50

Campaign 2015 – 2020

Why We Should Give The Power of Individual Giving

The Power of Regular Giving

For many people, the first step onto the giving ladder is by making an Individual Gift and it is one of the largest sources of income to the High School of Dundee Foundation.

Regular Giving welcomes people into a regular and repeating philanthropic relationship with the School. Typically, our Regular Donors give monthly or annually.

Typically our donors make an Individual Gift following an interaction with a representative of The Office of Development in response to a specific ‘ask’ for support with a discrete project or facility within the wider auspices of the Campaign.

This is the area where participation is the key – strength in numbers, and in the spirit of the global community of the High School of Dundee. Small amounts really do add up. If, for example, everyone on our database were to give the cost of a cup of coffee a day for a Campaign equivalent period to Campaign 2015 – 2020, when combined with the power of Gift Aid, we would raise a target smashing £73,690,142.73!*

We welcome Individual Gifts in many ways – through cash, cheque, direct debit, credit or debit cards, charity and affinity cheques and cards, shares, property, payroll giving and other assets and by setting up charitable trusts. The UK has a very generous system of tax-reliefs for individual giving. The most popular approach is Gift Aid, which accounts for 90 per cent of tax-effective giving. Gifts made through Gift Aid mean that the School can claim another 25p for every pound donated from HMRC, a substantial boost. Higher-ratetax payers too get a personal income tax-relief, in addition to the basic rate tax paid back to the School.

*per person equates as follows: £5703.13 (60 months – ‘Campaign equivalent period’) assuming a cup of coffee at £2.50 + gift aid = £3.125, x 365 = £1140.63 (12 months); a net monthly donor commitment of (£2.50 x 365 = £912.50 / 12) £76.04.

£73,690,142.73!*

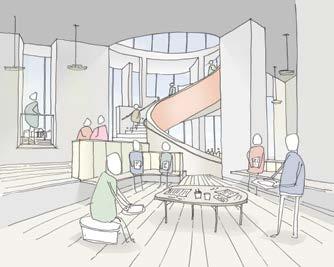

The Power of Legacy Giving Our generation has a good claim to be the ‘luckiest’ generation because: 1 We have not been directly involved in wars. 2 Our university education was free. 3 We have enjoyed ‘full’ employment. 4 Unlike newly-qualified graduates, we were able to buy our first homes in our early 20s, and over the years our present houses are in some cases worth 1000 times what the original purchase price was. 5 We have had the opportunity, if we wanted to, to retire early with very good pensions. 6 Our education at the High School – since it was a direct grant school, was effectively heavily subsidised by the state. 7 With the promised increase in the inheritance tax threshold to £1 million, few of us will have to pay any tax on our estate. The High School’s purchase of the former GPO building for development into a centre of excellence for performing and visual arts, which has been described by the Rector as a ‘once in a hundred years opportunity’, now provides FPs with our own opportunity to make a real contribution towards its completion. I have already made a legacy gift to the School which represents some 3% of the value of our house. With our Class 50th reunion on 18 June 2016, would it not be a great idea, while celebrating that Reunion, to commit to making a collective effort to raise

£1 million pounds largely, if not exclusively, through legacies. Throughout our time at the High School, we learnt the importance and value of giving to charities. Surely, our 50th reunion gives us all the opportunity to renew that sense of obligation and to repay our alma mater. Ian Yule Class of 1966