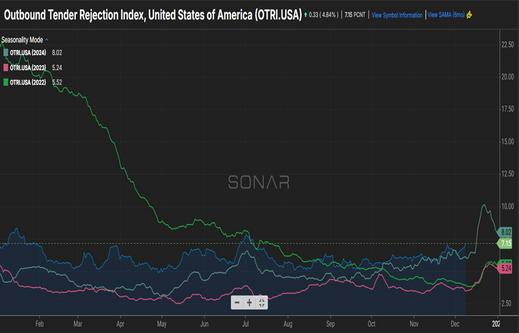

The Outbound Tender Rejection Index (OTRI) rose modestly to approximately 7% in line with seasonality Though some markets experienced tightness through the holiday, metrics continue to reflect adequate capacity and favorable conditions for shippers through the end of the year. Seasonal volatility should be expected but muted given available capacity.

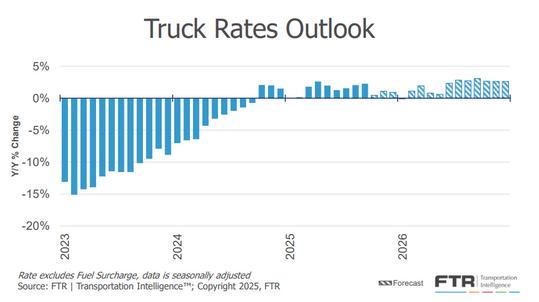

FTR intelligence continues to forecast stable market conditions through the end of the year with modest growth in RPM Barring major weather events or regulatory changes, most models show slow and steady growth in Q1

Source: Sonar.Surf

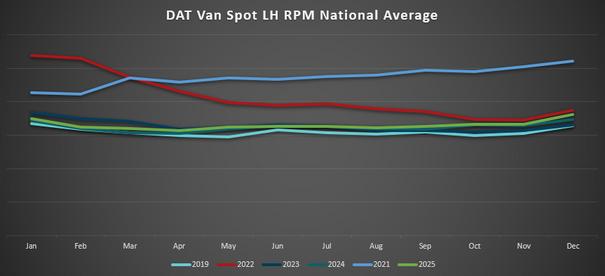

DAT's National Van Spot Linehal RPM shows an increase of 1 9% YoY, excluding fuel surcharges. The modest increases can be in part attributed to seasonal trends and regional peak demand. Early forecasts show a 2.7% increase for 2026.

Source: ftrintel com

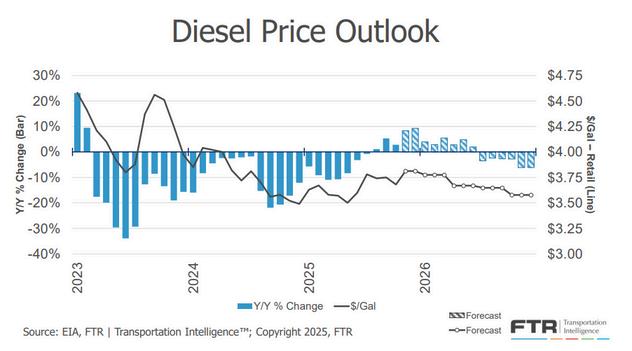

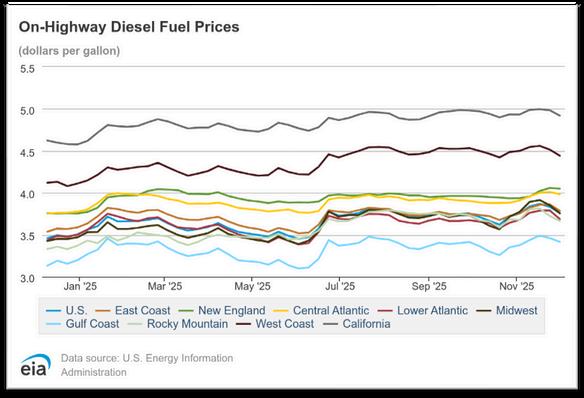

Diesel prices saw a slight decrease in the past week, following a rise of nearly 25 cents over the preceding four weeks. While crude prices have remained steady, it appears that very low distillate stocks in the Midwest contributed to this situation.

