Economics and finance

PUBLIUS

For example, a value of 0.5 for the Hurst coefficient indicates that the movements in the price trend are random. If not, then there is pattern to the stock price movement. For the period 2010-2021, the Hurst Studiesexponent also suggests that for the the S&P 500 averaged daily value market appears react quickly and coefficient for individual 0.7922. to Applying the Hurst efficientlystocks, to events such finds as initial one often more often than not that the public stocks’ offerings, new exchange price patterns have Hurst exponent value listings, higher and or expected earnings lower than 0.5, suggesting patterns to their announcements, but appears to take movements and providing an argument for the use of some time to reactanalysis. to unexpected technical

BEHAVIORAL FINANCE Behavioral finance is a psychology-based branch of finance that looks at the systematic impact human frailties and biases have on stock price movements. In the absence of market efficiencies, behaviorists try to show how such biases lead to anomalies and discernible trends that technical investors, as well as fundamentalists, could exploit. Behaviorists, in turn, counter the efficient market argument by pointing to fundamental risk that limits investors from taking advantage of mispricing. That is, a stock that is considered to be underpriced by fundamentalists, would earn an abnormal return if the stock moves to its intrinsic value. The fundamental risk, though, is that the stock could continue to be underpriced. Behavioral advocates contend that because of fundamental risk it takes time for a stock to reach its intrinsic value. They point to how such risk explains bubbles. Consider an analyst during the dot-com bubble

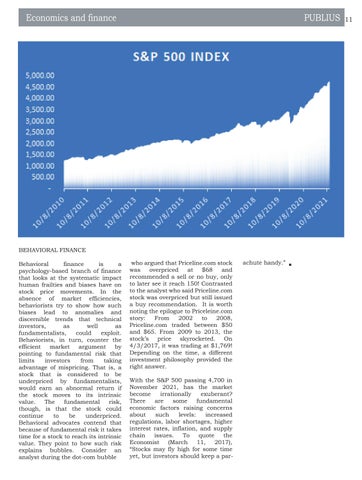

who argued that Priceline.com stock was overpriced at $68 and recommended a sell or no buy, only to later see it reach 150! Contrasted to the analyst who said Priceline.com stock was overpriced but still issued a buy recommendation. It is worth noting the epilogue to Priceleine.com story: From 2002 to 2008, Priceline.com traded between $50 and $65. From 2009 to 2013, the stock’s price skyrocketed. On 4/3/2017, it was trading at $1,769! Depending on the time, a different investment philosophy provided the right answer. With the S&P 500 passing 4,700 in November 2021, has the market become irrationally exuberant? There are some fundamental economic factors raising concerns about such levels: increased regulations, labor shortages, higher interest rates, inflation, and supply chain issues. To quote the Economist (March 11, 2017), “Stocks may fly high for some time yet, but investors should keep a par-

achute handy.”

11