N A V I G A T I N G T H E N E W T R A D E L A N D S C A P E

PREPARED BY SHARON JOHNSON, CHIEF LEGAL OFFICER, MODE GLOBAL

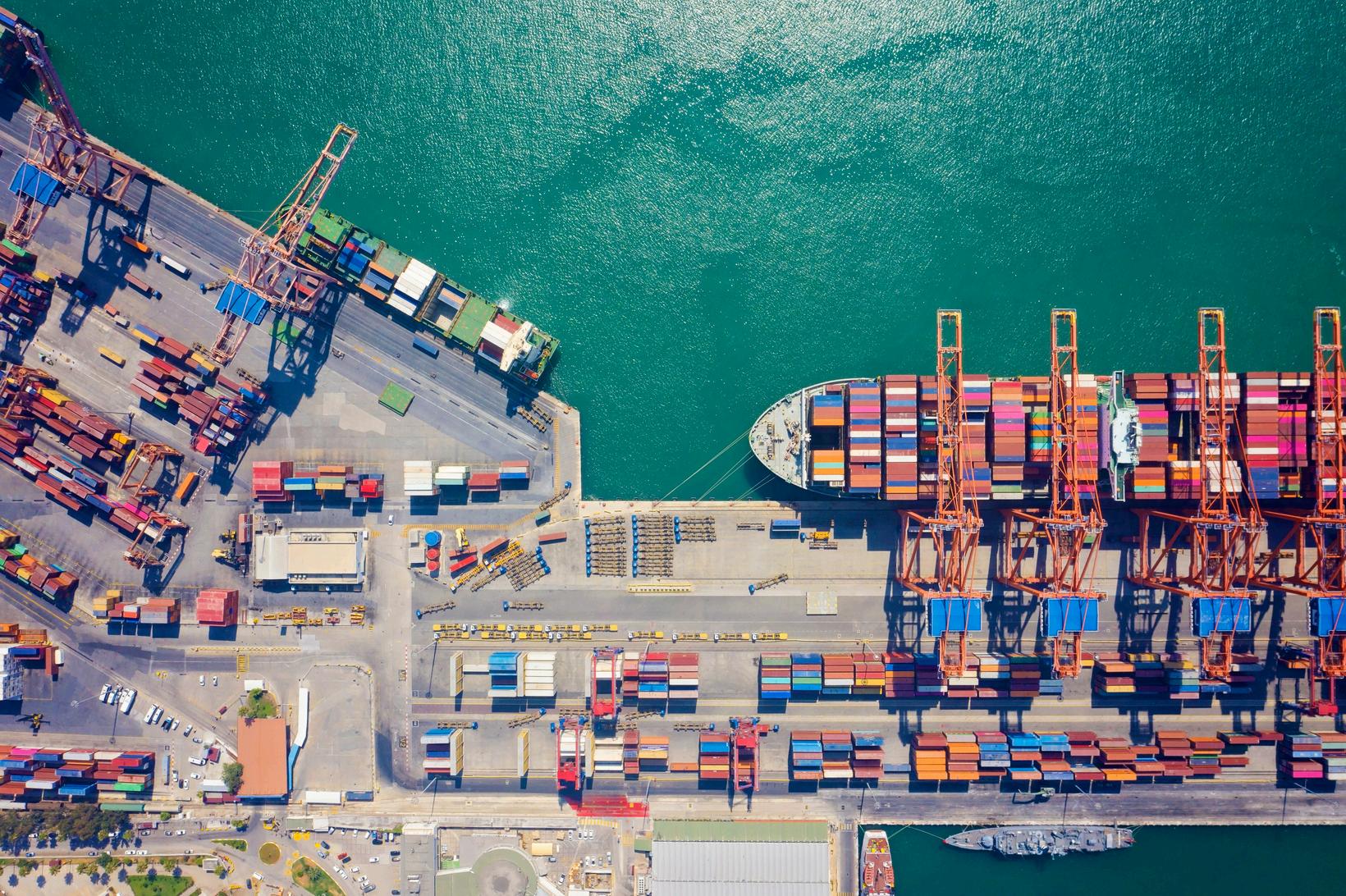

The Trump administration's tariff strategy represents a bold evolution in U.S. trade policy seeking to trigger significant restructuring of global trade relationships. This approach reflects a broader historical shift from decades of bipartisan support for global trade to a renewed emphasis on protectionism

During the Trump 45 administration, the focus was on addressing trade imbalances with China through Section 301 duties, which prompted many companies to diversify their supply chains away from China. This initial wave of tariffs led to the rise of "nearshoring" and "friendshoring" as key corporate strategies, with businesses searching for alternate suppliers in Southeast Asia, Canada, Mexico and Europe.

The Biden administration largely maintained and even expanded some of the China-focused duties, continuing the bipartisan approach to viewing China as a national security concern. This policy continuity allowed the nearshoring trend to gain momentum, with Mexico and Canada becoming the top two U.S. trading partners, displacing China to third position. Foreign investment poured into Mexico during this period including from China.

