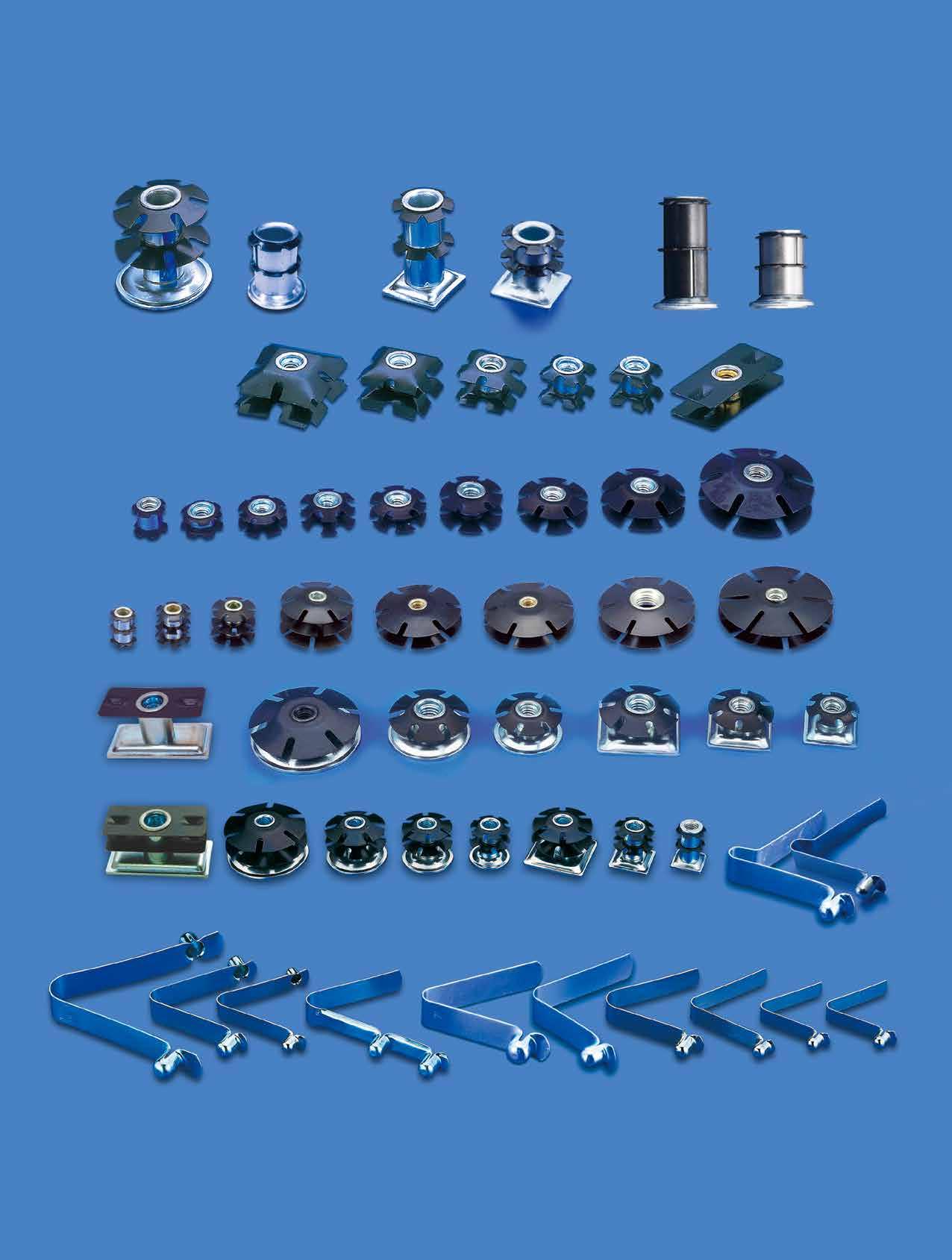

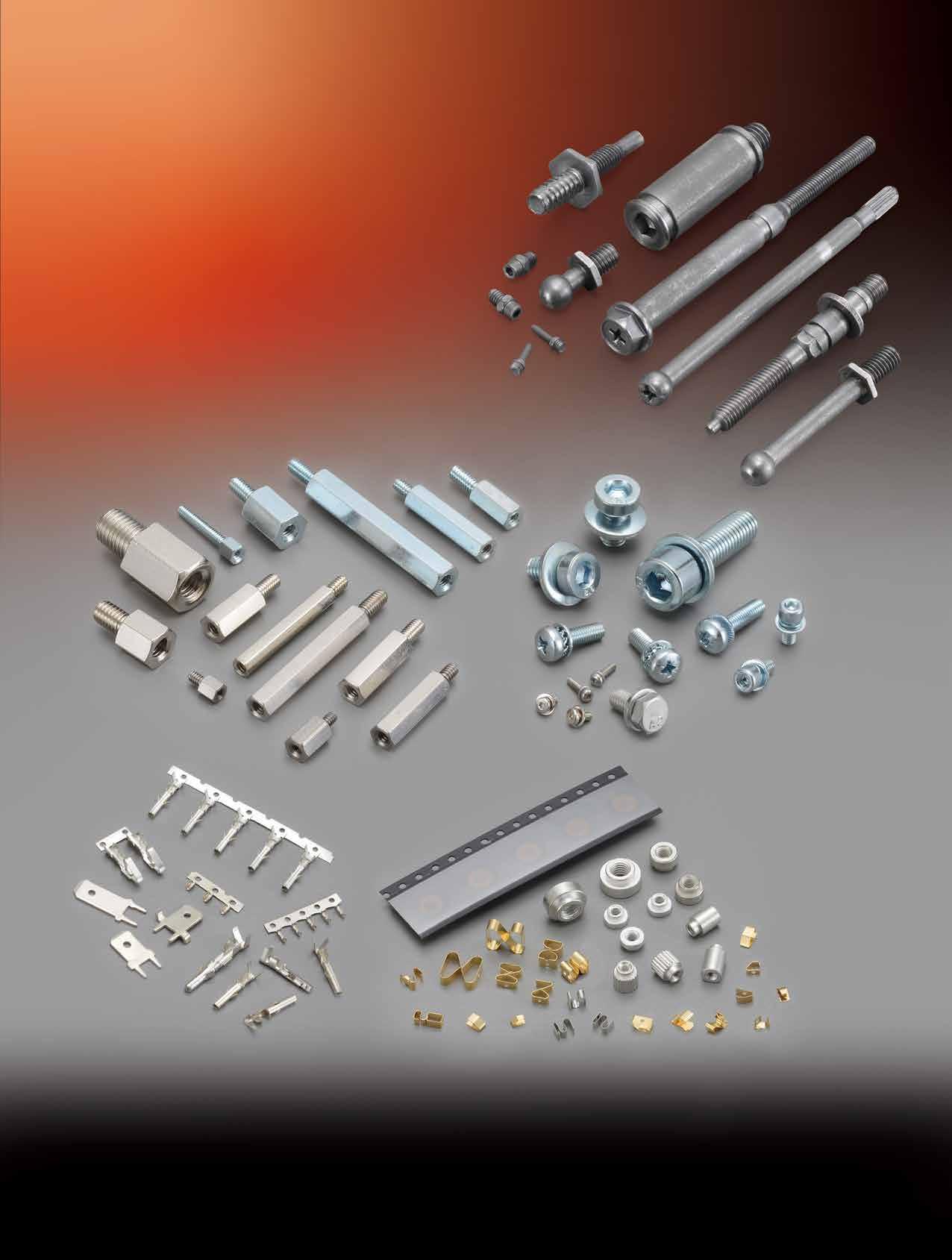

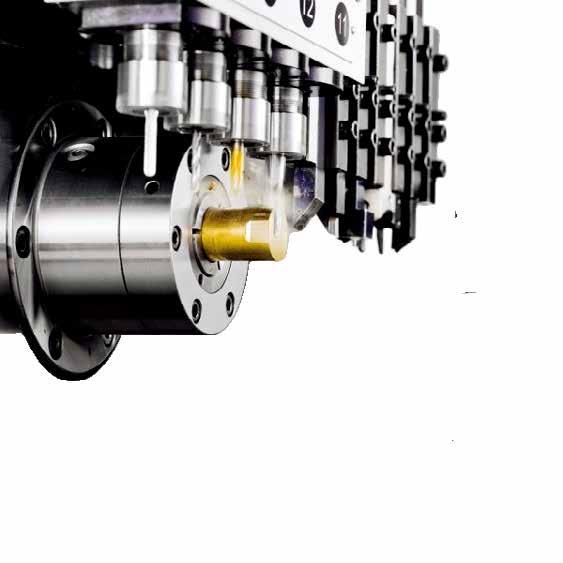

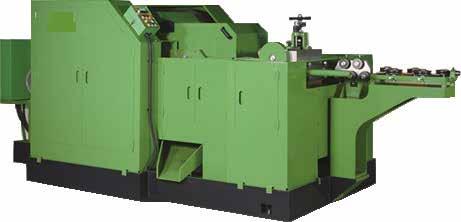

The widespread application of lightweight materials in manufacturing and the rapid development of the global electric vehicle market have driven increased demand for threaded inserts. The expansion of 5G infrastructure and IoT technologies has also created new opportunities for high-precision threaded inserts in the electronics and telecommunications sectors. Market forecasts predict that the global threaded insert market will grow from USD 420 million in 2024 to USD 570 million in 2031, with a compound annual growth rate of 5.1%. Chin Tai Sing Precision Manufactory (CTSP) produces copper inserts and press-fit fasteners, leveraging superior technology and quality to expand into international markets across multiple industries, including automotive, aerospace, electronics, telecommunications, construction, and defense.

