8 minute read

Contributors to the Economic History of Thought

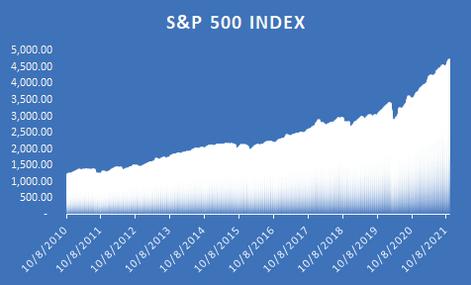

For example, a value of 0.5 for the Hurst coefficient indicates that the movements in the price trend are random. If not, then there is pattern to the stock price movement. For the period 2010-2021, the Hurst exponent daily value for the S&P 500 averaged Studies also suggests that the 0.7922. Applying the Hurst coefficient for individual market appears to react quickly and stocks, one often finds more often than not that the efficiently to events such as initial stocks’ price patterns have Hurst exponent value public offerings, new exchange higher or lower than 0.5, suggesting patterns to their listings, and expected earnings movements and providing an argument for the use of announcements, but appears to take technical analysis. some time to react to unexpected

BEHAVIORAL FINANCE

Advertisement

Behavioral finance is a psychology-based branch of finance that looks at the systematic impact human frailties and biases have on stock price movements. In the absence of market efficiencies, behaviorists try to show how such biases lead to anomalies and discernible trends that technical investors, as well as fundamentalists, could exploit. Behaviorists, in turn, counter the efficient market argument by pointing to fundamental risk that limits investors from taking advantage of mispricing. That is, a stock that is considered to be underpriced by fundamentalists, would earn an abnormal return if the stock moves to its intrinsic value. The fundamental risk, though, is that the stock could continue to be underpriced. Behavioral advocates contend that because of fundamental risk it takes time for a stock to reach its intrinsic value. They point to how such risk explains bubbles. Consider an analyst during the dot-com bubble who argued that Priceline.com stock was overpriced at $68 and recommended a sell or no buy, only to later see it reach 150! Contrasted to the analyst who said Priceline.com stock was overpriced but still issued a buy recommendation. It is worth noting the epilogue to Priceleine.com story: From 2002 to 2008, Priceline.com traded between $50 and $65. From 2009 to 2013, the stock’s price skyrocketed. On 4/3/2017, it was trading at $1,769! Depending on the time, a different investment philosophy provided the right answer.

With the S&P 500 passing 4,700 in November 2021, has the market become irrationally exuberant? There are some fundamental economic factors raising concerns about such levels: increased regulations, labor shortages, higher interest rates, inflation, and supply chain issues. To quote the Economist (March 11, 2017), “Stocks may fly high for some time yet, but investors should keep a par- achute handy.”

Paul Samuelson (by Garrett Andrews)

· Considered one of the most influential American economists. · His work contributed to the development of statistical, scientific, and mathematical aspects of economics. · His Economics: An Introductory Analysis is the best-selling economics textbook of all time. · His studies of the allocation of resources, government spending, and welfare economics are all part of Samuelson’s legacy. · Proponent of Keynesian Economics · Re-interpretation of the random walk theory is considered one of his most influential work. · His work on contingent claims served as a precursor to the Black-Scholes Option Pricing Model. At its conception, the random walk hypothesis posited that the fluctuations in the price of stocks were random and impossible to predict, but Samuelson argues that these fluctuations occur within an interval around the mean price of the stock, holding all other phenomena constant. For example, if a stock increased a half point in value with a standard deviation of three quarters of a point, it would be incorrect to argue that the value of the stock would be entirely random the next day. · Adam Smith’s Wealth of Nations inspired Ricardo to explore the field of economics · Holds similar views to Adam Smith but focused more on theory and applications rather than philosophy · In Britain, he opposed the Corn Laws on the grounds that the imposition of high tariffs caused wages to increase and profits to decrease. · Instead of protectionism, Ricardo thought comparative advantage was a better method; a country should focus on the relatively more efficiently produced product and outsource other products, so it can trade with other countries and create worldwide wealth and maximum efficiency. · Developed the Iron Law of Wages, where the working class's wages always shifted to the minimum value to subsist. If they had a surplus, then they’d increase their family size until they could only subsist.