It is clear now that nearshoring is yesterday’s playbook under Trump 47, the new mantra is reshoring, all day, every way This represents a major shift in manufacturing strategy as Trump's administration works to return production facilities to our country’s own backyard This evolution has created significant challenges for businesses that had already invested heavily in foreign

The Trump administration has implemented a hybrid tariff approach that combines a universal baseline tariff with country-specific reciprocal tariffs. The Administration has established a minimum 10% baseline tariff on all goods from all countries except those compliant with the USMCA free trade agreement, which went into effect on April 5, 2025, at 12:01 am ET. Additionally, for approximately 60 countries identified as "worst offenders," supplemental "reciprocal" tariffs are being implemented at half the rate they charge on U.S. exports, effective April 9, 2025. While specific rates vary by country and are subject to change based on negotiations or retaliatory measures, initial announced rates included higher tariffs for major trading partners such as China, the European Union, Vietnam, India, South Korea and Thailand.1

This hybrid approach represents a compromise between the universal tariff concept discussed during the campaign (potentially 20% across the board) and the reciprocal tariff idea that emerged earlier this year. The administration has indicated that these tariff levels may not be final. If countries retaliate with their own tariffs, the U S tariffs could increase further Conversely, if countries cooperate and reduce their own trade barriers, tariffs could potentially decrease

For automobiles specifically, a 25% tariff on all foreign-made vehicles went into effect immediately at midnight ET on the day of the announcement but for now are excluded from the new universal and reciprocal tariffs.

Regarding Canada and Mexico, 25% tariffs on goods from these countries went into effect on April 2, 2025. However, on April 4, President Trump announced a one-month pause on tariffs for goods that fall under the USMCA agreement following significant pressure from the auto industry, which raised concerns about the impact on North American supply chains developed over the past 30 years.

Regarding China, to prevent tariff evasion, the new ad valorem rates applicable to China will also apply to imports from Hong Kong and Macau Special Administrative Regions, specifically to reduce the risk of transshipment Additionally, duty-free, low-value de minimis imports from China will lose their duty-free status on May 2, 2025, with postal items subject to either 30% of their value or $2550 per item.

The legal foundation for these tariff actions comes from President Trump's formal declaration of a national emergency due to economic and national security risks posed by trade deficits, invoking the International Emergency Economic Powers Act of 1977 (IEEPA) The President’s legal authority to use IEEPA in this way has not been attempted before or challenged by a lawsuit.

For the most current country-specific tariff rates, please refer to the U.S. Customs and Border Protection website (www.cbp.gov) or the International Trade Administration's tariff lookup tool. 1

The announcement and implementation of the new tariffs are already affecting global markets Global markets have plummeted on the trading days immediately following “Liberation Day,” as investors reacted to concerns that the tariffs could slow economic growth. Companies with supply chains heavily reliant on overseas manufacturing were among the most affected.

In anticipation of increased costs for raw materials and finished goods, some businesses have begun notifying customers of new surcharges and added fees to help offset the increased costs, while others have already implemented price adjustments In manufacturing, there are companies who have initiated layoffs in response to changing market conditions and a decline in incoming orders. Select projects are being put on hold or rebid as rising prices force scope revisions. There have been reports of smaller firms indicating that if the tariffs are fully enacted, their current business models may not be sustainable.

The tariff situation has created challenges for cross-border logistics For example, there have been challenges at the U S -Mexico border with importers rushing to bring goods into the U S before tariffs take full effect, creating congestion at border crossings. This push to move goods across borders strains transportation capacity, particularly in cross-border lanes. Additionally, spot rates in lanes from Canada to the U.S. have been rising.

Inresponsetotheshiftingtarifflandscape,companiesareleaningintoresilienceandreevaluating theirstrategies,whichmayinclude:

1.SupplyChainRedesign:Businessesarereassessing andinsomecases,fundamentally restructuring theirsupplychains.ThismayincludepausingprojectsthatinvolveMexicoorCanada astheywaitforgreaterclarityontradepolicydevelopments.

2.InventoryPositioning:Someshippersareholdinginventoriesattheborderor"in-country,"though thisisnotsustainablelong-term

3.ContractandCostAdjustments:Tariffpressuresarepromptingmanufacturersandproduct supplierstorevisithowtheymanagecommercialagreements.Someareseekingtoenterintocostsharingdiscussionswiththeirupstreamsuppliers updatingpurchasecontracts,adjustingvolume commitmentsandrenegotiatingpricingterms Atthesametime,traditionalannualcontractingcycles areevolving,withsomeshiftingtomid-yearpricingupdates,redesignsormini-bidstomaintain agility.Ontheretailend,anumberofcompaniesarenotifyingcustomersofaddedcharges,withprice increasesorsurchargesbeingintroducedtooffsetrisingcosts.

4.BondedWarehouseandForeignTradeZone(FTZ)Utilization:BondedwarehousesandFTZscan serveasastrategiccashflowtoolbyallowingbusinessestodeferdutypaymentsuntilinventoryis withdrawn,ratherthanpayinglargesumsupfront.Thiscanmeanpayingdutiesonanas-consumed basisandifgoodsareultimatelyre-exportedratherthanconsumeddomestically,thennodutieswill havebeenpaid.

5.SupplierVetting:OnecommonapproachsincetheTrump45administrationwastofindalternate suppliersaroundtheworld.Today,companiesareurgedtoexercisecautionwhensourcingfrom alternativesuppliersinlesser-targetedcountries.Instancesoftariffcircumvention suchasrouting goodsthroughthirdcountriestomasktheiroriginorevenfalsifyingorigins havebeen documented,particularlyinmarketslikeVietnamandCambodia.Withthecurrentadministration signalingatoughstanceonevasion,companiesshouldprioritizethoroughduediligencetoensure importcomplianceandavoidenforcementrisk

Businessesshouldbepreparedforcontinueduncertaintyandthepossibilityofadditionaltrade measures.Themostresilientcompaniesareembracingflexibility,recognizingthatrigidsupplychain commitmentsmaybevulnerabletocontinueddisruption.Acarefulassessmentofyoursupplychain includingpotentialtariffimpacts isessentialtodevelopingstrategiesthatcanadaptunder pressureratherthanbreak

If you are a current MODE customer, please reach out to your dedicated MODE family of brands represent tomer and need help with your supply chain, please r Experts.