Permit me to borrow the title of this column from the final episode of M*A*S*H, the single highest rated television show in US history. Why this title? This is my final column as publisher of AFTERMARKET INTERNATIONAL.

Nothing is certain in life, as the expression goes, except death and taxes. So true and my association with this brand now comes to an end. And to use another phrase “not with a bang but a whimper”.

My association with AI dates back a long time, almost 30 years. If that’s not a lifetime in the hurly burly of the media biz then I don’t know what is. I’ve been with AI longer than any other endeavor. I started selling for it in the late 90s when it was owned by Adams Business Media) and it was known with the rather confusing name of Auto & Truck International). From there it “moved’ to Keller Publishing who renamed us AFTERMARKET INTERNATIONAL. Keller owned it until January 31, 2007 when JABS Media LLC acquired the title. I own JABS Media and still do today.

At the time we were a print publication, six times annually in both English and Spanish. We had virtually no digital presence, no email addresses for our readership and an antiquated device for generating sales leads for advertisers. They were called reader service (aka bingo) cards.

We also had physical distribution at many tradeshows worldwide such as Autopromotec, Equip Auto, Rematec, Big R and a many in the Automechanika family.

Over time things changed due the evolution of the media landscape. We worked very hard at collecting email addresses of our 20,000 audience, moved to digital and reduced our tradeshow exposure. Printing

and shipping thousands of issues to various venues is costly and we didn’t have the revenues to support it.

Then in February 2020 a new opportunity arose. I was at a tradeshow for the appliance and HVAC industry as JABS owns a brand in that field too. I happened to meet Max Jaramillo who owns Latin Press Inc. of Miami. Max and I hit it off immediately, as publishers/owners often do, and kept in contact. Though the pandemic slowed our discussions, Latin Press purchased our brand in March, 2022 but retained me as publisher. That role expires December 31 this year.

We have made great strides with Latin Press. We now are quarterly, we have a weekly enewsletter and exhibit at AAPEX. We also have our own tradeshow, AutoAmericas, for the Latin American market. Originally in Miami we move to Santo Domingo in the Dominican Republic next year. It’s been a great match. Thank you LP!

While we had our ups and downs over the years we always were profitable and had a lot of fun along the way. I traveled internationally more than I ever thought I would and met many fascinating people in our industry. I had a tremendous relationship with members of the Overseas Automotive Council (OAC) and hold that organization in very high regard. It’s a must for aftermarket suppliers wanting to sell outside the US.

What’s next on the horizon? Not exactly sure… JABS still owns its sister brand THE APPLIANCE & HVAC REPORT. And perhaps I may do some other activities in the auto aftermarket. Time will tell, it always does.

Thank you one and all (too many too list) and may you have happy and prosperous lives.

Goodbye, Farewell and Amen Brad Glazer, Publisher Aftermarket International

GENERAL MANAGEMENT

Max Jaramillo / Manuela Jaramillo

EDITOR

Laura Restrepo C. lrestrepo@aftermarketinternational.com

PROJECT MANAGER

Andrés Caballero acaballero@aftermarketinternational.com

PUBLISHER

Brad Glazer bglazer@aftermarketinternational.com

ACCOUNT MANAGERS

COLOMBIA

Fabio Giraldo fgiraldo@aftermarketinternational.com

DATABASE MANAGER

Maria Eugenia Rave mrave@aftermarketinternational.com

PRODUCTION MANAGER

Fabio Franco ffranco@aftermarketinternational.com

LAYOUT AND DESIGN

Jhonnatan Martínez jmartinez@aftermarketinternational.com

FRONT PAGE Latin Press

OFFICE PHONES:

Latin Press USA Miami, USA Tel +1 [305] 285 3133

Latin Press México Ciudad de México Tel +52 [55] 4170 8330

Latin Press Colombia Bogotá, Colombia Tel +57 [601] 381 9215

São Paulo, Brasil Tel +55 [11] 3042 2103

The opinions expressed by the authors of the articles in this journal do not commit the publishing house.

Printed by Panamericana Formas e Impresos S.A. Acting only as printer. Printed in Colombia

ISSN 2834-8885

With this issue, we close a special chapter: the last one of 2025. A year that, without a doubt, was defined by change. The auto parts industry underwent significant transformations in tariff and regulatory matters, demanding that companies and professionals quickly adapt to new scenarios. Internally, within our own organization, we also made adjustments that pushed us to rethink processes and ways of working. And on a personal level, I faced my own challenges and changes which, though demanding, became meaningful opportunities for growth.

What makes this period remarkable is that, despite its complexity, it was also a year of expansion and knowledge. The automotive aftermarket in Latin America demonstrated its resilience and its potential to keep moving forward. Technological innovation, the professionalization of workshops and distributors, and the ongoing pursuit of efficiency and sustainability were central themes that left us with valuable lessons.

Through this magazine, we aimed to accompany the community throughout this journey. Every article, interview, and feature we published had the purpose of offering relevant and reliable information—insights that could bring clarity in times of uncertainty and serve as a foundation for decisionmaking. Today, looking back, we can say that 2025 not only challenged us but also made us stronger as a sector and as a specialized media outlet.

This year’s closing is also a moment for gratitude. First and foremost, to our readers, advertisers, and partners, whose trust makes the continuity of this project possible. And, in particular, to those who shared their knowledge and expertise through our pages in 2025: Carlos Panzieri, Francisco Aristizábal, Sandra Álvarez, Eduardo Alexandri, and María Zoraida Gallo—together with all the contributors who have joined us in previous years. Each of their contributions enriched the conversation and broadened our perspective on the challenges and opportunities within the auto parts sector.

Looking ahead to 2026, we want to renew this invitation: if you are a professional in the field and wish to share your experience, research, or analysis, this magazine is open to you. Our publication is a space for dialogue and collective building, where every voice helps strengthen the industry and project it into the future.

The challenges ahead—electrification, digitalization, new business models, and the training of specialized talent—will be even more demanding. Yet we trust that, as a community, we will continue finding ways to innovate, grow, and transform. We will remain here, committed to delivering content that inspires, guides, and connects all players in the automotive aftermarket. Because movement never stops—and together we will keep driving the future of auto parts.

Laura Restrepo Editor

9/Genuine vs. Aftermarket Spare Parts: Is There a Real Difference?

12/Closing and sealing in a twin-tube shock absorber

15/Open Call for Speakers: AutoAméricas Show 2026 Comes to Santo Domingo

6/Out front

20/Business News

6/Aftermarket 2026: Resilience, Transformation, and New Global Opportunities

9

Find information, contacts, links to industry associations, free literature from businesses that advertise in the publication, events, and downloadable issue archives dating to 2007 at aftermarketinternational.com

For advertising, contact Andrés Caballero at +1 [305] 285 3133 Ext. 94

acaballero@aftermarketinternational.com

By Laura Restrepo C.

Between resilience and transformation, the global aftermarket heads into 2026 with steady growth and new business opportunities.

The global automotive parts and service aftermarket enters 2026 with a unique combination of strength and structural change. In a scenario where inflation, trade uncertainty, and new regulations seem to threaten the pace of business, the automotive aftermarket stands as a resilient pillar of global mobility, maintaining stable growth rates and creating opportunities for transformation.

The most recent Auto Care Factbook 2026, published by the Auto Care Association, confirms that the U.S. automotive parts and service industry reached USD 413.7 billion in 2024, with a 5.7% growth rate, nearly in line with the projected 5.9%. For 2025, an addi-

tional 5.1% increase is expected, while the projection for 2028 places the combined light, medium, and heavy-duty vehicle market at USD 664.3 billion.

“This year’s edition highlights that the U.S. automotive aftermarket industry has demonstrated remarkable resilience, showing steady year-over-year growth—even amid global supply chain disruptions and rising inflation,” explained Bill Hanvey, president and CEO of the Auto Care Association. “The auto care industry reached $414 billion in 2024 and is projected to surpass $664 billion by 2028. This consistent expansion reflects the essential nature of vehicle maintenance and repair, as America’s more than 239 million licensed drivers increasingly choose to extend the life of their vehicles—now averaging over 12.8 years on the road—rather than replace them”.

This fact is key: an aging fleet translates into more parts replacement, more services, and greater demand for technological solutions to extend vehicle lifespans.

The picture is even more ambitious when looking at the global market. According to an analysis by Custom Market Insights, the global aftermarket will grow from USD 405.8 billion in 2024 to USD 669.2 billion in 2033, with a compound annual growth rate (CAGR) of 6.2% starting in 2026.

This dynamism is explained by several factors:

• The electrification of mobility, creating new parts categories (batteries, chargers, electric powertrain components).

• The adoption of digital technologies such as AI, IoT, and predictive maintenance.

• The boom of e-commerce as the preferred channel for purchasing spare parts.

• The growth of regions like Asia-Pacific, where vehicle fleets and consumers’ disposable income are driving unprecedented demand.

The shift toward electric and hybrid vehicles opens an unprecedented chapter in the aftermarket. The e-compressor segment—critical for cli-

mate control systems in EVs—will grow at a CAGR of 11.5% through 2034, reaching USD 11.2 billion, according to CMI. Europe and North America lead in innovation, but Asia-Pacific is driving volume growth.

Connected vehicles and IoT sensors are reshaping the aftermarket. Shops now receive automatic alerts of failures before they occur, enabling proactive maintenance and reducing downtime. Moreover, AI-driven inventory management optimizes costs and improves parts availability.

The digital channel consolidates as a growth engine. E-commerce platforms and mobile apps are becoming the first choice for spare parts purchases, especially in markets such as the U.S. and China. This forces distributors and manufacturers to rethink the customer experience.

• Global market 2024: USD 405.8 billion

• Projection 2033: USD 669.2 billion

• U.S. light vehicle aftermarket 2024: USD 413.7 billion

• Expected growth 2025: 5.1%

• Average vehicle age in the U.S.: 12.8 years

• Asia-Pacific: >35% of projected growth

The aftermarket is not immune to the green agenda. The use of recycled materials, remanufacturing programs, and regulatory pressure in Europe and North America are accelerating the adoption of sustainable practices. For many players, sustainability is already a competitive differentiator.

