Electromobility, AI, and Sustainability Are Reshaping the Sector

Software-Defined Vehicles Are Transforming the Industry from Within

Electromobility, AI, and Sustainability Are Reshaping the Sector

Software-Defined Vehicles Are Transforming the Industry from Within

In 2022 Latin Press Inc. purchased AFTERMARKET INTERNATIONAL. One of the reasons behind the acquisition (perhaps the main reason) was to initiate a tradeshow for the industry.

And it was done. For the last 3 years, we’ve had AutoAmericas, a 2-day event where buyers and others from Latin America came to the US for our show. We held it in Miami, Florida, USA to great acclaim.

Now we are extending our reach further. In 2026 we are moving AutoAmericas to the Dominican Republic. Specifically, Friday-Saturday March 20-21 in Santo Domingo. We are announcing it now to give all a chance to include on their calendars!

It’s the next step in our event’s evolution.

In other news, MEMA, The Vehicle Suppliers Association, announced that president and CEO Bill Long will retire Jan. 3, next year. Bill has had a long and distinguished career in the automotive industry, especially in the aftermarket. He will be replaced by Paul McCarthy, long-time MEMA executive. I have known both Bill and Paul for a fair number of years and can attest to their dedication to the industry and their integrity. Good luck guys!

This issue has a lot of valuable information, especially as it relates to Latin America. Here is our editorial lineup:

• The era of software-defined vehicles accelerates

• Review of the Monroe CVSA shock absorber

• Mexican Auto Parts Congress

• Trends reshaping the automotive aftermarket in Latin America (and how to stay ahead)

Meeting the needs of our audience in more than 100 countries is what we aim to do. And we think we do it pretty well.

As always, best to you and yours!

Brad Glazer, Publisher Aftermarket International

GENERAL MANAGEMENT Max Jaramillo / Manuela Jaramillo

EDITOR

Laura Restrepo C. lrestrepo@aftermarketinternational.com

PROJECT MANAGER Andrés Caballero acaballero@aftermarketinternational.com

PUBLISHER Brad Glazer bglazer@aftermarketinternational.com

ACCOUNT MANAGERS

MEXICO Sandra Camacho scamacho@aftermarketinternational.com

COLOMBIA Fabio Giraldo fgiraldo@aftermarketinternational.com

DATABASE MANAGER Maria Eugenia Rave mrave@aftermarketinternational.com

PRODUCTION MANAGER Fabio Franco ffranco@aftermarketinternational.com

LAYOUT AND DESIGN Jhonnatan Martínez jmartinez@aftermarketinternational.com

FRONT PAGE Latin Press

OFFICE PHONES: Latin Press USA Miami, USA Tel +1 [305] 285 3133

Latin Press México Ciudad de México Tel +52 [55] 4170 8330

Latin Press Colombia Bogotá, Colombia Tel +57 [601] 381 9215

São Paulo, Brasil Tel +55 [11] 3042 2103

The opinions expressed by the authors of the articles in this journal do not commit the publishing house.

Printed by Panamericana Formas e Impresos S.A. Acting only as printer.

Printed in Colombia

ISSN 2834-8885

The auto parts sector and the automotive industry are constantly undergoing transformation. We see this in the advancement of technologies, new market demands, the evolution of distribution channels, and especially in the regulatory frameworks that must accompany this movement. At Aftermarket International, it has been a deeply enriching experience to closely follow this evolution and contribute to the dialogue among the different players that bring this ecosystem to life.

One of the topics that marked the agenda in recent months was, without a doubt, the discussion around tariffs on imported auto parts. This debate brought to the forefront a recurring tension: the need to protect and strengthen the national industry versus the reality of an increasingly global and interdependent market. The initial changes caused uncertainty and concern among manufacturers, distributors, and workshops, as they faced cost increases that directly impacted the sector’s competitiveness.

However, the most valuable aspect of this process was the capacity for dialogue. The sector’s voices were heard, spaces for conversation were created among business leaders, associations, and authorities, and ultimately a review was achieved that took into account the market’s operational realities. This case leaves us with an important lesson: decisions that impact an entire industry cannot be made in isolation. They require analysis, listening, and above all, a willingness to build sustainable solutions for everyone.

Now more than ever, we reaffirm our conviction that the sector’s growth depends on working together. It is not enough to adapt to change: we must anticipate, understand, and act collectively to create economic conditions that allow innovation, growth, and quality job creation.

In line with strengthening the technical and professional community in the aftermarket, I want to invite you to be part of a new gathering: Repintado Days, a specialized automotive repainting event that will take place on June 19 in Medellín. It will be a day dedicated to knowledge exchange, best practices, and live demonstrations with top-level experts. A space designed for those who work every day to transform and renew the vehicle fleet with professionalism and commitment.

From this magazine, we will continue to be committed to ongoing updates, rigorous analysis, and generating content that contributes to the development of our industry. Thank you for joining us on this journey. Let’s keep working together, with vision, dialogue, and the certainty that every challenge brings a new opportunity.

Laura Restrepo Editor

12/A Global Vision with Local Commitment: This Was the Mexican Automotive Parts Congress 2025

