2001-2025 | SEVENTH EDITION

ISSN: 2688-383X (print) | 2688-3848 (online) ISBN: 978-1-970078-56-5

Published by: Irving Levin Associates, LLC P.O. Box 1117 New Canaan, CT 06840

Phone (203) 846-6800 | Fax (203) 846-8300 info@levinassociates.com

Managing Editor:

Advertising:

Benjamin Swett Cristina Blazek-Hearty

$199.00

© 2025 Irving Levin Associates, LLC

All rights reserved. Reproduction or quotation in whole or part without permission is forbidden. First Class Postage is paid at New Canaan, CT.

This publication is not a complete analysis of every material fact regarding any company, industry or security. Opinions expressed are subject to change without notice. Statements of fact have been obtained from sources considered reliable but no representation is made as to their completeness or accuracy.

POSTMASTER: Send address changes to Irving Levin Associates, LLC P.O. Box 1117, New Canaan, CT 06840

Irving Levin Associates Publications and Services

Subscriptions & Memberships

Long-Term Care:

LevinPro LTC

LevinPro LTC News

The SeniorCare Investor

Health Care:

LevinPro HC

The seniors housing and care merger and acquisition market has grown tremendously since the turn of the century in terms of deal and dollar volume but faces some potential and fundamental risks that buyers need to know.

The senior care industry has proven its resiliency in the last several years and is nearing its "golden years" when baby boomers begin to age into its properties at levels never before seen. That does not discount numerous headwinds ahead, but demographic tailwinds, little new construction, attractive pricing for properties and a general belief in the industry's future success has led to M&A volume that broke records in 2024 and may rise further in 2025.

Several challenges shook the industry to its foundations, from the pandemic and a staffing crisis to soaring inflation and capital costs. Although it is fading into memory, the COVID-19 virus targeted the sick, frail and elderly, prompting a negative perception of communal living among seniors by both seniors themselves and their adult children, not helped by an unfriendly and often-misleading media. The effects of that perception may still dampen demand for seniors housing for years to come.

Affordability will also eat into future demand, as inflation and ensuing high capital costs forced owners to raise rents to the point of pricing out more and more seniors. In addition, it may take years for communities to recover their pre-pandemic and pre-inflationary operating margins. These issues took a greater toll on middle- and lower-market communities, which could not compensate, i.e. raise rents, for the higher fixed costs (staffing, food, capital, etc.) as easily as communities catering to higher income residents.

Lower expected returns for the vast majority of seniors housing and care properties in operation, combined with higher capital costs and less liquidity, led to a collapse in prices for seniors housing and skilled nursing properties. Lower prices also discouraged many owners with performing, usually Class-A, properties from selling, which skewed the supply of

properties for sale to be much older and struggling operationally. Their owners tended to be highly motivated either by the operating losses, a debt maturity or fund life, further lowering prices in negotiations.

However, once interest rates stabilized, more buyers and lenders re-entered the M&A space, propped up prices and encouraged more owners of performing properties to entertain potential sales. A relative lack of new construction due to high capital and development costs also redirected capital to acquisition opportunities, increasing the supply of prospective buyers. And with baby boomers nearing the average move-in age for seniors housing, anyone who wants to take advantage of the demographic wave has to make their moves now, or at least very soon.

So, we expect to see new records for M&A activity, as well as for per-unit prices, in the near term. And The SeniorCare Investor will cover it all.

Ben Swett is the Managing Editor of The SeniorCare Investor, The Senior Care Acquisition Report and the LevinPro LTC & HC products at Irving Levin Associates. Since joining the company in 2014, he has reported on the senior care M&A, finance, and development markets. He has a BA in History from Hamilton College and an MBA in Finance from UConn.

Contact Information: editorial@levinassociates.com 203-846-6800 www.levinassociates.com

Get an estimated value of any type of seniors housing or skilled nursing property using LevinPro LTC’s newly launched property valuation tool. This tool is for anyone assessing an acquisition, advising on a sale or wanting to know where property valuations are today. An essential part of your workflow, the LTC Deal Valuation Tool adds another datapoint to your decision-making.

The number of mergers and acquisitions steadily increased throughout the 2010s in the seniors housing and care industry, until the pandemic led to an understandable drop in M&A activity. Dealmaking quickly rebounded to record highs and is on track to break more records in 2025.

