We are one of the fastest growing convenience store retail associations, representing thousands of retailers and an ever increasing number of major vendors. Our members get exclusive access to discounts, incentives, and rebates while our vendors get an opportunity to build brand equity and loyalty. Store owners gain the power of a group with a single representative that communicates on their behalf. Our members put more money in their pockets! Become a member and utilize the collective bargaining power of our HRA family.

We represent more than 5,000 retailers and 45 major vendors. You will have us behind you as a representative that will communicate on your behalf.

Our focus is your success!

Gain bulk buying power, discounts, and rebate programs and you will see savings roll in every quarter. There is no cost to join.

Operate your business with a robust partnership giving you access to savings, services, and a team helping you operate a more profitable and seamless c-store. Ensure you are operating with the highest gross profit possible by partnering with us. If you don’t save, we don’t earn.

Through our partnership with vendors you gain access to the power of collective bargaining! Amazing pricing and deals are no longer only for large chains.

The rush of summer has faded, the hum of fall promotions has steadied, and suddenly we find ourselves taking a breath. It’s that strange, wonderful stretch where the air cools, the mornings darken, and the stores we run start to feel a little more like community outposts again.

This is when perspective creeps in. It’s the time to look around, take stock of what worked, what didn’t, and what’s changing faster than any of us expected. And this year, there’s plenty of that. The 2025 NACS Show in Chicago reminded everyone that convenience retail isn’t slowing down, it’s evolving in all directions at once. New technology, new product categories, new consumer expectations. It’s dizzying, but if you take a moment from a high-level view, you start to see a pattern.

The through-line this season is balance. That’s what every successful store, brand, and product seems to be chasing right now. Not growth for growth’s sake, but balance between speed and quality, between innovation and authenticity, and between what’s new and what’s still true.

You can see it in the cooler, where energy drinks are growing up, with protein and caffeine coming together to fuel a day without the crash. You can see it at the coffee station, where hot drinks are finding new life as comfort items rather than commodities. You can see it in the steady rise of hemp-derived beverages, where curiosity and caution are finally learning to coexist. And you can feel it in the way operators talk about their businesses with less panic and more purpose.

That’s what this issue is about. It’s about the new rhythm of convenience, which is brighter, calmer, and more connected. We explore how THC beverages are making their cautious debut in mainstream retail and what that means for independents who are always first to see a shift before it hits the headlines. We dive deep into the changing definition of “energy,” where function and flavor finally share the same shelf. We talk about technology that makes life easier rather than more complicated, and forecourts that are turning asphalt into opportunity.

And woven through it all is one idea: you don’t need to overhaul your store to evolve. You just need to keep paying attention to your customers, your team, and the quiet signals that tell you where the market’s moving. That’s what independents do best. We see it before anyone else does.

As the holidays approach and we all try to find that balance between business and life, I hope this issue gives you both practical ideas and a little peace of mind. The future isn’t some distant horizon; it’s happening right now. It’s in the choices your customers make every single day, and the fact that they keep choosing you.

Warm regards,

Editor-in-Chief, C-Store Connect Magazine

Scan for Full Details

The thing about trade shows is that they can either overwhelm you or inspire you, and sometimes both. You walk through miles of aisles and feel like you’ve seen the same five products over and over again, or you can step back and realize what’s actually shifting beneath the surface. NACS 2025 in Chicago was one of those shows where the story wasn’t about any one product or booth, it was about momentum. You feel it on the show floor, see it in how vendors talked about the future, and hear it in the hallways when retailers compared notes.

What struck me the most: the big, national players may dominate the headlines, but the ideas gaining real traction are the ones independent operators are putting into place right now.

...they can either overwhelm you or inspire you, and sometimes both.”

The show wasn’t about who had the biggest booth; it was about who had the smartest approach. The conversations that mattered most were about grounding technology in practicality, rethinking category roles, and refocusing on trust, efficiency, and emotional connection.

Five signals stood out that will carry directly into Q1 of 2026 as indicators of where convenience is actually headed.

Let’s take them one by one.

The days of customers simply taking a chance on your hot case are over. That was a clear theme everywhere in Chicago. Whether it was a vendor showing off new prep equipment or a panelist discussing food safety transparency, the tone was unmistakable: customers want to see it, trust it, and understand it before they buy it.

That doesn’t mean the c-store kitchen is under siege; it means it’s maturing. Operators who have been hesitant to push deeper into made-to-order or prepared meals because they feared customers wouldn’t trust the quality are learning that trust can be built faster than ever if

it’s made visible. The stores generating repeat meal traffic are the ones that let customers watch food being handled, keep prep areas open and lit, and label every package like it came from a deli, not a gas station.

One operator said they started putting “Made fresh at 10:15 a.m.” stickers on their sandwiches. That one tiny label changed how customers viewed the case. It made freshness tangible. Another began posting short social clips of staff prepping pizza dough —not polished marketing, just a real video —and saw local engagement double. The underlying shift is simple but huge: foodservice isn’t about price or speed anymore. It’s about perceived integrity. The more you show, the more you sell.

Going into 2026, that’s the foodservice headline to remember. If you’ve been

quietly running a small kitchen or deli, it’s time to let customers see it. Transparency has become your new marketing department.

NACS 2025 made the beverage explosion quite clear. Energy drinks aren’t just a category anymore; they’re an ecosystem. What’s fascinating is how they’ve started merging with the pro-

tein, vitamin, and hydration spaces, creating hybrid drinks that blur the line between nutrition and indulgence.

One of the most talked about takeaways is how quickly consumer demand is being reshaped by health-conscious convenience. It’s not just about caffeine anymore; it’s about *functionality.* Drinks that hydrate better, restore electrolytes faster, give a cleaner energy source, or add protein are now mainstream expectations. That’s true across age groups, but especially among Gen Z and young professionals on the go.

For independent operators, that means rethinking cooler space with a little more boldness. The days when “functional” meant one or two SKUs tucked beside the water are gone. Now, the best-performing stores are dedicating entire shelves to performance-oriented drinks and rotating them seasonally. They’re treating the cooler like a fitness aisle.

It’s also worth noting how quickly meat snacks, protein bars, and energy beverages are clustering together in shopper missions. They’re feeding off one another. A customer reaching for a high-protein drink is far more likely to grab a meat stick or low-sugar snack. It’s habit-forming and easy to merchandise.

The lesson heading into 2026: treat functionality as a lifestyle, not a product type. The stores that do will see customers return again and again

because the store starts to feel like part of their routine, not just a stop along the way.

The thing about technology in our industry is that for years, it’s been either too expensive or too complicated to be useful for independents. That wall is finally coming down. The buzz in Chicago wasn’t about futuristic robots or massive data systems; it was about accessible, affordable, and scalable tools that help small operators make real improvements without needing a full-time IT person.

The common thread is practicality. The technology people are talking about isn’t there to impress; it’s there to help. Smart coolers that monitor product temperature and send alerts, mobile checkout systems that inte -

grate loyalty, and forecasting apps that actually prevent over-ordering are reshaping how independents operate.

The takeaway for 2026 is simple: you don’t need to leap into AI headfirst to keep up. Start small. Pick one tool that makes your life easier or your shelves smarter. If it saves you time and/or money, that’s progress.

It’s easy to think of the forecourt as static — pumps, signage, trash cans, and maybe a car wash. But that space is becoming one of the most valuable pieces of real estate in the business. Several operators are finally starting to see the pump area as a sales floor in its own right.

Think about it. Every customer who fuels is already pausing for two to four

minutes. That’s two to four minutes of potential engagement. Some of the smartest independents are starting to use that time to their advantage with meaningful prompts. Forecourt screens tied to loyalty programs, QR codes offering discounts on coffee or breakfast, and even subtle things like pump toppers that highlight local partnerships or promote new snack drops.

There’s also a growing opportunity to rethink the physical use of that space. As more customers drive hybrids and EVs, those fueling patterns are changing. The conversation isn’t just about adding chargers; it’s about integrating food, drink, and community services right there at the pump island.