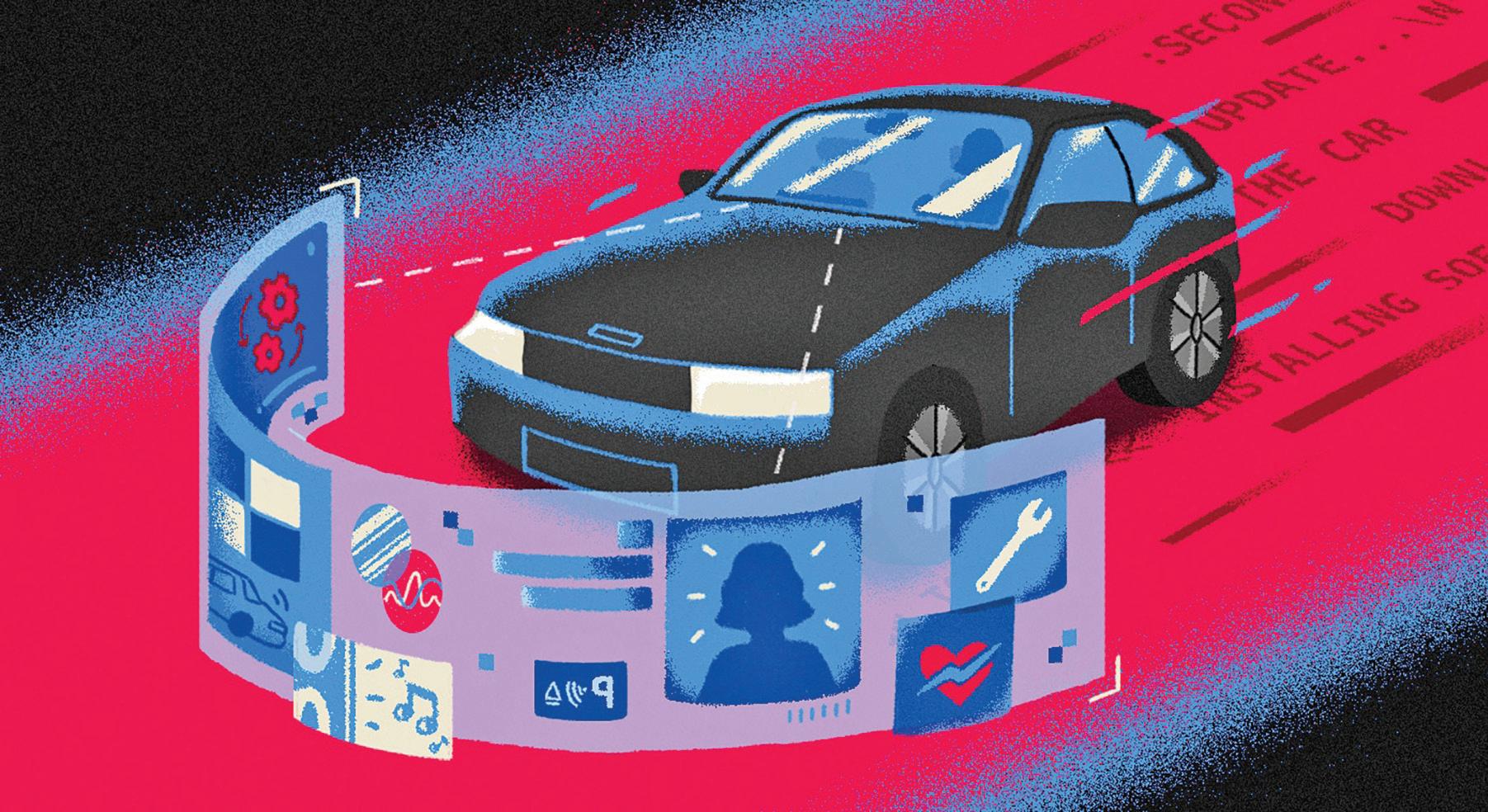

16/Monroe CVSA Shock Absorber Inspection

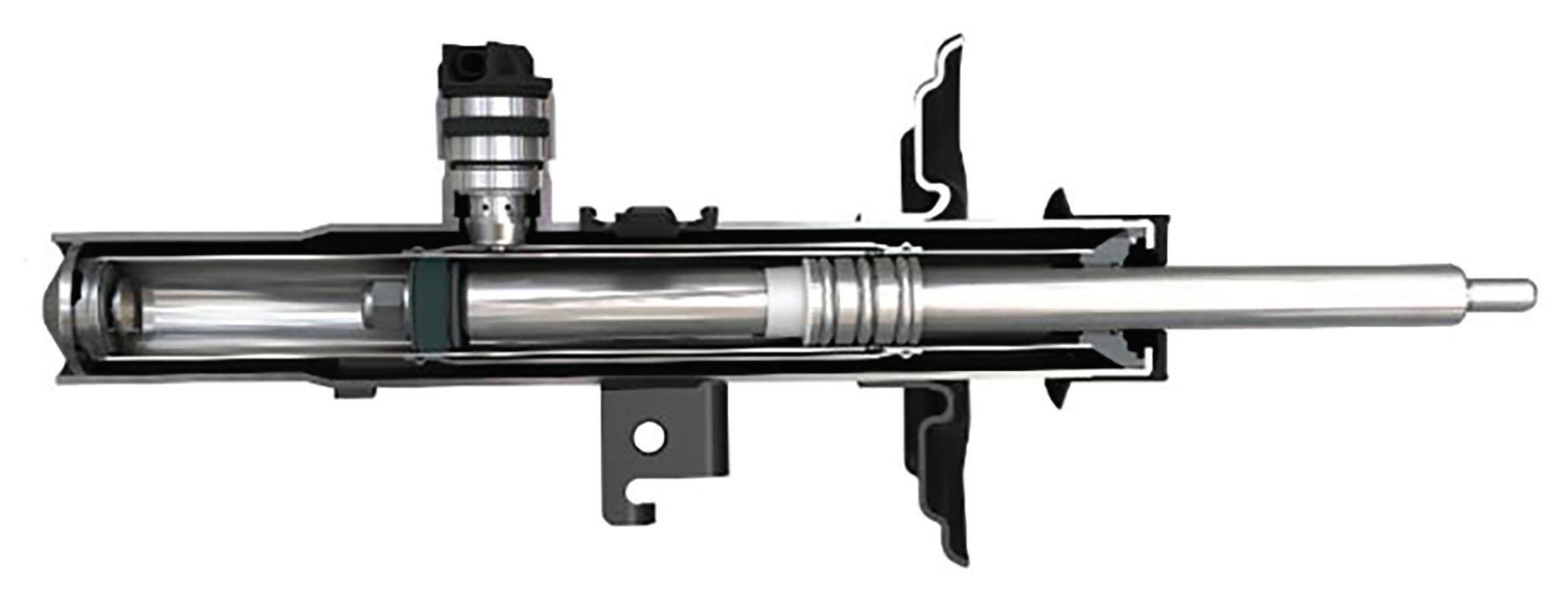

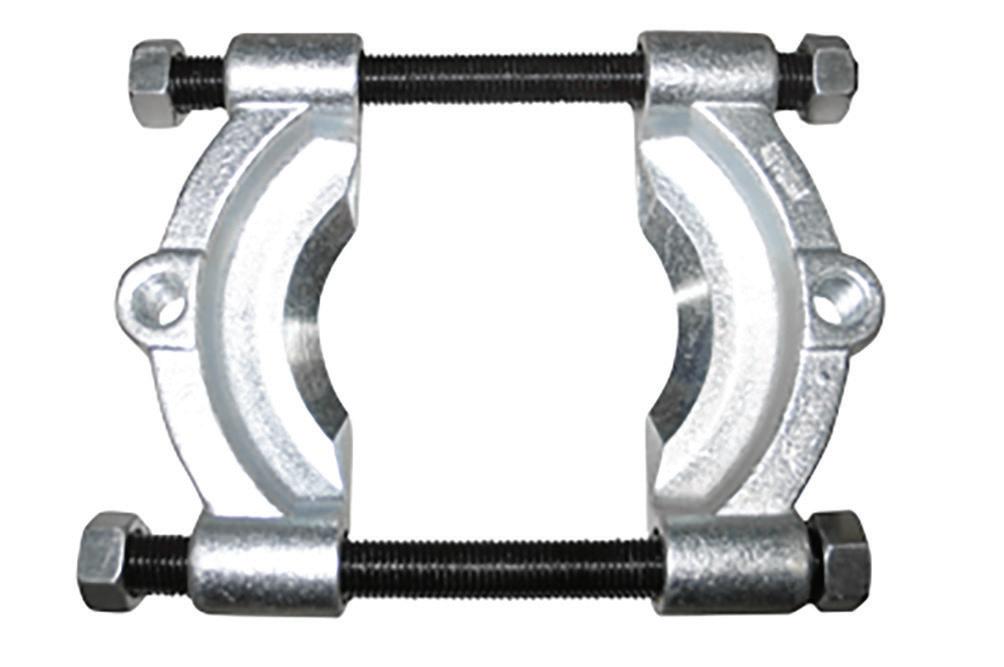

18/Corrective Maintenance for Leaks in a Telescopic Hydraulic Cylinder: Educational Guide

20/Break-In Procedures for Diesel Engines

6/Out Front

26/Business News

6/Trends Reshaping Automotive Aftermarket in Latin America (and How to Stay Ahead)

9/The Era of Software-Defined Vehicles Accelerates

Find information, contacts, links to industry associations, free literature from businesses that advertise in the publication, events, and downloadable issue archives dating to 2007 at aftermarketinternational.com

For advertising, contact Brad Glazer at 216 233-6943 bglazer@aftermarketinternational.como Andrés Caballero al +1 [305] 285 3133 Ext. 94 acaballero@aftermarketinternational.com

By Sandra Álvarez*

While the global automotive industry navigates one of the most significant transformations in decades, the aftermarket—often an invisible cog— is reinventing itself from within.

The automotive industry is experiencing one of the deepest shifts in recent decades. In the aftermarket, these movements are as silent as they are decisive. At GroupAuto—operating in Central America, Colombia, Ecuador, and Venezuela—we witness this every day alongside our distributors, workshops, suppliers, and technology partners.

From this regional perspective, here are some key signals that every company in the sector should have on its radar if they want to anticipate and actively shape this transformation:

The transition to electric vehicles (EVs) and hybrid technologies is advancing at different speeds across countries. While Europe is beginning to slow its rollout due to regulatory and infrastructure challenges, China remains the global driver. In Latin

America, we face structural, pricing, and availability hurdles—but also huge opportunities for those who are prepared. Networks like EuroTaller already have workshops trained to service electric and hybrid vehicles, with ongoing education, access to technical data, and specialized tools.

AI is no longer just for major manufacturers; it’s reaching every link in the chain. From predictive diagnostic tools to intelligent procurement management, distributors and workshops that invest in tech solutions will lead.

In our network, we use management software, technical support platforms, virtual assistants, and chatbots to optimize operations and enhance the end-customer experience.

Location matters more than ever. Panama and its Free Zone are solidifying their role as a regional logistics hub. In these tariff-vulnerable times, collaborating with ecosystem-partner distributors translates to improved availability and competitiveness.

Parts buyers—even in B2B—have gone digital. They want to see prices, check availability, and place orders online. Integrated platforms between distributors and workshops are now a necessity, not a differentiator. At GroupAuto, we offer turnkey digitalization solutions.

Today’s most successful companies don’t compete alone… they grow in networks. Collaboration has become a true competitive advantage. Alliances among distributors, manufacturers, workshop networks, fleets, leasing companies, and tech startups are transforming how we serve the market, access vital data, and offer comprehensive solutions. In our case, each new workshop or partner strengthens the entire ecosystem. Integrating technologies like AI, geolocation tools, or management platforms is only possible with a collaborative vision.

New consumers and regulations are driving more sustainable practices. From remanufacturing to parts traceability, sustainability will be a requirement to remain in the market. And it’s not just about the environment—sustainability also means helping family-owned businesses in this sector grow, innovate, and stay relevant over the long term.

At GroupAuto, we believe in an industry that evolves through connection, knowledge, and joint action. The aftermarket of the future is already here—and it does not walk alone: it is built by listening, training, sharing, and growing in networks.

With more technical training, better administrative management, advances in digitalization, OE-brand positioning, and strategic alliances, we continue to strengthen a living, robust, and purposeful network.

Because evolution doesn’t happen in isolation. It happens in networks.

By Eduardo Alexandri*

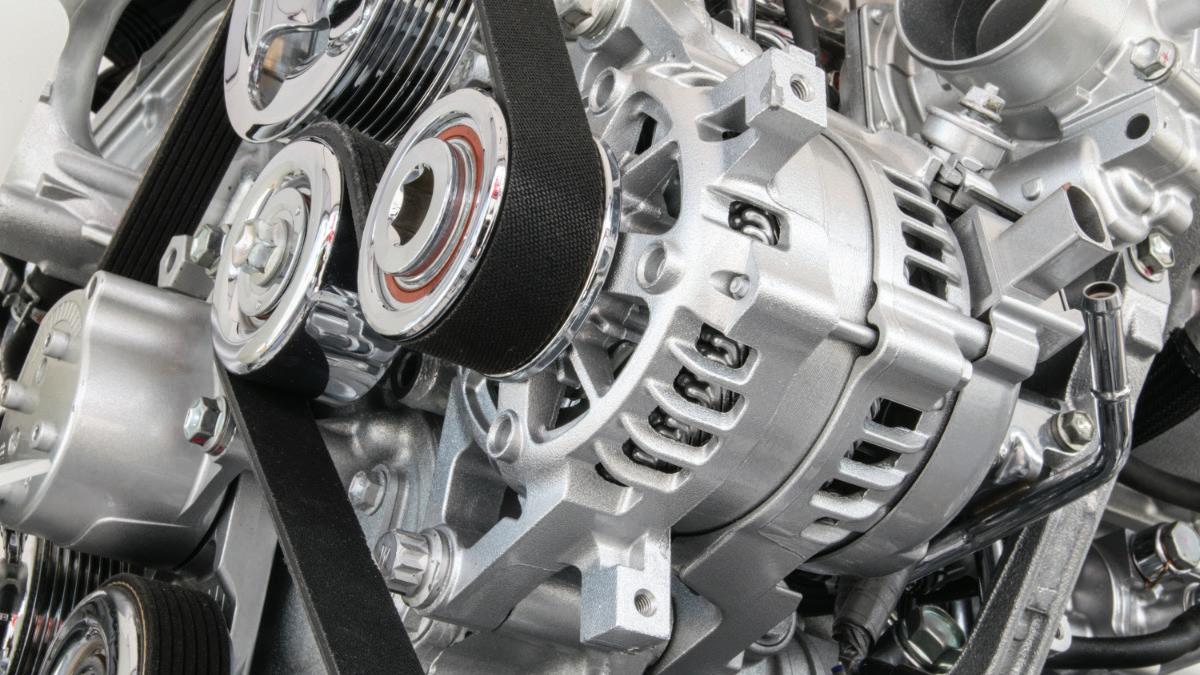

WThe car of the future has already arrived, and it’s not autonomous—it’s software-defined. While the industry awaits fully automated driving, software is already transforming vehicles into intelligent, connected, and constantly evolving platforms.

hile the automotive industry and consumers await the arrival of autonomous vehicles, software-defined vehicles (SDVs) continue to evolve. What was once a primarily mechanical product is now being transformed into a software-driven ecosystem.

