Goodfix Industrial’s contact: Ms. Cece Ma Email: info@fixdex.com

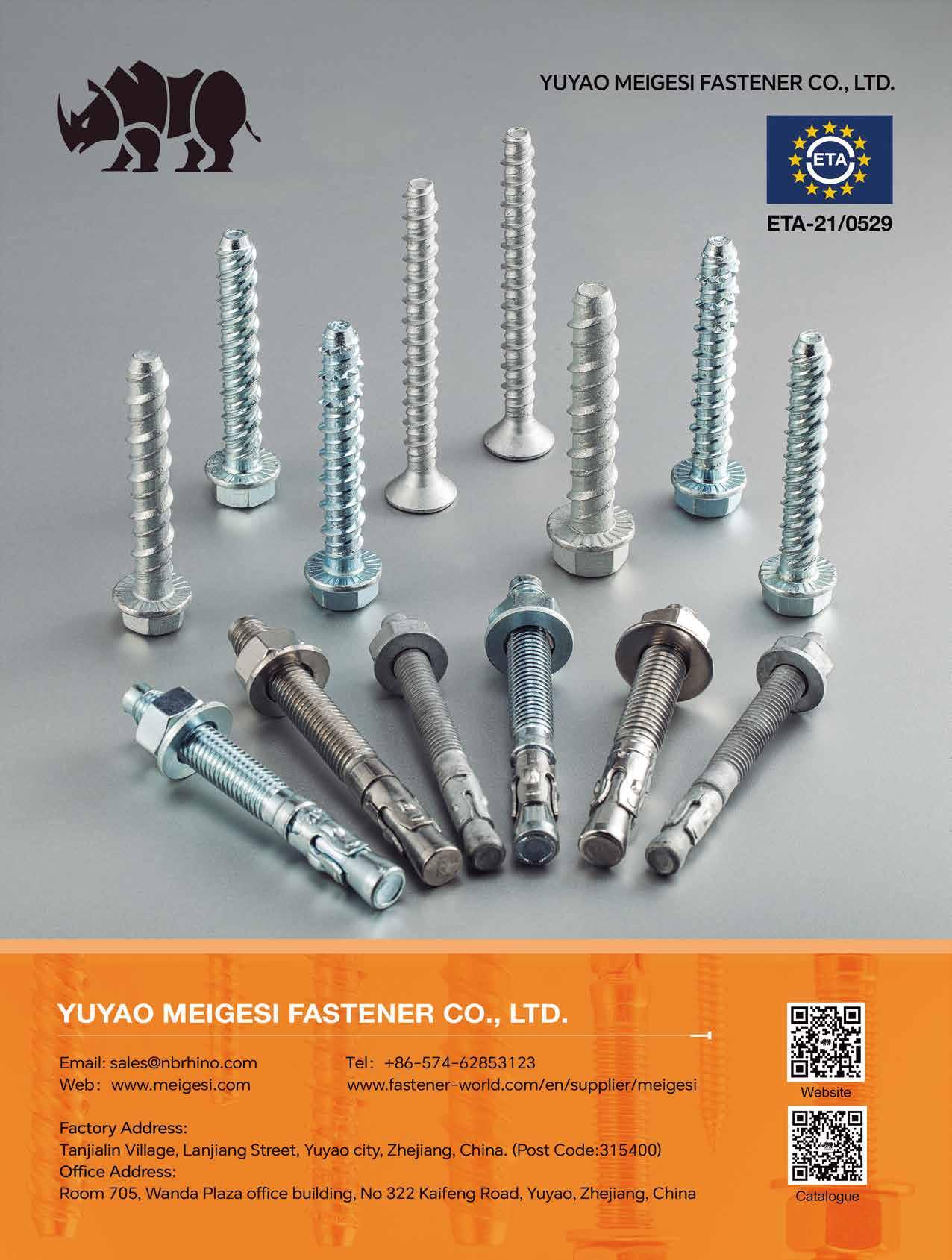

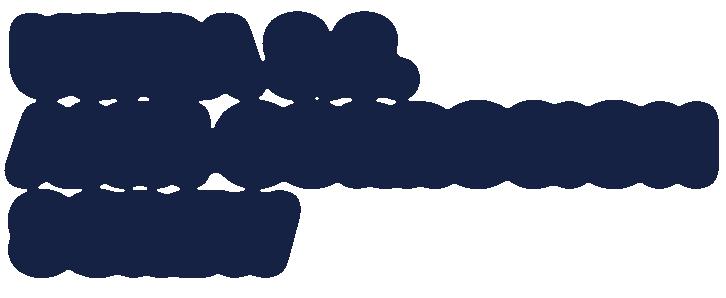

Goodfix Industrial operates 4 modern production bases covering over 300,000 square meters, featuring 20 fully automated digital anchor production lines with impressive annual capacity. The company has established its own R&D workstations and holds 33 patents, focusing on innovation in concrete anchoring, architectural hardware connections, and support systems. The product range spans photovoltaic mounting systems, post-installed concrete reinforcement anchors, specialized anchors for nuclear power plants and subways, as well as small-packaged household fasteners like self-tapping screws and expansion bolts—meeting the demand in large infrastructure projects all the way to home repairs.

Among these, its photovoltaic mounting system, a one-stop solution, uses high-strength aluminum alloy and galvanized steel, capable of withstanding winds up to category 12 and customizable for various scenarios, accelerating the completion of renewable energy projects. Its nuclear-grade anchors, successfully manufactured within China, have greatly reduced cost and obtained national S1-level certification, offering high temperature and radiation resistance and providing double-layer safety assurance for major national projects. These achievements have positioned the company as a leader in the Chinese and global construction fastener market.

Goodfix Industrial’s international brand FIXDEX is registered in over 60 countries and holds certificates including ETA, ICC, FM, UL, and CE. With in-house environmental impact assessment and multiple surface treatment production lines, every product is traceable from material to the finished state, ensuring manageable performance. This cross-industry and closed-loop production enables the company to deliver highquality products with short lead times, favored by the world. By the end of 2026, the company plans to establish overseas branches and warehouses in Southeast Asia, the Middle East, Europe, Latin America, and Africa to strengthen global supply chain deployment.

Annually, about 6% of sales are reinvested into R&D. The company’s 2,300-square-meter R&D center is equipped with 60 advanced instruments and 7 pilot production lines to offer standard and customized products. Solutions are available for sub-markets such as curtain walls, elevators, seismic resistance applications, rail transit, and photovoltaics, helping partners stand out in their fields.

The company is committed to turning wastewater into clean water through its established large treatment facilities and recycling processes. It holds ISO 9001, ISO 14001, and OHSMS 18001 certificates and has passed national-level clean production audits. From material sourcing to waste disposal, it implements full-chain green manufacturing, making it the preferred environmentally responsible supplier for overseas buyers.

Supplying products for Huawei, BYD, and the Xi’an subway, Goodfix Industrial—now a firm cornerstone of Chinese constructions— continues to advance integration of ERP, CRM, and CAM systems, blending digitalization with automation to evolve into a world-class smart manufacturing facility. Guided by the principles of Strength, Durability, and Safety, it is dedicated to advancing construction hardware technology and installation methods to build a first-class Chinese brand on the world stage.

海迅:不銹鋼緊固件的全球基石

I

n today’s rapidly changing global market, quality and a stable product supply are crucial across all industries. Hisener, a leading fastener trader from China, is becoming an indispensable cornerstone for overseas countries in securing major infrastructure, public facilities, and industrial installations with its excellent stainless steel products and strong technical support.

Hisener: "We are continuing expansion and innovation in 2025!"