Seniors housing and care M&A exploded throughout the 2010s, with the sector boasting a "recession-resistant" reputation and investors already referencing the baby boomers as their reason to acquire or develop, even though baby boomers would not really age into communities for another 10 to 15 years.

So, transaction totals rose from 89 publicly announced transactions in 2009 to a then-high of 365 deals in 2015, according to statistics from LevinPro LTC. After a couple of years of lower activity, deal making took off again in 2018, reaching 436 deals (a 41% increase over the 308 transactions announced in 2017) and peaking at 459 deals in 2019. Including transactions that were confidentially disclosed or took place off market, that total would be even higher.

The buying frenzy came to a temporary hiatus for a reason nobody could have predicted. The first confirmed case of COVID-19 was announced early in

the first quarter of 2020 (January 21st, officially), and investors halted much of their activity by the end of the first quarter and through Q3:20. COVID-19 raged through the population (especially the frail and elderly), lockdowns forced providers to shut their doors, unemployment soared, political uncertainty persisted through the summer and fall, and much was still unknown about the virus or the prospect for vaccines.

The M&A market rebounded quickly, spurred by low interest rates, resulting in 363 deals in 2020, which was the fourth-highest deal total ever at the time, before buyers announced 457 deals in 2021 and 561 deals in 2022, the busiest year on record at the time. But then interest rates started to rise, slowing acquisition demand and lowering prices. The "relative" slowdown affected the first half of 2023, with just 219 transactions reported for an annualized total of 438 deals.

However, by the middle of 2023, interest rates had stabilized, albeit at a much higher level than any time in the previous 10 years. That rate stability, as well as the belief that inflation would not be solved quickly and that rates would stay elevated for longer than most originally thought, led many owners with a time horizon on their properties (either because of poor operations, expiring fund life or maturing debt) to sell instead of holding out for higher prices.

So, M&A activity reached new heights, accelerating to 518 deals in 2023, soaring to 717 deals in 2024 and reaching new heights in activity in the 12 months ended June 30, 2025, with 733 deals.

Even though activity rebounded quickly, the size of deals has dropped with the rise in interest rates, and buyers were not willing to make big bets and sellers were less willing to divest large portfolios when values were low. The lack of large deals can actually help explain the record number of transactions being announced in 2024 and 2025, as a large portfolio deal that would have once included 10, 20 or more properties in a single deal (and entered once in the M&A database) is now being divided into two, three, five or even 10 separate deals (and entered 10 times in the database).

Breaking up portfolio deals helps attract more and different groups of buyers to the bidding table for

the smaller pieces. The portfolios can also be divided between the performing properties, which can usually be financed with debt at a higher price, and the non-performing ones that usually must be purchased with cash at a steep discount. Portfolios are becoming slightly more attractive in 2025, but until interest rates fall meaningfully, single-asset transactions will be the preferred investment strategy for most.

Dollar volume has ticked up since the low in 2023, when interest rate upheaval was its highest, rising from $7.9 billion in 2023 to $10.7 billion in 2024 to $11.9 billion in the 12 months ended June 30, 2025. Those figures fall below most annual totals in the last 15 years.

In the last several years, only a couple of transactions factored into the top-10 since 2001, based on purchase price. The 2025 deal featured Amica Senior Lifestyles' Canadian portfolio, which sold to Welltower for $3.185 billion. In the U.S., the other deal was the 2021 sale of DigitalBridge Group’s healthcare assets for $3.21 billion. The portfolio consists of 53 managed seniors housing communities (4,756 units), 106 managed MOBs (3.8 million square feet), 65 triple-net leased seniors housing communities (3,534 units), 83 triple-net skilled nursing facilities (9,723 beds) and nine triple-net hospitals.

Welltower was responsible for several of 2025's larg-

est portfolio transactions of 2025, so far. In addition to the Amica deal, the REIT purchased 48 skilled nursing facilities for $990.9 million consisting of $750.8 million of cash consideration and $240.1 million of common stock consideration. In connection with the closing, the acquired properties were leased to Aspire Healthcare under a long-term triple-net master lease. The deal previously fell through, allowing Welltower to negotiate a significant price reduction "to the tune of a couple $100 million bucks."

It also closed on the acquisition of the public, nontraded REIT NorthStar Healthcare Income for an approximate enterprise value of $900 million. CS Capital Advisors served as financial advisor, and Morrison & Foerster LLP served as legal advisor, to NorthStar.

