If there’s one thing that defines this season for our stores, it’s movement. People are moving—on road trips, between job sites, through heat waves—and they’re relying on us to keep them going. That means energy, hydration, flavor, relief. It means being ready, being smart, and yes, being a little bit creative with how we stock, staff, and serve.

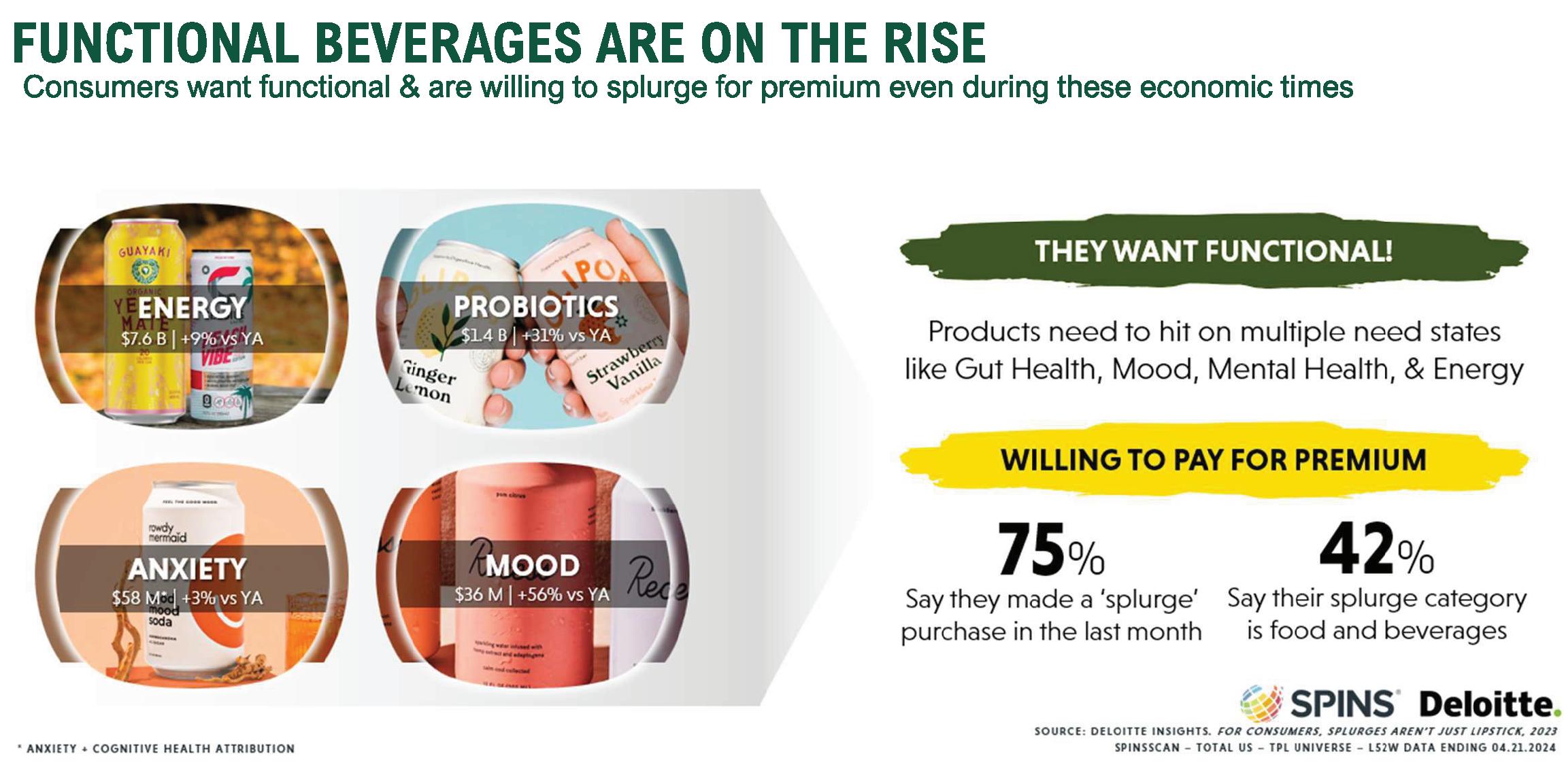

This issue of *C-Store Connect* is built around that summer momentum. We took a hard look at what’s really working in high-turnover categories—from the ever-evolving energy drink shelf to the cooler strategies that aren’t just attractive, but actually sell. We looked at functional beverages that cater to health-minded shoppers and how snack pairings can turn small stops into real revenue. We revisited frozen and fountain favorites, because nostalgia still moves product— and because when it’s 95 degrees, nobody’s turning down a slush. And we looked closely at staffing, because the best layout in the world won’t save you if you don’t have the right team in place to execute it.

Everything in this issue is aimed at helping you do what you do best: serve your customers quickly, reliably, and with something extra that keeps them coming back. That might be a surprise new flavor, a clean cooler shelf with just the right mix, or a friendly face who remembers what your regulars drink on Mondays. It’s those details that add up.

So as we ride through peak season together, remember: your store is more than a stop—it’s a solution. You’re not just fueling tanks and carts; you’re fueling days, work shifts, vacations, and routines. And when you get it right, your store becomes the place they come back to, not just because it’s convenient, but because it’s consistent.

Here’s to a profitable, smooth-running, and high-energy July.

Warm regards,

Editor-in-Chief, C-Store Connect Magazine

We are one of the fastest growing convenience store retail associations, representing thousands of retailers and an ever increasing number of major vendors. Our members get exclusive access to discounts, incentives, and rebates while our vendors get an opportunity to build brand equity and loyalty. Store owners gain the power of a group with a single representative that communicates on their behalf. Our members put more money in their pockets! Become a member and utilize the collective bargaining power of our HRA family.

We represent more than 5,000 retailers and 45 major vendors. You will have us behind you as a representative that will communicate on your behalf.

Our focus is your success!

Gain bulk buying power, discounts, and rebate programs and you will see savings roll in every quarter. There is no cost to join.

Operate your business with a robust partnership giving you access to savings, services, and a team helping you operate a more profitable and seamless c-store. Ensure you are operating with the highest gross profit possible by partnering with us. If you don’t save, we don’t earn.

Through our partnership with vendors you gain access to the power of collective bargaining! Amazing pricing and deals are no longer only for large chains.

Camp Twin Lakes provides adaptive and deeply impactful camp experiences to children and families living with serious illnesses, disabilities, and life challenges, year-round.

Our intentionally-designed programs help campers overcome obstacles as they learn new skills to more independently manage their challenges. As they make memories with their peers, the isolation they often feel vanishes in the comfort of new friendships forged by the strongest bonds - the challenges they have in common.

Each summer, Camp Twin Lakes serves thousands of children and teens from across the country during weeklong overnight camping programs. Each week, Camp serves a di erent unique diagnosis or life challenge at our three medically-supported campuses located in Winder and Rutledge, GA.

24 - 16oz

- 16oz

2 $5for .50 2 $5for .00

The Red Bull Summer Edition with the taste of white peach, a touch of citrus peel and floral notes.

#1 NEW ITEM In Total Beverage #1 NEW ITEM In Energy

5 OF THE TOP 10

New Energy Drink Items Are Red Bull

2 OF THE TOP 4 NEW ITEMS Are White Peach Full Sugar and Sugar Free

22 ITEMS PER STORE PER WEEK Summer Edition Sales

Stepping into a convenience store in the Southeast this July, you’re greeted by a vibrant row of energy drinks—towering cans in neon hues, zero-sugar blends, and tropical flavors competing for attention. It’s more than just display—it reflects reality: energy drinks now make up nearly 28 percent of all packaged-beverage sales in c - stores, surpassing sodas (26 percent) and sports drinks (15 percent), according to NACS/ Circana data . Southeastern retailers report category growth of 6–8 percent annually—well ahead of national averages—fueled by rising demand for flavorful, functional, and lifestyle-aligned beverages.

This category’s expansion isn’t just driven by caffeine. It’s shaped by climate, consumer routines, and evolving shopper tastes. The Southeast’s sweltering summers and busy traffic corridors make energy drinks a natural pick-meup. Add in a rise in social media–driven experimentation, and you have a market primed for premium, plant-based, wellness-leaning, and nostalgic beverage innovations—spreading awareness and elevating category relevance.

Monster Energy, already a staple in

c - stores, launched Ultra Blue Hawaiian—a zero-sugar, tropical-flavored version—in early 2025, and demand has surged regionally. Monster’s packaging, evocative of tiki cocktails, feels perfectly suited to the Southeast’s evocations of

beach vacations and poolside refreshment. According to internal sampling reports seen in Jacksonville and Savannah c - stores, Ultra Blue Hawaiian has lifted energy drink sales by up to 15 percent compared to summer 2024. Patrons describe the flavor as “crisp,” “not

overly sweet,” and “a refreshing twist on caffeine”—attributes that convert impulse and repeat buys.