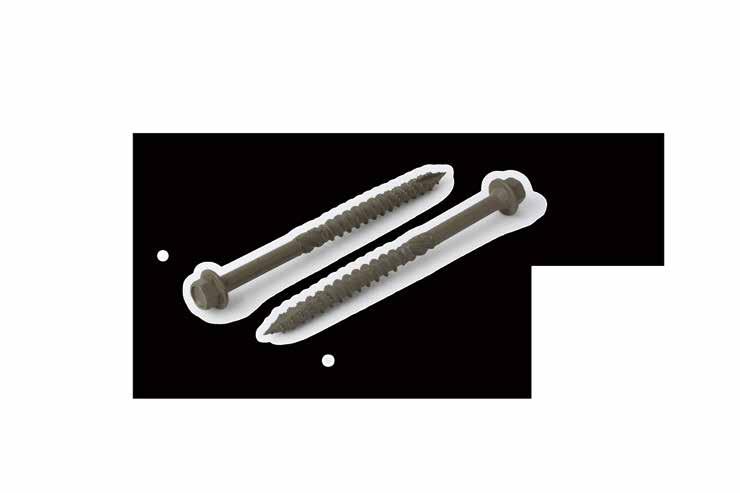

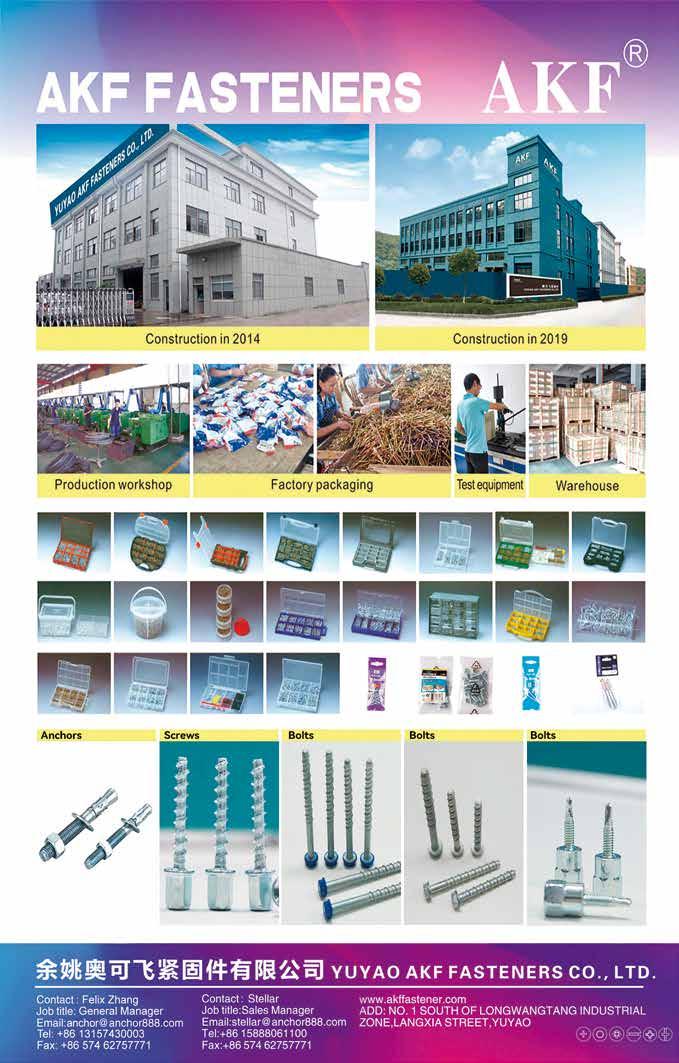

Since the launch of its automated smart factory, overseas demand for Hisener’s stainless steel products has steadily increased. To meet this, Hisener has added workshops to expand production. The company mainly uses high-quality 304, 316, and 410 series stainless steel materials, covering a wide range of specifications for various applications. It also innovates to enhance product performance according to overseas industrial needs. Notably, the bi-metal screws developed by Hisener achieve a maximum penetration strength of 12.5mm and possess strong pull-out resistance. Under equivalent performance conditions, the bi-metal screws offer better cost-effectiveness, earning positive feedback from many users. Hisener’s stainless steel screws are widely used in construction, solar energy, and machinery equipment sectors. Such demand from these industries continues to grow in 2025, driving Hisener’s participation in trade shows in Germany and other key international events to provide global buyers with one-stop purchasing services.

Contact: Simon Liang, General Manager

Email: simon@hisener.com

Hisener’s stainless steel deck screws have obtained CE certificate, while its stainless steel wood structural screws hold the ETA 22/0584 certificate. These certificates reflect the company’s strict quality standards and provide reliable assurance to customers.Their stainless steel products perform exceptionally well in harsh climates and corrosive environments. The company is equipped with salt spray and acid rain testing facilities, conducting continuous 24-hour tests on each batch to ensure corrosion resistance standards are met. These test data and laboratory reports fully demonstrate Hisener’s practical application capabilities of stainless steel products.

Beyond technology, Hisener’s stainless steel and bi-metal screws create multiple added values for users. Their strengths lie in quality and cost control, balancing price competitiveness with performance to attract buyers from both advanced and emerging countries. Especially in economic downturns, offering the most cost-effective products is the greatest value for buyers. Moving forward, the company will continue to increase R&D investment and seek high-quality talents to enhance customer experience.

Hisener is fully committed to global product promotion and sales, actively expanding wherever there is demand. This strategy reflects its emphasis on the global supply chain and its determination to provide excellent Chinese products worldwide. Starting in May, it intermittently releases product information on social media platforms and increases customer interaction to improve service satisfaction, further strengthening its position in the global supply chain and establishing Hisener as the cornerstone to count on.

Since moving to Dongguan in 2002, Tobon Screws, a major manufacturer of precision screws benefited from the well-developed industrial cluster and the proximity to customers, has showed significant improvement in its manufacturing capacity and quality standards year after year. Its systematic and intelligent lean production has also enabled it to achieve great success in its development and cooperation with customers around the world. In order to further respond to the adjustments of its major customers' global deployment strategies and strengthen the development of a wider range of customer base, Tobon determined to set up its first overseas factory at the industrial park near Hanoi in mid-2024, and has already started mass production since H2 2024. The Vietnam factory not only replicates the management and manufacturing experience of the Dongguan factory, but also complies with many of the stringent requirements of a modern factory.

“Vietnam Tobon Screws is our 1st overseas factory. It is not only a complete replicate of the Dongguan HQ's operation with a higher standard, but also our first step to serve the overseas market from our overseas base,” said Vice General Manager Barry Liu.

Occupying an area of 2,500 sq m, Vietnam Tobon Screws is located in the Frasers Real Estate Industrial Park, which is home to a large number of international leading manufacturers, and is only 30 km away from the downtown of Hanoi. The spacious facility is equipped with more than 60 screw manufacturing machines from Japan and Taiwan, 6 full-size optical sorting machines, and 3 precision lathes. Like the Dongguan factory, which has 200 sets of production equipment, the Vietnam factory also focuses on the production of precision screws, with a maximum monthly capacity of 100 million pcs. These two factories not only share resources, but also work together to develop new products to expand the market, and the complementary nature of each other has allowed Tobon to ship from both the China and Vietnam factories to meet customers’ needs.

Many of Tobon's customers have established factories in Vietnam for years or are planning to invest in Southeast Asia. Considering customer needs, market potential and competitive advantages, Tobon has decided to locate its 1st overseas factory in Vietnam. Tobon also plans to process 1/2 of its capacity in Vietnam in the future to satisfy customers' needs with localized services.

With more than 30 years of experience in customer cooperation, Tobon understands what customers need. The product design & type database accumulated over the years enables Tobon to provide better fastening solutions for customers' needs such as low volume and high variety. Professional cold heading technology, advanced ERP/MES systems and automated equipment also allow it to help customers reduce cost and improve efficiency to ensure higher quality performance.

“We once served a customer with +600 types of products, half of which had an annual demand of less than 10,000 pcs. Not only did we provide support for their factories in Europe, America and Asia, but we also helped them reduce the management costs by more than 20% and their cost of products with improved performance by more than 40%,” said Liu.

“The Vietnam factory was established not only to respond to the changes in international trade and customer needs, but also as a demonstration of our optimism for the future of Vietnam's economy and manufacturing,” said Liu.

As a quality enterprise with social responsibility, Vietnam Tobon not only strictly complies with local environmental regulations, but also plans to transfer the experience of the Dongguan factory in implementing the CBAM reporting to itself. Vietnam Tobon will continue to deepen its cooperation with local manufacturing to provide better products. In 2025, it also plans to participate in important exhibitions in the U.S., Mexico, and Vietnam, hoping that its high-quality precision screws will be seen by customers around the world.

Tobon's contact: Barry Liu, Vice General Manager

The construction of Jinan Railway Line 6 was constructed a few years ago and the products it used to anchor the critical rail system were the high-strength, safe S-class anchor bolts supplied by Handan Tedun Fastener. Tedun’s anchor bolts feature advantages such as excellent resistance to vibration/tensile/shear, fireproof, fatigue-proof, and adaptability to cracking concrete, making them repeatedly specified in many large construction projects.

Tedun's anchor bolts have demonstrated high strength and load resistance in accordance with international standards. Not only has it passed the mechanical performance test of CNAS, the test of associate companies, and the strict EU ETA certification, but it has also passed the fire and seismic performance test, greatly enhancing the installation efficiency, saving the construction time of users, and ensuring the safety of use of products. Such innovative and practical products have been widely used in the reinforcement of curtain walls, railways, highways, subways, bridges, and other important projects.

”We once cooperated with a light rail construction project in Macau, mainly supplying them heavy duty anchor bolts. Every time, they would give us great recognition and praise that the quality of our products had been on par with the international standards,” said General Manager Xuan Wang.

Born for the R&D and production of innovative construction anchor solutions, Tedun Group's products include chemical anchors, mechanical anchors, heavy-duty anchors, self-tapping anchor bolts, wedge anchors, expansion anchors, etc. Currently it has 3 workshops with a total area of about 12,600 sq m and 2 warehouses with a total area of 4,500 sq m. 25 automated production lines in the factory are equipped with 46 sets of production machines and 13 sets of inspection instruments, creating a monthly production of 4,600,000 sets. 歐盟ETA認證 「特盾」錨栓

Anchor bolts, though small in size, are a key element in maintaining construction safety. In spite of the competition and challenges from industry counterparts, the domestic involution and varying quality on the market, Tedun still adheres to the principle of high-cost manufacturing and ensures the high safety and reliability of products for customers through various QC methods (including establishing a lab and carrying out QC control in each process) to reduce the defective rate.

Contact: Xuan Wang, General Manager

Email: sales05@tedunzg.com

“Strict quality control has enabled us to successfully obtain certificates from relevant fastener associations and provincial units,” added Wang.

Tedun currently sells nearly 90% of its products in the Chinese market, with the remaining 10% going to Dubai in the Middle East, Russia, France, Canada and other countries, making it a particularly important support for domestic and overseas customers in their pursuit of high quality, high technology and the creation of additional brand value. In 2025, Tedun also actively participated in the Fastener Fair Global in Germany, hoping to accelerate the expansion of overseas markets and expand the customer base.

“With the ETA certification as a new starting point, we will accelerate the R&D of new products and optimize the anchor solutions, so that we can work together with global construction customers to strengthen the foundation of construction safety,” said Wang.

Copyright owned by Fastener World / Article by Gang Hao Chang, Vice Editor-in-Chief

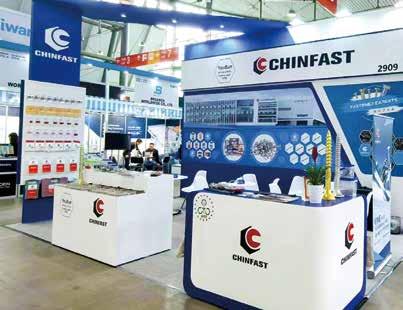

Founded in 2005, CHINFAST boasts two wholly-owned factories, namely Joystart Automotive Parts (Zhejiang) Co., Ltd. and Haiyan Yousun Enterprise Co., Ltd., with an export volume of 8,000 containers in 2023. Deeply rooted in the fastener industry, CHINFAST has established business relationships with more than 500 enterprises worldwide. To further strengthen its connection with the demands of first-tier retailers and distributors in Europe and the United States, CHINFAST Co., Ltd., which has been specializing in industrial fastener production for nearly 20 years, has actively expanded its business over the past five years. It has extended its business from the original focus on the manufacturing of multi-purpose wood screws, timber screw and decking screws to DIY fastener packaging services, aiming to create a new milestone for the sustainable development of the enterprise in the ever-changing global market.

