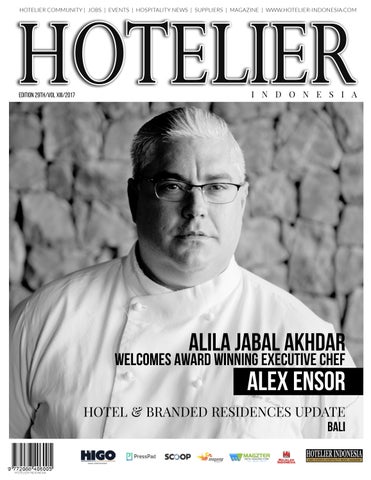

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com HOTELIER INDONESIA HOTELIER INDONESIA HOTELIER COMMUNITY | JOBS | EVENTS | HOSPITALITY NEWS | SUPPLIERS | MAGAZINE | WWW.HOTELIER-INDONESIA.COM EDITION 29TH/VOL XIII/2017 ALILA JABAL AKHDAR WELCOMES AWARD WINNING EXECUTIVE CHEF ALEX ENSOR HOTEL & BRANDED RESIDENCES UPDATE BALI

@higoapps : Scan Here Hotelier Indonesia magazine is now available on HIGO © PT. HIGO FITUR INDONESIA IMAGINE if you can without flipping around magazine r e a d #TilesPage

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 4 FEATURES 06 Business Technology Platform Rachel Grier explain it all here 08 The Executive Chef Alex Ensor Award Winning Executive Chef 10 A Small Soap For A Big Hope Anantara Uluwatu Bali BUSINESS 14 Come Smell The Omani Roses a truly spectacular sight 16 5 Ways Cater the Fitness a fitness centre for your property 18 Meliá Bangkok open in 2022 Meliá partnered with TCC Group 21 Travellers’ Choice Awards Mandarin Oriental, Tokyo Wins 24 Hard Rock Hotel Shenzhen Open First Property In Summer 2017 TECHNOLOGY 25 Automation & The Hospitality The end of the accountant? 26 nSight for IDeaS™ Drive More Profitable Bookings 67 Travelico™ Socially Conscious Alternative EVENTS 30 Sparkling & Colourful Night Annual Corporate Gathering 70 Food & hotel indonesia 2017 (Show Preview) PROMO 86 Wedding Celebration Package Intercontinental Resort Bali HOT | CONTENTS 08 14 26 34 86 30

FROM THE EDITOR

Quantity over quality: be careful what you wish for... BALI HOTEL & BRANDED RESIDENCES UPDATE is the Main Report for this edition. Created collaboration between Horwath htl and C9 Hotelworks Company Ltd. A must Read Report to rich your knowledge and prepare the stra tegic plan ahead. Start to read now here

New Booking Platform is just launch this week. Traveliko is the name. It is specifically designed to promote fair, ethical, value-added travel while helping make the world a better place. Get to know the more here

And of course many great news as always ... see you for more soon..

EDITOR-IN-CHIEF

Hery Sudrajat Advertising +62.812.1978.1196 sales@hotelier-indonesia.com

PUBLISHER

Hoticom Media International JOBS | EVENTS | HOSPITALITY NEWS | MAGAZINE www.hotelier-indonesia.com

Editorial Disclaimer

Editor In Chief | Founder Hery Sudrajat

Editor In Chief | Founder Hery Sudrajat

Hotelier Indonesia News www.hotelier-indonesia.com

Hotelier Indonesia Jobs www. jobs.hotelier-indonesia.com

Hotelier Indonesia Events www. events.hotelier-indonesia.com

Hotelier Indonesia Tabloid www. tabloid.hotelier-indonesia.com

Hotelier Indonesia (No ISSN:2088-4060) and Hotelier-Indonesia.com consider its sources reliable and verifies as much data as possible. However, reporting inaccuracies can occur, consequently readers using this information do so at their own risk.Hotelier Indonesia Magazine and Website are sold with the understanding that the publisher is not rendering legal or financial advice.

Although persons and companies mentioned herein are believed to be reputable, neither Hotelier Indonesia, nor any of its employees, sales executives or contributors accept any responsibility whatsoever for such persons’ and companies’ activities. No part of this publication and/or website may be reproduced, stored in a retrieval system or transmitted in any form without prior written permission of the Publisher. Permission is only deemed valid if approval is in writing.

Contact : info@hotelier-indonesia.com

Hotelier Indonesia Golf www. travelblog.hotelier-indonesia.com

Hotelier Indonesia TravelStore www. promo.hotelier-indonesia.com

Hotelier Indonesia Hotel Deals www. deals.hotelier-indonesia.com

Hotelier Indonesia Suppliers www. hotelier-indonesia.com /p/suppliers

Hotelier Indonesia Spa www.spa.hotelier-indonesia.com

www.hotelier-indonesia.com

5

HOTELIER INDONESIA | 29th | Vol 13 | 2017 |

HOTELIER INDONESIA 29th | Vol 13 2017 www.hotelier-indonesia.com 1 HOTELIER INDONESIA HOTELIER COMMUNITY JOBS | EVENTS HOSPITALITY NEWS SUPPLIERS MAGAZINE WWW.HOTELIER-INDONESIA.COM EDITION 29TH/VOL XIII/2017

ALILA JABAL AKHDAR

WELCOMES AWARD WINNING EXECUTIVE CHEF

ALEX ENSOR HOTEL

&

BRANDED RESIDENCES UPDATE BALI

Written by: Rachel Grier, Asia-Pacific managing director, IDeaS Revenue Solutions

Revenue management systems are used by leading hotel brands around the world. However, it can be argued that smaller and independent properties in Indonesia need the technology even more than larger hotels given that limited room volumes mean every pricing decision counts. With the right investment in processes, technology and staff, it’s possible for small scale independent hoteliers to not just survive, but thrive in today’s competitive hotel environment.

It goes without saying that independent hoteliers in Indonesia and across the APAC region often find themselves in challenging situations: they often don’t have the resources to compete with the large global hotel chains in terms of marketing budgets and investment in third party booking channels, or have the well-recognised brand name that goes handin-hand with these activities. Smaller, independent hotels frequently have fewer resources compared to larger chain hotels, and often do not have a dedicated revenue manager.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 6

HOW SMALL THINKING CAN LIMIT AN INDEPENDENT HOTEL REVENUE MANAGEMENT SYSTEMS ARE BEST VIEWED AS AN INVESTMENT IN AN ESSENTIAL BUSINESS TECHNOLOGY PLATFORM

the right investment in processes, technology and staff, it’s possible for small scale independent hoteliers to

environment HOT | SOLUTIONS

With

not just survive, but thrive in today’s competitive hotel

This means that the revenue strategy is left up to the general manager, director of sales and marketing, reservations manag er, or even the accountant– all of whom already have very busy schedules filled with other responsibilities. This lack of a dedicated resource and isolated operat ing systems mean that rooms are often either overpriced or under-priced, which ultimately turns guests away or secures guests at a lower-then-ideal booking rate for the hotel.

Every room counts in smaller scale inde pendent hotels, which means that pric ing rooms incorrectly has a much more noticeable impact on the property’s over all revenue performance. If there is a pricing error at a larger hotel, it’s easier to “bury” the rate mistake or absorb any short-term revenue loss due to a greater volume of rooms and bookings.

Similar to larger hotels, small, indepen dent properties are constantly generating data – such as that used in developing demand forecasts. Hotel data comes from a multitude of sources, changes rapidly, and is critical to making proper pricing decisions. A good forecast as part of an ongoing revenue management program can assist room rate decision making, staff allocation, property maintenance and a range of critical hotel operations. Using data and analytics from an accu rate forecast is the best way to determine marketing and pricing strategies for the future.

Data should be detailed and be both his torical and forward-looking. Historically, the data should include (at least) the number of occupied rooms, coupled with revenue by market segment per day.

Also, hoteliers need to ensure they include the number of rooms and reve nue on the books by day (and by market segment) for at least the next 90 days. If data is collected every day it will allow the hotel to establish simple booking pace forecasts by segment and day of week, from which they will be able to compare it to historical data. If done consistently, this will allow hoteliers to quickly make any changes when demand picks up and tweak their strategies and decisions accordingly.

One of the biggest challenges with man ual revenue management practices is the inability to collect quality data in a timely manner, while being able to use it before it is obsolete. Put simply, without automation, it is difficult to compile and analyse all this continuous information accurately and effectively. Global hotel brands equip their properties with rev enue management technology for this reason. Automated revenue systems and technologies allow revenue managers to move beyond data collection to focus on revenue strategy, leveraging every oppor tunity in good times or working with the sales and marketing teams to stimulate demand and lock in business for any soft ening in market conditions.

Hotels with a revenue management system simply have better aggregation of data, leading to better insights and more granular forecasts earlier on, which ultimately delivers better performance.

