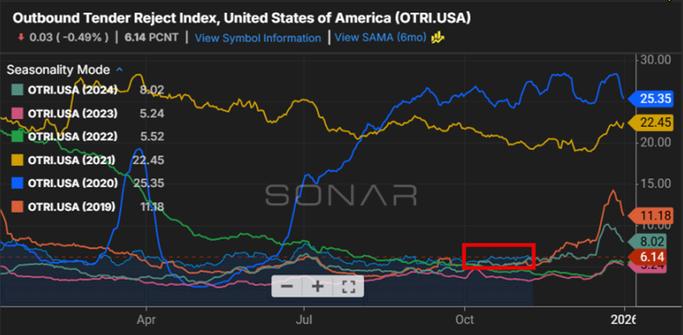

The Outbound Tender Rejection Index (OTRI) remained stable at approximately 6% throughout October, consistent with the shipper-friendly market conditions that have persisted through most of 2025. These levels continue to reflect adequate carrier capacity and favorable conditions for shippers as the year progresses through Q4. With no significant capacity disruptions on the horizon, the market is expected to maintain this balance through the remainder of the year. Holiday season volatility should remain relatively muted compared to historical bull holiday market conditions.

Source: Sonar.Surf

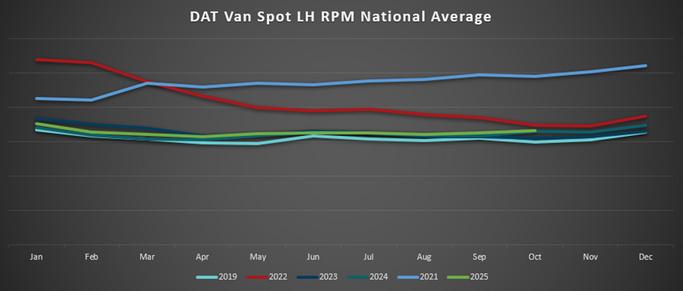

DAT's National Van Spot Linehaul RPM increased 1% year-over-year in October Meanwhile, fuel surcharges showed modest yearover-year gains, contributing to a 2% increase in all-in RPM compared to the same period last year. This marks the third consecutive month with both linehaul and all-in RPM posting year-over-year gains, a notable shift from the declines seen earlier in 2025. While these incremental improvements suggest the market may be stabilizing after an extended downturn, they do not yet signal a significant shift in market dynamics

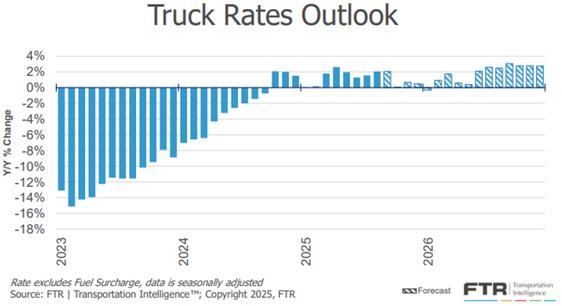

FTR Intelligence continues to forecast a stable market environment through the remainder of 2025 and into 2026. Linehaul rate growth remains projected at a modest pace, with fuel surcharge trends gradually reversing earlier declines. The combination of these factors suggests all-in RPM levels may continue to show slight year-overyear gains in the near term; however, broader market conditions remain shipper friendly. Fatal accidents involving non-English proficient drivers have intensified regulatory enforcement of language requirements, but measurable effects on capacity or pricing have not yet materialized a significant impact on overall capacity to drive a large rate shift.