One operator in Tennessee set up a “grab-and-go” window adjacent to the forecourt where customers could

order drinks or snacks while fueling. It wasn’t a full drive-thru, but it had the same effect. Sales rose 12 percent, and customer satisfaction scores spiked. The point isn’t that every store should rush to remodel. It’s that the forecourt no longer has to be a passive space.

Heading into 2026, that’s worth remembering. Don’t let your forecourt sit idle; treat it like the front porch of your business, a place to engage.

It wasn’t all product talk at NACS this year. The sessions that drew the most nods from small operators weren’t about the latest tech or food trend; they were about people. Safety, staffing, burnout, and how to keep a small team motivated in a world that feels harder every year.

There’s an emotional honesty settling into the industry right now that staffing shortages aren’t just logistical, they’re cultural. People want to work where they feel safe, seen, and part of something steady. That’s hard to deliver when you’re short-staffed or when security feels uncertain.

Operators are experimenting with smarter scheduling, cross-training, and even low-cost automation to give teams breathing room. Some are investing in simple camera upgrades and better lighting to help their employees feel secure. That sense of safety radiates outward. When your

team feels comfortable, customers feel comfortable.

As you plan for 2026, think about energy drinks, tech, and merchandising, but don’t lose sight of your people. Safety and culture are the foundation on which everything else rests.

If you put all five of these signals together — foodservice trust, functional beverages, grounded technology, smarter forecourts, and human-centered operations — a clear picture emerges. The next phase of convenience isn’t about being faster or flashier. It’s about being *smarter and more intentional.*

The world doesn’t need another “convenient” store. It needs stores that understand customers’ deeply ingrained habits, health goals, routines, and worries. It needs operators who see technology as a tool and treat staff as the core of the experience, not just a line item.

That’s what the best of NACS 2025 hinted at: a shift from transaction to relationship. The industry is maturing, and independents are in a better position than anyone to lead the way. You don’t need a corporate budget to build trust or test a new layout. You need curiosity, consistency, and the willingness to see opportunity where others see limits.

As we roll into 2026, the playbook writes itself. Show customers what’s fresh and real. Double down on functionality and adopt one piece of tech that saves time rather than adds stress. Make the forecourt feel alive and keep your team safe and proud to work for you.

These signals aren’t just coming out of Chicago; they’re coming from every store that’s adapting, experimenting, and staying close to its customers. Because at the end of the day, that’s what convenience really is: a relationship built one visit at a time.

With a strong commitment to excellent service, a vast inventory, investments in technology and a team of experienced professionals, DON delivers industry-leading products you can depend on, exceptional service you deserve and tailored solutions that meet your needs.

• 7 nationwide full-service distribution centers - over 1.3M square feet

• Fully integrated operating platform (SAP), SKU commonality across all DCs

• 12,000+ in stock products

• 1,300+ trained associates

• 300+ experienced and tenured sales professionals

• 24/7 online ordering (don.com)

• Data rich reporting capabilities

• Globally-sourced product selection from the industry’s leading suppliers

• DON Fleet In House Transportation Network

• Value Added Services Team for new store openings and rollouts

• DON BUILD - Equipment, Design and Build Team

DON is providing HRA with the best selection from the folowing categories:

• Equipment

• Kitchen Supplies

• Sanitation and Maintenance

• Disposables

• Chemicals

We get it – things happen. Whether you’ve had an equipment breakdown, a large last minute reservation or are just looking to cut down on paper, we’re here to help with don.com. Along with 24/7 access to online products and ordering, you’ll enjoy several other advantages:

• 24/7 access to our complete line of products

• Customize your favorites list for quick reordering

• Option to lock down and limit access to specified products

• Optional “Order Approval” mode available

• Confirmation of order and delivery day

• Quick access to order history and invoices with product images and item numbers

• Robust tracking tools, reporting and information resources

There are certain products in this industry that slip quietly into our coolers and shelves, and before you even realize it, they’ve rewritten an entire category. Meat sticks are one of them. Not long ago, they were an impulse add-on, the afterthought hanging beside the jerky section, a quick, salty snack that maybe caught someone’s eye on a road trip. But in the past few years, something much bigger has been happening. The meat stick has evolved from a gas-station indulgence into a legitimate category engine. It’s no longer a guilty pleasure; it’s a lifestyle snack, a protein powerhouse, and in many stores, one of the most reliable margin builders you can have.

If you’ve been watching your own sales data closely, you’ve probably seen it. The numbers tell the story: protein is up, sugar is down, and meat snacks are quietly outpacing most other salty snack formats. But the reasons behind that rise go deeper than health trends or social media buzz. What’s really driving this growth is a shift in how people think about food itself. Convenience no longer just means easy; it means *functional.*

they’ve rewritten an entire category”

And that single shift in mindset has opened the door for meat sticks to become what candy bars used to be: the default grab-and-go option when someone wants energy, flavor, and satisfaction without slowing down.

Spend enough time talking with customers and you start to hear it. They’re tired of snacks that don’t hold them over. They want something that feels like a small meal, not a handful of air. That’s where meat sticks fit so neatly into modern habits. A protein bar might do the same job, but it’s not as satisfying. A sandwich might fill the gap, but it takes time. A meat stick sits perfectly between those extremes because it is portable, savory, familiar, and quick. It fits in the glove box, the desk drawer, or the gym bag. It’s a snack that doesn’t need refrigeration but still feels real, and that combination has turned it into a staple rather than a novelty.

The shift didn’t happen overnight. A decade ago, meat snacks were a narrow space dominated by a few big brands. The packaging screamed rugged masculinity, with images of hunters, cowboys,

log cabins, and smoke. The marketing was loud and proud and a little one-dimensional. But the new generation of brands, and even the old guard who’ve adapted, have broadened the appeal. They’ve leaned into health claims, clean labels, and ingredients customers can pronounce. Some have gone fully premium, emphasizing grass-fed beef or turkey with minimal preservatives. Others are experimenting with flavors like sweet heat, teriyaki honey, jalapeño cheddar, and even vegan analogs made from mushrooms or pea protein. The result is a category that no longer belongs to a niche audience. It belongs to everyone.

One of the more fascinating outcomes of this transformation is how meat sticks have carved out a new kind of emotional space. They’re comfort food and fuel at the same time. A driver picking one up during a long day might not think of it as a “health snack,” but they’ll still justify it that way, protein instead of carbs, and savory instead of sweet. For a parent grabbing one between errands, it’s the rare snack that feels like an adult decision in a sea of sugary choices. And for younger consumers, especially

those under 35, it fits perfectly into the language of modern wellness: portable protein, portion control, and macros that align with fitness culture.

That’s where social media has played an unexpected role. Meat sticks aren’t flashy, but they’ve found their place in the everyday content of life online through gym bag check-ins, travel vlogs, desk-drawer snack hauls, and “fuel for the day” posts. It’s not influencer hype that’s driving awareness; it’s authenticity. These are real people showing what they actually eat, and the humble meat stick keeps showing up. Every one of those moments translates into an unconscious reminder for your customers: this is normal, this is healthy, this is what busy people do. That’s marketing gold, and it’s happening for free.

For store operators, the opportunity isn’t just about riding a trend; it’s about

recognizing a structural change in consumer behavior. When a category stops depending on novelty and starts depending on habit, you’ve reached a turning point. That’s where meat sticks are right now. And it’s why stores that once treated them as an afterthought are now giving them their own space, displays, and pricing strategy.

The best-performing stores don’t bury the category near the candy. They treat it like a destination. They build secondary placements near checkout, beside protein drinks, and even in the foodservice line. Every placement tells a story: this isn’t just another snack, it’s fuel. And when customers start to believe that story, the basket gets bigger. A protein drink and a meat stick become a meal. Add a bottle of water or an energy beverage, and you’ve just turned a quick stop into a profitable routine.

What’s fascinating about this evolution is that it’s democratizing the category again. Independents have as much to gain here as any large chain, maybe more. Big boxes can’t pivot displays quickly or tell local stories. But small operators can. They can experiment with regional flavors, highlight local brands, or offer limited-edition bundles tied to events or seasons. A college-town store can push high-protein packs during finals week. A rural store can feature hunting-season bundles or partner with local meat producers. The format’s flexibility — small, shelf-stable, and high-margin — gives independents an agility advantage that national players can’t easily replicate.

