TheOutboundTenderRejections Index(OTRI)remainedcompressed throughFebruary,closingat5.26%. Thissustainedsoftnesscontinuesto favorshippers,withlittleindicationof upwardpressurebeforeInternational Roadcheckweekinmid-May.

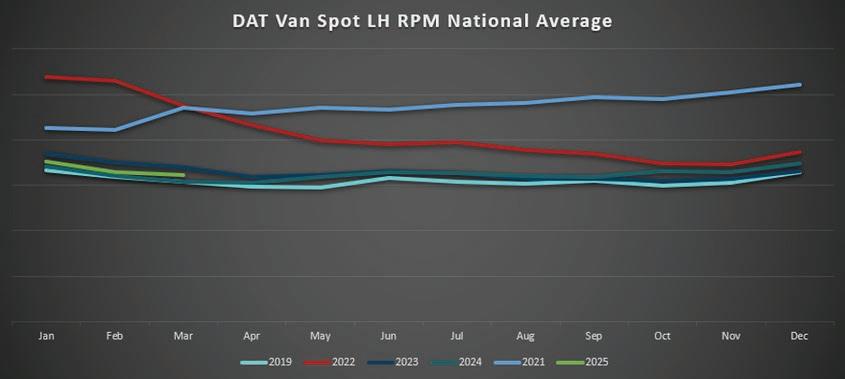

Spotmarketconditionsfolloweda familiartrend,withNationalVanSpot LinehaulRPMincreasingby$0.07per mileyear-over-year,markinga4% gain.However,fallingdieselprices weighedonoverallcosts,leadingtoa 1.4 %year-over-yeardeclinein NationalDryVanAll-InRPM.

Lookingahead,FTR Intelligencemaintainsits outlookforastable 2025.Nationallinehaul ratesareprojectedto seesub-5%year-overyeargrowth,but continueddeclinesin fuelsurchargesmay offsetthesegains, keepingall-inRPM relativelyflatorslightly negative.

Source:DAT.com/trendlines

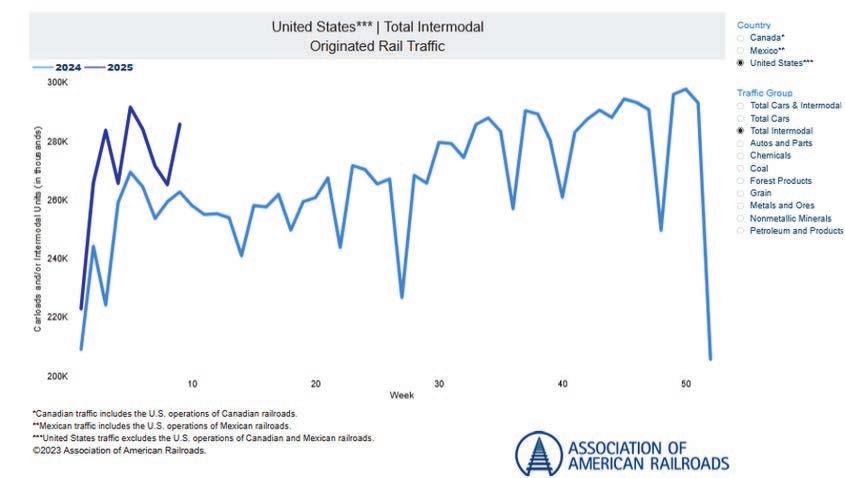

AsQ1isdrawingtoaclose,Intermodalprovidershavecontinuedtopushrateincreasesover2024levels. Intermodalvolumehasdroppedfivepercentonayear-over-yearbasis,accordingtotheAssociationofAmerican Railroads,tostart2025.EquipmentcapacityandrailroadgatereservationshavenotbeenanissueduringQ1.

AsweapproachtheendofQ12025,theLess-Than-Truckload(LTL)industryisexperiencingadynamiclandscape characterizedbycautiousoptimism,evolvingdemandpatternsandstrategiccorporatemaneuvers.

