The Future of is in Marcus Evans Healthcare

Top Stories August 2025

Health System M&A Pulse

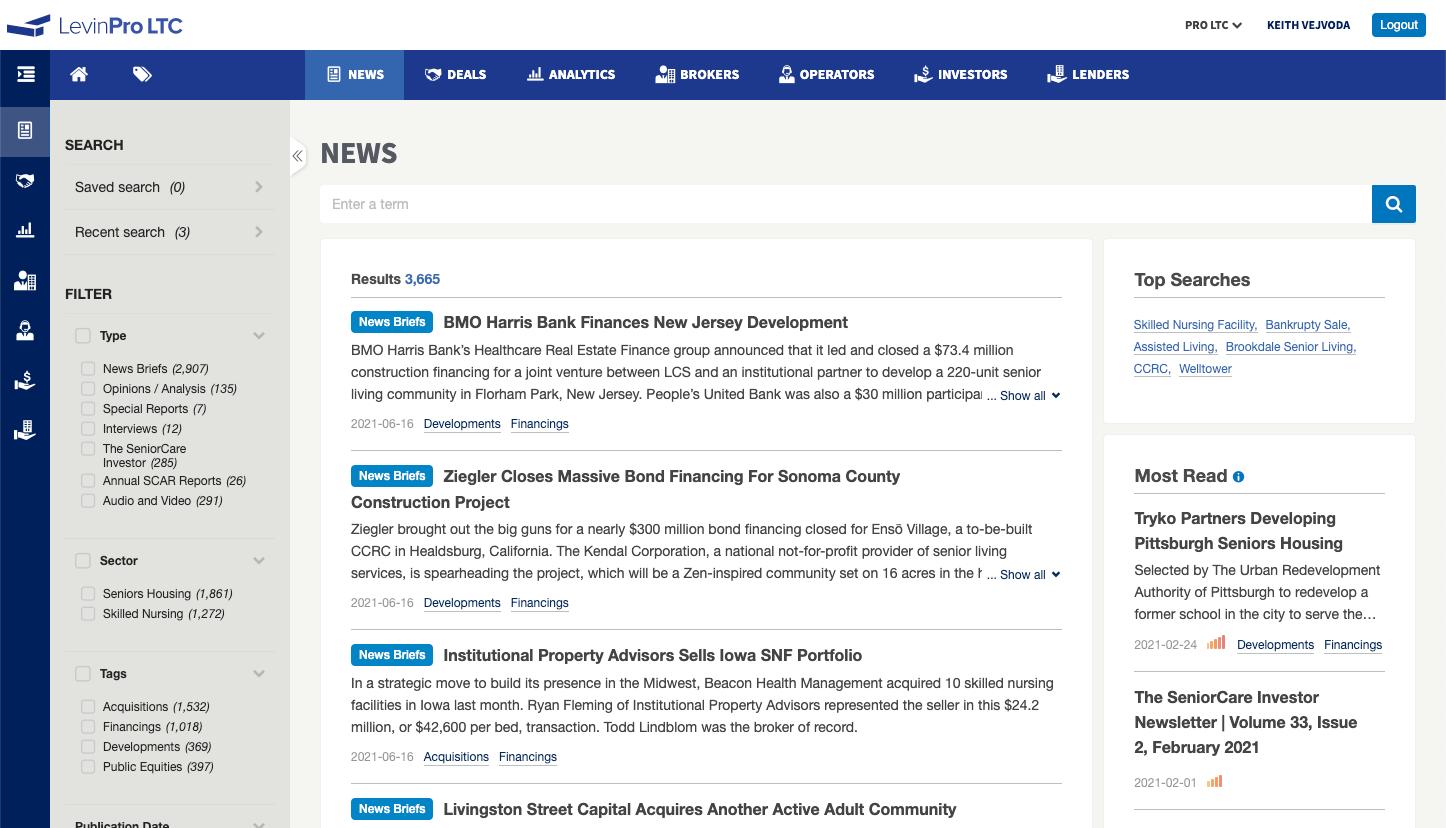

For U.S. health systems, the 2025 market has been volatile, to say the least. From Medicare and Medicaid cuts to escalating costs, health systems have had to adapt to a sweep of changes in the industry. These headwinds have taken a toll on M&A volume, as health systems have had to slow down their pace. Compared with the first half of 2024, M&A activity from health systems has declined by 16% in the first half of 2025 (57 deals), with investment in hospital facilities falling by more than 50%, according to data captured in the LevinPro HC platform.

