PREPARED

We are one of the fastest growing convenience store retail associations, representing thousands of retailers and an ever increasing number of major vendors. Our members get exclusive access to discounts, incentives, and rebates while our vendors get an opportunity to build brand equity and loyalty. Store owners gain the power of a group with a single representative that communicates on their behalf. Our members put more money in their pockets! Become a member and utilize the collective bargaining power of our HRA family.

We represent more than 5,000 retailers and 45 major vendors. You will have us behind you as a representative that will communicate on your behalf.

Our focus is your success!

Gain bulk buying power, discounts, and rebate programs and you will see savings roll in every quarter. There is no cost to join.

Operate your business with a robust partnership giving you access to savings, services, and a team helping you operate a more profitable and seamless c-store. Ensure you are operating with the highest gross profit possible by partnering with us. If you don’t save, we don’t earn.

Through our partnership with vendors you gain access to the power of collective bargaining! Amazing pricing and deals are no longer only for large chains.

October has always been a transitional month. The long heat of summer finally breaks, school routines are firmly in place, football is back, and the holidays are already starting to creep onto calendars. For convenience stores, this means one thing above all else: change. Customers’ habits shift in October more than almost any other month of the year. They spend differently, they shop differently, and they’re looking for stores that feel one step ahead of them.

That’s exactly what this issue is about. It’s not enough to think of October as just another month, or of Halloween as just another day. The most successful operators know that this season is filled with opportunities, from party packs for tailgates to mid-October candy refills to the growing popularity of meal kits and protein drinks for busy families. The stores that lean into these rhythms don’t just sell more product. They build trust by showing customers they understand how life actually works.

At the same time, we’ve packed this issue with ideas that stretch beyond the season. From AI-driven shelving that makes stores feel smarter to the return of the drive-thru as a true convenience channel, October is a reminder that innovation isn’t slowing down. The tools and strategies shaping the future of this industry aren’t theoretical, they’re being tested and adopted in stores just like yours by operators who understand that staying current is the best way to stay competitive.

Taken together, the stories in these pages highlight a simple truth: convenience isn’t just about being nearby, it’s about anticipating what customers need when they need it, and delivering it in a way that feels effortless. That might mean a tailgate bundle on a Saturday morning, a protein shake before work, a last-minute candy run on October 30th, or a perfectly optimized shelf that always seems to have the right item in the right spot. However you get there, the result is the same, a stronger business, a happier customer, and a store that feels essential in the daily life of your community.

As you head into the final quarter of the year, I encourage you to think about October not just as a season of pumpkins and costumes, but as a springboard. The lessons you practice now in creating bundles, fine-tuning shelves, investing in efficiency, and connecting with community events are the very same lessons that will carry you into November, December, and beyond. This is the time to sharpen your strategy and remind your customers why your store isn’t just convenient, it’s indispensable.

Happy Halloween season, and here’s to finishing the year strong.

Warm regards, Editor-in-Chief, C-Store Connect Magazine

The flavor you’ve been waiting for is back. Experience the crisp, refreshing taste of Diet Coke with a twist of zesty lime flavor in retro limited-edition packaging. It’s the same iconic diet soda you know and love, with a bold citrusy kick that hits just right. Some things are just too good to stay gone.

Drive SSD growth this fall by recruiting Diet SSD flavor-seekers with Diet Coke Lime, for a limited time only!

The Red Bull Winter Edition with the taste of Fuji apples and the warm spiciness of ginger.

The Winter Edition contains caffeine that helps to improve concentration and increase alertness.

The Winter Edition contains B-group vitamins (niacin, pantothenic acid, B6, B12), which contribute to the reduction of tiredness and fatigue.

The Winter Edition contains sugar, a fast-absorbing form of carbohydrate involved in a wide range of biological processes and an energy source for the brain and muscles.

October has a way of sneaking up on store owners. The summer rush is over, the weather cools, and for a moment it feels like business might settle into a predictable rhythm. But just as quickly, the calendar shifts. Football, fall festivals, and Halloween pass in a blink, and suddenly the holidays are bearing down. For convenience stores, this isn’t just another season. It’s the quarter that often determines whether the year closes strong or with a sigh. While coolers and kitchens still carry the load, there is another category that can deliver outsized results in Q4 if treated with purpose: gift cards.

For many independents, gift cards sit on a rack by the counter, quietly selling themselves. Customers grab one here and there, usually when they’re already on the way to a party or need a last-minute stocking stuffer. That alone is worth having them. But the real opportunity comes when stores stop treating gift cards as passive items and start seeing them as strategic tools. Because when leveraged correctly, they don’t just drive direct sales. They trigger impulse purchases, increase basket size, attract new customers, and build brand recognition long after the holidays are over.

The sheer scale of the gift card market is reason enough to pay attention. In 2025, U.S. consumers are projected to spend over $200 billion on gift cards. That number has doubled in less than a decade, fueled by the convenience of digital delivery and the appeal of “choice as a gift.” And while supermarkets, mass merchandisers, and digital

$25 card to Apple or Amazon — they were picking up the makings of a gift bag to go with it. Another operator in North Carolina stationed a gift card rack near the beer cave with signage that read, “Don’t show up empty-handed.” It turned beer runs into gift runs during December gatherings.

Staff engagement is another underrated lever. A friendly reminder at checkout can plant the idea that turns into a sale. It doesn’t need to be pushy. A simple, “Do you need any gift cards today?” often jogs a memory. Someone who forgot a nephew’s birthday or tomorrow’s office exchange might decide right then. Owners who train cashiers to treat cards as part of customer service, not a scripted upsell, report stronger sales across the board.

no rack space, no theft concerns, and often better margins. Some stores report digital card sales climbing fastest in the final 48 hours before Christmas, when panic sets in and physical options feel too slow. Being able to serve that demand cements the c-store as a problem solver.

The side benefit of card sales is the way they increase other spending. Research shows that nearly two-thirds of c-store gift card transactions include an additional item. Think of the shopper who comes in for a card, then grabs a soda for the ride or a bag of chips to tide them over. In some cases, the add-on purchase is larger than the card margin itself. That’s the hidden multiplier effect. Even more importantly, when recipients come in to redeem, they become new

platforms capture the lion’s share, convenience stores hold a unique position. They are open when other retailers are not. They are located in every town and on every corner. And they are already the destination for forgotten items, last-minute errands, and quick fixes. A well-placed gift card display taps into that exact behavior.

To maximize the return, placement and promotion matter. A dusty rack hidden by the lottery terminal won’t capture anyone’s attention. Successful operators are building seasonal stories around gift cards. A store in Alabama built a “holiday helper” display that paired candy canes, hot cocoa packets, and small gift bags with racks of cards. The result was not just higher card sales, but a lift in the associated items around them. Shoppers weren’t just buying a

The digital frontier opens even more doors. Increasingly, consumers expect to be able to send a gift instantly. That’s why more c-stores are partnering with providers that enable digital code sales at the register. A customer can walk in, buy a digital gift, and send it via text or email within minutes. For younger shoppers, this is often the preferred option, and for independents, it means

customers. Every $25 redemption is an audition. If the store is clean, the service sharp, and the shelves stocked with appealing options, odds are good that person returns. That’s customer acquisition at essentially no marketing cost.

Independent branding takes this further. More c-stores are issuing their own branded cards, not just reselling national brands. For chains, this is already common practice, but even a single-site operator can work with providers to create local cards. A Raceway-branded card in Georgia or a locally owned Quick Mart card in Tennessee carries real meaning in its community. It says, “We’re your store.” For holiday gift exchanges, that local pride resonates. Recipients know the card ties directly back to a business they trust. And for

the store, branded cards lock in future visits rather than sending dollars to Starbucks or Best Buy.

Fraud prevention is the one area that requires vigilance. Gift card scams have become more sophisticated, with criminals targeting retailers through social engineering or tampered packaging. Owners must ensure their POS systems are configured with activation protections, that staff know the warning signs, and that cards are displayed securely. Providers offer reconciliation tools and monitoring systems to flag anomalies. Ignoring this side of the business is a mistake; a single fraud case can wipe out the profit of dozens of legitimate sales. But when protocols are followed, the risk is manageable.

