HAVANA CLUB CUBAN SPICED +56% VALUE AND +66% VOLUME SALE

HAVANA CLUB CUBAN SPICED +56% VALUE AND +66% VOLUME SALE

• Dodgy sellers left with nowhere to hide as trading standards’ new enforcement team prepares to combat illegal products and underage sales

• Local shops to see increased test purchasing and inspections as part of government crackdown

HAVANA CLUB AGED 7 YEARS #3 PREMIUM GOLDEN RUM

BY VALUE

RESPONSIBLY.

New online high fat, sugar and salt proposals further threaten sweet sales

POST OFFICE

Retailers react to latest £26m remuneration increase for the financial year

How to boost takehome sales as UK prepares for series of outdoor events

Women in Convenience aims to address this inequality and make meaningful changes.

We are asking female retailers to complete our short survey, to share their thoughts and experiences, so that we can begin to understand what is behind the inequality, and how Women in Convenience can best help tackle the issues that female retailers face in the workplace.

The survey can be accessed at the following link: bit.ly/3wPzrmR or by scanning the QR code.

We really appreciate your time – thank you.

You can find out more about Women in Convenience and how to get involved by visiting betterretailing.com/women-in-convenience

Over 75% of female retailers feel that there is inequality in the independent convenience sector.

Your guide to finding the products and services you need for your business

• Dodgy sellers left with nowhere to hide as trading standards’ new enforcement team prepares to combat illegal products and underage sales

• Local shops to see increased test purchasing and inspections as part of government crackdown

Last week, I moved out of London. After spending nearly six years in the capital, I’m certainly going through an adjustment period, whether that’s not seeing double-decker buses, or people actually smiling at me for no reason.

Being away from the hustle and bustle means, of course, that stores in neighbourhood towns are catering to far fewer people, and tend to face less competition. However, what quickly struck me is how much more reliant residents are on their local shops.

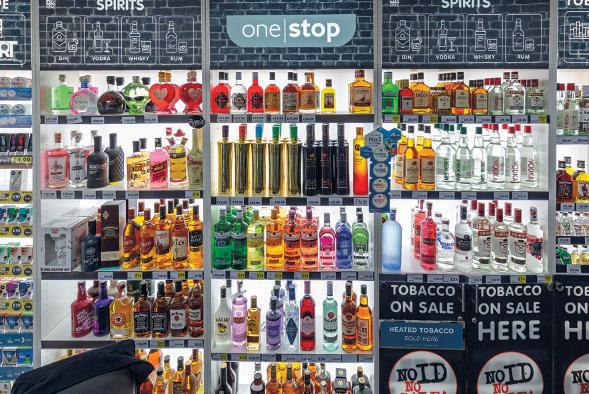

As a result, those stores go above and beyond to become one-stop shops for their customers.

Their ranges are impressive and diverse, stocking everything from household and gardening tools to storage boxes, greeting cards and all the DIY accessories you could want – the latter proving particularly helpful when I was unpacking.

It’s clear these independent retailers have spent a lot of time understanding their demographics, and are reaping the rewards.

Why would shoppers venture to big supermarkets on the outskirts of towns when they can pick up most of what they need on their local high streets?

Whether a shop is in a city, town or village, though, range diversification is essential.

ALEX YAU

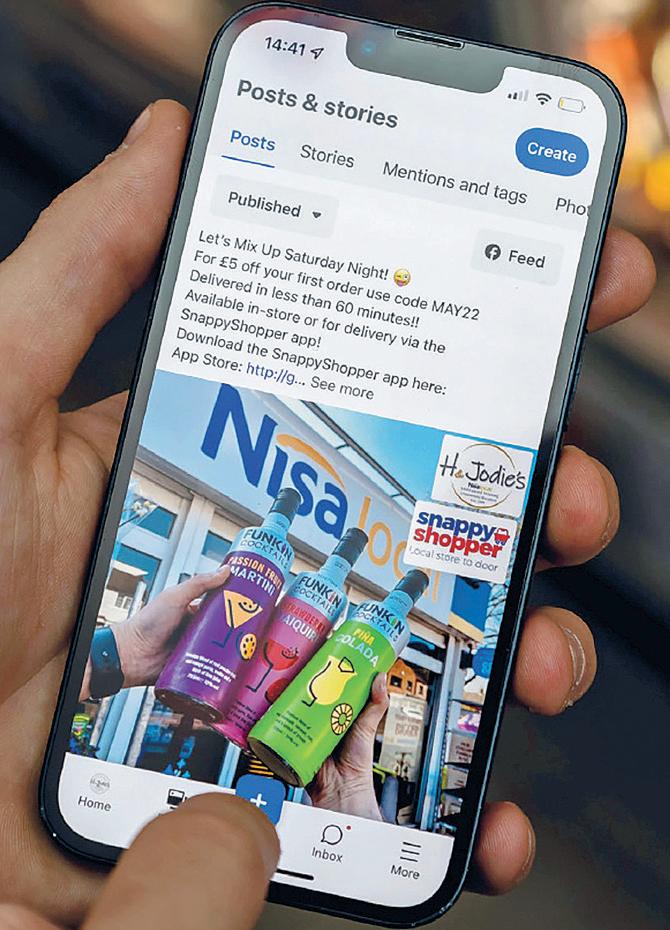

LOCAL shops are concerned that new government proposals to restrict the online advertising of products high in fat, sugar and salt (HFSS) could further threaten their confectionery sales.

If approved, the proposals would affect retailer and supplier paid-for advertising of

A good place to start is having conversations with your customers. Take a gamble and ask them what they’d like to see you sell, and consider stocking it, however wacky it might be. You might be surprised by how well the suggestions sell. The power of shoppers’ needs reigns supreme, after all.

@retailexpress betterretailing.com facebook.com/betterretailing

products such as snacks and confectionery on social media.

Although unaf�iliated stores will be exempt, franchise and symbol group retailers will be affected as they are de�ined under HFSS restrictions as a business with 249 employees or more.

The legislation counts them as part of the wider symbol group, and not a separate business.

POOR availability of disposable vaping lines in supermarkets due to widespread recalls has bene�ited independent retailers.

Nishi Patel, of Londis Bexley Park in Dartford, said: “Our [legal] disposable vape sales rose by £1,000 compared with

the previous week. I think it’s a combination of the supermarkets withdrawing lines and the increase in tobacco duty announced in the Budget. Customers don’t want to pay more for tobacco, so have been pushed towards affordable vape products.”

NISA has experienced a 2.5% decline in retail sales, Co-op’s annual results to 31 December 2022 have revealed. Retail sales across the symbol group hit £1.38bn in the year. In comparison,

ACS chief executive James Lowman warned that local shops could be unfairly targeted. He said: “Social media is a common tool used by retailers to communicate with their customers about the products and services they have available in store.

“We are concerned that the proposals to further restrict HFSS advertising will negatively and disproportionately

affect local shops that use the online space to market their business.

“The inclusion of symbol group operators under a broad umbrella term of a franchise agreement will result in thousands of small convenience stores being unfairly penalised by the restrictions as it will undermine their ability to reach their local customers and trade competitively.”

MORE than 1,000 free-touse NoteMachine ATMs are to charge customers 69p per withdrawal, with the �irm blaming funding cuts for the fee introduction.

NoteMachine chief executive Steve Makaritis said: “This move to pay-to-use comes

after years of campaigning to sustain the funding that supports free-to-use ATMs. The government legislation protects ‘access to cash’, but crucially fails to address the broken funding model that is forcing ATM operators to convert free cash machines.”

For the full story, go to betterretailing.com and search ‘NoteMachine’

sales for Nisa’s wholesale arm outgrew the retail division as it experienced 3.8% growth to £1.44bn.

In the results, Nisa managing director Peter Batt identi�ied wholesale as a key area for the company’s growth.

THE multiple is selecting a preferred EPoS provider for Daily franchisees, with companies MSP, TLM Technologies and CBE understood to be shortlisted.

The supermarket did not con�irm whether the three

companies were in the running, but stated the process is to be completed later this year. TLM Technologies and MSP declined to comment, while CBE failed to respond when Retail Express went to press.

For the full story, go to betterretailing.com and search ‘Morrisons’

MEGAN HUMPHREY

RETAILERS have described the introduction of an enforcement squad to tackle the illegal sales of vapes to under-18s as “long overdue”, but want to see “long-term action”. Health minister Neil O’Brien announced a raft of tough measures last week, as part of the government’s wider plans to reduce smoking and tackle youth vaping.

Part of this included a new illicit vapes enforcement squad – backed by £3m of government funding – to enforce the rules on vaping. Led by trading standards, the team will share knowledge and intelligence across regional networks and local authorities.

Convenience stores and vape shops were name checked in the announcement, with O’Brien stating test purchasing would be carried out, alongside increased inspections.