Monster’s approach recognizes more than raw caffeine—it taps into associative identity. Heat, leisure, and exotic taste come together in a single product experience. When such branding aligns with regional climate and psychology, conversions often follow. The energy drink’s success underlines the importance of targeting flavor innovation for seasonal relevance—an insight Southeast operators can replicate with merchandisers and planograms built around summer-ready items.

Bang Energy has distinguished itself through its high caffeine, vibrant branding, and gym/lifestyle associations. In Atlanta, convenience stores reported Bang outselling traditional sugar-laden sodas by 20 percent on college campuses—a reflection of its appeal to Gen Z and millennial shoppers seeking strong focus and energy. Bang packs 300 mg of caffeine per can—a punch that grabs attention, but it’s the savvy packaging and “supplement-like” ingredient list that foster trust among performance-driven buyers.

lacking large coolers.

racetrack-adjacent communities. NOS sellers in northern Florida cite “repeat buyers in pickup trucks and gearheads” who see the drink as part of their identity. Limited-edition cans like NOS Stealth have spiked sales during local motorsport events by nearly 12 percent, proving the volatility potential of eventlinked promotions.

Bucked Up, with its blend of caffeine, BCAAs, and nootropics, positions as both athletic recovery and energy. Store owners in Greenville, SC, noted customers grabbing Bucked Up cans along with grilled chicken sandwiches—seeing it as a post-workout snack. This behavioral insight—tying energy drinks to foodservice upsell—translates into revenue beyond the cooler. Retailers report a 28 percent increase in basket size when foods are offered near wellness-oriented cans like Bucked Up.

Lucky Energy, by contrast, is built around clean-label transparency. Its minimalist can design and short ingredient list appeal to wellness shoppers in markets like Asheville, NC and Charleston, SC. Managers describe Lucky drinkers as more deliberate shoppers—checking labels, asking about sugar content, and pairing with probiotic or vitamin drinks. Adding Lucky to the cooler often brings a new demographic—women focused on wellness—into energy category transactions.

NOS remains rooted in performance and motorsport culture, with the brand still energized in motocross, car-tuning, and

Uptime is a newer entrant, leaning into mental focus and low-sugar messaging. Its launch in college markets—Tallahassee and Athens, GA—has demonstrated that energy drinks go hand in hand with study sessions and academic life. Students cited Uptime’s clean flavor and functional tagline (“Stay sharp”) as differentiators. For c - stores near campuses, Uptime offers a fresh, health-forward option to broaden shelf reach.

Across the Southeast, consumers increasingly expect wellness benefits from their caffeine. Drinks infused with adaptogen botanicals—ashwagandha, lion’s mane, cordyceps—are moving from niche outlets into major cooler zones . One Asheville retailer described a 30 percent week-over-week increase in adaptogen-infused cans during a local yoga festival, attributing success to ingredient interest and on-hand sampler events. This reflects a shift away from raw caffeine to more holistic appeal— customers don’t just want energy; they want function and wellness. Powdered single-serve packets—marketed by other brands for focus, immune support, or recovery—are gaining shelf attention and versatility in service environments

Nostalgia is another powerful force. The re-launch of Jolt Cola in early 2025— with 200 mg caffeine in a zero-sugar 16-ounce can—has stirred buzz across Huntsville, AL, and Greenville, SC . The brand’s retro positioning has drawn curiosity from older customers who remember it fondly, and younger ones intrigued by its potency. Managers note that even a small display of Jolt yields strong age-crossing impulse sales—a phenomenon worth test-driving for operators seeking uniqueness.

Legendary brand Red Bull reportedly plans a Wild Berries flavor and a monkfruit-sweetened variant by fall 2025. Brands introducing second-generation sugar alternatives are proving to meet dual demand for flavor and health. Celsius, although not one of our advertisers, is also relevant here: the brand has dominated wellness-focused energy with 47 percent of category growth in 2023, supported by PepsiCo’s distribution muscle, projecting continued expansion into convenience channels . Their success signals wider opportunities for all healthier energy brands operating in the space.

The U.S. energy drink market is projected to grow from $20.7 billion in 2024 to $41.4 billion by 2033—a CAGR of ~8 percent . Globally, the category is on track to reach nearly $95 billion by 2032, growing at ~4.6 percent annually. In North America, a powerhouse in energy drink sales (about 40 percent of

global volume), convenience stores account for over 70 percent of distribution, making them the strategic launchpad for innovations.

In the Southeast, summer temperature averages above 90°F for over six months, and tourism patterns drive foot traffic into gas - station convenience stores. Operators here see 15 percent higher energy drink purchases compared to other regions in July and August. Pair that with rising traveler frequency—interstate tourism plus local weekenders—and you have an “annual surge season” that warrants dynamic planning.

For Southeastern c - store owners, the energy drink opportunity requires tactical coolers and flexible strategy. Rather than rows of familiar brands, it’s about “curated collision points”—pairing core staples (Monster, Bang, NOS) with newer disruptors (Bucked Up, Lucky, Uptime), seasonal releases (Ultra Blue Hawaiian), and novelty items (Jolt) to pull in varied customer segments.

Placement matters. Eye-level coolers with temperature control should feature health-leaning variants, next to fresh food or yogurt stations. Smaller chillers or impulse towers near checkout can spotlight limited-edition flavors or smaller formats. Seeing Bucked Up next to a fountain sandwich increases basket value by up to 30 percent, based on NACS insights and retailer case studies.

engagement. An Asheville store stocked adaptogen drinks during a wellness weekend saw customers lingering, which generated cross-sells with fresh juices and cold-pressed tea. Another in Savannah paired Monster Ultra Blue Hawaiian with tiki-bar themed foodservice specials to emulate beach bar nostalgia, lifting combo sales by 18 percent overnight.

Operators should push for early access to limited releases. Monster’s promotional samples of Ultra Blue Hawaiian were distributed to top-performing retailers ahead of summer—yielding initial sell-through rates of 80 percent in 10 days. Jolt’s pilot arrived with similar excitement, with empty cans frequently displayed in-store Google reviews (“Got the Jolt! Love the throwback taste!”). C-store operators can leverage this by turning limited-time offers into buzz campaigns via social media and in-store signage.

Temperature and stock freshness are crucial. Southeastern heat can degrade taste, especially in plant-based blends. One Florida operator reported a 20 percent drop in perceived quality for unrefrigerated adaptogen drinks. Conversely, cooler expansion—adding an extra door to accommodate wellness cans—boosted energy-drink sales by 12 percent monthover-month.

customer base. Second, layer in premium, wellness-forward players—Bucked Up, Lucky, Uptime—to capture growth demographics around health and fitness. Third, experiment with novelty—monster tropicals, Jolt nostalgia, adaptogen and powder-based products—to build interest, impulse, and seasonal momentum.

Start planning shelf resets now. Work with Monster reps to secure Ultra Blue Hawaiian variants and point-of-sale tieins. Talk to Bucked Up and Lucky reps about demo units or localized sampling events around fitness centers or college campuses. Structure impulse towers near registers with limited-time cans like Jolt or new Red Bull flavors to draw the eye and increase basket size. Consider branded merchandising materials—Monster cardboard coolers, Bucked Up counter stands—to strengthen brand association and elevate shelf presence.

Track results. Compare weekly unit sales before and after resets; monitor cooler temperatures and tap consumer feedback. Look at add-on rates—such as pairing energy drinks with heated foods or snacks—for correlation between layout and sales growth.

Seasonal and sampling events amplify

As we move into summer 2025, c - store operators in the Southeast should chart a three-pronged approach. First, maintain reliable core brand presence— Monster, Bang, NOS—that match your

Above all, think like a creative operator. The Southeast’s heat and culture create an opportunity to treat energy drinks not just as a “caffeine option,” but as lifestyle products connected to fitness, heat relief, nostalgia, and impulse. With the right assortment, seasonal tie-ins, and visuals, your July lineup can transform convenience-cooler browsing into a profitable experience for your customers—and your bottom line.

There’s a quiet art to a well-built cooler in a convenience store—something that doesn’t call attention to itself but moves product like a magnet. For many c-store owners, the cooler is the first place eyes land when customers walk in. It’s the literal and figurative refreshment zone: cold, colorful, inviting, and loaded with opportunity. In the heat-heavy months of summer, especially in the Southeast, how that cooler is stocked and arranged can make the difference between a single sale and a whole basket of purchases. And with a growing mix of traditional beverages, better-for-you options, energy drinks, and functional innovations crowding the category, optimizing the cooler

significantly larger basket sizes.

Smart cooler setup begins with understanding the behavioral rhythm of your customer base. In many Southeast markets, mornings are dominated by functional drinks—think energy, protein, hydration. Drinks like Bang, Celsius, and Alani Nu thrive in these early hours, often chosen alongside a breakfast sandwich or protein bar. Placement near grab-andgo breakfast options or even coffee pods can stimulate cross-category purchases. Monster Energy’s new Ultra variants and 1st Phorm’s ready-to-drink performance blends have started to occupy this early day space too, adding a new level of functional layering to morning merchan-

has never been more important—or more complex.

