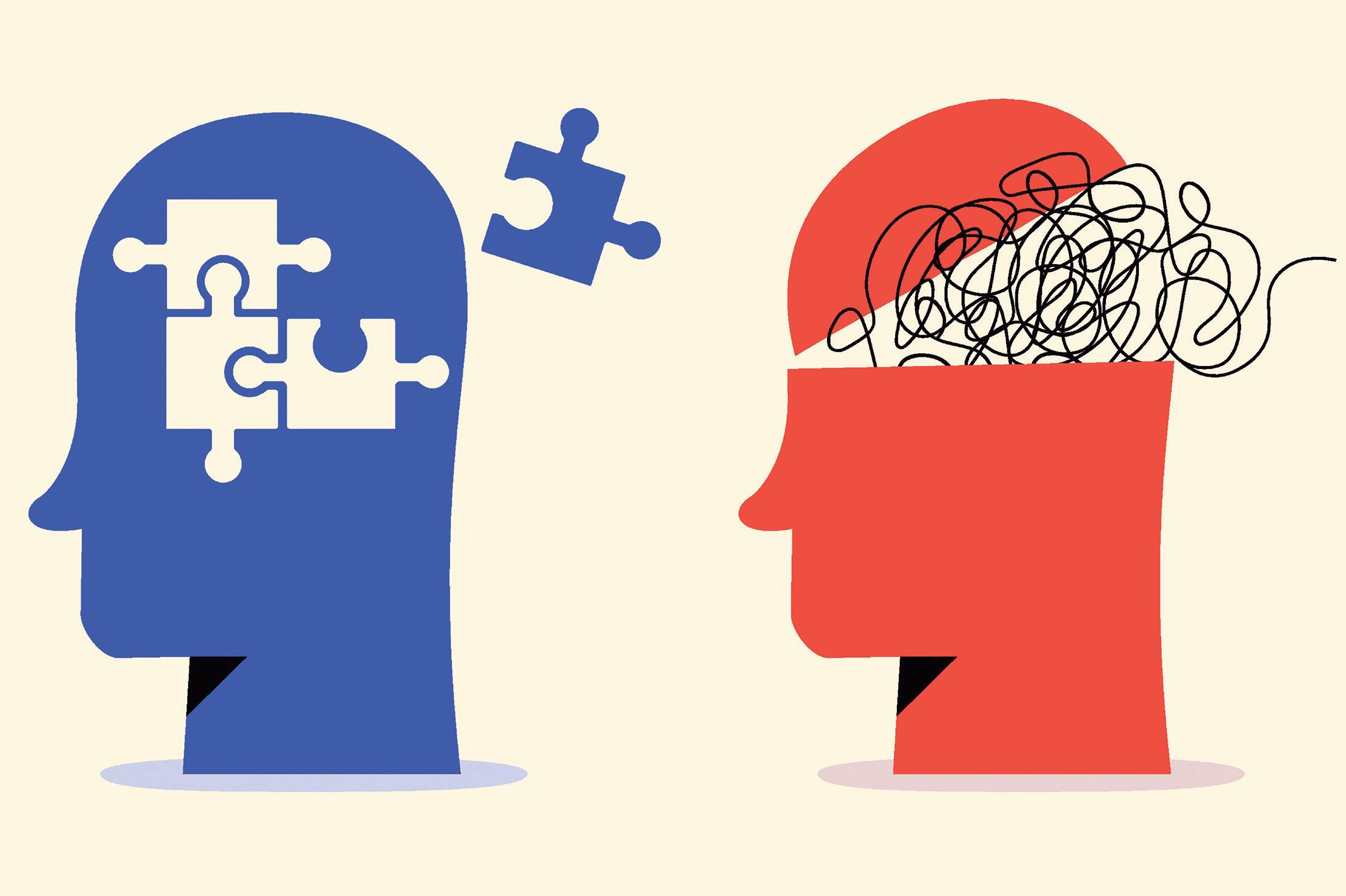

Diversity, inclusion and ethical practices

How to run an operation that leads the industry on mental health, equity and diversity

How to run an operation that leads the industry on mental health, equity and diversity

DISCOVER THE UK’S NO.1 NICOTINE POUCH*

CONTACT YOUR BAT KEY ACCOUNT MANAGER

This product contains nicotine and is addictive. For adult nicotine consumers only.

*Based on NielsenIQ RMS data for the Nicotine Pouches category for the 12-month period ending 04/02/2023 for the UK total retail market (Copyright © 2023, Nielsen Consumer LLC)

Editor

The wholesale industry has changed beyond recognition in the past five years, thanks to huge changes in the areas of e-commerce, sustainability and warehouse technologies, to name just a few. These alterations have improved the bottom line, and overhauled efficiencies and productivity as well.

However, mental health is a topic the industry has been slow to react to and should, therefore, be the next focal point for the channel. There is no longer an excuse for businesses to not place it high on their list of priorities. This is evident after looking at

EDITORIAL

Editor Paul Hill

Editor in chief Louise Banham

Head of design

Anne-Claire Pickard

Production editor Ryan Cooper

Sub editors Jim Findlay, Robin Jarossi

Senior designer Jody Cooke

Junior designer Lauren Jackson

Contributors Billie Dhadda, David Gilroy, Rob Mannion, Emma Mitchell, Elit Rowland, Maximilian Schwerdtfeger, Charles Smith

Production coordinator Chris Gardner

the results of GroceryAid’s recent Impact Report, which revealed a 44% increase in incidents of colleague support compared to the previous year, as well as £5.6m spent supporting colleagues. The charity also reported 10,000 calls from people working in the industry looking for financial, emotional and practical support last year, as well as its BACP-trained call handlers providing more than 5,000 in-the-moment counselling sessions. These figures highlight why wholesalers need to place the mental health of staff at the forefront of every business decision, and this report signposts ways to go about it. Featuring information from the likes of the Diversity in Wholesale initiative, as well as real-life case studies from such names as Filshill, Bidfood and Pricecheck, this edition is here to guide wholesalers on how to become a thought leader in this critical area.

Elsewhere, with the cost-of-living crisis affecting the channel, this report is here to help with a What to Stock guide using new data to tell you what products to stock in your depot and give your customers the best returns.

P6-7: Viewpoint

David Gilroy explains the diversity, inclusion and equity paradigm

P8: Insight

What a new initiative from the FWD means for inclusion and equality

P10: Interview

GroceryAid gives an update on its work in wholesale

P11: Opinion

Why there are still huge barriers facing women in the workforce

P12-13: Interview

Women in Wholesale: in conversation with Elit Rowland and Emma Mitchell

P14 Opinion

Finding a balanced lifestyle working in wholesale

P15-17: Case studies

Some of the biggest names in wholesale explain their strategies

P18-19 Spotlight

The director of Cyprofood reveals the firm’s nationwide growth plans

P20-21: Summary

How to run a more diverse, inclusive and ethical operation

P22: Insight

SALES

Head of commercial

Natalie Reeve 020 7689 3367

Senior account director

Charlotte Jesson 020 7689 3389

Account managers

Marie Dickens 020 7689 3366

Megan Byrne 020 7689 3372

Lindsay Hudson 020 7689 3366

Commerical project manager

Ifzal Afzal 020 7689 3382

Join the conversation: @BW_mag

The results of a Newtrade Insight diversity and inclusion report

P4-5: Working Together Project

How did CCEP’s changes perform in the chilled coffee category

P23-25: Foodservice Focus

The issues and opportunities within the pubs and bars sector

P26-27: Working Together Project

How JTI and Parfetts are working together to achieve success

P28-46: What to Stock

Our annual guide to the bestselling products

P48-55: Sector review

How to navigate Christmas, Halloween and Bonfire Night https://bit.ly/3lvj7FC

Coca-Cola Europacific Partners (CCEP) and Costa Coffee recently visited Parfetts Stockport and Dhamecha Hayes to offer advice and relay their RTD chilled coffee fixtures, with the aim of improving sales in one of the fastest-growing segments within soft drinks.

“It was great travelling across the country to discuss the exciting opportunity we’ve identified to grow RTD coffee sales. We’re doing the same with retailers – driving demand along the supply chain so we can help the segment reach its potential,” said Matthew O’Hagan, senior portfolio execution manager, FMCG UK&I at Costa Coffee.