Activity in the third quarter has remained stagnant, with only eight transactions announced since July 1.

With the market in flux, we’re examining some notable transactions and trends that have defined the health system industry in 2025 so far.

Health system mergers have slowed significantly in the first half of 2025

Five mergers have closed so far in 2025 (four if you only count U.S.-based deals), a much slower pace than the 12 announced in 2024.

The largest merger in the United States was Prime Healthcare’s acquisition of Central Maine Healthcare, which generated more than $500 million in net patient revenue in 2023 (the most recent information available), and serves approximately 400,000 patients in central, western and mid-coast Maine.

Prime Healthcare will become the sole corporate member for Central Maine Healthcare. The deal includes the following facilities: Central Maine Medical Center, Bridgton Hospital, Rumford Hospital, Rumford Community Home, Bolster Heights, Maine College of Health Professions, CMH Cancer Care Center and a combination of more than 40 physician practices. Other major health system deals this year include

Emory Healthcare and Houston Healthcare’s merger in Georgia, and St. Luke’s University Health Network’s acquisition of Grand View Health in Pennsylvania.

Health systems are still pushing into the outpatient market

Hospitals are no longer the priority for health systems in the acquisition space. Increasingly, organizations are focusing on expanding outpatient services rather than bolstering bed counts. As of mid-August, health systems have announced more than 30 transactions in the physician space alone, along with acquisitions for medical outpatient buildings and ambulatory surgery centers.

Novant Health has been one of the most active acquirers in 2025, acquiring five physician practices and a diagnostics center. Its most recent deal was for Performance Orthopaedic Surgery & Sports Medicine, which offers adult and pediatric orthopedic and sports medicine care for patients in and around the RaleighDurham, North Carolina metro area.

We’d be remiss not to mention Ascension’s major acquisition of AmSurg Corp. , one of the largest operators of ambulatory surgery centers in the country. No price was officially disclosed, but certain media outlets reported the deal was valued at $3.9 billion.

Once finalized, the deal would add more than 250 ambulatory surgery centers across 34 states to Ascension’s network.

Investing in emerging technologies and AI

Health systems are exploring new areas to invest in and expand their networks, such as emerging technologies to enhance patient care.

In May, Cedars-Sinai and Redesign Health launched a new Digital Innovation Platform, where they aim to collaborate and “nurture a digital innovation ecosystem in Los Angeles to improve the delivery of high-value healthcare.”

The press release from Cedars-Sinai previewed some of the technology the partnership will be focusing on, including AI, to build solutions for personalized medicine, specialty care access, hospital workflow optimization and increased care coordination

Other healthcare systems are also investing heavily in new AI technologies.

Aidoc, a leading clinical AI platform, announced a $150 million financing round led by General Catalyst and Square Peg, with participation from NVentures (NVIDIA’s venture capital arm) and four major U.S. health systems, including Hartford HealthCare, Mercy, Sutter Health and WellSpan Health. This round also includes a $40 million revolving credit facility, bringing the company’s total funding to $370 million.

Optum Buys Holston Medical Group in Tennessee

Optum has bought another physician group, this time in Tennessee. The UnitedHealth Group subsidiary acquired Holston Medical Group, a multi-specialty practice based in Kingsport, Tennessee. It provides primary care, pediatrics, women's health, urgent care and outpatient diagnostic care services. The group has more than 70 locations in Northeast Tennessee and Southwest Virginia. According to its website, the practice employs more than 200 physicians. No terms were disclosed.

This deal isn’t the first for Optum in the physician space; after all, Optum is one of the companies that spearheaded the trend of putting payor and provider under one umbrella.

Its most recent deal was for Crystal Run Healthcare, a multi-specialty physician group with 390 providers across more than 30 locations in New York. No terms were disclosed for this purchase either.

According to Optum’s website, it currently has 70,000 employed or aligned physicians in its network.

