8 minute read

Is Avatrade Legal in INDIA

from Avatrade Review

by ForexMakets

Is Avatrade Legal in INDIA

Introduction

In recent years, online trading has gained significant popularity among Indian investors. Among the plethora of trading platforms available, AvaTrade has emerged as a notable contender. However, potential traders often find themselves questioning: Is AvaTrade legal in India? This article delves deep into this query, providing a detailed analysis tailored for traders seeking clarity.

💥💥💥 Trade with AvaTrade: 👉 Open An Account or 👉 Go to Broker

Understanding AvaTrade

AvaTrade is a global online brokerage firm that offers trading services in various financial instruments, including forex, stocks, commodities, indices, and cryptocurrencies. Established in 2006 and headquartered in Dublin, Ireland, AvaTrade has expanded its operations worldwide, serving over 400,000 clients across more than 150 countries. The platform is renowned for its user-friendly interface, diverse range of trading tools, and robust customer support.

"Your trading success starts with the right broker. 🔍 Explore our expert Forex broker reviews now!"

Regulatory Landscape in India

Before delving into AvaTrade's legal standing, it's essential to understand the regulatory framework governing online trading in India. The primary regulatory authority overseeing financial markets in India is the Securities and Exchange Board of India (SEBI). SEBI's role is to protect investor interests, ensure market integrity, and promote the development of the securities market.

In addition to SEBI, the Reserve Bank of India (RBI) plays a crucial role in regulating foreign exchange transactions under the Foreign Exchange Management Act (FEMA). FEMA governs the inflow and outflow of foreign exchange and sets guidelines for residents and non-residents engaging in forex trading.

AvaTrade's Regulatory Status

AvaTrade operates under multiple international regulatory bodies, ensuring compliance with global financial standards. Some of the prominent regulators overseeing AvaTrade include:

Central Bank of Ireland (CBI): Regulates AvaTrade EU Ltd under license number C53877.

Australian Securities and Investments Commission (ASIC): Oversees Ava Capital Markets Australia Pty Ltd under license number 406684.

Financial Services Authority (FSA), Japan: Regulates AvaTrade Japan K.K.

Financial Sector Conduct Authority (FSCA), South Africa: Supervises AvaTrade South Africa.

British Virgin Islands Financial Services Commission (BVI FSC): Regulates AvaTrade International under license number SIBA/L/13/1049.

Despite these international licenses, AvaTrade is not regulated by SEBI or RBI, which are the primary authorities for financial activities within India.

💥💥💥 Trade with AvaTrade: 👉 Open An Account or 👉 Go to Broker

Trading with AvaTrade from India

While AvaTrade is not regulated by Indian authorities, Indian residents can still access the platform. However, it's crucial to understand the legal implications:

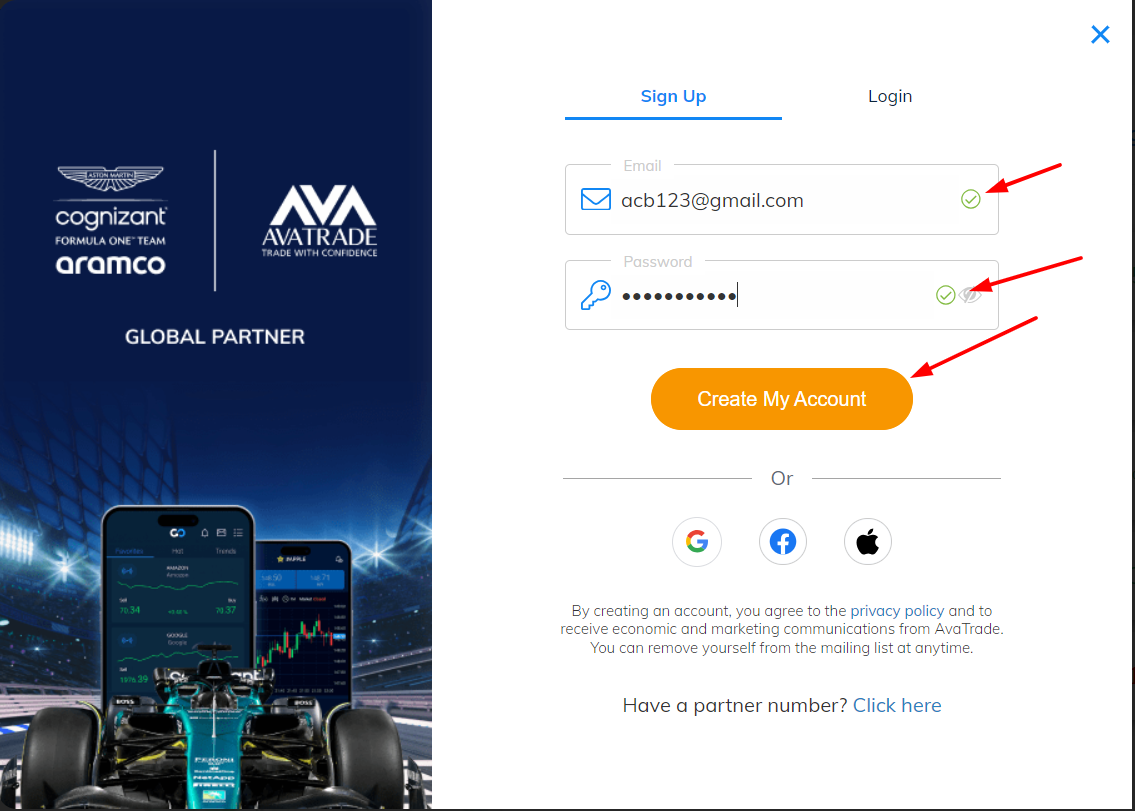

Opening an Account: Indian traders can open an account with AvaTrade by providing necessary identification and address proof, complying with Know Your Customer (KYC) norms.

Deposits and Withdrawals: Transactions are typically conducted in foreign currencies like USD or EUR. The use of international payment gateways may attract foreign exchange charges.

Trading Instruments: AvaTrade offers a wide range of instruments, but Indian traders should be cautious about trading certain instruments that may not align with FEMA guidelines.

Leverage and Margin: AvaTrade provides leverage up to 400:1, which is significantly higher than what is permitted for Indian brokers under SEBI regulations.

Taxation: Profits earned from trading are subject to taxation in India. Traders must report their earnings and pay taxes accordingly.

Tax Implications for Indian Traders

Engaging in forex trading through platforms like AvaTrade has tax implications for Indian traders:

Short-Term Capital Gains (STCG): If the holding period is less than 36 months, profits are considered short-term capital gains and are taxed at 15%.

Long-Term Capital Gains (LTCG): If the holding period exceeds 36 months, profits are considered long-term capital gains and are taxed at 10% exceeding ₹1 lakh.

Business Income: If trading is considered a business activity, profits are taxed as per the individual's income tax slab rates.

It's advisable for traders to maintain detailed records of all transactions and consult with a tax professional to ensure compliance with Indian tax laws.

Alternatives for Indian Traders

Given the regulatory constraints, Indian traders might consider alternative platforms that are SEBI-registered and offer forex trading services:

Zerodha: One of India's leading stockbrokers, Zerodha offers forex trading in currency derivatives like USD/INR, EUR/INR, and GBP/INR.

Upstox: Provides access to currency derivatives and is regulated by SEBI.

ICICI Direct: A well-established broker offering forex trading services under SEBI's purview.

These platforms ensure compliance with Indian regulations, providing a safer trading environment for Indian residents.

Marketing Insights: Encouraging Forex Trading

For traders looking to capitalize on forex trading opportunities, it's essential to choose a platform that aligns with their trading goals and regulatory requirements. While AvaTrade offers attractive features, Indian traders should weigh the benefits against the legal considerations. Exploring SEBI-registered platforms can provide a balance between global trading opportunities and regulatory compliance.

Conclusion

In conclusion, while AvaTrade is a reputable and well-regulated international broker, Indian traders should exercise caution when considering it as a trading platform. The absence of SEBI and RBI regulation means that traders are subject to international laws, which may not offer the same level of protection as domestic regulations. It's imperative for traders to conduct thorough research, understand the legal implications, and consider alternative platforms that comply with Indian regulations.

Frequently Asked Questions

Q1: Can Indian residents legally trade on AvaTrade?

A1: While Indian residents can access AvaTrade, it's not regulated by Indian authorities, and traders should be aware of the legal implications.

Q2: Is AvaTrade regulated in India?

A2: No, AvaTrade is not regulated by SEBI or RBI.

