumiere and By Candlelight.

With almost half of UK adults switching to lowalcohol options, it is worth retailers stocking a variety of drinks for Halloween. Diageo has a varied portfolio of alcohol-free products, including Guinness 0.0%, Tanqueray 0.0%, Gordon’s 0.0% Alcohol Free Spirit and Gordon’s Pink 0.0% Alcohol Free Spirit.

27 5-18 SEPTEMBER 2023 betterretailing.com

CATEGORY ADVICE HALLOWEEN & BONFIRE NIGHT

PROMOTION

IF you want to maximise sales ahead of Halloween and Bonre Night, then the preparations need to start early. Early promotion won’t necessarily generate immediate sales, but it’s more important to get your store in people’s minds when they’re thinking about where to stock up closer to the time.

“I always have a small display in the shop right when kids start going back to school. This shows people that we will be stocking products for Halloween. You’ve got to be ahead

of the game. Post on social media what you have, and you’ll nd more customers coming in. This helps add to the theatre of the occasion and builds anticipation so that when Halloween rolls around, people think of your store rst,” says Trudy Davies, from Woosnam & Davies News in Llanidloes, Powys.

Social media is a vital tool for retailers to utilise across the Halloween and Bon re Night season. With both occasions rich with imagery, there’s

plenty that retailers can do to decorate stores and create eyecatching posts on Facebook, Instagram and TikTok.

“I begin thinking about my Halloween stock in May, and by the beginning of September I free up space in store for Halloween xtures and displays.

I ensure that we have a strong presence online, especially through Facebook, and use it in the lead up to Halloween to show customers what stock we have,” says McAteer.

With Halloween stock in such