Operators across the region are seeing a transformation in both the product mix and the way consumers shop these cold spaces. It’s no longer enough to carry the basics: water, soda, and a handful of energy drinks. The modern customer wants variety, but they also expect clarity. They may walk in looking for something refreshing, but if the options are confusing or overwhelming, they might stick to old habits—or worse, leave without buying. In-store data confirms what many owners already know: strategic cooler planning directly correlates to higher conversion rates, longer dwell time, and

dising.

By late morning through mid-afternoon, hydration and recovery products start to dominate. Customers—especially those traveling or working in outdoor trades— begin reaching for Biolyte, Body Armor, Recover 180, and electrolytic waters like SmartWater and Eternal. These shoppers tend to linger a bit longer, often evaluating labels or comparing claims. If the cooler layout makes it easy to identify categories—without overwhelming signage or cluttered racks—these customers will more often than not pick up a second item, usually a snack or prepared food, before heading out.

Evenings shift yet again. Carbonated sodas, energy drinks, and indulgent beverages take center stage. This is when beverages like F’real shakes, Dipping Dots drinks, and the occasional BuzzBalls grab come into play. These items are not daily habits; they are impulse-driven, emotionally satisfying purchases. When organized alongside familiar brands like Coca-Cola, Pepsi, and Red Bull, these novelties ride the wave of trust and curiosity. One retailer in central Georgia noted a 22 percent sales bump after positioning BuzzBalls alongside Monster and Red Bull for evening shoppers, capitalizing on the “weekend unwind” mindset that starts as early as Thursday evening and builds through Sunday.

The mechanics behind an effective cooler aren’t just about knowing what to stock. They hinge on how to present it. Visual merchandising in the cooler should mirror the logic of the shopper’s journey, not the logic of the supply chain. That means avoiding overstuffed layouts where drinks blur together and instead curating flow—starting with hydration and wellness at one end, functional performance in the middle, and indulgent sips near checkout. Operators who’ve tested this approach report higher customer satis -

faction scores and stronger repeat visits, particularly among Gen Z and millennial shoppers who tend to “shop with their eyes first.”

Temperature zones matter as well. In particularly hot months, stocking the most temperature-sensitive products— dairy drinks, kombucha, and functional blends like Frazil or Cali Kulture’s new chilled THC-alternative drinks—away from cooler doors can reduce spoilage and maintain product integrity. Stores that use digital thermometers to manage cooler consistency have seen fewer returns and improved sell-through rates. Several brands are even investing in custom cooler equipment to optimize visibility—Frazil and Uptime, for example, offer branded coolers with LED framing and lock-in rack systems that prevent product shift during high-traffic hours.

Another rising practice is dynamic product rotation. Rather than holding one layout through a full season, successful operators rotate displays every two to three weeks to highlight trending products. This doesn’t mean a full reset—just a shift in prominence. When Coca-Cola or Poppi releases a seasonal flavor, that can gets prime eye-level placement for a short window, driving trial. When a local favorite like Creature Comforts launches a summer IPA or non-alcoholic variant, integrating it into the adult beverage section with signage about local sourcing adds both novelty and a sense of community pride.

Emerging data technologies are helping stores refine their layouts further. Retailers using tools like Modisoft or SmartBizPay’s dashboard analytics can see heatmaps of where customers dwell and which SKUs move quickest. In one case, a suburban Atlanta store removed a poorly performing juice blend to make room for Lucky Energy’s new clean-label variant and saw sales climb nearly

30 percent within a week. The decision wasn’t guesswork—it was powered by clear customer flow data.

Space planning also extends beyond the cooler. Secondary placements near the front counter, especially for high-velocity energy and hydration drinks, capture those last-second decisions. A can of Reign, a bottle of Prime, or a pouch of ZOA next to tobacco or lottery can be a powerful closer, especially when paired with a sign that suggests “grab a cold one for the road.” These placements work best when stock is rotated frequently, kept chilled, and aligned with current promos. Beverage suppliers often provide free racks or co-branded coolers to make this kind of cross-merchandising easier.

But even the smartest cooler fails without the human element. Staff training remains an underrated lever in boosting beverage turnover. When employees are encouraged to suggest a new flavor or recommend a pairing, it humanizes the transaction and increases perceived value. One store chain in Alabama started incentivizing cooler engagement—giving small bonuses to staff who upsold high-margin drinks like Cremily or DRNX Water—and saw basket size increase by over 18 percent. Customers responded not just to the product, but to the engagement.

The lesson is this: your cooler is more than a cold box. It’s a stage. And every decision, from placement to promotion to people, affects what story it tells. A great cooler doesn’t just serve drinks—it sells an experience. It reflects the rhythms of the day, the seasonality of the moment, and the tastes of your specific community. Whether it’s sparkling hydration or old-school soda, protein water or indulgent frozen sips, the products are just ingredients. The magic happens when c-store owners design that space with intention, allowing their customers to feel seen, understood, and refreshed.

Identify, select, sample, and introduce compelling new products quickly and easily with low order minimums

Capitalize on current trends and changing shopping habits to drive incremental revenue

Supplement your planograms and sets without disrupting operational efficiencies

Enjoy the convenience of using your existing ordering processes and payment methods

Increase store traffic and conversion opportunities with new and returning customers

When you wander into a convenience store these days, the cooler section looks different than it did just a few years ago. Nestled beside energy drinks and traditional sodas, you’ll now find colorful cans that tout fiber, live cultures, and digestive wellness. Brands like Poppi and Olipop have quietly claimed their space, tapping into a changing mindset among younger, label-conscious shoppers who no longer want to hide their health concerns behind discreetly packaged beverages. Instead, they want their drinks to speak openly of benefits—such as a gentle boost to digestion or a fiber-rich sip that aligns with their broader wellness lifestyle.

The rise of these gut-friendly beverages is far from superficial. Market analysts pegged the global value of probiotic drinks at nearly $49.5 billion in 2024, with forecasts suggesting that could more than double to $116.9 billion by 2034. That magnitude reflects the shifting tides in consumer behavior, where convenience store shelves have become

pivotal launchpads for gut-health innovation. In North America, probiotic soda sales hovered around $444 million in 2023, with experts predicting that number will climb to $766 million by 2030. Significantly, c-stores already account for more than half of that retail volume, proving that operators are not just witnesses but beneficiaries of this trend.

Poppi and Olipop are the standout brands leading this charge, each carrying a distinct personality that resonates with buyers. Poppi, recently acquired by PepsiCo in a $1.9 billion deal, rides the wave of social media buzz and catchy marketing. Its apple cider vinegar base, low sugar, and fizzy feel have made it a hit among trend-savvy consumers, even earning a spot in Super Bowl commercials. Meanwhile, Olipop climbed to $400 million in sales by early 2025, thriving on its retro-inspired flavors, fiber-laden formulas, and label transparency. It doesn’t scream buzzwords, but with nine grams of fiber per can and real botanical ingredients, it has earned the trust of consumers who want substance with subtlety.

These brands are igniting new foot traffic for operators in the Southeast. In c-stores near college campuses and urban centers, Poppi attracts the Instagram-hungry crowd, while Olipop engages shoppers who scrutinize ingredients and fiber counts before committing. Their presence together on the same shelf helps stores capture both the impulse crowd and the informed buyer, increasing opportunities through differentiation.

But soda isn’t the only vehicle for guthealth drinks. The shelves are branching out with kombucha, probiotic juices, and creamy probiotic yogurts. The probiotic drink market in North America alone was estimated at $14.25 billion in 2024, growing steadily as consumers look to integrate wellness more comfortably into their routines. Around universities across the Southeast, pairing a probiotic shot with a breakfast sandwich has become a subtle but lucrative trend, and some c-stores report these combinations increase the perceived value of simple grab-and-go purchases.

Driving all this change are Millennials and Gen Z shoppers. Millennials grew up drinking soda, but now expect products that harmonize flavor with health. Gen Z, meanwhile, demands authenticity and transparency. They’re willing to pay $2.49 per can for gut-health benefits, and they trust their friends—or influencers—when making their choices. The result: Poppi and Olipop aren’t just driving value through product; they’re steering sales through cultural relevance.

This shift hasn’t gone unnoticed by industrial giants. Coca-Cola and PepsiCo are no longer passive observers. Coca-Cola introduced Simply Pop, and PepsiCo moved Poppi into its mainstream beverage lineup. These moves signal that gut-related drinks have graduated from curiosity to strategic investment—an inevitability in today’s wellness-focused marketplace.

Not everything is smooth sailing. Some palates are still skeptical, associating whole-food fiber additives with chalky or medicinal flavors. Poppi faced a lawsuit in 2024 over claims that its marketing overstated digestive benefits, reminding operators that messaging must be truthful and transparent. As a result, consumers and retailers are learning to navigate the nuance: gut-health drinks are beneficial, but they’re not magical cures. Even so, the subtle joy of cleansing soda without the guilt has generated repeat habits—if the flavor holds up.