One reason gift cards resonate so strongly in c-stores is their alignment with the idea of convenience itself. Customers don’t want to spend time hunting down the perfect gift. They want a solution. A card offers flexibility, safety, and immediacy. In October and November, when parties, tailgates, and early gift exchanges fill calendars, convenience wins. By December, when procrastination peaks, convenience is king. Positioning your store as the reliable place to grab the forgotten gift pays off not just in sales but in reputation.

Looking ahead, the integration of loyalty and gift cards may be the next evolution. Some platforms already allow customers to convert loyalty points into gift cards or load store-branded cards directly through mobile apps. That

crossover creates stickiness, keeping customers in your ecosystem rather than drifting to competitors. Imagine a shopper redeeming loyalty points to cover part of a gift card purchase, then returning to spend both the card and more dollars later. That flywheel keeps spinning, and it starts with offering the option in the first place.

The playbook is not complicated, but it does require intention. Stock cards early and keep racks full. Place them where they can’t be missed. Build seasonal displays that make them feel like part of a bigger solution. Train staff to mention them without pressure. Explore digital options to capture the last-minute crowd. And if possible, issue store-branded cards that reinforce your identity. Do these things consistently, and gift cards move from being an afterthought to a profit line you can count on every Q4.

The truth is that gift cards are not glamorous. They don’t have the buzz of a new beverage launch or the excitement of a seasonal foodservice hit. But they are steady, scalable, and perfectly suited for the season. They turn forgotten errands into opportunities, create new customer relationships, and fill gaps in baskets with profitable add-ons. For independent operators trying to squeeze every ounce of revenue from the year’s final months, that reliability is invaluable.

As October rolls on, the smart move is to stop seeing gift cards as passive products and start treating them as the seasonal strategy they are. When customers ask themselves where they can grab a quick gift, your store should be the first answer. That’s the real value of the holiday gift card playbook: turning everyday convenience into lasting income, one small card at a time.

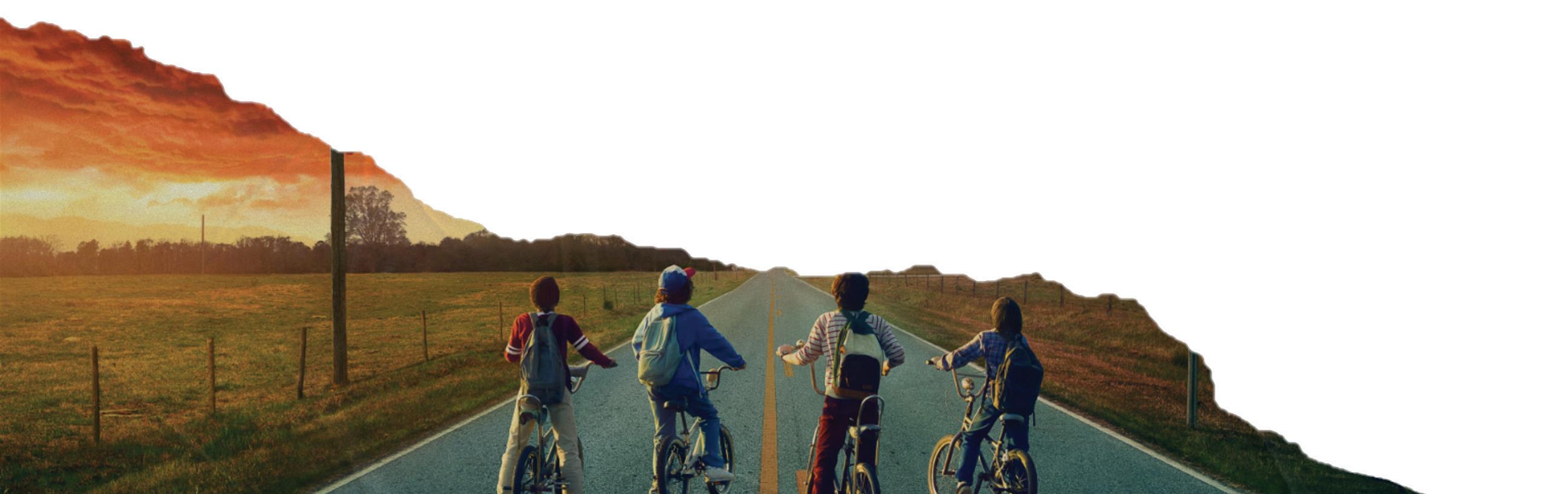

Stranger Things attracts an enthusiastic youth cohort and is popular with teen athletes.

Stranger Things Season 4 set a Nielsen record for the most-watched show ever at the time!

43% 2.4x #1

Gatorade SKUs are the most productive in the Sports Drink category, averaging $2.3MM per item, per week!

Gatorade displays are significantly more productive vs #2 Sport Drink competitor!

Gatorade is highly productive when on Feature & Display, growing register rings by over 40%!

As a Horizon Retailer Association approved provider for members, Vestis understands the needs of small businesses like yours. Plus, price assurance means you have a dependable source for all your Uniforms and Workplace supplies.

• National negotiated prices on rental programs and Direct Sale merchandise

• 4 weeks free for new program locations

Kuii, which means green in the Mixtec language, was created with the purpose of developing delicious and refreshing drinks for the entire family.

Our mission is to deliver thirst-quenching, quality products at affordable prices. From our carefully crafted bottles to the freshest coconuts gathered locally in Thailand, we take pride in creating personal relationships with our customers through superior products. Our mindful attention to every detail ensures that no matter your drink of choice, each flavorful sip was made with you in mind.

Kuii Drinks represent a family of incredibly delicious coconut milk drinks. Our wide assortment of flavors will take your taste buds on a vacation of a lifetime. All of our drinks unlock a different kind of vacation made to the highest quality.

50% of Kuii buyers are under 45 years old (137 index) underpinned by GenZ (168 index) who represents the largest purchasing group.

61% of Kuii buying HHs are note white (174 index) with the majority of the multi-cultural consumer base being Hispanic/Latino (279 index)

Kuii buying households often have children present (142 index) and tend to have a family size of 4+ people (152 index).

Our

The

Kuii has the 2nd, 6th, and 10th highest sales velocity and the 2nd and 3rd highest unit velocity for single-serve Hispanic beverages.

For years, the dinner daypart was a blind spot for convenience stores. The industry built its reputation on mornings, dominated lunches with grab-and-go, and captured late-night impulse with snacks and energy drinks. But the question of what customers eat at six o’clock remained mostly unanswered. That’s beginning to change, and October is the perfect moment to focus on it. As the days get shorter, families look for solutions that save time, stretch dollars, and still feel like a meal worth sitting down for. Meal kits and take-home bundles are no longer just for grocery stores. They are moving into the convenience channel, and for the operators who execute well, they are quietly becoming a steady stream of traffic and margin.

The shift is driven partly by economics. Grocery prices remain volatile, restaurant tabs continue to climb, and households are recalibrating how they spend on food. In recent consumer surveys, more than half of adults said they are cooking more at home than a year ago, but many admitted they still want the convenience of prepared or partially prepared foods. That tension — between wanting to save and wanting ease — is exactly where c-stores can win. Unlike restaurants, c-stores already sit on the path home. Unlike grocery, they can move faster, stocking smaller quantities and responding quickly to changing demand. A bundle of sandwiches, a pizza with a two-liter, or a hot-case chicken paired with sides is not a complicated leap. It’s a reframing of what the store already does well.

Some operators are getting more ambitious, offering kits that mimic the subscription model. A few regional chains now sell “family night” boxes: precooked proteins, side dishes, and even desserts bundled in one package. Customers can take them home, heat them up, and call it dinner. Others have experimented with taco kits, pasta

bundles, or build-your-own sub packs. The difference between a product that moves and one that languishes is often less about the food itself and more about the framing. Families don’t buy “three sandwiches and chips.” They buy “Friday night dinner.” Shoppers don’t reach for “a pizza and drinks.” They respond to “game-day bundle.”

The message is just as important as the menu.

The demand is already visible in data. NACS research shows that prepared food remains one of the fastest-growing inside categories for c-stores, contributing an outsized share of margin compared to packaged goods. Stores that invest in hot food programs consistently outperform peers. The natural extension is to position those foods not only as single meals but as family solutions. An operator in Kentucky reported that bundling two pizzas with wings and a drink led to a 40 percent increase in Friday night sales compared to selling the same items individually. The products didn’t change — the packaging and marketing did.