Alongside this, the team will also produce guidance to help build regulatory compliance and will have the power to remove illegal products from shops and at borders.

The minister also announced a call for evidence to identify opportunities to reduce the number of children accessing and using vapes, while ensuring they remain available as a quitting aid for adult smokers. As a result, a ‘swap to stop’

scheme will be launched, which will see one in �ive smokers in England be provided with a vape starter kit alongside behavioural support to help them quit smoking.

He said: “While vaping is a preferable alternative to smoking for adults, we are concerned about the rise in youth vaping, particularly the increasing use of disposable vaping products.

“The new illicit vapes enforcement squad will work across the UK and clamp down on those businesses that sell vapes to children – which is illegal – and get them hooked on nicotine.

“Our call for evidence will also allow us to get a �irm understanding of the steps we can take to reduce the number of children accessing and using vapes.”

Anita Nye, owner of Premier Eldred Drive Stores in Orpington, Kent, told Retail Express she supports the move, but “there needs to be action seen from it in order for it to have an impact”.

She explained: “I’ve been told trading standards don’t have the resources to deal with reports I’ve made about vape shops selling products to children, so I need to see they are being held accountable as much as convenience stores.”

Sue Nithyanandan, from Costcutter Epsom in Surrey, agreed: “This is long overdue. It will help give legitimate retailers muchneeded reassurance. We

have retrained our staff and they have no excuse.”

However, other store owners expressed concern over the long-term impact.

Fiona Malone, of Tenby Stores & Post Of�ice in Pembrokeshire, added: “My concern is do they have the staf�ing to enforce it? Will it be long-term or a �ive-minute wonder?”

Last month, the UK Vape Industry Association launched its youth vaping prevention action plan in

Parliament, which included �ines of up to £10,000 per instance for retailers; a new national registration scheme for retailers; the introduction of the �irst-ever national test-purchasing scheme; and funding from the �ines and retailer registration scheme to be used to �inance enforcement by trading standards.

In response to O’Brien’s announcement, the trade body’s director general, John Dunne, said: “We’re

especially pleased that the government has taken on board our idea of a test-purchasing scheme which will help to keep a much-needed close eye on the sales activities of retailers.”

The vape category has been dogged by controversy in recent months, after certain El�bar, Lost Mary and SKE Crystal batches had to be removed from supermarket shelves, due to them being over the legal 2ml e-liquid limit.

“If things start going out of date or you have to start reducing them, then it’s time to say goodbye. The till system is fantastic, and we go through that and see how many have sold each week. There have been a few grocery lines that have taken a hit – things that saw a lot of demand over lockdown, but then became surplus to requirement. Trends change, and you have to be brutal.”

Kelly Busby, Londis Seaborn Stores, Morecambe, Lancashire“There’s more nuance to the topic than simply cutting slow sellers. There are certain products we’ll keep in if customers come for them on a regular basis. If certain products sell through, even if the sell through isn’t great but it supports a customer coming in for a larger basket spend, we take the decision to maintain them. This is particularly important for premium products in categories which customers will continue to shop for.”

Terry Caton, Londis, Chesterfield, Derbyshire“We check our EPoS for random categories every month and evaluate the best and worst sellers. That identifies things quickly and then we’ll delist it. We reduce what’s left and get shot of it. If it’s been sitting on our shelves for a long time, we don’t want it there any longer. We don’t rush out to look for a replacement product unless we happen upon something that might work.”

Meten Lakhani, St Mary’s Supermarket, Southampton, Hampshire

have an issue to discuss with other retailers? Call 020 7689 3357 or email megan.humphrey@newtrade.co.uk

NATIONAL LOTTERY: Retailers are to receive upgraded training and equipment to support their lottery services as part of a new agreement between upcoming operator Allwyn and Vodafone. Allwyn claimed the move would help “support retailers and grow sales”, and pledged to give training to store owners to help them understand the new technology.

For the full story, go to betterretailing.com and search ‘lottery’

FACIAL RECOGNITION: The UK’s data protection watchdog has ruled in favour of Facewatch’s technology used to protect staff from criminals. The firm produces security cameras that use facial-recognition technology to recognise prolific shoplifters and alert staff.

ENERGY: Small devices are costing stores thousands of pounds a year in energy bills, testing by Retail Express’ sister-title, RN, has revealed. The energy consumption of 20 common plug-in appliances when idle was measured across five London stores. Based on all the appliances running 24 hours per a day, a store paying 35p per kWh faces annual costs of £3,886.46, rising to £5,552.09 at 50p per kWh or £9,438.55 for those paying 85p per kWh.

For the full story, go to betterretailing.com and search ‘energy bills’

NEWSPAPERS: Retailers have slammed Daily Mail Group’s (DMG) decision to cut retailer percentage terms during its latest price rises. From 4 April, Monday to Friday Daily Mail editions increased by 10p to £1, with the percentage margin falling from 22.31% to 21.8%. The pence margin rose from 20.1p to 21.8p.

C Y MY CMY

POST office retailers have welcomed a £26m uplift in banking deposit remuneration, but warned more still must be done.

The changes represent a 20% increase for the 2023/24 financial year, with postmasters being informed in an email by Post Office (PO) group chief retail officer Martin Roberts last month.

The package also includes the doubling of payout transaction remuneration confirmed to stay at increased levels; a 12.87% increase in mailwork payments; and a 9.5% increase in outreach remuneration.

The move builds upon the previous doubling of the transaction rate for deposits announced last August.

However, despite welcoming the increase, Com-

munications Workers Union postmaster branch secretary Mark Baker warned it was not enough.

He told Retail Express: “The operating costs of running a banking service in post offices are significant.

“Last year, PO was paid £200m by the banks for access to our network. That’s over £17,000 for every branch, on average.

nificant increase, otherwise this is just a gesture.”

Chief executive of the Federation of National SubPostmasters Calum Greenhow also claimed the trade body was not informed about the changes until a day before its official announcement.

He added: “While the increase is welcomed, it is reflective of the continued managed decline in the overall business of PO.”

“There needs to be a sig-

A SOCIAL media craze involving pickles has helped retailers generate hundreds of pounds in sales.

Independent retailers have been quick to stock Van Holten’s Pickles, which have been made famous on TikTok.

HERE FOR EMOTIONAL SUPPORT TAKE POSITIVE PRACTICAL STEPS

#LetsTalkGroceryAid Call our Helpline for ‘in the moment’ emotional support and to discuss what other services may benefit you Receive accurate information on everyday issues, including legal, financial and consumer law

Get help managing your finances and budgeting for the future. You may also be eligible for a non-repayable grant

PAYPOINT has warned investors it could face legal action regarding exclusivity clauses previously printed in contracts with energy suppliers and retailers.

In 2021, the company removed the clauses following Ofgem’s investigation into whether PayPoint “abused a dominant position” to “restrict or distort competition”.

Free and Confidential Support Available 24/7, 365 days a year, through the FREE Helpline and website, for grocery colleagues, their partners/spouses and dependants

GET FINANCES BACK ON TRACK 08088 021 122

GA Day 2022 A4 Double Sided Poster_AW.pdf 2 07/02/2022 16:14 RN Full page ad.indd 1 04/04/2022 15:49

Users of the social media site have posted videos of them eating the spicy snack. Serge Notay, of Premier Notay’s in Batley, West Yorkshire, said: “I have been selling them as part of a pickle kit for £9.99. I’ve sold 70 kits.”

NISA is giving its retailers the opportunity to provide feedback through monthly panels.

Several of the symbol group’s store owners told Retail Express that 40-to-50 partners nationwide are given the opportunity to attend.

received letter before action correspondence from a small number of market participants”. The company said it would “respond robustly”. 18 APRIL-1 MAY 2023 betterretailing.com For the Post Office’s full response, go to betterretailing. com and search ‘Post Office’ For the full story, go to betterretailing.com and search ‘Nisa’

A Nisa spokesperson said: “We are working hard to ensure we have the best proposition, and the feedback retailers provide through their retail development managers, face-to-face and online forums is key.”

INDEPENDENT retailers are being encouraged to focus on craft cider, as this segment will be this year’s biggest pro�it driver, according to Westons Cider.

In its annual cider report, published last month, the supplier told Retail Express that craft was the only segment in growth in convenience, as well as total market, but there was still headroom to grow.

They explained craft made up 17.8% of value in convenience, compared with 19.5% total market. Distribution of craft cider was 92% across convenience, compared to 98% in total market.

“Retailers should be stocking several crafted apple lines. If the crafted category receives wider distribution across convenience, then this could single-handedly return the entire cider category to growth,” they said.

In terms of value, craft, as de�ined by brands that focus on heritage, averages £3.60 per litre in convenience compared to total cider at £2.53 per litre.

Elsewhere, the supplier explained apple ciders should occupy approximately two thirds of total space within cans (including single, pints and four-packs).

