and

and

First, our show AutoAmericas is moving to Santo Domingo in the Dominican Republic. After 3 successful years in Miami we have decided to expand our reach. AutoAmeicas will be March 20-21, 2026 at the Dominican Fiesta Hotel.

Second, as usual we will have a “kickoff” party for our show. We call it Alegria and will be held in conjunction with AAPEX. We again thank WALKER PRODUCTS for being sponsor of Alegria (and also supplying the lanyards at the show).

And speaking of AAPEX we will again be exhibiting.

I want to close with a key topic: tariffs. Ambrose Conroy, founder of Seraph, recently explained how these impact global auto parts purchasing. The Section 301 tariffs on Chinese products have forced companies to rethink their supply chains, with costs often passed on to consumers.

However, this disruption also creates opportunities. The “China plus one” strategy is boosting production in countries like Vietnam, Mexico, and the U.S., while some companies are redesigning parts or exploring the possibility of relocating production. Planning, logistics, and storage are also being strengthened to better manage disruptions.

Although tariffs generate pressure, they also drive innovation and resilience. As Conroy points out: those who adapt will not only survive, but thrive.

GENERAL MANAGEMENT Max Jaramillo / Manuela Jaramillo

EDITOR

Laura Restrepo C. lrestrepo@aftermarketinternational.com

PROJECT MANAGER Andrés Caballero acaballero@aftermarketinternational.com

PUBLISHER Brad Glazer bglazer@aftermarketinternational.com

ACCOUNT MANAGERS

COLOMBIA Fabio Giraldo fgiraldo@aftermarketinternational.com

DATABASE MANAGER Maria Eugenia Rave mrave@aftermarketinternational.com

PRODUCTION MANAGER Fabio Franco ffranco@aftermarketinternational.com

LAYOUT AND DESIGN Jhonnatan Martínez jmartinez@aftermarketinternational.com

FRONT PAGE Latin Press

OFFICE PHONES: Latin Press USA Miami, USA Tel +1 [305] 285 3133

Latin Press México Ciudad de México Tel +52 [55] 4170 8330

Latin Press Colombia Bogotá, Colombia Tel +57 [601] 381 9215

São Paulo, Brasil Tel +55 [11] 3042 2103

Brad Glazer, Publisher Aftermarket International

The opinions expressed by the authors of the articles in this journal do not commit the publishing house.

Printed by Panamericana Formas e Impresos S.A. Acting only as printer.

Printed in Colombia

ISSN 2834-8885

The automotive world is undergoing a transformation that waits for no one. Every year, the number of electric vehicles sold grows at a double-digit rate—and with it, the pressure for the entire supply chain—manufacturers, distributors, workshops, and technicians—to reconfigure the way they work. It is no longer just about adapting to new technologies, but about understanding that the mechanical heart of the automobile is changing completely.

In this new landscape, electric propulsion systems are replacing many of the traditional components of the combustion engine, while at the same time opening up a universe of new parts: high-voltage batteries, electronic controllers, specialized cooling systems, and software that regulates every movement of the vehicle. This means that the auto parts industry must reinvent its catalog, train its workforce, and anticipate the demand of a market that is evolving faster than it seems.

We are not facing a threat, but a historic opportunity. Those who prepare today will not only remain in business tomorrow—they will be protagonists of the mobility of the future. That is precisely the conversation we want to foster at the AutoAméricas 2026 Academic Congress, a space to debate, learn, and envision the future of the industry.

If you have knowledge, research, or success stories about electric mobility, innovation in auto parts, or any key topic for our sector, we invite you to apply as a speaker and take an active role in this exchange of ideas. The future is already underway… and it does not allow for distracted passengers.

Laura Restrepo Editor

Features

6/Repintado Days: brought together automotive refinishing specialists in Medellín

9/Before the color comes the character: the invisible art behind automotive refinishing

Find information, contacts, links to industry associations, free literature from businesses that advertise in the publication, events, and downloadable issue archives dating to 2007 at aftermarketinternational.com

For advertising, contact Brad Glazer at 216 233-6943 bglazer@aftermarketinternational.como

Andrés Caballero al +1 [305] 285 3133 Ext. 94 acaballero@aftermarketinternational.com

13/A twin-tube shock absorber from scratch!

16/Diesel engine Failure analysis theory

18/Five surprising ways your car learns from its environment

and conferences 23/Business News

Medellín was the stage for the first edition of Repintado Days, an event that brought together different players from the automotive sector around training, innovation, and the exchange of experiences.

On June 19, the first edition of Repintado Days was held in Medellín, a specialized gathering that brought together a select group of technicians, workshops, distributors, wholesalers, dealerships, and industry brands at Comfama Ciudad del Río.

During an intensive day of training, networking, and technical demonstrations, attendees had the opportunity to get up to date with the new challenges of the industry and strengthen their technical skills. The response was very positive, with a full house and active participation in all activities.

The agenda, which ran from 10:00 a.m. to 3:00 p.m., included six lectures by renowned experts:

• “Spot Repair in Automotive Painting”, by Yonger Alexander García Giraldo (Atelier Academy Car).

• “Polyester System, Aluminum, and Pearls”, by Paula Bedoya Franco (Gricoat).

• “Beyond Color: Science and Precision in Refinish”, by Marcos Jaramillo (Autotech – Eurotaller).

• “Trends in the Automotive Refinish Market in Colombia vs. Other Regions”, by Walter Rodríguez (ITPA).

• “Localized Repair Techniques with UV-Curing Products”, by Julián A. Restrepo and Ederley Vélez Ortiz.

• “Your Name in Every Layer: Leadership, Personal Branding, and Mastery in Refinish”, by Fred Wilson.

In addition to the lectures, participants visited an interactive trade show where innovative products, specialized tools, and emerging technologies were showcased, fostering direct interaction between suppliers and attendees.

The automotive refinish industry is undergoing a stage of transformation marked by the arrival of new technologies, the shift toward more sustainable products, and the technical demands of more modern vehicles, such as electric cars. In this context, Repintado Days stood out as a close-knit space focused on providing technical updates and useful tools to industry professionals.

Organized by Aftermarket International and Zona de Pinturas, and coordinated by Laura Restrepo and Andrea Ochoa, this first edition in Medellín was part of the official activities of AutoAméricas Show.

By Zona de Pinturas Magazine and Aftermarket International Magazine

Por Revista Zona de Pinturas y Revista Aftermarket International

In automotive refinishing, shine doesn’t begin in the spray booth, but much earlier, in the silent stages that rarely make it into conversations. Sandpapers, discs, and tapes— tools invisible to the untrained eye—determine whether a finish will captivate for years or disappoint in weeks. Behind every flawless color lies a precise preparation process, quality materials, and hands that master the craft down to the millimeter.

Automotive paint—the final layer that captivates with its shine and protects with its composition—is rarely associated with everything that happens before the color touches the bodywork. Yet behind the perfect finish everyone admires lies an invisible, rigorous, and deeply technical science that defines the success or failure of any refinishing job.

In the words of Juan Fernando Velásquez, Export Director at Abracol: “The preparation of a part, to ensure good quality, is to ensure good preparation.” And that preparation begins long before the color comes into play.

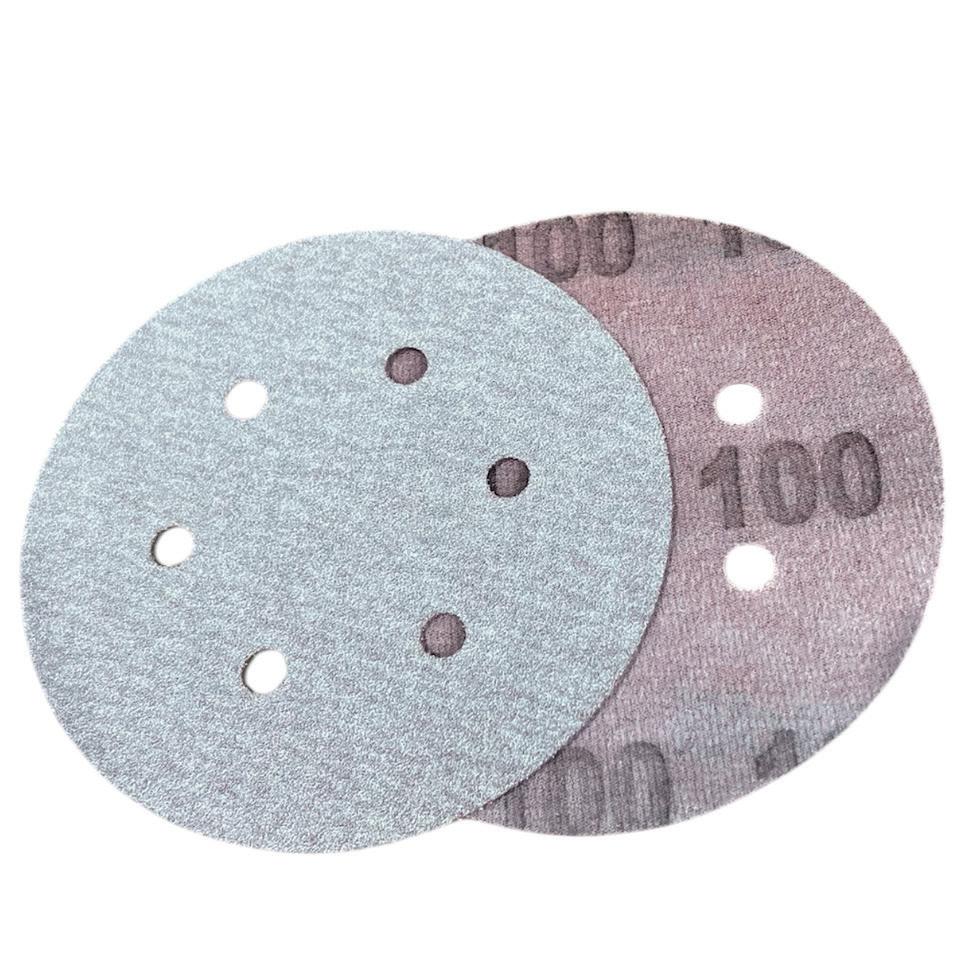

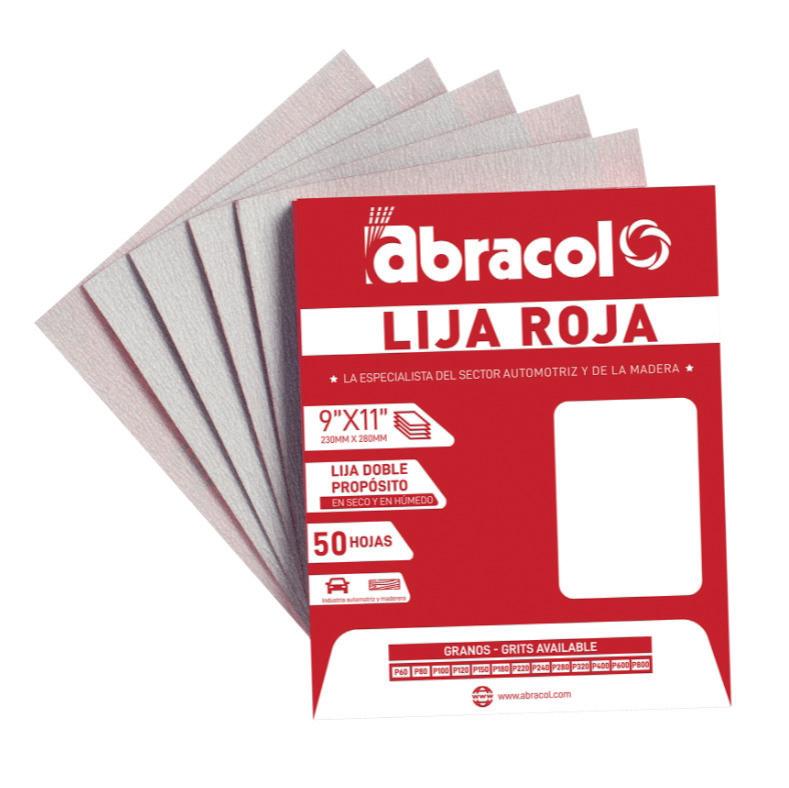

In the world of refinishing, beauty is not enough. Technical precision and professional discipline are the true art. To achieve clean, uniform, and highly adhesive surfaces, the refinisher relies on essential tools such as red sandpaper, Velcro discs, and automotive masking tape. These materials—discreet and often invisible to the untrained eye—make the difference between a part that withstands time and one that requires costly rework.