An analysis of leading automakers reveals that they currently allocate between 25% and 35% of their research and development budgets to software. This shift is resulting in cars with more than 150 million lines of code, hundreds of Electronic Control Units (ECUs), and thousands of semiconductors in a single mid-range vehicle.

Software is redefining differentiation in the automotive industry, driving both safety and the personalization of the onboard experience.

Advanced safety functions, such as lane departure warning systems, adaptive cruise control, and parking assistance, increasingly depend on software. As autonomy

advances, both drivers and passengers will experience unprecedented personalization in their onboard experience.

To offer these innovations, Original Equipment Manufacturers (OEMs) are bringing in more tech executives and hiring thousands of software engineers.

One source reveals that 40% of a car’s bill of

materials is made up of software and semiconductors.

There are already developments in the market that enable highly personalized audio experiences inside the vehicle, where each seat becomes a node within the car’s network, allowing passengers to enjoy their own content without interruptions. In some regions, brands have taken this innovation even further, offering immersive entertainment experiences.

With this shift toward software and personalized experiences, vehicle maintenance is also evolving. Just as mobile phones went from flip models to smart devices with constant updates, cars are ceasing to be static products to become Internet of Things (IoT) platforms, with continuous improvements through subscription-based services.

Today, with the rise of software and Overthe-Air (OTA) updates, vehicles will continue to evolve and improve over time.

To enable these updates, software-defined vehicles require a flexible architecture. Traditionally, the various systems in a car operated independently, but today manufacturers are migrating toward more centralized computing models, grouping functions into shared resources.

One example of this evolution is the optimized digital cockpit, which integrates navigation, the instrument cluster, and telematics into a single system. This consolidation reduces the number of Electronic Control Units and simplifies the vehicle’s architecture.

The trend points toward High-Performance Centralized Computing (HPCC), which optimizes the use of ECUs and internal storage, reducing the amount of wiring and components. This also has an impact on storage efficiency, eliminating unnecessary duplication of data across different systems.

The goal is to reduce the number of processors in the vehicle. High-performance centralized computing takes this optimization to the next level, driving the development of software-defined vehicles. Additionally, advances in vehicular networks are enabling the replacement of traditional data cabling with an Ethernet-based infrastructure, which transports real-time information throughout the vehicle. This approach simplifies the vehicle’s architecture by reducing the number of cables and allowing for greater efficiency in data processing.

As the software-defined vehicle ecosystem takes shape, the adoption of common standards becomes essential to ensure safety, interoperability, and reliability.

The more electronic components are integrated into a vehicle, the stricter the safety measures must be to protect passengers, prevent cyberattacks, and minimize false alarms. For this reason, autonomous vehicle segments have begun adopting more rigorous standards.

Standardization is also key due to the complex network of suppliers involved in manufacturing a car. If we seek technological innovation, it must come from multiple sources and align with

established standards to ensure efficient and safe integration. In an environment where OTA software updates are a reality, ensuring safety is a priority. Cars cannot fail. They must be reliable. That is why the industry’s certification and validation processes continue to evolve to ensure that each component meets the highest standards.

While the automotive industry moves toward full autonomy, software-defined vehicles are leading the way with higher levels of personalization and flexibility.

Vehicles are evolving into true micro data centers on wheels. And as technology continues to advance, global standards will be the compass guiding this transformation.

Referencias

https://www.rolandberger.com/en/Insights/Publications/Computerson-wheels.html

https://spectrum.ieee.org/software-eating-car https://www.mobilityoutlook.com/commentary/harnessing-the-fullpotential-of-connected-vehicles-with-semiconductors/

Por Eduardo Alexandri, director general de Sandisk para Latinoamérica.

By Aftermarket International

From the participation of international associations to the promotion of the Women’s Committee, the congress demonstrated that collaboration and a global vision

are key to the industry’s future.

With over 440 attendees, high-value content, and an atmosphere of integration, the third edition of the Mexican Automotive Parts Congress solidified itself as one of the most important gatherings for the auto parts sector in Mexico. The change of venue was not just a logistical adjustment: it responded to the need to offer greater comfort to participants and to facilitate cohesion of activities by bringing all attendees together in a single room.

“We wanted everyone to be integrated in the same space, and we achieved that,” explained Roberto de la Rosa, president of ARIDRA. The new format strengthened networking and attention to the conferences, one of the most carefully managed aspects of the event.

True to its focus on quality over quantity, the congress maintained its call directed at

strategic profiles: decision-makers, executives, and mid-to-high level professionals and above. “We don’t seek thousands of people, but the right audience. A capacity of between 400 and 450 attendees is ideal for the congress’s objective,” De la Rosa affirmed.

One of the main achievements was the careful curation of content. ARIDRA placed special emphasis on avoiding presentations becoming mere advertisements. “A manager from a multinational company told me: ‘I have been to many congresses filled with commercials. This was not the case here. They shared market information for the market.’ Comments like that tell us we are on the right track,” he shared.

This approach involved prior work with each speaker to review and validate their presentations, ensuring they were informative and relevant to the audience. “We learned a lot from the first edition, when

commercial presentations still slipped in. Today, that no longer happens,” De la Rosa stressed.

The 2025 edition of the Congress also stood out for its growing international projection. The participation of the AutoCare Association, the largest organization in the sector in the Americas, marked an important step for ARIDRA’s global positioning. Represented by Ted Hughes, this collaboration reinforces the goal of building bridges with other associations on the continent.

“Mexico is a key country in the automotive sector due to its export capacity. Having alliances with organizations like AutoCare or associations from countries like Argentina, Colombia, or Brazil allows us to share experiences, identify opportunities, and join efforts,” noted the president of ARIDRA.

At the regional level, Colombia has shown special interest in strengthening ties with Mexico due to its limited local production capacities, opening doors for the export of Mexican auto parts. Additionally, ARIDRA maintains active contact with embassies and trade missions, such as Argentina’s, and continues exploring collaboration models like those encountered in Europe during international visits.

Another milestone of the year was the first convention of the ARIDRA Women’s Committee. What began as an initiative for 15 people ended up exceeding expectations by gathering more than 50 participants.

“I’m proud to see how this project has grown,” expressed De la Rosa. Beyond promoting inclusion, the Committee has focused its efforts on generating value for the entire industry through mentoring, training spaces, and support networks. “Many think

it’s a committee only for women, but they are working for everyone. I myself have already signed up to be part of the mentoring for the next generation,” he added.

With an eye on further strengthening the event, the organizing team has already begun planning the 2026 edition. Priorities include adjusting the date to avoid clashes with other important sector events and further improving the attendee experience.

Although there are currently no concrete plans to replicate the congress outside Mexico, the possibility is on the table. “If we con-

solidate two more editions at this level, we could consider taking the event to another country, always in collaboration with local stakeholders,” De la Rosa anticipated. Countries like Colombia, Argentina, and Panama are emerging as potential partners for a future internationalization of the ARIDRA Congress.

With firm steps and a shared vision, ARIDRA shows that building community, sharing knowledge, and fostering international collaboration are key to strengthening the continent’s auto parts industry.

By Laura Restrepo C.

This June, Medellín will become the Latin American epicenter of automotive refinishing with the arrival of Repintado Days, a specialized event set to take place on June 19 at the Comfama Ciudad del Río venue.

During an intensive day of training, networking, and technical demonstrations, key players in the sector will have the opportunity to update themselves on the latest industry challenges and strengthen their technical skills.

Organized by Aftermarket International and Zona de Pinturas, Repintado Days is shaping up to be a unique meeting point for workshops, technicians, distributors, wholesalers, dealerships, and specialized brands. The event is designed to foster professional development and enable direct interaction with leading market suppliers.

With a schedule running from 10:00 a.m. to 3:00 p.m., the event will feature five technical talks delivered by industry experts, focused on refinishing procedures, new technologies, best practices in workshops, and market trends.

In addition, attendees will be able to explore a commercial exhibition showcasing innovative products, specialized tools, and emerging technologies—all within an interactive format that promotes active participation and business opportunities.

The event is limited to 60 participants, with free admission upon prior registration. All attendees will receive exclusive technical materials and a certificate of participation, reinforcing the event’s educational value.

The automotive refinishing sector is undergoing a transformation driven by the arrival of new technologies and the increasing prevalence of vehicles with more demanding technical requirements. A clear example is electric vehicles (EVs), whose refinishing process involves new considerations regarding safety, curing temperatures, and compatibility with electronic systems.

Although this topic is not directly included in the Repintado Days agenda, its relevance highlights the need for continuous training and professional development in workshops. Adapting to these changes is crucial to remain competitive and to provide safe, high-quality service.