The arrival of autonomous vehicles and connectivity services opens opportunities in areas such as software updates, sensor calibration, and specialized maintenance. Though still in its early stages, this field has high potential heading into the next decade.

• United States: Mature market, driven by fleet longevity and digitalization of processes.

• Europe: Strict environmental regulations, accelerated transition to e-mobility, and strong focus on sustainability.

• Asia-Pacific: Most dynamic region, accounting for more than 35% of projected growth thanks to expanding fleets and government-driven modernization.

• Latin America: Growth potential tied to urbanization and digitalization, though electrification advances at a more gradual pace.

• Middle East and Africa: Developing markets, focused on commercial fleets and cost-efficient solutions.

The aftermarket doesn’t just grow: it adapts. According to the Factbook, 239 million licensed drivers in the U.S. prefer to extend the lifespan of their vehicles rather than replace them. This trend is mirrored in other regions, where economic uncertainty and environmental awareness push consumers to prioritize repair and maintenance.

All signs indicate that 2026 will be a year of strategic transition:

• Consolidation of stable growth (global CAGR >6%).

• Greater role of electrification in the aftermarket.

• Full digitalization of the customer experience.

• New business lines linked to software, connectivity, and advanced services.

The conclusion is clear: the aftermarket is no longer a secondary business but becomes a backbone of future mobility.

By Francisco Aristizábal *

SIn the world of automotive spare parts, the eternal dilemma between genuine components and aftermarket alternatives continues to spark debate. Beyond price and availability, the real difference lies in aspects such as quality, technical support, warranty, and the brand’s ability to respond.

ince the beginning of the automotive industry, the replacement parts market has been commonly divided into two categories: parts supplied directly by the engine manufacturer (known as genuine or original parts), and all the “others”—a broad group often considered generic replicas or unapproved counterparts.

While genuine parts are recommended by OEMs, issues like price and availability often make aftermarket alternatives a viable option. However, it is essential to understand key aspects of these alternatives, such as their origin, quality, support, fit, and functionality.

Not all aftermarket parts are created equal. There is a premium group of brands, some of which are Original Equipment Suppliers (OES). These brands should be the first considered when purchasing parts. They offer high-quality products that are evaluated and verified, bac-

ked by strong technical and sales support, and most importantly, clear warranty policies. Often, engine manufacturers are merely assemblers, not producers, they rely on specialized companies for parts design and manufacturing. Many of these companies belong to the premium aftermarket group, developing their own differentiated portfolios that sometimes even solve design flaws found in OE parts.

In today’s image-driven world, social media has helped elevate certain brands that focus heavily on marketing and sales campaigns. These companies often boast extensive online catalogs and fulfillment policies, supported by massive inventories sourced from various countries at low prices. However, they are typically re-packers with little to no quality control. While some may hold ISO certifications for logistics and sales, they lack qualifications in design or manufacturing. Their quality varies depending on the source and is often inconsistent.

Then there are the “white box” or private-label brands, increasingly popular in Latin America, the Middle East, and other regions. These are created by large, experienced wholesale distributors who leverage their market position to offer low-cost alternatives. While they claim to source from OE factories, their focus on price over quality has led to market deterioration. This trend confuses users and undermines established brands, relegating quality, support, and warranty to secondary concerns. Even some engine manufacturers have launched their own aftermarket lines under “classic” or “heritage” branding, often with disappointing results and further market disruption.

Ultimately, choosing the best option in an ever-expanding universe of brands comes down to your own knowledge and judgment. The heavy-duty sector, once immune to brand proliferation, is now among the most affected, making the selection process increasingly challenging.

To help guide your decision, consider asking the following questions when evaluating a brand:

• Is it a recognized brand?

• Is it an OE supplier?

• Do the parts meet or exceed OE specifications for form and fit?

• Is there local technical or sales support?

• Is there a clear warranty policy?

• Does the brand have its own manufacturing facilities or at least a dedicated quality control process?

The key difference between premium aftermarket brands and others lies in their investment in quality control and their ability to respond when failures occur. In my experience, support and warranty handling are more important than any other factor. I’ve seen genuine parts fail with poor claims support, while aftermarket brands have fully backed expensive claims, even in demanding sectors like mining and oil & gas. A trusted brand isn’t necessarily the most popular on social media; experience, technology, and support are what truly matter.

As always, this information is intended as a general guide. Specific

details may vary depending on the equipment manufacturer and application. Be sure to consult OEM literature and service materials. The AERA Tech Line is also available to assist with questions in this area.

Francisco Aristizábal, Technical Specialist, AERA

This article was originally published in AERA’s Engine Professional magazine. It is reprinted in Aftermarket International with permission from the author.

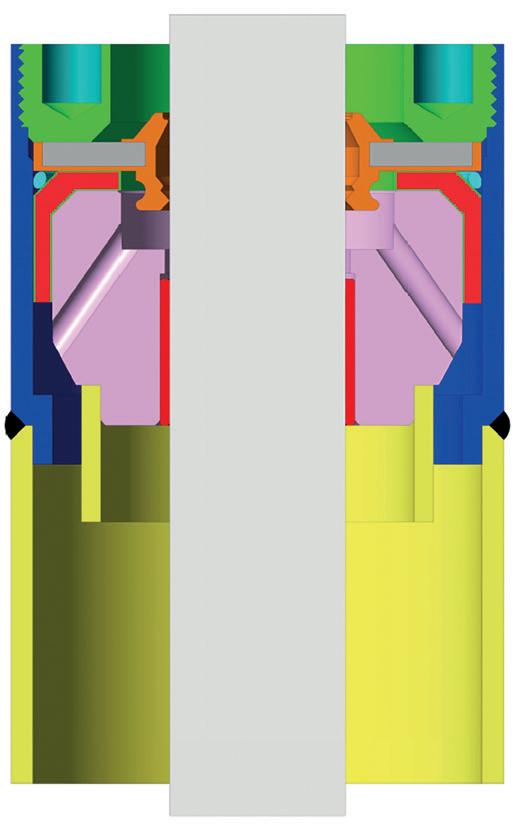

By Carlos Panzieri*

Let’s look at the different types of closing and sealing systems in twin-tube shock absorbers: their evolution over time, the most current systems, and their advantages and disadvantages.