Apple ciders in glass formats largely sit within the craft segment.

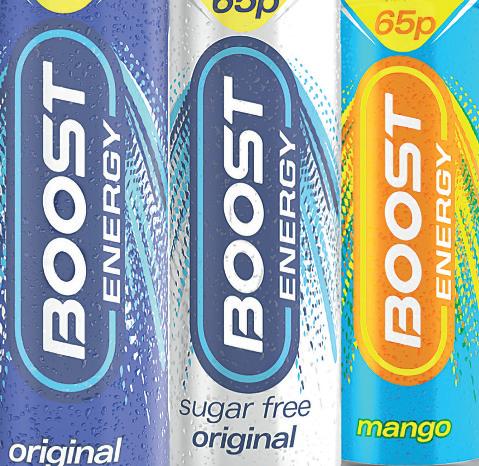

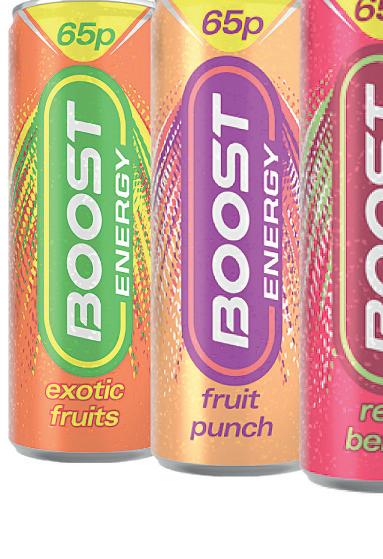

BOOST Drinks has launched a limited-edition Raspberry & Mango variety under its Sport range.

The new �lavour is available in a 500ml bottle at an RRP of 79p. Its launch comes as raspberry and mango �lavour pro�iles are seeing 55% and 58% growth, respectively.

Additionally, Boost Sport has seen 63% annual value growth and is the numbertwo sports drink brand in value and volume, according to IRI.

The supplier will support the launch with a competition in collaboration with its partner Leeds United Football Club. Trade publication readers will have the chance

to attend a three-hour stadium tour experience at the club.

The top 10 brands across the total off-trade market in order are: Strongbow, Strongbow Dark Fruit, Thatchers Gold, Henry We-

stons Vintage, Kopparberg Strawberry & Line, Kopparberg Mixed Fruit, Magners, Thatchers Haze, Inch’s and Frosty Jack’s.

DIAGEO has expanded its Captain Morgan ready-todrink (RTD) range with the launch of a Strawberry Daiquiri variety.

The new �lavour (ABV 5%) is available now in 250ml cans. Retailers can choose between a £2.39 price-marked pack (PMP) or a plain pack with an RRP of £2.59.

Its launch comes as the RTD category has grown in value by 16.7% in the past 12 months. It also follows on from Captain Morgan’s new pack design.

Lizzy True, Captain Morgan marketing manager at Diageo GB, said: “The RTD

THE Creamy Tomato, Chicken & Mozzarella Slice is the latest limited-edition launch from Ginsters.

Available now with an RRP of £1.95, it is part of the supplier’s strategy of introducing seasonal �lavours that are aimed to bring excitement to the food-to-go category.

It follows on from last year’s Cauli�lower Cheese Slice and the reintroduction of its Festive Slice.

The supplier wants to continue give shoppers excitement for the lunchtime occasion, with 20% more in-home lunch occasions taking place than before the pandemic.

Ginsters’ limited-editions

COCONUT water brand Coconutea is launching in the UK with six �lavour varieties.

Coconutea is a premium coconut water made with Sri Lanka’s king coconut combined with green tea.

The six varieties, each available at an RRP of £3.49, are Lemon, Peach, Pineapple, Passionfruit, Strawberry and Soursop. Coconutea is

rich in magnesium, sodium, potassium and B-complex vitamins, which the supplier says makes it ideal as a rehydration drink.

Distributor Vivo Tea Company is targeting the UK retail sector, as it believes it has identi�ied a gap in the market. The coconut water category is predicted to grow by 35%, according to Mintel.

have brought in more than 600,00 new shoppers and contributed 47% incremental sales growth.

PROCTER & Gamble (P&G) has launched a Country Garden range, its �irst spring limited-edition collection across its home and fabric brands, in partnership with in�luencer Mrs Hinch.

The range features across brands including Lenor, Bold, Flash and Fairy. It is designed with the scent of tulips and jasmine.

RRPs are as follows: Pods at £8.50, Fabric Conditioner at £3.50, In-Wash Scent Boosters at £3, Bold Gel at £5, Febreze Air Mist at £2.50, Febreze Fabric Refresher at £2.50, Febreze

Bathroom at £2.50, Febreze 3Volution Plug-In Re�ills at £3.50, Flash Spray Wipe Done at £2.50, Flash All Purpose at £3, Flash Speed Mop Wet Cloth Re�ills £7, Fairy Platinum Plus at £10,and Fairy MaxPower at £3.

category provides an opportunity for brands, such as Captain Morgan, to replicate serves that are popular in the on-trade, and package them into convenient formats so the drinks can be enjoyed during a range of occasions.”

HEINEKEN is building on the launch of last year’s Strongbow Ultra range with the addition of an Apple variety.

The new addition (4% ABV) is available in single and four-pack 330ml cans. At 80 calories per can, it contains 36% fewer calories than Original.

This is also less than the 95 calories per can in Dark Fruit Ultra. It is also gluten-free and vegan.

To drive awareness of the can, the supplier will support the launch with a multimillion-pound campaign commencing this month. It will include the return of last year’s ‘Drink the G.O.A.T’ ad campaign, alongside consumer sampling.

WORLD of Sweets is urging retailers to stock up on branded freezables ahead of summer, as the category has seen considerable growth.

According to IRI, the freezables market grew by 70% annually in 2022.

The wholesaler will soon stock Warheads Extreme Sour Snap Ice in Green Apple, Watermelon, Black Cherry and Blue Raspberry

varieties at an RRP of £1.75. World of Sweets’ other brands include Barratt Ice Duos, which are available in Fruit Salad, Dip Dab, Wham and Refreshers varieties. They are available to retailers in packs of 14 at individual RRPs of £1.75. The Barratt Ice Duo is available in a single-pole format at an RRP of 35p, available in packs of 60.

JAMESON has launched Jameson Connects, a new digital platform for its customers.

Customers will be able to access the platform via a QR code available on the necks of all Jameson Original bottles.

They can then gain access to events, experiences and content, which fall under the brand’s ‘Widen the circle’ campaign.

This content will change on a monthly basis to give customers a reason to return to the platform.

It includes early access to gigs, competitions, cocktail recipes, snack inspiration and merchandise.

The launch of Jameson

Connects comes as the brand’s 2.7% growth is performing ahead of total whisky in the off-trade in the past 12 weeks.

It is also leading the growth of Irish whiskey in the UK, holding a 73.8% value share.

Leanne Banks, marketing director at Pernod Ricard UK, said: “Jameson has a rich heritage of bringing people together for shared moments of connection and Jameson Connects is the next step in the evolution of the brand’s community.”

HANCOCKSis encouraging retailers with pick-and-mix ranges to stock up on regalthemed Kingsway confectionery ahead of King Charles III’s coronation on 6 May.

Some of the brand’s bestselling regal-themed sweets include Ravazzi Gummy Crowns, Gold Milk Chocolate Coins, Royale Sherbert Lemons and Lemon Bon Bons. Lemon cream is said to be the new King’s favourite dessert.

Kingsway is also encouraging stores to merchandise a range of red, white and blue sweets. Its lines in these colours include Paintballs in Red and Blue, Mint Imperials, Ravazzi Stars, Ravazzi Red Hearts, Blue Raspberry Bon

Bons and Fizzy Blue babies. These can be merchandised as part of a wider pick-and-mix display or in pre-packaged coronationthemed bags, decorated with coloured ribbon or in the branded Kingsway Pick N Mix Paper Bag.

BREWDOG has rolled out a pack update across its multipack range to help differentiate between its various beer styles and provide on-shelf standout.

The refresh sees the packs change from all white to integrate the can design of the beers within. They also will feature three-word descrip-

tors focusing on taste with a visual of the beer in a glass.

This highlights the colour of the liquid and helps shoppers more easily select the speci�ic beer style they want.

The new packs began rolling out to wholesale on 4 April. BrewDog is also changing the design across outer casing and shippers

to help retailers recognise the styles when shopping in depots.

Hannah Corker, customer marketing manager at BrewDog, said: “There are so many different styles of craft beer to explore and discover, that it can be daunting for shoppers entering the category for the �irst time.”

JACK Daniel’s and CocaCola have launched a co-branded ready-to-drink (RTD) option.

Made with Jack Daniel’s Tennessee Whiskey and Coca-Cola, the new variety (5% ABV, RRP £2.30) is inspired by the bar mix and will replace the existing Jack Daniel’s & Cola RTD can.

