Some Research

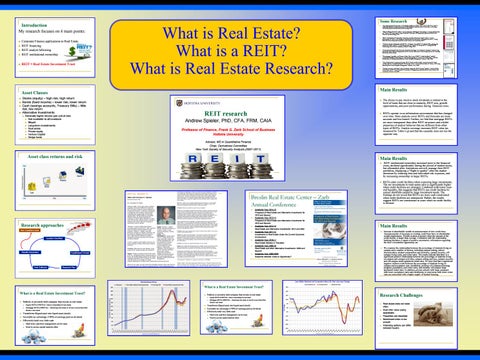

Introduction My research focuses on 4 main points: Corporate Finance applications to Real Estate REIT financing REIT analyst following REIT institutional ownership

REIT = Real Estate Investment Trust

What is Real Estate? What is a REIT? What is Real Estate Research?

Stocks (equity) – high risk, high return Bonds (fixed income) – lower risk, lower return Cash (savings accounts, Treasury Bills) – little risk, low return Alternative Investments

“An International Perspective of Volatility Spillover Effect: The Case of REITs”, with E. Nikbakht (Hofstra University) and M. Shahrokhi (California State University – Fresno), International Journal of Business, forthcoming, 2016

“Who Follows REITs?” with E. Devos (Eastern Michigan University), E. Devos (University of Texas – El Paso) and S. Ong (National University of Singapore), Journal of Real Estate Research, forthcoming, 2015

"REIT Institutional Ownership Dynamics and the Financial Crisis" with E. Devos (University of Texas – El Paso), S. Ong (National University of Singapore) and D. Tsang (McGill University), Journal of Real Estate Finance and Economics, 2013 “Elective Stock Dividends and REITs: Evidence from REIT Dividend Policy during the Financial Crisis” with E. Devos (University of Texas – El Paso) and D. Tsang (McGill University), Real Estate Economics, Volume 41(3), 2013

“Demand and Supply for University Student Housing: An Empirical Analysis” with S. Ong (National University of Singapore) and M. Petrova (Syracuse University), Journal of Housing Research, 2013, 22 (2)

"Investment, Liquidity and Private Debt: The Case of REIT Credit Facilities" with R. Campbell (Hofstra University), E. DeVos (University of Texas – El Paso) and C. Maxam (University of Idaho), Journal of Real Estate Portfolio Management, Volume 14:3, 2008

“The Information Content of Equity REIT Bank Credit Facility Announcements” (lead article), with R. Campbell (Hofstra University) and E. DeVos (University of Texas – El Paso), Journal of Real Estate Portfolio Management, Volume 14:1, 2008

“Analyst Activity and Firm Value: Evidence from the REIT Sector” with E. DeVos (Ohio University) and S. Ong (National University of Singapore), Journal of Real Estate Finance and Economics, Volume 33, 2007

Main Results

Asset Classes

Generally higher returns (per unit of risk) Not available to all investors Illiquid Long-term investments Real estate Private equity Venture Capital Hedge funds

REIT research

The choice to pay elective stock dividends is related to the level of loans that are close to maturity, REIT size, growth opportunities, and poor performance during financial crisis.

REITs operate in an information environment that has changed over time. More analysts cover REITs and forecasts are more accurate and less biased. Further, we find that mortgage REITs are more transparent than other REIT structures and exhibit properties of analyst behavior that are different from other types of REITs. Analyst coverage increases REIT value (as measured by Tobin’s q) and that the causality does not run the opposite way.

Andrew Spieler, PhD, CFA, FRM, CAIA Professor of Finance, Frank G. Zarb School of Business Hofstra University Advisor, MS in Quantitative Finance Chair, Derivatives Committee New York Society of Security Analysts (2007-2011)

Asset class returns and risk

Main Results

REIT institutional ownership increased prior to the financial crisis, declined significantly during the period of market stress, but rebounded after. Institutions actively manage their REIT portfolios, displaying a “flight to quality” after the market downturn by reducing beta and individual risk exposure, and by increasing ownership in larger REITs.

REITs enter credit facilities when expecting large investments. The net investments to total assets ratio is significantly higher when credit facilities are arranged. Combined with lower yearend liquidity, this suggests that REITs use credit facilities to correct shortfalls caused by large investment needs. The findings do not reveal that REITs are more cash constrained when credit facilities are announced. Rather, the results suggest REITs are constrained in years when no credit facility is formed.

Breslin Real Estate Center – Zarb Annual Conference

Research approaches

New Questions Arise

Question Identified

Results Interpreted

Data Collected

Hypotheses Formed

Academic Year 2014-15 Prospects of Real Estate and Alternative Investments for 2015 and Beyond Academic Year 2013-14 Prospects of Real Estate and Alternative Investments for 2015 and Beyond Academic Year 2012-13 Real Estate and Alternative Investments: 2012 and After Academic Year 2011-12 Investments in Real Estate Under the Current Economic Environment Academic Year 2010-11 Real Estate Markets in Transition Academic Year 2009-10 Real Estate and other Alternative Investments: 2009 and Beyond Academic Year 2008-2009 Subprime Markets: Crisis or Opportunity?

Main Results

Increase in shareholder wealth at announcement of new credit lines. Announcements of increases in existing credit lines have no shareholder wealth implications. Wealth creation is greater when the amount of the credit facility is larger than average. Consistent with the relationship banking literature, a signal of positive asymmetric information regarding the firm’s investment opportunity set.

We examine the relationship between the percentage of students living on campus and a number of factors, including campus setting, school characteristics, student composition and activities, campus security, offcampus living costs, and crime rates. The results indicate that there is a significant positive relationship between the percentage of students living on campus and campus activities, campus setting and size, campus security, and off-campus small apartment rental rates. We also find that a significant negative relation exists between the percentage of students living on campus and acceptance rate, enrollment, presence of a distance-learning program, population, and crime rates, and monthly off-campus large apartment rental rates. In addition, private schools with large campuses with lower acceptance rates and enrollment, in rural areas with lower crime rates are associated with a higher supply of student housing.

Research Plan

What is a Real Estate Investment Trust?

What is a Real Estate Investment Trust?

Publicly or privately held company that invests in real estate

Publicly or privately held company that invests in real estate Equity REITs (EREITs) – direct ownership of real estate Mortgage REITs (MREITs) - financing real estate or invest in securities that finance real estate

Transforms illiquid asset into liquid asset (stock) Favorable tax advantage if 90% of earnings paid as dividend Effectively hold very little cash

Short term cash flow management can be issue Need to access capital markets often

Equity REITs (EREITs) – direct ownership of real estate Mortgage REITs (MREITs) - financing real estate or invest in securities that finance real estate

Transforms illiquid asset into liquid asset (stock) Favorable tax advantage if 90% of earnings paid as dividend Effectively hold very little cash

Short term cash flow management can be issue Need to access capital markets often

Research Challenges

Real estate does not trade often Must infer value (using appraisals) Properties are dissimilar Benchmark index is too smooth Financing options can differ between buyers