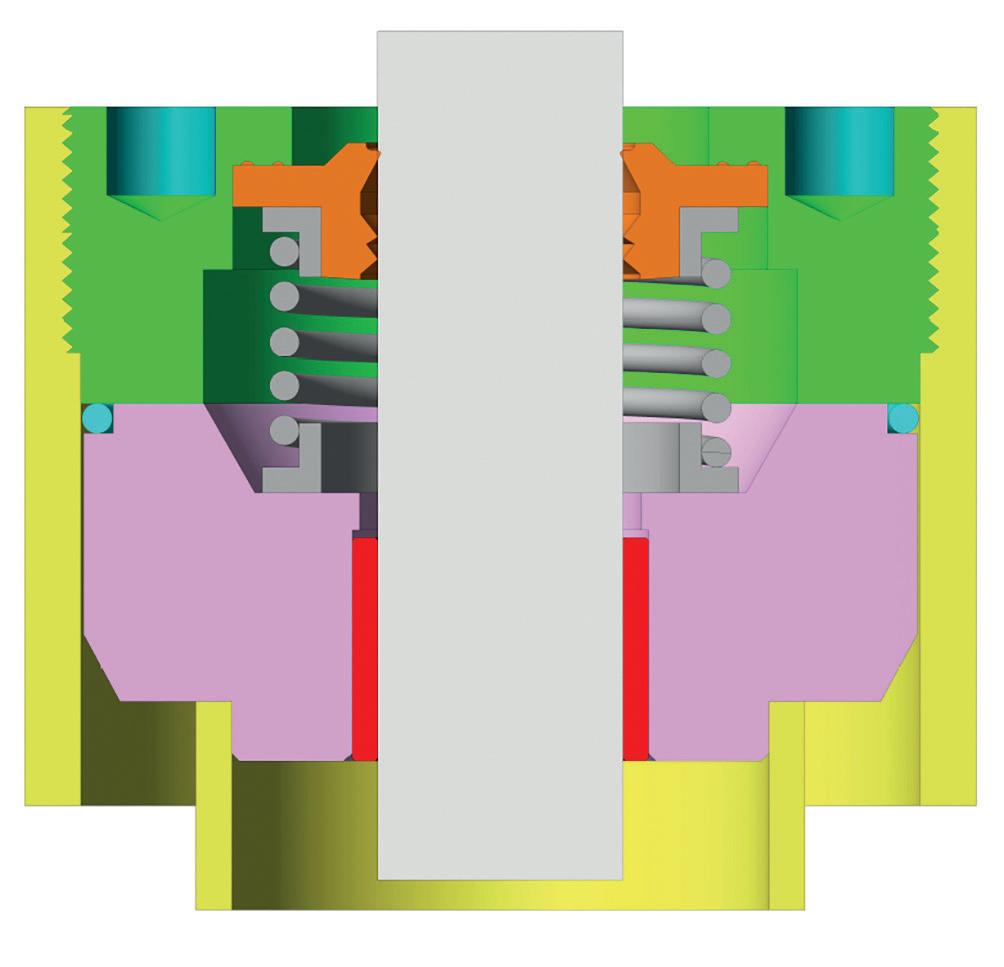

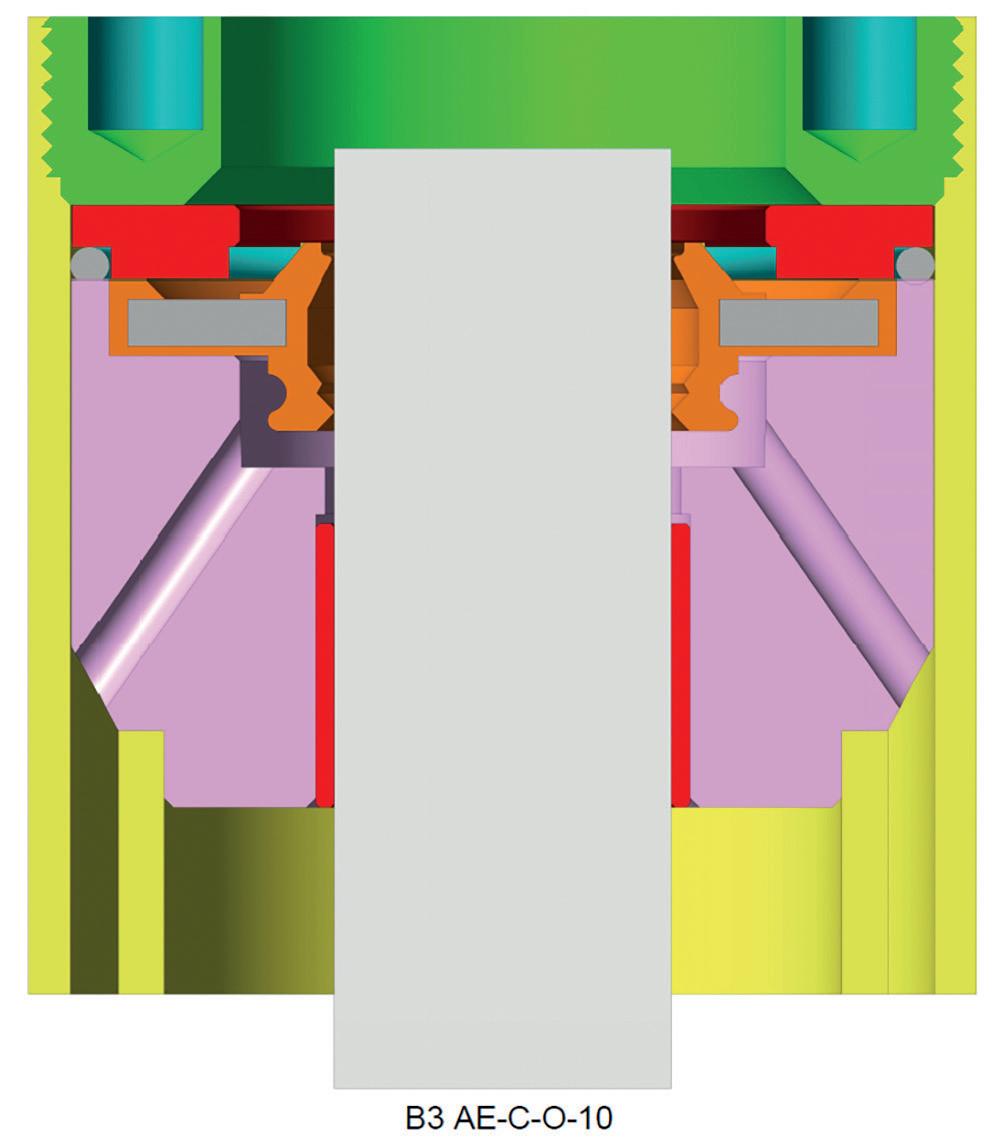

In the past, twin-tube shock absorbers for vehicles and trains were locked with a threaded ring (im.01). The oil seal was small in size and sealed against the ring and the shaft thanks to the mechanical pressure exerted by a coil spring. The sealing between the guide and the body, on the other hand, relied on an o-ring.

This closing system had the advantage of allowing easy refurbishment of the shock absorber but was expensive. In the end, since it was an advantage only for the end user, manufacturers developed other solutions.

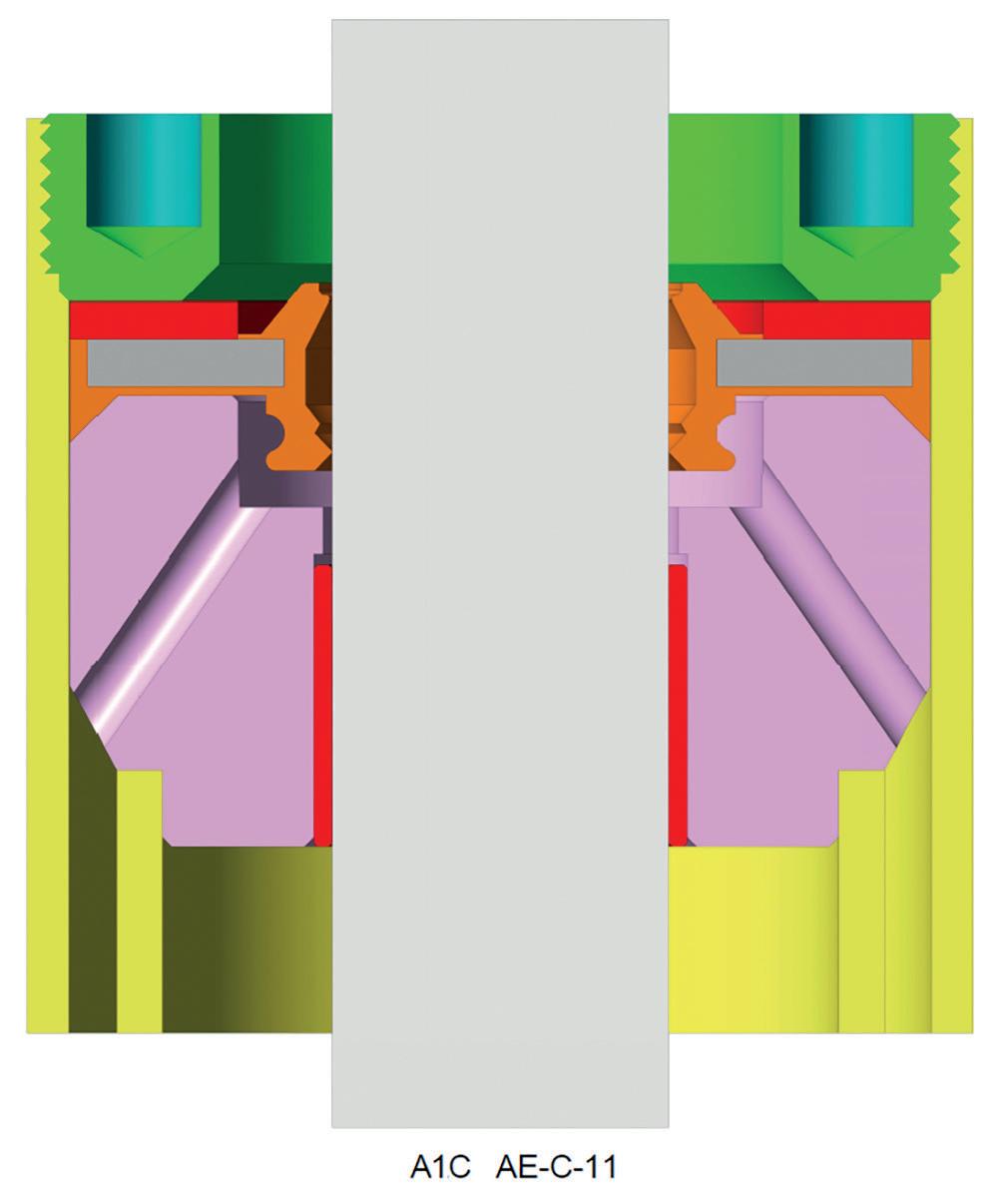

According to Emmetec terminology, the closing and sealing system Type A (im.02) consists of a lock created by bending the edge of the body above the oil seal, and an oil seal that seals between the guide and the body with a circumferential lip positioned on its lower side, replacing the o-ring of the previous case.

This is probably the best solution because it offers several advantages:

1. the closing and sealing surfaces are separated;

2. a very thick sealing lip, which guarantees perfect sealing;

3. high heat dissipation capacity.

This system was used by Way Assauto in almost all Italian cars from the 1980s until the beginning of the new century, and it is still found in some Bilstein, as well as in some Chinese and Japanese shock absorbers manufactured in Malaysia.

This system can be easily refurbished (im.03) by shortening the internal cylinder of the shock absorber by about 10 mm, lowering the guide and the oil seal, threading the body, and locking it with a threaded ring.

