COPYWRITER / ACRREDITED EDITOR

Are you our next Copywriter? ?

Are you our next Wedding Planner? ? ?

Are you our next Life Coach?

Are you our next Bookkeeper?

By Warren Strybosch

The Find Maroondah is a community paper that aims to support all things Maroondah. We want to provide a place where all Not-For-Profits (NFP), schools, sporting groups and other like organisations can share their news in one place. For instance, submitting up-andcoming events in the Find Maroondah for Free.

We do not proclaim to be another newspaper and we will not be aiming to compete with other news outlets. You can obtain your news from other sources. We feel you get enough of this already. We will keep our news topics to a minimum and only provide what we feel is most relevant topics to you each month.

We invite local council and the current council members to participate by submitting information each month so as to keep us informed of any changes that may be of relevance to us, their local constituents.

We will also try and showcase different organisations throughout the year so you, the reader, can learn more about what is on offer in your local area.

To help support the paper, we invite local business owners to sponsor the paper and in return we will provide exclusive advertising and opportunities to submit articles about their businesses. As a community we encourage you to support these businesses/columnists. Without their support, we would not be able to provide this community paper to you.

Lastly, we want to ask you, the local community, to support the fundraising initiatives that we will be developing

and rolling out over the coming years. Our aim is to help as many NFP and other like organisations to raise much needed funds to help them to keep operating. Our fundraising initiatives will never simply ask for money from you. We will also aim to provide something of worth to you before you part with your hard-earned money. The first initiative is the Find Cards and Find Coupons – similar to the Entertainment Book but cheaper and more localised. Any NFP and similar organisations e.g., schools, sporting clubs, can participate.

Follow us on facebook (https://www. facebook.com/findmaroondah) so you keep up to date with what we are doing.

We value your support,

The Find Maroondah Team.

EDITORIAL ENQUIRES: Warren Strybosch | 1300 88 38 30 editor@findmaroondah.com.au

PUBLISHER: Issuu Pty Ltd

POSTAL ADDRESS: 248 Wonga Road, Warranwood VIC 3134

ADVERTISING AND ACCOUNTS: editor@findmaroondah.com.au

GENERAL ENQUIRIES: 1300 88 38 30

EMAIL SPORT: editor@findmaroondah.com.au

WEBSITE: www.findmaroondah.com.au

The Find Maroondah was established in 2019 and is owned by the Find Foundation, a Not-For-Profit organisation with a core focus of helping other Not-For-Profits, schools, clubs and other similar organisations in the local community - to bring everyone together in one place and to support each other. We provide the above organisations FREE advertising in the community paper to promote themselves as well as to make the community more aware of the services these organisations can offer. The Find Maroondah has a strong editorial focus and is supported via local grants and financed predominantly by local business owners.

The City of Maroondah is a local government area in Victoria, Australia in the eastern suburbs of Melbourne. Maroondah had a population of approximately 118,000 as at the 2019 Report which includes 9000 business and close to 46,000 households. The City of Maroondah was created through the amalgation the former Cities of Ringwood and Croydon in December 1994.

The Find Maroondah acknowledge the Traditional Owners of the lands where Maroondah now stands, the Wurundjeri people of the Kulin nation, and pays repect to their Elders - past, present and emerging - and acknowledges the important role Aboriginal and Torres Strait Islander people continue to play within our community.

Readers are advised that the Find Maroondah accepts no responsibility for financial, health or other claims published in advertising or in articles written