It is the result of a global agreement struck between the two brands last year and was initially launched in Mexico in November 2022.

In the UK, it is also available in a Coca-Cola Zero Sugar variety.

Currently, Jack Daniel’s & Cola is the number-one pre-

mixed line in the UK, with a retail sales value of £38m, according to Elaine Maher, associate director at CocaCola Europaci�ic Partners.

“This is a huge moment for us, for our customers and for the alcoholic RTD category,” Maher said. “The UK is the biggest RTD market in Europe and expected to grow signi�icantly by 2030, driven largely by pre-mixed cocktails. Within this, whisky-based varieties are in growth.

“Jack Daniel’s & Cola is already the number-one premixed line in Great Britain, worth £38m, and with consumer testing revealing that shoppers are more likely to pick up the new Coca-Cola

NOMADIC has marked its 25th anniversary with a rebrand that updates its packaging and removes the ‘Dairy’ from its name.

The supplier says its new logo is bolder and more simpli�ied, and the added coloured chevrons indicate product �lavours.

It also says the removal of ‘Dairy’ from its name shows a willingness to extend its product range into new categories.

This comes in the wake of the launch of its Protein Pudding range, Nomadic’s �irst non-yoghurt products. However, the supplier hopes to maintain its numberone ranking in convenience for adult yoghurt sales, per

IRI

Nomadic is supporting the rebrand with in-store PoS and a marketing campaign set to launch early this summer.

co-branded Jack Daniel’s RTD, we’re con�ident further growth will follow particu-

larly as we’re also making a Coca-Cola Zero Sugar option available in Great Britain.”

ICE cream brand Jude’s has launched a Salted Caramel Collection and has expanded its Little Jude’s range with Fruit Twists.

The Salted Caramel Collection consists of two mini tubs each of Salted Caramel Crunch and Salted Caramel & Chocolate ice cream, at an

CAPTAIN Morgan has launched its ‘Enjoy slow’ campaign in partnership with singer and rapper Bree Runway, which it says is its largest-ever global responsible drinking campaign.

It consists of a digital and broadcast advert launching initially in Great Britain and South Africa before wider global expansion. The

UNILEVER has announced plans to improve on-pack accessibility by adding a QR code to its packaging, launching �irst on Persil packs in the UK.

The supplier says the QR code is intended to create a more inclusive experience for blind and partially sighted people in store and at home.

The codes have been designed by augmented-reality company Zappar in collaboration with Unilever and the Royal National Institute of Blind People.

They have additional markings around them, improving detectability. The accessibility app Zapvision can detect the product from more than one metre away and provide

product information, including how to open the box, use the product and recycling information.

Depending on the app’s settings, this information can be provided via audio or enlarged text.

supplier anticipates it will deliver more than 163 million impressions. It features a sloweddown remix of popular ’90s track ‘Rhythm of the Night’ performed by Bree Runway. The aim of the campaign is to encourage drinkers to set their own pace and not be afraid to say no to a drink or another round.

LIPTON Ice Tea has relaunched its range with a modernised design and a reduction in sugar.

The new packaging is present across all �lavours, while the reduction in sugar has taken place across the core varieties of Peach, Lemon and Green Mint & Lime �lavours.

Green Mint & Lime has had its sugar content reduced by 29%, while Peach and Lemon’s sugar content has gone down by 33%.

The supplier said the decision to reduce sugar content came as half of shoppers say they are actively reducing the amount of sugar they consume.

Meanwhile, the rebrand

comes as the brand grew in value by 27% in 2022, according to the supplier.

RRP of £4.80.

Meanwhile, Little Jude’s Fruit Twists feature strawberry and mango & coconut ice cream wrapped around an apple lolly.

The lollies have 30% less sugar than comparable lollies, and are available in boxes of �ive at an RRP of £3.30.

BIRDS Eye Green Cuisine has announced a partnership with Team GB ahead of the Paris 2024 Olympic Games. Following the success of their previous partnership, the collaboration will see the brand educate people on the health and nutritional bene�its of plant-based food, as well as the environmental bene�its.

It will also build on Birds

Eye Green Cuisine’s ‘Welcome to the plant age’ campaign, inviting people to rethink the accessibility of �lexitarian diets.

According to Victoria Westwood, UK & Ireland marketing cluster lead at Green Cuisine, the brand is now worth £17.3m, ahead of plant-based consumption’s projected 500% growth in the next 15 years.

CARABAO is expanding its offering with the launch of a Sport range in Orange and Mixed Berry varieties.

The supplier said the carbohydrate-electrolyte drink has been launched in time for warmer weather to aid hydration.

It is also aspartame-free, following research which says 60% of regular isotonic sports drinks drinkers who exercise weekly are concerned about the presence of the sweetener in sports drinks.

Carabao Sport is made with natural colours and �lavours, with 113 calories per bottle, containing 4.4g of sugar per 100ml.

John Luck, chief market-

ing of�icer at Carabao, said: “As current sponsor of The Carabao Cup, and with an existing range of great tasting, low-calorie energy drinks, launching a sports drink is a natural extension for the Carabao brand.”

ACCOLADE Wines has revealed a new look for Lambrini alongside a marketing campaign to boost shopper awareness.

The supplier said the new look modernises the brand, with the use of pear imagery linking to the taste of the perry.

In support of the redesign, there will be in-store materials highlighting different Lambrini serves.

Lambrini is also partnering with Baby, star of RuPaul’s Drag Race, in a digital campaign.

The rebrand comes as

Lambrini is the leader in the perry category, commanding 60% of value sales.

It also has a 26% value share of the perry and �lavoured wine sector across the total market.

Charlotte Jefferies, marketing manager at Accolade Wines, said: “We know that, now more than ever, consumers are watching what they spend, but they still want to have a good time.

“Bigger nights out are becoming less regular, but having fun at home is on the rise. Lambrini is the perfect way to enjoy a great night in and still make it feel special.”

WEETABIX has announced that 100% of the packaging across its entire product range is now designed to be fully recyclable, two years ahead of schedule.

All the supplier’s paperbased packaging components and On The Go bottles are widely recyclable at home. Meanwhile, plasticwrap components can be recycled with soft plastics at supermarkets.

The supplier said these changes will reduce its carbon footprint by 648.4 tonnes per year.

Mark Tyrrell, packaging development manager at Weetabix, said: “The next step for us will be to further reduce the carbon footprint of our packaging, as a contributing factor to Weetabix’s commitment to producing the �irst zero-carbon box of cereal.”

PERFETTI Van Melle has announced that its Smint brand is the number-one sugar-free mint brand in the UK, citing IRI �igures.

According to the market research �irm, Smint occupies 35% of the sugarfree mint market, having grown by 44% in the past four weeks.

The supplier said the brand’s growth, ahead of competitors including Polo and Tic Tac, is three times

the category rate.

Caroline Grimshaw, product manager at Smint, said: “Thanks to constant innovation, combined with investment in the brand, Smint continues to be a must-stock for retailers.

“Perfetti Van Melle’s position at the forefront of the market means it’s positioned to cater to demand for healthier choices, while still providing that refreshing moment for consumers.”

“My storage solutions were sorted after booking my FREE consultation with the Business Solutions Team”

Bakery Owner

Emma

PILLAR 1

Distribution & Availability

Massive congratulations to Daniel Ryan from Hiccups Off License in Stoke-on-Trent, Depan Patel from Bon Bon in Canterbury, Hanif Master from Ribble Valley Forecourt in Burnley and Shantha Kumar from Premier Downend in Bristol who are JTI’s national winners of its Nordic Spirit ‘Perfect Store’ competition.

Each retailer excelled against five simple pillars which helped to generate awareness of nicotine pouches, entice existing adult smokers and vapers, and boost sales of Nordic Spirit.

Each winner has won a prize bundle worth up to £20,000 per store, which includes an all-expenses paid trip to the Nordic region, £2,000 wholesaler credit, tickets to events and much more.

But how did they do it?

Follow the five Perfect Store pillars below to boost your Nordic Spirit sales.

PILLAR 2

Visibility

Maintain full distribution and availability to meet demand: We’d recommend stocking at least 3 cans per SKU

PILLAR 3

Presence

Ensure clear visibility of products in-store: Placing a Nordic Spirit unit on the countertop can help support sales

PILLAR 4

Engagement

Increase brand presence via in-store POS materials: Showcase assets at front of store, point of purchase and back wall to maximise awareness

Build up brand and nicotine pouch category knowledge to educate customers: You can learn more about Nordic Spirit on jtiadvance.co.uk

PILLAR 5

On-shelf

Pricing

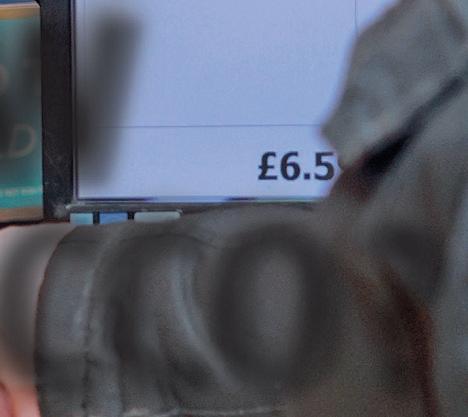

Tactical on-shelf pricing ensures consumer confidence: Sell at our RRP of £6.50 for 20 pouches and make pricing clearly visible*

Hanif Master

Hanif Master from Ribble Valley Forecourt in Burnley saw an immediate sales increase.

