FEBRUARY 22, 2024

Thor Jonasson

Deputy Division Chief, Debt and Capital Markets Instruments Division

The views expressed herein are those of the author and should not be attributed to the IMF, its Executive Board, or its management

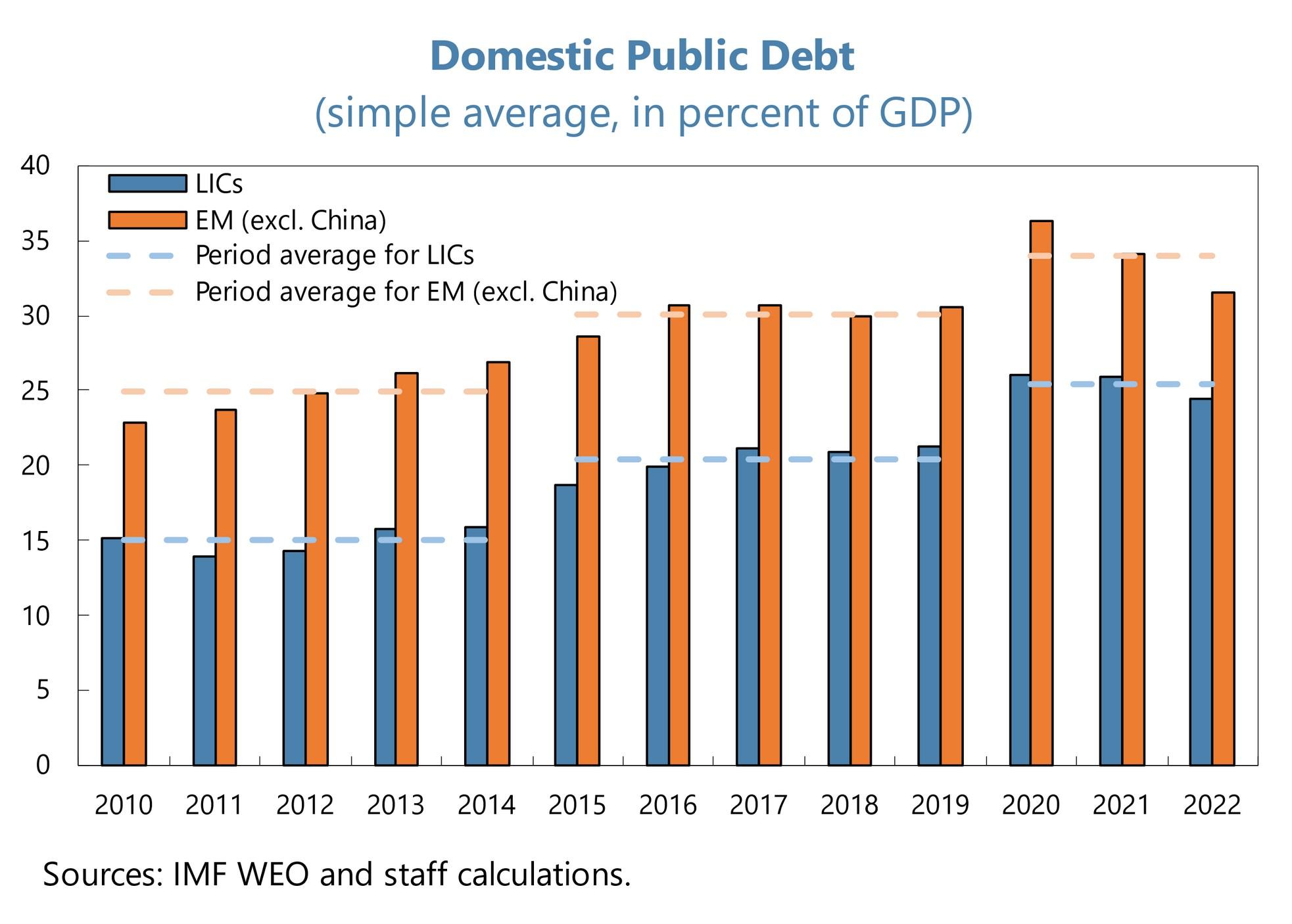

Since COVID 19 crisis in 2020

• Domestic debt grew particularly in LICs (same level as EMs 10 years ago)

