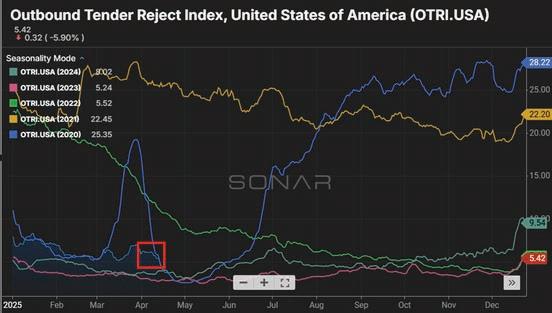

TheOutboundTenderRejectionsIndex (OTRI)heldsteadyatlowlevelsthrough March,consistentwithexpectationsfora softQ1.Thistrendislikelytocontinueinto April,withaseasonalbumpanticipatedin mid-MayduringInternationalRoadcheck. PertheCommercialVehicleSafetyAlliance (CVSA),InternationalRoadcheckisahighvisibility,high-volumecommercialmotor vehicleanddriverinspectionand regulatorycomplianceenforcement initiativethattak esplaceoverthreedays (May13-15)inCanada,Mexicoandthe UnitedStates.

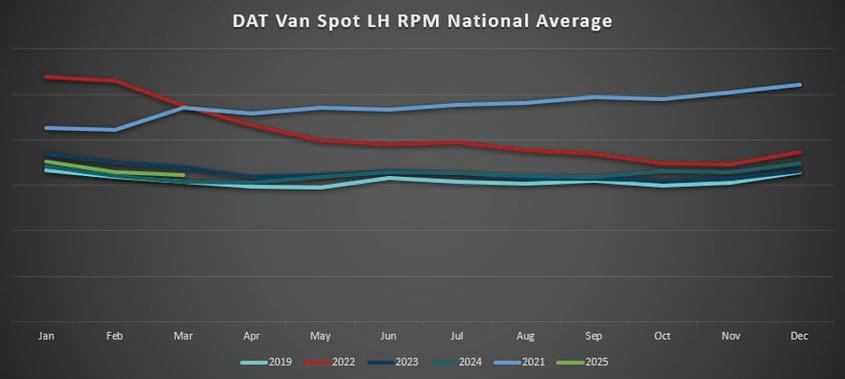

DAT'sNationalVanSpotLinehaulRPMrose4%year-over-yearinMarch,buttheimpactoflowerdieselprices offsetthosegains,leavingall-inRPMflatcomparedtothesameperiodlastyear.Barringmajordisruptions,rates areexpectedtofollow2024seasonalpatterns,climbinginMayandholdingslightlyelevatedlevelsthroughJuly.

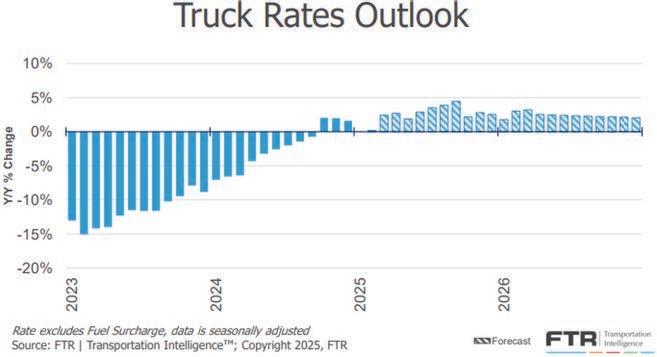

Lookingahead,FTR Intelligencemaintainsits outlookforastable 2025.Nationallinehaul ratesareprojectedto seesub-5%year-overyeargrowth,but continueddeclinesin fuelsurchargesmay offsetthesegains, keepingall-inRPM relativelyflatorslightly negative.