Over the past five years, the U.S. market has experienced political transitions and emerged from the pandemic, resulting in surging demand in the aerospace and defense sectors, which has fueled demand for CTSP’s products. Utilizing its precision manufacturing capabilities, CTSP has quickly entered the market by collaborating with automotive and aerospace clients. European countries such as Germany, France, and the UK possess advanced automotive manufacturing technologies, and their strict environmental regulations and demand for green technology and high-performance automotive components present opportunities for the company. CTSP states: “We not only manufacture parts, but are also committed to solving increasingly complex engineering challenges for our clients.” The company is implementing Industry 4.0 by integrating IoT and automation technologies, as well as incorporating AI and machine learning tools into its processes to establish demand forecasting and smart manufacturing, meeting the high-performance component requirements of European and American manufacturers.

The Asia-Pacific market is currently the fastest-growing region for threaded inserts. Strong demand for automotive and electronics in China, India, and Japan, combined with rapid urbanization and infrastructure expansion in emerging Asia-Pacific countries, is driving demand in construction and machinery applications. CTSP is leveraging geographic and supply chain advantages to support Asia-Pacific customers and accelerate growth in the region.

CTSP’s product supply network covers both advanced and emerging countries worldwide. In addition to producing standard products, the company offers customized component designs and provides stainless steel, aluminum, and other materials, with a monthly production capacity exceeding 20 million pieces. Over more than 20 years, the company has become renowned for excellent quality and high yield, establishing stable global client relationships and earning high praise. Currently, it has obtained RoHS environmental certification, ISO 9001:2015, and IATF 16949 certifications, meeting client requirements for high-quality, low-pollution products.

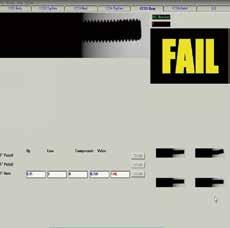

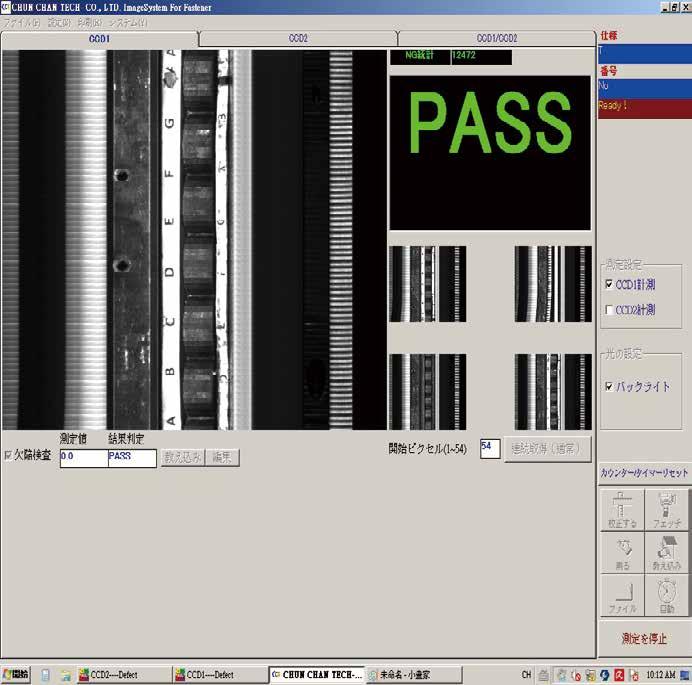

The company is currently investing in new equipment and systems to expand its product lines and service scope, including OEM and ODM manufacturing capabilities. A dedicated quality control department conducts rigorous inspections during production to ensure product quality and consistency. These experiences, certifications, and technological investments give CTSP strong competitiveness among global peers. “In the fiercely competitive fastener market, we stand out through precision manufacturing and innovative thinking. As the global manufacturing industry increasingly values sustainability, performance, efficiency, and price competitiveness, our investments in advanced production and design tools lay a solid foundation for becoming the world’s leading brand in threaded inserts,” said CTSP.

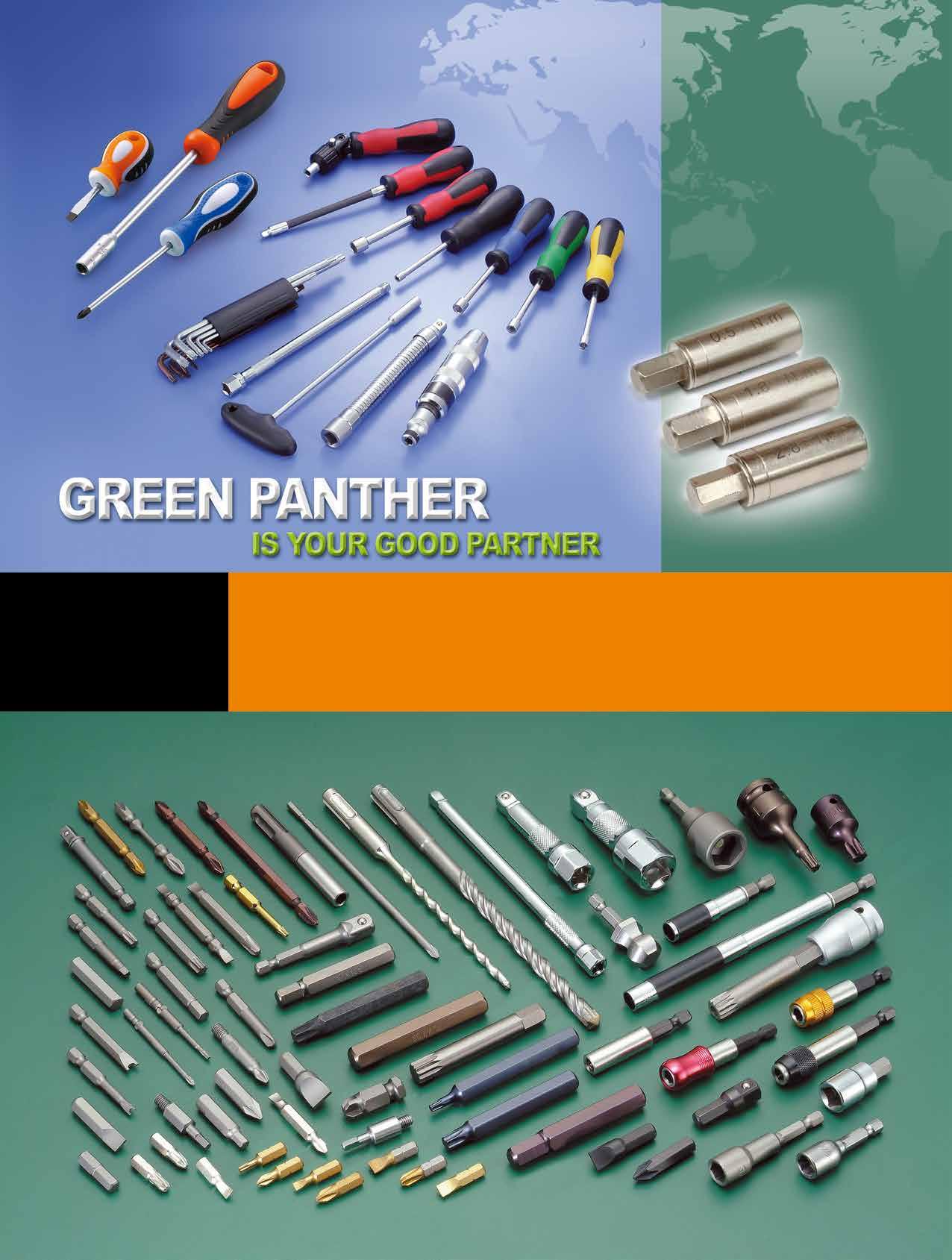

雍昌工業新品上市! YC-PU001易取起子頭

Yun Chan Industry has been focused on the R&D and manufacturing of hand tools for 50 years. Their core products include screwdriver sets, sockets, various screwdriver bits, extension rods, and customized tool parts. With stable quality, flexible production capabilities, and professional customization services, they have earned the trust of customers at home and abroad.

They have introduced automated equipment and smart manufacturing management systems in recent years, improving production capacity and quality stability as well as lead time management. In addition to ISO 9001, they have passed DUNS and TÜV. Continuing to expand overseas markets, they have successfully entered multiple major European and American distribution channels and worked with brands in the supply chain as a solid foundation for corporate transformation and growth.

Patent Screwdriver Bits Certified in Taiwan and the U.S.

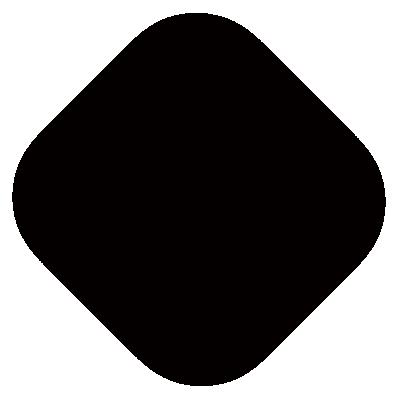

Conventional screwdriver bits are often difficult to remove from storage boxes or tools in use, especially when users wear gloves, which can cause slipping. Answering customer requests, Yun Chan Industry’s developers launched a project in 2023 to develop the "YC-PU001 Easygrip Pro Screwdriver Bit."

This product features an ergonomically designed Diamond-Shaped Knurled Surface that enhances fingertip grip. Even when wearing gloves or with sweaty palms, users can easily remove and put the bit into the box or magnetic holder, reducing the risk of dropping during operation and improving work efficiency. The bit undergoes surface treatment (options including nickel plating, chrome plating, and black phosphate coating), providing High Corrosion Resistance and Friction Strength that make them 2 to 3 times more durable than ordinary bits. Made from S2 high-alloy steel, it exhibits Excellent Heat and Fatigue Resistance, passing 10,000-cycle torque tests without breaking, suitable for repeated assembly and frequent use in automotive and machinery assembly lines. Yun Chan Industry stated that mass production began in Q4 2024, with OEM customized service available. This product has already been incorporated into the product lines of several professional brands.