Cardinal Health Strikes $1.9 Billion Deal for Solaris Health

Cardinal Health, the global healthcare conglomerate, made another large push into the healthcare provider space last month. On August 12, through its subsidiary The Specialty Alliance, Cardinal Health bought Solaris Health in a $1.9 billion deal, its fifth deal since the start of 2024.

Solaris Health is one of the largest urology and management service organizations in the United States, with more member physicians than any other provider of urological and specialty services. Its physicians span 14 states (Colorado, Florida, Georgia, Illinois, Indiana, Kentucky, Maryland, Michigan, New York, North Carolina, Ohio, Pennsylvania, South Carolina and Washington), with more than 750 members.

After the deal closes, Solaris Health physicians and several members of management will join GI Alliance physician owners and management as equity holders and operators in The Specialty Alliance. For its part, Solaris Health has been a prolific acquirer in the healthcare M&A space, adding 13 new physician groups to its network since 2021. The group was formed in 2020 by Lee Equity Partners after the private equity group bought and combined Integrated Medical Professionals and The Urology Group in a $240 million deal.

Cardinal Health’s acquisition spree began with the acquisition of Specialty Networks, LLC (the subsidiary above) in January 2024 for $1.2 billion in cash from Bain Capital. It followed that deal with a small transaction in May 2024 for Innara Health, a neonatal medical device company, for an undisclosed sum. In September, Cardinal announced another major deal, spending $1.1 billion to absorb Integrated Oncology Network LLC, a radiation oncology management and cancer center development company.

The company was busy the following November, announcing two deals valued at more than $1 billion. It purchased Advanced Diabetes Supply Group, a national distributor of specialized diabetes supplies,

from Court Square Capital Partners, for $1.1 billion, and GI Alliance, a physician-led and majority physicianowned GI practice management company, from Apollo Global Management, for $2.8 billion.

UnitedHealth Divests 164 Locations to Settle Antitrust Concerns in Amedisys Deal

UnitedHealth Group has agreed to sell off a number of hospice and home health locations to resolve U.S. antitrust concerns over its $3.3 billion acquisition of Amedisys . The Justice Department and attorneys general from four states (Maryland, Illinois, New Jersey and New York) filed a civil antitrust lawsuit in November 2024 to block the deal, arguing it would reduce competition in the home health services market.

The divestiture includes 164 home health and hospice locations (including one affiliated palliative care facility) across 19 states, accounting for approximately $528 million in annual revenue. The settlement also requires divestiture of eight additional locations if regulatory approval for associated facilities is not obtained and includes a monitor to oversee compliance.

The settlement allows the Amedisys acquisition, first proposed in June 2023 by UnitedHealth's Optum subsidiary, to proceed. Amedisys, based in Baton Rouge, Louisiana, provides home health, hospice and palliative care to more than 465,000 patients annually across 38 states and the District of Columbia. The deal, valued at $101 per share, aims to expand UnitedHealth's home-based care offerings, building on its February 2023 acquisition of LHC Group. Regulators feared the merger would raise prices, lower care quality and suppress wages in overlapping markets.

The Justice Department also fined Amedisys $1.1 million violating the Hart-Scott-Rodino Act after the company failed to flag missing information during the merger review. Unlike the Biden administration’s stricter approach, Trump-era antitrust enforcers have shown a greater openness to resolving merger concerns through divestitures, enabling deals like this to move forward.

“In no sector of our economy is competition more important to Americans’ well-being than healthcare. This settlement protects quality and price competition for hundreds of thousands of vulnerable patients and wage competition for thousands of nurses,” said Assistant Attorney General Abigail Slater of the Justice Department’s Antitrust Division. “I commend the Antitrust Division’s Staff for doggedly investigating and prosecuting this case on behalf of seniors, hospice patients, nurses, and their families.”

UnitedHealth’s SCA Health Acquires U.S. Digestive Health

SCA Health announced on August 18 that it was entering an agreement to acquire U.S. Digestive Health, which serves Pennsylvania and Delaware.

The seller was Amulet Capital Partners, LP, a middlemarket private equity firm focused exclusively on healthcare.

U.S. Digestive Health was formed in 2019 by Amulet Capital Partners in partnership with member practice partner physicians. According to its website, as of August 19, 2025, there are 149 physicians on staff. Additionally, the company runs more than 20 ambulatory surgery centers. It is based in Exton, Pennsylvania.

