This Report Handover Date 30th April 2025

Senior Responsible Owner (SRO): Alice Bunn

Programme or Project Title Headquarters Building

Does this review cover the entire Project / Programme? Yes

Co-opted Trustee and Chair of the Sponsor Board Christopher O’Boyle

Business Case stage reached: Outline Business Case

Review Start Date: 28th April 2025

Review End Date: 30th April 2025

Review Team Leader: Bernard Kinchin

Review Team Members: Bob Tindall

Report Distribution Christopher O’Boyle, Alice Bunn

Previous Review: Gateway 2 January 2025

About this report

This report is an evidence-based snapshot of the programme’s/project's status at the time of the review. It reflects the views of the independent review team, based on information evaluated over the review period, and is delivered to the SRO immediately at the conclusion of the review.

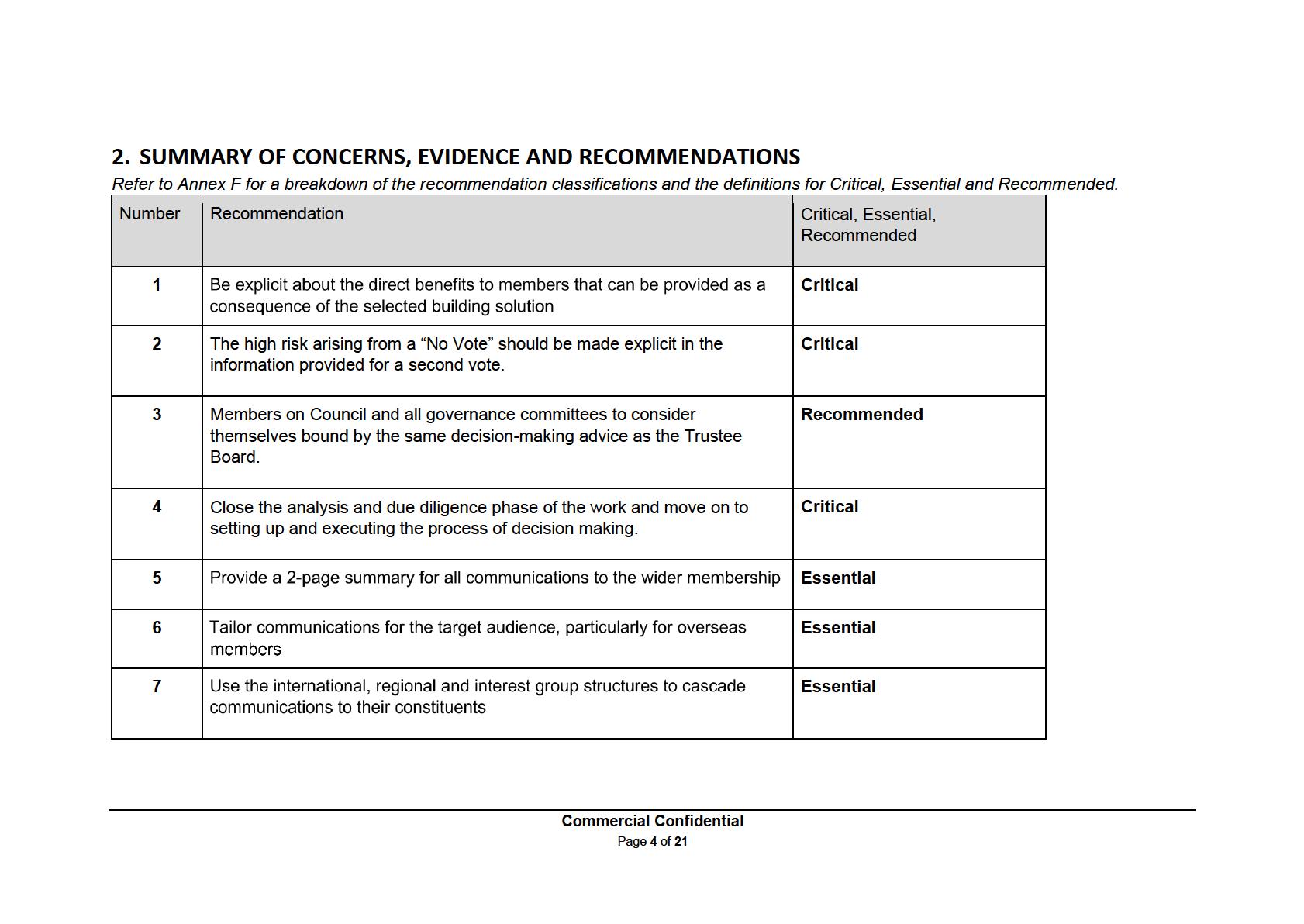

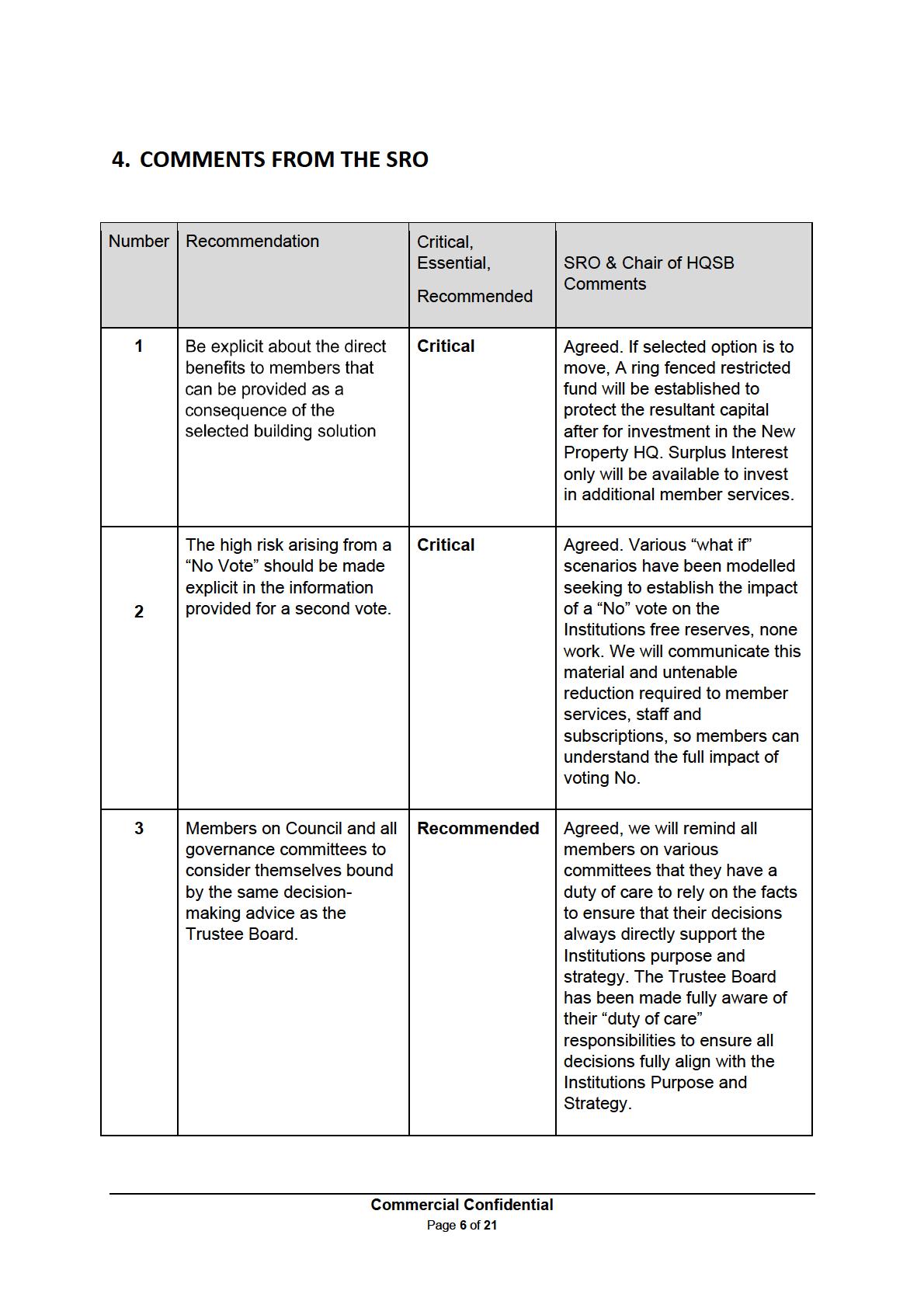

4 Close the analysis and due diligence phase of the work and move on to setting up and executing the process of decision making.

5

6

7

Critical Agreed, extensive and comprehensive DD has been carried out validating the professional team’s work. A close out meeting is scheduled with Council to confirm closure. The OBC approvals process is continuing in parallel.

Essential Agreed, we will prepare a short summary extracted from the OBC executive summary for all members. Further details, respecting commercial constraints, will be made available for those members interested in the detail too.

Essential Agreed, Council have already started arranging bespoke webinars for their special interest groups.

Essential Agreed, Council have already started arranging bespoke webinars for their special interest groups.

