Elena

Elena

1 Higher-for-longer rates will continue to drive default risk in 2024

Sovereign credit conditions will stabilize but remain difficult as debt flattens at higher levels and growth is muted. Default risks for frontier markets will remain elevated.

The Global Sovereign Debt Roundtable is working to improve the debt restructuring process. But will sovereign debt restructurings deliver sufficient debt relief to avoid years of impaired access to finance and growth, in an environment of rising climate and social investment needs?

The role of credit ratings in the market can be misunderstood

3

4

Credit ratings provide an independent, forward-looking opinion and a relative rank ordering of sovereign credit risk. Credit ratings have been much less volatile than other market measures of sovereign credit risk that are dominant drivers of market access.

At default resolution, credit ratings are re-assessed to reflect any material benefits from debt reduction, remaining credit challenges and forward-looking economic, policy and debt trajectory expectation.

Higher-for-longer rates will continue to drive default risk in 2024 1

For details, see Credit conditions – Global: 2024 Outlook - Adjusting to a new normal driven by rates, geopolitics and technology, November 2023. Source: Moody's Investors Service

Looser conditions

Tighter conditions

Brazil, Mexico, India and Indonesia FCIs in positive territory; China, Turkey and South Africa FCIs in negative territory; Argentina FCI deeply negative driven by equity markets component

*Moody’s Financial Conditions Indicators (FCIs) combine 13-18 financial variables to offer a composite picture of financial conditions. Data as of January 2024.

Source: Moody's Investors Service, Economic Pulse Check: Alternative Data Monitor, February 2024

» The global debt-to-GDP ratio now hovers around 331%, an increase of 8 percentage points since pre-pandemic times. The global government debt-to-GDP ratio began to rise again in the first half of 2023 after declining for seven quarters.

» The most substantial reduction was in advanced economies. Increases in government borrowing have boosted the total EM debt-to-GDP ratio to 255% in Q4 2023, reaching the previous record high in 2021.

Government debt-to-GDP ratio is rising again in 2023, whereas other sectors' ratios are declining (Debt-to-GDP ratio by borrower category)

Households

Nonfinancial corporations Government Financial corporations

Bursting of the dot-com bubble Global financial crisis

COVID-19 pandemic

Debt-to-GDP ratio of emerging market economies is still on the rise (Debt-to-GDP ratio)

Advanced economies, debt-to-GDP ratio

Emerging market economies, debt-to-GDP ratio (right axis)

For details, see Debt after COVID – January 2024: Higher for longer rates test the global banking system

Sources: Moody’s Investors Service and IIF

Increase in debt due to the COVID-19 shock follows a decade of rising debt in emerging and frontier markets

(Median general government debt-to-GDP ratio by country group)

Advanced economies

Frontier market economies Global

Emerging market economies

Frontier economies are facing higher debt servicing costs

(Interest payments as % of general government revenue)

Advanced economies

Frontier market economies

Emerging market economies

Conditions will remain difficult for governments as debt stabilizes at higher levels and growth is muted

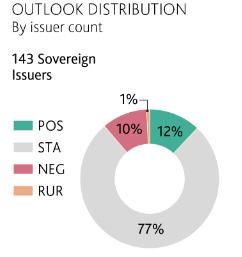

The share of ratings on positive outlook is almost balanced with share of ratings on negative outlook

2024 regional sovereign outlooks are stable except for Asia-Pacific and Sub-Saharan Africa

Region 2024 Sovereign Outlook

Euro Area Stable as debts decline and economies grow modestly

Central and Eastern Europe

Stable on more robust economy and roughly steady fiscal strength

Commonwealth of Independent States Stable as the regional adapts to geopolitical challenges

Middle East and North Africa

Stable on conducive growth environment, despite geopolitics

Sub-Saharan Africa Negative on large debt maturities amid tight funding conditions

Asia-Pacific Negative on downside risks to China and spillovers, weak global demand and deteriorating debt affordability

Latin America & the Caribbean Stable amid lower debt affordability and receding political risks

Outlook distribution data as of November 2023. Regional outlooks as of January 2024.

