TrusteeBoardresponsetocommentsmadebyCounciltechnicalgroup

The commentsmadebytheCouncil technical group(setoutby them below)arenotnew.Theseviews were taken into account by Trustees when theymade their choice of a “preferred option” on 27th September.

Therearegenericpointstonote:

1. The Trustees have selected a “preferred option”, so moving us on from more than a decade of costly optioneering. If members support the motion, it provides a focus for development of a final business case (FBC) and implementation plan (including necessary funding and management arrangements). Significant detail needs to be developed as we move from the current evidence base, which is sufficient for down-selecting a preferred option, to one that meets the requirements ofanFBCandisinformedbymarketrealities.Thisprovidesopportunitytoaddressquestionsraised by the Council group that are relevant to the assessments being carried out, as the market voice will be heard and evaluated.

Alongside preparations for putting BCW on the market, and subsequently assessing the attractiveness otherwise of any bids, this next phase includes a more detailed assessment of the extent of options that maybe available for a new HQ,and associated costs. This will add rigour to the headline data that already exists from desktop assessments. There will also be ongoing evaluation of major risks that cannot be resolved through market data, with mitigation actions as needed. Examples include managing funds over a short-term transition period, long-term fund managementstrategy ofa designatedBCW legacy Fund, and timing ofany salerelativeto market conditions.

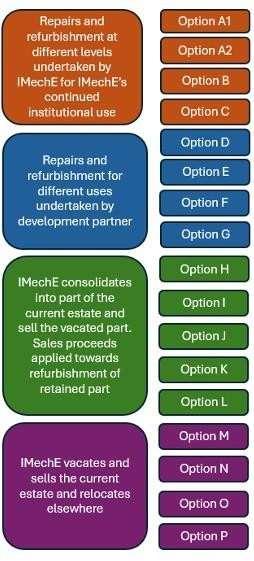

2. Trusteesgrouped the17optionsconsideredbyHQSBinto4categories(sell allandrelocate;keep all and fully refurbish; major partnership, requiring significant commitment from IMechE; consolidation, using a part-sale to self-fund refurbishment). Any of these categories would require amemberballoteitherduetosaleortothelikelihoodofsomeformofcharge(security)beingmade on the building. Of these four, based on information available to TB, only “sell all” was seen as viable.

Supportby members for the preferred option of “sell all” will allow us to go to market in good faith, as credible sellers and buyers, able to get actual rather than estimated values for BCW. It means we can be ready to act if opportunities emerge that the FBC confirms to be in the best interests of the IMechE. Equally, it does not force us to act in the absence of suitable opportunity – this is not “sell at any cost”.

3. Trustees are mindful of their duty to take decisions in the best interest of the IMechE, benefitting also from professional advisors contributing their independent expertise. The Trustee assessment looked broaderthanHQSB analysis,yetreplicatedthe “green book”framework,inwhichtheNPV/ MFAassessmentsformthebedrockofthe“economiccase”.Thisisoneoffiveaspectstoconsider, the other four covering:

• Strategic case: the strategic need (captured in the vision that TB. has set out for a future HQ) coupled with fit to IMechE purpose. The strategic case was approved by Trustees on 13th November 2024

• Commercialcase:theviabilityandriskprofileofthecommercialapproaches(notingthatTBhas arelativelylowriskappetiteinthisareagivenIMechE’srecenthistoryoncommercialactivities).

• Financial case: affordability over time, recognising the strengthening IMechE finances and e.g. new sources of funds/ loans. FB guidance was that any significant investment in the building should be self-funding to avoid depleting resources better focussed on corepurpose.

• Management case: ensuring that the selected option can be delivered successfully by IMechE, and that we have thecompetencies available to us to deliverwhat is required.

Information provided for the commercial, financial and management cases, was less mature than for the strategic and economic cases. It was primarily in these areas that a degree of judgement was applied to reflect TB experience of IMechE capabilities and risk appetites.

4. The Council group had difficulty validating the NPVs produced by HQSB’s external property experts.Trusteesacknowledgedthe effortsmade toclosethedifferencesinassumptions between this group and the external property advisors engaged by IMechE, and that this was not resolved.

TheCouncilgroupcommented (below)that“Inputting credible but prudent assumptions suggested by the Council experts brings the credible stay options into at least equivalent NPV values as the leave option(s).”