Yun Chan Industry’s contact: Ray Hsiao, Sales Manager

Email: ray@greenpanther.com.tw

The company revealed that demand for high-quality hand tools in Europe and the U.S. is steadily growing, particularly in DIY, automotive repair, machinery maintenance, and electrical engineering sectors, which continue to drive sales of screwdriver sets and sockets. Although local European and American manufacturers exist, high production costs mean high reliance on imports. "We have partnered with wellknown European tool brands to supply tool kits and successfully entered major U.S. hardware retail chains. We penetrate the market through exhibitions and OEM collaborations, providing know-how and technical support to build trust. European and American buyers value stable quality, flexible supply, compliant design and certification, and cost-effective pricing. We reduce costs through modular design, offer low MOQ customization options, and apply for certifications like GS and CE to meet diverse market needs."

Looking ahead, they are planning to: (1) expand automated production lines to increase capacity by 30%; (2) exhibit in hardware shows in Cologne and Las Vegas; (3) strengthen professional OEM services to increase international visibility; (4) focus on environmentally friendly hand tool supply. "We adhere to ‘stable quality, flexible supply, innovative R&D’ and look forward to becoming your long-trusted partner. Buyers worldwide are welcome to join us to make a win-win!" said the company.

Copyright owned by Fastener

Article by Dean Tseng

Sphere 1 宣布晉升 Drew Hoyer 為副總裁

Sphere 1, a leading cooperative specializing in tool, fastener, and concrete accessory distribution, has announced the promotion of Drew Hoyer to Vice President, effective immediately. Hoyer, who joined Sphere 1 in July 2022 as Senior Director of Marketing & Events, has been a key figure in driving the cooperative’s growth and member engagement.

During his tenure, Hoyer has demonstrated exceptional leadership by implementing innovative marketing strategies and organizing successful events that have strengthened relationships with members and preferred suppliers. His efforts have significantly contributed to enhancing Sphere 1’s community and advancing its mission.

In his new role, Hoyer will take on expanded responsibilities, focusing on shaping the cooperative’s strategic vision, fostering growth, and delivering increased value to members and suppliers. Rob Moe, CEO of Sphere 1, praised Hoyer’s transformative contributions and collaborative spirit, highlighting his suitability for this leadership position.

Expressing gratitude for the promotion, Hoyer stated, “I am truly honored to step into this leadership position. Sphere 1 has been an incredible organization to grow with, and I’m eager to build upon our strong foundation to take our initiatives and cooperative health to the next level.”

The National Fastener Distributors Association (NFDA) has awarded Mark Shannon the 2025 Fastener Professional of the Year. Shannon, a second-generation leader, dedicated 47 years to Tower Fasteners, the company his father founded in 1967. Taking the helm in 1997, Shannon expanded Tower Fasteners, including opening its first European distribution site in Dublin, Ireland, in 2018. In 2022, Tower Fasteners was acquired by MSC Corp., where Shannon served as President during the transition. An active NFDA member since 2000 and President from 2008-2009, Shannon played a key role in expanding membership. He also contributed to industry boards and international supply chain initiatives.

台灣手工具銷美占比高 川普關稅之下台廠仍具競爭優勢

Taiwan’s hand tool industry boasts a comprehensive supply chain and has long relied on the U.S. and Europe as its primary export markets. Facing the tariff increase imposed by the U.S., most industry players report that they have not yet received instructions from clients to adjust orders, but are concerned that higher tariffs will push up enduser prices and affect demand. Taiwan’s main competitors are Chinese manufacturers, but Taiwanese firms still hold a competitive advantage over their Chinese counterparts, and the U.S. lacks local suppliers.

For digital hand tool maker Eclatorq Technology, about 65% of its sales go to the U.S. Production remains normal for now, and future shipments will be adjusted according to customer shipping schedules.

The company points out that digital hand tools have higher unit prices and gross margins, so the impact of tariffs is relatively limited. With 90% of revenue coming from direct customers and no substitute products in the market, end-user prices can be 8 to 10 times the purchase price. Thus, increased costs for DIY products are manageable, while price hikes for professional-grade products may occur, but demand is usually stable. Taiwan exports about USD 2.5 billion worth of hand tools to the U.S. annually, accounting for 50% of total exports. While short-term profits may decline, the industry’s competitiveness remains stronger than China’s.

因應美25%關稅 業者稱市場進入保守觀望

Fasteners imported into the U.S. are currently subject to respective basic import duties depending on their respective tariff codes and the extra 25% tariff on steel & aluminum including their derivatives, which will create considerable cost pressures on suppliers and U.S. importers and consumers, causing problems of cost-sharing and transfer. A few Taiwanese export-oriented suppliers have expressed their views on the possible impact of the 25% tariff.

Anchor Fasteners G.M. Hector Chu said: “Taiwan still has an advantage when comparing the tariffs imposed by the U.S. on Taiwan and China. What is more worrisome is that the tariffs will reduce consumption in various industries, resulting in lower market demand and an economic downturn. Chinese manufacturers will inevitably shift their focus to the European and Asian markets, which will lead to tougher competition in these markets, adding to Taiwan's woes. At the end of the Covid pandemic, Taiwanese manufacturers had been in a recession for consecutive years, and they thought they had finally waited for a chance to recover, but then there comes an even more terrible black swan. It will take time to see if U.S. manufacturing can replace imports. The market was globalized in the past, but now it is going to be more localized. It is also difficult for export-oriented Taiwanese SMEs to set up factories in the U.S. The tariff is so high that it is difficult to share the full amount. In the end, most of the tariff will be passed on to customers and a small portion will be shared by manufacturers.

Chun Yu Domestic Sales Division Manager Denise Lee said: “After the confirmation of Trump's reciprocal tariffs on April 2, our domestic wire customers seem to have been affected, and a few of their customers have suspended or cancelled the orders, and only the parts with no inventory will continue to be arranged for shipment. Although the current duty rates are as we predicted (for example, the wire coil is subject to 25%, 731814.10 (small screws) is 6.2% plus 25%, and 731814.15 (bolts) is 8.6% plus 25%), importers do not want to bear so much tariffs and would like to ask exporters to share some of the costs. Some of our customers have also contacted us recently asking for pricing renegotiation.”

Chun Yu International Hardware Sales Division Manager Jas Huang said: “I think that the increase in tariffs by the US on various countries (especially China) will benefit Taiwanese manufacturers in the short term with the order transfer effect, but I’m still not optimistic about the long term economic outlook. Due to the constant changes in U.S. tariffs, the purchasing countries are now keeping a close eye on the market development and adopting a conservative policy, so the order volume cannot be increased.”

Bi-Mirth Vice President Tom Shih said: “Since steel and aluminum products are covered by Section 232 of the Trade Expansion Act of 1962 and are exempted from reciprocal tariffs, fasteners entering the U.S. will only be subject to respective basic import duties, plus a 25% tariff, depending on the item. In the case of coach screw, that's the basic 12.5% tax rate plus the 25% tax rate, which is 37.5% in total. Theoretically, it's true that taxes have increased, but in reality, almost every country is facing the same rate of tax increase, not just Taiwan. Currently, our shipments to U.S. customers are continuing as usual, and we have not been asked to suspend shipments or reduce orders. It should be noted that the actual tax rates for non-steel and aluminum products (such as assembly parts or rubber & plastic washers) may still depend on how the U.S. Customs will determine the rate at that time. Moreover, as the current tax measures change from one day to the next, we may not be able to see the extent of the impact on the industry until the end of April.”

Fang Sheng G. M. Jess Tsai said: “Previously, fasteners of some countries (such as Japan, S. Korea) exported to the U.S. will enjoy duty-free or lower tax rates under bilateral agreements, but if we look at the 25% tariff alone, because every country has been taxed, the advantage every country originally has is still there. The greater impact may be felt by local consumers in the U.S. It has been heard that U.S. importers will adopt a gradual price increase strategy, so only after the existing stock is emptied will consumers have to bear the 25% tariff directly on their subsequent purchases. Special attention should be paid to the ripple effect caused by the demand change among different industries. Although the impact on the fastener industry is relatively small due to the non-applicability of reciprocal tariffs, mid- to high-level industries such as machinery and other CNC machine tools are facing a big impact, and machinery requires the use of a lot of fasteners, so perhaps the real impact will slowly emerge later. Of course, the government's assistance in securing a lower tax rate and making the New Taiwan Dollar (NTD) more competitive will definitely minimize the impact. The actual impact of the tax measures should surface in H2 of the year. In addition, special attention should be paid to the concern about whether there are manufacturers who will try to circumvent the tax from the third country.”

TFTA Chairman Arthur Chiang said: “As for the tariff cost that some manufacturers may be forced to share at the request of their U.S. importers, TFTA's position is to discourage our company members from doing so, after all, the raw materials, utilities and other manufacturing costs of Taiwanese manufacturers are already much higher compared to other countries. Currently, if U.S. importers still have inventory, the extent of the impact may not be so obvious and the response to CPI may not be so fast, meaning the actual impact may be still a few months away. After the implementation of the 25% tariff, it is expected that the purchasing volume of U.S. customers may drop by 30% in the short term, but the demand will pick up after their inventory is emptied.

NFDA President Scott McDaniel said: “In the United States, tariffs have been used since the early days of our republic. Some countries have used tariffs to make their domestic

production more cost competitive. I cannot say what is the correct or best path but understanding the history is important. My personal opinion is that free trade should prevail, and tariffs be minimized by all countries. This will allow those goods and materials that offer the lowest total cost of ownership the opportunity to drive value to consumers and other businesses. We cannot stop change any more than we can stop the sun from rising and setting every day. I encourage everyone to embrace the changes while looking for opportunities to help your suppliers and customers.”

Most of the respondents interviewed by Fastener World believe that the actual impact of the 25% tariff or even reciprocal tariffs may not be revealed until the second half of the year when the implementation of the tax measures becomes more specific and clear, so they will try to respond appropriately to upcoming changes while the public sentiment remains conservative.

美國對中國扣件課徵高關稅,中國市場被排除

Kent Chen, General Manager of Sheh Fung Screws, a major Taiwanese fastener manufacturer, stated at the 2025 Global New Economic Order Trends Forum that the U.S. market accounts for over 60% of Sheh Fung Screws’ exports, with China being its biggest competitor. As the U.S.-China trade war intensifies, the cumulative tariffs on Chinese fastener products exported to the U.S. have reached a new high. Coupled with Europe's anti-dumping duties on Chinese products, China has been "directly excluded" from the market.