Source: ftrintel.com

National Spot Rates

Rates

Source: DAT.com/trendlines

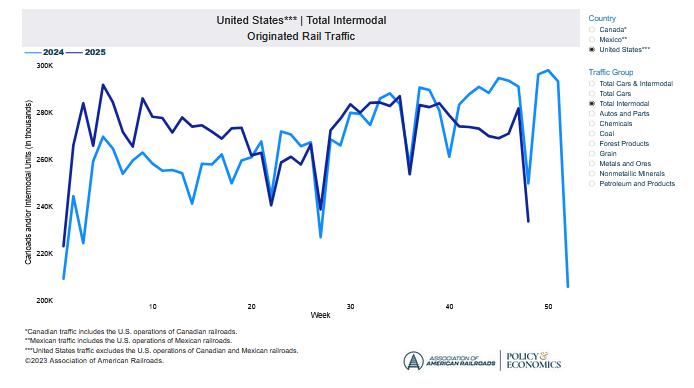

Intermodal carriers in Southern California are continuing to enforce peak season surcharges and allocations in December, neither of which are expected to end before the Christmas break. Parcel peak season continues to consume intermodal capacity and is expected to run until mid-January, creating the potential that peak season charges and allocations will run well into 2026.

Intermodal contract pricing in 2026 is expected to see increases between 3-5% depending on the lanes and markets. 2026 Spot rates are expected to remain low in back haul lanes to the West Coast. When peak season ends, spot pricing is expected to decrease out of Southern California.

The trend of soft intermodal volumes is expected to continue into 2026. U.S. volumes are expected to remain flat with growth being driven by domestic 53-foot containers in Mexico and Canadian cross-border lanes

Here are links to some top stories in the industry for you to check out:

Five Trends

Shaping the LTL Market as 2026 Approaches

FedEx Freight Begins Enforcing NMFC Updates

Old Dominion Again Sees Yields

Improve as Volumes Sag

Yellow Settles with Pensions

As we wrap up the year, the LTL market is showing a bit more movement, but not enough to call it a turnaround November brought the first signs of shipment growth at a couple of major carriers, though freight mix and weightper-shipment still held tonnage down. It’s a small step in the right direction, but the overall market remains soft.

Pricing is still holding strong, but it’s starting to shift. The LTL PPI slipped for the first time in several months, breaking a long streak of steady increases. Even with that dip, pricing is still nearly 10% above last year, which shows how sticky LTL rates remain. Shippers say carriers are defending existing pricing harder than ever, but there’s a little more flexibility showing up on new business, especially in lanes where capacity is under-utilized. It’s not a pricing reset, but it’s a more tactical market than earlier in the year.

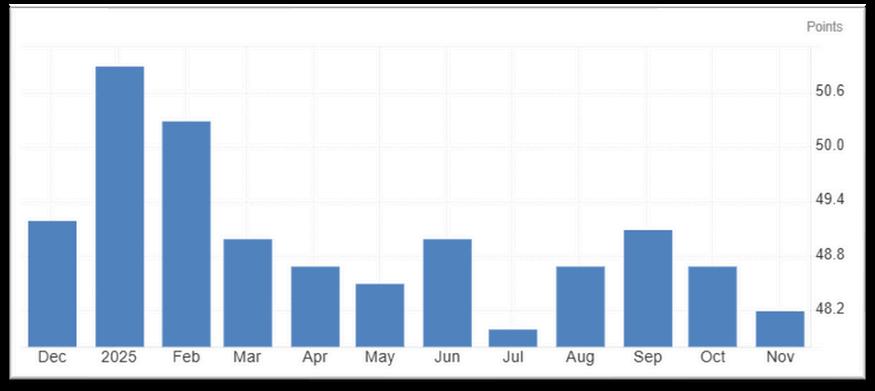

Manufacturing signals are mixed and could drag early 2026 volumes. The ISM PMI stayed in contraction for November, while S&P Global’s PMI showed expansion, but largely because companies pulled in materials ahead of tariff increases. The result is that warehouses are loaded with unsold goods at a level we haven’t seen in years. That kind of inventory build usually forces production cuts later, meaning freight tied to industrial orders could soften again heading into Q1 unless sales catch up quickly

Network strategy is shifting from expansion to efficiency. With the Yellow terminal sell-off being basically over, and with freight demand still soft, most carriers are pressing pause on adding more facilities. The focus now is improving density, tightening linehaul flow and getting more out of the terminals they already operate. Even with all the buying since 2023, the total number of LTL doors in the U.S. is still below pre-Yellow levels. This helps keep pricing firm, but also means carriers are being extremely selective about the freight they onboard.