By Gen Alcampor

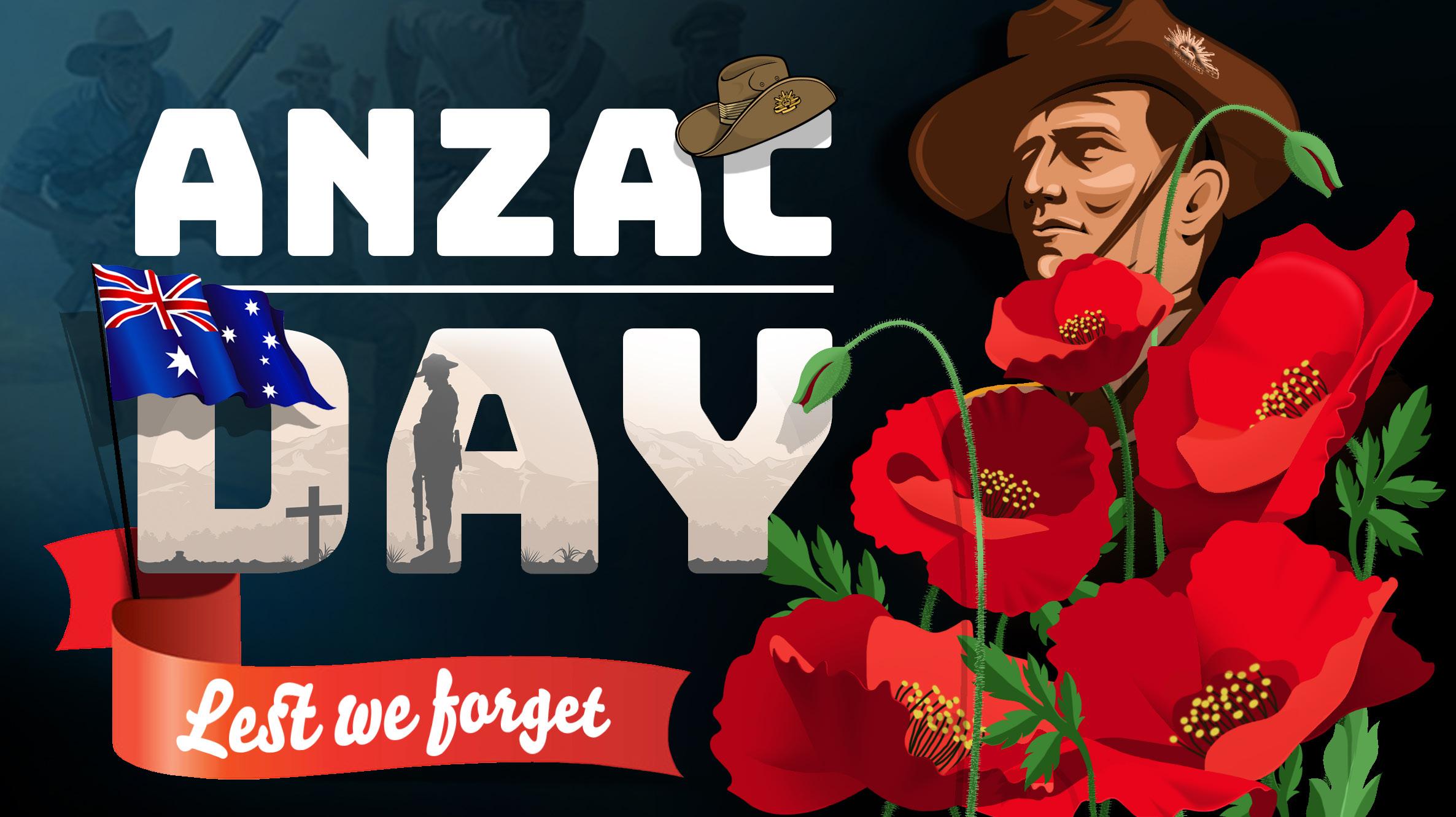

Anzac Day is one of the most significant national days in Australia. It is observed annually on April 25th, which commemorates the landing of Australian and New Zealand Army Corps (ANZAC) troops at Gallipoli in 1915 during World War I. The day serves as a tribute to the courage, sacrifice, and resilience of all servicemen and women who have served in conflicts since.

Anzac Day is marked by a series of ceremonies and events, with the most prominent being the Dawn Service at the Shrine of Remembrance in Melbourne. Thousands of people gather before sunrise to honor the Anzacs in a solemn and moving tribute. The service includes prayers, speeches, hymns,

and the haunting sounds of the Last Post, followed by a moment of silence.

Across regional Victoria, communities hold their own Dawn Services in local war memorials, bringing together people of all ages to pay their respects. These ceremonies often include wreath-laying, recitations of the Ode of Remembrance, and reflections on the sacrifices made by Australian service members.

As each year passes, Anzac Day remains a vital part of Victoria’s cultural and historical identity. It reminds us of the cost of freedom and the enduring spirit of those who served. By attending services, participating in marches, or simply taking a moment to reflect, we ensure that the legacy of the Anzacs lives on for future generations.

Anzac Day in Victoria is more than just a public holiday—it is a time for reflection, gratitude, and community spirit. It is a

day when Australians come together to remember the sacrifices of those who served and to uphold the values of courage, mateship, and perseverance that define the Anzac legacy.

Anzac Day continues to serve as a bridge between generations, ensuring that the lessons of history are never forgotten. By attending services, participating in commemorations, or simply taking a moment of silence, Victorians reaffirm their commitment to honoring those who defended the nation’s freedom. The Anzac spirit remains an enduring symbol of resilience and unity, reminding us all of the power of remembrance.

By Liz Sanzaro

1. The EPA (Environment Protection Agency)

Australian Conservation Foundation (ACF) sent us an email regarding the role of the EPA. Croydon Conservation Society (CCS) wrote to the ACF reporting that they would like greater power for the EPA to stop the environment minister from interfering with calling projects and overriding decisions.

2. Boomerang Alliance, who we have supported for over 20 years and have been a catalyst for refundable depots in the community, are now pushing for wine bottle recycling as well as the current aluminium cans and plastic bottles. This has been a long-term project to benefit the community and get plastic bottles out of waterways.

Two of our committee members are also current members of the MEAC. At the last MEAC meeting for the year, Liz read a response to CCS from the Minister for Planning Sonia Kilkenny, regarding illegal canopy tree removal and with that, another email covering the Monash Magistrates Court case fining four co-owners of a block where a significant tree was "blocking" the sale. The current system only works if Councils take legal action. Unfortunately, cases like this help clog up the Magistrates Court system, where trees are generally of little consequence. Illegal tree removal affects us all as we need shade to help stop heat retention over summer. Excessive heat is responsible for deaths. CCS keeps watch over tree removal through Planning Alerts and objects where mature trees are at risk. Council often works then with the developer to maintain trees.

4. Do you know who Barak was?

There is a memorial stone plinth with a plaque in Hughes Park, adjacent to Maroondah Highway for William Barak, an important Wurundjeri leader. His image is also built into the balconies of the building on the old CUB site which is best viewed from the Shrine of Remembrance. At a Council MEAC meeting, we tabled a photo of the building in Melbourne. CCS hopes Council can get a large photo of this building with his image and some information about the role he played as an artist and Aboriginal activist. Council has a Maroondah First Nation Reconciliation plan.

5. This year CCS is moving with the times with our Strategic Statement. To do all things lawful to preserve the natural environment, especially the native flora and fauna of Maroondah and surrounding districts.

6. CCS is also having our Website re-designed after 20 years. It will be phone friendly as we move with the times. We will let you know when this is completed.

CCS provides advice on wide-ranging issues, in particular sensitive planning to maintain our "green, leafy" Maroondah. However Section 77 of the Town and Country Planning act 1990 empowers the Secretary of State to call in a planning application for his own determination. The power can be exercised at any time up to planning permission being issued by a local planning authority. This is concerning for Councils' autonomy and for our region. CCS will work with Council to assist so this is not something that will apply in Maroondah.

By Warren Strybosch

From 1 July 2025, there will be some important changes to superannuation and legacy pensions. For those people nearing retirement these changes might need some consideration.

Also, it is important for all employers to be reminded of the changes affecting the timing of superannuation payments when making employee salary payments.