LTLexpertsarehopefulbutrealisticabout2025,anticipatingmodestgrowthinfreightvolumesanddemandfor services.WhilesomepubliclytradedLTLcarriershavecitedsoftnessintonnageandshipments,industryforecasts stillsuggestth atshipperfreightvolumeswillstabilizein2025,withtraditionalseasonalpatternsreemerging.While industrialshipmentrecoveryisprimarilyexpectedtobuoyfreightdemand,especiallyas2025progresses,the sustainedgrowthofe-commercewillcontinuetodrivedemandforLTLservices.Asonlineshoppingbecomes increasinglyprevalent,LTLcarriersareadaptingtheiroperationsandpricingmethodologies,accordingly.

Whilechallengessuchascost press ures,economicuncertainties andregulatorychangespersist, innovationssuchasautomated freightmanagementsystems,ecofriendlytruckinginitiativesand freightoptimizationtechnologyare beingadoptedtoimproveroute optimization,sustainabilityand transparencyinfreight transportation.

TheU.S.nationalaverage costpergallonforon highwaydieselinthemonth ofFebruary2025camein at$3.675,whichis$.041or 1.1%higherthanJanuary’s averageof$3.634.TheU.S. nationalaveragein Februaryof2024was $4.044,whichis$.369or 9.1%morethanFebruary 2025.Westartthesecond weekofMarch2025offat $3.582pergallonforthe U.S.nationalaverage.

FedExhasbeennavigatingacompetitivelandscapemarkedbyoperationalchallengesand strategicrealignments:

OperationalIntegration: FedExisworkingtomergeitsExpressandGroundnetworksto eliminateredundancies.Thisintegrationaimstostreamlineoperationsbuthasuncovered technologyandproductivitychallengesthatthecompanyisactivelyaddressing.

MarketPosition: Despitetheseefforts,FedEx'son-timeperformanceduringthe2024peak seasondeclinedto91.8%,downfrom98.3%in2023,indicatingareasneeding improvement.

UPShasundertakensignificantstrategicshiftstoenhanceprofitabilityandoperationalcontrol: ReductioninAmazonDeliveries: UPSplanstoreduceitsvolumeofAmazonpackagesby 50%byJune2026.ThisdecisionallowsUPStofocusonmoreprofitableshipmentsand regaincontroloveritsdeliverynetwork.

FinancialOutlook: FollowingtheannouncementtoscalebackAmazondeliveries,UPS's sharesexperiencedasignificantdrop,reflectinginvestorconcernsoverpotentialrevenue impacts.However,thecompanyemphasizesthatthismoveispartofabroaderstrategyto prioritizeprofitabilityovervolume.

TheUnitedStatesPostalServiceisundergoingtransformationsamidfinancialchallengesand operationalchanges:

PrivatizationDiscussions: ThereareongoingdebatesaboutprivatizingUSPSdueto substantialfinanciallosses,includinga$9.5billiondeficitintherecentfiscalyear.Sucha movecouldsignificantlyimpacte-commercedeliveries,especiallyinruralareas.

InternationalShippingAdjustments: USPSbrieflysuspendedincomingpackagesfrom ChinaandHongKonginresponsetonewtariffsandtheeliminationofcustomsexceptions forlow-valuepackages.Thissuspensionwasquicklyreversed,andUSPSisnow collaboratingwithCustomsandBorderProtectiontoimplementatariffcollectionsystem.

Amazoncontinuestoexpanditslogisticscapabilities,influencingtraditionalcarriers: LogisticsExpansion: Amazon'sin-houselogisticsnetworkhasgrownsubstantially,now managingasignificantportionofitsdeliveries.Thisexpansionchallengestraditionalcarriers likeUPSandFedEx,promptingthemtoreassesstheirstrategiesandcustomerbases.