Source: Moody's Investors Service, Sovereigns – Global: 2024 Outlook – Stable but difficult as debt flattens at higher levels, growth is muted, November 2023.

Following the record number of defaults in 2022 and 2020

Defaults of Moody’s-rated sovereign issuers leapt to a record high in 2020-2023

2023 defaults: Argentina, Mozambique, Ecuador, Cameroon, Niger, Ethiopia

2022: El Salvador, Mali, Sri Lanka, Belarus, Russia, Ukraine, Ghana

2021: Belize

2020: Argentina, Lebanon, Ecuador, Suriname, Belize, Zambia

For details, see Sovereigns – Global: Sovereign default and recovery rates, 1983-2022, April 2023.

Source: Moody’s Investors Service

2023 share of sovereign ratings in the Caa-C category is over two times the historical average (Rating distribution of sovereign issuers, in percentages)

Sovereign ratings effectively rank order default risk (Issuer-weighted cumulative sovereign default rates, 1983-2022)

One year

Five year

While the share of sovereign ratings in the Caa-C category has jumped, the share of debt in the B and Caa-C categories is small

Moody’s sovereign rating distribution, as of February 2024

(Number of ratings in each rating category)

Total amount of government debt by rating category as of end-2023 (Share of total government debt, %)

Zambia requested treatment under the Common Framework on 1 February, 2021, following a default on its 2024 eurobond on 14 November, 2020. A Paris Club debt restructuring agreement was reached in June 2023 and a Memorandum of Understanding between Zambia and its bilateral creditors was agreed in October 2023.

Ethiopia requested treatment under the Common Framework on 3 February, 2021. On 30 November, 2023, the Paris Club agreed to provide a debt standstill for 2024. In December 2023, Ethiopia defaulted on its eurobond.

The Common Framework for Debt Treatments beyond the DSSI was endorsed by the G20 and the Paris Club in November 2020.

The IMF launched the Global Sovereign Debt Roundtable in February 2023 to “build greater common understanding among key stakeholders involved in debt restructurings, and work together on the current shortcomings in debt restructuring processes, both within and outside the Common Framework, and ways to address them.”

Ghana

Requested treatment under the Common Framework on 10 January, 2023, after announcing a debt suspension including eurobonds on 19 December, 2022. The exchange on domestic debt was settled on 21 February, 2023.

The first country to request a debt treatment under the Common Framework on 27 January, 2021. Commercial debt included an oil-backed loan from Glencore. Paris Club and Glencore debt restructuring agreements reached in November 2022.

*The GSDR facilitated common understanding on information sharing and the role of MDBs in restructuring processes; advanced discussions on the topics of cutoff dates, comparability of treatment, defining the debt restructuring perimeter, debt service suspension and arrears, issues in domestic debt restructurings, and the use of state contingent debt instruments.

Sources: Paris Club, the IMF and Moody’s Investors Service

» Would restructurings deliver sufficient debt relief to avoid years of impaired access to finance and growth?

– In an environment of muted global growth and interest rates higher than in the past two decades, “growing out” of debt troubles could be difficult.

– Financing needs are likely to increase to cover climate and social investment.

– Frontier markets’ financing sources have narrowed compared to the last decade. Financing from China has declined, bond market spreads have risen for sovereigns with low creditworthiness, bilateral financing is far from abundant and a marked increase in MDB financing is uncertain.

» Will sovereign debt markets evolve fast enough to meet the challenges of climate change?

– Climate shocks and trends are a key contributor to sovereign creditworthiness.

– There is a greater recognition that the magnitude of climate finance needs argue for a multi -pronged approach. That could include a combination of grants, IMF, World Bank and MDB finance, public finance, public -private partnerships and private finance, but financing provided through these sources is well below identified needs.