“We were the only shop in a busy location selling Nordic. In the first six weeks of following the Nordic Spirit Perfect Store model, our sales increased from 30% percent to 65%. Even now we restock twice a week. We are finding same customers are coming back and at the same time we are generating new customers.

“The selection of flavours has appealed to our shoppers. The great thing about Nordic Spirit is there is no smoke, no vapour, and you can enjoy it indoors, outdoors and even when travelling. We have invested time in educating staff about Nordic Spirit and therefore they are confident talking to customers on a daily basis.”

Depan Patel

Depan Patel from Bon Bon in Canterbury, was able to create the perfect layout for Nordic Spirit in their store.

“The Perfect Store competition has increased visibility and accessibility of Nordic Spirit products, which has helped to drive sales. A well-executed Perfect Store program can help to create a positive brand image, as consumers are more likely to associate the brand with high-quality products that are readily available. The POS and in-store information also helped to educate customers on nicotine pouches.”

Contact

Daniel Ryan

Daniel Ryan from Hiccups Off License in Stoke-on-Trent, saw their Nordic Spirit sales double and bring in new customers:

“We have put the brand pride of place in our store! Following the Nordic Spirit Perfect Store Guidelines has seen our sales of Nordic Spirit increase to 4-5 outers a week, up from 1-2. We have also had comments from our customers about how good it looks - and it has enabled us to increase our sales because of the visual affect.

“We have picked up a number of new customers who know we are never out of stock, and they have become regulars not only for Nordic Spirit but for other products as well. This means we have increased our turnover with these new customers.”

Shantha Kumar

Shantha Kumar from Premier

Downend in Bristol, said they have seen an increase in customers asking about Nordic Spirit in store:

“The Nordic Spirit Perfect Store POS has led to an increase of local and new customers coming into the store asking about this product. It has massively helped our sales on Nordic Spirit, which have probably tripled. We have also found a lot more customers have asked questions about the product, whereas before no one ever asked.”

TOPICS

What do you think? Call Retail Express on 020 7689 3358 for the chance to be featured

SOCIAL MEDIA: How are you promoting your store online?

”I USE social media for special occasions, such as Mother’s Day and Easter. I don’t use it on a daily or weekly basis. It takes time and just remembering to post on a regular basis is difficult. However, I should really spend more time on it. I see other shops use it a lot more than I do.”

“I POST online when I get new products, special offers and other general information. The promotions gather attention when I post them on social media. You can have different themed specials, such as Christmas, and customers come in and say they saw the offer on a Facebook post.”

OWN LABEL: Are you seeing an increase in demand?

“PEOPLE are more considerate about purchases due to having tighter overall budgets. Customers are making decisions based on the economic climate, and prices are rising, so we have seen an increase in ownlabel product purchases.”

SYMBOL GROUPS: Would you like more face-to-face meetings?

”I’M on the Londis retail forum, so I probably get to see them a little bit more than other people, but it would be better to meet them face-to-face more. It’s not like it used to be with the quarterly meetings. Emails, text messages and WhatsApp tend to be misconstrued.”

Natalie Lightfoot, Londis Solo Convenience, Glasgow

“I FEEL quite content with One Stop. If there is anything I need to ask, I can call or directly email them. I don’t meet often face-to-face, however, but I’m fortunate that I can talk freely to them. It would be good to see them more face-to-face now we are post-pandemic.”

Aman Uppal, One Stop Mount Nod, Coventry

People have confidence in local

Vince Malone, Tenby Village Stores & Post Office, Pembrokeshire

“THERE is a slight increase as everyone is thinking about the cost of goods. You have to make sure they have options and certain brands as prices have gone up by quite a lot. People on budgets are going to want to pick up things that make their baskets cheaper.”

Atul Sodha, Londis Harefield, west London

I would like to see them more face-to-face

WHOLESALE: Are rising prices forcing you to shop around?

“IT’S going to get to the stage where I’m going to have to look around because it’s getting more difficult. We haven’t had much help on the government side. I can see my son having to go out and look around for what’s cheaper. Everyone is having trouble. Retailers need more support.”

Amy Sohal, Ken’s Convenience Store, Cheshire

“I HAVE to stay compliant with Spar, but you always have to keep your options open with the way everything is. Local supply is what we are trying to concentrate on at the moment. People have confidence in local suppliers, the quality tends to be good and fresh, and that’s a big attraction for customers.”

Sunita Aggarwal, Spar Wigston, Leicester

MY energy bill came through the other day after being delayed.

They hadn’t billed me for four months even though I’m on a direct debit. It all looked correct to me, but I queried it anyway with the company.

As it happened, they told me that they hadn’t applied my discount, which meant that they were charging me more than they should have done.

And yet, there they were still taking my direct debit.

I’M a retailer based in England and I’ve been reading up about the deposit return scheme (DRS) being introduced in Scotland this year through Retail Express.

I know it will make its way into the rest of the UK and I want to get prepared for it. I have space for a reverse vending machine and I see it

as a potential way of making some extra money. I don’t know where to go to �ind out more. I want to learn as much as I can to prepare, but it is dif�icult to �ind any information. Could Retail Express help?

Ken Singh, BB Nevision Superstore, Pontefract

Ken Singh, BB Nevision Superstore, Pontefract

Retail Express news editor

Alex Yau responds: “The scheme is set to be rolled out across England, Wales and Northern Ireland in 2025. It will not align with the one being introduced in Scotland in August, with the main difference being the exclusion of glass. It is likely retailers will be fed information about the

scheme slowly, if the Scottish rollout – which has been subject to criticism, due to its lack of clarity on how store owners need to prepare – is anything to go by. The best thing I can suggest for now is to speak to trade bodies, including the Fed and ACS, as they will be best placed to answer any queries.”

Atul Sodha, Londis Peverills, Uxbridge – @AtulSodha

After a long conversation with them, they reduced it back to what it should have been, but I also put in a complaint for incorrect direct debit billing anyway.

It was all done via live chat, and I saved the entire conversation, so I now have evidence, should I decide to take it any further. I’m not planning to do so at the moment, but it’s part of best practice. It’s also very important when you’re making these queries and talking to suppliers about your bill that you remain calm and aren’t rude. I hate using a live chat, but when she told me I had a discount that hadn’t been applied, it was brilliant.

I don’t know how big the discount is yet – they didn’t have that information on my screen – but it would have been easy for me to just accept the bill and pay it. How many people would just say ‘that looks about right’ and not query it?

I have a smart meter installed at my store, but best practice means you need to be consistently looking at what your reading is and comparing it with your bill. I believe my readings are correct, so I trust them more than the bill. I receive a bill, I check it and then I go from there. I might not have checked the bill because it looked alright, but now I always check. It’s just standard practice for me now.

And I will always save the live chat and make sure to lodge a complaint if a direct debit was incorrectly taken. If I have to sit on a call for 20 minutes to get to the bottom of it, I want to get something that will benefit me. And it’s not just energy bills, either. I’m increasingly questioning other bills as well. Booker have changed my deliveries so they come from a different depot on a different day, but I’m getting the bill on the same day as before, so I’m questioning that as well.

CHOCOMEL has partnered with Retail Express to offer five of its readers the chance to win £50-worth of Chocomel, the premium chocolate milk drink, currently available in a price-marked pack (PMP) format. Now supported by a £10m TV campaign, ‘Sharing not required’, Chocomel will be more visible to consumers than ever before, meaning brand awareness will be at an all-time high.

“SEVERAL retailers – Harj Dhasee, Josh Baker, Arjun Patel, Avtar Sidhu and Raaj Chandarana – and I have teamed up with KP Snacks to put a spotlight on Testicular Cancer Awareness month in April. We filmed a video and KP has produced limited-edition packs where 10p will be donated to the Movember foundation for every one sold. There’s a £50,000 target. Testicular cancer is a taboo subject, but it can easily be prevented if detected early. The video we’re in is a playful way of having a conversation about it. The slogan is ‘Check Your Nuts’.”

‘Testicular cancer is a taboo subject’

Communication is key: Atul Sodha, of Londis Harefield in Uxbridge, said: “BAT UK has a wide range, but we need them to tell us what to stock. If we understand the category, it’s easier to relay that to our customers.”

