BENEFITS

Non-Union

WELL NESSTOTAL

WHAT’S IN THIS GUIDE: WELCOME TO YOUR 2023 BENEFITS ��������������� 3 ELIGIBILITY AND ENROLLMENT ��������������������� 4 ENROLLING FOR BENEFITS 6 ACCOLADE HEALTH ASSISTANT ����������������������� 7 MEDICAL ��������������������������������������������������������������� 9 PHARMACY ��������������������������������������������������������� 10 THE HONICKMAN TOTAL WELLNESS PROGRAM 12 TELADOC ������������������������������������������������������������� 14 WHAT IS A HEALTH SAVINGS ACCOUNT (HSA)? �������������������������������������������������������������������� 15 HOW DOES AN HSA WORK? ����������������������������� 15 YOUR QUICK AND EASY GUIDE TO HOW AN HSA WORKS 16 MERITAIN ONLINE TOOLS �������������������������������� 18 VISION ������������������������������������������������������������������ 19 DENTAL ��������������������������������������������������������������� 20 FLEXIBLE SPENDING ACCOUNT REIMBURSEMENT PLANS 21 HSA VS � FSA �������������������������������������������������������� 24 LIFE AND ACCIDENTAL DEATH AND DISMEMBERMENT (AD&D) ������������������������������� 25 DISABILITY INSURANCE ���������������������������������� 25 ADDITIONAL BENEFITS 26 IMPORTANT CONTACT INFORMATION ��������� 28 2 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

We are pleased to offer eligible employees a competitive and comprehensive benefits package, designed to give you and your family access to the

you need to live well. Our commitment to your health and well-being includes a wide range of benefit options that will allow you to create a customized benefit package. While some benefits are automatically provided by the Company, others allow you to choose different levels of coverage. Making informed decisions about your healthcare is the best way to help ensure a healthy future—and it can help you stretch your health dollars as well. Taking the time to choose the right benefits can make a big difference in your health and life – and give you valuable peace of mind that you’re covered when you need it most. When making your elections, carefully consider your own and your family’s needs for 2023. The choices you make now will remain in effect until the next open enrollment period unless you experience a qualifying life event. The information outlined in the following pages summarizes the various benefit options available to you and your family members. Please review it carefully before choosing.

WELCOME TO YOUR 2023 BENEFITS

YOUR NEW BENEFITS WEBSITE! Your benefits website with all of your resources is the same, but with a new website address: Benefits.HonGrp.com It’s your one-stop shop for everything benefits where you can: 5 View your benefits 5 View your contribution rates 5 Access Accolade 5 Learn about the wellness incentive 5 View your Open Enrollment Checklist 5 Find a provider 5 Download important forms Benefits.HonGrp.com Password: Benefits 3 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

healthcare services

ELIGIBILITY AND ENROLLMENT

Active Employees

After reaching eligibility requirements and being scheduled to work at least 30 hours per week, you may enroll for coverage in the benefit plans described throughout this guide. The benefits become effective on the first of the month following 60 days of continuous active employment (unless otherwise noted).

Dependents

Eligible dependents include:

• Your legal spouse, unless covered or eligible for other Group health insurance coverage, or your legally separated spouse;

• Your dependent children (including your natural born children, adopted children, stepchildren, court-ordered dependent children or children for whom you are a courtappointed legal guardian) under age 26 regardless of the dependent’s marital status, financial dependence, full-time student or employment status;

• Your disabled dependent children (incapable of selfsustaining employment and dependent upon you for support) regardless of age, provided the child was covered under our benefits prior to age 26 for medical, prescription, dental and vision coverage (approval by the Plan Administrator is required).

Note: No individual may be eligible for coverage as an employee and as a dependent of an employee at the same time.

Retiree Medical Coverage

If you retire at age 60 or older AND have at least 28 years of service, you (and your eligible dependents) will be offered the opportunity to maintain your benefits through COBRA continuation coverage for the lesser of five years or age 65 for medical, prescription drug, dental and vision.

When Coverage Ends

Coverage may end under certain circumstances:

• All benefits for you and your dependents end on your last day of employment.

• Coverage for dependents terminate when they no longer meet the definition of an eligible dependent.

Some plans may have a conversion or portability provision. Additional information, including COBRA rights and conversion privileges, will be mailed to you and/or your dependents upon loss of eligibility.

4 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

Qualifying Life Events

If you experience a qualifying life event and do not complete the change(s) to benefits within a 31-day period following the date of the life event through Workday, your coverage will remain unchanged for the remainder of the plan year and your additional dependents will not have coverage.

In compliance with IRS Section 125 regulations, medical, prescription, dental, vision, and flexible spending account elections may be changed during the calendar year only if you have a qualifying life event. Qualifying life events include, but are not limited to, the following:

Qualified Family Status Change

Please note that any benefit election changes must be made within 31 days of the life event and must be consistent with the qualifying life event change. If you do not make the change within 31 days of the qualifying life event through Workday, your coverage will remain unchanged for the remainder of the plan year and your additional dependents will not have coverage.

Benefit Allowed to Change

A change in your legal marital status

adoption or death

A change in the number of dependents, including birth, adoption, placement for

Medical Dental Vision FSA

Marriage Certificate, Divorce Decree, or Death Certificate Birth Certificate, Adoption Agreement, Death Certificate, or Hospital Discharge papers Letter from the employer confirming prior coverage termina tion date or COBRA Documents.

confirming change in coverage or COBRA

Termination/ commencement of employment or a significant change in health by you, your spouse or your dependent A change in work schedule, such as a reduction or increase in hours by you, your spouse or your dependent which results in a loss or gain of coverage Loss or Gain of dependent status

Documentation

Letter from spouse’s employer

Documents and effective date of change.

5 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

Enrolling for Benefits

Employees must enroll in Workday benefits to:

• Confirm/change your healthcare coverage for yourself or your dependents

• Make a contribution to a Health Savings Account

• Make a contribution to the Healthcare, Dependent Care, or limited Purpose Flexible Spending Account

• Waive your healthcare benefits (Documentation Required)

How do I enroll in Workday for 2023 Benefits?

Go to the Workday website: hongrp.com/wd/ On the Workday homepage enter your username and password

There will be an INBOX notification allowing you to enroll in Open Enrollment

Employees must update Workday Personal Information so the HR system remains current:

• Provide emergency contact

• Add Beneficiary information

• Update address, email addresses, telephone numbers etc.

• Provide AAP Information (Veteran status, Gender, Race/Ethnicity)

How do I change Workday personal information?

Go to the Workday website: hongrp.com/wd/ On the Workday homepage enter your username and password

On your homepage enter “view all apps”

Select the “Personal Information App”

Select the Option you need to Update

Questions? Please contact Accolade at 833.939.2331 for questions regarding your benefits. Please email benefits@hongrp.com for questions regarding your Workday enrollment and/or the Workday password reset.

Waiver (Opt Out) Option

If you decide not to participate in our non-union healthcare plan(s) for the year, you are eligible for a waive (opt out) option of receiving $10 per week.

You must waive all benefits (medical, pharmacy, dental and vision) to receive the waive (opt out) option and you must also show proof that you have coverage elsewhere (e.g. though spouse’s employer, individual coverage etc.)