Source:ftrintel.com

Spotratesfallforeachsegment

Source:DAT.com/trendlines

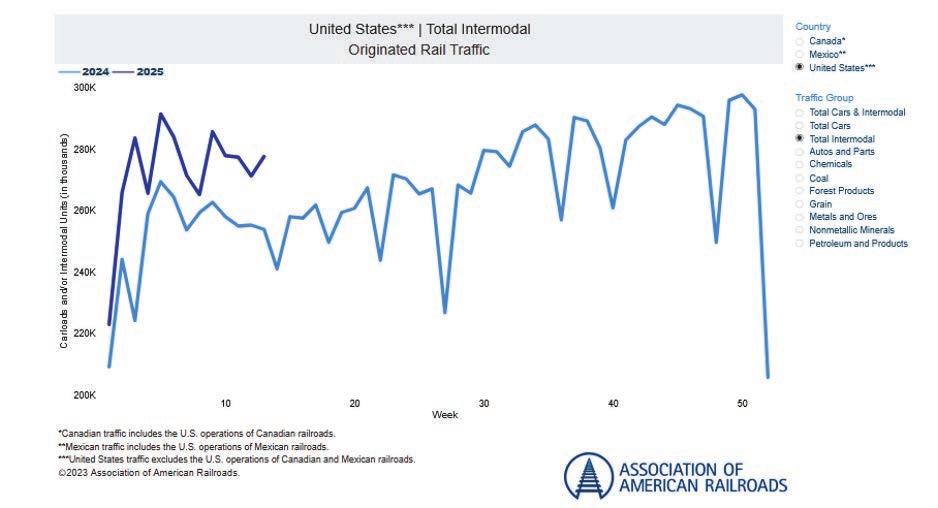

Q12025continuedtoseeintermodalcarriersissuerateincreasesfromtheprevious2024ratelevels.Gate reservationsandequipmentremainreadilyavailabledespite2025volumesbeinghigherthan2024.Thenextfew monthsareexpectedtoseecapacityreadilyavailableuntilpeakseasonbeginsinlatesummerorearlyfall.

LTLcarriershaveimplementedgeneralrateincreases(GRIs)for2025,rangingfrom4.9%to7.9%.Contract renewalspersist,butslightlybelowtheGRIfigures.Theseadjustmentsaredrivenbyanticipatedvolumegrowth andrisingoperationalcosts.TheupcomingoverhauloftheNationalMotorFreightTrafficAssociation(NMFTA) freightclassificationsystem,nowscheduledforJuly2025,isexpectedtofurtherinfluencep ricingstructures, particularlyaffectinglighter,bulkiershipmentscommonine-commerce.

TheLTLmarketisexperiencingagradualrebalancing.Whileoverallcapacityremainsample,strategicacquisitions andmergersarereshapingthecompetitivelandscape.Thesemovesaimtooptimizenetworksandimproveservice offerings,whilealsopositioningthecarriersfavorablyforincreasedmarketshareandgrowthwithcurrent customers .

Onthedemandside,consumerspendingshowssignsofrecovery,contributingtoamodestuptickinfreight volumes.However,themarketremainssensitivetoeconomicfluctuations,andcarriersarecloselymonitoring shipmenttrendstoadjustcapacityaccordingly.

Lookingahead,theLTLsectorispoisedforcontinuedstabilization.Analystsprojecta3.5%increasei nLTL volumesfor2025,supportedbysteadyconsumerdemandandstrategicnetworkenhancements.

However,theimplementationoftheNMFTA'snewdensity-basedclassificationsystemmayintroduceshort-term disruptionsasshippersandcarriersadapttothechanges.Additionally,externalfactorssuchasfuelpricevolatility andpotentiallaboractionscouldimpactmarketdynamics.

TonavigatetheevolvingLTLlandscapeeffectively,shippersshouldconsiderthefollowingstrategies:

ReviewFreightClassifications: AssesshowtheupcomingNMFTAchangesmayaffectyourshipmentsand adjustpackagingorshippingmethodsaccordingly.

MonitorCarrierPerformance: Stayinformedaboutcarriernetworkchangesandservicelevelstoensure alignmentwithyourlogisticsneeds.

LeverageTechnology: Utilizetransportationmanagementsystems(TMS)anddataanalyticstooptimize routing,consolidateshipments,andmanagecostseffectively.