Bottom line: December closes out a year defined by discipline over growth. Volumes showed small signs of life in November, but not enough to change the broader trend. Pricing is firm but slowly normalizing. Manufacturing is sending mixed signals and carriers are doubling down on efficiency rather than expansion. The big question heading into 2026 is whether industrial demand can stabilize before inventory pressure forces more cutbacks.

SOURCE: Transport Topics, “Carrier Logistics Unveils AI Tool to Streamline LTL Ops,” Nov. 13, 2025

Carrier Logistics Inc. has introduced an AI-driven tool that extracts shipment details directly from bills of lading and loads them into its FACTS freight management system. By replacing manual entry with automated data capture, carriers can create shipments faster, reduce errors and improve overall accuracy. The company notes that the technology directly addresses long-standing inefficiencies in capturing critical shipment information.

SOURCE: FreightWaves, “3PL Systems and Shiplify Bring New Transparency to LTL Accessorials,” Nov 13, 2025

A new integration between 3PL Systems’ BrokerWare TMS and Shiplify brings automated accessorial detection into the quoting process The system identifies carrier-specific accessorials, such as liftgate, residential delivery or limited access before a quote is finalized, reducing the guesswork that often leads to rebills and margin loss. By applying rules consistently across carriers, the technology provides brokers and shippers with clearer, more predictable pricing.

These technological developments reflect a wider industry movement toward automation, cleaner data and more predictable LTL pricing. MODE is already operating ahead of that curve through tools such as our direct API–powered NMFC lookup process, which provides accurate classification and shipment details upfront. As more carriers and vendors introduce AI-driven data capture and automated accessorial detection, MODE is wellpositioned to capitalize on this shift. Our existing infrastructure allows us to quote with greater precision, reduce disputes and strengthen our value proposition as customers seek partners who can navigate LTL complexity with confidence

The ISM Manufacturing PMI slipped to 48.2 in November 2025, the weakest reading in four months and the ninth consecutive month of contraction. The downturn was driven by sharper declines in supplier deliveries, new orders and employment, with roughly two-thirds of manufacturers still managing headcount reductions rather than hiring Price pressures intensified slightly, and order backlogs shrank further, highlighting persistent demand softness. Offsetting some weakness, production returned to growth and inventory drawdowns eased.

Source: Trading Economics & Federal Reserve

The U S national average cost per gallon for on-highway diesel in November 2025 came in at roughly $3.82, which is $0.048 (1.3%) higher than October’s average of about $3.772. November 2024’s average was approximately $3 897 (noting a prior downward trend), putting November 2025 at about $0.077 (2.0%) lower year-over-year. As of the first week of December 2025 (week ending December 1, 2025), the national average stands at $3.758 per gallon, a decrease of $0 062 (1 6%) from the end of November.

1. 2026 Parcel Carrier Rate Increases: What You Need to Know

All major U.S. parcel carriers have announced their 2026 General Rate Increases (GRIs), ranging from ~5.9% to 7.8%. Below is a quick snapshot to keep you informed.

Major Carriers at a Glance

FedEx (Effective Jan 5, 2026): 5.9% average increase across domestic, international and freight services.

UPS (Effective Dec 22, 2025): 5.9% average increase across ground, air and international services

USPS (Effective Jan 18, 2026):

Priority Mail: ~6.6%

Ground Advantage: ~7.8%

Parcel Select: ~6.0%

Priority Mail Express: ~5.1%

DHL Express / DHL eCommerce (Effective Jan 1, 2026): 5.9% average increase across services.

Regional & Smaller Carriers (Effective Jan 1–5, 2026): ~5.9% average, with limited public surcharge details.