If you waived benefits in 2022 you must continue to waive benefits in 2023 to receive the waive (opt out) option for the 2023 plan year.

6 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

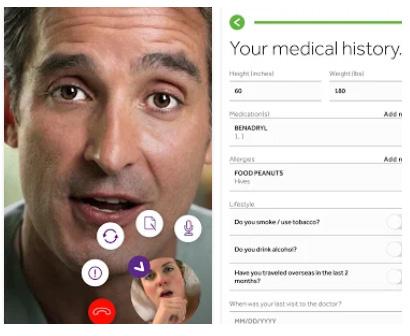

Your Very Own Personal Health Assistant!

Navigating the healthcare system can be tough. And sometimes just finding the right answer takes more time than any of us have in our busy lives.

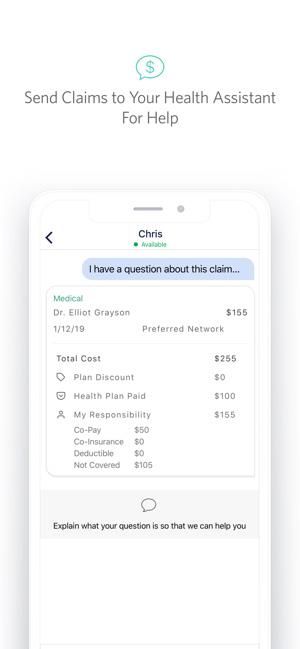

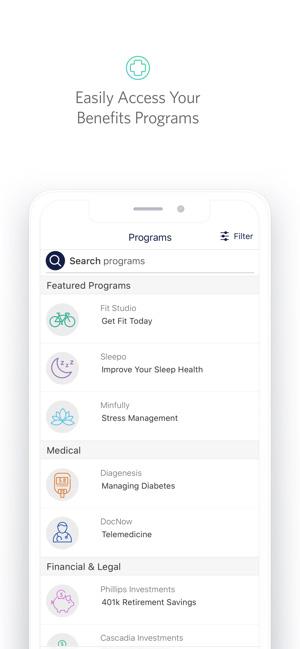

We are continuing our partnership with Accolade to provide you and each family member enrolled in a Honickman medical plan with your very own Accolade Health Assistant®. He or she will soon be your single point of contact for any health question or health related issue. You and your entire family will come to know your assistant by name and may contact them during the day directly by phone, email or mobile app.

Questions like…

• Who can I call for help?

• What are the right questions to ask my doctor?

• What do I do next?

• Where do I go for the highest quality care that doesn’t cost a lot of money?

Health assistants are supported by a team of doctors, nurses, pharmacists and benefits specialists in the event your situation involves knowledge of a specific medical condition or course of treatment.

The first time you connect with Accolade, you and your enrolled family members will be introduced to your Accolade Health Assistant.

Your medical benefits, including what’s covered, what’s not and why

Everyday general health questions, ID card requests, and inquiries about your eligibility

Finding an in-network doctor or other healthcare provider that fits your needs in terms of their specialty, location, language needs, etc.

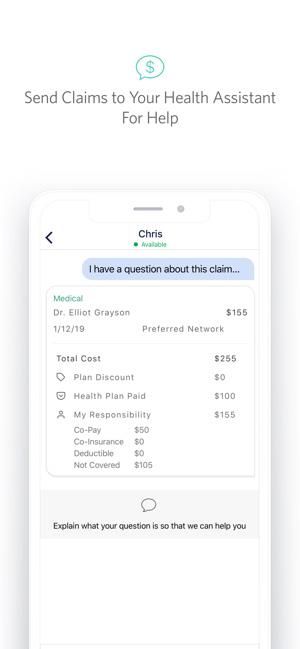

Healthcare bills and claims…they will help you reconcile your Explanation of Benefits (EOBs) to the bills you receive from doctors, hospitals and other healthcare providers

Treatment options and things you can do to improve your condition, avoid setbacks and complications

Prescription drug questions

Finding appointments for second opinions and “hard to access” experts in their field

Where to go for the highest quality care at the lowest cost… how to avoid physicians and medical facilities that charge the highest prices for diagnostic tests, treatment and screenings

Coordination of services available through government programs and community resources for things like transportation to and from doctor’s appointments, programs that offer more affordable prescription drug prices, etc.

What’s Next?

ACCOLADE HEALTH ASSISTANT

You and your covered family members can connect with your Accolade Health Assistant for:

Look for communications from Accolade and the company throughout the year. The Honickman Companies’ goal is to simplify your healthcare experience. That’s why we’re working with Accolade, your personal health assistant and advocate. Take charge of your health To get started with Accolade, just call the phone number or visit the website below� 1-833-939-2331 member�accolade�com Precertification: https://precert accolade com/honickman 7 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

Health Plan Administration

Meritain, an Aetna company, is the administrator of your medical plan utilizing the Aetna Choice POS II network. Meritain has nearly 40 years of experience as a claims administrator and because Meritain is owned by Aetna. All health plan members will continue to use the Aetna provider network for all in-network services.

So what will Meritain do?

• Pay all claims and handle all appeals

• Send ID cards to all plan participants

• Send you your Explanation of Benefit forms

• Meritain will also administer your vision benefit which is included in your medical benefit. Through Meritain, you will have access to the VSP network of providers and have access to VSP discounts.

Accolade will be your first point of contact for any questions. The phone number is on the front and back.

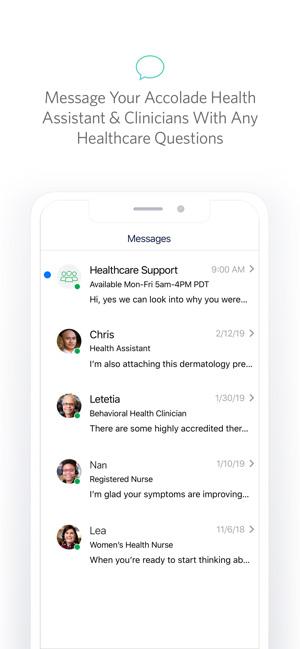

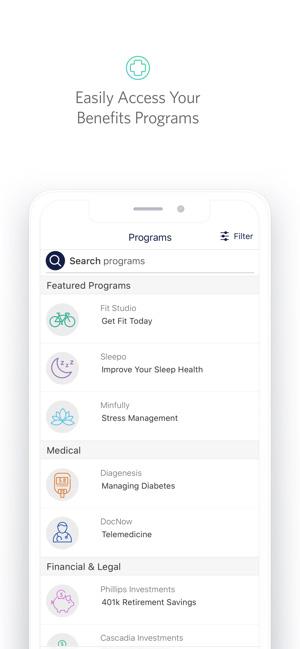

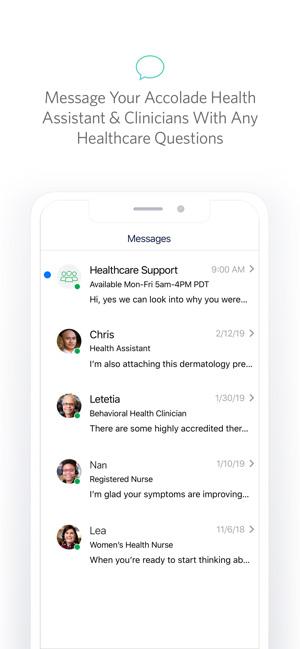

Activate your Accolade account today

• Visit member.accolade.com or download the Accolade mobile app on the App Store or Google Play.