Importantly, a revenue management system can also help independent Indonesian hoteliers balance the right business mix and address length of stay issues. Many independent hotels fall into the trap of focusing on peak nights and often accept lower-rated business when it isn’t needed, which simply trades down rev enue. With fewer rooms in smaller scale inde pendent hotels, managing booking pace and capturing optimal reservations by accepting the most valuable demand across arrival dates and lengths of stay is critical to maximising revenues.

So, as an independent hotelier, how do you compete with “the big boys”? How can you gain access to the same set of tools and insights so that you can provide the maximum return to your asset owner in good or challenging times?

It’s simple: get a revenue management system and even the playing field. Time is today’s most valuable currency, and if you are paying a tal ented revenue manager to compile data into endless spreadsheets and siloed reports, frankly you are wasting your money.

Revenue management systems are best viewed as an investment in an essential business technology platform or tool for your business, rather than a “nice to have” expense. The insights, efficiencies and operational benefits are significant, driving measurable performance as well as profitability. Hotels of all types typi cally experience 3 to 8 percent uplift in RevPAR when they move to an automated revenue management system, and in IDeaS’ experience, investment in a revenue management system generally pays back within a four month win dow, delivering both tangible and intangible benefits to the independent hotelier.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 7

Automated revenue systems and technologies allow revenue managers to move beyond data collection to focus on revenue strategy,”

“I am thoroughly excited to be starting at Alila Jabal Akhdar Oman. It’s an amazing oppor tunity to be working on top of the world! I look forward to creating new menus with the fresh, local mountain produce, to further elevate the culinary experience which Alila Jabal Akhdar has become famous for”

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 8

HOT | TEAM

AWARD WINNING EXECUTIVE CHEF ALEX ENSOR A

LILA JABAL AKHDAR WELCOMES AWARD WINNING EXECUTIVE CHEF ALEX ENSOR

Alila Jabal Akhdar is thrilled to welcome the arrival of star-studded Chef, Alex Ensor, who will be bringing his culinary skills to the kitchen in Juniper restaurant as their new Executive Chef. With over 20 years experience in many reputable establishments across the southern hemisphere in Australia, New Zealand and Jakarta, Chef Alex has made a name for himself in the culinary world with his success and winning an exten sive list of awards.

Coming into Alila Jabal Akhdar right after his 2-year tenure at Alila Jakarta, Chef Alex started out his career back in 1997 in New Zealand, his home country, working at the Huka Lodge in Taupo and has since travelled and worked through Australia and Jakarta. He continued to build his career at award-winning restau rants such as Sydney’s Level 41 (winner of 21 Best Restaurant Awards), Guillaume @ Bennelong (winner of three hats SMH 3 stars in Gourmet Traveler), Jakarta’s SHY fine-dining restaurant, Buddha Bar and wowed the well-heeled at Alila Jakarta.

Having worked alongside master chefs, Guillaume Brahimi and Dietmar Sawyere, Chef Alex took his heightened skills and went on to receive his first Hat Award and feature in Australian Gourmet Pages. Chef Alex has over the years maintained his image in the public eye by doing various guest chef dinners around the world and receiving coverage in food magazines and press reviews as well as some TV shows!

“I am thoroughly excited to be starting at Alila Jabal Akhdar Oman. It’s an amazing opportunity to be working on top of the world! I look forward to creating new menus with the fresh, local mountain produce, to further elevate the culinary experience which Alila Jabal Akhdar has become famous for” commented Chef Alex Ensor. “I am proud to be on the Alila team and I am eager to showcase the artisanship which brand Alila is known for in Oman and the rest of the world.”

For reservations, email: jabalakhdar@alilahotels.com OR call: +968 2534 4200 / +968 99104204 www.discoveryloyalty.com

ALILA JABAL AKHDAR IS THRILLED TO WELCOME

THE ARRIVAL OF STAR-STUDDED CHEF, ALEX ENSOR

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 9

“I am proud to be on the Alila team and I am eager to showcase the artisanship which brand Alila is known for in Oman and the rest of the world.”

ALILA JABAL AKHDAR WELCOMES

The Peliatan Ballroom, with its 162 sq m of flexible function space, and a ceiling height of 4 m, can be divided into two separate sound-proofed func tion areas each with its own entry door.

Each area can seat 100 people, banquet style, and 150 people, theater style. When combined, the ballroom can accomodate 210 people seated banquet style and 300 people theater style, the largest in Ubud. Whereas the Sukma Boardroom provides exclusive meeting space for up to 14 people.

The spacious pre-function area is ideal for coffee breaks, pre-dinner cock tails or product displays. All function spaces are equipped with modern audio visual equipment and high speed WiFi and internet access.

Who says meeting food has to be boring? Sens offer an inspired array of menu selections that are sure to impress, featuring regional and internation al specialties, and can custom tailor menus for you.

Sens team can also help you plan unique and unforgettable events, whether you’d like to transform a ballroom into a rainforest or set up a locally-in spired Amazing Race around Ubud.

We take just as much pride in our accommodations. Comfortable and con temporary, rooms come with thoughtful touches like universal power points, 24 hour room service, free and fast WiFi and a host of complimentary amenities so you can be at your best. And of course, SenS Spa is perfect for unwinding during breaks.

P.O. Box 2828 , 80571 Ubud - Bali Phone

+62

849 3328 Fax

3327 reservations.ubud@senshotelsresorts.com

Jl. Sukma, Banjar Tebesaya Desa Peliatan,

:

361

: +62 361 849

A SMALL SOAP FOR A BIG HOPE

ANANTARA ULUWATU BALI RESORT

Every year in Bali 75 tons of soap are thrown away in hotels and villas which have only been used once or twice by guests and the numbers are growing while many people across the island have no access to basic hygiene products.

The team was moved by their programme “Soap For Hope” and acted immediately. Soap for Hope is actually the brainchild of Sealed Air Corp, a cleaning and sanitation solutions provider, and it aims to recycle lightly used hotel guest soap and distribute it to underprivileged families and communities in Asia, the Middle East and Africa.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 12

nantara Uluwatu Bali Resort is pleased to announce a collaboration with ROLE Foundation, a foundation that concentrate on stopping land-based waste from getting into the oceans and creating sustainable jobs to protect the livelihoods of coastal communities.

HOT | NEWS

A

The project was first launched in 2003 in the UAE in collaboration with couple of hotels, and today it operates with over 50 hotels in 10 countries to divert soap from landfills and donate recycled soap to those who need it most. When the soap arrive at the reprocessing center, the used hospitality soap is broken down, sanitized and reconstructed incorporating a range of organic fragrances such as lemongrass and jasmine. They then distribute the finished product to orphanages, the elderly and disadvantaged people in Bali for free and sell some of the soap in the founda tion shop.

“This is a very good program for us to join as we can help the local community. Children are getting sick because of poor hygiene resulting from a lack of access to soap and we used to throw away so much of it every day.

During the month of November and December we manage to deliver 25 kg of soap. Such actions are important and have a great impact on our team members as well as this program shines light on clever and useful recycling.

Bali relise heavily on tourism as source of income, so it is in the interest of local people to improve and preserve cleanliness throughout the island an it’s beaches,” explained Dimi tri Delepierre, Executive Assistant Manager of Anantara Uluwatu Bali Resort.

The results are less solid waste, new skill sets and means of livelihood for local people and better sanitation in villages.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 13

This is a very good program for us to join as we can help the local community. Children are getting sick because of poor hygiene resulting from a lack of access to soap and we used to throw away so much of it every day.

COME SMELL THE OMANI ROSES

February 2017 - This year, guests at Alila Jabal Akhdar, will be able to celebrate the rose harvest in Oman with a rose-inspired experience. Every year, from the end of March until midMay, the rugged, rocky mountain landscape of Jabal Akhdar - the Green Mountain in Arabic - is transformed into a spec tacular shade of pink. Lying in prize position, overlooking the 7,000 Damask roses cov ering the mountain range, is Alila Jabal Akhdar, which sits 2,500 meters above sea-level and enjoys stunning views over the Al Hajar mountain range.

Throughout the rose season, guests can book a special twonight Rose Experience. It offers guests the chance to get up close and personal with a guided tour through the Jabal Akhdar rose terraces – a truly spectacular sight – and enjoy a soothing rose petal bath with a glass of chilled sparkling rose wine upon their return to the resort. Finally, indulge in a specially concocted Spa Alila Roses treatment, which benefits from the medicinal properties of a naturally infused rose petal oil.