MarketPosition: AmazonLogisticshassurpassedUPSinU.S.parcelvolume,reflectingits growingdominanceinthedeliverysector.ThisshiftunderscoresAmazon'scommitmentto controllingitssupplychainandreducingrelianceonexternalcarriers.

Severaloverarchingtrendsareshapingthesmallparcelmarket: E-commerceGrowth: Thecontinuousriseofe-commercedrivesdemandforefficientparceldeliveryservices, promptingcarrierstoinnovateandexpandtheirnetworks.

TechnologicalAdvancements: Investmentsinautomation,artificialintelligenceandalternativedelivery methods(suchasdrones)arebecomingessentialforcarriersaimingtoenhanceefficiencyandmeetcustomer expectations.

RegulatoryChanges: Newtradepoliciesandtariffregulationsareimpactinginternationalshippingdynamics, requiringcarrierstoadapttheiroperationsaccordingly.

Inconclusion,theU.S.smallparcelmarketisinastateofflux,withmajorplayerslikeFedEx,UPS,USPSand Amazonmakingstrategicdecisionstonavigatechallengesandcapitalizeonemergingopportunities.Staying informedaboutthesedevelopmentsiscrucialforstakeholderstoadaptandthri ve.

Volume: Slowrecoverybutdemandlikelynotstrongenoughtooffsetratedecline.

Rates: RatesslippingagainmovingtoMarch–BCOnegotiationspushingdownward.

Capacity: FewerblanksailingsinlateFebruaryandearlyMarchascarriersestablishmarketpositions.

TrumpTariffUpdate: 30-daypauseannounced,pushingpotentialtariffstoApril2.

VolumerecoveryfromAsiainQ1remainsslow,whichisnotsurprisinggiventherecentturmoilcreatedbythe shiftingcarrieralliances,announcements/implementationofnewtariffsandrisinginventory/salesratios.Thisisall comingrightafterastrongJanuarywhenimportvolumesfromAsiaincreasedsignificantlyoverthepreviousyear.

U.S.importsfromAsiawereupnearly13%inJanuaryyearoveryearandthatisalsocomparedtoa17.6%growth overtheJanuary2023totals;however,Februaryvolumeslostsomeofthatground,withadeclineofabout1112%comparedtoJanuarybutstilla4.7%increasecomparedtoFebruary2024.

Februaryimportvolumewasthesecondhighest totalforthemonthoverthelastfiveyears,trailing February2022byjust73,341TEUs;however,this declineismostlyinlinewiththeavera geseasonal declineseenoverthelastthreetofouryears.

Despitethisexpecteddecline,ashortermonthfor sailingsandaChineseLunarNewYearthat extendedthroughtoFebruary12,overallU.S. containervolumesinFebruaryweredecent. MovingintoMarch,theactualimpactofFebruary’s 10%tariffimplementationonvolumesisdifficultto gaugebutitispossiblewecouldseesome additionaldeclinesinChinaordersthroughMarch.

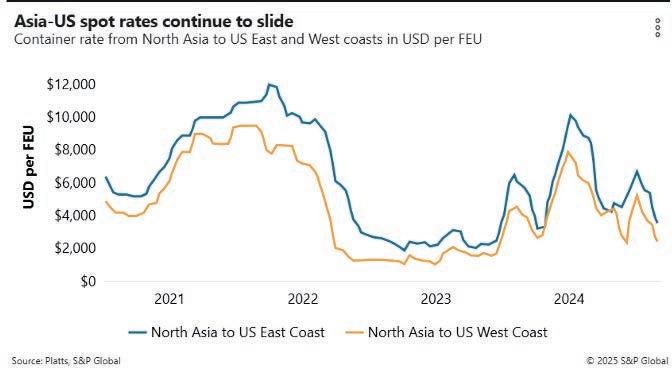

MovingintoMarch,carrierattemptstoraiseratesonMarch1predictablyfailed,andFAKratesmoveddownward intothe$2000sperFEU(WestCoast)andthe$3000s(EastCoast)forthefirsttimesinceDecember2023.

