Debt Vulnerabilities and Trends in Debt Restructurings

GIC: Seventh Annual Sovereign Debt Restructuring

Conference

FEBRUARY 22, 2024

Disclaimer: The views expressed herein are those of the author and should not be attributed to the IMF, its Executive Board, or its Management.

Mark Flanagan Deputy Director, Strategy Policy andReview

DepartmentOutline

The nature of the debt challenge in LICs and EMs

Addressing liquidity problems Debt restructuring challenges in LICs and MICs

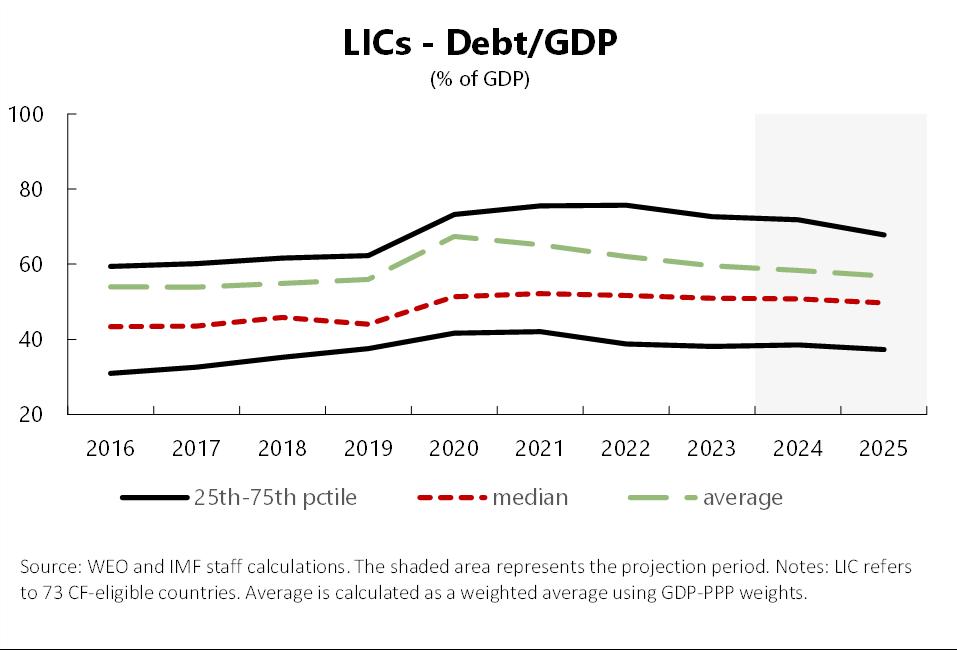

LICs: continued debt distress risks, but debt levels remain lower than pre-HIPC

Debt

Source: LIC DSA database. As of November 30, 2023

Source: IMF Global Debt Database, IMF World Economic Outlook, World Bank International Debt Statistics, and IMF staff calculations (Chuku et al 2023).

Note: IQR refers to interquartile range

EMs: debt distress risks in EMs remain stable, with spreads declining

Risk assessment based on fan chart tool results

Note: Green area = Low risk (Crisis probability < 9%, Missed crisis probability = 10%). Yellow area = Moderate risk (Crisis probability >9%, <20%).

Light Pink = High risk (Crisis probability >20%, False alarm probability = 10%). Dark Pink area = Crisis probability >40%.