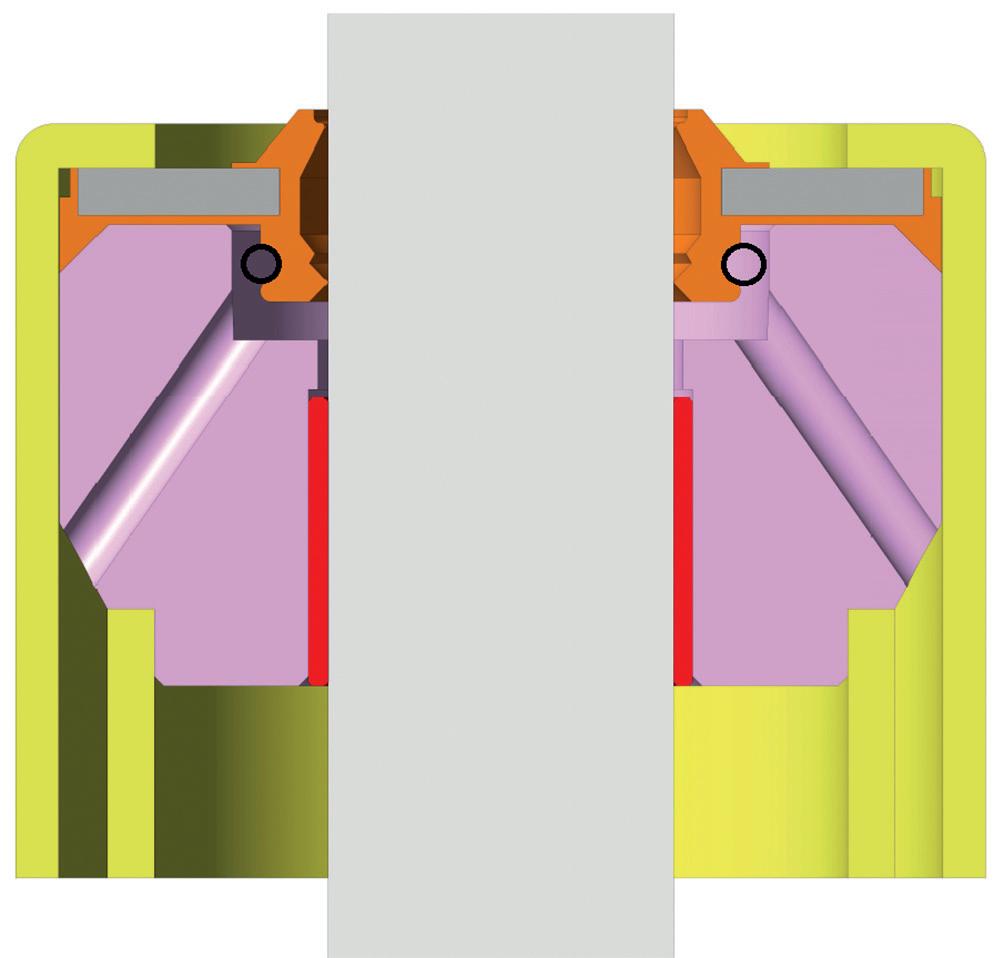

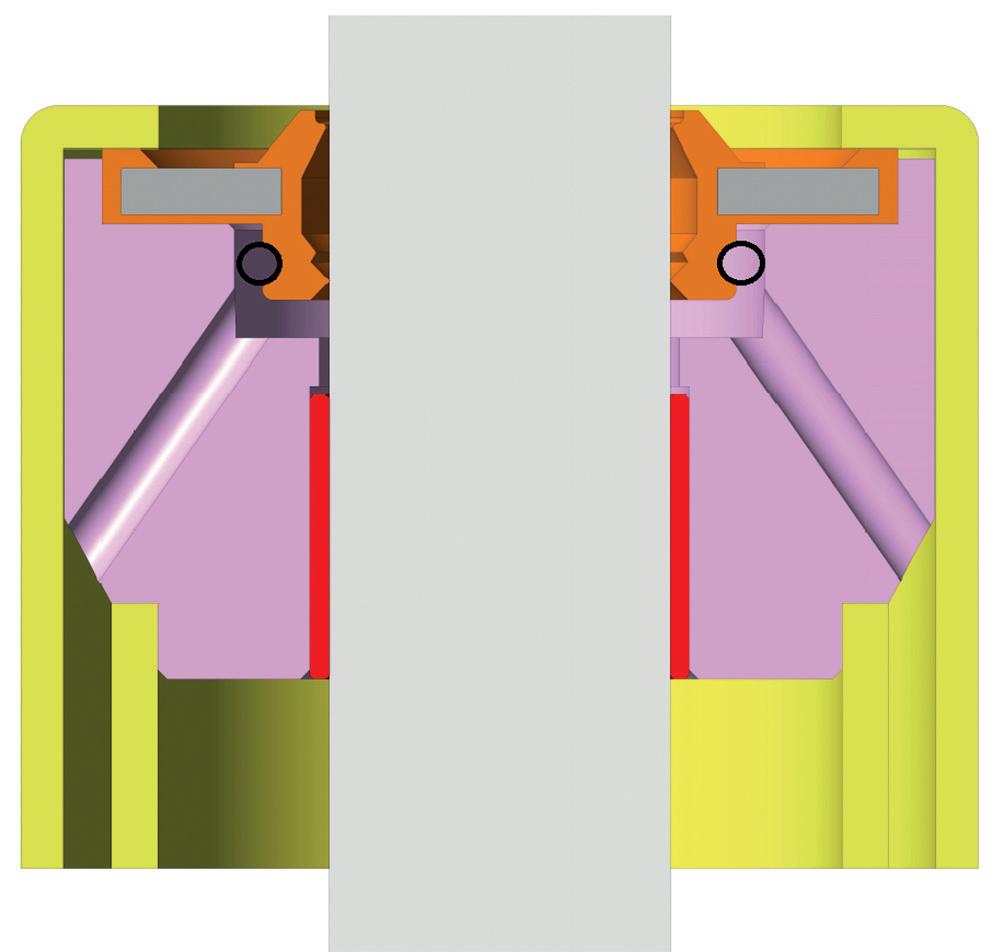

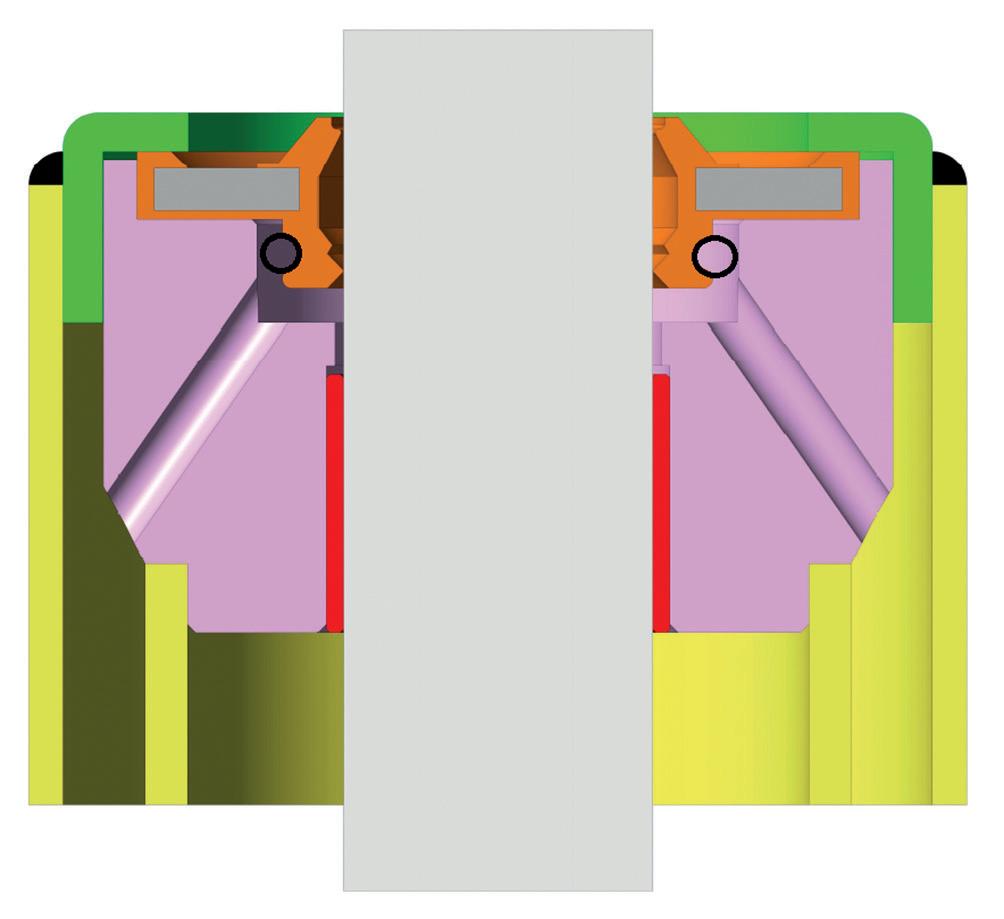

According to Emmetec terminology, the closing and sealing system Type B (im.04) consists of bending the edge of the body above the oil seal, with the oil seal itself sealing against the bent edge through a lip on its upper side.

In this case, compared to the previous one, guidance of the guide in the body is favored over sealing. However, both systems are very effective and, if properly manufactured, reliable. Over time, since the upper lip of the oil seal serves as both the sealing and pressing surface, the ability to retain gas may decrease slightly, although the oil sealing remains effective.

This system is used by Boge, Sachs, Monroe, Bilstein, and the majority of Chinese manufacturers.

It can also be refurbished (im.05) by shortening the internal cylinder by about 12 mm and inserting a ring (in red) that presses both the upper lip of the oil seal and an o-ring, thereby sealing between the guide and the body, and between the guide and the oil seal.

Also according to Emmetec terminology, the closing and sealing system Type C is similar to Type B, but instead of bending, the body is closed by welding a steel cap (in green in im.06).

This system is obsolete and, considering the advantages of Types A and B, presents only disadvantages:

1. the welding process can damage the oil seal, especially if it is also required to seal gas;

2. welding can cause metallic particles from the body to detach into the oil, eventually blocking the valves;

3. the steel cap has an additional cost compared to Type B;

4. a refrigerated welding machine (essential to avoid burning all the seals) is much more expensive and slower than a bending machine.

This system, therefore, indicates obsolete and lower-quality products.

As shown in image 07, it can also be refurbished, but since it requires replacing part of the body and fitting a new guide, it is not worthwhile.

The quality of an oil seal depends on:

1. its design;

2. the storage of raw rubber, since once the rubber has been mixed with additives, it must be vulcanized as quickly as possible or it will lose its chemical and physical properties. For this reason, it is not advisable to purchase oil seals from companies that do not perform rubber compounding in-house;

3. the type of compound;

4. the storage conditions of the oil seal in warehouses.

Regarding the different rubber compounds, most shock absorber seals are made of NBR (nitrile butadiene rubber), a compound that offers good resistance to mineral and vegetable oils, benzene/gasoline, common diluted acids and alkalis, good flexibility, high wear resistance, and temperature resistance between -40 °C and 108 °C.

However, it is advisable to choose seals made of HNBR (hydrogenated nitrile butadiene rubber), a compound similar to NBR but hydrogenated, which allows operation in a temperature range between -40 °C and 165 °C. Depending on the additives, resistance at high temperatures can be improved at the expense of low-temperature performance, or vice versa.

Another fairly common compound is fluoroelastomer (FKM), also known as Viton. Compared to HNBR, it has equivalent chemical resistance and much higher high-temperature resistance (between -30 °C and 240 °C, depending on the additives), but lower mechanical resistance.