• Domestic debt issuance helped offset the scaling back of external financing

But has been a longer-term trend

► In the context of higher public debt in EMDEs (ex.China) ~ 40% (2013) 56% (2023) of GDP

► Domestic debt / Total public debt in EMDEs (ex. China): 33% (2000) 55% ( 2023)

Differentiation in current market access conditions for EMDEs

Indebted sovereigns facing loss of market access frequently experience increasing strains in domestic financial conditions

► Domestic financing rises as fiscal needs still need to be met

► Government debt holdings by banks deepens sovereign-bank nexus

► Domestic debt maturities shorten (high sovereign risk premium)

► Central bank holdings of government debt can increase through monetary financing

► Rising official arrears, especially to SoEs

The same pressures are observed when IMF arrangement is delayed or SoDR is protracted

► Negative feedback loop can affect program targets

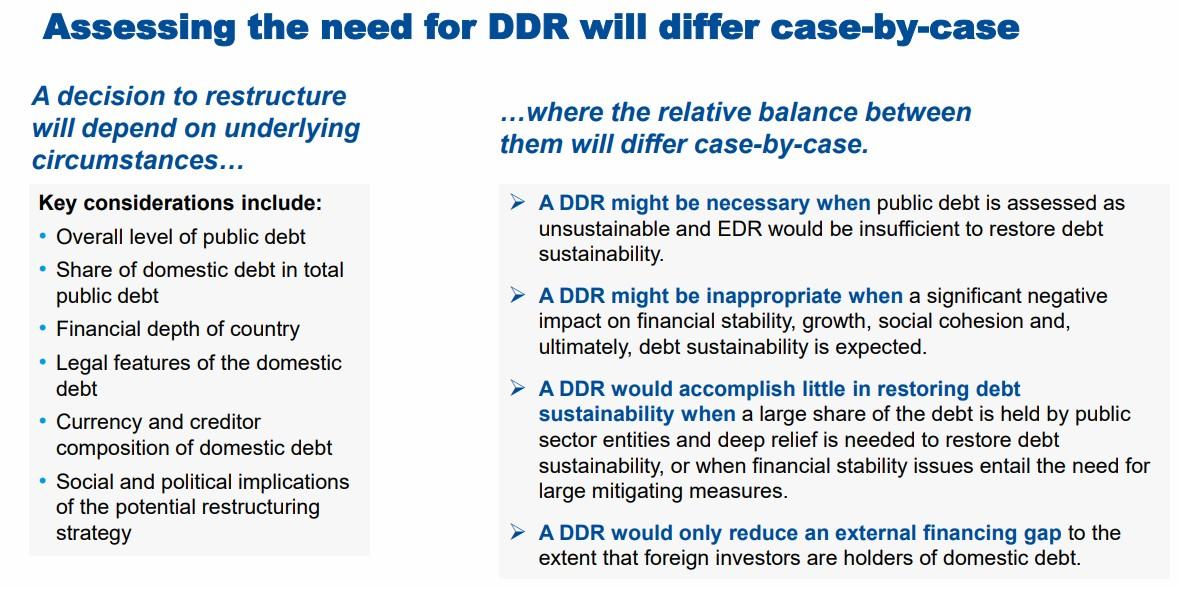

DDR feasibility and design constrained by high costs associated with a financial crisis

Banks are highly leveraged and in LICs/EMEs have high sovereign exposures

◆Banks typically already under stress and the risk of a banking crisis is non-linear, even risk of small losses can trigger a deposit run

DDR with significant haircuts could result in undercapitalized or insolvent banks triggering a dual sovereign banking crisis.

Not just negative equity that matters—path is important

▶ Is CB left with sufficient interest earning assets to meet costs of implementing monetary policy?