While still under Amulet Capital Partners’ ownership, U.S. Digestive Health completed seven transactions, expanding its presence by nearly 60 physicians.

SCA Health, based in Birmingham, Alabama, is an operator of outpatient surgery facilities with a network of more than 300 ambulatory surgery centers in 35 states performing more than 1 million outpatient surgery procedures annually. It is backed by UnitedHealth Group.

The financial terms of the transaction were not disclosed. This strengthens SCA Health's footprint in Pennsylvania.

Guardian Pharmacy Services Strengthens Pacific Northwest Presence With Acquisition

Guardian Pharmacy Services, Inc. announced on August 4 its acquisition of Managed Healthcare Pharmacy in Eugene, Oregon.

Established in 1991, Managed Healthcare Pharmacy is one of Oregon’s largest long-term care (LTC) pharmacies, serving LTC communities across both Oregon and Washington. The pharmacy serves residents in assisted living and behavioral health communities, as well as individuals with intellectual and developmental disabilities.

Founded in 2004 and headquartered in Atlanta, Georgia, Guardian is one of the nation's largest LTC pharmacy companies. Guardian's pharmacies provide client services and resident care to LTC communities, including assisted living and skilled nursing, group home, behavioral health and to organizations that serve individuals with intellectual and developmental disabilities. With a network of more than 50 pharmacies nationwide, Guardian provides service to more than 189,000 residents and approximately 7,000 LTC facilities across 38 states, as of March 31, 2025.

This transaction establishes Guardian's first physical footprint in Oregon and expands its presence in the Pacific Northwest. All existing leadership and staff will remain in place, and the pharmacy will continue operating under its existing name. Financial terms of the deal were not disclosed.

Brightstar Capital Partners Acquires Analyte Health

New York City-based Brightstar Capital Partners announced on August 4 that it acquired Analyte Health.

Analyte Health is a leading national company empowering patients to acquire and understand healthcare diagnostic information. By combining a national network of patient service diagnostic centers, a family of online digital assets and a national telehealth footprint, Analyte Health has delivered more than 2.2

million test results since its inception in 2007.

Brightstar Capital Partners is a middle market private equity firm with more than $4 billion assets under management that is focused on investing in business services, industrials, consumer and government services and technology.

As part of the transaction, Analyte founder Fiyyaz Pirani will continue as CEO and retain a significant ownership stake in Analyte.

J.P. Morgan Securities LLC served as exclusive financial advisor and Kirkland & Ellis LLP served as legal advisor to Brightstar. Intrepid Investment Bankers LLC served as financial advisor and Kastner Gravelle LLP as legal advisor to Analyte.

The Braff Group Advises Alegre Home Care in Affiliation with Transforming Age

Elder Care Alliance (ECA), a mission-driven nonprofit serving older adults across California and part of Transforming Age’s nonprofit network, announced on August 13 its affiliation with Alegre Home Care

The Braff Group, a mergers and acquisitions advisory firm specializing exclusively in healthcare services, served as the exclusive financial advisor for Alegre Home Care. The Pittsburgh-based firm was selected as Alegre’s advisor due to its extensive experience in California’s home care sector. Terms of the transaction were not disclosed.

The strategic partnership marks Transforming Age’s entry into California’s home care market. It enhances ECA’s network, now supporting more than 11,000 older adults through five residential communities and the Mercy Brown Bag Program.

Alegre Home Care offers home care services to a diverse range of individuals in Northern California. With a team of more than 400 caregivers, Alegre has become one of the region's most trusted providers of relationship-based, culturally aware homecare services and is currently providing more than 300,000 care

hours a year for older adults.

Alegre's Founder and CEO, Charles Symes will remain in place to help with the ownership transition and will serve as Home Care Consultant to the broader organization, thereafter, preserving Alegre's leadership stability and operational integrity.

"This affiliation is a meaningful step forward," said Symes. "Over time, as I've come to know the people behind this long-standing nonprofit, I have been moved by how we share similar values of innovation, inclusion, affordability, connection, wellness and compassion."