EngageinCollaborativePlanning:Workcloselywithcarriersandlogisticspartnerstoforecastdemand,share insightsanddevelopmutuallybeneficialsolutions.

Fuel:

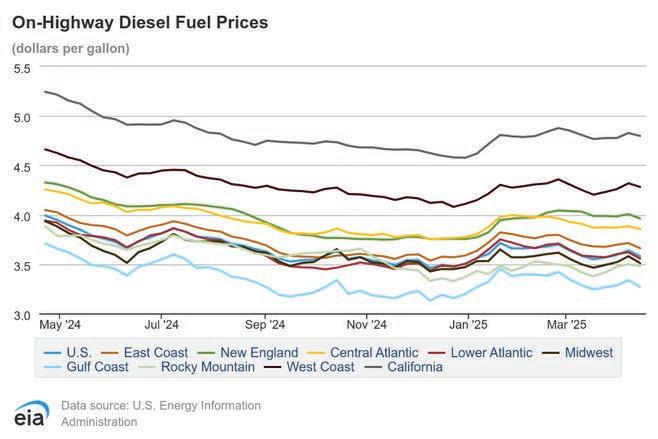

TheU.S.nationalaveragecost pergallonforonhighway dieselinthemonthofMarch 2025cameinat$3.585,which is$.9or2.4%lowerthan February2025averageof $3.675.TheU.S.national averageinMarchof2024was $4.022,whichis$.44or10.9% morethanMarch2025.We startthesecondweekofApril 2025offat$3.579pergallon fortheU.S.nationalaverage.

SmallParcel&DeliveryMarket:ExplosiveGrowth

GlobalParcelMarket: $474.15B(2024)→ $502.57B(2025)|6.0%CAGR Source

ExpressDeliveryBoom: $324.79B→ $351.43B|8.2%CAGR drivenby1-and2-dayshipping Source

E-CommerceLogisticsSurge: Expectedtohit$848.87Bin2025|14.1%YoYgrowth Source

U.S.ParcelVolumeIsBreakingRecords( Fullarticle)

2024: 23.8 billionparcelsshipped

Totalrevenue: $188B,averaging$8perparcel

TechThatDelivers(FullArticle)

AI-poweredroutinganddemandforecastingaretransformingdeliveryefficiency Automation&smartlogisticshelpbusinessesshipfaster,cheaperandsmarter

Volume: AnalystspredictU.S.importdeclinesforAprilandcontinuingevenintothetraditionalpeakseason

Rates: AfterastableMarchandApril1GRI,ratesbegintodeclinewithtariffuncertaintyandconcernrelated tolikelyvolumedeclines

Capacity: Blanksailingsincreasingalongwithservicesuspensionasimportdemandstartstoslow

TariffUpdate: Veryfluidsituationregardingtariffnews,detailsavailableinthe MODEGlobalAdvisory: TariffUpdate

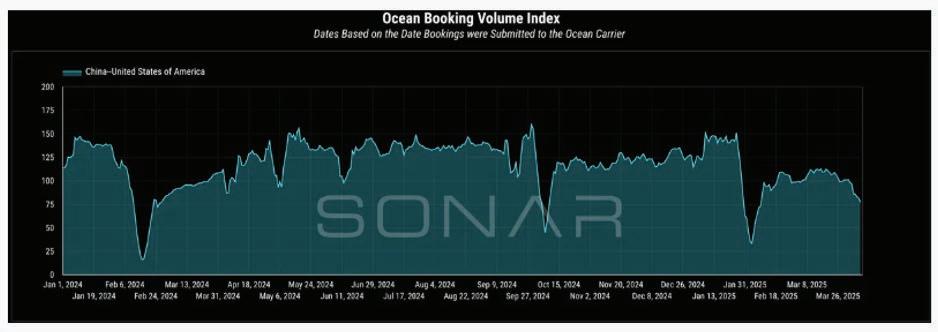

AstheTrumpadministration’stariffactivityrampedupmovingintoApril,itisapparentnowthattheseactionsare startingtoimpactglobaltrade.WeareseeingoceancontainerbookingsfromChinatotheUnitedStatesdecline sharplyinrecentweeks.