The results were hugely positive, with Costa Coffee RTD sales volumes for the six weeks post-fixture relay compared to the six weeks prior at Hayes and Stockport seeing outstanding increases of 208% and 312%, respectively.

The trial period was mostly warm, which is always good news in soft drinks – and sales of RTD chilled coffee across all Parfetts and Dhamecha depots increased over the six weeks in question. But they were some way behind the two sites that benefited from the relays and advice from CCEP and Costa Coffee.

Compared to Parfetts Stockport’s volume sales uplift of 312% for the Costa Coffee RTD range during the six weeks post-relay, its other sites achieved 115%, on average. And for Dhamecha, 208% growth in Hayes outperformed the 151% on average elsewhere – inspiring seven other depots to apply the same changes.

Jamie Ferguson, head of marketing at Parfetts, said: “Implementing the Costa fixture plan in the trial depot has driven retailer engagement with RTD chilled coffee in general. We have seen positive feedback from retailers who can now shop the category more easily rather than hunting the SKU on their shopping list all around the depot.”

“Being part of the trial has seen us bring all our RTD chilled coffee products together into one location and create more impact at fixture,” added Vinod Ramgi, Dhamecha Hayes depot manager. “This has made it easier for customers to locate products, and the support of the sampling and active selling days has helped us to educate our customers.”

By not just offering advice on specific products and rather championing the entire category, CCEP has made its wholesale partners hugely successful and put them in a fantastic position to achieve long-term success in an already fast-growing segment.

As well as supporting wholesalers in leveraging the opportunity, CCEP provides category advice and sales tools to help convenience customers maximise sales. The ambition is that wholesalers and retailers are aligned on the opportunity.

“It’s brilliant that the changes we made have paid off for both depots, and that our partners recognise the huge potential in RTD chilled coffee,” concluded O’Hagan. “It was great working with Parfetts and Dhamecha, allowing us to drive positive change in depot. We are confident this will accelerate sales for both the segment and our Costa brand by providing a clearer standout view of the category.”

208%

Costa Coffee RTD sales volume uplift at Dhamecha Hayes

312%

Costa Coffee RTD sales volume uplift at Parfetts Stockport

151%

Average Costa Coffee RTD sales volume uplift for all other Dhamecha cash and carries

115%

Costa sales volumes for all non-Parfetts Stockport cash and carries

1. Bring all RTD chilled coffee brands together in one location, making the category easier for retailers to locate in depot.

2. Increase space to recognise the strong growth the segment is enjoying and to support availability.

3. ‘Brand block’ for maxi-

mum impact, and ensure all key brands, flavours and consumer need states are catered for.

4. Raise awareness through in-depot point of sale and signage.

5. Replicate in-depot efforts online, with prominent branded content that’s easy to navigate.

“Ultimately, it’s about making the segment easy for retailers to find and shop – which is just what we’re advising retailers themselves to do in store, when catering for consumers. And together we’ve proved that it works.”

• RTD coffee is worth £289.2m, +14.7%

• Costa Coffee RTD is worth £24.5m, up more than 50% in value (making it the fastest-growing major brand), and it’s up 45% in volume

• Costa Coffee RTD is gaining category value share, +2.2% (the largest gain of any brand)

• Take-home packs are driving the growth in RTD chilled coffee, increasing in value by 65.1% – the Costa Coffee RTD range is growing ahead, up 105.4% in value

• On-the-go formats still account for 85% of total RTD chilled coffee value sales and also continue to grow – up 8.6% across the segment and 46.4% across the Costa range

All Total GB brand/category data Nielsen Total GB MAT we 17.06.23. All wholesaler/ depot-specific sales volume data comparing six weeks post relay (w/c 24.05.23 to w/c 29.05.23) with six weeks pre relay w/c 13.03.23 to w/c 17.04.23)

To watch a video from CCEP’s visits to Parfetts and Dhamecha, please head to betterwholesaling.com/ working-together-project-ccep/2

The Beano has diversified. On its 85th birthday, the comic has transformed to become more representative of modern Britain. Characters Fatty and Spotty of the Bash Street Kids are out. In come new faces including Harsha, Mandi and Khadija. Mike Stirling, the director of mischief, told The Sunday Times: “This is about being awake to things. What would be easy to do would be to keep The Beano the way it had always been forever.”

The comic is marking the 85th anniversary with various guest appearances including Stormzy, who was voted the most popular by its readers. Just like many other organisations in this country, The Beano is recognising that the make-up of its audience is changing, so is adjusting its proposition to better reflect and connect with its readers.

In many ways, this is a microcosm of our changing culture. The Beano was

first published in 1938, just before the second world war. Despite winning the war, by 1951 the country was striving to recover; impoverished and exhausted. A sepia-infused world, remaining militarised and suffering critical shortages of food and consumer goods. Highly industrialised, urbanised, seriously polluted and operating on a social system largely based on Victorian values.

The population totalled around 50 million and was overwhelmingly indigenous. The 1951 census shows that only 3% of the population had been born overseas and a great majority of the immigrants were white and European. The 1948 British Nationality Act had confirmed unrestricted entry to Commonwealth citizens. The first postwar immigrants from Jamaica arrived in Britain, onboard the Empire Windrush, but there were still fewer than 140,000 people of colour across the country.

In 1951, far fewer women were in paid employment than today. They were generally not expected to have proper careers, but to seek short-term employment before they married and had children. After the war, many young women gave up paid work and raised a family at home. Public attitudes towards sex and marriage remained strongly conservative. There was virtually no formal sex education, either for children or for adults. Any form of homosexuality was illegal and those whose sexual behaviour deviated from the heterosexual norm had to adopt a low profile for fear of legal prosecution

or social persecution.

Class divisions were clearly reflected in how people dressed, as well as how they spoke. Working men tended to wear caps and clothes for manual labour, while middle-class men were distinguished by their white collars, suits and hats. Class divisions were also apparent in the educational system and not just in the divide between state schools (which taught the great majority) and private schools (which catered for a wealthy minority). The 1944 Education Act had created a binary system of secondary education at ‘11 plus’. Most children went to secondary modern schools, which they left at the age of 15 with few or no qualifications. Those who went to grammar schools stayed on a little longer and got qualifications, but few went on to higher education. Only a small proportion of young people went to university and most were middle-class males who had often been privately educated.

Towards the end of the ’50s, Britain was becoming more affluent and changing rapidly in every area. Ground-breaking legislation further accelerated the transition to a more diverse and tolerant society. The Electoral Law Act in 1968 made voting rights for all men and women equal regardless of gender or

The country was transitioning from sepia to Technicolor and the seeds were sown for the multicultural diverse society we recognise today

Gilroy’s viewpoint: The Diversity, Inclusion, Equity Paradigm: Diversity is important and vital, without which, equity and inclusion cannot be possibleDavid Gilroy is the managing director of Store Excel

class. The Sexual Offences Act 1967 partially legalised homosexual acts between consenting participants. The country was transitioning from sepia to Technicolor and the seeds were sown for the multi-cultural diverse society that we recognise today.

The latest 2021 census shows the religious make-up of the nation to be more diverse than ever, with fewer than half of people describing themselves as Christian and over 300,000 households as multi-faith. The Muslim Council of Britain says that the figures show that society is capable of “togetherness”.

We are all aware that our industry serves a highly diverse customer base. The majority of small stores are owned and run by various ethnic groups. The hospitality industry offers cuisines originating from all over the world. Not only that, it is now fusing those offerings to create new and exciting dishes unique to Britain and taking them to new settings. Street food and box parks, for example. Thanks to the highly successful influx of Ugandan Asians in 1972, cities such as Leicester have been transformed. The arguments for greater diversity are strong: a variety of experiences enhancing of problem solving, better cross-learning, a larger talent pool from which to recruit and a better under-

standing of customers. A workforce that reflects back the customer profile facilitates authentic customer relationships.

I have seen a lot of this in action in my personal experience in wholesale. And the industry is making positive strides forward in diversity with initiatives such as the FWD’s Diversity in Wholesale and its Standards and Dignity Charter.

However, Robert J Ely in his Harvard Business Review research paper ‘Getting Serious About Diversity’ cautions that increasing diversity does not in itself increase effectiveness. What matters is how an organisation harnesses diversity and whether it is willing to reshape its power structure. This is underlined on the FWD website, where it states that women account for 47% of people working in wholesale, but only an estimated 17% are senior managers and directors. Ely is clear that companies will not reap the benefits from diversity unless they build a culture that insists on equality. Look no further than the music industry.