In this context, initiatives like Repintado Days play a key role in supporting technical evolution and providing valuable tools for industry professionals.

The launch of Repintado Days responds to a context in which the automotive refinishing sector is rapidly evolving—driven by an aging vehicle fleet, increased demand for aesthetic repairs, and the shift toward more sustainable and efficient products. The need for ongoing updates in both processes and technology makes events like this essential for professionals in the field.

In addition to technical content, the event will feature commercial spaces, business roundtables, and sponsorship opportunities for brands seeking to connect with a highly specialized and technical audience.

Those who wish to participate can register for free by scanning the QR code.

For sponsorship or speaking opportunities, contact: lrestrepo@aftermarketinternational.com

With coordination by Laura Restrepo, editor of Aftermarket International, and Andrea Ochoa, editor of Zona de Pinturas, this first edition of Repintado Days is part of the official activities of AutoAméricas Show, solidifying its role as a growth engine for the automotive refinishing industry in Latin America.

By Carlos Panzieri*

LThe Monroe CVSA shock absorber, found in high-end vehicles such as Audi, BMW, and Mercedes-Benz, requires specific procedures for inspection and reconditioning. In this article, we explain step by step how to carry out a proper intervention using specialized tools and kits.

et’s see how to reman the Monroe CVSA, probably the most common electronically adjustable shock absorber, installed on many Audi, BMW, Ford, Mercedes Benz and Volvo.

1. Wash and dry the shock absorber.

2. Check it on the dynamometer to get an idea of its conditions:

• It is leaking oil;

• The oil has lost its physical-chemical features;

• It has some problem with the valves.

3. Open the shock absorber on the Mangusta or on the lathe, shortening it as little as possible.

4. Remove the guide, the rod and empty it.

5. Mark the position of the solenoid cable or the solenoid itself, in relation to its housing.

6. Using a guillotine extractor such as the Z-09010 (im.01) or a simple hammer and chisel, remove the original solenoid.

7. Remove the internal components: safety ring, gasket and solenoid remains

8.Use the Emmetec catalogue to choose:

• The guide overhaul kit (im. 02).

• The solenoid.

• The key to unscrew the electronic valve 98-521A (2.0mm) or 98517 (3.5mm) (im. 03).

• The cylinder centering device: 98-518 (76mm) or 98-519 (65mm) (im.04).

9. Using the appropriate key, unscrew the CVSA electronic regulation valve.

10. Remove the internal cylinders and carefully clean all their components (im. 05).

11. Depending on the closing kit, turn, thread or weld the new guide housing.

12. Replace the bushing and the guide scraper with the components included in the Emmetec kit.

13. Temporarily assemble the internal cylinders, the rod and the closing group without oil, and measure how much the internal cylinder must be shortened in order to properly close the shock absorber.

• The amount to be shortened will depend on the shock absorber model, the kit chosen and the opening point, so it cannot be specified in advance. In any case, if in doubt, contact Emmetec technicians.

If the kit is closed with a ring threaded on the outside, proceed as indicated:

• Reassemble the bottom valve + inner cylinder + overhaul kit and measure the distance the threaded ring protrudes from the edge of the shock absorber.

• Shorten the inner cylinder (on the bottom valve side!) so that when reassembling it, the threaded ring protrudes 1 mm from the cylinder.

• Reassemble the components and check that the O-ring does not force the thread of the cylinder, otherwise it will be cut.

• Disassemble everything.

• Shorten the second inner cylinder as necessary on the guide side!

• Reassemble all the components by centering them with the cylinder centering tool (equipped with an O-ring) and check that the threaded ring protrudes 1 mm from the cylinder body. Then, regardless of the type of kit used, proceed as follows:

• Add oil, insert the piston-rod assembly, bleed and check that the oil flows correctly through the piston and the bottom valve.

• If not, check the bottom valve using the Emmetec screws and nuts

• Replace the centering tool with the CVSA Regulating Valve (which will have had its original O-ring replaced with the one supplied in the kit) but not the solenoid!

• Pressurize the shock absorber to about 6/8 bar.

• Test the shock absorber on the dyno and if it works correctly, fit the solenoid as well.

• Paint it.

By María Zoraida Gallo*

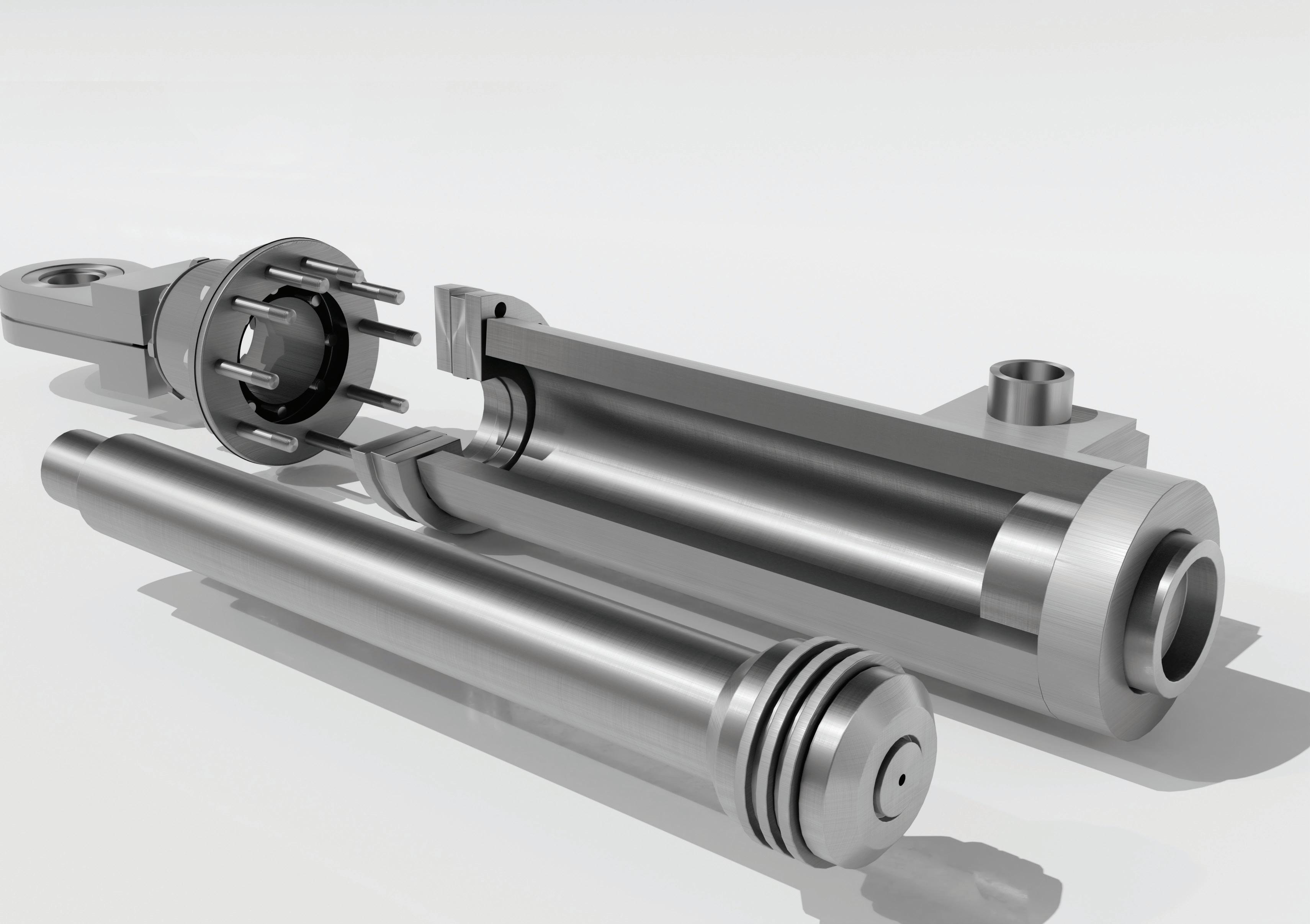

TA leak in a telescopic hydraulic cylinder can severely affect equipment performance. This guide outlines the key steps to carry out effective and safe corrective maintenance.

elescopic hydraulic cylinders are crucial components in the operation of dump trucks and other heavy-load equipment, enabling the controlled lifting and lowering of the platform. This article explores the process of performing corrective maintenance on a leak in this type of cylinder.

The first step in corrective maintenance is identifying the source of the leak. This is done through a visual inspection of the cylinder, paying close attention to signs of oil around the seals and the body of the cylinder. Once the leak is located, the cylinder is disassembled for a more detailed analysis.

With the cylinder removed, it is carefully disassembled. During this phase, seals, gaskets, and internal surfaces are examined for wear, cuts, or damage that may be causing the leak. It is essential to clean and inspect each component thoroughly to ensure an accurate diagnosis.

Once the cause of the leak is identified, the damaged seals and gaskets are replaced with new, high-quality parts. During this process, it’s crucial to ensure all components are properly fitted and lubricated to prevent future leaks.

After replacing the components, the cylinder is reassembled and reinstalled. Functional tests under load are then performed to confirm the leak has been resolved and the cylinder is operating efficiently.

Corrective maintenance not only restores the functionality of the cylinder but also prevents major damage to the hydraulic system and ensures the safe operation of the equipment. Additionally, a well-maintained cylinder contributes to operational efficiency and extends the lifespan of the machinery.

María Zoraida Gallo, Manager, Hidráulicas y Repuestos H&R

By Francisco Aristizábal

Poor break-in can ruin a diesel engine rebuild. This article explains why it matters—and how to do it right.

