The Local 1014 Health Plan Board of Trustees is proud to present the Winter 2022/2023 edition of The 1014 Health Line.

HOW THE HEALTH PLAN WORKS

How The Local 1014 Health Plan Works

Whether you just enrolled in The Local 1014 Health Plan of if you’re already covered by our Plan, below are some important insurance terms for your reference. A more comprehensive explanation of the details and coverage below can be found in the Summary Plan Description at www.local1014medical.org.

Annual Deductible

Each calendar year, you must meet the annual deductible before The Local 1014 Health Plan will begin to pay most covered expenses.

Your Local 1014 Health Plan Board of Trustees is dedicated to providing the highest level of service to our members while remaining on the cutting edge of the healthcare. To that end, all our Trustees are members of The International Foundation of Employee Benefit Plans (IFEBP). IFEBP is the leading educational organization dedicated to providing objective, solution-oriented education, research and information for over 8,200 organizations worldwide.

This October, The Local 1014 Health Plan Board of Trustees attended the 68th Annual IFEBP Conference. Local 1014 Health Plan Trustees attended seminars on topics including: cybersecurity, mental health support and suicide prevention, legal and legislative updates for health plans, recruitment and succession planning and investment strategies and best practices to keep our plan healthy for many years to come. These learning opportunities allow our Board to continue to effectively provide innovative benefits to meet our Firefighters’ unique needs.

As we close out the year, we are reminded of the great strides we have made this year towards providing the most comprehensive healthcare for our members and their families. With 2023 approaching we are looking to expand our coverage even more to meet your needs and fulfill our mission of protecting Fire Personnel and their families for life through excellence, quality, collaboration, and stewardship.

The Local 1014 Health Plan Board of Trustees would like to wish you and your loved ones a happy and HEALTHY Holiday Season and a joyous New Year. It is an honor to serve our fellow members of the Los Angeles County Fire Department and their families.

There are two types of deductibles:

1. Individual deductible: $200 per person (the deductible applies separately to each covered person)

2. Family deductible: $600 per family. When the combined individual deductible of three or more family members equals the family deductible amount, the family deductible is met. If you cover only yourself and one dependent, the individual deductible applies to each of you. Expenses incurred in one calendar year cannot be used to meet the deductible for the following calendar year. Note: Prescription drug, dental, and vision expenses do not apply to the annual deductible.

Coinsurance

Once you meet the deductible, you share cost with The Local 1014 Health Plan (this is called coinsurance). When you go to an in-network provider, The Local 1014 Health Plan will pay 90% of most allowable expenses and you will pay the balance. When you go to an out-of-network provider, The Local 1014 Health Plan will pay 70% of reasonable and customary charges and you pay the balance.

Copayments

For certain covered expenses, you pay a predetermined fee called a copayment or “copay.” For emergency room visits, a separate copayment of $50 applies to each visit when the covered person is not admitted directly from the emergency room to the hospital for continued necessary acute care. The emergency room copay does not apply in the case of an accident, when directed to the emergency room by a physician, when the covered person is transported by ambulance or if there is a reason to believe that the covered person has an emergency medical condition.

Out-of-pocket limit

To protect you from mounting medical bills resulting from serious illness of injury, The Local 1014 Health Plan limits the amount of coinsurance you must pay each year after you meet the annual deductible.

o If you use in-network providers, your annual out-of-pocket limit is 10% of allowable expenses, up to $1,000 for individual or family coverage.

o If you use out-of-network providers, your annual out-of-pocket limit is 30% of allowable expenses, up to $1,500 for individual or family coverage, plus any amounts above reasonable and customary charges.

Note: The $1,000 in-network out-of-pocket limit is combined with, or counts towards, the $1,500 out-of-network limit.

Once you have reached the annual out-of-pocket limit after meeting your deductible, The Local 1014 Health Plan will pay 100% of allowable expenses, up to the specific Plan limits, for the remainder of that calendar year. Annual deductibles, prescription drug or other copayments, non-covered expenses and amounts that exceed reasonable and customary charges do not count toward your out-of-pocket limit.

With 2023 approaching we are looking to expand our coverage even more to meet your needs and fulfill our mission of protecting Fire Personnel and their families for life through excellence, quality, collaboration, and stewardship.”

TAKE ADVANTAGE OF OUR

FEATURE TODAY! SIGNING UP IS EASY

and can be done TODAY!

NOW AVAILABLE TO SPOUSES AND DEPENDENTS

Now Local 1014 Health Plan members and their families can find the answer to questions about your medical benefits anytime, using any internet connected computer, tablet – even your smartphone!