• Enter basic information like your name, date of birth, and ZIP code to complete your registration.

• Log in to view your benefits and learn more about valuable resources available to you and your family.

• Start Messaging your Health Assistant or nurse with health and benefits questions, big or small!

Helpful tip: Your covered family members can create their own account to view benefits and directly message a Health Assistant or nurse.

You can contact Accolade for all your benefit questions. Email benefits@hongrp.com for questions regarding your workday enrollment and/or your workday password reset.

ID

will

your

information.

Member Medical Plan Group #: Group# Member: FIRST NAME LAST NAME Member ID: 123456789123 Honickman Companies, Pepsi Cola - Canada Dry - BDCI Pharmacy Plan RXBIN: 000000 RXPCN: RXGRP: Generic Preferred Non-Preferred Specialty express-scripts.com Member: 555-555-5555 Pharmacy: 555-555-5555 XX1Division: M Me e em m mb b be e er rr S Se e errrv v viic c ce e es s s a an n nd d E Ellig g giiib b biiiliittty y Q Q Qu u ue e es s stttiio o on n ns s C Ca a allll 5 5 55 5 55 5 5 55 5 55 5 5 5 55 5 55 5 55 5 5 member.accolade.com Office Visit/ Spec Hospital Urgent Care Emergency Room Coverage: Plan: Aetna Choice POS II Important Information D De e ed d du u uc c ctttiib b bllle e a an n nd d d O OO O OP P A Am m mo o ou u un n nttts s s ( ((S S S n ng g glle e e/F F Fa a am m mi i y y y))): : 1004-MN 5365 P8113-P8113-PA1---1010 M(CP2)D()V() 20210921T5A Sh: 0 Bin 1 J017 Env [1] CSets 1 of 1

ID Cards

Cards

include

medical, prescription drug and Accolade phone

8 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

We recognize healthcare coverage is an important part of your benefits package because it protects you and your family from severe financial loss or hardship if an illness or injury occurs. We have designed a program that provides excellent options at affordable costs. The choice in options allows you to choose the coverage level that best meets your needs.

You can choose from two medical/prescription drug/vision plans. Both plans are alike in many ways and differ in some.

Alike:

• Large network of doctors and hospitals

• No referrals needed

• Flexibility of out-of-network coverage, if needed

• All plans cover the same services/treatments

• Deductibles and out-of-pocket maximums are nonembedded

Different:

• Your out-of-pocket costs when you visit a doctor or hospital through your deductibles, out-of-pocket maximum, etc.

• Your out-of-pocket costs through your paycheck (your employee contributions)

• The company contributes $500 for single or $1,000 for other coverage levels into your HSA. If you are enrolled in Medicare Part A, government regulations do not allow you to have an HSA, therefore your company contributions will be funded to a healthcare FSA (see Page 20 for details on healthcare FSA). If you are a new hire, these monies will be prorated based upon the month benefits begin.

What is a Non-Embedded Deductible and Out-of-Pocket Maximum?

Non-embedded means that all out-of-pocket expenses are applied to the family deductible and out-of-pocket maximum until satisfied.

It doesn’t matter if one person in your family incurs all the expenses that meet the deductible and/or out-of-pocket maximum or if it is a combination of two or more of your family member’s expenses.

Example

Mary, Bob and their child John, purchase an HSA plan with a non-embedded deductible and out-of-pocket maximum.

The plan design is:

Deductible Out-of-pocket Maximum

Individual $2,750 $6,650

Family $5,500 $7,350

Note: This example does not include the employer funding that we provide to your H.S.A

Mary has a hospitalization where she incurs $3,000 in out of pocket expenses. Even though the HSA has an individual deductible of $2,750, she will be responsible for the full $3,000 since the family deductible is $5,500.

MEDICAL

9 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

PHARMACY

Your medical options also provide comprehensive coverage for prescription drugs. The cost of your prescription will differ based upon whether it is a generic, preferred, non-preferred brand, or specialty.

Whenever possible, consider using a generic medication. With generics, you will save money on your cost of the prescription.

Mail Order Program

For medications you use on a day-to-day basis, you may wish to use the mail order option with Express Scripts, Inc. (ESI) to receive up to a 90-day supply (vs the typical 30-day supply at retail). Some examples of day-to-day prescriptions include those you or your covered dependent may take for high blood pressure, high cholesterol, or diabetes.

You will pay more for long-term drugs unless prescriptions are ordered through the mail using the Express Scripts Pharmacy. After you refill a prescription two times, your third fill will need to go to ESI mail order--otherwise you will pay 15% more coinsurance if you continue to purchase specific long-term drugs at retail. This program applies to a specific list of drugs. You should either check express-scripts.com or call Customer Service at (877) 554-3093 to verify the status of your drug. The specific list of drugs can also be found on the Company website.

• Mail your prescription, order form, and payment in the mail order envelope (available from Customer Service), or ask your doctor to fax your prescription by calling 1-888-327-9791 for instructions.

• Automatic refills: Call the phone number on your Rx bottle or go to express-scripts.com > ESI username / password sign-in or register now as first-time user >Prescriptions > Automatic Refills > start Automatic Refills.

10 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

2023 PLAN DESIGN

Employer-Funded HSA

Benefit Reimbursement Schedule

Calendar Year Deductible (Employee/Family)

Calendar-Year Out-of-Pocket Maximum (Employee/Family)

Coinsurance Levels (You Pay)

Preventive Services

Plan A (POS II) - Meritain

In-Network (You Pay)

Based upon Aetna Contracted Fee

N/A

Out-of-Network (You Pay)

Based upon 70th percentile of Fair Health. Potential balance billing may apply.

Non-Embedded 1

Plan B (HSA) - Meritain

In-Network (You Pay) Out-of-Network (You Pay)

$500 per single/ $1,000 per family 2

Based upon Aetna Contracted Fee

Based upon 70th percentile of Fair Health. Potential balance billing may apply.

Non-Embedded 1

$1,500 / $3,000 $4,000 / $8,000 $2,750 / $5,500 $6,000 / $12,000

Non-Embedded 1

Non-Embedded 1

$4,500 / $7,000 $8,000 / $16,000 $6,650 / $7,350 $8,000 / $16,000

20% after deductible 40% after deductible 20% after deductible 40% after deductible

No Charge 40% after deductible No Charge 40% after deductible

Physician Office Visit 20% (Deductible waived) 40% after deductible 20% after deductible 40% after deductible

Specialist Office Visit 20% (Deductible waived) 40% after deductible 20% after deductible 40% after deductible

Inpatient Hospital

20% after deductible 40% after deductible 20% after deductible 40% after deductible

Outpatient Hospital 20% after deductible 40% after deductible 20% after deductible 40% after deductible

Emergency Care

RX PLAN

20% after $200 copay for true emergencies (Deductible waived) 20% after deductible for true emergencies

IN-NETWORK ONLY - EXPRESS SCRIPTS

Calendar Year Deductible $200 per family

Calendar-Year Out-of-Pocket Maximum (Employee/Family)

Retail Pharmacy 3

• Generic

• Formulary Brand-Name (Preferred)