Growing up in the ’60s, I listened to British groups such as the Rolling Stones and Cream adopting and developing black American blues music. Also, the Motown groups of both genders. The ’70s for me in south London was a rich mix of Caribbean all-

night parties, reggae and funk. The likes of Bob Marley and Stevie Wonder –intoxicating for me from a totally white background. Music is all-encompassing, inclusive and has the power to unite. Diversity in music comes naturally and makes for adventurous, exciting sounds. The industry has also led on gay rights and the fight against Aids. Notably the Elton John Aids Foundation.

The Chartered Institute of Personnel and Development (CIPD) favours inclusion in the diversity, inclusion and equality framework: “While there has been recognisable progress in diversity in recent decades, a focus on increasing diversity alone falls short of tackling the systemic challenges around workplace equality, personal bias or exclusionary culture. Hiring a diverse workforce doesn’t guarantee that every employee has the same experience or opportunities in the workplace.” Their report ‘Building Inclusive Workplaces’ highlights the complexity and also the challenges facing businesses around diversity and inclusivity.

The CIPD opines that people are fundamental to business success, and creating an environment where everyone can meaningfully contribute simply makes sense. Indeed, some research supports the idea that inclusion is linked to creativity, knowledge-sharing and reduced absenteeism. But this study highlights that research into inclusion is less well-established than research into diversity. Inclusion is a complex concept that interacts with diversity and equity – both issues that extend beyond the workplace.

Social mobility, education and socialisation all contribute to structural and power inequalities in societies. Organisations and employees have much to gain from being more inclusive. Creating a positive environment where everyone can influence, share knowledge and have their perspective valued is key for employee satisfaction, retention and well-being. And, crucially, being inclusive allows different perspectives to be heard, irrespective of the nature of that difference.

Diversity is important and vital. Without which, equity and inclusion cannot be possible. Our industry is headed in the right direction and probably ahead of others, but there is still much to do l

Diversity in Wholesale (DIW) is a new initiative from the FWD to encourage diversity and inclusion in the wholesale channel by providing support and a welcoming environment for people from all backgrounds. It builds on the work of Women in Wholesale and will continue with the 2023 programme,

with the events specifically for women retaining the Women in Wholesale branding.

The FWD believes that for the wholesale sector to attract, retain and inspire the widest range of available talent, it needs to provide an environment where people of any age, gender, ethnic group or social background are given opportunities and the right support they need to succeed.

This gives a voice to the up-and-coming leaders within the sector. The group has 60 members and is designed for ambitious individuals who are 30 or under working within the FWD membership. They meet once a quarter with an opportunity to have a new demographic of voices heard and a chance for talent to come to the fore in order to support the strategic objectives of the FWD.

They have been challenged to determine the best way to inspire, retain and develop future industry talent, as well as give input to FWD activities and events to ensure they are future-proofed.

The FWD and the ACS have relaunched an updated Charter, with both associations agreeing that it can serve as a tool to unify members on best practice while at events and in the workplace.

This includes the launch of the Standards & Dignity badge, with the aim that an employee of a business signed up to the Charter should feel reassured that they will be mixing with colleagues and contacts who will follow the highest standards of conduct when the Standards & Dignity badge-style logo is seen on ticket confirmations, companies’ websites and email signatures.

Women in Wholesale is an educational networking programme designed to inspire, support and develop women of all levels working in UK grocery and foodservice wholesale. It holds several events throughout the year:

• Speed Mentoring – A fast-paced mentoring session with industry leaders.

• Menopause Café – Inclusive online café.

• Male Allies – A quarterly digital webinar empowering men to be visible advocates for gender equality in wholesale.

• Wellness Group – Designed to support mental-health firstaiders and leaders to share well-being best practice.

This will offer senior managers and future talent in the foodservice and convenience wholesale channel the inspiration and tools needed to provide a workplace culture and mindset where everyone can succeed.

Taking place on 12 September 2023 at 30 Euston Square, London, with the theme of ‘Celebrating Difference’, it will allow wholesalers to learn from other businesses that are challenging perceptions, thinking differently, and creating more happy and motivated teams. l

When launching new products and promotions on big brands, getting wholesale and retail joined up is crucial to ensure success.

Carolyn Thomson from Suntory Beverage and Food GB&I (SBF GB&I) recently visited Chris Gallacher from United Wholesale (Scotland) and Navid Amjed from Day Today Elite in Glasgow. We followed the journey of Ribena’s on pack promotion in partnership with Hasbro from depot to shelf, to help retailers unlock more sales opportunities.

Carolyn Thomson, Regional Account Manager, SBF GB&I explains: “It's key for wholesalers to engage with partnerships like the one between Ribena and Hasbro, as it helps retailers get excited about brands. They can then pass that excitement onto the consumer, which means they are more likely to pick up the drink.

“If something is promoted strongly in wholesale it shows the retailer how much we believe in the promotion and the product – and then gives them clear guidance on how they should then show their customers what it is all about”.

Chris Gallacher, Managing Director, United Wholesale (Scotland) adds: “Our job is about getting that product from the depot to the shopper. We need to educate the retailer about on-pack promotions and use PoS to create some theatre in stores – to show retailers how big these promotions can be.

“We’ve got numerous different platforms for communicating with retailers – our weekly newsletters, WhatsApp broadcasts, push notifications through our apps, and banners on our websites. We use all of these, along with strong in-depot communication, to help create excitement.

“Partnerships like this show retailers the brand cares. They want to get added value onto their packs, and we have a great platform to make that come alive.”

Back big brands! Ribena is worth almost £120M

Promotions drive sales

720,000 Ribena shoppers entered the Hasbro competition in 2022

So we know this promotion starts from a strong position

Carolyn Thomson said: “Retailers can take advantage of promotions like these by making sure they highlight the offer to the consumers. This involves creating a journey from the front of the shop, right the way through the store, that is disrupted by the news of the on-pack offer.

“With strong promotion, shoppers will see it on the bottle on shelf, then by the time they get to the check out, they will have clocked the PoS, shelf-barkers, standing units and more. There’s no reason for them to miss the offer and unlock the opportunity to win one of our games.

Chris Gallacher summarises: “Today we’ve learned how we can get the product from the wholesaler to the consumer and get everyone engaged on that journey.”

RETAIL TO SEE THE FULL VIDEO OF SBF GB&I’S DEPOT-TO-SHELF JOURNEY, SCAN THE QR CODE, OR FOLLOW @SUNTORYBF_GBI ON TWITTER AND LINKEDINto work with more organisations to raise awareness of our services. Any wholesalers who would like to discuss how GroceryAid can help their colleagues should contact Emma Shepherd, head of marketing and communications.

What made the charity extend its responsibilities to foodservice wholesalers? Will this continue?

BWI: What work is GroceryAid doing on mental health within the wholesale industry?

ML: GroceryAid is working closely with the wholesale industry to raise awareness of the welfare support services available through its free, confidential 24hour helpline, which operates 365 days a year. The number is 08088 021122.

Anyone calling the GroceryAid helpline will be speaking to a BACP-accredited counsellor who can provide ‘in the moment’ emotional support to colleagues who are anxious or stressed.

The counsellors can offer advice or support and may signpost the client to one of the additional services available. Full details can be found at groceryaid.org.uk/get-help/ emotional-support-advice. All of these services are offered free of charge to both the employee and their employer.

GroceryAid recognises that the wholesalers are a vital part of the trade, and we are always looking

During the pandemic, foodservice wholesaler businesses were severely impacted due to the closure of hospitality outlets. We recognised early on that there was not a charity supporting foodservice colleagues. Many of the foodservice wholesalers also have a grocery wholesaler business so were already eligible, but we contacted FWD and advised that we would set up a ring-fenced fund during that time to support those who were also only supplying hospitality.

When the pandemic came to an end, the Trustee Board agreed that foodservice as a whole would meet the eligibility criteria for support from GroceryAid, so it is ongoing.

What were the findings of your 2022-23 Impact Report?