The margin potential speaks for itself. Compared to chips or candy, meat sticks deliver higher per-unit profit and less waste. They don’t crush, melt, or expire quickly. That reliability makes them the kind of product you can stock confidently, even with limited storage space. And because they span dayparts, they fill the gaps between coffee, lunch, and dinner runs. Few categories have that kind of range.

But the real secret to the success of meat snacks might be that they align so perfectly with the “micro-meal” trend. People aren’t eating three meals a day anymore. They’re eating six smaller ones, scattered through commutes, shifts, and workouts. A stick of beef or turkey fits into that rhythm effortlessly. It’s not a compromise, it’s the plan. In a world where wellness messaging and everyday practicality are finally overlapping, that’s exactly the kind of product that thrives.

There’s also something tactile and nostalgic about it; the simple act of unwrapping a stick, tearing off a bite, and getting that immediate savory hit is sensory in a way that bars and shakes just can’t replicate. It’s food that feels real. In an era when so many products are trying to taste like something else, the meat stick stands out by being unapologetically itself. Customers appreciate that honesty, comforting and straightforward, and that’s part of its charm.

out. Every year brings a new wave of bold experiments, from extreme heat to global fusion. Some work while others don’t. The key is balance. The best-selling SKUs still lean on classic profiles because those are comfort flavors. But sprinkling in a few trend-driven options keeps the display interesting and signals that your store is up to date. If customers see Korean BBQ or mango habanero next to traditional varieties, it gives them a reason to pause, to consider, to engage.

What’s also emerging is the rise of plant-based and hybrid options in this space. Even though they’re a tiny fraction of total sales today, they’re symbolic of where innovation is heading. A few years ago, it would have been unthinkable for a vegan meat stick to sit next to beef jerky in a c-store. Now, it’s starting to happen, and it doesn’t seem out of place. That says a lot about how

inclusive the modern snack aisle has become. You don’t have to abandon your traditional customers to attract new ones; you just have to give everyone a choice that fits their values.

Packaging, too, has gotten smarter. Transparent wrappers, cleaner fonts, and portion-size indicators all build trust. Customers read labels now and want to see the grams of protein, the sodium levels, and the calorie count. They’re comparing, even subconsciously. The brands that make that information visible are winning. For independents, that’s an easy merchandising cue: face those labels outward, light the section well, and use simple signage that reinforces the protein message. You don’t need gimmicks, you just need clarity.

There’s also a crossover effect happening between the front counter and the cooler. Many stores are now stocking

One thing operators should keep an eye on, though, is how the flavor race plays

refrigerated premium sticks or mini sausage links alongside fresh foods. It’s a subtle signal that the product belongs in the same conversation as sandwiches and salads, not just snacks. That repositioning helps capture customers looking for quick lunch add-ons and reframes the meat stick from something you grab on a whim to something you add with purpose.

If there’s one thread running through all of this, it’s that meat sticks have become the ultimate example of what happens when convenience meets culture. They’ve adapted to every shift, and they’ve done it without losing authenticity. That adaptability is rare, and it’s what makes the category feel less like a fad and more like a foundation.

In some ways, they’re teaching us how to think about product evolution in the broader sense. When a simple, low-

tech product can reinvent itself through smarter marketing, cleaner ingredients, and a little cultural awareness, it proves that innovation doesn’t always have to mean invention. Sometimes it just means paying attention.

So what does that mean for your store? It means looking at your snack wall not as a static planogram, but as a living ecosystem. It means noticing which SKUs actually move, and which are just filling space. It means treating the meat stick as a category worth curating, not one worth forgetting. It’s a behavioral shift that’s reshaping what convenience looks like at the register, in the cooler, and in the car.

When you think about what drives success in a modern c-store, it’s rarely one big idea; it’s usually dozens of small ones that work together like the right mix of price points, placement, storytelling,

and timing. The meat stick category is proof of that. Its rise wasn’t fueled by a single marketing campaign or a viral moment. It grew because it fit the way people live now and solved a problem without making a fuss.

In a world full of noise about disruption and digital transformation, sometimes the most powerful innovations are the simplest. A product that people genuinely like, offered in a place that feels familiar, supported by honest marketing and steady availability.

As we head toward the end of 2025 and into the new year, pay attention to what your shelves are quietly telling you. Watch which categories customers reach for without thinking. Watch how often that grab involves protein because the meat stick isn’t just having a moment, it’s rewriting the rhythm of the snack aisle.

Every few years, there’s a shift you can feel in the cooler. The moment when something new starts crowding its way between the regular stock. It usually starts quietly with one or two unfamiliar cans that regulars start asking about. Then, before you know it, it’s a category. Right now, that space belongs to the protein-plus-caffeine hybrid. The drinks that promise alertness and recovery in the same sip, that blur the line between fuel and food, and that have suddenly become the favorite grab-and-go option for people who don’t have time to separate breakfast from their morning jolt.

For a long time, protein and caffeine lived in different universes. One belonged to the gym crowd, the other to the office crowd. But modern life doesn’t leave people with clean categories anymore. Everyone’s busy, everyone’s multi-tasking, and everyone’s chasing energy that lasts without crashing. The idea of combining caffeine’s kick with protein’s staying power makes too much sense to ignore. That’s why the cooler is evolving again, because it reflects how people actually live.

You can see the convergence everywhere: coffee-based protein drinks, energy drinks boasting collagen or whey, and meal-replacement shakes with espresso undertones. It’s the natural next step after the functional beverage boom. Now the consumer wants a drink that does it all with quick energy, sustained fuel, and maybe even a few health points on the side.

What’s fascinating about this shift is who’s driving it. It’s not just athletes or

gym-goers. It’s teachers, truck drivers, nurses, and students. The people whose schedules don’t allow for sitdown meals or multiple stops. The same customers who used to grab an energy drink and a bag of chips are now looking for something that feels smarter and more efficient. They want energy that doesn’t feel like junk energy and protein that doesn’t feel like work.

This is where this new wave of drinks hits the sweet spot. They’re accessible as they’re sold in the same coolers as everything else. They’re familiar flavors

like coffee, chocolate, and caramel. But they’re also positioned differently. They don’t talk about bulking or bodybuilding; they talk about balance. They sell the idea that you can stay alert and steady, and that you can work hard without feeling wiped out. In other words, they sell stamina.

If that sounds like a perfect fit for convenience retail, that’s because it is. C-stores have always thrived on stamina — the ability to keep up with customers who are constantly on the move. When you think about it, the entire store model is built on the same promise these drinks make: quick energy that keeps you going. So when a product line aligns directly with your customers’ lives, it creates opportunity.

What makes this category so interesting is how natural the cross-pollination feels. The energy-drink brands started

it, sneaking in protein to soften the crash and attract health-conscious buyers. Then the protein brands responded, adding caffeine to make themselves more relevant to morning routines. The result is a blur of brands, flavors, and functions that’s only going to get wider. Some of the fastest-growing SKUs in national distribution right now are hybrid beverages with both caffeine and protein claims — ranging from 10 to 20 grams of protein and 150 to 200 milligrams of caffeine. That balance hits the consumer’s comfort zone perfectly: enough to feel, not enough to worry about.

While the formulations are converging, the marketing stories are diverging. Some brands lean toward the gym aesthetic with bold fonts, muscular imagery, and promises of strength. Others go in the opposite direction, using clean designs, words like “focus” and “sustain,” images of mornings, and laptops instead of dumbbells. For c-stores, that diversity is a gift. It means you can curate your cooler to fit your community. A college-town store might stock the focusand-study versions. A highway stop might push the endurance-and-drive

SKUs. A suburban site might highlight the balanced, lifestyle-friendly options. The flexibility is built in.

From an operational standpoint, these drinks are easy to handle, shelf-stable, high-margin, and well-supported, but the real key is placement. They don’t belong buried with supplements or stuck beside plain protein shakes. They belong in the front-row cooler, right where coffee and energy meet. That’s where the discovery happens. Customers scanning for a pick-me-up are open to persuasion. When they see something that promises energy with substance, they pause. That pause is where conversion lives.