Ultimately, even if NPV values were to be broadly equivalent for credible stay and leave options, judgements on other dimensions such as fit to vision and purpose, commercial risk, delivery capability,certaintyoffundingandaffordabilitystillsupportthechosenpreferredoption(forreasons explained in recent webinars). Options implicitly proposed here, such as running an office rental business (whilst renting offices for our own staff elsewhere) and partnering with a hotel company were rejected for reasons other than financial ones. The risk to the Institution of operating beyond its core purpose and competencies, and borrowing money to do so, would bevery significant,and Trustees reflected on the recent investment performance of non-coreinvestments.

If members supportthe motion, and we are able to go to market with BCW,then the responses wereceivewill reducevaluationuncertainties bygivingusactual asopposed toassumedmarket values andcan be used to inform the FBC prior to any final decision.

5. Note that progressing without any sale or charge on the building remains as the counterfactual to be considered in the FBC and is one potential fallback option. This would likely involve piecemeal actions funded on a case-by-case basis, constrained by affordability and prioritised according to IMechE needs and woulddeflect funding from the Institution’s core purpose.

TheCouncil technical group optionof smallerscalerepairs and refurbishments,initially funded by a small loan and subsequently funded by revenue generation could be considered as partof the counter factual.The Trustee view is that such an approachis unlikely to deliver our stated vision inthe foreseeablefutureandisexpectedto involvehigher riskand cost.Nonetheless,itmaybea valid option to consider asa counterfactual.

6. Trustees have appreciated Council’s involvement throughout the process – including their active participationthroughamemberofCouncilonHQSBfrom theoutset.Theirinputhasbeenvaluable in providing fresh perspectives that both supported and challenged thinking.

Whilst this note highlights areas of difference, it is equally important to note that there are also areas of agreement. Not least of which is our common vision and purpose supporting future generations of engineers, no matter where they are.

If the motion is supported then, consistent with wider good practice, we will review and potentially refresh current HQ project governance structures to reflect different demands as we shift from optioneeringintodetailed development and activeengagementwith themarket.Aspartof this,we will want to retain active involvement from Council to benefit from diversity of thought.

DetailedresponsesbytheTrusteestotheCLCtechnicalgroupcommentsaresetoutbelow.

Thereis also amore detailed response to the NPV calculations,which has primarily been prepared by HQSB as this relates specifically to their analysis.

Reconciliation of assumptions underpinning the analysis of the Outline Business Case (OBC) covering the evaluation of options for the IMechE’s Birdcage Walk (BCW) Estate

CLCtechnicalGroupcomments

UnlikeinpreviousstagesoftheHQSB process, the Council’s experts were not involved inthesetting ofanalytical processes or the assumptions underpinning the Outline Business Case in particular those underpinning the multifactor analysis (MFA) and the net present value (NPV) calculations.

Upon receipt of the OBC Council experts found themselves unable to validate several of the core assumptions underpinning the OBC analysisandconveyedthis intheCLC advice on the OBC to the Trustees.

In order to facilitate a reconciliation of theOBCandCouncilexpertsviewson the assumptions (as reccommended by all of Finance Board, Past Presidents and CLC), this document compares the significant differences

TrusteeBoardresponse

TBapprovedthe establishment oftheHQSBonthe 26th July 2024 based on Councilrecommendation of the 27th June 2024.

HQSB included representation from Council – as an equal voting member and were actively involved over the entire period. As part of this,Councilrepsweregivenaccesstoexternalexpertswhoprepared the business case, including legal briefings, up untilthe point at which due diligence was deemed to be concluded (31st July 2025).

Multi-factoranalysis

CLC reps were involved in drafting the MFA inputs and wordings commencing in Aug 24, as part of work on the Strategic Outline Case. These were adopted for the OBC, and applied in the session facilitated byanindependentexternalconsultant(assuggested byCouncil)which generated the outputs in the OBC and CLC members’ votes were included in the analysis. They subsequently validated the sensitivity analysis which resulted in the top 5 rankings remaining unchanged.

NPVassessments

Trustees acknowledged efforts made by all parties to close the differences in assumptions between this group and the external property advisors engaged by IMechE. This includes additional sensitivity analyses being carried out and, we understand, over 30 emails on this subject alone from 28th March 2025 through to 27th June2025. In addition, threefacetofacemeetingswereheldbetween the professional team and CLC and one with TB members.