– The use of innovative instruments – green bonds, sustainability-linked bonds, climate-resilient debt clauses, backed debt, etc. – is growing and will help diversify the investor base but volumes are still short of what is needed.

The role of credit ratings in the market can be misunderstood 3

» Credit ratings provide an independent, forward-looking opinion and a relative rank ordering of sovereign credit risk as a complement to investors’ own analysis.

» Moody’s defines credit risk as the risk that an entity may not meet its contractual financial obligations as they come due and any estimated financial loss in the event of default.

» Decades of data benchmarking Moody’s sovereign ratings against actual default experience confirm that they effectively rank-order default risk.

» The number of Moody’s rated sovereign issuers grew to 143 in 2023, from 100 in 2000, reflecting the deepening of global financial markets and increasing access to finance for emerging market sovereign issuers.

Sovereign ratings have a history of effectively capturing relative default risk

Sources: Moody’s Investors Service, Rating Symbols and Definitions, November 2023 and Sovereign default and recovery rates, 1983-2022, April 2023.

» Credit ratings have been much less volatile than other market measures of sovereign credit risk that are dominant drivers of market access.

» Market investment decisions are a result of a riskreturn analysis, generally reflected in market prices.

» Ratings have been much more stable than other market measures of sovereign credit risk and have served as a moderating force through periods of tightening market liquidity, including through the COVID-19 pandemic.

» When changes do occur, ratings are much less likely to be reversed during a short period of time.

» Ratings have emphasized differentiation during periods of liquidity stress.

Market-implied measures are more volatile and reverse more often than Moody’s ratings

Average annual volatility statistics (as % of issuers, 1999-H1 2021)

Moody’s ratings

19%

Experiencing one or more rating change

Market-implied measures (Bond yield-implied ratings)

81%

2%

Experiencing large rating changes (>2 notches)

0.4%

Experiencing rating reversal within 12 months

24%

81%

How strong is the economic structure?

Reflects a country’s shockabsorption capacity. The capacity of the sovereign to generate revenue and service debt over the medium term relies upon fostering economic growth and prosperity.

1) growth dynamics (average real GDP growth, volatility)

2) scale of the economy (nominal GDP)

3) wealth (GDP per capita, PPP)

How does the debt burden compare with the government’s resource mobilization capacity?

INDICATORS / SCORES

How robust are the institutions and how predictable are the policies?

Considers whether the country’s institutional features are conducive to supporting the sovereign’s ability and willingness to repay its debt.

1) quality of institutions (qualitative assessment)

2) policy effectiveness (qualitative assessment)

What is the risk of a direct and sudden threat to the fundamental credit profile?

Captures the overall health of government finances. Assesses a sovereign’s ability to deploy resources to face current and expected liabilities.

1) debt burden (debt-to-GDP, debt-to-revenues)

2) debt affordability (interest payments-to-GDP, interest payments-to-revenue)

Source: Rating Methodology: Sovereigns, November 2022

Denotes the risk that sudden, extreme, events may severely strain public finances, thus sharply increasing the sovereign’s probability of default.

1) political risk (qual.)

2) government liquidity risk (qual.)

3) banking sector risk (banking sector size, average bca)

4) external vulnerability risk (qual.)

» A missed or delayed disbursement of a contractually obligated interest or principal payment (excluding missed payments cured within a contractually allowed grace period), as defined in credit agreements and indentures;

» A bankruptcy filing or legal receivership by the debt issuer or obligor that will likely cause a miss or delay in future contractually obligated debt service payments;

» A distressed exchange whereby (1) an issuer offers creditors a new or restructured debt, or a new package of securities, cash or assets, that amount to a diminished value relative to the debt obligation’s original promise; and (2) the exchange has the effect of allowing the issuer to avoid a likely eventual default;

» A change in the payment terms of a credit agreement or indenture imposed by the sovereign that results in a diminished financial obligation, such as a forced currency re-denomination (imposed by the debtor, or the debtor’s sovereign) or a forced change in some other aspect of the original promise, such as indexation or maturity.

