8 minute read

Is Avatrade Available in INDIA

from Avatrade Review

by ForexMakets

AvaTrade is not directly regulated in India but allows Indian traders to open and use accounts under international regulations. Always check RBI and SEBI guidelines before trading.

In the ever-evolving world of online trading, choosing a reliable and accessible platform is crucial for traders to ensure they get the best experience and opportunities. One such platform that has gained widespread recognition globally is Avatrade. But what about India? Can traders in India access Avatrade for forex trading? This detailed guide will answer this question and provide valuable insights on how Avatrade India works, its features, regulatory compliance, and whether it's a good fit for Indian traders. So, if you're wondering whether you can trade forex with Avatrade in India, read on.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

What is Avatrade?

Avatrade is a popular online trading platform that allows traders to invest in a wide range of assets, including forex, stocks, commodities, cryptocurrencies, and indices. Founded in 2006, Avatrade has grown into a major player in the global financial markets, offering a secure and accessible trading environment for investors around the world.

With a reputation for reliability, Avatrade is regulated in several major financial jurisdictions, which adds to its trustworthiness and credibility. Its user-friendly platforms and competitive trading conditions make it an appealing choice for traders of all experience levels.

Now, let's answer the burning question for Indian traders—Is Avatrade available in India?

See more:

Is Avatrade Available in India?

Yes, Avatrade is available in India, and Indian traders can open accounts and trade on the platform. In fact, India is one of the growing markets for online forex trading, and Avatrade recognizes the potential of this market. With easy access to global financial markets and a wide range of assets, Indian traders can benefit from the Avatrade platform.

However, it's important to note that the Indian government has strict regulations around trading and investing in foreign currencies. The Reserve Bank of India (RBI) regulates forex trading and has restrictions in place that might affect how Indian traders engage with international brokers like Avatrade.

Despite these regulations, Avatrade ensures that Indian traders can access its services, as long as they comply with the local laws. This means that you will need to use the platform in line with the RBI's foreign exchange regulations. Traders need to be aware of these laws, as non-compliance can lead to penalties.

✅ Key Point: While Avatrade is available in India, Indian traders should be cautious and ensure that they are following all necessary regulatory guidelines to avoid any legal issues.

Why Choose Avatrade for Forex Trading in India?

When considering which platform to use for forex trading in India, Avatrade stands out for several reasons. Here's why you should consider Avatrade India:

Regulated and Trusted: Avatrade is regulated by several top-tier financial authorities, including the Central Bank of Ireland and the Australian Securities and Investments Commission (ASIC). This ensures that traders' funds are safe and that the platform operates with high transparency and integrity.

Wide Range of Assets: Indian traders can access a variety of markets, from forex to stocks, commodities, cryptocurrencies, and even ETFs. This diversity allows you to explore multiple trading options beyond just currency pairs.

User-Friendly Platforms: Avatrade offers several trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and AvaTradeGO. These platforms are designed for both beginners and experienced traders, making it easy to analyze the markets and execute trades.

Educational Resources: For traders who are just starting out or those looking to refine their skills, Avatrade offers a wide range of educational materials. This includes webinars, tutorials, e-books, and other resources that can help you improve your trading knowledge.

Competitive Spreads and Leverage: Avatrade offers competitive spreads, making it an appealing choice for traders looking to minimize costs. Additionally, the platform provides leverage options that allow traders to magnify their potential profits (though this also increases the risk).

Customer Support: The customer support at Avatrade is available 24/5, ensuring that any questions or issues can be resolved promptly. You can contact support via email, phone, or live chat.

❌ Important Consideration: While Avatrade offers many advantages, traders should keep in mind that leverage can be a double-edged sword. It can amplify both gains and losses, so it's important to trade responsibly and use risk management strategies.

How to Open an Avatrade Account in India

Opening an account with Avatrade in India is a straightforward process. Here's a step-by-step guide:

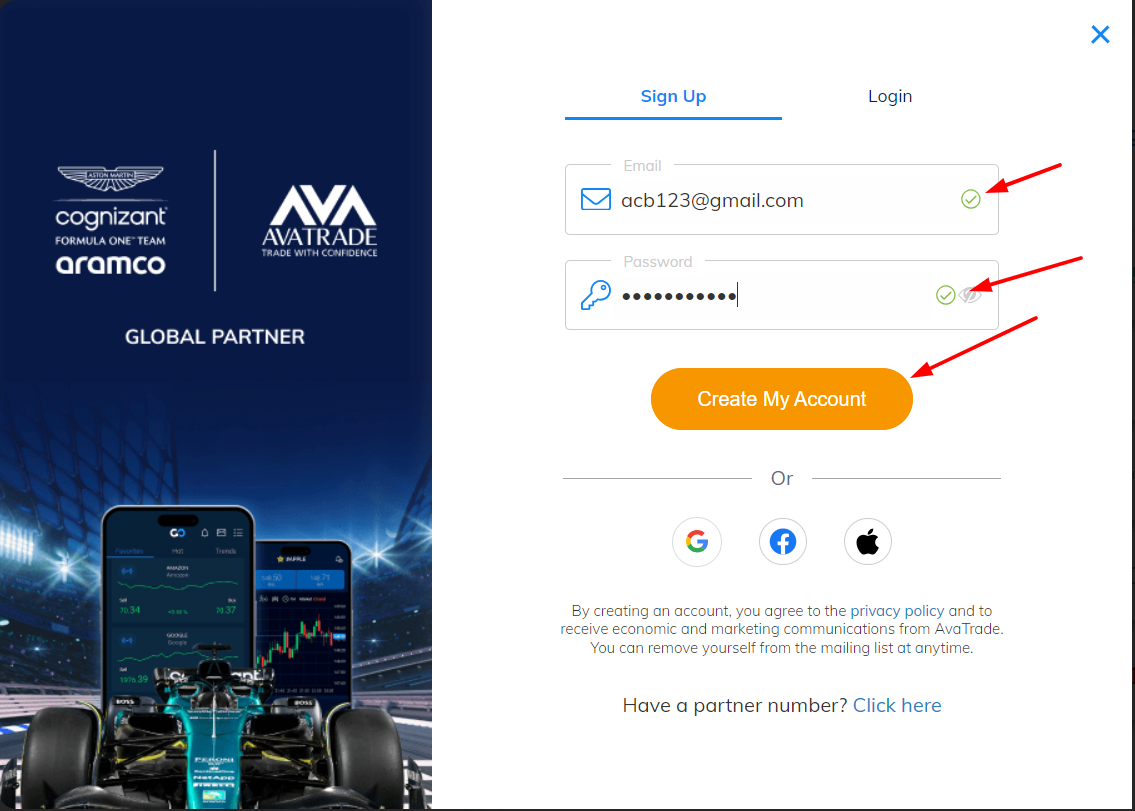

Visit the Avatrade Website: Go to the official Avatrade website and click on the "Sign Up" button.

Provide Personal Information: You will need to enter your personal details, such as your name, email address, phone number, and country of residence (India).

Verify Your Identity: As part of the Know Your Customer (KYC) process, Avatrade will require you to submit documents to verify your identity and address. This can include a government-issued ID (like your Aadhar card or passport) and a utility bill with your name and address.

Choose Your Account Type: Avatrade offers different account types, including standard accounts and demo accounts. Choose the one that best suits your trading style.

Make Your First Deposit: Once your account is verified, you can deposit funds using one of the available payment methods, such as credit/debit cards, bank transfers, or e-wallets.

Start Trading: After your deposit is processed, you can start trading on Avatrade using the platform of your choice.

Avatrade India Features and Tools

Avatrade India offers a wide range of features and trading tools that can enhance your trading experience:

Trading Platforms: As mentioned earlier, Avatrade offers MT4, MT5, and its proprietary platform, AvaTradeGO. These platforms are equipped with advanced charting tools, indicators, and real-time market data.

Mobile Trading: AvaTradeGO is a mobile app that allows you to trade on the go. It provides all the essential features you need to manage your trades from your smartphone or tablet.

Market Analysis Tools: Avatrade provides access to market analysis, news, and reports to help traders stay informed and make well-rounded decisions.

Risk Management: Avatrade offers various risk management tools such as stop-loss orders, take-profit orders, and trailing stops to help you manage your trades effectively.

Avatrade Regulatory Compliance in India

While Avatrade is regulated in various jurisdictions worldwide, it's essential for Indian traders to be aware of the RBI's foreign exchange policies. These policies dictate how forex trading can be conducted in India, including restrictions on certain types of foreign currency trading.

✅ Key Point: Avatrade operates in full compliance with international regulations, but traders in India need to ensure that their trading activities are within the boundaries of Indian laws. Always consult with a legal professional if you're uncertain about any regulations.

Avatrade Trading Platforms

As a trader in India, you can use several trading platforms to trade on Avatrade:

MetaTrader 4 (MT4): A highly popular platform for forex traders, known for its ease of use and wide array of tools and resources.

MetaTrader 5 (MT5): The upgraded version of MT4, offering additional features like more timeframes, enhanced charting tools, and an economic calendar.

AvaTradeGO: A mobile trading app designed for on-the-go traders, providing a user-friendly interface and all the necessary tools to manage your trades.

Deposits and Withdrawals with Avatrade in India

Depositing and withdrawing funds with Avatrade India is relatively easy. Avatrade supports various payment methods, including credit/debit cards, bank transfers, and e-wallets. However, be mindful of any transaction fees and processing times.

❌ Important Note: Always ensure that you are depositing funds in accordance with Indian regulations on forex trading.

💥💥💥 Trader with AvaTrade: 👉 Open An Account or 👉 Go to broker

Risk Management and Customer Support

Trading forex can be highly volatile, so Avatrade provides a variety of risk management tools to help traders protect their capital. You can set stop-loss and take-profit orders to automatically close trades at specific prices.

Additionally, Avatrade offers excellent customer support through multiple channels. If you need help with a trading issue or have any questions, you can reach their team easily.

💥 Read more:

FAQs

1. Is Avatrade available in India?Yes, Avatrade is available in India for forex and other forms of online trading. However, Indian traders need to comply with local regulations.

2. How do I open an account with Avatrade?You can open an account by visiting the Avatrade website, providing your personal information, and verifying your identity.

3. Is Avatrade regulated?Yes, Avatrade is regulated in multiple jurisdictions, including Europe and Australia.

4. Can I trade cryptocurrencies with Avatrade in India?Yes, Avatrade offers trading in cryptocurrencies like Bitcoin, Ethereum, and others.

5. What platforms does Avatrade offer?Avatrade offers MT4, MT5, and the mobile app AvaTradeGO.

6. Does Avatrade offer customer support in India?Yes, Avatrade provides 24/5 customer support through email, phone, and live chat.

7. How do I deposit funds into my Avatrade account?You can deposit funds via credit/debit card, bank transfer, or e-wallets.

8. What is the minimum deposit for Avatrade in India?The minimum deposit required depends on the account type, but it's generally around $100 (or the equivalent in INR).

9. Is leverage available with Avatrade in India?Yes, Avatrade offers leverage, but it should be used cautiously due to the increased risk.

10. Is Avatrade safe to use for Indian traders?Yes, Avatrade is a regulated platform and has a strong reputation for security and customer trust.