Using sales data: Kay Patel, of Best-one Wanstead in east London, said: “We rely on sales data and suppliers to help us to determine our alternative nicotine range. It’s not always clear what to remove.” Utilising rep visits: Andrew Cruden, from Market Square News in Northampton, said: “We have sales reps visit regularly, but we’d like them to give feedback on the store’s perception.”

Expert view: Brad Rogers, field sales operations manager, BAT UK and Mustafa Zaidi, head of business development, BAT UK Rogers said: “There is a clear need for us to work with retailers to educate them on alternative nicotine products, including disposables and nicotine pouches. These should be split into four areas: visibility of the fixture, having a clean and uncluttered display, as well as strong pricing and being competitive in your local area.

“By focusing on educating retailers so this can be applied in store, adult nicotine consumers will then be able to find products easier and understand what’s on offer to suit their needs.”

Zaidi added: “Our BAT UK sales representatives communicate any changes to our range and are only too happy to discuss solutions we offer retailers, like merchandising advice. They can help with PoS materials, promotions and discounts, but based on today’s feedback, we will research other ways to relay key information to retailers.”

In February, BAT UK and RETAIL EXPRESS publisher NEWTRADE MEDIA hosted leading retailers for a networking roundtable to explore the challenges and opportunities in tobacco and alternative nicotine products

Incentives are key: Retailers said supplier incentives are key, such as cash prizes or days out. They added suppliers should highlight why they are being rewarded, i.e selling a certain product. Have the right products: “Have a list of your core range available for sales reps and use this to add points to a card,” said Sue Nithyanandan, of Costcutter Epsom in Surrey. “It needs to be products that will sell in store.”

Offer the right resources: “If a product is offering a reward, tell us about it. This helps make us aware of the product and that we need to drive sales,” explained Patel.

Expert view: Afzal Rahman, B2B manager, BAT UK Rahman said: “Our rewards programme is a one-stop solution for retailers to get access to category education, which enables them to understand what new products are launching so retailers are better equipped to answer questions and queries from customers.

“The loyalty scheme is also a way for retailers to get access to the points and rewards that they have received by completing specific tasks laid out by BAT UK, which they can claim as a reward payout.

“One of the key learnings we are taking away today is to bring key retailers together under one roof to understand best practice and understand what is important to retailers when using a rewards programme. We will then be going back out into the field implementing these to help retailers and their teams to manage the alternative nicotine products category.”

Build an online portal: Cruden said: “Create a portal for staff training and to earn points for cash prizes, vouchers or days out. This motivates staff and shows they are valued by suppliers, just as much as we do.”

Create brand ambassadors: “Incentivise and help staff become brand ambassadors,” said Nithyanandan. “This will help retailers, and the supplier by driving sales. It’s a win-win.”

Build staff relationships: “It’d be great for suppliers to get to know staff,” Paresh Vyas, of Jack Lanes Convenience in Manchester, said. “By understanding their interests, incentives can be personalised.”

Expert view: Mustafa Zaidi, head of business development, BAT UK

“The cost-of-living crisis will play a big role in 2023 and will impact both retailers and their teams. Listening to retailers who attended the panel, we plan to focus on our strategy to help improve resources to train teams.

“Staff are imperative to a store’s day-to-day running, and driving the sales of products and the importance of having the right training in place cannot be understated. We recommend working with your team and using materials from our BAT UK sales representatives to help.

“Retaining your team is also vital to the success of a store and its sales. While we have an excellent rewards programme, we’ll review how staff can be incentivised, too. Some of the ideas included completing an interactive scheme to further their training to collect points that can be transferred into vouchers or days out.”

To find out how you can maximise sales of alternative nicotine products, or to be a part of a future event, call 020 7689 0500 or visit betterretailing.com/vaping-opportunity

CHARLES WHITTING finds out where the opportunities lie for tobacco in an increasingly changeable market

ONCE an essential part of any store’s offer, cigarettes are seeing their importance shrink in the face of growing numbers of quitters and people switching to vapes.

While they remain a key part of a store’s offer, and drive footfall from smokers who will purchase additional products, the category appears to be continuing its decline in

popularity. That doesn’t mean they aren’t still a key category.

“Cigarettes are still important,” says Reuben Singh Mander, from The Three Singh’s in Selby, North Yorkshire.

“We have quite an elderly community, who have smoked all their lives, and they’ll pick them up when shopping, but we’re still seeing sales drop off.

It’s down 6% from last year.”

It’s also important to remember that this decline is coming from a substantial height, with the tobacco market totalling £14bn in the past year.

This means retailers need to be taking their tobacco offer seriously, while also looking to take advantage of growing opportunities within next-gen nicotine.

WHILE brands might have elicited customer loyalty back in the day, today it’s all about seeking value for money and getting the best price at the counter.

For retailers, it is essential to have strong availability within their tobacco offer, but also that they are keeping a close eye on their prices to ensure they remain competitive

with neighbouring stores.

“It’s no surprise that value brands in particular are so sought after in the current climate, with price a key factor when deciding what brand to purchase.

“In fact, 80.4% of tobacco sales volumes are currently in the value or ultra-value readymade cigarettes (RMC) and

roll-your-own (RYO) sector, and together are the fastest-growing in share terms,” says Gemma Bateson, sales director at JTI UK.

Shuayb Hamid, from One Stop Keresley Post Office in Coventry, uses One Stop to get certain cigarettes at lower prices, which he is then able to pass onto his customers. And he still believes he gets more tobacco

custom than his competitors because his are cheaper.

“We’re selling Benson & Hedges Blue for £11.98 and there are some stores selling them for £13,” he says. “We’ll sometimes get people buying 100 cigarettes at a time. We sell our Chesterfield at £9.50 and we are still able to get a good margin from that.”

“THE sale of illicit tobacco is a global industry that harms honest tobacco traders and damages communities, and we firmly believe it should not be tolerated.

“Between 2020-21, estimates show 9% of cigarettes and 34% of rolling tobacco were non-UK duty paid, meaning the government lost £2.5bn in tobacco tax revenue.

“As such, since 2000, £51.3bn in tax revenue has been lost as a result of non-UK duty paid cigarettes or rolling tobacco being sold in the UK.

“With the current cost-of-living crisis, it’s likely that there will be a rise in illicit trade in the UK.

“To combat this, we strongly encourage retailers to stay alert and take action. They can reporting any suspected illicit trade by contacting our salesforce through our dedicated SARA trade platform, emailing suspectit.reportit@uk.imptob.com, or calling us directly through our anti-illicit trade hotline on 0800 0495992.”

• Tackling illicit vapes: how to protect your vape sales by staying clear of non-compliant stock

• Nicotine pouches: an update on the most popular lines, and how retailers are managing the segment

• Regional trends: The bestselling 10ml e-liquids and short fills in convenience

All the latest product launches, and… Quick guide: understanding how coils can affect your customers’ vape experience Gantries and displays: a guide on how to take your vape display to the next level in 2023

AMID the ongoing situation with disposable vapes, some might have thought that traditional tobacco sales might enjoy something of a bump in popularity in recent weeks, but that doesn’t appear to have happened for most.

Hamid feels that the disposables crisis is over, with One Stop once again selling them to him and customers seemingly undeterred by any of the issues of the past few months. And while he still sells plenty of cigarettes and tobacco products, he is still encouraging them to switch to vapes and is seeing plenty of growth in that category at present.

“I tell customers that if they want to stop smoking, we have all the alternatives here for them,” he says. “As soon as they tell me they’re trying to

quit, that’s an opportunity for me as well. I’ll mention the disposables or the Iqos kits that don’t have any tar and don’t need a lighter.”

Like tobacco, the price of next-gen nicotine products appears to be the decisive factor for customers.

Data from KAM, on behalf of Philip Morris Limited (PML), has revealed that affordability is ranked as the most important consideration for adult smoking customers choosing a smoke-free alternative in 2023.

“More than half (57%) of all UK retailers believe smokers switching to alternatives in 2023 will purchase the cheapest products available, followed by those offering the best value for money,” says a PML spokesperson.

JTI UK has refreshed its Sterling Essential Rolling product for 2023 – now with rolling papers, an enhanced blend and a convenient zip pouch. The new features offer an easy and accessible format for existing adult smokers, with everything they need in one pouch. The new Sterling Essential Rolling taps into the ultra-value segment. Available across all UK channels, Sterling Essential Rolling comes in outers of 5x30g pouches (RRP £14.55 per pouch) and 5x50g (RRP £23.85 per pouch).

Imperial Tobacco has announced the launch of two limited-edition products for independent retailers. Richmond, Players JPS and L&B Blue 21 packs are returning, as well as a 32g format of rolling tobacco. Richmond 21s have an RRP of £10.65, while Players JPS and L&B Blue 21s both have an RRP of £10.90. The new limited-edition range of rolling tobacco features two of its bestselling brands, Riverstone and Players JPS Easy Rolling tobacco – its fastest-growing brand nationwide – both of which are available to buy at an RRP of £14.55.