We would like to thank the gateway reviewers for their observations and note that they have also suggested that a full record of all decisions is retained so that if there was ever a vote of No confidence, or legal challenge, this factual evidence can be used to successfully defeat that challenge, as all decisions have all been based on factual evidence.

5.3 Option Development and Appraisal

5.3.1

The Process

Since the last review the HQSB has initiated and completed several critical stages of work. It has:

• developed the options for a way forward on the future of the Institution’s headquarters

• assessed each one for cost and value

• prepared an Outline Business Case on the back of that assessment

• Shortlisted 2 options from 17

All of these stages have involved considerable input, and have been complex due to the wide scope of the task, the need to consult with a very wide range of people and the liaison with a range of professionals in order to provide valuations and costings in a timely manner

The process and assessments have been carried out thoroughly and to a professional standard

The consequences of a “No Vote” are explored below.

5.3.2

The Options

As a result of the work described above, 2 options have been identified for final consideration. They are:

• Sell the whole of the Institution’s Birdcage Walk (BCW) site and occupy a “new” property (recommended)

• Retain 1 BCW and sell the rest of the site

Several factors have underpinned and guided the shortlisting process:

• The availability of funding

• Complying with Finance Board’s requirement for any development to be selffunding

• The retention of free reserves at an amount no lower than £5m

These factors are set in the overall context of adherence to a low level of risk as predetermined by the Board and the need always to directly support the Institution’s purpose and strategy.

The work incorporates a number of estimates relating to financial viability and are based on the best professional advice, which has been extensive. To this end, estimates of property values are the best assessments of property values at this time, as are those relating to rental costs and potential rental income and the cost of works. These figures will change. However, the relative overall values of the options are unlikely to change. Equally, the overall ranking is unlikely to be altered by small changes in interest rates, rates of return and similar factors.

The analysis indicates that the option to move from the BCW site entirely scores the most highly in terms of affordability, the capacity to self-fund, the preservation of free reserves at the required level and risk The alternative option – retaining 1 BCW but selling the rest of the site – is viable but carries with it significantly more risk, as outlined below:

• There is a much higher construction risk in adapting an old building that is in a poor condition and splitting services which currently cover the whole of the site

• The relationship with a purchaser is more complex, as work has to be carried out in both premises and is inter-dependant

• The site is significantly more attractive in its entirety rather than in part and there is therefore a reduction in capital value

• Retaining 1 BCW will absorb much if not all of the income gained from the sale of the rest of the site meaning that the Institution’s cash will be tied up in a diminished asset