“What’s the last thing done to a car? What’s the first thing perceived when it’s sold? Paint,” Velásquez suggests with persuasive logic. Everything is absorbed through the eyes, but the final outcome is not based solely on color. It is the result of a series of prior technical stages, carried out meticulously.

Sanding techniques have evolved. Traditional wet sanding with conventional papers has given way to dry sanding, which is cleaner, more efficient, and more controlled. In this process, red sandpaper represents a key advancement: its thermally treated grain provides greater durability and consistent abrasion, while its zinc stearate coating prevents clogging, allowing for a smoother, faster preparation.

“Today they disguise a lot with pearls and those chameleon colors,” Velásquez acknowledges, “but if you don’t follow a perfect sanding sequence with good raw materials... something will go wrong.” Poor preparation not only affects aesthetics—it can cause defects like bubbles, dullness, uneven tones, or even premature paint peeling.

The Velcro disc is another fundamental ally. It enables precision work on both flat and curved surfaces, ensuring uniformity and avoiding vibrations that create imperfections. Its design guarantees a firm fit to the pad, a key condition for maintaining stability during sanding.

“The success of our red sandpaper Velcro at Abracol is that it doesn’t slip; it grips very well. A bad pad creates scratches—imperfections that only show at the end of the process,” says Velásquez. The combination of a good pad and a quality disc ensures a uniform base, crucial for the correct application of primers, color, and final clear coat.

The masking process is as important as any step before painting. Abracol’s automotive tape prevents coatings from invading unwanted areas and allows for defined lines and clean finishes. In workshops without pressurized booths or with limited conditions—a common reality in many regions of Latin America—its role is even more critical.

Poor-quality tape can melt with oven heat or leave residue, ruining the surface. “What a good tape depends on is a good backing and good adhesive, and that it guarantees—by experience and by the company that sells it—that you have a reliable product, that it won’t melt and will give you sharp lines,” assures Velásquez.

For those working in automotive refinishing, every step matters. It’s not just about applying paint or achieving surface shine: quality lies in the foundation, especially in strictly following the sanding sequence.

Many errors stem precisely from skipping or altering this basic process.

“And you don’t make the ‘mil jump’—that is, jumping from 80 to 600—because the 80-grit scratch won’t be removed by 600-grit. You can only jump two grits max: 80, 120, 180, then you apply putty, which you sand with 220 or 240 grit, and then you’ve got a super

fine scratch. So people who are perfectionists run the whole sequence: 80, 120, 180, 240. It takes longer, but the finish… it takes a bit more time, but you get a top finish,” the expert explains.

A poor choice of sandpaper or skipping too many grits can compromise the entire job: leaving visible pores, moisture residues, blistering under sunlight, and ultimately forcing costly rework.

“People think that by jumping from 80 to 220, they saved, what, 2,000 pesos. And how much do you charge for painting a vehicle? 2,000 pesos is nothing. But if you add it all up—sandpaper, tape, masking paper—it accounts for 30%. But then you have to redo the whole refinishing process,” Velásquez warns clearly.

Paint isn’t magic. No matter how advanced refinishing systems may be, there is no technology capable of perfectly replicating the original factory finish. Brands like Sherwin-Williams, Axalta, and Wanda have acknowledged this. That’s why success in the workshop depends on a fundamental triangle: good preparation, quality materials, and skilled human talent.

“Everything depends on the equalizer, the painter, and the detailer. The detailer gives it the shine, but if you have good surface preparation, you don’t need to polish the clear at the end. Polishing with microfiber pads is often to correct mistakes,” says Velásquez. A job well executed from the beginning avoids unnecessary corrections and extends the life of the finish.

The refinishing industry has evolved. The aftermarket sector is increasingly integrating professionalized processes, certified materials, and technical training. Events such as Repintado by Autoamericas or Automechanika highlight this transformation.

“The 2024 event featured 575 exhibitors from 43 countries and received 24,000 visitors from 57 countries,” notes Laura Restrepo, Editor of Aftermarket, emphasizing the importance of these gatherings in connecting an industry that once operated in silos.

Here, manufacturers, distributors, and technicians converge with a common goal: to optimize every link in the process, from sheet metal to clear coat.

The rise of detailing in Latin America has also changed the way both small and large workshops work. In the United States, where the practice is more advanced, technicians use differentiated pads, control speeds, work with specific compounds, and apply millimetric sanding techniques. That expertise is crossing borders.

“I like your sandpaper because it leaves scratches just like 3M’s. And those scratches are removed by polishes. There are very high-quality polishes. He sells Pro’s, manufactured by Dupont in the United States,” recounts Velásquez about a detailer in Guadalajara who now runs his own business.

To this, add the judgment and experience of the technician. “You said something that to me is very true. It’s an art. Preparing a car is an art. There are no schools in the world that teach you to refinish vehicles because cars are different, damages are different, climates are different, labor is different, parts are different. It’s the experience you pick up on the street,” Velásquez states with conviction.

Ultimately, the true art of automotive refinishing doesn’t begin with the spray gun but with the initial evaluation of the part. Proper preparation, with the right materials and executed by expert hands, ensures that the color not only covers but enhances. That it not only shines but endures.

Because in the world of refinishing, before the color comes character.

And that character is built with technique, respect for processes, and detailed knowledge of every millimeter of the surface.

“When you respect the entire process, you get the ideal result.”

By Carlos Panzieri*

Suppose a new twin-tube shock absorber needs to be made from the original body: how do you do it?

Acustomer wants to install shorter and stiffer springs and damp them with a stiffer shock absorber, so we need to make a new shock absorber using only the original body. Let’s see how to do it step by step.

A. Analysis of the Original Shock Absorber:

1. Rod:

a. Measure its diameter, which, for example, will be 22 mm. b. Measure its fully extended and fully compressed length, and therefore its travel.

2. Shock Absorber:

a. Test it on a dyno to verify the original forces.

B. Open the shock absorber on the lathe, remove all its parts, clean them, and set them aside.

C. Measure the internal diameter of the body, which, for example, will be 47.85 mm (although 47.75 or 47.95 mm could also be suitable).

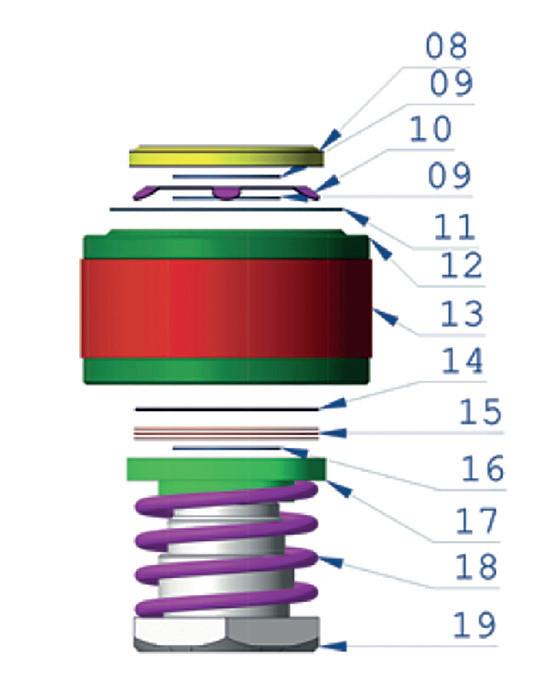

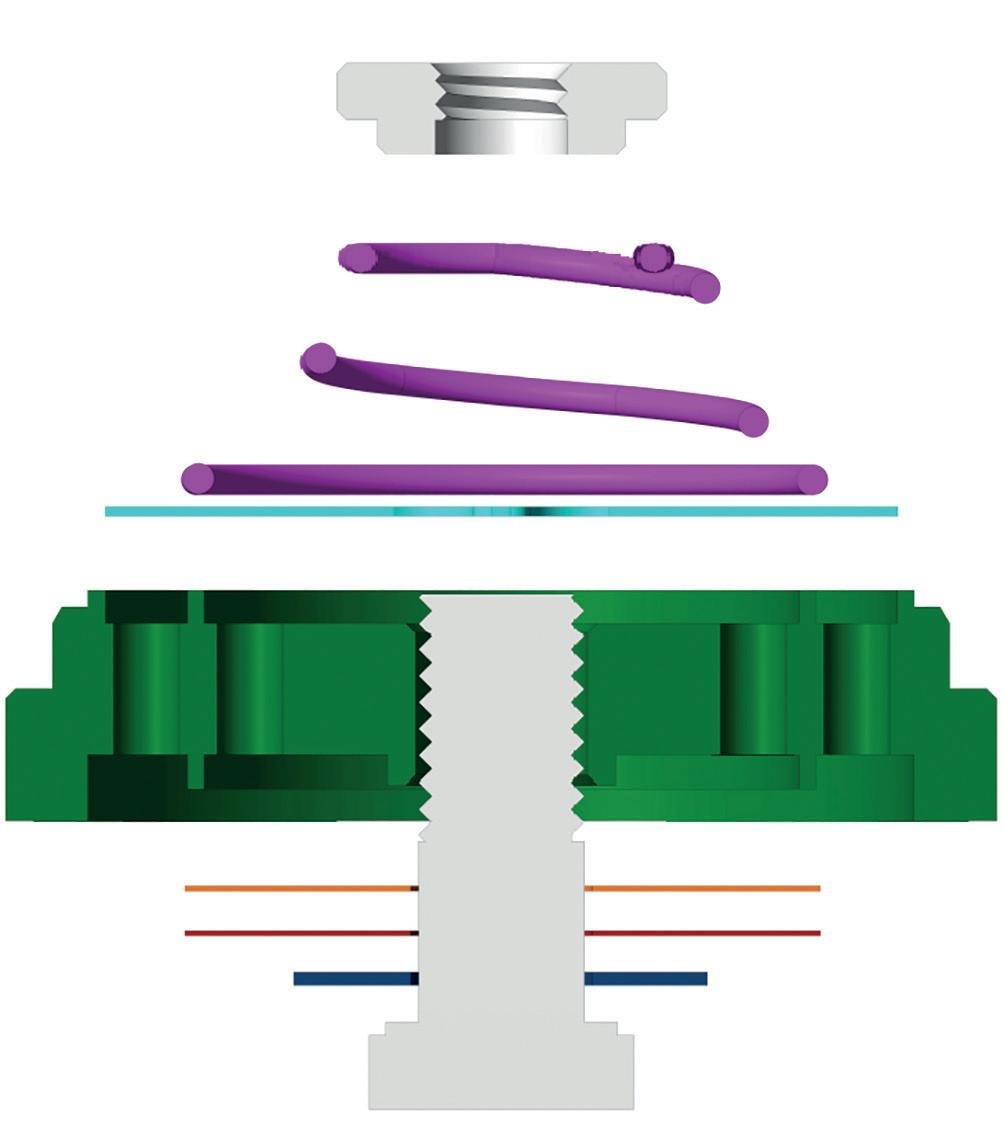

D. Choose a locking and sealing system. To do so, consult the www. Emmetec.com catalogue and select a system like the one shown in images 01 and 02, consisting of:

1. a threaded ring (green) 02-207 with an M47.80x1.00 pitch that closes the shock absorber by pressing on it;

2. a washer (red) 50-081A that distributes the pressure of the threaded ring onto

3. an o-ring (gray) 04-158 (35.00x41.00x3.00 mm), which seals between the washer and the guide;

4. a low-pressure oil seal (orange) 03-360;

5. a guide (pink) 06-228 that houses the oil seal, which fits into a tube for a 32.00 mm piston and includes

6. a bushing (red) 05-161 (22.00x25.00x17.00) with a Teflon surface treatment, the details of which appear in image 02.

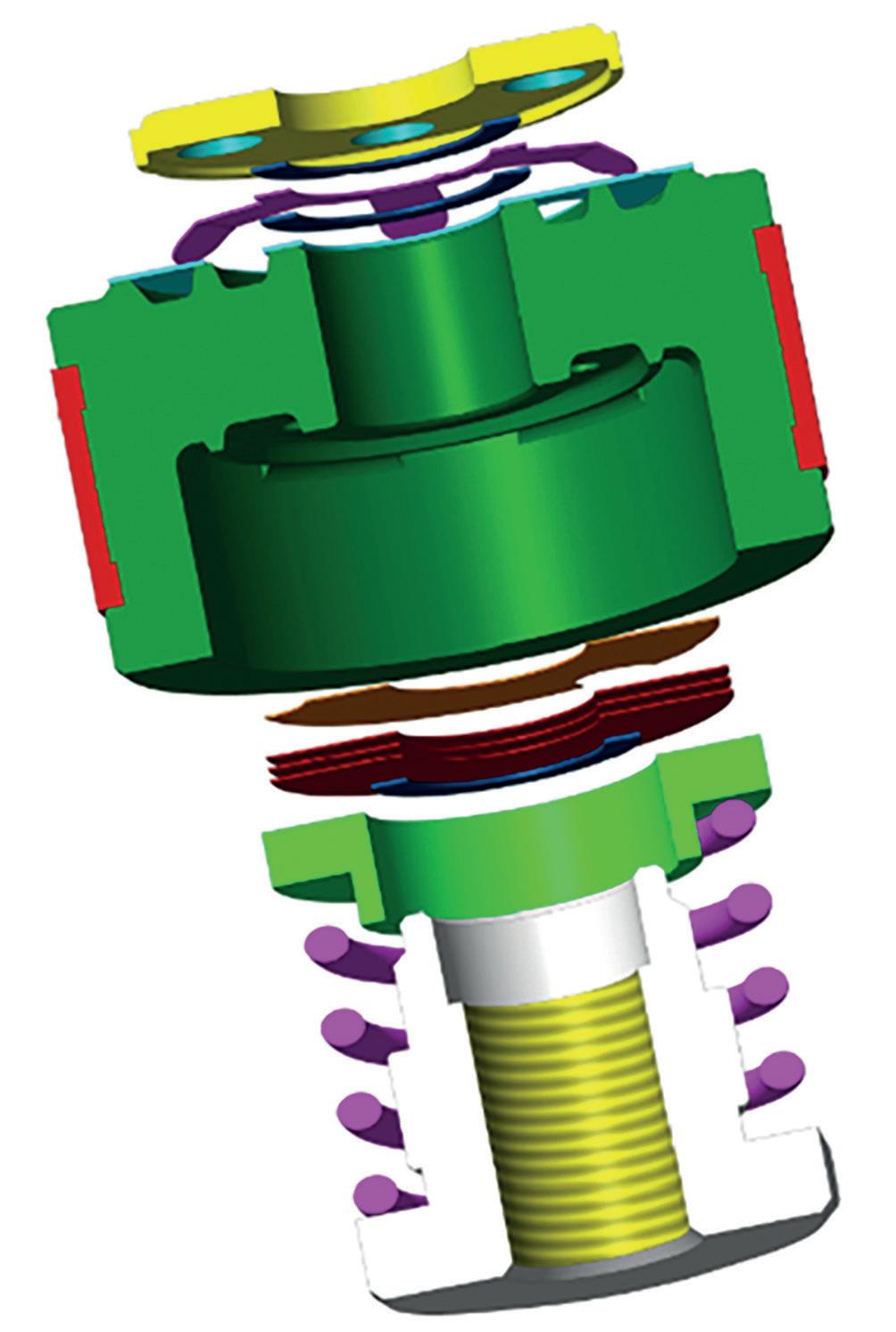

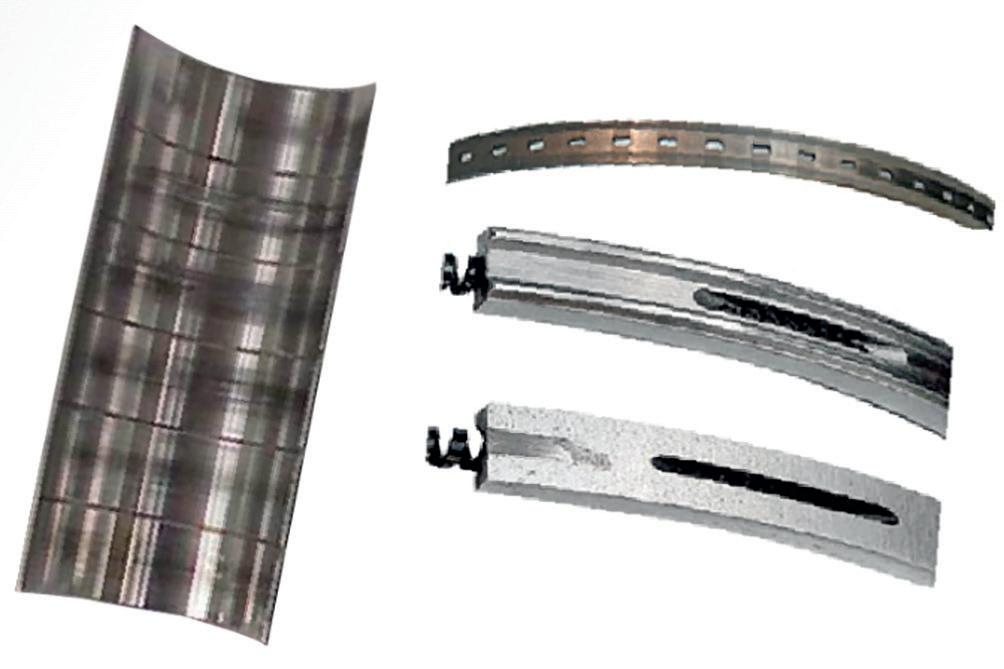

E. Still in the Emmetec catalogue, we find everything necessary to build the piston valve. Among the various systems, we chose the P.E.1.P.32 mm = RIV1 32 mm system shown in images 03 and 04, consisting of:

08. a limiting disc that prevents damage to the underlying components in the event of an extension impact;

09. a washer that leaves a small gap between the limiter (08) and the star-shaped spring (10), allowing the latter to deform under oil pressure;

10. a star-shaped spring that preloads the diaphragm (11);

09. another washer, similar or identical to the previous one, that creates space between the diaphragm (11) and the star-shaped spring (09) to limit its preload;

11. the diaphragm that closes the oil passages during compression, while leaving them open during rebound;

12. the 32 mm piston;

13. its Teflon band;

14. the calibrator, which may have several bypasses and different widths;

15. the discs, which may be one or more;

16. a washer;

17. the rebound preload spring guide;

18. the rebound preload spring;

19. and finally, the locking nut.

F. Still in the Emmetec catalogue, we found everything needed to build a 32 mm bottom valve and chose the V.E.1.32 mm = RIV332 mm shown in image 05, consisting of:

1. a nut (gray);

2. a spiral spring (purple);

3. a diaphragm (light blue);

4. the bottom valve body itself (green);

5. a calibrator (orange);

6. one or more discs (red);

7. a washer (blue);

8. and a screw (gray).

G. We can try using the original 22 mm rod by cutting the machined part from the side of the original piston and modifying it to accommodate the Emmetec piston parts. If this isn’t possible, Emmetec also offers 22 mm diameter rods. It’s important to remember that if you install a spring shorter than the original, you must also shorten the rod length once it’s extended; otherwise, the spring will escape from its housing.

Scan the QR code or click here to view the tutorial.

H. We can try using the original 32 mm inner cylinder as the piston, but if it’s shorter than necessary, we can use Emmetec cylinders.