Our annual findings revealed a 44% increase in incidents of colleague support compared to the previous year, as well as a 14% rise in referrals to Law Express. As well as this, it showed that we spent £5.6m supporting colleagues, including £642,000 awarded in School Essentials Grants, which ensured

more than 2,340 children had the right equipment and clothing when they returned to school in September 2022.

Our helpline also received more than 10,000 calls from colleagues looking for financial, emotional and practical support, and the BACP-trained call handlers provided more than 5,000 in-the-moment counselling sessions.

Furthermore, we issued 5,000 personalised actions plans and more than 15,000 colleagues attended GroceryAid events such as Barcode Festival.

We recently appointed Kieran Hemsworth as our new chief executive, bringing 30 years of experience in the FMCG industry and most recently taking time to complete an MBA.

With a background in corporate leadership, marketing and strategy, Kieran spent more than 17 years at Coca-Cola ascending to European operational marketing vice president, before taking on managing director roles at Ginsters and PZ Cussons.

He said: “I am delighted to be appointed chief executive of

GroceryAid. From my 30 years in the industry, I have huge admiration for the vital work that the charity does – which provided a critical lifeline for so many of our industry colleagues during the Covid-19 pandemic.”

Elsewhere at GroceryAid, we recently managed to raise £1m at our annual Barcode Festival, with more than 100 sponsors supporting the charity.

“We have seen thousands of colleagues, from all areas of the industry, enjoy a spectacular event while strengthening industry relationships, launching products, raising brands’ awareness and creating new business relationships,” said Jane Hill, our director of fundraising, marketing and engagement.

We are proud of how the event has grown to become an iconic event in the industry calendar which has raised a record-breaking amount this year. With our welfare team experiencing a 44% increase in incidents of support last year, Barcode raises vital funds that enable us to keep these services completely free and confidential to anyone working in grocery. Also, tickets for next year are now available. l

that I speak to are telling me there is still only one female on a team of Caucasian males and their voice isn’t being heard.

Industrial tool and hardware provider Stanley Black & Decker is another great example of a corporate business doing D&I well.

The number of women who sit on FTSE 350 boards has hit its target three years early, according to a government-backed FTSE Women Leaders Review, which was recently released. More than 40% of directors at the UK’s largest listed companies were women in 2022, an increase from 9.5% in 2011, and only 10 of the FTSE 350 companies still have all-male executive teams. While this is fantastic news, it’s only the tip of the iceberg when it comes to women in the workplace.

Unfortunately, the annual report didn’t highlight that leadership opportunities for women below board level is not growing at the same rate, which is much more in line with what I am hearing every day from the candidates I work with. Some of the CMOs

It’s encouraging to see that greater steps are being taken to recognise diversity and inclusion in the workplace. For example, the European Council and European Parliament recently gave its final approval on a new law entitled the ‘Women on Boards Directive’, requiring that listed companies implement quotas to increase gender diversity on corporate boards throughout the European Union by 2026. These regulations would require EU-listed companies to have at least 40% of their non-executive director positions held by women.

The Law Society has also released its diversity and inclusion framework encouraging businesses to take a systematic approach and embed D&I in a way that has a lasting impact. And some large corporations are taking note.

Mars is a great example of this. The company recently announced that for the second consecutive year, it had received a score of 90% on the Corporate Equality Index, a national report on corporate policies and practices relating to (LGBTQ) workplace equality, administered by the Human Rights Campaign Foundation.

The firm appointed a chief diversity officer in 2021 to drive its D&I Charter. The company reports that 33% of its global workforce are women, 34% of its US workforce are racially or ethnically diverse, and 18% of its board directors are racially or ethnically diverse.

However, despite these great steps taking place in some large organisations, there is still a lot more that needs to be done.

I set out in my career 20 years ago to help women to overcome the invisible barriers they face in the workplace and break the glass ceiling, yet despite lots of noise, nothing has really changed in 20 years. Yes, there are more women in certain industries like luxury and beauty, but, overall, there’s not that much change. Some of the large businesses I work with still only have between 20-40% of their workforce represented by women.

We have come a long way since the days when women were not allowed to vote, let alone hold senior positions in the workplace. Yet, despite all our progress, there is still a glass ceiling that holds many women back from reaching their full potential. It’s time for us to break through this barrier and make sure everyone has an equal chance at success in their professional lives.

So, how can we break through this glass ceiling? The most important thing to remember is that you must never give up. As a woman striving for success in a male-dominated industry, you will face obstacles and setbacks along the way. It’s important not to get discouraged – instead, use those challenges as motivation to prove your worth.

Another key step is to build strong relationships with your colleagues and mentors who will support your ambitions. Networking with like-minded individuals who want to see you succeed can help increase your visibility within an organisation and open up opportunities for promotions or new roles. Additionally, don’t be afraid to speak up and don’t wait around for someone else to recognise your potential.

Despite advances made over time, there is still much work ahead when it comes to breaking through the glass ceiling for women in the workplace. As more companies are focusing on creating equitable environments where all genders can thrive, now more than ever before is an exciting time for women looking to make their mark on their respective industries and create paths for future generations of working women. With hard work, dedication, ambition and focus on building relationships with supportive colleagues and mentors –anything is possible! l

Working from home and earning a higher income made me very happy indeed.

What do you love most about working in this industry?

Our sector is full of entrepreneurs. I was lucky enough to meet Mustafa Kiamil, the chief executive of JJ Foodservice, during a wholesaler profile visit.

My commitment to JJ swiftly escalated from one day a week to three, until I eventually became an official employee. Now, after nine years, I am proud to consider myself a member of the JJ family.

What has been the biggest challenge you have faced as a woman working in a male-dominated industry?

LWC Drinks recently launched a new network to inspire and support women in the business – with the support of key senior male allies. In the first session, Emma Mitchell, PR and communications manager at the wholesaler, interviewed Elit Rowland, head of communications at JJ Foodservice as well as founder of the Women in Wholesale Initiative.

EM: How and where did your career in the wholesale industry begin?

ER: After leaving my role as editor of Better Wholesaling, I wanted to stay involved in the wholesale industry. I loved it, so I started offering PR services to wholesalers.

My first clients were the Today’s Group (now Unitas) and JJ Foodservice. Additionally, I continued working for Better Wholesaling as a freelancer.

I recall spotting him in the staff kitchen area and requesting to take a photo for the magazine. He politely said he didn’t like having his photo taken, which was fair enough. However, when I explained I was a journalist, he kindly invited me to his office, made me a coffee and shared the extraordinary story of how JJ started, and its rapid growth.

I was utterly captivated and instantly knew that this was the kind of company I wanted to be a part of. A few years later, Terry Larkin, the group general manager, brought me on board as a PR consultant when I launched my own venture.

What truly set JJ apart was Mustafa’s support for experimentation – he encourages us all to be entrepreneurs and to try new things without the fear of failure. It was only with JJ’s backing that I initiated Women in Wholesale.

We even conducted inclusion projects within the warehouse, which helped us to increase female representation in our largest warehouse from 0% to 30%.

Eight years ago, it was uncomfortable being the only (or one of a few) women in the room at industry events, but times are changing, and everyone is starting to see the benefits of having more diverse teams.

Today, thanks to a lot of work being done by the FWD and initiatives like Women in Wholesale, our sector is shaping up to be a great place to work. The culture is changing, and we have a lot of support from senior male allies who are the catalyst for change.

Back in 2012, only 11% of senior managers in wholesale were female – today, that’s increased to 20%, and positive attitudes towards shared parental leave and flexible working are all helping to support women who want to pursue more ambitious career paths.

But there are challenges and it can take years to break a culture of bias. It’s a generational issue and I personally feel that many of the challenges we have today will not be there tomorrow – our children are growing up in much better, more inclusive times.

What do you feel are some of the greatest barriers women can face when trying to make it to the top in the industry, and what are your top tips for overcoming these?

I personally feel that too many women wait to be asked or chosen for opportunities.

If you are competent and have what it takes to bring a new idea to the table or get a promotion, then ask for it. Build a compelling case. Senior managers are busy, and they need people who have the courage to put themselves forward.

I’ve always been a big believer in making it easy for your managers to say “yes”. Don’t give them too much to think about – lay it all out in a logical, factual way and demonstrate how your case will benefit the team and the business. If you don’t get what you want this time, don’t worry – you might get it next time. And whether you are aware of it or not – you’ve stuck your head out as someone with courage and ideas. That will get noticed.