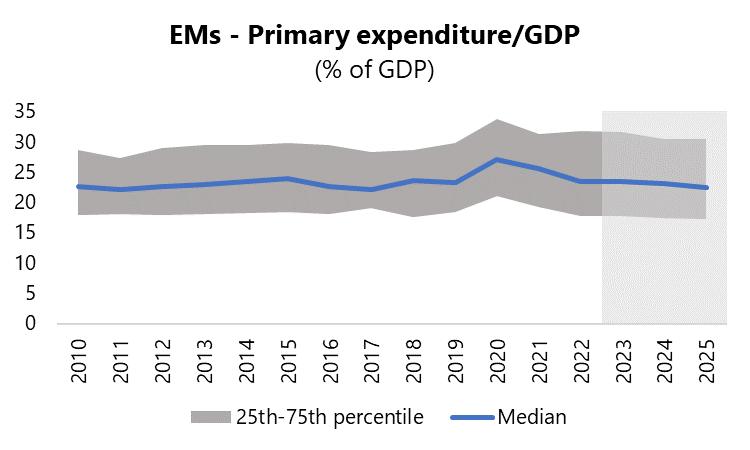

Debt-to-GDP in EMs and LICs has stabilized…

…And fiscal policy has reverted to the pre-covid stance

However, interest expenses have been trending up…

…squeezing non-interest primary expenditure, moreso in LICs…

Source: WEO and IMF staff calculations.

Notes: Data for 2023-24 are estimates and projections. LICs refer to 73 CF-eligible countries; EMs refer to WEO’s Emerging Market and MiddleIncome Economies.

And, higher spending needs still loom.

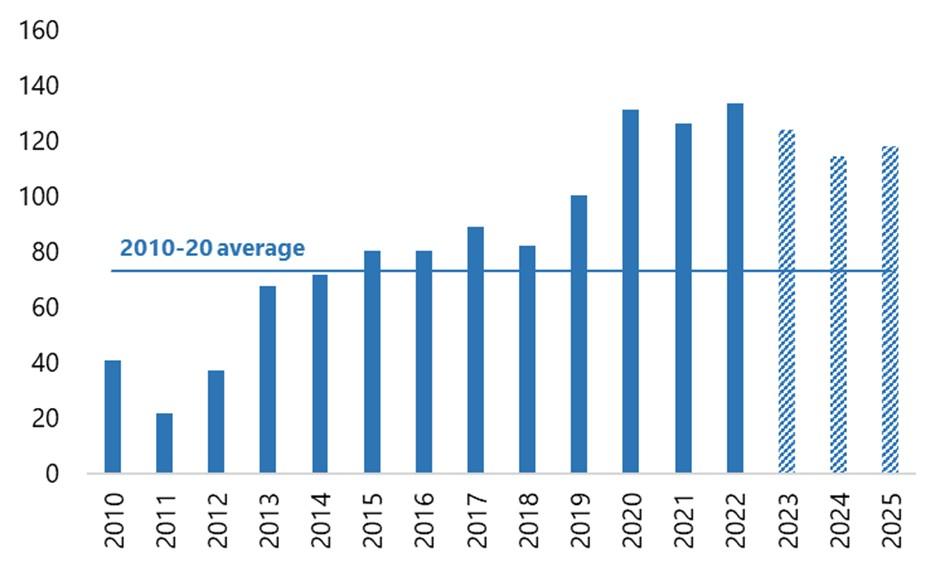

LICs’ external gross financing needs are expected to be high going forward

LICs: General Government Overall Fiscal Deficit, 2010-2025 (USD bn)

Source: IMF WEO database (October 2023).

Note: LICs refer to the 73 CF-eligible countries. The horizontal line represents the average from 2010 to 2020.

LICs: Principal Repayments on External PPG Debt, 2010–2025 (USD bn)

Sources: IMF staff calculations based on World Bank International Debt Statistics database.

Note: LICs refer to the 73 CF-eligible countries. Data for 2023-25 reflects amortization of outstanding debt stock as of end-2022. The horizontal line represents the average from 2010 to 2020.

