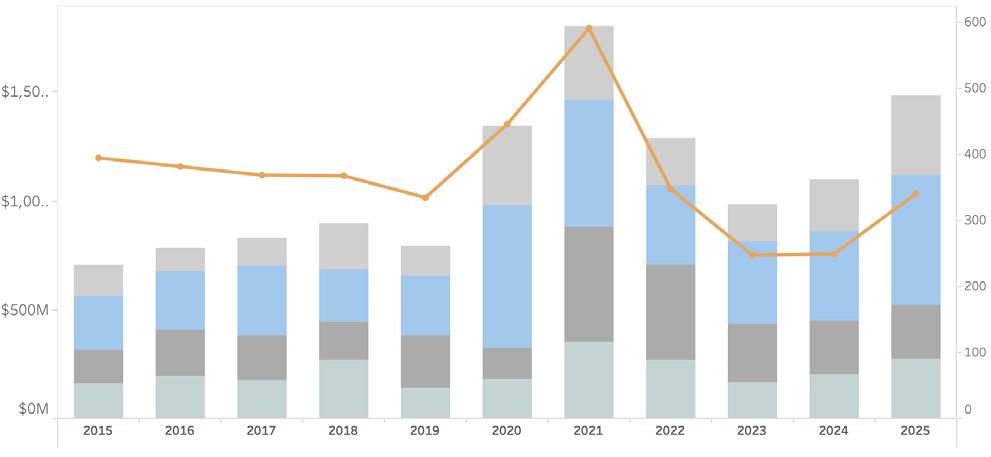

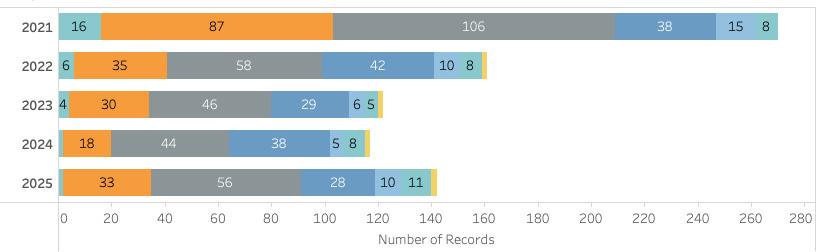

Amid a series of headline-making luxury sales, Nantucket saw its highest-grossing month of real estate activity ever recorded. Monthly sales included 65 transactions totaling $372 million, the island’s all-time record for monthly dollar volume thanks to nine residential transactions exceeding $10 million, including the highest year-to-date sale at $37.7 million. On a cumulative basis for the 10 months ending October 31, 2025, there were 342 property transfers totaling $1.49 billion, an increase of 37 percent and 36 percent from 2024, and bested only to the same period in 2021. Beyond these standout figures, overall contract activity declined—consistent with typical seasonal patterns—and inventory levels continued to fall below those of a year ago. Here are Fisher’s October Market Insights...

