靠技術拼出大單

鈺強聚焦車用、AI布局 專 攻全球中高階產業應用 領域以及擁有卓越 CNC 精密零件加工技術的鈺 強五金近幾年在產品應用範圍拓展有 成,廠區產線持續維持高稼動率。除 了有近 90% 的產品外銷供應歐洲和 美洲 T2 市場的變速箱、車用加熱系 統零件、電動車充電樁插頭零件等關 鍵客戶的訂單需求,近幾年更積極延 伸產品項目,在鞏固既有車用產品的 穩定供單外,把事業觸角進一步拓 展到 AI 等新興高端應用產業,為鈺 強未來在全球市場的拓展和接 單量再添新一波助攻柴火。

鈺強聯絡人 : 曾再生先生 Email: yc.cnc@msa.hinet.net

高效率無人化生產秘訣: 日系精密機台+經驗值滿點的技術團隊

為求讓產品品質達到客戶難以挑剔的程度和提升工廠效率,鈺強 在機台的選擇和技術團隊的培養費了不少心力。廠內特別 選用日本 小型 CNC 機台一線品牌,其完整的功能和具高度彈性的參數設定 不只讓操作人員能完成精密度、耐用度和穩定度都高的產品,也可大 幅減少刀具損耗和替換次數,讓機台操作維護和時間管理上更加具效 率。另外,鈺強的 技術團隊皆具備至少 10-20 年的經驗,有能力 按照客戶的設計去繪製圖面和分析數據,進而選出最適合的刀具、方 式、材質和所需功能來進行加工。鈺強曾再生董事長表示 : 「我們高效 率的生產並非來自簡單按按機台上幾個按鈕而已,而是透過多位具數 十年經驗專業師傅在機台上決策出最正確合適的指令來具體實踐。畢 竟光是一項車牙就有 10 幾種方式能選擇,如果人員沒有充足的技術 知識和經驗加以配合絕對作不出來。」

設備定期汰舊升級 鈺強二廠規劃中 作為備受客戶肯定的解決方案供應者,鈺強在設備節能減碳、汰 舊換新以及擴展客戶服務的腳步一直都是現在進行式。除了已在今年 完成半數舊設備汰換為變頻省電裝置外,也預計在今年年底 完成二廠建置規劃

,希望透過設備升級和新廠建置來拉高產能和 提升運作效率,服務更多車用和 AI 領域以及有精密工業零件需求的客 戶。曾再生董事長表示 : 「讓員工把工作當作自己的事業在做是我的 經營哲學,未來二廠完工啟用後也考慮讓員工入股,提升員工的責任 心和對公司的認同感。面對當前關稅的挑戰鈺強並不畏懼,因為品質、 技術和人才就是我們競爭力的最大後盾。」

著作權所有:惠達雜誌

智慧油壓沖床引領自動化新紀元

金

上源將油壓機與機械沖床截長補短,開發出全新系列油 壓沖床。該公司解決油壓機的問題,包括:速度慢、耗 電大、溫升高、易漏油、液壓油更換耗材多,也解決機械沖 床的問題,包括:行程固定、無法多段變速、速度快、剛性強、 模具壽命短、慢速導致的沖壓力道減弱、運轉時震度高與噪 音大。

其中,油壓機實現以下優點包括:出力穩定、高度可調 整、行程與壓力可變、多段速度選擇、可調整保壓時間、適 合多樣化加工、壓力速度變化對模具衝擊小、模具壽命較長、 低運作噪音。金上源所開發全系列的油壓沖床搭載特殊油壓 系統與油壓缸,改善傳統油壓機速度慢的缺點,使馬達更節 能,壓力輸出更大。全機型皆配備壓力與行程控制,提供製 程選項。油溫冷卻裝置有效控制溫升改善漏油,油耗量僅為 傳統油壓機的三分之一,實現減碳。

以油壓沖床為基礎,金上源延伸開發出轉盤式多工位油 壓沖床,適用於組立裝配扣件,可同時自動送料、組裝及沖 壓工件,並自動退出成品。防鬆螺帽壓點機則主打精密溫控 系統,控制液壓油溫於 33 至 36 度,避免環境影響油溫、壓 力輸出與產品良率,穩定壓製過程的壓力。

安裝於沖壓區的良劣揀選裝置是專利選購配備,設定螺帽 變形壓力範圍,沖壓過程即時檢知壓力過大或不足的螺帽並將 其分離,也可設定不良品數量避免造成過多損失。特殊油壓系 統可擴大提供二至四段壓力調整範圍,確保壓力穩定。

該設備專為防鬆螺帽加工設計,可定點壓製已攻完內螺 紋的螺帽,實現防鬆。它採用智慧電源與空壓管理系統,閒 置或異常時自動切換省電模式並發出燈號警示,降低能源損 耗。內建精密螺帽選向供料系統,自動辨識並校正螺帽方向 以避免壓製缺陷,提升良率。使用者可加裝儲料模組,支援 長時間無人化自動生產,節省人力成本並降低材料浪費。在 安全性方面,它配有沖壓作業防護裝置,包括壓力區安全護 罩與電子安全開關機構,護罩在運轉中開啟時機台即刻停止 運作,護罩未關妥前無法重新啟動,確保操作人員安全。

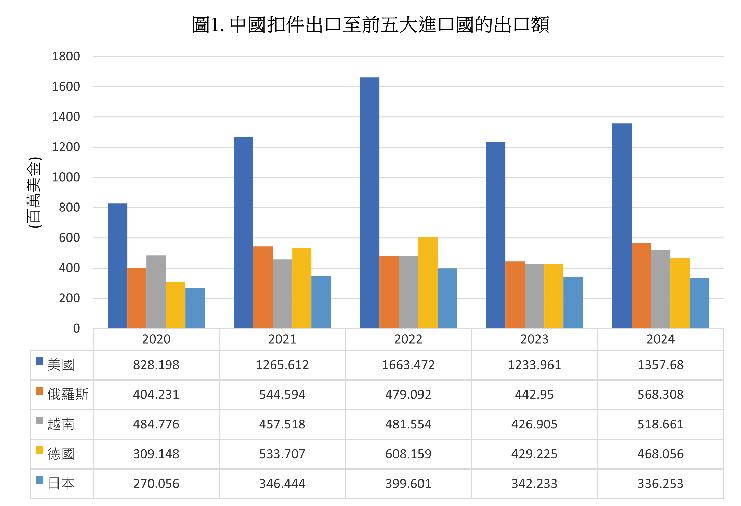

防鬆螺帽壓點變形若使用機械式沖床會 在螺帽厚度較高 , 壓得較深,反之較淺,大大 影響防鬆螺紋的鬆緊度。金上源特殊油壓沖 床則不受厚度公差影響,壓力輸出穩定,變 形量一致,提升防鬆品質。金上源持續以專 業技術深耕油壓沖床與自動化設備,致力提 供業界高效、穩定、安全的成型解決方案, 協助客戶提升產線競爭力與生產效能。

捷仂高速螺絲成型機 提升美國製造單位利潤的利器

著作權所有:惠達雜誌 / 撰文:曾柏勳

美國進口需求與市場切入契機

台灣機械新秀捷仂正積極擴展美國市 場,期望以自主研發的產品協助美國扣件 產業提升產能與競爭力。美國的製造回流 需求龐大,但短期內仍無法完全自給自足, 需大量仰賴進口設備與零件。他們看準此 市場缺口,強調其產品具備多項優勢,成 為美國客戶值得採購的利器。

他們的產品已達到與歐美品牌相當的速 度水準且具備極高性價比,讓美國客戶能 以較低成本擁有高效能設備。此外,他們 特別考量歐美操作員身材較高大,將操作位

置移至側邊,符合人體工學設計,避免彎 腰調整,提升操作舒適度與效率。因應美 國人工成本高昂,捷仂所有設備均標配遠 端操作功能,方便客戶進行整廠自動化建 置或一人多工作業,實現便利監控與調整。

機台還內建壓造力檢測功能,即使產線相 隔兩地,也能提前偵測壓造力偏移,預防 生產異常,降低維修成本與停機風險。

鎖定汽車與建築扣件需求 捷仂指出其美國顧客主要來自汽車與建築扣件業,川普的關稅 促使這些產業積極提升產能與降低成本。捷仂的高效能設備不僅能 倍增產量,還能降低人力、設備維護與能源消耗,幫助客戶提升每 單位利潤,強化市場競爭力。他們正積極尋找美國合作夥伴,希望 成為美國扣件業的得力助手。憑藉專利技術與品質,他們已獲多家 美國指標廠商採購,目標今年銷售達 10 台,顯示市場接受度提升。

擴展型號與持續研發

他們持續擴展不同尺寸與型號,並專攻多功能整合與便利的設定設計,預計年底或明年將推出更多實用升級,解 決客戶瓶頸,滿足多元需求。未來將強化橫向多功能與操作便利性,提升客戶使用體驗。在服務方面,提供遠端支 援與售後服務,無論客戶在美國或其他市場均可即時協助。他們與多家台灣廠商合作,針對客戶需求提供機構設計 與軟體客製化服務,並提供製程優化顧問級諮詢,確保客戶獲得專業且全方位的技術支援。捷仂強調具備最強企圖 心與積極態度,是值得信賴的高速螺絲成型機供應商,相信客戶能感受到他們對設備的熱忱與超越期待的效能。期 望與客戶一同成長,成為扣件產業的得力助手與夥伴,持續推動產業創新與突破,為全球製造業注入新動能。

聯絡人:顏世欽先生 / Email: jieletech@jiele.com.tw

廠區及服務據點分布

• 廠區 9 座

• 廠區面積 124,506 m 2

• 員工人數 1,776-2,058 人

• 年產能 8767.6 億支

• 產線數 624 條

重慶辦公室

重慶廠 東莞廠

越南廠

去

年甫剛慶祝成立 40 週年的台灣耐落 是各類專業螺絲預塗防鬆處理以及 先進塗佈技術的知名提供商。旗下產品可提供 包括預塗式防鬆、防漏、防焊渣、防鎖死、絕緣 及潤滑等功能,為全球客戶提供扣件最佳的解 決方案。

台灣耐落長久以來致力扣件預塗的應用創 新,希冀能以安全的產品為用戶創造出安心的 生活。同時,秉持著專注用心的精神,持續地 為客戶提供價值解決方案。不只 結合 NYLOK、 precote、Loctite 等全球知名品牌一起研發預 塗膠應用科技,也積極協同客戶從前期開發、測 試驗證及導入應用至建立規範,是許多標竿大 廠指名的合作夥伴。

昆山一廠

昆山二廠 & 中國本部

溫州廠

楊梅廠 & 台灣本部

台中辦公室

• 工廠

• 辦公室

作為被眾多全球客戶視為扣件預塗膠品牌的不二之選,耐落 目前在亞洲地區共設有 9 座專業廠區和 2 處辦公室,總面積達 124,506 平方公尺、旗下員工數逾 2,000 位、624 條生產線的年產 能可達 870 億支。除了原有的台灣 ( 楊梅、台中、高雄 ) 和中國 ( 昆山、 東莞、溫州、重慶 ) 服務據點,過去兩三年也積極往東南亞拓點布局, 除了 2023 年開設的越南廠區,2024 年開始建造的泰國廠也於今年 開始進入量產,擴大的產能將為廣大全球客戶提供更有效率的服務 和更優質的預塗 膠產品,進一步促 進區域內產業的 共榮發展。

除了傳統於車 用、3C 電子、自行 車、智慧製造、智 能移動⋯等高階 產業在自動化精 密組裝和產品應用外,近期也拓展在 AI 相關產業的應用開發。耐落 一方面透過導入生產資訊化管理和和全自動品質監控系統強化產 品品質,另一方面也針對這些產品「輕、薄、短、小」的特性和應用 趨勢,積極提升自我的塗佈技術和工程應用整合能力,期盼能在協 助客戶和產業發展進步的過程中扮演不可或缺的強力支持後盾。

就 在產銷聯誼會召開的前一天,川普加倍鋼鋁關稅至 50%,並於 6 月 4 號 立即生效。6 月 5 日,台灣螺絲公會理事長蔡永裕先生在聯誼會中偕 同中鋼代表和上百名與會的螺絲業者交流時表示,今年螺絲產業遇到了與 往年截然不同的全新局面,許多業者非常關注「川普關稅」與「台幣匯率」, 其變化對於營利的影響是直接且全面性的。

為了在此情勢下持續保持台灣扣件供應鏈強大的韌性,蔡理事長 分成兩個層面提出了四大戰略。在民間業者與政府協作的層次上,理 事長提倡業者彼此間合作組成「Team Taiwan 螺絲戰隊」,在國際上 透過「合力接單」爭取外銷訂單,並由政府在背後提供政策支援。同時, 在企業端的營運與資產管理層面上,理事長建議業者在川普關稅問題 上「與客戶妥善協商」,而在近期台幣匯率走強的背景下,業者須做好「匯 率風險評估」以應對川普關稅政策連帶觸發的台幣波動。

恒耀國際吳榮彬董事長在會中分享,過去半年內匯率波動大,再加上川 普對鋼鋁材料以及車用零組件產品課徵關稅,公司在三月份單月虧損達 100 歐元。不過,他強調仍會持續憑藉自家在車用扣件產品技術的獨特性力拼接單。此 外,他還提醒雖然許多扣件企業南向開發東南亞市場,但目前公司選擇在越南設廠生產 的成本並未明顯降低,進軍的台商必須考量相關風險。最後,他點出扣件業佔台灣總體

因此在向政府尋求協助之前,業者更應自立自強才是長久之道。

2025 年第 3 季中鋼與螺絲業產銷聯誼會 螺絲公會蔡理事長呼籲 四大戰略遠見 面對川普關稅議題,有設備業者 透過實務經驗表示,川普的關稅制 裁對中國廠商的實質影響並沒有預 想中的大,就算美國把對中國課徵的 關稅拉高到 100%,「中國廠商照樣 能把產品外銷出去」。此外,也有與 會者提到,近期台灣鋼材銷往日本的 價格,與中國鋼材銷往日本的價格相 比價差高達近 40%,「中國的原料成 本比台灣便宜很多!走訪海外,不論 前進哪個市場,近幾年到處都看到 中國廠商的身影,台灣在海外各地與 中國競爭,希望中鋼能提供幫助我 們提高價格競爭力的開價」。另有小 螺絲業者表示目前加倍的鋼鋁關稅 可不只有表面的 50% 而已,「再加上 其他附加稅,光是小螺絲銷美的實質 關稅可達到 56% 左右」,因此業者必 須審慎評估風險可承受度並與客戶 妥善議價。

中鋼向螺絲業者報告全球局勢 時表示,國際貨幣基金組織將今年全 球 GDP 成長率從 2.8% 下修到 1.8%, 川普 2.0 為全球帶來前所未見的共 同挑戰。例如中國已經連續 2 年、台 灣連續 3 年、日本連續 11 年製造業 採購經理人指數下滑到榮枯線以下。 美國今年的 GDP 成長率甚至連保 2 都有困難。川普政策的反覆不定,也 增加了海外廠商轉單的難度。

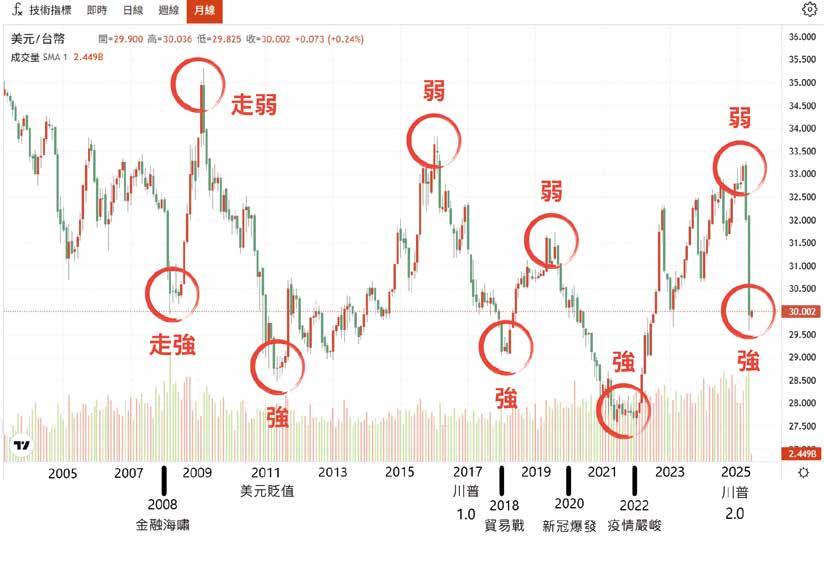

中鋼透過分析海外情資,說明川 普關稅對美國當地物價通膨的衝擊 在今年 5、6 月還尚未反映出來,預 測美國物價實質的升高可能發生在 7 至 8 月。在分析台幣匯率走勢時, 中鋼觀測到「180 天遠期外匯」匯率 已經來到 29.45 元,持續摜破 30 元 大關的狀態,因此中鋼預測 未來三個 月內台幣走強的機率較高,但走強到 28 元的機率將較 5 月初低。

著作權所有:惠達雜誌 / 撰文:曾柏勳

中鋼提出了另一個關注焦點。自從川普調高鋼鋁稅後,美國鋼材期 貨從單日 111 美金暴升到每噸 973 美金,美國鋼材價格短期內走升,導 致美國在 2025 年鋼材進口量可能減少超過 30%。換句話說,關稅使外 國鋼材更難賣到美國,結果是不只有中國鋼材傾銷全球,連歐洲鋼材也必 須向其他海外市場找尋出路。

中鋼也提醒,截至 6 月 5 日聯誼會當日,雖然國際貿易法庭裁定川 普對等關稅越權並命令取消,但川普向較高層級的聯邦法院提起上訴, 法院已將國際貿易法庭的命令暫緩執行,這代表對等關稅在川普上訴期 間仍可徵收。此外,中鋼提醒表示「川普手中的牌還有很多,除了 232 條 款、《國際經濟緊急權力法》之外,他還可援引其他諸多法案來開徵關稅」, 因此業者仍須關注川普的組合拳。

中鋼代表表示,透過聯誼會傾聽業者心聲,希望能為各家業者的特 定需求提供客製化調整因應,將有限的資源精準投入到業者的需求上。

政府與中鋼或可評估將國際競爭力較低的鋼品項目開放從海外進口, 協助國內業者降低原物料成本,如此一來,面對強力進軍全球的中國競 爭者與其他海外競爭廠商,台灣廠商更有機會為扣件產業再下一城。

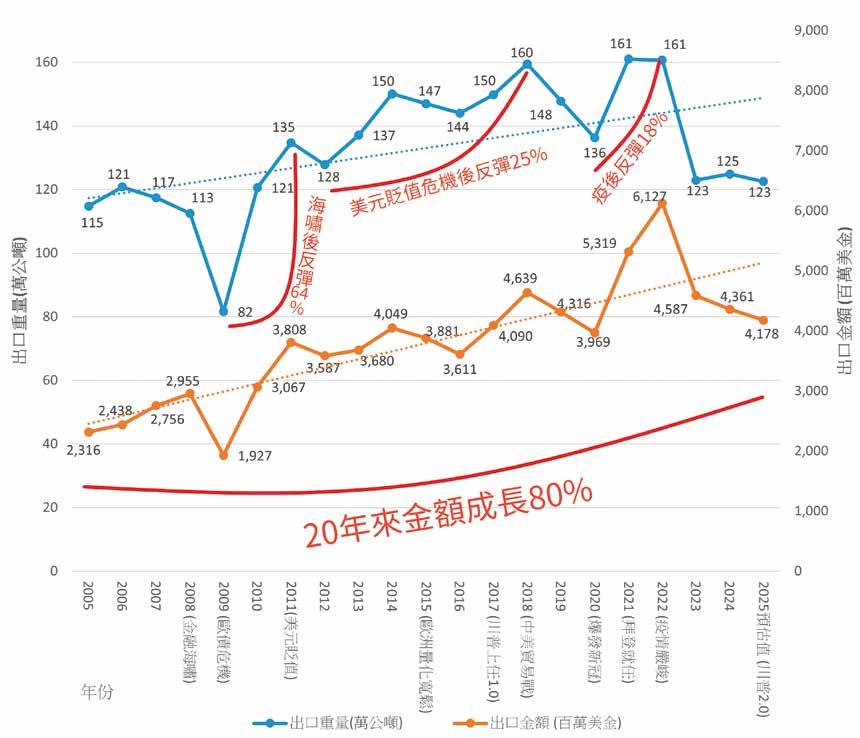

(附錄) 2025年1至4月扣件出口量價統計同期比 (來源:台灣螺絲公會)

EIFI會員大會成功落幕 義大利工業扣件協會 (EIFI) 會員大會今年 5 月 8 -10 日在西班牙塞維亞舉行,與會者如同以往踴躍,這也是建 立人際網絡和分享知識的絕佳機會。

在這美麗城市的 Only You 旅館中,EIFI 邀請來自全球 協會的嘉賓、來自汽車 / 建築業、地緣政治和經濟領域的 講者和企業家。

EIFI 理事長 Paolo Pozzi 詳述協會 2025 年舉辦的活 動,對協會來說,這些活動大力強化了與歐洲執政當局的持 續對話,藉以維護扣件業利益。眾所周知,歐洲已推出一連 串具目的性的行動來解決當前產業面臨的結構性挑戰,但 歐盟治理模式的侷限性仍明顯,以至於常被認為腳步太慢 無法跟上市場需求。

製造業 ( 尤其是汽車業 ) 正面臨越來越大的壓力,需 要快速具體且協調的解方。未來措施的成功與否取決於克 服僵化程序和意識形態的能力。

EIFI 的汽車市場小組主席 Wolfgang Scheiding 概述 了全球經濟形勢,重點介紹汽車產銷以及扣件前景。在其 演講後,ACICAE - 巴斯克汽車業聚落和 AIC - 汽車情報中 心技術長 Mikel Lorente 發表了有趣的演講,談到汽車領 域的電氣化戰略以及以電池系統為重點的 BEV 用扣件。

一般工業經銷市場小組的主席 Ramon Ceravalls 強 調其小組致力於透過分享規模僅次於汽車業的建築扣件 市場法規、永續發展和市場趨勢的關鍵更新來協助會員保 持競爭力。加泰羅尼亞建築技術研究所 (ITeC) 的 Josep R Fontana 對歐盟建築市場前景做深入介紹,在 2023 和 2024 年的負成長後,歐盟建築市場將謹慎緩慢地成長。

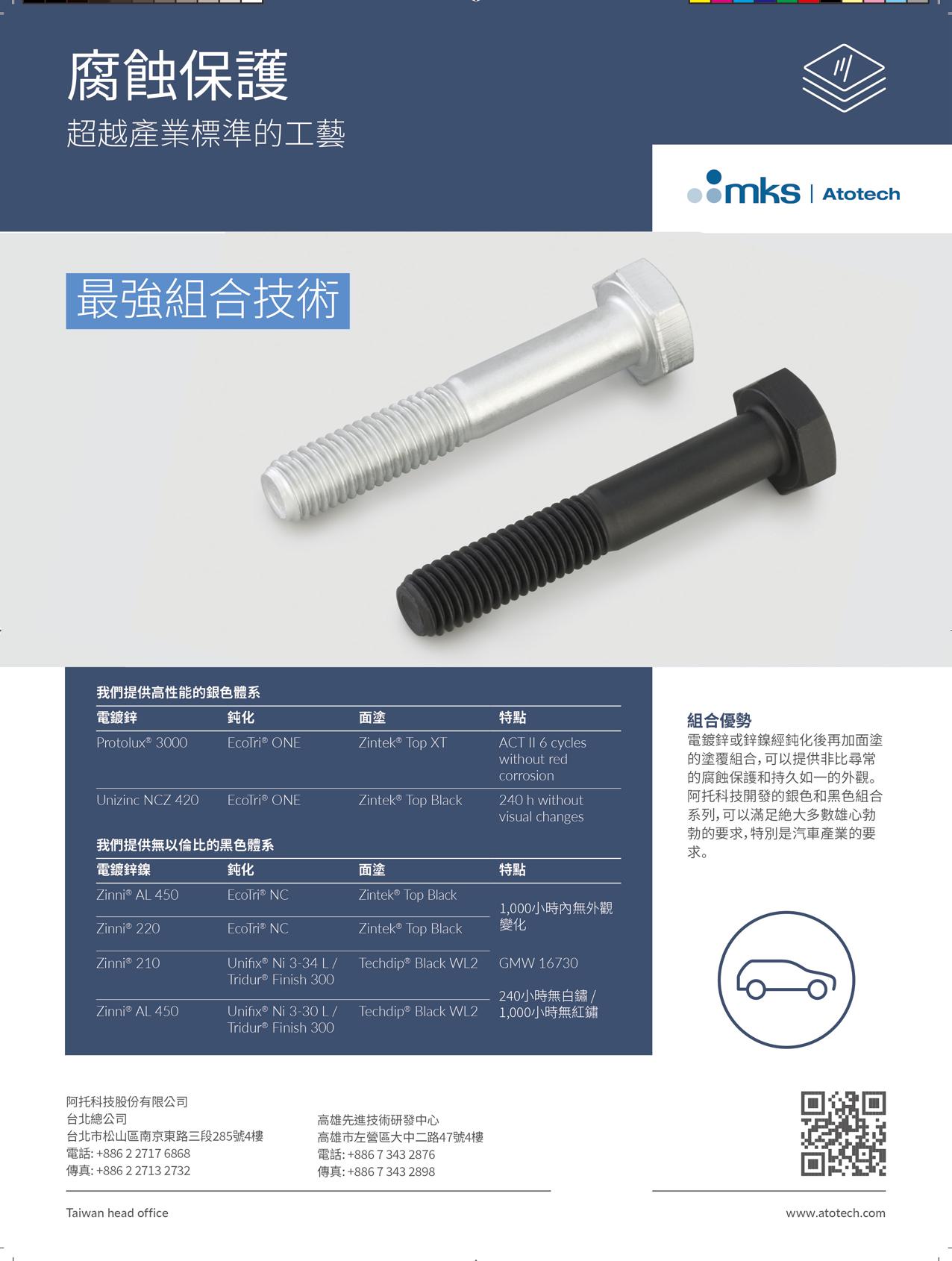

EIFI 總經理 Hans Führlbeck 總結各市場小組和運作 委員會成功完成的工作,並重點分享了過去 12 個月的主 要工作目標,像是每月(基於半數歐洲扣件生產所用已抽 和未抽線線材)所公佈的 EIFI 線材成本變化指數、CBAM 活動、與 FRED 達成讓所有協會會員都能使用碳足跡計 算工具的協議以及 3 月 25 日在司徒加特扣件展舉辦的 PFAS 活動邀請同是活動贊助商的化學品製造商 ( 包括 Dörken Coatings、MKS Atotech、Precote、MacDermid Enthone、Nof Metal Coatings Europe)、塗料商、扣件生 產商及其客戶的講者。此活動登記的出席率非常高(超過 100 人),顯示出對 PFAS 主題的濃厚興趣。