• Non-Formulary Brand-Name (Nonpreferred)

• Specialty

Mandatory Mail Order Pharmacy

• Generic

• Formulary Brand-Name (Preferred)

• Non-Formulary Brand-Name (Nonpreferred)

• Specialty

VISION PLAN

Included in Medical OOP

$10.00 minimum copay 25% after deductible 35% after deductible 45% after deductible

50% after deductible

$10.00 minimum copay 25% after deductible 35% after deductible 45% after deductible 50% after deductible

Meritain

IN-NETWORK ONLY - EXPRESS SCRIPTS

The medical/rx deductible does not apply to prescription drugs that are used for preventive care. 3

Included in Medical OOP

25% after deductible 35% after deductible 45% after deductible 50% after deductible

25% after deductible 35% after deductible 45% after deductible

50% after deductible

Meritain

COMPARING YOUR MEDICAL, PRESCRIPTION, AND VISION

PLAN OPTIONS

In-Network Out-of-Network In-Network

every 12 months) 100% no deductible or copay (covered under medical plan) Subject to Plan deductible and coinsurance (covered under medical plan) 100% no deductible or copay (covered under medical plan) Subject to Plan deductible and coinsurance (covered under medical plan) Lenses & Frames including contacts (1x every 24 months) Plan pays up to $100 Plan pays up to $100 Plan pays up to $100 Plan pays up to $100 1 Please see page 10 for “What is a Non-Embedded Deductible and Out-of-Pocket Maximum?” 2 New hire employer-funded HSA amounts are prorated based upon the month benefits begin. If you are enrolled in Medicare Part A, your employer funded contribution will be provided to you through a healthcare FSA 3 Copy of full preventive list can be found on Benefits.HonGrp.com (password: Benefits) or by calling ESI at 1-877-554-3093 4 Additional 15% coinsurance copay penalty applies on the 3rd fill of a maintenance drug at retail pharmacy covered under the Exclusive Mail Order Program WEEKLY CONTRIBUTIONS (BEFORE WELLNESS INCENTIVES) Plan A (POS II) Plan B (HSA) ANNUAL SALARY RANGE Up to $49,999 $50,000$74,999 $75,000$149,999 $150,000 + Up to $49,999 $50,000$74,999 $75,000$149,999 $150,000 + Employee $31.63 $42.56 $51.69 $62.57 $20.56 $27.16 $32.85 $39.63 Employee + Child(ren) $40.41 $57.95 $71.29 $86.30 $24.12 $35.86 $41.76 $50.37 Employee + Spouse $60.84 $86.85 $105.87 $128.13 $35.44 $51.85 $63.67

Employee + Family $73.12 $106.23 $129.89 $157.19 $43.04 $63.57 $78.32 $94.46 11 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

Out-of-Network Exam (1x

$76.80

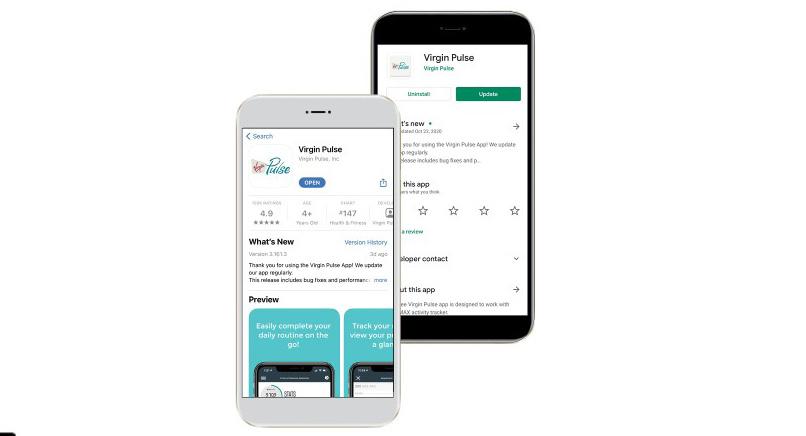

THE HONICKMAN TOTAL WELLNESS PROGRAM. ARE YOU REGISTERED?

Your points-based wellness program will continue to be available through Virgin Pulse. All Non-Union employees (medicalenrolled and those not enrolled in the Honickman medical plan) and medical-enrolled spouses can participate. The Honickman Total Wellness program provides many resources to support your physical, social, emotional, and financial wellbeing, including an engaging app, interactive challenges, fitness device integration, online and telephonic health coaching, health and wellness tips and content, mindfulness, resiliency and financial well-being resources and more!

Don’t Miss Out — Earn Your 2024 Wellness Credit & Rewards!

Medical-enrolled employees may earn up to $520 total, up to $130 per quarter, towards the Honickman 2024 Wellness Incentive. The Honickman Total Wellness Program includes four quarterly games in 2023. Employees must earn at least 15,000 points in each quarter to reach Level 4 to earn $130 for that quarter ($520 total, if at least 15,000 points are earned each of the four quarters). Medical-enrolled spouses may also participate and can earn up to $130 per quarter when they earn 15,000 points and reach Level 4 (up to $520 total). The incentive will be applied as a wellness credit to your paycheck starting January 2024. As an alternative option, you can earn the full incentive ($520 employee, $520 spouse) if you (and spouse) each earn at least 60,000 points total in 2023 by December 31, 2023.

Earning points on the Virgin Pulse platform is easy! We encourage you to access Virgin Pulse daily -- the more you log in, the easier it is to earn points geared to your specific health and well-being interests. Here are just some ways you can earn your points:

Activity Frequency

Complete the Health Check survey

Total Points Per Quarter

One-time in 2023 500

Well Adult Office Visit Annually 250

Create a personal challenge Monthly 150

Join a personal challenge Monthly 300

Complete a Journey (up to 3; 150 Points each) Quarterly 450

Complete a Biometric Screening One-time in 2023 1,000

Track your Healthy Habits Daily 2,700

Track your Healthy Habits 20 days in a month Monthly 900

Do your Daily Card Daily 3,600

Complete 10 cards in a month Monthly 300

Complete a RethinkCare program (50 Points/week) Weekly 600

Steps & Activity (up to 140 Points/day) Daily 12,600

20-Day Triple Tracker: Reach 7,000 steps/15 active minutes/15 workout minutes Monthly 1,200

Participate in a Company-wide Challenge

Offered quarterly 50-850+ (based on participation)

Employees not enrolled in the Honickman medical plan are also eligible to earn raffle prizes.

On the Virgin Pulse platform, refer to the Rewards section for details.

SPECIAL CONSIDERATIONS FOR RECENT HIRES

If your date of hire is between July 1, 2023 - December 31, 2023, you will automatically receive the 2024 wellness incentive*. If your spouse is also covered on the medical plan, you will automatically receive the spousal credit.* It’s that simple.

*The 2024 wellness premium credit will be applied in January 2024 or on your date of benefits eligibility, if later.

Sign up now at join.virginpulse. com/honickmantotalwellness

Already a member? Sign in at member.virginpulse.com/ honickmantotalwellness

12 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

Engage In Some Healthy Competition

Rally your coworkers for the latest company step challenge! Or gather a small group of coworkers or friends, and challenge one another to start a new healthy habit.

• Company challenges: Stay tuned for company-wide challenges where you can go headto-head with friends and rivals across your organization. Post comments to cheer each other on.