KEY MARKET METRICS

MONTHLY SALES HIGHLIGHTS

Market Insights BY

JEN ALLEN

RESIDENTIAL SALES ANALYSIS

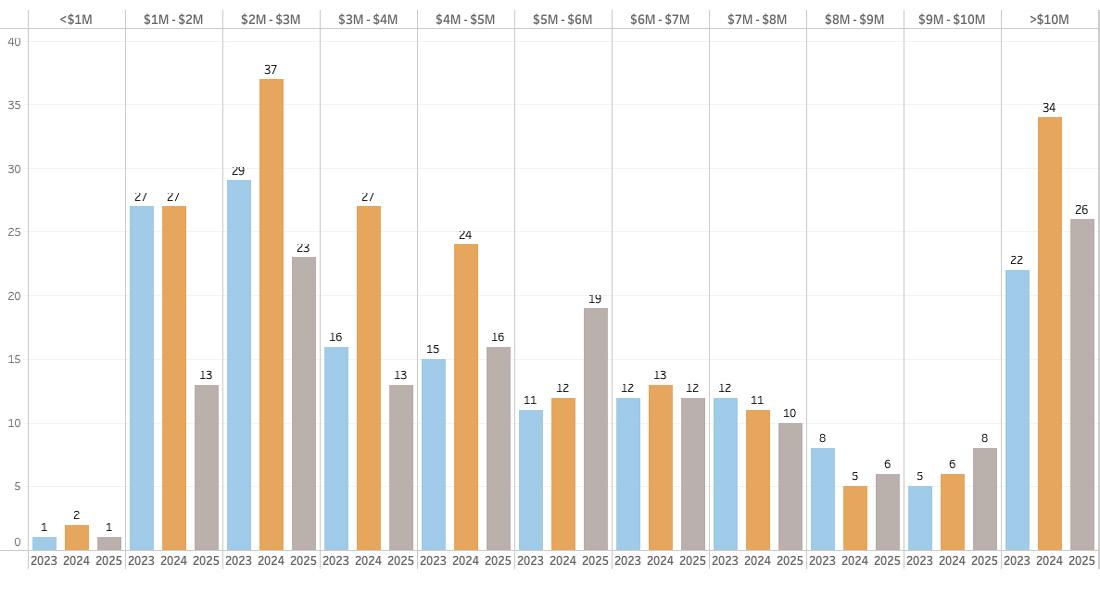

• In reviewing year-to-date residential sales activity by price point, the most significant increase in transaction activity as a percentage of total activity was for single-family home sales between $1 million and $2 million, which rose four percentage points from one year ago. On the other hand, the biggest decline, six percent, occurred for sales between $4 million and $5 million. These two price point shifts are contributing factors to why the median home sale value is lower than in 2024 despite a broader rise in aggregate dollar volume.

• There’s been a relative increase in lower end residential transactions alongside a decrease in what is normally a healthy middle segment of the market. Even as you move to the higher end of the market with sales between $5 million and $7 million, the percentage of total transaction volume is lower than one year ago. So, despite a two percent increase in sales above $10 million, it isn’t enough to “pull” the median home sale value higher in 2025. Although it is sufficient enough to bump the average home sale value three percent ahead of 2024 values.

PROPERTY INVENTORY & PRICE REDUCTIONS

• October single-family home sales (excluding condos, co-ops & covenant properties) measured 55 transactions totaling $347 million. This is 15 percent higher on a transaction basis but 51 percent higher on a dollar volume basis from one year ago. The sizable jump in dollar volume can be attributed to the nine transactions above $10 million, including the highest sale of the year thus far for $37.7 million. During the same period in 2024, there were just three transactions above $10 million. This activity brought the year-to-date transaction total to 245 single-family home sales totaling $1.23 billion through October 31, 2025. The five-year average for this same period is 261 homes totaling $1 billion.

• Sales metrics reflected a median sale value that remains 12 percent lower than in 2024, an average discount of approximately six percent from the last asking price and an average sale value of 164 percent higher than the town’s assessed value. Monthly marketing time remained largely unchanged from 2024 and was consistent with the five-year average.

SALES BY PRICE POINT & PROPERTY INVENTORY

• As of October 31, 2025, there were 147 properties (residential, land & commercial) listed for sale and the total months’ supply (how long it would take to sell all listings based on trailing 12-month sales) measured four months. This projected marketing time is four months faster than one year ago thanks to a solid rise in transaction activity in 2025. Nearly every price point saw steady or fewer listings as compared to last year. The number of properties listed between $5 million to $6 million was the only price point to see notable year over year growth.

• Typically, during the fourth quarter we tend to see price reductions increase as sellers look to encourage buyers to procure a contract before year’s end. This year is different, at least relative to 2024. During the month of October, there were 20 price adjustments, down from 40 adjustments during this time last year and 32 adjustments one month ago. The average price discount from the original list price was approximately 11 percent. Interestingly, new contract activity declined relative to 2024 so it remains to be seen if these adjustments will spur buyers to act.