He noted that his products have been subject to the U.S. Section 232 tariffs of 25% since March 4. Although these tariffs are primarily borne by importers, customers are requesting Sheh Fung Screws to absorb about 10% of the tariff rate, which was still under negotiation at the time of the forum. He analyzed that the impact of tariffs on final retail prices is limited, increasing by about 5%, which consumers barely notice. The main concerns are the risks of U.S. inflation and economic recession.

Furthermore, Sheh Fung Screws has established a factory in Vietnam to diversify risks, as Vietnam enjoys zero tariffs on exports to Europe and has lower production costs, offering a price advantage of about 10%. Although the U.S. imposes high taxes on Vietnam, the impact on the company is limited. Order visibility remains at 2 to 3 months, and although the utilization rates of factories in Taiwan and Vietnam have decreased, operations will not be suspended.

美國對螺絲課徵的關稅正在衝擊美國製造業

The rising cost of screws is affecting the entire supply chain. Tariffs introduced by Trump on steel and aluminum imports have disrupted supply chains for companies producing a wide range of products, from automotive parts to household appliances, football helmets, and lawnmowers. Unlike the tariffs implemented by Trump in 2018, the latest tariffs cover

a broader range of imported goods, including screws, nails, and bolts. Import tariffs on steel and aluminum have increased the costs of both foreign and domestic metals used to manufacture these components. Manufacturing executives have stated that the U.S. lacks sufficient factories to produce the necessary steel wire, screws, and other fasteners to replace imported goods.

The tariffs have disrupted supply chains for manufacturers, prompting some U.S. companies to seek domestic suppliers for small components. Gene Simpson, president of Illinois-based fastener manufacturer Semblex, said: "The production capacity we need does not exist in the U.S. Suppliers are limited." Companies using screws and other metal components affected by tariffs have noted that their customers will not tolerate price increases. Some construction contractors may delay projects until they find ways to mitigate the impact of import tariffs. According to Jason Miller, a supply chain management professor at Michigan State University, approximately USD 178 billion worth of steel and aluminum products imported into the U.S. last year are now subject to a 25% tariff. This is more than three times the value of goods impacted by the initial tariffs in 2018.

“Think Tariffs Boost U.S. Factories? Try Building a Screw Plant,” Investor Critiques Trump’s Economic Strategy

「試著蓋一間螺絲工廠吧!」天使投資人拆解川普「美國製造」關稅的幻象

Angel investor Balaji S. Srinivasan criticized Donald Trump's tariff strategy in a post on X, calling it economically regressive and disconnected from industrial realities. He remarked, "If you think tariffs incentivize building factories in the U.S., try building a screw factory!" Srinivasan argued that these measures fail to encourage American manufacturing and instead stifle it with debt, layoffs, and price hikes.

In a detailed post, Srinivasan dismantled the logic behind steep tariffs, using a hypothetical example to show how a profitable US-based business can be turned upside down overnight. “Suppose your US company imports USD1M of high quality parts, and adds in its own components to produce finished goods sold for USD1.2M per batch. Your gross profit is USD200k per batch,” he wrote. Now, impose a 30% tariff on the imported parts. The company is forced to pay USD300,000 upfront at customs—cash it likely doesn't have. “Even if you do sell everything, you’re now losing USD100k per batch.” This, Srinivasan says, is the brutal math of protectionism. Instead of reshoring production, tariffs end up punishing companies that still operate domestically but rely on global supply chains. "With a sinking feeling, you realize your profitable business has suddenly become unprofitable."

印度目標2035年佔全球電動工具10%、手工具25%市場份額

India aims to capture 10% of the global power tool market and 25% of the hand tool market, targeting USD25 billion in combined exports over the next decade. The global trade market for these tools is projected to grow from USD100 billion to USD190 billion by 2035, with hand tools rising from USD34 billion to USD60 billion and power tools from USD63 billion to USD134 billion. India currently holds a 1.8% share in hand tools (USD600 million exports) and 0.7% in power tools (USD470 million exports).

The report recommends establishing 3 to 4 world-class hand tool clusters under public-private partnerships, aggregating 4,000 acres with plug-and-play infrastructure, worker housing, and streamlined facilities. Key reforms include rationalizing import duties on raw materials like steel, simplifying export schemes, and revising labor laws. Without reforms, an additional 8,000 crore (USD960 million) in bridge support is deemed necessary, expected to generate 2 to 3 time returns in tax revenue. Achieving these goals could create 3.5 million jobs, positioning India as a high-quality global manufacturing hub.

復盛應用跨業收購伯鑫 打造台灣手工具艦隊

FuSheng Precision (Taiwan) announced the acquisition of 51% share of Taiwanese hand tool manufacturer Proxene for approximately NTD 1.481 billion. Proxene, Asia's largest industrial adjustable wrench manufacturer, reported an annual revenue of around NTD 900 million last year, serving clients including renowned brands in Europe, the U.S., and Japan. FuSheng Precision's CFO stated that the integration of resources will form a "Taiwan Hand Tool Alliance" to enhance global competitiveness, with Proxene's management team remaining largely unchanged, though FuSheng Precision will secure a majority of board seats.

FuSheng Precision disclosed its 2023 financial results: NTD28.37 billion revenue (up 16% YoY), NTD3.79 billion net profit (up 57.9% YoY), NTD28.17 EPS, and plans to distribute NTD19.7 cash dividend per share. Established over 70 years ago, the company leverages expertise in metal forming and multinational mass production, employing 20,000 globally. It has actively expanded into aerospace, automotive, and hand tool sectors. Taiwan's hand tool industry, with the annual output exceeding NTD100 billion, ranks among the world's top three exporters. This merger aims to help the industry navigate geopolitical challenges and automation transformation.

OSG株式會社連續三年獲得「白色500」健康經營優良法人認證

OSG Corporation has been recognized for the third consecutive year as an “Outstanding Health & Productivity Managing Organization 2025” by the Ministry of Economy, Trade and Industry and the Japan Health Council. This certification honors companies that actively promote health management, with the White 500 designation awarded to the top 500 large enterprises demonstrating exemplary health initiatives.

Since declaring itself a “Healthy Company” in 1996, OSG has been committed to advancing employee health. Based on regular health checkup results, the company has focused on reducing key health risks such as metabolic syndrome and smoking rates by launching the “OSG Health Mission 25.” This initiative involves implementing targeted health measures across all business locations. In fiscal year 2024, OSG further strengthened its health management system by having its Safety and Health Promotion Team and hygiene managers at each site obtain the “Health Management Advisor” certification, offered by the Tokyo Chamber of Commerce and Industry. This has enabled more accessible and effective health support within the organization.

These ongoing efforts have been highly evaluated, leading to the latest certification. OSG Corporation pledges to continue promoting health management and enhancing employee well-being in the years ahead.

Snap-on取得賓士診斷系統授權認可

Snap-on® announced its diagnostic platforms have been approved by Mercedes-Benz USA and certified by the Auto Authentication Authority (AutoAuth) to access MercedesBenz vehicles’ gateway modules. The capability is available on Snap-on’s Wi-Fi-enabled products running the latest software, enabling technicians to interface with secured vehicle systems.

Automakers, including Mercedes-Benz, are implementing secure gateway modules on 2021 and newer models to protect vehicle networks from unauthorized access and cyberattacks. These gateways require aftermarket tools to undergo registration and authentication for critical diagnostic functions.

The Snap-on Security Link™ provides a standardized method for accessing secured systems, simplifying the authentication process for technicians. The feature, included in current software at no extra cost, streamlines OEM-level diagnostics, allowing efficient execution of secured functions like code clearing and system calibration.

Ingersoll Rand Inc. announced the immediate appointment of Michelle Swanenburg, T. Rowe Price’s HR head, to its Board of Directors. Swanenburg, who oversees HR strategy for the USD 1.63 trillion asset manager, brings over 20 years of leadership experience, including prior roles at Oaktree Capital Management and board positions with The Waterfront Partnership of Baltimore and Stevenson University’s President’s Advisory Council.

CEO Vicente Reynal highlighted Swanenburg’s expertise in human capital management and corporate governance as critical to advancing Ingersoll Rand’s “Deploy Talent” strategy, emphasizing workforce development and global culture initiatives. The company, a provider of mission-critical industrial and life sciences solutions, operates 80+ brands and prioritizes innovation in harsh-condition technologies.

The appointment aligns with Ingersoll Rand’s focus on enhancing employee experiences and operational efficiency. Swanenburg’s background in organizational growth and risk management is expected to bolster governance as the company navigates evolving market demands.

San Diego-based Airsupply Jeyco, a provider of tool kitting, MRO products, and distribution solutions for aerospace, defense, and industrial sectors, has been acquired by investment firm Tide Rock and rebranded as Airsupply Tools LLC. Terms of the deal were not disclosed.

Tide Rock, a non-leveraged buyout firm with a portfolio of B2B businesses, highlighted Airsupply’s role as the sole manufacturer of "white box" tool kits for the U.S. Navy and Marine Corps. The

Ingersoll Rand斥資2,700萬美元收購兩企業 強化空氣處理技術佈局

Ingersoll Rand announced the acquisition of two companiesAdvanced Gas Technologies and G&D Chillers-for a combined USD 27 million, strengthening its air treatment solutions. Advanced Gas Technologies, an Ontario-based supplier of gas generation systems for Canadian industrial customers, and G&D Chillers, an Oregonbased provider of glycol chillers for the food and beverage sector, will join the company’s Industrial Technologies and Services segment. Additional financial terms were not disclosed.

“Both are solid businesses with strong performance and growth potential backed by great teams,” said Chairman and CEO Vicente Reynal. The move enhances Ingersoll Rand’s offerings in gas generation and industrial cooling, aligning with its strategy to deliver mission-critical solutions across sectors. The acquisitions expand its capabilities in serving industries requiring specialized air treatment technologies, including food processing and manufacturing.