Another top tip: you need male allies. Not mates, but senior people that believe in your vision.

I was lucky enough to have some great senior allies in my career. Support at the top helps to turbo-charge your vision and make it a reality.

You’ve created an incredible community with the Women in Wholesale Network. What inspired you to start this and what was your vision for it?

In a nutshell, I was tired of being the only woman at industry events – I knew there were other women out there who wanted to learn and network.

Growing up, my dad taught

me that it’s good to have your fingers in a few pies – so instead of complaining about the lack of females, I saw the opportunity to make things better, and it had commercial value, too.

The first conference sold out within three months. The vision was to make women more confident and workplaces more inclusive. Gender inclusion was the most obvious starting point. Eventually we wouldn’t need a female-only network and the five-year plan was to transition to People in Wholesale – sharing recruitment and retention ideas.

Today, that’s happened with the launch of the Federation of Wholesale Distributors’ Diversity in Wholesale initiative, which we are proud to be part of and supporting.

And finally, if you could go back in time and give yourself one piece of advice when you were starting out, what would it be?

If you have a good idea, don’t be complacent. You need to keep adapting it to make it relevant. If you don’t have the time or the vision, then collaborate with people who do. l

If there’s a business owner out there who claims to sleep well every single night, I’ll show you a liar. I’m convinced it isn’t possible.

However successful your business is, there are always plenty of issues to hijack your kip: a disgruntled customer, those unpaid invoices, or the pressure to recruit the right person for a key role. Throw in uncontrollable external factors such as a global pandemic or a major economic downturn and you’ve got more than enough to fill up your brain.

Running a business is a 24/7 job, and without taking the proper steps to look after your mental health, you’ll soon find yourself fraying at the edges – and I know enough fellow business owners to know it’s a problem that’s rife in every single sector.

When you first decide to start or take on a business, or a senior role within one, you’re naturally blinded by the opportunity. There’s a vision of what can be achieved, countless plans and strategies you can’t wait to implement, and your get up and go drives you forward from one thing to the next.

That never truly dies out, but the array of challenges that always crop up will sometimes make it feel as though those dreams have been sidelined temporarily. The good times are great, but they don’t always last as long you’d like because there is also something else waiting around the corner to deal with.

It takes a lot to keep going and find a way through those tough times. It can often feel very lonely because as much as your family will offer words of support or reassurance, they’re not close enough to really help when those big issues hit. Conversely, you can’t talk to your employees in the same way as you would if you were colleagues because you have to maintain that healthy balance between being friendly and open, and being their boss.

Personally, I find time talking to other business owners about these issues really cathartic. These are the people who know exactly what it’s like to walk in your shoes and feel the same daily responsibility you do, so it’s crucial to have a network of trusted cohorts you can pick up the phone to.

This is one of the less-talkedabout reasons why building relationships with other business owners is so important. While wholesale industry events are a great way to get yourself in a room of empathetic business owners, these sort of challenges are not sector-specific and it’s possible to find your community with anyone who understands the issues we all face on a daily basis. The most important thing is that anyone feeling overwhelmed should lean on the people around them.

In the tough times, you need to find your own coping techniques, too. Things can whir around in your head all day, every day otherwise, and it’s difficult to be present with friends or family when that happens, so somehow you need to find an escape to

break that cycle.

For me, I find that by going for a run, putting on a podcast or audio book and letting those endorphins flow, I’m taking my mind to new places. It’s awakened new interests in me and has led to me reading more about the topics I’m listening to on my runs. It provides me with the partition between work and home, and gives me something different to think about as I drop off to sleep.

It’s far too easy to neglect your own mental health as a business owner as you focus on everything else going on around you. But for your business to be on top form, you need to be firing on all cylinders, so I can’t stress enough the importance of getting the balance right for you as well as everybody else. l

far too easy to neglect your

Image credit: Getty Images/rudall30

Debbie Harrison Joint managing director, Pricecheck Jess Douglas Director,In terms of equality and diversity, Confex is now 60/40 on women/men in the team. The working-from-home structure has now enabled us to branch our talent pool and, whereas in the past we were fixed to employ people within commuting distance of the head office in the Cotswolds, we are now able to have opened our area and have employees based all around the UK from different ethnicities.

In terms of mental health, I partook in an online mental-health practitioner course with the FWD and am now a certified online mental-health advisor. We have three-weekly meetings online where everyone gets to discuss their workload and to help with support where needed. GroceryAid is one of our main chosen charities and all employees are aware of the benefits available free of charge should they need any mental-health support.

Pricecheck continues to improve its well-being package to support physical, financial and mental health – from annual check-ups to 24/7 access to online doctors through our healthcare provider. We also offer access to an independent financial advisor. And, to challenge stigma in the workplace, we have appointed mental-health champions alongside mental-health first-aiders.

Our recruitment strategy has always been inclusive of age, ethnicity or gender, and we’re proud to beat the industry average for female representation. To support our female colleagues, we have launched a new menopause policy to raise awareness, encourage open conversations and direct staff to relevant advice. Equality also means equal chances – from engaging with schools in locally deprived areas, to offering apprenticeships and working with universities to kickstart careers, we aim to raise aspirations. Diversity is engrained into our culture; our management teams are educated on topics surrounding ED&I, equal opportunities and unconscious bias to create a supportive environment for everyone.

Leading figures from across the channel give their take on mental health, diversity and how they implement it across their operations

Paul Hill

ConfexSimon Hannah Chief executive, JW Filshill

Filshill has an incredibly active well-being programme led by Amanda Casey (safety & well-being manager), which we believe is industry leading and something that we are incredibly proud of. We have 30 fully trained mental-health first-aiders in the business across all departments (myself included) who have collectively made more than 200 support interventions to colleagues since inception. Fifty-three per cent of these interventions have led to signposting to GroceryAid for additional support. We are lucky in our sector having GroceryAid there to assist and help. Some of these interventions have been supporting some of our suppliers, too.

All meetings in the business begin with a ‘two word’ mentalhealth check-in – one word for how you are feeling at home and one word for how you are feeling at work. This has led to a massive reduction in mental-health stigma. The key to this being successful is vulnerability, particularly from the leadership team.

In terms of the proactive elements, we have a well-being team made up of 12 colleagues from across the business. We believe that proactive well-being circulates across six key elements – sleep, exercise, social interaction, meaningful activities, helping others and stress management. Our well-being team organise regular activities in these pillars aligned to our 12-month well-being event calendar. The team recently arranged a well-being event for all of our staff and their families at Finlaystone Country Park – we had 350 attendees.

In relation to DEI, we have a team being led by Sue Man (marketing manager), we have appointed an external support resource (Diversity Scotland) to help us map out our journey, which includes reviewing current company policies, surveying and engaging with all of our staff with the goal of building a three-year DEI picture and one-year DEI plan (broken down into four 90-day bursts of activity). We are currently circulating a DEI survey to all colleagues as we speak. The outputs of that will define what improvements we need to make, what learning events we need to put in place and what our priorities will be within that timescale and structure.

Margaret Gooch HR director, Sysco GBIt’s important to be able to come to work and really be yourself. Our growing network of community groups are helping raise awareness of the differing needs and experiences of our workforce, identifying barriers to inclusivity and equality, and helping us become a more inclusive place to work.

As people have become more open about their mental health, Sysco GB has looked to support its employees to be happy and productive in the workplace. We set up our Mental Health First Aiders to be a point of contact for any employee who is experiencing a mental-health issue or emotional distress. Since we started the programme in 2020, we’ve trained 214 colleagues to become Mental Health First Aiders.

Ben Fisher Employee engagement manager, BidfoodEveryone deserves respect and fairness within the workplace, and without this, you are not only going to instil a negative culture from the offset, but you’re also actively encouraging poor engagement across your teams.

At Bidfood, it’s important for us to provide ample opportunities to everyone, while maintaining a culture of treating our people with fairness and respect. The diversity of people within our business is something we believe should be embraced, which, in turn, can unlock a multitude of great benefits and value.

Prioritising ethnicity, diversity and inclusion allows businesses to explore new ways of thinking, while increasing engagement and productivity, and can improve the relationships we have with customers. It’s important to understand, though, that this doesn’t just happen. It takes senior buy-in along with people in the business that are willing to work hard to make a difference, outside of their usual day-to-day responsibility.