Despite these challenges, we’re seeing

new products take shape that soften the edge of these concerns. Olipop has introduced softer flavors like Peach & Cream and Banana Cream, striking a balance between indulgence and wellness. Poppi’s Cherry Cola and Grape flavors expand its appeal—and help shield the brand from over-reliance on ACV (apple cider vinegar). These innovations signal maturity in the space, where taste quality matches marketing promises.

Bottle design, too, reflects thoughtful evolution. Some probiotic brands now use transparent containers to showcase fruit pulp, while others offer resealable bottles or single-serve shots that hold live cultures better in hot climates—a critical point for Southeast operators. For stores near the coast or tourist traffic areas where heat risk is high, these packaging improvements stand between freshness and spoilage.

Looking ahead to late 2025, the landscape promises more depth. Some

brands are exploring blends of probiotics with adaptogenic botanicals—ashwagandha, turmeric, or basil—to offer not just gut support but calm-focus wellness. Industry insiders expect more shelf-stable versions designed to sit outside refrigerated coolers, opening my whole aisles to the gut-health concept even in stores with limited chiller space.

For c-store owners, the conversation becomes about curation and education

as much as selection. Placing Poppi and Olipop side by side, perhaps under a gentle shelf marker like “Functional Fizz,” can spark consumer curiosity. Sampling events tied to local wellness occasions—say, a post-yoga glow or early-morning farmers market—can be powerful enticements. Even a small taste test on a warm Saturday afternoon could convert exploratory sippers into loyal customers.

It’s equally important to support consumer education with accessible signage. A small note by a can—per-

haps explaining the difference between prebiotic fiber and live probiotic cultures—helps customers make informed decisions. Staff should be ready to clarify that while a gut-health drink won’t cure all digestion woes, it can be a daily ally when balanced with hydration and healthy eating.

On the back end, tracking performance is crucial. If Poppi and Olipop perform well, consider expanding your guthealth shelf by adding probiotic shots or low-sugar kombucha. Hot weather-proof refrigeration will protect product integrity. Margins may be slightly lower due to higher manufacturing costs, but with smart pricing—like pair-ups or slow-moving clearances—operators can preserve profitability while showcasing innovation.

Sometimes the best proof comes from local success stories. One Savannah-area store integrated a kombucha

mini-fridge next to breakfast burritos and coffee. Regulars started grabbing the gut-health drink as they went, remarking how it eased digestion during long workdays. Managers said sales of kombucha shot up 45 percent in six months, without cannibalizing soda or energy drink lines. Another Greenville gas station started rotating in probiotic shots near its frozen juice dispensers and saw a 20 percent jump in category sales. These anecdotes reflect what top market data is telling us: gut-health beverages appeal to everyday wellness needs, even outside traditional health food niches.

Beyond incremental gains, digestive-wellness drinks help stores innovate brand perception. In a competitive landscape, being known as the store with “that healthier soda” or “the gut drink spot” sets a c-store apart. That identity builds loyalty faster than discount fuel.

We’re not at the finish line yet—taste continues to be key. Early Reddit thread reviews offer a balanced perspective: some folks loved the flavors; others found the experience flat compared to traditional sodas. But fast feedback cycles, refreshing new flavors, and ever-more approachable branding tell us that the category is iterating toward broader acceptance. As Coca-Cola, Pepsi, and numerous challenger brands keep investing, the category’s continuity and growth potential solidify.

All of this points to an undeniable conclusion: gut-health beverages are more than a fad. They’re a response to lifestyle shifts, climate, diet, and generational values—especially in places like the Southeast, where heat drives thirst, and eco-conscious, wellness-minded shoppers are prevalent. The interplay between platform brands like Poppi, challenger brands like Olipop, and curated store strategy is reshaping how consumers purchase beverages. For c-store owners, adopting and advancing these drinks isn’t just smart merchandising—it’s a practical pivot toward future readiness.

By rethinking cooler space, refreshing tastes, and giving shoppers context for their new purchase options, convenience stores can tap directly into this thriving market. The gut-health soda isn’t merely a drink—it’s a glance into larger trends in healthitude, consumer literacy, and category evolution. And as long as stores continue the storytelling—verifying benefits, explaining labels, and experimenting with flavors—they’ll enjoy what the analysts have forecast: durable sales today and new growth in the wellness categories of tomorrow.

Minute Maid is stepping into the ring with WWE in 2025 to o cially launch its new "Bring the Juice" brand platform as WWE's O cial Juice Partner.

For more than 30 years, WWE has transformed Monday nights from mundane to must-watch with Monday Night Raw. WWE’s weekly agship program, which has rede ned sports entertainment, is entering a new era with Net ix. The shift presents the perfect opportunity for Minute Maid to join the action and take Mondays to the next level through "Bring the Juice", which is all about inspiring con dence to take on life's dull moments. Because no day symbolizes the monotony of life like Monday.

From arena branding to fan engagement moments, Minute Maid will help power Raw, ensuring fans stay hyped from the rst bell to the nal pin.

"This partnership allows us to tap into one of the world's most passionate fan bases, and engage Minute Maid lovers— particularly young multicultural consumers— through a culturally relevant entertainment platform," said Jorge Luzlo, head of marketing, Minute Maid Juice Portfolio, the Coca-Cola Company North America Operating Unit.

"There's a lot of compatibility between our Cohen brand voices…. WWE’s electrifying swagger aligns with our ‘Bring the Juice’ platform, which invites consumers to embrace the vitality within themselves.”

As the O cial Juice Partner of WWE, Minute Maid will "Bring the Juice" through activations at WWE Premium Live Events, such as WrestleMania® 41 and Summer Slam, custom broadcast integrations and branding within Raw, WWE 2K25 gaming tie-in and the collaborative social/digital content series, "Juice Up Your Mondays." The partners also will tag-team on limited time Minute Maid packaging featuring WWE superstars, including 12 ounce cans, 12 packs, and 20 ounce bottles of Lemonade, Fruit Punch, and Blue Raspberry, as well as 59 ounce cartons of Berry Punch, Fruit Punch, and Tropical Punch rolling out in June.

"We are excited to partner with the Coca-Cola company to name Minute Maid the O cial Juice Partner of WWE," said Grant Norris-Jones, Executive Vice President and Head of Global Partnerships for TKO. “Minute Maid is a trusted family brand with unmatched global reach, and we look forward to collaborating on new and innovative integrations that will resonate with both audiences.”

Vitaminwater is unveiling a bold new look and a pair of new avors to help the pioneering brand stand out in the crowded, increasingly homogenized ingredient enhance waters category.

The refreshed visual identity - which rolled out across the vitaminwater portfolio starting in March - features a cleaner, bolder packing label design with vibrant, avor-forward colors, and enlarged and staked logo with modernized typography, and playful avor descriptions channeling the irreverent voice of the New York-born-and-bred brand.

“vitaminwater’s ownable and immediately recognizable look has stayed consistent since the beginning,” said Amanda Harkins, vitaminwater brand director, Coco-Cola North America Operating Unit. “But what hasn’t stayed consistent is the competitive landscape and consumer demand for bolder, fresher and more modern brands. We realized it was time for a disruptive, game-changing visual and vocal identity that would sharpen our edge in ways that appeal to existing fans and rein in the next generation of vitaminwater drinkers."

The redesign leans into avor and functionality, with a simpler, less-medicinal look that will stand out on the shelf and reinvigorate vitaminwater’s relevance and vibrancy. Beyond packaging, the new look will come to life in outdoor creative, social/digital media, in-store merchandising and more.

At the heart of our creative brief was a challenge to make the brand more provocative and irreverent while preserving our core credentials,” said Matt Cooper, design director, vitaminwater. “We did an audit of what makes this brand cool through a 2025lens and explored how we could modernize the

equation the brand used to create the enhanced water category 25 years ago.”

The design more clearly di erentiates full-sugar varieties (bold black labels) from zero-sugar options (crisp white labels), and the brand's signature on-pack with and humor more directly addresses today’s fast-moving, social media-driven consumers with language such as ‘immunity from all the bs” and “focus: time for a full review of your ex’s pro le."

To co-star the redesign, vitaminwater is rolling out its rst new full-sugar avor innovation in years - elevate (blue raspberry limeade avor with multivitamins) - as well as re-hydrate zero sugar (pineapple passionfruit with electrolytes).

In addition, fan-favorite zero sugar power-c (dragonfruit avor supporting immunity with vitamin c and zinc) will roll out nationally in the coming months. "What makes vitaminwater unique is we’re the only enhanced water brand to o er drinkers both full- and zero-sugar options,” Harins said.

The lineup additions re ect demand for functional avors. “We’re leaning into functional bene ts people can understand,” Harkins added. “For example, re-hydrate zero sugar is packed with sports drink-level electrolytes, but we're positioning it as an everyday replenishment option. In a word where everyone is pushing claims, we want to make sure we maintain our equity of a culture-shaping brand de ned by quality and great taste.”