On this basis, the option of selling the whole of the BCW has a sound rational basis. It is understood and appreciated that the heritage value of the BCW site carries a strong resonance within the Institution and is the subject of genuine concern. Any alternative site option must seriously address how it can reflect the history and achievements of the Institution

5.3.3 Other Considerations

Addressing some of the additional detail relating to the two options:

• staying put in 1 BCW would clearly entail significant construction works

• it has been assumed that 1 BCW it will continue to house both member activities and staff. This is considered to be to the advantage of the working culture and is assessed to have minimal impact on property costs

• moving to an alternative site offers the possibility of moving into either a modern or more traditional building. It is assumed that the site will be in London

• A traditional building has the benefit of reflecting heritage through its frontage alone, but there is also – with imagination and will – the capacity to reflect heritage in a more modern building in terms of how it is fitted out.

• in respect of an alternative site, a decision remains to opt for purchase or lease. Purchase provides stability over a longer period of time. It would also provide a positive antidote to the uncertainty on property which has hung over the institution for a long period of time and would provide a fixed asset which will appreciate over time

• the alternative site option also frees up substantial capital, which would be invested as a fund. Additional member benefits could be supported to the equivalent of returns from the fund. These could be linked specifically to the stated aims of the 2030 strategy. However, for historical reasons, there is considerable concern that such funds should be secure and not subject to risk other than normal investment risk.

5.4. The Second Vote

5.4.1

The Process

There is a need to follow the current planning process through to its conclusion, particularly given that there have been a number of attempts to resolve the issue of the BCW HQ before. The pace of this needs to be energetic, but at a tempo which enables all interested parties to digest the information put before them. If there are modifications to the current timeline, this should not be at the expense of a clear and timebound conclusion.

A second vote is required for the membership to confirm, or otherwise, the solution that will be recommended by the Trustee Board.

The approval process has been identified and plans are in place to take decision-making through to its conclusion. There is some doubt about the timing of the final Trustee Board decision because of the overlap with end-of-year procedures but this will be resolved. The plan is to hold a second vote in July and it is important that this takes place before the summer holidays impose a delay.

Member webinars are being prepared and briefings will take place in June. The specific requirements for the Trustee Board decision are established and will be applied and detailed records maintained. The Trustee Board decision will be made with the advice of the Council and governance boards in addition to that of the professional and legal advice that is being provided.

In this context the term “No Vote” is used to describe the situation in which members vote against the preferred option offered.

There is no identified solution in the case of a “No Vote”.

Funding that will enable full remedial works to be carried out and the building to be operated with confidence safely and securely has not been identified. Maintenance works will be de minimis as has been happening in recent years.

There is a requirement that rented out space will achieve EPC B by 2030 It is most unlikely that this will be achieved and therefore rental income will be lost.

A “No Vote” will result in a seriously compromised building with high risk to the operation and finances of the organisation

The Review Team notes that “option” 1A is not a viable “option,” neither as a final solution nor in the case of a “No Vote”. It is a demonstration of the impact of the works that are required in the short term to bring the building up to an acceptable standard. The assessment shows that the “option” fails on financial grounds.

RECOMMENDATION 2: The high risk arising from a “No Vote” should be made explicit in the information provided for a second vote.

5.4.2

Decision Making

A number of attempts have been made to solve the property challenge in the past years. All have failed It is a fact that there are different opinions on the best property solution for the organisation. On this occasion HQSB have carried out extensive work with great diligence.to analyse and assess possible options. Professional advice has been prepared and presented carefully. Nevertheless, there will still be differences of opinion. In addition, Trustees will consider all factors that have an effect on the organisation including heritage and reputation. It is to be hoped that all parties will act professionally and allow all information and assessments to be presented to the membership without prejudice or bias

It is noted that the Annual Report and Accounts contains a statement of the Institution’s risk appetite. The various risks identified for this endeavour range from having a zero tolerance to having a low tolerance, which must be recognised when making final decisions.