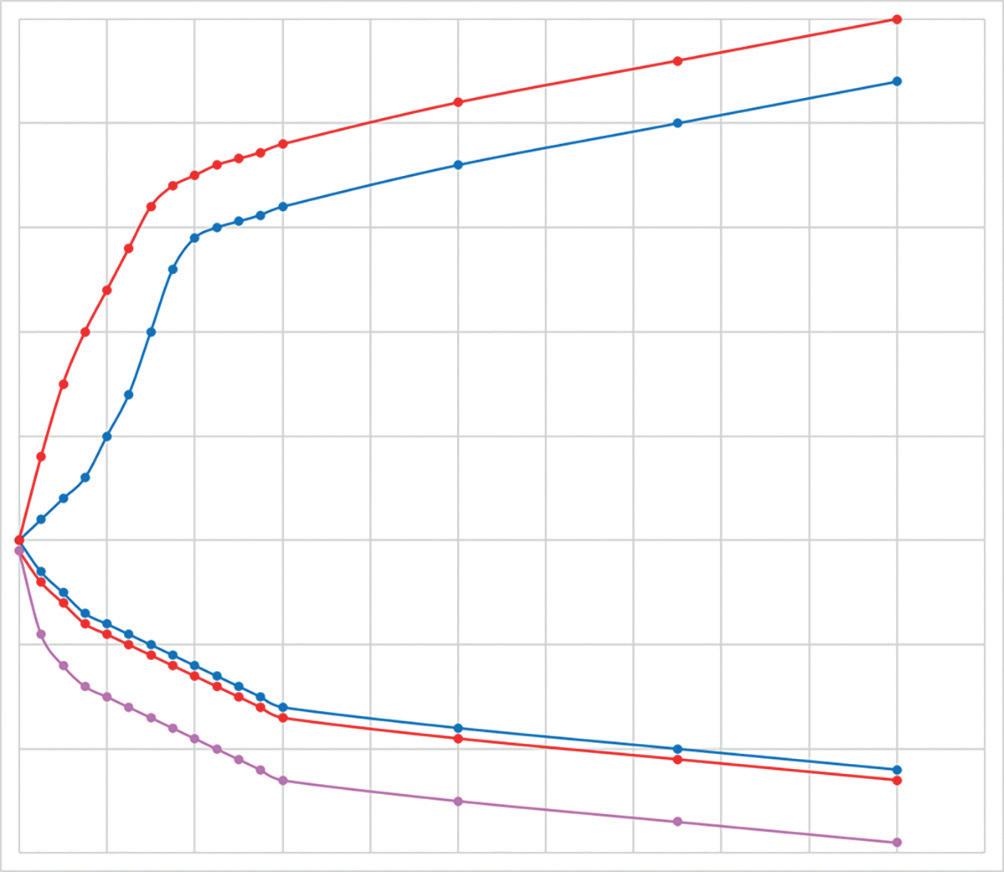

I. Once the shock absorber is assembled, we must test it on the dyno (image 06) and compare the resulting graph (red) with the original (blue). Since the new spring is stiffer than the original:

1. and has less travel, we must make the shock absorber stiffer in rebound than the original, especially at low speeds to prevent roll;

2. we may not need to stiffen the compression damping, but if while driving we notice that the tire sidewall deforms excessively when cornering, we can try to solve the problem by stiffening it at low speeds (pink).

In any case, the final adjustments should be made during road testing:

1. choose a compression limiter that reduces roll while preventing suspension rebound. Generally, it is advisable to allow a wheel travel of 1.5–2.0 cm before the limiter begins to compress;

2. the shock absorber forces must prevent excessively large and rapid rolls that compromise vehicle stability, but without generating vibrations that compromise comfort or tire grip.

Explaining in detail how to build a new shock absorber in just a few pages, without knowing the vehicle, suspension, or tire type, is impossible. However, we’ve at least tried to show you where to start.

For more details or any other questions, our technicians at www. jadausa.com and www.emmetec.com are always at your disposal!

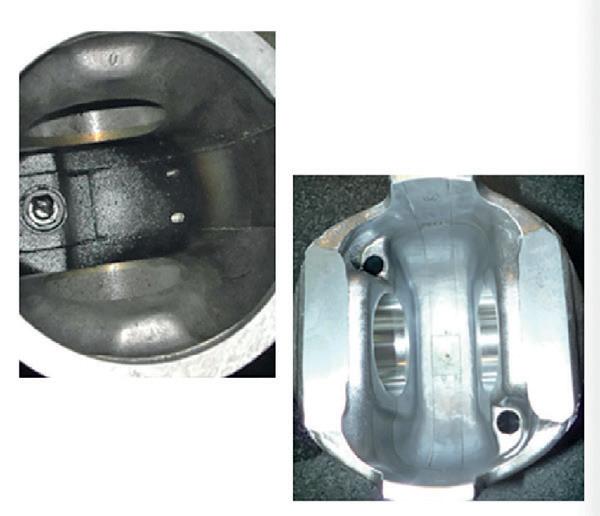

By Francisco Aristizábal

In the world of diesel engines, a failure is rarely the result of chance.

Behind every seized piston, worn bearing, or broken part, there is a set of technical causes that, when analyzed methodically, reveal the true origin of the problem. The theory of failure analysis, when applied rigorously, not only makes proper repair possible, but also helps prevent history from repeating itself.

Failure analysis theory in internal combustion engines occurs in stages and is a detailed process that allows you to identify in a scientific way the root causes of the failures. Engine operation conditions must be considered, the failed parts, and all related info to find and correct the causes for a proper repair.

As a first step, all the history about previous maintenance operations scheduled or not must be analyzed, and all the information included in the last report of the operation parameters before the failure as well; finally, the failed parts, no matter how much are broken or damaged, must be prepared to be checked, rightly tagged and classified.

OEM, aftermarket parts manufacturers, AERA and other technical information must all be considered. The causes of the failures could be roughly classified in four groups according to their origin: Failures due to bad engine operation (55%), lack of maintenance (34%), assembly failures in repair process (10%) and defective spare parts (1%).

This group includes: fast/cold starting, overspeed, excessive idle rating, high operation temperature, low oil level could generate premature wear in parts like piston rings or engine bearings.

Poor maintenance / service with oil change intervals, coolant, fuel, or air systems, could generate common failures like cavitation, retarded/advanced injections, even failures like seized pistons.

Here, failures like cylinder distortion, bad honing techniques, valve guide issues (valve guide sizing process), utilizing wrong specifications / break-in procedures, can cause issues like oil high consumption, and other lube system problems.

Finally, in this group, no matter if they are OEM or aftermarket parts, wrong design supplied/applied parts, dimensional errors or inappropriate materials are included. Issues such as failed pistons due to a wrong selection or application in the oil cooling (marine is different from truck applications design as example) are relatively common. 95% of the time, these kinds of failures can be prevented. To avoid this kind of failure, check before installing the parts.

To identify the failure and their cause(s), the correction stage is necessary. Follow all the procedures and recommendations as per the OEM, service literature and standards, and keep a summary for the records including data and conclusions is the next step.

There are several failure handbooks (including our own AERA Failure Analysis Manual) and some are focused primarily on other

components like pistons or bearings. Overall focus is the key to not having a complete engine failure, most of time it is a combination of causes for the failure to occur.

As always, we mention all this info as it is intended to serve as a general guide. Specific information may vary depending on the equipment manufacturer and application. Always check their literature and any other OEM service material. The AERA tech line is also available to solve questions on these matters.

Francisco Aristizabal AERA Technical Specialist

francisco@aera.org • 815-201-0779

This article was originally published in Engine Professional Magazine and is now republished in Aftermarket International with the author’s permission.

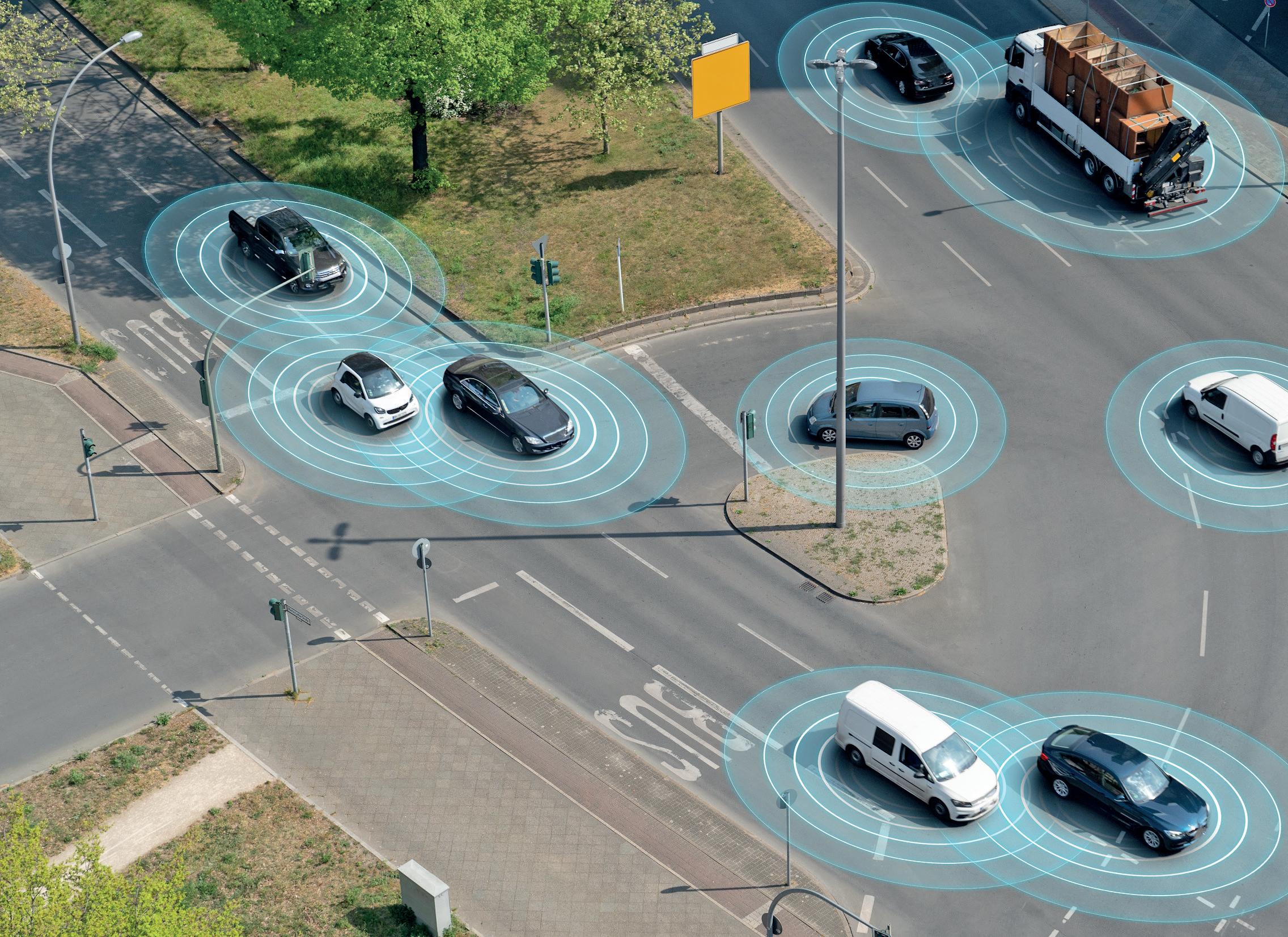

By Eduardo Alexandri*

Today’s cars are much more than transportation: they communicate, anticipate, and learn from their surroundings.

Welcome to the era of the smart vehicle.

General Manager of Sandisk for Latin America.

Today’s cars are beginning to look drastically different from their predecessors. Yes, we still start the engine, press the pedal, turn the steering wheel, and set off—but that’s where the similarities end. With the arrival of autonomous vehicles, the difference is even more pronounced.

Modern cars rely on a wide variety of innovative applications focused on safety, connectivity, and entertainment. From high-definition 3D maps and advanced driver assistance systems (ADAS) to data loggers, enhanced infotainment systems, and over-the-air updates, these applications require massive backend computing power and real-time edge data storage. In-vehicle real-time storage is crucial to mitigate latency and connectivity issues, especially in critical safety applications like rearview cameras.