Ingersoll Rand, a global provider of flow control and compression equipment, operates 80+ brands and continues to prioritize innovation in harsh-condition industrial applications.

company’s Jeyco MRO division supplies major tool brands, maintains a robust supplier network, and offers custom manufacturing.

"Airsupply has spent 25 years building best-in-class tool kitting solutions critical to clients," said Tide Rock President Brooks Kincaid, emphasizing plans to expand distribution channels. Airsupply President Sean Hutchens stated the acquisition would enhance reach for aerospace and defense clients while scaling patented solutions and growing the Jeyco MRO division.

JRG Automotive收購Stanley Engineered Fastening公司的兩輪車塑膠部門

JRG Automotive Industries has expanded its South Indian manufacturing presence by acquiring the two-wheeler functional plastics division of Stanley Engineered Fastening India (SEFI). The deal includes two production facilities in Manesar and Bangalore, enhancing JRG’s footprint in key automotive regions.

The acquired division produces plastic injection-moulded components for two-wheeler OEMs, construction equipment makers, and Tier-1 suppliers across India. SEFI, part of Stanley Black & Decker, will continue its core engineered metals and plastic fastening operations in Chennai and Bangalore. Pawan Goyal, JRG’s Founder and MD, said the acquisition strengthens the company’s capabilities and expands its reach into infrastructure equipment manufacturing. JRG, known for precision plastic components for automotive and defense sectors, aims to double its revenue this year through strategic growth initiatives.

Alcoa

On March 12, 2025, Alcoa Inc. announced the acquisition of Republic Fastener Manufacturing Corporation and Van Petty Manufacturing from The Wood Family Trust. Both companies specialize in aerospace fasteners and are based in California.

Founded in 1968, Republic Fastener focuses on “super standard” aerospace locknuts and operates the Boots Aircraft Division, offering a broad range of sheet metal and wrenchable fasteners used by major airframe manufacturers worldwide. Van Petty, established in 1943, produces high-performance precision aerospace fasteners primarily for engine and equipment manufacturers. Together, the two businesses generated USD 51 million in revenue in 2007.

This acquisition marks a significant expansion for Alcoa Fastening Systems, which has seen aerospace revenues grow from USD 1.5 billion in 2002 to over USD 3.7 billion in 2007. Alcoa’s aerospace portfolio includes fastening systems, investment castings, forgings, and aluminum extrusions serving the aerospace market globally.

五金新品大道

Milwaukee® has broadened its range of fastening tools to meet the diverse needs and accessibility challenges faced by professional tradespeople. The newly introduced 6-in-1 Stubby Multi-Bit Screwdriver is specially designed for use in confined spaces, featuring a compact 3-inch length and equipped with four bits and two nut drivers. Additionally, the 2-piece Multi-Bit Screwdriver Set pairs this stubby model with Milwaukee’s 11-in-1 MultiBit Screwdriver for enhanced versatility.

The 11-in-1 Multi-Bit Screwdriver comes with eight bits and three nut drivers, all housed in durable tri-lobe handles that provide superior grip and control. Both screwdrivers include a removable, dual-sided bit holder that organizes bits efficiently and allows quick swapping between different sizes and types. These bit holders are chrome-plated to resist the tough conditions commonly encountered on job sites, ensuring long-lasting durability and reliable performance. Milwaukee supports both tools with its Limited Lifetime warranty, underscoring their professional-grade quality.

Features:

6-in-1 Stubby Multi-Bit Screwdriver

• Better Access: 3” Length

• Comfortable Tri-Lobe Handle

• Anti-Peel Cushion Grip

• Included Bits: PH1, PH2, SL3/16", SL1/4"

• Included Nut Drivers: 1/4", 5/16"

2pc 11-in-1 Multi-Bit Screwdriver and 6-in-1 Stubby Multi-Bit Screwdriver Set

• Comfortable Tri-Lobe Handle

• Anti-Peel Cushion Grip

• Included Bits: PH1, PH2, SL3/16", SL1/4", SQ1, SQ2, T10, T15

• Included Nut Drivers: 1/4", 5/16", 3/8"

K-Tool International has introduced its new super duty 1” drive air impact wrench, engineered to deliver powerful performance with a lightweight design. This impact wrench generates an impressive 2,700 ft-lbs of break-away torque while weighing only 12.4 lbs. Its construction features magnesium front and rear housings combined with a composite center housing, providing an optimal balance of strength and reduced weight.

Built for precision and control, the tool includes a side handle to improve handling and a variable speed trigger that supports multi-speed operation. It operates at 1,000 blows per minute and is driven by a seven-vane super motor capable of reaching 5,500 RPM, enabling rapid achievement of maximum torque. Additionally, the handle exhaust system directs airflow away from both the user and the workspace, maintaining a cleaner and safer environment.

Made by Chinese titanium gadget manufacturer Titaner, TiSpanner is making waves as a versatile tool combining spanner, multitool, and survival gadget functionalities. Crafted from Grade 5 titanium, this compact device is designed for durability and portability, fitting easily on a keychain.

Its core function as a spanner offers adjustable wrench capabilities, accommodating various bolt sizes. Beyond that, it integrates features like a bottle opener, screwdriver, and even a small pry bar, making it useful for everyday tasks and repairs. The TiSpanner also incorporates survival features, including a fire starter and a glass breaker, catering to outdoor enthusiasts and emergency situations.

Its lightweight yet robust construction ensures it can withstand harsh conditions, appealing to professionals, DIYers, and adventurers alike. The TiSpanner aims to be an all-in-one solution, reducing the need for multiple tools and providing peace of mind in various scenarios.

The 40V max XGT 4-Speed High-Torque 1" Impact Wrench (model GWT10) is engineered by Makita specifically for demanding tasks such as removing wheels and attachments on heavy machinery and trucks. This cordless square-drive wrench eliminates the need for bulky air compressors and is said to outperform pneumatic models, offering up to 2,950 ft-lbs of fastening torque and 2,320 ft-lbs of nut-busting torque.

The tool is versatile enough for use in industries including oil and gas rig anchoring, pipe fitting, automotive repair, rail

Milwaukee Tool has launched a new 12-piece External TORX Socket Set, designed specifically for professional automotive technicians and mechanics. The set includes sockets in 1/4”, 3/8”, and 1/2” drive sizes, offering versatility for a range of applications. A standout feature of these sockets is the innovative FOUR FLAT sides, which prevent the sockets from rolling on flat surfaces and make them compatible with wrenches for added convenience. The sockets are finished with chrome plating to resist rust and corrosion, ensuring long-lasting durability even in demanding shop environments. Each socket is laser-engraved with size markings for easy identification, helping users quickly select the right tool for the job.

For improved organization, the set comes with a dedicated storage rail, keeping all pieces neatly arranged and accessible. Like all Milwaukee sockets, this set is backed by a Lifetime Guarantee, reflecting the company’s commitment to quality and reliability. With its anti-roll design, corrosion resistance, and clear markings, the new Milwaukee 12-piece External TORX Socket Set is engineered to meet the needs of professionals seeking dependable and efficient hand tools for their daily work.

Features:

• Most Versatile Sockets. Anti-Roll, Wrench-Ready

• FOUR FLAT Sides deter rolling

• FOUR FLAT Sides feature wrench-ready design

• Laser-engraved sizes for Better Visibility

maintenance, and structural steel assembly. It features a 6-inch extended anvil for deep fasteners, a 360-degree adjustable side handle for user comfort, multiple speed settings, and an LED ring for allaround illumination. The wrench weighs 26.8 pounds with battery and comes with two 40V XGT batteries, a rapid charger, and carrying bag.

Other features:

• Come with two 40V XGT batteries, a rapid charger and a bag.

• Three forward and three reverse Auto-Stop modes.

• Four-speed power selection switch.

• “Ultra smooth” variable-speed trigger.

• 6-inch Extended Anvil for reaching deep fasteners.

• Rubber joint for battery installation to protect the battery against tool impact.

• LED light ring for 360-degree illumination.

• 360-Degree Handle. Tools are not needed to install the side handle, which can be easily positioned to the user’s preference.

• Tethering ring for strap support and hanging the tool on equipment.

• Length: 22.5 inches.

• Net weight with battery: 26.8 pounds.

The popular e-ASSIST Electric-Assist Screwdriver from Japan’s Vessel Tools is now available to U.S. customers, bringing a compact and innovative solution to installers and tradespeople working in confined spaces. Vessel Tools has designed this tool with a distinctive ball-shaped handle for enhanced ergonomics and reduced user fatigue.

Weighing just 0.6 lbs, the e-ASSIST screwdriver offers a lightweight alternative to bulkier powered drivers, making it especially suitable for overhead work. Its electric motor provides three adjustable speeds—280, 340, and 400 RPM—and users can also lock the tool for manual operation when needed. The screwdriver is powered by a rechargeable lithium-ion battery and can be conveniently charged via USB-C.

Additional features include a high-brightness LED for improved visibility, a non-slip “Super Cushion” grip, and compatibility with standard 6.35mm hex bits. The set comes with five bits and a USB charging cable. With its compact design and versatile functions, the e-ASSIST screwdriver aims to deliver both convenience and efficiency for professionals and DIYers in the U.S. market.

This tool allows you to cut steel wire up to 4mm with one hand. Easily cut the 4mm wire used when setting up scaffolding. The design enables the entire process taking the tool from the waist bag, releasing the lock, and cutting the wire to be completed with one hand, improving efficiency in narrow and unstable environments.

Manufacturer: FUJIYA CO., LTD.

Given the need for strength, tools are often made of iron that are easy to manufacture. However, this often results in tools that are too heavy, making them unsuitable for safe and comfortable works. To ensure professional mechanics, who work for extended periods, can perform their tasks comfortably, the development of a ratchet handle with a streamlined structure was required.

Manufacturer: KYOTO TOOL CO., LTD.

DTD500 allows you to use electric power to change or rotate inserts (cutting blades) on a machining tool, which was previously done with hand tools. This power tool has two functions: it can quickly loosen and tighten screws, and it can also retighten them manually using the torque wrench function. It helps to eliminate operator variations in working time and accuracy, and reduces workload.