AccordingtoContainerAtlasdata,dailyoceancontainerbookingsfromChinatotheU.S.reachedtheirpeakon March19buthavesincefallenbyabout31%.Thisdeclineunderscorestheimmediat eimpactofthenewtariffson near-termvolumes.

ThedownturnisnotlimitedtotheAsiatoU.S.route.Globaloceancontainerbookingshavealsoseenasignificant decline,falling18.4%betweenMarch30andApril8.Currentbookinglevelsarenowrunning13%belowthose seenin2024,areversalfromthatyear’sgrowth.

WiththeTrumpreciprocaltariffsnotapplyingtogoodsloadedbeforeApril9,analystsfeelthattherewillbea briefscramblepushingcontainerratesanddemandupforafewdays.Butthisislikelytobefol lowedbya significantdropinvolumesandratesasimporterspauseorderstoletthetariffsituationstabilize.

Thispatterncouldleadtoasubstantiallyreducedpeakseason,similartohowtariff-drivenfrontloadingin2018led tolowercontainerratesanddemandin2019.Onceinventoriesrundown,thestrengthofthecontainermarket willdependonthebroadereconomicimpactsofthetradewar.

TradeanalystsarenowforecastingMayU.S.importsat1.66millionTEUs—d own22.4%fromMarch’sprevious forecastand20.1%lowerthanactualvolumesfromMay2024.IftheMayreductionscometofruition,itwould representthefirstyear-over-yearU.S.importdropforanymonthsinceSeptember2023.

ThemajorU.S.retailersarealsonowforecastingimportsof1.57millionTEUsforJune,down24%comparedwith theMarchnumbers.Additionally,Julyimportexpectationswereloweredby15%to1.69millionTEUs.Thetwo forecastsamounttoanimpor tvolumedeclineofalmost27%yearoveryear.

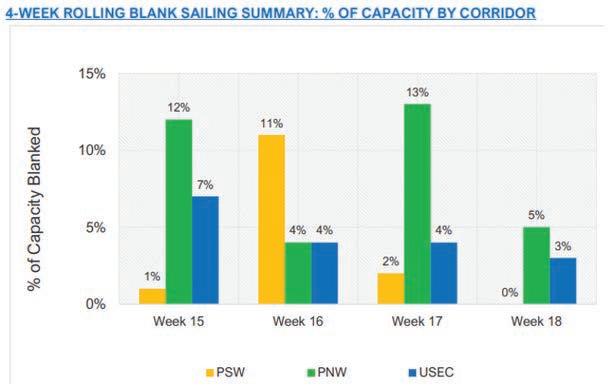

Carriershavealreadybegun announcingsignificantblank sailingandservicesuspensionsas itbecomesapparentthatdemand isnotexpectedtosurgelikeit didoneyearago.

Blanksailingsoverthelast severalweekshaveresultedin singledigitimpactstototaltrade capacitywithcarriersinthe reorganizedalliances;however, thesewillcontinuetoincrease throughoutApril.Oceancarriers aretryingtogainstronger controloftheircapacitysup ply toavoidaratecollapsewith expectedcontinueddropsin volumesinkeytradelanes.

Source:M+RSpedagGroup

MSChasannouncedmultipleblanksailingsforApriltoalignsupplywithforecasteddemand,whiletheOcean AlliancecarriersCOSCO,CMACGM,EvergreenandOOCLhaveannouncedatwo-monthsuspensionstartingin ApriloftheAWE7/CBXservice,whichconnectsSoutheastAsiaandSouth&CentralChinawiththeEastCoast portsofNorfolk,Savannah,CharlestonandMiami.

Itisimportantto notethattheoceancarriershavealsocontinuedtoorderandbringonnewbuildshipsthathave beenorderedoverthelastonetotwoyears.Overallnetcapacitycontinuestogrowfromcarriernewbuild introductionsonthemajortradelanes,evenwithRedSeadiversionscontinuingtoabsorbcapacity.