Indexation of the general transfer balance cap to $2 million

From 1 July 2025, the general transfer balance cap (TBC) increases from $1.9 million to $2 million in line with changes in the Consumer Price Index (CPI). An overhaul in the superannuation system back in 2017 introduced the general TBC regime to set limits on the amount transferred to tax-free retirement income streams. Whilst the cap limit was set at $1.6 million on 1 July 2017, the increase in the CPI over time lead to an increase in the general TBC limit over the years.

Indexation of the General TBC limits since 2017

Indexation of the general TBC can directly impact:

• an individual’s personal TBC in some cases based on application of proportional indexation rules, and

• the total super balance limit that determines the eligibility to use the Non-Concessional Contribution (NCC) cap.

This indexation brings an opportunity for eligible people to transfer more monies to retirement income streams and contribute NCCs especially in cases where they may have missed out in the past as a result of exceeding their total super balance by a small margin.

Effective 1 July 2025, as previously legislated, the final tranche of 0.5% will be applied to the Superannuation Guarantee (SG) rate to be set at 12%. The SG rate was legislated to increase in gradual increments of 0.5% each year from 1 July 2021 until it reaches 12% on 1 July 2025.

Individuals should check with their employers if the increase in SG is being paid in addition to their base salary or if their base salary will be adjusted in order to offset the increase in the SG rate. Clients who salary sacrifice to maximise their cap space will need to ensure that, the increase in SG will not push them over their allowable concessional contribution cap limit.

Regulations to allow individuals to exit certain legacy retirement income streams within a five year time frame came into effect in December 2024 (subject to any disallowance). Individuals can exit a legacy product provided:

• the commencement date was prior to 20 September 2007 or the income stream was started as a conversion of an earlier legacy product that commenced prior to 20 September 2007, and

• the income stream is an annuity (excluding defined benefit from a large APRA fund), a market-linked income stream, life expectancy income stream or a lifetime annuity/income stream.

The Government intends that social security treatment will not be preserved for those who choose to transition out of their legacy retirement product. However, (subject to the passage of legislation) no debts will arise from the re-assessment of these products’ asset values for the period before conversion.

Any reserve supporting the commuted income stream will not be counted towards the concessional or non-concessional contribution cap. Other reserve allocations will count towards the individual’s non-concessional contribution cap instead of their concessional contribution cap. The ability to commute the monies from these legacy income stream presents new advice opportunities for investing those monies into products that can maximise client outcomes.

Additional funding to support timely payment of Super Guarantee payments

The Government has allocated an additional funding of $50 million over three years from 1 July 2026 to extend the Tax Integrity Program. This will enable the ATO to continue its engagement program to ensure timely payment of tax and superannuation liabilities. The measure requiring employers to make SG payments on the same day as salaries and wages was previously announced in 2023-24 Federal Budget. Further updates to the initial announcement were made in September 2024 outlining the following amongst other measures:

• requirement to pay the SG within 7 days of the Ordinary Time Earnings (OTE) being paid

• an updated SG charge rule in cases where the employers fail to pay contributions in full and on time

• revised SuperStream data and payment standards to allow payments via the New Payments Platform, and

• revision on choice of fund rules enabling an easy process for employees to nominate their super fund.

This measure is proposed to be effective from 1 July 2026 but hasn’t been legislated yet. Draft

has been released by the Government on 14 March 2025 inviting feedback by 11 April 2025.

for public

By Jodie Moore

There are two types of reports that a business may be required to submit to the ATO on a regular basis – Business Activity Statement (BAS) and Instalment Activity Statement (IAS). These are used to report and pay several tax obligations. The difference between them is dependent on whether a business is registered for GST or not (see my article in the May 2024 edition about GST).

What is an IAS?

An Instalment Activity Statement (IAS) is used by businesses that are not registered for GST but still need to report and pay other tax obligations. The IAS is used to report:

• PAYG Withholding (Employee Tax)

• PAYG Instalments (Business Tax Prepayments)

• Fringe Benefits Tax (FBT) Instalments

Who Needs to Lodge an IAS?

• Businesses not registered for GST but still withholding tax from employee wages.

• Businesses required to make PAYG instalments without a GST obligation.

• Entities directed to by the ATO.

Due Dates for IAS Lodgment

The IAS is usually required quarterly and is due by the 28th of the month following the quarter. For example, an IAS for the July to September quarter must be lodged by October 28. If you use a BAS Agent or Accountant to submit this for you, then you get additional time. Once your PAYG Withholding exceeds $25,001, you will need to switch to Monthly reporting.

What is BAS?

A Business Activity Statement (BAS) is for businesses that are registered for Goods and Services Tax (GST). It is used to report and pay several tax obligations, including:

• GST (Goods and Services Tax)

• PAYG Withholding (Pay As You Go) –Employee Tax

• PAYG Instalments – Business Income Tax, prepayment

• Fringe Benefits Tax (FBT) Instalments

• Luxury Car Tax (LCT)

• Fuel Tax Credits (FTC)

• Wine Equalisation Tax (WET)

Businesses registered for GST must lodge a BAS, usually on a quarterly basis. However, some businesses with a large turnover may need to lodge monthly, while smaller businesses may qualify for annual reporting.

The BAS lodgement and payment deadlines depend on the reporting frequency:

Monthly

Quarterly (Standard)

Annually

21st of the following month

28th of the following month after the quarter ends (e.g., for Q1: July–September, due by October 28)

When lodging the annual income tax return

If you use a BAS agent or Tax agent however, you will generally get additional time for the March, June and September Quarters. Late lodgement or payment may result in penalties and interest charges from the ATO.

Purpose Reports GST, PAYG, and other taxes Reports PAYG and other tax obligations (no GST)

Who Lodges?

Lodgment Frequency

Due Date

Businesses registered for GST

Monthly, Quarterly, or Annually (depending on size of business)

21st or 28th of the following month (depending on frequency)

Businesses can lodge their BAS and IAS through various methods:

1. Online via the ATO Business Portal

2. Through a registered tax agent or BAS agent

3. Via Standard Business Reporting (SBR) software

4. By mail (paper lodgement, less common)

Tips for Managing BAS and IAS Compliance

• Keep accurate financial records: Ensure all invoices, receipts, and payroll records are up-to-date.