Manufacturer: KYOCERA INDUSTRIAL TOOLS CORPORATION

Model SBB is a screw-type, all-direction clamp that helps operators lift and transport steel and other loads. Capable of pulling and lifting vertically, horizontally, and diagonally, it supports shipbuilding, bridge construction, civil engineering, steel construction and other industries. Prioritizing safety in its core design, Model SBB continually evolves to improve safety and usability.

Manufacturer: EAGLE CLAMP CO., LTD.

Amid increasing societal demands for safety across various industries, including aircraft manufacturing and MRO (Maintenance, Repair, and Overhaul), this tool significantly enhances the prevention of tool loss and FOD (Foreign Object Debris). Equipped with RFID technology that dramatically improves reading accuracy, the tool allows for efficient searching and identification.

Manufacturer: KYOTO TOOL CO., LTD.

This is a plastic pipe fitting for water supply that allows you to easily check the inserted status of a plastic pipe. The fluorescent-colored ring with steps changes its shape to a flat one as the pipe is inserted, allowing you to confirm that the pipe has been inserted to the full depth. This plastic pipe fitting prevents leakage due to insufficient insertion during installation.

Manufacturer: BAKUMA INDUSTRIAL CO., LTD

Compiled by Fastener World

New Energy Vehicles (NEVs), including electric vehicles (EVs), have gained widespread attention and rapid development globally in recent years as a crucial alternative to gasoline vehicles. NEVs include battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hydrogen fuel cell electric vehicles (FCEVs). With technological advancements and policymaking, NEVs in the Chinese market have demonstrated significant progress in market share, technological innovation, and development in supply chains. The rapid growth of the NEV market benefits from multiple factors. To address environmental pollution and energy crises, governments worldwide have formulated a series of policies supporting NEV development, such as providing purchase subsidies, tax incentives, and building charging infrastructure, actively promoting the adoption of NEVs. In addition, increased consumer environmental awareness and the demand for energy conservation have further boosted the expansion of the NEV market.

Technological innovation is the core driving force behind NEV development. Continuous breakthroughs in battery technology, such as increased lithium-ion battery energy density, reduced costs, and faster charging speed, provide a solid guarantee for the performance improvement and market acceptance of NEVs. Advancements in electric motors and their control systems, lightweight materials, and intelligent driving technology have also significantly improved the overall performance and user experience of NEVs. For example, some high-end vehicles widely use autonomous driving technology and have gradually gained an important position in the electric vehicle market.

The improvement of the supply chain is an important support for the sustainable development of NEVs. With the growth of market demand, the integration of upstream and downstream manufacturers in the NEV supply chain has become a trend. This integration extends from the mining and supply of key raw materials such as lithium and cobalt in the upstream, to the manufacturing of core components such as power batteries and electric motors in the midstream, and then to the production and sales of whole vehicles in the downstream, forming a complete and

efficient industrial ecosystem. As the world's largest NEV (including EV) market, China has a complete supply chain layout, attracting a large amount of capital and manufacturer investment, which has driven the rapid development of the industry and the market. Despite the significant progress of NEVs, their development still faces many challenges. For example, the recycling and environmental protection of power batteries, the imperfect construction of charging infrastructure, and range anxiety are important issues that need to be addressed. In addition, global economic uncertainties and supply chain risks also have a potential impact on the NEV industry. With the further release of market demand and the continuous improvement of the supply chain, NEVs will usher in a more brilliant stage of development. The 2010s were the heyday for the rapid development of China's NEV industry. In 2012, China issued the "Energy Saving and New Energy Vehicle Industry Development Plan (2012-2020)", which clearly proposed that the cumulative production and sales of NEVs should reach 5 million vehicles by 2020. To achieve this goal, the government expanded its support for NEVs, including providing purchase subsidies, reducing purchase taxes, and accelerating the construction of charging infrastructures. Meanwhile, leading Chinese manufacturers such as BYD, BAIC BJEV, and NIO actively invested in R&D, launching a series of competitive NEVs. With the growth of market demand and the improvement of technological level, China's NEV industry occupies an important position in the global market. As of 2024, China's NEV ownership has exceeded 6.5 million vehicles, making it the world's largest NEV market. Concurrently, China's NEV supply chain has been formed. From the supply of power battery materials in the upstream to the manufacturing, assembly, and sales of whole vehicles in the downstream, a large number of manufacturers are involved in all aspects and demonstrate competitiveness in the international market.

In recent years, with the proposal of the dual carbon goals (carbon peaking and carbon neutrality), China's NEV industry has ushered in new development opportunities. The government continues to expand its policy support for NEVs, promoting connectivity of NEVs and making them smart. Meanwhile, the construction of charging infrastructure has been further expanded, and the convenience of using NEVs has been significantly improved. In 2024, China's NEV sales at home and abroad reached a new high of 4.75 million vehicles, accounting for 55.2% of the global market. Led by government policies, China's NEV industry has experienced a process from initial start-up to rapid development. Leading manufacturers are actively expanding their domestic and international deployment and building factories. In the future, with continuous technological breakthroughs and further market maturity, China's NEV industry will continue to develop.

China's electric vehicle industry is currently experiencing significant growth and consolidating its global leadership position. Electric vehicles achieved a significant milestone in August 2024, with sales exceeding 1 million vehicles, marking a major increase in the electrification of the automotive market. This represents 30.6% of all vehicle sales in that month, highlighting the continued upward trend of electric vehicles. Sales of new energy vehicles have exceeded those of internal combustion engine vehicles for the first time. This shift marks a major milestone in China's transition to automotive electrification, driven by increased consumer acceptance and manufacturers' aggressive marketing strategies. S&P Global Mobility predicted that NEVs would account for 46% of the passenger car market in 2024, up from 36% in 2023. In 2024, BYD has sold more than 1 million new energy vehicles, strengthening its dominant market position. Other automotive brands such as Xpeng, Zeekr, and GAC Aion are also beginning to emerge.

The cumulative sales volume of China's auto market in 2024 reached 22.892 million vehicles, an increase of 5.5% compared to the previous year.

According to the retail sales data released by the China Passenger Car Association, the cumulative sales volume of China's auto market in 2024 reached 22.892 million vehicles, an increase of 5.5% compared to the previous year. The cumulative sales volume of new energy vehicles was 10.749 million vehicles, an increase of 47.5% compared to the previous year, with a cumulative penetration rate of 45.8%. Among them, the sales volume of pure electric vehicles was 6.281 million vehicles, accounting for 58.5% of the market. The Chinese auto market in 2024 was highly competitive. BYD led sales volume with 4.25 million vehicles, while Tesla's sales volume declined to 910,000 vehicles. Independent brands such as Geely and Chang'an were growing rapidly, narrowing the gap with the leading group. In 2025, BYD will accelerate the sales of smart vehicles, and Tesla will usher in for the next generation of Model Y.

Table 1. China's New Energy Vehicle Sales Ranking in 2024

Source: China Association of Automobile Manufacturers;

China's NEV market has made significant progress in recent years, with sales continuing to reach new highs. According to data from the China Association of Automobile Manufacturers, China's NEV production in 2023 was 9.587 million vehicles, and sales were 9.495 million vehicles, an increase of 35.8% and 37.9% respectively compared to the previous year. From January to May 2024, the cumulative sales volume of new energy vehicles was 3.89 million vehicles, an increase of 32.5% compared to the previous year.

From the perspective of power sources, China's NEV market is dominated by pure electric vehicles (BEVs), and the proportion of plugin hybrid vehicles is increasing year by year. From January to May 2024, the sales volume of pure electric vehicles was 2.407 million vehicles, accounting for 62%; the sales volume of plug-in hybrid vehicles was 1.486 million vehicles, accounting for 38%. In terms of price, the sales volume of new energy vehicles is mainly concentrated in the price range of RMB 150,000 to 200,000. From January to May 2024, the cumulative sales volume was 1.028 million vehicles, accounting for 27.8%. In terms of sales by vehicle models, in May 2024, the models with the highest sales volume falling within RMB 80,000, RMB 80,000 to 150,000, RMB 150,000 to 200,000, RMB 200,000 to 300,000, and above RMB 300,000, were Seagull (34,000 vehicles), Qin PLUS (49,000 vehicles), Song PLUS New Energy (33,000 vehicles), Model Y (40,000 vehicles), and AITO M9 (16,000 vehicles), respectively.

Regarding power battery technology, lithium iron phosphate (LFP) power batteries account for nearly 70% of the installed capacity in China. Low-end models mainly use LFP batteries, while high-end models mostly use ternary lithium batteries. In terms of new cars, pure electric vehicles such as Xiaomi SU7 and Zeekr 001 have shown strong market competitiveness with their excellent performance. BYD has further consolidated its leading position in the field of LFP batteries through multiple plug-in hybrid extended-range new cars. In addition, the level of autonomous driving technology for new energy vehicles continues to improve. From January to February 2024, L2 and above-level autonomous driving new energy vehicles accounted for 62.5%, an increase of 7.2% compared to the same period last year. The installation rate of intelligent driver assistance systems is also increasing year by year. The market penetration rate of new energy vehicles is increasing year by year. According to data from the China Association of Automobile Manufacturers, the penetration rate of new energy vehicles in China reached 31.6% in 2023, an increase of 5.9% compared to 2022. From January to May 2024, the penetration rate of new energy vehicles reached 33.9%, and the penetration rate further increased to 39.5% in May.