To function seamlessly, vehicles must observe and adapt to the world around them in real time. From traffic lights to changing wea-

ther, modern automobiles constantly collect and react to incoming information. They’re designed to anticipate, assist, and communicate with other vehicles and with the environment—often without us even noticing. Below are five surprising ways your car is connected to the world around it:

As you drive down a road, your car can interact with road infrastructure, including lane markings, traffic lights, or road signs. The wireless exchange of data between vehicles and infrastructure is possible thanks to Vehicle-to-Infrastructure (V2I) communication systems, which enable real-time decision-making.

Has the traffic light changed? Are you drifting too close to the edge of the road? Knowing this information helps drivers make safe, efficient decisions. For example, if the light is about to turn green, the car may decelerate instead of coming to a complete stop, saving fuel and helping keep traffic flowing smoothly.

Since there are usually multiple cars on the road at once, the ability to interact with each other is vital. Vehicle-to-Vehicle (V2V) communication systems allow cars to constantly monitor and respond to others nearby.

For example, if one car suddenly brakes to avoid a pothole, approaching vehicles can receive a warning to change lanes if needed. V2V technology enables vehicles to wirelessly transmit data about speed, direction, and braking up to ten times per second.

This real-time, in-motion communication can help prevent acci-

dents and lay the foundation for a future where cars drive themselves.

Today’s cars are equipped with smart sensors, cameras, and radars that act as digital eyes and ears, silently scanning everything around them—not just what’s ahead.

From detecting a pedestrian in direct view to identifying potholes or recognizing a vehicle in the driver’s blind spot, this technology acts like an invisible co-pilot. It simplifies lane changes, makes parking easier, and enhances overall driving safety.

Additionally, since this data is shared (anonymously) with manufacturers and urban planners, it can also help improve road systems for everyone.

From dense fog to nearly invisible patches of ice, your car’s built-in sensors can detect subtle changes long before you notice them. Many vehicles can monitor rain, fog, temperature drops, and rising humidity, allowing them to quietly adjust their response to keep you safe.

This might mean automatically activating windshield wipers, preheating the battery on cold days, or adjusting traction control on slippery surfaces. Vehicle networks also allow cars to send quick alerts to others nearby about road hazards.

When your GPS app suggests a faster route or helps you avoid traffic, it’s because thousands (or millions) of cars are sharing real-time movement data.

Your car’s navigation system securely shares real-time updates about traffic jams, accidents, and average highway speeds without compromising personal information. It’s as if your vehicle silently teams up with others online to create smarter, smoother routes for all drivers.

Today’s vehicles are not only electric—they evolve, constantly adapt, and become more connected with every mile. They absorb information from surrounding traffic, weather changes, city rhythms, and every nearby vehicle. Technology, particularly data storage, is a key enabler of these advancements. Companies like Sandisk continuously innovate to provide storage solutions that support the evolution of the smart vehicle.

So next time you’re waiting at a traffic light or driving down a quiet road, remember: your car isn’t just moving—it’s analyzing, predicting, and working in the background to make your journey smarter and safer.

On June 6 in Bogotá, the EuroTaller network —an initiative by Groupauto— presented the 2025 EuroPremium Award for the best workshop in Venezuela and Ecuador to Quality Centro Automotriz, based in Quito.

This award highlights the commitment to quality, innovation, and customer service within the EuroTaller network, which brings together independent workshops under international operating standards. The Quality team, led by Cristian Jaramillo, was recognized for its outstanding management, focus on continuous improvement, and strict compliance with the processes established by the network.

This new recognition adds to the one received last March at the AutoAméricas Show 2025 in Miami, where Quality Centro Automotriz was chosen as Latin America’s Best Workshop at the CALA Awards, consolidating its position as a regional benchmark in automotive repair and maintenance services.

Although its international recognition is mainly linked to its Quito branch, the workshop also operates in Cuenca, Ecuador. With more

than 14 years of experience, Quality has positioned itself as a reliable alternative to authorized services of various brands, thanks to its highly trained technical team that is constantly updating its skills.

During the Expopartes trade fair, EuroTaller also held its traditional EuroTaller Route, a series of visits to partner suppliers and distributors, as well as an informative talk on its operating model and the benefits it provides to independent workshops. These activities strengthened ties among players in the automotive ecosystem and reaffirmed EuroTaller’s commitment to the professionalization of technical services in Latin America.

GroupAuto Central America, Colombia, Ecuador, and Venezuela is part of International Trading Group and operates with the support of Groupauto International. Through its EuroTaller and Top Truck networks, it works in partnership with renowned original equipment auto parts brands such as FEBI, Hengst Filtration, Schaeffler, DENSO, Continental, MANN+HUMMEL, Wolf Lubricants, Exide-Deta Group, SKF Group, ZF Group, and Elring.

By Aftermarket International

From June 4–6, 2025, at Corferias International Business and Exhibition Center in Bogotá, the 28th edition of Expopartes, organized by Asopartes, took place.

This year, the event reached international scale with more than 600 exhibitors — both national and international — from 28 countries, and an impressive attendance of nearly 30,000 professional visitors from across Latin America.

A total of 25,000 m² of exhibition space was set up, featuring brands of spare parts, maintenance, repair, accessories, equipment, and services for combustion vehicles, electric vehicles, heavy-duty trucks, intercity transportation, and last-mile mobility. The sector reports solid figures: in 2024, Colombia imported $3.1 billion in automotive products (+3.79%), and the regional auto parts market reached $14.5 billion, with an annual growth rate projected at 4.8% between 2025 and 2034.

Carlos Andrés Pineda Osorio, president of Asopartes, highlighted that the trade show connected innovation with real demand, strengthening formal commerce and advancing the professionalization

of the mobility ecosystem. In addition, Expopartes projected $250 million in business over the three days.

The 2025 edition stood out for its innovative focus: it featured conferences on sustainability, digital transformation, and new mobility trends, as well as events such as the International Women’s Leadership Forum, the International Meeting of Industry Presidents, and the Xtreme Fest zone, dedicated to responsible automotive customization.

Commemorating the 50th anniversary of Asopartes, the event reaffirmed Bogotá as a strategic hub for the Latin American aftermarket and consolidated the trade show as the region’s most important platform for the industry, combining business, innovation, and professional training.

Mexico. The country consolidates its position as the main supplier of auto parts to the United States, representing 43.48% of its imports in the first half of the year, the largest share recorded in history and above competitors such as Canada, China and Japan.

According to the National Auto Parts Industry (INA), the sector’s monthly production registered an increase of 5.05% in May compared to April, with an estimated value of 10,225 million dollars, driven by the greater demand for vehicles in the U.S. market.

Although in the accumulated January-May there is still a contraction of 8.63% compared to the same period in 2024, the INA estimates that June’s production could exceed the monthly average of 2025, located at 9,689 million dollars, reflecting the resilience of the sector in the face of a volatile global environment.

In the first five months of 2025, Mexican exports of auto parts totaled 42,216 million dollars, while imports were 27,711 million, which generated a trade surplus of 14,505 million dollars. 87% of these exports were destined for the U.S. and 3.5% for Canada.

Between January and May, the main production segments were: electrical parts (19% of the total, with 9,300 million dollars), transmissions and clutches (4,818 million dollars), fabrics, carpets and seats (4,372 million dollars), engine parts (3,933 million dollars) and suspension and steering systems (3,298 million dollars).

Production was concentrated in Coahuila (15%), Guanajuato (13.7%), Nuevo León (13.3%), Chihuahua (8.7%) and Querétaro (7.8%). Regionally, the north of the country contributed 44.1%, the Bajío 35.9% and the central zone 15.1%.

United States. BendPak announced the launch of the new 10APSRT Short Two-Post Lift, designed to meet the needs of low-ceiling, high-volume shops, such as tire, brake, wheel, and automotive detailing service centers.

With a 10,000-pound capacity, this model joins the 12,000-pound 12AP-SRT introduced earlier this year, expanding on the successful AP-SRT series.

The 10AP-SRT represents an innovative solution for shops that require the productivity of a two-post lift, but without the height and space demanded by traditional full-lift models. Its compact design, with 93.5-inch-tall columns and a maximum lift of 46.25 inches, makes it ideal for operations in continuous-flow service bays and tight spaces.

“Many shops lift vehicles only partially, but are forced to purchase full-height lifts that cost more, take up more space, and are used at half capacity,” said Sean Price, director of product development. “Our 10AP-SRT and 12AP-SRT models are designed precisely to fill that gap: they offer shops cleaner distribution, greater efficiency and an overall safer working environment.”

The new model incorporates BendPak’s patented triple telescopic swing arms, which allow more lifting points to be reached and adjusted to low-profile vehicles. In addition, it features the patented ASARS (Automatic Swing Arm Restraint System), which uses forged steel components and offers more than 2,000 pounds of holding force, ensuring the safety of the arms during operation.

To optimize performance, the 10AP-SRT is equipped with a high-performance power unit that provides fast lifting speeds, reducing cycle times in workshops. Its flexibility is increased by the possibility of being configured in symmetrical or asymmetrical mode, making it easier to service a wide variety of vehicles.

Scan the code to read more

The 10AP-SRT is certified to the ALI Gold seal, which endorses the highest safety and performance standards in the industry, and comes with the BendPak 5-2-1 warranty: five years for the elevator structure, two years for the hydraulic system, and one year for components, labor, and transportation.

“From sedans to light trucks, the BendPak 10AP-SRT delivers the performance, efficiency and safety that today’s shops demand, without the excess height and cost of a full-height lift,” added Price.

United States. The Specialty Equipment Market Association (SEMA) presented its most recent 2025 Market Report, in which it reveals important consumer trends that are shaping the automotive aftermarket and accessories industry, as well as the automotive sector in general.

The analysis points to a sustained, albeit more subdued, growth environment, with clear opportunities for manufacturers, distributors, and specialty market enthusiasts.

During 2024, consumers in the United States spent more than 52,650 million dollars on vehicle customization and modification.

The report, available to media upon request, provides a detailed breakdown by vehicle type and product category.

Market insights: between enthusiasm and moderation After the boom experienced during the pandemic, SEMA anticipates a return to more stable annual growth rates, between 4% and 5%. Factors such as the aging of the vehicle fleet — which reached an average age of 8 years, according to S&P Global Mobility — and rising new car prices are driving owners to invest in upgrades, repairs and customization.

Sales remained stable or slightly higher in most product categories during 2024. The suspension, exhaust and engine control lines stood out, with growth of more than 2%, a trend that has been dragging on since 2021. By contrast, mobile electronics, such as GPS navigation and sound systems, fell due to the increasing inclusion of integrated technology in new vehicles.

In terms of vehicle type, pickups continue to dominate the market, while crossovers (CUVs) are consolidated as the fastest growing segment. In contrast, sedans, coupes and some sports cars continue to decline.

In addition, the consolidation of the hybrid shopping model – online and in-store – reflects a definitive change in aftermarket consumption habits.

Germany. Continental Tires took a new step in its global sustainability strategy by achieving ISCC PLUS certification at all of its European new tire manufacturing plants. This recognition, which is international in scope, endorses the company’s compliance with the documented use of renewable and recycled raw materials, as well as the complete traceability of these materials throughout its value chain.