• Use accounting software: Platforms

Businesses not registered for GST but required to report PAYG

Monthly or Quarterly (depending on size of business)

21st or 28th of the following month (depending on frequency)

• like Xero, MYOB, or QuickBooks can simplify BAS and IAS reporting.

• Understand ATO payment plans: If unable to pay on time, businesses can negotiate a payment plan with the ATO to avoid penalties.

• Lodge on time: Late lodgement may result in penalties and general interest charges.

• Seek professional help: A BAS agent or accountant can ensure compliance and help reduce errors.

Conclusion

It is important to understand your obligations when it comes to BAS and IAS. Keeping adequate records and lodging on time will help you to stay compliant and avoid unnecessary penalties.

If you had a day to yourself, would you spend it in bed?

By Kathryn Messenger

People often come into my clinic for fatigue, and this is one of the questions I ask, as it tells me some important information. Fatigue can present in so many different ways, and understanding the nature of it, is the start of understanding exactly what is going on in your body.

Some people start their day with fatigue, and it improves as the day goes on, others start fine, but can hardly stay awake after lunch, and others get progressively more exhausted as the day goes on. For these people, when It’s bad enough, their ideal day is a day in bed, as they are just too tired to enjoy other activities.

If you’re sleeping through the night and getting enough sleep, this is likely to be adrenal fatigue: when you have been stressed or anxious for a long time, and your body has put the breaks on, trying to get you the rest that you need. Often at or even before this point, people turn to caffeine, the easy fix for the fatigue.

This may work for a while, then one of two things happens, either the caffeine stops being effective, or it keeps you awake at night. In both circumstances, you wind up being tired again.

The first thing to do, is to calm the nervous system. If your body has been pushed for a long time, it’s time to slow down and have some rest. Spending times with friends, creative activities, and exercise can all be really helpful here.

Breathing exercises can also be really helpful, and if you have learnt how to do them, they can be really effective in a moment or stress or anxiety. There are a lot of different techniques for calming breathing, choose one where your exhale is longer than your inhale.

So, now that we’re addressed the nervous system, it’s time to look at your diet. Sugar and refined carbohydrates will give you a sudden energy boost, followed by a

slump. If you feel like you need the boost, add protein and fats to keep your energy constant. For example, dried fruit on its own will give you a low afterwards, but if you combine it with nuts and seeds, the fats and protein will keep the energy going steadily for longer.

If you are absolutely exhausted and your ideal day would be in bed, herbal or nutritional supplements, can make an amazing difference to help you get your energy back, whilst you work on calming your nervous system.

Kathryn Messenger

By Ethan Strybosch

What if your next fundraising campaign didn’t just meet expectations—but shattered them?

If you’re aiming to boost donations, expand your reach, or build lasting donor relationships, it’s not about working harder—it’s about working smarter.

These five powerful campaigns aren’t just ideas—they’re proven strategies that inspire action and deliver real, measurable results.

Peer-to-Peer Fundraising: Empower your Supporters

Peer-to-peer (P2P) fundraising isn’t just a trend—it’s one of the most effective ways to organically grow your NFP’s donor base. It empowers your supporters to fundraise on your behalf as individuals reach out to friends, family and colleagues, tapping into personal networks to spread your non-for-profit’s message. 92% of people trust recommendations from friends and family over any other form of advertising (Nielsen), making P2P fundraising a fantastic avenue for successful NFP campaigns. Plus, peerto-peer campaigns typically raise twice as much as traditional fundraising efforts because they reach wider audiences.

The key to success is equipping your fundraisers with the right tools, such as social media templates, email scripts, and easy-to-use donation pages, to make the process accessible and enjoyable. Recognising top fundraisers with shoutouts or small rewards can also keep motivation high.

(And

“Movember’s global campaign is a great example,raising over $1 billion worldwide by turning personal stories into powerful fundraising tools. The combination of humour, personal connection,and global participation makes it one of the most effective peer-to-peer campaigns ever.”

Seasonal giving campaigns align with key dates like Giving Tuesday, EOFY appeals, and the holiday season are times when people are naturally more inclined to give. Giving Tuesday alone raised over $3.1 billion in the U.S. in 2022, and 30% of all annual donations happen in December, with 10% occurring in the final three days of the year. By leaning into seasonal giving campaigns, your NFP can use these giving trends to increase fundraising throughout the year.

Creating urgency through countdowns, limited-time donation matches, or highlighting specific goals can significantly boost results.

Success Story:

The Salvation Army’s Red Kettle Campaignisaseasonalstaple,raising over $100 million annually during the holidays through both physical donation kettles and online giving platforms. Its recognisable branding and community engagement make it a model for successful seasonal giving.

As we discussed in our January Newsletter, social media is a powerful tool for non-profits, especially when it’s used to tell compelling stories. Story-driven campaigns can humanise your NFP’s cause which in turn creates emotional connections that inspire action. Focusing on real people and authentic stories that reflect the heart of your non-forprofit’s mission engages audiences. Short, emotional videos perform extremely well on social media such as TikTok, Instagram, and Facebook. You can further engagement with your fundraising campaign by encouraging followers to share their own stories and use dedicated hashtags to spread your NFP’s reach.

Success Story:

“Charity:Water’s#WhyWatercampaign is a perfect example, using personal stories from communities impacted by clean water projects to create a global movement that has helped over 15 million people. Their simple, powerful storytelling approach turns donors into passionate advocates.”

While one-time donations are important, recurring giving campaigns create a steady, reliable stream of income. Over one year, monthly donors give 42% more than one-time donors and have a retention rate of 90%, compared to 46% for one-time contributors.

Highlighting the convenience and longterm impact of monthly donations can turn casual supporters into lifelong advocates of your non-for-profit. Offering exclusive updates or behind-the-scenes content on projects occurring within your NFP helps keep these donors engaged.