Within senior care, the lack of mega deals has been more pronounced in the seniors housing market. The skilled nursing sector has continued to see some portfolio deals, as buyers in that space believe they can more easily turn around operations through better referrals, patient coding and new contracts with often-related ancillary service businesses.

And SNF buyers have had a larger stable of lenders willing to deploy capital at decent leverage because of the believed operational strength of their operating partners and in their ability to increase revenues.

The strength of the skilled nursing market, from a valuation perspective, surprised many in the immediate wake of the pandemic. That is because facilities were often caring for the sickest and frailest populations who were especially vulnerable to the coronavirus, and they received a lot of negative attention in the early days of the pandemic because of outbreaks and higher numbers of patient deaths. They then saw census plunge due to lack of elective surgeries and home health options (most of which were/are inappropriate for patients that require skilled nursing care). Many proclaimed the death of the industry.

However, with the return of elective surgeries, strong referral relationships that filled beds and the lingering benefits of the PDPM (Patient Driven Payment Model) rule change at the end of 2019, investors still saw a huge opportunity for profit in the skilled nursing industry. Investors that could wrap around ancillary services such as therapy, staffing or food services that benefitted from an increased patient population could earn revenues not just from the facilities themselves, adding to their appeal. Bidding wars ensued among investors trying to increase their bed counts, which pushed up prices for skilled nursing facilities to levels never before seen.

The average price per bed rose to $98,000 in 2021 and to $114,200 in 2022, which was a record by some 15% from the next-highest average in 2016.

The sale of Stonerise Healthcare’s 17 skilled nursing facilities in West Virginia was emblematic of the new market, with an estimated price of more than $315,000 per bed. For a variety of factors, the deal stands out among all the rest, with its geographic concentration, favorable reimbursement environment in West Virginia, relatively young age, high quality facilities and ancillary businesses.

In 2022, interest rates had risen and squeezed the spreads of other real estate sectors like seniors housing and multifamily, leading investors in search of yield to the SNF business, where cap rates have traditionally stuck between 12% and 13.5% in good economic times and bad.

However, sustained high interest rates finally began to eat into SNF valuations in 2023, as lenders pulled

back from the market or pushed back on pricing. The operating risks (like the threat of a federal minimum staffing mandate at the time), let alone the capital costs, were just too high to justify the kind of value that the market was consistently seeing. As such, the average price per bed for skilled nursing facilities in the four quarters ended June 2023 dropped 6.5% to $106,800 and another 8% to $97,700 per bed in calendar-year 2023. It fell another 7% to $91,300 per bed in the four quarters ended June 2024 before settling at $83,800 per bed in calendar-year 2024.

Quality and case mix will continue to be a major factor in SNF values, with the introduction of the PDPM reimbursement rule change in October 2019 rewarding those facilities with more medically complex Medicare patients. CMS also announced significant reimbursement rate increases for its traditional Medicare patients, staving off a downward rate readjustment to account for inflationary and labor issues. Most states have also provided generous, and needed, increases to Medicaid rates.

Ken Assiran, Managing Director, Senior Housing | Capital Funding Group sponsored content

With seniors housing and care M&A continuing its unprecedented momentum in 2025, industry leaders are looking for clarity, creativity, and capital to keep pace. CFG, a trusted financing partner in the space, has remained active and steadily grown through shifting market conditions. In the following Q&A, CFG Managing Director Ken Assiran shares insights on current M&A trends, financing strategies amidst ongoing operational headwinds, and how the company’s relationship-driven approach, deep sector expertise, and long-term vision are helping clients succeed in today’s evolving landscape.

1. What trends are you seeing with M&A transactions in the seniors housing and care space this year, and how is CFG helping clients navigate the momentum from 2024?

M&A activity in seniors housing and care remained strong in the first half of 2025, building on a record-setting 2024. This sustained momentum is fueled by well-capitalized, opportunistic buyers and a growing number of banks re-entering the lending market. While we’re seeing a mix of stabilized and value-add acquisitions, value-add continues to dominate as it is driven by the abundance of assets trading below replacement cost and limited availability of construction financing. Despite broader headwinds in the construction lending space, we continue to finance select projects that meet our disciplined underwriting standards.

At CFG, we’re more than a lender. We’re a hands-on partner, staying deeply engaged with our clients and offering strategic guidance at every stage of the deal. From financing strategies to broader investment decisions, we act as a trusted advisor, helping clients navigate today’s complex and fast-moving M&A landscape.