With this new accreditation, the plants in Lousado (Portugal), Puchov (Slovakia), Korbach (Germany) and Sarreguemines (France) are now part of the group of certified sites, in addition to the facilities in Otrokovice (Czech Republic) and Timișoara (Romania). The textile plant Industria Textil do Ave (ITA), located in Lousado, which supplies technical textiles and reinforcement materials for the production of tires in Europe, also received the certification.

The progress is not limited to the European continent. The tire plant in Hefei (China) was also recently certified, marking the beginning of a global expansion of the ISCC PLUS model within the group.

“The ISCC PLUS certification of all our tire plants in Europe is an important milestone and a clear signal towards a more sustainable industry in Europe,” said Jorge Almeida, Head of Sustainability at Continental Tires.

“But we won’t stop there. Our plants in other regions will follow

Scan the code to read more

this path step by step, as our plant in Hefei, which is already certified, has already done. We have a strong ambition to make our tyre production more sustainable globally throughout our entire supply chain.”

This year, Continental is looking to significantly increase the use of materials certified under mass balance, such as synthetic rubbers made from bio-based or circular raw materials, and carbon black partially obtained from recycled oils. The company’s goal is that, by 2030, at least 40% of the materials in its tires will come from renewable or recycled sources.

Scan the code to read more

United States. VIPAR Heavy Duty announced that Jim Pennig, current Vice President of Business Development, officially retired on June 30, 2025, following an outstanding track record of nearly two decades at the helm of the organization’s growth strategy.

During his time with the company, Pennig was instrumental in the expansion of the VIPAR Heavy Duty and Power Heavy Duty networks, led market entry in Mexico and Latin America, and laid the groundwork for the national accounts program. His legacy also includes widespread recognition and respect within the heavy-duty vehicle aftermarket industry, thanks to his collaborative approach, work ethic and strategic leadership.

“Jim’s contributions to our organization and the industry are immeasurable,” said Chris Baer, President and CEO, VIPAR Heavy Duty. “His leadership, strategic insight, and unwavering dedication have helped shape who we are today. We are incredibly grateful for his service and wish him all the best in his well-earned retirement”.

The company also reported that Joe Meyer will assume the role of vice president of business development. Meyer joined the company in 2018 as a program manager and has 35 years of sales and business development experience in the heavy-duty vehicle market. The transition has been prepared jointly by Pennig and Meyer to ensure continuity in operations and relationships with distributors and suppliers.

VIPAR Heavy Duty expressed its appreciation to Jim Pennig for his leadership and the lasting impact he leaves on the organization and the industry.

United States. MEMA Original Equipment Suppliers announced new details about its Digital Transformation in Mobility event, which will be held on July 29 at the MEMA OE Suppliers Conference Center, located in Southfield, Michigan.

This meeting, which will take place in a half-day format, will focus on how digitalization is transforming operations throughout the automotive supply chain. The program is especially aimed at engineering leaders, plant managers, operations executives, as well as marketing and finance managers.

Highlights include:

A hands-on session on how to get started using digital tools to improve visibility and operational efficiency.

A panel of original equipment manufacturer (OEM) and supplier leaders focused on the evaluation and adoption of advanced manufacturing technologies.

Specialized guidance on cybersecurity risk management during digital transformation processes.

In addition, executives from key companies in the sector such as Lear, Ford, Plante Moran and Cooper Standard were confirmed.

The event seeks to provide a comprehensive vision so that supplier companies can implement digital solutions from the production floor to the administrative areas, maintaining operational security and leveraging dynamic platforms for growth.

For more information on the agenda and registration, you can visit the official website of the event.

Mexico. With the aim of strengthening supply to the country’s main automotive manufacturers, the company Advanced Composites Mexico, a subsidiary of the Japanese group Mitsui Chemicals, inaugurated its new logistics center in Aguascalientes, backed by an investment of more than 14.7 million dollars.

This expansion consolidates the company’s operational capacity and responds to the growing demand for specialized composites for the automotive industry.

With this new infrastructure, the firm seeks to optimize delivery times, increase efficiency in distribution and strengthen its response capacity to companies such as Nissan, Honda, General Motors, Toyota, Volkswagen and Ford, which depend on high-performance TPO and polypropylene compounds for their manufacturing processes. The investment was announced during the recent tour of the governor of Aguascalientes, Tere Jiménez, to Japan.

Mitsui Chemicals reinforces its commitment to Mexico

With more than three decades of presence in Aguascalientes, Advanced Composites Mexico reaffirms its long-term strategy in the country. The expansion is part of a comprehensive plan to streng-

then its supply network in North America and take advantage of the Bajío’s strategic position within the automotive sector.

The new logistics center not only increases installed capacity, but also boosts regional competitiveness by incorporating higher standards in quality, logistics, and sustainability.

In addition to its contribution to the automotive value chain, the project will generate direct jobs and strengthen the logistics ecosystem of Aguascalientes. The company highlighted its intention to integrate sustainable technologies into the handling of materials and the operation of the center, as part of its global commitments in environmental matters.

Executives of Advanced Composites stressed the importance of having a solid business environment, specialized labor and efficient connectivity, factors that were key to make this investment in the state.

International. A significant advance in the circular economy has come to the automotive industry: Fiat has launched the new Grande Panda model, the first to use recycled material from Tetra Pak post-consumer packaging in visible components inside.

Each unit of the Grande Panda integrates recycled material equivalent to 140 beverage containers, whose thin layers of polyethylene and polyaluminum are transformed into parts such as the center console, dashboard and interior door panels. This development positions Fiat as a pioneer in the use of this type of waste in applications of high aesthetic value.

The key material is a compound called Lapolen Ecotek, produced by Lapo Compound, made from polyaluminium, a mixture of polymers and aluminium recovered from Tetra Pak packaging recycling. The collaboration between Fiat and Lapo Compound made it possible not only to meet the demanding technical standards of the automotive sector, but also to achieve a glossy finish with a specific blue tone, allowing it to be used in visible areas of the vehicle.

“We believe in creating products that not only meet strict quality standards, but also contribute to a circular economy,” said Giuseppe Crisci, CEO of Lapo Compound.

This effort also reinforces Fiat’s sustainability strategy under the “less is more” approach, which is committed to eliminating unnecessary parts and reducing polluting materials such as chrome and leather.

“The incorporation of recycled material from beverage containers aligns with Fiat’s mission to produce more sustainable and affordable vehicles,” said Mónica Montes.

Scan the code to read more

United States. VIPAR Heavy Duty announced the appointment of Joe Meyer as the new Vice President of Business Development. With more than 35 years of experience in the heavy-duty aftermarket, Meyer has been a key figure within the organization since 2018, when he assumed the role of Program Manager.

During his career at VIPAR, he has led strategic relationships with suppliers and designed high-impact programs for the companies that make up the VIPAR Heavy Duty family. His strategic approach and ability to align supplier capabilities with distributor needs have been instrumental in the success of several of the company’s most important projects.

“Joe is an excellent program manager who has built strong relationships across the industry,” said Larry Griffin, Vice President of Program Management. “He knows how to skillfully align supplier strengths with customer requirements, resolves challenges fairly and professionally, and represents VIPAR with integrity. While he will be missed in Program Management, I am confident he will excel as Vice President of Business Development.”

Meyer has extensive sales and business management experience at companies in the sector such as Bendix Commercial Vehicle Systems, Grote Industries, Borg Warner Automotive and Chicago Rawhide (now SKF). This experience, coupled with his in-depth knowledge of the supplier-distributor ecosystem, prepares him to lead VIPAR’s growth initiatives and strategic partnerships throughout the Americas.

Mexico. The German company projects sustained growth towards 2030 and strengthens its presence in the country with a new investment of 100 million dollars.

Bosch Mexico commemorates 70 years of operations in the country, consolidating itself as a key player in technology, manufacturing and services for industries such as automotive, electronics and consumer goods. With a cumulative investment of more than 20,000 million pesos, the company reported net sales of 76,469 million pesos in 2024, which represented a growth of 2.9% compared to the previous year.

Currently, Bosch has a workforce of 20,000 employees, distributed in 16 locations covering the four business sectors of the company. Among them, 11 manufacturing plants and engineering centers stand out, such as the one in Guadalajara, where more than 1,000 engineers develop software solutions.

“Bosch stayed afloat in a year of market variations and external pressures at a global level. We foresee 2025 as a challenging year as well,

“Joe has dedicated his entire career to sales and strategy. He is a planner, a thoughtful leader, and someone who doesn’t cut corners,” said Chris Baer, president and CEO of VIPAR Heavy Duty. “He has worked closely with each of our department leaders, knows our business inside out, and understands the pressures facing both our distributors and suppliers. Having someone with their knowledge, vision and interpersonal skills on our management team is a real plus.”

Based in his St. Louis, Missouri, office and with an academic background at Southwest Missouri State University, Meyer takes on this new challenge with enthusiasm.

“I feel truly fortunate with this opportunity and look forward to working alongside my team, distributors and suppliers to grow the business together as VIPAR Heavy Duty moves forward. The industry continues to change and evolve, and I am ready to take on the challenges that this will bring,” Meyer concluded.

but we are prepared to capitalize on the opportunities and maintain our excellence. Mexico is key to our global strategy, thanks to its ability to develop talent, technology and solutions that impact the future of our industry,” said Alexander Firsching, president of Bosch Mexico. “Our priority is to continue to drive innovation while strengthening our local operations.”

Bosch’s history in Mexico began in 1955 and has been marked by milestones such as the opening of its first automotive plant in Toluca, in 1966. Since then, the company has developed innovative products such as motors for window lifters, compact alternators and windshield wiper systems.

Scan the code to read more

Canada. Mevotech announced the release of 84 new exclusive parts found in no other aftermarket source. The expansion includes components from the TTX, Supreme and Original Grade lines, specifically designed to improve performance, ease of installation and extend the life of vehicles.

With this update, the Canadian company expands the coverage of its products to more than 98 million vehicles in North America, consolidating its commitment to innovative solutions for the aftermarket.

Among the novelties, the incorporation of 12 new references to its TTX wheel hub assembly line stands out, including a unique application in the market, designed to withstand extreme working conditions. Each part has been developed based on real workshop challenges, with the aim of optimizing repair times and providing greater durability.

“We always design with the coach in mind; it’s the foundation of our engineering and design process,” said Richard Stothers, senior vice president of Engineering and Research at Mevotech. “These new parts represent intelligent solutions that raise the quality of service in the workshop and offer a real competitive advantage.”

Featured releases:

• TTX™ – High Performance in Demanding Conditions

• TXF50330 (Wheel Hub) – Chevrolet Silverado 3500 HD / GMC Sierra 3500 HD (2025–2020)

• TXMS25681/82 (External Steering Terminal) – Jeep Grand Cherokee L / Grand Cherokee (2025–2021)

• TXMS408142 (Stabilizer Link) – Ford Bronco (2025–2021)

• Supreme – Durability, Precision and Anti-Corrosion Protection

• CMS251301/02 (Control Arms) – Jeep Grand Cherokee L / Grand Cherokee (2025–2021)

• MS40562 (Ball Joint) – Ford F-150 / F-150 Lightning (2025–2022)

With this announcement, Mevotech continues to consolidate its leadership in the sector, supporting distributors in the expansion of their catalogs and technicians with components that make a difference in the workshop.