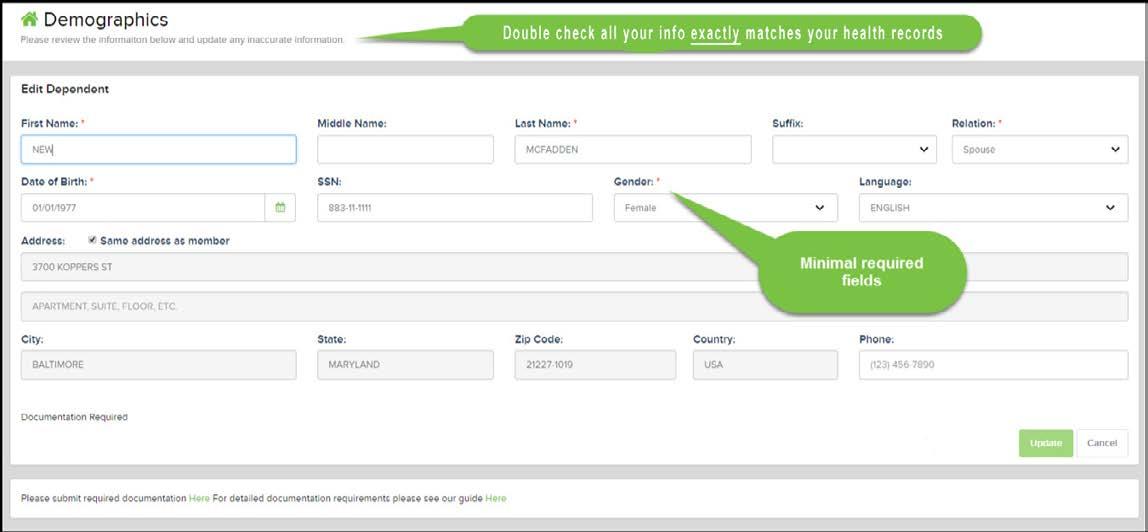

We are excited to announce we are enhancing MEMBERXG to provide access to spouses and dependents. Your secure login gives you 24/7 access to your personal medical benefits details and status, as well as important plan documents and updates.

Sign on any time, any day, from anywhere you can access the internet, and quickly get the information you need. There is no charge for this service and your spouse or adult dependents can get their own free account.

To register, you can find the link on our website under www.local1014medical.org/ MEMBERXG or scan the QR code to register.

How to Create Your Member or Dependent Account:

On the initial MemberXG screen, click the Create Account box in the upper right corner. Enter the following information:

User Type—either Member or Dependent

Email Address

Confirm Email Address

First Name and Last Name (capital letters)

SSN (last four digits)

Date of Birth (MM/DD/YYYY format)

Zip Code

Mobile Phone number (optional)

Click Next.

Enter a password, review the Terms of Use and Privacy Policy and select the checkbox.

Click Finish, the account is created, and you are returned to the initial MemberXG screen.

NOTE:

When registering all fields must match EXACTLY in order to create an account. One email address per user. For security, you will be asked to verify your identity each time you login from a new device.

HAVE QUALIFYING LIFE EVENT—MAKE SURE TO NOTIFY THE LOCAL 1014 HEALTH PLAN TO ENSURE YOU RECEIVE PROPER COVERAGE

Time frames for completing mid-year enrollment changes other than special enrollment rights

REMINDER: You must notify Local 1014’s Membership Department within 30 days if you experience a qualifying life event that will result in a change in your situation — like getting married, having a baby, or a death in the family.

Qualifying Life Events:

Getting married or divorced

Having a baby or adopting a child

Deat h in the family

Losing eligibility for Medicare, Medicaid, or CHIP

Turning 26 and losing coverage through a parent’s plan

Change of job status or employment circumstances

Life changes and we want to ensure that your Local 1014 Health Plan changes with you. Don’t risk a gap in coverage, make sure to notify the 1014 Membership Department if you have a qualifying life event. They can be reached at 800-660-1014.

NEW BENEFITS

New VSP Benefits

We offer a vison plan through VSP that give you the most flexibility and the highest dollar value with a $300 allowance for a wide selection of frames every 12 months and a $300 allowance for contacts lenses every 12 months with expanded coverage for additional coatings and materials! That means better designer frames for less money!

We also offer Suncare benefit of $300 every 12 months for sunglasses!

Prescription Lenses For Breathing Apparatus

The Local 1014 Health Plan is truly tailored to meet the need of Firefighters. Through our provider, VSP Local 1014 Health Plan members are eligible to receive a FREE prescription lens insert for the department issued breathing apparatus. These inserts allow anyone to use prescription eyeglasses inside their breathing apparatus without compromising the seal.

Each member is eligible for one prescription face mask insert every 12 months, allowing the prescription to be adjusted as your prescription eyeglasses are adjusted.

“This benefit not only allows for ease and comfort while wearing our masks, but helps keep our members safe when they are in the most dangerous situations. I would encourage everyone who needs it to look up this benefit today. Its FREE and you will be glad you did.” --Dave Morse, LACoFD Firefighter and Local 1014 Health Plan Trustee

To find out more about this unique benefit contact VSP today at 800-877-7195.