2. We’ve seen many lenders come and go in the space. What has enabled CFG to stay active— and even grow—through market volatility?

CFG has built lasting trust by delivering when others couldn’t. Our ability to execute consistently through market volatility has strengthened long-standing relationships and fueled new ones. As conditions evolve, we remain focused on growing through strategic outreach, referrals and our commitment to relationship-driven lending.

3. While deal volume is up, the market still faces staffing, occupancy, and rate pressures. How are these risks impacting financing strategies?

Staffing, occupancy, and rate pressures have become the new normal, but strong operators are still achieving solid margins. At CFG, we haven’t changed our underwriting standards. Instead, we stay transparent with borrowers and tailor financing solutions to meet their evolving needs. With extensive expertise in seniors housing, skilled nursing and healthcare lending, our team executes financing solutions tailored to the unique needs and goals of our borrowers in the industry. Our comprehensive loan offerings, paired with our entrepreneurial approach to lending, allow our team to efficiently execute deals of all sizes and complexities, with clarity and confidence.

4. Given tighter underwriting and interest rate uncertainty, what capital solutions are gaining traction with borrowers right now?

In today’s environment, we’re focused on converting floating-rate bridge debt into long-term, fixed-rate HUD financing. While HUD rates have risen, they’ve increased less sharply than short-term benchmarks like SOFR—making

them an effective refinancing solution for many borrowers. To mitigate interest rate risk, we require hedging through caps or swaps. With the current downward SOFR curve, swaps have become especially attractive, allowing borrowers to lock in fixed rates well below their floating rates which provides immediate savings and long-term planning certainty.

CFG’s flexible capital continues to fill gaps in the capital stack. Our one-stop-shop loan offerings enable us to offer subordinate debt, mezzanine financing, and other private credit instruments, enabling us to fill the void left in the capital structure with senior lenders.

5. Beyond financing, how is CFG investing in the future of healthcare and senior care?

CFG’s commitment to the industry goes beyond that of your typical lender. We’re deeply invested in the future of the long-term care industry. We actively support AHCA/NCAL, ASHA, NIC, and work closely with HUD, Congress, and state associations to advocate for policy improvements and help develop industry solutions. Under the new administration, our CEO, Jack Dwyer, and team have engaged directly with HUD and legislators to strengthen the HUD 232 program and champion legislation addressing workforce and reimbursement challenges.

Additionally, Jack founded Dwyer Workforce Development (DWD), an innovative 501(c)(3) tackling the healthcare workforce crisis. DWD provides Certified Nursing Assistant (CNA) training, job placement support in healthcare facilities, need-based wraparound services, and person-centered case management—uplifting individuals who seek healthcare careers and improving care for seniors nationwide. Since DWD’s inception just a few years ago, the nonprofit has quickly become a national organization serving over 9,000 individuals with impressive outcomes: 81% of Dwyer Scholars completed CNA training, and of those, 86% were placed in healthcare careers.

For two decades, skilled nursing cap rates continued their general downward trend. However, they did not compress to the degree that seniors housing communities had experienced and largely stayed between 12.0% and 13.5%. The sector maintained that consistency amid more volatile interest rate changes and global economic trends.

During the Great Financial Crisis, the sector saw a moderate increase in cap rate, rising from 12.1% in 2007 to 12.9% in 2008 and peaking at 13.1% in 2010. Other real estate classes were not so lucky. In the years afterward, the consistently high yields that skilled nursing offered drew investors to the sector, helping to compress the average cap rate to around 12.0%. Incredibly low interest rates after the Great Financial Crisis and abundant capital also contributed to the cap rate compression, but not nearly as much as on the seniors housing side.

Then, the risk of owning and operating a skilled nursing facility shot up as COVID-19 cases and deaths rose across the country, unfortunately all too often in the facilities themselves. And the average cap rate followed, increasing 50 basis points from 12.2% in 2019 to 12.7% in 2020. But then came 2021, when low interest rates combined with high investor demand (and higher prices) depressed the average skilled

nursing cap rate below the standard 12.0%-13.5% range to 11.3%, which is the lowest average cap rate ever for the sector.