Packaging is often the hidden lever. Customers need to see that the bundle is designed for them, not pieced together at the last minute. Branded boxes, carryout bags, or clear signage create a sense of intention. A well-labeled box that reads “Family Meal Kit” signals quality and value. It also simplifies the decision. Parents do not want to stand in a store at six o’clock trying to figure out what goes with what. They want to grab, pay, and go. Packaging delivers

that clarity.

There is also a strong seasonal angle. In October, tailgates and football gatherings are natural occasions for bundles. Stores that market “Game Day Packs” of wings, chips, and drinks tap into an existing rhythm of group eating. By November and December, holiday gatherings open the door to larger trays and party platters. Even if a store lacks a full kitchen, there are ways to assemble trays of cold sandwiches, chips, and cookies that serve a crowd. The trick is to stage it as a prepared solution, not just a collection of retail items. Customers are willing to pay a premium for someone else to do the assembly.

C-store catering is beginning to find its footing here too. Several chains now openly advertise catering menus for

office lunches, team parties, and small events. The economics are compelling: incremental revenue on items already in the food program, higher average ticket sizes, and visibility in spaces where the store might otherwise never appear. For independents, the bar is lower than it sounds. A simple flyer or social media post showing that trays can be ordered 24 hours in advance can unlock a new revenue stream. Many customers assume convenience stores won’t do catering until they’re told otherwise. Once they know, they often prefer it because pickup is easy and hours are flexible.

Meal kits and bundles also respond well to promotions. Buy-one, get-one offers on bundles may sound generous, but they drive trial that often converts into habit. Loyalty integration matters too. Offering double points on family packs

or app-exclusive discounts creates repeat behavior. And because margins on prepared food are stronger than packaged, the promotions don’t erode profit the way they might in other categories.

There are challenges, of course. Forecasting demand for larger bundles is tricky. Waste must be managed carefully, especially with perishable sides. Staffing can be stretched if prep is com-

the trick is to stage it as a prepared solution”

plicated. That’s why the most successful programs keep it simple. They start with core items already moving through the store and build bundles around them. Over time, as patterns emerge, they expand into more elaborate kits. The lesson is that a bundle should not add complexity. It should reduce it — for both the customer and the operator.

The broader story is about positioning. C-stores are not trying to replace restaurants or grocery chains head-on. They are carving out the space between them. For a family on a budget that still wants a treat, a c-store meal bundle is cheaper than takeout and faster than cooking from scratch. For a college student hosting friends for a game, a pizza and soda bundle is easier than ordering delivery. For a commuter who forgot dinner until the drive home, a pre-assembled kit solves the problem in

one stop. That’s the value proposition: immediate, affordable, and easy.

Looking ahead, the opportunity is only going to grow. With the rise of GLP-1 drugs reshaping how consumers think about portion sizes and protein intake, convenience stores have a chance to innovate with balanced bundles. Smaller portions, lean proteins, and functional beverages can become part of the dinner solution. As shoppers demand healthier but still convenient options, c-stores can evolve beyond indulgent bundles to offer choices that align with new lifestyles. The category will not stay static. It will keep bending to consumer preference, and the stores that listen will be the ones that keep winning.

October is the moment to lean in. Families are busy, evenings are darker, and gatherings are frequent. A simple

display that says “Dinner Tonight” or “Game Day Pack” can trigger trial. Once customers realize your store is capable of solving the dinner dilemma, they start looking for you not just in the morning or at lunch, but on their way home. That shift is powerful. It transforms the store from a stop on the margin of life to part of the main routine.

Meal kits and take-home bundles may not feel flashy. They don’t always carry the buzz of a new energy drink or the novelty of a seasonal snack. But they deliver something deeper: relevance. They position the convenience store as a true food destination, a place that solves everyday problems in real time. For an industry built on being there when people need it most, there may be no greater compliment. Dinner tonight is waiting — and c-stores are finally ready to serve it.

For decades, the gas pump was little more than a tollbooth for motorists. Customers swiped a card, pumped their fuel, and drove off, often without so much as glancing at the storefront ten yards away. For c-store owners, that scenario was maddening. The store was stocked, staffed, and ready, yet countless drivers treated it as little more than scenery while they refueled. The money was in the lot, but it wasn’t making its way inside. That reality has shaped convenience retail for years — until now.

Technology is transforming the forecourt into a selling channel in its own right.

Ordering at the pump and targeted pump advertising are no longer experiments confined to trade show demos. They are live in markets across the country, and in stores that deploy them with intention, they are delivering real results. Forecourt commerce is becoming a profit lever, not just a customer convenience.

The timing couldn’t be better. Customers spend an average of three to five minutes at the dispenser. That’s an eternity in advertising terms — longer than a TV spot, a radio ad, or a typical social media impression. The pump has always held attention, but now it can

channel it into action. High-definition screens, contactless payment options, and loyalty integrations have turned the dispenser into a digital storefront. And unlike billboards or banner ads, pump screens know exactly when and where a customer is making a purchase decision. That’s the advantage operators can no longer afford to ignore.

Consider the evolution. In the early 2000s, some chains experimented with “gas station TV” — looping content meant to entertain drivers. The concept had novelty, but it rarely drove incremental sales. Customers tuned it out. The leap forward came when those same screens were tied directly into store systems, allowing real offers to be made and acted on in real time. Instead of passive entertainment, the pump be -

came interactive. A driver could see an ad for a hot coffee, tap once to accept, and have the order routed inside. By the time they stepped into the store, their drink was ready. That shift — from billboard to transaction point — is what makes today’s pump-side commerce different.

Operators piloting these systems report meaningful lift. Industry case studies show double-digit increases in featured product sales when pump offers are tied to time of day and weather. Coffee promotions spike during cool mornings. Frozen drinks surge in the heat. Pizza and bundled meals move faster in the evening. Even impulse items like candy bars and energy drinks see traction when the message is contextual. One operator in Texas reported a 15 percent

increase in morning food sales within weeks of turning on daypart-specific pump offers. The driver’s mindset was already tuned to breakfast; the pump simply nudged them inside.

The real breakthrough comes when loyalty and personalization are layered in. Imagine a customer who consistently buys an energy drink two or three times a week. When they swipe their loyalty card at the pump, the screen could automatically offer them a deal on that very brand. Another customer who has been earning points toward a free coffee could be reminded that they’re just one purchase away from redeeming. These are not generic ads. They are personalized prompts, and research shows that personalized offers can drive conversion rates two to three times higher than standard promotions. In other words, when the pump knows your habits, it sells more effectively.

Some owners worry that customers don’t want to be pitched while they fuel. But surveys tell a different story. Most drivers say they are open to offers if they feel relevant, timely, and easy to act on. The friction comes when systems are clunky. If it takes six taps to order a sandwich, customers won’t bother. If the menu is confusing or the screen freezes, they won’t try again. The challenge for operators is not whether customers will engage, but whether the experience is smooth enough to make it worth their time. That means investing in user-friendly software, training staff to fulfill quickly, and testing the flow before going live.

Operational readiness is critical. Pumpside orders must be fulfilled seamlessly, or the entire system backfires. If a driver accepts an offer for hot wings and then waits ten minutes inside because the staff didn’t see the order, they may never use the feature again. The technology itself is usually reliable — tickets drop into the POS or kitchen queue automatically — but human execution is what makes the promise real. Stores that succeed treat pump orders as a priority, not an afterthought. Staff know to check the queue constantly, and orders are staged before the customer even walks in. That kind of coordination makes the process feel magical. Without it, it feels broken.

Advertising alone has its place too. Even when no order is placed, pump video builds awareness and nudges behavior. Studies show that customers exposed to pump ads recall brands at higher rates and are more likely to make an unplanned purchase inside. For seasonal promotions, the pump can be especially powerful. October offers a perfect example: candy sales, pumpkin spice drinks, and game-day bundles are all prime candidates for forecourt advertising. A driver who sees a candy

promo while filling up before trick-ortreating is far more likely to walk inside and stock up.

Vendor partnerships make this even more attractive. Beverage companies, snack brands, and even QSR suppliers are investing heavily in forecourt media. For c-stores, that means potential co-op dollars or subsidized equipment. If you are considering upgrading dispensers, this is the time to ask your vendors how they can support it. They benefit from the exposure, and you benefit from both

customers exposed to pump ads recall brands at higher rates”

the sales lift and the additional revenue stream. Some operators are already generating advertising income directly from pump screens, creating a dual benefit: higher product sales and direct media revenue.