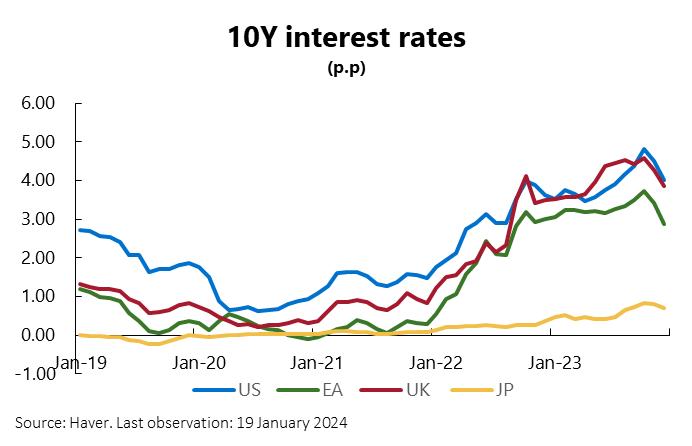

This is against a backdrop of looser fiscal policy and higher borrowing costs in AEs

Notes:

• Borrowing needs in AEs do not present any near-to-MT debt distress risks; these risks in AEs are long-term in nature (i.e. > 10 years)

• Extent and timing of policy easing cycle remains to be seen; core inflation appears to be a little sticky (appendix slide)

EM and LIC spreads have stabilized but remain higher at the top of the distribution

Net flows from credit markets to LICs and EMs have been weak (though some signs of life of late)

Notes:

LICs: Net external PPG debt flows by creditor type (USD bn)

Official creditors Private creditors Total

Source: IMF staff calculationsbasedon World BankInternational Debt Statistics.

Note: LICsrefer to the 73CF-eligiblecountries.

• Akin to a “sudden stop” last year. Notable pullback by Chinese official and private creditors (including minimal bond issuance) have offset rising multilateral flows.

• Of late: Ivory Coast, Benin, Kenya (all with reasonable metrics for demand, and with spread tightening in Kenya)

In sum, a solvency crisis does not appear to be brewing

But there appears to be:

• A liquidity problem: an issue of arranging financing on sustainable terms, in a period when debt service is increasing

• Overlaid on the well-known financing for development problem/gap

Different scenarios:

Markets re-open, perhaps aided by tighter fiscal policies in AEs (but larger EM/LIC financing needs remain an issue).

Partial market re-opening, leading to a further squeeze on non-interest spending in LICs (failure to invest): how long can this be sustained?

Continued tight market conditions and unsustainable spending squeeze, widening spreads, with solvency issues becoming more prominent.

Baseline: Remains closer to the first bullet, but (i) risks (two other bullets) need to be kept under close watch; and (ii) there remains a need to scale up financing for development

Outline

Debt challenges in LICs and EMs

Addressing liquidity problems

Debt restructuring challenges in LICs and MICs

Policy options to address the debt challenge

How to improve credit-worthiness allowing low-cost funding to materialize at higher scale?

Mobilizing domestic revenues.

Key fact: The typical Sub-Saharan African country raised only 13 percent of GDP in revenues in 2022, compared with 18 percent in other emerging economies and developing countries and 27 percent in advanced economies.

Mobilizing higher net exports. Structural reforms but improving the net energy balance can be critical.

Key fact: For non-fuel exporters, energy subsidies have risen from $15-20 billion in the mid-teens, to $50+ billion at present

Procuring lower-cost funding including from ODA providers. MDB grants can be helpful too, but lending may contribute to an overhang of super-senior debt beyond some point (frustrating market access)

• Key fact: In constant 2021 dollars, ODA grants have been flat since 2010, at around $50 billion

Is there a need for a more systemic approach?

Market evolution and country specific solutions may be enough, but several commentators have contemplated whether a systemic approach would be needed (Diwan, Songwe and Kessler (2024); other “non-papers” floating around)

What would a more systemic approach involve? Not HIPC 2, rather:

More ambitious domestic reforms, including to support climate goals…

Incentivized by stronger and coordinated MDB/IFI support and by…

Improvements in the global debt restructuring architecture to support upfront liquidity relief.

Remarks:

o DRM and climate reforms need to be undertaken and supported regardless of a formal initiative

o The Common Framework includes the possibility of providing liquidity relief, although this has not been used. Would need greater predictability and speed. Progress has been made already.

o Linking any initiative to private debt rescheduling could dissuade participants (the DSSI stopped short of this)

Summary. Not there yet, and not clear that linking things would help. But keep this under close watch.