In 2022, as interest rates started to rise, the average slightly increased to 11.4% and then jumped to 12.9% in 2023, the highest average in more than 10 years. Interest rates settled, and the cap rate for 2024 fell to 12.2%, on average, before dropping another 10 basis points to 12.1% in the four quarters ended June 2025. However, it must be noted that the average cap rate only reflects a portion of the SNFs sold during the year (those with market cap rates), and reflects the financials used to calculate each cap rate, which were almost always trailing figures excluding government aid.

Because of the stress on the sector, mostly affecting smaller operators, there were many struggling SNFs that sold from 2023 to 2025 with negative trailing EBITDA that were not included in the cap rate average. Facilities with little positive cash flow that yield very small cap rates would also not have been included in our calculations, since they were not “cap rate” deals but rather “per-bed” deals. This happens every year but was only exaggerated in the last three years. So, the average cap rate is not totally representative of the recent M&A market.

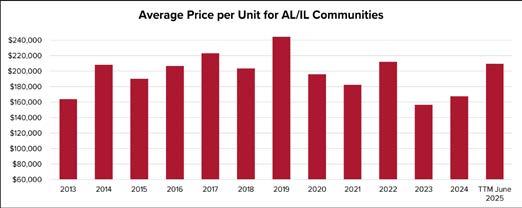

While pricing remained strong in the SNF space in the years following the pandemic, the average price per unit for seniors housing communities, which include independent living, assisted living and memory care, has steadily declined since 2019. The sector hit a peak back then, with an average of $244,200 per unit in 2019. The market readjusted to a post-COVID world that included staffing shortages, rising expenses and lagging census, dropping the average price per unit by 20% to $196,000 per unit in 2020 and another 7% to $182,300 per unit in 2021.

As the sector started to stabilize post-pandemic, with improving census and resident rate hikes, prices rebounded in 2022, averaging $211,800 per unit. There were also a few more owners of high-quality communities that were tempted off the M&A sidelines knowing that their well-performing properties would command a premium in a market flooded with struggling operations.

However, rising interest rates forced many potential buyers from the market while also lowering the prices that investors and lenders were willing to pay and finance. So the price for seniors housing communities dropped on an apples-to-apples basis, fewer owners of high-quality owners chose to sell and accept

a lower price (if they could help it), and the market was flooded with struggling and value-add properties. That combination caused the average price per unit, unsurprisingly, to plummet to $156,300, the lowest average since 2012. The average price per unit continued its descent into 2024, with an average of $140,200 in the four quarters ended June 2024, the lowest level since 2010. But similar to the skilled nursing market, stabilizing interest rates helped stabilize the prices paid for communities, with the average price per unit rebounding to $167,300 in calendar-year 2024 and soaring to $209,400 in the four quarters ended June 2025.

It is important to remember that the average price per unit is derived from the property sales included in the average in a given time period. That is an obvious statement, but in some years you may have an apples-to-apples increase in pricing of certain communities year over year but still see a decrease in the average price per unit if there were relatively fewer high-quality/high-priced sales included in the average in a given year. For those more granular pricing comparisons, check out the latest edition of The Senior Care Acquisition Report or visit LevinPro LTC.

Since the turn of the century, assisted living communities have accounted for the majority of sales and of dollar volume in the overall seniors housing market,

Oxford Finance LLC provides capital for growth and development to public and private companies operating in a variety of industries worldwide.

We have remained a leader in the lending industry because of our financial strength and commitment to be fair, flexible and responsive to the changing needs of our clients.

Providing More Than Monetary

Over the years, Oxford has been steadfast in our commitment to:

Offer Flexible Solutions – Ensuring that the loan terms, draw-down period, availability, interest rates, collateral mix and loan amounts meet the expectations and needs of our clients

Approve and Execute Transactions Quickly –Avoiding bureaucratic layers and empowering our professional team to perform a thorough screening, promptly prepare accurate loan documents and close in a timely manner

Establish Personal Relationships – Having a knowledgeable team of experts from our Business Development, Credit & Portfolio and Legal departments dedicated to individual clients from the beginning to the end of each loan transaction

Oxford

• Origination of more than $14 billion in loans

• Credit facilities ranging from $5MM to $250MM

• Real estate and cash flow term loans

• Revolving credit facilities

• Headquarters in Alexandria, Virginia, with offices in California, and the greater Boston and New York City metropolitan areas

REAL ESTATE TERM LOANS

• Bridge, mini-permanent and mezzanine

• Range from $5MM to $250MM

• Two- to five-year term

• Up to 25-year amortization period, with interest only option

• Delayed draw feature to fund additional acquisitions available in select situations