We have also started a campaign to ‘celebrate differences’, focusing first on Ramadan and Pride, with a calendar full of more stories to tell throughout the year. There is always more to do, but we are committed to working with our teams to make sure Bidfood is an inclusive, safe and desirable place to work.

For us, the key is about understanding what our people need to be healthy and happy at work. We set up a health and well-being steering group a few years ago, and since then we’ve delivered two annual well-being surveys to understand our people. With that data, we’ve been able to put in place a wide range of solutions and services to help improve the well-being of our people. These included creating a guide where people can find everything they need in one place, which includes creating a guide and delivering mental-health awareness training to more than 80% of our managers.

As a result of the work we’ve done so far, we’re extremely proud to have recently won Gold at the UK Employee Experience Awards 2023 in the Health and Well-being category, and are currently shortlisted for another similar award.

Steve Whitwam Managing director, HarvestWe have two mental-health first-aiders in the business who will support the team with space to talk as well as signposting to other well-being services or emergency interventions, if required.

Our whole management team has undergone training from the Burnt Chef Project to support them in identifying members of the team who may be struggling with their mental health and where to go to either get support for them or signpost them to further support.

We also sign up to Hospitality Action, where our team has 24-hour access to talk to someone about any concerns they may have, and we actively promote this around the business. Mental-health support forms part of the induction for new starters as well.

In both 2020 and 2022, Creed achieved a ‘2-star’ Best Companies accreditation – reaching an ‘Outstanding’ level, and in both years were successfully listed as one of the Top 100 Best Companies to work for in the UK by The Sunday Times and Best Companies. Creed scored particularly well in the Well-being factor.

Creed is committed to improving the lives and livelihoods of its colleagues, customers and communities, and with the business centred around people, core values, well-being, fairness and inclusion, the company remains committed to creating opportunities within local communities – including jobs and training placements, as well as supporting and delivering community and charity projects and events.

Creed is continuing to prioritise financial well-being and is committed to ensuring that its people are fairly rewarded for the work they do. The company has been a Living Wage Foundation-accredited employer for the past eight years, ensuring that it pays a minimum rate to all employees set considerably higher than the rate set by legislation.

In addition to offering their people a huge range of discounts through its CREDO portal and staff orders at greatly reduced rates, Creed launched a benefits roadshow last year and is continuing to review feedback to improve its offering, supporting their people through the costof-living crises with additional payments.

Creed is also continuing to build an open and inclusive culture by investing in improving understanding, awareness and communication around mental health and well-being, and by providing support through its policies and its Employee Assistance Programme.

Last year, Creed assembled a team of 14 Well-being Champions, comprised of employees in various roles across the business, each of which completed mental-health training, with a view to supporting colleagues in all departments. They are focused on charity, inclusion, and mental and physical well-being. Informal flexible working agreements have been in place since the Covid-19 pandemic and we continue to review how employees are supported to manage their work-life balance.

Furthermore, Creed has recently increased its focus on developing a culture of equity among its employees, undertaking disability awareness training and an internal equity, diversity and inclusion survey, capturing data with a view to improving equality within the organisation. In the past year, International Women’s Day, World Mental Health Day and Pride Month have all been marked with events across the company.

Equality Act Training has also been given to all managers, supervisors and team leaders, with a goal to continue making Creed an inclusive environment, that is free from discrimination and bias. l

Hill speaks

BWI: Tell us about the origin of the business

CA: We are a north Londonbased wholesaler that has been operating as a fresh produce distributor since 2007 in Tottenham. In that time, we have expanded our category and product range considerably. We are constantly working on developing our products and expanding to supply and satisfy other sectors.

We were one of the first wholesale companies in the UK to man a 24/7 operation since our formation, which makes us flexible for customers and suppliers. One of our main priorities is the quality of the products we import.

What is the structure of the company and your growth plans?

Cyprofood falls under the parent company Masca Holdings, of which I am chairman. We now have 10 individual companies under this. As well as operating in industries such as property

development and construction, we also have one company that solely does food distribution for wholesalers and retailers, with a focus on ethnic and Mediterranean foods.

Furthermore, Masca has another business named Noble Premium that focuses on Eastern and Central European products. We also recently did a soft launch in a facility next door to Cyprofood for another business called Hepsy that will wholesale china, glassware and cleaning materials. These firms are proof

that we are constantly re-engineering and evolving our operations depending on the market and our customers’ requests.

We have grown in double digits each year since our formation, and did it through knowing the retail industry and where the value was. We were also one of the first companies that started the day shift for fruit and vegetable wholesale, which brought customer loyalty. People used to go to the wholesale markets

at night and leave their homes to get their fruit and veg for the next day of business. We instead created a 24/7 operation for our customers, which made it a lot easier for them when purchasing their goods, especially in markets such as fruit and veg.

Where do you get your products from?

Fruit and veg is still a big area for us, but we now do frozen, tobacco and ambient to name just a few. There is no limit to what we sell now and have expanded

to not just serve retailers, but foodservice outlets as well.

Our customers tend to dictate what new products or categories we focus on, and we are always adding to our portfolio to aid our customers. I would say we are now 50% foodservice and 50% convenience, but we don’t neglect either depending on if the other is bringing more profit in.

We also have customers from all over the UK and have facilities that serve the entire UK. To achieve this, we use third-party logistics firms to help with that. For example, the furthest we distribute to is Belfast and Dundee.

We have moved three times and expanded our current location into an old Bestway depot next door to our current one. The next stage of our evolution is to expand into west London in a move to the Park Royal area. We’re currently working on this, and these things don’t happen overnight, but we plan to be become a national company with 10 branches of Cyprofood across the UK within five-to-eight years. We also have a growth

target for Masca Holdings of £300m by 2025, with Cyprofood contributing £100m to this. As far as symbol groups are concerned, we don’t have any plans to create one. We want to create value for the retailer, not become one ourselves.

Why did you recently join the buying group Sugro?

We wanted to increase our buying power, and Sugro has been vital in our research and buying directly from suppliers. With the help of the business development team, we are now able to gain competitive prices from suppliers due to their power and strength in the market.

What is your USP?

Our USP is to provide what our customers want. If we don’t have it, it’s because we’ve not been asked for it yet. We’re always listening to our customers. The hardest thing in this industry is to manage and maintain fresh produce, and we are very good at that and I don’t see any other company that can do it like we do. I like to think we are creating a new channel by selling whatever our customers ask for. l

so

As workforces become more diverse, prioritising diversity, inclusion and ethical practice offers wholesalers the key to overcoming many business challenges. Start your journey by identifying gaps in diversity and workplace ethics. Yes, supply chain disruptions and the cost-ofliving crisis are urgent day-to-day concerns, but embracing diversity is increasingly important in driving innovation, exploring new ways of thinking, improving problem-solving and, ultimately, increasing company profits, by bringing additional knowledge and experience to the business.

Diverse workforces attract a wider selection of candidates, with unique skills and perspectives to support business growth. Begin making your gender representation more equal and acquiring younger talent by setting targets for recruiting female staff and under-30s. Celebrating differences and overcoming unconscious bias builds a strong company culture, and creates equality of opportunity for careers in wholesaling.

First, secure management buy-in, and enlist advocates company-wide who are prepared to help make a difference. Encouraging fairness and respect fosters engagement and productivity. Counteract unconscious bias by educating managers on the benefits of diversity

Continual training on EDI topics builds skills and knowledge needed for leading diverse teams. Ensure equal development opportunities through appropriate training, and sign up to the Disability Confident scheme, providing inclusive and accessible recruitment and reasonable adjustments.

Support staff wishing to work from home with flexible hours and consider applicants seeking part-time and term-time-only contracts. Challenge stigma and fight bias through point-based interviews and hiring panels, and implement Dignity at Work policies preventing bullying and harassment, and clarify what’s acceptable behaviour. Also, take every opportunity to celebrate differences, whether raising awareness of physical and mental disabilities, honouring different religions, or marking Pride month, and work with expert employees to improve business-wide cultural knowledge.