Looking further ahead, pump commerce will likely merge with mobile and loyalty into one ecosystem. Picture this: a driv -

er pulls in, taps their loyalty app, selects fuel, and instantly sees personalized offers on the pump screen. They order a meal, apply points toward the purchase, and pay with a digital wallet, all before the nozzle clicks. By the time they step inside, their order is bagged and waiting. That’s not science fiction. Large chains are already piloting systems that

come close. And as costs come down, independents will be able to adopt similar capabilities.

Artificial intelligence is set to make this even sharper. Instead of generic promotions, AI can analyze transaction history, weather, traffic patterns, and even regional events to decide what to promote in real time. On a rainy afternoon, the pump might prioritize hot coffee and soup. On a Friday evening near a stadium, it might push beer and snacks. These micro-adjustments, made automatically, can optimize every fueling

interaction for sales. For owners, that means the pump stops being static hardware and becomes a dynamic, data-driven sales engine.

The rise of EVs adds another dimension. While adoption is uneven, one thing is certain: charging sessions take longer than fueling. That makes forecourt commerce even more relevant. Drivers waiting 15 to 30 minutes at a charger are highly motivated to engage with food and beverage offers.

Early pilots show that EV drivers are more likely to order ahead at the pump or charger, knowing they’ll have downtime anyway. For c-stores investing in EV infrastructure, pairing it with robust pump-side ordering systems will be essential to capturing that dwell time.

The cost question is real. Upgrading dispensers and integrating software can feel daunting, especially for independents. But the return on investment is increasingly clear. Incremental sales from pump-side ordering add up quickly, especially in food and beverage categories with healthy margins. Advertising revenue from vendors offsets costs even further. And the customer experience benefits — con-

venience, speed, personalization — help build loyalty in ways that are hard to measure but easy to feel. The bigger risk may not be the cost of upgrading, but the cost of standing still. Customers are coming to expect interactivity. A forecourt that looks outdated risks making the entire store feel behind the times.

The pump has always been the front door of the business. For too long, it was a door many customers never walked through. Now, with technology and execution, that door is opening wider. The question is not whether pumpside commerce can work, the evidence reflects it. The question is whether operators are ready to embrace it, to iron out the details, and to make it seamless. Because when the pump stops being just about fuel and starts being about engagement, the entire store benefits.

October is the right time to begin. Cooler mornings call for coffee offers. Football weekends demand bundle promotions. Holiday travel invites snack and beverage deals. Customers are already in the right frame of mind. The job of the store is to meet them there, at the pump, where attention is captive and opportunity is waiting.

The forecourt has finally become more than a place to fuel. It’s becoming a place to sell, to connect, and to grow. And for c-store owners looking to stay ahead in a competitive market, that shift could be the difference between another routine quarter and one that truly converts.

Convenience stores have long thrived on quick energy. For decades, that meant carbonated sodas, then Convenience stores have always been about speed. For decades, the cold vault was defined by what could give customers an instant jolt: sodas in the 1980s, energy drinks in the 2000s, and a rainbow of functional beverages in the 2010s promising everything from sharper focus to calmer moods. But something quieter, steadier, and far more habit-forming is happening now. Protein drinks and meal-replacement beverages are no longer niche products for athletes or dieters. They are mainstream solutions for millions of Americans who want quick, portable, and nutritious fuel — and they are becoming one of the most important beverage shifts convenience retail has seen in years.

Spend just one morning watching your customers and you’ll see it. The commuter who skips breakfast but doesn’t want to face a long day on coffee alone. The parent juggling a school drop-off, grabbing something to tide them over until lunch. The college student who needs protein after a workout but doesn’t have time to sit down at a café. The truck driver fueling up before a long stretch of highway. They’re all turning to protein drinks. What was once a specialty category is now a universal one.

The numbers back this up. Ready-todrink protein shakes have been posting double-digit growth in the convenience channel even as traditional soda sales flatten. NielsenIQ reports show protein beverages are consistently among the top growth categories inside c-stores. Customers are gravitating toward brands that emphasize low sugar, clean ingredients, and high protein content, and they are willing to pay more per bottle because they see it as a meal, not just a drink. When viewed against the cost of fast food or even grocery-prepared

meals, a $4.99 protein shake feels like value.

Part of the surge is being fueled by an unexpected cultural shift: the widespread adoption of GLP-1 medications like Ozempic and Wegovy. These drugs suppress appetite, and millions of Americans are taking them. But while people on GLP-1s may skip meals, they still need protein to maintain muscle mass and energy levels. Nutritionists are encouraging smaller, protein-rich snacks and beverages. That has created a new wave of customers who look at protein shakes not as a supplement but as a necessity. Convenience stores, open early and late and positioned directly along commute routes, are in the perfect place to capture that spend.

What makes protein drinks so valuable for operators is their consistency. Unlike faddish beverages that spike and fade, protein shakes become part of a daily or weekly habit. A commuter who discovers a shake that works for them is back five mornings a week. A gym-goer grabs one after every workout. A truck driver builds it into their routine. That kind of repeat purchase builds a loyal customer base that is less price-sensitive and more reliable than many other beverage shoppers.

It also changes how the store is perceived. A c-store with a cooler stocked full of protein drinks and meal replacements signals something to every shopper who walks in: this is not just a place for sugar and caffeine. This is a store that understands modern needs and caters to healthier routines. Even customers who never buy a protein drink notice. The halo effect improves the overall image of the store as clean, current, and customer-focused. In competitive markets, perception can make all the difference.

Meal-replacement drinks add another layer. Once relegated to diet aisles and specialty retailers, they are now being embraced by a much wider audience. Office workers use them as lunch between meetings. Students drink them on the go. Families buy them to cover chaotic evenings when cooking is impossible. For c-stores, these products align with the very definition of convenience: providing a solution when time is scarce. And because meal replacements often command higher price points, they deliver stronger margins per unit than many traditional beverages.

Operators who invest in this category often find it lifts other sales too. Customers who buy a protein shake are more likely to pick up a protein bar, trail mix, or fresh fruit. Bundling opportunities are strong: a store might promote a “protein pack” that pairs a shake with a bar and a piece of fruit. These cross-sales not only lift basket size but also help reposition the store as a destination for complete solutions, not just individual items.

The challenge is execution. Too many SKUs can confuse customers and tie up working capital. The key is balance: anchor the set with proven national brands that customers expect, then add one or two rotation slots for innovation. That way, you capture buzz around new launches without overwhelming your cooler. Placement matters too. Protein drinks shoved to the bottom shelf won’t move. Eye-level positioning near energy drinks or bottled water gives them visibility and frames them as part of the mainstream beverage mix. Signage with simple messages — “Power Your Morning” or “Protein for the Road” — helps reframe the price point and build trial.

Speaking of price, that’s often the sticking point. A $5 protein shake seems expensive next to a $2 soda. But when framed as a meal replacement, the math

changes. Compared to a $10 fast food combo, the shake is cheap. Staff can reinforce this by suggesting protein shakes as part of meal bundles. Over time, once customers integrate protein into their routine, price resistance fades. They’re not buying a drink. They’re buying a solution.

Vendor partnerships can make a huge difference here. Beverage manufacturers are eager to grow this category and often provide sampling programs, promotional pricing, and marketing support. Some offer branded coolers or POS materials that help elevate the display. Operators who work closely with vendors to stage sampling events or loyalty promotions often see faster adoption. A free trial tied to a loyalty program can convert a one-time buyer into a repeat customer who returns multiple times a week.

Looking at the bigger picture, the competition for this category is coming from multiple directions. Grocery stores stock protein drinks, but they don’t always have the convenience of single-serve graband-go placement. Gyms sell shakes, but their selection is limited, and their hours are restrictive. Quick-service restaurants dabble in protein-focused smoothies, but they require longer waits. That leaves c-stores in the sweet spot: broad assortment, easy access, fast transactions, and the ability to meet the customer exactly when and where they need it.

The innovation pipeline shows the category will only expand. Beyond whey, plant-based proteins are gaining ground, appealing to vegans and flexitarians. Collagen-enhanced drinks are targeting joint and skin health. Some new launches combine probiotics, electrolytes, or adaptogens with protein, creating hybrid beverages that cross functional lines. These “stacked” drinks blur the boundary between hydration, nutrition, and supplementation. For operators, the

lesson is to keep assortments dynamic. Customers are curious, but they still rely on staples. The winning formula is a steady base plus space for experimentation.