It’s important to remember that this isn’t just a young-person trend. Older demographics are responding, too. As awareness of blood-sugar management and sustained energy spreads, more people are reaching for protein-forward drinks as part of their daily routine. They may not care about “macros,” but they care about how they feel after lunch. They notice that the coffee-plus-protein combo keeps them sharper longer. That’s the moment when habit turns into

loyalty.

One of the most encouraging aspects of this space is how it opens the door for independents to compete with big chains. You don’t need a blender or a smoothie bar to participate. All you need is cold storage, smart signage, and a willingness to stock what’s next. The customer doesn’t care if the drink came from a corporate marketing team or a single-store operator. They care that you had it when they wanted it.

It’s worth noting that the broader beverage industry has taken notice. You can see the giants repositioning. Coffee companies are exploring protein, energy companies are releasing “clean” lines with functional ingredients, and even breakfast-bar brands are testing drinkable formats. It isn’t speculative anymore; the lines between meal, snack, and energy are dissolving, and c-stores are sitting right at the crossroads.

From a marketing perspective, the language around this category is evolving fast. You don’t hear “protein shake” as often anymore; you hear “fuel,” “recovery,” “performance energy.” You don’t hear “energy drink”; you hear “focus,” “balance,” and “clean kick.” It’s all part of the same cultural recalibration. A move away from extremes and toward moderation. Customers don’t want the hardest-hitting product anymore; they want the smartest-feeling one. That subtle difference is shaping everything from packaging design to shelf layout.

When a guest walks into your store at seven in the morning or two in the after-

noon, they’re not necessarily thinking, *I need protein and caffeine.* They’re thinking, *I need to get through the next few hours without crashing.* These drinks answer that need. Position them accordingly and show that you understand their day. Turn the trend into a business advantage.

There’s also an experiential angle that often gets overlooked. These drinks aren’t just functional; they’re enjoyable. The flavors have come a long way from the chalky shakes of old. They’re smooth, indulgent, even dessert-like. That’s why pairing them near the bakery or breakfast items works so well. It nudges customers toward a complete experience — something quick, comforting, and slightly elevated from their routine.

We’re also beginning to see interesting regional differences. In colder climates, coffee-based protein drinks dominate. In the South and West, where iced energy reigns, fruit-flavored protein-plus-caffeine blends are growing faster. That tells you something important: the convergence is less about a specific product and more about a mindset. People want function in their flavor. They want energy that tastes like enjoyment, not endurance.

If the last few years have taught us anything, it’s that convenience retail thrives when it adapts faster than anyone else. Energy drinks exploded here first. Hard seltzers found early trial here. Now, the next wave is forming in your coolers again. The question isn’t whether this hybrid trend will last; it’s

how quickly you’ll make room for it.

From a category-management perspective, the numbers are promising. Analysts tracking functional beverages project steady double-digit growth for the protein-energy segment through 2026, even as traditional soda and juice continue to flatten. The products carry higher price points, attract repeat buyers, and fit seamlessly into existing distribution.

Of course, with opportunity comes clutter. Not every brand will survive the shakeout ahead. There will be consolidation, reformulation, and inevitable marketing overreach. Your job isn’t to

predict winners; it’s to curate stability. Start with a few SKUs that have staying power with clean ingredients, recognizable branding, and credible sourcing. Watch how they move, then adjust. The beauty of being independent is agility. You don’t need corporate approval to pivot. You can respond to your customers faster than anyone else can.

hard no longer fits how people live today. They’re working longer, sleeping less, moving more, and thinking about wellness even when they’re too busy to practice it. They want energy that lasts and nutrition that fits. The protein-plus-caffeine drink is the shorthand for that philosophy. It’s the new morning fuel, the new road snack, the new afternoon rescue.

In a way, this trend feels like the maturation of the energy-drink generation.

The kids who grew up on neon cans are adults now. They still crave stimulation, but they also crave stability. They want something that respects their metabolism, not abuses it. They want to feel in control. And when you can give them that feeling in a form that’s cold, convenient, and tastes good, then you’ve got something great.

So as you walk your coolers this month, look for space to embrace what’s next. Maybe it’s a single new shelf tag, maybe it’s a small “Better Energy” section. Start small, but start. Because this convergence isn’t coming; it’s here. Customers who used to choose between a shake and an energy drink no longer have to choose.

If there’s one thing this industry has proven again and again, it’s that when you listen to what customers want, they reward you with loyalty.

The deeper story here, though, isn’t about beverages at all. It’s about how Americans are redefining energy itself. The old model of high sugar, high caffeine, burn bright, and crash

The shift is happening right where it always does — in the hands of a customer standing in your store, deciding, in a split second, what kind of day they want to have.

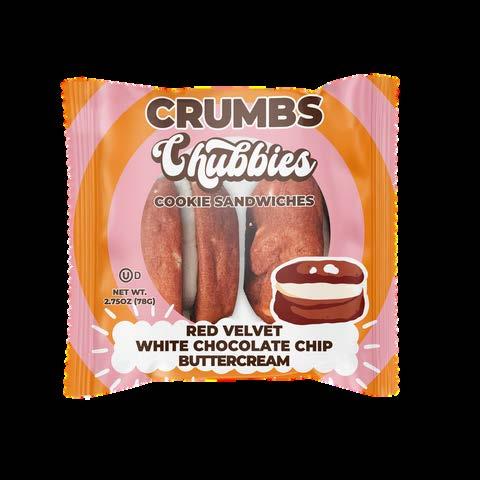

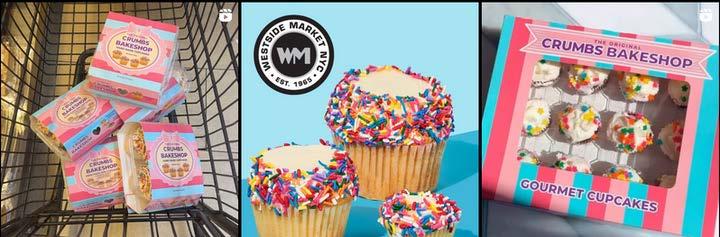

The iconic brand that pioneered gourmet cupcakes in the United States and ushered in the Cupcake Craze around the globe by 2007 is back in retail with the same quality products millions of customers enjoyed.

Elevated bakery consumers identify CRUMBS as the original brand in gourmet baked goods.

CRUMBS had 75+ locations nationwide, selling 1M+ cupcakes a month in NYC alone, and ranked 10th fastest growing company nationwide in the food and beverage industry in 2009 (800% growth since 2006).

94% 94%

Completely or Somewhat agreed they wished CRUMBS Bake Shop would come back

Beginning in late 2024, CRUMBS signature products (cupcakes and cookies) are back in retail.

88% 88%

Completely or Somewhat agreed CRUMBS Bake Shop offered something other bakeries couldn’t match

87% 87%

Completely or Somewhat agreed they actively miss CRUMBS Bake Shop

[ 0 ] SUGAR

[ 0 ] ARTIFICAL COLORS

[ 0 ] ARTIFICAL FLAVORS

[ 5 ] CALORIES

BUY3 cases GET2 FREE BUY3 cases GET2 FREE

PLANT POWERED GOODNESS

PLANT POWERED GOODNESS

Supports: Balance, Brain Fog, Vitality, Mood, Stress, Immune Defense, Balance

Supports: Balance, Brain Fog, Vitality, Mood, Stress, Immune Defense, Balance

V I TAM I NS & M I NERALS

100% Daily B3, B5, B6, B7, B12, Chromium, Selenium

100% Daily B3, B5, B6, B7, B12, D3, Chromium, Selenium VITAMINS MINERALS

ANT I OX I DANTS

Supports: Immunity, Inflamation, Skin, Circulation, Heart & Lung Health,

Supports: Immunity, Inflamation, Skin, Circulation, Heart & Lung Health, ANTIOXIDANTS