In terms of exports, from January to April 2024, China's exports of new energy vehicles were 663,000 vehicles, an increase of 27% compared to the previous year. Among them, passenger car exports were 649,000 vehicles, an increase of 30% compared to the previous year. Among passenger car exports, BEV exports were 557,000 vehicles, an increase of 20% compared to the previous year, accounting for 86%; PHEV exports were 92,000 vehicles, an increase of 144% compared to the previous year, accounting for 14%. In April 2024, China's exports of new energy vehicles were 207,000 vehicles, of which passenger car exports were 203,000 vehicles, an increase of 59% compared to the previous year. The average price of China's new energy vehicle exports has also been increasing year by year. From January to April 2024, the average export price of new energy vehicles in China was US$23,000, a significant increase compared to 2019. The price increase reflects the increasing competitiveness of China's new energy vehicles in the international market and also demonstrates the progress in new energy vehicle technology and manufacturing. Figure 1 shows the export volume of new energy vehicles (including pure electric vehicles) in China from January to April 2024.

Source: China Association

The rapid growth of China's electric vehicle market benefits from many factors. To deal with environmental pollution and energy crises, the government has formulated a series of supporting policies such as providing car purchase subsidies, tax reductions and exemptions, and charging infrastructure, which promotes the popularity of pure electric vehicles. Consumers' increasing environmental awareness and demand for energy conservation will also promote the development of the pure electric vehicle market. Led by policies, China's pure electric vehicle industry has experienced a process from initial start-up to rapid development. Leading manufacturers such as BYD are not only actively expanding their domestic deployment but also expanding their factories and markets in Eastern Europe, Mexico, and Central and South America, which will trigger the booming development opportunities of the electric vehicle supply chain.

As of 2025, South America is home to an estimated 445.9 million people, reflecting a steady annual growth rate of approximately 0.69% from the previous year. This population accounts for about 5.47% of the global populace, with a density of roughly 24.56 individuals per square kilometre. Economically, the continent's performance has been modest. In 2024, the combined Gross Domestic Product (GDP) of Latin America and the Caribbean was projected to reach approximately 2.4 trillion USD, with Brazil contributing the largest share at an estimated 2.4 trillion USD. The region's GDP growth rate for 2024 was estimated at 1.9%, the lowest among global regions, highlighting persistent structural challenges. Projections for 2025 indicate a slight improvement, with the growth anticipated to accelerate to 2.6%.

Despite these modest growth rates, certain countries have demonstrated resilience. For instance, Argentina experienced a significant economic boost in January 2025, with activity increasing by 6.5% compared to the same month of the previous year, marking the highest year-on-year growth since mid-2022. Nonetheless, the overall economic landscape of South America remains complex, influenced by a myriad of factors including political shifts, global market dynamics, and internal policy decisions.

The South American fastening tool market is poised for steady growth in 2025, supported by ongoing infrastructure projects, the expansion of the automotive sector— particularly in key economies like Brazil and Argentina—and advancements in manufacturing technologies. This growth aligns with the region's anticipated GDP recovery, projected to reach 2.6% in 2025, despite broader economic challenges.

In 2025, the South American assembly fastening tools market is projected to reach a valuation of approximately 133.54 million USD, accounting for about 4% of the global market share. The market is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2025 to 2033.

• Brazil: The Brazilian market is anticipated to be valued at 57.15 million USD in 2025, with a CAGR of 6.3%. This growth is largely attributed to the country's focus on infrastructure development and the expansion of the oil and gas sector.

* Brazil's emphasis on infrastructure development and the expansion of its oil and gas sector has significantly boosted the demand for fastening tools, essential components in construction and industrial applications. The government's Growth Acceleration Program (PAC) has allocated approximately 70 billion USD for efficient and sustainable transport projects, including highways, railways, ports, and airports, with highways and roads receiving 37 billion USD and railways 18.8 billion USD. These large-scale infrastructure endeavours necessitate substantial quantities of fastening tools for assembling structures and machinery.

* Concurrently, Brazil's oil and gas industry is set to receive over 122 billion USD in investments between 2025 and 2029, primarily targeting offshore production in the Campos and Santos Basins. This surge in exploration and production activities further amplifies the need for specialized fastening

solutions capable of withstanding the demanding conditions of offshore operations. Reflecting these developments, Brazil's mining and oil & gas fasteners market is projected to grow at a compound annual growth rate (CAGR) of 5.6%, reaching a revenue of 119.9 million USD by 2030. This growth underscores the critical role of fastening tools in supporting Brazil's ambitious infrastructure and energy sector expansions.

• Argentina: Projected to reach 22.43 million USD in 2025, the Argentine market is expected to grow at a CAGR of 6.6%. The country's automotive industry plays a significant role in driving this demand.

* Argentina's automotive industry is a pivotal contributor to the nation's economy, accounting for 3% of the Gross Domestic Product (GDP), 10% of industrial production, and 10% of total exports in 2023. In that year, the sector produced approximately 610,700 motor vehicles, marking an 8.1% increase from the previous year. This growth trajectory continued into early 2025, with vehicle production reaching 72,477 units in the first two months, reflecting a 20.5% rise compared to the same period in 2024. Such robust production levels necessitate a substantial supply of fastening tools, essential for assembling various vehicle components. The industry's reliance on over 200 auto parts companies underscores the critical role of fastening solutions in ensuring the structural integrity and safety of vehicles. Furthermore, with exports exceeding 8 billion USD annually, primarily to regional markets like Brazil, Chile, and Colombia, the demand for high-quality fastening tools remains integral to maintaining Argentina's competitive edge in automotive manufacturing.

• Colombia: With an estimated market size of 11.89 million USD in 2025, Colombia is set to experience a CAGR of 5.5%, supported by ongoing infrastructure projects and industrial growth.

* Colombia is making significant strides in infrastructure development and industrial growth, with substantial investments aimed at enhancing its transportation networks and energy sectors. The government has committed over 24.9 billion USD to more than 31 projects, including the reactivation of 1,800 kilometres of railway networks, construction of 15 highway projects, modernization and expansion of five airports, and strengthening of river and port systems. Notably, the El Dorado Máximo Desarrollo (EDMAX) project is set to transform Bogotá's El Dorado Airport by 2035, doubling the passenger terminal area and increasing cargo capacity by 14%, aiming to accommodate up to 73 million passengers annually by 2050. In the energy sector, Ecopetrol, Colombia's state-run energy company, plans to invest between 500 million and 700 million USD to construct a Sustainable Aviation Fuel (SAF) production plant at the Barrancabermeja refinery, expected to produce approximately 6,000 barrels of SAF daily by 2030. These initiatives not only bolster Colombia's infrastructure and industrial landscape, but also drive demand for fastening tools, essential for the assembly and maintenance of transportation systems and energy facilities.

• Peru: The Peruvian market is forecasted to reach 10.95 million USD in 2025, growing at a CAGR of 5.9%, driven by investments in construction and mining sectors.

* Peru's economic landscape in 2025 is significantly bolstered by robust investments in both the construction and mining sectors. The nation's mining portfolio has expanded to encompass 68 projects, collectively valued at 62.6 billion USD, with 17 new initiatives contributing an additional 8 billion USD. Notably, major projects such as Tía María, Zafranal, and Pampa de Pongo are anticipated to commence construction within the year, signaling a vigorous advancement in mining activities. This surge in mining endeavors is expected to elevate mineral exports, which have already experienced a 28% increase at the onset of 2025, thereby amplifying the demand for construction services and associated infrastructure. In parallel, the construction industry is projected to grow by 5.1% in real terms in 2024, driven by private investments in mining and public expenditure on transport and energy infrastructure projects. These developments underscore a synergistic relationship between the mining and construction sectors, collectively fostering economic growth and enhancing Peru's industrial landscape.

* As the industry evolves, manufacturers are increasingly integrating automation and smart technologies into their production processes. Advanced fastening tools featuring precision engineering, automated tightening mechanisms, and realtime monitoring capabilities are becoming more prevalent. These innovations enhance efficiency, reduce errors, and improve safety in industrial applications. Additionally, companies are investing in research and development to create fastening solutions tailored to the specific needs of South America's expanding construction, automotive, and energy sectors.

* Environmental sustainability is becoming a priority for manufacturers and consumers alike. The fastening tool market is witnessing a shift toward eco-friendly solutions, including the use of recyclable materials and energy-efficient production methods. Companies are also exploring biodegradable coatings and advanced surface treatments to reduce environmental impact without compromising performance. As governments across South America implement stricter environmental regulations, businesses that prioritize sustainability will likely gain a competitive advantage in the market.

* Despite existing challenges, the South American fastening tool market is positioned for strong growth in 2025. Infrastructure expansion, automotive sector advancements, and increased investment in industrial manufacturing are key drivers of demand. While raw material price fluctuations and counterfeit products pose risks, the adoption of advanced technologies and sustainable practices will help stabilize and strengthen the industry. By embracing innovation and regulatory improvements, manufacturers and distributors can capitalize on the region’s growing demand for high-quality fastening solutions.

Data note: The data for this article is derived from the US Census trade statistics. US Census trade statistics analyze imports and exports on all modes of transportation. That value is calculated in USD by general FOB for imports and FOB for exports. Fasteners in this article are defined as any product under HS Codes 8204 (hand operated spanners and wrenches), 8207 (interchangeable tools for hand tools), and 8205 (hand tools others, blow torches). The volume in terms of mass is recorded in Gross Weight (KG).

As the U.S. fastening tools market approaches the second quarter of 2025, it navigates a dynamic trade landscape marked by shifting global supply chain uncertainties, evolving trade politics and fluctuating economic conditions. The U.S. remains a significant player in global trade, importing both essential components and materials as well as finished products while also exporting advanced fastening solutions to its primary trading partners. Recent trade patterns have been influenced by economic recovery post-pandemic, strategic reshoring initiatives, and ongoing tariff impacts, impacting industries like manufacturing, automotive and construction. As market demand steadily increased, understanding these trade dynamics becomes crucial to anticipating opportunities and overcoming challenges in the fastening tools market over the next several years.

In February 2025, U.S. fastening tool imports declined by nearly 9% in total FOB USD value and 11% in gross weight (kg) compared to January. Taiwan remained the top trading partner, accounting for over 36% of total import value, followed by China at approximately 24%. Meanwhile, Vietnam saw a notable 35% increase in fastening tool trade with the U.S., suggesting U.S. companies diversified their supply chains ahead of anticipated tariffs. Imports of interchangeable tools (HS 820790) increased by 8%, whereas other fastening tool categories declined by over 10%. The majority of these imports continued to enter the U.S. via west coast port districts, particularly Los Angeles, CA, and Seattle, WA.