Outline

Debt challenges in LICs and EMs

Addressing liquidity problems

Debt restructuring challenges in LICs and MICs

Restructuring timelines

Restructuring timeline of recent cases (in months)

Zambia

Sri Lanka

Ghana

• Timelines are improving (chart).

• However, may be close to or at the minimum for official creditors:

An official restructuring will only be as fast as the slowest of its underlying member components.

Non-PC creditors’ have been learning fast (they deserve credit), but their underlying systems are a constraint.

• In theory, private creditors could “play” first, but debtor’s financial and legal advisors have incentives to wait:

Large official creditors carry more “influence”, care a lot about CoT and can be more difficult to pin down.

Issues with creditor coordination

Comparability of treatment:

Conceptually difficult. Many complications (divergent original terms; different views about the relevant discount rate)

Historically, like “guided discretion” (3-part definition exists, but without precisely pinning down the concepts, nor clarity about the weighting)

Game is more complex now; “tolerances” are shifting and advisors trying to understand

Perimeter of the restructuring:

All creditors want this to be as wide as possible (but to exclude elements of their own debt)

Cut off date: moving away from DSSI to SLA date

Domestic debt: legally easier but economic constraints (i.e. will restructuring it actually help?)

SOEs (guaranteed or not): whether they “belong” in the public sector or should be seen as “commercial”

GSDR is a forum through which greater consensus is being sought on these issues

Substance:

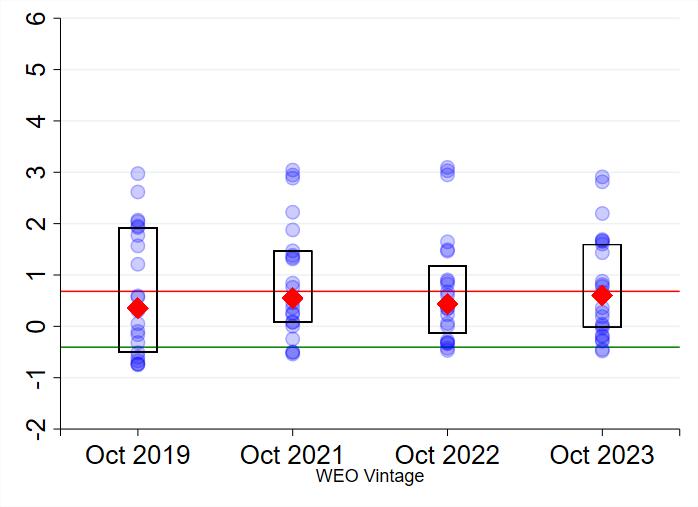

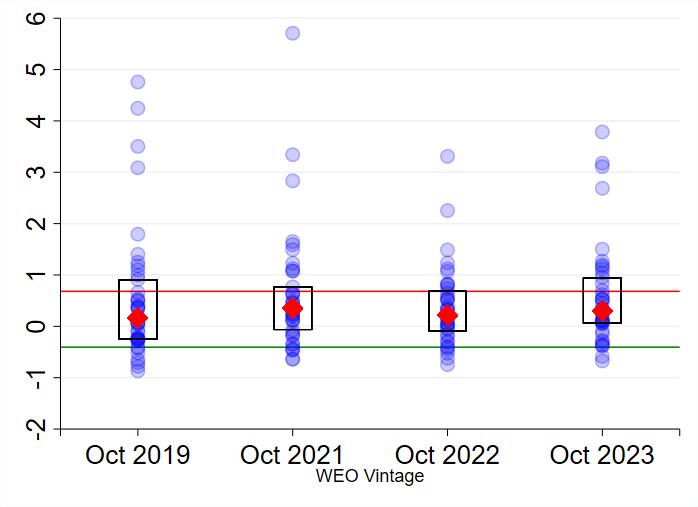

DSA-related issues

• Measuring debt carrying capacity (and handling discontinuities)

• Modeling choices to secure “objective” (“low” missed crises and false alarms)

• Accounting for medium-to long term risks (e.g. climate)

• Measurement of “solvency” vs “liquidity” risk

• Macro-fiscal framework (what is an appropriate baseline)

Information sharing:

• Availability of DSF templates, underlying data etc.