As noted above (Para 4), despite these efforts, the differences remainedunresolved.Ultimately, withNPV/ MFAisbeingoneoffive aspectsconsidered,NPVwasnota decidingfactorinTB’s preferred option selection.

FurtherdetailsontheMFA andNPVassessments areincluded in sections below.

Overview

Whichsaleoptionwasevaluatedand assumed in the Trustees decisionmaking?

Whilst 27 options (Including each of the remain options considered credible at the time) were specifically evaluated, it is not clear which of the sale options the MFA and NPV evaluation (and presumably the Trustees decision) is based. Variants of the sale option can be defined accordingtothefollowingparameters.

freeholdorleaseholdsaleof the BCW estate

rentorbuynew accommodation

Preserveremainingfundsor “bleed off” (interest and possiblycapital)overtimeto

The decision being put to members is to confirm our ability to progress a “preferred option” that involves the sale of the BCW estate. In brief, the motion being presented:

enablesthe saleof theentireBCWestateonafreeholdor leasehold basis.

doesnotlimit optionsfor our futureHQ: the expectationis that this will involve purchase of a new, smaller building to meet members’future needs (leasehold or freehold). Nevertheless, rental options for a new HQ (on a short- or long-term basis) could also be legitimately considered as being within the bounds of the motion should that prove advantageous.

does not allow (without further member vote) part sale ofthe BCWbuildingoroptions involving someform ofchargeonthe building, such as using a mortgage to self-invest in full refurbishment or entering large-scale partnerships requiring security linked to the building

Trusteesrecognisethatvariants,suchasthosesuggested,willaffect the NPV. Determining these would be considered as part of the detailedassessmentssupportingtheFBC,oncethemarketresponseis

supportoperations.

MFA and NPV results will be significantlydifferentdependingupon which combination of these parameters is the sale option recommended by the OBC and chosen by the Trustees.

The option evaluated needs to be made clear and the MFA & NPV evaluationsconfirmed/checked/rerun based upon this option.

known.

Optionsonhowtomanageanysurplusfunds(the“BCWdesignated legacy fund”) will be developed during the next phase of work.

As the motion is itself vague upon whichcombinationofthesefactors, the Trustees made their decision it wouldbehelpfultoseeasensitivity analysis of the extremes of these variants.

Whentosell?

The London property market is very poor at the moment, institution management is depleted, and the 3 yearstablebusinessplanisnotyetin place. No consideration seems to have been given to timing of a sale. The“when”questionissurelyatleast as important as the “what”?

Values from the NPV calculations did not materially affect overall judgementsmade bytheTrustees aboutriskanddeliverabilityofthe options (see Para 4, above).

Ultimately,Trusteesnotedthat,aswithany propertytransaction,values remain subject to market conditions; until the estate is placed on the market and firm bids are received, final figures cannot be known. MFAanalysesinevitablycontainanelementofsubjectivity.

AsNPVdid not materiallyaffectthe choice of preferred option, a further sensitivity analysis at this time would be of limited value.

Shouldmember approvalbegiven,Trustees willnotdecidewhether to sell and in what form until market values have been established and work to support the FBC has been completed. Consideration can be givenatthat timeto appropriatesensitivity analysisto supporttheFBC and associated risk assessments.

Amarket analysis willbeprovided inthecaseof ayes vote, but before the Trustees are asked to authorise placing the BCW estate onto the market to seek offers.

The timing of any sale remains an important consideration – covering thoseaspectsnotedhere, as wellasotherfactors suchas thepotential costs and risk exposure of an ageing building; as well as being clear in how any funds might be managed in the transition period between our current and future HQ.

The question of whether or when to sell is ultimately one that the Trustees willmakewith advicefrom andinputs from other Institution bodies,including itsgovernancecommitteesandCouncil,aswellas expert external advisors.

Financialevaluation(NetPresentValue(NPV)calculations)

BelowarehighlightedassumptionsunderpinningtheNPVassessmentthatCouncilexpertshavedifficultyvalidating.

Inputtingcredible but prudentassumptions suggested by theCouncilexperts bringsthecrediblestay options intoatleast equivalent NPVvalues asthe leave option(s) and improves the probability of being able to procure a loan for a first stage of repair/refurbishment until increasing revenue can fund ongoing refurbishment.