• FKM is recommended for shock absorber seals in racing cars that must withstand very high operating temperatures but are not required to reach 100,000 km;

• NBR is recommended where price is the main concern;

• HNBR is the ideal choice in most other cases, especially for vehicles (such as SUVs, trucks, and buses) that must withstand cold winters, hot summers, and long distances.

If you would like to know more about these technical aspects or have any other questions, please contact the Technical Department at www.jadausa.com and www.emmetec.com. As oil seal manufacturers, they will provide you with all the information you need.

Carlos Panzieri

Technical Consultant at Emmetec & Orpav panziericarlos@gmail.com

By Laura Restrepo C.

AutoAméricas Show 2026 has opened its call for speakers. The event, taking place on March 20–21 in Santo Domingo, is seeking expert voices to bring vision, knowledge, and innovation to the automotive aftermarket in Latin America, the Caribbean, and South Florida.

On March 20–21, 2026, the city of Santo Domingo, Dominican Republic, will host a new edition of AutoAméricas Show. The Dominican Fiesta Hotel, Ámbar Ballroom, will become the meeting point where experts, leaders, and visionaries of the automotive industry will share knowledge, experiences, and future insights.

AutoAméricas Show is not only a space for exhibition and networking: it is a high-impact academic congress that offers speakers the opportunity to present research, success stories, new technologies, and trends that are transforming the aftermarket.

Speaking at the event means engaging with a diverse audience of business leaders, distributors, workshops, manufacturers, and specialists seeking innovative solutions and strategic perspectives to address the industry’s challenges.

Those interested in presenting a talk or conference must submit their proposal including the following information:

• Conference title

• Brief description

• Speaker photograph

• Professional profile

Once the information is submitted, the organizing committee will contact applicants with details on the next steps.

Applications will remain open until November 15, 2025.

By arriving in Santo Domingo, AutoAméricas Show expands its regional reach and reinforces its role as a platform for professio-

nal development and a key business meeting point. The academic congress will feature content designed to anticipate trends, foster debate, and strengthen collaboration among the different players in the automotive value chain.

Don’t miss this opportunity

If you want to position yourself as a reference in the industry, AutoAméricas Show 2026 is the place to share your vision, experience, and expertise.

More information at the official website: www.autoamericas.show

In previous editions, AutoAméricas Show has welcomed speakers and panelists who left a lasting impact on the industry. In 2025, for instance, Ronnie Pool from Epicor Software Corporation shared how return automation and efficient local delivery management can transform the auto parts business. Another highlight was the panel “Women on the Move: Transforming the Automotive Industry,” featuring leaders such as Norvy Barreiro (Netpartes), Mónica Ortiz (Checorepuestos), María Zoraida Gallo (Hidráulicas y Repuestos H&R), and Olga Lucía Méndez (Proquimsa), who showcased the power of female leadership in the sector.

The congress also offered technical insights from Francisco José Aristizábal, AERA specialist, who addressed the challenges and opportunities facing workshops and rebuilders in the transition to electric vehicles. Meanwhile, the panel “Driving into the Future”, with representatives from GrupoAuto EuroTaller, Tuulapp, and regional partners, sparked conversations on how information and collaboration enhance competitiveness in the aftermarket.

These contributions are just one example of the high-level content attendees can expect at Santo Domingo 2026: conferences that inspire, connect, and create opportunities for transformation across the entire automotive value chain.

International. Bosch and CARIAD, a software company of the Volkswagen Group, announced a new breakthrough in their Automated Driving Alliance with the joint development of an artificial intelligence (AI) software stack for Level 2 and Level 3 assisted and automated driving functions.

The solution, which is already being tested in vehicle fleets, will be ready for production projects from mid-2026.

The initiative seeks to make smarter and safer systems available to millions of drivers – from volume vehicles to high-end models, capable of imitating the natural behavior of a human driver. The software covers all key cognitive tasks: perception, interpretation, decision-making, and action.

The first versions of this technology are already running in test models such as the ID.Buzz and the Audi Q8. This year, hundreds of additional units equipped with state-of-the-art sensors will be added to the validation fleet operating in Europe, Japan and the United States. These vehicles collect high-quality data that allows the AI stack to be optimized and complex traffic situations to be addressed.

United States. With new vehicle payments already topping $1,000 a month and declining credit scores, Americans are holding on to their vehicles longer.

The average age of the 291 million cars on the road reached 12.8 years in 2025, up from 11.9 years in 2024, according to AAPEX’s new Media Guide.

The report, prepared with data from the 2025 Joint Channel Forecast and the 2025 Auto Care Factbook, confirms that the aftermarket is consolidating itself as a key part of mobility.

software-defined vehicle architecture, while Bosch will make the solution available to other manufacturers worldwide, thus promoting the global adoption of automated driving.

Peter Bosch, CEO of CARIAD, said: “We are demonstrating that the German automotive industry has mastered the key technologies of artificial intelligence and automated driving. With the expertise of our developers and engineers, we secure an integral part of Europe’s digital sovereignty. Our goal at the Alliance is to make the convenience and safety of automated driving systems available to as many people as possible, so they can gain valuable time when they are in their car.”

Scan the code to read more

“The automotive aftermarket is the largest market many Americans have never heard of, and yet we depend on it to keep our vehicles running,” said Mark Bogdansky, vice president of Trade Shows and Community Engagement for the Auto Care Association.

Globally, this sector moves 2.3 trillion dollars, with the United States as the leader. In 2025 alone, the U.S. market is expected to grow 5.3%, reaching $435 billion, equivalent to 1.5% of GDP. In addition, it generates employment for almost 5 million people in the country.

In this context, the AAPEX fair, which takes place every year in Las Vegas together with the SEMA Show, is consolidated as the most important meeting point for the industry. In 2024 it brought together 45,000 participants from 128 countries, more than 2,600 manufacturers and suppliers, and buyers from chains such as AutoZone, O’Reilly, Advance Auto Parts, NAPA and Walmart.

“Given recent business uncertainty, the increasing emphasis on relocating manufacturing operations, and an aging vehicle fleet that requires maintenance and repairs, it is reasonable to expect that finding new suppliers will once again be a top reason to attend AAPEX 2025,” said Liz Goad, Vice President of Events, MEMA Aftermarket Suppliers.

United States. The GSP North America team carried out an intense strategic planning day that lasted three days, with the aim of reviewing initiatives, generating new opportunities and strengthening collaboration for the end of the year.

Beyond the meetings and presentations, the meeting allowed

United States. BendPak announced the launch of the new 10APSRT Short Two-Post Lift, designed to meet the needs of low-ceiling, high-volume shops, such as tire, brake, wheel, and automotive detailing service centers.

With a 10,000-pound capacity, this model joins the 12,000-pound 12AP-SRT introduced earlier this year, expanding on the successful AP-SRT series.

The 10AP-SRT represents an innovative solution for shops that require the productivity of a two-post lift, but without the height and space demanded by traditional full-lift models. Its compact design, with 93.5-inch-tall columns and a maximum lift of 46.25 inches, makes it ideal for operations in continuous-flow service bays and tight spaces.

“Many shops lift vehicles only partially, but are forced to purchase full-height lifts that cost more, take up more space, and are used at half capacity,” said Sean Price, director of product development. “Our 10AP-SRT and 12AP-SRT models are designed precisely to fill that gap: they offer shops cleaner distribution, greater efficiency and an overall safer working environment.”

The new model incorporates BendPak’s patented triple telescopic swing arms, which allow more lifting points to be reached and adjusted to low-profile vehicles. In addition, it features the patented ASARS (Automatic Swing Arm Restraint System), which uses for-

the entire group to gather in the same space, share ideas and work together on the main challenges of the region. “Each conversation reminded us why collaboration is one of our greatest strengths,” the organizing team highlighted.

The meeting also had a very special moment: the celebration of the career of David Young, who after an outstanding career in the company begins a well-deserved retirement. The surprise included a tour of his career, accompanied by photographs, anecdotes and messages of gratitude.

David has been recognized as a benchmark for energy, knowledge and positivity at GSP. “He is the type of person who not only does his job, but makes the road better for everyone around him,” his colleagues highlighted.

With this positive balance, GSP North America reaffirms its commitment to maintain the momentum generated in these three days of joint work to achieve the 2025 goals and continue to consolidate its culture of collaboration.

ged steel components and offers more than 2,000 pounds of holding force, ensuring the safety of the arms during operation.

To optimize performance, the 10AP-SRT is equipped with a high-performance power unit that provides fast lifting speeds, reducing cycle times in workshops. Its flexibility is increased by the possibility of being configured in symmetrical or asymmetrical mode, making it easier to service a wide variety of vehicles.

The 10AP-SRT is certified to the ALI Gold seal, which endorses the highest safety and performance standards in the industry, and comes with the BendPak 5-2-1 warranty: five years for the elevator structure, two years for the hydraulic system, and one year for components, labor, and transportation.

“From sedans to light trucks, the BendPak 10AP-SRT delivers the performance, efficiency and safety that today’s shops demand, without the excess height and cost of a full-height lift,” added Price.

Mexico. The country reached a record of more than 88,000 electric and hybrid vehicles sold between January and August this year, the highest figure recorded for a similar period.

It is projected that 2025 will close with 130,500 units sold, according to the advance of the EvolvX Report, which will be presented by Latam Mobility at its next meeting in the country’s capital.

The study, based on figures from INEGI and international sources, confirms the consolidation of the electrified automotive market in Mexico. Sales of hybrid, plug-in hybrid, and battery-electric vehicles rose from 24,405 units in 2020 to more than 124,000 in 2024, increasing fivefold in just five years.

In the case of battery electric vehicles (BEVs), the growth has been even more remarkable: from just 450 units in 2020 to about 24,300 in 2024, reflecting an accelerated expansion.

“This confirms that Mexican electrification is betting on more charging infrastructure to increasingly encourage electric vehicles,” said Rebeca González, co-founder of Latam Mobility.

The specialized platform projects that by 2030 Mexico could reach two growth scenarios: a conservative one, with an annual increase of 10%, would take the market to more than 210,000 units; while an optimistic scenario, with an annual growth of 20%, would allow it to exceed 324,000 units.