Five ways wholesalers can run a more diverse, inclusive and ethical operation

Wholesalers can reduce colleagues’ feelings of shame around mental health issues by creating an emotionally safe workplace. Appoint mental-health champions and first-aiders to encourage deeper discussion and provide support. Encourage employees to become certified online mental-health advisors through the FWD’s online course. Hold online meetings where people can discuss workload problems and get support, and impose out-of-hours email curfews. Promote men’s mental health and implement menopause policies, and raise awareness, encourage open conversations and direct people to qualified advisors.

Provide onsite physio services, set physical well-being challenges and encourage volunteering. Work with healthcare partners to offer well-being checks and access to online doctors and counsellors. Point employees to GroceryAid’s support services, and Hospitality Action’s 24/7 365-day service offering debt, financial and legal advice, and emotional support. Back this up by creating online guides with toolkits, tips, resources and links to support physical, financial, mental and social well-being.

Wholesalers should start by being more mindful of the products they buy and the people making them, as consumers become increasingly concerned with how and where goods are manufactured, and the impact on carbon emissions.

While wholesalers don’t have the same power as suppliers or retailers to change their production methods or incentivise purchase, they can be more proactive about their role in the supply chain and ability to influence change. As part of their due diligence, wholesalers should request information from suppliers on their production and sourcing of goods, and never knowingly deal with companies that cannot demonstrate transparency within their businesses and supply chains.

Wholesalers can exercise environmental responsibility by actively reducing their carbon footprint, through exploring greener warehouse and logistics solutions, shortening travel routes and improving transport systems to better cater for backhauling. This will have an instrumental effect on both operating costs and environmental impact.

In the first place, wholesalers should commit to quick, reactive, honest communication to provide the best possible customer service and enhance supplier relationships. Remember the three-step process: determine the issue, identify the best remedial actions and see how to avoid recurrences. Finally, communicate this approach to account managers and customers.

Hold regular supplier and customer forums to share brand plans and NPD news, and be similarly open with sales data to help customers analyse and improve sales and margins. Share non-confidential market data that gives a true picture of trading conditions and explains the challenges you all face. Additionally, wholesalers should ensure they deliver what’s been agreed and are open about availability of stock, to ensure everyone gets a fair allocation. Be clear about delivery charges, and take a stand on fair and transparent pricing, including things like shared margin reductions on PMPs, and challenge suppliers to do likewise. l

With thanks to:

Ben Fisher, employee engagement manager, Bidfood Jess Douglas, director, ConfexChloe

Staniforth, marketing manager, Pricecheck Jenny Squire, group marketing manager, Savona FoodserviceBetter Wholesaling Insight’s sister insight platform, Newtrade Insight, recently unveiled a report entitled ‘Diversity, Equity & Inclusion: Challenges and Opportunities for Convenience Stores’ in which it looked at DE&I from the perspective of wholesalers’ customers. The research was carried out by Newtrade Insight and is based on a survey of 200 wholesale customers from across the UK in the second quarter of 2023 using email, phone and social media.

“Our independent retailers are outstanding at understanding and supporting their local areas, so they probably are steps ahead of their larger organisations because they exist to serve their communities,” said Clare Bocking, chair of Women in Wholesale. “We can learn from them, as major suppliers and organisations, in what it truly means to be inclusive and to be able to provide a diverse range of needs across a diverse consumer base.”

When it comes to diversity, equity and inclusion, convenience store owners are largely split on where they need more information, with a majority saying they believed there is enough information from various stakeholders, such as wholesalers. When asked from whom they would like more information, the most popular answer is ‘the government’ at 45.5%, followed closely by ‘local authorities and council’ at 45%, ‘trade bodies’ (43.5%) and ‘trade press’ (41%). Equally, they are split on what type of information

Who would you like to receive more information on diversity, equity and inclusion from?

1A majority of retailers visiting cash and carries know up-to-date anti-discrimination legislation.

2Trade press and trade bodies are the most popular sources of information and where retailers want more information from, so it is their responsibility to inform as much as possible.

3Improving employees’ mental health and knowledge of legislation are the two areas retailers want most help in.

they are looking for. In total, 68% of wholesale customers said they need more information from at least one party when it comes to diversity, equity and inclusion.

The most popular answer was ‘advice on how to help my employees’ mental and physical well-being’, which 47% chose.

‘Information on relevant anti-discrimination legislation’ was also important, with 46.5% highlighting it as an area they need help with. In addition, 45% of retailers said they’d be more likely to work with suppliers that support diversity, equity and inclusion initiatives,

such as Newtrade Media’s Women in Convenience. This is a strong indication of retailers’ willingness to learn more about best practice around diversity, equity and inclusion, up to and including the stakeholders they work with.

With the role of a wholesaler evolving, retailers are no longer expected to just provide goods, but instead offer advice and insight on how to run their operations. DE&I forms part of this and wholesalers will gradually be looked upon to provide knowledge on this subject to their customers as the sector evolves. l

4There is a direct connection between a wide range of sources and knowing the best practices.

5There are areas of inclusion, such as making their stores more accessible for disabled customers and employees, that retailers are committed to.

6Forty-five per cent of retailers would be more likely to work with partners that take part in specific initiatives, such as Women in Convenience.

Visit newtrade.co.uk/newtrade-insight for the full report

The UK pub and bar market is forecasted to reach a value of £23.3bn in 2023, marking 1% growth beyond its pre-pandemic value. According to Lumina Intelligence, this growth comes despite economic challenges that has resulted in a decrease in consumer spending.

Despite this, the sector is predicted to see a decline in outlets, with a weekly closure of seven pubs throughout 2023 due to increased costs, leading to an estimated annual rate of decline of 0.8%. However, this still leaves a total of 41,916 operational sites across the country, each offering

a huge opportunity to wholesalers, some of which offer their opinions and insight here.

The inevitable challenges the pubs and bars have faced have meant there is a real need to adapt. There is a skilled labour shortage, so de-skilling menus is something that pubs are doing, and something we are keen to support with product innovation, more meal solutions, plantbased ideas and value engineering, which support those hardpressed kitchens.

But it also means looking for

efficiencies across the business – how can we help pubs save on energy costs? What solutions and equipment can we identify that reduces the need to burn gas? One of the biggest changes is the death of mediocrity. The cost-of-living crisis means that consumers want an experience that delivers value, but they still expect the same high standards they enjoyed pre-Covid-19 and Brexit. Pubs and bars need to have an identity and purpose, and deliver it well.

From a food perspective, it’s still being driven by plantbased. Pubs need to ensure they are not just playing lip service, but reimagining their menu for

today’s consumer. It’s a lifestyle choice that is going to continue to grow as environmental concerns continue to increase.

Ebrahim Mukadam,

managing director, LWC DrinksOur role is to make a difference to our customers; if we can’t, then we shouldn’t be supplying them. Offering menu and business support is one of the most important elements of our service. Yes, fundamentally, we are a wholesale distributor of drinks, but we are also a customer service-first business. This means that we don’t just see the relationship as a transactional one, we are there to add value to our customers wherever we can.

For this exact reason, all our account managers are – or in the process of becoming – The Wine & Spirit Education Trust (WSET)-qualified, to ensure that they are equipped with the latest and best industry and product knowledge. Our wine development managers and brand activation managers are always on hand to come in and offer staff training – or, alternatively, customers can come and visit our depot wine studios. We have a dedicated team of in-house designers, who are all exceptionally experienced in creating incredible bespoke menus, and we have a marketing team that can again help drive rate of sale and offer support.

From an industry perspective, unfortunately, it is no secret that the hospitality industry is

struggling, with soaring rates, staffing issues, the cost-of-living crisis and now the duty changes. Last year alone, Britain suffered a net decline of more than 4,500 licensed venues – a very sad figure, indeed. However, we are pleased to see that more independent bars and cafés are cropping up and, as a business, we want to support them however we can.

Covid-19 changed consumer behaviour considerably, and the post-pandemic hospitality scene is very different to what it once was. Consumers are seeking out more of an experience from the on-trade. They are going out less frequently, so when they do go out, they want a more memorable experience.

For months, consumers be-

came home bartenders and drinks experts. They experimented with cocktails and became accustomed to saving money and drinking at home. The venues that are thriving seem to be the ones that are innovating or pivoting slightly. Whether that be a new beer garden, an exciting new food menu, regular events or simply keeping things fresh. Going out is now about more than just the drinks, the pull really needs to be there. Within our own customer base, we are constantly working with operators to explore how we can make their drinks menu and venue as enticing as possible. We might have one of our activation managers pop down and host a tasting event or a brand takeover. Or one of our wine development managers might offer to do a

complete wine list overhaul. We also keep our fingers on the pulse of consumer change and demand, so that our account managers can relay this back to the customer and offer the best advice possible. We really see our customers’ challenges as our own challenges.