“The transaction marked the entry of Transforming Age into home care in the state of California,” Kristopher Novak, Managing Director at The Braff Group, told the LevinPro HC team over email. “Transforming Age recently affiliated with Elder Care Alliance serving the Bay Area with several programs focused on caring for seniors including their network of senior living facilities.”

Novak emphasized that Alegre’s alignment with ECA’s values and shared history made it an ideal partner.

Novak continued, “Alegre Care and Elder Care Alliance have a history of working together across many of these markets and facilities. Transforming Age maintains a strategic focus on expanding home-based care options to more markets with Transforming Age affiliated facilities. Alegre Care also affords Transforming Age the ability to expand services to additional markets across California.”

Southern Orthodontic Partners Acquires TC Orthodontics

Southern Orthodontic Partners (SOP), a portfolio company of Shore Capital Partners, announced on August 13 that it acquired TC Orthodontics

TC Orthodontics is based in seven locations in the Minneapolis MSA. According to its website, the practice is run by a team of seven orthodontists.

Based in Nashville, Tennessee, SOP works with

orthodontic practices to provide expertise in finance, marketing, recruiting, benefits and other practice administration to allow orthodontists to focus on patient care.

This marks SOP’s third transaction of 2025. The financial terms were not disclosed. Previously, SOP purchased Nakfoor Orthodontics, which is based in Illinois. In April, SOP also announced the addition of Hunter Family Orthodontics, based in Texas, and Rinaldi Orthodontics, located in Ohio, to its network.

Great Hill Partners Acquires Blue Cloud Pediatric Surgery Centers From The Rise Fund

Great Hill Partners, based in Massachusetts, announced that it acquired Blue Cloud Pediatric Surgery Centers from TPG’s The Rise Fund.

Blue Cloud Pediatric Surgery Centers is the largest operator of pediatric dental ambulatory surgery centers (ASCs) in the United States, with 15 facilities across six states serving more than 23,000 patients each year. Founded in 2011, it performs more pediatric dental surgeries per year than any other healthcare provider in the United States, primarily serving Medicaid and special needs patients. The company is based in Glen Rock, Pennsylvania.

Great Hill Partners is a leading growth-oriented private equity firm. It targets investments of $100 million to $500 million in high-growth companies across the software, financial services, healthcare, consumer and business services sectors.

Evercore served as exclusive financial advisor to Blue Cloud and Houlihan Lokey served as exclusive financial advisor to Great Hill. Goodwin Procter LLP acted as legal counsel to Great Hill, while Kirkland & Ellis LLP advised Blue Cloud. Terms of the transaction were not disclosed.

JAG Physical Therapy Expands With Long Island Acquisition

JAG Physical Therapy announced on August 18 that it

has expanded on Long Island with the acquisition of a practice in Huntington, New York.

The target, Proactive Physical Therapy , offers specialized manual therapy and performance training designed to help golfers improve their swing and fitness and to treat injuries. The company offers hyperbaric oxygen therapy that supports and accelerates healing, reduces swelling and reduces time of recovery.

JAG provides physical and occupational therapy and rehabilitative care to patients and sports teams. The company has more than 170 locations throughout New York City, New Jersey, Westchester and Rockland counties, Long Island and Pennsylvania. The chain is the official provider of physical therapy for sports teams such as the New Jersey Devils, Columbia University Athletics and Princeton University Athletics. The company underwent a rebranding in October 2023, changing its name from JAG-ONE Physical Therapy to JAG Physical Therapy to simplify its brand identity and enhance unity across its locations.

Proactive Physical Therapy will be rebranded and operate under the JAG Physical Therapy banner. Steve Login, clinical director and founder of Proactive Physical Therapy, will remain with the practice. Terms of the deal were not disclosed.

THL Partners Acquires Headlands Research

On August 14, THL Partners announced that it acquired Headlands Research from KKR & Co

Headlands Research is a globally integrated clinical trial site organization. With a multinational network of 21 clinical trial sites, Headlands Research has successfully completed more than 5,000 clinical trials. It is based in San Francisco, California.

THL Partners is a private equity firm investing in middlemarket growth companies exclusively within three sectors: healthcare, financial technology & services and technology & business solutions. Since 1974, THL has raised more than $35 billion of equity capital, invested in upwards of 170 companies and completed more than 600 add-on acquisitions representing an aggregate

enterprise value at acquisition of more than $250 billion.