UPIVEB 技術專家兼 Agrati 集團品質總監 Massimiliano Testa 發表強調標準化活動在扣件業重要 性的演說。他講述了幾個工作小組和分會中完成的各項活

▲ Paolo Pozzi

▲ Wolfgang Scheiding ▲ Mikel Lorente

▲ Massimiliano Testa

▲ Ramon Ceravalls

▲ Inès Van Lierde

▲ Josep R Fontana

▲ Gian Marco Dalpane

▲ Hans Führlbeck

▲ Daniel Walker

動,強調為確保產品品質、安全和進入國際市場而制定修訂標準的合 作努力。

AEGIS Europe 共同主席 Inès Van Lierde 談到歐洲產業面臨的挑 戰。歐洲製造商受到國外不公平競爭與國內鬆散政策因應的夾殺。結 果造成市佔流失、就業率下滑、戰略自主性被削弱。

在各行各業中,某些第三國的產量持續攀升,這並非因為市場需求, 而是受到扭曲全球競爭的國家補貼所導致。歐洲急需對產能過剩危機 採取結構性應對措施:建立專門機制以抵銷其影響、在歐盟委員會貿 易總署內建立更強大的貿易防衛工具,以及在 CBAM 內建立出口調整 機制,以確保公平競爭。

少了這些工具,歐洲產業就有被邊緣化的風險,導致無法與全球競 爭的規模和強度相匹配。現在是行動的時候。挑戰是結構性的,做出 的回應也是如此。

Alex Agirre 獲頒 Robert Dicke 獎

左至右 : Paolo Pozzi、Alex Agirre、 Christian F. Kocherscheidt、 Fabrizio Fontana)

特別感謝歐洲扣件經銷 商協會副理事長 Gian Marco Dalpane、美國工業扣件協會 總經理 Daniel Walker 螺絲貿易協會理事長蔣國清與 會,並藉由分享其協會動態為知識共享做出貢獻。

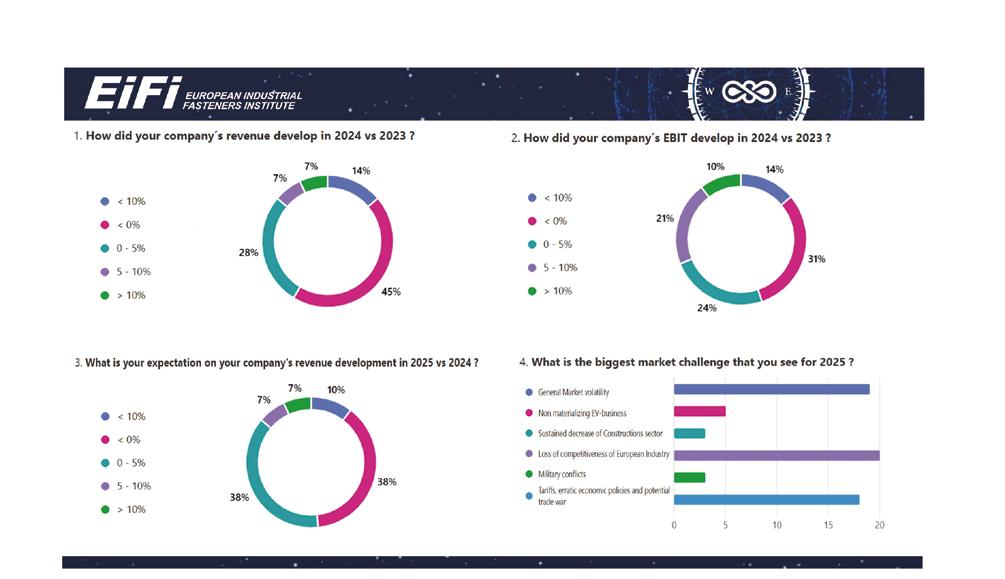

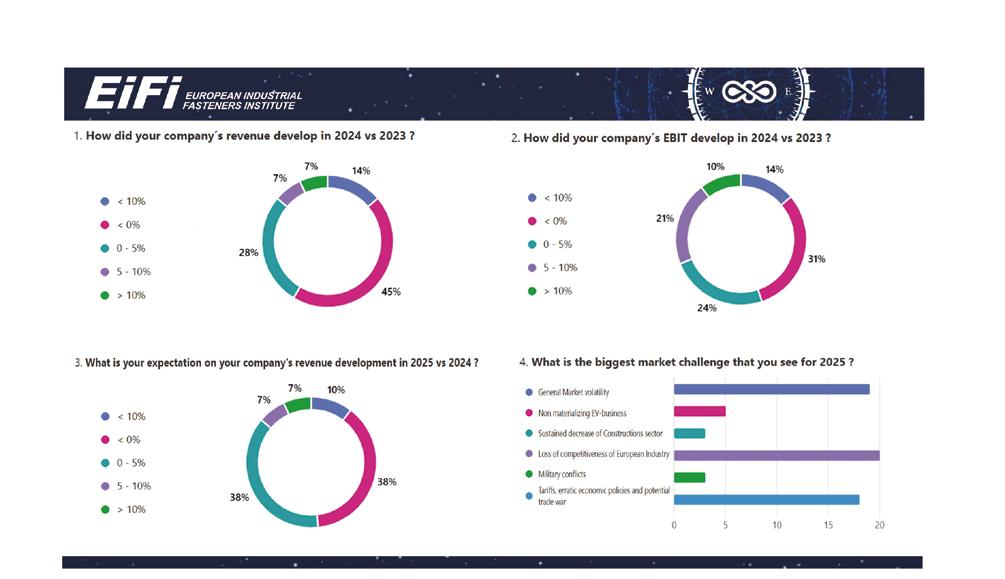

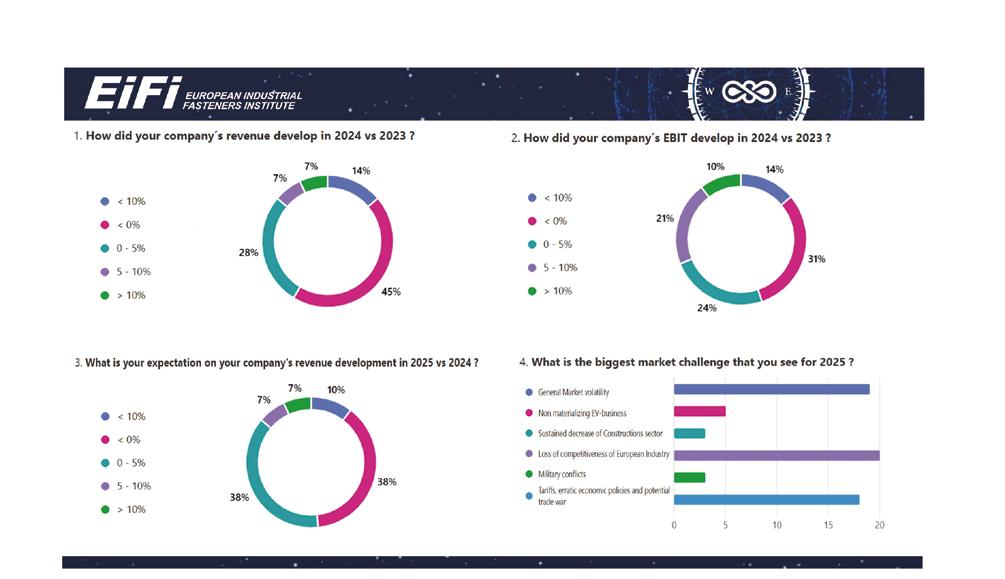

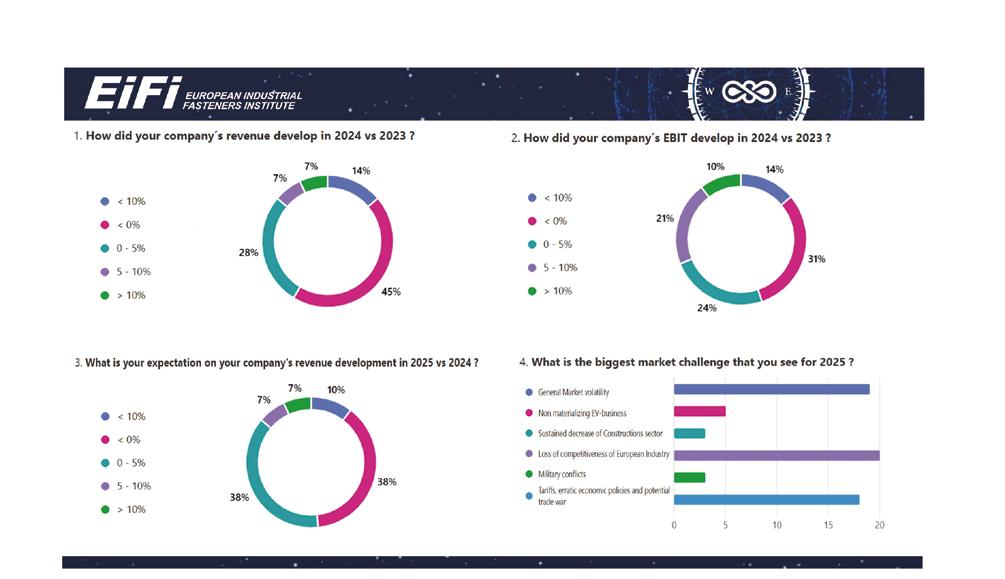

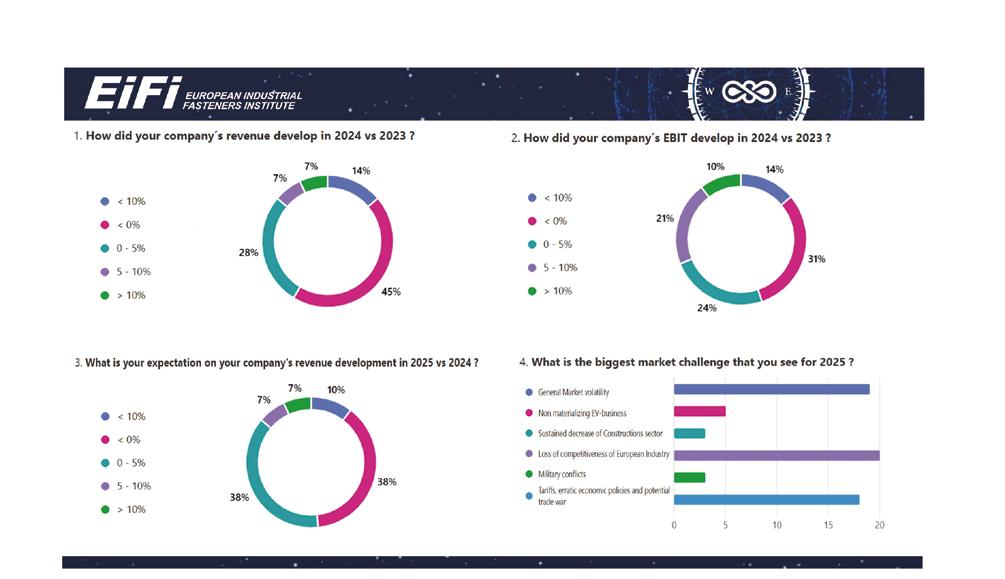

EIFI 會員又怎麼評估市場現況? 一如預期,EIFI 定期調查顯示結果 並

1. 貴司2024和2023的營收比較如何?

2. 貴司2024和2023的稅息前利潤比較如何?

3. 您對貴司2025和2024營收發展比較的期待?

4. 您認為2025最大的市場挑戰為何?

基本市場變化 未具體實現的電動車業務 建築行業持續衰退 歐洲產業流失的競爭力 軍事衝突 關稅、不確定的經濟政策和 潛在貿易戰

El Orden Mundial 談發表「不斷變化的全球秩序:從去全球化到破碎化

• 世界正在破碎化

• 物流安全 > 獲利能力

• 很多國家變得更加單邊主義

• 以規則為基礎的世界秩序即將終結

• 競爭與不確定性的時代

Eduardo Saldaña 隨後也邀請 Belén Carreño Bravo(財經記者、 電視分析師、前編輯和作家)、Fernando Espada(TATA STEEL 西班 牙分公司執行長兼 EUROMETAL 副總)和 Benjamin Krieger(歐洲汽 車供應商協會秘書長)等專業人士上台,他們在有趣的圓桌會談中從 經濟、工業層面就「歐洲產業未來」抒發己見。

5 月 9 日的晚宴安排於 Guadalquivir 河畔對面的 Abades Triana 餐廳,晚宴中也頒發 Robert Dicke 獎給西班牙金屬扣件和緊固元件製 造商協會 (ASEFI) 會長、EIFI 理事會成員暨 DOISTUA SA 公司總經理 Alex Agirre。

Robert Dicke 榮譽服務獎係由 EIFI 大會 於 2008 年 5 月為紀念 Altenloh, Brinck & Co. GmbH & Co. KG 合夥人兼 2005 年前擔任 EIFI 副理事長的 Robert Dicke 所設立。

此獎主要頒發給對機械扣件業有重大且持 久貢獻的個人以及在追求 EIFI 創立目標過程中 為 EIFI 做出傑出服務的人。

感謝 ASEFI 的 Alex Agirre 理事長、Ramon Ceravalls 副理事長、Alex Gonzalez 秘書長把 2025 年 EIFI 會員大會辦得有聲有色。

明年英國見 !

若

要票選今年上半年影響產業市場最劇烈的議題,川普過去幾

個月來對全球各國連續拋出的關稅措施和台幣匯率不斷測試 2 字頭的高低振盪絕對是位居一二。這兩大議題不單單只是影響台 灣產品外銷全球市場的整體競爭力,也是許多扣件、零組件、手工 具等傳產業者能不能安然生存下去繼續為台灣創匯的兩大關鍵。

據 統計,在今年 3 月初美國對各國鋼鋁產品 ( 含扣件 ) 實施加 徵 25% 關稅後 (6/4 日後已提高至 50%) , 4 月份台灣的扣件 外銷量表現隨即創下新低,前月比降幅近 23% ,尤其在最重要的 歐美市場客戶因為市場不確定性選擇暫時觀望紛紛延緩下單後,分 別出現 24% 和 33% 的萎縮,國內多數業者的接單都受到很大的衝 擊。如果關稅和匯率的問題持續擴大影響,而政府在這部分又沒有

表現出更積極的態度提出因應方案,勢必會加劇這些中小企業的經 營困境,對未來整體產業的永續發展、企業主和員工生計來說將是 三輸局面。

社論 是否該與客戶分攤關稅? 國內意見仍有分歧 針

對美國關稅造成市場終端售價墊高進 一步導致產品競爭力降低的問題,據 了解,目前台灣業界存在兩派看法。有部分 業者認為為求維繫與現有客戶的永續合作和 確保企業未來能持續穩定地接單,短期內應 該與美國客戶協商相互分攤關稅來降低彼此 的經營成本。例如 : 車用扣件上櫃大廠恒耀 公司就跟美國客戶協議彼此分擔關稅來降低 成本增加的衝擊 ; 不過也有另一派認為進口 關稅本來就是下單客戶應該支付的部分,不 應該本末倒置為供應商應該自行吸收成本或 是按比例分攤。台灣螺絲公會蔡永裕理事長 先前也曾對此表達明確態度,呼籲國內業者 能避免採取分攤關稅策略,因為這樣可能會

關稅、匯率夾殺下的 市場商機 削弱未來台灣扣件的外銷價格,客戶也可能會 因此要求其他供應商比照辦理讓台灣重回 拚低價的老路,進而使毛利率已經在夾 縫中求生存的廠商更加難以生存。

依

筆者觀察,大廠因為在市場佈局、

行銷通路、研發技術和客戶基礎 上具有多面向的優勢,被取代性較低,比較可以從其他領 域去想辦法抵銷因關稅分攤造成的損失,受影響的程度 就相對小一些。反觀單槍匹馬規模較小的企業在市場下因 較不具話語權,在與客戶協商關稅成本分攤時就可能佔下 風,如果能與同業組成合作聯盟的方式,在跟客戶協商時 也比較有話語權。另外也能加強自家產品的特殊性和無法 取代性,讓客戶不買就沒有其他選擇,如此來強化自己的 競爭實力。不過政府相關單位和也應再加強支持業者的力 道,像是協助業者組成「國家隊」以及靠國家的力量把更 多有利業者接單的條件做好做滿,否則光靠業者一己之力 可能也是徒勞無功。在影響業者成本最大的線材部分, 台 灣政府或許應該認真審視目前的線材進口政策,跟國內業 者坐下來好好談談,適合開放的就應盡早開放,允許業者 能進口更具競爭力的線材,如此一來,中鋼也能專注於更 高附加價值的線材生產,這對國內業者來說不一定是壞 事。

否則若因為國內無法取得有競爭力的線材而迫使業者 出走,對國內扣件業的穩定發展也絕非長久之福。

台幣兌美元匯率坐3望2, 政府如何幫助出口業者?

台幣兌美元從過去幾個月不斷測試 2 字頭

以來,升值的壓力逐漸湧現,年初到現在 已經累計升值超過 12%,這對許多以美元報價的出口業者 來說不只是做越多虧越多的問題,也連帶影響對外報價的 競爭力,甚至有聽聞客戶選擇把訂單轉至匯率相對更有彈 性的越南和印度等情況,對台灣業者可謂是損失慘重,元 氣大傷。台灣央行雖然在匯率管控上有稍微動作,但可能 擔心讓台灣被美國冠上匯率操縱國的罵名又不敢有太大的 動作,如此尷尬的局面導致台幣的匯率才剛回到 3 字頭的 安全線又不斷回測 2 字頭的底線。縱使可以理解央行的考 量,但對於平均匯損就高達數百萬甚至是千萬的廠商來說, 這可是攸關公司生死存亡的問題。螺絲公會蔡永裕理事長 曾表示,台灣螺絲 97% 都外銷,若台幣對美元匯率進一步

提升,產業將面臨生存戰,緩升控制得宜下,螺絲產業才 能生存。

為 了解決傳產業者當前的經營困境, 政府應該趕快擬 定更多完整的救援配套,同時放寬申請限制,像是 提供更優惠的企業貸款或補貼方案(例如:中小微企業優 惠貸款),同時也能透過政府單位的資源主動協助企業訂 單媒合或協助企業員工訓練的專案(例如:補助業界開發 國際市場計畫),並主動把這些資訊透過專責窗口盡快提 供給有需要的企業去申請。

關注新興產業商機和特定市場復甦徵兆 儘 管貿易摩擦、地緣政治和政策不確定性等問題讓全 球許多產業面臨發展難題,但仍有一些業者和市場 在近期有出現較為顯著的復甦信號。例如 : 因應 美國客戶 積極發展AI、機器人, 恒耀也開始跨足這些領域。汽扣 廠友鋮今年前五個月營收較去年同期增加 7.48% ,看好後 續營運表現。久陽則因為 歐美客戶去庫存化已告一段落 需 求回升,單季營收和毛利都有不錯表現,接單能見度達三 個月。歐洲經濟火車頭 德國建築許可證核發數量也從連續 3年減少轉為增加, 預期將可推升建築和工業用扣件需 求。另外,今年 4 月 台灣出口到中東沙烏地阿拉伯的扣件 數量也有顯著增加, 上海緊固件工博會中許多中國廠商也 透露近期在中東市場的接單表現不俗,這些都是想要開拓 新市場的國內業者可以加強關注的部分。

在 美國市場部分,儘管關稅問題可能會讓美國在地的 大型經銷商優先嚐到甜頭,但若考量到美國當地傳 統扣件製造業者並不多,在替代品尋找不易的情形下, 目前海外供應商仍是其主要供應來源。加上 50% 的鋼鋁 關稅是全球一致的稅率,在稅率相同的起跑點上, 台灣業 者仍可以透過價格和品質競爭力來與多數國家競爭。未來 台灣業者也能嘗試開拓更多在車用、建築以外的領域,順 應趨勢開發與AI機器人、智慧製造等更先進領域的市場, 幫自己找出更多潛力商機。

本期雜誌的拉斯台灣展商宣傳 特輯中,我們可以看到仍有許多台灣展商報名參展,這顯 示美國市場對台灣廠商來說仍有很大的吸引力,只要您的 產品品質夠好,具有高度競爭性,相信都有機會在這些商 機市場取得一席之地。

著作權所有: 惠達雜誌 / 撰文: 副總編輯張剛豪

2022至2024年 台灣扣件廠商營收排行 (

營收額、稅後純益、資產總額單位為億元新台幣 )

扣件製造商 在扣件製造商類別中,共有 18 家企業入榜前兩千大 排行,對比上一次天下雜誌公告的 21 家入榜者,減少了 3 家,這是連續第二次扣件製造商入榜家數減少,換句話說 過去兩次調查以來入榜的家數總共減少了 5 家。

2024 年,營業額排名有上升的入榜者以向上的綠色 箭頭做標識,僅有 4 家,比 2023 年的 9 家減少了超過 50% ,這是連續第二次減幅超過一半 (2022 年當時排名有 上升的入榜者有 17 家 ) 。 2024 年,營收額下跌的入榜者 高達 15 家,全 18 家入榜者的平均營收成長率僅有 1.42% , 但比 2023 年的負 14.6% 成長許多; 2024 年平均獲利率為 9.11% ,高於 2023 年的 8.78% 。此資料反映出 台灣扣件營 收龍頭廠商在 2022 年接單量大增,在 2023 年接單量大落, 雖然在 2024 年仍維持正成長獲利率,但與全台灣兩千大

企業相較下,扣件業者整體的營收競爭能力明顯下滑,致 使入榜家數與名次上升的家數持續減少。

從營收額規模來看,前三名分別是恒耀國際、開曼東 明控股、春雨工廠,其中恒耀與東明在 2024 年的名次排 名發生了對調的狀況。光是這 3 家在 2024 年的營收額總 和 (348.45 億新台幣 ) ,就佔了全部 18 家入選企業營收總 額 (826.12 億新台幣 ) 的 42.1% 。

2024 年,資產總額最高的前三大入選者依序為恒耀國 際、晉禾企業、開曼東明控股,基本上與 2023 年的情況 相當,但其中恒耀國際與晉禾企業的資產總額名次排名發 生了對調的狀況。

台灣兩千大排名 ( 服務業 )

扣件貿易商 在扣件貿易商類別中,僅有大成國際鋼鐵入榜,與前一次相同。 2024 年大成國際鋼鐵的營收額下跌 7.78% ,收在 227.1 億台幣,是 2023 年營收額下跌 6% 後的再度下跌。 2024 年的獲利率從 2023 年的 12% 下降到 10% 左右,與 2022 年獲利率 17% 相比是連續下滑,但仍維持兩位數的成長動能。從市場現況來看,許多台灣扣件貿易商有在海外設立據點 且無提報海外營收數據,且會以其他多個公司名稱的名義進行營運,若非如此還會有更多家入榜。

扣件相關原料、設備製造商 在機械設備類別中, 2023 年在榜單中的春日機械工業,在 2024 年持續入榜,其名次下滑,但其營收額成長率從 2023 年的下跌 7% 轉為成長 6.4% 。在原料類別中, 2023 年的所有入榜者的營收額都下滑了兩位數,平均下滑 20% ,然 而在 2024 年已有多達 6 家的營收額出現正成長,其中燁鋒輕合金的成長幅度最高,達 16.1% 。顯示 台灣扣件相關原料廠 商在 2024 年的營收有回到正成長軌道跡象。

手工具製造商 台灣兩千大排名 ( 製造業

資料來源 /《第 823 期天下雜誌 2025 兩千大企業調查》; 資料整理 / 惠達編輯部 ( 營收額、稅後純益、資產總額單位為億元新台幣 )

在手工具類別中,史丹利七和國際的營收額從 2023 年的下跌兩位數轉為成長 9.12% ,反之,車王電子從 2023 年的 成長兩位數轉為下跌 16.46% 。前者的營收額從 2023 年的 42.66 億成長到 46.55 億。後者從 40.04 億減少到 33.45 億。以 資本額來看的話,史丹利七和國際的規模仍達到百億台幣。

扣件大廠財報 台灣 (新台幣) 整理 / 惠達雜誌 更新於2025年5月16日 幣值單位:百萬

12,122.582 vs. 12,168.336

6,132.453 vs. 5,078.103

S TYC N 大國鋼 的 2024 年營收為 227.103 億新台幣,較 2023 年 的 246.273 億新台幣下降 7.7%。2024 年淨利潤為 22.802

億新台幣,較 2023 年的 31.249 億新台幣下降 27.0%。

總資產由 2023 年的 474.963 億新台幣減少至 2024 年的 437.283 億新台幣。

春雨 的 2024 年營收為 91.651 億元,較 2023 年的 84.606

億新台幣成長 8.3%。2024 年淨利潤為 2.871 億新台幣,較 2023 年的 2.536 億新台幣成長 13.2%。總資產由 2023 年 的 121.683 億新台幣下降至 2024 年的 121.225 億新台幣。

鐿鈦 的 2024 年營收為 23.762 億新台幣,較 2023 年的 24.446 億新台幣下降 2.8%。2024 年淨利潤為 2.598 億新 台幣,較 2023 年的 3.405 億新台幣下降 23.6%。總資產由 2023 年的 47.890 億新台幣減少至 2024 年的 46.719 億新 台幣。

豐達科技 的 2024 年營收為 35.017 億新台幣,較 2023 年 的 30.706 億新台幣成長 14.0%。2024 年淨利潤為 3.759 億

新台幣,較 2023 年的 3.076 億新台幣成長 22.2%。總資產 由 2023 年的 50.781 億新台幣增加至 2024 年的 61.324 億 新台幣。

久陽 的 2024 年營收為 41.359 億新台幣,較 2023 年的 43.210 億新台幣下降 4.2%。2024 年淨損失為 3,601.2 萬新 台幣,2023 年則為淨利潤 1.508 億新台幣。總資產由 2023 年的 52.032 億新台幣增加至 2024 年的 56.770 億新台幣。

鋐昇 的 2024 年營收為 15.387 億新台幣,較 2023 年的 14.970 億新台幣成長 2.7%。2024 年淨利潤為 1.037 億新 台幣,較 2023 年的 6,412.6 萬新台幣成長 61.7%。總資產 由 2023 年的 19.871 億新台幣增加至 2024 年的 26.778 億 新台幣。

恒耀國際 的 2024 年營收為 131.366 億新台幣,較 2023 年 的 122.379 億新台幣成長 7.3%。2024 年淨利潤為 7.393 億 新台幣,較 2023 年的 4.735 億新台幣成長 56.1%。總資產

9,205.759 vs. 8,911.084

由 2023 年的 185.923 億新台幣增加至 2024 年的 215.254 億新台幣。

華祺 的 2024 年營收為 15.612 億新台幣,較 2023 年的 15.357 億新台幣成長 1.6%。2024 年淨利潤為 1.524 億新 台幣,較 2023 年的 8,134.9 萬新台幣成長 87.3%。總資 產由 2023 年的 24.815 億新台幣增加至 2024 年的 26.425 億新台幣。