REVOLVING LINES OF CREDIT

• Asset-based

• Range from $5MM to $50MM

• Two- to five-year term

• Interest only

STRUCTURED PRODUCTS

• Customizable financing solution available to facilitate the acquisition of qualified healthcare properties

• When paired with our traditional Real Estate Term Loan, potential financing up to 95% loanto-cost available

• Buyer retains 100% of ownership

Trazy Maziek

Senior Managing Director

Head of Real Estate & ABL

Phone: 858.750.2563

tmaziek@oxfordfinance.com

Kevin Harbour

Managing Director

Phone: 949.558.3677

kharbour@oxfordfinance.com

Richard Russakoff

Senior Director

Phone: 424.252.2845

rrussakoff@oxfordfinance.com

Katherine Thornett

Senior Director

Phone: 703.236.2939

kthornett@oxfordfinance.com

and 2025 is yet again no exception, with assisted living representing close to four of every five seniors housing properties sold.

Being a much smaller market compared with assisted living, the independent living sector is prone to more wild swings in its average price per unit, and one or several large transactions with especially high or low prices can have an outsized impact on the average. There was some remarkable stability in the average price in the years leading up to the pandemic, when the average price hovered between $228,200 per unit and $238,100 per unit, which was possibly a reflection of the sector’s more stable operating environment.

However, a few high- or low-priced sales can sway the average price, and the sector has been on a roller coaster since the pandemic, experiencing a significant 24% drop in 2021 to $177,400 per unit followed by a 46% increase in 2022 to $259,400 per unit.

Then, the average dropped by 24% to $196,200 per unit in 2023 and by another 7% to $183,000 per unit in 2024. True to form for the sector, the average

swung back, rising 28% to $234,100 per unit in the four quarters ended 2025.

The high-end of the seniors housing M&A market is slowly returning, even amid high interest rates. Owners that delayed sales in the previous two years in hopes of a more favorable valuation environment are coming to the conclusion that market conditions are not improving drastically any time soon, and if they want to recycle capital for other acquisitions or investments, now is the time to sell. They have brought more than a handful of $400,000+ per unit transactions to the market, featuring high-quality, well-performing IL communities that helped boost the sectors average price per unit.

Proponents of independent living touted its durability during the pandemic, especially relative to the AL market, since it required fewer staff, catered to a younger, healthier population and did not suffer from the effects of overdevelopment. The sector’s average occupancy hovered around the healthy level of 90.0% just before the pandemic, so it had a larger census cushion to absorb the impacts of COVID-19. That strong occupancy also gave these communities more flexibility to charge higher rents, resulting in surer financial footing going into the pandemic as

well. Independent living is also a lot closer to attracting the oncoming baby boomers, since the average move-in age is theoretically lower than assisted living.

On the other hand, the burgeoning active adult sector, which is not a subsector of IL, may be poaching some of IL’s younger potential residents. Once in active adult, it is possible those residents will bypass independent living services and go straight into assisted living or skilled nursing, as needed.

Because active adult communities come with fewer services, they typically charge lower rents than IL. But they usually still offer activities and a better social life than if the seniors just stayed at home, which is a big selling point for IL. Sometime down the road as their resident population ages, active adult communities could begin to add IL-like features, such as communal dining and laundry services and even certain care options. That could have ramifications across the entire seniors housing spectrum.

Conversely, the rise of active adult could also prove to be a boon for other seniors housing sectors, including IL, since it gets those elderly adults out of their homes, a major barrier to moving into seniors housing anyway, and out living among their peers, another

major draw to seniors housing communities.

The sector set a record for the lowest average cap rate in 2021 and 2022 at 6.6%, back when interest rates were close to historic lows. However, with rising capital costs and a lower quality of property being sold, on average, the cap rate rose to 7.5% in 2023. Despite the drop in average price, the average cap rate also fell to 7.1% in 2024, and as prices rose in the four quarters ended June 2025, the cap rate confoundingly rose as well to 7.4%. However, such a small sector can experience wild swings in its average cap rate as well that may not be as representative of today's market than the average price per unit would.

Anecdotally, the "floor" for cap rates effectively rose to 6.5% or 7% when interest rates were at their peak in 2023 and early 2024, which still did not leave much room for error when a long-term mortgage from Fannie Mae or Freddie Mac carries a 5.5% interest rate, or when acquisition debt far surpasses 6.5%. The cap rate floor has dropped by perhaps 50 basis points since then.