The refreshed VIS will show up in extensions of the 2024 “vitaminwater from New York” campaign, which showcased the brand’s Big Apple roots.

Your current POS likely requires an expensive upgrade to one component of an old legacy system. Take advantage of this limited time offer for a completely new system!

Includes:

• Complete Passport Point of Sale System

• Enhanced Dispenser Hub (EDH)

• 1st Year Software Maintenance, Help Desk, and Warranty

Get an entire new system, not just one component.

The full POS system with 1st year warranty, help desk and software maintenance at no additional cost. Don’t wait for other critical components like the store controller, PIN pad, scanner to fail. Get it all new, now!

Switching is seamless.

Passport works with all current dispenser-types and integrates with your existing interfaces including back-office, loyalty, price signs, coupon acceptance, and proprietary fleet cards, just to name a few.

Grow your business by selling at the pump!

The first-to-market solution where customers can buy c-store items at the pump with one card swipe.

Driven by the unmatched history of Gilbarco Veeder-Root and Invenco by GVR, Passport is trusted by thousands of convenience retailers.

Universal Compatibility:

• Works with all current dispenser manufacturers, ensuring a seamless integration across a mixed network.

• Over 120 partner integrations to streamline operations and increase customer satisfaction. Partner solutions include back-office management, loyalty, couponing, electronic price signs and more. See full list here.

Flexible Payment Options: Accepts all payment and loyalty methods, including major fleet cards and EBT.

Easy Employee Training:

Train staff in 20 minutes using intuitive UI, on-screen prompts, and online tutorials.

Grows with Your Business:

Easily expand with additional cashiering lanes, self-checkout, foodservice, order-at-the-pump, and drive-thru options.

24/7/365 Industry-Leading Help Desk & Software Maintenance: Access to remote technical support, regular software updates and manage and monitor your sites remotely.

Invest now in the POS built for you! A completely new system — not an upgraded component of an existing register. Transition is easy, integration with your existing interfaces is seamless, and is implemented by your local contractor.

*Contact Brad McFry with Meco of Atlanta at (770) 928-2052 for more details.

Frozen dispensed beverages have quietly become the most profitable niche in foodservice”

When you think of convenience stores in the heat of summer, what likely comes to mind aren’t cold sodas or bottled water, but those swirling cups of slush and the nostalgic pull of fountain drinks. What one store called ‘the thrill of the chill’ has evolved into a driving force behind foot traffic, basket size, and customer satisfaction. After all, the sensory appeal of seeing icy cold liquids pour or freeze is compelling—and it taps into one of the most primal ways we cope with heat.

Frozen dispensed beverages have quietly become the most profitable niche in foodservice. According to the NACS State of the Industry, frozen dispensed drink sales rose from $3,501 per store in 2022 to $4,134 per store in 2023—making them the fastest-growing segment in foodservice and delivering the highest overall margins alongside fountain drinks. That performance tells a simple story—customers love them, and they leave with a pocket-sized thrill that fuels loyalty and repeat visits.

In the Southeast, where summer temperatures hover near or above 90°F for large swaths of the season, this isn’t just an opportunity—it’s a must-have. Consumers aren’t just looking for something cold; they want an experience. As one c-store manager in Georgia summarized, “A slush on a hot day isn’t just a drink, it’s a moment of relief.” When stores deliver that moment—especially in crowded travel hubs or labor-intensive neighborhoods—they win attention and dollars.

The trend also reflects broader industry shifts. C-Store Dive recently profiled major chains like QuikTrip recasting the self-serve beverage experience entirely—ushering in customizable frozen drink dispensers that allow flavor melds like peach lemonade swirls, iced teas, and zero-sugar fountain options. Customization is now expected: consumers want control over taste, sweetness, and even functional additions like caffeine or vitamins. Reports show non-alcoholic beverage offerings rose 10.7% on foodservice menus in 2024, and oper-

ators credit custom fountain stationary elements for that growth.

Frozen beverages sit at a unique intersection of indulgence and satisfaction. They’re elevated nostalgia—think classic Slurpees and soda floats—combined with opportunity for innovation. Major players like 7-Eleven with its peach candy lemonade Slurpee pickup or Circle K and 7-Elevens with exclusive summer Gatorade fountain blends are pushing boundaries, captivating both routine and novelty-driven customers.

Savvy operators have taken note. Stores that invest in multi-functional machines— like Coca-Cola’s Freestyle or newer frozen soda dispensers—don’t just create a means to an end, they spark engagement. These aren’t merely dispensers; they are sensory theatre inviting people to linger, play, and share. One store installed a Freestyle in April 2025 and saw fountain drink units rise not just in volume but in per-cup revenue, as customers experimented with flavor swirls and mix-ins—a behavior that spilled over C-STORE

to frozen drink interest.

Margins, too, tell the tale. Frozen dispensed drinks earned around 65% margins in 2023, higher than any other foodservice category according to NACS data. A simple slush made with syrup, ice, and water can cost pennies to produce but sell for $2.49 or more. The freshness is visual, the volume is controlled, and the profit is consistent. Add-ons like looped sugared rims or candy mix-ins can nudge price further without increasing labor.

Fountain drinks also enjoy a budget-friendly appeal. Whether with Coca-Cola Freestyle or Pepsi Spire, custom fountain programs offer broad variety with minimal inventory complexity. Customers can craft custom flavor blends, and operators need only maintain one machine with syrup cartridges and CO2. In high-traffic Southeast markets, these machines reduce refreshment fatigue. They’ve become a behind-the-counter hero, driving flavored innovation without fridge space.

But as with any foodservice strategy, the details matter. Equipment choice and placement shape experience. Newer frozen beverage machines support dual zoning—ice-coffee on one side, frozen lemonade on the other—with independent temperature panels. QuikTrip’s Bevolution platform is rolling out by 2026, prioritizing these features to maximize versatility in smaller footprints. They allow operators to rotate flavors quickly, supporting limited-time offers or partnerships.

Flavor selection is even more crucial in our region. Southeast store chains are gravitating toward tropical favorites— mango, coconut, passion fruit—aimed at glossing over heat with promise of vacation. Machine programming can support this easily. One Mississippi-based chain rotated through flavors tied to local food festivals, noticing an immediate spike in fountain engagement. Patrons treat flavor drops not as frivolous, but as a curated indulgence—a mini-vacation in a cup.

Slush and frozen trends also benefit from brand partnerships. Sunny Sky, known for proprietary frozen flavors like Sour Patch Kids lemonade or red berry, has had exceptional results. A pilot slush blend named after the candy generated record LTO performance, outperforming prior flavor trials. The lesson: tap into cultural relevance and partner at the product level—not just rely on generic flavor stock.

Of course, maintenance and hygiene are drivers of trust. Frozen drink machines depend on clean lines and correct ice ratio. Operators using AIbacked video systems have instituted alerts when smoothie heads stall or require flushing. This boosts safety and preserves taste. Consumers who otherwise assumed self-serve machines were sketchy become impressed by timely sanitation stickers and machine checks that reinforce reliability.

Operational simplicity matters too. The best systems plug into existing beverage bar footprints. Brands like Frazil or Freezoni provide turnkey equipment with remote monitoring—ensuring syrup consistency and preventing partial freezes. They also support local operators by rotating seasonal flavors. A slush family-owned store in Alabama reported less staff training time after switching to such a unit, because employees no longer needed to manually mix ice and syrup or handle awkward cleaning routines.

People shop with their eyes, and these machines provide visual marketing at the point of service. Even subtle layering—like mixing energy slush with lemonade for summer weeks—generates voice-of-mouth. Customers ask staff, “Do you have the lemon-energy swirl?” and then buy it. The combination of

color, motion, and novelty persuades better than any signboard.

There’s a social media dimension, too. The photo-friendly swirl drinks practically invite Instagram shares, especially when stores add limited-edition cups or playful straw toppers. For seasonal campaigns—like Fourth of July “red, white, and blue” slush combos—the posts pile up and free promotion follows. A prominent Florida c-store saw a 17% week-over-week sales increase through combining slush LTOs with contest hashtags on TikTok.

When done right, the synergy between frozen and fountain simplifies storytelling. Instead of buying multiple cups across categories, customers can explore flavor combinations, reduce waste, and feel creative. Offering a slush infusion to a soda—or adding ice to a fountain energy drink—can be positioned as customizable. One chain placed a “Make Your Own Mashup” placard above its Freestyle machine, complete with recipe cards. Results: more per-cup revenue, higher upselling on syrups, and an energized customer base.

Value packaging drives awareness too. Frosted lids with heat-sensitive prints that change color, seasonal cups, or collectible sleeves incentivize repeat visits. Seen as small investments, these items strengthen brand identity. In the Southeast, where travel fuel stops are sometimes routine, well-placed frozen drink promotions feel like local moments rather than generic transactions.