2. Costs are rising, but smart shippers are beating increases with data and packaging tweaks. 2025–2026 surcharges are hitting heavier and oversized packages the hardest. Forward-thinking companies are running package audits, shifting to dimensionally friendly materials and using tech that identifies the “cheapest carrier for this shipment” in real time. The result: many firms are absorbing rate hikes without blowing up their shipping budget It’s not just about cutting costs, it’s about shipping smarter, not harder

3. Tech is finally paying off — AI routing and real-time tracking aren’t buzzwords anymore. Carriers are rolling out AI-powered routing, automated sortation, EV fleets and improved tracking APIs and shippers are seeing the benefits. We’re entering an era where delivery ETAs are more accurate, exceptions are easier to catch and customer experience is smoother. This creates fewer WISMO (“Where is my order?”) calls and better brand trust. The companies that adopt these tools early often see measurable reductions in delivery times and support costs.

4. Your customers want delivery choices, not just speed. Consumers today are more price-sensitive, and many will choose a slower, cheaper option as long as it’s reliable and transparent. Offering choices at checkout economy, standard, express consistently improves conversion and reduces abandoned carts. Even a simple “green delivery” or “budget 3–5 day” option can drive higher satisfaction. The key insight: shoppers want control, not just speed and giving them options strengthens loyalty and reduces service complaints.

Volume: November volumes were underwhelming, and there is not much change in the demand outlook for next few months.

Rates: Early December rate levels slightly up from November, but signs are pointing to continued erosion in Asia to U.S. rates.

Capacity: Overcapacity continues to be a theme moving into December. With lower demand and abundance of space, expect downward pressure on rates.

Tariff news: Some promise on the horizon of more carriers considering the resumption of Suez Canal transit.

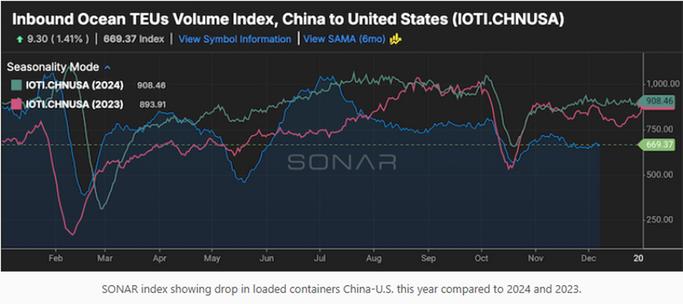

Inbound TEU volumes in the Asia to U.S. trade for November were, as expected, relatively unimpressive. Unfortunately, there seems limited hope on the horizon for improvements as those import volumes are expected to drop below 2 million TEUs. These are the lowest levels since 2020.

Additionally, trade analysts feel that U.S. import volume declines are even expected to accelerate over the next 60 days as shippers/importers recognize the upcoming Chinese New Year holiday when factories slow or halt production for their annual celebration. The tempered demand for Asia imported goods can be tracked to a few key factors, most notably questions about the current state of U.S./China trade relations.

Tariff uncertainty is expected to keep a lid on U.S. import growth until spring 2026, according to most trade and industry analysts. As reported in previous updates, retailers are delaying orders and scaling back shipments due to concerns over tariff uncertainty and reduced consumer demand in the U.S.

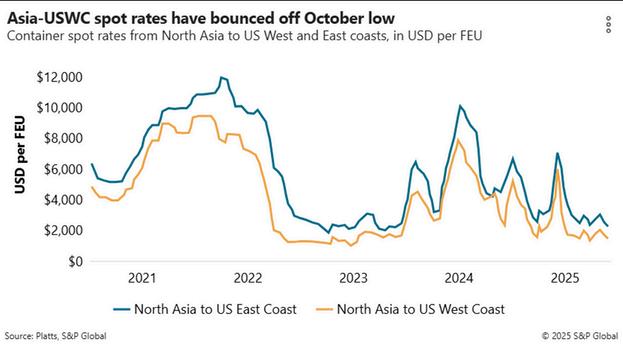

Overall, container rates moving into December in the Asia to the U.S. trade lane saw a slight short-term increase of 7-8% in the latest week after bottoming out in November. Spot rates from Asia to the U.S. increased about 7% or $140 per FEU in a short-term rebound in pricing after the decreases in late November.

Rates from Shanghai to Los Angeles rose by 8%, reaching $2,256 per FEU, and those to New York increased by 6% to $2,895 per FEU.