The main products of CHINFAST are multi-purpose wood screws, trumpet head wood screws, and various window fastener series. Its patented pointed tail design offers superior speed performance compared to ordinary screws. Meeting the 1,200-hour salt spray requirement allows customers with anti-corrosion and rust-proof requirements to use them with greater peace of mind. CHINFAST is currently developing a product with a double-cut tail, which is in the trial production stage. The patented double-cut tail design elevates the product's performance

to a new level. This product combines the advantages of wood screws, self-tapping screws, and self-drilling screws, providing customers with a brand-new and efficient user experience.

The ERP smart factory management system ensures the traceability of all products from production to packaging. CHINFAST is equipped with double first-class laboratories, and the production process strictly follows the ISO9001 system. With 15 QC personnel, each batch of products must undergo initial inspection, process inspection, warehousing inspection, packaging inspection and final inspection, with records kept online for each step to ensure traceability. The responsibility of CHINFAST's QC team is to prevent any defective products reaching customers. CHINFAST is equipped with advanced cold heading equipment imported from Taiwan, China, which has more stable performance. At the same time, the workshop is equipped with automatic high-rise warehouses, automatic packaging lines and AGV robots, which play an important role in the company's production and packaging of high-quality fasteners.

Europe is one of the main markets of CHINFAST. In the future, CHINFAST will continue to develop deeply in Europe and expand into the South American and Australian markets. It is believed that with the expansion of these markets, CHINFAST's export volume will reach a new high.

As the president of Jiaxing Fastener Import and Export Association, General Manager Yu Fengming has spared no effort to develop the fastener export business. CHINFAST is an enterprise with 20 years of experience in fastener exports, holding ETA and CE certifications, as well as SMETA and BSCI reports. The automated production and packaging standards of JOYSTART also provide a guarantee for CHINFAST to explore

emerging markets. At the same time, as a factory with an average antidumping tax rate in Europe, YOUSUN benefits a larger number of European customers. CHINFAST is familiar to the needs of various markets and can quickly and accurately meet customer requirements, providing customers with high-quality after-sales service. In addition, CHINFAST has an experienced DIY packaging team, which has unparalleled competitiveness in terms of both financial strength and product professionality.

Contact: Mr. George Yu

Email: george@chinfast.com

Article by Gang Hao Chang, Vice Editor-in-Chief of Fastener World

Copyright owned by Fastener World

惠達特搜全球新聞

CMCA Fastener Subdivision President Xue Kang-Sheng Continues Term & Visits AoZhan Aviation

薛康生續任中國機械通用零部件工業協會緊固件分會會長並參訪奧展航空

The member assembly held in Hangzhou from March 21 to 22 saw Mr. Xue Kang-Sheng re-elected as president of the ninth council through voting, witnessed by key leadership representatives and industry professionals in attendance. He expressed deep gratitude for the support and trust bestowed by the representatives, pledging to continue guiding the fastener industry toward high-quality development. During the same period, he led a delegation from CMCA Fastener Subdivision to visit Aozhan Aviation Fasteners, gaining insights into their production quality control and manufacturing technologies. Through this exchange, they charted new development targets for the high-quality upgrade of Chinaese fastener industry.

Foshan Fastener Manufacturing Industry Association Anniversary Celebration and Members' Meeting

佛山市緊固件製造行業協會周年慶暨會員大會

On March 27, association members gathered to witness this significant event advancing Foshan's fastener industry development. President Mr. Heh Jian-Wei reviewed the resilience and innovation demonstrated by industry peers over the past year amid complex market conditions, highlighting breakthroughs in technological innovation, green transformation initiatives, supply chain collaboration, and global market expansion. Executive President Mr. Zhang Yong announced the association’s annual work plan, emphasizing efforts to promote collaborative development across the fastener supply chain and strengthen partnerships with upstream and downstream sectors such as steel, automotive, and machinery manufacturing.

Hong Kong Screw & Fastener Council (HKSFC) Kicks Off New Leadership with Grand Inauguration Ceremony

香港螺絲業協會以盛大就職典禮揭開新領導層

On March 28, 2025, HKSFC held its 11th Council Inauguration Ceremony and Spring Gala, marking the official commencement of the new council. Chairman Mr. Tsui Ping Fai expressed gratitude for societal support and underscored the critical role of fasteners in modern industry. He urged members to actively integrate AI technologies into industry practices to drive innovation and emphasized the association’s commitment to uniting stakeholders in elevating Hong Kong’s fastener industry to new heights.

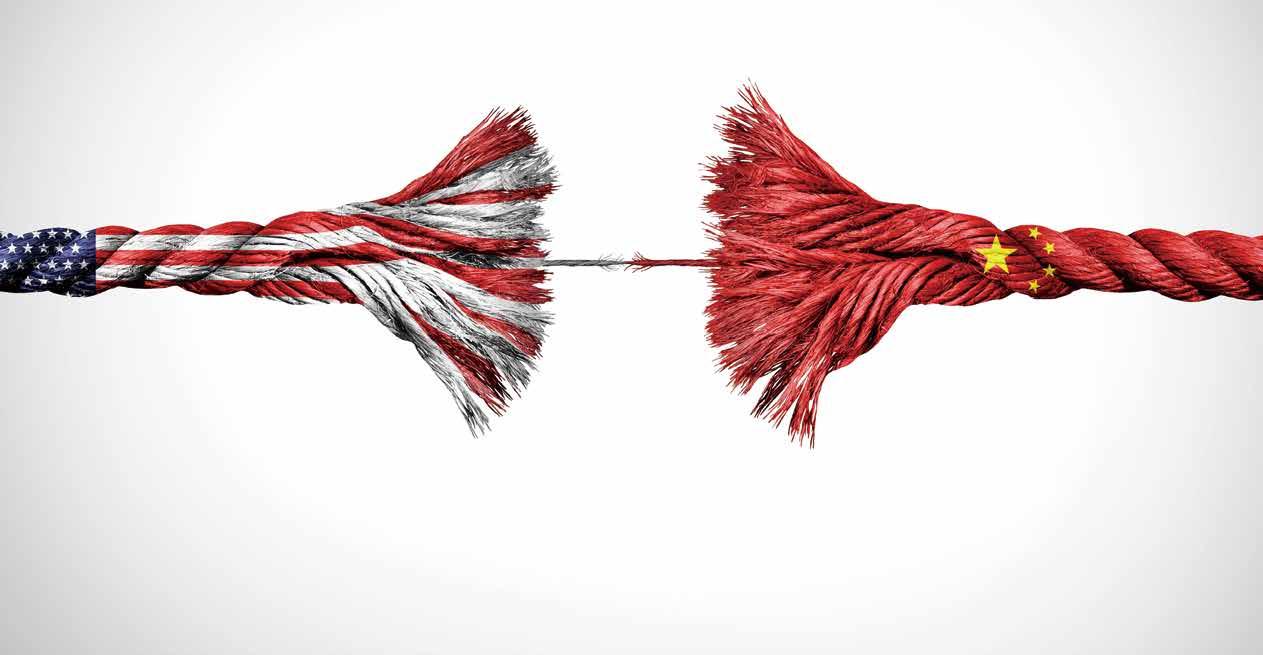

China and US Reach Major Trade Breakthrough, Slash Tariffs 中美達成重大貿易突破,雙方大幅削減關稅

In a surprising and significant development, the United States and China announced on May 12, 2025, a major breakthrough in their ongoing trade conflict by agreeing to drastically reduce tariffs on each other’s goods for an initial 90-day period. This move marks a critical step toward de-escalating a trade war that has disrupted global markets, supply chains, and economic growth.

According to a joint statement, both nations acknowledged the importance of a sustainable, long-term, and mutually beneficial economic and trade relationship. Under the agreement, the US temporarily cut its overall tariffs on Chinese goods from 145% to 30%, while China

reduced its levies on American imports from 125% to 10%. These tariff reductions have been implemented since May 14. However, certain US tariffs related to fentanyl remain in place. China also agreed to suspend or cancel several nontariff countermeasures imposed on the US, including export restrictions on rare-earth minerals and blacklisting some American companies.

Economic pressures have mounted on both sides: the US recently experienced its first quarterly GDP contraction since 2022, and China’s exports to the US sharply declined, impacting its manufacturing sector. The agreement is viewed as a "best case scenario" start to broader negotiations aimed at further tariff reductions. Both countries will continue talks through a newly established mechanism led by Chinese Vice Premier He Li-Feng and US Treasury Secretary Scott Bessent, with discussions alternating between China, the US, or a third country. US officials emphasized a mutual desire to avoid economic decoupling and promote balanced trade. This breakthrough signals hope for improved US-China economic relations and global market stability in the months ahead.

The recent surge in tariffs on steel and aluminum imports, reinstated by the Trump administration at a 25% rate, has sharply increased the prices of screws and other industrial fasteners, affecting both manufacturers and everyday consumers. An example comes from a recent encounter at a Home Depot, where a customer wearing a T-shirt with an American flag lamented, “Screws are so expensive right now,” highlighting how tariff-driven price increases are felt by ordinary Americans trying to complete simple projects like building a chicken coop. This anecdote underscores how tariffs ripple down to everyday purchases, not just large industrial buyers.

The tariffs have forced manufacturers and suppliers to either absorb higher costs or pass them on to customers, pushing up prices for construction firms and small businesses reliant on screws and bolts. Some contractors warn that rising fastener prices may delay projects or force cancellations, tightening margins in an already challenging economic environment. The Federal Reserve noted tariffs have contributed to a 0.3% rise in consumer prices this year, with many companies selectively raising prices on affected items to offset increased import costs. While tariffs aim to protect domestic industries, the unintended consequence is inflationary pressure on essential components like screws, impacting both industry and consumers alike.

受美國關稅影響,韓國3月對美鋼鐵出口同比下降近19%

The Korea International Trade Association (KITA) released data showing that South Korea's steel exports to the United States in March 2025 were USD 340 million, representing an 18.9% year-on-year decline. The export volume also decreased by about 14.9%. This drop was mainly due to the U.S. government's imposition of a 25% tariff on all imported steel starting March 12, which also abolished the duty-free quotas previously granted to South Korea and other countries.

Industry insiders noted that since most transactions are completed several months in advance, it is still difficult to fully assess the tariff's impact, but initial effects have already begun to appear. In response to the tariffs, South Korean steel companies plan to increase their production within the United States. Hyundai Steel announced a USD 5.8 billion investment to build its first overseas electric arc furnace steel mill in Louisiana, expected to begin operations by 2029. The U.S. tariffs have raised concerns about rising costs in construction, automotive, and manufacturing sectors, potentially affecting supply chains and product prices.