All that said, operators must act on data. Convenience stores using analytics tools like Modisoft or Sysco’s back-end dashboards can track flavor performance and seasonality-driv -

en spikes. One Tampa chain pulled apricot-ginger slush from rotation after consumer-engagement signals showed weaker uptake and replaced it with sour apple lemonade—a local favorite during strawberry festival week. It’s a cycle of testing and refining, not a set-it-and-forget-it approach.

Margin management matters, too. Premium frozen drinks can blur the line between treat and indulgent splurge. With syrup, ice, and cup cost minimal, a 16 oz frozen drink can carry a 250 to 300% margin, depending on pricing. Stores that quote gulp-size pricing—say, $2.49 to $3.49—see greater profitability than a simple fountain soda upsell. A slush cup sold next to a frozen soda draws parallel profit structures with emotional upsell—“I deserve that.”

That combination of profit and delight makes frozen and fountain drinks a unique category. They don’t just add to margins—they add memory, personality, and experiential differentiation that sets one c-store apart from another. One owner compared them to a small parlor coin-op machine—they stir practice and

nostalgia in equal measure.

So, if your store hasn’t yet fully embraced the possibilities of frozen and fountain, the time is now. Evaluate your space—can you integrate a dual-temperature machine? Are your syrup cartridges stocked? Can you launch an LTO flavor tied to a local event or nostalgic moment? What kind of decorative cups or placards could make this feature a talking point rather than a side note?

In the Southeast, summer is long. Cooler storms hot. Travelers abundant. Construction crews and landscapers needing relief. Enter the frozen and fountain experience—and leave with loyalty. Build it well, maintain it diligently, rotate it intentionally, and it becomes less of a feature and more of a destination.

The return of frozen sips isn’t just about quenching thirst—it’s about edging ahead in the convenience game. When your store becomes known not just for fuel and snacks, but for the swirly delight of a perfectly chilled slush, you stake claim to the cooler—and the hearts—of your customers.

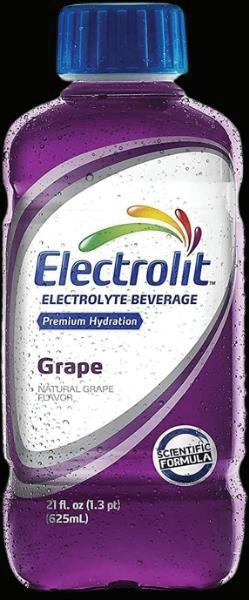

Optimal Sodium & Glucose ratio to allow immediate absorption of essential minerals.

Glucose is the body’s natural source of energy, provides immediate recover y

Helps to regulate acidity and avoid gastrointestinal problems.

After opening a Krispy Krunchy Chicken®, average c-store foot traffic increases ~10-12% and average merchandise sales increase ~15-20%*

You know us for our bone-in chicken, tenders, award-winning Cajun chicken sandwich and honey biscuits. Now try our premium whole-muscle chicken nuggets!

Offering strong margins with great profits for you and great value for your guests.

Benefit from low start-up costs, best-in-class training and support, and national marketing support. No franchise or royalty fees.

Tailored and comprehensive graphic support, ensuring seamless integration with your chain.

SCAN HERE to learn more about the brand chains trust.

Your Digital Shopping Solution

Available for web and mobile, Sysco Shop delivers the flexibility to find quality products and place orders on your schedule anytime, anywhere.

Review your orders, track your deliveries, and coordinate the most integral aspects of your business and par tnership with Sysco.

Explore thousands of unique items, including exclusive Sysco products and brands, to build a profitable menu catered to your unique customers.

Place new orders, review and reorder past purchases, and build lists of new and unique items to keep your stock fresh, flavor ful, and on-trend.

Online ordering is available 24/7. Shop anytime by visiting shop.sysco.com.

On the go? With Sysco Shop mobile, you can run your business or k itchen when you want and where you want. Download the app today

HRA was proud to celebrate the grand opening of a brand-new Shell station in Hiram, Georgia, alongside store owner Niki and an enthusiastic crowd of customers, vendors, and sta . The event brought together the best of what convenience retail can be—with support from partner vendors like Monster, Hill & Brooks Co ee, and F’real helping to bring the energy (and avor). The day was lled with ra e prizes, giveaways, and great company.

The star of the show? Niki’s large, in-store kitchen serving up piping hot Krispy Krunchy chicken and buttery biscuits that kept customers coming back for seconds. Free milkshakes added to the celebration while guests explored a beautiful, modern interior stocked with everything from snacks and soda to fresh, healthy selections, beer and wine, and a standout co ee and tea program. It was a true celebration of convenience done right—and who knows? Maybe someone who picked up a lottery ticket that day will be the next big winner.

When the mercury climbs and summer hits full stride in the Southeast, convenience store foodservice becomes more than a grab-and-go stop—it becomes a hot zone of opportunity and competition. In recent years, savvy c-store operators have tapped into the trend of fast, flavorful, and fresh foodservice offerings that rival quick-service restaurants. In 2024, prepared foods accounted for more than 27 percent of in-store sales and nearly 39 percent of in-store gross margins, marking a dramatic transformation. As inflation eases and consumer confidence returns, projections for 2025 put c-store foodservice growth at around 2.3 percent—outpacing limited-service restaurant growth.

These numbers reflect a hunger for hot and cold eats that are quick, satisfying, and offer value for money during summer’s peak.

At the heart of this surge lies a core principle: simplicity. Stores that have streamlined menus to a curated selection of on-trend items—think spicy chicken wraps, hot honey-glazed sausage biscuits, and customizable breakfast burritos—are seeing dou -

ble-digit growth in sales. One store chain recently reported a 14 percent increase in same-store foodservice sales in 2024, climbing another 31 percent by early 2025. Their secret was focusing on fewer, well-prepared items

that deliver every time. That level of consistent performance breeds loyalty— and repeat foot traffic.

Summer brings heat, but it also demands freshness and flavor. Hot-honey sauces, ghost pepper-infused sandwiches, and globally inspired spices like aji amarillo and harissa are becoming kitchen favorites. Southeast operators have discovered that customers want bold, fun summer flavors without waiting in long QSR lines.

Stores in Tampa and Charlotte, for example, have seen an uptick in spicy chicken wrap purchases after introducing sriracha-mayo dipping sauce and limited-time jalapeño-cheddar buns.

These aren’t just impulse purchases; they’re flavor experiences that invite repeat visits.

Behind the counter, staffing becomes equally crucial during summer’s peak. Stores experiencing turnover have started simplifying prep with multipurpose kitchen equipment and digital ordering systems to reduce training time. One chain in Mississippi installed a combi-oven with touch programming, allowing staff to steam, bake, and warm foods without switching appliances. The result? Less time wasted on temperature controls and more consistent product quality—even during shift changes and less experienced staff periods.

With summer driving heavier tourist and commuter traffic, convenience stores that successfully blend hot and cold offerings gain a distinct advantage. Hot food selections such as breakfast sandwiches, sausage biscuits, and even simple quesadillas help increase average

basket size, especially when placed near beverage stations. One Savannah, Georgia store reports that pairing hot breakfast items with their flavored coffees and cold blended drinks boosts combo sales 30 percent above average. The sensory appeal—steam, sizzling griddle sounds—invites customers to stay a bit longer, refilling loyalty-app coffees or adding snacks.

Cold options matter, too. Pre-made protein-packed snack bowls, fresh fruit cups, and gourmet deli sandwiches have surged in popularity with younger, health-conscious consumers. In markets like Asheville, operators have noticed increased frequency of midday visits after introducing refrigerated cases stocked with protein wraps and cold-pressed smoothies. The challenge is freshness—keeping produce crisp and proteins refrigerated requires smart stock rotation and investments in small-format coolers with quick-access

doors.

This is where smart inventory flows into storeback logic. With self-service coolers that open instantly, staff can quickly check and restock best-sellers before they’re gone. Stores using mobile POS integrated with sales data see what sells fastest and when. One chain in North Carolina discovered dairy-based breakfast bowls outsold yogurt parfaits two to one during early hours, changing their restock strategy to match morning demand. That type of data integration not only minimizes waste but supports informed seasonal planning.

Value is the silent engine driving all of this. In a region still mindful of rising food prices, stores that deliver quality at accessible prices capture trust. Operators offering value bundles—such as a hot dog, side of nachos, and a fountain drink for under five dollars—attract weekend road-trippers and commuters. These bundles echo quick-service promotions, but with the ease of c-store speed. Technomic research suggests that 55 percent of foodservice operators will prioritize value pricing in 2025; for Southeast c-stores, that’s a prescription for more customers coming through the door rather than going elsewhere.

Beyond the economics, foodservice also creates identity. Stores that lean into food forward experiences—like

nullifying traditional gas station stereotypes by emphasizing chef-endorsed burgers or UV cooking equipment—are becoming culinary destinations. Dash In, part of the Wills Group, is a perfect example. In its Washington, DC-area location, customers gather around a mini kitchen behind the counter ordering burgers crafted by a local chef, devouring hot handheld snacks fresh from a conveyor-fryer. The result is a space more akin to a casual fast-food joint than a fueling stop—and customers stay 12 to 21 minutes per visit, compared to under nine minutes at conventional c-stores.