Success Story:

World Vision’s Child Sponsorship Program is a shining example of a successful recurring giving campaign. Donors receive regular updates, photos, and personal stories about the child they’re sponsoring, creating an emotional connection that fosters long-term support—often lasting for years.

Event-Based Fundraising: Create Memorable Experiences

Events, whether in-person or virtual, are another fantastic way to raise funds for your NFP and strengthen community ties. Fundraising events can account for up to 35% of annual donations for many organisations, including NFP’s and 84% of attendees say they’re more likely to donate after participating. The rise of virtual events has expanded reach even further, increasing participation by 30% in many cases.

Combining ticket sales with activities like raffles, auctions, or donation challenges for projects or a mission in your NFP can maximise revenue while fostering a sense of belonging among supporters.

Success Story:

The Global Citizen Festival blends entertainment with activism, attracting millions of participants worldwide. By leveraging celebrity influence, live music, and powerful advocacy messages, it drives not just donations but also policy changes and global awareness for critical causes.

Key Takeaways for Campaign Success in Your Non-for-profit

• Personal Connections Matter: Authentic, emotional stories resonate more than generic appeals.

• Urgency Drives Action: Campaigns with time-sensitive goals or donation matches perform better.

• Diversify Your Channels: Combine email, social media, events, and paid ads for maximum reach.

• Consistency Builds Trust: Regular communication with your audience keeps your cause top of mind and strengthens donor relationships over time.

Ready to Elevate Your Next Fundraising Campaign?

If you’re looking to launch campaigns that drive donations and build lasting donor relationships, we’re here to help.

By Warren Strybosch

At 7:30pm on Tuesday 25 March 2025, the Treasurer, Jim Chalmers, released the Government’s 2025-26 Budget. The Treasurer identified five main Budget priorities:

• Helping with the cost of living;

• Strengthening Medicare;

• Building more homes;

• Investing in every stage of education; and

• Making our economy stronger, more productive and more resilient.

The Budget features a number of measures that will impact those leading into retirement and those already in retirement.

It is important to note that at this time any proposed measures are not yet law and could change through implementation.

The big picture

The Budget deficit has made an unwelcome, but not surprising, return. The Albanese government has been clear that we were headed back into the red, and Treasurer Chalmers says the $42.1 billion deficit is less than what was forecast at both the last election and at the mid-year update. Gross debt has been reduced by $177 billion down to $940 billion, saving around $60 billion in interest over the decade.

Nonetheless, Australia is navigating choppy international waters with a “volatile and unpredictable” global economy.

Australia will feel the shockwaves from escalating trade tensions, two major global conflicts – in Ukraine and the Middle East, and slowing growth in China. Treasury predicts the global economy will grow by 3.25 per cent in each of the next three years in the longest stretch of below-average growth since the early 1990s.

However, Australia is in a good position to deal with the difficult conditions, the Treasurer says.

The Australian economy has “turned a corner” and continues to outperform many advanced economies. Inflation

has moderated “significantly”, and the labour market has outperformed expectations. Meanwhile growth is predicted to increase from 1.5 per cent to 2.5 per cent by 2026-27.

Much of the 2025 Federal Budget was already known, after a volley of preelection spruiking for votes. But Treasurer Jim Chalmers had one surprise up his sleeve - $17 billion in tax cuts. The first round of cuts will kick in on 1 July 2026 and a second round on 1 July 2027, saving the average earner $536 each year when fully implemented.

Reduction in the lowest marginal tax rate for individuals.

The lowest individual marginal tax rate will be reduced over two financial years from the current 16% to 14%.

From 1 July 2026, the 16% tax rate, which applies to taxable income between $18,201 and $45,000, will be reduced to 15%. From 1 July 2027, this tax rate will be reduced further to 14%.

The reduction in the lowest marginal tax rate means that in 2026-27, individuals may see a tax reduction of $268 and in 2027-28 and future years, a reduction of $536 per year compared to the 2024-25 tax rates.

The energy bill relief is also being extended to the end of this year. At a cost of $1.8 billion, every household and around one million small businesses will each receive $150 off their electricity bills in two quarterly payments.

The government claims that energy bill relief has helped to drop electricity prices by 25.2 per cent across 2024.

Students aren’t forgotten in the Budget with a cut of $19 billion in student loan debt, with all outstanding student debts reduced by 20 per cent and a promised change to make the student loan repayment system fairer.

The government is tackling the cost of living where it’s often most obvious – at the cash register. It is providing support for fresh produce suppliers to enforce their rights and will make it easier to open new supermarkets. It’s also planning to focus on “unfair and excessive” card surcharges.

Almost $8 billion will be spent to expand bulk billing, the largest single investment in Medicare since its creation 40 years ago.

Treasurer Chalmers says 9-out-of-10 GP visits should be bulk billed by the end of the decade with an extra 4,800 bulk billing practices.

The Medicare Levy low-income thresholds to be exempt from paying the Medicare Levy for singles, families and seniors and pensioners will increase in 2024-25. *Individual resident taxpayer and does not include 2% Medicare Levy, where relevant.

There’ll also be another 50 Urgent Care Clinics across the country, taking the total to 137, and public hospitals will get a boost of $1.8 billion to help cut waiting lists, reduce waiting times in emergency rooms and manage ambulance ramping.

The cost of medicines is also in the government’s sights. The maximum cost of drugs on the Pharmaceutical Benefits Scheme (PBS) will be lowered for everyone with a Medicare Card and no concession card. From 1 January 2026, the maximum co-payment will be lowered from $31.60 to $25.00 per script and remain at $7.70 for pensioners and concession cardholders. Four out of five PBS medicines will become cheaper for general non-Safety Net patients, with larger savings for medicines eligible for a 60 day prescription.

An extra $1.8 billion is also being invested to list new medicines on the PBS. Increasing the housing stock.

The government’s previously announced target of 1.2 million new homes over five years has seen 45,000 homes completed in the first quarter.

The budget sees an extra $54 million to encourage modern construction methods and $120 million to help states and territories remove red tape.