Steve

Steve

We have seen most success from operators that invest and think about value for money. There are many operators out there struggling, but many of these seem to be the ones where the customer doesn’t feel like they have value. When we talk about value, we mean that the consumer feels the experience they have had is in line with the cost they have paid. We see some very high prices

in some establishments with a plate of food or experience that doesn’t match. Many operators are working to traditional GPs of around 75% and not thinking about how much cash margin they are making. With the rate of price increases we have seen over the past few years, operators should be looking at cash margin alongside GP percentage margin. I recently saw sausage & mash for £30 in one pub. When I discussed this with the chef, he was adamant he had to make 75% GP, but his cash margin was huge.

We are also seeing many of our customers continuing to look for solutions as they struggle to find chefs. At Harvest, we have sourced many high-end products that will complement a chef’s menu but offer them a consistent

quality product which doesn’t need much skill. Our frozen sales have seen a large increase over the past 12 months and this seems to follow customer trends for more consistent high-quality products to slot into their menus. We are also seeing an increase in sales of our fresh pre-prepared vegetables, allowing chefs to focus more time on the finished product rather than the prep.

The Bestway Wholesale catering customer base comprises approximately 25% of sales to caterers and on-trade outlets, and our pub, club and bar customers are visited regularly by a designated territory sales managers to review ideas on food and drinks menus and support customers with recommendations to help the growth of their business.

The great partnerships we enjoy with our suppliers ensure that we maintain consistency of availability, and our pubs and

bar customers are well stocked to meet consumer demand. The territory sales managers also work collaboratively with supplier brands to provide items such as glassware and ice buckets to customers.

A prime example is the managers working in partnership with a representative from Kopparberg, who introduces and installs a new tap for Kopparberg Cider to a pub, club or bar. Hospitality establishments with beer gardens are provided with branded Kopparberg parasols to promote the new beer brand to customers. We also have a contact centre team which is always on hand to give advice and support to our customers.

As one of the leading pub suppliers, we have a diverse portfolio of managed, leased, tenanted and independent pub customers. While this may be perceived as a challenge, we’ve discovered

that the best way to approach our customers is to treat them as business partners, because when they grow, we grow. We’re constantly looking for ways to offer that extra level of support, especially with the difficult market pubs and bars have to operate in. To tackle this, we have equipped our customers with the following support tools to help their venues run as smoothly as possible:

• Pub Kitchen Club – our dedicated pub hub that focuses on core pub challenges. In addition to this, there is first-hand advice and guidance from key industry voices, including St Austell Brewery, Oakman Inns Group and The Alchemist.

• Unlock your Menu – this support hub was created to give customers the leg-up they need to overcome the ongoing industry challenges they face. Everything from reducing costs, to increasing kitchen efficiencies and menu engineering is included to drive overall gross profit.

• The Navigator report – food inflation has a massive effect on the way the industry works, so we regularly update customers on the inflationary pressures in the supply chain to help them understand the market and stay ahead of the curve when planning menus.

There’s also a huge focus on creating an improved dining and drinking experience for pub customers. In fact, many groups have started to invest in upgrades to their estates to capitalise on the demand for premium outdoor socialising experiences. It’s something pubs should consider, as making adaptable spaces that are suitable for all seasons will mean more space for customers and a better ambiance, creating the heightened social experience and growth they’re seeking.

Premiumisation is proving to be essential for pubs, as an emphasis on value for money strengthens among consumers.

The fact that there’s been a rise in treat occasions by 25-to-34year-olds and 55-to-64 yearolds1 shows how operators should consider targeting these demographics with treat led-offers and marketing messaging.

Here are the other general trends in the sector from Bidfood’s perspective:

• Premium soft drinks – as well as premium food, there’s also been an interest in premium soft drinks from consumers as those opting for alcohol-free alternatives continues to rise.

• The rise of rum and tequila –while gin was once the front-runner, tequila and rum are now top of the podium due to their versatility. Both spirits can be enjoyed with mixers, as the main ingredient in cocktails and even just on their own.

• Signature cocktails and mocktails – now more than ever, consumers are seeking unique experiences when drinking out, and more than a third say they’ll always choose the signature drink on the menu2. Operators shouldn’t forget to include mocktails, too, as an interest in non-alcoholic alternatives among 18-to-55-year-olds has more than doubled since August 20203

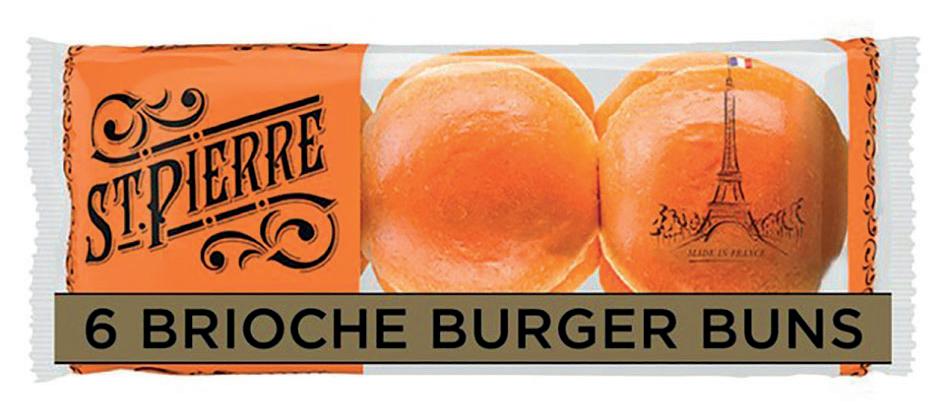

• Chicken burgers – there has been a rise in chicken burgers across menus as people decide to cut down on their red-meat consumption1. This also aligns perfectly with the cuisine trends hitting the UK right now, such as fried chicken and barbecue, where you can inject Japanese, Korean and other Asian flavours.

• Healthier options – since the implementation of the Calorie Labelling legislation in April last year, more consumers are conscious of their calorie intake. So, offering a range of low-, midand higher-calorie options will appeal to a variety of people and occasions. l

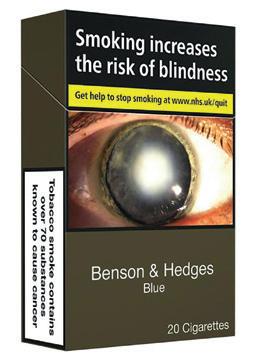

The wholesale channel has always played a huge role for JTI UK in its continued success as the UK’s leading tobacco manufacturer. The supplier recently paid a visit to Parfetts’ brandnew depot in Birmingham to raise awareness of one of its most trusted and well-known tobacco brands Benson & Hedges’ new limited-edition anniversary outers. The supplier was also on hand to offer advice on what wholesalers can do to really make the most of their tobacco rooms and maximise sales.

“It’s brilliant visiting our wholesale partners at modern premises such as this in Birmingham,” explained Victoria Reilly, JTI wholesale and convenience new business development manager. “We’re currently celebrating 150 years of Benson & Hedges, and couldn’t be prouder to have reached this extraordinary anniversary and still have such a successful brand that wholesalers can rely on to provide their retailers with great-quality cigarettes and rolling tobacco.”

“We’re always more than happy to work with JTI here in Birmingham to find out what’s going on with their brands. These partnerships with trusted suppliers are great for us and our retail customers,” added Mark Wright, Parfetts deputy general manager.

As existing adult smokers continue to look for more affordable options in the market, JTI has been busy innovating, particularly within the ultra-value segment, “where 58.7% of all sales volumes are currently in the value and ultra-value RMC and RYO sector1,” explained Reilly. Last

year, JTI launched Benson & Hedges Blue Rolling into the ultra-value segment to provide wholesalers with what it calls high-quality value for existing adult smokers. They also recently repositioned Sovereign Blue’s RRP to align with its ultra-value offerings and introduced Mayfair Silver into the sector.

They went on to offer valuable insight on how wholesalers should stock their tobacco rooms for maximum sales, including their top tips (see box on p27)