· With George Stigler and others, Friedman was one of the leaders of the Chicago school of economics, a neoclassical school of economic thought associated with the work of the faculty at the University of Chicago. The Chicago School challenged Keynesianism in favor of monetarism and rational expectations. Several of Friedman’s students and colleagues went on to become leading economists, including Gary Becker, Robert Fogel, Thomas Sowell and Robert Lucas Jr. · His political philosophy defended the free market economic system. In his 1962 book Capitalism and Freedom, Friedman advocated policies such as a volunteer military, freely floating exchange rates, a negative income tax, and school vouchers. · Major scholarly contributions: · A Monetary History of the United States, 1867–1960 written with Anna J. Schwartz: Friedman and Schwartz use historical time series and economic analysis to argue the then-novel proposition that changes in the money supply profoundly influenced the U.S. economy, especially the behavior of economic fluctuations. · Consumption Function: Friedman argues that Keynes’s consumption function relating income to propensity to consume was in error by not distinguishing between transitory and permanent income. · Awarded Nobel Prize in 1976 in Economic Sciences · Served as economic advisor to Margaret Thatcher and Ronald Reagan · Emphasized using economics as public policy rather than mathematics · Along with Paul Samuelson, Friedman is considered one of the most influential economists of the second half of the 20th century. Milton Friedman (by Hunter Pagon)

Eugene Fama (by Luke Schmelzer)

Ludwig von Mises (by Daniel Joyce)

· Developed the Efficient Market Hypothesis that states share prices reflect all available information. This hypothesis contained three different forms of market efficiency: · Strong form - stock price includes all information, both public and private · Semi-strong form - all public information is included in stock price but private information is not completely accessible · Weak form - no information is available (only historical stock price information is available · Developed the Fama-French multi-factor model that determined the equilibrium return on a stock. By showing empirically that there were multiple factors determining an investment’s equilibrium return. He extended Sharpe’s CAPM. · Along with Carl Menger, F.A. Hayek, and Joseph Schumpeter, von Mises was one of the leaders of the Austrian School of Economics · Mises is known for his role, along with Hayek, in disputing the possibility of rational economic planning. · Could speak German, Polish, and French fluently by 12 · Known as a classical liberalist economist · Scholarly work mainly focused on monetary policy and the business cycle · Mises thought the success the West had after World War II was mainly due to the liberty and freedom individuals had in their societies.

· Developed the Capital Asset Pricing Model (CAPM); a theory that proposes that the equilibrium return on an asset is determined only by market risk since other risks can be diversified away with a well-diversified portfolio. · Developed the Sharpe Ratio that measures an investment’s risk premium (expected return minus the risk-free rate) per market risk to rank stock and portfolio investments. · Received the 1991 Nobel Prize in Economics for analyzing financial markets and their relationship to expenditure decisions, employment, production, and prices · Keynesian economist who argued that monetary policy could not be predicted to determine output and unemployment · During 1961–62, he served as a member of John F. Kennedy's Council of Economic Advisors, and from 1962-68 as a consultant. Along with Walter Heller, Arthur Okun, Robert Solow, and Kenneth Arrow, he helped design the Keynesian economic policy implemented by the Kennedy administration. · An advisor to presidential candidate George McGovern in 1972 · While interest rates were important, Tobin did not think they were the only factor in consumption and capital investment. · “Tobin’s q” was a tool to predict whether capital investment would increase or decrease · Developed portfolio-selection theory that stated investors have a balance between high-risk, high-return investments and low-risk, low-return investments.

James Tobin (by Jacob Tarter)

James Buchanan (by Addison Moe)

· Recognized for Public Choice Theory: “Politics without Romantics” · Provided a political science perspective to economics. · Believe that serving in the Navy encouraged his socialist and populist views. · In politics, there is a self-gain incentive; compares politics to Game Theory. · Not a follower of Keynes; · Quote: “Economists should cease proffering policy advice as if they were employed by a benevolent despot, and they should look to the structure within which political decisions are made.” · Received the Presidential Medal of Freedom, the Nobel Memorial Prize in Economic Science, and the National Medal of Science for Behavioral and Social Science. · Becker studied discrimination; his theory was that discrimination is costly to the company because the opportunity for a productive worker is lost. · Becker’s human capital theories addressed how companies should invest in humans. · His works included studies on social issues

Gary Becker (by Molly Kilbane)

2021 NOBEL PRIZE IN ECONOMICS

Joshua D. Angrist, Ford Professor of Economics, Massachusetts Institute of Technology Guido W. Imbens, Professor of Economics, Stanford University, were awarded the 2021 Nobel Prize in Economics for natural experiment research on labor markets

David Card, Professor of Economics, University of California, Berkeley,