EVERYDAY HYDRAT I ON

Electrolytes: 90mg Sodium + Potassium

Electrolytes: 90mg Sodium + Potassium HYDRATION

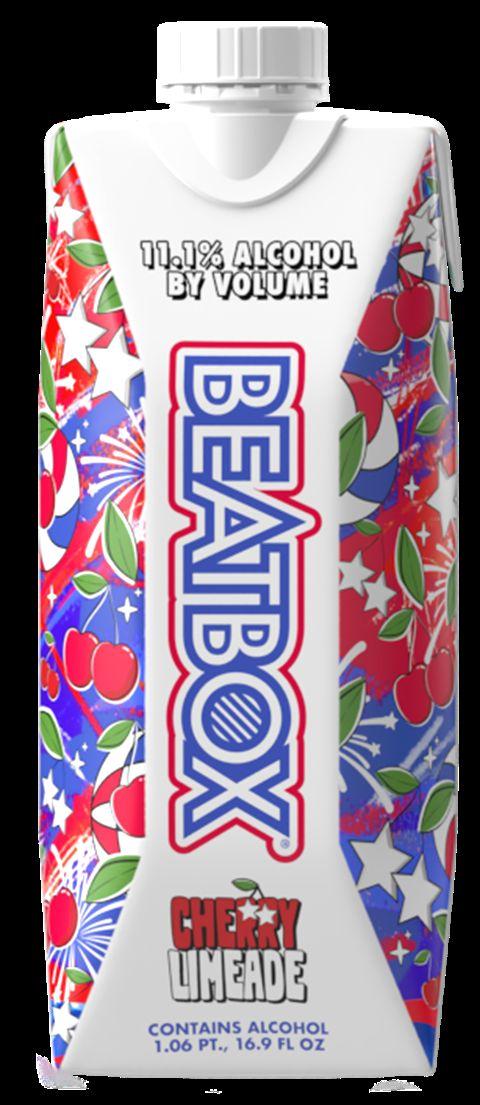

There’s a quiet conversation happening right now in convenience retail that’s cautious, curious, and just a little electric. It’s about those cans showing up in more coolers across the country, the ones that look like seltzers but come with a wink. Hemp-derived THC beverages. Not long ago, they were a fringe product, sold mostly in smoke shops and online boutiques. Today, they’re inching toward the mainstream, one headline, one shelf placement, and one cautious pilot at a time.

When Target launched its Minnesota trial earlier this year, the industry noticed. Not because Target suddenly became a cannabis pioneer, but because the move signaled something more important: legitimacy. If a national retailer with Target’s reputation is willing to dip a toe into hemp-derived THC, within the bounds of Minnesota’s unusually permissive regulations, then the wall between mainstream retail and cannabinoid beverages is beginning to crumble.

For convenience store operators, that’s both exciting and complicated. This is a category full of promise and pitfalls, profits and policies. It sits at the intersection of consumer curiosity, shifting laws, and rapidly evolving cultural norms. And the question now isn’t whether THC beverages will continue to spread, it’s whether c-stores with their reach, refrigeration, and relationship to everyday shoppers are ready for them.

Let’s start with the basics: what makes this moment different? For one, the product itself. The THC beverages of 2025 don’t look or taste like the edgy, uncertain products of even a few years ago. They’re sleek, low-dose, predictable, and intentionally mild. They’ve

learned from the hard seltzer playbook of friendly branding, modern flavors, and clear labeling. Most are formulated with five milligrams of hemp-derived delta-9 THC, enough for a light buzz but nowhere near intoxicating for most adults. The goal isn’t to get high; it’s to relax. They’re designed for the same moment that a beer or hard seltzer would fill. The after-work wind-down, weekend hangout, or social setting where you want to feel something, but stay in control.

That’s what’s changing everything. The cannabis category has always carried the cultural baggage of legality, stigma, and uncertainty. But this new wave of drinks sidesteps much of that by leaning into familiarity. They’re sold in cans,

cautious, curious, and just a little

often alongside kombucha or energy seltzers, and they carry nutritional panels, barcodes, and flavor descriptors rather than counterculture cues. They’re not hidden behind glass or whispered about; they’re becoming part of the beverage landscape. And as more states refine their hemp laws, the category is finding daylight in the same coolers that hold energy drinks and flavored waters.

For independents, that’s a fascinating prospect. You already own the space where new beverage behaviors are born. Energy drinks, kombucha, and CBD sodas all built their early followings in convenience stores. You were the test lab for functional hydration before anyone

called it that. Now, THC drinks could follow the same arc if operators move carefully, stay compliant, and focus on education as much as excitement.

The compliance piece can’t be overstated. The patchwork of state and federal rules around hemp derivatives remains messy. What’s federally legal under the 2018 Farm Bill — hemp-derived delta-9 THC with less than 0.3% THC by dry weight — still collides with varying state interpretations. Minnesota, for instance, explicitly allows low-dose THC edibles and beverages under state law. But in many neighboring states, even trace levels of THC in a drink could trigger enforcement. For independents operating across county or state lines, that’s the tightrope. One cooler item could be perfectly legal in one jurisdiction and prohibited in another.

That’s why the smartest early adopters are working hand in hand with their distributors, local regulators, and trusted legal advisors. They’re not sneaking products in through gray channels; they’re getting clarity up front. Because no short-term lift in sales is worth longterm risk. This is one of those moments where due diligence is a competitive advantage.

Still, the potential upside is undeniable. In states where these products are clearly permitted, THC beverages are turning heads for the same reason energy drinks did twenty years ago — they promise something new. They fill a gap that consumers already recognize: the desire for relaxation without alcohol. Gen Z in particular is drinking less, but still seeking social rituals. They’re looking for the feeling of “unwind” without the hangover, calories, or baggage of

booze. THC drinks fit that cultural moment perfectly.

And here’s where c-stores shine. The category depends on discovery. Customers aren’t searching for THC beverages online; they’re finding them by accident, by curiosity, and by impulse. A well-placed can in the cooler can become a conversation starter. Operators who create safe, compliant spaces for trial can become tastemakers in their communities.

they’re finding them by accident, by curiosity, and by impulse”

But there’s a responsibility that comes with that role. Education and clarity matter. These drinks require adult consumers to understand what they’re buying. That means prominent signage, staff awareness, and clear ID protocols. It means training your team to confidently and politely answer basic questions. “Yes, it’s hemp-derived and legal in this state.” “Yes, it contains THC, so you should be 21 or older.” “No, you shouldn’t drink it before driving.” Those small, respectful conversations build trust. They also protect your store’s reputation.

The parallels to craft beer are everywhere. Small producers, creative flavor profiles, local pride, and a consumer base that values experience over intoxication. But unlike alcohol, THC drinks carry the novelty of being new *and* the intrigue of being functional. They promise calm, focus, and light euphoria. Benefits that align more closely with wellness than vice. The overlap is powerful. It’s why national analysts are projecting steady growth for the category even amid regulatory uncertainty. Consumers are curious, and curiosity is a hard force to stop once it starts.

Still, independents have to navigate

this trend carefully. The worst thing you can do is treat THC drinks as a gimmick. They’re not energy shots or viral novelties; they’re lifestyle products. That means placement matters. Don’t bury them in the back or lump them with CBD waters; give them their own small spotlight, ideally near other functional or premium beverages. Subtle framing through quality over curiosity makes all the difference.

There’s also an opportunity to connect these drinks to broader consumer shifts such as alcohol moderation, sober curiosity, and functional relaxation. They show up in everything from kombucha sales to mocktail menus. If your store becomes known as a place where adults can explore those choices comfortably, you’re future-proofing your brand. You’re not just selling THC drinks, you’re positioning yourself as a modern, open-minded retailer who reads the room.

The elephant in the room, of course, is perception. Not every community will

embrace the idea of THC beverages in mainstream retail. Some will see it as controversial or risky. That’s why communication is everything. How you present the product determines how it’s received. Professional packaging, clean signage, and clear compliance protocols go a long way. When it looks and feels legitimate, customers treat it that way.

We’re also starting to see interesting cross-category alignment. Some stores report that customers who buy THC beverages also spend more on snacks, energy drinks, and non-alcoholic alternatives. The same demographic that’s curious about hemp drinks tends to be adventurous overall. They’re the kind of shopper who tries new things, cares about brands, and talks to friends. Capturing that audience means staying ahead of the curve without crossing the line.