福特因關稅影響調漲墨西哥製車款價格

Ford has announced immediate price increases on three of its Mexico-produced models effective May 2, 2025. Some models will see price hikes of up to USD 2,000, marking one of the clearest examples of how US auto tariffs are affecting consumers. The price adjustments follow President Trump's imposition of a 25% tariff on imported auto parts, which Ford estimates will cost the company USD 2.5 billion annually. Ford plans to absorb USD 1.5 billion of these costs but will pass on about USD 1 billion to customers through higher vehicle prices. Spread over the 2.08 million vehicles Ford sold in the US last year, this translates to roughly USD 480 added to the price of US-built SUVs and trucks.

Ford noted the company's reliance on foreign parts, such as carpeting and fasteners not sufficiently produced in the US, that are subject to tariffs. Despite this, Ford's strong US manufacturing base limits its exposure compared to rivals like General Motors, which expects USD 4-USD 5 billion in tariff costs.

歐洲ENVI支持歐盟碳邊境調整機制重大簡化方案

On May 12, 2025, the European Parliament's Committee on Environment, Climate Change and Food Safety (ENVI) endorsed the European Commission's proposal to simplify the EU CBAM. This simplification package, known as ‘Omnibus I,’ was introduced in February 2025 to improve the efficiency and accessibility of CBAM. MEPs approved several technical clarifications aimed at streamlining the implementation of CBAM. A significant change is the introduction of a new de minimis threshold of 50 tons of CO2 emissions per year, exempting around 90% of importers (who are mostly small and medium-sized enterprises and individuals who import small quantities) from CBAM obligations. Despite this exemption, the mechanism will continue to cover approximately 99% of CO2 emissions from imports in sectors such as iron, steel, aluminum, cement, and fertilizers.

The proposal also simplifies the authorization process for declarants, enhances emissions calculation methods, and improves the management of financial liabilities. Additionally, it strengthens measures to prevent abuse of the system, ensuring its integrity and effectiveness. Rapporteur Antonio Decaro emphasized the importance of balancing simplification with maintaining the environmental integrity of CBAM to effectively prevent carbon leakage. The full European Parliament voted on the negotiation mandate on May 22, 2025. Looking ahead, the European Commission plans to review the possibility of extending CBAM's scope to other high-risk sectors in early 2026. This ongoing development reflects the EU's commitment to driving global climate ambition and supporting a just transition to a lowcarbon economy.

歐盟鋼鐵業呼籲提前準備CBAM以防2026年貿易中斷

With the EU Carbon Border Adjustment Mechanism (CBAM) set to begin on January 1, 2026, European steel industry players remain unprepared for its gradual implementation, warns Alexander Julius, president of EUROMETAL, in a presentation in Milan on May 8. Although CBAM's fiscal impact will start in May 2027, companies must register on the EU platform and declare emissions from Scope 1 and 2, with Scope 3 emissions to follow. Julius highlights a major cash flow challenge: importers will pay for only 2.5% of embedded emissions in 2026, rising to 100% by 2034, meaning financial reserves must be built well in advance. The complexity and extra costs, estimated at €56 per tonne for high-emission steel, could overwhelm smaller businesses and disrupt supply chains. Stronger collaboration across the supply chain and emission surcharges in contracts are recommended. The European Commission plans to propose amendments in late 2025, including expanding CBAM's scope downstream and anti-circumvention measures to protect EU manufacturing industries from carbon leakage through steel derivatives.

Suzhou Taicang Launches High-End Aerospace Fastener Production Project 蘇州太倉航空高端緊固件生產項目 正式啟動

On April 26, 2025, the project officially commenced construction in Taicang, Suzhou. The project is invested and built by China Aviation Industry Standard Parts Manufacturing Co., Ltd., a subsidiary of the Aviation Industry Corporation of China. The company specializes in the development and production of highend aerospace fasteners, providing professional connection technology solutions and integrated services for aerospace equipment construction. Once completed and fully operational, the project is expected to achieve an annual output value exceeding RMB 1 billion and generate over RMB 40 million in annual tax revenue. It is anticipated to inject new vitality into the local economy and promote the upgrade of the aerospace industry. Furthermore, the project aims to set a new benchmark for the expansion of the fastener industry in high-end fields, strengthening Taicang's position as a key hub for aerospace manufacturing.

永年區首席品質官培訓大會成功舉辦

On February 15, the Yongnian District Market Supervision Bureau organized the 2025 Chief Quality Officer Training Conference, attended by over 170 quality officers. The event focused on enhancing corporate quality management capabilities. Mr. Zheng Zhongwei, head of the bureau’s quality department, delivered an analysis of China’s Product Quality Law, using practical cases to clarify legal responsibilities. Deputy Director Mr. Gao Deju conducted specialized training on the roles and functions of chief quality officers, sharing advanced quality management methodologies.

浙江東明在泰國設立首家海外分公司

On April 21, 2025, the company opened its first overseas branch in Bangkok, Thailand, marking a major step in its global expansion. After 300 days of preparation and cooperation between its headquarters and the Thai team, the company aims to shift from exporting products to building a global ecosystem in stainless steel fasteners. This move responds to ongoing US-China trade tensions and rising US tariffs that disrupt supply chains. By localizing production and diversifying markets, the company seeks to reduce risks from unilateral trade policies and boost its international competitiveness. The Thai branch will focus on cross-border technical collaboration, innovative logistics, and deep market development to strengthen the company's presence in Southeast Asia and the world. This strategic step lays the foundation for further global growth amid changing trade dynamics.

江蘇法思特獲得汽車構件高強度緊固件螺栓專利

This innovation provides enhanced protection for fastening bolts, improving their durability and reliability in vehicle applications. The patented technology addresses common issues such as bolt loosening and corrosion, which are critical for ensuring the safety and performance of automotive assemblies. By leveraging advanced materials and precision manufacturing techniques, this new bolt offers superior mechanical strength and resistance to harsh environmental conditions. This development is expected to strengthen the company's position in the automotive fastener market and meet the increasing demand for high-quality, reliable fastening solutions in the automotive industry.

飛沃科技與貝克休斯簽署燃氣輪機C類零部件戰 略合作協議

On March 25, 2025, at the Baker Hughes Asia-Pacific Supplier Conference, Finework Technology was invited as a core supplier of gas turbines and signed a strategic collaboration agreement for gas turbine C-parts with global energy giant Baker Hughes. On March 31, Leo Di Filippo, Baker Hughes' Director of Rotating Parts Procurement, led a delegation to visit Finework and signed a procurement framework agreement. During the visit, Finework introduced the company's development and expansion plans. The delegation toured Finework's offshore hex bolt production base, aerospace industrial park, and CNAS laboratory, gaining deep insights into Finework's manufacturing strength and advanced testing capabilities. The agreements mark a milestone for Finework in the international gas turbine supply chain, positioning it for rapid growth in high-end equipment

manufacturing globally. Finework will supply core gas turbine components, including fasteners, to Baker Hughes worldwide. The partnership enhances Finework's global reputation and opens broad overseas markets. Finework plans to continue investing in R&D and deepen collaboartion with Baker Hughes to create more successful projects in global energy equipment.

新能源汽車市場帶動增長,超捷股份2025年第一季業績強勁

On April 24, 2025, Essence Fastening Systems released its Q1 financial report, showing revenue of RMB 189 million, up 38.36% year-on-year, and net profit of RMB 15.99 million, a 27.18% increase. Adjusted net profit excluding non-recurring items rose 47.22% to RMB 15.64 million. The company's main products include high-strength precision fasteners and special connectors used in automotive turbochargers, transmission parking control, exhaust systems, seats, lighting, and mirrors. In new energy vehicles, products are applied in battery trays, chassis, body, inverters, and battery swapping systems.

The company's 2024 annual report showed RMB 137 million in new revenue and RMB 212 million in orders. The company is actively developing new energy vehicle clients such as BYD, Tesla, and Xiaomi Auto, and key battery and motor system customers. Overseas expansion focuses on Mexico, targeting clients including Magna and Bosch. The company also formed a dedicated humanoid robot business team and secured commercial aerospace contracts for rocket structural parts. In 2025, the company plans to expand automotive export business, promote aerospace deliveries, and enhance profitability.

美國關稅衝擊,Tree Island Steel 公司2025年第一季營收下滑

Tree Island Steel, a leading North American wire and fastener products manufacturer, announced a significant revenue drop in the first quarter of 2025, citing the impact of new U.S. tariffs on imported steel and wire products. The company reported that Q1 revenues fell to USD 52.4 million, down from USD 60.7 million a year earlier. Management attributed the decline to reduced demand and higher costs caused by the tariffs, which have disrupted supply chains and increased the prices of raw materials. CEO Remy Stachowiak noted that the company is working to mitigate these challenges by optimizing operations and seeking alternative supply sources. The company's outlook for the rest of 2025 remains cautious as tariff uncertainties continue to weigh on the industry.

B&F Fastener Supply, a Minnesota-based distributor founded in 1988, announced it has changed its name to “BFirst Industrial.” The rebranding reflects the company’s dedication to providing top-quality products and services in the fastener industry. Despite the new name, existing contracts, orders, and accounts remain unaffected. BFirst Industrial emphasized that its commitment to customer support and operational excellence continues unchanged. Over recent years, the company has expanded by acquiring firms like TPI and Northern States Supply and now operates 17 locations across Minnesota, Wisconsin, Iowa, Nebraska, and the Dakotas.

Howmet Aerospace is well positioned to benefit from the recently announced US-China trade agreement, which aims to reduce tariffs and ease the trade tensions that have affected global supply chains and manufacturing costs. The aerospace sector, a critical market for Howmet, stands to gain as tariffs on key raw materials and finished aerospace components are lowered. Howmet, a leading manufacturer of advanced metal parts used in aircraft engines and structures, could see increased demand and improved profit margins as a result of reduced costs and expanded export opportunities. Industry analysts emphasize that the easing of trade barriers is expected to facilitate smoother cross-border transactions and reduce expenses for manufacturers like Howmet. The positive outlook reflects broader optimism about the easing of trade barriers and renewed growth prospects in aerospace manufacturing.