820420 - SOCKET WRENCHES WITH OR WITHOUT HANDLES, DRIVES AND EXTENSIONS, AND PARTS THEREOF, OF BASE METAL

820790INTERCHANGEABLE TOOLS OTHERS, AND

820411 - SPANNERS

820540SCREWDRIVERS, AND PARTS THEREOF, OF

820412 - SPANNERS AND WRENCHES,

Historically, Taiwan and China have been the primary trading partners for the U.S., collectively accounting for approximately 60–70% of total fastening tool imports. In 2024, Taiwan represented 38% of the total FOB value of imports, while China contributed 25%.

Regarding import volumes, the U.S. predominantly sources socket wrenches (HS 820420) from Taiwan, accounting for nearly 53% of the total annual volume from the country. In contrast, China provides nearly equal volumes of socket wrenches (HS 820420) and non-adjustable hand-operated spanners and wrenches (HS 820411), which altogether constitute approximately 55% of its annual shipments to the U.S. In both 2023 and 2024, Vietnam emerged as the third-largest trading partner, supplying more than 10% of the annual import volume, primarily in interchangeable tools (HS 820790) and non-adjustable spanners and wrenches (HS 820411).

In terms of exports, the U.S. predominantly ships fastening tools to Canada and Mexico, collectively representing 39% of total export volume in February 2025. Notably, U.S. exports to Mexico surged by 346% in gross weight (kg), despite a corresponding decline of nearly 30% in FOB value, indicating a shift toward exporting higher volumes of lower-priced fastening tools or adjustments in market pricing dynamics. Additionally, exports to significant markets such as Japan, China, and Germany experienced notable increases in value in February 2025 compared to January, highlighting a strengthening demand in these international markets.

Overall, the U.S. export volume for fastening tools rose by approximately 22% month-over-month from January to February 2025. Spanners and wrenches (HS 820411) and interchangeable tools (HS 820730) comprised the bulk of these exports, underscoring continued global demand for these product categories.

Historically, Canada and Mexico have consistently remained the top trading partners, together accounting for about 47% of the total annual FOB export value in recent years. Interchangeable tools (HS 820790) are particularly prominent in exports to Mexico, representing 59% of total FOB export value in 2024, followed by spanners and wrenches (HS 820411), which accounted for nearly 21%. This trend underscores Mexico's strong reliance on U.S.-manufactured fastening solutions, reflecting broader cross-border industrial cooperation and supply chain integration.

820790 -

820411 - SPANNERS AND WRENCHES, HAND-OPERATED,

820420 - SOCKET

820412 - SPANNERS

820540SCREWDRIVERS, AND PARTS THEREOF, OF

▼ U.S. Fastening Tools Export in 2022-2024 (by Country)

820411 -

820420 - SOCKET WRENCHES WITH OR WITHOUT HANDLES, DRIVES AND EXTENSIONS, AND

820412 - SPANNERS

820540 -

Despite positive trade trends, the U.S. fastening tools market faces significant challenges and restraints moving forward. The newly imposed tariffs on April 2, 2025, affecting all imported goods, including fastening tools, present a major hurdle. These tariffs are likely to increase costs for U.S. importers, manufacturers, and ultimately consumers, potentially slowing market growth due to elevated prices and reduced profit margins. The April 2nd tariffs include an additional 34% tariff on all Chinese imports, supplementing existing duties to reach a cumulative rate of 54%. Taiwanese imports are subject to a new 32% tariff. Additionally, the imposition of these tariffs raises concerns about reciprocal tariffs from major trading partners, particularly Taiwan, China, and Vietnam, which could lead to strained trade relations and further market disruptions. The country-specific reciprocal tariffs on nations with significant trade surpluses with the U.S. were commenced on April 9, 2025. The risk of retaliatory measures could impact export volumes and competitiveness of U.S. fastening tools abroad. Supply chain instability, exacerbated by these tariffs and the threat of reciprocal action, poses another critical challenge, prompting companies to reconsider sourcing strategies, diversify their supplier base, and possibly shift toward domestic manufacturing to mitigate the impact of global trade tensions.

Looking ahead, the U.S. fastening tools market in 2025 stands at a pivotal point, shaped by dynamic trade relationships, evolving economic conditions, and technological advancements. Although new tariffs introduce uncertainties and potential disruptions, they also present opportunities for domestic suppliers and manufacturers to strengthen their positions by enhancing production capabilities and embracing innovation, including automation and smart fastening technologies. Industry stakeholders must remain agile, adapting quickly to changing trade policies, diversifying supply chains, and capitalizing on growth areas such as infrastructure projects, automotive production, and advanced manufacturing. Success will depend on strategic foresight, proactive risk management, and continuous investment in technological innovation, ensuring sustained competitiveness and resilience in a rapidly evolving global market landscape.

The evolving landscape also emphasizes a notable shift toward sustainability and environmentally friendly practices within the fastening tools industry. Growing regulatory pressures and increased consumer awareness are driving demand for more sustainable and recyclable materials, energy-efficient manufacturing processes, and eco-conscious product designs. Industry leaders and manufacturers in the U.S. are increasingly investing in research and development to meet these sustainability objectives, creating opportunities for competitive differentiation. Adopting sustainable practices not only aligns companies with regulatory trends but also enhances their appeal to environmentally conscious customers, providing a strategic advantage in a highly competitive marketplace.

Copyright owned by Fastener World /

In 2024, the European Union (EU) experienced notable shifts in the trade of fastening tools, encompassing both manual and power-driven hand tools used for securing and assembling materials. This analysis delves into the import and export dynamics of these tools, highlighting key statistics, trends, and country-specific performances, with a focus on Germany, Italy, France, and Spain.

The global hand tools market, which includes fastening tools, was valued at approximately USD 28.30 billion in 2024. Projections indicate growth to around USD 43.96 billion by 2034, reflecting a compound annual growth rate (CAGR) of about 4.5% during the forecast period. This growth is driven by factors such as widespread industrialization, the growing popularity of DIY projects, continuous technological advancements, and the rapid expansion of the e-commerce sector. Technological innovations in automation and connectivity, such as AI-driven tools and smart devices, are expected to further boost demand in the coming years. The rise in urbanization and infrastructure development, especially in emerging economies, is also contributing to the expansion of the market.

The European Union's trade in fastening tools, categorized under HS Codes 8205 and 8467, highlights a strong demand for both hand-operated and power-driven fastening tools. In 2024, the total import value of these tools reached approximately USD 14.47 billion, while exports amounted to USD 11.15 billion, reflecting a relatively high trade activity within the sector.

HS8205: This category includes traditional fastening tools such as wrenches, pliers, and manual screwdrivers. The import figures suggest a strong reliance on external suppliers, while exports remain lower, indicating that the EU still imports a significant share of its hand tool requirements.

HS8467: Power-driven fastening tools, such as electric drills and impact drivers, represent a much larger portion of the market. The import value is substantially higher than HS 8205, demonstrating the growing preference for technologically advanced fastening solutions. The export value, while lower than imports, suggests that EU manufacturers remain competitive in global markets.

The EU's trade balance in fastening tools remains negative, with imports surpassing exports. This indicates strong domestic demand but also suggests reliance on non-EU manufacturers, particularly in the power tool segment. The data also implies potential opportunities for EU-based manufacturers to expand production and enhance competitiveness in exports, especially in emerging technologies such as robotics-assisted fastening tools. EU manufacturers could also focus on high-end, niche markets where innovation, durability, and precision are prioritized, offering premium products to high-value industries.

In 2024, the EU's imports of fastening tools experienced a slight decline, totalling approximately 750,000 tons, marking a 0.5% decrease from the previous year. Despite this contraction, the overall trend from 2013 to 2024 shows a moderate growth, with an average annual increase of 3.1%. However, imports decreased by 19.5% compared to 2022 figures, indicating some volatility in recent years. This decrease could be attributed to shifting global supply chain dynamics, as well as increased self-reliance by European manufacturers and changes in international trade agreements. Germany, as a leading importer within the EU, recorded significant import volumes, reflecting its robust industrial base and demand for high-quality fastening tools. The country's imports were valued at approximately USD 3.06 billion, with a substantial portion sourced from global markets, particularly China, the United States, and Taiwan, which have emerged as competitive sources of low-cost, high-quality tools. Moreover, Germany is focusing on increasing the automation and digitalization of its manufacturing processes, leading to greater demand for advanced fastening technologies.

On the export front, the EU's fastening tools exports saw a notable decline, with shipments decreasing by 24.1% to 349,000 tons in 2024. This marks the second consecutive year of decline after three years of growth, indicating challenges in maintaining export volumes. The most rapid growth was observed in 2021, with a 15% increase, reaching a peak of 499,000 tons. The decline can be attributed to factors such as global supply chain disruptions and increased competition from low-cost manufacturers in Asia, particularly China and India. Germany dominated the European export market for fastening tools, accounting for the largest share. In recent years, remarkable growth was observed in countries like Croatia, with a 124.42% increase in exports. Conversely, nations like Latvia and Ireland experienced significant declines in exports by 15.41% and 17.62%, respectively, highlighting the uneven distribution of trade performances within the EU.

Germany: As both a leading importer and exporter, Germany's fastening tools market is substantial. The country's imports were valued at approximately USD 3.06 billion, with exports also playing a significant role in the EU's overall trade dynamics. Germany's dominant position is strengthened by its robust industrial sector and advanced manufacturing capabilities. Moreover, Germany’s focus on Industry 4.0 technologies is likely to further drive demand for innovative fastening tools. Italy, France, and Spain: These countries are major manufacturers of fastening tools and general hardware. However, they face stiff competition from cheaper imports, particularly from China, which poses challenges to their domestic industries. While Italy has shown resilience in high-end tool manufacturing, France and Spain have struggled to maintain their positions in the global market, largely due to the outsourcing of production to low-cost countries and rising raw material costs.