» A default on debt owed to official sector creditors would not be captured by the issuer rating

– Moody’s issuer ratings speak to credit risk borne by private sector creditors.

– However, default to official sector creditors may indicate greater financial pressure than we had previously anticipated, which could affect the rating.

» Two potential direct channels of impact of official-sector debt relief on private-sector debt repayments:

– Comparability of treatment provisions that could result in losses on private-sector debt.

– Cross-default clauses that could trigger a default on bank loans or some bond contracts.

» Official sector debt relief would bring benefits to debt sustainability and/or policy frameworks which will be reflected in credit analysis.

Approximate expected recoveries associated with ratings for defaulted securities

» Moody’s does not have a ‘default’ rating, such as “D” or “SD”, as Moody’s ratings also reflect any financial loss in the event of default.

» An event of default that changes Moody’s risk assessment can have rating implications.

» If a country already has an unsustainable debt load, ratings would already be very low anticipating high default risk.

» Historically, the average loss, approximated generally by trading prices, for sovereign bonds has been about 50% over 1983-2022.

Expected recovery rate Fundamental

99 to 100% B1*

97 to 99% B2*

95 to 97% B3*

90 to 95% Caa1

80 to 90% Caa2

65 to 80% Caa3

35 to 65% Ca

Less than 35% C

*For instruments rated B1, B2, or B3, the uncertainty around expected recovery rates should also be low. For example, if a defaulted security has a higher than a 10% chance of recovering less than 90%, it would generally be rated lower than B3.

Source: Moody’s Investors Service, Rating Symbols and Definitions, November 2023

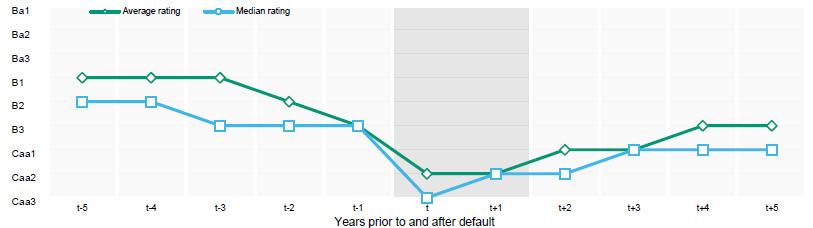

» At default resolution, ratings are re-assessed to reflect any material benefits from debt reduction, remaining credit challenges and forward-looking economic, policy and debt trajectory expectations.

» Slow rating recovery post default has reflected re-default risk and the length of time it has taken to address the underlying problems that caused default.

» Historically, credit standing has remained stressed for several years after default: The average rating has taken four years to return to B3 after default.

Average and median rating of sovereign issuers around default since 1983

Source: Moody’s Investors Service, Sovereign default and recovery rates, 1983-2022, April 2023.

Outlook:

» Credit conditions – Global: 2024 Outlook – Adjusting to a new normal driven by rates, geopolitics and technology, 31 October 2023

» Sovereigns – Global: 2024 Outlook – Stable but difficult as debt flattens at higher levels, growth is muted, November 2023

Methodology:

» Sovereign Ratings Methodology, November 2022

» Rating Symbols and Definitions, November 2023

» Multilateral Development Banks and Other Supranational Entities, February 2024

Sovereign defaults research:

» Sovereign default and recovery rates, 1983-2022, April 2023

» Sovereign Debt Restructurings: Key Facts from History, February 2022

» Sovereign Defaults Series: The causes of sovereign defaults, August 2020

Sector research:

» FAQ on sovereign distressed exchanges, March 2023

» Protracted debt restructurings are credit negative for borrowers and lenders, February 2023

» State-contingent debt instruments can aid debt restructuring, but can carry fiscal risks, January 2024

» Credit impact of climate resilient debt clauses depends on scale, details of terms, October 2023

» FAQ on debt-for-climate/nature swaps, October 2022

» Debt after COVID – January 2024: Higher for longer rates test the global banking system, January 2024