Alila Jabal Akhdar is a design-forward hotel with 86 beautiful rooms and suites, seamlessly blending an eco-design of local stone with traditional Omani architecture and stunning sur roundings. Vintage trunks decorate the rooms and the lobby is filled with abstract patterns of roses in a nod to the local perfume production. Spa Alila is filled with an aroma that is reminiscent of an old Oman, a mist of oils grounded in frankincense and juniper berry. There are seven treatment rooms, a Vichy show er room, Jacuzzis and an array of Asianinspired treatments and excellent massag es. On arrival guests are greeted with a refreshing rosewater & elderflower spritzer. The hotel also offers a wealth of other experiences including the brand new Via Ferrata experiences, a protected climbing route built to international standards. With two different routes at Level 2 and Level 5 and lead by expert Omani guides, it is a perfect adventure for thrill seekers of all levels.

The two-night ROSES Experience starts from USD1,109 per cou ple based on two sharing with daily dinner, bed and breakfast.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 14

CELEBRATE THE 2017 ROSE HARVEST AT ALILA JABAL AKHDAR

HOT | DEALS

It offers guests the chance to get up close and personal with a guided tour through the Jabal Akhdar rose terraces – a truly spectacular sight.

DISCOVERY PROGRAMME

It also includes the guided tour of the Rose terraces, rose petal bath and bubbles and a Spa Alila signature Rose treatment per person. It is valid for stays from 15 March –13 May 2017 (Rose Season). For further information visit www.alilahotels.com/jabalakhdar

About DISCOVERY programme

A memorable trip demands more than a comfortable stay. DISCOVERY, an award-winning global loyalty programme, provides nearly 10 million members recognition and perks across 550 hotels, resorts, and palaces in 76 countries. Elite members have the opportunity to immerse themselves in local culture through Local Experiences, distinctive activities that capture an authentic taste of each destina tion. For more information visit www.discoveryloyalty.com

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 15

Five Ways Property Managers Can Cater to the Fitness-Minded Traveller

Although adding a fitness centre to your hospitality property might fall under the category of “nice to have”, fitness spaces and offerings are becoming the industry standard. As an example, 84 percent of American hotels had a fitness centre in 2014. In addition, 53 percent of travellers always or often exercise when they’re on the road –

That’s a large chunk of business you could be missing out on if you don’t have a gym or fitness facility. Having a fitness offering on your property can make the difference between a guest choosing your property or picking a competitor’s.

However, a staggering 55 percent of business travellers have walked out of a hotel gym due to facilities that did not meet their expectations, highlighting the importance of having a good fitness offering. To ensure that your guests remain satisfied customers, it’s important to invest in one that meets guests’ needs.

Here are a few easy-to-implement tips for budgets of any size that will help you attract fitness-minded travelers and keep them coming back to your hotel time and again.

BEYOND THE

CENTRE FITNESS AS A WHOLE-BODY AFFAIR INVEST IN THE FUNDAMENTALS

If in doubt, ask! If you are thinking about adding a fitness facility to your property, take some time to do some research as part of the planning process. Go and visit gyms near your property – what do they offer, and what could you replicate in your facility? See if you can do a casual workout session to truly measure the experience. Secondly, survey your guests and ask them what they’d like from an onsite gym, and critically, if they would use it. When it comes time to launch it, demonstrating that you listened to what your guests asked for will be worth its weight in customer service gold.

1.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 16

IF

NO PROBLEM

IN DOUBT, ASK! NO FITNESS ROOM?

GOES

FITNESS

HOT | TALKS

Remember That Fitness Goes Beyond the Fitness Centre.

Maintaining a healthy lifestyle goes beyond the fitness room. In order to keep fit travellers loyal to your establishment, you should make it easier for travellers to maintain both their fitness levels and their diets. Make sure that your property’s dining options (both in-room, at the breakfast bar, and in the hotel restau rant) have healthy offerings so that fit travellers can keep up with healthy eating.

Think of Fitness as a Whole-Body Affair

Although most people associate fitness with running or lifting weights, health-minded travelers make whole-body health a priority. You can take advantage of this mindset by adding valuable services like spa experi ences, private training sessions, and group classes to your fitness offerings. In some instances, it might even make sense to create a wellness-weekend package that offers your guests personal train ing, fitness classes, and a spa session. By offering these services alongside your regular fitness amenity, you have the opportunity to enhance your guests’ stay experience and increase your bottom line.

Invest in the Fundamentals

While it might seem like a great idea to invest in the trendiest equipment, it’s best to stick to tried-and-true gym equipment like dumbbells, treadmills, ellipticals, and station ary bicycles.

Most exercisers are already familiar with these pieces of equipment, so it makes it easier for them to recreate their regular workout on the road. More importantly, when you decide to invest in equipment, try to buy commercial-grade pieces with a service plan whenever possible. Even though it might cost more money up front, investing in high-quality equipment will ultimately keep guests satisfied –commercial-grade products last longer and a service plan ensures that if a problem arises, it can be fixed immediately

No Fitness Room? No Problem

If you don’t have the option to add a fitness amenity to your space, there are still ways that you can attract the health-minded trav eller. Think about partnering with a local gym that’s close to your property to make their space available to guests, or make in-room fitness equipment (think small dumb bells, on-demand exercise videos, jump ropes, and yoga mats) available to guests. Also be sure that your front desk staff is aware of local studios, walking and running trails, and fitness options so that they can help guests find their fitness fix.

More and more people are trying to live healthy and active lives, and you can play a role in helping them do that. By making fitness a priority in your establishment, you’ll likely see an increase in new business, customer loyalty, and overall guest satisfaction.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 17

3. 2. 5. 4.

Meliá Hotels International Marks Entry into Bangkok

MELIÁ BANGKOK SLATED TO OPEN IN 2022

Meliá Hotels International Marks Entry into Bangkok with Signing of Meliá Bangkok

Slated to open in 2022, Meliá Bangkok under scores the Group’s focus on strengthening its international presence

Meliá Hotels International, Spain’s leading hotel group, announced the signing of Meliá Bangkok, marking the group’s first property in Bangkok and secondoverall in the country.Meliá Bangkok forms part of Meliá’s strategic focus on international growth – one that has made Meliá the first Spanish hotel group to open hotels in markets, such as China, the U.S. and the U.A.E. The new agreementwith Asset World (TCCAW), a member of TCC Group, one of the largest business conglomerates in Thailand, provides a significant boost to Meliá Hotels International’s growth and expansion in Asia. Meliá Bangkok, located in the vibrant Sukhumvit district, is another milestone in Meliá Hotels International’s long-term partnership with TCC Group, which spans many years and one that has been built on mutual respect and trust, and a shared concept of hospitality.

“It gives us great confidence to partner with Asset World to launch the Meliá Hotels & Resorts brand in a thriving destina tion such as Bangkok,” said Bernardo Cabot Estarellas, Senior Vice President Asia Pacific of Meliá Hotels International.

He added, “Our growth strategy must be accompanied with major local partners who share our vision, philosophy and cul ture – even more so when we’re entering the second most visited country in Southeast Asia. I believe Meliá Hotels International’s impeccable track record of 60 years in hotel management and Spanish service culture will stand us in good stead to achieve growth while delivering an unmatched guest experience.”

Nishant Grover, Chief Operating Officer of Asset World said, “We are delighted to widen our relationship with Meliá Hotels International, with the addition of this third property. We stand committed to bringing best of hospitality to Thailand and firmly believe that Meliá Bangkok would further our vision of creating unique product and service offerings for our guests.”

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 18

HOT | BUSINESS

Managed under the Meliá Hotels & Resorts brand, the brand-new, upscale hotel will bol ster the group’s already strong portfolio of urban resorts around the world. Meliá Bangkok will feature a total of 315 luxurious guest accommodations, and offer exceptional F&B outlets, spa amenities, a fitness center and meeting facilities, complementing the mixeduse development of retail and office space. With a central location in the heart of Sukhumvit plied by thoroughfares of the city, and 30 min utes from Suvarnabhumi International Airport, Meliá Bangkok will grant guests easy access to Bangkok Mall, an ultra modern complex housing entertainment (including two theme parks), commercial, residential and office spac es; Terminal 21; and Benjasiri Park.

Meliá Hotels & Resorts, the most international brand of the group, has 126 properties world wide and over 30 years of presence in Asia; and Meliá Bangkok is yet another reaffirmation of the group’s commitment to the region. The brand is highly valued by travellers worldwide and characterized by the personalized experi ences provided through the Passion for Service culture. In 2016 Meliá Hotels International celebrates its 60th Anniversary and maintains its robust momentum in Asia, where the group will double its portfolio of new hotels by 2020: At present there are 13 hotels open and anoth er 21 hotels in the pipeline; Meliá Bangkok brings the total number of properties in the region to 35.