While in Europe and China pure electric vehicles dominate sales, in Mexico the transition is mainly supported by conventional and plug-in hybrids, which are consolidating themselves as the gateway to cleaner mobility.

“At Latam Mobility we seek not only to inform the sector, but also to serve as a basis for designing public policies, strengthening trust and accelerating the energy transition in the country. The future of mobility in Mexico will be electrified and its pace will be boosted with more infrastructure, incentives and the offer of models,” added González.

International. Steering and suspension systems face greater demands on BEVs due to their weight and acceleration. Sidem has developed reinforced solutions to guarantee safety, durability and comfort in this type of car.

Battery electric vehicles (BEVs) place new demands on steering and suspension systems due to their greater weight – due to the battery – and the speed of acceleration compared to internal combustion cars. In response to this challenge, Sidem has developed a reinforced range of components capable of withstanding the extra effort and offering a safer and more comfortable driving experience.

The new components incorporate chrome-plated steel ball joint bolts and a larger diameter in ball joints, axial joints and stabilizer bars, ensuring resistance to the high torque and vibrations of BEVs. Even in some Tesla models, the ball joints designed by Sidem are larger than those of the original equipment, adding extra strength to cope with the greater weight and power.

The company has also optimised the suspension design, taking into account the aerodynamics of BEVs to reduce roll in corners and maintain the vehicle’s efficiency.

More comfort with less noise and vibration

Since BEVs generate less noise than combustion vehicles, it is key to

Scan the code to read more

minimise the vibrations that reach the passenger compartment. To this end, Sidem’s range of silentblocks ensures greater isolation and comfort when driving. In models such as the Audi e-tron, the control arms integrate hydraulic silentblocks that allow even low-intensity vibrations to be absorbed thanks to the flow of the liquid through rubber chambers.

Another development is a steering arm specific to first-generation Tesla models. In this case, the ball joint is integrated directly into the aluminium housing, which increases strength and ensures both installation and safe driving.

With these innovations, Sidem reinforces its leadership in steering and suspension components, offering solutions for both internal combustion vehicles and all types of electric vehicles.

Scan the code to read more

United States. MEMA Aftermarket Suppliers’ Business Technology Council (BTC) announced the finalists for the 2025 Technology Innovation Award.

This recognition rewards companies with the most disruptive developments to drive efficiency and digital transformation in the automotive aftermarket industry.

The winner will be announced during the Aftermarket Technology Conference, which will take place October 5-7 in Springfield, Missouri.

This year’s finalists are:

Epicor Software Corporation:

Catalog Coverage Monitor for Manufacturers

eShipping:

Global Data View with Synapsum Profitability Intelligence

PDM Automotive:

PDM Growth Partner Program

PhaseZero:

Product Content AI Agents

Tromml:

Minecart, an AI-powered sales enablement platform

“The BTC Technology Innovation Award highlights and honors the inventive spirit and contributions of solution and service providers in the automotive aftermarket. This year’s finalists have set a high standard with their innovative proposals,” said Sara Kaderly, director of programming and remanufacturing leader at MEMA Aftermarket Suppliers.

BTC has established itself as the main forum for business technology in the aftermarket, offering a space for networking and exchange of best practices on emerging technologies that help companies reduce costs, optimize processes and open new business opportunities.

For more information about the conference and attendee registration, visit MEMATech.or

First brake caliper made from 100% recycled aluminium sets a benchmark in sustainability

Italy. Brembo presented the innovation that reduces CO₂ emissions by 70% in the life cycle of the component, without compromising design or performance.

After more than five years of research and development, Brembo officially announced the introduction of a 100% recycled aluminium alloy for the production of original brake calipers, a key milestone in the company’s sustainability strategy.

The project, which began in 2020, sought to improve the environmental profile of Brembo’s manufacturing processes. A full assessment of the production cycle made it possible to identify the areas of greatest impact, with aluminium at the heart of the strategy, thanks to its ability to be infinitely recycled without losing quality.

After extensive testing and exploration of globally available alloys, the company found the ideal choice: a material that retains the same mechanical performance and smeltability of conventional aluminium, but with a 70% reduction in CO₂ emissions over its life cycle.

“The use of recycled aluminum in the production of our iconic calipers reflects our ongoing commitment to innovation for sustainability. This solution is designed to meet the highest standards of performance and environmental responsibility,” said Daniele Schillaci, CEO of Brembo. “Brembo’s path is one of continuous improvement and unwavering commitment, and this innovation represents our contribution to building a future where our products are smarter, safer and more sustainable than those of yesterday.”

The switch to the new material required redesigning the product and updating manufacturing processes to ensure its scalability in all Brembo plants globally, while maintaining the quality and performance that distinguish the brand. The company has already started supplying one of its main customers and the transition is progressing in all markets.

Scan the code to read more

Mexico. Friction One strengthened its presence in North America with the opening of a new brake pad and disc production plant in Ciudad Juárez. The facility, acquired from DRiV earlier this year, is part of the company’s strategy to expand its manufacturing capacity in the region.

The new plant will be key in Friction One’s expansion plans. With more than two decades of experience in friction manufacturing under private label, the company assured that the complex will operate with a focus on automation and advanced quality systems, which will improve the speed, consistency and throughput of production.

The center will produce brake pads, brake discs and CV joint (CV) blocks, aimed at both the aftermarket and original equipment manufacturers (OEs). By 2025, an annual capacity of 10 million sets of brake pads, 1.5 million discs and 1 million CV blocks is projected. The goal is to increase the production of pickups to 16 million sets by 2026.

In the transition process, Friction One retained 95% of the plant’s staff, ensuring operational continuity and technical expertise. The workforce, made up of operators, managers, engineers and supply chain specialists, was bolstered with engineering and operations professionals from the company’s global network.

“We are investing heavily in the new North American plant to maximize its potential, and we aim to achieve a 60% increase in unit

production from Juarez by this time next year.”

“The addition of this plant marks just the beginning of our global strategy and broader geographic footprint,” added Yogi Yogesh Coudhary, COO of Friction One.

During the inauguration, attendees toured the facilities and learned first-hand about the technology installed, which includes automatic positive mold presses and fully automated grinding and painting lines.

With these innovations, the Ciudad Juárez plant consolidates itself as a key player in meeting the growing demand for high-quality, copper-free brake pads and components.

United States. NETSOL Technologies announced the signing of a five-year, multi-million dollar contract with one of the leading Japanese automotive financiers in Australia.

The agreement, structured under a monthly recurring revenue model and which will also cover operations in New Zealand, includes the implementation of the flagship Transcend Finance platform, a solution that offers comprehensive lifecycle management, flexible digital tools and compliance functions for automotive finance companies.

NETSOL has maintained a relationship with this client since 2008 and has accompanied them with critical solutions in different regions. This new contract reinforces confidence in the company’s ability to deliver stability, innovation and long-term value.

In addition to standard implementation services, the company will deploy a specialized team on-site to support the financial company’s internal teams, which will ensure continuity in operation and a smooth deployment.

“This agreement marks a milestone in NETSOL’s continued expansion in the Asia-Pacific region, reaffirming the company’s position as a trusted partner to major automakers and their financial arms,” said Najeeb Ghauri, founder and CEO of NETSOL Technologies, Inc.

He added: “This is a historic achievement for NETSOL and a clear validation of our strategic focus on delivering unified, cutting-edge platforms to the world’s most renowned automotive OEMs and financiers. The customer has been a valued partner for many years and we are deeply honored to be chosen again, not only to upgrade their legacy systems, but also to replace competing solutions in different regions.”

Scan the code to read more

Thailand. German lubricant manufacturer LIQUI MOLY has announced the start of engine oil production in Thailand, a strategic step to secure the supply of its markets in Asia and to meet growing demand in the region.

Since its foundation in 1957, all of the company’s engine oils had been labelled “Made in Germany”. Now, for the first time, the brand will offer products with the “Made in Thailand” label, without sacrificing the quality standards that distinguish it.

The new plant will enable LIQUI MOLY to reduce delivery times and reduce the environmental impact of its operations. “Our goal is to meet the existing demand even better. The new production facility allows us to deliver our engine oils faster and in a more environmentally friendly way. This is because long sea transports will no longer be necessary and therefore large amounts of CO₂ can be saved,” explained Roland Braun, Sales Director Asia at LIQUI MOLY.

The production site in Thailand will supply not only the local market, but the whole of Asia, while the representative office in Bangkok will coordinate regional distribution. Even Australia will receive bulk containers from Thailand to avoid the long journeys from Germany.

The movement also responds to global logistical challenges. “Like many other companies, the situation in the Red Sea presents us with great challenges in maintaining our supply chains. The decision to establish local production in Thailand is a consequential step to improve our sourcing in Asia. We are in good company, as we have seen many international companies make the same decision,” said Salvatore Coniglio, CEO of LIQUI MOLY.

The company stressed that customers will continue to find the same quality as always in its products. “’Made in Germany’ is a valued designation of origin and a promise of quality all over the world. It is very important to us that locally produced engine oils are of the same quality as those from our plant in Germany. Because it is that high quality that our customers value and expect from us. We will keep that promise,” said Roland Braun.

LIQUI MOLY explained that the formulas, raw materials and packaging will continue to be supplied by the same trusted partners who support the manufacturing process in Germany, in order to ensure uniformity in standards.

In a first stage, the Thai plant will produce oils for cars, motorcycles and heavy-duty vehicles. The company highlighted the enormous potential of the region, with a constantly growing vehicle fleet and a high number of motorcycles. “Southeast Asia and Asia as a whole are an important market for us. The large number of Asian cars offers us great sales opportunities that we can now better serve with local production. (…) In many Asian countries, motorcycles are not only a diversion, but a means of transportation. In Vietnam and Thailand there are 67.5 million registered motorcycles. By comparison: Germany has fewer than 5 million, and India has 221 million. We will also serve this market with local production,” added Braun.

The company clarified that vehicles from European manufacturers will continue to receive “Made in Germany” oils, while production in Thailand will focus on meeting growing regional demand.