• Healthy Habit Challenges: Challenge your coworkers and friends to track a healthy habit for 5 out of 7 days. Use the chat feature to share your strategy for achieving the healthy habit each day.

• Personal Step Challenges: Challenge your coworkers and friends to a step-off. You choose the type (1 day, weekday or weekend) and then invite your coworkers and friends. Use the chat feature to share your strategy and motivation.

Have you ordered your FREE fitness device yet?

Every Non-Union employee and medical-enrolled spouse who joins Honickman as a new hire in 2023 can receive a Max Buzz fitness device at no cost to you or may choose to redeem their Pulse Cash for another item* in the Virgin Pulse store! Once registered for Virgin Pulse, go to the online store to redeem your Pulse Cash.

You can also connect other compatible devices and apps to the Virgin Pulse platform for free to track your daily steps. On the Virgin Pulse platform, go to the Devices & Apps section to review your options.

*Note: Member will be required to pay any difference in the cost of the item selected via credit card.

Rally your coworkers for the latest company step challenge! Or gather a small group of coworkers or friends, and challenge one another to start a new healthy habit. Company challenges Stay tuned for company wide challenges where you can go head to head with friends and rivals across your organization. Post comments to cheer each other on. Healthy Habit Challenges Challenge your coworkers and friends to track a healthy habit for 5 out of 7 days. Use the chat feature to share your strategy for achieving the healthy habit each day. Personal Step Challenges Challenge your coworkers and friends to a step off. You choose the type (1 day, weekday or weekend) and then invite your coworkers and friends. Use the chat feature to share your strategy and motivation. Have questions? Virgin Pulse is here to help! Check out support.virginpulse.com Live chat on member.virginpulse.com Monday–Friday, 2:00 am–9:00 pm EST Give Virgin Pulse a call: 888-671-9395 Monday–Friday, 8:00 am–9:00 pm EST Send Virgin Pulse an email: support@ virginpulse.com Not sure if you can fully participate in this program because of a disability or medical condition? Check out the support page for answers at support.virginpulse.com. 13 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

TELADOC: DON’T LET SICKNESS SLOW YOU DOWN! TALK TO A DOCTOR BY PHONE OR VIDEO 24/7!

Teladoc is here to help you and your family feel better while traveling, at work, or at home – day or night. Wherever you are, you’ve got access to a national network of U.S. board-certified doctors all year long by phone or video. Get the care you need for:

• Flu

• Sore throats

Why Use Teladoc?

• Pink eye

• Bronchitis

• Talk to a doctor anytime, anywhere

• Receive quality care via phone, video or mobile app

• Prompt treatment, talk to a doctor in minutes

• Sinus infections

• Rashes

• Allergies

• And more!

• A network of doctors that can treat every member of the family

• Prescriptions sent to pharmacy of choice if medically necessary

• Teladoc is less expensive than the ER or urgent care

Behavioral Health Benefits:

Call:1-800-DOC-CONSULT (362-2667) or visit: Teladoc.com

Taking care of your mental health is an important part of your overall well-being. With Teladoc’s Behavioral Health, adults 18 and older can get care for anxiety, depression, grief, family issues, and more. You can make an appointment seven days a week, from 7 a.m. to 9 p.m. local time. Choose to see a Psychiatrist, Psychologist, Social Worker, or Therapist and establish an ongoing relationship.

Use Teladoc’s Behavioral Health service for:

• Confidential treatment

• Convenience to speak with a Therapist from anywhere

• Flexible scheduling

• Quick access to the right provider for you

14 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

WHAT

HOW

You, your spouse, and dependent children.

(HSA)?

Your contributions, earnings and withdrawals for qualified medical expenses are all tax-free. It’s a triple tax-savings opportunity that can put more money in your pocket. Save up to 30% on taxes $100 without an HSA $70 in your pocket $30 in taxes $100 with an HSA

Who can use your HSA?

Even if they’re not covered by your health plan. You own your HSA It goes where you go and carries over each year. Change HSA banks Switch health plans Retire

$100 in your pocket

and adds

$100

$250

Every little bit counts,

up quickly If you save: In 5 years In 10 Years In 15 years $50 per month $3,000 $6,000 $9,000

per month $6,000 $12,000 $18,000

per month $15,000 $30,000 $45,000

expenses

Increase

savings

IS A HEALTH SAVINGS ACCOUNT

A Health Savings Account (HSA) Plan is designed to give you more accountability for your healthcare decisions. HSA Plans allow you to: • Control healthcare

•

tax

• Lower insurance • Carry it with you • Create healthcare savings for retirement

15 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

DOES AN HSA WORK? Enroll in the HSA Plan We contribute to your HSA: $500 for single coverage / $1,000 for other coverage levels. If not used, it remains in your HSA.* You can also add and save money in your HSA. If not used, it remains in your HSA. Pay for eligible medical expenses 1 2 3 4 * New hire employer-funded HSA amounts are prorated based upon the month benefits begin. Please refer to Page 11 for details on how the company will contribute on your behalf if you are Medicare eligible and are covered by Part A.

YOUR QUICK AND EASY GUIDE TO HOW AN HSA WORKS

Your Basics Are Covered

There is NO CHARGE for in-network preventive care services! You pay no charge for keeping yourself healthy, $0 for physicals, well visits, and preventive screenings expenses.*

Use Your HSA Funds to Pay for Services!

Example - If bill is $100

You Pay: $0 Plan Pays: $100

Don’t forget

You will pay 100% of the cost of services when you get sick, are hospitalized or need prescription drugs until you meet your deductible.

Example - If bill is $100

You Pay: $100 Plan Pays: $0

Deductible - The amount of money you have to pay before the company will make any payments towards healthcare services. Your deductible amount varies based on the plan or level of coverage (Single vs Family) you select.

We will make a contribution to your HSA account in January, 2023 or after your account set-up has been completed.**

Help is On the Way

Once you meet the deductible, you and the company split the cost of your medical and pharmacy expenses based on your coinsurance. Under the HSA plan for in-network services, you pay 20% and the company pays the remaining 80%.

Coinsurance - Your share of the costs of a covered change to healthcare. service. It’s a percentage of the amount charged for services. You start paying coinsurance after you’ve paid your deductible.

You’re Done! The Company Has it from Here!

Your out-of-pocket maximum has been reached! Your medical and prescription drug expenses are now paid 100% by the company.

Example - If bill is $100

You Pay: $0 Plan Pays: $100

Example - If bill is $100

You Pay: $20 Plan Pays: $80

Out-of-pocket maximum

An annual limit on the amount of money that you would have to pay outof-pocket for healthcare services.

* Reminder: services must be provided by an in-network provider and hospital/facility. Also, the visit must be billed as preventive care. ** New hire employer-funded HSA amounts are prorated based upon the month benefits begin. Please refer to Page 11 for details on how the company will contribute on your behalf if you are Medicare eligible and are covered by Part A.

Contributions** Single Coverage $500 All Other Coverage Levels $1,000 16 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

Company

14 + 1 REASONS TO LOVE AN HSA

A Health Savings Account (HSA) has a lot going for it! If you aren’t making regular contributions, you’re missing out on its many advantages:

1. An HSA allows you to save, spend, and invest tax free.

2. An HSA is a bank account, so you own it.

3. An HSA offers you triple tax savings:

• Any money put into the account is tax deductible.