About Meliá Hotels International

Founded in 1956 in Palma de Mallorca (Spain), Meliá Hotels International is one of the largest hotel companies worldwide as well as the absolute leader within the Spanish market, with more than 375 hotels (current portfolio and pipeline) throughout more than 43 coun tries and four continents under the brands:

Gran Meliá, Meliá Hotels & Resorts, Paradisus Resorts, ME by Meliá, INNSIDE by Meliá, Tryp by Wyndham and Sol Hotels. The strategic focus on international growth has allowed Meliá Hotels International to be the first Spanish hotel com pany with presence in key markets such as China, the Arabian Gulf and the US, as well as maintaining its leadership in traditional markets such as Europe, Latin America and the Caribbean. Its high degree of globalization, a diversified busi ness model, the consistent growth plan supported by strategic alli ances with major investors and its commitment to responsible tourism are the major strengths of Meliá Hotels International, being the Spanish Hotel leader in Corporate Reputation (Merco Ranking) and one of the most attractive to work worldwide.

www.meliahotelsinternational.com Email: icha@bwcomms.com

Meliá Hotels International’s long-term partnership with TCC Group

Featuring 315 luxurious guest accommodations, and offer exceptional F&B outlets, spa amenities, a fitness center and meeting facilities, complementing the mixed-use development of retail and office space. ”

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 19

Featuring JAKARTA INTERNATIONAL EXPO KEMAYORAN, INDONESIA The 14th International Hotel, Catering Equipment, Food & Drink Exhibition The 15th International Retail Technology, Equipment, Display and Storage Exhibition Incorporating: 5 – 8 April 2017 O RG AN I S ED B Y SUPPO RTI N G O RG AN I S ATI ON S Ministry of Tourism, Republic of Indonesia Indonesian Retail Merchants Association Specialty Coffee Association of Indonesia Indonesian Food & Beverages Association Association of Culinary Professionals Indonesian Cold Chain Association Indonesian Packaging Association The Indonesian Fishery Products Processing & Marketing Association Pre-register your visit online at

Hong Kong, 9 February 2017 – Mandarin Oriental, Tokyo has been recog nized as the best hotel in Japan in three categories at the TripAdvisor Travellers’ Choice™ Awards. The hotel was ranked first in Japan in the Top Hotels, Luxury and Best Service classifications in the travel site’s list of Best Hotels 2017 announced in January. Never before has a Japanese hotel topped these three categories at one time since the awards began fifteen years ago.

TripAdvisor presents awards based on the millions of travellers’ reviews and opinions posted on the site. It has nine categories of hotel award: Top Hotels, Luxury, Bargain, Small, Best Service, B&Bs and Inns, Roman ce, Family and Hall of Fame. A hotel must show it offers remarkable value, service and quality to win an award.

“Mandarin Oriental, Tokyo is absolutely delighted to have received these accolades, which are a tremendous affirmation of our team’s dedication to providing the very best in hospitality for our guests. These awards are very encouraging for the entire hotel team and we are deeply appre ciative,” said Paul Jones, General Manager at Mandarin Oriental, Tokyo.

Visit www.mandarinoriental.com to book one of the hotel’s luxurious room packages, and find out why Mandarin Oriental, Tokyo has been vo ted the Top Hotel in Japan. For room reservations and enquiries, please call +81 (0) 3 3270 8800, or email: motyo-reservations@mohg.com

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 21

WINS

AT

MANDARIN ORIENTAL, TOKYO

IN THREE CATEGORIES

2017 TRIPADVISOR TRAVELLERS’ CHOICE AWARDS FOR HOTELS

9 - 12 AUGUST 2017 GrandCity, Surabaya - Indonesia DISCOVER MORE EASTFOOD INDONESIA EXPO 2017 The 9th International Exhibition on Food & Beverage Products, Ingredients, Technology and Services EASTFOODINDONESIA.COM EAST FOOD INDONESIA 2017 The Focused Platform For International Food & Beverage Exhibition In Surabaya Kementerian Perindustrian REPUBLIK INDONESIA APTINDO Asosisasi Produsen tepung Terigu Indonesia Exhibition Organizer Supporting Ministry Supporting Associations KRISTA EXHIBITIONS. PT. Kristamedia Pratama. Jalan Blandongan No. 28d/g. Jakarta 11220. Indonesia. Phone +62 21 6345861, 6345862, 6334581, 6345002. Fax +62 21 6340140, 6342113. Email : info@kristamedia.com Website : www.kristamedia.com

NEWS EVENTS JOBS ALL the GOOD THINGS HOTELIER INDONESIA www.hotelier-indonesia.com DONT MISS

Hard Rock International Announces Hard Rock Hotel

The Sound of Your Stay - offering com plimentary in-room Fender guitars and DJ-equipment.

Hotelier Indonesia - Hard Rock Internatio nal Announces Launch of Hard Rock Hotel Shenzhen

Brand Slated To Open First Mainland China Property In Summer 2017

SHENZHEN, CHINA, February 15, 2017 – Hard Rock Hotels announces the launch of its first hotel in China, Hard Rock Hotel Shenzhen. Slated to open in summer 2017, the new Hard Rock property will offer a luxury stay for modern travelers who are seeking a reprieve from traditional accom modations.

Blending pop culture and premium hospi tality, Hard Rock Hotel Shenzhen promises a host of world-class leisure, dining and entertainment options and the thread that unites them all – music.

Destined to become a new landmark in the Guangdong region, Hard Rock Hotel Shen zhen will continue the brand’s tradition of presenting memorable moments through music. Whether a guest prefers rap, pop, reggae or R&B, travelers can experience an unparalleled music amenity program –

Throughout the property, guests will enjoy rare and valuable memorabilia on display. Carefully chosen from Hard Rock’s world-famous, 80,000+ piece collection, each prized piece celebrates legendary music icons from around the world.

The 258 rooms and suites feature a creati ve mix of music-inspired décor and modern Chinese elements. A range of high-end accommodations, including Studio Suites, Rock Royalty Studio Suites and Rock Star Suite®, provide the ultimate all-access pass to a luxury VIP experience, as well as stunning views of the surrounding area

While music soothes the soul, food satisfies the senses and Hard Rock Hotel Shenzhen will boast a variety of dining destinations. Travelers can choose from the signature Hard Rock Cafe, a rooftop restaurant and pool bar,

The Cake Shop, GMT+8 Lobby Lounge or browse the all-day offerings at Sessions. Other facilities include the Body Rock® fit ness center, Rock Shop®, and Roxity Kids’ Club for budding little rockstars.

Shenzhen

Hard Rock Hotel Shenzhen will also featu re more than 1,000 square meters of event and meeting facilities.

“We are proud to bring the Hard Rock Hotel experience to Mainland China where consumers are equally passionate about music and travel,” said Peter Wynne, Area Vice President of Operations - Asia Pacific Hotels, Hard Rock Hotels.

“While Hard Rock Hotel Shenzhen will offer a one-of-a-kind luxury experience, guests can expect the same music-cente red fun as other Hard Rock Hotels around the world. As our brand has proven over the years, nothing is more universal than a love of music and having a great time.”

Located in the famed Mission Hills Cen treville, Hard Rock Hotel Shenzhen offers convenient access to the world’s number one golf course and close proximity to an extensive range of leisure, wellness and en tertainment offerings. Hard Rock Hotel is located 45 minutes from Shenzhen Bao’An International Airport and 35 minutes from the city center.

Hotelier Indonesia Magazine - Business, Hot News, Opening, Shenzen

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 24

AUTOMATION AND THE HOSPITALITY INDUSTRY

By David Topolewski, CEO of Qooco

Given the high costs and manpower shortages experienced in the hospitality sector in general, automation and hospitality are two words rarely used in the same sentence. Other indus tries have embraced automation, manufacturing has massively increased its productivity thanks to machines, and Robotics Pro cess Automation (RPA) led by companies such as UiPath promi ses to replace the repetitive, rules-based tasks present in many financial institutions, yet local hotels seem to be free of such te chnology, despite the presence of many repetitive, rules-based jobs.