Asia-U.S.WestCoastratesfellbyaround18%accordingtotheFreightosBalticIndexattheendofFebruary, movingintoMarch.RatesfortheAsia-U.S.EastCoasttradealsodroppedabout21%.

Theoceancarriershadfiledgen eralrateincreases(GRIs)effectiveMarch1andMarch15withtheintentionof pushingspotratesupleadingintoannualcontractnegotiations.Butmostanalystssaythereissignificant skepticismwhetherthoseincreaseswillstick.Itisbeingreportedthatsomecarriersarealreadyundercutting currentspotrateswithspecial“bullet”ratesbelow$2,000totheWestCoast.

WithBCOannualcontractnegotiationscontinuinginMarch,carrierswillsurelytrytoforceF AKratesupbymidMarch.EarlyreportsoftheBCOnegotiationsindicatethatsomelargeretailersarepushingbackoncarrier proposalslookingforhealthyincreasesovertheircurrentcontractrates;however,anyofthoseincreasesmaybe temporaryasitseemsclearthatcurrentdemandlevelswouldnotsupportsustainedincreases.

ItseemsmorelikelythatsomelevelofrateerosionwilloccurafterthefirsthalfofMarch,andthatratescould potentiallydipbelowthe$ 2000/FEUleveltoU.S.WestCoastandthe$3000/FEUmarktoU.S.EastCoast.

Asnewalliancestructuresgetsolidified,blank sailingsmovingintoMarchappeartobethelowest inthelastyearwithonlyanestimated13sailings scheduledtobecanceledoverthenextfourweeks. ThisshouldindicatethatcapacityintheU.S.import tradewillbeavailable.

Thesenewalliances–theGeminiCooperation (Maersk+HapagLloyd),PremierAlliance(HMM, ONE,YangMing)andMSC(+ZIMontheAsiaUSEC)–arenowbeginningtoestablishtheirnew orrevisednetworkswithmoreconsistent schedules;however,withthisincreasedcapacity thereisalsoamarketriskthatasdemandcontinues tolag,ratescouldcontinuetoerode.

Source:M+RSpedagGroup

DespiteaHouthi-declaredceasefireandahopethatRedSeashippingissueswouldstarttoimprove,thereisstill significantuncertaintyandriskswhichhaveledtocarriersresistingresumingnormaltransitsandschedules.No newattackshavebeenreported,buttheregion'soverallinstabilitycontinue stobeaconcernformostocean carriers.

OnMarch6,itwasannouncedthatPresidentTrumpwillbedelayingthepreviouslyannounced25%tariffson goodsfromCanadaandMexicountilApril2.

PresidentTrumphadearlieronlymentionedanexemptionforMexico,buttherecentamendmentthathesigned tohisorderfor25%leviesonimportsfrombothcountriesapparentlycoversCanadaaswell. Foratleastthenext30days,U.S.importerswon’tberequiredto paytariffsonimportsfromCanadaandMexico thatadheretotheU.S.-Mexico-CanadaAgreement.

TheWhiteHousealsoannouncedthatitwouldgrantaone-monthdelayfortariffsonautomanufacturerswhose carscomplywiththeUSMCA.

TheWhiteHousedidnotspecifyifthe30-dayexemptionincludedbothfinishedvehiclesandautopartsimported fromCanadaandMexico.CommerceSecretaryHowardLutnicksaidaone-monthexemptionformorethanjust thefinishedvehiclesisli kely.

The10%dutyonimportsofCanadianelectricityandoilremaininplace,astheyarenotpartoftheUSMCA. TheWhiteHousePressteamsaidthegoalofthispause(afterdiscussionswiththeBig3automakers)istogive automakersthatcomplywiththeUnitedStates-Mexico-CanadaAgreementmoretimetoshifttheirsupplychains totheU.S.