三星科技 的 2024 年營收為 68.194 億新台幣,較 2023 年 的 66.449 億新台幣成長 2.6%。2024 年淨利潤為 10.566 億新台幣,較 2023 年的 9.970 億新台幣成長 5.9%。總資 產由 2023 年的 87.829 億新台幣增加至 2024 年的 88.524 億新台幣。

世豐螺絲 的 2024 年營收為 23.224 億新台幣,較 2023 年 的 23.236 億新台幣下降 0.04%。2024 年淨利潤為 2.054 億新台幣,較 2023 年的 2.666 億新台幣下降 22.9%。 總資產由 2023 年的 33.939 億新台幣減少至 2024 年的 32.330 億新台幣。

世德 的 2024 年營收為 27.600 億新台幣,較 2023 年的 27.766 億新台幣下降 0.6%。2024 年淨利潤為 2.647 億新 台幣,較 2023 年的 3.299 億新台幣下降 19.7%。總資產 由 2023 年的 34.228 億新台幣增加至 2024 年的 39.370 億 新台幣。

開曼東明 的 2024 年營收為 125.433 億新台幣,較 2023 年的 129.660 億新台幣下降 3.2%。2024 年淨利潤為 5.756 億新台幣,較 2023 年的 1.351 億新台幣成長 325.8%。 總資產由 2023 年的 122.857 億新台幣增加至 2024 年的 139.470 億新台幣。

聚亨 的 2024 年營收為 80.038 億新台幣,較 2023 年的 84.200 億新台幣下降 4.9%。2024 年淨損失為 1.653 億新 台幣,2023 年則為淨利潤 8,087.7 萬新台幣。總資產由 2023 年的 89.110 億新台幣增加至 2024 年的 92.057 億新 台幣。

美國 (美元) Chicago Rivet & Machine 公司 2024 年的淨銷售額為 2,698.6 萬美元,較 2023 年的 3,150.7 萬美元下降 14.3%。2024 年淨虧損為 561.5 萬美元,較 2023 年的 440.1 萬美元的淨虧損擴大。總資產從 2023 年的 2,783.0 萬美元減少至 2024 年的 2,337.0 萬美元。

Hillman 集團 2024 年的淨銷售額為 14.725 億美元,較 2023 年的 14.764 億美元下降 0.2%。2024 年淨利潤為 1,725.5 萬美元,較 2023 年的淨虧損 958.9 萬美元轉為盈利。總資產從 2023 年的 23.311 億美元降至 2024 年的 23.305 億美元。

Trimas 公司 2024 年的淨銷售額為 9.250 億美元,較 2023 年的 8.935 億美元增長 3.5%。淨收入為 2,425.0 萬美元,較 2023 年的 4,036 萬美元下降 39.9%。總資產從 2023 年的 13.416 億美元減少至 2024 年的 13.241 億美元。

歐洲 Lisi 集團 2024 年營收為 17.940 億歐元,較 2023 年的 16.304 億歐元成長 10.0%。2024 年淨利為 5,600.6 萬歐元,較 2023 年的 3,753.3 萬歐元成長 49.2%。總資產從 2023 年的 20.585 億歐元增加至 2024 年的 22.102 億歐元。

Norma 集團 2024 年營收為 11.551 億歐元,較 2023 年的 12.227 億歐元下降 5.5%。2024 年淨利為 1,469.6 萬歐元, 較 2023 年的 2,783.2 萬歐元下降 47.1%。總資產從 2023 年的 14.932 億歐元減少至 2024 年的 14.366 億歐元。

SFS 集團 2024 年淨銷售額為 30.311 億瑞士法郎,較 2023 年的 30.730 億瑞士法郎下降 1.3%。2024 年淨利為 2.413 億瑞士法郎,較 2023 年的 2.660 億瑞士法郎下降 9.2%。總資產從 2023 年的 25.468 億瑞士法郎增加至 2024 年的 26.122 億瑞士法郎。

Vossloh 公司 2024 年營收為 12.096 億歐元,較 2023 年的 12.143 億歐元下降 0.38%。2024 年淨利為 6,320 萬歐元, 較 2023 年的 3,870 萬歐元成長 63.3%。總資產從 2023 年的 13.927 億歐元增加至 2024 年的 14.908 億歐元。

中國 (人民幣) 同期比

-2.3 超捷股份 的 2024 年營收為人民幣 3.773 億人民幣,較 2023 年的 3.722 億人民幣增長 1.3%。

年淨利潤為 2,987.0 萬人民幣,較 2023 年的 9,120.7 萬人民幣下降 67.2%。總資產由 2023 年的 11.414 億人民幣增加至 2024 年的 12.031 億 人民幣。

晉億實業 的 2024 年營收為 23.697 億人民幣,較 2023 年的 23.141 億人民幣下降 2.3%。2024 年淨利潤為 1.301 億人民幣, 2023 年則為淨虧損 1,928.5 萬人民幣。總資產由 2023 年的 52.196 億人民幣減少至 2024 年的人民幣 51.814 億人民幣。

日本 (日元)

公司名

( 損失 )

( 損失 )

(2025 年 ) vs. 5,357 (2024 年 )

(2023 年 )

Mitsuchi 公司 2024 年營收為 131.47 億日元,較 2023 年的 125.55 億日元增加 4.7%。公司在 2024 年實現淨利 4.19 億 日元,2023 年則為淨損 3,200 萬日元。總資產從 2023 年的 166.83 億日元減少至 2024 年的 164.50 億日元。公司預測 2025 年營收為 138.72 億日元,成長 5.5%。

Nifco 公司 2025 年營收為 3,530.38 億日元,較 2024 年的 3,716.39 億日元下降 5.0%。公司在 2025 年實現淨利 447.67 億日元,較 2024 年的 182.52 億日元成長 145.3%。總資產從 2024 年的 3,804.05 億日元減至 2025 年的 3,798.16 億日 元。公司預測 2026 年營收為 3,480.00 億日元,下降 1.4%。

Sanko Techno 公司 2025 年營收為 212.50 億日元,較 2024 年的 211.42 億日元成長 0.5%。公司在 2025 年實現淨利 11.22 億日元,較 2024 年的 17.40 億日元下降 35.5%。總資產從 2024 年的 246.29 億日元增加至 2025 年的 265.58 億 日元。公司預測 2026 年營收為 220.00 億日元,成長 3.5%。

Torq 公司 2024 年營收為 224.09 億日元,較 2023 年的 217.57 億日元成長 3.0%。公司在 2024 年實現淨利 8.95 億日 元,較 2023 年的 8.45 億日元成長 5.9%。總資產從 2023 年的 326.89 億日元增加至 2024 年的 336.80 億日元。公司預 測 2025 年營收為 231.00 億日元,成長 3.1%。

印度 (盧比) Tools 公司 2025 年總收入為 65.161 億盧比,較 2024 年的 61.369 億盧比成長 6.1%。淨利為 4.286 億盧比,較 2024 年的 3.88 億盧比成長 10.4%。總資產從 2024 年的 61.441 億盧比增加至 2025 年的 63.578

東南亞 2024 總資產 ( 馬來西亞令吉 )

Tong Heer 公司 2025 年營收為 5.416 億令吉,較 2024 年的 5.980 億令吉下降 9.4%。淨利為 176.4 萬令吉,較 2024 年 的 642.2 萬令吉下降 72.5%。總資產從 2024 年的 6.646 億令吉增加至 2025 年的 6.845 億令吉。

惠達編輯部

惠達特搜全球新聞 I市場觀察 川普關稅2.0I

I協會動態I Ed Smith 當選 2025-2026 年度 NFDA 主席

Wurth Industry USA 公司的 Ed Smith 當選為 2025 至 2026 年度美

國扣件經銷商協會(NFDA)主席。Melissa Patel(Field 公司)將擔任 副主席,Christian Reich(Goebel Fasteners 公司)將繼續擔任副主席 助理,Scott McDaniel(Martin Fastening Solutions 公司)將以前任主 席身份繼續留任董事會。

此外,Lisa Breton(DB Roberts 公司)、Scott Camp(Atlas Distribution Services 公司)和 Jennifer Sturm(Empire Bolt & Screw 公司) 已當選為董事會成員,任期自 2025 年 6 月 11 日起生效。

NFDA 董事會繼續由以下成員服務:Steve Andrasik (Brighton-Best International 公司)、Alex Goldberg(AMPG 公司)、Scott Longfellow(Huyett 公司)及 Angela Philippart (AFC Industries 公司)。

美進口鋼鋁關稅 6 月 4 日提高至 50%

美國川普總統 5 月 31 日宣布,為了促進美國鋼鐵業的發展和 刺激當地生產,將進一步把對全球進口鋼鋁產品課徵的關稅提高至 50% ,並自 6 月 4 日開始生效。此舉也意味原本依據 232 條款所課 徵的 25% 關稅被調高一倍,勢必再次讓全球鋼鋁產品業者面臨更 大成本壓力。

雖然美國國際貿易法院已裁定先前川普總統援引 「 國 際緊急經濟權力法 」 所實施的對等關稅超出總統職權,要求必須立 即停止,但川普政府已提上訴。而鋼鋁稅所援引的法律不同,所以不會因此上訴案受到任何影響。

關稅推高螺絲價格,影響消費者與企業日常生活

川普政府的鋼鋁進口關稅,導致螺絲及其他工業扣件價格大幅上漲,影響製造業及 普通消費者。一則例子來自美國家得寶大賣場,一名穿著美國國旗 T 恤的男子感嘆:「螺 絲現在太貴了」,反映出關稅導致的價格上漲已深入普通美國人日常生活,連簡單的雞 舍建造都受影響。此情況凸顯關稅如何從工業層面波及到民眾購物。

關稅使製造商及供應商不得不吸收成本或轉嫁給客戶,推高建築及小企業對螺絲、 螺栓的需求成本。一些承包商警告,螺絲價格上漲可能拖延工程甚至取消計劃,在經濟 挑戰下加劇企業利潤壓力。聯邦儲備局指出,今年關稅已推動消費者物價指數上升 0.3% , 許多企業選擇針對受影響商品調漲價格以抵銷進口成本增加。儘管關稅旨在保護國內產業,但其副作用是推升螺絲等 基本零件價格,影響產業及消費者雙方。

中國企業因美國關稅而大幅提升 對英國出口 中國企業大幅增加對英國的出口,達到多年未 見的水平,這主要是因為美國總統川普實施的高額 關稅。中英兩國官方數據顯示,中國出口額上升, 貨物正被重新移轉以避開美國關稅。英國 4 月份 自中國進口額達到 60 億英鎊,為兩年多來最高, 2025 年前五個月達近 20 億美元。此可能藉由增加 廉價商品供應來幫助降低英國通膨,但同時也可能 壓低當地製造商價格。英國商務大臣喬納森正密切 監控情況,防止傾銷,特別是在鋼鐵等行業。貿易 移轉反映出美國貿易壁壘下,中國商品需求的流動 只會發生地理位置上的變動,而不會消失。

航太產業警告 美國新關稅恐 危及飛安與供應鏈

航太產業警告,對進口商用飛機、噴氣發動機及零件 徵收新關稅,可能危及飛行安全並擾亂關鍵供應鏈。今年 4 月,川普總統已對幾乎所有進口飛機及零件徵收 10% 關 稅,商務部隨後啟動「第 232 條款」調查,評估進口商品 對國家安全的風險,或將導致更高關稅。代表波音、空中 巴士及 GE 航太等數百家企業的航空工業協會( AIA )敦促 商務部延長公眾評論期 90 天,並至少延緩 180 天實施新關 稅。業界強調,關稅上升恐破壞航空供應鏈復甦,增加假 冒零件流入,帶來意外後果。另指出國內尋找零件出現挑 戰,新的供應商可能需長達 10 年以符合安全認證。 AIA 指 出今年二月賓州一家航太扣件供應商發生火災,對生產造 成影響,以及從新供應商尋找零件發生困難。航空公司警 告,關稅將推高機票價格,削弱美國經濟與國安。

I產業動態I 中鋼第 3 季棒線及汽車盤價調降 台灣中鋼 6 月 19 日舉行 2025 年第 3 季盤價會議,除了鋼板產品維持平盤外,其餘鋼品價格 皆進行調降。棒線部分每公噸調降新台幣 800 元,汽車料部分每公噸調降新台幣 500 元。中鋼表 示,由於美國關稅持續引發市場不確定性,市場氛圍仍處觀望階段。台灣出口也受匯率影響有趨緩 趨勢。歐洲鋼價因淡季而下修,亞洲鋼品出口也走弱,短期鋼市將進入調節期,因此考量全球鋼市需求疲軟以及相 關政策干擾,為適時協助客戶爭取訂單,針對多數鋼盤價進行調降。

歐盟對中國無頭螺絲徵收臨時反傾銷稅 歐盟執委會於 2025 年 6 月 13 日通過第 2025/1189 號法規,對原產於中國的無頭螺絲 進口徵收臨時反傾銷稅。此調查於 2024 年 10 月 17

日啟動,源自歐洲工業扣件協會的申訴,指控中國產品傾銷並對 歐盟產業造成實質損害。調查產品為廣泛應用於汽車、再生能源、電器及建築等領域的鐵或鋼製無頭螺絲及螺栓(不 含不鏽鋼),並排除外六角木螺絲及其他木螺絲、螺旋掛鉤與螺旋環、自攻螺絲,以及用於固定鐵路軌道建設材料 的螺絲和螺栓(即調查中的產品)。

執委會對歐盟生產商、非相關進口商及中國出口商抽樣以蒐集資料。部分中國出口商未配合調查,導致樣本調 整。調查期間為 2023 年 7 月 1 日至 2024 年 6 月 30 日。考量歐盟生產商恐遭報復,執委會對其身份予以保密。此臨 時措施旨在保護歐盟無頭螺絲產業免受不公平競爭,調查仍在進行中。

加拿大國貿法庭啟動對中台碳鋼螺絲日落複審 加拿大國際貿易法庭(CITT)公告將對原產或出口自中國和台灣的 特定碳鋼扣件進行反傾銷措施到期複審,另外也將對原產或出口自中國的相同產品進行反補貼到期複審。審查期間, 加拿大邊境服務局(CBSA)將先行判定涉案產品的措施到期是否可能導致相關產品傾銷或補貼的持續或恢復。如果 CBSA 確認有此可能,加拿大國際貿易法庭 (CITT) 將進一步裁定持續或恢復的傾銷或補貼是否可能對加國產業造成損

害。CBSA 將在收到 CITT 啟動期滿複審通知後的 150 天內 (2025 年 10 月 2 日之前 ) 提供裁定通知。CITT 也會在 2025 年 10 月 17 日前發出正式裁定和理由聲明。CITT 將於 2026 年 1 月 5 日開始 舉行關於此次到期審查的聽證會。聽證會的類型將於之後通知。

南非擬提高扣件進口關稅

南非政府計劃提高進口扣件的關稅 至 30%,此舉旨在刺激國內生產並創造 就業機會。然而,南非太陽能產業協會 (Sapvia)等業界組織擔憂,關稅上調 可能推高太陽能板與電池製造成本,影 響可再生能源發展。此政策反映出保護當地產業與支持綠色能源 目標之間的平衡挑戰。

具體來說:

• 其他木螺絲目前免稅,最高可調整至 15% 。

• 自攻螺絲目前免稅,最高可調整至 30% 。

• 用於飛機的螺栓目前免稅,最高可調整至 30% 。

• 不鏽鋼全螺紋六角頭螺絲和螺栓目前稅率為 10% ,最高可調 整至 30% 。

• 不鏽鋼螺帽多數免稅,但最高可調整至 30% ,其中含尼龍嵌 件的六角螺帽目前稅率為 10% ,最高可調整至 30% 。

• 彈簧墊片和其他鎖緊墊片中,開岔或雙圈彈簧墊片目前稅率為 10%,最高可調整至 30%,其他墊片目前免稅,最高可調整至 30%。

歐洲 ENVI 支持歐盟碳邊境調整機 制重大簡化方案

2025 年 5 月 12 日, 歐洲議會環境、氣候 變化與食品安全委員 會( ENVI )支持歐盟 委員會提出的碳邊境 調整機制( CBAM )

簡化方案。該方案屬於 2025 年 2 月發布的「 Omnibus I 」簡化計劃,旨在提升 CBAM 的實施效率與可及性。

議員們通過多項技術性澄清修訂,重點包括設立新的 50 噸二氧化碳排放免徵門檻,約 90% 的進口商(主

要為中小企業及少量進口個人)將免於履行 CBAM 義 務。儘管如此,該機制仍涵蓋鐵鋼、鋁、水泥及肥料 等進口產品約 99% 的碳排放。

方案同時簡化申報人授權程序,優化排放計算方 法,改善財務責任管理,並加強防止系統濫用的措施, 確保機制的完整性與有效性。報告人 Antonio Decaro 強調,簡化措施必須與維護 CBAM 環保目標相平衡, 確保有效防止碳洩漏。全體議會於 2025 年 5 月 22 日 對談判授權進行表決。未來,歐盟委員會計劃於 2026 年初評估是否將 CBAM 擴展至其他高風險行業,展現 歐盟推動全球氣候目標及支持公正轉型的決心。

歐盟鋼鐵業籲提前準備 CBAM 以防 2026 年貿易中斷

CBAM 將於 2026 年 1 月 1 日啟動,但 歐洲鋼鐵業者對其逐步實施仍未充分準備, EUROMETAL 主席 Alexander Julius 在 5 月 8 日 的一場演講中警告。雖然 CBAM 的財務影響會自 2027 年 5 月開始,但企業需先在歐盟平台註冊並 申報範疇 1 和 2 排放,未來將擴及範疇 3 排放。

Julius 指出,現金流壓力大, 2026 年僅需支 付 2.5% 碳排放費用, 2034 年增至 100% ,進口 商需提前積累財務儲備。 CBAM 的複雜性及每噸 約 56 歐元的額外成本,可能使中小企業難以承 受,並擾亂供應鏈。建議供應鏈加強合作,並在 合約中引入排放附加費。歐盟委員會計劃於 2025 年底提出修訂方案,擴大 CBAM 範圍至下游產品 並加強防止規避措施,以保護歐盟製造業免受鋼 鐵衍生品碳洩漏影響。

I廠商動態I 豐達科與德國 MTU 簽訂五年長約 並持續擴大馬來西亞產能 航太扣件大廠豐達科於 2025 年巴黎航展宣布,與德國 航空引擎巨擘 MTU Aero Engines 簽署為期五年的長期合 作合約。此合約不僅鞏固雙方在台灣航太扣件領域的合作, 也擴展至豐達科位於中國蘇州的精密加工業務,展現其全 球供應鏈佈局的戰略眼光。 MTU 為全球領先的商用及軍用 航空引擎開發與維修廠商, 2024 年營收達 75 億歐元,產 品應用於全球約三分之一商用飛機。

此外,豐達科子公司 MY NAFCO PRECISION SDN. BHD 近期斥資約新台幣 1.3 億元取得馬來西亞森美蘭州芙蓉市 土地及廠房,強化航太及汽車產業的全球生產布局。該廠 於 2025 年 4 月啟用,並持續擴廠與增購設備,總投資預 估超過 4,000 萬美元。豐達科看好今年航太市場需求穩健, 並受惠波音 SPS Technologies 工廠火災帶來的急單,預期 未來 2 至 3 季營收將持續成長。

大國鋼因應關稅調漲價 格,第二季財報可望改善

大成鋼旗下子公司大國鋼因應關 稅上調,於今年 3 月調漲售價,預計將 反映在第二季財報表現上。大國鋼主要生產碳鋼、不鏽鋼 及合金鋼扣件,業務以螺絲及螺帽為主,北美市場佔比超 過九成。調價後, 4 至 5 月毛利率提升至 39% ,較第一季 33.48% 明顯改善,出貨量預估今年成長 2 至 4% 。 2025 年 第一季營收為 58.78 億元,年增 2.98% ,稅後純益 7.66 億 元,年增 32% ,每股盈餘 0.74 元。大國鋼對今年營運表現 持樂觀態度,受惠價格與出貨量雙雙成長。

美國關稅衝擊,Tree Island Steel

2025 年第一季營收下滑

北美知名線材與扣件產品製造商 Tree Island Steel 宣 布, 2025 年第一季營收大幅下滑,主因是美國對進口鋼鐵 及線材產品徵收新關稅。公司報告指出,第一季營收降至 5,240 萬美元,較去年同期的 6,070 萬美元明顯減少。管理 層表示,關稅導致需求減少及原材料成本上升,進一步擾

亂供應鏈。執行長 Remy Stachowiak 強調,公司正積 極優化營運並尋找替代供應來源,以減輕衝擊。展望 2025 年,管理層對產業前景持審慎態度,因關稅不確 定性仍將持續影響。

B&F Fastener Supply 公司更名為 BFirst Industrial

成立於 1988 年的美 國明尼蘇達州經銷商 B&F Fastener Supply 宣布更名為 「BFirst Industrial」。此次品牌更新體現了公司致力 於提供優質扣件產品與服務的承諾。更名不影響現有合 約、訂單及客戶帳戶。BFirst Industrial 強調,對客戶 支持與運營卓越的承諾保持不變。近年來,公司透過收 購 TPI、Northern States Supply 等企業擴大規模,目 前在明尼蘇達州、威斯康辛州、愛荷華州、內布拉斯加 州及達科他州共設有 17 個據點。

Howmet 公司 將受益於美中貿易協議

Howmet Aerospace 因應近期美中貿易協議而具 備良好受益條件。該協議旨在降低關稅,緩解影響全 球供應鏈及製造成本的貿易緊張局勢。航太產業是 Howmet 的核心市場,關稅降低將使其在關鍵原材料 及成品零件方面受益。作為飛機引擎及結構用高階金 屬零件的領先製造商, Howmet 有望因成本下降與出 口機會增加而提升需求及利潤率。產業分析師指出, 貿易壁壘放寬將促進跨境交易順暢,降低製造商成本。 整體樂觀情緒反映出貿易壁壘放寬及航太製造業增長 前景的改善。

在泰國設立首 家海外分公司 2025 年 4 月 21 日,浙江東明不銹鋼製品股份有 限公司在泰國曼谷成立首家海外分公司,邁出全球擴 展重要一步。經過 300 天籌備,總部與泰國團隊合作, 東明致力於從出口轉型為構建全球不銹鋼扣件生態系 統。此舉呼應中美貿易緊張及美國關稅上升帶來的供 應鏈影響。透過區域生產和市場多元化,東明降低貿 易風險,提升國際競爭力。泰國分公司將專注技術協 作、物流創新及市場開拓,強化東南亞及全球布局, 為未來發展奠定基礎。

I併購資訊I White Cap 簽訂收購 Advanced Fastening Supply

業務的最終協議 為專業承包商提供特殊建築用品和安全產品的領先經銷商 White Cap 已簽署最終協議收購 Advanced Fastening Supply (AFS) 的業務。 AFS 是一家位於威斯康辛州的供應商,為商業和住宅終端市場提供扣件、工具、安全產品和其 他配件。 AFS 在威斯康辛州的 Appleton/Greenville 、 Madison 和 Waukesha 有三個營運據點。 White Cap 執行長 Alan Sollenberger 表示 : 「我們期待在未來幾週歡迎 AFS 加入 White Cap 的大家庭。他們的良好聲譽和產品組合將增強我們 為美國中西部承包商提供完成工作所需的工具、扣件和安全解決方案的能力。」 AFS 共同持有人 George Rasmussen 表示:「 White Cap 和我們一樣以客為尊並致力於提供全方位的工地解決方案。我們可以一起為 AFS 團隊打開新的成長 機會之門,為威斯康辛州和其他地區的客戶提供更多的價值、服務和解決方案。」

Portland Bolt 收購 Bennett Bolt Works 以拓展規模

美國地腳螺栓和非標建築扣件製造商兼全球供應商 Portland Bolt & Manufacturing Co., LLC (Portland Bolt) 宣佈收購 Bennett Bolt Works,後者是一家位於紐約的螺栓 和扣件製造商,產品主要用於高速公路護欄系統、橋樑建築和高架標誌結構。成立於 1978 年,位於紐約州約旦市的

Bennett Bolt Works 在其利基市場建立了品質、可靠性和優質客戶服務的聲譽。此次收購強化了 Portland Bolt 的製造 能力和區域業務,加強了該公司支持全美關鍵基礎設施項目的承諾。

Portland Bolt 執行長 Blake Ray 表示 : 「 Bennett Bolt Works 在公路和橋梁基礎設施領域擁有良好聲譽。藉由把他 們的專業技術引入 Portland Bolt 的大家庭,我們將以更高的效率和客戶服務來強化我們為全美重要基礎設施項目提供 服務的能力。」 Bennett Bolt Works 所有人 Eireann Govern 表示:「與 Portland Bolt 合作是 Bennett Bolt Works 令人 振奮的下一篇章。他們的行業專長和對品質的承諾與我們的使命完美契合,這確保了無縫接軌以及持續為運輸基礎設施 產業提供卓越服務。」

Portland Bolt 將保留現有的 Bennett Bolt Works 團隊,並繼續在紐約的廠房運作。展望未來,該公司將以 Portland Bolt Northeast 的名義繼續運營。

Nord-Lock Group 併購 Energy Bolting Limited Nord-Lock 集團宣佈收購優質專業螺栓公司 Energy Bolting 。總部位於英國的 Energy Bolting 是優質特殊螺栓的專家,專門開發客製化的關鍵扣件,以滿足操作條件 嚴苛的產業應用。Energy Bolting 非常注重客戶服務、縮短交貨時間、認證和可追溯性, 以及嚴格的品質控制,因此已在主要市場穩步擴展業務,並建立了忠實的客戶群。

Nord-Lock 集團收購 Energy Bolting 主要是為了將優質特殊螺栓整合入其產品組合中。此次收購也與 Nord-Lock Group 的戰略方向不謀而合,即擴大其在關鍵螺栓接合解決方案方面的供應,並加強其在石油與天然氣、發電和國防等 關鍵行業的地位。

Nord-Lock 集團執行長 Daniel Westberg 表示 : 「收購 Energy Bolting 使我們的集團處於擴展業務的有利位置。我 們長期以來的目標是將優質的特殊螺栓納入我們的產品組合,並在關鍵產業中搶佔市場份額。憑藉著 Energy Bolting 的 專業知識和令人印象深刻的營運能力,我們完全有能力在各個領域中脫穎而出。」 Energy Bolting 總經理 Robin HartArcher 表示 : 「我們為自己在優質特殊螺栓領域的強勢地位以及在獲得重要行業認證方面的成績感到自豪。為了支持我 們下一階段的成長,我們一直專注於加強接觸新客戶的方式。憑藉 Nord-Lock 集團的全球銷售網絡以及與領先的 OEM 廠商建立的關係,我們現在擁有了一個令人信服的平台來拓展新的市場。」

歐洲新聞 新聞提供: Fastener + Fixing Magazine www.fastenerandfixing.com

印度 Right Tight Fasteners 公司加入 Fontana 集團

今年二月,Fontana 集團完成了對印度領先業界的扣件製造商 Right Tight Fasteners 公司的多數股權收購。Right Tight Fasteners 專注於生 產高強度特殊螺栓及螺帽,擁有超過四十年的歷史,透過此次被收購,使 Fontana 集團在印度擁有五個戰略性工廠,服務汽車、 農業、工業及建築等多個行業的客戶。