This could be about to change the back-end of our hotels. Here are three areas in which automation could transform the makeup of hotels:

The robot housekeeper – A few years ago, researchers at the Uni versity of Berkeley introduced us to Brett, a robot that could pick up and fold towels, (see video here), taking about 24 ½ minutes for each towel. While this may seem slow, to the point of ridicule, the fact that a robot is able to detect, scan and manipulate a ‘soft’ object is impressive. Fast forward a few years, and the robot is now able to connect Lego pieces, hang shirts on a hanger and fix a toy. Still no human, but robots are getting better, slowly, and it may not be long before they are employed to assist current housekeepers

The end of the accountant? – Hotel accounts departments are also ripe for automation. Dozens of employees are hired to pro cess the hundreds of invoices, claims and bills that run through the hotel on a daily basis. This often requires little more than checking the invoice, copy-pasting data, transferring informa tion – rules based, repetitive tasks. Robotics Process Automation (RPA) is software that uses computer systems exactly as a human does – via the user interface (e.g. Windows). Highly accurate, and never making mistakes, RPA does the monotonous tasks that hu mans simply are not designed to do, and can significantly redu ce cost and improve efficiency for (often cash-strapped) hotels. Counting the cost – Technology can now detect physical items too. SAP software allows Airline-service crews to scan the num ber of paper cups they bring into an airplane. Hotels still em ploy people to conduct inventory checks on a daily basis for everything from the amount of shampoo and soap to cans of tomatoes and bottles of olive oil. Counting and recounting stock takes hours, and is the kind of mundane While technology has been added to the front-of-house in an effort to make the guest experience more efficient and smoo ther, it seems that back-of-house is too often neglected. From RPA to robot housekeepers, hotels will soon have the ability to create some real cost savings for the hotel of the future.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 25

25 HOT | TECH

nSight for IDeaS™ Help Indonesian Hoteliers Drive More Profitable Bookings HOT | SOLUTIONS First-to-market revenue management solution provides exclusive access to travel intelligence and online demand data to give hoteliers an unseen competitive advantage HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 26

Jakarta – February, 2017 – IDeaS Revenue Solu tions and nSight Travel Intelligence have teamed up to offer Indonesian hoteliers a new experien ce in revenue management that allows managers to “futurecast” inventory demand based on a rich set of data points never before available on a single technology platform. With access to both nSight’s predictive consumer shopping intelligence data and IDeaS’ advanced revenue management solutions, Indonesian hoteliers can now have exclusive access to the most advanced demand-intelligence solution on the market to increase bookings and drive better revenue.

Hoteliers have previously been limited to high-level booking data and lost business data for only brand.com when building demand fore casts. With nSight for IDeaS, hoteliers now have access to aggregated data from more than five thousand online travel sites, giving them much deeper and more cohesive insights on consumer behavior across all relevant online and offline booking channels.

“The ability to integrate never-before-accessible information – such as relationships between intent to book and pricing – will elevate a hotel’s demand forecast and ultimately its revenue opportunities,” said Sanjay Nagalia, chief ope rating officer for IDeaS. “Our partnership with nSight is the first solution to truly bridge two profit-focused functions. By bringing revenue management and marketing closer together, we’re giving our clients an exclusive advantage over the competition.”

Rich, Real-Time Data Drives Revenue

nSight for IDeaS goes beyond traditional data sources like brand.com regrets and denials data. Instead it utilizes real-time, relevant and forward-looking demand intelligence from on line travel agents and travel websites to provide powerful data that can be used to more accurate ly apply profit-generating pricing strategies.

“The sheer amount of data available can be overwhelming and ‘big data’ has become code for ‘lots of work’. We are changing all that with nSight for IDeaS,” said Rich Maradik, founder and CEO for nSight. “The simplicity in which hoteliers can now access and leverage large vo lumes of data is something the market has never seen before.

nSight for IDeaS™ to Help Indonesian Hoteliers Drive More Profitable Bookings

By combining data from the hotel’s RMS with predictive data, and offering it through an intuitive dashboard, we help revenue and marketing teams simplify and focus on proven revenue-generating priorities.”

About nSight

nSight combines the world’s largest view of consumer shopping data with predic tive marketing and revenue management solutions to deliver more guests to your hotel and visitors to your destination. Only nSight aggregates more than 85 million travel consumer shops and boo kings daily across over 5,000 third-party travel websites. Understanding consumer shopping behavior, rate impact and future market demand enables better marketing and revenue management decisions.

Follow nSight on Twitter, Facebook and LinkedIn. For more information, visit www.nsightfortravel.com.

About IDeaS

With more than one million rooms priced daily on its advanced systems, IDeaS Revenue Solutions leads the industry with the latest revenue management software solutions and advisory services. Powered by SAS® and more than 25 years of experience, IDeaS proudly supports more than 7,000 clients in 94 countries and is relentless about providing hoteliers more insightful ways to manage the data behind hotel pricing.

IDeaS empowers its clients to build and main tain revenue management cultures—from single entities to world-renowned estates—by focusing on a simple promise: Driving Better Revenue. IDeaS has the knowledge, expertise and matu rity to build upon proven revenue management principles with next-generation analytics for more user-friendly, insightful and profitable revenue opportunities—not just for rooms, but across the entire hotel enterprise. For more information, visit www.ideas.com.

The information hotels can leverage using nSight for IDeaS can offer a distinct competitive advantage for pricing rooms, personalizing marketing efforts and aligning the overall consumer experience across channels. It effectively narrows the disconnect between revenue management and marketing teams by delivering insights relevant to both functions. nSight for IDeaS enables the two disciplines to collaborate with confidence, more accurately understand guests, and better target and track marketing campaigns. These well-aligned goals, in turn, allow hotels to maximize direct bookings and drive profitability.

“

Integrate never-before-accessible information

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 27

QUILA A JOURNEY OF MULTI-SENSORY GASTRONOMY AT ALILA VILLAS ULUWATU

The newly unveiled QUILA dining room at Alila Villas Uluwatu, Bali offers an exclusive journey of gastronomy where every bite is exquisite and loaded with multi-sensory surprises. The name QUILA combines ‘qui’, which stands for ‘he who trans forms’, with Alila, and aptly reflects the transformative dining experience presented within its exclusive setting.

Diners seeking a culinary thrill are taken on an exhilara ting ride for all the senses in a daily-changing dinner menu comprising a variety of different plates, artfully tailored by Executive Chef Marc Lorés Panadés. Each plate is perfectly sized to deliver a powerful punch, a flavoursome bite, or a provocative palate.

Reflecting Chef Marc’s philosophy of “getting to the root of every single product, by getting as local, organic and sustai nable as possible”, the menu of mainly Mediterranean-ins pired creations combines fresh seasonal local produce with modern cooking techniques, styled in uniquely different and playful ways.

The imaginative use of sound, texture and aroma add other dimensions of sensory stimulation, along with carefully considered wine pairings that elevate the sense of absolu te satiation. This exclusive dining experience is limited to a maximum of 10 guests each night within QUILA’s intimate five-table indoor setting.

Dietary requirements and preferences can be shared with Chef Marc in advance, who will tailor them into each diner’s personalised gastronomic journey. At QUILA, embrace your sense of adventure. Surrender to the unexpected. Savour the surprise…

For more information or reservations, please contact us at +62 361 848 2166 OR email: uluwatu@alilahotels.com

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 28

HOT | PLATE

“ Sparkling & Colourful Night”

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 30

ANNUAL CORPORATE GATHERING EVENT AT THE EXECUTIVE LOUNGE (23RD FLOOR) OF MENARA PENINSULA HOTEL (MPH), JAKARTA.

CORPORATE GATHERING Menara Peninsula Hotel

“ Sparkling & Colourful Night” 13 January 2017 @MPH Executive Lounge

Jakarta, January 13th,2017. Menara Pe ninsula Hotel Jakarta open the New Year by holding an Annual Corporate Gathe ring event at the Executive Lounge (23rd Floor) of Menara Peninsula Hotel (MPH), Jakarta.

This annual event was made to honor MPH loyal corporate clients all around Jakarta. Approximately 150 guests at tended to this event wore smart casual, bright costumes and bring the concept of masquerade party according to the theme.

Executive Lounge was transformed into a cozy and glowing lounge with fantas tic DJ table in the corner and various of food-stalls. There was also photobooth available for guests to take photos using the masks provided as the accessories.

The guests were taken on hotel tour to see the newly renovated Executive Club Floors. Starting from Executive Club Room, then the Club Studio, Club Junior, and Peninsula Suite rooms.

The event was started at 6.30pm and opened by the MC, then continued with the welcoming speech by Djulkarnain, General Manager of Menara Peninsula Hotel. Muhammad Haris Rysman Kevin, the Director of Sales also joined on the main stage, followed by the introduction of Sales & Marketing team.

On that occasion, GM of Menara Penin sula Hotel also announced the plan of re novating their function rooms, the KAFE COLEMAN main restaurant, and 15 floors regular guest rooms. “We really believe when it’s finished, this will one of the great accommodations you want to ex perience when you’re in Jakarta.” Djulkar nain added.

Djulkarnain, General Manager of Menara Peninsula Hotel said, “This event is held as a token of appreciation to the company and in order to close synergy and coope ration that has existed very well in 2016 and will continue in 2017. This year, we brought something different by choo sing “Sparkling & Colourful Night” as the event’s theme to represent the ultimate excitement and glamour.”

“It’s always a good time,” said Kevin. “We love our customers and it’s fun to be whe re everyone gets to know each other be yond work on this type of occasion.”

MENARA PENINSULA HOTEL

The guests were then entertained with magic performance by DJ & violin, ga mes, door prizes, and grand prizes of 3D2N Stay in YTC Peninsula.Excelsior Hotel Singapore, 3D2N stay in SINTESA Jimbaran - Bali, and three smartphones for the TOP FIVE PRODUCERS in 2016.