Thevesselcapacityonorderisnowat28%ofthecurrentfleet(8.6millionTEUs),accordingtoindustryanalysts. Dataforthosecarriersscrappingoldervesselsshowsonly2, 379TEUsofcapacity;thisiscurrentlyscheduledtobe scrappedthisyearcomparedwithmorethan91,000TEUsin2024.

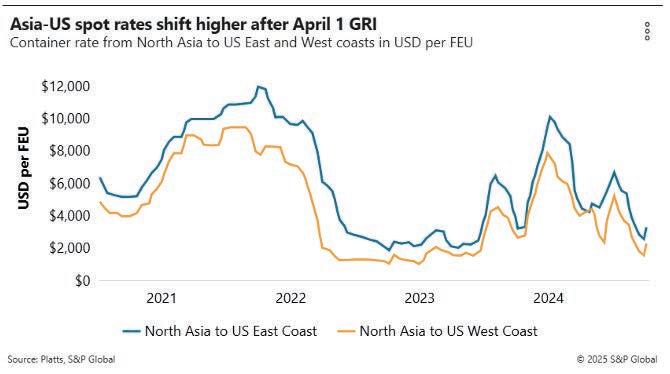

TranspacificratesmostlystabilizedinlateMarch.ThenormalpaceofannualBCOcontractnegotiationsslowedin thesecondhalfofMarchasshippersassessedcarriers’proposedrateincreasesabovelastyear.Carriers, attemptingtobuildsupportfortheirproposedannualrateincreases,thenannouncedFAKrateincreasesonApril1 tolevelsaround$2,500/FEUtotheU.S.WestCoastand$3,500totheU.S.EastCoast.

Thelargerretailersinmid/lateMarchfinaliz edcontractswiththeircorecarriersintherangeof$1,600to$1,800 perFEUfromAsiatotheWestCoastandabout$2,600to$2,800perFEUtotheEastCoast.Thoseratesare about15%to20%higherthanwhattheysignedforintheirexisting2024–2025contracts.

However,withspotratesindeclineuntillateMarch(seebelowchart),carrierswereforcedtoacceptlevelsabout $200to$400undertheirexpectations.Now,withamostlysuccessfulApril1GRItoprovidesomesupport , carriersaremakingafinalpushtoreversethemomentumandgetclosetotheiroriginalgoals.

SomecarriersinthefirstweekofAprillaunchedasecondroundofnegotiationswithNVOCCs,whichwilllikely putadditionalpressureonmid-sizedimporterstofinalizetheircontractnegotiations.Industryestimatesarethat mostNVOcontractswillsettlenear$2,000perFEUtotheWestCoast.

Withtheflurryofannouncementsofsignificanttariffincreases,mostnotablyf orChina,U.S.importershave alreadysignaledadropinorders,asoutlinedabove.Withasharpdropindemand,itwillbedifficultforocean carrierstomaintainratelevelsastheyscrambletokeeptheirvolumesup.

TariffUpdate:

FormorespecificdetailsontheTrumpTariffsandglobaltradeimpact,pleaseseethe MODEGlobalAdvisory: TariffUpdate.

AdditionalUpdates:

Amidstthechaosofalmostdailyannouncementsofincreasedtariffs,onApril9,theTrumpAdministration abruptlybackeddownonthereciprocaltariffsonmostnationsfor90daysbutraisedthetaxrateonChinese importsto125%.Theadministrationauthorizedthe90-daypausetothepreviouslyannouncedlevelsand substantiallyloweredtheReciprocalTariffduringthisperiodto10%,whichbecameeffectiveimmediately.

The10%ta riffwasthebaselinerateformostnationsthatwentintoeffectonApril5.It'smeaningfullylowerthan the20%tariffthatPresidentTrumphadsetforgoodsfromtheEuropeanUnion,24%onimportsfromJapanand 25%onproductsfromSouthKorea.Still,10%wouldrepresentanincreaseinthetariffspreviouslychargedbythe U.S.governmenttothosenations.

OnFriday,April11,ChinaretaliatedagainstthehigherU.S.tariffsbyimplementinga125%tarifflevelonU.S. good s,upfromtheprevious84%tarifflevel,inresponsetowhatisbecominganescalatingtradewar.