• Availability of real time information on macro-fiscal framework

• Limitation: while we may be persuaded by arguments, Fund staff do not negotiate the macro-fiscal framework.

IMF DSA framework reviews:

• LIC DSF underway

• SRDSF in 2026+

Macro forecasting not precise enough to “win” an argument thus typically handled through SCDIs, but difficult to design and evaluate (appendix slide)

> SRDSF template now available here.

> IMF Guidance on information sharing available here.

IMF policy-related issues

Though the Fund and creditors have been finding a way through, experience is raising issues for Fund policies, including around:

i. The application of additional safeguards under the LIOA policy (lack of clarity around when and how they should be applied)

ii. Handling financing assurances reviews when progress towards a restructuring is slow (and when the standard of advancing with adequate safeguards must be met)

iii. Consistent and even-handed application of the Fund’s financing assurances policy (which is optimized to the historic official creditor landscape)

iv. Elongated creditor processes and avoiding Fund “engagement gaps” with the debtor country

v. Elongated creditor processes and handling emergency financing needs that may arise (e.g. natural disasters) These issues are actively being debated and will likely be addressed soon.

Thank you

The global financial cycle: past the peak?

The social spending squeeze, from a different perspective

Sources: WEO, WB World Development Indicators, and IMF staff calculations.

Notes: LICs refer to 45 CF-eligible countries and EMs to 41 WEO-sample countries, for which data is available for 2010-2022.

Update: some momentum on debt restructuring cases

Country Status of the negotiations

Chad MOU signed in Dec. 2022. Maiden CF treatment (actual debt relief in 2024 and possible additional relief contingent on oil price developments).

COMMON FRAMEWORK (CF)

Ethiopia

Ghana

OCC agreed to provide a debt service suspension. Work will continue conditional on Fund staff and the authorities reaching SLA on a Fund-supported program.

DDR completed over the summer. OCC and Ghana agreed on a term sheet and the first review of Fund-supported program was completed. Engagement between government and external private creditors is advancing.

Zambia

Suriname

NONCOMMON FRAMEWORK

Sri Lanka

The OCC and Zambia agreed on a final MOU, and the second review of the Fundsupported program was completed. Negotiations continue with private creditors to reach a treatment consistent with program parameters and CoT.

Malawi

Agreements reached with all official bilateral creditors and bond exchange successfully completed. Fourth review of the Fund-supported program completed.

Some domestic debt has been restructured under the authorities’ DDO. Agreement in principle reached with official creditors (OCC and China). Discussions underway with Eurobond holders on a restructuring plan in line with IMF program parameters.

Fund-supported program approved in November. Continuing negotiations with official bilateral creditors and key private creditors (in “good faith”).

SCDIs: Key Issues for the Fund

1. Fund is open to the use of SCDIs (debt crisis prevention and bridging differences of views in restructurings)

2. Fund does not get involved in the micro details of the instruments’ design in specific cases.

3. However, the Fund needs to assess the impact of these instruments on the achievement of program goals:

SCDIs are not “free” and their cost needs to be evaluated. Need to calculate their impact on debt sustainability and confirm they fit within the debt targets that guide the restructuring.

The impact on debtor-creditor relations must be assessed. SCDIs may lead other creditors to re-open discussions (they may demand the same treatment) and need to confirm that this would then fit.

Risks inherent to the specific design need to be manageable. The Fund assumes that legal advisors will mitigate litigation risk, but risks related to uncapped exposures or to pay-off in states of the world where the country’s repayment capacity is diminished must be assessed.

It is important to note that greater complexity in SCDI design, while “optimal” in an academic sense, leads to greater challenges in making the assessments above, and in “passing” these tests.