United States. The company announced the launch of a revamped and significantly expanded Affiliate Accessories Program for dealers in the United States.

The initiative includes more than 1,000 aftermarket products, selected from trusted and popular brands, targeting users of Chrysler, Dodge, Jeep and Ram vehicles. All accessories can be purchased online through the Mopar online store or directly from participating dealers, either at the time of purchase of the vehicle or later.

“We are partnering with our most trusted and popular suppliers to enhance the convenience and variety of accessory options for customers and dealers, providing a one-stop shopping experience,” said Darren Bradshaw, senior vice president of Mopar North America.

“By providing easy access to the largest and best selection of accessories available for modifications and customization, we work strategically to grow our business, enhance the dealership experience and continue to add accessory partners who share our passion for quality and customer satisfaction.”

The new accessories cover a wide range of lifestyles and uses, from performance upgrades to camping solutions, racks, tools, lighting, audio, security and much more. All have been reviewed by Mopar experts to ensure compatibility and proper fit, and are individually supported by each provider.

Matt Godfrey, general manager of sales at Golling Chrysler, Dodge, Jeep and Ram in Bloomfield Hills, Michigan, has seen remarkable results with the expanded program:

“The Mopar Affiliate Accessories Program enhances the customer experience by providing easy access to the most popular accessories shoppers are looking for,” said Godfrey. “We’ve seen a clear increase in customizations through the program, and at the end of the day, both our dealership and our customers are a winner with this allin-one option.”

Currently, more than 40 suppliers participate in the program, including brands such as THULE, AEV, Baja Designs, WeatherTech, Bilstein, MB Quart, Leitner, Curt and many more. Items can be delivered to the selling dealership for pickup or installation, further simplifying the customer experience.

United States. BendPak introduced its new HD-9EWT four-post lift, specifically designed to serve the needs of large vehicles such as pickup trucks, SUVs, sports cars and off-road vehicles.

With a wider structure, higher lifting height and reinforced components, this new solution expands the capabilities of both professional workshops and residential users.

The HD-9EWT offers a maximum lift height of 87 inches (2.21 meters), providing greater access to the underside of the vehicle. Its wider design allows for comfortable handling of units with large tires, wide fenders and extended mirrors, without risk of damage.

“The expanded dimensions of the new HD-9EWT offer added peace of mind when maneuvering large vehicles,” said Jeff Kritzer, president and CEO of BendPak. “This new design is focused on operator safety and comfort. Its additional width prevents damage to doors and mirrors, while its higher elevation allows it to work with taller vehicles and is also comfortable for taller technicians.”

The lift features multiple locking posi-

United States. Original equipment manufacturers (OEMs)’ hybrid product portfolio will exceed 26.3 million units globally by 2030, with a compound annual growth rate (CAGR) of 10.0%, according to projections by analyst firm MarketsandMarkets.

The study notes that the adoption of hybrid vehicles – including HEV and PHEV models – will be driven mainly by strict emission reduction targets in Europe, such as those set by the EU7 regulation. These regulations are putting pressure on manufacturers to offer cleaner and more efficient solutions, and positioning hybrids as a key option in the transition between internal combustion engines (ICEs) and battery electric vehicles (BEVs).

The analysis highlights that SUVs will account for the largest share of hybrid sales by 2030. Its popularity is attributed to the combination of extended range, cargo space and advanced comfort and safety features. Currently, this type of vehicle already represents more than 50% of global sales, a trend that is replicated in the hybrid market.

Among the various types of hybrid drive, plug-in hybrid electric vehicles (PHEVs) will register the highest growth, with a CAGR of 14.4% until 2030. These models offer the best of both worlds: electric operation for short journeys and combustion engine for long distances, making them attractive to a wide range of users. Howe-

tions, a fast-operating electro-hydraulic system, and accessible controls. Its construction includes reinforced pulleys, hidden stainless steel cables, self-lubricating rollers and an internal design that reduces visual clutter.

In addition, for shops that do not have a compressed air system, BendPak offers the GoAir Mini, a compact 110V compressor that can be integrated directly into the lift to operate the pneumatic locks.

The HD-9EWT has been third-party tested and certified by the Automotive Lift Institute (ALI), meeting the highest safety and performance standards in the industry.

ver, it is anticipated that their prominence will diminish beyond that date, as BEVs gain more acceptance.

Europe: the epicentre of hybrid mobility

Europe will consolidate itself as the main market for hybrids. The European Union’s environmental goals, which include a 55% reduction in CO₂ emissions from new vehicles, are accelerating demand for options such as HEVs and PHEVs. The operational efficiency of hybrids, together with technologies such as the start-stop system and optimized engines, positions them as a viable solution to meet these objectives.

Among the main OEMs key in the development of hybrid solutions are: Toyota, BYD, Renault-Nissan-Mitsubishi, Hyundai, Honda, Volkswagen, BMW, Ford, and Mercedes-Benz.

In addition to detailing projections, the study identifies the main factors driving the market—such as environmental regulations— as well as constraints (high cost vs. ICEs) and opportunities (battery advancements)

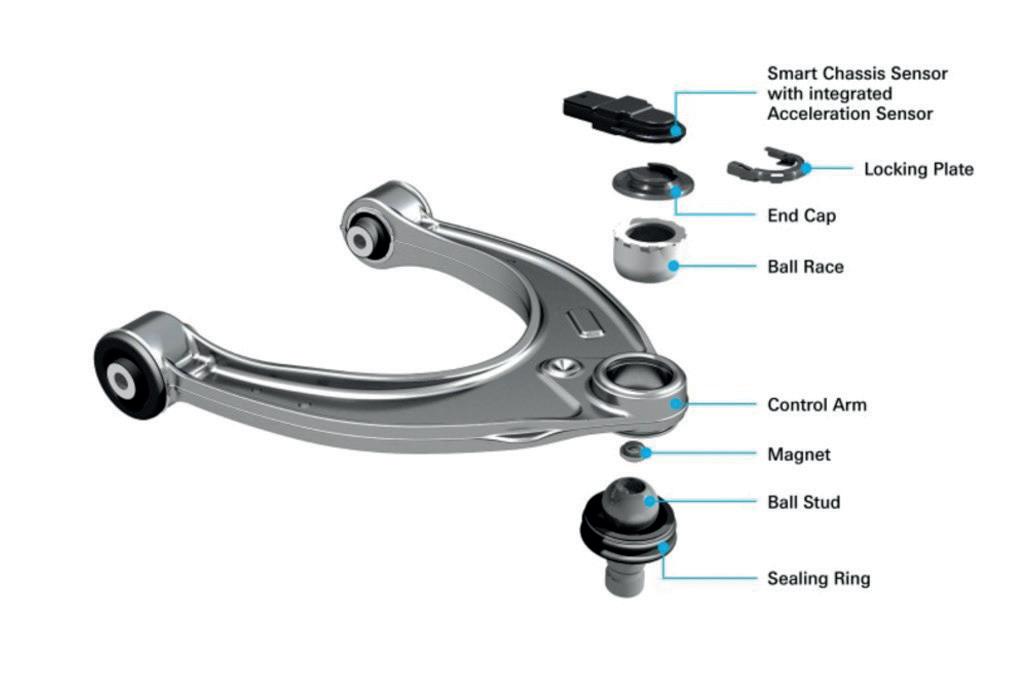

Germany. With the advancement of trends such as electrification, software-defined vehicles, and automated driving, the automotive chassis is consolidated as a strategic axis in the architecture of modern vehicles.

In this context, ZF presents a substantial update of its Chassis 2.0 strategy, which combines intelligent components, by-wire technologies and digital platforms aimed at more connected and efficient mobility.

Chassis 2.0: Technology integration and advanced system-ready components

ZF is industrializing steer-by-wire and brake-by-wire technologies, eliminating mechanical links in favor of electronic solutions that enable new driving functions. The series production of the NIO ET9 with a fully electronic steering system from ZF marks a significant step forward in this field. In addition to this project, there are contracts with two other Chinese manufacturers and Mercedes-Benz, which will integrate this technology from 2026.

“At ZF, we benefit from this trend in two ways,” explained Dr. Peter Holdmann, Member of the ZF Board of Management and responsible for Automotive Chassis Technology. “First, because of the expected global increase in demand for system-ready components, such as our steer-by-wire or brake-by-wire solutions. In addition, there is a strong demand for new and compelling features that

seamlessly coordinate these components and deliver great benefits to end users.”

In addition to the steering and braking systems, ZF maintains a prominent position in damping. With solutions such as the semi-active CDC (Continuous Damping Control) system and the sMOTION asset, the company has a 40% share of this segment globally. In the direction of the rear axle, its AKC system leads with 73% of the market, reaching up to 80% in Asia.

Tokyo. Toyota Motor and Honda Motor are set to report a sharp drop in first-quarter operating profit this week, hit by tighter tariffs on U.S. imports and a stronger yen, despite strong demand for hybrid vehicles.

According to analyst estimates, Toyota would report a 31% yearon-year decline, with profits of 902 billion yen ($6.14 billion), marking its weakest quarterly result in more than two years. Honda, for its part, would announce a 36% drop, to 311,700 million yen, chaining its second quarter down.

The pressure is mainly coming from the US, where new trade policies raised tariffs on Japanese vehicles to 15%, following a bilateral agreement that eliminated the previous total of 27.5%.

Although it represents a reduction, the uncertainty generated is affecting market confidence and the final prices of vehicles.

Dependence on the US market

Scan the code to read more

Honda’s exposure to the U.S. market has grown significantly, accounting for nearly 40 percent of its sales in the first half of the year. Double-digit declines in markets such as China, Asia and Europe contributed to a 5% global drop in sales.

Toyota, in contrast, achieved overall growth of 6%, thanks to strong demand for its hybrid models such as Camry and Sienna, which offer better margins than traditional combustion models. It also showed an uptick in China, with a 7% year-on-year increase in sales.

Strategy Review and Hybrid Approach

Honda has already signaled a strategic shift: it announced in May a reduction in its investment in electric vehicles due to slowing global demand, and will redirect resources towards strengthening its hybrid portfolio.

Analysts and investors will closely follow the strategies of both companies in terms of prices, production and forecasts for the rest of the year, amid a global industry marked by regulatory changes and currency fluctuations.

Toyota shares have fallen 16% so far in 2025, while Honda’s are unchanged.

International. The market will grow from $260 billion in 2025 to $1.77 billion, driven by demand for electric vehicles and wireless devices.

The global solid-state battery market will grow at a CAGR of 37.5% between 2025 and 2031, according to a new report from MarketsandMarkets. Offering higher energy density, more safety, and a

longer lifespan compared to lithium-ion batteries, this technology is gaining traction in industries such as automotive, aerospace, and medical devices.

One of the main drivers of this growth is the transition to electric mobility. The use of solid electrolytes eliminates the risk of leakage and overheating, critical factors in new generation electric vehicles. In addition, the evolution of manufacturing processes is accelerating the commercialization of this technology.