But with persistent high interest rates in this current market, most IL investors probably are not using the cap rate when valuing their purchases. And many of

the IL deals featured struggling properties that did not have a market cap rate. So, the lack of movement in cap rate is not always emblematic of the typical IL community that sold in the most recent four-quarter period.

Few sellers were willing to accept a higher cap rate for their portfolios, too, and have refused to sell. The largest IL deal of the last couple of years, so far, totaled $180.5 million and involved Retirement Housing Foundation's 15 seniors housing communities across six states. Acquired by Pacifica Companies, the portfolio comprises 3,200 independent living units, 850 assisted living/memory care units and 563 skilled nursing beds.

The lack of big deals in 2024 and 2025 reveals that investors were not confident to make large bets on the independent living space, but more so that seller expectations in price did not fall accordingly with the rise in capital costs. Accepting a cap rate of 6.5% on a portfolio you bought for a 5.5% cap rate is a tough pill to swallow for an owner.

As a result, few large portfolios were put up for sale because owners could theoretically weather the effects of inflation and staffing shortages (and not turn

to an M&A event) better than in assisted living. That is slowly changing in 2025, however, as market conditions improve.

Comparing the two main seniors housing sectors, independent living typcially beats assisted living in terms of average price per unit, with one exception in the last five years. That was again the case in the four quarters ended June 2025, with both sectors rising from their calendar-year 2024 averages.

The IL sector rose more dramatically, and it is the sector best positioned to capture the baby boomers first, but looking forward, there is certainly a case that more “need-based” services could be a better investment amid economic issues, affordability concerns, and that a “luxury” such as independent living could be overlooked by potential residents deciding to stay home or move into active adult. IL's success is also closely tied to that of the housing market, and a dip in house sales or prices could impact a resident's ability or comfort level to move into a community.

It is too early to tell, but some caution from investors (in the form of a slightly higher cap rate) could be warranted, even for high-quality communities.

Long-term care and health care investment intelligence. Gain an informational edge with focused news briefs, expert analysis, and in-depth deals intelligence spanning long-term care and health care industries.

www.levinassociates.com

Assisted living has received the majority of investor attention for much of the 21st century, for good and bad. After developing a “recession-resistant” reputation, demographic-fueled enthusiasm led to a period of overbuilding in the mid-2010s and decreased occupancy as a result. Increased competition in many markets across the country exacerbated the problems caused by an already-tight labor market, with poaching of key staff an all-too-common and expensive trend. These issues hit lower-end and middle market assisted living communities more, as they could not raise rents as easily to counteract higher wages and rampant discounting. And they left the sector in a more precarious position going into 2020.

The pandemic did take a heavier toll on assisted living communities than independent living, not only because of their older, frailer patients but also for their greater staffing needs. But investor interest still targeted the higher acuity sector, since those communities accounted for four-fifths of the seniors housing communities sold in 2025, so far. Demographics will come to the sector’s aid at some point, but likely not starting until the late-2020s.

In the years following the pandemic, the sector’s aver-

age price remains well below the pre-pandemic high of $248,400 per unit in 2019. It plunged by 30% to $174,700 per unit in 2020 before rising modestly in 2021 to $186,800 per unit and to $195,200 in 2022 as a result of two straight years of post-pandemic performance gains by operators and a higher share of properties sold being “A” quality communities in this sector. Those highest quality communities could charge higher rents, attract and retain staff and did not require major capex to stay competitive, and they sold at a premium as a result.

However, as capital costs soared throughout 2023, owners of those highest quality communities did not see the value of selling because the buyers could not justify the prices for their well performing, “A” quality assets. If they did not have a debt maturity or fund life horizon, or were not bailing out struggling operations, most did not need to sell, and so they stayed on the M&A sidelines. On the other hand, the properties that were selling were often in distress and owned by highly motivated sellers. Buyers have fewer options compared with skilled nursing to quickly turn around operations of a struggling assisted living business and accounted for that fill-up risk and general margin compression. As such, it became a buyer’s market, and the average price per unit plunged to $145,400 per unit in 2023, the lowest average since

2010. Prices did stabilize slightly in 2024, with the average rising to $160,900 per unit, and continued into 2025, jumping to $184,800 in the four quarters ended June 2025.