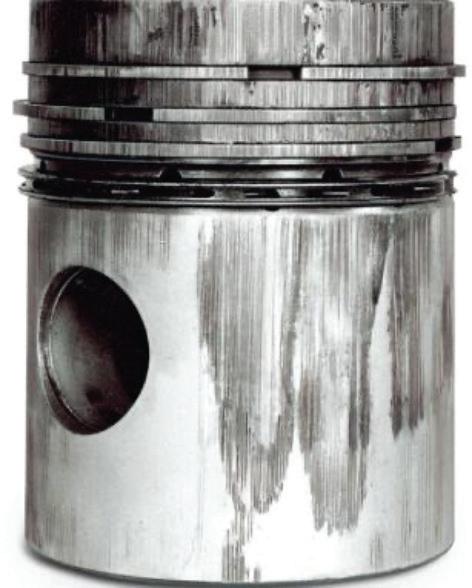

There are many factors involved in a successful engine overhaul process—an experienced technician, a machine shop with the right knowledge and equipment, and the highest-quality replacement parts. However, no matter how well these elements are covered, an incorrect break-in procedure can undo all the good work previously done.

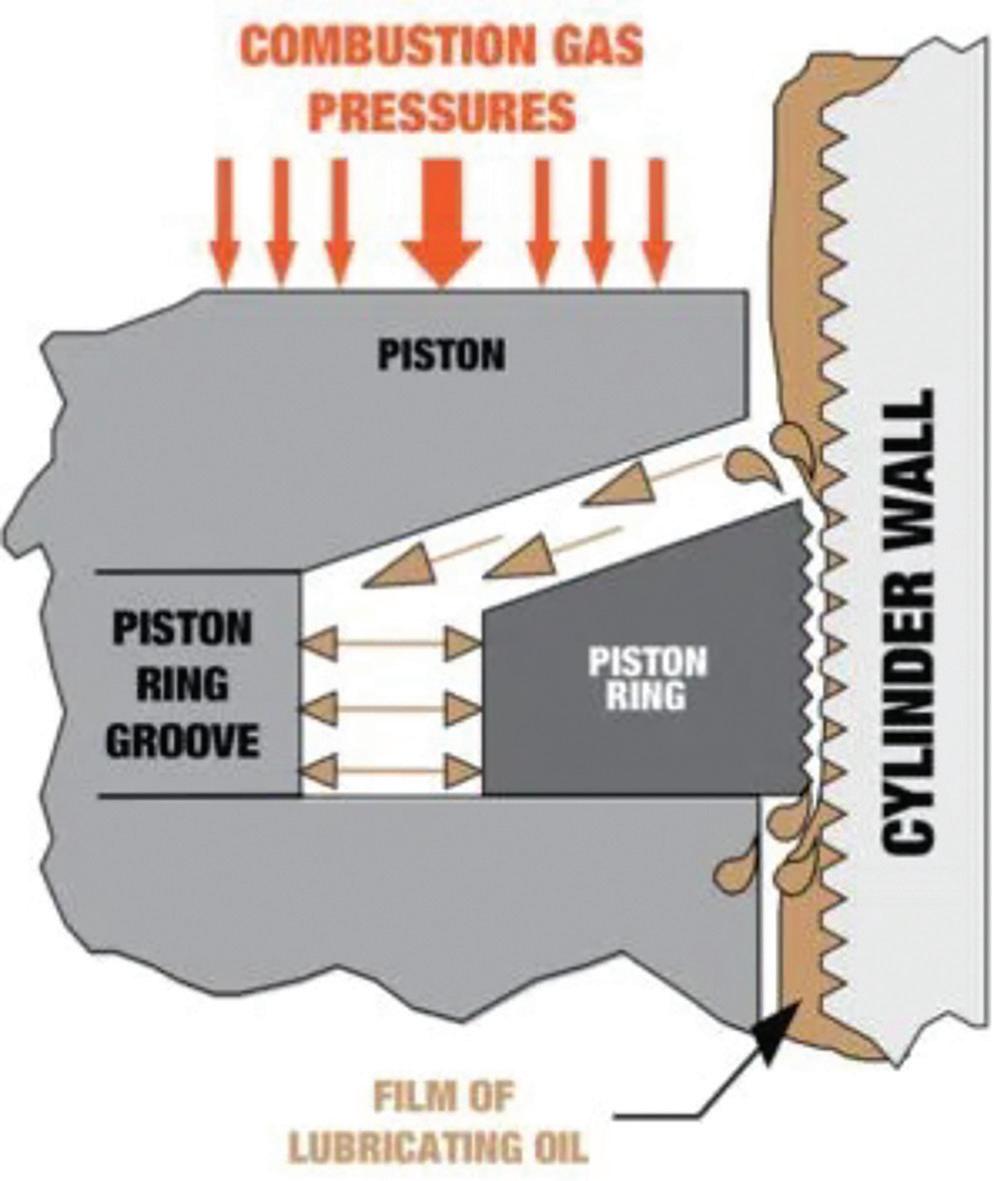

All new or reconditioned parts require an initial run-in period to properly adjust within the complete engine assembly. Bearings and valvetrain components need this, but especially the piston rings, which must expand and seal within the cylinder liners or bores. Their contact surface must match the surface of the liners or cylinders, thus establishing a uniform contact surface for maximum performance and long engine life. This is especially true for diesel engines—the first 200 kilometers of operation for a truck, or the first 100 hours for construction, industrial, or agricultural equipment, are essential to this process.

There are alternative procedures to using a dynamometer, depending on the type and application of the equipment. These methods aim to apply high loads with minimal idling, to help engine components break in properly.

In a truck, operating the vehicle with its maximum rated load and a constant throttle position of 75–80% during the first 200 km ensures good combustion pressures inside the cylinders. This forces the rings to expand against the cylinder walls, enabling proper control of the lubricant film and good sealing. Similarly, agricultural equipment should be operated with implements engaged and within crop rows, forcing the engine under “controlled operating load conditions.” Over-revving and prolonged idling during these early stages should always be avoided.

A common misconception—especially in Latin American countries—is to equate break-in with long periods of engine idling, which leads to disastrous consequences. Beyond high oil consumption, the breakdown of the lubricant film and incomplete combustion due to low piston crown temperatures—since the engine is under no load—are unfortunately very common. A correct break-in process keeps crankcase pressure (blow-by) and oil consumption to a minimum.

Here are some general recommendations for break-in after a repair or overhaul:

After rebuilding, start the engine and let it idle for no more than 5–10 minutes—just enough time to check for leaks and verify proper oil pressure, coolant temperature, and other engine or equipment operating conditions.

Follow the OEM’s recommendations regarding alternative break-in procedures depending on the specific application (truck, marine, industrial, etc.), always avoiding zero load and over-revving.

Whenever possible, use break-in oil during the initial operation period (100–500 hours). These oils are formulated to provide a controlled environment for ring and liner operation while offering necessary protection against valvetrain and gear wear.

As mentioned, this article is intended as a general guide. Specific break-in procedures and recommendations may vary depending on the manufacturer and/or application. Always refer to the OEM’s service literature. As always, AERA’s technical hotline is available to answer any questions on the subject.

Francisco Aristizábal, Technical Specialist, AERA

This article was originally published in AERA’s Engine Professional magazine. It is reprinted in Aftermarket International with permission from the author.

In the maintenance and repair sector of industrial and commercial vehicles, choosing the right spare part is essential to ensure safety, efficiency, and durability.

Terms like OE, OEM, and Aftermarket are commonly used and likely familiar to many readers. However, they are not always fully understood by those who don’t work daily in the spare parts or vehicle maintenance world. In this article, we explain in detail what these acronyms mean, the differences between these types of spare parts, and how to make the best choice for your vehicle or fleet.

OE (Original Equipment) parts, also called “genuine” parts, are components supplied directly by the vehicle manufacturer (for example, IVECO, Mercedes-Benz, Volvo) and are the same parts installed during original assembly. These parts bear the brand’s logo and are packaged in official packaging.

Key characteristics of OE parts:

• Comply with the vehicle manufacturer’s quality standards.

• Official packaging and identification code.

• Perfect compatibility and guaranteed certification.

OE Parts – Pros and Cons:

Advantages:

• Maximum safety and compatibility.

• Identical to the parts being replaced.

Disadvantages:

• Generally more expensive than other options.

• Limited availability or longer delivery times in some cases.

OEM parts are made by the same suppliers that manufacture components for the vehicle maker but are sold under the supplier’s brand, not the vehicle brand. For example, if a CNH filter is manufactured by KNORR-BREMSE, the OEM part is that same filter, but with the KNORR-BREMSE logo.

Key characteristics of OEM parts:

• Same quality, materials, and specifications as OE parts.

• More competitive pricing.

• Packaging and branding from the original component manufacturer (not the vehicle brand).

OEM Parts – Pros and Cons:

Advantages:

• Reliability equivalent to OE parts.

• Lower cost with significant savings.

• Identical compatibility and performance.

Disadvantages:

• Do not bear the vehicle manufacturer’s logo, which may raise concerns.

• May not be available for all models or markets.

Aftermarket parts are manufactured by independent companies that do not supply parts as original equipment but produce components compatible with OE/OEM parts. Some companies obtain licenses or blueprints to produce equivalent parts; others develop alternative designs.

Key characteristics of Aftermarket parts:

• Wide range of manufacturers and variable quality.

• Lower costs and a broad price range.

• Available even for older or discontinued vehicles.

Advantages:

• Much cheaper than OE and OEM options.

• Some components may perform better than the originals.

• Wide range of manufacturers.

Disadvantages:

• Quality is not always consistent; some use inferior materials.

• May lack warranty.

• Compatibility risks if the brand is unknown.

The answer depends on each customer’s needs:

• If total warranty and official certification are the priority, OE parts are the best choice.

• If you want the same quality at a better price, OEM is the ideal option.

• If you’re looking for cost-effective solutions—especially for older vehicles or those requiring frequent maintenance—a good Aftermarket part from a trusted brand may be more than enough.