Jalan Letjend. S. Parman Kav.78 Jakarta Barat 11410 Phone. 021 5350888 Fax. 021 5359838 www.menarapeninsula.com

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 31

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 32

The design architects of the project are the Colorado-based firm, [au] workshop who envision the design as a modern, vertical urban resort epitomizing the Hawaiian tradition of the “lanai” with its seamless indoor-outdoor sense of place.

MANDARIN ORIENTAL TO OPEN LUXURY HOTEL AND RESIDENCES

IN HONOLULU, HAWAII

Hong Kong, 7 February 2017 – Mandarin Oriental Hotel Group has announced its intention to open a new luxury hotel and branded residences in Honolulu on the Hawaiian island of Oahu. The project, which has a target opening date in early 2020, will enable Mandarin Oriental to introduce its hospitality to this important tourism and business destination.

Mandarin Oriental, Honolulu will be the anchor of Mana`olana Place, a 36-story mixed-use tower with gardens and public plazas, currently being developed by Los Angeles-based Salem Partners. Located in the heart of the Ala Moana district, the hotel is a short walk to Waikiki Beach and Ala Moana Beach. It will also be adjacent to the Hawaii Convention Center and the Ala Moana Center.

The hotel’s 125 contemporary guestrooms and suites will be designed to reflect the Hawaiian culture, together with features inspired by Mandarin Oriental’s oriental heritage. The Group will also manage 107 Residences at Mandarin Oriental, located on the Mana’olana tower’s upper floors, which will provide some of the most luxurious private homes on the island.

Mandarin Oriental, Honolulu will feature a rooftop restaurant and bar with landscaped outdoor terraces, providing views of Dia mond Head, Ala Moana Beach and Down town Honolulu.

There will also be a lobby lounge, an all-day dining restaurant and extensive banqueting and meeting spaces with views over the surrounding terraces and gardens.

In keeping with the Group’s wellness con cepts, a Spa at Mandarin Oriental will offer holistic rejuvenation and relaxation with eight treatment rooms. Further leisure op tions include a comprehensive fitness centre and an outdoor swimming pool.

The design architects of the project are the Colorado-based firm, [au]workshop who en vision the design as a modern, vertical urban resort epitomizing the Hawaiian tradition of the “lanai” with its seamless indoor-outdoor sense of place.

“We are delighted with this opportunity to open a hotel in Honolulu and look forward to bringing Mandarin Oriental’s legendary hospitality back to Hawaii,” said James Riley, Group Chief Executive of Mandarin Orien tal. “This new development will be a welcome addition to the brand’s expansion around the world,” he added.

“We are proud to bring the award-winning Mandarin Oriental brand to Honolulu,” said James Ratkovich of Salem Partners. “Mandarin Oriental, Honolulu will set a new standard for luxury service in the islands and will offer a preferred choice to travellers and potential homeowners who desire the finest accommodation,” he added.

Honolulu is Hawaii’s political and economic centre, and is home to iconic destinations such as Waikiki Beach, Pearl Harbour and Diamond Head. As the state’s capital, Hono lulu is the most populous city in Hawaii and serves as the primary entry point to the is lands’ tourism industry and a major gateway to the United States and Asia-Pacific.

About Salem Partners

Founded in 1997, Salem Partners is a leading investment bank, real estate development and wealth management firm. Salem’s invest ment bankers have completed transactions in media and entertainment, healthcare and life sciences, aerospace and defense, and real estate industries. The wealth manage ment division provides customized invest ment and family office services to clients who prize topflight expertise combined with in-depth relationships. Real estate development is headed by industry veterans experienced in all segments of the built environment.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 33

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 34 5 BEDROOM GRAND CLIFF FRONT RESIDENCE KARMA KANDARA HOT | ZONE

Invite your inner circle to celebrate a milestone birthday or anniversary at our 5-Bedroom Grand Cliff Front Residence. Designed for larger groups of friends and families travelling together, or to truly impress your better half with a romantic getaway beyond compare, experience Bali’s fabled Bukit Peninsula from the cliff top edge of Kandara’s ‘Billionaire’s Row’.

POST YOUR NEXT HOSPITALITY RECRUITMENT HERE FOR FREE

www.jobs.hotelier-indonesia.com

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 36 Karma Kandara Accommodation Featured: 5 BEDROOM GRAND CLIFF FRONT RESIDENCE Package Rate : USD 7196++/ IDR 93.550.000++ Inclusions: Daily a la carte breakfast • Deluxe fruit basket Exclusive in-villa BBQ max for 10 pax with private chef and waiter Private in-villa cocktail for Max. 10 pax • Yoga Class for max 10 pax HOT | ZONE

Terms and Conditions:

• Minimal Stay 2 nights

• Validity April 2017 – March 2018

• Booked Period Immediately – 31 March 2018

• Stay Period 1 April 2017 – 31 March 2018

High Season (15 July – 31 August): at USD 100++ per night

Peak Season (28 – 31 Dec 2016): at USD 250++ per night

Room description

Invite your inner circle to celebrate a milesto ne birthday or anniversary at our 5-Bedroom Grand Cliff Front Residence. Designed for lar ger groups of friends and families travelling together, or to truly impress your better half with a romantic getaway beyond compare, experience Bali’s fabled Bukit Peninsula from the cliff top edge of Kandara’s ‘Billionaire’s Row’. Spend your days admiring the dazzling ocean view from two exclusive swimming pools and your nights in the soothing private Jacuzzi beneath the stars. This six-star desti nation villa invites you to experience Karma’s iconic jet-set lifestyle with a home cinema, in-villa spa, workout gym, relaxing sauna, gourmet kitchen and luxury interiors.

• Villa Amenities

• 2nd bathroom

• Air conditioned

• Alarm Clock

• Balcony

• Barbeque Bath

• Bathrobes Provided

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 37

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 38 Cable/Satellite TV • CD Player • Dishwasher • Cots Available • DVD Player • Hairdryer • Iron/Ironing board King Bed Kitchen • Kitchenette • Laundry Facilities • Linen and Towels Provided • Microwave • Non-Smoking • Queen bed Rollaway Beds Available Room Service • Sofa Bed • Stairs • Telephone • Television • Toaster • Tea/Coffee Making • Views Spend your days admiring the dazzling ocean view from two exclusive swimming pools and your nights in the soothing private Jacuzzi beneath the stars. This six-star destination villa invites you to experience Karma’s iconic jet-set lifestyle with a home cinema,in-villa spa, workout gym, relaxing sauna, gourmet kitchen and luxury interiors. HOT | ZONE

•

•

•

•

•

•

•

•

•

•

Wireless Internet

Desk

Free In-House Movies

iPod Dock Fridge - Fullsize

Outdoor Setting

Verandah

2 Queen Beds

2 Double Beds Complimentary fruit basket

Room Safe

Jacuzzi

Linen Provided

•

BRIEF & STYLE

Set on a spectacular limestone cliff top high above the Indian Ocean, Kar ma Kandara is comprised of 54 priva te pool villas of 1 – 5 bedrooms. Each boasts private pool, en-suites and spacious living, kitchen and dining areas with top of the line appliances, sleek contemporary furnishings and traditional artworks.

The resort’s award-winning amenities include gymnasium, signature ‘K’ main infinity pool, library and meeting faci lities, 24-hour reception and in-villa dining. Destination restaurant di Mare, a post-modern pavilion serving Medi terranean cuisine with a Pan-pacific twist, overlooks the Indian Ocean with after-hours hotspot, Temple Lounge, just a few steps above. Accessed via an innovative, cliff-side hill tram, Kar ma Beach Bali is a bamboo folly set on a white beach lapped by a cerulean lagoon, where guests enjoy custom cocktails and Mediterranean flavours.

Karma Spa brings together sublime cliff-hanging spa shacks where body workers and visiting masters perform healing rituals and mas sages. The resort also offers a dedica ted Kid’s Club.

Karma Kandara is comprised of 54 private pool villas of 1 – 5 bedrooms. Each boasts private pool, en-suites and spacious living, kitchen and dining areas with top of the line appliances, sleek contemporary furnishings and traditional artworks.

Inside

The resort offers spacious villas, such as the grand luxury cliff front residen ces, which are the preferred Bali

“Karma Spa brings together sublime cliff-hanging spa shacks where body workers and visiting masters perform healing rituals and massages”

accommodation for the region’s who’s who.

Their generous size makes them ideal for families, friends and groups who can enjoy the pleasures of a palatial private villa experience com plete with pool courtyard, be drooms with en-suite ba throoms, audiovi sual systems and fully equipped kitchens within the context of a full service 5-star luxury boutique resort.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 40

HOT | ZONE

Renowned as the region’s premier spot for weddings, private events and unique corporate gatherings, Karma Kandara’s culinary team is on hand to custo mize sumptuous canapés, hand-rolled sushi and freshly grilled seafood straight from the Indian Ocean.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 41

Outside

The resort is a contemporary elaboration on the classical Ba linese garden compound design, with pavilions thoughtfully centered about an elegant pool courtyard.