Q3: What are the tax implications for Indian traders using AvaTrade?

A3: Profits from trading are subject to Indian tax laws, including capital gains tax.

Q4: Are there SEBI-registered brokers offering forex trading?

A4: Yes, brokers like Zerodha, Upstox, and ICICI Direct offer forex trading services under SEBI regulation.

Q5: Does AvaTrade offer leverage for Indian traders?

A5: Yes, AvaTrade offers leverage up to 400:1, which is higher than SEBI's permitted limits.

Q6: How do I deposit funds into AvaTrade from India?A6: You can deposit via international methods such as credit/debit cards, wire transfers, or e-wallets like Skrill or Neteller. ✅ However, these may incur foreign transaction fees and currency conversion charges.

Q7: What are the risks of using AvaTrade from India?A7: The key risks include lack of SEBI protection, potential FEMA violations if not handled properly, and tax complications. ❌ If AvaTrade ceases operations or disputes arise, Indian traders may not have strong legal recourse within India.

Q8: Is using a VPN necessary to access AvaTrade in India?A8: No, AvaTrade is accessible from India without a VPN. But using a VPN to bypass geographical or regulatory restrictions is not recommended as it could violate terms of service and laws.

Q9: Is there any penalty for trading on an unregulated platform in India?A9: Currently, Indian laws do not specifically penalize individual traders using foreign platforms unless they violate FEMA or tax regulations. Still, engaging in speculative forex trading outside authorized exchanges may lead to complications.

Q10: Why do so many Indian traders still use AvaTrade despite the risks?A10: Because of features like higher leverage, access to global markets, advanced tools like MetaTrader 4/5, and the chance to profit in volatile forex environments, many experienced traders are attracted to AvaTrade. ✅ But this comes with the responsibility of understanding and managing associated legal and financial risks.

✅ Why AvaTrade Might Still Be Worth Considering for Advanced Indian Traders

Despite regulatory challenges, AvaTrade offers several advantages that are hard to ignore for experienced traders who understand the landscape:

Diverse Instruments: Trade forex, cryptocurrencies, stocks, indices, and commodities from a single platform.

Advanced Tools: Support for MT4, MT5, and AvaOptions—perfect for both technical traders and options strategists.

Automated Trading: Use Expert Advisors (EAs), DupliTrade, or ZuluTrade for automated strategies.

Negative Balance Protection: Helps mitigate loss during high-volatility periods. ✅

Multilingual Support: AvaTrade offers support in several languages, including English and Hindi.

Educational Resources: Free courses, webinars, trading strategies, and daily analysis.

💡 Pro Marketing Tip: If you're serious about trading and want access to global markets, don't wait. Create your AvaTrade demo account today to explore risk-free. Understand the platform before going live.

❌ Important Considerations Before You Trade

Lack of Local Regulation: AvaTrade is not under SEBI or RBI—traders must rely on international jurisdictions.

Forex Restrictions: FEMA prohibits speculative forex trading on international platforms. Stick to currency pairs allowed by RBI.

Forex isn’t Lottery: Trading is not a get-rich-quick scheme. Losses are possible. Ensure you’ve developed a sound strategy.

Encouraging Account Creation – Final Call to Action 🚀

Are you an Indian trader looking to break free from limited options and access a truly global trading platform?

👉 Experience global trading power with AvaTrade.✅ Access 1,250+ instruments✅ Trade forex with up to 400:1 leverage✅ Use advanced platforms: MetaTrader 5, AvaOptions, ZuluTrade✅ Start with a demo account or go live instantly✅ 24/5 multilingual support

💥💥💥 Trade with AvaTrade: 👉 Open An Account or 👉 Go to Broker

🎯 Take the next step in your trading journey. Register with AvaTrade and begin trading smarter, faster, and globally.

Recap – Is AvaTrade Legal in India?

Technically, yes, Indian residents can access AvaTrade.

But it is not officially regulated by Indian authorities (SEBI or RBI). ❌

You must stay compliant with FEMA and Indian tax laws.

Use at your own discretion, preferably after consulting legal and financial experts.

💥 See more:

Avatrade Review India 2025: Pros & Cons A Comprehensive Review

Avatrade Broker Review 2025: Pros & Cons A Comprehensive Review

What is Avatrade broker? Fees, Services and More