THL will invest in Headlands Research through its flagship Fund IX. This transaction will fuel Headlands’ continued expansion enhance its technology and centralized infrastructure, and further strengthen its ability to deliver diverse clinical trial data for pharmaceutical and biotech sponsors in support of Headlands’ mission to improve lives by advancing innovative medical therapies. The transaction is expected to close in 2025.

McDermott Will & Schulte and Paul, Weiss, Rifkind, Wharton & Garrison served as legal advisors to THL, and Jefferies as lead financial advisor. Edgemont Partners also acted as a financial advisor to THL. KKR and Headlands were advised on the transaction by Houlihan Lokey as exclusive financial advisor and Kirkland & Ellis as legal advisor.

Mississippi Sports Medicine and Orthopaedic Center Acquires Mississippi Practice

Mississippi Sports Medicine and Orthopaedic Center (MSMOC) announced its acquisition of Oxford Orthopaedics & Sports Medicine for an undisclosed price.

Oxford Orthopaedics & Sports Medicine has one location in Oxford, Mississippi. According to its website, there are six physicians on staff.

MSMOC is a provider with services including ambulatory surgery, advanced imaging, rehabilitation, pain management, urgent care and sports medicine. MSMOC receives around 89,000 patient visits annually and performs more than 10,000 surgeries each year. It is backed by private equity firms FFL Partners and Thurston Group

Cypress West Partners and TPG Angelo Gordon Acquire Arizona and Nevada MOB

On August 8, Cypress West Partners and TPG Angelo Gordon announced the acquisition of two medical outpatient buildings (MOBs). The transaction included one location in Tucson, Arizona, and one location in Las

Vegas, Nevada. The financial terms were not disclosed.

The Tucson MOB comprises two buildings and totals 68,000 square feet. The MOB has a diverse rent roll that is anchored by Northwest Hospital at 34% of the building. Other specialties located within the properties include bone and joint, primary care, internal medicine, eyecare/cataract surgery, family medicine, endocrinology, cardiovascular and amputation prevention.

The Las Vegas MOB is a three-story building that comprises 39,279 square feet. Built in 2009, the MOB is leased to seven healthcare tenants in specialties including orthopedic, endocrinology, vascular, pediatrics, infusion, eyecare, pharmacy, hemostasis and thrombosis. The ground floor features a multi-specialty surgery center on a long-term lease.

Cypress West Partners is a privately held investor, developer, owner and operator of medical properties throughout the western United States. The Cypress West Partners portfolio includes close to 2 million square feet of medical outpatient properties, including more than 250,000 square feet of medical outpatient space currently in various stages of development.

Headquartered in Los Angeles, California, TPG Angelo Gordon is a $74 billion diversified credit and real estate investing platform within TPG.

In total, the buildings are 81% leased, but no further breakdown was disclosed. This marks the second acquisition for the joint venture between Cypress West Partners and TPG Angelo Gordon for 2025.

Trinity Medical WNY Acquires Seton Imaging Radiology

Trinity Medical WNY PC announced that it entered into an agreement to acquire Seton Imaging Radiology PLLC.

Serving Western and Upstate New York, Seton Imaging Radiology is among the region’s largest providers of imaging services. It offers radiology services, offering

MRI, CT, ultrasound, digital mammography, X-ray and bone density testing. It has more than 32,700 patients.

Part of Catholic Health, Trinity Medical WNY is a physician group that provides a wide range of medical services across 31 locations in New York. It provides cardiology, gastroenterology, nephrology, oncology, OB/GYN, podiatry, vascular and surgical care. According to its website, there are 89 physicians on staff.

About 30 employees transitioned as part of the Seton deal, including Dr. Scott Cholewinski, Seton's president and CEO, who will remain with the practice serving as site supervisor. Janine Janik will serve as practice administrator, and Dane Franklin will oversee operations as system director for imaging services and radiology. Terms of the deal were not disclosed.

Seton Imaging has partnered with Catholic Health for decades, including providing on-site services at Kenmore Mercy Hospital until 2017, when the hospital added an on-site imaging department of its own.