A decision to adopt Option I might be considered as a compromise if Option M is found to be the best option but is not preferred by those who consider that remaining in BCW is a priority. Under those circumstances it should be noted that Option I is not a tactical option to be adopted. The solution has to be in the best interests of the organisation.

The Trustee Board has received extensive and explicit advice on the parameters for their decision-making. Recognising that Council Members already undertake to act in the best interests of the Institution it would be appropriate for them to align themselves with the Trustee Board obligations and for Council members to consider themselves bound by the same advice rules

RECOMMENDATION 3: Members on Council and all governance committees to consider themselves bound by the same decision-making advice as the Trustee Board.

In this context the Review Team has heard that previous attempts to resolve the property issue have resulted in considerable conflict to the long-term financial and reputational detriment of the organisation. This cannot be allowed to happen again and a decision has to be made. Professional advice is extensive. There is explicit advice about Trustees decision-making obligations if they decide not to accept that advice. A “No Vote” is not defendable. All parties have an obligation to work towards a solution that is in the best interests of the organisation.

The Review Team notes that arrangements are being made for informal meetings of the Trustee Board and Council members to understand how decision making might proceed collaboratively. This is a welcome development.

5.4.3

Timing

As discussed above there is a short window of opportunity for all interested parties to review the OBC before the formal Trustee Board decision. Formal consultation has been arranged to give the relevant Institution’s committees the opportunity to provide feedback.

The model has been subject to numerous sensitivities and market comparables have been applied to validate the input assumption for all options. This due diligence analysis has validated the professional team’s rankings It has now reached the point at which the

process of analysis and due diligence should be closed and emphasis moved to setting up and executing the process of decision making.

RECOMMENDATION 4: Close the analysis and due diligence phase of the work and move on to setting up and executing the process of decision making.

This period should be used to allow everybody to mull over the propositions without pressure and to form their own rational decisions.