該協議由擁有多年良好企業經營聲譽的 Chhabra 家族簽訂,符合 Fontana 集團加強亞洲市場布局的長 遠策略。收購旨在提升客戶價值與服務,配合全球市場 佈局。Right Tight Fasteners 總部位於馬哈拉施特拉邦的納西克城,將與 Fontana 集團自 2015 年起在印度的現 有業務整合,整合後印度將擁有六個生產基地,員工總數達 2,000 人,使 Fontana 成為印度第二大特殊扣件製造商。

Fontana 集團執行長 Giuseppe Fontana 表示:「收購印度領先企業正好符合我們長期的在地化策略,透過在 關鍵市場建立當地設施與組織,更好地服務當地市場。印度經濟規模龐大且潛力可觀,是通往整個遠東地區的重 要門戶。」Right Tight Fasteners 執行董事 Balbir Singh Chhabra 補充:「與 Fontana 集團的策略夥伴關係將使 我們能利用其先進技術、堅實基礎設施及最佳實務,提升我們的服務。」

此外,雙方合作還將帶來設立研發中心的發展機會,結合雙方專業知識,並與其他地區的創新團隊合作。

Fabory 公司強化在比荷盧聯盟的市場地位 Fabory 已達成協議,收購 Stokvis Trading B.V.,這是 一家專精於 ASTM 標準的企業,同時也是比荷盧聯盟最大的 扣件供應商之一。此次收購進一步鞏固了 Fabory 在石化產 業專用扣件市場的領導地位。雙方在策略上的高度契合,使 Fabory 能提供更強大且更具相關性的產品組合,進一步擴展 其深厚且多元的扣件產品陣容、品質與工程技術,同時提供差 異化的供應鏈解決方案。

Fabory 執行長 Martin Verdegaal 表示:「我們很榮幸歡 迎 Stokvis 公司加入 Fabory 這個大家庭。Stokvis 與客戶長期建立的良好關係令我們印象深刻,且雙方在產品品 質與物流服務方面擁有共同願景。Stokvis 品牌及團隊在比荷盧聯盟的石化市場中享有高度信賴,我們期待與他們 共同推動市場的進一步發展。」Stokvis 將繼續以獨立單位來運作,保有其品牌。現任銷售團隊主管 Wouter Noga 將繼續擔任該職務,確保業務的連續性與穩定發展。 034 Fastener World no.213/2025 惠達雜誌

Owlett-Jaton 公司執行長 Ian Doherty 退休 自 2025 年 3 月 31 日起,Owlett-Jaton 執行長 Ian Doherty 已正式退休,結束其 在經銷業的豐富職涯。他於 2016 年加入 Owlett-Jaton,憑藉對客戶服務的熱忱以及 在銷售、市場行銷與供應鏈運營方面的豐富實務經驗,帶領這家領先的批發供應商 度過多項重大戰略挑戰,包括英國脫歐、新冠疫情、航運中斷、UKCA 認證以及碳邊 境調整機制等。值得一提的是,他在 2020 年將多個貿易部門整合為一,這項舉措幫 助 Owlett-Jaton 邁向下一階段的成長。除了在 Owlett-Jaton 擔任的角色外,過去五 年他也擔任過英國及愛爾蘭扣件經銷商協會(BIAFD)主席,並代表該協會參與歐洲 扣件經銷商協會(EFDA)。他大學畢業後曾服役於英國陸軍,隨後加入聯合利華公司 (Unilever),在這家消費品巨頭工作近二十年,期間取得會計師資格,並擔任財務、 銷售、市場行銷及供應鏈等多項職務。晚期曾任聯合利華澳洲冰淇淋事業部執行董 事。返回英國後,他在多個高階職位中深化供應鏈專業能力,包括經營一家大型文具 批發商。銷售總監 Tony Williams 表示:「我們感謝他過去八年半對 Owlett-Jaton 的貢獻,並祝福他未來一切順利。」

Newbury Investments 公司營運長 Andrew Ballantine 將暫代執行董事的職務,直到 Ian Doherty 的繼任者就任。Ian Doherty 則將以非執行董事的職務繼續支持公司發展。

Hilti 集團表現穩健 2024 年,Hilti 集團以當地貨幣計實現銷售成長 1.5%(以瑞士法郎計 則下降 1.4%),營業額達 64 億瑞士法郎(約 66.5 億歐元)。儘管市場環境充滿挑戰,集團仍成功擴大市場佔有率。受 匯率的強烈負面影響,營業利益仍與去年持平,達 7.69 億瑞士法郎。2024 年,Hilti 持續大力投資創新及其企業策略「Lead 2030」中所訂定的戰略重點。Hilti 集團執行長 Jahangir Doongaji 表示:「在 2024 年多變的環境下,我們以當地貨幣計 實現銷售成長。儘管面臨匯率重大負面影響及持續的業務投資,我們仍維持營業利益與去年相當。我們將在 2025 年繼 續投資,推動 Lead 2030 策略的實施。」在歐洲市場,Hilti 以當地貨幣計銷售額基本持平(下降 0.2%)。中北歐受經濟 環境影響較大,南歐則呈現穩健成長。美洲地區銷售成長 2.2%,其中拉丁美洲達雙位數成長。亞太地區銷售增長 4.7%, 北亞貢獻尤為顯著。東歐、中東及非洲地區銷售額以當地貨幣計增長 5.9%。

2024 年,Hilti 集團推出超過 80 項新產品與服務,持續受惠於創新研發投資。研發支出達 4.66 億瑞士法郎,年增 2.6%, 占集團銷售額 7.2%。此外,Hilti 大幅擴展全球生產網絡,以確保供應鏈長期韌性。建築市場預測顯示 2025 年整體商業 環境將與 2024 年類似,但因地區不同而差異明顯。市場波動與不確定性可能使瑞士法郎持續走強。秉持「讓建設更美好」 的宗旨,Hilti 將持續大幅投資創新並強化市場拓展資源。Hilti 集團預期 2025 年以當地貨幣計銷售額將有低個位數成長, 銷售利潤率將與 2024 年相當。

Bufab 以毛利率成長開啟 2025 年度 Bufab 公布業績顯示毛利率及營業利潤率均有所提升,淨銷售額成長 1.6%,達 到 21.84 億瑞典克朗(約 1.99 億歐元)。Bufab 集團總裁兼執行長 Erik Lundén 表示:「今年開局良好,毛利率與營業利 潤率均獲得強化,有機成長持續呈現正向趨勢。」Bufab 報告顯示,在連續數季負成長後,總體銷售成長 1.6%,有機成 長雖下降 0.1%,但較去年第四季的 1.5% 降幅已有明顯改善。亞太區表現亮眼,尤其是中國市場帶動 17.2% 的強勁有機 成長。Erik 指出:「需求最強勁的領域為國防、能源及醫療產業,農業、汽車、家具與室內裝潢則表現較弱。重要的一般 工業、建築及行動住宅與拖車市場則保持穩定。」Erik 說:「針對美國與其他國家的貿易關稅快速變動,我們密切關注 相關發展。雖然短期內較高的關稅可能對 Bufab

在美國的業務造成影響,但作為一家大型且穩定的供應商,我們較小 型競爭者更能有效應對這些干擾,長遠來看或將受益。我們已積極與供應商及顧客合作,確保在該區域維持強勢地位 與良好獲利能力。」

他總結道:「儘管市場氣氛不確定,我們對未來持樂觀態度。未來將專注於擴大市占率、逐步提升利潤率並創造強 勁現金流,為市場回溫時奠定堅實基礎,持續推動長期、永續且獲利的成長之路。」 此外,Bufab 財務長 Pär Ihrskog 決 定卸任尋求新挑戰,他將持續任職至 2025 年 10 月,接替人選的招募程序將立即展開。

美洲新聞 新聞提供:John Wolz,FIN 編輯 (globalfastenernews.com) Mike McNulty,FTI 副總裁兼編輯 (www.fastenertech.com)

美中關稅的暫停交火不惠及扣件產業 路透社報導,中國與美國已同意在 90 天內降低彼此商品的關稅,為這場可能引發全球經濟衰退並加深兩大經 濟體裂痕的貿易戰帶來暫時緩解。美國對中國商品課的關稅將從 145% 降至 30%,中國則表示會將其普遍關稅從 125% 降至 10%。白宮將此視為一項重大協議,但這次貿易戰的新進展對扣件產業並無實質幫助。Interstate Screw Corp. 公司在社群上表示:「許多我們重視的中國合作夥伴紛紛告知我們『關稅戰爭結束了』,但事實並非如此。對我 們產業來說,關稅戰爭根本未結束。」大型經銷商 Huyett 則稱這次暫停對製造業來說是「毫無意義的開始」。目前對鐵、 鋼及其衍生品(包括扣件)的關稅沒有「實質改變」。事實上,自今年初以來,中國扣件被課的關稅反而增加了 45%, 而來自台灣、越南、印度、墨西哥和加拿大的進口品則面臨 25% 的關稅。中國大部分扣件的關稅率高達 70%,其中包 含 20% 的「芬太尼」關稅、25% 的鋼鋁關稅,以及川普總統第一任期內設定的 25% 關稅。

福特執行長:我們必須進口汽車扣件

儘管白宮強力推動企業採購國產零件,卻不切實際。福特汽車公司執行長 Jim Farley 表示自家企業必須進口扣件及其他零件來組裝車輛。

Farley 指出:「我們必須進口某些零件,像是扣件、墊圈、地毯⋯⋯這些在國內 根本買不到。」即使部分零件能從美國供應商取得,進口仍較便宜,有助於保持零售 價格競爭力。暢銷車款 F-150 所使用的零件中,有 20% 至 25% 是進口的。他說,「零 件的可負擔性對美國非常重要,因為我們必須保持車輛的價格合理。我們當然希望 能在美國生產,但也要讓在美國製造的車輛價格負擔得起。」,福特已調漲從墨西哥 進口的三款美國市場車型價格,每輛最高漲 2,000 美元。

經濟學家勸告西太平洋扣件協會:勿過度反應

經濟學家 Chris Thornberg 博士在 2025 年春季西太平洋扣件協會(Pac-West Fastener Association)年會上建議業者「走出去做生意,但要謹慎而非恐懼」,並提醒「不 要過度擴張或過度借貸」。Thornberg 指出,目前美國經濟的主要驅動力是家庭消費力。 他在年會中表示通膨已下降,信貸供應增加。然而,第二任川普政府上任前八週充滿「新 聞與政策混亂」,全球貿易動盪可能引發外部危機提前爆發。他特別提到,台灣作為主 要扣件生產國,目前尚未受到關稅威脅。他說,川普對某些國家徵收關稅可能招致報復, 首要任務是「處理聯邦赤字」,他稱聯邦赤字「不可再繼續下去」,無論是兩年、四年或 六年後,赤字危機終將來臨。他同時分析房市現況,指出現有房屋銷售下滑,2010 年是 因為買方不足,現在則是賣方不足,建築的需求發生了問題。現實發生的事是建設者聚焦在建造更新更貴的建築, 而非「可負擔住宅」,其實建築業應聚焦提供市場真正需要的產品。

Thornberg 認為,經濟現實不如「說故事」重要。去年美國民眾對經濟感受悲觀,70% 認為通膨超過收入;但反 之 2024 年底經濟熱絡、通膨受控、股市上揚。多數美國人不偏向任何政黨,投票基於「氛圍感受」,政治人物也愛 說話術之人。他回顧近年美國經濟狀況:2019 年房地產衰退、2020 年疫情、2021 年並未復甦、2022 年通膨、2023 年收益率曲線衰退、2024 年成為「全球羨慕的焦點」,而 2025 年可能變成「貿易戰下的衰退」。他預測美國經濟 隨著話術與現實之間的角力而做出反應。說故事是很重要的,他說,「我們的思考邏輯並不如我們自己所想像」。

Thornberg 警告,美國出生率下降與嚴格的移民政策可能造成勞動力短缺。消費需求目前仍穩健,但關稅上升可能 打擊消費力。美元價值與利率變動也是經濟風險。

美國西太平洋扣件協會 : 打造未來職場,留住人才關鍵

美國西太平洋扣件協會的「打造未來職場」專題座談中,多位業界 專家分享了吸引與留住員工的寶貴經驗與建議。Advance Components 公司的 Gary Cravens 說,年輕員工及潛在人才需要感受到扣件產業並 非像「生鏽的螺栓」一樣單調。他說:「但一般人認為談論機器人技術、 航太產業比談論生鏽的螺帽螺栓還要酷多了。」為此 Cravens 花了十年 時間在公司內部建立新文化,他說這過程「從深入對話開始」,一旦文化 形成,會帶來強大的正面氛圍。

Copper State Nut & Bolt 公司的 Carl Spackman 表示:「我們重視 人際關係。」Spirol 公司的 Mike Lentini 則建議業者走進學校,介紹製 造業並教導學生操作 C7C 機器。Spackman 說從幼稚園到高中贊助各 類活動,讓學生認識扣件產業及公司。

Lentini 說 Spirol 公司也推行新進員工部門輪調計畫,第一線新進人才剛到職第一天可能不知最終會坐哪個職位, 輪調計畫可幫助他們探索適合自己的職涯路徑。Lentini 指出,現今招聘市場「還算過得去,但留才困難」,許多優秀 員工在達到最高生產力後,可能會因為只多賺一點點(每小時多 50 美分)而選擇兩年後離職,Spirol 公司表示必須了 解離職原因。

Spackman 則關注如何讓員工不只追逐薪水,Cravens 分享 Advance Components 公司提供彈性工時、401K 退 休金、學費補助與健保等福利,並強調工作與生活平衡。Cravens 主張「隨時可與員工溝通」且試圖與每個員工見面 互動,他建議尊重員工並讓他們感受到自己是企業一份子。他提到自己從未在像亞馬遜那樣嚴苛的環境工作過,那 裡的員工甚至只有七分半鐘的廁所時間。

Lentini 靠頻繁的團隊會議來了解員工的動力來源以及他們喜歡做的事情,他將這視為一種顧客服務。

Spackman 表示,Copper State 鼓勵經理們在工作與生活平衡上發揮領導作用,「這傳達了一個完美的訊息 / 就是允 許人們展現人性」。

Spackman 說新進員工需要和其他新進員工待在一起「並肩作戰」,且不需要過度指導他們。

Cravens 補充說, 人們會自然感受到企業文化,然後「自我管理」。Lentini 建議,除了密集的訓練外,公司還應該鼓勵員工透過共進晚 餐或午餐來建立彼此關係。Lentini 表示,對 Spirol 公司來說,領導力的培養從康乃狄克總部開始,且具有全球性。新 進員工可能會被介紹到五個不同的部門。

Cravens 表示,每週的管理會議會討論所有熱門議題。要怎麼解決問題? Cravens 發現,員工會開始提出自己的 想法。雖然管理會議通常不邀請基層員工參加,但 Spackman 說,在某個階段就會想鼓勵他們參與。Cravens 預測 未來十年內,大多數文書職位將被淘汰。簡單的錯誤和策略性的失誤是有區別的。「那些文書工作很可能會逐漸消失,」 Cravens 說。Lentini 鼓勵在規範範圍內自由思考。他也鼓勵讓未來的關鍵員工積極參與「年輕扣件專業人士」組織 (Young Fastener Professionals,簡稱 YFP),YFP 讓他們「成為更大團體的一份子」。

Fastenal 公司宣布兩股合一股票分割 Fastenal 公司宣布,其董事會已批准對公司已發行普 通股進行兩股合一的股票分割,透過修訂公司的章程來實 施。此修訂同時會使公司授權普通股的股數按比例增加。

凡於 2025 年 5 月 5 日營業結束時持有 Fastenal 普通股的 股東,按每持有一股普通股,額外獲得一股普通股。股票 分割於 2025 年 5 月 21 日營業結束時生效,並於約 5 月 22 日開始以調整後的股數進行交易。

Fastenal 在全球 25 個國家擁有超過 3,500 個銷售據點,供應扣件、安全產品、金屬切割產品及其他工業用品,客 戶涵蓋製造、建築、倉儲、批發及政府機構。公司透過投資當地專家與庫存、客戶導向技術、廣泛服務以及一流的採 購與物流,提供更優質的能力幫助客戶在全球供應鏈中降低成本、風險及限制。

Buckeye Fasteners 的母公司 Fastener Industries 榮獲員工持股計畫型企業里程碑獎

Buckeye Fasteners 公司宣布,其母公司 Fastener Industries, Inc. 於第 39 屆俄亥俄州員工持股會議上,榮獲員工持股計畫型企業里程碑 獎,以表彰其 45 年來對員工持股制度的堅持與成功。自 1980 年轉型 為員工持股計畫型企業以來,Fastener Industries 培育出以員工為核 心的合作文化,成為企業成功的重要動力。作為旗下子公司,Buckeye Fasteners 也積極推行此模式,確保每位團隊成員都能共享公司未來的 成長與利益。Fastener Industries 總裁 Thomas S. Calton 表示:「今年 我們很榮幸獲得俄亥俄州員工持股會議協會的里程碑獎。這份榮譽見 證了我們創辦人 Rich Biernacki 及 1980 年購入公司的原始股東的遠見、 奉獻與努力。他們的前瞻性為我們建立了持股文化,這是我們長期成功 的關鍵。」

Fontana Gruppo 併購 MNP Corporation

Rolled Threads Unlimited 慶祝成立 40 週年

2025 年 4 月 3 日,Rolled Threads Unlimited 慶祝其精密滾牙服務邁入 40 年, 憑藉無與倫比的 專業技術持續 成長。該公司於 1985 年創立,從 一家小型企業起 步,感謝客戶與 員工的支持,業 務持續蓬勃發展。

創辦人 Gerald Jerry Buscher 最初以 兩台滾牙機在一處租賃的簡陋空間開始營 運,1987 年公司遷至美國威斯康辛州沃基 肖市的新廠房。在 2002 年,被 FW Ladky & Associates 公司收購。隨著年銷售額先 後突破 500 萬美元、900 萬美元及 1300 萬 美元大關,公司進一步購買了現有廠房內 5000 平方英尺的製造空間,並引進最新的 滾牙技術設備,包括 Videx 與 Tesker 品牌 的滾牙機,以及 IFP KPHMA 零件清洗機。

Boker's 先進離心機系統 MNP Corporation 公 司於 2025 年被 Fontana Gruppo 公司收購,標誌 著 Fontana 全球擴張策 略的重要里程碑。此次收 購結合了北美兩家最大 且備受尊敬的家族經營 扣件製造商,為員工、客 戶與供應商帶來前所未 有的新機遇。Fontana 在 今年早些時候亦收購了 印度市場的 Right Tight Fasteners 公司,進一步鞏固其全球布局。此次整合將匯聚扣件產 業中頂尖人才,共同致力於提供最高標準的品質與服務。超過 55 年 來,MNP Corporation 一直由 Berman 家族持有。隨著 MNP 成為 Fontana 旗下的一部分,仍將堅守數十年來定義 MNP 的核心價值:卓 越、創新與以客為尊。雖然這是令人振奮的新篇章,MNP 對成長與成 功的追求將持續不變,只是現在擁有更多資源、更廣的影響力,以及 為所有夥伴帶來更大潛力的機會。

Boker ’s, Inc. 是一家領先的精密金屬 沖壓與墊片製造商,近期擴充內部製造能 力,安裝了先進的離心機系統,作為拋光 與去毛邊流程中的重要設備。此系統旨在 優化去毛邊工序,提供更穩定一致的加工 品質、改善表面光潔度,並降低環境影響, 這些都是設計工程師與採購團隊極為重視 的關鍵指標。

新離心機系統透過持續監測並調整水 質硬度、pH 值、溫度以及肥皂和化學物質 濃度等關鍵參數,能精確控制並維持拋光 過程中的化學條件,確保零件在理想且穩 定的條件下處理,降低變異性,達到符合 現代工程規範的高品質表面效果。

土耳其新聞 土耳其扣件進出口分析 新聞提供:Irem Yaren BAYSAL, Fastener Eurasia Magazine 雜誌編輯 www.fastenereurope.com

扣件產業在土耳其工業生產中佔有關鍵地位。該領域與汽車、建築、白色家電、機械製造及國防工業等產業直 接整合,並且在外貿表現上對該國經濟有顯著貢獻。近年來,全球供應鏈變革、區域出口機會與匯率影響等多重因素, 直接左右土耳其的進出口數據。

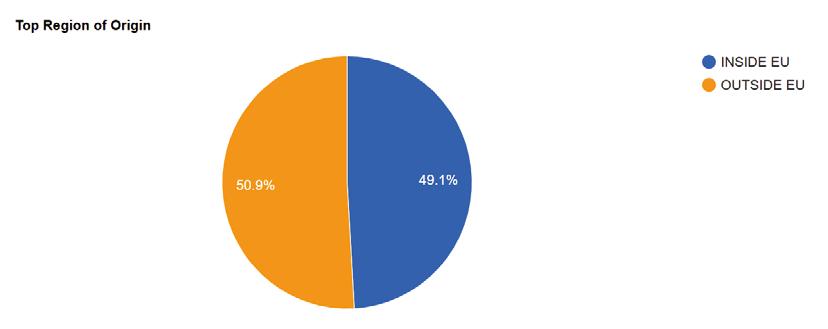

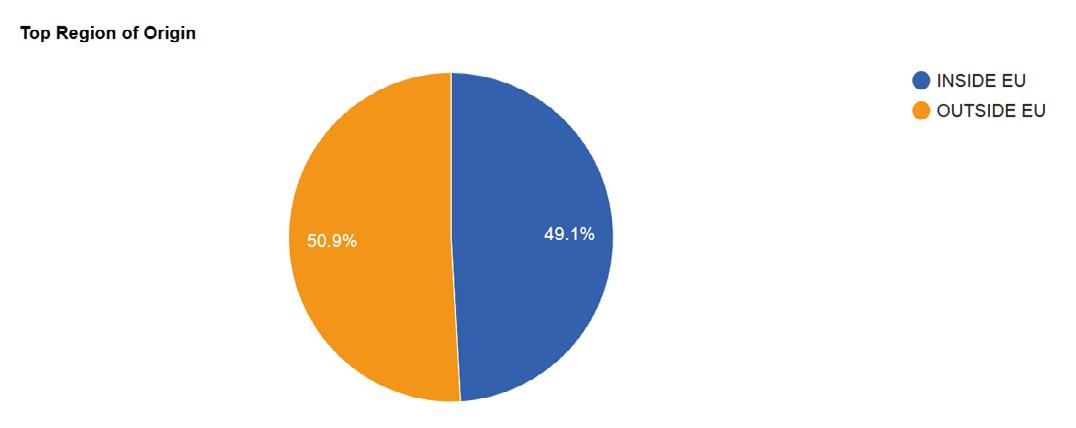

土耳其扣件大部分出口銷往已開發工業國家

歐盟國家佔土耳其總出口額的 60% 以上,顯示土耳其與歐洲在產業整合與技術相容性方面的密切連結。2020 年後,尤其是新冠疫情後全球供應鏈安全需求提升,區域生產基地(如:土耳其)的重要性增加,這使得土耳其扣 件製造商在出口競爭力上獲得強化。

此外,2023 年起,隨著電動車、再生能源系統及模組化建築解決方案等新興工業應用對特殊扣件需求的增加, 土耳其的出口產品結構也更加多元化。

進口結構以及依賴的風險程度

土耳其進口多為高附加價值產品,出口則以標準且大量生產的產品為主。土耳其進口的產品主要來自德國、中 國、台灣、南韓及義大利等高科技製造國家;土耳其仍高度依賴進口航空、醫療器材及國防工業等產業使用的特殊 扣件。此外,土耳其國內在某些合金鋼材及特殊塗層技術的產品生產能力方面尚未達到足夠水準。

這種情況使產業容易受到匯率波動的影響,增加成本的不確定性。因此,強化國內生產能力、鼓勵新投資及提 升研發導向的生產成為刻不容緩的關鍵任務。

淨貿易餘額與策略評估

根據 2023 年的海外貿易餘額數據分析,土耳其扣件產業的進出口差距已逐漸縮小。整體來看,出口在數量上 超過進口,但在金額上仍略低於進口。這主要是因為出口產品多為附加價值較低的標準品。

然而,這一現象同時展現出土耳其產業的潛力。土耳其可透過擴大產品多樣性,並提升高科技及高附加價值扣 件的生產,進一步改善外貿收支,朝出口導向發展。事實上,政府提供的投資誘因、歐盟綠色新政中推動的低碳生 產轉型義務,以及日益增加的國際需求,都為這一轉型提供了強有力的支持。

美中關稅對土耳其的負面影響

美國對中國加徵的關稅是直接針對中國在鋼

國內市場疲軟,在此背景下的外貿流量亦趨弱, 同期鋼鐵進口量小幅增加不到 1%,達 560 萬噸。相 對地,土耳其鋼鐵製造商積極拓展出口市場,同期 出口量達 500 萬噸,年增 17.3%。

土耳其鋼鐵製造商協會(TCUD)認為,為確保 鋼鐵產業永續發展,必須「創造廢鋼替代原料來源, 限制來自遠東國家日益增加的傾銷進口,將加工貿 易制度應用置於國內供應優先的框架內,並提升鋼 鐵產業對改善經常帳赤字的貢獻」。

巴西 新聞 Hassmann 歡慶 70 週年 Hassmann 家族第三代 Augusto Hassmann 表示 : 「在即將到來的十月,Hassmann 公司將 正式慶祝成立 70 週年。身為巴西扣件製造商, 我們正透過人工智慧、工業 4.0 及國際化來實現 流程現代化。」他繼續說道:「這是巴西最堅實、 最穩健的產業之一的 70 週年紀念。我們主要使 用冷鍛製程生產,同時也使用機械加工等輔助 製程。我們正在擴大市場布局並在美國設有子公 司。」

Hassmann 躋身 DAF 最佳供應商之列 2025 年 4 月 2 日,卡車製造商 DAF Trucks 打開其位 於荷蘭 Eindhoven 市總部的大門,慶祝並頒發獎項給供 應商績效管理計畫 (SPM)的最佳供應商。

巴西扣件製造商之一的 Hassmann 公司因其在 2024 年度的高水準表現入選最佳公司之列。代表人 Peter Hassmann 接下了該獎項。

巴西扣件業者將參加美國拉斯 維加斯螺絲暨機械設備展

下一屆的美國拉斯維加斯螺絲暨機械設 備展(IFE)將有來自巴西的同業參加。此展定 於 2025 年 9 月 16-17 日舉行,截至 6 月第二 週,經銷商 Âncora 和 Walsywa、扣件製造商 Hassmann、Jomarca、MaxDel 和 Metaltork、 Zingacem Martins(表面處理服務)和 GPTech (鉚接扣件技術)已經確認參展。

巴西貿易和投資促進局 (ApexBrasil) 提供 參展補貼保證。此舉不僅能促進巴西品牌打入 新市場,更能提升巴西品牌在全球舞台上的可 見度與知名度。

ApexBrasil 是受巴西聯邦政府監督的非 營利組織,於 2003 年在 Luiz Inácio Lula da Silva 總統第一任期內成立,是貿易促進組織和 投資推廣機構。