Scandinavian Tobacco Group announced a redesign of its Moments brand at the start of 2023. The new pack design can be seen on packs of Moments Blue and Moments Original, with packs of Moments Panatella following in May.

THE UK’S No1 FASTEST GROWING SUPER COMBO FROM

Ultra value

SINCE retailers haven’t been allowed to display their tobacco products openly in the store, many have taken down the gantry behind their counter and placed their cigarettes and rolling tobacco in drawers beneath the counter.

While this has given retailers the opportunity to use that gantry space to showcase other products – Singh Mander has used it to display spirits, for example – it also means tobacco is out of sight and potentially out of mind.

WHILE tobacco products need to be kept out of sight, there are still products associated with the category that retailers can put on display which will not only drive sales, but will serve as a prompt for further tobacco purchases.

Tobacco accessories, in particular, are a high-margin product that at least half of smokers will be looking to purchase. The growing demand for RYO tobacco means that rolling papers and filters should be an essential part of any retailer’s offer.

“The rise in RYO sales means there’s a significant opportunity here for retailers when it comes to tobacco accessories,”

Top trends from JTI UK

Retailers should focus on stocking ultra-value tobacco brands as, now more than ever, customers are looking for more affordable options in the market.

Heated tobacco

Heated tobacco is rapidly becoming an emerging category within tobacco. More and more customers are looking for an alternative but familiar tobacco experience with devices that heat tobacco instead of burning it. For this reason, the heated tobacco market is growing and provides a big opportunity for retailers, now worth £91m in the last year in traditional retail, with growth of 14.9% year on year.

Demand for flavours

Sales of tobacco-flavoured heated tobacco variants account for 50% of all refill sales in traditional retail, with menthol flavoured accounting for 43%.

says Imperial’s Gully. “In order to cater to this growing demand, retailers should make sure that they are fully equipped with filters, papers, lighters and other flavour-related innovations.”

Singh Mander feels he should give more attention to his tobacco accessories, which are stored on the bottom shelf of his gantrybecause they are useful both as a high-margin product in their own right, but also as a sales driver.

“We’re not pushing them as much as we could be at the moment,” he says. “But it’s a high-margin category – you’re looking at 40-50%.”

On top of this, lighters offer

Singh Mander saw a significant drop-off in tobacco sales when he transferred them to the drawer, so he has trained staff to ask known smokers about tobacco. While retailers can drive tobacco sales at the point of purchase in this way, staff knowledge has never been more important for driving sales and return footfall. If they can help customers navigate the category and point them in the direction of what they want, it will generate considerable customer loyalty.

“Staff who are well educated on which products offer their customers the greatest value for money will be in a far superior position to help their customers find the best products that suit their needs.

“This will, in turn, probably see these customers returning to that same store multiple times, thanks to the more personable and informative purchasing experience in store,” says Tom Gully, head of consumer marketing UK&I at Imperial Tobacco.

retailers the greatest scope for combining value options with upselling opportunities should retailers decide to start stocking more premium options.

“For some time, we’ve been educating convenience retailers on the benefits of creating an eye-catching tobacco accessories display, which can act as a signpost for the wider category and highlight innovative new products or great deals. Our compact displays have been a successful tool to support this,” says Gavin Anderson, sales and marketing director at Republic Technologies UK. “Top-performing within the accessories category are rolling papers, the

highest value sector.”

Additionally, retailers should not forget that cigars are a tobacco product with different packaging requirements and which enjoy a boost in sales during the summer months.

“It’s worth reminding convenience retailers that as cigars are exempt from the plain-packaging legislation, we recommend they stock them on the middle shelf of the gantry where they are more likely to be purchased by adult smokers who can see them,” says Nataly Scarpetta, marketing manager at Scandinavian Tobacco Group UK.

It’s an offence to sell tobacco to persons under 18 years old. For tobacco trade use only. Not to be left within sight of consumers.

Football, Wimbledon, Formula 1, The Hundred and The Open are just some of this summer’s key sports events, providing opportunities to boost take-home sales. Follow our retailers’ advice, writes CHARLES SMITH, and you’ll see ‘champion’ results

AS cash-squeezed shoppers rein in their spending, they’re still treating themselves with affordable luxuries. Pub outings are pricey, so it’s a nobrainer to switch to catching this summer’s sports action at home with family and friends, and making an event of it. But what are the key dates to take note of?

The summer of sport starts

in earnest on Saturday 3 June, with the men’s FA Cup Final, and the Men’s and Women’s Ashes starting on 16 June and 22 June, respectively. In July, there’s Wimbledon from Monday 3 to Sunday 16 July, the British Grand Prix on Sunday 9 July, and from Thursday 20 July, the 151st Open Championship men’s major at the Wirral. The same day also sees

the start of a month of sporting action overseas, with the 2023 FIFA Women’s World Cup in Australia and New Zealand, with European champions England a serious contender. Finally, from 1 August to 27 August, there’s cricket action back here with The Hundred. The cost-of-living crisis might impact shopper buying habits, with customers want-

ing to get more for their money. Larger formats and multipacks will be vital to capitalising on the summer sports season, so make sure to plan ahead and order early.

July and August will mean hot weather also, so add ice to your list and make sure drinks are chilled and linked purchases, such as snacks, are easily accessible.

HOW SUMMER SPORTS WILL BE AFFECTED

The National Living wage increase in 2023 and low unemployment rates are causing difficulties for store owners in finding, training and retaining strong teams. This edition of The Retail Success Handbook examines recruitment strategies in a competitive job market, maximising efficiencies and retaining employees. We also explore ways to improve employee skills and loyalty, while maintaining profitability, including:

Best practice for recruiting and onboarding staff

Creating value through staff incentives and staff welfare

Exploring effective options to train and boost productivity

Smarter ways to promote products and interact with customers more effectively

“SPORTING events have a halo effect, producing sales uplifts across the store,” says Amish Shingadia, of Budgens Caterways & Post Office in Horsham, West Sussex.

“You need to know your demographic and put out a value message with deals on bigpack products, sharing packs and multipacks.

“Wimbledon and Formula 1 appeal to middle-aged and older shoppers, and football and rugby to middle-aged and younger ones.”

Andrew Cruden, of Market

Square Newsagents in Northampton, echoes this and says Silverstone is also an important sales driver for him.

“Silverstone’s very important for us, being only 12 miles away,” he says “The local council put up a big screen in the market square, which is on our doorstep. It brings everyone together on the same side, which you don’t get with other sports.”

It’s worth checking out social media or your local council’s website to see if there are any sporting events hap-

top tips

KP Snacks’ merchandising advice

Themed fixtures

Promotional offers that make shopping easy are a good way to drive impulse purchases.

Cross-category purchase

Encourage trial and boost cross-category buying among shoppers by positioning nuts and crisps in the beers, wines and spirits aisle, if permitted.

Interruption

Window posters and shelf barkers are great ways to catch the eyes on the path to purchase and encourage impulse sales – 70% of bagged snacks shoppers buy on impulse.

Secondary display

Retailers should implement more than one site of bestsellers in high-footfall areas of the store, with special displays unlocking further purchases.

pening nearby. This will allow you to get additional products in to cope with demand. It will also result in additional and repeat custom if the products are available. If it’s a warm day, products associated with a picnic will be popular, as will chilled alcohol and ready-todrink cans.

to 30s, living with their parents. You need to forward plan, especially with finals involving local teams or individuals,” she says. “We’re close to the Crystal Palace ground, so people round here support them and the other London clubs.”

The importance of capitalising on summer sports is knowing which events are coming up and when, and having a list readily available for staff members so they can ensure stock is

are imperative for driving imready for any last-minute sales.

Meanwhile, Anita Nye, of Eldred Drive Stores in Orpington, Kent, says the evenings are imperative for driving impulse sales.

“The biggest spenders are men in their 20s

LINKEDpurchases will be a vital source of sales for retailers during the summer sports season. For example, nuts and crisps are often bought with soft drinks and alcohol, as noted by Nye.

“The big categories for us are alcohol and snacks,” says Nye.

“Summer sports mean increases in sales of these and other things, depending on the time of year, like barbecue food and accessories, such as coal.

“Over Wimbledon fortnight,

we sell everything you’d expect – strawberries and cream, and Pimm’s, especially with British people in the finals. For nighttime sports events, you should stock up on pizza, garlic bread, chips and curries.”

Location will have a big impact on what sells, as will the event taking place. For Shingadia, prosecco, Robinsons squash, and strawberries and cream are big sellers for Wimbledon. “Guinness is big for

rugby, no matter who is playing,” he says.