OBC approach

Due primarily to the uncertainty surrounding inputs andassumptionsandthehuge effect they have on the output value, using 30 year NPV to evaluate options of this nature brings with it many risks compared to for example “real options” evaluation.

To mitigate these risks Council Reps insistedthat the Strategic Outline Case (SOC) required that the OBC include a robust sensitivity analysis of the NPV calculations and a “decision tree”toplotthepossibilitiesand associated risks. Neither of these requirements was complied with by the programme team drafting the OBC.

The assessment of the stay optionsincludedtheassumption that staff at 2024 levels would stay in the BCW estate

CouncilRepsProposal

Carry out a robust but simplesensitivityanalysis of the key NPV inputs.

Carry out a robust but simple assessmentof the possibilities using a decision tree (what could change? How willit affect the foreseen outcome?)

Complete a market testing as approved by the membership in January 2025 but never done, to discuss with potential partners/developers/purch ases alternative options or combinations of options. The objective is to narrow downvariabilityinthedata.

The most viable stay solutions and the business modelof the Institution’s comparators (and the IMechE in the past) would have primarily member facilities in the prime accommodation with most stafflocatedingoodquality but cheaper accommodation.The

HQSBResponse

Varioussensitivityanalyses werecarriedoutasrequested.

As noted,thekey uncertainty is the marketvalue ofthe Birdcage Walk Estate. Theprofessional property advisors recommended that the market was only approached after a member vote, as bidders would then see a credible possibility of a sale, and be more realistic in the analyses. Goingtooearly,beforethevote,could giverisetomisleadingdata.

The professional advisors (as well as the insights gained from previous reviews) gave us a reasonable estimateof likely values – whilstrecognisingthatfor a uniquebuilding suchas BCWit will always be hard to be definitive until the property is on the market and bids received.

The concept of a decision tree (or similar) to deal with some of the more significant uncertainties, is more manageablewith thegreater focus providedby a“preferredoption” andhavingreceived a market response.

Should the members voteyes, then Trustees willbase their decision onwhether and when to sell based onmarketvalueratherthanestimates (with this consideredas partoftheoverallFBC,with primary consideration being the best interests of the institution – looking at all5 aspects of the FBC).InthisrespecttheTrusteesandtheCLCrepsappeartobeinagreement.

Multipleaccommodationassumptions weremodelledas partof theDD on aleaseholdand freehold basis as requested by the CLC tech reps.

The Council Rep’s proposal is similar to options B,C,D,E,F,G. We understand the logic, but it is less relevant now given the choice of preferred option. It would, in effect, involve a significant capital investment inacommercialproperty business anddiversionof funds/distractionfromcore purpose. IMechE has amply demonstrated the risk of its involvement in commercial ventures that it is ill equipped to lead. This risk is amplified if significant debt is involved.

We agree that theFBCneeds tolook to futureneeds andstaffingnumbers as itconsiders options for the new building and the counterfactual for BCW (Para 5 above).

TheNPVanalysisforatleast one otherwise credible stay options assumes that the current value of the estate is of the order of 1/3 to ¼ of comparators and other estimates

remainingspacewouldbe revenueearningasoffices or hotel rooms. The NPV analysis needs to include this possibility.

Theanalysisneedsto be based on foreseen 2026 and beyond staff levels (i.e. post subsidiary divestmentandefficiency savingsforeseeninthe3 year plan)

Most valuations and comparisons with equivalent estates have put the estates current valuenearer£30to£60m.

A sense check based on yield from a hotel development(includingthe costof2refurbishments in 30 years) put the value a hotelierwouldbeprepared to pay as around £80m

The consultants’valuation seems to be too low and hascontributed toanNPV thathasledtostayoptions being eliminated too early

Attheir meetingof 27th September,Trusteesconsideredbroadcategories including partnering options and keeping all the estate and running surplus space as a business. Trustees were aware of the range of valuations quoted on the left, and the basis for the choice of preferred option is set out above (Para 40.

Property Residual valueassumptionsfor Residential, OfficeandHoteluses have been provided to CLC Tech reps. The input assumptions and values used by HQSB correlate closely with the market comparables provided by other independent organisations over the last 12 yrs.

Abuildingsuch as 1-3 BCWis extremely difficulttovaluesincethebuilding andits location are unique. Should the members vote yes, it will be possible to establish actual market values for different development options. This will inform the FBC.