日本三住集團以3.5億美元收購Fictiv

Portland Bolt

In late April 2025, Portland Bolt & Manufacturing Co., a leading fastener supplier based in Oregon, announced the acquisition of Vermont-based Applied Bolting Technology. Applied Bolting is renowned for its industry-leading direct tension indicating washers, which are critical components in structural and industrial bolting applications. Portland Bolt's CEO Blake Ray expressed enthusiasm about the acquisition, highlighting that Applied Bolting's innovative products, strong customer relationships, and commitment to industry education complement Portland Bolt's existing business. The acquisition is expected to enhance Portland Bolt's product offerings, expand its geographic reach, and strengthen its manufacturing capabilities. John Cummings, President of Applied Bolting, added that the combined strengths of both companies will enable them to grow their market presence and continue delivering high-performance bolting solutions globally. This acquisition follows Portland Bolt's earlier purchase of Southern Anchor Bolt in South Carolina, reflecting the company's strategic efforts to broaden its portfolio and footprint in the fastener industry.

On April 17, 2025, Tokyo-based Misumi Group Inc. announced the acquisition of San Francisco-headquartered Fictiv Inc. in a USD 350 million all-cash deal. Fictiv, founded in 2013, provides on-demand procurement services for custom mechanical components to the U.S. manufacturing industry and operates in the U.S., China, India, and Mexico with about 400 employees and a global network of 250 manufacturing partners. Misumi said the acquisition will enhance its digital services and expand its customer base by integrating Fictiv's advanced technology and supply chain innovation. This move aims to elevate Misumi's value proposition from traditional production equipment to upstream product development in the value chain. Misumi's U.S. presence includes a supplier network with manufacturing and distribution centers. Fictiv's CEO Dave Evans called the deal a milestone, highlighting the shared vision to make a manufacturing platform that is smarter, faster, and more scalable. compiled by Fastener World

供應鏈重組覓生機 歐洲採購人潮湧現2025司徒加特螺絲展

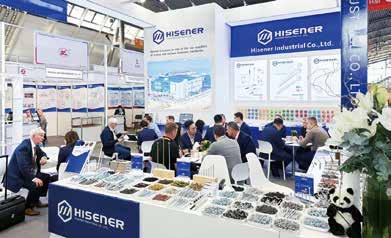

As a bellwether for the European fastener industry, Fastener Fair Global is embracing its tenth edition in 2025. The show spanned halls 1, 3, 5, and 7, covering 52,000 square meters of exhibition space, showcasing over 1,000 exhibitors from more than 40 countries. The event also featured an innovation display area showcasing many creative new products for the year.

According to the organizer’s press release, the majority of exhibitors came from major fastener-manufacturing countries/regions, with high participation from Germany, Italy, Taiwan, China, India, Turkey, the Netherlands, the UK, Spain, and France. Fastener World (the Taiwan sales representative for Fastener Fair Global) led over 160 Taiwanese exhibitors there to participate, forming a highlight at the event. Additionally, exhibitors from other Asian countries like India, Indonesia, Vietnam, and Japan booked large booths to showcase products, aiming to secure more partnerships and competitive advantages in a challenging market environment.

Fastener World sent many exhibition specialists to our two booths in halls 5 and 7 (5-2621 and 7-4260). Besides matching visitors with fastener suppliers from various countries, we were interacting with other exhibitors to gather the latest market intelligence from European suppliers. Our specialists revealed that from the first day of the show, there was a surge of visitors, mostly European distributors and importers. We had many visitors flocking at our booths, including fastener manufacturers, buyers and distributors who mentioned that the global fastener supply chain is undergoing a "restructuring" in 2025, and that many importers are seeking to establish additional sources beyond their current suppliers and are building more robust and intimate supplier partnerships to face future challenges such as tariffs, carbon reduction targets, as well as potential economic and supply chain risks.

The organizer has announced that the next Fastener Fair Global will be held on April 6-8, 2027 at Messe Stuttgart. For more information, check out Fastener World’s website at www.fastener-world.com

GUANGQINGCHANG

As the world's largest and most leading international exhibition within the fastener industry, Fastener Fair Global not only attracts a great number of leading European and American fastener manufacturers and distributors (such as Sacma, Eurobolt, Ambrovit) to participate every year, but also draws the attention of many fastener businesses from Asia (Taiwan, China, India, Japan and S. Korea, for example) which regard the Fair as their first choice and a shortcut to entering the European market and expanding the market share in Europe. The exhibitors and visitors of the Fair are highly international. Not only did we see many familiar frequent exhibitors, but we also met many new faces on-site. Through face-to-face interaction at the Fair, exhibitors and visitors can accelerate the exchange of technical and industrial info between each other on the one hand, and open up unlimited possibilities for future bilateral cooperation on the other hand.

China, the world's most populous nation, experienced a demographic shift in 2024, with its population decreasing by approximately 1.39 million to reach 1.408 billion by the year's end. This figure represents about 17.2% of the global population, underscoring China's significant presence on the world stage. Economically, China maintained its position as the second-largest economy globally, with a Gross Domestic Product (GDP) estimated at US$17.8 trillion in 2023. In 2024, the country reported a GDP growth rate of 5.0%, reflecting its ongoing economic resilience and development. This growth trajectory highlights China's pivotal role in shaping global economic trends and underscores its influence within the international marketplace.1

China's fastening tool industry, encompassing products such as electric screwdrivers, rivet guns, nail guns, and torque wrenches, plays a pivotal role in both domestic manufacturing and global supply chains. In 2024, the sector demonstrated notable trends in production, exports, and imports, reflecting broader economic dynamics and market demands.

In 2024, China's production of interchangeable tools for hand tools, a category that includes various fastening tools, was estimated at approximately 939,000 tons, maintaining levels similar to the previous year. This steady output indicates the industry's resilience amidst fluctuating global demand and supply chain challenges. The production value was estimated at US$10.5 billion, reflecting a consistent performance over the period.

China's import of interchangeable tools for hand tools saw significant activity in 2024. The country imported approximately 34,000 tons of these tools, marking a 29% increase from the previous year. This surge suggests a

growing domestic demand for specialized or high-quality fastening tools not readily available through local production. In value terms, imports totalled around US$1.1 billion, indicating a modest increase. Germany emerged as the leading supplier, accounting for 41% of the total import volume, followed by Japan and Taiwan.

◆ The fastening tool trade between the European Union (EU) and China:

It is characterized by regulatory complexities and import restrictions, which often serve as challenges for Chinese exporters. The EU has stringent environmental and quality standards, which require Chinese manufacturers to meet specific certifications for their fastening tools to enter the market. Moreover, tariffs and anti-dumping measures have occasionally made Chinese products less competitive compared to those from European or other international suppliers. Despite these barriers, China’s cost-effective production remains an attractive selling point, particularly in construction and automotive industries, where there is continuous demand for affordable yet durable tools. China can explore opportunities by aligning its products with EU standards, focusing on eco-friendly manufacturing practices, and expanding partnerships within the EU’s large-scale infrastructure projects, which are expected to rise in the coming years.

◆ The trade of fastening tools between China and Japan:

It presents unique challenges due to Japan's preference for highquality and precision tools, a demand that often outpaces what Chinese manufacturers currently offer. Additionally, Japan’s robust domestic industry limits reliance on imports for certain types of fastening tools, particularly those requiring high precision or innovation. However, this presents a significant opportunity for China to tap into a niche market by providing cost-effective solutions for basic and medium-precision tools. As Japan looks to modernize its manufacturing sectors and pursue more automated solutions in industries like automotive, electronics, and robotics, China can expand its market share by offering innovative, efficient, and competitively priced fastening tools that help streamline production processes. The key opportunity lies in adapting to Japan’s high standards while leveraging affordable production capabilities to cater to growing automation demands.

1https://www.statista.com/statistics/263616/gross-domestic-product-gdp-growth-rate-in-china/ 2https://app.indexbox.io/table/8207/156/

◆ The relationship between Taiwan and China in fastening tool trade:

It is influenced by the political dynamics and competitive pressures between the two economies. Taiwan boasts a highly advanced manufacturing sector, with its local tool production often setting the standard for quality and innovation. Chinese manufacturers face stiff competition from Taiwan’s established brands, especially in high-end tools for precision industries like electronics. However, Taiwan’s demand for affordable, mass-produced fastening tools opens the door for China to provide cost-effective alternatives. By focusing on technological upgrades and providing tools that complement Taiwan’s high-tech industries, Chinese manufacturers can strengthen their position as suppliers of value-oriented fastening solutions. Additionally, trade agreements between China and Taiwan could help facilitate smoother trade flows, creating potential for increased market penetration in the Taiwanese market.

In 2024, China’s fastening tool industry demonstrated strong export growth, reinforcing its position as a key supplier in the global market. The country exported approximately 449,000 tons of interchangeable tools for hand tools, including fastening tools such as electric screwdrivers, rivet guns, and nail guns. This marked a 9.4% increase compared to the previous year, highlighting the sector's expanding international demand. The total export value of these tools reached US$4.8 billion, reflecting China's competitive pricing and large-scale manufacturing capabilities. The primary destinations for these exports included the United States (57,000 tons), Russia (33,000 tons), and India (27,000 tons), collectively accounting for 26% of China’s total fastening tool exports. This steady growth indicates China's continued dominance in the fastening tool trade, driven by its extensive production capacity and ability to meet diverse market needs.

◆ The trade relationship between China and the United States in fastening tools remains complex:

Shaped by tariffs, technological competition, and shifting supply chains. One of the biggest challenges is the ongoing U.S.-China trade tensions, which have led to high tariffs on Chinese-made fastening tools, making them less competitive in the U.S. market. Additionally, the United States has been actively reshoring manufacturing and investing in domestic tool production to reduce reliance on Chinese imports. However, despite these obstacles, China remains the largest supplier of fastening tools to the U.S., benefiting from its cost-effective production and large-scale manufacturing capabilities. The growing demand for electric fastening tools in the U.S. construction and automotive sectors presents an opportunity for Chinese manufacturers to innovate and produce higherquality, precision fastening tools that align with U.S. industry standards.