▲ Peter Hassmann (1)

全新表面處理公司正式成立

Super Coating 於 2025 年 3 月開始營運。它是巴西 一家新的金屬表面處理服務供應商。該公司隸屬於 Super Plating 集團,總部位於巴西聖保羅州 Diadema 市,非常 靠近聖保羅大都會區周圍的主要高速公路,周圍主要是汽 車製造商、汽車零件工業和巴西一些主要的扣件工業。

共同創辦人兼董事 José de Assis 表示:「我們的總 部佔地 1,350 平方公尺,月產能約 500 噸。」Assis 畢業於 麥肯齊長老會大學化學領域。自 2012 年起即在同一城市 創立 Super Plating Tratamento de Superfície 公司並擔 任董事。新公司的共同創辦人和合作夥伴是畢業於聖保羅 大學 (USP) 主修電化學和腐蝕學的 Luis Palomino 博士; Tiago de Oliveira Silva 也是來自麥肯齊的化學家。

由於 Silva 在鋅薄片、鍍鋅和磷酸鹽領域擁有超過 25 年的經驗,因此由他負責營運。Assis 表示 : 「我們擁有 最先進的浸鍍 / 噴塗製程機器和自動磷化生產線,以及磷酸鋅、鋅鈣和錳製程。我們在汽車、農業、土木建築、風力 發電和其他市場用的金屬部件領域非常活躍。我們與 NOF Metal Coatings 建立了穩固的合作夥伴關係,目標是以 高品質、高速度以及這些大型工業所需要的專業技術來服務廣大的巴西市場。」

新聞提供:Sergio Milatias, Revista do Parafuso(巴西扣件雜誌)主編 revistadoparafuso@revistadoparafuso.com www.revistadoparafuso.com

扣件新品大道 整理 / 惠達編輯部 2 3 1

「TryLead Stainless」 不鏽鋼扣件系列

日本 Synegic 推出此系列產品 以優異的耐腐蝕性與耐久性著稱,適 用於海洋、化工及戶外等嚴苛環境。

TryLead Stainless 包含螺絲、螺栓及 螺帽,採用高品質不鏽鋼材料製造,符 合嚴格工業標準。

Synegic 強調,新系 列產品在保持優良機械強度的同時, 有效抵抗生鏽與氧化,延長組件壽命。

公司亦提供詳盡的技術資料與支援, 協助客戶挑選最適合的扣件。

TryLead Stainless 系列展現 Synegic 持續創 新緊固解決方案的決心,提升各產 業的可靠性與效能。此次新品發表是 Synegic 擴充產品線、滿足市場需求 的最新成果。客戶可透過 Synegic 取 得產品目錄及技術資料,便於工程與 製造流程整合。

適合狹小扳手操作空間的新螺栓

高性能扣件品牌 ARP 推出用於狹小扳手操作空間 的全新系列螺栓。該系列以五入包裝按尺寸分類,包含 3/8-16 及 3/8-24 規格,配備 3/8 吋或 7/16 吋頭部,以及 7/16-14

和 7/16-20 規格,配備 7/16 吋或 1/2 吋扳手頭。材質提供拋光不 鏽鋼及黑氧化 8740 鉻鉬鋼兩種選擇,抗拉強度達 180,000 psi,

約比標準 8 級五金零件強 20%。

螺栓的頭下長度多樣,3/8 吋規格介於 0.5 吋至 5 吋,7/16 吋

規格介於 1.5 吋至 5 吋,並提供六角及 12 點頭型可選。所有螺栓 均由 ARP 自家鍛造、熱處理及精密加工,嚴格把關品質。此系列 產品讓 ARP 廣泛用於賽車及汽車產業的專用扣件及完整引擎配 件套件更加完整。

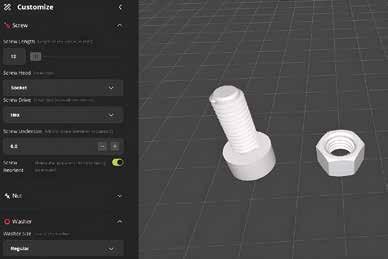

實用的線上 公制螺絲、 螺帽與墊片 3D 模型生成器

這款由開發人員 Jason 製作的線上工具,讓使用者 能快速生成可自訂的公制螺 絲、螺帽與墊片 3D 模型, 尺寸涵蓋 M2 至 M16。該工 具以 OpenSCAD 為基礎,搭配簡潔的網頁介面,使用者可輕鬆調整螺紋尺 寸、頭型及各項參數,無需專業 CAD 知識即可操作。生成的模型可下載為 常用 3D 列印格式 .stl 與 .3mf,方便愛好者、工程師及設計師用於原型製作 或專案開發。此工具特別適合需要快速 3D 列印螺絲的場合,如狹小空間 組裝或客製化夾具,當市售零件無法完全符合需求時提供便利性。雖然像 McMaster-Carr 等供應商仍是取得 CAD 模型的好來源,但此生成器強調 彈性與即時設計。進階用戶也可下載 OpenSCAD 在用戶端的電腦上進行 修改。該專案展現了製造者及工程社群對參數化建模與 3D 列印的熱忱, 促進數位設計與實體硬體的結合。線上工具連結:https://makerworld. com/zh/models/1055250-screw-generator-parametric-screws-nutswasher#profileId-1042636

創新 EZI-SA 後置錨栓 日本 Sanko Techno 推出 EZI-SA 後置

螺絲固定型吊栓錨栓系統,專為混凝土結 構吊栓進行設計。EZI-SA 適用於帶有鋼筋網架及半預

鑄板等多種混凝土基材。施工時,先鑽孔並清除孔內碎 屑,再以衝擊起子旋入錨栓,直至的檢查環突出可見,即 可確認錨栓已正確埋入。

產品配備橙色(標準長度)及綠色(短長度)檢查環,

方便工人及監工透過目視確認安裝完成。錨栓的錐形軸 身可減少與板面掛鉤,並設有阻擋件控制鑽孔深度,且有雙層墊片設計。它可有效防止混凝土板面的剪切破壞, 提升安全性與耐用度。

EZI-SA 僅限垂直吊栓使用,禁止重複使用錨栓及孔洞,施工時須配戴安全帽及護目鏡,避免過度鎖緊及使 用超過 36V 的衝擊起子。安裝過程無廢料產生,方便環保處理。EZI-SA 提供 W3/8 螺紋規格,較短 35 釐米及標 準 55 釐米兩種埋入深度,符合嚴格建築標準,為混凝土吊栓提供安全高效的鎖固解決方案。

鋁製「System 6」防盜螺絲

日本 Saima 株式會社於 TRF 系列防盜螺絲中推出 新產品「System 6」小螺絲,首次加入鋁製款式。該產品 於今年 3 月德國司徒加特展首次亮相,海外迴響熱烈,促使公司開 始在日本國內備貨銷售。System 6 採用陽極處理鋁材,提供黑、藍、 綠、紫、紅等多種標準色,並可接受客製化顏色訂製。

全新 SBW4 軌道緊固系統 System 6 小螺絲尺寸涵蓋 M3、M4、M5,長度從 6 毫米至 16 毫米不等,支持單顆起售,滿足多元化客戶需求。Saima 強調此產 品兼具防盜功能與美觀性,適用於需兼顧安全與外觀的場合。 4 5 6

Voestalpine Fastening Systems 公司推出全新 SBW4 軌道緊固系統,升級波蘭鐵路基礎設施中廣 泛使用的 SBW3 緊固系統。該系統乃基於多年經驗,針對組裝人體工學、電氣阻抗、材料重量及自動化 適應性等關鍵問題進行改良。 SBW4 採用重新設計的 SB3/5 鑄鐵錨固件與 WIW60C 絕緣夾具,標準化夾具定位 並簡化手動安裝。中空錨頭設計減輕 20% 重量,降低生產與運輸成本,並 減少環境負擔。PWE6094R 軌枕墊片 改良側肋結構,提高電氣阻抗,持續 超越 EN 13481-2 安全標準。系統同 時支援自動化裝配線,提升效率並減 少錯誤。

該系統經華沙鐵路研究所 嚴格測試,符合嚴苛品質與安全標準, 所有零件均已申請專利。SBW4 能加 速軌道鋪設,提升其可靠性,並減少 碳足跡,為鐵路建設與維護帶來經濟 與環保雙重效益。

Calculating 美國高階應用扣件 商機分析 市場概要 截至 2023 年,美國工業扣件市場價值約為 172.6 億 美元,預計到 2033 年將達到 230.4 億美元,年複合成長 率為 2.96%。此成長動力來自於需要高性能扣件之產業 ( 例如 : 航太、汽車和電子 ) 的需求增加。1

尤其是航太產業對扣件的需求強勁。儘管面臨關稅等 挑戰,美國航太產業的供應商仍調高其利潤預測,原因是 航太零件(包括扣件)的需求強勁。這顯示了市場的韌性, 對於能夠滿足先進應用嚴格要求的供應商而言是一個商 機。2

關鍵市場領域 航太

航太產業是先進扣件的重要消費市場。隨著航空器的 複雜性不斷增加以及對輕量且堅固零件的需求,對專用扣 件的需求激增。

美國航太產業持續成長,波音和空中巴士 等公司的訂單都創新高。這種成長轉化為對高效能扣件需 求的增加,為專門生產航太級零件的製造商帶來商機。

2025 年,美國航太及國防製造市場的產值預計將增 加 1,162.8 億美元。預計 2025 年產值將達到 2,445.1 億 美元,同期年複合成長率為 0.24%。預計北美洲將成為市 場主導,該區域的成長速度最快。3

汽車 汽車工業仍然是工業扣件的最大應用領域。隨著電動 車(EV)和自駕技術的發展,對輕量且耐用扣件的需求變 得更加明顯。鋁和複合材料等材料更頻繁被用於減輕汽車 重量和提高燃油效率。

2025 年,美國汽車產業預計將呈現喜憂參半的成長 趨勢。新車銷售量預計將達到 1,630 萬輛,較 2024 年成 長 3%,顯示前景樂觀。然而,乘用車營收的年成長率預計 為 -1.47%,到 2029 年,市場規模預計為 6,009 億美元。 最大的市場區塊為 SUV 車型,預計 2025 年的市場規模為 3,368 億美元。4

電子 電子產業有智慧手機、筆電和可穿戴技術等裝置用微 型精密扣件的需求。隨著裝置變得更精巧複雜,對於能在 不影響空間或效能的情況下提供穩固連接的扣件需求也與 日俱增。

預計 2025 年美國消費性電子產品市場將溫和成長。 有些預測顯示 2025 至 2029 年之間的年複合成長率為 1.49%,有些則預測 2025 至 2030 年之間的成長率會有 4.6% 的較高成長。整體而言,該產業可望持續成長,儘管 與前幾年相比,成長速度會較慢。5

1. https://www.visionresearchreports.com/us-industrial-fasteners-market/40817?utm_source=chatgpt.com

2. https://www.reuters.com/business/aerospace-defense/howmet-aerospace-lifts-2025-profit-forecast-robust-parts-demand-2025-05-01/?utm_source=chatgpt.com

3. https://www.precedenceresearch.com/aerospace-market

4. https://www.spglobal.com/automotive-insights/en/blogs/2025/02/us-auto-sales-2025

5. https://www.statista.com/outlook/cmo/consumer-electronics/united-states

建築和基礎建設 建築業在結構應用上使用大量扣件。隨著對永 續建築實務的重視以及預製組件的使用,對於能夠 快速組裝與拆卸的扣件需求與日俱增。對於暴露在 惡劣環境條件下的基礎建設專案而言,耐腐蝕及高 強度的扣件需求尤其殷切。

預計 2025 年美國建築與基礎建設產業的年成 長率為 5.6%,市值將達到 1.27 兆美元。雖然建築業 在 2020 年至 2024 年之間經歷了強勁的成長,年複

合成長率達 7.3%,但 2025 年至 2029 年的預測則 顯示年複合成長率為 4.4%,成長速度較慢。6 這顯 示市場已轉向採用更具永續性的技術,並著重於透 過 AI 和 IoT 等先進技術來提高效率和創造價值。

新興趨勢 • 先進材料: 新材料的開發正在徹底改變扣 件市場。製造商正在投資研究利用石墨烯 複合材料等具有極佳強度重量比的材料來 製造扣件。這些材料對於重視減輕重量且 又不能降低強度的航太及汽車應用來說特 別有幫助。

• 此外,生物基聚合物和回收材料的使用也 符合業界朝向永續發展的趨勢。環保扣件 不僅符合環保法規,也能吸引重視環保的 消費者和公司。

• 智慧緊固技術: 將智慧技術整合至緊固解 決方案是新興趨勢。RFID 扣件和扭力監測 系統等創新技術透過提供有關緊固狀況的 即時資料來強化組裝流程。這些技術對於 精密度和可追蹤性要求極高的產業 ( 例如 : 航太和汽車製造業 ) 尤其具價值。擴增實境 (AR) 工具也被用來協助緊固製程。例如,具 備 AR 功能的連接扭力扳手可以引導操作 人員完成複雜的組裝任務,確保準確性和 效率。

• 客製化與特殊扣件: 針對特定應用量身打 造的客製化扣件需求日益增加。各行各業 都在尋找符合獨特設計要求的扣件,不論 是為了美觀目的、特定機械特性,或是與 3D 列印等先進製程的相容性。防破壞以及各 種高性能的特殊扣件在航太、汽車和電子 等領域越來越受歡迎。這些扣件可提供更 高的安全性和性能,滿足先進應用的特殊 需求。

結語 扣件產業雖然面臨挑戰,但正處於創新與成長的軌道上。

如果利益相關者能夠主動參與新興趨勢,並投資於先進應用, 將能夠在美國扣件市場不斷演進的格局中處於有利地位。其中 一些挑戰包括 :

• 供應鏈與關稅: 扣件產業面臨供應鏈中斷和關稅相 關的挑戰。關稅對生產成本有影響,但仍能將這些成 本轉嫁給客戶以維持獲利能力。要克服這些挑戰,需 要策略性的採購和供應鏈管理,以確保一致的交貨和 成本效益。

• 永續性與環境法規: 環境問題和法規促使製造商採 用永續性的作法。這包括使用回收材料、降低能源消 耗及減少廢棄物。以永續性為優先考量的公司不僅能 符合法規要求,還能吸引具有環保意識的消費者和企 業,從而獲得競爭優勢。

• 技術進步: 迎接技術進步帶來的重大機遇。採用自動 化、機器人和先進製造技術可提高生產效率和產品品 質。投資研發以創新緊固解決方案將使公司走在產業 的最前端。

6. https://www.businesswire.com/news/home/20250430919764/en/ United-States-Construction-Industry-Databook-2025-IndustrialConstruction-Grows-with-E-commerce-and-Reshoring-TrendsInstitutional-Construction-Faces-Funding-and-RegulatoryHurdles---ResearchAndMarkets.com

總而言之,在技術創新、不斷演進的產業需求,以及對永 續發展的重視下,美國先進應用領域的扣件市場已準備好大 幅成長。能夠適應這些趨勢,並滿足航空、汽車和電子等領域 專業需求的公司,將發現大量的擴展機會。透過投資先進材料、 智慧技術及永續作為,製造商可在這個充滿活力的市場中取 得競爭優勢。

著作權所有

美國市場 建築 扣 件商機 2025 在強勁的基礎建設發展、技術進步以及朝永續建築發展的共同推進下,美國的建築扣件市場將於 2025 年顯著成長。 根據美國經濟分析局的資料顯示,截至 2025 年,美國建築業仍是該國經濟的基石,對 GDP 的貢獻超過 4.1%。2024 年 投入使用的建築總值超過 2.1 兆美元,預測顯示由於聯邦基礎建設支出以及住房和商業財產需求的增加,建築業將持續 成長。受到人口結構壓力和低房屋存量的影響,住宅用建築 ( 包括單戶住宅和多戶住宅 ) 約佔總建築支出的 45%。同時, 在製造業回流及民間參與公共建設的帶動下,非住宅用建築 ( 包括製造工廠、辦公空間及醫療設施 ) 較去年同期成長 7.6%。此外,《基礎建設投資與就業法案》在未來十年內將撥出 1.2 兆美元,為運輸、公用事業和公共工程注入前所未 有的資金,直接刺激對結構材料(包括建築扣件)的需求。這種跨領域的擴張,使美國在 2025 年成為全球最具活力、 機會最豐富的建築市場之一。

市場概要 全球建築扣件市場預計將從 2023 年的 884 億 美元成長至 2033 年的 1,467 億美元,年複合成長 率為 5.1% 。此一擴張反映出全球對於建築扣件的需 求不斷增加,其動力來自於基礎建設的發展,以及 對耐用、高效能扣件解決方案的需求。 2023 年美國 建築扣件市場規模為 46.8 億美元。 美國建築扣件產 業預計從 2024 年的 48.5 億美元成長至 2035 年的 71.6 億美元。在預測期間 (2025 – 2035 年 ) ,美國 建築扣件市場的年複合成長率預計約為 3.603% 。 1

此成長主要是由於扣件(如 : 螺栓、螺絲、壁虎、 墊圈和螺帽)在各種應用中扮演重要角色的建築業 需求增加所帶動,包括框架、屋頂和基礎建設工程。 在聯邦資金的支持下,住宅與大型基礎建設計畫的激 增,大幅提升了結構扣件的需求。建築材料和技術的 創新,例如 : 預製和鋼構,也鼓勵採用具有較高強度 重量比、耐腐蝕性和易於安裝的專用扣件。儘管面臨 原物料價格波動和全球供應鏈限制等挑戰,美國建築 扣件市場仍將在強勁的建築活動和基礎設施開發的持 續投資的帶動下,保持上升軌跡。

各區域觀察 美國市場的建築活動呈現區域性差異,因此扣件需求 也呈現區域性差異 :

• 東北部 : 都市重建計畫與老舊基礎設施翻新帶動需求。

在美國東北地區,包括紐約州、麻薩諸塞州、賓州 和新澤西州等重要州,廣泛的都市重建計畫和翻新老化 基礎設施的迫切需要,大幅拉動了對建築扣件的需求。 根據美國土木工程師學會 (ASCE) 的資料,東北地區超 過 45% 的橋梁已使用超過 50 年,供水、下水道與運輸 系統的許多重要元件可追溯至 20 世紀初。單在紐約市, 美國設計與建設部在 2022 年至 2026 年間就撥出 130 多 億美元進行基礎設施升級,其中大部分用於道路重鋪、 橋樑加固及公共住宅翻新,每個專案都廣泛使用高耐用 性扣件進行結構與公用設施加固。波士頓已啟動超過 80 億美元的再開發專案,包括綠線延伸及海岸復原建設, 進一步刺激對耐腐蝕壁虎、抗震螺栓及特殊鋼材扣件的 需求。隨著舊式建築的改造以符合現代能源法規和結構 安全標準,預計到 2027 年美國東北地區扣件市場的年 複合增長率將為 5.3% ,使其成為扣件製造商和供應商最 活躍、機會最豐富的地區之一。

1https://www.marketresearchfuture.com/reports/us-construction-fasteners-market-18483?utm_source=chatgpt.com

惠達雜誌

• 中西部 : 產業計畫和製造設施有助於穩定扣件的使 用量。

中西部地區 ( 包括俄亥俄州、密西根州、伊利諾州 和印第安納州等工業重鎮 ) 強大的製造業和工業發展基 礎持續帶動對建築扣件的穩定需求。根據美國統計局 的資料顯示,中西部佔全國製造業總產值近 25%,截 至 2024 年,每年製造業 GDP 超過 5,800 億美元。英 特爾 ( 在俄亥俄州投資 200 億美元建立晶片製造廠 )、 福特 ( 投資 37 億美元在密西根州和俄亥俄州生產電動 車和電池 ) 和 Stellantis ( 投資 25 億美元在印第安納 州建立電池廠 ) 等公司的重大投資正在改變該地區的 工業面貌。在建造和長期維護階段,這些設施都需要 數百萬個結構和機械扣件。此外,中西部正經歷倉儲 和物流中心的復興,芝加哥和哥倫布等城市在 2022 年

至 2024 年間新增超過 6000 萬平方英呎的工業空間, 增加了對鋼製壁虎、混凝土螺絲和抗震螺栓的需求。 隨著該地區老化的工廠基礎設施現代化,並轉向先進 製造業,中西部地區的扣件市場預計到 2027 年將保持

4.7% 的年複合增長率,對扣件供應商和 OEM 代工廠 來說,這是量能和交易金額成長的機會。

• 南部 : 人口快速成長導致住宅用建築增加。

美國南部 ( 包括德州、佛州、喬治亞州和北卡羅

挑戰與考量 儘管市場展現顯著的成長機會,但同時也面臨幾項 需要小心關注的關鍵挑戰 :

• 原物料成本:佔扣件製造商總原物料成本近 70% 的 鋼價過去兩年的波動幅度高達 25% 。如此的波動直 接影響生產支出,迫使公司頻繁調整定價策略以維持 獲利能力。例如,鋼價上漲 10% 會讓最終產品成本 上漲 7% ,影響在對價格敏感市場的競爭力。

• 供應鏈中斷:過去 18 個月由於新冠疫情、地緣政治 緊張和塞港等因素造成的供應鏈中斷已導致關鍵原料 的平均交期延後 30 至 50 天。約有 40% 的扣件製造 商表示出現間歇性缺料迫使生產減緩或暫時停工,突 顯出全球供應鏈的脆弱性。

• 法規遵循:遵守日益嚴格的建築規範和環保法規影響 了扣件業約 85% 的公司。要維持合規性就必須持續投 資研發,研發預算平均每年成長 12%。在對不符合規 定的產品處以罰款或限制市場准入的法規推動下,環 保塗層和可回收材料等創新產品正逐漸成為標準。

來納州等快速成長的州 ) 人口持續快速成長,直接帶動住 宅建築激增,進而帶動扣件需求。根據美國統計局的資 料顯示, 2023 年人口成長最快的 10 個州中,有 7 個位 於南部,其中德州在一年內新增超過 47 萬名居民,佛州 則增加超過 36.5 萬名居民。這種人口結構的轉變助長了 龐大的房屋需求: 2024 年,南部將有超過 740,000 個新 的單戶住宅動工,佔美國單戶住宅動工總數的 55% 。每 棟住宅建築都需要數以千計從框架釘、螺絲到地腳螺栓 的各種扣件,這讓該區扣件的消耗量大幅上升。此外, 奧斯汀、亞特蘭大和坦帕等城市對於多戶家庭開發和總 體規劃社區的強勁需求,已將美國南方的住宅許可證推 高至每年近 120 萬個單位。由於人口持續流入,加上有 利的稅務環境,預計到 2026 年南部住宅市場的扣件使用 量將維持 5.2% 的年成長率,使其成為以建築業為目標的 扣件製造商的關鍵地區。

• 西部 : 地震好發地區對抗震建築的重視影響著扣件規範。

在西部地區,由於地震風險高,約 75% 的新建案 採用抗震設計。如此的關注帶來嚴格的扣件規範,超過 60% 建築中使用的扣件需要符合更嚴謹的剪切和拉伸強 度標準,藉以承受地震力。因此,製造商報告指出,對 抗震認證的專用扣件需求增加了 40% ,直接影響建築材 料的選擇和安全規範。

未來展望 為了善用預期的市場成長,企業應策略性地專注於多 項關鍵領域 :

• 產品多元化:創新並開發專為利基應用而設計的扣件, 例如 : 適用於地震好發地區的抗震解決方案,以及適用 於綠色建築的節能扣件。

• 永續發展重點:優先使用環保材料,並實施永續製程, 以符合不斷演進的綠色建築標準和法規。

• 數位整合:採用先進的數位工具來強化庫存管理、提升客 戶參與度,以及優化供應鏈作業,以提高效率和回應能力。

• 訓練與支援:廣泛投資對承包商和建築商的全面技術訓 練和支援計畫,以確保扣件的正確選擇、處理和安裝, 減少錯誤並提昇整體專案品質。

由於基礎建設投資的增加、持續的技術進步,以及對 永續發展的強烈重視,美國的建築扣件市場預計將在 2025 年經歷強勁成長。企業若能主動配合這些新興趨勢調整策 略,並同時因應關鍵挑戰,將能在這個充滿活力與競爭的 環境中茁壯成長。

著作權所有 : 惠達雜誌 / 撰文 : Behrooz Lotfian

台灣螺絲公會 打造「台灣館」 助業者突破美國關稅與匯損逆風

拉斯展即將揭開序幕,台灣螺絲公會理事長蔡永裕與高雄市政府合作並爭取到經 發局補助約 350 萬元,突破以往僅租用單一攤位的慣例,將攤位擴大至六個,設立「台 灣館」專區,免費提供給未在展場設攤的台灣業者使用,協助業者集中展示商品、邀 請客戶洽談,提升爭取訂單的機會。

此館的形象將主打台灣過去橫跨半世紀以來的扣件製造工藝以及足以媲美歐美國 家的高質、高性價比的扣件產品,並在會場上設置兩間可閉門商談的會議室,以及四 張開放的會議桌,提供給公會的會員邀請任何客戶前來使用。公會還將邀請美國扣件 經銷商協會成員前來做客。此舉預期將有效提升台灣業者在美國市場的曝光度與訂單 能見度。

台灣螺絲產業高度依賴外銷,美國市場占台灣出口約 45% ,但今年面臨美國鋼鋁 關稅加徵 50% 及台幣大幅升值等雙重衝擊,許多業者因匯差損失慘重,經營壓力 倍增。蔡永裕表示,設立「台灣館」是為了幫助業者走出關稅和匯率逆風,創 造更多商機,強化台灣螺絲產業在全球市場的競爭力。

今年展會因美國關稅政策成為業界觀察焦點,公會與高雄市政府 攜手設立的台灣館將成為台灣螺絲業者搶攻美國市場的關鍵利器。

滙達籌組 拉斯展展後參訪團 規劃參訪大成鋼美國總部及 全美最大扣件通路商大國鋼 (BBI)

美國拉斯維加斯螺絲 暨機械設備展 以傳統為本,依創新前行

定於今年 9 月 15-17 日在拉斯維加斯舉 辦的展會主題為「以傳統為本,依創新前 行」,反映出產業穩固的基礎與持續的革 新。與會者可以期待看到一個受大家長久喜 愛且充滿活力和令人興奮的嶄新展覽體驗。

2025 年的 IFE 展將再度舉辦經典的特 色活動,例如 : 歡迎派對、高爾夫球賽和著 名的 IFE 頒獎典禮,提供業界交流和慶祝的 絕佳機會。知識的傳授也將成為 2025 年展 會的核心環節,展場內外將會有更豐富的學 習機會。今年 IFE 展也將於開展前的週一舉 辦半日會議,該會議有三場一小時的深入研 討會,內容涵蓋與會者和參展商息息相關的 重要產業議題。此外,在整個展會期間,由 專家主持的會議將針對產業挑戰、未來趨勢 和創新解決方案進行討論,確保所有參與者 都能獲得寶貴的見解。

2025 年美國拉斯維加斯螺絲暨機械設 備展 (IFE 展 ) 將再次成為全球扣件產業專 業人士不可錯過的盛會。隨著攤位銷售即 將快速額滿,供應商和製造商正積極搶位 以展出最新的扣件、技術、機械和工具。

IFE 北美區客戶經理 Ali Gonzalez 表示 : 「IFE

將是我們迄今為止最具活力的盛會,扣 件行業的佼佼者將聚集在同一屋簷下。我們的主題是『以傳統為本,依創新前行』,我們 將在尊重行業傳統的同時,透過擴展教育和頂級交流活動迎接未來。無論您是參展商還是 與會者,這裡都是您交流、學習和發展業務的好地方。

請勿錯過參與扣件產業盛會的機會!