TheNPV analysis for at least one otherwise credible stay option assumes that the estate will have close to zero value in 30 years

Over the last 30 yearsproperty inthe location of BCW or equivalent has appreciatedbetween 1.5and 2.5 times inflation. An assumptioninlinewith this would be more credible

ThishasbeenconsideredbyHQSB,withinputfromitsexternal propertyprofessionaladvisors.

Different assetclasses will demonstrate different relative performancewhen different time periods are considered. In general, market forces willmean that assets with a similar level of volatility will produce similar returns when averaged over a sufficient period.

Thestatement that the BCW estate has doubled in realvalue over the last 30 years is equivalent to saying that its value grew at an average of 2.3% per annum (real and gross). This does not necessarilyrepresent agoodinvestment, given thatendowment managers typicallytarget growthof 3 to 5% (real and net).

The residual value of assets in an NPV analysis can be treated indifferent ways, noting that the value is only realisable if one chooses to sell. If a discountrateof 5% is chosen, then the discount factor for values in30 years time is 0.23. If 8% is chosen,then this fallsto 0.10. Hence, theeffect of residual value on NPV in a 30 year analysis is much less significant than might be thought.

The implication behind the question is that the Institution will ‘miss out’ on capital growth if the building is sold. However, since the intention is to invest the proceeds in a new building together with a diversified investmentportfolio, thecapitalvalue after 30years inany ‘sell’option is likely to be at least as good as with a ‘keep all’ option.