Even smaller stores can replicate elements of that success by focusing on cooked-to-order-prime items paired with dine-in-ready offerings. Ventless cooker ovens can fry taquitos, warm pretzels, or prepare buffalo cauliflower bites without requiring major HVAC modifications. What matters is the “show”—either visual prep or visible warmers that broadcast arrival of a made-just-now snack. In hot July afternoons, those five inviting steam clouds above a food warmer can shift customer perception entirely—this is food made for me right now.

It also means using loyalty systems to convert foodservice trials into habits. Push alerts for “Breakfast Burrito Wednesday” or discounts on chicken wraps after noon remind customers to swing by for meals rather than just fuel.

In a region where Gen Z and Millennials increasingly see c-stores as convenient dining alternatives, pairing foodservice offers with loyalty rewards encourages trial and retention.

One challenge facing Southeast c-stores is perishability. High summer heat can render prepped food unsellable within hours. Buffer this with rolling bake schedules and detailed FIFO (first-in-first-out) training. One operator in coastal Florida introduced dual time clocks—one for prep and one for sale— on wrapped sandwiches. The result was 20 percent fewer expired items and clearer waste tracking. Another operator reduced shrink by 15 percent after implementing opaque prepped bins with labels showing prep and expiry times, reducing scanner errors and food loss.

Regional themes also enhance resonance. Local flavor—like shrimp po’boys in Georgia or Texas-inspired brisket tacos—carry cultural authenticity that transforms mundane meals into anticipated visits. For instance, a small c-store chain in Baton Rouge partnered with a local deli to supply boudin rolls daily—fare driving daily repeat buys because the product couldn’t be found elsewhere. That local edge can’t be outsourced and endears stores to their communities.

during heatwaves have warmed up to globally inspired sauces like tangy hot honey glaze, smoky sriracha aioli, or citrus-infused harissa wraps. These flavors deliver excitement without requiring specialized equipment—simple drizzle mechanisms and high-ROI ingredients help elevate taste and differentiate offerings without skyrocketing costs.

Looking ahead through the summer, convenience stores with an integrated foodservice vision win. That means combining data-driven menu curation, smart prep systems, value-focused pricing, and sensory-first environments. It also means investing in training for staff and managers so quality is consistent, from pre-office patties to post-gym burritos.

Even global food trends have found a place in Southeastern summer menus. Patrons craving something different

By mid-summer, stores should track week-over-week foodservice sales and table average. If breakfast sales dip, it may signal the need for a new morning item or temperature tweak. If combo performance stalls, consider adding sides with light dusting (like seasoned chips or fruit cups) or rotating hot sauces to introduce novelty. Southeast operators in 2025 have an open road: cook smart, flavor boldly, price fairly, and design for comfort—and their foodservice counters will drive not just meals, but loyalty and stand-out performance. When convenience store food matches fast-food appeal and fosters dwell time, it no longer competes—it leads.

Thriving in foodservice means staying adaptable, innovative, and ahead of the curve. Cutting Edge Solutions (CES) makes this easier by giving you exclusive access to cutting-edge ingredients and game-changing solutions that enhance your menu and streamline operations. With new products launching four times a year, CES designs products to help operators optimize efficiency, empower chefs to express their creativity, and create an extraordinary dining experience to keep guests coming back.

SYSCO CLASSIC

SYSCO CLASSIC

Turn up the flavor with jalapeño cheddar pull-apart flatbread—a bold, cheesy, and downright irresistible innovation. This plank-style flatbread is built for sharing (or not!) with nine soft pillowy sticks. Each one is topped with a rich, creamy white cheddar sauce, crispy bacon, spicy jalapeños, then sprinkled with melty mozzarella and sharp yellow cheddar cheese. The pull-apart design makes it easy to serve—whether as a shareable starter, bar snack, or game-day must-have.

SUPC 7354522 • 24/10.25 OZ

A comforting and complex classic that brings authentic Cajun flavor without the hassle. Our chicken and Andouille gumbo features tender chicken, smoky sausage, and a medley of fresh vegetables in a deep, rich roux—perfectly balanced with spice and depth. Ready to serve over rice, it brings the soul of New Orleans to your menu in a fraction of the time. No shortcuts—just genuine, restaurant-quality gumbo that chefs can trust.

SUPC 3352711 • 4/5 LB

SYSCO IMPERIAL

Enhance your menu with a standout, one-of-a-kind ingredient that’s a sustainable superfood packed with umami-rich flavor. These chef-crafted seaweed kelp chickpea balls feature wild-harvested New England kelp that’s nutrient-dense and brings a distinct ocean-fresh savory flavor. Combined with hearty and rich chickpeas, they are unique, nutritious, and versatile across menu applications or cuisines. Naturally gluten-free, allergen-friendly, and vegetarian, they’re equally ideal for bringing unique twists to classics or creating new dishes that go beyond the expected.

SUPC 7358221 • 2/5 LB

SYSCO IMPERIAL

Elevate your dishes with this rich and savory aged cheddar cheese sauce, crafted from naturally aged Tillamook® medium cheddar. Made with unpasteurized milk for deeper complexity, this sauce delivers a smooth, creamy texture and robust flavor, ideal for a wide range of culinary applications. From velvety mac and cheese to indulgent sandwiches and signature sauces, this versatile cheddar sauce brings craveable depth, character, and unmistakable quality to every bite.

SUPC 7362885 • 4/5 LB

SYSCO CLASSIC FRENCH CHOUXNUTS

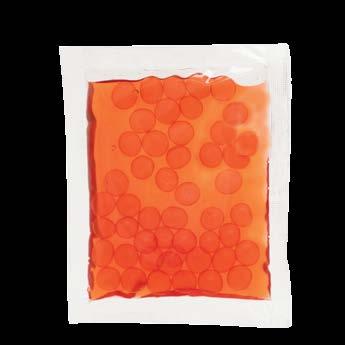

Add eye-catching pizzazz, tantalizing textures, and mouthwatering flavors with these authentic, portion-controlled Taiwanese boba pearls. Available in three bold flavors, they’re packed with personality and ready to serve in seconds. These innovative pearls elevate beverages and desserts while minimizing prep and maximizing profit. Brown sugar tapioca boba packets deliver rich flavor and chewy texture, especially when paired with perfectly sweet brown sugar boba syrup packets for an enhanced marbling effect. Popping boba packets offer juice-filled pearls that deliver a delightful “pop” of mango or strawberry, creating a fun, vibrant, and fruity experience.

Available in multiple varieties and flavors:

Brown Sugar Boba Syrup Packet

SUPC 7364719 • 120/1.05 OZ

Mango Popping Boba Packet

SUPC 7364718 • 120/1.76 OZ

Brown Sugar Tapioca Boba Packet

SUPC 7364683 • 120/1.05 OZ

Strawberry Popping Boba Packet

SUPC 7364682 • 120/1.76 OZ

Bring something memorable to your menu with French chouxnuts—where classic filled choux pastry meets the beloved familiar format of a doughnut. A crisp exterior with a light, airy cream puff-like interior pairs perfectly with bold, luscious fillings. The unique texture and eye-catching presentation create an unforgettable taste and visual experience. Bring true French flair to any menu with the chouxnut—a conversation starter that blends traditional technique with a familiar indulgent twist, keeping customers coming back for more.

Available in three delicious flavors:

Triple Chocolate French Chouxnut SUPC 7356262 • 12/3 OZ

Lemon Drizzle French Chouxnut SUPC 7356265 • 12/3 OZ

Raspberry & White Chocolate French Chouxnut SUPC 7356260 • 12/3 OZ

Give diners an eco-friendly experience with the world’s first upcycled agave-based cutlery, proudly BPI-Certified Compostable. Made from repurposed agave fiber—an abundant byproduct of tequila production—this durable, sustainable alternative to conventional plastic helps reduce landfill waste while providing a premium, functional solution for foodservice. Unlike paper or wood options, our medium-weight cutlery is strong, resistant to breaking, and offers a smooth, high-quality feel with a natural appearance.

Agave-Based Compostable Knife Bulk SUPC 7311248 • 1000 CT EARTH PLUS COMPOSTABLE AGAVEBASED CUTLERY

Agave-Based Compostable Cutlery Kit S&P&N SUPC 7311239 • 250 CT

Agave-Based Compostable Spoon Bulk SUPC 7311252 • 1000 CT

Agave-Based Compostable Fork Bulk SUPC 7311250 • 1000 CT

There’s a particular kind of energy that fills the air around the foodservice counter of a convenience store on a summer afternoon. It’s a mix of hunger, heat, and anticipation—customers are looking for something more than a drink or a snack, and owners have the opportunity to turn that moment into a curated experience. The idea behind **“Snack Stack: Pairing Profitable Bites with Functional Drinks”** isn’t just a catchy concept—it’s a blueprint for driving sales by matching tasty, high-margin foods with trending beverage options in ways that feel effortless yet strategically intentional.