報名參展請洽台灣總代理滙達 滙達業務部 TEL: 06-295 4000 / Email: sales@fastener-world.com.tw

1043

恆昭企業股份有限公司 www.srcrivet.com

Air Tools, Hand Tools, Rivets/Rivet Nuts

恆昭集團( SRC )是全球主要全系列拉釘、 拉帽與省力化高品質拉釘工具的研發製造商之 一。中國廠目前拉釘年產超過 60 億支,拉釘工 具月產 10 萬支。我們在 2021 年於泰國設立 4.5 萬平方公尺的新廠。目前泰國廠已使用 50% 的面 積,有約 200 套自動成型設備,將增加到 300 套, 未來泰國廠的拉釘月產量將從現在的目標 1 億支 達到 3 億支。恆昭累積超過 40 年的專業銷售經 驗,行銷全球 150 餘國,累積 700 多家客戶。專 業技術、誠信服務的 SRC, 將是你的最佳選擇。

1137 寬仕工業股份有限公司 www.kwantex.com.tw

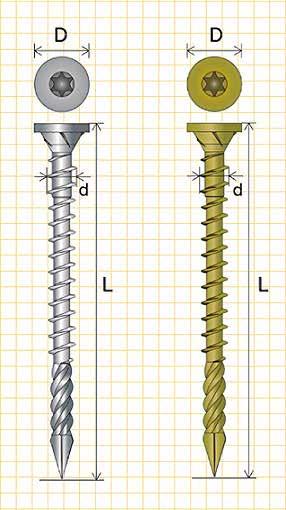

Hand Tools, Screws

寬仕工業股份有限公司是台灣專業螺絲研發 製造商。我們的產品主要用於木工、傢俱業和 建築市場,每年致力於開發新產品,例如 KTX Archimedes´Secret Screw, KTX-Hidden Decking Screw System, KTX-Terrace(IPE) Screw 、 TTX Socket Screw 等等。

寬仕將於 2025 年 9 月美國拉斯維加斯展展示 這些創新產品,歡迎來我司攤位 1137 參觀。除了

ISO 9001、ISO 14001、ISO 45001 管理系統,寬仕 也於 2022 年取得 ISO 14064-1:2018 ( 溫室氣體查驗

聲明書 ),2023 年取得 ISO 14067:2018 ( 碳足跡查 證聲明書 )。2024 年底完成 ESG 永續報告書,2025 年開始使用綠電,作為公司投入公司治理、環境永 續和社會關懷的實際呈現。

1140

友鋮股份有限公司 www.spec.com.tw

Screws, Studs & Threaded Rods, Threaded Fasteners 友鋮股份有限公司成立於 2001 年,是一家 領先的多元客製扣件製造商。總部設於台灣並擁 有自己的製造工廠,我們服務於廣泛的產業,包 括汽車、電子、建築和工業應用。友鋮透過取得 ISO 9001 、 IATF 16949 、 A2LA 、 ISO 14001 等認 證,以及經第三方驗證的碳足跡評估展現對品質 與永續發展的承諾。 2024 年,友鋮正式成為台灣

的上市櫃公司。在友鋮,我們相信強大的夥伴關係是長 期成功的關鍵。無論您是客戶、員工或供應商,都是我 們旅程中重要的一員。我們期待與您共創美好未來。

936

連宜股份有限公司 www.rexlen.com.tw

Bolts, Safety Products, Threaded Fasteners

Rexlen Corp. 在扣件產業已深根超過 40 年,我們 擁有 ISO & TAF/ISO 17025 認證,工廠端也陸續通過 ISO 、 IATF 16949 、 ISO14001 & A2LA 實驗室認證。透 過製程的創新及改善,為客戶提供交期準時,高品質且 具競爭力的價格。我們更擅長客製化產品,同時也致力 於提供全球客戶需求且滿意的服務。

851

宗鉦企業股份有限公司

www.cfc.net.tw

Fittings, Pipes & Hoses, Lubricants, Nuts & Locknuts

材質 : 碳鋼、不銹鋼、黃銅、鋁

產品項目 : Conical Washer Nut, Keps Nut, Nylon Nut with Washer, Flange Nylon Nut with Washer, Flange Nut with Washer, Nylon Cap Nut, Cap Nut with Washer, Acorn Cap Nut, Flange Nut, Flange Nylon Insert Lock Nut, Nylon Insert Lock Nut, Finish Hex Nuts, Heavy Hex Nut, Coupling Nut, All Metal Prevailing Torque Type Nut, Self-locking Nut, U Nuts, Flange Welding Nut, Hex Welding Nut, Square Welding Nut, Round Welding Nut, Fitting Nut, Special Nut, Automotive Nut.

1146

金大鼎企業股份有限公司 www.lwfasteners.com.tw

Bolts, Nuts & Locknuts, Threaded Fasteners

金大鼎企業是一家在台灣擁有超過 30 年經驗的專業 扣件供應商,我們專精於建築、汽車、機械及一般產業 的應用。金大鼎與台灣、中國、越南、泰國等地數百個 合格分包商合作,提供全方位的緊固產品,包括螺栓、 螺帽、螺絲、墊圈、沖壓件、組合零件、銷、非金屬及 機械零件等。擁有廣泛的採購能力和深入的產業知識, 金大鼎在專案報價時提供有價值的建議,協助客戶降低 進口成本並簡化採購流程。我們的使命是提供結合品質、 效率和成本效益的一站式採購解決方案。為了更好地服 務我們的全球客戶,我們在台灣和中國均設有倉庫,使 我們能夠根據年度需求為合約訂單支援庫存計劃並提供 來自工廠的產品。確保可穩定供應和快速回應對關鍵產 品的需求。

透過我們經驗豐富的銷售團隊和專業的品 質檢驗人員,金大鼎致力於為全球客戶提供增 值服務、穩定的品質和長期合作的機會。

1041 鉞昌五金有限公司 www.aeh.com.tw

Cold Heading/Forming “Specials”, Rivets/Rivet Nuts, Threaded Fasteners

鉞昌五金有限公司創立於 1980 年,總部設

於台灣台北,專業製造與出口各式扣件產品。

我們的主要產品包含機械螺絲、焊接螺絲、防 拆螺絲、螺帽、以及各式盲鉚釘、實心鉚釘與 中空鉚釘等,並提供多樣化表面處理的客製化 零件。產品廣泛應用於機械設備、建築、汽車 運輸與家具五金等產業。我們不僅提供產品, 更致力於打造長期穩定的合作關係。多年來, 已成功與歐美、日本等國際客戶建立深厚合作 基礎。持續創新與技術升級,是我們永不妥協 的經營理念。

940

鉮 達國際股份有限公司

www.falcon-senda.com.tw

Electronic Fasteners, Screws, Specials 鉮達國際股份有限公司成立於 2007 年,專 注於螺絲的製造與出口,主要是以黑鐵材質為 主,產品尺寸涵蓋 #0 至 1/2 吋、M1.6 至 M10, 長度 : 達 300MM。主要產品包括依圖客製螺絲、 三角牙螺絲、自攻螺絲、內六角頭螺絲、塑膠 牙螺絲、硬木用螺絲(Screw for hard wood)、 機械牙螺絲、公制螺紋螺絲(Metric Thread Screws)、鑽尾螺絲等,此外,所有螺絲均可 依客人要求做特殊表面處理、包裝。

1047 貿詮實業有限公司 www.maochuan.com.tw

Fasteners, Stamping Parts, U-Nut, Deep Drawing Parts.

我們的專業在生產沖壓產品,特別是汽 車零件、建築和電子零件。擁有 50 多年的經 驗,我們嚴格執行 ISO 14001/ ISO 14064-1/ ISO9001/ IATF 16949/ VDA6.1 環境與品質管 理。我們提供客製化產品和最全面的服務,為 客戶整合整個生產流程。

詳情請瀏覽 www.maochuan.com.tw

847

淳康國際股份有限公司

www.a-stainless.com.tw

Screws, Wires/Wire Forms 淳康國際股份有限公司已有超過 30 年的不銹鋼扣件和 線材專業經驗。

產品範圍 :

標準品項

符合 IFI 、 DIN 、 ISO 和 JIS 標準

規格 : M1.0 ~ M12 (#2 ~ #3/8)

長度 : 1/8 ” ~ 16 ” (4.76 ~ 400mm)

材質 : 18-8SS (A2) 、 316C (A4) 、 305J1 、 410SS (C1)

以及特殊鋼材等級

針對硬木應用的專利設計

特殊設計

1040

瑞滬企業股份有限公司 www.ray-fu.com

Electronic Fasteners, Hex Head Cap Screws, Screws

瑞滬企業是一家專業的線材和扣件製造商及出口商。我們 擁有線材生產、螺絲製造、熱處理及包裝的一體化設備,提供 全方位的一站式服務。我們的產品服務於各行各業,包括建 築、家庭裝修和汽車零組件,主要市場集中在歐洲、美洲和亞 太地區。在瑞滬,我們以品質為優先,並致力於持續改善。我 們已取得 ISO 9001、ISO 14001、IATF 16949、ETA 和 AS9100D 等認證,以擴大我們的產品種類和提升客戶服務。

639

金詳企業股份有限公司 www.jinhsiang.com

CNC Machining, Metal Working, Metrics Fasteners 專精於 CNC 車銑複合零件加工、自動車床加工、 CNC 銑床加工,為服務客戶,從原物料採購、機械加工、熱處理、 表面處理到組裝、包裝,金詳提供完整的服務,生產之零組 件運用於醫療、電子、機械、建築五金、衛浴五金、自行車、 汽車、機車、船舶、軍工 等領域。為了提供給客戶優良 的產品品質、有競爭力的價格、快速且精確的交期,致力於 生產技術的提升與生產流程的控管,並具備嚴格的品質管理 制度與精良的量測設備。公司設備有凸輪自動車床、 CNC 走心 / 走刀車銑複合機、CNC 銑床。加工材料:鐵、銅、鋁、 不銹鋼、合金鋼、鈦金屬、塑膠鋼等材料。加工能力:直徑 1.5mm~300mm ,歡迎各產業 O.E.M./O.D.M. 。

俊良貿易 擁有電鍍廠的扣件和五金件製造出口商

俊良貿易是台灣一家領先的工業扣件和金屬五金零件製造商和出口商。自 1978 年以來,俊良貿 易在亞洲的全資工廠已為全球客戶提供高品質的螺絲、螺栓、墊片、螺帽、壁虎和客製化五金產品將 近 50 年。旗下所有據點均已通過 ISO9001 和 IATF16949 認證,並專注於以符合成本效益的方式為客 戶提供品質極為穩定的產品和服務。

內部生產能力包括冷鍛頭、搓牙、二次加 工(包括鑽頭成型)、熱處理(中性硬化、滲 碳和碳氮化)、鋅 - 錫合金電鍍、浸鍍有機面漆、 墊片組裝、光學篩揀、客製化包裝和全球化物 流。目前平均每月生產及出口約 300 個貨櫃。 美國客戶合計消耗了近 1/3 的產量;若將整個北 美市場都計算在內,則該比例將增加至 40%。 歐洲仍然是一個龐大的市場,南美、澳洲、紐 西蘭、日本,以及越來越多的東南亞市場也是 如此。但北美仍是俊良貿易最重要的市場。

俊良貿易自有的 ZNK+ 合金電鍍廠於 2023 年在高雄啟用,專注於預防在嚴苛戶外環境中 的扣件腐蝕。月產能已於 2025 年初倍增至每 月 800 噸以上,並在北美、歐洲、澳洲和紐西 蘭市場中,越來越頻繁地被應用於更極端 ISO Class 4 和 Class 5 ( 鹽霧要求超過 2,000 小時 ) 的環境中。

俊良貿易在 2025 年美國拉斯維加斯螺絲暨機 械設備展 (IFE) 的參展重點將放在與現有客戶會 面、交換產業資訊 ( 包括關稅與目前報價 ) ,以及 讓客戶知道俊良貿易在台灣和海外擴充生產的最新 動態。俊良貿易期望拓展在專業建築、 DIY 包裝扣 件、 HVAC 及工業等領域拓展銷售通路,尤其是那 些需要暴露於極端天氣下的應用。

我們的客戶一直在尋求產品組合的差異化,並 降低整體採購成本,同時盡可能增加價值。今年的 重點將是俊良貿易自有 ZNK+ 富鋅多金屬合金塗層 系統的擴大產能介紹。俊良貿易也正與美國市場的 客戶緊密合作,優化供應鏈活動,來減輕較高進口 關稅所帶來的負擔。 誠摯歡迎您的造訪 !

著作權所有:惠達雜誌 / 撰文:曾柏勳

侑城股份有限公司積極拓展美國市場,今年將參加美 國拉斯展,展現其在汽車扣件及建築螺絲技術的領先實 力,並深入了解當地商業環境與客戶需求,期望藉此機會 強化與美國汽車產業的合作關係。今年展出的重點產品包 括 Aster Screw 螺絲以及客製化汽車扣件,其中包括電動 車應用零件。

專利Aster

Screw建築螺絲 Aster Screw 是一款多用途木工及建築專用螺絲, 配合新發明的 AT DRIVE ,與鑽頭能有更緊密的配合, 實現螺絲與木材的完美接合,提升鎖入效率與省力性, 同時有效避免螺絲鬆脫問題。這項創新不僅提升施工效 率,也強化產品耐用性,符合現代建築及製造業對高品 質扣件的需求。

擴大服務美國Tier 1、2 汽車供應鏈 攤位號 : 1151

在汽車扣件方面,侑城不斷投入先進設備升級,包括多衝程機台、 CNC 自動車床及多軸銑床加工設備, 致力於生產多元且精密的扣件產品。尤其針對電動車充電樁所需的銅系產品,侑城展現高度技術整合能力與 客製化服務,滿足汽車產業對高品質扣件的嚴苛標準。

侑城在此次展會中主要鎖定汽車產業的 Tier 1 、Tier 2 供應商與 OEM 製造商,期望建立穩固的合作管道。

面對美國市場的買主需求,侑城強調其在技術提升、品管嚴謹、產能擴充及客戶服務上的優勢,透過持續提 升產品附加價值與高值化扣件的開發,打造無法被取代的市場競爭力。

電動車充電樁商機浮現 侑城創新再啟航 目前侑城的全球銷售重心仍以歐洲市場為主,美國市場佔比約 20% ,而這次他們已做足準備透過此展再 擴大美國市場業務版圖。在美國市場,侑城觀察到電動車充電樁相關零件的商機逐漸顯著,這也成為公司未 來業務拓展的重要方向。

侑城憑藉其專利技術與先進製造設備,結合客製化服務,力求在全球汽車扣件市場中占有一席之地。此次 參展不僅是展示產品實力的舞台,更是開拓國際合作與深化美國市場布局的關鍵一步。他們將持續以技術創 新和品質提升為核心,積極應對全球市場挑戰,穩健推動企業國際化發展。

www.yowchern.com.tw 侑城 車用扣件與建築螺絲 拓展美國市場的創新之路

著作權所有:惠達雜誌 / 撰文:曾柏勳

攤位號 : 1240

順承企業 多元佈局 一應俱全的扣件供應 30年來,在美國市場從不缺席

順承與美國市場的歷史淵源久遠,這家從貿 易跨足製造的台灣元老級知名扣件廠商,從台灣 扣件產業剛誕生時就伴隨其成長至今。自 90 年 代起,順承就開始在俄亥俄直到拉斯維加斯的扣 件展會中參展, 30 年來每年不間斷,一直與美 國客戶保持友好緊密合作的關係。在今年的拉斯 展,順承也非常期待與位於美國的許多舊雨新 知的客戶相會,並表示在此展中與客戶面對面溝 通,便能以最有效率的方式回應客戶之需求,體 現順承對美國顧客的重視。

在現今快速演變的時代,以美國、歐洲為首 的扣件採購需求仍然強勁,許多國家的買主在尋 找具有「風險分散」能力的供貨來源。順承早在

多年前提早在世界多地佈局,在風險承擔能力方面 獲得許多客戶的肯定。至今該公司已建立起抵禦 風險的三大優勢,致力提供穩定的全球扣件供應。

多元化據點佈局,分散地域風險 成立 48 年以來,順承在台灣、中國、印尼、 越南、泰國、馬來西亞設立了工廠,充分發揮以 貿易起家的國貿能力,輔以台灣高品質的製造技 術且具有價格競爭力的成本優勢,享譽國際。多 點布局的優勢在於分散國際市場動盪時的區域性 風險,為全球顧客提供穩定的扣件供應。該公司 目前有四成顧客來自美國,五成來自歐洲,其餘 顧客來自世界其他各地。不論何時,順承都在您 背後提供安心的支援。

全方位扣件產品一應俱全, 一條龍供應

越南廠及中國廠主攻碳鋼螺絲 ( 其中越南廠以 小螺絲與尖尾螺絲為主;中國廠以大支螺栓為主 ) ; 印尼及馬來西亞廠主要生產不鏽鋼螺絲。所有工廠, 包括打頭、搓牙、割尾、夾尾、熱處理、電鍍都是 在各廠內的嚴格品管之下一條龍完成。

順承深知顧客對供應鏈效率與靈活性的需求, 特別在扣件產業中,能提供即時且穩定的庫存服務 是贏得信賴的關鍵。再透過即時生產系統,快速調 整生產排程與出貨頻率,確保產品在最短時間內送 達客戶手中,降低客戶的庫存壓力。

高度協調的生產與供應鏈管理,不僅提升了順 承對市場變化的反應速度,也強化了其作為全球扣 件供應商的競爭優勢。未來,順承將持續秉持創新 與服務並重的精神,深化與國際市場的連結,為客 戶帶來更卓越的價值與支援。

集創新、技術於一身 豐鵬 志在成為 「問題解決者」 攤位號 : 747

擁逾 18 項專利、將近 40 年的生產及研發經驗、 2,500 噸月產能、全年無休品質管理以及多達 200 種以 上客製螺絲解決方案是豐鵬持續對外展現超前優勢的絕佳證明。旗下生產的專利螺絲、特殊孔螺絲等品項熱 銷歐美日等 25 國,銷售佔比約 50% 的美國更是其重要的戰略市場。隨著 9 月拉斯維加斯螺絲暨機械設備展 開幕在即,豐鵬也已蓄勢待發,希望能在展期與美國業界夥伴和新客戶加強互動,也希望深入了解在地產業 並尋求更多與有高附加價值客製品需求客戶的合作機會。

為輕鋼構鎖固而生

幽浮大扁頭螺絲重磅發表

在強大研發力支持下,豐鵬曾發表許多為特殊 建材或工具打造的客製螺絲,包括無須預鑽孔即 能提升硬木對硬木鎖固效率的 MS 系列木螺絲。而 最新為輕型鋼構開發設計的幽浮大扁頭螺絲 (UFOFrame Pro Screws) 更是其為美國市場在兼顧效 率、品質和成本效益的最新力作,可一勞永逸解決 安裝效率低、螺絲滑牙、連接不穩及表面不美觀 等問題。此款新品主要為金屬對金屬對接設計,尤 其適用連接建築或其他結構輕型薄金屬部件等輕型 鋼構應用。特殊 UFO 改良型圓頭設計可在鋼表面 實現平整飾面,確保緊密貼合。深度增加 15% 的 十字孔則提供更高扭矩阻力,有效減少滑牙。專利 G2 尖點可輕易穿透連接高達 20GA.+20GA. 的鋼材, 取代傳統螺絲。

擴大OEM/ODM合作

開發市場最需要的解決方案

通過 ISO 9001 、 ISO 14001 、 CE 、 ETA 認證的豐 鵬與客戶合作緊密,其完整產線和客製彈性可協助開 發特殊扣件確保產品與新工具 / 材料的兼容性。研發 團隊和即時客服系統也能為客戶提供全方位技術諮詢 和售後服務。把業務從「單純銷售」提升至「提供解 決方案」是豐鵬在美國實現戰略升級的重要一步。透 過 OEM/ODM 或客製專案,豐鵬期望強化與重視品質 創新與永續的業者 ( 尤其是建築、裝潢、木作結構及 輕鋼結構等產業批發商、經銷商及大型承包商 ) 合作, 一起開發市場需要的扣件方案。因應歐美環保法規, 豐鵬也積極推動 ISO 14064 溫室氣體盤查,導入用電 監測和碳排管理,持續投資智慧製造提高產能和交期 靈活性,努力為全球客戶提供低碳的優質產品。

豐鵬表示 : 「我們積極透過參展、數位行銷和客 戶推薦深化品牌認知和市場滲透。未來我們將針對區 域需求投入更多專利品和客製方案,偕客戶打造更具 競爭力的合作模式,也期待在拉斯展與各地買家、經 銷商和產業夥伴建立聯繫合作,把產品價值最大化, 一起把扣件業帶往效率、創新和永續的新紀元。」

著作權所有 : 惠達雜誌 撰文

複合螺絲專家 看好未來全球相關產業應用對複合螺絲的熱切需求,旗下擁有一群在焊接技術和複合材料領域具備數 10 年經驗專業團隊的榮燊科技自 2022 年底成立以來即致力於複合螺絲的開發生產。近幾年來在眾多複合螺 絲同業之中更以新興黑馬之姿,展現其對生產品管規範的重視及在節能減碳降低過多原物料浪費的努力。

為了積極拓展全球客群,尋求更大的市場曝光度,榮燊今年 9 月將以展商身份參與美國拉斯維加斯螺 絲暨機械設備展,而這也是榮燊首度前進開發美國市場,屆時將向來訪的潛力客戶展示其在複合鑽尾、自 攻螺絲的優異製造技術和開發實力。

榮燊複合螺絲特色: 高強度、 大扭力、耐腐蝕、節能減碳

榮燊位於高雄岡山的廠區備有自動異材焊接機、 退火爐、搓牙機、全自動超音波清洗機和高週波局部 熱處理設備,以及專業的螺絲製造機台和全檢設備。

不只能滿足複合螺絲生產過程所需要的各種需求,也 能達到廣大客戶對良好的品質、合理的價格以及最短 的交期的多重期待。例如 : 榮燊以 SUS304 不銹鋼和

SCM440 合金鋼所熔接成型加工而成的複合螺絲就展 現出更優質的高強度扭力表現,另外其優異的防蝕耐 候表現和施工容易度也獲得不少客戶的肯定。

榮燊公司表示,採用自動化焊接製程可省去以 往需要進行車削的麻煩,也不必再擔心有浪費鋼材 的問題,製程上更加環保,達到節能減碳的目標。

加上每一支從榮燊出廠的複合螺絲皆經過局部高週 波熱處理,因此能確保更加穩定的產品品質。

符合歐盟法規 擴大策略聯盟 藉由開發符合歐盟建築產品法規( CPR No.3052011/EU )節能環保要求的高效率和高良率 複合螺絲,榮燊目前在歐盟市場的業務拓展持續看 俏。未來也正規劃在與現有歐盟客戶維繫良好關係 之際,積極與不銹鋼大廠搭起策略聯盟的橋樑,期 盼能進一步開拓美國和更多國際市場。

榮燊公司相信,複合螺絲毫無疑問將是未來全 球建築螺絲的應用主流,因此也將持續在美國和歐 盟市場擴大布局超前部署。只要當前的經濟不確定 性和地緣政治危機能獲得妥善解決,同時善用外部 機會和內部的優勢,絕對能為自己創造更多最有利 的商機。

攤位號 : 836

為拓展北美市場並推廣具差異化的高附加價值產品,慶達科技股份有限公司將在拉斯展中展示其在模具開 發、客製化與大批量生產的整合能力。此外,藉由推廣結構用強固螺絲、自攻螺絲及耐蝕塗層系列等專利產品, 強化市場區隔並提升利潤空間。

規劃展示:多材質應用螺絲 + 抗蝕塗層

慶達將展示的 SKT ® 螺絲可用於木材、塑膠、石膏板、金屬板(無需預鑽)及混凝土(需預鑽),不需頻 繁換螺絲,大幅省時省人力。其特殊螺紋與鋒利螺尖設計,使安裝快速且省電,沉頭設計確保安裝後表面平整, 適合 DIY 用戶及專業工班。將同步展示的 SKT ® 塗層具備卓越抗腐蝕性能,通過 SST 2,500 小時及 Kesternich 25 次循環測試,符合 ASTM B117 及 DIN50018 標準。它通過歐洲 C4 認證,可選購抗紫外線塗層,且提供銀、 紅、綠、黑灰、青銅等顏色選項,適合品牌化及 DIY 包裝設計。

慶達擁有自主專利設計與模具 開發能力,提供符合強度與安裝效 率的螺紋設計,縮短開發時程。他 們導入 ISO 體制與全製程追溯,提 供 PPAP 、扭剪測試及塗層壽命報 告;能快速換模且有備援產線,支 援急單需求,確保交期穩定;提供 客製化與附加價值服務,協助客戶 開發包裝與操作說明;推動 RoHS 合規,提供碳足跡與能耗改善報告, 支援綠色永續。這些特性都難以被 其他競爭者取代。

聚焦北美木構建築與去中化商機 慶達服務商業領域及工業市場。前者涵蓋美國 DIY 商店及大型零售商,後者則與主要企業的工程部 門合作,針對特定工業應用提供一條龍客製化解決方 案,尤其是需整合木材、鋼材等多種材料的組裝需 求。他們的產品 100% 出口,美國市場占 50% ,歐 洲占 30% ,其餘 20% 分布於澳洲、日本、韓國及其 他亞洲國家。隨著北美木構建築興起,對高強度、長

尺寸、耐氣候結構螺絲需求大增。這類產品不僅要求 抗剪力、拉拔力與安裝效率,更重視合規與供應鏈彈 性。加上美國買主在全球供應策略上減少依賴中國製 造,尋求高品質、交期穩定且有技術支援的替代供應 商,台灣慶達成為首選之一。透過技術創新與市場策 略,慶達成功在全球建立競爭優勢,為台灣品牌在國 際舞台上爭取更大聲量與市場份額。

著作權所有:惠達雜誌 / 撰文:曾柏勳

政策觀察: 2025年 美國動向展望 及其對扣件出口的影響

政策觀察: 2025年 美國動向展望 及其對扣件出口的影響 2025 年,美國川普總統重返白宮,重新打出「美 國優先」的旗號,迎來新一波的貿易政策。這些政策 對全球貿易趨勢有即時深遠的影響 - 尤其是對扣件業 等出口密集型產業。