October is a strategic season to emphasize these products. Routines are firmly set after summer, mornings are cooler and busier, and the holiday stretch is approaching. Marketing protein drinks as “breakfast made easy” or “nutrition for the road” ties directly into customer needs. By November, holiday travel and stress create another window. Travelers want something filling but not heavy, and shoppers juggling events and errands appreciate quick, nutritious options. With the right promotion, protein drinks can become part of those seasonal solutions.

Looking to the future, personalization may be the next wave. With loyalty programs and AI-powered recommendations, c-stores could eventually suggest specific protein products based on past purchases, health preferences, or time of day. Imagine a loyalty app that pings a customer at 7:30 a.m. with a coupon for their preferred protein shake, ready at the store they usually visit. Or a pumpside offer that reminds a gym-goer to

add protein after their Tuesday workout. These tools are not far off, and they will make the category even more powerful.

The quiet shift toward protein and meal-replacement drinks is about more than just adding SKUs. It’s about positioning the store for where consumer habits are headed. Convenience today is defined not just by speed, but by function. Customers want food and drink that fit their lifestyles, fuel their bodies, and make their lives easier. Stores that curate assortments thoughtfully, promote with intention, and partner with vendors to drive adoption will capture not just sales, but loyalty and reputation.

For c-store owners looking for the next dependable growth driver, this may be it. The cooler has always been a battleground, but now it’s becoming a platform for solutions, not just refreshment. Protein and meal-replacement beverages may not shout the loudest, but they are building the kind of steady, repeat business that every operator craves. Ignore the shift, and you risk being left behind. Embrace it, and you position your store not only as a stop for today’s customer but as a partner in their routines for years to come.

McLaneXpress is an online wholesaler that offers direct delivery of single-pick, cases or pallets of top-selling grocery merchandise such as tobacco, salty snacks, candy, and more to retailers across select states. McLaneXpress is an offering from McLane Company Inc., mclaneco.com, one of the largest supply chain services leaders in the United States.

• Tobacco

• Salty Snacks

• Candy

• Edible & Non-Edible Grocery

BENEFITS:

• Foodservice

• Health & Beauty Products

• Automotive

• And More

• Convenient, direct delivery to your stores

• Competitive pricing to maximize your profit margins

• All major credit cards accepted

• Free standard shipping for orders $1500 or more

• Access to CVP (Consumer Value Products), McLane’s premier line of private label brands that offer affordable products to consumers and higher margins to retailers

VISIT McLaneXpress.com TO SHOP THE PRODUCTS YOU WANT AT THE PRICES YOU NEED.

October doesn’t just signal the return of cooler mornings and pumpkin-flavored everything. It kicks off one of the most social stretches of the year — football weekends, tailgates, school fundraisers, office potlucks, and the steady drumbeat of holiday gatherings that run through December. For many households, these occasions come fast and often, and every one of them has the same requirement: food and drink that can feed a group. That’s where convenience stores, long associated with single-serve snacks and drinks, have a bigger opportunity than most realize. With the right framing, packaging, and marketing, c-stores can turn their existing offer into tailgate packs, party bundles, and holiday trays — without adding a full kitchen or tearing down walls.

The opportunity is rooted in behavior. Americans are spending more time entertaining at home or with friends, especially in the wake of higher restaurant prices. A 2025 consumer survey found that nearly two-thirds of households plan to host or attend more home-based gatherings this year compared to pre-pandemic levels. But hosting comes with stress. People

want options that are easy, affordable, and ready to go. Grocery stores offer deli trays and catering, but they require advance notice and longer waits. Restaurants can be expensive, and delivery fees pile up. C-stores,

positioned on the way to stadiums, schools, offices, and neighborhoods, can meet the need for fast, flexible group solutions.

The key is to stop thinking of your current assortment as only single-serve.

A pack of twelve wings, two pizzas, or a sandwich bundle looks like lunch for a few individuals on paper. Repackaged as a “Game Day Pack” or “Family Night Bundle,” it becomes an occasion-based product that commands attention. This isn’t about reinventing your kitchen. It’s about reframing what you already sell. That’s why the stores seeing success in this space often rely on smart packaging and clear marketing more than new equipment.

Take the example of a Midwestern chain that leaned into football season last year. They already offered pizza and chicken, but they began promoting a “Tailgate Trio” — two large pizzas, a dozen wings, and a two-liter soda for a set price. Sales jumped 30 percent compared to the same period the year before. Customers weren’t just buying food. They were buying a solution to their Saturday problem: how to feed a group before kickoff. Another independent operator in Georgia began assembling “Holiday Helper Packs” in November — trays of cold sandwiches, chips, and cookies. The items were the same as what they

always sold individually, but packaged together and priced attractively, they became a hit with office managers and families alike.

Packaging is a critical part of this. Customers need to see that the bundle is designed for them, not cobbled together at the counter. Branded boxes, clamshell trays, or even simple stickers with names like “Game Day Pack” create confidence. It also saves customers time in the store. They don’t have to figure out which chips go with which sandwiches or how many drinks to buy. The store has done the math for them. For many shoppers, that’s worth paying extra for.

October is especially fertile ground for these promotions. College football Saturdays, NFL Sundays, and even Friday night high school games all create demand for grab-and-go party food. Customers driving to a tailgate don’t want to detour to a grocery store deli with long lines. They want to pull in, fuel up, and leave with food in the trunk. Stores that position themselves as tailgate headquarters — with signage at the forecourt and bundle displays inside — can capture that spend. The same logic applies to Halloween parties, Friendsgiving gatherings, and December holiday potlucks. The occasions change, but the need for quick solutions stays constant.

open late, often 24 hours. That means you can be the last-minute hero for someone heading to a party at 8 p.m. who realizes they forgot to bring food. A stack of premade bundles near checkout with clear pricing can save that customer’s evening — and earn you a loyal fan for future occasions.

not just transactions. That reputation builds over time. It shifts the store from being a stop of necessity to a stop of choice. And in a competitive market, that positioning is invaluable.

One of the most underrated advantages c-stores hold in this space is hours. Grocery stores close early, and restaurants get backed up on weekends and holidays. But c-stores are

There is also a larger brand story at play. When customers see your store as the place that saved their tailgate or made their office potluck easier, they associate you with solutions,

Operators don’t need to tackle this alone. Vendors are often eager partners. Beverage companies love tie-ins with tailgate packs because they align perfectly with social occasions. Snack manufacturers see trays and bundles as ways to increase velocity. Some even provide promotional support,

packaging, or co-op dollars for stores willing to highlight their products in bundle promotions. A simple conversation with your distributor or rep can uncover resources you didn’t know were available.

Marketing these packs is half the battle. In-store signage is a given, but don’t overlook the power of digital. A quick social media post showing a ready-to-go party tray, or a loyalty app push notification advertising “Game Day Packs Available Friday,” can drive awareness and preorders. Some independents are even building simple order-ahead systems for larger trays, requiring just 24 hours’ notice. The technology doesn’t have to be sophisticated. Even a phone number for preorders creates a catering-like channel that many customers didn’t know existed.

Pricing strategy is another lever. Customers expect bundles to feel like a deal, even if the store maintains healthy margins. Anchoring packs at round numbers — $19.99, $29.99, $39.99 — helps. The perception of value is what drives adoption. Over time, once customers get in the habit of buying packs, stores can experiment with upsells: adding premium sides, larger beverage options, or desserts at incremental prices. The point is to get them in the habit first.

offering “complete kits” that bundle drinks, food, and supplies. Customers appreciate the simplicity, and stores benefit from higher ticket sizes.

Looking ahead, the potential is even greater as technology merges with these offers. Imagine a customer fueling up on a Saturday morning. The pump screen offers them a “Tailgate Pack for the Big Game.” They tap yes, pay at the dispenser, and pick it up on the way out. Or picture a loyalty app that pushes a notification Friday afternoon: “Don’t forget your Game Day Pack — preorder now.” These

integrations are already being piloted by larger chains, and independents can adopt lighter versions with basic preorder systems.