• Withdrawals from the account for eligible health expenses (including dental and vision) are tax-free.

• Interest earnings are tax-free.

4. With an HSA, you can choose from a wide range of selfdirected investment options such as securities, including mutual funds, stocks, bonds and more.

5. Your HSA savings grow over time, and when you need to use those funds for healthcare, the money is there for you.

6. You can use your HSA funds for yourself, your spouse and your dependent children (even if they aren’t covered under your HSA Plan!).

7. You can spend your HSA funds on a wide range of qualifying healthcare expenses, such as doctors’ visits, prescriptions, and even dental and vision care.

8. Your HSA funds roll over and accumulate year to year if not spent. Unused HSA dollars are yours to keep even if you leave the company.

9. An HSA is an excellent way to save money for your retirement health care needs.

10. Making contributions is easy through regular payroll deductions, electronic transfer, or check. You select how much to contribute when you enroll, and you can change the amount any time during the year.

11. Each year in January (or after your account setup is completed if you are a new hire), the company will contribute $500 to your HSA for single coverage, and $1,000 for other coverage levels.*

*New hire employer-funded HSA amounts are prorated based upon the month benefits begin.

12. Under IRS rules, you can contribute up to $3,850 (including the company’s contribution) for employee-only and $7,750 for employee + family in 2023.

13. If you are age 55 or older, the IRS allows you to make an additional $1,000 “catch up” contribution each year.

14. Once funds are available in your HSA, PayFlex makes it easy to pay for your eligible expenses:

• Use the PayFlex Card, your HSA account debit card, OR

• Pay for eligible expenses with cash, check or personal credit card, and then withdraw funds from your HSA to pay yourself back.

One more reason to love an HSA: Contributing to your HSA is easy! Simply…. Fill out the paperwork from PayFlex which you will receive when electing the HSA for the first time.

17 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

MERITAIN ONLINE TOOLS

DocFind® Online Directory

With DocuFind, it’s easy to find doctors and hospitals in your network! When you and your family need care, you can look for doctors and hospitals in the Aetna Choice POS II network. With up-to-date listings, you can search for providers by name, specialty, gender, hospital affiliations and more. You can use DicuFind anywhere you have internet access, just:

• Visit http://www.aetna.com/docfind/custom/mymeritain/

Meritain Health ® Member Portal

Pepsi-Cola & National Brand Beverages, LTD

Did you know you can find a variety of health care tools and resources at www.meritain.com?

• Key in the ZIP code, city, county or state of the desired geographical area in the Enter location here field. Click Search

Your member website gives you 24-hour access to a number of tools and resources that can help you manage your health benefits.

At meritain.com you can:

• Key in Aetna Choic POS II (Open Access) under Select a Plan, Or you can select Aetna Choice POS II (Open Access) from the list of plans. Click Continue

• Begin filtering your search depending on your desired filters!

Online Member Portal

At meritain.com, you can

• Check your eligibility and benefits

• Find the status of claims

• View your Explanations of Benefits (EOBs)

• Review your benefits plan document

• View deductibles and out-of-pocket limits

• Access your ID card

If you are a new user, you’ll need to register and create an account. When registering, you’ll need you member ID and group ID from your ID card. Scan the QR code and click on the link to register or visit www.meritain.com and click register!

{ Check your eligibility and benefits.

{ Find the status of claims.

{ View your Explanations of Benefits (EOBs).

{ Review your benefit plan document.

{ View deductibles and out-of-pocket limits.

{ Access your ID card.

Access is as easy as 1–2–3

If you have an account, simply log in. If you’re a new user, you’ll need to register with these simple steps. When you’re registering, you’ll need your member ID and group ID from your ID card. (If you’re new to the plan, you’ll receive your ID card in the mail soon.)

Step 1

Step 2 Select Member Then, click Continue

Scan the QR code below and click on the link to register or visit www.meritain.com and click Register. 18 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

VISION PLAN

Exam (1x every 12 months)

Lenses & Frames including contacts (1x every 24 months)

Option A (PPO)

Option B (POS II)

Meritain Meritain In-Network Out-of-Network In-Network Out-of-Network

100% no deductible or copay (covered under medical plan)

Subject to Plan deductible and coinsurance (covered under medical plan)

100% no deductible or copay (covered under medical plan)

Subject to Plan deductible and coinsurance (covered under medical plan)

Plan pays up to $100 Plan pays up to $100 Plan pays up to $100 Plan pays up to $100

Meritain/VSP Vision Benefit

If you choose Medical Option A or B, your vision benefit is with Meritain/VSP Savings Pass. As you know, Meritain Health has partnered with VSP, giving you access to (1) the VSP network of vision providers and (2) discounts when you use the VSP Savings Pass.

IMPORTANT: The VSP Savings Pass is not insurance; your insurance coverage is provided by Meritain Health through your medical plan.

Follow These Steps

To take advantage of your Meritain Health vision benefit and to avoid potential confusion, we recommend you follow these steps:

1. Locate a VSP network doctor at vsp.com or call 800.877.7195.

2. Tell your VSP network doctor that you are a VSP member with the VSP Savings Pass to save on an eye exam and eyewear.

3. At the time of payment, show your Meritain Health medical ID card and note that the hardware benefit is through your medical plan. If you have an issue with the provider, the provider should call Accolade at 1-833939-2331 for an explanation on how the provider should submit the claim to Meritian.

4. You can also be reimbursed by using the Meritain Vision claim form found on the Company website or available from Meritain.com

VSP Savings Pass/ Member Out-of-Pocket Costs

Annual WellVision Exam

Retinal Screening

Lenses

Lens Enhancements

Frames

Sunglasses

Contact Lenses

Laser Vision Correction

• $50 with purchase of a complete pair of prescription glasses.

• 20% savings without purchase.

• Guaranteed pricing with WellVision Exam, not to exceed $39.

• With purchase of a complete pair of prescription glasses: single vision $40; lined trifocals $75; lined bifocals $60.

• Average savings of 20–25% on lens enhancements such as progressive, scratchresistant, and anti-reflective coatings.

• 25% savings when a complete pair of prescription glasses is purchased.

• 20% savings on unlimited non-prescription sunglasses from any VSP doctor within 12 months of your last WellVision Exam.

• 15% savings on contact lens exam (fitting and evaluation).

• Average 15% off regular price or 5% off promotional price; discounts only available from contracted facilities.

VISION

19 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

DENTAL

Aetna’s dental PPO plan helps you maintain good dental health through affordable options for preventive care, including regular checkups and other dental work.

The dental PPO plan is designed to encourage preventive treatment, allowing employees to achieve oral health while striving to minimize dental costs.

The Aetna dental PPO contracts with a network of preferred dentists, but allows you to seek care from any licensed dentist. However, when you visit a network dentist, you can maximize your plan benefits with access to lower out-of-pocket expenses because you will enjoy deeper discounts. In-network dentists will submit claims for you and receive payment directly from Aetna. Their payment will be based upon their pre-approved fees with Aetna. You are only responsible for your deductible and coinsurance. Lastly, if you visit a non-participating provider, you may be responsible for additional costs if the provider’s charges exceed the plan’s usual & customary levels.