隨著美國宣佈全國進入經濟緊急狀態、全面實施

10% 的進口關稅,以及各種雙邊關係日益緊張,全 球扣件出口商正處於一個急劇變化的貿易局面中。

川普政府領導下的2025美國貿易 政策變更概述

2025 年初最關鍵也最具爭議性的貿易政策變革 包括了川普政府於 2025 年 4 月 5 日根據國際緊急 經濟權力法 ( IEEPA) 宣佈對所有進口商品普遍徵收 10% 的關稅。這項措施適用於所有進口商品 ( 包括扣 件 ) ,不論原產國為何。此外,對美國有重大貿易順 差的國家 ( 例如 : 中國、墨西哥和德國 ) 現在也面臨 特定產品類別的關稅增加。除了這些措施之外,美國 政府還取消了最低 (de minimis) 門檻,該門檻之前 允許 800 美元以下的小額貨物可免稅進入美國。所

有來自中國和香港的包裹都已被取消這項豁免,對電 子商務和小型工業供應鏈造成重大影響。

對全球扣件出口影響

扣件 ( 從螺絲、螺帽到工業螺栓 ) 在製造業、建築業、國 防業和汽車業中是很基本的零件。美國既是扣件的主要進口 國,也是扣件的主要使用國,在很大程度上依賴來自亞洲和歐 洲的供應商。

關鍵數據 :

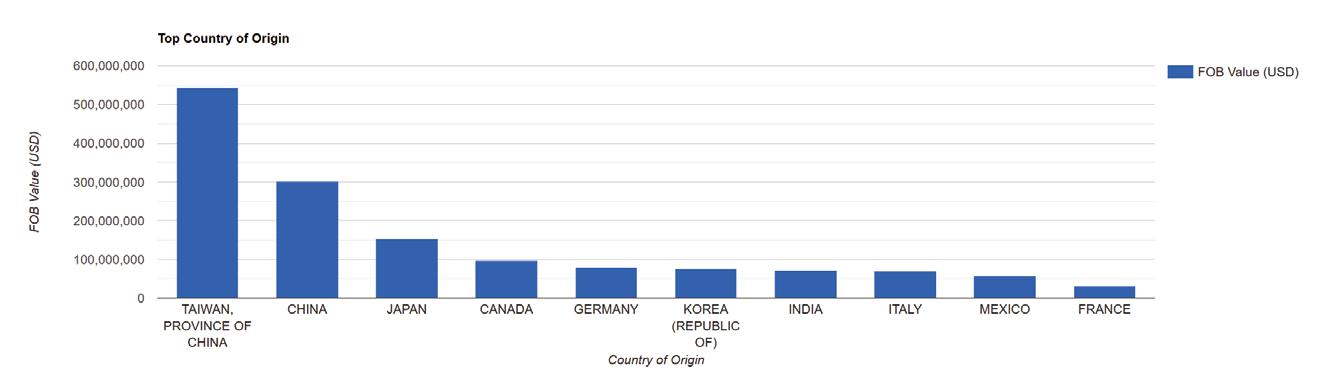

• 2024 年,美國進口了價值 71 億美元的扣件,其中超過 23 億 美元來自台灣,13 億美元來自中國,6.6 億美元來自日本,4.4 億美元來自德國 .. 等。

• 由於關稅引發的價格上漲,預計 2025 年每噸進口扣件的平 均價格將上漲 18-30% 。

• 根據美國工業扣件協會(IFI)的數據,美國國內生產能力不 足以滿足短期需求,尤其是在高規工業和航太級扣件方面。

立即性的後果 : 進口成本的上升迫使美國買家重新評估其供應商網絡,尤 其是在關稅和物流成本導致國際採購更加難以預測且成本更高 的情況下。在這種不斷變化的局面下,那些能夠維持價格穩定 或承擔部分關稅負擔的出口商將更有能力保住市佔。 買家越來 越重視一致性和可靠性,這促使他們重新評估長期合作夥伴關 係,轉而選擇那些能夠在全球不確定性背景下提供更具彈性定 價策略的合作夥伴。

同時,建築和汽車等主要產業正在努力解決嚴重的供應鏈中斷。由於 需要更改運輸路線和重新協商價格,交貨延遲和成本超支已變得司空見慣。

為此,許多美國原始設備製造商 (OEM) 正在加快在岸生產或從免稅國家採 購的步伐。

這種轉變為已簽署優惠雙邊協議的國家帶來了新的貿易機會, 使其成為尋求更穩定、更具成本效益供應解決方案的美國企業頗具吸引力 的替代方案。

歷史比較: 2017-2020 年川普時代與 2025 年政策

川普政府時期(2017-2020 年):貿易戰與關稅影響

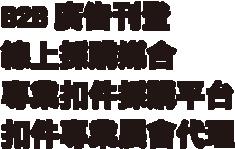

川普第一任期內,受中美貿易戰升級及對中國商品加徵關稅影響,美 國從中國進口的扣件數量( 圖1 )出現大幅波動。

• 2017-2018 年:進口額從 12.3 億美元增至 16.2 億美元,可能是由於關 稅生效前的超前部署所致。

• 2019-2020 年:急劇的下降緊跟在後, 2019 年降至 11.9 億美元, 2020 年進一步降至 8.98 億美元,反映了關稅執行和供應鏈中斷的 影響,而新 冠疫情的爆發又加劇了這一影響。

這段時期說明了,保護主義貿易政策和日益加劇的地緣政治緊張局勢 大大降低了中國扣件對美國進口商的吸引力。

拜登政府時期(2021-2024 年):復甦、多元化與持續波動 在拜登執政期間,由於疫情後需求激增,進口額在 2021 年反彈至 12.6

億美元,並在 2022 年達到 18.5 億美元的高峰。然而,這種復甦只是暫時的: • 2023–2024 年 : 進口額再次下降至 11.8 億美元,隨後小幅上升至 13.2 億 美元,這可能是由於努力實現供應鏈多樣化、對回流或近岸生產的興趣 增加,以及關稅和全球物流方面揮之不去的不確定性。

拜登延續了川普的大部分關稅政策,同 時釋放出對盟友供應鏈開放的訊號,促使 美國進口商採取更謹慎和多元化的採購策 略,而不是過度依賴中國。

預測摘要:美國從中國進口 的扣件( 2025-2028 年)

根據歷史趨勢以及可能出現的新增或 持續性關稅, 預計未來 4 年美國從中國進 口的扣件將逐漸下降。 2024 年,進口額 為 13.2 億美元。假設未來貿易政策的影響 適中,預測年減幅度將達到 1-5%:

• 2025 年 : 約 12.6 億美元

• 2026 年 : 約 12.2 億美元

• 2027 年 : 約 12 億美元

• 2028 年 : 約 11.8 億美元

這一趨勢反映了關稅引起的成本上漲、 美國買家持續努力從中國轉移採購,以及 採購策略性地轉移到免關稅國家或近岸國 家等因素的綜合作用。儘管由於中國的生 產規模,進口量可能仍很可觀,但除非未 來的貿易協定能夠改變目前趨勢,否則中 國在美國扣件的市佔預計將穩步下降。

隨著未來四年從中國進口的扣件數量 預期將逐步下降,地緣政治和政策環境不 僅將影響貿易量,也將影響全球採購策略 的結構。繼 2022 年達到約 18.5 億美元的 高峰後, 2024 年進口額下 降至 13.2 億美元,預計到 2028 年受關稅上漲、供應鏈 多元化和地緣政治緊張局勢 的影響將進一步下降至 11.8 億美元。

• 中國:結構性壓力與策 略轉變

中國將面臨最嚴峻的貿 易條件,包括高關稅和取 消小額貨物最低限度條款。

這項政策轉變直接影響到 1,800 多家扣件企業,並大 幅增加了與美國買家開展業 務的成本。 因此,中國出口 圖 1.

商現在必須迅速適應,可以是與美國經銷商合作,投資 美國組裝據點,不然就是在其最大的出口市場之一失去 市佔。預計中國進口量將下降,這與此壓力相符,因為 美國公司逐漸尋求穩定、免關稅的貨源。

• 歐洲:高關稅與市場萎縮

德國、義大利和法國等歐洲國家也未能倖免。 歐盟 的扣件產品被徵收 50% 的關稅( 6 月 4 日後),這削弱 了它們的競爭力。尤其是德國出口商,光在 2025 年就可 能損失 10-12% 的美國市佔, 這對他們現有的市場地位 來說是一個重大打擊。此次關稅影響強化了美國進口商 轉向多元化、遠離高成本、高政策風險市場的普遍趨勢。

• 台灣、越南和印度:多元化的受益者

相較之下, 台灣、越南和印度等國正逐漸成為美國 更青睞的替代市場。

台灣擁有高品質、高附加價值的工 業扣件產業,尤其有利於抓住正在從中國和歐盟轉移的 需求。同時,越南和印度既具備成本效益,又擁有不斷 增長的製造業基礎,使其成為美國買家的戰略供應來源。

未來四年美國扣件採購領域可能會出現策 略性調整:來自中國的進口量將逐年下降,歐 洲企業將因關稅而失去競爭優勢,而亞太國 家(尤其是台灣)將吸收這些轉移的需求。

這種調整不僅會影響貿易量,還會因為出口商競相爭取 美國市場加速供應鏈重組、合資企業和在地化組裝業務。

誰是扣件關稅的最大受害者? 扣件關稅上調的連鎖反應將對不同行業產生顯著 差異,但某些行業將承受更重的衝擊,尤其是汽車、 航太以及建築 / 基礎設施行業。這些產業嚴重依賴可靠 且具成本效益的扣件供應鏈,而新的定價壓力可能會侵 蝕利潤率、擾亂生產進度,並迫使企業在採購和生產方 面做出策略性轉變。

• 汽車:壓力下利潤空間緊縮

美國汽車產業尤其脆弱。一輛典型的美製汽車使用 超過 3,000 支扣件,這些扣件被嵌入安全系統、結構部 件和內部組件中。 由於新的關稅和進口扣件價格上漲, 每輛車的製造成本可能上升高達 190 美元。 雖然乍看之 下這個數字似乎不大,但規模化生產的影響將愈發嚴重, 尤其對於利潤微薄的大眾市場汽車製造商而言。其結果 可能是獲利能力下降、生產計畫延遲,以及本地化或重 新談判供應商合約的壓力加大。政策轉變也可能加速對 國內扣件生產的投資,儘管產能提升需要時間。

• 航太:特殊採購面臨風險

航太產業面臨更專業的挑戰。許多航太級扣件是精 密工程零件,主要從歐洲供應商進口。對歐盟進口產品 徵收 50% 的關稅將對該行業造成不成比例的衝擊,因 為該行業已經承擔高昂的研發和法規遵循成本。因此, 商用航空項目和美國國防合約都可能面臨成本上漲。 為此,航太企業可能會被迫投資國內的扣件製造能力, 或在政治中立的國家尋找利基供應商。

然而,由於嚴格 的認證標準和較長的資格認證週期,任何轉變都將是漸 進的,並且在後勤方面非常複雜。

• 建築與基礎設施:風險項目

在建築和基礎設施領域,由於這些領域依賴大量用 於結構鋼、公用事業和土木工程的通用扣件,其影響 將是廣泛的,且對大型專案尤其有害。

許多 2024 年預 算中的基礎設施開發項目並未預料到扣件成本的飆升。 隨著關稅生效,這些項目現在面臨利潤侵蝕、潛在延誤 或被迫重新設計以保持成本限制內的情況。

政府和私人 開發商可能需要申請關鍵進口產品的戰略豁免,或加快 當地採購計劃,以避免供應中斷。這種態勢也可能重 新激發人們對美製扣件的興趣,尤其是在「購買美國 貨」條款下由聯邦政府資助的基礎設施建設中。

總結 總而言之,川普政府推行的「美國優先」 政策正在重塑全球扣件出口樣貌。對包括中 國和歐洲在內的主要貿易夥伴徵收 10% 的進 口關稅,以及提高扣件關稅,預計將推高價格, 並嚴重擾亂供應鏈。這些變化將對汽車、航太和 建築等嚴重依賴扣件進行生產和基礎設施建設的 產業造成特別嚴重的影響。隨著美國日益尋求多元化 採購策略,台灣、越南和印度等國正在成為可行的替 代方案,並有可能在未來幾年重塑全球扣件供應網絡。

這些貿易政策的長期影響可能會導致美國從中國 和歐盟等傳統供應商進口的扣件數量下降,因為美國 企業正在尋求更穩定、更具成本效益的採購解決方案。

雖然其國內產能最終可能會上升,但滿足專用扣件的 需求仍需時日,尤其是在高規格領域。因此,扣件產 業將面臨一段動盪時期,出口商需要迅速適應美國貿 易政策的變化。對於那些能夠適應變化的企業來說, 這種轉變提供了一個在重組、注重關稅的貿易環境中 搶得市佔的機會。

惠達雜誌 /

Sharareh Shahidi Hamedani 博士

重塑中國扣件出口策略 過 去二十年來,全球經濟格局經歷了巨大的轉變。這 種變化的核心是中美兩個經濟巨頭之間力量平衡 的轉變。自 2000 年代初以來,中國已從一個低成本的製造 中心躍升為世界第二大經濟體,並透過大量基礎設施投資、 技術發展以及 「一帶一路 」等全球貿易倡議擴大其影響力。

同時,美國一直保持其世界領先經濟體的地位,推動創新、 金融支配地位和全球消費市場。

美中關稅衝突: 概要

這場貿易衝突的起源可追溯至 2018 年, 當時川普政府發起 301 條款調查,指控中國 不公平貿易行為、竊取智慧財產權和強制技 術轉移。為了作出回應,美國當局推出了一系 列的關稅措施,影響價值超過 5,500 億美元 的中國商品 ( 包括扣件 )。

美國對包括鋼鐵螺絲、六角螺栓、自攻 螺絲、墊片和結構扣件等多種中國扣件加徵 關稅。根據美國國際貿易委員會的數據顯示, 2018 年至 2021 年間,中國扣件進口價值下 降了 31%,這是貿易流動中斷的劇烈信號。

中國政府以自己的報復性關稅作為回 應,但對於扣件出口商來說,痛苦已經很 劇烈了。2017 年中國佔美國所有扣件進口 的 23.5% 以上,這個優勢在 2018 年後開始 縮減,2024 年中國佔美國所有扣件進口的 19%。

行動上的回應:為了生存進 行重組

1. 產能遷移

為了抵銷美國關稅的直接影響,許多中 國扣件公司開始將生產轉移到東南亞國家。

在越南、馬來西亞和泰國等國的中國企業為 了可持續進入美國市場,投資激增。

川普就任總統後出現了轉折。與前幾屆政府截然不同的 是,川普對中國發動了全面的關稅戰,指責中國不公平的貿 易行為和經濟侵略。這標誌著一個新時代的開始:關稅、制 裁和經濟民族主義將成為更廣泛的地緣政治競爭工具。

根據中國扣件協會(CFA)的資料,自 2019 年以來,廣東省和 浙江省有超過 15% 的一級扣件製造商將部分業務轉移至境外。 這種趨勢被稱為 「跨國轉線」,使出口商可以將其產品來源重新 標示為美國關稅不針對的國家。

然而,在川普第二任期間,美國政府針對這種轉向策略,對幾 個有充當中國貨物中介疑慮的東南亞國家大幅提高關稅。透過擴 大貿易執法範圍和收緊原產地規則,美國政府旨在堵住因跨國轉 運而被利用的漏洞。政策升級迫使中國製造商探索更複雜的離岸 策略,或將重點轉移到非美國市場。

2. 智慧製造和自動化 無法遷移的公司則轉向國內發展,使營運效率化並投資於自 動化。扣件生產廠的自動化升級有助於降低勞動力成本,部分彌 補了出口收入的損失。自動化還能提高產品的一致性並減少交貨 延遲,這些都是在全球競爭中的關鍵要素。越來越多的中國公司 正在將機械手臂、CNC 機器和基於人工智能的缺陷檢測整合到他 們的生產線中。

3. 壓縮對供應鏈依賴 透過減少對第三方原料供應商的依賴,並採用垂直整合的方 式,企業正在降低內部成本結構。將鋼材加工、鍍鋅和包裝整合在 同一廠房內的做法,在頂尖廠商中越來越普遍。

定價策略: 邊際利潤的取捨兩難

1. 價格戰兩難 為了在加徵關稅的情況下在美國保有價格 競爭力,出口商削減了邊際利潤。中國機電進出 口商會(CCCME)的數據顯示,自 2019 年以來, 扣件出口行業的平均毛利率已從 12% 降至 6%。 一些出口商為了維持與美國買家的長期合作關 係,自行承擔了部分關稅。例如,據報導,有家 總部位於杭州的扣件公司在主要的 B2B 交易中 補貼了關稅成本,此舉有助於保留合約,但卻導 致淨利潤大幅下降。

2025 年,美國根據重新啟動的 「美國第一 貿易強化法案」,針對包括扣件在內的更廣泛 工業產品,推出了新一輪的全面關稅,使情況更 加惡化。這些懲罰性的關稅,在某些情況下是先 前稅率的兩倍,將許多中國出口商推入無法承 受的成本壓力。本來就利潤微薄的企業被迫退 出美國市場,或大幅調整定價和供應鏈。該產 業現在面臨關鍵時刻,一些公司為了生存,轉而 尋求更高價值的產品或歐洲和拉丁美洲的替代 市場。

2. 產品區隔和分層定價

隨著價格競爭加劇,利潤空間縮小,中國 製造商正將重點從純成本策略轉向長期品牌發 展。領先企業不再單純以價格來區分市場,而是 投資於品牌形象和定位,以克服全球一直以來 對 「中國製造 」等同於廉價低品質產品的看法。

這種策略性的轉向包括建立差異化的產品 線 ( 基本、中級和高級產品 ) 。 不僅是依據功 能,而是依據品牌承諾、可靠性和感知價值。在 汽車和航太等關鍵產業中,信任和認證非常重 要,強大的品牌可以讓製造商有理由提高價格, 並降低被替代的風險。然而,建立一個可信的品 牌需要時間、一致性和大量的行銷投資,這是 許多中國公司現在才開始優先考慮的。

生產策略:

重塑扣件工廠 1. 創新和產品複雜度

出口商正從大量生產低價值的扣件過渡到 開發進入門檻較高的客製化高精密扣件。這種 策略性的轉向降低了價格競爭的風險,並增加 了客戶關係的黏著度。例如,針對航太客戶推 出一系列耐腐蝕、熱處理鈦螺栓的製造商,在 2020 年至 2023 年間,每單位平均售價從 0.06 美元倍增至 0.14 美元。

2. 環境合規性與永續性 除了關稅之外,美國進口商也越來越要求產品符合 ESG (環 境、社會與治理)規範。碳足跡或廢棄物處理標準不佳的工廠可能 會被列入黑名單。指標性的出口商正投資於無鋅塗層、水處理系統 及 ISO 14001 認證,以符合買家的期望。這種「環保合規性」不僅 保住了進入高薪西方市場的機會,而且最終可能成為競爭優勢。

市場多樣化: 對非美國市場的出口增加

1. 歐洲與 「一帶一路 」國家 為了避免對美國的依賴,中國對歐洲和 「一帶一路 」國家的 扣件出口迅速擴張。從 2019 年到 2024 年,中國對歐盟的扣件出 口增長了 50%。此增長部分得益於中歐鐵路快線,鐵路運輸時間 從海運的 45 天縮短到 15 天,提升了中國扣件在歐洲市場的吸引 力。2019 年至 2024 年,對亞洲的出口增長超過 52%。

2. 國內消費與雙重循環 作為中國更廣泛的「雙重循環」戰略的一部分,政策制定者 正在推動製造商平衡出口收入與不斷增長的國內消費。基礎建設 支出與都市化計畫正刺激國內建築與運輸業對扣件的需求。2024 年,中國國內對工業扣件的需求成長了 11%,地方政府的補貼進 一步激勵了本土採購,減少了對不穩定國外市場的依賴。

總結 美國對中國扣件徵收關稅不僅僅是一項稅收,更催生了一場 變革。曾經依靠數量和成本優勢茁壯成長的出口商,現在正專注 於敏捷性、價值創造和市場靈活性。從生產基地的轉移到產品線 的再造以及自動化的應用,中國的扣件行業正處於深刻的戰略演 變之中。

中國扣件出口的未來: 三種可能情況 1. 復甦與重新平衡 在這種樂觀情況下,新政府領導下的關稅談判會有所緩和, 而中國扣件製造商也會重新奪回部分失去的美國市佔。創新與多 樣化仍在繼續,但貿易正常化為企業提供了喘息空間。

2. 策略性地退出美國 在此情況下,中國公司將永久減少對美國的關注,將美國視 為高風險、低利潤的市場。投資將轉移到歐盟、非洲和南美,部 分轉移到東盟作為緩衝。

3. 全球整合 中國扣件業中最激進的未來包括產業整合,規模較小的企業 將被收購或淘汰。倖存者將成為規模較大、垂直整合、出口中立 的強大企業。

著作權所有: 惠達雜誌 /撰文Behrooz Lotfian

美中貿易緊張

如何重塑全球扣件 供應鏈 ※數據說明:本文數據來自美國人口普查貿易統計。美國人口普查貿易統計數據分析所有運輸方式的進出口。 進出口數據皆以一般美元離岸價 (FOB)計算。本文中的扣件定義為海關編碼 7318 下的任何產品(鋼鐵螺絲、螺栓、 螺帽、方頭螺絲、螺絲鉤、鉚釘、銷、開口銷、墊圈及類似品)。數量以總重 (公斤) 記錄。

持續的中美貿易緊張局勢對全球扣件供應鏈產生連鎖反應,從根本上重塑了多個行業的貿易流動、製造行為和策略規劃。 這些動態在 2025 年前幾個月開始透過兩大經濟強權間的貿易統計數據和扣件貿易變化顯現出來。此外,關稅和法規措施的 升級也開始對貿易政策和國際市場策略產生立即性影響。最後,製造商和進口商需要應對營運壓力,包括成本上升和物流中 斷,這些壓力加劇了中美之間的經濟差距。

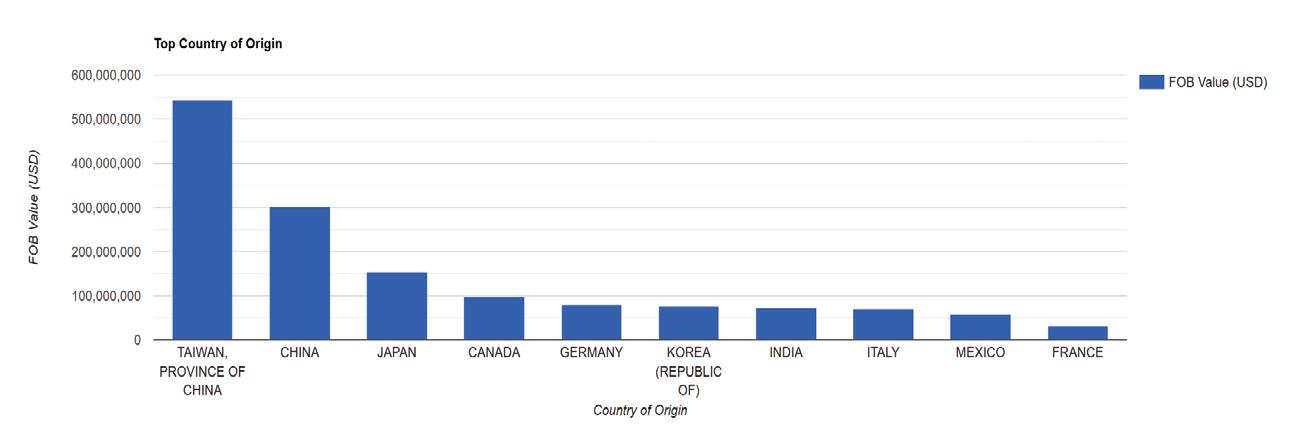

中美扣件交易統計趨勢 從整體來看,美國扣件供應鏈主要來自台灣和中國大陸。歷史上,台灣在美國扣件貿易中一直保持著 30% 以上的市佔, 其次是中國,市場份額保持在 17%-20% 之間 (表1) 。 日本、加拿大和德國等國扣件進口量緊追在後,分別佔 5% 到 10% 以上的市佔率。 2025 年 2 月,美國從中國進口的扣件總額為 9,500 萬美元,較 1 月的 1.21 億美元大幅下降 21% (表2) 。 2025 年 2 月的大幅下降可以歸因於 2024 年底美國總統大選結果公佈後的關稅威脅,美國進口商可能開始轉向更保守的心態。 整體而言, 2025 年 2 月美國扣件進口總量與 2025 年 1 月相比下降了近 11% 。

表 1. 2022-2024 年美國扣件進口來源

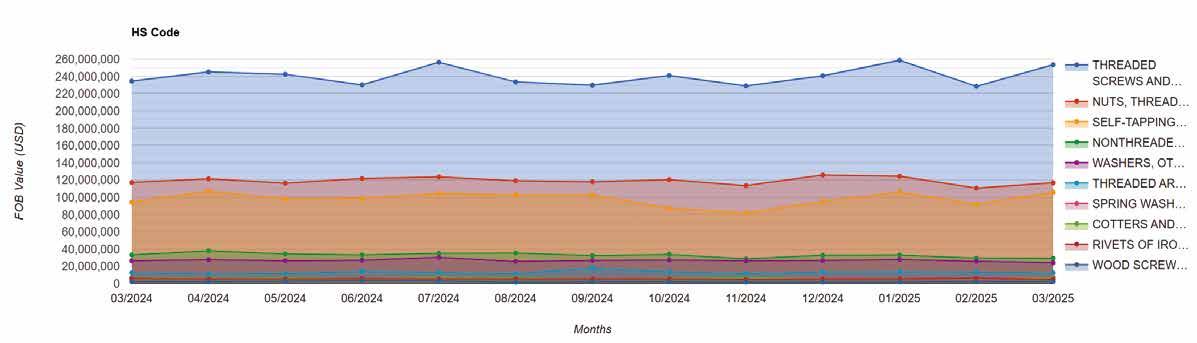

美國主要從中國進口海關編碼為 731815 (螺絲和螺栓)、 731816 (螺帽)和 731814 (自攻螺絲)的扣件 (表3) 。 這 些都是汽車業引擎組裝和懸吊系統的常見部件。此外,它們也用於製造機械設備、電子產品和家電。 2025 年 2 月,美國 從中國進口海關編碼為 731815 、 731816 和 731814 的扣件分別下降了 21.6% 、 17% 和近 27% 。除了市佔率下降外, 2025 年 2 月扣件進口量也大幅下降了 24% (表4) 。

表 3. 2022-2024 年美國從中國進口扣件品項 海關編碼

731815 - 不論

731814 – 鋼鐵

螺紋自攻螺絲

就美國扣件出口而言,中國一直是其第三大貿易夥伴,佔了 5% 的市場。排在中國之前的是加拿大和墨西哥,這兩個國 家合計佔了超過 50% 的市場。

由於《美墨加貿易協定》的簽署,美國與其鄰國夥伴的貿易往來因關稅優勢等諸多因素而受 益。 2025 年 2 月,美國對中扣件出口總額小幅下降 9%(表5)。美國對中出口的扣件包括 731815 、731816 和 731829(非 螺紋扣件) (表6) 。