The beauty of tailgate and holiday packs is that they don’t require a kitchen remodel. You don’t need a full-service deli to succeed. You need

smart packaging, thoughtful marketing, and the willingness to frame existing items as solutions for groups. If you already sell pizza, sandwiches, wings, or even hot dogs, you have the building blocks. The transformation is in how you package, price, and present them.

As we move deeper into fall, the demand for these solutions will only grow. Families will be busier, gatherings more frequent, and customers more pressed for time. The stores that step up and say, “We’ve got your game-day covered” or “We’ve got your holiday party handled” will not just see sales spikes — they’ll earn a place in the rhythm of community life.

That’s the bigger picture. Convenience retail has always been about meeting people where they are, in the middle of their daily lives. Tailgate and holiday packs are a modern expression of that mission. They show that the c-store isn’t just a place to grab a drink and go. It’s a partner in celebrations, in traditions, and in the simple need to feed a group without stress. Done right, it’s one of the most human ways to remind customers why convenience matters.

The opportunity stretches beyond food, too. Tailgate and holiday packs can include non-food items: disposable cups, napkins, even branded coolers. Some operators have started

Improve customer loyalty, increase traffic and convenience store sales, and build your brand with Excel’s hassle-free automatic air machines.

With Excel’s cutting-edge technology, our digital air machines are used more frequently than non-digital air machines. Not only do customers appreciate the convenience and e ciency, but they tend to return for gas or convenience store purchases, driving tra c and increasing sales. Our current clients have already seen these results, and as customers prioritize proper tire in ation, the positive impact on convenience stores will only grow.

CUSTOMER EXPERIENCE

Our Excel Digital Air Machines simplify the tire in ation process for customers by eliminating the need for manual pressure checks with pens or gauges. Moreover, the machines stop automatically once the tire reaches the desired PSI, reducing the risk of over-in ation. By o ering a hassle-free and e cient digital air in ation experience, we can enhance customer satisfaction and long-term loyalty to your business.

CUSTOMER CARE

Enhance your gas station’s reputation and customer satisfaction by o ering our top-of-the-line air machines. Not only will this demonstrate your commitment to exceptional service, but it will also provide a hassle-free tire lling experience for your customers. By ensuring proper tire in ation, you’ll also be prioritizing your customers’ safety and well-being. This goes hand in hand with improving driving performance and reducing the risk of accidents. With our custom branded decals, you can elevate your gas station’s visibility and reputation in the market. Promote your brand and attract more customers by adding a personal touch to our Excel digital air machines.

Introducing our Air Excel Revenue Share Program – the ultimate solution for gas stations looking to o er hassle-free digital air in ation at ZERO cost. We take care of everything, from installation to maintenance to collections, so you can stay focused on what really matters – growing your business.

With our state-of-the-art air machines, conveniently available in over 30,000 locations across the nation, we proudly claim the title of America’s Leader in Digital Air In ation. Join us today and experience the modern and user-friendly approach to in ating tires.

For years, Halloween in retail was treated as a 24-hour sprint. Candy shipments arrived in late September, families grabbed bags in a rush at the end of the month, and by dawn on November 1st, the seasonal aisle had been stripped bare and replaced with pumpkins on clearance and the first signs of Christmas. Convenience stores, always adept at quick turns and last-minute shoppers, leaned into that rhythm but rarely saw Halloween as more than a candy grab.

That mindset is changing. In 2025, Halloween is no longer a day. It is a season, a month-long cascade of micro-occasions that stretch from early October stocking to late October panic runs, with parties, community events, and refills in between. For c-store operators, this evolution opens up a powerful opportunity: Halloween becomes not just a spike in candy sales, but a framework for customer connection, incremental trips, and basket growth.

The scale of Halloween retail spending tells the story. According to the National Retail Federation, Halloween-related sales surpassed $12 billion in 2024, with the average U.S. household spending more than $100 on candy, décor, costumes, and party supplies. Of that, nearly $4 billion went directly to candy. Analysts project 2025 to exceed those records again, fueled by population growth, inflation-adjusted pricing, and the holiday’s expansion beyond children.

What matters most for convenience retail is the way those dollars are spread out. Research shows that more than half of Halloween candy buyers make multiple purchases in October. They stock up early, dip into the stash, realize by mid-month that it’s gone, and buy again. Then, in the final 48 hours, a surge of shoppers flood local stores when they discover they need more than they thought. That cycle means candy has at least three waves of demand — early, middle, and late — and each wave is a chance for c-stores to pull customers in.

Halloween has expanded its cultural footprint. It is no longer confined to costumed kids knocking on doors. Adults are throwing elaborate parties. Offices run “spooky snack” days. Neighborhoods organize trunk-or-treat events in parking lots. Colleges and sports teams host themed weekends. Streaming platforms drive demand with Halloween movie marathons. This broadening of

the audience means that Halloween is no longer just a children’s candy holiday — it’s a multi-demographic, multi-occasion season of snacks, drinks, and social gatherings.

That cultural shift is a gift to c-stores. Every one of those moments requires grab-and-go products: candy bags, salty snacks, party beverages, even ice, pizza, and sandwiches. The stores that recognize this aren’t just waiting for trick-or-treaters. They’re positioning themselves as community suppliers for the entire season.

Suppliers and vendors see Halloween as a laboratory for seasonal innovation. Candy companies roll out pumpkinand ghost-themed packaging, test new limited flavors, and push large-format bags for parties. Beverage brands lean into apple, pumpkin spice, cinnamon, and caramel flavors that create seasonal excitement. Snack companies wrap their core SKUs in Halloween graphics to boost visibility.

Halloween is no longer confined to costumed kids knocking on doors”

C-store operators can leverage this by leaning on vendor support. Many suppliers provide free point-of-sale displays, signage, or co-op dollars during Halloween. A single themed endcap — candy paired with soda and chips — can create a “party pack” effect without requiring the store to reconfigure its layout. Local partnerships also help. Some stores collaborate with regional bakeries for Halloween-themed cookies or cupcakes, giving them a local angle

that differentiates from the big-box competition.

For operators, the key to unlocking Halloween as a season is pacing. Early October is about being the first place customers see when they decide to “get ahead.” Marketing should emphasize stocking up early, showing abundance, and reminding customers that “the best selection is now.” Mid-October is about the refill — this is when households run out of the first candy stash. Operators can run promotions like “Need a refill?” or “Keep the bowl full.” Late October is about urgency, when last-minute shoppers want candy right before the

big night. Here, clear signage — “Your Last-Minute Candy Stop” — and extended stock availability are critical.

Each phase also carries opportunities beyond candy. Early October is a good time to sell seasonal beverages and snacks tied to parties. Mid-October often overlaps with football season, meaning tailgate promotions can combine with Halloween products. Late October is perfect for bundles aimed at parties: chips, drinks, and candy grouped together.

Perhaps the greatest untapped value for

c-stores is the community role Halloween offers. Stores are natural gathering points, and Halloween is one of the few holidays that still centers on neighborhoods. Some operators have embraced this by hosting small events: parking-lot trunk-or-treats, free coffee for parents escorting kids, or in-store costume contests with small prizes.

One independent operator in Kentucky has made her store a safe trick-or-treat stop every year. Families know they can stop by the well-lit forecourt for candy and restrooms. The goodwill translates into repeat visits long after October. Another store in Florida tied candy giveaways to a food drive, asking customers

to drop canned goods in exchange for a Halloween treat. These initiatives build reputation as much as revenue. Customers remember which stores invest in their kids and neighborhoods.

Halloween is inherently visual. Stores that create a festive environment capture attention and build energy. Decorations don’t have to be elaborate — cobwebs over cooler doors, themed signage at checkout, or pumpkin decals on the windows create mood. Music playlists and staff costumes add personality. One Southeast chain encouraged employees to dress up during Halloween weekend, offering customers discounts if they came in costume too. The result was not just higher traffic but social media buzz, with customers posting selfies from the store.

That visibility turns the store into a place where people want to linger, not just transact. For c-stores that often struggle to build personality beyond utility, Halloween provides a low-cost way to change perception.

Digital tools can make Halloween campaigns more effective. Loyalty apps can track when customers buy candy early in October, then trigger push notifications mid-month reminding them to refill. Pump screens can run themed ads promoting candy-and-soda bundles, turning idle fueling minutes into purchase prompts. Social media posts showing

decorated stores, staff costumes, or prize winners extend the campaign outside the four walls.