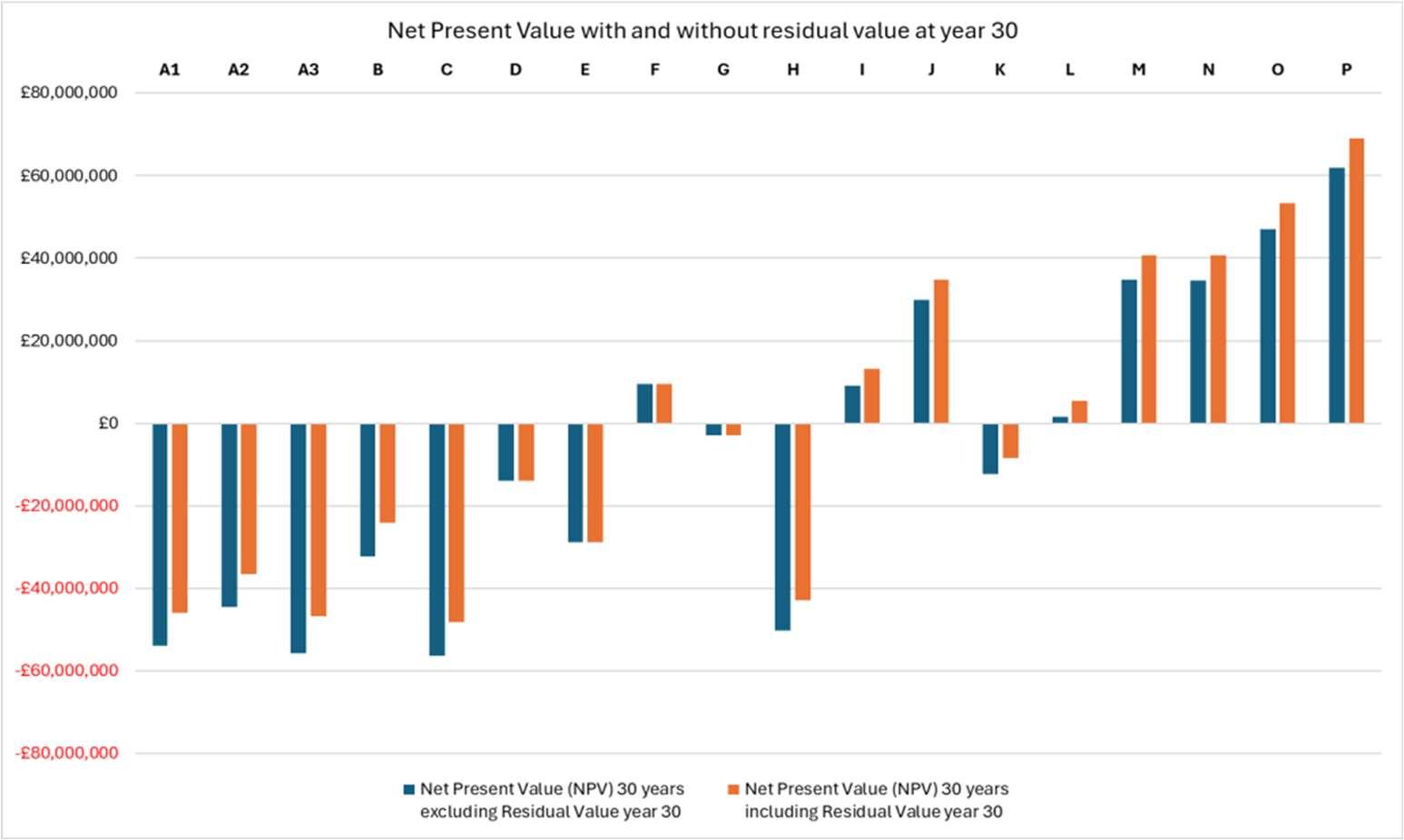

ALLoptionsweremodelledwithandwithoutresidualvalueatyear30,asshowninthefigurebelow.

The office rent figures per sq. foot used for the OBC evaluationofpotentialrevenue seem low compared to recognisedpublicsurveydata.

Inaddition,C&Wusehigheryield values than one would have expected (thereby reducing the capital valuation)

The Lambert Smith Hampton TotalOffice CostSurvey(TOCS) is the most definitive independent survey of its type, providing detailedinformation on office costs for over 50 UK locations and has verydifferent datafrom that used by the consultants.

Rental and yield figures vary considerably for different locations within London. Figures used in HQSB’s OBC are based on local Westminster comparables rather than the more generic TOCS locations.

An“Optimismbias”of26%has been added to the NPV calculation of the stay options. This is beyond the range recommended in the “Green Book” to which the team are working

Avalueforoptimismbias should be tailored to each option. So for example, a lower optimism bias would be expectedforapartnering optionwithaquality developer

Eachshortlisted optionwas risk adjusted individually andtheeffects financially evaluated.

For office accommodation it was assumed that the Institution would bear the cost of cleaning and routine maintenance. Normal practice isforlandlordtooff-chargethis to tenants (in addition to rent) at50%markup

Aloaninterestrateof7.5%was used in the NPV calculations.

Recalculate on the assumptionthatnormal practice applies

The retain all options, which require the institution to upgrade to EPC B (c. £50m+) to allow renting assumes arentalincome of £1.56m pa and arates contribution of£170k pa+ utility consumption at cost. Where the Institution leases, a £15 per sq ft s/c is assumed.

The current basis of charging rent is on an all-inclusive basis and if it was to be run differently as a property company then additionalmanagement and accountingwould be necessary andthe funding costsofthemortgage,securedonthebuilding,wouldmateriallyimpacttheIncome&Expenditureof theInstitution.

A value of 6% or slightlylowerismuch more credible.

Themodelassumes aloan interestof 6.5% inthemainanalysis. Wehavealsomodelledtheeffects of different interest rates on the NPV.

It is assumed that over £50m needstobespent“upfront”on refurbishment

A more credible assumption would be a staged approach to bringingtheestateupto prime fully-refurbished standard.

HQSB analysis has shown that to achieve full refurbishment in a staged, “piecemeal” way would be very disruptive and moreexpensiveoverall. For exampleheatingandventilation systemswillneed to be replaced as a single item, and it makes little sense to do this without improving insulation etc.

HQSB havemodelled and costedspreadingcosts over 10years (£51m),5years (£37.5m) and2 years (£36m) as shown in the tables below.

Note Para 6 above: progressing without any sale or charge on the building remains as the counterfactualto beconsidered intheFBCand is one potentialfallback option. This would likely involve smaller, piecemeal actions funded on a case-by-case basis, constrained by affordability and prioritised according to IMechEneeds.

The Council technical group option of smaller scale repairs and refurbishments, initially funded by a smallloan and subsequently fundedby revenue generationcould beconsideredas partofthecounter factual. The Trustee view is that such an approach is unlikely to deliver our stated vision in the foreseeable future and is expected to involve higher risk and cost.

Multi–FactorAnalysis(MFA)

Themulti-factor analysis usedwascompiled by amemberof staffwithoutagreementof orconsultationwithCouncilexperts in this subject. InCouncil experts view (including that of a professionalanalyst) it has the following significant shortcomings that need to be corrected or at least factored in.