◆ The fastening tool trade between China and Russia:

It has seen significant growth, particularly as Russia shifts its supply chain away from Western countries due to sanctions and geopolitical tensions. The primary challenge in this trade relationship is logistics and payment difficulties, as international banking restrictions have affected transactions. Additionally, Russia’s preference for European-quality tools poses a challenge for Chinese manufacturers, who must meet stringent performance expectations. However, China has a

major opportunity to expand its market share in Russia by offering cost-effective, high-quality fastening tools, particularly for the infrastructure, energy, and defense industries. With Russian companies looking for reliable suppliers outside of Europe, Chinese fastening tool manufacturers can capitalize on this demand by establishing local partnerships and improving product reliability.

◆ The fastening tool trade between China and India:

It faces hurdles related to import restrictions and local manufacturing policies. The Indian government has implemented measures to boost domestic production under the "Make in India" initiative, leading to higher import duties on Chinese tools. Additionally, political tensions and border disputes occasionally disrupt trade flows. However, China remains a dominant supplier of fastening tools to India, given its competitive pricing and ability to supply in bulk. The rapid growth of India’s construction, infrastructure, and automotive sectors presents a major opportunity for Chinese fastening tool manufacturers. By investing in localized production units, joint ventures, or technology transfer agreements, Chinese firms can strengthen their foothold in the Indian market while navigating trade restrictions more effectively.

The Chinese fastening tool industry is poised for transformation, with projections indicating a compound annual growth rate (CAGR) of 2.2% through 2035. This anticipated growth is likely to be driven by increased investments in research and development, a focus on producing high-end tools, and strategies aimed at reducing reliance on foreign technology. Additionally, the expanding domestic and international demand for advanced fastening solutions presents opportunities for Chinese manufacturers to innovate and capture larger market shares. Addressing challenges related to high-end tool manufacturing and leveraging growth opportunities.

Looking ahead, China's fastening tool industry is poised for transformation:

• Technological Innovation: Continued emphasis on R&D is expected to yield more advanced and specialized products, catering to evolving global demands.

• Market Diversification: Expanding into emerging markets and reducing reliance on traditional partners will mitigate risks associated with geopolitical tensions.

• Environmental Compliance: Adhering to stringent environmental regulations.

RMB 1,141.448 million in 2023.

1,203.135 vs. 1,141.448

5,181.470 vs. 5,219.639

Gem-Year Industrial’s 2024 revenue was RMB 2,369.711 million, up 2.3% from RMB 2,314.182 million in 2023. Net profit was RMB 130.141 million in 2024, compared to net profit loss of RMB 19.285 million in 2023. Total assets decreased to RMB 5,181.470 million in 2024 from RMB 5,219.639 million in 2023.

14,065 vs. 14,155

Alcoa's 2024 net sales were USD 11,895 million, up 12.7% from USD 10,551 million in 2023. The company ended the year with a net income of USD 60 million in 2024,

Chicago Rivet & Machine's 2024 net sales were USD 26.986 million, down 14.3% from USD 31.507 million in 2023. Net loss was USD 5.615 million in 2024, down from a net loss of USD 4.401 million in 2023. Total assets decreased to USD 23.370 million in 2024 from USD 27.830 million in 2023.

Fastenal's 2024 net sales were USD 7,546.0 million, up 2.7% from USD 7,346.7 million in 2023. Net income was USD 1,150.6 million in 2024, down 0.3% from USD 1,155.0 million in 2023. Total assets increased to USD 4,698.0 million in 2024 from USD 4,462.9 million in 2023.

Grainger's 2024 net sales were USD 17,168 million, up 4.1% from USD 16,478 million in 2023. Net income was USD 1,909 million in 2024, up 4.3% from USD 1,829 million in 2023. Total assets increased to USD 8,829 million in 2024 from USD 8,147 million in 2023.

4,698.0 vs. 4,462.9

8,829

8,147

2,330.503 vs. 2,331.101

2,737.350 vs. 2,704.724

1,324.180 vs. 1,341.660

Hillman Group's 2024 net sales were USD 1,472.595 million, down 0.2% from USD 1,476.477 million in 2023. Net income was USD 17.255 million in 2024, down from a net loss of USD 9.589 million in 2023. Total assets decreased to USD 2,330.503 million in 2024 from USD 2,331.101 million in 2023.

Simpson Manufacturing's 2024 net sales were USD 2,232.139 million, up 0.8% from USD 2,213.803 million in 2023. Net income was USD 322.224 million in 2024, down 8.9% from USD 353.987 million in 2023. Total assets increased to USD 2,737.350 million in 2024 from USD 2,704.724 million in 2023.

Trimas’ 2024 net sales were USD 925.010 million, up 3.5% from USD 893.550 million in 2023. Net income was USD 24.250 million in 2024, down 39.9% from USD 40.360 million in 2023. Total assets decreased to USD 1,324.180 million in 2024 from USD 1,341.660 million in 2023.

CHF)

Bossard's 2024 net sales were CHF 986.4 million, down 7.7% (in CHF) or down 5.8% (in local currency) from CHF 1,069.0 million in 2023. Europe, at 567.5 million, registered the largest sales portion generated within the group in 2024, but down 3.2% from the previous year. America registered the largest drop margin within the group, while Asia registered a sales gain both in CHF and local currency.

9,191 vs. 8,600

2,210.283 vs. 2,058.566

1,436.628 vs. 1,493.278

2,612.2 vs. 2,546.8

Bufab's 2024 net sales were SEK 8,035 million, down 7.4% from SEK 8,680 million in 2023. Net profit was SEK 551 million in 2024, down 4.0% from SEK 574 million in 2023. Total assets increased to SEK 9,191 million in 2024 from SEK 8,600 million in 2023.

1,490.8 vs. 1,392.7

Bulten's 2024 net sales were SEK 5,807 million, up 0.8% from SEK 5,757 million in 2023. Net profit was SEK 135 million in 2024, up 31.0% from SEK 103 million in 2023. Total assets increased to SEK 5,099 million in 2024 from SEK 4,852 million in 2023.

Lisi Group's 2024 revenue was EUR 1,794.050 million, up 10.0% from EUR 1,630.444 million in 2023. Net profit was EUR 56.006 million in 2024, up 49.2% from EUR 37.533 million in 2023. Total assets increased to EUR 2,210.283 million in 2024 from EUR 2,058.566 million in 2023.

Norma Group's 2024 revenue was EUR 1,155.128 million, down 5.5% from EUR 1,222.781 million in 2023. Net profit was EUR 14.696 million in 2024, down 47.1% from EUR 27.832 million in 2023. Total assets decreased to EUR 1,436.628 million in 2024 from EUR 1,493.278 million in 2023.

SFS Group’s 2024 net sales were CHF 3,031.1 million, down 1.3% from CHF 3,073.0 million in 2023. Net profit was CHF 241.3 million in 2024, down 9.2% from CHF 266.0 million in 2023. Total assets increased to CHF 2,612.2 million in 2024 from CHF 2,546.8 million in 2023.

Vossloh's 2024 revenue was EUR 1,209.6 million, down 0.38% from EUR 1,214.3 million in 2023. Net profit was EUR 63.2 million in 2024, up 63.3% from EUR 38.7 million in 2023. Total assets increased to EUR 1,490.8 million in 2024 from EUR 1,392.7 million in 2023.

Würth's 2024 sales were EUR 20,214 million, down 0.8% from EUR 20,396 million in 2023. Net income was EUR 672.4 million in 2024, down 40.2% from EUR 1,124.9 million in 2023. Total assets increased to EUR 19,272.9 million in 2024 from EUR 17,995.2 million in 2023.

16,450 in

vs. 16,683 in

Amatei’s 2025 revenue was JPY 5,583 million, up 0.9% from JPY 5,533 million in 2024. The company ended the year with a net profit of JPY 142 million in 2025, up 6.5% from JPY 133 million in net profit in 2024. Total assets decreased to JPY 5,231 million in 2025 from JPY 5,357 million in 2024. The company forecasts 2026’s revenue at JPY 5,700 million, up 2.1%.

JPF's 2024 revenue was JPY 5,040 million, down 1.3% from JPY 5,108 million in 2023. The company ended the year with a net profit of JPY 509 million in 2024, compared to a loss of JPY 108 million in net profit in 2023. Total assets decreased to JPY 5,785 million in 2024 from JPY 7,459 million in 2023. The company forecasts 2025’s revenue at JPY 5,330 million, up 5.7%.

in

in 2023

in

in

Mitsuchi’s 2024 revenue was JPY 13,147 million, up 4.7% from JPY 12,555 million in 2023. The company ended the year with a net profit of JPY 419 million in 2024, compared to a loss of JPY 32 million in net profit in 2023. Total assets decreased to JPY 16,450 million in 2024 from JPY 16,683 million in 2023. The company forecasts 2025’s revenue at JPY 13,872 million, up 5.5%.

Nifco’s 2025 revenue was JPY 353,038 million, down 5.0% from JPY 371,639 million in 2024. The company ended the year with a net profit of JPY 44,767 million in 2025, up 145.3% from JPY 18,252 million in 2024. Total assets decreased to JPY 379,816 million in 2025 from JPY 380,405 million in 2024. The company forecasts 2026’s revenue at JPY 348,000 million, down 1.4%.

Nitto Seiko's 2024 revenue was JPY 47,069 million, up 5.2% from JPY 44,744 million in 2023. The company ended the year with a net profit of JPY 2,199 million in 2024, up 26.8% from JPY 1,734 million in 2023. Total assets increased to JPY 55,604 million in 2024 from JPY 53,344 million in 2023. The company forecasts 2025’s revenue at JPY 50,100 million, up 6.4%.

Sanko Techno’s 2025 revenue was JPY 21,250 million, up 0.5% from JPY 21,142 million in 2024. The company ended the year with a net profit of JPY 1,122 million in 2025, down 35.5% from JPY 1,740 million in 2024. Total assets increased to JPY 26,558 million in 2025 from JPY 24,629 million in 2024. The company forecasts 2026’s revenue at JPY 22,000 million, up 3.5%.

Torq’s 2024 revenue was JPY 22,409 million, up 3.0% from JPY 21,757 million in 2023. The company ended the year with a net profit of JPY 895 million in 2024, up 5.9% from JPY 845 million in 2023. Total assets increased to JPY 33,680 million in 2024 from JPY 32,689 million in 2023. The company forecasts 2025’s revenue at JPY 23,100 million, up 3.1%.