5.5. Communications

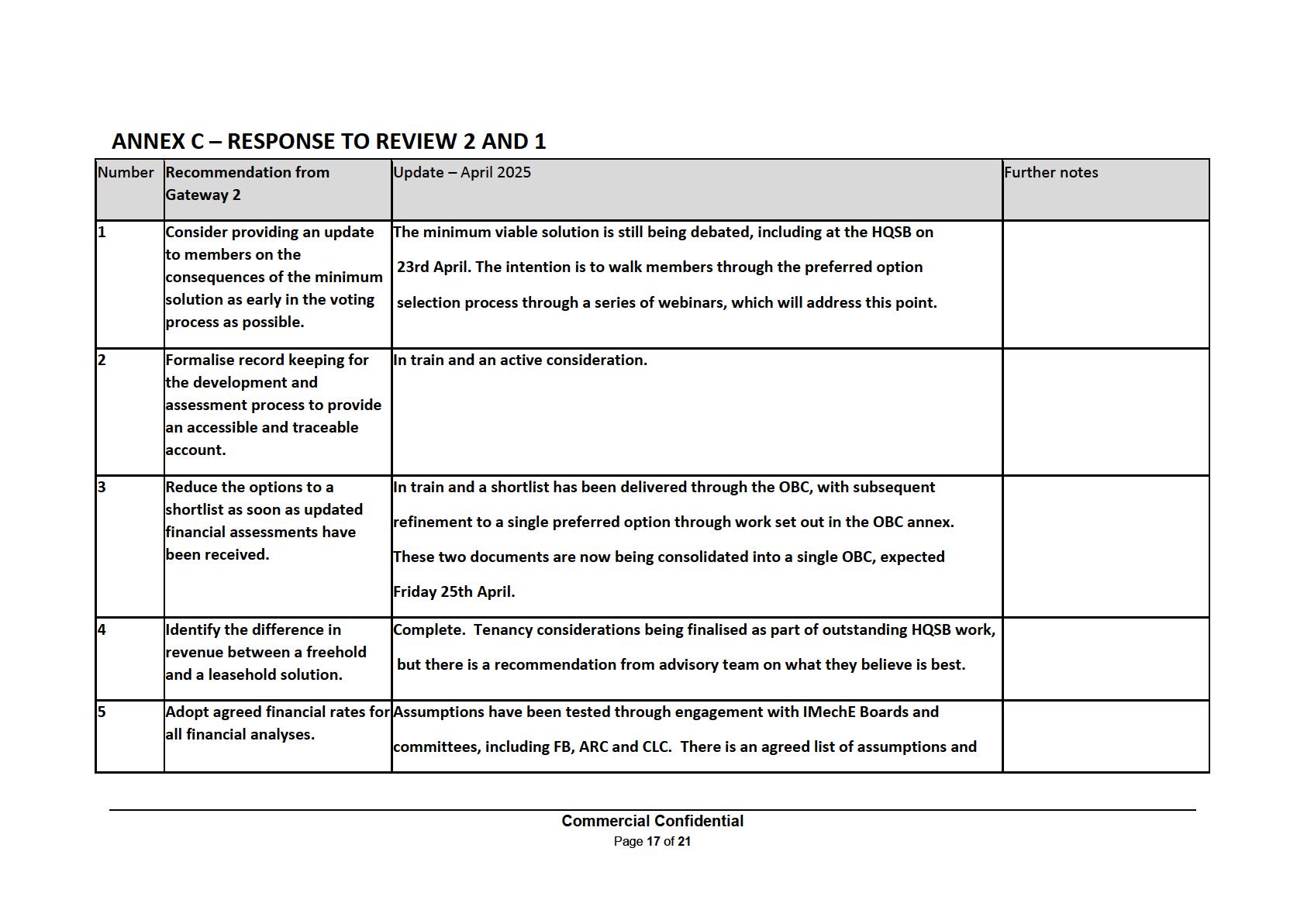

rates which are being used in the model, with sensitivity analysis being run.

6 Develop the plan of work and project controls Plan of work has been set out and delivered through G&T, overseen by HQSB. RASCI model being challenged by CLC

7 Maintain an overview on the potential conflict between options and the Trustees fiduciary duties as schemes develop

8 Consider developing a 5 year budget plan

In train – this is a core consideration and further legal advice has been taken to ensure Trustees are clear on duties and tension between member impact and charitable purpose, as defined by the Charity Commission.

Significant work has been undertaken to better understand and improve the Institution’s financial position, with an ongoing discussion between FB, TB and the Executive on the 3 year budget approval.

The financial model extends 30 years, and there has been a 10 year financial model for institution finances and interplay with the shortlisted HQ options.

Divestment of commercial subsidiaries and pension buy-in plans.

9 Review the process of preparing communications and establish single point responsibility for their production

Lessons learned process undertaken from first member vote, with proposal being presented for second member vote. HQSB has a comms subgroup with responsibility for discussing and producing the comms, before HQSB and TB approval.

Recommendations from Gateway 1

1 Draft Business Cases to be short with appendices for detail and supported by brief summaries to protect commercially sensitive information

Actioned– SOBC executive summary document was produced for members, with additional information shared with member committees as appropriate and required.

2 Continue to pursue collaborative and consensual decision making but recognise that this needs to be commensurate with and urgent decision required.

3 Define and accelerate the approvals process for decision making for the programmeandensurethat it is approved by Trustees on advice from Council

Actioned–significanteffort put in to moving forward in step between HQSB, CLC and TB.

Accelerated approvals process defined and approved by Trustee Board.

4 Investigate the affordability of potential building solutions taking account of the cash flow timing requirements of different solutions. Completed

Refined process for Member Vote2 discussed and agreed, and subsequently communicated to members. This accelerates and reduces risk to the Institution through any sales process.