It’s worth noting that this category will evolve quickly. Regulatory clarity will improve, new states will open, and formulations will standardize. What feels

experimental now will feel routine in two years. The key for independents is to keep learning. Talk to distributors who understand compliance and read the fine print. The operators who educate themselves early will be the ones who thrive when the dust settles.

The story of THC beverages isn’t really about cannabis; it’s about consumer behavior and about how people adapt their habits as culture shifts. Twenty years ago, no one could have imagined energy drinks replacing coffee for an entire generation. Ten years ago, no one thought seltzers would outsell beer. Today, the next pivot might be THC replacing the casual drink at the end

Stay informed, compliant, and connected to your customers”

of the day. That’s the level of disruption we’re talking about.

For c-stores, this is both a challenge and a gift. You’re the laboratory of American habits. You see trends before anyone else does. You don’t need to jump in blindly, but you should be watching closely, experimenting responsibly, and preparing for the moment when your customers start asking questions.

The trick, as always, is to meet the opportunity with the same care and common sense that built this industry in the first place. Stay informed, compliant, and connected to your customers. The products may be new, but the principle hasn’t changed: give people what they want, the right way, at the right time.

Tight now, what many of them want is a new kind of beverage experience. One that’s lighter, calmer, and a little more modern. The kind that belongs in your cooler, waiting for a curious customer to make the future feel just a little more normal.

Your favorite candy bar reimagined in

KitKat Bar on a Stick: Elevating Snack Growth Iconic Flavor in a Perfect Size, and new Format

KitKat Cones are the #1 Candy Bar IC Cone by $ sales Candy bar in Conv!1 Item Details:

Case GTIN: 10072554965811

Bars do more than 2x the dollars and units than any other format in Convenience1

Incremental item as only ~10% of bar buyers overlap with cone buyers2

The Bar format is up +4.5% YoY in $ sales since 2020 in Convenience1

Delivers on thedelightful crispy and creamy experience of the Kit Katcandy in a frozen dessert bar format!

If you’ve been in this business long enough, you know the front lot tells a story before a customer ever sets foot inside. The hum of the pumps, the glow of the canopy lights, and the rhythm of cars pulling in and out are the heartbeat of a convenience store. For decades, that space outside the doors has been the functional part of the business, the place that generates volume and traffic, while the inside drives margin. But lately, something’s changing. The forecourt itself is evolving. It’s not just where customers fuel up anymore; it’s becoming a platform that can deliver more revenue streams, more engagement, and more reasons for people to stop by.

We all know the headlines. Electric vehicles are coming. Car washes have gone digital. Loyalty programs are linking pumps to apps. But the real story isn’t about chargers or wash cycles, it’s about imagination. It’s about independents realizing that the forecourt doesn’t have to be a passive space. It can be active, profitable, and

personal. It can become an extension of the store’s identity, not just its utility.

It’s almost funny how much potential has been sitting in plain sight. Those few minutes at the pump are full of possibilities. For years, big chains have been trying to monetize that time with screens, ads, or push notifications. But independents are increasingly taking a more human approach. They’re asking a different question: what does my community actually need while they’re here?

In some markets, that’s meant adding parcel lockers like those from Amazon, UPS, FedEx, or even local co-op versions, helping rural customers pick up online orders without driving 20 miles into town. In others, it’s meant self-service ice kiosks, propane exchanges, air-and-vac combos, or small vending setups that run 24 hours even when the store is closed. These are simple, unglamorous amenities, but they all do the same thing: give customers another reason to visit and quietly build loyalty by solving small everyday problems.

Of course, EV charging is part of this story, but not the whole story. The conversation around electric infrastructure often feels binary — either you’re all in, or you’re left behind. But

for independents, the reality is more nuanced. Installing chargers can be expensive and logistically challenging, and in many markets, utilization rates remain low. The smarter approach some operators are taking is to think hybrid: one or two chargers paired

with new forecourt services that appeal to *all* drivers. The charger becomes a magnet, not a silo.

A store owner doesn’t view his new EV charger as an energy play; he views it as an attention play. “It’s a billboard that works,” he said. “It tells the community I’m modern, I’m thinking ahead.” He paired the charger with an outdoor seating area and a small coffee window. Now, while drivers wait the fifteen or twenty minutes to top off, they buy snacks, order food, and linger. What could have been dead time has turned into dwell time, and dwell time is profitable.

That’s the philosophy behind every successful forecourt reinvention: meet the customer where they are, and give them one more reason to stay a few minutes longer.

Some of the most creative ideas aren’t high-tech. A store in Tennessee adds a small farmers’ market stand every Saturday morning. Local growers rent the space for a minimal fee, and the store benefits from the crowd it draws. Another operator in Wisconsin

uses the lot for seasonal pop-ups, such as a food truck in summer, a Christmas-tree stand in December, and a charity car wash in spring. These things don’t require permanent infrastructure, and they all create life and movement around the store. That motion signals relevance. It tells drivers passing by that this place is active and that something’s always happening here.

That’s what matters now, because the biggest challenge facing c-stores isn’t competition from other stations, it’s invisibility. Drivers are on autopi38C-STORE CONNECT MAGAZINE

lot. They use navigation apps that tell them where to stop based on price and proximity. If your site doesn’t look alive, it doesn’t even register. A vibrant forecourt breaks through that autopilot. It creates curiosity, and curiosity is the first step toward a stop.

There’s also an operational logic to diversifying the forecourt. Fuel sales fluctuate with market conditions, but services like air, ice, propane, and lockers are remarkably stable. They may not make headlines, but they build consistency. They generate reliable micro-revenues that keep the busi-

ness afloat when fuel margins tighten. A few dollars here, a few dollars there, multiplied across hundreds of transactions a week, becomes meaningful.

What’s encouraging is how flexible the new generation of service vendors has become. Ten years ago, adding a kiosk or locker meant complex contracts and long-term commitments. Today, many companies operate on revenue-share models or monthto-month agreements. They handle maintenance and connectivity. That dramatically lowers the barrier for independents. You can test ideas without betting the farm.

And it’s not just about products; it’s about perception. Customers interpret the presence of modern amenities as a sign that the store is forward-thinking. They associate that feeling with trust. It’s subtle but powerful. When a customer feels like your lot is well kept and up to date, they assume the same about everything else you offer. Technology might draw them in, but care keeps them there.

Another overlooked frontier in the forecourt is convenience for non-fuel trips. Delivery drivers, ride-share workers, and service vehicles make up a growing portion of daily traffic. These customers often aren’t there for gas; they’re there for restrooms, wi-fi, quick meals, or a safe place to pause between gigs. Some forward-looking operators are designing mini-zones in their lots for these mobile professionals — shade canopies, trash bins, and reserved parking where they can rest

for ten minutes without feeling like they’re in the way. It’s a small gesture, but it builds goodwill with an audience that spends all day behind the wheel.

The connective tissue in all of this is experience. The modern forecourt isn’t just about services; it’s about how those services make people feel. When a customer pulls in and finds clean lighting, easy signage, and thoughtful amenities, they start to feel that your brand respects their time. That feeling becomes loyalty before they’ve even stepped inside. You don’t have to bombard them with marketing to earn it; you just have to make their brief stop a little smoother.

We often talk about the “store of the future” as if it’s some distant thing. But in reality, the future is already here; it just looks different in every community. In some towns, the next step might be digital air pumps that accept mobile payment. In others, it might be EV chargers, or click-andcollect lockers, or a small outdoor café. What matters isn’t the gadget itself; it’s the mindset. The operators who see their forecourt as living space, not static infrastructure, are the ones writing the next chapter of this industry.

Even the way stores handle cleanliness and lighting is evolving. LED upgrades, smart sensors, and motion-controlled fixtures not only save energy but also transform the site’s feel. A bright, consistent canopy light says “safe.” A dim one says “tired.” Customers notice the difference in-

stantly. The technology pays for itself in perception long before it pays for itself in electricity savings.

And as EV adoption slowly rises, that perception will become increasingly important. Drivers will begin choosing charging stops not just based on location or speed, but also on comfort. They’ll ask themselves, *Do I want to spend twenty minutes here?*

Independents can shine by creating spaces that feel welcoming rather than transactional. A little landscaping, a few benches, a sense of pride. Those things turn a utilitarian stop into a pleasant break, and that’s where

loyalty is born.