Reefer

Source: DAT com/trendlines

Source: ftrintel com

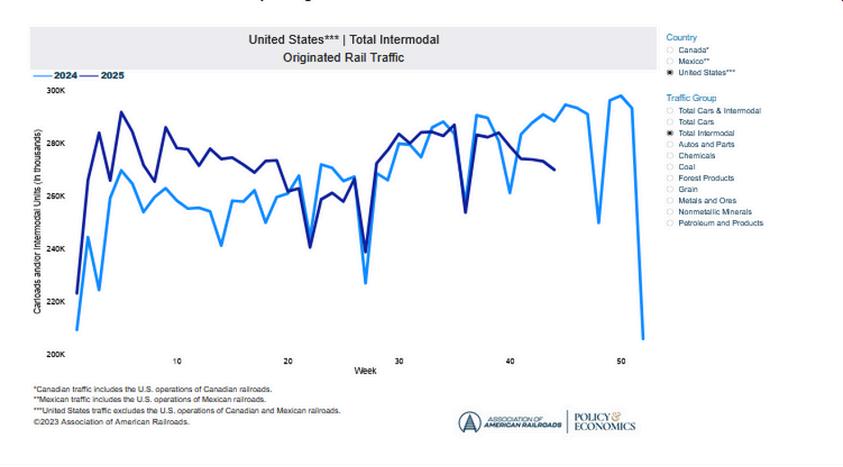

Peak season surcharges and allocations are still being charged by intermodal carriers in Southern California. There have not been any signs that peak season surcharges will be called off before Thanksgiving. In fact, many believe surcharges will last through the end of the year since parcel carriers’ volumes are increasing through upcoming holiday season.

Intermodal capacity is readily available in most of North America excluding Southern California. Spot rates out of Southern California remain high while peak season is still in effect; however, spot rates are lower than contract rates in various markets. Many intermodal carriers are providing aggressive rates in back haul lanes to California to reposition equipment.

Overall, Intermodal volumes for U S -based carriers are decreasing compared to 2024 due to high unseasonable volumes last year The negative volume comparison is expected to continue into early 2026

Here are links to some top stories in the industry for you to check out:

LTL Carriers Push General Rate

Hikes Despite Lackluster U.S. Freight Demand

ODFL Focuses on Costs to Limit Q3 Profit Hit in Weak Market

XPO Reports Q3

Revenue Jumps to $2 Billion

U.S. LTL ‘Land Rush’ Reaches Its End Amid Long-term Freight Decline

As we move into November, the LTL market is still running at the same slow pace we’ve seen most of the year. Volumes remain down across the major carriers, but pricing is holding strong and profits are steady because no one is giving up margin just to chase freight. The message from recent earnings calls was almost identical across the board: “Demand isn’t getting better yet, but it’s not falling apart either, so stay disciplined and keep protecting yield.”

Pricing discipline continues to show up in the numbers. ODFL, XPO and Saia all reported higher revenue per hundredweight year over year, and several carriers pushed through new GRIs heading into Q4 and early 2026. Contract renewals have stayed positive too, which tells us shippers are still willing to pay for reliability even in a soft market.

On the capacity side, the “Yellow land rush” is basically over Most of the terminals have been sold, and carriers are shifting their focus from expansion to getting more efficient inside the networks they already have Even with all the buying over the past two years, the industry still has fewer doors than before Yellow collapsed, and with demand this soft, no one is rushing to add new sites right now

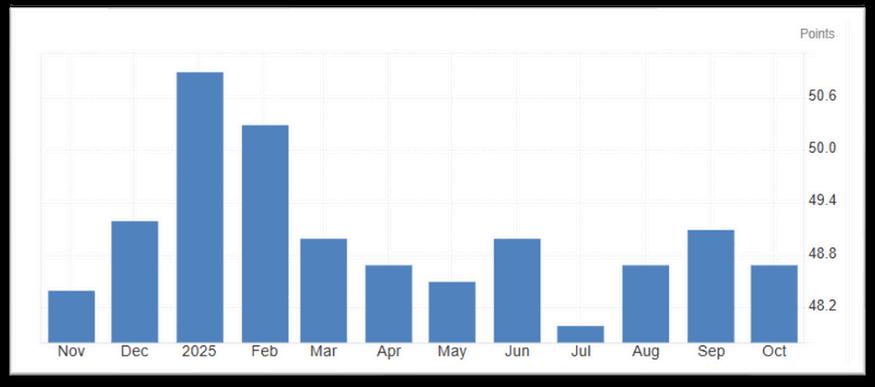

The broader economy isn’t doing the industry any favors. Manufacturing stayed in contraction again in October, and new orders slipped backward, which means industrial freight (the core of LTL) just isn’t ready to rebound. That’s why most carriers are keeping expectations flat through the end of the year and looking more toward 2026 for a true turnaround.