Meal options and multipacks will be in demand. Harj Gill, from Windmill Select & Save in Rubery, West Midlands, says 12-packs and boxes of beer, as well as large formats of Doritos and Pringles, are a must-stock.

Similarly, Iqbal’s big sellers are multipacks of beer, litres of spirits, larger packs of crisps and snacks, and soft drinks.

“In better weather, people

have barbecues when there’s sport on, and we sell disposable barbecues and catering sauces,” he says. “We follow the Premier offers and keep them in stock. We also promote local meats and pies from the local wholesale butcher.”

With the Women’s Football World Cup matches taking place in the morning, retailers can focus on the trade of coffee, pastries and cereal, with Weetabix getting behind the Lionesses.

“RETAILERS should highlight events with decorations, tailored around each occasion.” says Nye. “Ask the beer companies what they’ve got –sometimes they do promotions and prizes.”

Even smaller retailers can make an impact when it comes to summer sports, says Cruden: “We’re a small CTN, only 350sq ft, and don’t have space for in-store theatre, but we have

dump bins and piles of beer in the middle of the store.”

Shingadia also makes the best of it. “We have a small store, so we can’t go mad like bigger shops, but we have PoS and bunting in store. We put out floor displays and dump bins, and different countries’ flags for rugby internationals and British flags for Wimbledon. Suppliers give us rugby balls and footballs to

Boost Raspberry & Mango Sport

The limited-edition flavour aims to help stores capitalise on the growing demand for mango and raspberry flavours, growing by 58% and 55%, respectively. The new flavour will expand Boost’s offering in a category which has become the second-fastestgrowing category within soft drinks.

The Protein Ball Co

The Protein Ball Company’s new Keto Balls are a selection of 100% natural low-carb snacks, with no added sugar and a protein boost.

Lucozade Sport Zero Sugar

Available in Orange & Peach and Raspberry & Passionfruit flavours, the range is designed specifically for those taking part in sporting activities. It contains sodium and vitamin B3 to help reduce tiredness, and is available in 500ml bottles and 4x500ml multipacks.

KP Snacks’ Hot & Spicy Pop Chips

With healthy snacking growing 49% in the quarter ending 31 January, KP Snacks, which is also The Hundred Cricket Official Team Partner, has launched a Hot & Spicy variety to its Pop Chips range. It aims to help retailers capitalise on the growing trend of spicy flavours to excite and engage shoppers.

Weetabix on-pack promotion

With the FIFA Women’s World Cup morning matches on air in July and August, Weetabix is running an on-pack competition on its 24-, 48- and 72-packs and drinks, offering the chance to win a home nations kit every 90 minutes.

give away.”

However, some stores don’t have the space to make a show of each sporting event. This is where PoS and bunting can play a key role.

“We’re limited with what we can do with alcohol, outside the main fixtures,” says Iqbal. “We can’t have dump bins for alcohol, but we can promote alcohol with PoS and bunting, and promote on social media to

drive general footfall and our delivery service.”

Suppliers often create PoS materials or free-standing display units for key seasonal events, like summer sports. If a supplier, such as Britvic, often sponsors sporting events, it’s worth reaching out to them to see what’s available. This could help elevate any in-store theatre and make the display stand out, boosting sales.

“WE’VE not seen that big a difference in spending so far,” reckons Gill. “We’re in a village on the outskirts of Birmingham. People here seem to be sticking to local stores because it costs money to drive to the supermarket, and there’s been a shift to value brands and own label.”

In Horsham, Shingadia agrees about the shift away from brands: “People are doing things like buying two packs of own-label salsa dips instead of one branded one. Own label gives 30% margin versus 24% with brands, which means 25% more profit for retailers.”

Focus on price-marked packs

(PMPs), says Cruden in Northampton. “Before Covid-19, we sold these products at premium prices because of our premium position in the town. Just 5% of our stock was PMPs. Now people expect to see PMPs, and they’re around 70-80% of the total. If they’re not there, people turn around and walk out,” he says.

It’s a similar scenario in Scotland, says Iqbal in Kirkcaldy: “Everyone’s feeling the pinch, but still buying what they need. We’re not sure what’s going to happen about the deposit return scheme, which will put £2.40 on 12-packs of beer, but it’s not coming in until August.”

Are you struggling with the Cost of Living?

Are you worried about paying your bills and putting food on the table?

Have you worked in the sale or distribution of newspapers and magazines in the UK full time for 2 years or more?

If the answer is yes to the above questions then you could be eligible for a grant from the NewstrAid Cost of Living Crisis Fund.

Created in response to the current Cost of Living Crisis, the fund offers grants of up to £250 per household to help bridge the gap between income and costs for anyone with a newstrade connection. That means people who work or have previously worked in the sale and distribution of newspapers and magazines for a minimum of 2 years, full time.

For more information scan the QR code, call us FREE on 0800 917 8616 or email: mail@newstraid.org.uk

FOR convenience retailers, it’s a good time to invest in coffee both hot and cold. Coffee is the second-most popular drink in the world, behind only water, and retailers are now able to offer it at a worthy quality to consumers.

Vrajesh Patel, of Londis Dagenham in east London, has had a Costa machine for two years, which replaced his previous Kenco Millicano powdered machine. “More people are going for a bean-to-cup option, especially with the options we’ve got in hot food to go,” he says. “If you aren’t too both-

ered about footfall, then powdered is the way to go, but if you want to offer a good choice, you should go the bean-to-cup route. We went with Costa because it’s a brand everyone recognises and everyone knows the quality.” Since the change, Patel has increased his daily cup sales from five to 20.

Not only is the quality expected to rise, but the diversity of products is increasing. With the right machine, retailers can offer hot chocolate and plantbased varieties. At least one supplier is in the early stages of rolling out a machine which of-

need

fers iced coffee to go. Branding isn’t everything, however; you need to ensure you are attracting the correct customers by age and demographic to ensure it’s worthwhile.

“We did have a Lavazza machine, but it didn’t work for us,” says Serge Khunkhun of One Stop Woodcross in Bilston, Wolverhampton.

One Stop Woodcross in Bilston, tion, we see the same faces and I think you need a high-tranto full-sized

“Being in a community location, we see the same faces and I think you need a high-transient location or an element of passing traffic to benefit from the proper full-sized coffee offering that we had.”

DESPITE coffee’s obvious popularity, and the growing sales of ready-to-drink (RTD) chilled coffee, convenience retailers say they aren’t guaranteed sales. They need to make sure their offer stands out and caters to the right customers.

Ken Singh serves his local community at BB Superstore in Pontefract, West Yorkshire, but notices his customers are a certain type. “I do notice the people going somewhere and

who aren’t at home are the ones buying coffee,” he says.

At-home coffee has made huge strides of its own, particularly with hybrid working now firmly entrenched for many workers.

Singh says: “Not many get a Costa and take it home, it’s definitely a product for someone who wants a warm drink on a journey.”

Coffee customers also like familiarity, but retailers want

to be careful about offering the same option as everyone around them.

“Brands can be recognisable, but also ubiquitous,” says Chris Tomes, of Costcutter & The Food Shop in Swanage, Dorset, who has a Lavazza machine. “Most shops nearby do Costa Coffee. We did want to offer something slightly different. Our Tchibo machine didn’t work out and Lavazza is a household name.”

BEYOND the quality, the main considerations for an in-store coffee machine are the cost, how intensive maintenance is, and how quickly any faults can be reported and fixed by the supplier. “Questions retailers should be asking are: are there any daily minimum drinks targets required? What if there are

any additional charges, such as repairs or parts? What happens if the machine breaks down?” says Sarah Lowry, managing director at Jack’s Beans.

Profit-share models are predominant, with retailers taking more money from a higher number of cup sales. This is where having a regular customer base,

or a regular flow of transient footfall, will be vital. For retailers who want to offer the option, second-hand machines are available. These can save on initial costs and free stores from the obligation of sales targets.

From there, keeping the machine running is the next most important part of keeping coffee

sales up to date. There will be steps that suppliers advise retailers to take to ensure general upkeep.

“We press a button daily to put clean water through it, then once a month there’s a tablet to do a deep clean,” says Chris Tomes, of his Lavazza machine. If problems get more serious,

Top FOUR

Top four RTD iced coffee flavours

Caramel In 36% growth

Mocha In 18.4% growth

Espresso In 16% growth

Latte In 14% growth

however, retailers should be aware of what their contract states about whether maintenance is included, for how long, and how good the supplier’s reputation is at responding to requests for help.

Knowing your local competition is also worthwhile, especially the abundance of the chain

coffee retailers catering to more on-the-go shoppers than local cafes. “I’m the only store in a half-mile radius, then there’s a Co-op with a Costa, a Starbucks and a few other cafes,” says Patel. “We knew there wasn’t an actual Costa store yet, so we thought we might as well get a machine for the branding.”