Summer brings a noticeable change in consumer needs and expectations. Midwest heat feels different than Southeast humidity, but the psychological patterns are similar: shoppers want something quick, satisfying, and refreshing. They’re more open this time of year to upgrading their usual purchase into a combo that “hits the spot.” For instance, someone grabbing a hot dog or a sausage biscuit early in the morning might follow it with a Bang Energy for a boost, while later on, a spicy chicken wrap might pair beautifully with a Poppi or Olipop—something lighter, fiber-forward, and refreshing.

The magic lies in curation and presentation. Convenience store shoppers don’t want menus plastered on every surface—they crave options that feel convenient but also thoughtful, like someone remembered what they like. That’s why pairing items—without overthinking it—is so powerful. Take

a hot slice of pizza wrapped in gooey cheese or a fresh-made breakfast burrito and place it near energetic cans like Bucked Up or Uptime. You’re not telling customers what to do, but you are guiding them, nudging them gently toward value-driven purchases

that benefit both them and the store’s bottom line.

Data from NACS confirms what many store owners sense: when functional drinks like Celsius, Bang, or Monster are merchandised near hot, savory snacks, combo sales increase significantly—some stores report a 25 to 30 percent bump. One store in Columbus,

GA shared that after placing Bucked Up cans alongside their chicken tenders, they saw a measurable uptick in daily beverage units per transaction. Their install didn’t require cluster shelving, just strategic adjacency.

The relationships between product categories become clearer when you consider consumer routines. Someone stopping for gas mid-morning might be thinking only about coffee or breakfast—but if chocolate and caffeine are bundled, that morning habit becomes a value-enhanced ritual. Likewise, travelers during the summer road trip season might be drawn in by an icecold energy drink, then enticed to add a bag of Jack Links or Wonderful Pistachios as a protein complement. Each touchpoint reinforces the next, building a basket that feels natural rather than forced.

Partnership with vendors plays a major role. Representatives from Frito-Lay, Hormel, and Gatorade often bring compelling insights on snack-and-beverage trends. Some chains now collaborate with their Coca-Cola or Pepsi reps to set up test bays—limited-time displays where consumers can try summer flavors of Prime or fizz-forward DRNX Water alongside fresh-made snack offerings. These trial units create a moment of discovery, and when paired with a functional beverage, the probability of basket stacking increases dramatically.

Sweet snacks also have a place in this ecosystem. Chilled treats like Dipping

Dots or f’real milkshakes carry nostalgia and indulgence, and when paired with an energy drink—particularly in the evening—they position the purchase as a small reward or treat. One Florida-based operator credits evening combo sales with Dipping Dots and Monster as key to maintaining profitability during slower summer hours. The pairing turns a singular impulse into a micro-moment of enjoyable indulgence.

Foodservice managers are also blending snack-and-beverage planning with local culinary trends. A store chain in Mississippi integrated roadside favorites—like Cajun-style sausage biscuits—with electrolyte drinks like Biolyte or Body Armor. The result: customers complimented the unexpected but classic pairing, citing hydration as a natural follow-up to spicy breakfast. That kind of affinity-building combo may not appear in corporate brand plans, but it captures—and keeps—customers exactly where so many get lost amid generic selections.

Operationally, pairing combos requires support behind the scenes. Cleanliness, freshness, and quick access take precedence. Bags of chips placed carefully near warming units prevent dripping condensation; beverages must stay properly chilled even if they sit next to hot food displays. Stores that invest in dual-temp cabinets—allowing a hot segment next to cold drinks—see fewer complaints and better throughput. Staff need to monitor temps closely, especially in humid climates, to ensure drinks don’t warm and spoil or melt snacks begin to sweat.

Another overlooked but powerful tactic is timing. Studies show that shoppers escalate purchases when they perceive a window—like “only today” or “while it’s hot.” Convenience stores multiple times this summer created combo blitzes around major events—Independence Day weekends, NCAA tournaments, or local high school sports—and updated snack stack signage accordingly. One war story from a small chain in Tennessee describes how a Saturday after-

noon football game led to a spontaneous push of sausage wraps with Red Bull bundles. It sold out before kickoff, and customers came back asking if those combo packs would return.

Loyalty programs can reinforce these stacks. When a reward alert offers, say, $1 off any snack-and-drink combo featuring certain functional beverages, redemption rates soar. Implementing such offers not only boosts immediate sales but creates behavioral patterns, prompting repeat visits. Brands like Monster, Celsius, and Poppi provide digital coupons that can integrate seamlessly with store loyalty platforms, making combo offers feel natural, not pushy.

Throughout the day, tracking performance keeps operators ahead. With systems like Modisoft or Sysco-connected foodservice tools, c-store teams can monitor which combos are moving and which are stagnating. If desserts stall but savory-and-drink stacks thrive, it may suggest shifting display strategy. The goal is to maintain flow and freshness—no stale chips or warm bottles—and to pivot quickly if customer preferences shift during the heat of summer.

Profit margins on combo sales outperform single items because they leverage what customers already intend to buy. Instead of selling an item at a

discount, stores elevate the perceived value of the purchase. A hot sandwich and an Olipop or Poppi may sell for a price slightly less than the items purchased separately, but increase the total transaction by two items instead of one. This kind of strategic bundling grows revenue without eroding margin structures.

Ultimately, snack stack combos shine brightest when driven by authentic relevance. You don’t need an item to be trendy to pair it well. Sometimes a classic lässtern chicken sandwich tastes perfect next to a can of electrolytic water after a bit of yard work under the sun. Other times, a cupcake paired with a Prime Reign may be just the pick-me-up someone needs after harvesting vegetables at a roadside farmstand. Successful c-store owners learn to read their foot traffic, understand the local pulse, and gently nudge customers toward give-in moments that feel personal.

By mid-summer, store managers should have compiled a shortlist of top-performing stacks and be ready to rotate them. Some combos return, driven by events or holiday patterns—hot honey sausage and Monster for Memorial Day, for instance—while others fall off. That flexibility helps maintain freshness, novelty, and customer interest. Adds another benefit: it keeps staff excited. When coolers and foodservice counters change rhythm and show new pairings every few weeks, teams report better engagement and more genuine conversation with customers—who notice and sometimes ask what’s new.

What’s key is that snack stack combos don’t feel like forced add-ons. They feel like helpful suggestions. They’re the physical equivalent of saying, “Hey, pair this spicy snack with that cooling soda—it works, and you’ll feel good about your choice.” And when customers feel deliberately understood, they come back more often—crafting a pattern of convenience store behavior that transcends fuel, transcends transaction, and builds community.

ONE-DAY FORMAT - CLASS & PROCTORED EXAM IN THE SAME DAY

Full Package $185 $165 + S&H (Comprehensive Class, Proctored Exam, 7th edition ServSafe Food Manager book)

Scan for schedule of in-person classes

Partial Package $145 $135 (Comprehensive Class & Proctored Exam)

Online Partial Package $94

ServSafeManagerExam+RemoteProctorFee

Hybrid Combo $144 + S&H

ServSafeManager7thEditionBook+ExamFee+RemoteProctorFee

Online Full Package $174

ServSafeManagerOnlineCourse+ExamFee+RemoteProctorFee

*Online Manager Course available in English & Spanish

*ProctorU Exam available in English, Spanish and simple Chinese

*Requirements: computer (PC or Mac), a working webcam/mic, and a suitable location. Note: Mobile, tablet, and Chromebook devices are NOT supported.

ABOUT E.A. SWEEN COMPANY

As a famil y-owned and operated business, E.A. S ween values relationships, taking a hands-on approach to customer ser vice. You best products and ser vices while consumers enjoy a great-tasting, high-qualit y product.

E.A. S ween Company delivers real solutions that positivel y impact your bottom line:

• Optimiz ation of freez er and refrigerator storage.

• Reduction in waste with a 14-30 day shelf life.

•

• Consistent qualit y throughout the shelf life of our products.

Market Sandwich® – Upgrade on the go with premium ingredients and flavors.

Market Sandwich takes eating on the go to a new level. The #1 brand in the lunch sandwich category*, these products are made with premium meats, cheeses, sauces and

Deli Express® – Consistently great taste and exceptional quality for more than 60 years.

Our heritage brand delivers great taste at a great value. As the #2 brand in the lunch sandwich category*, consumers know they’ll get a delicious sandwich made with quality meats, cheeses and breads.

San Luis® – Satisfy your cravings while moving at the speed of life.

Inspired by bold and authentic flavors San Luis is the #3 brand in the Mexican category*. Our burritos combine quality ingredients and traditional spices to take on-the-go Mexican food to the next level.

*Data provided by Nielsen – 52 weeks ending 11/05/2022

At

When the mercury rises and daily traffic surges, convenience store operations don’t just need more hands—they need the right hands.