Mexico. Mexico’s transition to electromobility will only be sustainable if it is backed up with robust safety standards for lithium-ion batteries. This was agreed by specialists from government, industry and academia during the forum “Safe Mobility: Safety Standards for Batteries in Electric Vehicles”.

The meeting put on the table the critical risks that accompany these batteries – key in electric vehicles due to their high energy density – including thermal runaway, a self-heating phenomenon that can trigger toxic emissions, fires or explosions. Experts warned that, without clear regulation, technological innovation in electromobility can become a risk for people, goods and the environment.

According to ULSE data, in the United States, 40% of consumers are unaware of the risks of lithium battery overheating, 59% are not familiar with the concept of thermal runaway, and 48% have heard of a related incident in the last year, which shows the lack of preventive culture.

During his speech, Rodolfo Osorio, Head of Electromobility at the Ministry of Economy, stressed that the sector is key to the generation of jobs, the attraction of investments and the sustainability of the country. “The ‘Made in Mexico’ label must be accompanied by international standards that ensure quality and global competitiveness,” Osorio said.

The forum also presented national initiatives, such asthe Olinia

Project, which seeks to produce light and low-cost electric vehicles, backed by the government and with an investment of 25 million pesos in a battery plant whose production will start in May 2027.

“Electrification brought with it unprecedented risks, such as fires, that could only be mitigated by creating safety standards,” said Jeff Marootian, CEO of ULSE. “Today we face a similar situation with the rapid development of lithium batteries and electric vehicles. New technologies bring new risks, and standards not only prevent accidents: they also create the right environment for innovation to thrive.”

For her part, Judy Jeevarajan, Vice President and Executive Director of the UL Research Institutes Electrochemical Safety Research Institute, highlighted that safety depends on multiple factors: “Proper charging protocols, efficient cooling systems, rigorous testing, and designs focused on functionality rather than aesthetics. Even the size of the battery determines the chemical composition that should be used, and every variable can influence its safety.”

Finally, Denice Durrant, Director of Data Science and Engineering at ULSE, emphasized that regulation must accompany, not slow, technological progress. “We don’t want standards to limit innovation; we want them to promote it. UL Standards & Engagement maintains more than 1,700 active standards in areas such as fire safety, renewable energy and electromobility, and more than a century after its founding, these standards continue to evolve to meet new challenges.”

Mexico. The National Auto Parts Industry (INA) reported that the production of auto parts in Mexico reached a value of 58,629 million dollars during the first half of 2025, which reflects stability in the sector despite a complex international economic environment.

According to the INA, 80% of production is concentrated in the north and the Bajío, with states such as Coahuila, Guanajuato, Nuevo León, Chihuahua and Querétaro consolidating themselves as strategic poles.

In terms of the composition of the sector, electrical parts led production with 19.2% of the total, followed by transmissions and clutches (9.9%), fabrics, carpets and automotive seats (9.1%), engine parts (8.1%) and suspension and steering components (6.8%).

The value of exports amounted to 51,007 million dollars in the first six months of the year. Although this figure represents a decrease of 7.68% compared to 2024, the INA stressed that the trend points towards a recovery, driven by the direct correlation with the U.S. automotive industry, where a rebound in demand is anticipated in the second half of the year.

The outlook was less favorable in terms of Foreign Direct Investment (FDI). The sector registered 1,232 million dollars, which means a contraction of 24.6% compared to 2024. The INA explained that this drop is mainly due to the uncertainty generated by the announcements of tariffs in the United States and a volatile business climate that has led to the postponement of new projects.

The main capital flows came from Germany (US$480 million) and the United States (US$446 million), while China’s share remained

reduced by just 1.87% (US$23 million).

The INA reiterated its commitment to strengthening the sector and announced the holding of the XXIII International Congress of the Automotive Industry in Mexico (CIIAM), which will be held on October 1 and 2 at the Hacienda de Los Morales, Mexico City.

Under the slogan “Driving the Future of North America’s Automotive Supply Chain”, the congress will bring together global leaders to discuss technological innovation, electric mobility, sustainability and the strengthening of the regional value chain within the framework of the USMCA. During the event, the 4th edition of the National Automotive Industry Award will also be presented, which will recognize companies that promote competitiveness and the transformation of the sector.

United States. Orbia Fluor & Energy Materials announced a strategic alliance with Technical Chemical Company (TCC) to introduce FREEZE YF, a new automotive refrigerant that is emerging as a direct alternative to the expensive R-1234yf, to the U.S. market.

The product, based onOrbia’s Klea Edge 444A refrigerant, will be marketed under TCC’s renowned Johnsen’s brand. FREEZE YF offers more affordable cost, faster and more efficient cooling, and complies with all current U.S. refrigerant regulations, the companies highlighted.

“We are very excited to partner with Technical Chemical Company to launch R-444A under the renowned Johnsen’s brand. Our goal was to create a more economical and lower-impact refrigerant that cools faster without sacrificing regulatory compliance, offering a benefit to both service shops and consumers,” said Chuck Abbott, global chief marketing officer for Orbia Fluor & Energy Materials.

FREEZE YF features a Global Warming

Potential (GWP) of less than 150, is compatible with all air conditioning systems designed for R-1234yf, requires no modifications, and is EPA approved for professional automotive use. It will be offered in 8 oz. containers.

Larry Easterlin, vice president of sales at TCC, said, “Our customers have been looking for cost-effective alternatives to expensive R-1234yf that do not compromise performance or require modifications. FREEZE YF meets that need.”

With this alliance, Orbia reinforces its expansion strategy in the automotive sector, while TCC leverages its distribution network and presence in workshops to ensure broad access to the new coolant.

Mexico. Japanese investment exceeded 8 billion dollars, with Aguascalientes as the epicenter thanks to the presence of Nissan, which has turned the state into an international benchmark for automotive manufacturing.

During her visit to the entity, Arfiya Eri, Parliamentary Vice Minister of Foreign Affairs of Japan, endorsed the historic alliance between the two countries and highlighted Nissan’s role in local and national economic development.

The Japanese automaker accumulates more than 16 million vehicles produced at its Aguascalientes complex, from where it exports to more than 70 markets in America, Europe and Asia. Its A1 plant is among the fastest in the group, with a capacity of up to 65 units per hour, while the A2 concentrates the production of the Sentra, one of the brand’s flagship models.

Nissan’s operation in the state began in 1982 with the engine plant, to which the A1 plant was added in 1992 and the A2 plant in 2013, the latter with an investment of close to 2,000 million dollars. Today, its facilities are a model of world-class manufacturing.

In 2024, Mexico produced 3.99 million vehicles, with the Sentra among the most manufactured. For the 2025–2026 fiscal year, Nissan anticipates greater integration of operations, increased regional content and new opportunities for local suppliers, strengthening the automotive value chain.

The arrival of more than 8 billion dollars in Japanese capital since 1999 confirms Aguascalientes as the main recipient of these investments in the country. According to state authorities, this flow has promoted technology transfer, talent training and competitiveness in supply. The local government assured that it will continue to strengthen this relationship through the Japan Desk and strategic alliances that strengthen the industrial development of the region.

Spain. Schaeffler Vehicle Lifetime Solutions (VLS) is taking a decisive step into the independent aftermarket by integrating the Vitesco Technologies product range into its portfolio.

The strategy combines Schaeffler’s mechanical expertise with Vitesco’s electronic innovation, expanding the coverage of repair solutions for all types of powertrains : internal combustion, hybrids and electric.

The integration is a strategic step forward that opens up new market segments and accelerates the development of sustainable mobility solutions. Incorporated technologies include high-precision NOx sensors, advanced mechatronic actuators, and control units, key components to comply with emissions regulations and ensure reliable diagnostics.

In addition to reducing CO2 and improving the efficiency of powertrains, these solutions also contribute to lowering operating costs for vehicle operators.

With the increasing complexity of modern transmissions, independent shops face greater challenges in diagnosis and repair. To meet this need, Schaeffler VLS offers specialized training and technical information through its REPXPERT platform, strengthening the aftermarket capability.

Distribution also benefits: thanks to the Schaeffler Vitesco co-branding strategy, parts previously exclusive to the manufacturer network will now be available in OE quality and supported by a well-established supply chain.

“The integration of the Vitesco range is a strategic and significant milestone for Schaeffler VLS,” explains Ramdas Cherupara, Head of Product Development and Management at Schaeffler Vehicle Lifetime Solutions. “Dealers and workshops will benefit from a stable supply chain, high-quality products and comprehensive technical support for all aftermarket-relevant propulsion technologies. In the coming years there will be a further expansion of the range.”

With this move, Schaeffler reinforces its leadership in the transition to mechatronics, software and connectivity, ensuring that the independent aftermarket has access to the same advanced technologies as the official service.

Germany. Continental is prioritizing the use of renewable and recycled materials in its tire production. While in 2024 the proportion of these materials averaged 26%, the manufacturer expects an increase of 2 to 3 percentage points by the end of this year.

In just five years, by 2030, this figure is expected to rise to at least 40%. Among other materials, the focus is on rubber and resins from more sustainable sources. Both are essential for tire quality and performance.

Synthetic rubber from renewable and recycled materials, along with responsibly sourced natural rubber, play a crucial role in more sustainable tire production. This is due, among other things, to the high content of this key input in every tyre: modern high-performance tyres can contain up to 40% rubber by weight. The specific type of rubber used in a tire depends largely on the component and the function it serves.

Continental’s automotive tyres can be made up of up to 100 different raw materials, which in turn are used to manufacture up to 20 customised rubber compounds per product, among others. These include more and more recycled variants of additives and complementary raw materials, as well as circular resins that make the resulting rubber more flexible and improve the overall performance of the tyre.

“We are closing the loop: Continental is stepping up its commitment to the circular economy and charting its path into the future,” says Jorge Almeida, Chief Sustainability Officer at Continental Tires. “Innovative solutions allow us to use more sustainable raw materials, such as synthetic rubber produced from used cooking oil or resins made from certified renewable raw materials that originally come from vegetable oils.”