Bottom line: November feels a lot like October. Demand is soft, pricing is firm and carriers are staying sharp. The strategy right now is simple: protect margin, control costs, take the right freight and be ready when the cycle finally turns.

Source: Journal of Commerce (JOC), “Top LTL carriers maintain profit while planning paths to freight recovery, ” William B Cassidy, Oct 30, 2025

Even though freight demand is still sluggish, the major LTL carriers are proving they can navigate a slow market without giving up ground on pricing or profitability. Old Dominion, XPO and Saia each took slightly different routes through the third quarter, but the theme was consistent: carriers are staying disciplined, protecting yield and preparing for what many believe will be a healthier market in 2026.

Carrier executives say conversations with shippers are beginning to shift. According to XPO CEO Mario Harik, more customers are asking about future capacity rather than just today’s price. They know discount carriers are an option right now but they’re also questioning whether those same carriers will be there with capacity when the cycle finally turns. That concern is already shaping purchasing decisions.

Despite lower shipment counts compared to last year, carriers are focused on strategy rather than chasing freight. Old Dominion continues to prioritize margin over market share, holding tight to its premium-service model. Saia is leveraging its expanded national footprint to win more business from existing accounts rather than simply pushing volume XPO, meanwhile, is leaning into growth from small and mid-sized shippers and new premium service offerings, betting that these segments will accelerate as the recovery unfolds

Across the board, leaders agree: the market hasn’t turned yet, but the groundwork is being laid. Most expect steadiness through the end of 2025 and meaningful improvement in 2026, helped by potential interest rate cuts and broader industrial tailwinds.

What this means for MODE Global: With carriers doubling down on pricing discipline and long-term strategy, our value comes from helping customers navigate an environment where “cheap” doesn’t always equal “secure.” This is the time to strengthen relationships through accuracy, preparation and smart network design. We’ll continue supporting shippers with classing, pallet optimization and KPI reviews to drive better outcomes. At the same time, adjusting our carrier mix and pricing strategies will help control cost exposure and position MODE ahead of the expected 2026 recovery.

The ISM Manufacturing PMI slipped to 48.7 in October, signaling an eighth straight month of contraction and missing expectations. Production fell back into contraction, and weakness continued across new orders, inventories and backlogs. Employment declined again, with most respondents still focused on managing headcount rather than hiring Price pressures eased, but supplier deliveries slowed for the third month in a row Only two major sectors, Food & Beverage and Transportation Equipment, showed growth in October.

Source: Trading Economics & Federal Reserve

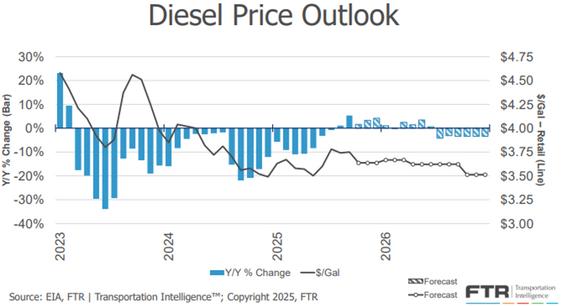

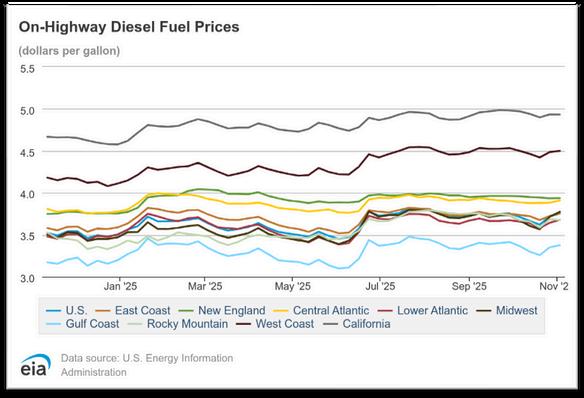

The U S national average cost per gallon for on-highway diesel in October 2025 is estimated at $3.772, which is $0.028 (0.7%) higher than September’s average of roughly $3.745. October 2024’s average was approximately $3 691, putting October 2025 at about $0.081 (2.2%) higher year-overyear. As of the first week of November 2025 (week ending November 3, 2025), the national average stands at $3.79 per gallon, which is $0.018 (0.5%) higher than the end of October