Some forward-thinking operators are using AI tools to tailor promotions. For example, if the POS shows a customer frequently buys salty snacks, the loyalty program might send them an offer for a “Halloween Movie Night Bundle” with chips, soda, and candy. These micro-targeted offers take the broad theme of Halloween and personalize it, making the customer feel understood.

Of course, stretching Halloween into a month-long season requires operational attention. Inventory flow must be staggered, not dumped all at once. Staff must be trained to rotate seasonal stock and keep displays full. Managers must resist the temptation to discount too heavily too early, preserving margin for the late-October rush. For stores in high-traffic areas, it may mean ordering extra inventory to avoid running out in the final days.

Staff engagement matters too. Encouraging employees to embrace the season — through costumes, contests, or recognition — builds morale and makes the customer experience more enjoyable. When employees have fun, customers notice. And when the season wraps, clear plans for sell-through or donation of leftover candy help close the loop without waste.

The discipline of treating Halloween as a season pays dividends for the rest of the calendar. The same playbook — early stocking, mid-season refill, last-minute urgency, bundling, community tie-ins — applies directly to Thanksgiving, Christmas, New Year’s, and even non-holiday events like the Super Bowl or local festivals. Halloween serves as a rehearsal for bigger moments. Stores that learn to stretch a one-day holiday into a multi-week engagement carry that skill into every high-traffic season.

Looking forward, the opportunity only grows. As consumer behavior continues to value experiences and occasions, retailers who embrace the seasonal mindset will win. C-stores that take Halloween seriously are not just selling candy — they are building loyalty, expanding customer baskets, and cementing their place in the rhythms of community life.

At its core, Halloween is about connection, joy, and imagination. For c-store operators, leaning into that spirit pays off in both sales and reputation. It doesn’t require massive capital. It requires intentional execution, creative presentation, and a willingness to see opportunity where others see just a single night.

When you make October a season, not a day, you don’t just sell more candy. You transform your store into a place people look forward to visiting. And that’s the kind of magic that lasts well beyond the last jack-o’-lantern.

The drive-thru has always been a uniquely American invention, born of a culture built on cars and fueled by a desire to do everything faster. It started with banks and burger joints, spread to coffee shops and pharmacies, and eventually became so normal that most of us barely noticed how much of daily life was conducted from the driver’s seat. But for decades, convenience stores — businesses literally built on the promise of speed and ease — sat mostly on the sidelines. Some experimented with windows, but the majority kept their focus on the inside of the store. The logic seemed sound: wasn’t the entire model already built around getting people in and out quickly? Why carve out a lane when the parking lot was already right there?

That logic is being rethought, and fast. In 2025, the drive-thru is enjoying a full-scale revival, and this time it isn’t confined to fast-food giants or specialty coffee chains. Convenience stores are entering the game in earnest. From regional chains with dozens of sites to independents operating a single location, operators are discovering that customers don’t just want convenience in theory — they want it without leaving the car. What began as a trickle of experiments during the pandemic has turned into a defining trend of the mid-2020s, and it is changing the way people think about what convenience retail can be.

You can trace the momentum back to foodservice. Ten or fifteen years ago, many convenience stores couldn’t have supported a drive-thru even if they wanted to. The menus were too thin, the

preparation too slow, and the perception of quality too low. Coffee might have been strong, but sandwiches and hot meals weren’t yet competitive with quick-service restaurants. Today, that has changed. Pizza programs rival the local pizzeria. Fried chicken is seasoned and crispy enough to earn repeat customers. Breakfast menus are wide enough to compete with national coffee brands. Customers already trust c-stores to deliver real meals, not just snacks. Extending that trust into a drive-thru lane feels natural.

The pandemic accelerated this reality. When contactless service became the norm, the idea of staying in your car for everything — groceries, prescriptions, dinners, even pet food — suddenly felt essential. People learned how much time they could save, how safe they could feel, and how simple errands could become when they didn’t have to unbuckle kids or step out into the weather. Even after restrictions lifted, those habits stuck. In fact, they hardened into expectations. Customers began to look at every business through the same lens: can I do this from the car? If the answer is yes, they’re more likely to stop. If the answer is no, they may pass you by.

Convenience stores are discovering that the presence of a drive-thru doesn’t just serve customers in the moment. It also changes perception. In surveys, more than two-thirds of consumers say they are more likely to choose a store with drive-thru over one without it, even if they don’t plan to use the lane every time. The window itself becomes a symbol of modernity. It tells customers that this business values their time, understands their routines, and has invested in making things easier. That signal is worth as much as the sales it generates, because it shapes how customers think about the brand.

Operators who have added drive-thru are already seeing the payoff. A regional chain in Texas carved out a lane for

coffee, tacos, and energy drinks, staffing it only during morning peaks. Within six months, the lane accounted for fifteen percent of breakfast sales — business they say would have gone elsewhere if the lane didn’t exist. An independent operator in the Midwest turned an unused side window into a pizza pickup station, connecting it to their kitchen program. Dinner traffic jumped almost immediately, and the store saw a new category of loyal customers: parents swinging by after practice, commuters too tired to cook, and families grabbing pizza on the way home. The investment was modest, but the impact was not.

What makes drive-thru particularly valuable is that it often captures incremental sales. Customers who might never have parked and walked inside are suddenly reachable. That doesn’t mean it cannibalizes inside traffic. More often, it grows the pie. One owner told me that his average tickets inside the store remained steady after adding a drive-thru, but his overall sales grew because he was now serving an entirely new set of occasions. People

who once chose a burger chain or coffee shop began choosing his store instead. That’s the competitive edge a lane can create.

Of course, nothing comes without challenges. Staffing is the top concern for most operators, but the experience of those already running drive-thru suggests it is manageable. Peak drive-thru times mirror existing busy periods: mornings, lunch, and dinner. Redirecting one employee during those hours is often enough, and the incremental sales cover the labor cost. Menu design is critical. Customers don’t expect the entire store in the lane; they expect speed. A drivethru menu that sticks to core items — coffee, a few sandwiches, pizza, popular snacks, and drinks — is plenty. Execution matters more than breadth. If the lane is consistently fast and accurate, customers will return.

Technology helps smooth the process. Digital menu boards keep choices clear. Kitchen display systems integrate orders seamlessly. Loyalty programs make it

personal. Imagine a commuter pulling up and seeing an offer for the exact coffee they usually buy, or a parent getting a prompt for pizza at dinnertime. Some larger chains are even experimenting with AI voice ordering to cut down on errors. Independents don’t need to match that level of investment to benefit. Even a tablet connected to the POS can power a functional, modern-feeling lane. What customers value most is speed, not bells and whistles.

There’s also a cultural element that shouldn’t be overlooked. Drive-thru taps into family life in ways that inside shopping can’t. Parents with kids in car seats will go out of their way to avoid unloading them for a quick stop. Workers on the clock appreciate grabbing lunch without wasting time parking. Women traveling alone late at night often feel safer staying in their car. For all these customers, drive-thru isn’t just a preference. It’s a solution to a real-life barrier. Stores that provide it become not only more convenient, but more trusted.

Operators can amplify that trust with small gestures. Some stores hand out seasonal extras — a fun-size candy bar in October, a peppermint stick in December, or a loyalty coupon for coffee in January. These touches cost pennies but create lasting impressions. Customers may not remember every transaction, but they remember when a store made them smile. Over time, that emotional connection builds loyalty stronger than any discount.

The future of drive-thru in convenience retail is wide open. In urban markets, we’re already seeing experimental micro-stores designed entirely around the car. They may be smaller inside, but with multiple lanes and digital boards outside, they function like convenience restaurants. In suburban and rural areas, larger footprints give operators space to add lanes alongside traditional entrances. EV charging is adding another twist: customers who spend fifteen to thirty minutes powering up are perfect candidates for drive-thru food ordering. Imagine pulling in, starting a charge, swinging through the lane, and picking up a hot sandwich

before your car is ready. The synergy is obvious, and some forward-thinking operators are already piloting it.

The bigger picture is about identity. Convenience stores have always been about saving time. But in 2025, saving time doesn’t just mean being nearby. It means being accessible in the exact way customers want. Sometimes that means inside, sometimes it means delivery, and increasingly it means drive-thru. Stores that provide multiple paths to purchase will own the future. Stores that cling to old definitions of convenience may find themselves left behind.