Pre-Treatment Estimate: Before beginning extensive dental work, it is STRONGLY recommended that you have your dentist obtain a pre-treatment estimate from the insurance company. A pre-treatment estimate ensures that you are aware of expected out-of-pocket costs before beginning treatment.

Aetna Dental ID Cards

Aetna will not provide ID cards.

Members can:

• Provide the dentist with your name, date of birth, and member ID number. They will reach out to Aetna directly.

• If you want a card, use your mobile app or go online at www.aetna.com and print the ID card.

• Use the Aetna Mobile app. Text “Apps” to 44040 to download the app

Dental Plan In-Network (You Pay) Out-of-Network (You Pay) Annual Deductible (excludes preventive care and orthodontia) $100 per person Annual Maximum (excludes preventive care and orthodontia) $1,000 per person / $5,000 per family Preventive Care 25% 25% Basic Services 25% 25% Major Services (eligible after 24 months) 50% 50% Orthodontics 50% 50% Orthodontia Deductible $100 per person lifetime Orthodontia Lifetime Maximum $1,000 per person YOUR WEEKLY DENTAL CONTRIBUTIONS Employee Employee + Spouse Employee + Child(ren) Employee + Family $2.20 $4.40 $4.40 $6.60 20 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

FLEXIBLE SPENDING ACCOUNT REIMBURSEMENT PLANS

Flexible spending accounts (FSAs) are designed to let you budget and pay for certain kinds of expenses, such as unexpected healthcare needs or dependent care, with pre-tax dollars.

We offer three types of FSAs, administered by Aetna: Healthcare FSA

You may contribute up to $3,050 per calendar year (pre-tax deduction) for eligible healthcare expenses such as medical copay, deductibles, dental and vision care service, etc.

Limited Healthcare FSA

You may contribute up to $3,050 per calendar year (pre-tax deduction) for eligible dental and vision expenses.

Dependent Care FSA

You may contribute up to $5,000 per calendar year ($2,500 if married, but filing a separate tax return) of your income or your spouse’s earned income, whichever is less, for eligible dependent care expenses (pre-tax deduction)

You must re-enroll each year if you want to participate. Be sure to make your selection for a FSA in Workday HR system during open enrollment or when you enroll in benefits.

21 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

Funds remaining in your Healthcare or Limited Healthcare FSA on December 31, 2023, will rollover a maximum of $610 into 2024 for you to use.

How Does the Rollover Work?

Example #1

Jack has $900 remaining in his Healthcare FSA on December 31, 2022 AND has elected to contribute $3,050 in his Healthcare FSA for 2023.

Example #2

12/31/22 $570 Funds available only for 2023

1/1/23 6/15/23 1/1/24 $900 Amount remaining in FSA at year-end $330 Amount available for 2022 run-out claims (claims incurred in 2022)

12/31/22 $570 Maximum amount available to carry over for 2024 is $610*

$0 Funds no longer available due to runout period ending 22 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

FSA Changes for 2023

$900 Amount remaining in FSA at year-end $570 Amount available to pay claims incurred in 2022 or 2023 claims $3,050 New election in 2023 $3,620 Funds available only for 2023 $610 Maximum amount available to carry over for 2024 $330 Amount available for 2022 run-out claims (claims incurred in 2022) $0 Funds no longer available due to runout period ending 1/1/23 6/15/23 1/1/24

Jill has $900 remaining in her Healthcare FSA on December 31, 2022 AND has elected to contribute $0 in her Healthcare FSA for 2023. $570 Amount available to pay claims incurred in 2022 or 2023 claims $0 New election in 2023

What happens to my accounts if I make a change in my medical plan?

Due to federal regulations, consider the following if you are moving from Plan A (POS II) to Plan B (HSA) or vice versa

If you currently participate in Plan A (POSII) and plan to change to Plan B (HSA)

If you are in Plan A (POSII) AND have elected to set aside monies in the Healthcare FSA, IRS guidelines require one of two things:

• You should use all your Healthcare FSA funds before December 31st. This means file all your claims before December 31st for claims incurred during this year. OR

• If you don’t use your Healthcare FSA funds prior to December 31st, then you are still eligible to use them during the company’s allowed $500 rollover. However, your rollover amount will be converted to a Limited Purpose FSA that can only be used for eligible dental and vision expenses.

We suggest that you use your Healthcare FSA balance as soon as possible if you are considering that change from Plan A (POSII) to Plan B (HSA).

If you currently participate in Plan B (HSA) and plan to change to Plan A (POSII)

If you are enrolled in Plan B (HSA) AND have funds remaining as of January 1st, you can continue to use your funds as you normally would for yourself or your eligible dependents for qualifying services such as medical, dental, vision, etc. However:

• You will NO LONGER be able to contribute to your HSA account as of January 1st, and

• If you elect a Healthcare FSA, these dollars will be withdrawn first from your Healthcare FSA account BEFORE the HSA dollars.

HSA dollars can help you save for your future medical needs but this savings vehicle will no longer be available to you if you move from Plan B (HSA) to Plan A (POS II).

23 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

HSA VS. FSA

We’ve talked about an HSA and an FSA, but what’s the difference between each? Below is a chart comparing a Health Savings Account and the various Flexible Spending Accounts.

Reviewing this chart will help you understand the benefits of the pre-tax savings accounts available to you based on the medical plans that you have enrolled in.

Features and Provisions

Eligible Plans HSA

Automatic annual enrollment?

Maximum 2023 annual contributions

Contributions subject to “use it or lose it’ rule?

Contributions qualify for tax advantages?

No – you must enroll each year during Open Enrollment or when you are first hired

Enrollment in a medical plan is not necessary. If you are enrolled for medical/rx/ vision benefits elsewhere, you still have access to this benefit.

No – you must enroll each year during Open Enrollment or when you are first hired

HSA

No – you must enroll each year during Open Enrollment or when you are first hired

Enrollment in a medical/rx/vision plan is not necessary; This is a stand alone benefit

No – you must enroll each year during Open Enrollment or when you are first hired

$3,850 - Individual $7,750 - Family (includes company contribution) $3,050 per year $3,050 per year $5,000, married: filing jointly $2,500 married filing separately

No Yes Yes Yes

Yes Pre-Tax Dollars Yes Pre-Tax Dollars Yes Pre-Tax Dollars Yes Pre-Tax Dollars

Contributions earn interest on a taxdeferred basis? Yes No No No

Account balances are portable if you change employers?

When can you change your contribution amounts during the year?

Use the account to build long-term savings?

Yes – If you leave the company, your HSA funds go with you No No No

For any reason

If you experience a qualifying event change during the year

If you experience a qualifying event change during the year

If you experience a qualifying event change during the year

Yes – You can allow your account balance to grow tax-free No No No

Rollover Provisions Yes Yes, up to $500 Yes, up to $500 No

Eligible Expenses

Eligible medical, dental, and vision expenses

Eligible medical, dental, and vision expenses

Eligible dental and vision expenses only

Day care facility fees, nursery or preschool expenses (excluding transportation, lunches, education services), local day camps, in-home babysitting fees (income must be claimed by provider).