With building set to increase, more apprentices are needed, and the government has announced financial incentives of up to $10,000 to encourage more people to take up apprenticeships in building trades. Some employers may also be eligible for $5,000 incentives for hiring apprentices.

The Help to Buy program that allows homebuyers to get into the market with lower deposits and small mortgages will be expanded with an extra $800 million to lift property price and income caps to make the scheme more accessible.

To help increase housing stock available, foreign buyers will be banned from purchasing existing dwellings for two years from 1 April 2025. Land banking by foreign owners will also be outlawed.

The Government will provide additional funding over five years from 2024-25 to continue delivery of the aged care reforms:

• $116.1 million in 2025–26 in additional funding for the Aged Care Quality and Safety Commission to deliver its regulatory functions under the Aged Care Act 2024

• $53.2 million in 2025–26 to continue implementation of the Single Assessment System and support the staged digital implementation of the Aged Care Act 2024 to ensure continuity of aged care assessment services

• $47.6 million over four years from 2025–26 to support First Nations organisations to deliver culturally appropriate aged care assessments for First Nations people

• $24.4 million in 2024–25 for additional Commonwealth Home Support Programme assessments to meet new requirements under the Aged Care Act 2024

• $7.8 million in 2025–26 for the Aged Care Quality and Safety Commission to support the staged digital implementation of the Aged Care Act 2024

The Government will provide additional funding over five years from 2024-25 to fund the outcome of the Fair Work Commission’s decision to increase the minimum award wages of registered and enrolled nurses employed in the aged care sector:

• $48.7 million over three years from 2024–25 for Commonwealth Home Support Programme providers to cover the cost of the increase in award wages

• $35.5 million over two years from 2025–26 to fund historical leave provisions for Commonwealthfunded aged care providers

The Government will also provide an additional $2.5 billion over five years from 2024-25 (and an additional $6.1 billion from 2029-30 to 2034-35) to meet the cost of the Fair Work Commission’s decision for aged care nurses with funding to other aged care programs including residential aged care, the Home Care Packages program and the Support at Home program.

Despite concerning events on the world stage, Australia’s economy is emerging “in better shape than almost any other advanced economy”.

Inflation and unemployment are coming down and wage growth will be stronger. To help underpin continuing economic growth, the Budget adds $22.7 billion to the government’s Future Made in Australia agenda.

It includes extra investment in renewable energies and low emissions technologies and an expansion of the Clean Energy Finance Corporation. The plan also includes more than $15 billion in support for private investment in hydrogen and critical minerals production, clean energy technology manufacturing, green metals and low carbon liquid fuels.

And, as the trade war kicks off, the Budget allocates $20 million to a Buy Australian campaign.

“The plan at the core of this Budget is about more than putting the worst behind us. It’s about seizing what’s ahead of us,” the Treasurer says.

Warren Strybosch

1300 88 38 30 |warren@findwealth.com.au www.findwealth.com.au

Financial Planning is offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth & Find Retirement.

Find Wealth is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221).Part of the Centrepoint Alliancegroup https://www.centrepointalliance. com.au/

Warren Strybosch is Authorised representative (No. 468091) of Alliance Wealth Pty Ltd. Services offered are superannuation, retirement planning and aged care advice.

This information has been provided as general advice. We have not considered your financial circumstances, needs or objectives. You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication.

Whilst all care has been taken in the preparation of this material, it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

Take a guided tour and discover the interesting architectural and social history of Wyreena. The main building is 100 years old and has had three fascinating chapters: from family home to a convent and now a thriving Community Arts Centre.

Wyreena Community Arts Centre is a historical property in Croydon, featuring The Arts Lounge, The Conservatory Café, beautiful gardens and an interactive Playspace. Wyreena offers a wide range of arts-based programs and workshops for all ages and abilities and is home to various community groups and creative businesses.

The main building was originally a family home. It was then sold to the Catholic Church in the 1950s and was a convent and commercial college. In the late 1970s, Wyreena was saved from development by passionate community members and in 1978 became a Community Arts Centre.

Two of the buildings on the property were built in the 1920s and 1930s, the main building was designed by Hudson and Wardrop who were the architects for the Shrine of Remembrance.

Maroondah City Council will submit fi ve motions for consideration at the Municipal Association of Victoria (MAV) State Council meeting on Friday 16 May 2025.

The MAV State Council meeting provides an opportunity for each member Council in Victoria to submit motions that have signifi cance at a state level for all Victorian municipalities.

Mayor of Maroondah and Maroondah’s representative for the MAV State Council, Councillor Kylie Spears, summarised the motions.

“At its meeting on Monday 17 March, Council endorsed fi ve motions to be submitted to the next MAV State Council meeting on Friday 16 May,” Cr Spears said.

“The motions relate to the new Waste Service Standards, FReeZA funding for young people, the revised Emergency Services and Volunteers Fund, Maternal and Child Health services for dad groups, and Victorian Electoral processes for future Local Government elections. Each of these motions has the potential to impact a range of community members here in Maroondah and in other Victorian municipalities.

“Of particular note for us are the new Waste Service Standards and how important it is to fi nd practical ways to reduce the cost burden of waste management services for Councils and ratepayers without sacrifi cing environmental outcomes.

“We also recognise the importance of reinstating FReeZA funding for youth-led programs, based on our 20-year history of successfully empowering young people through opportunities for social inclusion, creativity, community engagement and leadership.

“By submitting these motions for consideration, Council is continuing to advocate on the issues that matter the most to our community members while also considering the challenges faced by many other Councils throughout Victoria. “We will be calling upon the Victorian Government to work with us and the MAV to address these motions and help ensure our community’s needs can continue to be met now and into the future.”

You can read more about each of these motions in the agenda and minutes from the Council meeting on 17 March 2025.

The Pathways for Carers offers those caring for older people, or people with a disability or mental illness an opportunity to share walks together and to learn more about news, services and supports. Stay after the walk for a free coffee at Bark and Silk.

Anyone who is a carer of someone with a disability, mental health illness or older person is welcome to join us. We have a different guest walker attend each walk who talks about the services and programs their organisation offers carers and the people they care for. The walks are educational as well as offering the chance for some exercise.