▶ Should CB equity spiral downwards, options are CB default, inflation or eventual recapitalization by the government

CB liabilities are not an accounting fiction, rather assets held by the private sector

▶ If confidence lost in the CB, monetary stability will be lost

Consideration:

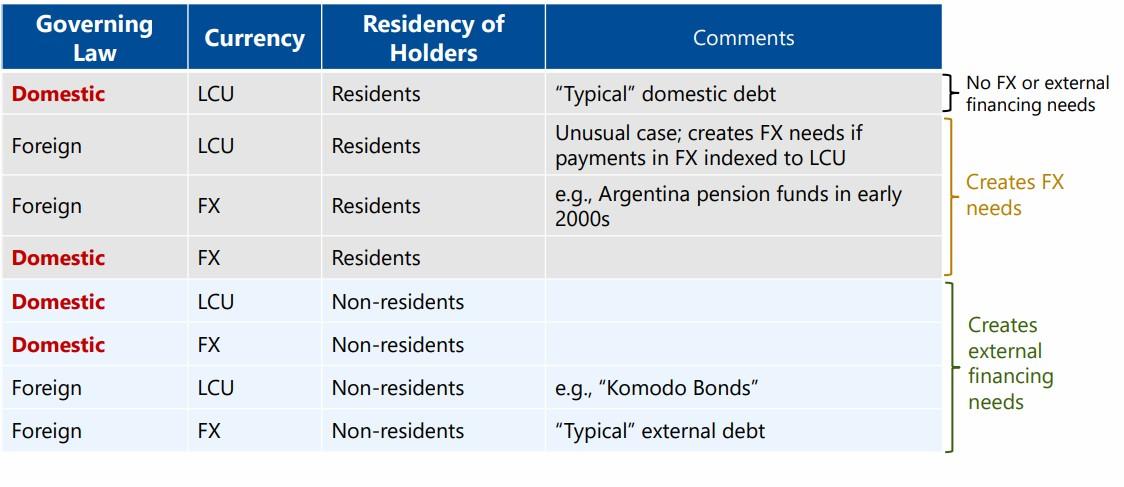

1) jurisdiction or investor residence, 2) interaction between DDR and EDR: e.g. treatment of domestic debt will also have impact on program external targets (Local debt denominated FX, nonresident holding of domestic debt)

Untreated domestic debt could delay macroeconomic stabilization but disorderly DDR destabilizing to financial stability, economy & DSA

Mitigation Strategy Examples Comments

Solvency

Liquidity

Accounting changes

• Payments in cash or assets

• Tax reductions

• Exemptions of certain creditors

• Central Bank collateralized lending

• Financial Stability Fund

• Reduces savings from DDR

• Leads to demands from others

Regulatory Forbearance

• Delayed recognition of losses

• Underestimate of losses

• Change in computation of ratios

• Temporary reduction of capital & liquidity ratios

• Needed for stability but can become solvency support and put CB balance sheet at risk

• Decreases transparency

• Delays recapitalization

• May undermine creditor confidence more widely

• Not recommended but sometimes unavoidable

Authorities’ decision to proceed with a DDR need a design and execution strategy

Design of instruments can mitigate vulnerabilities

Incentives can yield higher participation rates (“carrots” and “sticks”)

A credible reform plan aimed at restoring macroeconomic and financial stability as well as conditions for strong growth is essential for securing creditors’ buy-in

Communication to explain the rationale and parameters of the DR goals to all stakeholders, and to understand the creditors’ priorities and limitations

Fair and transparent process helps to encourage participation and reduces likelihood of litigation

Envelope for SoDR

Intercreditor Equity

Comparability of Treatment

Fair Burden Sharing

Equally Distributing Losses Among Creditors

Considerations raised (Rivetti, 2022):

▶ NPV reduction should be calculated on the entire debt stock for each category of creditors (as opposed to targeting only the debt falling due in the consolidation period)

▶ If any debt service were to be brought forward to a future date (for instance, because of a standstill) the same discount rate should be used

▶ The choice of the discount rate would only affect the contribution of interest rate reductions relative to maturity extensions (nominal haircuts are neutral to discount rates)

Several reforms have been suggested (e.g., Rivetti, 2022)

► Carrying out coordinated and simultaneous negotiations across creditors

► Using NPV reduction based upon a common discount rate as the single and unform measure of CoT and separate analysis of value recovery

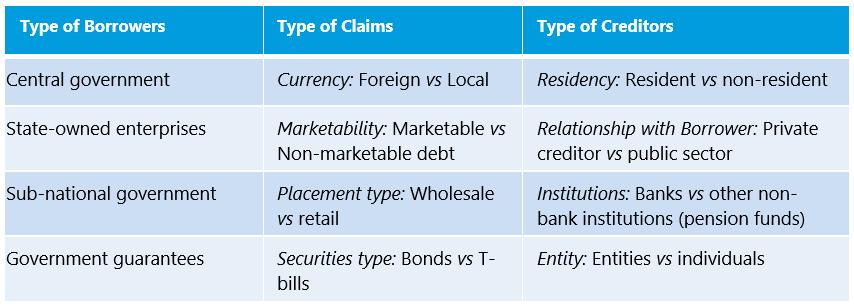

But which domestic debt should be part of the total restructuring perimeter?