In this article, we distinguish between OE, OEM, and Aftermarket parts based on well-established technical and commercial criteria. However, there is no absolute or universal classification. Some companies like Knorr-Bremse, while not technically OE for all manufacturers, are perceived as such due to their widespread presence, reputation, and quality.

This perception may vary depending on the market, the operator’s experience, and local customs. The goal of this guide is to provide helpful orientation tools—not to impose a single truth—while encouraging more conscious decision-making, especially for those new to the world of spare parts.

Choosing the right spare part is not always easy. The multitude of codes, versions, design variants, and compatibility considerations makes selection complex—especially in the vast aftermarket universe, where quality can vary greatly between manufacturers.

In this context, relying on expert and highly specialized suppliers like ECS Export is a strategic advantage.

For over 30 years, ECS Export has been passionately and expertly dedicated to sourcing spare parts for industrial vehicles, agricultural machinery, and heavy equipment. We supply both individual components and wholesale volumes to professional operators, distributors, specialized workshops, and companies managing entire fleets—offering reliable, efficient, and tailored solutions for each operating context.

With a team experienced in transport and logistics, we help each customer choose the most suitable components—whether OE, OEM, or Aftermarket—ensuring technical compatibility, optimal performance, and maximum cost-efficiency.

Choosing between OE, OEM, or Aftermarket requires a personalized analysis. Understanding the differences helps optimize maintenance, reduce long-term costs, and maintain high standards of reliability and safety.

Our approach is focused on expert guidance, prioritizing quality and the best cost-benefit ratio. Our catalog includes OE and OEM parts from leading brands (Iveco, Knorr-Bremse, Meritor, Valeo, Bosch) and top-tier Aftermarket components, selected using strict criteria for safety, durability, and performance equal to—or better than—the original.

With an international supplier network and an always-updated multi-brand catalog, we ensure fast response times, flexible international logistics, and continuous technical support before and after the sale.

• Coming soon: We will also be launching our first Aftermarket product under the ECS brand—an outcome of our technical expertise and continuous pursuit of reliable, efficient, and accessible solutions.

Choosing ECS Export means trusting a competent and transparent partner, ready to support you anywhere with tailored solutions and guaranteed quality.

International. With the aim of providing high-quality and complete solutions to the aftermarket, ZF Aftermarket launched a new line of sealing kits specially designed for mechatronics exchange in ZF 6HP and ZF 8HP automatic transmissions.

This new proposal responds to the growing demand for reliable components ready for installation in mechatronics maintenance, repair or disassembly processes.

The kits are comprised of original, highly durable parts including mechatronics guide sleeves, adapters, double-ring gaskets, and sea-

United States. The president’s statements generate temporary relief in the industry, although uncertainty persists about the direction of his trade policy.

U.S. President Donald Trump announced that he is considering temporary exemptions to the 25% tariffs on imported vehicles and auto parts, with the aim of giving auto companies more time to establish operations within the country.

“I’m considering something to help the auto companies with this. They’re switching to parts made in Canada, Mexico and other places, and they need some time, because they’re going to make them here,” Trump told reporters from the Oval Office.

While he did not offer details on the duration or extent of the potential waivers, his comments sparked an immediate positive reaction in the markets. Shares of General Motors, Ford Motor and Chrysler parent Stellantis NV rebounded after earlier declines.

The tariffs pushed by the Trump administration, which would take effect no later than May 3, have been sharply criticized for their potential impact on prices for consumers and integrated supply chains between the United States, Canada and Mexico. Despite the criticism, the president has defended the measure as part of his strategy to revitalize the national manufacturing industry.

ling tubes. Thanks to its comprehensive design, workshops can have everything they need in a single package, which facilitates more efficient technical intervention, reduces waiting times and improves the quality of service.

“The launch of these kits is part of our global strategy to strengthen the offer of preventive maintenance products in the automatic transmission segment,” ZF Aftermarket said in its official presentation. The brand highlights that these kits not only help prevent leaks and extend the life of the transmission, but also contribute to improving the overall performance of the vehicle, ensuring a more comfortable and safer driving experience.

In addition, the kits are designed to perfectly fit the technical requirements of the 6HP and 8HP models, widely used in vehicles of various brands worldwide. Its immediate availability through the network of authorized distributors facilitates access to a reliable product, which meets the highest quality standards of ZF.

With this addition, ZF Aftermarket continues to position itself as a strategic ally for workshops and professionals in the sector, offering solutions aimed at efficiency, performance and end customer satisfaction.

Currently, there is already an exception for vehicles that meet the local content requirements of the North American trade agreement. However, Detroit’s big three automakers have been lobbying the White House to expand exemptions and exclude certain low-cost components.

According to sources close to the matter, Ford, GM and Stellantis would be willing to accept tariffs on finished vehicles and key components such as engines and transmissions. But they have warned that the application of blanket auto parts levies could increase their costs by billions of dollars, jeopardize profits and even lead to layoffs, which would run counter to the president’s goals.

During the same day, Trump also announced that he is contemplating new tariffs on imported pharmaceutical products in the “not too distant future.” In addition, he defended the recent exclusions applied to consumer electronics from China, as a measure that will benefit U.S. companies such as Apple and Nvidia.

“I recently helped Tim Cook and that whole thing,” he added, referring to Apple’s chief executive. “I don’t want to harm anyone. But the end result is that we will achieve greatness for our country.”

Scan the code to read more

International. In the midst of the trade tension generated by the possible tariffs that the United States seeks to impose on manufacturing companies in Mexico, the German Rhenus Automotive announced an investment in a plant in Nuevo León.

The company, which specializes in automotive logistics and is a supplier to Volvo, joins the growing industry ecosystem in the state. Currently, the Swedish firm is building a plant in Ciénega de Flores, also in NL, to assemble trucks and trailers.

The announcement was made within the framework of a business tour of Europe led by Governor Samuel García, who highlighted the relevance of these investments to strengthen the state’s automotive supply chain.

“We were with Bosch, Schneider Electric, ZF and Siemens. Everyone is very happy in Nuevo León, expanding their plants and now we are going to Augsburg, Germany, to see Kuka from Robotics and Daye, who are also finishing their NL plant this summer, so, from Hannover, the third day, they tour Europe very productively,” said García.

During his visit, the president also highlighted the economic growth reported by the state, which exceeded that of several states in Mexico and the United States, according to INEGI figures.

“April 1, this is going to be a very good month, especially because Nuevo León grew 5.8 percent according to the latest data from

Inegi. In the United States, Texas, which is the state that grew the most in the world, was 3.5; Nuevo León 5.8, the U.S. national average 2.4, the Mexican national average 1.2 and Nuevo León 5.8,” he said.

A recent report on Texas’ economic performance in 2024 identified Mexico City, Chihuahua, and Nuevo León as the Mexican states most interconnected with the U.S. economy.

In this context, the number of foreign trade operations through the Colombia Bridge, which connects Anahuac, NL, with Laredo, Texas, has also increased.

In addition, it is expected that the relationship between Nuevo León, Coahuila and Tamaulipas with Texas will be strengthened with the upcoming construction of the passenger train between Saltillo and Nuevo Laredo, which will include a stopover in Monterrey.

United States. Bradenton, Florida-based ETCO Incorporated announced the launch of a comprehensive line of more than 1,800 automotive components.

This line includes spark plug and distributor terminals, insulating covers, and battery terminals, designed for original equipment manufacturers (OEMs) and large-scale distributors.

All products are manufactured in the United States under recognized quality standards such as SAE J2031 and J2032, as well as ISO 9001:2015 certification. In addition, the line includes options compatible with automatic or manual cable connection equipment and potting systems.

ETCO’s automotive terminals are available in loose or strip form, and are manufactured from a wide variety of materials such as brass, tinned steel, stainless steel, beryllium copper, phosphor bronze, as well as coated or layered alloys, with thicknesses from 0.006” to 0.078” and tolerances up to 0.0005”.

The company also offers custom solutions and circuitry for electric vehicles, with quotes available from the submission of plans.

International. MAHLE presented a new bionic radial blower for air conditioning systems in vehicles, setting a benchmark in energy efficiency and noise reduction.

Inspired by the aerodynamic shape of the penguin’s fins, this development is specially designed to optimize thermal performance in electric cars, where installation space is limited and efficiency demands are high.

This new component, whose structure was perfected with the support of artificial intelligence, promises to reduce noise emission by 60% compared to similar fans and improve the energy efficiency of the system by 15%. It is a solution applicable to all vehicle classes, from passenger cars to light and heavy commercial units.

“Evolution has endowed the penguin with fins that allow it to glide through the water with minimal drag and ultra-high efficiency. That shape served as a model for optimizing the impeller of our radial blower,” explained Dr. Uli Christian Blessing, Vice President R+D Thermal and Fluid Systems at MAHLE.

This breakthrough is the result of an AI-based design process, which generated more than 30 million virtual models in record time to find the ideal configuration. “Internally, we refer to this as ‘superhuman engineering,’” Blessing added.

The bionic fan architecture not only improves performance, but also allows for a more compact HVAC system arrangement by sitting in front of the evaporator, a key benefit in electric vehicles where every inch counts.

“The development of this new bionic radial blower underlines our system expertise and benefits from state-of-the-art artificial intelligence applications,” said Jumana Al-Sibai, member of the MAHLE Executive Board and responsible for the Thermal and Fluid Systems business unit.

At its Auto Shanghai booth (Hall 1.2), MAHLE is also showcasing other innovations based on bionic design, such as its high-performance fan for electric vehicles and a battery cooling plate, part of its MAHLE 2030+ strategy focused on electrification, thermal management and efficiency in combustion engines.

U.S. warns Colombia of possible sanctions if it does not stop new auto parts regulation

United States. Washington is asking to suspend a rule that would take effect on May 2, citing unfair trade barriers. Bogotá responds with the intention of negotiating.