The opportunity is hiding in plain sight: using your forecourt to express your brand’s personality. For some, that might mean high-tech and futuristic. For others, it might mean neighborly and familiar. The point is that it’s *yours.* Customers remember the details. They remember the place that had clean air pumps, or that sold ice at midnight, or that supported the local high school. Those impressions build the kind of loyalty no discount can buy.

ue to expand. It will include everything from digital loyalty touchpoints to physical amenities and community events. The spaces outside your doors will become as critical to the customer journey as the shelves inside. The stores that thrive will be the ones that see the lot not as asphalt, but as opportunity.

So take a walk across your forecourt sometime soon. Look at it with fresh eyes. Ask yourself what stories it tells. Does it say “old gas station,” or does it say “modern hub of the neighborhood”? Does it invite people to linger, to engage, to feel safe? Those impressions happen instantly, and they’re what separate the stores people use out of necessity from the ones they choose out of preference.

The beauty of this business is that reinvention doesn’t require perfection. It requires effort. Every new service, every brighter light, every creative idea layered onto that lot is another signal to the community that you’re evolving with them. That’s what Forecourt 2.0 really means — not technology for technology’s sake, but progress with purpose.

As we head toward 2026, the definition of “forecourt services” will contin-

Because at the end of the day, the forecourt has always been the front porch of convenience retail. It’s where first impressions are made, where relationships begin, and where the hum of everyday life plays out one tank, one charge, one coffee at a time. The future isn’t going to replace that; it’s just going to make it richer, smarter, and a little more human.

Technology always sounds exciting when you’re reading about it. It promises transformation, disruption, efficiency, and sometimes even new revenue streams. All the buzzwords that fill trade-show banners and press releases. But anyone who runs a convenience store knows that technology only matters if it actually makes your day easier. It’s one thing to hear about AI, self-checkout, or connected forecourts in theory; it’s another thing entirely to figure out what’s worth your money, what’s worth your time, and what will genuinely move the needle for your business.

That’s the part of the conversation that matters most. After years of hype cycles — apps that nobody used, gadgets that broke before the warranty ran out, and platforms that promised insights but delivered headaches — the industry seems to be entering a new, more grounded phase of technology adoption. Call it the “real results” era. The tools that are sticking aren’t the flashy ones; they’re the quiet ones. The ones that solve problems so simply you barely notice how transformative they are until you realize your stress level dropped and your margins improved.

Spend enough time talking to independent operators, and you start to hear a similar theme: nobody’s afraid of technology anymore, they’re just tired of wasting time on the wrong kind. That’s progress in itself. Ten years ago, tech in small retail was still seen as optional, often reserved for the big players. Now,

it’s part of the conversation every operator is having, even if the budgets and timelines look different. The question isn’t whether you’ll adopt it, but *which* versions will make sense for you.

The answer, more often than not, begins with the basics. Data used to be something you needed a consultant to interpret. Now, it’s built into the POS. You can see hourly sales, top items, low inventory, and category velocity without ever logging into a separate dashboard. The smart operators are using that visibility not just to react, but to plan. They know that their highest-margin snack might not be the top seller, but if they pair it with a beverage discount, both move faster. They’re treating data as an everyday decision tool, not a quarterly report. The mindset shift is from reactive to proactive and is probably the biggest upgrade of all.

Artificial intelligence gets all the buzz, but in reality, most of the AI relevant to c-stores isn’t about robots, chatbots, or anything futuristic. It’s about prediction. It’s the quiet intelligence that helps you

reorder smarter, staff smarter, and market smarter. Some back-office systems now use AI to flag anomalies, such as items selling slower than expected or patterns that might indicate theft or waste. Others help forecast busy periods based on weather or local events. You don’t have to understand how the algorithm works to appreciate the result: fewer surprises, smoother operations, and better profit control.

Operators are tired of constantly fighting fires. They want to know that the systems behind the counter have their back, catching things they might miss. And when technology becomes a partner instead of a burden, it changes the whole rhythm of the business.

the industry seems to be entering a new, more grounded phase”

Self-checkout is another example of that evolution. When it first started popping up in c-stores, the reactions were mixed. Some operators worried it would feel impersonal. Others feared it would confuse customers or lead to more shrink. But over the past couple of years, those fears have eased as the technology itself has matured. The latest generation of self-checkout systems is faster, friendlier, and far better at catching errors. Customers, especially younger ones, are comfortable using them because they already do it everywhere else.

What’s interesting is that in small stores, self-checkout isn’t replacing staff, it’s empowering them. When it’s done right, it becomes a relief valve during peak hours. The cashier who used to juggle

six impatient customers can now focus on service, food prep, or upselling while the kiosk handles quick purchases. In some stores, operators are reporting that self-checkout isn’t even being used as often as they expected, but just having it available improves the customer’s perception of the store. It signals modernity. It says, “We’re keeping up.”

That perception matters more than most people realize. Customers form opinions about a store’s quality and cleanliness based on cues unrelated to the mop or the counter. They read it from the tech. A working, well-designed self-checkout or contactless payment system tells them the store is run well. A glitchy card reader or outdated pump interface tells them the opposite. The little details of technology have become part of the brand experience, even for independents.

And then there’s the forecourt — the old

frontier that’s suddenly becoming new again. We’ve talked about it from a loyalty perspective, but from a technology standpoint, it’s worth diving deeper. The “smart forecourt” isn’t science fiction anymore. It’s not about replacing pumps with robots or turning the lot into a data lab. It’s about connecting the dots between what happens outside and what happens inside.

Operators are starting to see real results from systems that link fuel sales, payment, and customer behavior in meaningful ways. If a loyalty member fills up three times a week, the system can trigger a targeted coffee coupon or alert the owner that this is a regular worth recognizing. If a customer frequently pays at the pump but never comes inside, it can prompt a nudge: “Your next drink is free — come in and grab it.” Those micro-interactions turn anonymous transactions into relationships, and that’s the magic of tech-

nology when it’s done right. It doesn’t make the experience colder; it makes it warmer.

The key, as always, is simplicity. Technology in this industry has to be invisible. It has to fade into the background. Nobody wants to feel like they’re using a gadget; they just want to feel like the store “gets it.” The best tools make things feel effortless. When systems integrate smoothly, the customer never sees the complexity; they just experience ease. That’s what makes them come back.

For independents, that kind of integration used to be a dream. It required custom setups and consultants. Now, it’s becoming affordable and plug-and-play. Companies that used to serve only large chains are realizing there’s a massive market in the independent space, and they’re building solutions that fit smaller budgets and shorter learning curves. You don’t need a tech degree to install them anymore. You need curiosity and a willingness to test.

And that’s really the thread that connects all of this: curiosity. The operators who are thriving in this new tech landscape aren’t the ones who buy every gadget; they’re the ones who stay curious enough to experiment. They try one thing at a time. They measure it. They tweak it. They don’t chase trends; they chase results. And because they’re smaller and more flexible than national chains, they can pivot quickly. One of the great advantages of independence

is the freedom to test, learn, and adapt.

What’s happening now is that technology is starting to feel human again. It’s no longer something that happens *to* the operator; it’s something that works *with* them. AI isn’t a black box; it’s a helpful suggestion engine. Self-checkout isn’t a robot; it’s a way to buy yourself breathing room during rush hour. Smart forecourts aren’t a gimmick; they’re a way to make sure every customer who stops for fuel feels seen.

Even something as simple as digital signage is being reimagined. Instead of static ads, some operators are using their screens to tell small, rotating stories: local weather updates, staff spotlights, or messages from the owner. It’s a small thing, but it reinforces that sense of connection. In a world full of automation, reminders of humanity stand out. Technology gives you the platform; your voice gives it meaning.

That’s the paradox of the modern c-store: the more digital the world becomes, the more value customers place on authenticity. They still want fast and efficient, but they also want real. They want their local station to feel personal, even if it’s powered by AI in the background. The operators who manage to blend those two, modern systems and human warmth, are setting the new standard for what convenience feels like.

happening behind the scenes. Technology isn’t changing the core of this business; it’s supporting it. It’s freeing operators to focus on what has always mattered most: good food, clean stores, and friendly service. Every upgrade that eliminates friction or saves a few minutes of labor is an invitation to redirect that energy toward connection.