Superior building quality is matched by contemporary mi nimalist interiors, featuring plush furnishings and carefully selected traditional artworks.

Things to do

Garuda Wisnu Kencana (15 minutes away) offers a view of one of Bali’s most breath-taking monuments.

HOT | NEWS

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 42 HOT | ZONE

Classic attractions, fantasy experiences and modern technology blend together as you explore this unique cultural park. Uluwatu Temple (10 minutes away), known as Pura Luhur Uluwatu. It is one of the must-see temples in Bali and sits on the south-wes tern edge of a limestone cliff that is su rrounded by a forest, home to hordes of grey long-tailed macaques. Kecak ‘Fire Dance’ (10 minutes away). Loca ted at Uluwatu Temple, The Kecak Dance, also frequently dubbed ‘the monkey chant’ or the ‘fire dance’, due to its use of a tall fire torch as its centerpiece, is one of the most captivating and famed dance perfor mances in Bali.

Location

Karma Kandara is situated at the edge of a dramatic clifftop, perched along Bali’s famous ‘Billionaire’s Row’. It is located 30 minutes away from Ngurah Rai Internatio nal Airport.

Food and wine

Karma Kandara provides three world-class restaurants and five-star amenities that appeal to guests of all ages. Afternoon tea aficionados are invited to enjoy Cliff Tea at The Temple Lounge, served daily from 3PM to 5PM. Served with a glass of sparkling wine and international tea offerings, Temple Lounge’s delicious menu pampers guests with a variety of classic English light bites, inclu ding freshly cut sandwiches paired with delectable cakes and pastries. The Temple Lounge is also the pla ce to be for daily happy hour, where guests are treated like royalty from 6PM to 7PM with complimentary ca napés, exquisite cocktails and wine and beer specials.

There’s nothing quite like kick-star ting the weekend with Friday Steak & Wine Night at di Mare restaurant

with its awe-inspiring architecture and pa noramic ocean views. Paired with a fine selection of rich merlots and subtle pinot noirs, the chef serves up a bevy of signatu re dishes including Wagyu Tenderloin dri zzled in truffle sauce and complemented by creamed foraged mushrooms. di Mare is also a fabulous destination to enjoy Sun day Brunch from 11AM to 3PM.

Synonymous with beachfront glamour, Kar ma Beach Bali lures discerning connois seurs from across the globe to enjoy Karma Kandara’s exclusive white sand beach cove. Accessible via the resort’s private cliff-side inclinator, guests are welcome to enjoy uni que events throughout the week including Monday Night Movies beneath the stars and international music concerts comple mented by custom Karma Signature Cock tails and light bites to share.

Weddings & Events

Renowned as the region’s premier spot for weddings, private events and unique cor porate gatherings, Karma Kandara’s culi nary team is on hand to customize sump tuous canapés, hand-rolled sushi and freshly grilled seafood straight from the Indian Ocean. Guests may choose from one of the resort’s expansive private pool villas for an intimate event shared with their in ner circle, or for a VIP event that will surely land in the society pages, a sunset wedding at Karma Beach Bali is recommended for brides and grooms who wish to make the ultimate romantic statement. www.karmagroup.com

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 43

Hotel & Branded Residences BALI

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 44

February 2017 HOT | REPORTS

Hotel & Branded Residences Bali

HOTEL & BRANDED RESIDENCES UPDATE

Quantity over quality: be careful what you wish for.

After a very challenging 2015 for Bali, occupancy was up by more than 4% in 2016 bringing a whiff of fresh air and hope… but at what cost? Hotels’ enjoyment of solid occupancy across categories (excluding luxury) was driven by increasing foreign direct arrivals, a slowing in new hotel openings and a further slashing of rates. With the Thai government banning ‘zerodollar tours’ this has been an opportunity for Bali to swoop in and attract these poor yielding groups to fill rooms. With the government’s ambitious arrivals targets, it is foreseeable that the volume of such tourists is likely to increase but the long term benefits to the destination are arguable. Rates will continue to decline, Bali’s infrastructure will continue to be stressed and higher yielding more discerning guests may be turned off. It is a tight rope that is being walked with a quantity over quality policy. With the explosion in budget accommodation, private villa rentals and huge numbers of new rooms in all hotel categories in the last 5 years it is easy to see how volume bums in beds relieves immediate mortgage pressures for hotel owners. However, hotel ownership and destination management is not a short term game. Nurturing a destination, the maintenance of infrastructure and the development of long term sustainable development goals are essential to ensure Bali continues attracting people from all corners of the globe and across all rate categories.

BALI TOURISM ARRIVALS

2015 recap: domestic market up 12% y-o-y to around 7.1 million and foreign arrivals also up 6% y-o-y to 4 million bringing the total to over 11 million for the first time.

Foreign arrivals surged year end 2016 up by a significant 23% to 4.9 million. This was helped by the lack of political and natural hiccups, visa-free access ramping up and more direct flights to Bali which smashed the 4.2 million arrivals’ target for 2016.

Source : BPS Indonesia

Source : BPS Indonesia

With Indonesia’s central administration continuing their efforts to attract more foreign arrivals, the government boosted the Ministry of Tourism’s budget from IDR 300 billion in 2015 to IDR 6.1 trillion in 2016. It is understood that around 80% of the budget was allocated for tourism promotion, and partly to finance tourism campaigns abroad.

Indonesia’s leisure tourism is still largely concentrated on the island of Bali, which attracted more than 30% of foreign tourist arrivals in 2015. In 2016 with foreign arrivals just under 5 million year-end, it is clear that Bali remains the number 1 destination for holidaymakers. E-commerce providers including Traveloka, Pegipegi and Blibli report “Bali” as their most searched destination followed by Bandung and Jakarta.

The island is expecting another boost in air connectivity from Garuda Indonesia in 2017. As China’s importance as a source market grows overtaking Singapore, Malaysia and snapping on the heels of Australia; Garuda Indonesia plans to open a new route from Bali to Chengdu in China. The

www.horwathhtl.com www.c9hotelworks.com

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 45

Jakarta International Expo - Kemayoran www.expo-clean.com @expo_clean expocleanind @expo.clean Principal Partner : Platinum Partners : Silver Partners : PT. MEDIA ARTHA SENTOSA T : +62 21 5835 4654 F : +62 21 5830 1097 E : info@mediaarthasentosa.com Thursday, 23 March, 2017 : 10.00 - 19.00 OPENING HOURS Friday, 24 March, 2017 : 10.00 - 19.00 Saturday, 25 March, 2017 : 10.00 - 17.00

Hotel & Branded Residences Bali

direct flight will start in January and is scheduled to fly four times a week. In an effort to tap into this vast and growing Chinese market, Sriwijaya Air has also confirmed four main cities will be added to their daily flight routes: Hangzou, Nanjing, Wuhan and Changsa. The Ministry of Tourism has also recognized Eastern Europe as an emerging market to Bali with increased arrivals recorded, assisted in part by LOT Polish Airlines launching direct flights from Warsaw to Denpasar in 2016.

NGURAH RAI

Ngurah Rai International Airport remains the top foreign direct arrivals contributor for Indonesia, followed by Soekarno-Hatta, Jakarta and Hang Nadim, Batam. From January to November 2016, Ngurah Rai recorded 6% growth y-o-y, with Bali arrivals making up a whopping 40% of total arrivals to Indonesia. Batam recorded the highest growth rate of 9% y-o-y, meanwhile, Jakarta remains flat impacted by the global and local economic malaise.

Soekarno Hatta’s Terminal 3 Ultimate limped into operation in August 2016, serving domestic flights by national carrier Garuda Indonesia only. The goal of serving international flights (with the exception of budget airlines) by Q2 2017 seems optimistic. The government’s next project will be to improve the public transportation that will connect Jakarta city center with the airport.

Foreign Arrivals to Big 3 Airports ig g rp

Source : BPS Indonesia

www.horwathhtl.com www.c9hotelworks.com

NATIONALITY MIX

Source : BPS Indonesia

Following the signing of a decree waiving visa requirements for a total of 169 countries, including Australia (which was politically excluded for many months), year-end 2016 Australia remains the number one foreign source market to Bali making up 23% of total foreign arrivals, up 18% over the previous year.

Arrivals from the UK grew a significant 32%, France by 26% and Germany was up a noteworthy 28% y-o-y, helped by improved European connectivity through daily direct flights via Dubai.

China continued its strong arrivals growth year-end, up almost 300,000 people y-o-y (43%) to just under 1 million tourists. It was the 2nd fastest growth market by percentage and the largest by volume. With more flights scheduled to connect Bali and cities in China, we expect this volume to explode further and China to become the most important arrivals source market to Bali in Q1 2017.