Rubber is a vital input for global mobility. Vehicles such as cars, trucks, bicycles, and electric bicycles rely on rubber tires to get around, as do motorcycles, forklifts, and harbor cranes. The components of a tire include different types of rubber for different applications. Continental primarily uses two categories of rubber, each with specific technological benefits: natural rubber and synthetic rubber.

Natural rubber – traditional in the manufacture of tyres – is used, for example, in the treads of cars and trucks, where high wear resistance is required. Its special properties include impact resistance and durability, thanks to stress-induced crystallization, a unique characteristic that cannot yet be artificially reproduced.

Synthetic rubber, on the other hand, is incorporated together with natural rubber in the tread of cars due to its better braking performance and rolling resistance. Increasingly, Continental is using synthetic rubber derived from more sustainable sources, such as pyrolysis oil obtained from end-of-life tires or used cooking oil. For this more sustainable synthetic rubber, Continental sources raw materials from suppliers such as Synthos and TotalEnergies Cray Valley, which employ the mass balance approach and are ISCC PLUS certified for sustainability and carbon reduction. The production processes and raw materials used comply with this system.

Circular resins for more sustainable use of materials in tyre production

Continental takes a holistic approach to tire development, which includes ensuring, step by step, that all raw materials come from more sustainable sources. There are specific resins for almost all rubber compounds, which allow you to perfectly balance the elasticity and resistance of the tire.

Scan the code to read more

Germany. With its sights set on Saudi economic dynamism, Messe Frankfurt established its new subsidiary from where it will promote public-private partnerships, new trade fair formats and events aligned with Vision 2030.

This marks a strategic step that is part of its long-term investment plan in the Kingdom’s exhibition market, one of the fastest growing in the region.

The opening of this subsidiary is part of the objectives of Saudi Arabia’s Vision 2030 and seeks to strengthen the company’s regional presence, while promoting the development of the MICE sector (meetings, incentives, congresses and exhibitions) in the Middle East.

The new office will be in charge of organizing platforms adapted to the dynamics of the Saudi market, promoting interaction between industry players and the establishment of strategic alliances with government entities, associations and private companies. This is intended to contribute to the diversification of the country’s economy.

To lead this expansion, Azzan Mohamed (36) was appointed Managing Director of Messe Frankfurt Saudi Arabia. In this role, he will report to Ted Bloom, CEO of Messe Frankfurt Middle East (Dubai), and will be responsible for commercial affairs, the management of the current event portfolio and the development of new sector formats.

“With more than twelve years of experience in the industry, Azzan

possesses deep market knowledge and a proven track record in large-scale exhibition formats throughout the MENA region,” said Wolfgang Marzin, President and CEO of Messe Frankfurt.

Mohamed has an outstanding track record in the trade fair and exhibition industry. He was Group Exposure Director for the Energy portfolio at Informa Markets, and previously led the MENA Health portfolio. He also played a key role in the launch of Intersec Saudi Arabia during his time at Messe Frankfurt Middle East in Dubai.

Academically, he is an electrical engineer with a specialization in Business Administration from the American University of Sharjah, and is fluent in both Arabic and English.

With the creation of this subsidiary, Messe Frankfurt reaffirms its growth strategy in Saudi Arabia, relying on its international network and its experience in the events sector. The local presence will allow the generation of trade fair content that is closer to the needs of the market.

“We are committed to advancing Vision 2030 by creating purposeful, locally relevant platforms that strengthen industries and help diversify the Saudi economy,” said Azzan Mohamed.

Currently, the company’s portfolio in Saudi Arabia includes Beautyworld Saudi Arabia, Automechanika Riyadh and Intersec Saudi Arabia. In addition, in 2026 the launch of Achema Middle East is planned, in conjunction with the Dechema association.

United States. Stellantis took a new step in modernizing its logistics network in North America by confirming an investment of more than $41 million for the construction of a Mopar Parts Distribution Center (PDC) in Forsyth, Georgia.

The 422,000-square-foot facility will be located about 60 miles south of Atlanta and will aim to expedite the delivery of parts to dealers and customers of the Chrysler, Dodge, Jeep®, Ram, Alfa Romeo and FIAT brands in the southeastern United States. In addition, it will generate 90 jobs represented by the UAW union.

Innovation and sustainability in logistics

The new PDC will incorporate a 16,000-square-foot automated AutoStore system , with 66 robots capable of retrieving parts from high-density containers and transporting them to processing stations. This technology will speed up order processing, optimize inventories and reduce the necessary storage space, as well as improve energy efficiency.

“This facility is a key investment in Mopar’s long-term growth strategy and underscores our ability to support the engaged workforce behind our success,” said Darren Bradshaw, Senior Vice President, Mopar North America.

“It provides our UAW-represented employees with the tools, technology and environment needed to provide excellent service to dealers and customers, while reaffirming our commitment to efficiency and sustainability.”

The investment in Georgia is in addition to other recent projects by Stellantis to strengthen its distribution network in the region. In July, the company announced $388 million for a Mopar Megahub in Detroit, the largest in its history, and in January it celebrated the opening of a $64 million distribution center in East Fishkill, New York.

In total, the investments exceed $490 million, solidifying the company’s strategy to transform the service and parts experience throughout North America.

United States. The new alliance strengthens SEMA’s leadership in the automotive aftermarket and its support for the business needs and representation of the off-road industry.

SEMA announced the acquisition of the Off-Road Business Association (ORBA), an entity dedicated to representing companies and professionals in the off-road and powersports industries (motorcycles, ATVs, side-by-side utility vehicles and snowmobiles).

The off-road products and services segment is currently the largest and fastest-growing segment within the automotive aftermarket. With this acquisition, SEMA strengthens its ability to support the off-road and powersports communities, as well as the innovators who market their products to millions of enthusiasts in the United States.

“By acquiring ORBA, SEMA strengthens our joint efforts to preserve motorized access to our nation’s open spaces and ensure po-

licies that sustainably balance land use and conservation. SEMA has sought to have our Truck and Off-Road Alliance (TORA) work more closely with ORBA, in recognition and appreciation for their work and for the people who, with their efforts over decades, gave a voice to companies and enthusiasts in the off-road and powersports communities,” said Mike Spagnola, president and CEO of SEMA.

Fred Wiley, CEO of ORBA, said: “ORBA was created to provide additional resources to support the off-road industry through business knowledge and representation. By joining directly with SEMA, this industry will continue to have a seat at the table on key issues affecting motorized access to public lands, the defense of the right to modify andcompete, among other issues important to the off-road community. SEMA is uniquely positioned to lead future land access protection efforts and to represent the perspectives of off-road businesses and enthusiasts.”

In the same vein, Dawson Druesedow, president of the Truck and Off-Road Alliance (TORA), a board of SEMA, said: “The Truck and Off-Road Alliance (TORA) was created to represent the collective interest of member companies that manufacture, distribute, sell and install accessories for off-road vehicles, light trucks, ATVs, or that provide services to this industry. We are excited to have ORBA’s additional support under the SEMA brand and to expand representation and legal action efforts, not only to protect our community, but also to drive policies that allow our industry to thrive for generations.”

Under the terms of the agreement, SEMA will acquire all of ORBA’s assets. Fred Wiley will remain as SEMA’s senior strategic advisor on off-road and powersports issues.

TrakMotive announced the addition of 101 new CV axle part numbers, expanding its application coverage to more than a dozen major automotive manufacturers.

The new offer includes:

85 OE replacement CV axles

6 CV axes with OE innovations in Monobloc tube

7 intermediate axes

2 CV axle brackets

1 CV Axis for ATV

“All of these new part numbers are in stock and ready to ship,” said Ryan DeVoe, director of product management. “With more than 25 million parts opportunities in North America, this expansion opens up new possibilities for dealers and repair professionals.”

See the full catalog at this link

International. FORVIA HELLA announced the full availability of its innovative SlimLine series. This series sets new standards in terms of functionality, durability and design.

With a full line of advanced LED modules, the SlimLine series is designed to meet the demands of modern vehicles, offering high-performance lighting solutions for a wide variety of applications.

The SlimLine series includes three outstanding LED modules that offer advanced solutions for vehicular lighting:

• Bi-LED headlight: Combines low beam and high beam in a single module, improving visibility and safety.

• LED fog light with turning light: Integration of fog and turning light functions, improving safety during complicated maneuvers or in adverse weather conditions.

• LED Combined Headlight: Multifunctionality in a single module that integrates daytime running light, position light and flashing, optimizing space and reducing installation complexity.

The SlimLine Bi-LED headlight is the first rectangular Bi-LED module from FORVIA HELLA, standing out for its high light output and robustness. With a daylight-like color temperature of 5500 Kelvin, it ensures better night-time visibility and increased safety

for drivers. In addition, its modular system and customizable bezel allows it to be adapted to a wide range of vehicle designs and configurations, from premium cars to heavy machinery.

Highlights:

• High vibration resistance and IP 6K9K rating.

• Customizable bezel for a unique vehicle aesthetic.

• Compatible with electric vehicles and industrial machinery.

The SlimLine fog lamp with turning light innovatively combines two crucial functions in a single module. Its compact and rugged design ensures visibility and improved safety when driving in foggy conditions or during turns. With an operating temperature range from -40°C to +60°C, this module is ideal for a variety of vehicles, including those operating in harsh environments.

Highlights:

• Dual fog light and cornering light functions in a single module.

• High compatibility for the left and right sides of the vehicle.

• Water and dust resistance with IP 5K9K and IP 5K4K protection.

The SlimLine LED combination lamp integrates three essential functions in a single compact module: daytime running light (DRL), position light and flashing light. Its robust construction and low energy consumption ensure long-term reliability, while its versatile design allows it to be installed in a wide range of vehicles, from motorhomes to trucks and heavy machinery.

Main features:

• Three functions in a single module: DRL, position light and turn signal.

• Simple installation options with multiple connectors.

• Resistant to extreme conditions with IP 5K9K rating.

Scan the code to read more