表 5. 2025 一至二月美國出口至中國扣件

出口

目的國

海關編碼

- 不論有無 螺帽或墊片的鋼鐵

-

2025年的關稅緊張局勢 2025 年,中美貿易關係急遽緊張。首先,美國於 2 月以國家安全疑慮為由,對所有中國進口商品徵收 10% 的關稅。隨後, 美國於 3 月再次加徵關稅,將關稅稅率提升至 20% 。 4 月初,美國採取了更為強硬的立場,再加徵 34% 的關稅,使累計稅 率達到 54% ,不久後又進一步提高至 125% ,並澄清稱實際稅率將達到 145% 。作為回應,中國自 2 月起採取了一系列報復 措施,對美國主要出口商品徵收 10% 至 15% 的關稅,其中包括原油、液化天然氣、農業機械和汽車等大宗商品。 3 月時關 稅範圍擴大至大豆、紅葡萄酒和棉花等農產品。到 4 月中旬,中國進一步升級報復措施,先將所有美國商品的關稅提高至 84% ,隨後又提高至 125% 。中國也暫停了對高科技製造業至關重要的關鍵礦產和磁鐵的出口,標誌著中國在關稅之外的戰 略轉變。這些舉措共同標誌著貿易緊張局勢的急劇升級,對依賴中美供應鏈的產業(包括扣件業)產生了深遠影響。

關稅上調導致中國扣件價格大幅上漲,美國進口商和消費者的到岸成本也隨之上升。這很可能會導致依賴中國扣件的美

國製造商生產成本上升。考慮到扣件是多麼關鍵的部件,將會看到的供應鏈中斷次數就更不用說了。這些中斷可能導致延 誤或成本波動,最終為依賴中國供應商的公司帶來庫存規劃問題。

對製造和採購營運的現實影響 2025 年中美貿易緊張局勢的升級對整個扣件供應鏈的製造和採購運作產生了立即實質的影響。由於關稅上調導致進口成 本急劇上升,美國製造商面臨越來越大的利潤管理壓力,尤其是在汽車、電子和工業設備等對成本很敏感的產業。 採購團 隊正面臨交貨週期延長、特定扣件類型供應有限以及價格波動加劇等挑戰。未來政策變化的不確定性已促使許多公司調整 採購策略,例如提前下單或增加訂單量、提高安全庫存水平,或重新協商供應商合約以納入緊急條款。在營運面,製造商 也在承受來自中國供應延遲的影響,這迫使他們調整生產計劃,有時甚至導致裝配線停滯。

這些壓力不僅使供應商關係變 得緊張,而且還重塑了製造商在其全球採購策略中評估風險和彈性的方式。

總結來說, 2025 年關稅升級為美中之間的扣件運輸創造了一個成本更高、風險更大、更難以預測的貿易環境,對短期營 運和長期供應計劃都產生了影響。

著作權所有 : 惠達雜誌 / 撰文 : Sabrina Rodriguez

惠達雜誌

Fastener World no.213/2025

2025 越南河內螺絲展 塑造精密與創新的未來 2025 越南河內螺絲展是越南專為扣件與緊固元件產業所舉辦的指 標展覽,並以 2025 年越南製造展 (VME) 為主軸,匯集頂尖製造商、供 應商和業界專家共同探索最新技術、趨勢和商機。

在今年「讓不可能成為可能的未來」之主題下,展覽將展出扣件製 造、組裝系統和工業應用的尖端技術。無論您是想拓展交流管道、探索 新產品,還是想獲悉產業觀點,此展都是您的不二之選。

展館 : I.C.E. Hanoi, 91 Tran Hung Dao, Hoan Kiem, Ha Noi, Vietnam

日期 : 2025 年 8 月 6-8 日 | 09:00 – 17:00 (GMT +7)

展品項目 :

• 組裝及安裝系統

• 建築緊固元件

• 扣件製造技術

• 扣件製造機械

• 工業扣件和緊固元件

• 資訊、通訊及服務

• 螺絲與扣件

• 鎖固和軋紋機器

• 倉儲、經銷和工廠設備

訪客類型

來自關鍵產業的專業人士,包括 :

• 建築

• 汽車

• 航太

• 海事

• 電子 / 電氣產品

• 能源和發電

• 通訊技術

• 金屬產品

• 家具製造

• 基礎工程 ( 輕型 / 重型 )

• 暖通空調 / 冷氣 / 服務

• 衛生器具及配管工程安裝

歡迎參加「2025 年越南河內螺絲展」,發掘新的 商機、探索突破性的解決方案,並成為產業未來的 一份子。

• 更多展覽訊息請洽展會台灣銷 售總代理 - 匯達 業務部 (Email: sales@fastener-world.com.tw / Tel: 06-295 4000)

台灣展商 H03

匯達實業有限公司 www.fastener-world.com sales@fastener-world.com.tw 1987 年成立,匯達是國際馳名的扣件、五金及零組件產業行 銷媒體。超過 30 年經驗的團隊提供全球產業最具效益的市 場行銷方案,更整合實體刊物、線上 e 化平台、國際展會代理 和即時商訊服務,為業界提供多元化行銷管道、提升企業品 牌能見度、促進接單。

• 螺絲世界雙月刊 (1/3/5/7/9 月發行 + 11 月年鑑特刊 )

• 螺絲世界中國國際版 (2/6/10 月發行 )

• 五金工具、零組件、螺絲季刊 (2/5/8/10 月發行 )

• 全球新興國家螺絲特刊 ( 一年一刊 )

• 歐洲螺絲特刊 ( 兩年一刊 )

每期雜誌逾萬本發行全球 200 多國。每年參加 30 個以上國

際性展會,也是德國司徒加特螺絲展、美國拉斯維加斯螺絲 暨機械設備展、波蘭克拉科夫螺絲展、印度扣件展、墨西哥瓜 達拉哈拉螺絲展等展會的在台獨家攤位銷售代理。

淳康國際股份有限公司 www.a-stainless.com.tw angielu@a-stainless.com.tw

淳康國際股份有限公司已有超過 30 年的不銹鋼扣件和線材專業 經驗。

產品範圍 : 標準品項

符合 IFI、DIN、ISO 和 JIS 標準

規格 : M1.0 ~ M12 (#2 ~ #3/8)

長度 : 1/8" ~ 16" (4.76 ~ 400mm)

材質 : 18-8SS (A2)、316C (A4)、305J1、410SS (C1) 以及特殊鋼材等級

針對硬木應用的專利設計 特殊設計

台南振昌電機有限公司 www.chin-chang.com.tw tainanchinchang@tainanchinchang.com

設立 50 餘年,本公司熱處理爐設備包括退火、 回火、正常化、球狀化退火、調質、固溶化、滲碳、滲氮、 燒結、硬焊等各種批式、連續式之熱處理爐。承製產 業包括鋼鐵業、銅業、鋁業、螺絲線材業、汽機車零件、 自行車零件、五金、工具、模具、軸承齒輪、粉末冶金... 等等。台南振昌電機有限公司以服務與誠信擁抱天 下,歡迎國內外各界人士與本公司洽談合作,或洽詢 新爐技術,攜手共進,共同開發!

印度製造崛起:

2025 孟買螺絲展見證扣件產業 新機遇 由

於印度政府推動「印度製造」(Make in India)及「自力更生」(Atmanirbhar Bharat)政策,促進當地製造業升級與擴張, 基礎建設投資(如智慧城市、道路橋樑建設) 帶動了當地建築業對扣件的需求。在此背景中, 印度孟買螺絲展於 5 月 8 日至 10 日在印度孟 買國際展覽中心如火如荼開展。除了匯聚印度 當地與他國的扣件與機械展商之外,這一屆新 推出了「印度五金專區」,展出在「印度製造」 的國家政策之下當地蓬勃發展的工具與相關 機械產品、技術。

匯達的參展專員在此展的會場觀察到,第 一天開展人潮很多,包括匯達的攤位在內,許 多攤位都很忙且擠滿了訪客。這些攤位其中還 包括透過匯達報名參展的宏穎、琛元、鴻毅、 英飛凌。現場的展商多數來自印度,展品則相 當多元。專員提到:「看起來印度的扣件製造 業者有逐漸跟上台灣的腳步,也有向台灣採購 機械 ( 包括全新及二手的機械 )。」雖然在參展 當天,印度與巴基斯坦之間的關係達到高度緊 繃狀態且有濃厚的煙硝意味,但專員表示在孟 買當地感受不到此氣氛,一切正常運作。

專員觀察,現場有許多機械展商。此外,以 展商的屬性來看,大多是進口商 ( 進口產品至 印度當地 )、經銷商、品牌代理商,也包括模具 廠商與線材廠商。來訪的買主大多是印度人, 尋找的扣件產品種類很多元,包括家具用、建 築用、車用扣件,大多不會特地指定採購的扣 件類別。印度買主對於標準品的需求更大於客 製化產品。有買主表示,由於印度廠商無法提 供某些產品品項與原料,因此才來向中國或台 灣採購,匯達也在現場為這些買主提供即時的 廠商媒合服務。

主辦單位已公佈下一屆 2026 年 7 月 24-26 日在大諾伊達世博中心 (India Expo Mart) 開展,最新資訊請密切追蹤匯達官網 www.fastener-world.com。

著作權所有:惠達雜誌 / 撰文:曾柏勳

琛元 宏穎

鴻毅 英飛凌

接軌車用零組件供應鏈商機

年 5 月 21 至 23 日,一年一度的第 7 屆印 尼雅加達國際緊固件五金展在雅加達國 際展覽中心 (JIExpo Kemayoran Jakarta) 盛大開 展。在許多在地產業協會的協力支持下,2025 年的 展會共吸引來自 15 國約 150 家展商,使用約 8,000 平方公尺展覽場地,以及逾 15,000 名專業訪客一 起到場參與。

根據近期市場調查,印尼機車和汽車持有數 量與汽車扣件需求的持續成長呈現正相關,而扣件 是用來緊固汽車零件確保行駛安全的重要零部件, 在印尼車輛產業不斷成長的趨勢下,市場對扣件的 需求持續攀升。根據專家預估,2028 年以前印尼的 車用修護零部件市場營收將達到 176.8 億美元的 水準。此展同期也與其他車用零組件 (INAPA)、電 動車 (EV & Charging) 等汽車相關展會共同展出, 是觀察印尼車用相關零組件產業動態和發展趨勢 的重要平台之一。

惠達現場參展人員也觀察到,今年的訪客有許 多是來自印尼當地的車用零組件相關業者,也有幾 家來自印尼週邊國家,像是 : 印度、孟加拉、中國的 訪客前來攤位,主要以洽詢車用相關零組件、車輛 維修、車用五金工具的產品為主。

目前主辦單位已公布下一屆的展出日期是 2026 年 5 月 20-22 日在同地點舉行,更多展訊請 持續追蹤匯達官網 www.fastener-world.com。

著作權所有: 惠達雜誌 / 撰文: 副總編輯張剛豪

2025 中國上海國際緊固件 工業博覽會 - 成品、機械廠放眼「內銷」及「俄重建」商機

5

月 22-24 日,上千家中國和幾家海外緊固件相關 參展商齊聚上海世博展覽館一起為一年一度的上 海國際緊固件工業博覽會揭開序幕。今年共開設兩館,一 個是原材料、設備、模具和耗品館,另一個是緊固件成品館, 展出面積約 40,000 平方公尺。

展商普遍是以中國內銷為主的廠商,不過也有幾家希 望拓展中國內銷的歐美機械相關廠商 ( 例如 : SACMA 和 國民機械 ) 報名參展。此外,春日、鍵財、東明、正曜等約 10 來家台灣機械設備知名品牌,以及沖棒 / 工模具 / 線材 供應商也都選擇在今年參展加強曝光。

根據匯達人員觀察,受歐美新法規和關稅壁壘等因素 影響,今年的訪客主要以中國、印度或俄羅斯的買主為大 宗 ( 歐美訪客不多 ),且多是以內銷為主的買家。三天的展 期,訪客主要集中在第一天,惟第二日大雨攪局,觀展人 潮明顯受到影響。

有當地廠商向匯達人員透露,過去幾個月的全球大環 境變化對中國廠商的外銷表現影響甚大,因此很多廠商紛 紛改以強化內銷和轉向至印度、巴西、中南美等新興市場 的模式來應對。也有中國廠商提到,俄羅斯近期端出許多 戰後重建計畫對扣件需求大增,因此陸續也接到不少來自 俄羅斯買家的詢問和訂單,很多甚至是單一廠商無法全部 吸收必須分給 2-3 家下游廠才能如期交貨的大單。在歐美 不斷對中國施以經濟壓力之際,這樣的訂單確實為輸歐 美訂單大幅縮水的中國廠商帶來一線生機,緩解經營成本 壓力。此外,多位產業專家也受邀針對 CBAM 和美關稅的 議題舉行趨勢研討和產業高峰會。會中提到,CBAM 和美 關稅雖讓中企短期壓力加大,但若要避免中國市場內捲惡 化,廠商在外銷的布局仍要加強。

由於 6 月上海也舉辦了另一場國際扣件專業展,有展 商認為,雖然兩展規模都不小,在擴大市場機遇的前提下, 仍會積極參與這些產業盛事。但建議未來展期如此靠近 的情況下,或許能整合成一個大展,藉此吸引更多來訪海 外買主和擴大參展效益。

主辦單位已宣布下一屆展會將於 2026 年 5 月 20-22 日在上海世博展覽館舉辦。更多展訊請持續追蹤匯達官 網 www.fastener-world.com。

著作權所有: 惠達雜誌 / 撰文: 副總編輯張剛豪

2025 美國納什維爾螺絲展 建築類產品詢問度高

一 年一度的美國 Fastener Fair USA 於 5 月 28-29 日在美國東南部第 4 大城納什維爾 的 Music City Center 展覽場 C 館舉行。此展每年皆 在美國不同城市輪流舉辦,是北美地區專為扣件製 造供應鏈的製造商、經銷商、設備供應商、加工業者、 末端用戶之間創造交流合作和洽談機會的國際專業 貿易盛會之一。

今年的展商共計 206 家,主要來自建築、車用、 航太、家具、電子、重型機械、家電、航海、鐵道、醫療、 軍事、能源⋯等領域。展出各式工業扣件、建築扣件、 組裝及安裝系統、扣件製造技術等產品。匯達今年同 樣也加入台灣展區的眾多展商之列,與來自美國當地 的採購主現場進行互動交流。

根據匯達現場參展人員即時觀察回報,開展首日 台灣展區就出現好幾波看展人潮,甚至有續展的展 商表示比上屆人潮還要熱絡,這或許也是受今年美 國各種新關稅政策、匯率波動、運費大漲、原物料成 本攀升等不確定因素影響,進而催出更多當地買主 願意出來看展,藉此尋找更多替代的新機會。有些訪 客也對向東南亞和台灣供應商採購表達高度興趣。 來匯達攤位的訪客中有不少是想要採購建築相關產 品的。

雖然此展有不少只專注在區域性業務的美國在 地展商報名參加,但也吸引不少美國以外希望找到 合適的當地進口商和經銷商擴大合作的國際展商參 加。有中國展商就表示,在一些特定產品項目部分, 美國客戶還是需要仰賴中國的供應商,因為當地市 場無法充足供應。另一方面,台灣供應商一些較高附 加價值的品項在美國市場競爭對手較少,對當地買 家來說同樣具吸引力,但仍要注意台幣匯率的波動 可能對出口競爭力的影響。

主辦單位已宣布下一屆將於 2026 年 5 月 5-6 日 在美國東南部第 2 大城夏洛特的夏洛特會議中心舉 辦。據悉該城市也是家具製造業群聚重鎮,可能也有 機會吸引更多家具扣件買主前來。更多展訊請持續追 蹤匯達官網 www.fastener-world.com。

著作權所有: 惠達雜誌 / 撰文: 副總編輯張剛豪

2025 上海緊固件專業展 - 內銷仍重拚價、外銷拓展新興市場

今年的訪客主要還是以中國當地為主,海外訪客 並不算多。匯達現場參展人員表示,匯達攤位上有遇 到來自哈薩克、土耳其、馬來西亞和秘魯的海外買主, 會場上也偶有看到日本訪客到場參觀,可能也與 5 月 的另一個緊固件展日期太接近有關。

展覽期間許多展商和訪客也把握時間針對近期的 美國關稅、歐盟反傾銷、貨幣匯率、市場挑戰、新興市 場商機等議題進行意見交換。有中國展商就向匯達參 展人員表示,目前中國面臨來自歐盟的反傾銷稅額就 高達 90 幾 % 以及美國關稅不確定的影響,而來自中 國政府的補貼又不多,所以很多中國企業在經營上正 面臨艱鉅挑戰。不過也有展商表示,已有許多中國企 業紛紛轉向非歐美以外的市場發展,目前在中東和東 南亞已有不錯的表現。內銷方面,有廠商表示目前的市 場景氣仍低迷,中國國內以拚低價為優先的競爭策略 仍是難解的問題。

與

5 月底才剛落幕的上海國際緊固件工業博覽會日 期相差不到一個月,06/17-19 日的第 15 屆上海緊 固件專業展也於國家會展中心 ( 上海 ) 成功舉辦。

號稱「全球高端緊固件產業創新平台」,此展也經常被 視為觀察中國緊固件產業景氣的前哨站之一。今年共開設 1.1 號、2.1 號和 3 號館,吸引約 1,200 家以上中國當地和幾 家海外展商在 70,000 平方公尺的展場面積中展出各式碳鋼、 不銹鋼、特殊鋼製的標準 / 非標緊固件、車用連接件、鉚接 產品技術、金屬成型件,以及冷鐓成型設備、熱處理相關設 備技術、表面處理、工模具、檢測設備及實驗室儀器⋯等產 品服務。幾家台資機械設備類的企業也到場參展,希望能爭 取到中國當地扣件生產業者的訂單。

主辦單位在展覽期間同步舉辦十多場產業交流論 壇和螺絲之夜等交流活動和 B2B 買家配對會。下一屆 上海緊固件專業展將於 2026 年 6 月 24-26 日在國家 會展中心 ( 上海 ) 舉辦,繼續為海內外提供一個促進 意見交流、產業觀摩和商機媒合的重要商貿平台。

著作權所有: 惠達雜誌 / 撰文: 副總編輯張剛豪

2025 泰國曼谷國際工業製造展 人潮遽增!直接買主急需當地據點供應

6

月 18 至 21 日在曼谷 BITEC 會展中心舉辦的這場展會, 連續四天在開展半小時內集滿了訪客,比起前一屆的 人流顯然變得更多。此屆比起前一屆多出了幾個特徵:

主題館的多樣性增加

此屆除了中國館與台灣館之外,還有新加坡館、南韓館,並 設立了工模具專區。特別的是台灣精品獎(Taiwan Excellence Award)在展場中設立了特裝攤位,除了推廣此獎的得獎台灣 廠商之外,還在攤位上進行台灣製造技術的主題演講。

日資展商增加 日商過去數年來加大投資泰國,在此展中看到許多在泰國 當地設廠或是與泰國企業合作成立合資企業的日系展商。他們 雇用泰國當地員工在展場中提供現地供應的服務。這些日商大 多以非扣件業相關的機械公司和材料公司為主。

中國展商猛爆性增加 相對於其他主題館,此屆不只有一個中國館,而是多個中 國館散布在展場各處。若再加上數量相當多的零星中國展商的 攤位,目測此展的中國展商以及有中資背景的展商比例至少超 過一半。透過實地訪問,有中國展商還表示比例「甚至超過七 成」。中國展商表示,由於中國的內捲嚴重抑制內銷,許多中 國業者著眼於泰國衝刺外銷,因此對此屆中國展商的暴增「不 感到意外」。

訪客多為「直接買主」 此展的買主來自電子、組裝、汽車、機械這四大產業為主, 由於這些買主的產品需要使用非大量的扣件來完成組裝,因此 他們提出的採購要求有一個共通點:支援少量供應、必須在泰 國當地有設廠、可提供客製化產品。此現象也反映,在打入泰 國市場的扣件企業中,以能提供現地供應的企業最為吃香。 泰國的扣件需求前景仍佳

前來拜訪惠達攤位的訪客當中,有許多表示「很需要買扣 件,但在泰國當地不好找採購來源」。惠達為他們提供了與世 界各地供應商媒合的服務,並透過雜誌中的文字報導以及型 錄來推廣扣件、工模具、機械等相關產品。掌握前述的買主特性, 欲前進泰國的供應商將能在這一顆東南亞明珠中奪得商機。

著作權所有:惠達雜誌 / 撰文:曾柏勳

中國電動車產業發展政策 與 扣件商機(下) 一、中國電動車產業發展背景2010年代是中國新能源汽車產業飛速發展黃 金時期,2012年國家發佈《節能與新能源汽車 產業發展規劃(2012~2020年)》,明確提出2020 年新能源汽車累計產銷量達到500萬輛,為實現 這一目標,中國政府擴大對新能源汽車的支持力 度,包括提供購車補貼、減免購置稅與加快充電 基礎設施建設等措施。同時,中國領導廠商如比 亞迪、北汽新能源、蔚來汽車等積極投入研發, 推出一系列具有市場競爭力的新能源汽車。

隨著市場需求的成長與技術水準的提高,中國 新能源汽車產業在全球市場中佔據重要地位。截 至2024年,中國新能源汽車保有量已超過650萬 輛,成為全球最大的新能源汽車市場。此時,中 國新能源汽車供應鏈已形成,從上游的動力電池 材料供應到下游的整車製造組裝銷售,各環節都 有大量廠商參與,並在國際市場展現競爭力。

著作權所有: 惠達雜誌 / 撰文: 蕭瑞聖

近年來隨著“雙碳”目標的提出,中國新能源汽車產業迎來 新的發展機會,政府持續擴大對新能源汽車政策支持,推動新 能源汽車智慧化、網聯化發展,同時,充電基礎設施建設進一 步擴展,新能源汽車的使用便利性顯著提升。 2024年中國新能 源汽車銷售量再創新高達475萬輛,占全球市場55.2%,中國新 能源汽車產業在政府政策的引導下,經歷從起步到快速發展的 過程,領導廠商積極國內外布局與設廠,未來隨著技術不斷突 破與市場進一步成熟,中國新能源汽車產業將持續發展。

二、中國電動車產業政策 中國政府已實施一套全面政策,支持新能源汽車產業,旨在 將中國定位為全球新能源汽車的領導者,包括新能源汽車的採 用、生產與創新,主要政策領域包括補貼、規定產量、基礎設 施支持、研發投資和國際擴張激勵措施。

(一) 消費者和製造商補貼: 中國長期以來一直對新能源汽車買 家提供直接補貼,以使新能源汽車更加負擔得起,儘管隨著市 場成熟,這些補貼逐漸減少。符合一定行駛里程、能效與安全 標準的新能源汽車符合條件,吸引消費者購買電動車而非傳統

燃油車。對於製造商,稅收減免與生產補貼減少運 營成本,支持市場。政府實施新能源汽車購買稅收 優惠政策持續至2025年,特別有利於在城市地區流 行的低成本與中階新能源車型。

(二) 規定產量與新能源汽車積分制度: 中國的新能 源汽車規定產量系統要求汽車製造商達到特定的新 能源汽車產量配額,新能源汽車積分與產量掛鉤, 未達到這些配額的汽車製造商必須從超額達標的公 司購買積分,為所有公司提供增加新能源汽車產量 的激勵機制。從長期觀察 中國正逐步淘汰內燃機汽 車,目標是2030年新車銷售量的40%為新能源汽 車,到2035年實現全面電動化 ,這一積極的時間表 正塑造在中國營運的國內外車廠策略。

(三) 充電網絡基礎設施擴建: 中國在新能源汽車基 礎設施方面處於領先地位,建立全球最大的公共新 能源汽車充電網絡,得到政府支持的倡議提供快速 充電站和更換電池設施。中國政府、地方政府、蔚 來等公司合作,增加更換電池站,提高便利性,減 少新能源汽車的停機時間。

(四) 農村電氣化: 為廣泛推廣, 中國正在擴大農村 地區的新能源車基礎設施 ,旨在使新能源車在主要 城市以外可行,並促進各地區可永續的交通。

(五) 研發和創新: 在“中國製造2025”倡議下, 政府資助動力電池技術、自駕車與新能源車製造研 發,以建立高科技新能源車零組件的自力更生,減 少對外國供應商依賴 ,強調提高動力電池性能、降 低生產成本,並創造出口競爭力。

(六) 全球擴張支持與貿易保護: 中國政府鼓勵新能 源車製造商開拓國際市場,對出口到歐洲、日本與 拉丁美洲的廠商提供金融協助。 如比亞迪與蔚來等 中國新能源車自主品牌,利用政策建立強大的全球 佈局,進一步擴展的雄心。 在中國境內對外國電動 車實施進口限制與關稅,有助於保護中國企業 ,使 其能夠在面臨重大國際競爭的情況下仍能主導中國 本土市場,保護主義立場的目的則是培育國內自主 品牌,並強化在全球電動車市場的國際地位。

(七) 環保與ESG目標: 新能源車應用在中國環保策 略中發揮明顯進展,包括在2030年實現碳排放峰 值,並在2060年實現碳中和。透過將新能源車納入 環保、社會與治理(ESG)框架,中國旨在減少城市污 染,減少對化石燃料依賴,符合永續性目標。

三、中國電動車產業發展為扣件廠商 帶來機會 電動車廠商不斷開發動力電池與整車技術,由於續航里 程、動力電池散熱與車體輕量化議題仍然普遍存在於電動車市 場,廠商重新考慮製造結構、設計與組裝,藉以優化車輛性 能,電動車廠商必須優先考慮解決散熱與輕量化問題,使用精 簡化零組件,與此同時考量供應鏈碳足跡。

高品質扣件對於生產電動車至關重要,扣件需要確保電動 車的所有關鍵零組件保持連接與安全,設計良好的扣件可以 幫助電動車廠商確定最佳的緊固解決方案,以發揮車輛最佳性 能。根據統計,2024~2029年全球電動車市場複合年成長率為 15.7%,零組件廠商正準備迎合產業轉型消費市場,電動車廠商 需要設計最佳化零組件(包括扣件),使產品具備競爭優勢。

電動車扣件占車價成本相較關鍵零組件(如動力電池動力 馬達與控制器等)比例較低,但使用量可能佔據物料清單的 50%,對於所有電動車廠商而言,使用正確、高品質的扣件優 化車輛性能非常重要。

以下是電動車廠商在選擇最佳汽車扣件時考慮的關鍵因素: (1) 堅固耐用與輕量化: 冷成型可提升材料的冶金性能與結構 完整性,優先考量零組件強度與耐用性,扣件必須滿足精 密公差與振動要求、承載負荷屈伏強度65~90%,確保組 裝或使用中不致鬆脫或損壞。汽車扣件設計與製造可確保 非常高的安全性與可靠性,有助維持電動車主要結構與完 整性。