That’s what makes this moment exciting. For the first time in years, the tech conversation in convenience retail feels hopeful instead of overwhelming. It’s not about catching up with the giants; it’s about finding the right mix of tools that make your operation more sustainable and your customers more loyal. It’s about turning data into action without drowning in it. It’s about remembering that convenience isn’t defined by how advanced your systems are, but by how effortless you make life for the person standing at your counter.

So when you think about technology for your store in 2026, don’t start with the gadgets. Start with the problems. What takes too much time? What frustrates your team? What could make your customers’ day just a little smoother? Then look for the simplest solution that fixes it. If it’s powered by AI or automation, great. If it’s just a smarter layout or a better payment terminal, that’s fine too. The goal isn’t to digitize everything; it’s to make the whole experience feel a little more seamless.

That’s what real innovation looks like. Not the flash of a new product demo, but the quiet relief of knowing your business just got a little easier to run, your customers just got a little happier, and your margins just got a little healthier. Technology can do that when it’s chosen with care and used with heart. And that, more than any buzzword, is what moves the needle.

If there’s one theme that ties all of this together, it’s the quiet revolution

Every year, as soon as the first chill hits the air, the same question echoes through the industry: how much should I do for the holidays? It’s a fair question, especially for independent operators who don’t have corporate marketing teams or national promo calendars to lean on. You want to capture the holiday spirit, and the revenue that comes with it, without exhausting your team or breaking the bank. You want your store to feel festive without feeling forced. You want to catch the extra foot traffic that December brings, but you also want to stay grounded in what you do best: convenience.

The balance of staying seasonal without going overboard is the real art of holiday readiness in the c-store world. Because for most independents, the holidays aren’t about massive displays or deep discounts. They’re about moments. They’re about being in the right place at the right time, with the right offer, for people who are busier, more distracted, and more emotionally charged than they are any other time of year.

If you’ve ever stood behind the counter in December, you know exactly what I mean. The mood shifts. People are in a hurry, juggling work, family, and travel. They’re stressed but sentimental. They’re trying to do everything at once, and that’s where your store quietly steps in. You’re the stop that saves them five minutes, the cup of coffee that warms them up between errands, the place they can count on when everything else feels too complicated. That’s what makes this season so full of potential because you can remind customers why they already rely on you.

Let’s be honest: you don’t need a giant inflatable Santa or a corporate holiday playlist to make an impact. What you need is thoughtfulness. A little extra care in the details. A cleaner entrance. A brighter forecourt. A few small touches that tell customers, “We’re in the season too, and we’re glad you’re here.” The best holiday strategy for independents starts with empathy, not inventory.

Think about what your customers’ days actually look like in December. They’re on the move, crisscrossing town for shopping, school events, and family gatherings. They’re driving more, eating on the go more, and thinking about gifts, weather, and deadlines all at once. Your job is to make those moments easier. A simple cup of cocoa on special, a “buy one, gift one” on coffee cards, or a friendly “Stay warm out there” at checkout are the touches that stick.

It’s funny how often people underestimate the emotional side of this business. The holidays amplify that side tenfold. A convenience store is one of the few places open when everything else closes, and that reliability means something. You’re there for travelers trying to make it

home, for last-minute shoppers grabbing wrapping paper, for parents who just need five quiet minutes in the car with a hot drink. You’re part of the background of the season, and if you lean into that, it becomes powerful.

Some of the most successful operators approach the holidays less like a sales event and more like an act of hospitality. They don’t overhaul their stores; they fine-tune them. They make sure the coffee is extra fresh. They add a few comfort-food items to the hot case: chili, soup, and warm breakfast sandwiches. They check that every outdoor light works because visibility and safety matter more in the darker months. They make sure winter necessities are stocked and easy to grab. In other words, they

double down on being useful. Usefulness is the holiday advantage that convenience stores have always had over other retailers.

That doesn’t mean you can’t have fun with it. The best seasonal promotions feel spontaneous and human. A stack of locally made holiday treats by the register.

past bigger stations and stop at yours instead.

Holiday traffic patterns are different. Morning coffee rushes might come later because of school breaks. Afternoon snack runs might pick up earlier. Latenight activity often spikes as travelers hit the road after work and delivery drivers

A raffle for free coffee for a month. A “12 Days of Deals” board handwritten with chalk. These things work because they feel real, not programmed. Customers can tell when something comes from the owner’s sense of community rather than a national directive.

Another reason this season matters so much is that it’s the time when community bonds show up in ways that can’t be faked. Whether you sponsor a local food drive, hang kids’ artwork on the window, or donate a few cases of water to a charity event, it all tells a story. It says, “We’re part of this place.” Customers notice and remember. It gives them a reason to drive

it’s the time

work extra hours. If you adjust staffing or scheduling even slightly to reflect that rhythm, you’ll feel it in your bottom line. The goal is to stay flexible and ready for rushes without being overstaffed when things slow down.

what people crave. They want warmth, comfort, and substance. This is when soup programs shine, when chili and mac-and-cheese cups move fast, when breakfast sandwiches become an all-day item. If you’ve got a deli or kitchen, this is the season to let it show off. And even if you don’t, you can still lean into the theme with packaged comfort like hot pretzels, seasonal bakery items, or premium coffee blends that smell like nostalgia.

Then there’s gift-giving, the secret gold mine of holiday convenience retail. Every December, there’s a rush of people who realize they forgot something or someone. That’s where you come in.

Gift cards, small local products, or even simple “grab-and-go gift” displays can make a real impact. You’re not competing with big-box stores; you’re solving a problem they can’t. You’re the safety net for forgetfulness, and that’s a profitable niche to own.

Some operators worry that it’s too late in the year to make changes. But the truth is, holiday readiness doesn’t require a six-month plan. It requires a few focused days of attention. Walk your store and your lot the way a customer would. Does it feel bright? Organized? Inviting? Are the impulse sections ready for heavier traffic? Are your shelves clean and full? The little details in the smell of fresh coffee, the gleam of clean glass, and the greeting at the door matter more than any themed display.

Foodservice deserves a special look this time of year, too. Cold weather changes

People crave connection during the holidays, even in small ways. They’re looking for warmth, sincerity, and places that re-

mind them of what community feels like. When your store gives them even a flicker of that, it stands out from everything else in their week.

The other side of holiday readiness is the team. Your staff feels the same seasonal stress your customers do — long hours, cold mornings, unpredictable traffic. The best thing you can do for your store’s atmosphere is take care of your people. Bring in coffee or snacks during shifts. Say thank you more than usual. Make schedules early and stick to them when you can. A happy team radiates calm and kindness, and customers can feel it.

From a numbers standpoint, November through January can be the most profitable stretch of the year if you handle it right. Fuel volumes might dip with the weather, but inside sales make up the difference, especially in coffee, foodservice, and seasonal impulse. The trick is not to chase big promotions, but to amplify the small, reliable ones. The items that always move will move faster if you give them a subtle seasonal frame. A cup sleeve that says “Warm up with us.” A combo called “Holiday Fuel-Up.” Little language shifts like that can make ordinary items feel timely.

The temptation is to think holiday readiness means a full transformation. But in truth, it’s about amplification and turning up the qualities that already make your store special. If your coffee is your crown jewel, lean into that. If your team is known for friendliness, let that shine even brighter. If you’re the late-night stop in your area, own that identity. Customers

are drawn to authenticity, especially in a season when every brand is trying to sound cheerful.

As you plan for the last stretch of the year, think of your store as part of your community’s rhythm. You’re the place people pass between destinations, but also the place they rely on when they’re

chase trends or copy big chains. Fresh coffee, bright lights, kind words, clean counters, and maybe a touch of tinsel if you’re feeling festive. That’s all it takes to make a difference.

You don’t need to chase trends

tired, cold, or behind schedule. You’re the hot chocolate on the way home from the Christmas concert, the stop for batteries on Christmas Eve, the quiet corner where someone refuels between visits to family. The holidays don’t change your role; they just magnify it.

So don’t overthink it. You don’t need to