The growing adoption of wireless devices – such as hearing aids, IoT sensors, and wearables – is driving demand for safer, more compact, and more efficient batteries. In this segment, solid-state batteries are also emerging as an ideal solution, especially in harsh environments where lithium-ion batteries are not viable.

The United States, along with Canada and Mexico, will be one of the key regions for the development of solid-state batteries by 2031. Companies such as Solid Power, Sakuu, QuantumScape and Excellatron are leading research in this area, supported by demand from EV manufacturers such as Tesla, Ford, General Motors, Rivian and Volkswagen.

Tokio. The company announced the appointment of Doru Tașcă as the new President of ZF Japan, a position he will officially assume as of August 1.

In parallel, he will continue to play his role as a global key account executive for Japan-based original equipment manufacturers (OEMs), strengthening the connection between global customers and regional teams.

Tașcă joined ZF in September 2020 as a key account executive for Toyota. Since then, he has been recognized for leading high-impact regional projects and consolidating strategic relationships with clients.

With more than 20 years of experience in Japan’s automotive industry and more than five years within ZF, Tașcă has a strong track record in managing business relationships and implementing programs in cross-cultural contexts. His appointment is in line with ZF’s strategy to strengthen its local leadership in key markets.

In his new role, he will lead the company’s business strategy in Japan and assume strategic oversight of its operations, guiding alignment between global customers and local initiatives.

A vision for the future of mobility

“I am honored and grateful for the opportunity to lead ZF Japan at this pivotal time for our industry,” said Tașcă. “Together with our dedicated teams, I look forward to strengthening our partnerships, delivering value to our customers, and building an agile organization prepared for all future challenges.”

The appointment was also endorsed by ZF’s global senior management. Michael Neumann, Executive Vice President Sales and Customer Development at ZF Friedrichshafen AG, said:

“As the automotive industry continues to evolve rapidly, local leadership, capable of navigating complexity and driving customer-centric strategies, is more important than ever. Doru has consistently demonstrated a clear strategic vision and the ability to build lasting relationships with key customers. I am confident that he will provide strong leadership to our business in Japan and continue to strengthen the momentum he has already generated.”

Germany. Within the framework of IAA Mobility 2025, MAHLE reaffirmed its commitment to climate protection and technological diversity as strategic pillars to meet the challenges of the automotive sector.

The company presented innovations in electrification, biofuel-compatible engines and extended range systems, while calling on European legislators to recognize the role of sustainable internal combustion engines and carbon-neutral fuels.

MAHLE CEO Arnd Franz was emphatic: “We need regulation-neutral technology. To move fast with climate protection. So that the expertise and innovation of the European automotive industry continue to thrive in Europe. So that jobs are preserved and the economic strength of the continent is recovered.”

In a challenging economic environment, MAHLE intensified its focus on operational efficiency, including global reorganization in 200 days, advances in artificial intelligence, and new technical solutions such as its biomimetic radial blower for air conditioning, inspired by nature.

The firm also presented its new extended range system, capable of reaching up to 1,350 km according to the WLTP cycle, and a thermal management module with integrated heat pump that extends the range of electric vehicles by 20%.

Franz highlighted the untapped potential of renewable fuels and called for their inclusion in the EU’s climate strategy: “Any plan for rapid and effective climate protection in road transport is incomplete without renewable fuels. In addition to hydrogen, especially in the transport sector, biofuels can effectively contribute to individual mobility.”

United States. TERREPOWER, formerly known as BBB Industries, is consolidating its position as the world’s largest sustainable manufacturer by volume, at a booming time for the multi-billion dollar automotive and industrial aftermarket.

In 2024, the company produced 17 million remanufactured units out of a total of 20 million, avoiding more than 160,000 metric tons of CO₂ thanks to its carbon-neutral business model.

“Traditional remanufacturing extends the life of automotive and industrial parts, while TERREPOWER’s sustainable manufacturing processes also prioritize responsible sourcing, efficient waste management, a systematic approach to energy use, and resource conservation as part of our commitment to the environment,” said Duncan Gillis, CEO of TERREPOWER.

In a global economic environment marked by uncertainty, TERREPOWER’s scaled approach to sustainable manufacturing has enabled its clients to ensure operational continuity, economic stability, and risk mitigation. The trend toward nearshoring and onshoring, accelerated by changes in trade agreements and tariffs, also favors closer to the customer production with remanufactured components.

Today, the company has a presence in 90 countries and has more than 10,000 employees worldwide. Its expansion continues to be driven by the growing demand for high-quality, sustainable products. In this context, the recent appointment of Michael Boe as President of the European business unit, based in Zug, Switzerland, reinforces its international growth strategy.

“ TERREPOWER’s commitment to innovation and sustainability, coupled with its global growth strategy, makes this an incredible opportunity,” said Michael Boe, President of the European Unit.

Founded in 1987, the company grew from a family-owned business in the southern United States to a global player in the circular economy. The name change to TERREPOWER, made at the beginning of 2025, reflects a deeper commitment to sustainability and innovation.

Scan the code to read more

United States. The organization announced the appointment of Jennifer A. Lewis as vice president of regulatory affairs. In this role, she will represent the interests of suppliers before federal agencies and support members on issues such as vehicle safety, data governance, adoption of new technologies and cybersecurity.

Lewis has nearly 20 years of experience in federal policy enforcement. Her career includes a notable stint at the Federal Communications Commission (FCC), where she was senior counsel and deputy division director in the Office of Compliance.

At the FCC, he led investigations into data privacy, media regulation, and communications legislation, collaborating with media and technology companies, and negotiating

settlements that influenced federal policy.

At MEMA , she will work alongside Ana Meuwissen, Senior Vice President of Government Affairs, to lead the association’s regulatory strategy.

“Jennifer’s expertise at the intersection of law, technology, and public policy makes her an invaluable asset to MEMA and its members,” said Meuwissen. “His deep knowledge of the regulatory process and track record of building consensus in complex legal environments will strengthen MEMA’s voice as we continue to address critical issues shaping the future of mobility.”

Lewis holds a J.D. from American University and a Master of Business Administration with an emphasis in global information te-

chnology. In addition, she holds a Bachelor of Arts degree from Georgetown University and is admitted to the District of Columbia and Massachusetts bar associations.

United States. With the goal of strengthening the skills and knowledge of heavy-duty truck parts professionals, the VIPAR Heavy Duty Family of Companies officially introduced the Nucleus Knowledge Center, an online training platform that combines on-demand courses, recorded webinars, and assessment resources into a single digital space.

The new system offers basic, intermediate and advanced training, covering all areas and functions of the business, from counter staff and external salespeople to specialized technicians. Its design includes a dashboard for administrators to assign courses, monitor participants’ progress, and automatically generate certificates of completion.

The platform, available exclusively to distributors in the VIPAR Heavy Duty and Power Heavy Duty networks, is built on a learning management system with a global reach.

“The launch of the Nucleus Knowledge Center represents a critical step in driving workforce development in the heavy-duty aftermarket,” said Jeff Paul, vice president of marketing for VIPAR Heavy Duty.

Paul stressed that the industry is going through a generational change and that training has become a critical element. “For distributors, the platform offers accessible, consistent and customizable training that strengthens product knowledge, improves customer service and boosts long-term business performance. In turn, it helps suppliers maximize the return on their training investments and ensures that those who sell and service their products do so with knowledge and confidence,” he added.

The development of the tool was spearheaded by Al Vaisvila, the company’s manager of training programs and end users, who worked collaboratively with distributors, suppliers, and a specialist in learning management systems.

“Our distributors are busy running their businesses. Finding, scheduling, and monitoring quality training can be a daunting task on top of the daily activities that require attention. This platform significantly reduces that burden while empowering their teams to identify the right parts, solve customer challenges, and maintain strong, long-lasting relationships,” said Vaisvila.

For Chris Baer, President and CEO of VIPAR Heavy Duty, the launch marks just the beginning of a strategy of innovation and continuous learning:

“This is just the beginning of a long-term initiative of continuous learning and innovation, and reflects our commitment to supporting distributors and suppliers. This is not a generic solution: it is a platform designed to evolve. We’re starting strong, and once you get on this path of continuous learning, the opportunities for growth don’t stop popping up.”

United States. PHINIA presented its 2024 Sustainability Report, revealing significant advances in emissions reduction, energy efficiency, development of clean technologies and strengthening of its corporate culture.

In its second year, the report shows measurable impacts on its environmental, social and governance (ESG) goals, including an 11.7% decrease in greenhouse gas emissions (Scope 1 and 2), 4.5% less energy consumption and that 89% of its R+D investment went to alternative fuel technologies and fuel efficiency.

“We believe that sustainability is not only essential to responsible business, but is an important factor in our long-term success and business strategy. Our sustainability initiatives create lasting value for our stakeholders and drive innovation through our people, our purpose, and our values in engineering, operations, and culture,” said Brady Ericson, president and CEO of PHINIA.

The document details emblematic projects such as the development of hydrogen engines (H2ICE) in alliance with Alpine Racing, GCK Group and Solution F; the progress of remanufacturing programs that in 2024 reused 52% of the mass of processed materials; and the launch of the global Inclusion strategy, with the expansion of the PHINIA Women in Science and Engineering (WISE+) programme to 24 chapters.

In addition, the company recognized 10 suppliers for their sustainability performance, implemented a global energy monitoring system that covers 85% of their consumption, and offered 145,000 hours of training, including mental health and wellness training.

“With this second annual report, we have gone from building a foundation to generating a measurable impact. We continue to shape a more sustainable future for our industry and communities through data-driven decisions, global collaboration, and strategic investments,” added Ericson.

International. The global market for smart car antennas will double in value in the next seven years, from $2.5 billion in 2023 to $5.2 billion in 2030, with an annual growth rate of 10.9%, according to the most recent study by MarketsandMarkets.

The advancement of connected vehicle technologies, the integration of infotainment systems, the development of autonomous vehicles and compliance with safety regulations are accelerating the adoption of these solutions, which offer high-speed, low-latency communication and real-time data exchange, key to the arrival of 5G technology in the automotive sector.

Very high frequency, the leading segment

Very high frequency antennas (800 MHz-2000 MHz) are projected to be the most in demand, as this range supports essen-

Scan the code to read more

tial applications such as mobile networks, GPS, navigation and V2X communication. Their ability to penetrate obstacles and maintain reliable connectivity in urban and rural environments makes them especially attractive for SUVs and premium vehicles. Manufacturers such as TE Connectivity, Hirschmann, Telex and Stratocell already provide this type of solution for high-end models.

Electronic control units (ECUs) for smart antennas are positioned as the component with the greatest expansion, as they are responsible for signal processing, data routing and communication with other vehicle systems. With the advent of autonomous vehicles and advanced ADAS, ECUs become essential for managing critical functions and ensuring antenna performance in complex environments.

The study notes that Asia-Pacific will be the fastest-growing market thanks to increased production and sales in China, Japan and India, the accelerated rollout of 5G networks and heavy investment by manufacturers such as Toyota, Honda, Hyundai, TATA and Mahindra in connectivity technologies. In this region, the adoption of vehicles with integrated navigation, connected infotainment, 360° cameras, remote control and OTA updates is increasing.

Scan the code to read more