The U.S. government has issued a serious warning to the Colombian government due to the imminent entry into force of a technical regulation on automotive safety, which could curb U.S. exports of auto parts to Colombia, estimated at 700 million dollars per year.

In a letter sent on April 11 to the Minister in charge of Commerce, Industry and Tourism, Cielo Rusinque, Ambassador Jamieson Greer — representative of the Office of the U.S. Trade Representative (USTR) — called for a halt to the implementation of the new rules, scheduled to take effect on May 2. According to Washington, these measures ignore the security standards in force in the US and could translate into trade sanctions.

“Colombia’s change of requirements without presenting evidence that current certification methods do not meet safety and performance objectives constitutes an unfair business practice,” Greer said in the document.

The main concern of the U.S. is that the Colombian regulations would exclude certifications of the Federal Motor Vehicle Safety Standards (FMVSS), widely used in international automotive trade. This decision, Greer warned, could trigger immediate action by his government.

The U.S. Trade Office was clear in pointing out that, if Colombia’s decision is upheld, the import of auto parts from the U.S. could completely cease, with significant consequences for both countries.

Scan the code to read more

United States. The global aftermarket for electric and hybrid vehicles (xEVs) reached a value of $59 billion in 2024 and is projected to grow to $195 billion by 2035, with a compound annual growth rate (CAGR) of 11.5%, according to a new report from analytics firm MarketsandMarkets.

The study highlights that this growth will be driven by the sustained increase in the number of xEVs on the road, the ageing and higher mileage of these vehicles, the use of telematics to offer personalised services and the digitalisation of the value chain to improve the customer experience.

With the transition from internal combustion engines to electric powertrains, the aftermarket sector will undergo a transformation marked by the principles of the “4Rs”: repair, reuse, recycle and remanufacture. In addition, a greater adoption of mobile services for the maintenance and diagnosis of electric vehicles is anticipated, as well as the boom in the conversion of old cars to electric systems, a trend that combines sustainability and customization.

The report also underlines the central role that data will play in the

International. This alliance aims to advance the development of autonomous driving technology and accelerate the commercial implementation of its Robotaxi services.

As part of the agreement, Pony.ai will integrate its Robotaxi services into Tencent Cloud’s digital platforms, including Weixin (known internationally as WeChat) and Tencent Maps, allowing it to significantly expand its reach to new users. This integration also includes improvements in operating models, product functionalities and onboard infotainment systems, elevating the passenger experience in this type of autonomous vehicle.

In addition, Pony.ai will leverage Tencent’s cloud computing, artificial intelligence, big data and virtual simulation infrastructure to strengthen the performance of its PonyWorld virtual model. This will allow vehicles to be simulated and trained to more accurately meet the challenges of the real environment, supporting all stages of autonomous vehicle development, from model training to deployment in real-world scenarios.

“We are excited to collaborate with Tencent Cloud, a trusted technology partner that shares our vision of bringing safe and intelligent mobility solutions to everyone. Tencent’s robust digital ecosystem

business models of the future. Predictive maintenance, based on real-time vehicle information, will enable proactive interventions, more efficient diagnostics and a personalized user experience. New opportunities will also open up from this data, facilitating a circular economy for EV components.

One of the pillars of the new aftermarket model will be the focus on batteries. The development of services focused on predictive monitoring of battery health and proactive maintenance is envisaged. These practices will extend their service life, optimize performance, and reduce failures, supported by efficient diagnostics and informed decisions about replacements or reuse in a “second life.”

Scan

will allow us to unlock new opportunities for innovation and bring Robotaxi services even closer to users. This alliance marks a new milestone, accelerating the path to commercial implementation of the Robotaxi by expanding the user base and cross-platform cooperation, while shaping the future of the industry,” stated Dr. James Peng, co-founder and CEO of Pony.ai.

Mr. Xiangping Zhong, Vice Chairman of Tencent Group, added: “Pony.ai stands out as a clear leader in the autonomous driving industry, setting benchmarks in technological innovation. We are delighted to enter into this strategic alliance to support the next phase of Robotaxis development, leveraging Tencent’s strengths in cloud computing, mapping and intelligent cockpit ecosystems. This collaboration goes beyond a simple technical integration: it marks the beginning of a long-term co-innovation journey for the benefit of our users.”

United States. Aeromotive, which specialises in the manufacture of cable harnesses and connectors for high-demand sectors, has strengthened its “Build-to-Print” programme by integrating advanced 3D printing technologies into its production line.

Since 2015, the company has adopted industrial additive manufacturing solutions, evolving along with technological development in equipment, software, and materials. Today, this capability translates into faster deliveries, greater customization, and significant cost reductions.

Among the main advantages are:

Agile prototyping: Rapid validation of complex designs from day one.

Immediate start of production: New lines ready in days, not weeks.

Scalability: Production of up to 400 parts per batch in a few hours.

Savings: Cost reduction between 50 and 70% compared to CNC machining.

Design flexibility: Instant adaptation to changes without the need for additional tools.

Efficient customization: Integrated elements such as PokaYoke and part identification at no extra cost.

“By combining precision, speed and adaptability, 3D printing allows us to better respond to the technical and logistical challenges of our customers,” the company said.

United States. Six of the main associations of the U.S. automotive sector sent a joint letter to senior officials of the Donald Trump administration requesting the immediate suspension of the new 25% tariffs on more than 100 categories of auto parts, which would come into force on May 3.

“Tariffs on auto parts will disrupt the global automotive supply chain and trigger a domino effect that will lead to higher car prices for consumers, lower dealership sales, and make vehicle maintenance and repair both more expensive and less predictable,” warns the letter, addressed to the Treasury secretary. Scott Bessent; the Secretary of Commerce, Howard Lutnick; and the commercial representative, Jamieson Greer.

The signatory associations represent manufacturers, dealers and parts suppliers: Alliance for Automotive Innovation, American Automotive Policy Council, Autos Drive America, Motor & Equipment Manufacturers Association, National Automobile Dealers Association and American International Automobile Dealers Association. In a rare gesture, they decided to present a united front

to oppose the tariffs, which would affect key components such as engines, steering wheels, hinges and more.

“Most auto parts suppliers don’t have the capital to deal with an abrupt disruption caused by tariffs. Many are already struggling and will face production stoppages, layoffs and bankruptcies,” the letter continues. “It only takes the bankruptcy of a supplier for an automaker’s production line to stop. When this happens, as it did during the pandemic, all suppliers are affected and workers lose their jobs.”

President Trump has defended tariffs as part of his reindustrialization policy. In his April 2 speech, on the day called “Liberation Day,” he declared: “Foreign cheats have looted our factories and foreign scavengers have destroyed our once beautiful American dream.”

However, the industry assures that these measures will have counterproductive effects. John Bozzella, president and CEO of the Alliance for Automotive Innovation, reiterated on March 28 that “Additional tariffs will increase costs for U.S. consumers, reduce the total number of vehicles sold in the U.S., and decrease U.S. auto exports, all before any new jobs or manufacturing capacity are created in the country.”

Bozzella also highlighted in a previous statement that “Auto manufacturing is the largest manufacturing sector in the United States. Automakers, battery manufacturers, and parts suppliers have invested billions in U.S. manufacturing and directly support communities and workers in Michigan, Tennessee, South Carolina, Alabama, Mississippi, Kentucky, Ohio, West Virginia, Texas, Indiana, Illinois, Missouri, Georgia, New York, and more.”

Scan the code to read more

United States. Tritium announced the launch of its new TRI-FLEX charging platform, a state-of-the-art solution that promises to transform charging infrastructure at scale.

Designed with an advanced distributed architecture, TRI-FLEX allows you to easily scale from four to 64 load points, responding to the critical scalability, network capacity, and flexibility challenges facing the industry as EVs become globally popular.

“Today marks a paradigm shift in EV charging infrastructure,” said Arcady Sosinov, CEO of Tritium. “TRI-FLEX is not just an incremental improvement, but a fundamental reinvention of distributed load architecture, designed to efficiently scale at the pace the market demands.”

Among its main features, the platform incorporates a power conversion system called TRI-FLEX Hub, which offers between 400 kW and 1.6 MW of power in AC and up to 3.2 MW in DC. This capacity allows up to 32 TRI-FLEX dispensers (equivalent to 64 charging points) to be powered, far exceeding conventional systems.

The design also allows 100 kW, 200 kW and 400 kW dispensers to be combined in the same configuration, adapting to various types of vehicles and operational needs, from private cars to commercial trucks. Thanks to its 25 kW power management and real-time load balancing, the platform maximizes energy efficiency and system performance.

Another highlight is its environmental resistance. TRI-FLEX is IP65 certified and has an advanced liquid cooling system that ensures reliable operation in extreme temperatures, from -35°C to +55°C.

According to Tritium, this innovation significantly reduces the total cost of ownership by avoiding costly network upgrades and facilitating phased deployment strategies tailored to actual demand.

Argentina. The Japanese automaker Nissan announced the closure of its factory in Cordoba, Argentina, a measure that has a full impact on the local automotive industry and sets off alerts throughout Latin America.

Although the company will maintain commercial operations in the country, the decision represents a blow to industrial employment and the country’s ability to continue being a production hub in the region.

The closure is not an isolated event, but the reflection of a broader trend. Faced with an economy marked by inflation, a volatile exchange rate, regulatory hurdles and an inconsistent industrial policy, Argentina loses attractiveness against competitors such as Mexico and Brazil. These countries offer more predictable and efficient conditions for automotive investment.

Nissan’s departure is a symptom of structural problems. The Córdoba plant, where the Frontier pick-up was produced, employed hundreds of workers and was one of the most recent bets in the sector in the country. Now, production will move to Mexico, where Nissan already operates five plants with better infrastructure, lower operating costs and preferential access to key markets.