662,367

653,167

全新SBW4軌道緊固系統

Voestalpine Fastening Systems has launched the SBW4 rail fastening system, an innovative upgrade to the long-standing SBW3 system widely used in Poland’s railway infrastructure. Building on decades of experience, the new SBW4 addresses key

This advanced wood screw by Hillman features a dual thread design that enables 30% faster installation while maintaining strong holding power. Tim Ferguson, Hillman’s VP of Product and Engineering, highlighted the fastener’s ability to eliminate pre-drilling with a selfstarting tip and optimized threads that reduce wood splitting. The screw also includes a star drive to prevent cam-out, integrated countersinking blades for clean finishes, and a no-split twist shank for durability.

challenges such as assembly ergonomics, electrical resistance, material weight, and automation compatibility The SBW4 features a redesigned SB3/5 cast iron anchor and WIW60C insulating clamp that standardize clamp positioning and simplify manual installation. A hollow anchor head reduces weight by 20%, cutting production and transport costs while lowering environmental impact. The PWE6094R rail pad’s improved lateral ribs enhance electrical resistance, consistently exceeding safety standards (EN 13481-2). The system is designed for integration into automated assembly lines, boosting efficiency and reducing errors. Tested rigorously at the Railway Institute in Warsaw, the SBW4 meets stringent quality and safety criteria, with all components patented for innovation. This system promises faster, more reliable track laying with a smaller carbon footprint, offering economic and ecological advantages for rail construction and maintenance.

Designed for decks, subfloors, framing, and fences, the Power Pro fasteners improve speed and efficiency in wood construction. Hillman plans to release complementary accessories in Q3 2025, such as magnetic tool holders and TrapJaw® spring-loaded pouches, along with durable beams and joist tapes.

太陽能支架用的隱藏式緊固件

Martin Roofing and Solar has won a prize from the U.S. Department of Energy’s Solar Energy Technologies Office (SETO) as a semifinalist in the American-Made Solar Prize program. The company’s innovation, the Hidden-Fastener Solar Mount (HFSM), is designed for asphalt shingle and composite slate roofs and eliminates the need to drill holes in the exterior roofing layer.

Unlike traditional solar mounts that penetrate all roof layers, HFSM installs beneath the roofing layer by attaching through the nail strip. This method avoids removing shingles; installers simply lift the shingle seal, install the mount, then reseal the shingles to cover fasteners. It can be used on existing roofs or integrated during reroofing, a common time for solar installation.

Constructed from durable, U.S.-made 5052-grade aluminum, each mount weighs just 0.6 lbs. Preston Nelson, Martin Solar’s director, highlights HFSM’s ability to virtually eliminate leak risk, offering installers greater confidence in rooftop solar installations.

超低推力單軸自動螺絲鎖付機

Nitto Seiko (Japan) officially announced the new "FEEDMAT® FM513 Series Ultra-Low Thrust SingleSpindle Automatic Screw Driving Machine." This new product is designed for industries with stringent component performance requirements such as the automotive sector. It effectively reduces the thrust applied during screw fastening, minimizing the risk of damage to screws and substrates, thereby enhancing product quality.

The new model employs digital thrust control technology to finely adjust the thrust during the fastening process, preventing excessive pressure that could cause screw seizing or substrate deformation. It also increases fastening speed by 40% compared to traditional products, significantly shortening production cycles. It is especially suitable for fastening screws in deep or specially shaped parts, meeting the demands for both "finer" and "faster" fastening.

Nitto Seiko emphasizes that this product integrates a screw feeder, fastening unit, and controller into a comprehensive system. Combined with last year's high-precision low-torque NX driver, it creates a rare complete screw fastening solution in the industry, providing a more efficient and reliable technological platform for automated production lines.

K&K Engineering’s new inspection machine, the “QV-7100AI,” utilizes AI to distinguish between good and defective products, while also enhancing the user operation experience. The goal is to reduce the workload of on-site inspection tasks.

The QV series inspection machines are centered around “High Quality Vision System,” offering customized models tailored to different inspection targets and building a solid track record. The newly launched “QV-7100AI” emphasizes operational efficiency and user experience on the shop floor. Through repeated research, the AI-based recognition function is integrated with an intuitive user interface, enabling quick setup and precise inspection. This model further expands the QV series product line and strengthens the company’s technological presence in the field of automated inspection.

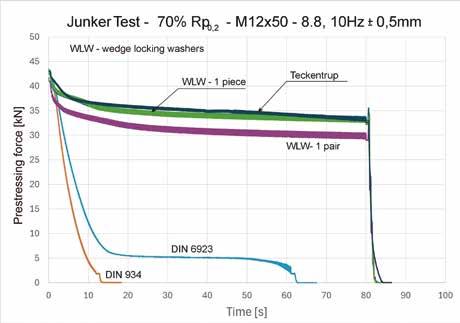

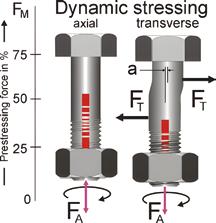

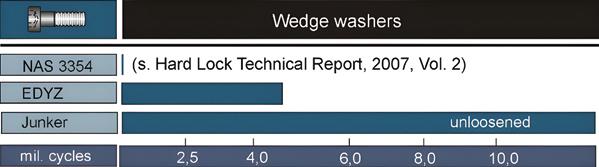

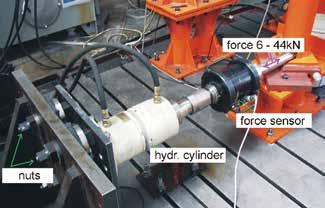

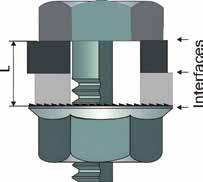

Tsukimori Kougyo developed this product to enable visual confirmation of fastening completion while ensuring stable axial force. Testing on M20 specifications under 280Nm tightening torque showed that after a 17-minute NAS vibration test, traditional hexagonal 4.8 bolts retained only 180Nm (64% of the original torque), whereas this product maintained 260Nm (93%), improving the axial force retention by 44%. The technology originated from a 2021 R&D project subsidized by Japan's Ministry of Economy, Trade and Industry, and secured a patent in 2022. Combining specialized wrenches with cold forging techniques, it streamlines installation while ensuring torque accuracy, supporting specifications up to M36 and offering innovative solutions for anti-loosening needs in construction parts.

Compiled by Fastener World

Data note: The data for this article is derived from the US Census trade statistics. US Census trade statistics analyze imports and exports on all modes of transportation. That value is calculated in USD by general FOB for imports and FOB for exports. Fasteners in this article are defined as any product under HS Code 7318 (screws, bolts, nuts, coach screws, screw hooks, rivets, cotters, cotter pins, washers and similar articles, of iron or steel). The volume in terms of mass is recorded in Gross Weight (KG).

The ongoing trade tensions between the United States and China have sent ripple effects throughout the global fastener supply chain, fundamentally reshaping trade flows, manufacturing practice and strategic planning across multiple industries. These dynamics are beginning to be seen in the first few months of 2025 through statistical trade data and the shift in fastener trade between these two major economic powers. Additionally, the escalation of tariffs and regulatory measures are beginning to have immediate impacts on trade policies and international market strategies. Ultimately, the manufacturers and importers are managing operational pressures including rising costs and logistical disruptions deepening the economic divide between the U.S. and China.

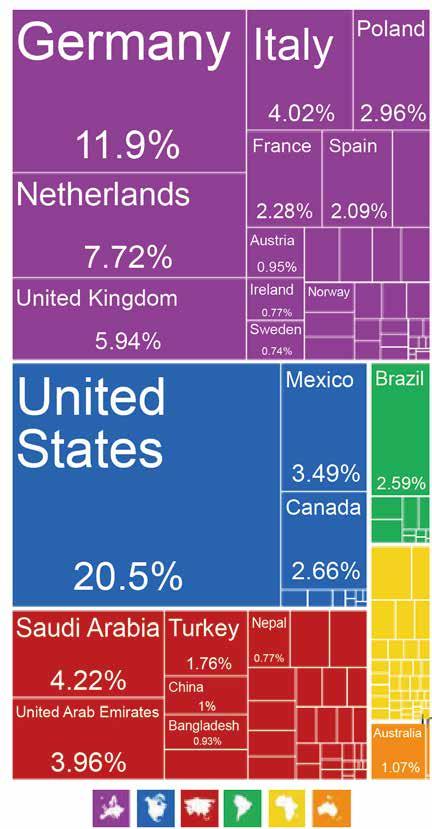

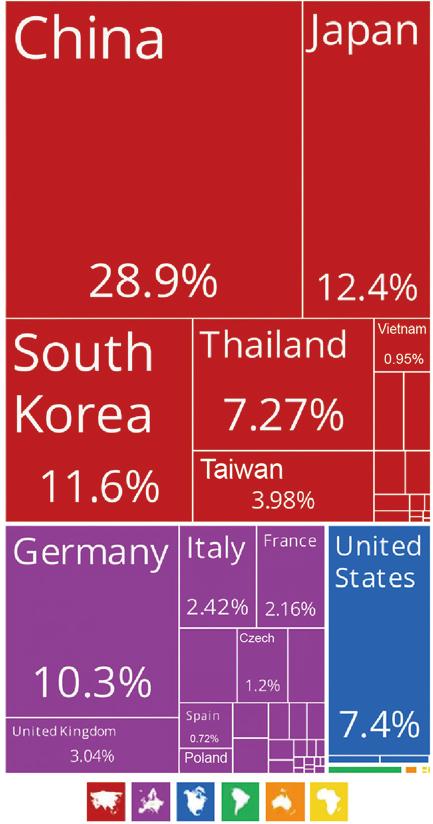

Looking at the fastener supply chain on a holistic level, the U.S. primarily sources from Taiwan and China. Historically, Taiwan has maintained upwards of 30% of the market share of fastener trade to the U.S., followed by China that has maintained anywhere from 17% to 20% of the total market share in FOB value (Table 1-1 to 1-2). Countries such as Japan, Canada and Germany follow suit, accounting for upwards of 5% to 10% of the total market share. In February 2025, U.S. fastener imports from China totaled USD Table 1-1. U.S. Import Origins of Fasteners (2022-2023)

95 million (Table 1-3), down from USD 121 million in January – a sharp 21% decline ( Table 1-2). This stark decline in February 2025 can be attributed to the tariff threats of late 2024 following the presidential election results where U.S. importers may have begun to shift to a more conservative mindset. Overall, there was a near 11% decline in total fastener imports into the U.S. in February 2025 compared to January 2025.