Volume: Late October volume surge to beat the tariff deadline, but softer long-term demand outlook according to recent NRF report.

Rates: GRIs at the end of October pushed rates up but short-lived, with limited near-term volumes forecasted, increases already falling back.

Capacity: Late October volume surge created some space constraints in China, but November should normalize with limited new demand coming.

Tariff news: U.S. and China come to an agreement – one-year trade truce – rolling back tariff increases.

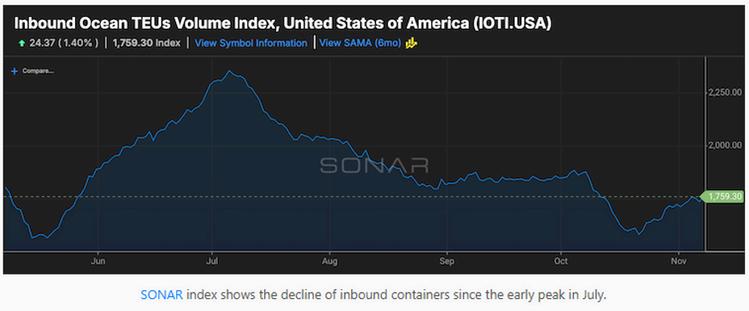

During the second half of October, volumes from China to the U S surged – following the threat of an additional 100% tariff effective November 1 (since rescinded *see Tariff News below) Importers who still had a need for goods, pushed orders to move before the sailing deadline of October 31.

However, this volume push was likely the last we will see for the remainder of the year The overall demand picture currently is not promising as most retailers frontloaded earlier in the year and were able to get their holiday stock in place much earlier than in past years.

The National Retail Federation has reported the latest data on U.S. import volume covered by the Global Port Tracker totaled 2.1 million TEUs in September, down 9.3% from August and 7.4% lower than the previous year. The NRF report calls for October volume of 1.99 million TEUs, a decrease of 11.5% YoY, and November volume of 1.85 million TEUs, a decrease of 14.4%. The December volume forecast is 1.75 million TEUs, a decrease of 17.9%.

One likely explanation for these decreases in volumes is that importers have begun diversifying their sourcing away from China to other origins in Southeast Asia like Vietnam or even to India. This has been an ongoing trend for several years, going back to the first Trump Administration. Additionally, this year it was clear that importers frontloaded orders due to the multiple iterations of trade threats that created a very early peak season resulting in a very slow November and December.

The NRF report also provided some long-term forecast data. Container import volumes are forecast to decline significantly from late 2025 through early 2026, following record volumes in some prior months due to frontloading

January 2026 is forecast at 1 98 million TEUs, a decline of 11 1% from the previous year February is forecasted at 1.85 million TEUs, down 9% and March at 1.79 million TEUs, a decrease of 16.7%.

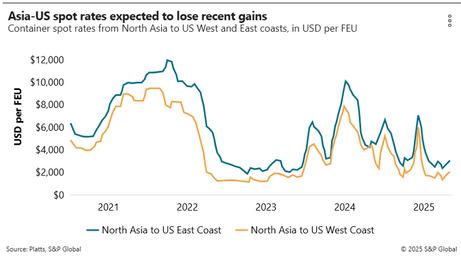

An unexpected surge in volumes from China in the second half of October provided the ocean carriers a window for pushing depressed October rates to the U S upward A general rate increase of around $800 per FEU was implemented after November 1 on the Asia to U S West Coast trade

Spot rates for Trans-Pacific containers to the U.S. West Coast jumped $800-$1,000 per FEU to $2,962 per FEU in the first week of November to levels not seen since July of this year But analysts are already reporting that carriers are quietly offering much lower rates amid weak demand and little hope for continued volume increases Rates from Asia to the U.S. East Coast have already fallen about $100300 per FEU in the second week of November.