To view eligible expenses, visit www.irs.gov/pub/irs-pdf/p503.pdf

Health Savings Account

Healthcare FSA Limited Healthcare FSA Dependent Care FSA

24 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

LIFE AND ACCIDENTAL DEATH AND DISMEMBERMENT (AD&D)

We recognize that life insurance provides critical financial protection, so we automatically cover all eligible employees with a basic amount of life and AD&D insurance.

You Will Receive

Up to a Maximum of Life Insurance

2X your base annual earnings $400,000 (reduced to 65% at age 70 and to 50% at age 75) AD&D Insurance

2X your base annual earnings $400,000 (reduced to 65% at age 70 and to 50% at age 75)

The life insurance benefit and the AD&D protection are provided at no cost to you and both are convertible and portable.

Eligibility: First of the month following 60 days of employment.

Important: Be sure to update your beneficiary information in the Workday HR System when necessary.

DISABILITY INSURANCE

After 6 months of employment, our Long-Term Disability (LTD) insurance provides you with monthly income in the event of a lengthy absence from work due to a total disability resulting from an illness or injury. The LTD benefit replaces up to 60 percent of pre-disability monthly income to a maximum of $10,000 per month.*

Benefits Begin Benefits Duration

You Will Receive Up to a Maximum of

Long-Term Disability

after 180 days of the disabling condition.

Maximum benefit ending at the participants eligiblitliy for social security disability or their regular retirement age.

Eligibility: First of the month following 6 months of employment.

60% of monthly earnings

$10,000/month

Note: *LTD benefits are reduced by certain other income benefits such as SSI and Worker’s Compensation etc. The minimum monthly benefit available after integration with other income benefits is the greater of $100 or 10% of the gross monthly benefit.

25 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

ADDITIONAL

EMPLOYEE ASSISTANCE PROGRAM (EAP)

Personal issues, planning for life events or simply managing daily life can affect your work, health and family. GuidanceResources® provides support, resources and information for personal and work-life issues. The EAP is companysponsored, confidential and provided at no charge to you and your dependents:

• Confidential telephonic counseling

• Financial information & resources

• Legal support & resources

• Work-life solutions

EMERGENCY TRAVEL ASSISTANCE

The Assist America program offers a wealth of travel, medical and safety-related services to you and your family members. Whether traveling for business or leisure (spouses traveling for business are not covered), more than 100 miles from home, Assist America services are available 24/7. The services can be as simple as getting the weather forecast for a travel destination or as complex as an emergency evacuation from halfway around the world.

IDENTITY THEFT PROTECTION

Assist America’s SecurAssist Identity Protection program provides:

• 24/7 telephone support and step-by-step guidance by anti-fraud experts

• A case worker assigned to you

» Helps you notify the credit bureaus

» Helps you file paperwork to correct your credit reports.

• Help canceling stolen cards and reissuing new cards

• Help notifying financial institutions and government agencies

BENEFITS

Call

(within US) or

(outside US) and provide the Membership

or

Visit Benefits.HonGrp.com and click on “SecurAssist” (under Partner Websites) and then use Access Code 18327, or call 1-877-409-9597 and provide the Membership #

Visit Benefits.HonGrp.com and click on “GuidanceResources” (under Partner Websites) and then use the web ID: EAPEssential, or call 1-800-460-4374. 26 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

1-800-872-1414

609-9861234

# 01-AA-SUL-100101,

email medservices@ assistamerica.com.

01-AA-SUL-100101

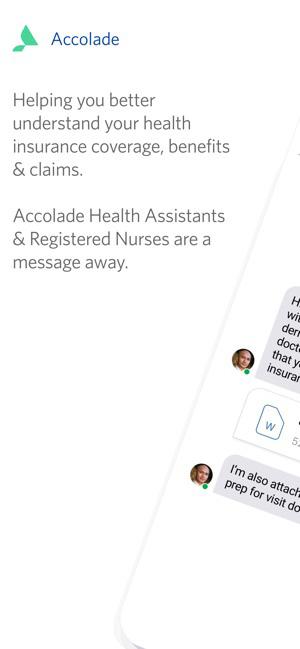

APPS MAKE YOUR LIFE EASIER!

we

Our vendor partners are keeping up with the times. Each one has an app that you can download to have immediate access to your ID card, claims information, or doctors in case of an emergency. Download the app before you need it! ACCOLADE VIRGIN PULSE Scan th e QR cod e b elow to d own l AETNA DENTAL TELADOC EXPRESS SCRIPTS 27 2023 Non-Union Benefits Guide • BenefitsInABottle has moved to BENEFITS.HONGRP.COM (password: Benefits) WELL NESSTOTAL

In today’s environment,

are lost without our cell phones. It becomes the “one stop shop” for our contact information, banking, and all things health.

IMPORTANT CONTACT INFORMATION

For more information, visit Benefits.HonGrp.com (password: Benefits)

Accolade

1-833-939-2331 member.accolade.com Precertification URL: https://precert.accolade.com/honickman N/A

Meritain Member Services 1-800-925-2272 www.meritain.com

Aetna Dental 1-877-238-6200 www.aetna.com

PayFlex Health Savings Account (HSA) 1-888-678-8242 www.payflex.com

PayFlex Flexible Spending Account Plans 1-888-678-8242 www.payflex.com

Meritain Policy Number - 18113

Aetna Policy Number - 718640

PayFlex Policy Number139238

PayFlex Policy Number139238

Express Scripts, Inc. (ESI) 1-877-554-3093 www.express-scripts.com N/A

Mail Order Customer Service 1-877-554-3093

Mail Order Physician Fax Info 1-888-327-9791 Mail Order Automated Refills Call the # on your Rx bottle Teladoc 1-800-DOC-CONSULT (362-2667) teladoc.com N/A

Employee Assistance Program 1-800-460-4374 www.guidanceresources.com and use the web ID: EAPEssential N/A

Emergency Travel Assistance 1-800-872-1414 (within US) or 609-986-1234 (outside US) email: medservices@assistamerica.com

Identity Theft Protection 1-877-409-9597 www.securassist.com/sunlife and use Access Code 18327

Membership # 01-AASUL-100101

Membership # 01-AASUL-100101

Vanguard Customer Service 1-800-523-1188 www.vanguard.com Plan number: 095612

HR – Northern Region

Pepsi Cola Bottling Company of New York, Inc. Good-O Beverage Company

114-02 15th Avenue College Point, NY 11356 (800) 406-5007 (Option 5)

HR – Central Region

Beverage Distribution Center, Inc.

Canada Dry Delaware Valley Bottling Co. Canada Dry Distributing Co. of Atlantic City Pepsi Cola & National Brand Beverages, Ltd. 8275 Route 130 Pennsauken, NJ 08110 (856) 661-4653

HR – Southern Region

Canada Dry Potomac Corporation 3600 Pennsy Drive Landover, MD 20785 (301) 773-5500 (ext. 2057)

WELL NESSTOTAL

BENEFITS.HONGRP.COM (password: Benefits)

NOTICE: This brochure provides key facts for non-union employees about eligibility for benefits and how each plan works; it describes the plans in effect on January 1, 2023. Provisions of the individual benefit plans are governed by the terms of the Plan Document. In case of any discrepancy between the wording in this brochure and the Plan Document, the Plan Document will always govern.

The Company reserves the right to change, modify, or terminate the plans, benefits, programs or services, at any time for any reason without notice. Eligibility for, or participation in, a program is not a guarantee of employment.