How to maximize creditor participation and ensure a fair and transparent process that would overall lower relief sought from each group?

How to ensure that the design is realistic and takes into account the country’s broader macroeconomic strategy and social and political realities?

How to communicate the debt exchange to all stakeholders as part of a consistent macroeconomic plan to address causes of the sovereign debt distress?

…”the prevention is better than the cure”

Debt management TA often focuses on developing and implementing debt management strategy, but important basics cannot be overlooked, such as:

• Lack of understanding/ability about loan terms and conditions and how to negotiate with creditors

• Poor quality debt recording due to lack of knowledge of underlying instruments or use of debt recording system. Leading to inability to produce debt reports.

• Lack of understanding of basic concepts in finance – time value of money, bond price/yield dynamics, cashflow structures, yield curves etc.

In order to deliver effective TA, need to make sure basic gaps are closed via training.

IMF Online Learning launched in 2014, with Debt Sustainability Analysis as one of the first Massive Open Online courses available.

Current courses and courses under development include:

Debt Management

• Medium-term Debt Management Strategy (MTDSx)

• Debt Management, Debt Reporting and Investor Relations (DMIRx)*

• Local Currency Bond Markets (LCBMx)*

Debt Sustainability

• Debt Sustainability Framework for LICs (LICDSFx)

• Public Debt, Investment, and Growth (DIGx),

• Public Debt Dynamics Under Uncertainty (DDUx) Projecting Public Debt (DDTx)

• Sovereign Risk and Debt Sustainability Analysis for Market Access Countries (MAC SRDSF)*

*In development

IMF OL Program is broader than just English-language MOOCs.

• Adaptations of courses into multiple languages – critical for making material available for LICs: e.g. MTDSx in French and Spanish, LIC DSFx in French, Spanish and Portuguese.

• Blended learning – integrating online content with face-to-face training, including developing pre-requisites for CD engagements through use of online material (e.g. training on MTDS framework).

• Microlearning – explaining fundamental concepts, offered via IMF Microlearning Channel on Youtube. New playlists on core concepts for public debt management

Targeted at debt management staff in countries with particularly low capacity in debt management.

IMF OL Program is broader than just English-language MOOCs.

• Adaptations of courses into multiple languages – critical for making material available for LICs: e.g. MTDSx in French and Spanish, LIC DSFx in French, Spanish and Portuguese.

• Blended learning – integrating online content with face-to-face training, including developing pre-requisites for CD engagements through use of online material (e.g. training on MTDS framework).

• Microlearning – explaining fundamental concepts, offered via IMF Microlearning Channel on Youtube. New playlists on core concepts for public debt management

Targeted at debt management staff in countries with particularly low capacity in debt management.

• Online learning is an effective method for teaching debt sustainability and management, leveraging frameworks and tools for maximum reach.

• There's a significant need for debt-related online courses (MOOCs) and microlearning modules to be available in French, Spanish, and Portuguese, catering to the needs of LowIncome Countries (LICs) and Fragile and Conflict-Affected States (FCS).

• Allocating time for training is challenging for nations with limited staffing; hence, it's crucial to balance the benefits of online learning with the in-depth engagement of in-person training.

• While certain foundational concepts like finance basics remain constant, it's important to evaluate our unique value proposition in contrast to other training providers and to consider synergies with various training methodologies.

• Looking ahead, AI is poised to enhance course development, introducing dynamic scenario creation and testing to solidify the learning experience.

IMF Policy Paper No. 2021/071: Issues in Restructuring of Sovereign Domestic Debt

IMF Staff Discussion Notes No. 2020/006: The Role of State-Contingent Debt Instruments in Sovereign Debt Restructurings

IMF MCM Departmental Paper No. 2020/003:

Managing Systemic Banking Crises: New Lessons and Lessons Relearned

IMF (2021). Issues in Restructuring of Sovereign Domestic Debt

IMF (2023). Restructuring Sovereign Domestic Debt: An Analytical Illustration