» Debt after COVID – June 2021: Focus on sovereign debt: Unequal debt realities, June 2021

© 2024 Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S CREDIT RATINGS AFFILIATES ARE THEIR CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND MATERIALS, PRODUCTS, SERVICES AND INFORMATION PUBLISHED BY MOODY’S (COLLECTIVELY, “PUBLICATIONS”) MAY INCLUDE SUCH CURRENT OPINIONS. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT OR IMPAIRMENT. SEE APPLICABLE MOODY’S RATING SYMBOLS AND DEFINITIONS PUBLICATION FOR INFORMATION ON THE TYPES OF CONTRACTUAL FINANCIAL OBLIGATIONS ADDRESSED BY MOODY’S CREDIT RATINGS. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS, NON-CREDIT ASSESSMENTS (“ASSESSMENTS”), AND OTHER OPINIONS INCLUDED IN MOODY’S PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY’S PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY’S ANALYTICS, INC. AND/OR ITS AFFILIATES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS DO NOT COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODY’S ISSUES ITS CREDIT RATINGS, ASSESSMENTS AND OTHER OPINIONS AND PUBLISHES ITS PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE.

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS, AND PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS AND INAPPROPRIATE FOR RETAIL INVESTORS TO USE MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS OR PUBLICATIONS WHEN MAKING AN INVESTMENT DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN CONSENT.

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS ARE NOT INTENDED FOR USE BY ANY PERSON AS A BENCHMARK AS THAT TERM IS DEFINED FOR REGULATORY PURPOSES AND MUST NOT BE USED IN ANY WAY THAT COULD RESULT IN THEM BEING CONSIDERED A BENCHMARK.

All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODY’S is not an auditor and cannot in every instance independently verify or validate information received in the credit rating process or in preparing its Publications.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any such information, even if MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or damages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a particular credit rating assigned by MOODY’S.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory losses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the avoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY CREDIT RATING, ASSESSMENT, OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER.

Moody’s Investors Service, Inc., a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody’s Investors Service, Inc. have, prior to assignment of any credit rating, agreed to pay to Moody’s Investors Service, Inc. for credit ratings opinions and services rendered by it fees ranging from $1,000 to approximately $5,000,000. MCO and Moody’s Investors Service also maintain policies and procedures to address the independence of Moody’s Investors Service credit ratings and credit rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold credit ratings from Moody’s Investors Service, Inc. and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the heading “Investor Relations Corporate Governance Charter Documents - Director and Shareholder Affiliation Policy.”

Additional terms for Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s Investors Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be provided only to “wholesale clients” within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODY’S that you are, or are accessing the document as a representative of, a “wholesale client” and that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to “retail clients” within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail investors.

Additional terms for Japan only: Moody's Japan K.K. (“MJKK”) is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly-owned by Moody’s Overseas Holdings Inc., a wholly-owned subsidiary of MCO. Moody’s SF Japan K.K. (“MSFJ”) is a wholly-owned credit rating agency subsidiary of MJKK. MSFJ is not a Nationally Recognized Statistical Rating Organization (“NRSRO”). Therefore, credit ratings assigned by MSFJ are Non-NRSRO Credit Ratings. Non-NRSRO Credit Ratings are assigned by an entity that is not a NRSRO and, consequently, the rated obligation will not qualify for certain types of treatment under U.S. laws. MJKK and MSFJ are credit rating agencies registered with the Japan Financial Services Agency and their registration numbers are FSA Commissioner (Ratings) No. 2 and 3 respectively.

MJKK or MSFJ (as applicable) hereby disclose that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by MJKK or MSFJ (as applicable) have, prior to assignment of any credit rating, agreed to pay to MJKK or MSFJ (as applicable) for credit ratings opinions and services rendered by it fees ranging from JPY100,000 to approximately JPY550,000,000.

MJKK and MSFJ also maintain policies and procedures to address Japanese regulatory requirements.