It seems relatively clear that the new rate increases are not holding and are already beginning to erode based on a fundamental lack of demand.

Eastbound rates from Asia to the U.S. West Coast fell below $2000 per FEU in second week of November, according to the Freightos Baltic Index.

Trans-Pacific carriers also announced a $1,000 per FEU GRI on shipments from Asia to the East Coast, but that GRI collapsed quickly. By the second week of November, the East Coast spot rate has dropped to about $2,750 to $2,850 per FEU.

The structural weakness in overall demand in the eastbound Trans-Pacific will likely continue through the end of the year because retailers have already imported their holiday season merchandise for the Black Friday sales It is not likely, but even with these conditions, it’s not impossible for carriers to consider and attempt further GRIs

The primary space crunch seemed to be in the Central China ports where the combination of sudden volume increase and reduced capacity caused overbooking and rollovers.

However, now with the announcement of the U.S./China trade deal put in place on November 1, it is likely that capacities will normalize again, as we move through the rest of November and December.

Space and service continuity from South China and Southeast Asia remained status quo through October, with fewer space disruptions than from China’s main ports, most likely due to far less of a sudden demand

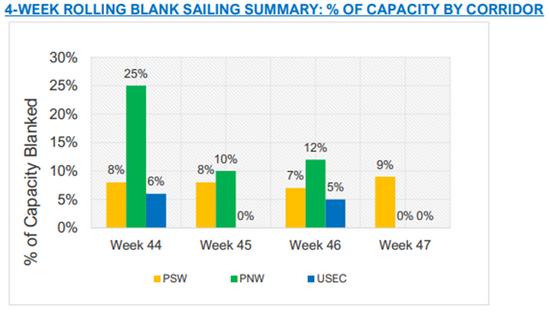

Overall, blank sailings have seemed to stabilize as the October demand surge calms down. Blank sailing forecasts for the month of November are moderate to low.

Source: M+R Spedag Group

In a bit of good news, the still developing ceasefire between Hamas and Israel has some industry experts feeling hopeful for a return of normal service rotation in the Red Sea/Suez Canal by the global ocean carriers.

Egypt's Suez Canal Authority (SCA) met with the major global shipping lines to encourage the return of vessels to the Suez Canal, which has experienced significant revenue declines due to Red Sea attacks.

A.P. Moller-Maersk, the world’s second-largest shipping line, in late October met with the Egyptian President to reaffirm the company’s investment in that country.

Mediterranean Shipping Co., the world’s largest container carrier, has said that it anticipated a swift return of southbound vessels, given the improved stability in the region

Evergreen has also said it is ready to resume transits as soon as the situation in the region stabilizes more “completely and permanently ”

Cosco representative Hani Al-Salami said structural changes in the international maritime community including falling rates and a shift in supply and demand will spur the return of lines to the Suez Canal.

With the return of the global carriers to the Suez Canal and a redeployment of what is considered “normal” operational vessel routing, vessel capacities and overall transit improvement could have significant positive impacts on global trade.

The U.S. and China agreed to a one-year trade truce, scaling back tariffs and suspending new economic controls, following their first presidential meeting since 2019

Under the agreement, the U.S. will reduce tariffs on Chinese goods (including halving the fentanyl-related tariffs) and delay restrictions on certain Chinese firms and sectors.

In return, China will pause rare earth export restrictions, increase purchases of American agricultural products, oil and gas, and commit to curbing illicit fentanyl flow.

Both nations also agreed to suspend tit-for-tat port fees, although average tariffs between the two countries will remain steep despite the reductions.

Despite the agreement, average tariffs between the U S and China will remain steep roughly 47% on Chinese imports and 32% on U.S. exports to China.