The walks are suitable for all fi tness levels and no bookings are required.

Join us for a walk

Pathways for Carers meet on the fourth Saturday of every month, from 1pm until 3pm.

Meet at Bark and Silk Café - located at the Burnt Bridge Shopping Centre - 434 Maroondah Hwy, Ringwood East. The group walk along the Mullum Mullum Creek trail before returning to the café for morning/afternoon tea.

Next date: Tuesday, 22 April 2025 | 10:30 AM to 11:45 PM

Celebrating The Seekers - 60 Years is an audio-visual treat, with rare footage and still photos of the group. His 12-string guitar was an integral part of their sound and being the arranger of the vocal harmonies, he had a unique place in the group. During his performance Keith pays a special tribute to his colleague and dear friend of 60 years, the late and great Judith Durham.

Kilsyth Group is in it’s 49th year and we are looking forward to Celebrating it’s 50th in 2026. Mrs Bobbie Malone who lived in Kilsyth, originally formed the Group and in 1983 Bobbie along with husband Alan moved to Bendigo where she started up the St Andrew’s Group in Bendigo.

Mr William Chalmers, Kilsyth, Scotland, designed our Logo after reading an article which appeared in his local Kilsyth Chronicle. The Tartan background is actually the Kilsyth Tartan. We are very proud of the Logo he designed.

We are a small non-profit Group and our aim is to teach Scottish Country Dancing to anyone in the local community who is interested. Scottish Country Dancing is the Social Dancing or as some would say the Ballroom Dancing of Scotland. It is not only danced in Scotland but it is danced all over the world.

Reels Jigs and Strathspeys are the three tempos used for Scottish Country Dancing. Reel time is very lively, followed by jig time and the Strathspey is a much slower tempo. Five basic steps are used to form a variety of formations that go into making up a dance. The dances are usually danced with 6 or 8 dancers who form a set. Sets could be in a line, square or triangle form. This is different to Highland Dancing - solo dancing, and no swords are required.

Scottish Country Dancing gives the brain a great workout as well as your body. Looking to boost your social life? Well, this could be the activity for you. You can come along on your own as no partner is required. Once you have mastered the dances and want to socialise more you can venture into Socials run by other groups throughout the year.

We are one of the independent groups of the RSCDS Melbourne & District Branch who are affiliated with the Royal Scottish Country Dancing Society (RSCDS), Edinburgh, Scotland.

On the 13th April we are holding our first event for the year which is a Ceilidh. It is being held at our class venue and commences at 2 pm. The program will consist of dances danced in Scotland at Ceilidh’s, wedding, festivals, Burns Nights and on St Andrew’s Day. They are taught and danced at schools in Scotland and also appear in programs at Deb Balls and at Scottish events held here in Australia. Ceilidh Dances are called out and demonstrated to assist those who get up for the dance. As well as class members, dancers from other groups come along to assist and enjoy the afternoon. A flyer for our Ceilidh will appear in this issue of Find Maroondah.

Towards the end of the year we hold our Social and dances on the program are taught during the year. Dancers from other groups come along and attend so it is great socialising event.

Classes are held: Monday evenings 8 pm - 10 pm Venue: Croydon Senior Citizens Hall, Unit 1, 7 Civic Square, Croydon

Contact: Ruth Chancellor email: rchancel@bigpond.net.au

This is a General Class and we would love to see some new faces come along and join the group. If you like the Scottish Music and your feet tap along to it, you should come along and give Scottish Country Dancing a go. You do not have to be Scottish and you do not need to bring along a partner.

As mentioned above it exercises both mind and body. It is a great social activity, no partner required. No special clothes, only soft shoes and it is low-cost entertainment. We hope you will come along and give us a go.

By Warren Strybosch

The rising cost of living is putting increasing pressure on retirees, many of whom are living on fixed incomes. With inflation driving up prices for everyday essentials like food, healthcare, and housing, retirees are finding it more challenging to make ends meet. For many, pensions, Social Security, or personal savings no longer stretch as far as they once did, forcing them to tighten their budgets or dip into savings faster than anticipated.

Healthcare costs, in particular, are a significant concern, with medical expenses rising sharply. Retirees often face higher premiums, out-of-pocket costs, and the need for more frequent medical care, further straining their financial resources. Housing costs are another burden, with rent and rates rising

in many areas, adding additional burden for those who own a home and for those who do not.

For those who rely on a fixed pension or savings, the combination of rising living costs and low-interest rates on investments makes it difficult to keep up. Many retirees are now delaying retirement or re-entering the workforce in some capacity to supplement their income.

The Department of Social Security (DSS) have released the rates and thresholds that will apply from 20 March to 30 June 2025.

The maximum Age Pension (including supplements) will increase from $1,144.40 (single) to $1,149.00 per fortnight and from $862.60 (each member of a couple) to $866.10 per fortnight.

This will lead to a change in the asset and income test thresholds cut-off thresholds as follows.

Financial Planning, SMSF, Super, Insurance, Pre-Retirement & Retirement Planning (Financial Planning) are offered via Find Wealth Pty Ltd ACN 140 585 075 t/a Find Wealth, Find Insurance and Find Retirement. Find Wealth Pty Ltd is a Corporate Authorised Representative (No 468091) of Alliance Wealth Pty Ltd ABN 93 161 647 007 (AFSL No. 449221).Part of the

Centrepoint Alliance group (www.centrepointalliance.com.au/fsg/aw).

Warren Strybosch

Authorised Representative (No. 468091) of Alliance Wealth Pty Ltd.

This information has been provided as general advice. We have not considered your financial circumstances,needs or objectives.You should consider the appropriateness of the advice. You should obtain and consider the relevant Product Disclosure Statement (PDS) and seek the assistance of an authorised financial adviser before making any decision regarding any products or strategies mentioned in this communication. Whilst all care has been taken in the preparation of this material,it is based on our understanding of current regulatory requirements and laws at the publication date. As these laws are subject to change you should talk to an authorised adviser for the most up-to-date information. No warranty is given in respect of the information provided and accordingly neither Alliance Wealth nor its related entities, employees or representatives accepts responsibility for any loss suffered by any person arising from reliance on this information.