Advent International to Acquire Patient Engagement Company PatientPoint

Advent International announced that it has signed a definitive agreement to acquire PatientPoint, Inc. for an undisclosed price. The transaction is expected to close in the fourth quarter of 2025.

PatientPoint provides integrated patient engagement solutions that surround key points of care, helping healthcare professionals improve patient health. The company operates a digital network in 30,000 physician offices, connecting patients, providers and health brands with information.

Advent International is a global private equity firm focused on buyouts of companies in Western and Central Europe, North America, Latin America and Asia. With 16 offices across five continents, the firm has invested in 430 private equity investments across 44 countries. As of March 31, 2025, the company oversees more than $94 billion in assets under management.

Jefferies and Citi served as financial advisors and Gibson Dunn & Crutcher LLP served as legal advisor to PatientPoint. Solomon Partners served as the financial advisor, and Ropes & Gray LLP served as the legal advisor to Advent.

Silver Creek Dental Partners Expands In California

On August 23, Silver Creek Dental Partners announced through a LinkedIn post that it was expanding its presence with the acquisition of Mission Hills Family Dental. The terms were not disclosed.

Mission Hills Family Dental is a dental practice with one location in San Marcos, California. The practice provides preventive, cosmetic, restorative and sedation dentistry. According to its website, the practice is run by a team of two physicians: Dr. Nicolle Miller and Dr. Kathleen T. Doppenberg.

Silver Creek Dental Partners is a boutique dental support organization founded in 2020 to provide management services to general dentistry practices throughout California. Per its website, the company is affiliated with 14 dental practices in the state.

This transaction marks Silver Creek Dental Partners' fifth acquisition of 2025. Previously, it purchased dental practices in Temecula, San Marcos and San Diego, California.

PE-Backed Emergency Care Partners Merges with The Emergency Center of Arizona

Emergency Care Partners (ECP), a leading national emergency medicine services provider, has announced the completion of a strategic merger with The Emergency Center of Arizona (TEA).

TEA is a physician-led emergency medicine services provider operating freestanding emergency centers in Arizona. Staffed by approximately 200 board-certified physicians and specialty-trained nurses, TEA provides emergency care for a wide range of medical conditions, serving communities with accessible, hospital-level

services outside traditional hospital settings.

ECP is a portfolio company of Varsity Healthcare Partners and Regal Healthcare Capital Partners

The company provides emergency medicine and outsourced emergency department management services to hospital facilities across Louisiana, New York and Pennsylvania.

TEA's providers will continue delivering emergency care while leveraging ECP's model, combining local physician equity partnerships with a differentiated clinical analytics platform. ECP remains a majority physician-owned organization, and the addition of TEA further strengthens its national network of aligned groups. Financial terms of the deal were not disclosed.

Imagen Dental Partners Enters New State with Acquisition

Imagen Dental Partners announced that it acquired Toothologie, a dental practice with one location in Union, Kentucky.

Founded in 2020, Imagen Dental Partners is a dental partnership organization that joins with dental practices, invests in them and supports their growth. Imagen Dental Partners supports practices in California, Arizona, Texas, Minnesota, Florida, Georgia, South Carolina, Tennessee, Kentucky, Illinois, Indiana, Ohio, Michigan, Oregon and Wisconsin. Financial terms were not disclosed.

Epiphany Dermatology Acquires Dermatology Associates, LLP

Epiphany Dermatology announced that it expanded its presence in Texas with the acquisition of Dermatology Associates, LLP.

Dermatology Associates is based in one location in Texarkana, Texas. According to its website, there is one physician on staff (Dr. Jeff Young) who is supported by one nurse practitioner and one medical aesthetician/ technician.

Through its partnerships with dermatologists in more than 100 locations in Arizona, Colorado, Georgia, Iowa, Kansas, Maryland, Minnesota, Missouri, Montana, Nevada, New Mexico, Oklahoma, South Carolina, Texas, Utah, Washington and Wyoming, Epiphany provides general dermatology, skin cancer care, Mohs surgery, cosmetic services and additional dermatologic services. It has been a portfolio company of Leonard Green & Partners since 2022.