Despite this recent uptick, rates on both the West and East Coast routes remain significantly lower (20-32%) compared to a month ago, primarily due to an ongoing oversupply of shipping capacity relative to lower demand.

To combat the rate erosion, carriers seem to be implementing a new strategy of more frequent, smaller weekly rate increases, which has led to some of the current spot rate “relative” stability It is also adding a degree of supporting higher FAK rates ahead of annual contract negotiations which occur in the first quarter of the year

Traditionally, carriers have implemented general rate increases (GRIs) on a fortnightly basis; however, a shift toward a more frequent, weekly adjustment strategy has emerged, and analysts claim this new approach means introducing smaller, more “palatable” rate increases. For years, carriers have employed larger, sporadic increases that tend to be less sustainable.

How effective this strategy will be is unknown, but with low levels of demand and increased overcapacity it seems hard to expect anything more than a moderate degree of stability in the short term.

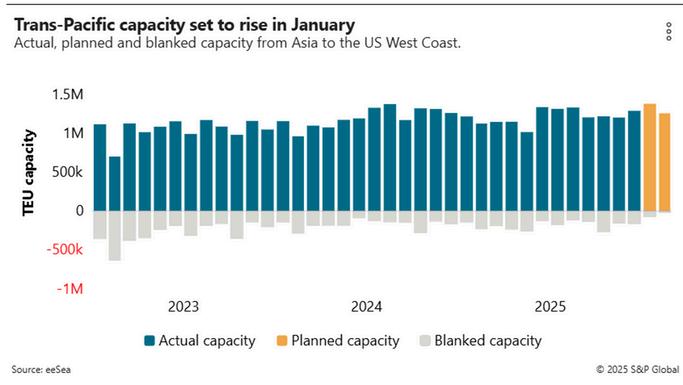

As reported in earlier updates, overall ocean containerized capacity is expanding at a rapid rate, especially moving into 2026. In November, weekly global containerized capacity reached nearly 5 million TEU, up 2.7% YoY, with Q3 alone up 3.4% versus Q2. Carrier MSC’s fleet has now surpassed 7 million TEU, a new industry record for a single carrier.

The current capacity situation will also be significantly impacted when the Red Sea/Suez Canal service returns to normal by adding to the functional capacity with more efficient vessel utilization

In the Asia to U S West Coast trade, available capacity is flat to slightly down at 1% indicating no meaningful tonnage expansion in the first part of December; however, overall capacity to the U.S. is up 7%, (roughly 20,000 TEUs compared to November), as sharply lower ocean rates ran up against higher supply numbers even with the recent short-lived rate recovery. ,

Containerized ocean tonnage from Asia to the U.S. East and Gulf coasts is set to hit a two-year high in January, up 14% from a year ago. Ocean carriers plan to keep capacity elevated, with tonnage from Asia to the U.S. West Coast set to rise almost 13% year over year in January That would equate to a nearly 37-month high

With relatively low blanks sailing levels planned for early December, the current overcapacity will push hard against carriers looking for rate increases. The expectation will be that, without a bump in demand, carriers will likely increase blank sailings moving into January.

Container ship transits through the Suez Canal are now reaching historical lows, as most major carriers continue to divert around Africa due to security concerns The end of November saw the second-lowest number of container vessels transit through the canal this year.

Yet, it appears there are positive signs of a significant return to normalcy. The Suez Canal Authority recently reported that Maersk’s return to the Red Sea was imminent; however, Maersk shortly thereafter reported that there was no firm date set or any type of return plan in place yet Perhaps a bit too early, but there are signs that Maersk is at least considering a return.

CMA CGM has announced its INDAMEX service will transit Suez Canal on fronthaul and backhaul voyages between India/Pakistan and U.S. East Coast in a move toward a full return of container transits in Red Sea region. Other major carriers, including Hapag-Lloyd, have also not announced a firm timeline for a significant Red Sea return, but are in the planning stages ZIM has stated it is still waiting for insurance approval

The return of normal transits in the Red Sea brings about a good news/bad news scenario. On the upside, container voyages via Suez Canal rather than around the Cape of Good Hope reduce full loop transit time of this service by two full weeks. That certainly means improved overall transit times but also means that two additional vessels will functionally be freed up per Suez transit. The downside is that it will create an additional infusion of vessels into the current overcapacity market.