•

1.

2. A Tax engagement letter will be emailed to you for signing via your

3. You will be then sent a tax checklist to complete

4. We will then require you to upload your documents to our secure portal.

5. Once we have received all your documentation, we will complete the return.

6. We will email you the completed return with our invoices. Once you sign the return and pay the invoice we will lodge the return on your behalf.

We specialise in the

• Biz Pack Insurance

• Landlord Insurance

• Public Liability Insurance

• Professional Indemnity Insurance.

but you should confirm any information with the

• Car Insurance

• Home & Contents

• Caravan

• eBikes

are unsure you should get independent advice before you apply for any

At Find we can help you find the ‘right’ personal insurance. Our aim is to help you obtain and retain the personal insurances that are appropriate for you and at cost that you can afford.

•

When

•

•

•

•

•

•

•

Osteopathy

Joanna

She

•

•

•

•

IBCLC lactation consultants are recognised around the world as the experts in lactation care. They provide evidencebased knowledge to assist mothers to establish and maintain breastfeeding. As professionals, they are charged with promoting, protecting and supporting breastfeeding. Joanna can help with a broad range of lactation consulting services, including:

• Teaching a new mum how to hold and position her baby to breastfeed

• Assess the suck, swallow and breathing of an infant

• Assess for tongue function and determine any evidence of restriction (tongue tie)

• Pre and post-frenectomy breastfeeding support

• Help increase or decrease milk supply

Crack the clues, catch the culprit & WIN!

Something’s gone missing this Easter, and it’s up to you to catch the culprit. Step into a maze filled with twists, turns, and mind-bending puzzles that will put your detective skills to the test.

Follow the trail of clues, solve cryptic riddles, and you could WIN a $300 Haigh’s Chocolates hamper!*

Upgrade your eyewear this autumn and save up to $200 on designer frames!

Gucci, Carrera, Hugo Boss & more – time to glow up for the new season!

This Easter, don’t just savour the fl avours. Dive into the experience with every crack of the cup! Easter is here, and this year The Coffee Club is unveiling a lineup of chocolate drinks that are sure to turn heads.

Looking for a fun, relaxed and family-friendly dining experience? TGI Fridays is the perfect place to go!

At TGI Fridays, we’ve got something for everyone – from a dedicated Kids Menu packed with crowd-pleasing favourites to fun in-restaurant activities to keep the little ones entertained while you enjoy your meal.

Discover more

In-Kind Sponsorship with Find Maroondah Community Paper

We invite a representative from each sporting club to submit team selections, results and any interesting stories relating to your club/sports.

For more information contact: Warren on 1300 88 38 30 or Email: editor@findmaroondah.com.au

Huge turn out for our one club training session before the season launch. It was great to have the netballers out there alongside our women’s and men’s football teams working together and having a bit of a laugh along the way.

2025 is shaping up to be a big one at Norwood FNC and we can’t wait!

A few photos from Saturday's practice hit out against Lilydale.

We're also on tik tok so give us a follow. Ella and Ella will be sharing some great stuff on there -

https://www.tiktok.com/@norwoodfnc

On Tuesday night we hosted our junior presentation night at our rooms. It was fantastic to see such a great turnout of juniors and their families with the rooms full of fun and excitement of the season gone. Thank you to all families apart of Eastfield cricket club we look forward to welcoming you back next year. We also thank our sponsors for their ongoing support. The Acorn Bar & Restaurant Michael Sukkar MP - Member for Deakin Jelmac

According to Michael Sukkar MP "It was great to launch the annual Deakin Challenge Trophy, an event I sponsor each year between Bowls Clubs in the Deakin electorate. This is a great chance for our Clubs to get together and enjoy some healthy rivalry. Thanks to Mitcham Bowling Club for hosting and all of the local clubs participating again this year: Croydon Bowling Club, Heatherdale Bowling Club, Eastwood Golf and Bowls Club, Heathmont Bowls Club, Ringwood Bowls Club, and Vermont South Bowling Club".

Experience the magic of Australia's No.1 dedicated Linda Ronstadt Show, featuring Lisa Mio & Wild Dreamers in an outstanding Supper & Show at Ringwood Bowls Club. Immerse yourself in the timeless classics from Linda Ronstadt’s extraordinary repertoire, featuring chart-toppers like ‘When Will I Be Loved’, ‘You’re No Good’, ‘It’s So Easy’, ‘Blue Bayou’, ‘Different Drum’, plus many, many more… Supper & Show $49* & Show Only $32* - *Online booking fees apply Showroom Doors open 8.00pm Showtime 8.40pm, Supper 9.30pm Group enquiries & to advise of dietary requirements, email: wilddreamersband@gmail. com or Telephone: Sue on Mob: 0419 138 461

Date Saturday 12 July 2025 8:00 PM - 11:00 PM (UTC+11)

Do you have an upcoming events? Place your EVENT AD here for FREE in our community online paper.

Simply upload your ad at www.findmaroondah.com.au/nfp-free-advertising or you can email the ad to the editor@findmaroondah.com.au and we will do the rest for you.

Pastoral

Senior pastor - Andrew Harris

Karen Pastor - Moo Hei

NextGen Pastor - Matt Moran

Worship Pastor - Leah McCormack

Transform Pastor - Ben Dickson

Community Engagement - Gitta Clayton

Children's Co-Ordinator - Meagan Dickson

Youth Co-Ordinator - Mat Weller

Hope City is a community partnering with Jesus to see His Church grow and to see people encounter God’s presence and be transformed by His Spirit and Word. We look to empower every believer in God’s purpose for their life so that the 7 Mountains of society will be impacted by God’s kingdom. We see a Church where every person experiences the goodness of God in their lives through energetic praise and intimate worship.