Adding a drive-thru is not always simple. Not every lot has the space. Not every building can accommodate a window. Not every operator has the labor flexibility. But the lesson of the revival is that when it’s possible, it pays off. Customers want it, vendors support it, and competitors are already offering it. Standing still carries risks that are just as real as the costs of building.

At the heart of it, the drive-thru revival is about more than architecture. It’s about understanding what customers value most: time, safety, and routine. When a store makes it possible to grab breakfast without unloading kids, or dinner without getting out in the rain, or coffee without standing in line, it’s doing more than selling food. It’s proving that it knows its customers and cares about their lives. That proof builds relationships that last far beyond a single transaction.

As convenience retail continues to evolve, the drive-thru will become one of its defining symbols. It tells the customer: we’ll meet you where you are, even if that’s behind the wheel. It shows the community: we’re investing in being faster, safer, and more modern. And it reminds the operator: growth comes not just from what you sell, but how you sell it. For decades, drive-thru belonged to restaurants. Now it belongs to convenience too. The revival is real, and the question isn’t whether customers want it. The question is whether you’re ready to roll down the window and join them.

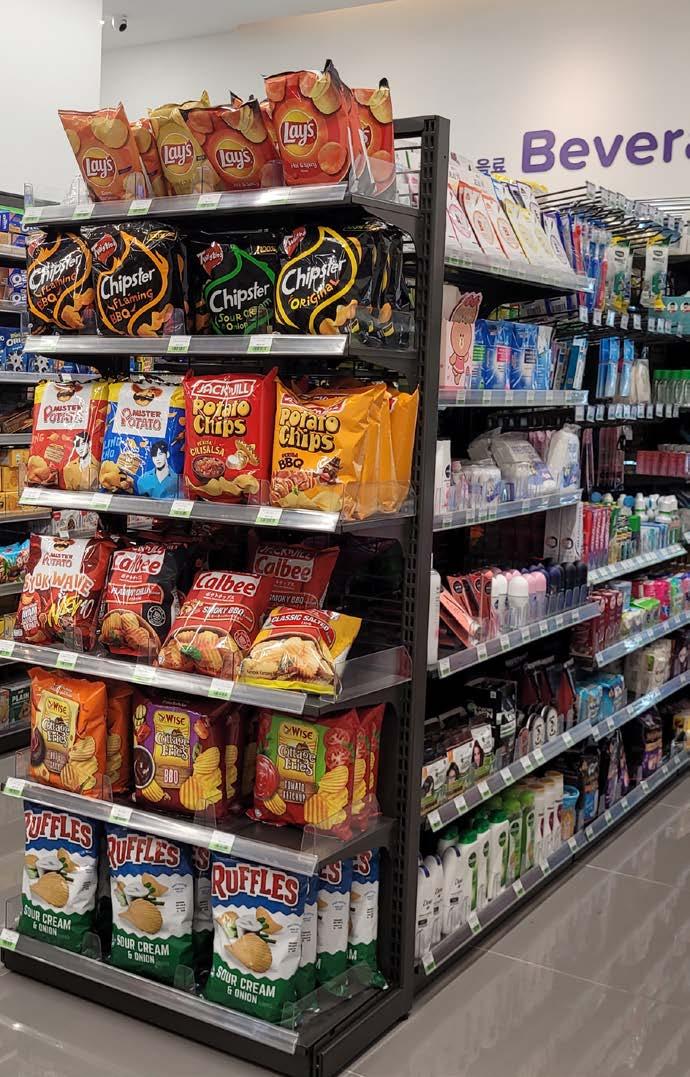

Walk into almost any convenience store and you’ll find yourself in front of shelves and cooler doors that look deceptively simple: rows of chips, stacks of candy, neatly lined bottles of soda, water, and energy drinks. But behind those rows is a quiet tug-of-war. Every inch of shelf space represents a battle between dozens of brands, categories, and customer habits. Move a top seller one row higher, and sales might climb. Swap out a slow mover for something new, and you might unlock a category trend before the competitor across town does. Planograms — the layouts that determine where everything goes — are the unsung backbone of retail strategy.

For years, they’ve been built on a combination of vendor influence, historical sales data, and the gut instincts of experienced operators. It worked, but it wasn’t perfect. Too often, shelves favored whoever shouted loudest, whether or not that actually reflected what customers wanted. Smaller brands sometimes got lost in the shuffle. Seasonal items might overstay their welcome. And in independents especially, planograms often came down to guesswork. But now, something new is entering the mix: artificial intelligence.

AI isn’t just creeping into the back office for inventory management or loss prevention anymore. It’s making its way into the shelf itself, offering data-driven insights on exactly what should be placed where, and in what quantities. The promise is powerful: higher sales, lower waste, bigger baskets, and a smoother experience for customers who feel like

the store just “gets them.” For convenience stores competing on razor-thin margins, that kind of edge can matter as much as any new product launch.

The timing makes sense. The industry is under pressure. Inside sales growth has slowed from pandemic highs, inflation is reshaping how people spend, and competition from grocery pickup and

applied in a way that feels manageable, affordable, and practical”

QSR apps is pulling traffic. At the same time, customer expectations are rising. They don’t just want options — they want the right options, in the right place, right when they walk in. AI is being positioned as the tool that can make all of that happen. And the truth is, it’s not a tool for the future anymore. It’s here, and operators both large and small are beginning to experiment with it.

The basic idea is simple enough: AI tools crunch vast amounts of data — sales velocity, daypart demand, weather patterns, even loyalty behavior — to suggest how shelves should be set. Instead of a static planogram that changes once a year, AI-driven layouts can evolve dynamically. If energy drink sales spike every Friday afternoon, the AI can tell you to expand facings right before the rush. If flavored water moves in July but dies in November, the AI will recommend scaling back. If customers in one neighborhood are trending toward plant-based snacks, the AI will flag that before it becomes obvious. The shelf stops being reactive and starts being predictive.

But here’s the real-world tension: most independents don’t have teams of analysts or IT budgets that rival national chains. They’re running lean. They’re already stretched on labor, on time, and on money. So the question isn’t whether AI can optimize shelves — it’s whether it can be applied in a way that feels manageable, affordable, and practical. That’s where the conversation is headed now, and why the story of AI in planogram optimization is less about technology and more about accessibility.

For the big players, the shift is already well underway. Chains like 7-Eleven and Casey’s have invested in sophisticated merchandising systems that lean on AI to test layouts and predict sales lift. They have entire departments devoted to tweaking facings and rolling out updates across hundreds or thousands of stores. For independents, that can feel intimidat -

ing, almost like AI is out of reach. But in practice, the gap is narrowing. Tech vendors are beginning to offer scaled-down versions of their tools, often bundled with loyalty programs or POS systems. Instead of needing a six-figure software investment, an operator might be able to access AI-driven shelf recommendations for a monthly fee, baked into platforms they’re already using.

That opens the door for experimentation. Take the case of a three-store operator in Kentucky who started using an AI-powered merchandising tool last year. He didn’t overhaul every shelf at once. Instead, he focused on his beverage cooler, where he knew margins were strong and competition was fiercest. The AI recommended rebalancing facings — fewer slow-moving flavored waters, more of a trending energy drink, and a repositioning of single-serve milks closer to protein shakes. The results weren’t explosive, but they were steady: a 7 percent sales lift in that cooler over three months, paired with a noticeable reduction in expired product. For him, that was proof enough. Now he’s expanding the experiment to snacks.

The lesson from stories like his is that AI doesn’t need to be an all-or-nothing play. It can start small, in one category or one store, and build from there. Even modest changes, when multiplied across hundreds of transactions a week, add up. And in an industry where every dollar of margin counts, a few percentage points of lift can be the difference between a good quarter and a flat one.

Beyond the numbers, there’s a customer experience story here. Shoppers rarely articulate why one store feels easier to shop than another, but often it comes down to layout. When bestsellers are in obvious spots, when trending items are given visibility, when shelves look full and intentional, customers move faster and buy more. AI helps create that seamless experience. It can spot that your younger

demographic is buying plant-based jerky and suggest giving it prime placement. It can detect that customers in your area buy more sports drinks in the afternoon than in the morning, and push those bottles forward in time for the rush. When a store feels like it’s anticipating customer needs, customers notice — even if they can’t explain why.