Table 1-2. U.S. Import Origins of Fasteners (2024-Jan. 2025)

Table 1-3. U.S. Import Origins of Fasteners (Feb. 2025)

Table 2-1. Fasteners Imported from China to the U.S. by Category (2022-2023)

731811 - Coach Screws, Threaded, Of Iron Or Steel

731814 - Self-Tapping Screws, Threaded, Of Iron Or Steel

731815 - Threaded Screws And Bolts Others, With Or Without Their Nuts Or Washers, Of Iron Or Steel

731816 - Nuts, Threaded, Of Iron Or Steel

731819 - Threaded Articles Of Iron Or Steel Others

731821 - Spring Washers And Other Lock Washers, Of Iron Or Steel

731822 - Washers, Other Than Lock Washers, Of Iron Or Steel 731823 - Rivets Of Iron Or Steel

731824 - Cotters And Cotter Pins, Of Iron Or Steel

731829 - Nonthreaded Articles (Fasteners) Others, Of Iron Or Steel

Table 2-2. Fasteners Imported from China to the U.S. by Category (2024-Feb. 2025)

731811 - Coach Screws, Threaded, Of Iron Or Steel

731814 - Self-Tapping Screws, Threaded, Of Iron Or Steel

731815 - Threaded Screws And Bolts Others, With Or Without Their Nuts Or Washers, Of Iron Or Steel

731816 - Nuts, Threaded, Of Iron Or Steel

731819 - Threaded Articles Of Iron Or Steel Others

731821 - Spring Washers And Other Lock Washers, Of Iron Or Steel

731822 - Washers, Other Than Lock Washers, Of Iron Or Steel

731823 - Rivets Of Iron Or Steel

731824 - Cotters And Cotter Pins, Of Iron Or Steel

731829 - Nonthreaded Articles (Fasteners) Others, Of Iron Or Steel

Table 3-1. Fasteners Exported from the U.S. to China (Jan. – Feb. 2025)

The U.S. primarily imports fasteners from China within HS 731815 (threaded screws and bolts), 731816 (nuts, threaded), and 731814 (selftapping screws) ( Table 2-1 to 2-2). These are all common components in the automotive industry for engine assembly and suspension systems. However, these are also components used for manufacturing machinery equipment, electronics and appliances. In February 2025, U.S. imports from China fell by 21.6% for HS 731815, 17% for HS 731816, and nearly 27% for HS 731814. In addition to the decline in market share by value, February 2025 also saw a significant drop in fastener import volumes, with a 24% decrease recorded (Table 2-2).

Table 3-2. Fasteners Exported from the U.S. to China (Jan. – Feb. 2025)

731812 - Wood Screws Other Than Coach Screws, Threaded, Of Iron Or Steel

731814 - Self-Tapping Screws, Threaded, Of Iron Or Steel

731815 - Threaded Screws And Bolts Others, With Or Without Their Nuts Or Washers, Of Iron Or Steel

731816 - Nuts, Threaded, Of Iron Or Steel

731819 - Threaded Articles Of Iron Or Steel Others

731821 - Spring Washers And Other Lock Washers, Of Iron Or Steel

731822 - Washers, Other Than Lock Washers, Of Iron Or Steel

731823 - Rivets Of Iron Or Steel

731824 - Cotters And Cotter Pins, Of Iron Or Steel

731829 - Nonthreaded Articles (Fasteners) Others, Of Iron Or Steel

In relation to U.S. fastener exports, China has remained strong as its third largest trading partner accounting for 5% of the total market share. Ahead of China are Canada and Mexico which together account for over 50% of the total market share. Due to the USMCA trade agreement, U.S. trade with its immediate neighboring partners is beneficial for several reasons including advantages on tariffs. In February 2025, there was a slight decrease of 9% in total fastener exports from the U.S. to China ( Table 3-1 to 3-2). Amongst the fasteners exported from the U.S. to China are 731815, 731816, and 731829 (non-threaded articles of fasteners) (Table 4).

In 2025, the U.S.-China trade relationship intensified sharply, beginning in February when the United States imposed a 10% tariff on all Chinese imports of goods, citing national security concerns. This was quickly followed by a second increase in March which raised the tariff to 20%. By early April, a more aggressive stance was taken as the U.S. implemented an additional 34% tariff, bringing the cumulative rate to 54%, and immediately increased it further to 125% with a clarification pushing the effective rate to 145%. In response, China launched a series of retaliatory measures beginning in February where the imposed tariff ranging from 10-15% on key U.S. exports including commodities such as crude oil, LNG, agricultural machinery, and vehicles. In March, this expanded to agricultural goods such as soybeans, port and cotton. By mid-April, China escalated its retaliation, first raising tariffs on all U.S. goods to 84%, and then to 125%. It also suspended exports of critical minerals and magnets essential to high-tech manufacturing, signaling a strategic shift beyond tariffs. These actions combined marked a severe escalation in trade tensions, with profound implication for industries reliant on U.S.-China supply chains, including fasteners.

Higher tariffs sharply increase the price of Chinese fasteners leading to a higher landed cost for US Importers and consumers. This will more than likely cause a rise in production costs for U.S. manufacturers who rely on Chinese fasteners. Let alone the number of supply chain disruptions that will be seen considering how fasteners are a critical component. These disruptions could lead to delays or cost fluctuations, and ultimately cause inventory planning issues for companies relying on Chinese suppliers.

The 2025 escalation in U.S.-China trade tensions has had immediate, tangible effects on manufacturing and procurement operations across the fastener supply chain. With import costs rising sharply due to elevated tariffs, U.S. manufacturers face mounting pressure to manage tighter margins, especially in cost-sensitive sectors like automotive, electronics, and industrial equipment. Procurement teams are contending with increased lead times, limited availability of specific fastener types, and greater volatility in pricing. The uncertainty around future policy shifts has led many companies to adjust purchasing strategies such as placing earlier or larger orders, increasing safety stock levels, or renegotiating supplier contracts to include contingency clauses. Operationally, manufacturers are also absorbing the impact of supply delays from China, forcing adjustments to production schedules and occasionally leading to stalled assembly lines. These pressures are not only straining supplier relationships but also reshaping how manufacturers evaluate risk and resilience within their global sourcing strategies.

In summary, the 2025 tariff escalation has created a costlier, riskier and less predictable trade environment for fasteners moving between the U.S. and China, with consequences for both immediate operations and long-term supply planning.

Copyright owned by Fastener World / Article by Sabrina Rodriguez

In 2025, President Donald Trump’s return to the White House has ushered in a fresh wave of trade policies under the renewed "America First" banner. These policies have immediate and far-reaching consequences for global trade dynamics—especially for export-intensive sectors such as the fastener industry.

With the declaration of a national economic emergency, implementation of a blanket 10% import tariff, and a growing list of bilateral tensions, fastener exporters around the globe are navigating a dramatically altered trade landscape.

The most pivotal and controversial trade policy changes introduced in early 2025 include a universal 10% tariff on all imports, announced on April 5, 2025, by the Trump administration under the IEEPA. This measure applies to all imported goods, including fasteners, regardless of the country of origin. Additionally, countries with significant trade surpluses with the U.S.—such as China, Mexico, and Germany—now face increased tariffs on selected product categories. Compounding these measures, the administration has also eliminated the de minimis threshold, which previously allowed small-value shipments under USD 800 to enter the U.S. duty-free. This exemption has been revoked for all parcels originating from China and Hong Kong, significantly affecting e-commerce and small-scale industrial supply chains.

Fasteners—ranging from screws and nuts to industrial bolts— are fundamental in manufacturing, construction, defence, and automotive sectors. The U.S. is both a major importer and user of fasteners, relying heavily on suppliers from Asia and Europe.

Key Figures

• In 2024, the U.S. imported USD 7.1 billion worth of fasteners, with over USD 2.3 billion from Taiwan, USD 1.3 billion from China, USD 660 million from Japan, and USD 440 million from Germany, and so on.

• The average price per ton of imported fasteners is expected to rise by 18–30% in 2025 due to tariff-driven price inflation.

• According to the Industrial Fasteners Institute (IFI), U.S. domestic production capacity is insufficient to meet short-term demand, especially in high-spec industrial and aerospace-grade fasteners.

Rising import costs are forcing U.S. buyers to reassess their supplier networks, particularly as tariffs and logistical expenses make international sourcing less predictable and more expensive. Exporters who demonstrate pricing stability or absorb part of the tariff burden are better positioned to retain their market share in this shifting landscape. Buyers are increasingly valuing consistency and reliability, prompting a re-evaluation of long-standing partnerships in favor of those who can offer more resilient pricing strategies amid global uncertainty.

At the same time, major sectors like construction and automotive are grappling with significant supply chain disruptions. Delivery delays and cost overruns have become common due to the need to reroute shipments and renegotiate prices. In response, many U.S.-based Original Equipment Manufacturers (OEMs) are accelerating efforts to onshore production or source from tariff-exempt countries. This shift is opening up new trade opportunities for nations with favorable bilateral agreements, positioning them as attractive alternatives for U.S. companies seeking more stable and cost-effective supply solutions.

Trump Administration (2017–2020): Trade War and Tariff Impact

During Trump's first term, U.S. fastener imports from China (Figure 1) experienced significant fluctuations due to the escalating U.S.-China trade war and the implementation of tariffs on Chinese goods.

• 2017–2018: Imports rose from USD 1.23 billion to USD 1.62 billion, likely due to front-loading before tariffs took effect.

• 2019–2020: A sharp decline followed— dropping to USD 1.19 billion in 2019 and further to USD 898 million in 2020— reflecting the impact of tariff enforcement and supply chain disruptions, compounded by the onset of the COVID-19 pandemic.

This period illustrates how protectionist trade policy and rising geopolitical tensions significantly reduced the attractiveness of Chinese fasteners for U.S. importers.

Under Biden, imports rebounded to USD 1.26 billion in 2021 and peaked at USD 1.85 billion in 2022 as demand surged post-pandemic. However, the resurgence was temporary.