Values rose for a variety of reasons. Interest rate stability brought more lenders into the capital markets, thereby improving capital costs and terms for potential borrowers. Thus, borrowers could support higher prices if they got into a bidding war. Communities also improved their operations, being one additional year removed from the effects of the pandemic, staffing shortages and inflation. And the overall quality of communities being put up for sale rose, helping to boost the average price per unit with a higher share of high-quality, well-performing properties.

Scarcity of new development, with more capital being redirected to M&A as a result, could lead to further pricing increases in assisted living in 2025 and beyond. Slightly lower cap rates combined with higher levels of NOI could lead to some record-high per-unit

prices in 2026, as well.

Assisted living has come a long way from the throes of the GFC, when average cap rates exceeded 9%, and when 6% cap rates were nearly unheard-of. Despite the numerous risks facing the industry, average cap rate kept declining throughout the pandemic, eventually to 7.5% in 2022. Even during the pandemic, there were still 6% or lower cap rate deals, as buyers clamored for the few stabilized, high-quality deals on the market.

Soaring interest rates eventually pushed cap rates to their highest level since the early 2010s. The average cap rate spiked to 8.6% in both 2023 and 2024. Anecdotally, the cap rate "floor" rose to around 7.0% in the first half of 2024, with sub-7% cap rate deals just not making sense in a world with the 10-Year Treasury rate above 4%.

As rates steadily declined in mid-2024, investors and lenders started to see a few sub-7% cap rate deals

close, and that trend continued into 2025. Lower cap rates could spur more owners of high-quality properties to re-enter the M&A market. But the higher cap rates also account for some of the serious and fundamental risks facing the assisted living sector.

Some risks include the aging physical plants of thousands of AL communities across the country, the attractiveness of the current inventory to the future baby boomer customers, the trend towards home health, the affordability factor for middle- and lower-market seniors, shortening lengths of stay for an older and frailer move-in population, permanently higher labor needs and costs, plus any major, future disruptive event yet to be considered (like a pandemic).

All of these risks could potentially lower the penetration rate for assisted living (and all seniors housing) services and defy many of the all-too-rosy supply and demand projections for the industry. This makes it more important for operators to demonstrate the value of their services and the positive impact on seniors' quality of life, as well as to adapt to the preferences of the boomers. Capital providers will also have to help fund needed capex and conversion projects to meet that need, in addition to investing prudently and with more conservative leverage going forward.

Opportunities for growth abound in the seniors housing and care industry, as the demand for both need-based and lifestyle-based option increases with the rise of the senior population. More communities need to be built to meet that demand, although the projected unit shortfall is an unknown. That is because we do not know how future demand will be affected by affordability issues, a change in taste, economic factors or improvements in technology that could allow someone to age in their homes in a safe, social and cost-effective manner. It is a risk that investors growing and entering the industry need to be aware of, whether they are targeting higher-income seniors, the middle market or lower-income adults.

Economic realties on the ground have stymied much of the new construction that still has to happen to care to the inevitably higher population of frail seniors coming. That means most will be growing their portfolios via acquisition, and that unprecedented demand, combined with improving capital markets conditions and operating environments, will likely push prices and deal activity to new heights.

Trusted by investors, advisors, providers, payors, academics, and government agencies to understand the nuances of healthcare investment and consolidation. Gain access to the most detailed healthcare acquisition data available.

Request Demo

From the one-doctor physician practice to a large-cap business, we track all healthcare transactions.

Private Equity

Speed up diligence and sector thesis development research

Rely on proprietary, privatelysourced valuation data

Deal Database

• Acquirer or target company

• Target sector and subsector

• Acquirer sector

• Acquirer type

• Deal value

• Location

• Key words and phrases

12 key sectors with drill-downs into physician group specialties, hospital types, behavioral health types, etc.

Our analysts speak to company leaders and key advisors to gain insight on valuations and strategic roadmaps.

Medical Groups

Use data to refine your growth and partnership strategy

Advisors

Track subsectors and identify trends with ease

The data you need, when you need it

34,000+ transactions, searchable by:

Health Systems

Tap extensive hospital M&A data and valuation stats

Academics

Study market structure and consolidation impacts

Easily spot trends with: Key Analytics

• Monthly deal volume by sector

• Top physician group specialties by deal total

• Private equity activity by sector

• Number of hospitals and beds acquired

• Price per bed (hospitals)

• Acquisitions by PE firms and their portfolio companies

Phone: 203-846-6800 Email: info@levinassociates.com