Other markets to note:

• South Korean arrivals fell, as did Singaporean arrivals year-end 2016, down by 2 and 7% respectively;

• Growth from India was 58% y-o-y and likely to increase further in 2017 with Garuda inaugurating the first direct link between India and Indonesia in December 2016 (“direct” flights linking Mumbai to Jakarta via Bangkok thrice weekly);

• Arrivals from the USA increased by a strong 27%, perhaps helped by investmests in Times Square billboard advertising made by the Ministry of Tourism for the first time in 2016;

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 47

KEY FACTORS AFFECTING BALI 2016

Lower spend per visitor: a 2016 survey by the Bank of Indonesia highlights that the typical Chinese tourist spends around one quarter of that spent by a typical European or Australian tourist. With the proportion of Chinese tourists increasing the economic benefits of each new tourist is reducing.

Shorter length of stay: the average length of stay in Bali YTD September 2016 fell to 3.11 days, down from 3.20 days y-o-y. The sub-market suffering the greatest was Denpasar, dropping from 4.53 to 2.73 days YTD September 2016. This is a double-whammy for hotels, with lower yield per tourist and a shorter length of stay.

Delayed hotel openings: Owners / investors are delaying the opening of new properties as market performance continues to endure the pressure of new rooms and poor rates. Supply growth in 2015 and 2016 is estimated at around 5%, much lower than the 14% increase recorded in 2014. The pipeline of new hotels remains massive but the delays are allowing the forces of supply and demand to work their magic.

Increased occupancy and decreased ADR: the following sections will highlight performance across categories yearend 2016 but it is very interesting to note that the above demographic shift in arrivals is causing hotels to lower rates to achieve marginal bumps in occupancy BUT in most cases with reduced RevPAR.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 48 www.horwathhtl.com www.c9hotelworks.com

• The

are back, up

•

Top 5 Foreign Mkts YTD Sep 2016 (% total)

Top 5 Regional YTD Sep Mkts 2015 North Asia* 31% Australia + NZ 25% Europe 22% ASEAN 9% Americas 6% Top 5 Growth Mkts YTD Sep 2016 (total increase) China 298,393 Australia 151,387 India 68,222 UK 53,622 USA 36,582 Source : BPS Statistics Indonesia *North Asia = China, Taiwan, Japan, South Korea

Hotel & Branded Residences Bali

Russians

nearly 30%;

Regionally, there is no significant change in the source mix with the ASEAN market growing a small 3% y-o-y and the other Asian market (non-ASEAN) falling 5%.

Australia 23% China 20% Japan 5% UK 4.5% India 4%

HOT | REPORTS

Hotel & Branded Residences Bali

Hotel Performance 2011 – 2016 (IDR)

RevPAR suffering a 6% fall on the back of an 11% fall in 2015. Although arrivals to the island have been steadily increasing this year, the shift of nationality and weaker spending power has forced hotels in this segment to rethink their pricing strategy. With the huge luxury resort pipeline, it is believed that it will take many years for the Luxury segment to rebound from this downfall and it is arguable that it will also require a rethink of the central government’s quantity over quality tourism strategy.

Luxury 2011 – 2016 (IDR) ry

Source : BHA and Horwath HTL

The above graph highlights performance across Bali since 2011 with some telling results to YE 2016:

• IDR ADR increased y-o-y until 2016 (whereas USD ADR has decreased y-o-y since 2012);

• occupancy has fluctuated from a peak in 2011 to a low year-end 2015; and most importantly;

• IDR RevPAR increased from 2011 to 215 before dipping slightly in 2016 (whereas USD RevPAR has decreased over the same period, remaining flat in 2016).

There are some small improvements YTD September 2016 however:

20152016

Occupancy -5% pts-4% pts

ADR (IDR) 8%-6% ADR (USD) -5%-5%

RevPAR (IDR) 1%-1% RevPAR (USD) -11%0%

Occupancy has been solid all year, as shown in the 4% points increase year-end 2016. ADR in IDR and USD tells a contrary story, increasing 8% and falling 5% respectively. This, of course plays into RevPAR which also shows opposite results, up in IDR and down significantly in USD.

Performance by segment

Luxury (> USD 350): On the back of solid performance improvements recorded between 2011 and 2014, the last 2 years have been gloomy in the Luxury segment. All performance matrices are showing a slip in 2016, with

Luxury

Occupancy

20152016

-6% pts-1% pts

ADR (IDR) 15%-5% ADR (USD) -1% -4% RevPAR (IDR) 4% -7% RevPAR (USD) -11%-6%

Upper Upscale (USD 151 – 349): This segment shows more promise as 2016 occupancy performance shows a 5% increase. ADR was sacrificed to keep occupancy rate buoyant amidst the pressure of new supply and changing arrivals demographics in 2016. With an estimated 74 new hotels opening in the next four years, arrivals growth will need to continue growing at similar rates to the 23% y-o-y figure if this segment is to balance occupancy and ADR with a resultant increase in RevPAR.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 50 www.horwathhtl.com www.c9hotelworks.com

Source : BHA and Horwath HTL

HOT | REPORTS

For

www.sphereconferences.com 25 April 2017 Ho Chi Minh City, Vietnam 31 January –1 February 2018 Philippines HICI2017 (184mmx250mm).indd 1 3/3/17 2:25 PM

more information on our Hospitality Investment Series, please contact Zalifah at Zalifah@sphereconferences.com or call +65 6848 6054

Upper Upscale20152016

Occupancy 5% pts5% pts

ADR (IDR) 8% 1%

ADR (USD) -4%-4% RevPAR (IDR) 4% 1% RevPAR (USD) -8%3%

Upscale (USD 101 to 150): A quantity over quality tourism strategy begins to pay dividends in this market segment where the rate is between USD 100 and 150. By year-end 2016, the Upscale segment enjoyed a reasonable 4% bump in occupancy at the expense of a comparable fall in rate (both USD and IDR) with a consequent status quo performance in RevPAR. If hoteliers hold fast on ADR in 2017, the forecast increase in arrivals should allow them to boost RevPAR for the first time since 2014.

Upscale 20152016

Occupancy 5% 4%

ADR (IDR) 7%-5% ADR (USD) -6%-4% RevPAR (IDR) RevPAR (USD) -12%1%

Midscale (USD 40 – 101): Having the strongest domestic component amongst segments plus the price point most attuned to the mass market, hotels within the Midscale enjoyed the brightest year. Occupancy grew 8% (last year it dropped 6%) whilst ADR only fell marginally with the resultant RevPAR up between 5 and 6% YTD September. In the future, although the Midscale category will continue to face the heaviest pressure from forecast new supply (~ 40% of total) it is also the best placed to absorb the increased volume tourist base.

HOTELIER INDONESIA | 29th | Vol 13 | 2017 | www.hotelier-indonesia.com 52

www.horwathhtl.com www.c9hotelworks.com

Hotel & Branded Residences Bali

Upper Upscale 2011 – 2016 (IDR) UppeUp

Source : BHA and Horwath HTL

Upscale Hotel Performance 2011 – 2016 Up

Source : BHA and Horwath HTL

HOT | REPORTS

Hotel & Branded Residences Bali

Midscale Hotel Performance 2011 – 2016

Year-end 2016 we have witnessed a fluctuation in average length of stay depending on rate categories. In the Luxury, Upscale and Midscale markets, ALOS is down but it was up slightly in the Upper Upscale market. As seen in the graph the shortest is Luxury with 2.9 days, down from 3.1 days in 2015. The largest drop was 0.3 days in the Midscale category.

Performance by Location Occupancy

Occupancy by Location 2011 – 2016 pay

Source : BHA and Horwath HTL

Midscale 20152016

Occupancy 6% 6%

ADR (IDR) 3%-4% ADR (USD) -9%-3% RevPAR (IDR) -4%3% RevPAR (USD) -15%4%

RevPAR Summary by Rate

2016 RevPAR USDIDR

Luxury -6%-7% Upper Upscale 4% 1% Upscale 1% Midscale 4% 3%

Average Length Of Stay

ALOS by rate category 2014 – 2016 y egy

Source : BHA and Horwath HTL

www.horwathhtl.com www.c9hotelworks.com

Source : BHA and Horwath HTL

With arrivals up, occupancy performance across all areas has improved. Interestingly in each area, except Others and Nusa Dua there was a uniform increase in occupancy of 2%. Nusa Dua and Others both enjoyed 6% increases in 2016, both having also dropped 4% in 2015 y-o-y.

HOTELIER INDONESIA | 29th | Vol 13 |

|

53

2017

www.hotelier-indonesia.com

Hotel & Branded Residences Bali

Average Daily Rates

ADR by Location 2011 – 2016 (USD) (U)