Through this partnership, Dr. Young and his staff gain additional resources to help with operations, managed care, marketing, compliance, human resources, clinical training, recruiting, IT and many other support services. Epiphany also benefits from the clinical expertise of Dr. Young’s team, as best practices are collaboratively shared across the Epiphany network. This marks Epiphany Dermatology's eighth acquisition of 2025.

Plymouth Psych Group Acquires Psychology Consultation Specialist

Plymouth Psych Group (PPG) announced that it acquired Psychology Consultation Specialist (PCS), based in Plymouth, Minnesota.

PCS is an outpatient mental health practice that was established in 2008. PCS provides neuropsychological and attention deficit hyperactivity disorder testing, psychotherapy, coaching and pediatric developmental assessments for autism and intellectual disabilities.

PPG, also located in Plymouth, Minnesota, is a fullservice mental health clinic dedicated to serving patients of all ages and their families. The multidisciplinary team includes psychiatrists, nurse practitioners, developmental pediatricians, psychologists, therapists and registered dietitians.

PPG has selected ClinicMind's platform to unify operations across the expanded organization. Terms were not disclosed.

Megadeals...cont. from page 1

rates have likely contributed to more disciplined capital deployment, especially on large-scale transactions.

Among the largest deals during the first half of the year was Johnson & Johnson’s $14.6 billion acquisition of Intra-Cellular Therapies, a biopharmaceutical company focused on the development and commercialization of therapeutics for central nervous system disorders.

In another high-profile transaction, New York-based private equity firm Sycamore Partners announced its $9.9 billion deal to take Walgreens Boots Alliance private, signaling a strategic overhaul of the retail pharmacy giant.

Biotechnology emerged as the sector with the most megadeals in the first half of 2025, accounting for five transactions. These deals were largely concentrated in high-growth subfields like precision oncology and gene editing, where buyers are targeting bolt-on acquisitions to accelerate R&D timelines and expand beyond traditional small-molecule drugs.

With an aggregate value of approximately $29.6 billion, these transactions represented more than 42% of total megadeal spending during the period.

Notable examples include Sanofi 's acquisition of Blueprint Medicines and Merck 's acquisition of SpringWorks Therapeutics, both of which aimed to secure targeted therapies amid growing demand for personalized medicine.

Private equity's active participation, evident in seven of the 18 deals, underscores a shift toward buy-and-build strategies that leverage operational efficiencies and portfolio diversification.

Rather than betting on platform-setting acquisitions, many sponsors are focusing on targeted investments in growth-stage or specialty companies where value can be created through add-on acquisitions, infrastructure enhancements or clinical integration.

The $5.3 billion acquisition of ModMed by private equity firm Clearlake Capital is a prime example, as it aligns with broader efforts to modernize specialty practice management through the use of health IT.

Similarly, Bain Capital ’s $3.3 billion purchase of Mitsubishi Tanabe Pharma ’s assets expands its exposure to more therapeutic areas such as autoimmune diseases, diabetes and central nervous system disorders. Even as the number of megadeals declines, private equity buyers remain active, especially in areas where they see opportunities to scale operations or expand into high-demand specialties.

Total disclosed spending across all of healthcare M&A reached $88.4 billion in the first half of 2025, a steep drop from $116.4 billion during the same period in 2024 and $133.7 billion in the first half of 2023. The pullback in aggregate deal value further underscores the cautious tone of the current dealmaking environment, particularly among the industry’s largest buyers.

Despite this cautious start, megadeal activity appears to be gaining momentum heading into the second half of the year. Four megadeals were announced in July 2025 alone, matching the four deals recorded during the same month in both 2024 and 2023. Whether that momentum holds will be a key indicator of how the rest of the year shapes up for healthcare M&A.

Looking ahead, the path for megadeal activity in healthcare M&A will likely rest on the broader financing landscape and regulatory environment. Many buyers remain well-capitalized, with strong financial positions fueling strategic pursuits such as acquiring innovative therapies, bolstering technology platforms or expanding their geographic footprints. Yet, competition for high-quality assets is intensifying, and valuations for desirable targets remain high despite a slower overall deal pace.

As a result, market players are likely to focus on selective, high-conviction deals, prioritizing billiondollar transactions that promise immediate operational benefits and long-term growth potential.