While Argentina loses a strategic operation, Mexico consolidates itself as the brand’s new epicenter in the region. The same is true of Brazil, which keeps its Resende plant active despite the global adjustments in the sector.

Labour impact and political pressure

Nissan’s decision involves immediate layoffs and puts pressure on the Argentine government, which is facing criticism for failing to retain key investments. Unions fear a wave of similar closures if macroeconomic imbalances that hinder local production are not corrected.

Continúe leyendo aquí

Jobs in the automotive sector – well paid, stable and with growth possibilities – are an engine for the Argentine middle class. Its disappearance puts one of the pillars of industrial employment in check and forces us to rethink the economic model.

Colombia. The Japanese multinational Isuzu Motor Corporation inaugurated a new company in the Bogota Free Trade Zone as part of its international expansion plan, focused on sustainability, taking advantage of local talent and strengthening its exports of remanufactured engines.

With this new headquarters – under the name Isuzu Colombia Zona Franca – the firm seeks to serve markets such as the United States, Venezuela and Europe more efficiently, with growth projections towards Ecuador, Peru and Chile. The decision consolidates Colombia as a strategic hub for Isuzu’s operations in Latin America.

“The skilled workforce, the privileged geographical location and the growing demand for solutions to keep the fleet of trucks and buses operational in the region were key to choosing Colombia as the base for this operation,” said Keisuke Kishi, general manager of Isuzu Remanufactura de Colombia.

Since its arrival in the country in 2017, Isuzu Remanufactura de Colombia has operated under a circular economy model, focused on the remanufacturing of engines for commercial vehicles, the transfer of knowledge and the generation of specialized employment. The company has invested close to three million dollars and currently has 40 employees, mostly technicians trained in advanced industrial processes.

“The fact that a company like Isuzu continues to expand its operation in Colombia is a clear sign of investor confidence in the country of beauty. From ProColombia, we have accompanied this process

with strategic orientation on the free trade regime and its competitive advantages, contributing to making this export vision a concrete reality today,” said Carmen Caballero, president of ProColombia.

All remanufactured engines meet the brand’s international quality standards, and are rigorously tested to ensure efficiency, safety and low emissions. In addition, the company has implemented environmental initiatives, such as a wastewater treatment plant and strict industrial waste management protocols.

The plant in Colombia – along with the one located in Hokkaido, Japan – is one of only two of the Isuzu group in the world dedicated to engine remanufacturing, which highlights the importance of the Colombian operation within the company’s global strategy.

International. The three brands dominate the new order driven by electrification and technological innovation with 33% of global automotive market profits.

These three companies are positioned as the new leaders in a sector marked by electrification, technological disruption and changing consumer preferences.

Tesla continues to lead the ranking by market capitalization, with more than 837,000 million euros, despite the volatility derived from the decisions of its CEO, Elon Musk. Its role as a

pioneer in electric vehicles continues to give it a competitive edge.

Toyota, for its part, maintains its reputation as an efficient and profitable manufacturer, with a capitalization of 258,000 million euros. Although its historical commitment has been to hybrids, the Japanese company is accelerating its transition to the 100% electric vehicle so as not to lag behind its competitors.

BYD has established itself as the third major player in the sector. The Chinese manufacturer has climbed rapidly thanks to its focus on batteries and competitive pricing, surpassing Volkswagen in capitalization since 2021. Its recent innovation in ultra-fast charging systems, capable of recovering a battery in five minutes, has strengthened its global positioning, especially in Europe.

The decline in prominence of traditional manufacturers such as Volkswagen and Renault contrasts with the rise of Asian brands, which are dictating the pace of change. Net profit projections for the coming months put Toyota in first place with 27 billion euros, followed by Volkswagen, General Motors and Tesla.

The map of the automotive sector has changed: the brands that lead electrification are capturing the benefits, while the rest seek to adapt to the new scenario.

International. The Italian firm developed exclusive versions of the P Zero R and Winter 2 for the new Porsche 911 GTS, the first hybrid model in this iconic line.

Pirelli is strengthening its partnership with Porsche by equipping the new 911 GTS, the first hybrid model in the 911 family, with tyres specifically designed to meet the demands of this innovative engine.

The tyre of choice is a tailor-made version of the P Zero R, developed with advanced simulation technology to strike a balance between high performance and everyday driving. A winter variant, the P Zero Winter 2, was also designed to ensure sporty behaviour even in extreme cold conditions. Both tyres bear the “N” mark on the sidewall, which certifies their exclusive homologation for Porsche.

Thanks to the use of Pirelli’s Virtual Development Centre (VDC) in Germany, the design of these tyres was able to reduce development time and the number of physical prototypes by 30%. This methodology allowed to fine-tune every detail of the P Zero R, which offers excellent wet grip, low noise and energy efficiency in line with the needs of the new hybrid system.

The P Zero Winter 2, meanwhile, incorporates a directional tread

that improves traction on snow and wet surfaces, without sacrificing dry performance.

This launch marks a new chapter in the collaboration between Pirelli and Porsche, which now has 338 approvals for models across all ranges, including sedans, SUVs and sports cars, both combustion and hybrid and electric. Highlights include the P Zero Trofeo RS for the 911 GT3 RS and the Scorpion All Terrain Plus for the 911 Dakar.

United States. The VIPAR Heavy Duty family of companies announced the addition of Tom Ruud as the new Program Manager, based in Sioux Falls, South Dakota.

Ruud will assume responsibilities for program management, the Global Parts Network (including the Product Distribution Center and brake-related products) and business systems. He will report directly to Larry Griffin, Vice President of Program Management.

With more than 13 years of experience in the heavy-duty vehicle industry, Ruud has worked in key areas such as product and program management, supply chain, production operations, and warehouses. Prior to joining VIPAR Heavy Duty, he served as Chief Supply Chain Officer at Wheelco Truck & Trailer Parts and Service, a company acquired by FleetPride, Inc. in 2024. Most recently, he was Senior Manager of OE Operations at FleetPride.

“We are very excited to welcome Tom to the VIPAR Heavy Duty Family of Companies,” said Larry Griffin. “His extensive industry experience brings a valuable perspective that will support our continued growth. In addition to his role as program manager, he will be involved in strategic initiatives that are key to our long-term success.”

Griffin stressed that Ruud’s expertise in areas such as ERP systems, pricing, procurement and global sourcing will be essential to meeting today’s supply chain challenges.

Ruud, for his part, expressed his excitement about joining the team: “What I’ve always loved about the heavy-duty vehicle industry is that even though it’s large and complex, it still feels like a small, tight-knit community. It’s a relationship-based business, full of good, reliable, hardworking people.”

“When I first entered the industry 13 years ago, I was amazed at how quickly things were evolving, especially in areas like marketing, supply chain, and technology. I’ve seen firsthand how this industry has not only caught up, but in many ways has taken the lead.”

Regarding his arrival at VIPAR Heavy Duty, Ruud added: “I have known the organization and its leadership for many years, and the decision to join their team was an easy one. It was the culture that appealed to me: VIPAR Heavy Duty is a well-run organization that truly cares about its people and its role in the industry. Surrounding yourself with good people makes all the difference.”

Dominican Republic. For the first time, the AutoAmericas Show – a benchmark event for the auto parts and automotive services industry in Latin America and the Caribbean – will be held in the Dominican Republic.

The 2026 edition will leave behind its traditional headquarters in Miami to land in Santo Domingo, thus opening a strategic door to new markets and growth opportunities for professionals in the sector.

AutoAmericas, the International Auto Parts Congress and Exhibition, officially announces that its 2026 edition will be held in Santo Domingo, Dominican Republic, on March 20 and 21, 2026 at the renowned Dominican Fiesta Hotel. This new venue marks a milestone for the event, which for the first time moves to Dominican territory, reaffirming its commitment to the regional integration of the automotive sector.

The announcement comes after the successful cocktail party held on April 10 in Santo Domingo, which brought together manufacturers, distributors, mechanics, entrepreneurs from the tuning world and enthusiasts of the sector. The great call demonstrated the potential of the Dominican market and the importance of bringing AutoAméricas to this new scenario.

The 2026 edition will include a robust trade show, a high-level academic program, vehicle showcase, and the long-awaited CALA AWARDS, which recognize the excellence of the region’s auto repair shops.

Andrés Caballero, Project Manager of the event, said:

“The energy and commitment we saw at the Santo Domingo cocktail party confirmed to us that this was the next step for AutoAmericas’ growth. In 2026, we will bring to the Dominican Republic an edition that will combine innovation, business opportunities and high-level training for the entire automotive industry.”

New scenario, same key opportunities

The change of venue does not alter the essence of the AutoAméricas Show: it continues to be the platform where the latest innovations in the sector converge. From diagnostic tools to solutions for vehicle electrification, attendees will have direct access to the products and trends that are transforming workshops and dealerships throughout the region.

Regional networking with international reach

The new location represents a great opportunity to strengthen ties with professionals from the Caribbean and expand business possibilities in emerging markets. More than 1,000 attendees, including manufacturers, distributors, technology providers and startups, will meet to share experiences, close alliances and project the future of the industry.

Congress and training with a strategic focus

AutoAméricas Show includes a robust program of conferences and workshops that address the most relevant topics of the moment: from artificial intelligence applied to automotive repair to the new dynamics of electrification and vehicle connectivity. The entrance to the congress has a symbolic value of USD $10, which includes access to all the conferences and the commercial exhibition.

Meet the leaders and see the evolution of the sector up close

The event will bring together the main players in the regional automotive industry. From big brands to start-ups, everyone will be present to showcase their vision and their most innovative solutions. It will be the ideal place to get inspired, update and detect new opportunities to grow your business.