OBC CouncilRepsCounter proposal Comment

None of the elements of the Institution’s purpose were in included as factors against which the options were evaluated.Linksweretothem were “reverse engineered” when this was pointedouthalfwaythroughthe evaluation.

The MFA should be rerun with the Institution’s purposes andsubsetsthereofas the primary evaluation criteria.

TheMFAwasundertakenwithCouncilinput.

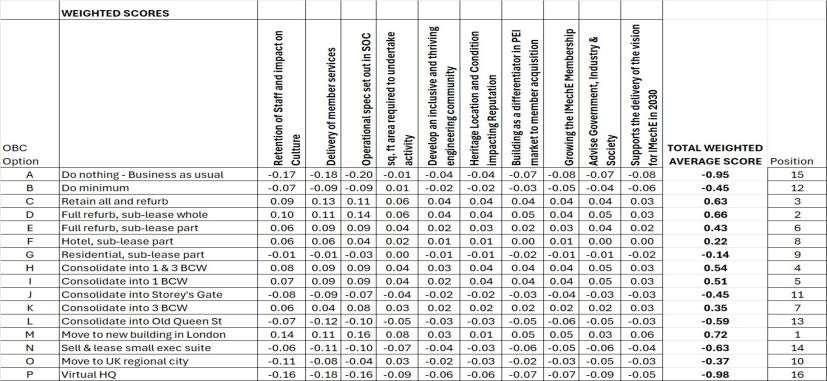

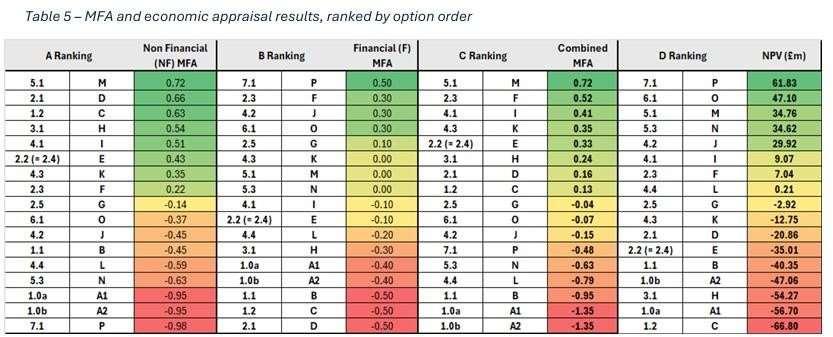

The MFA utilised the approved word metrics from the Strategic Outline Case. This built on the inputs fromtheCLC tech groupmember who assistedinadvisingonthe format.The metrics werespecifically chosen to relate to the HQ requirements rather than the much broader Institution Purpose. As the CLC reps note, the metrics can be related back to the purpose relatively easily. The MFA workshop was independently facilitated, as recommended by CLC and scored individually. The sensitivities to different weighting factors weretested and did not change the rankingof the top 5 options. Details are given in the table below.

MFA Workshop results

23rd Jan 2025Facilitated by Concerto

The weighting of the factors used was inappropriate. For example,theevaluationgave Staff Retention as one of the highest weighted factors but took no account of Member retention at all

To take account of the inappropriate weighting theTrusteesaskedCLC reps to run a sensitivity analysis on the weightingswhichgavea significantly different result.This result needs to be made clear to members andtheirreps

Theweighting was reversedonsome oftheoptions to increasethe importanceof heritage andreduce the staff weighting. The ranking of the top 5 options was unchanged. Details are given below.

Some of the factors used were a comparison against maintaining the current estate, as is (itself one of the options being evaluated). This is contrarytonormalMFApractice which compares all options against independent criteria rather than status quo. To use the status quo as an evaluation criterion introduces an implicit bias againstthestatusquooption.

This is another reason thattheMFAneedstobe rerun with more appropriate evaluation criteria.

AlloptionswerebeingevaluatedimpartiallyagainsttheapprovedStrategicOutlineBusinesscase.

Thesensitivity analysis allowedfora 300% increase to theweightingonheritage andreputation, differentiator in the PEI market & Government and the same reduction to staff.

Any MFA is a tool containing an element of subjectivity. It provided usefulinsight to inform the economic casebut, as notedabove,this is justoneelementconsideredwhenselectingapreferred option.