16 minute read

Which exness account is best? How to choose the right account for you?

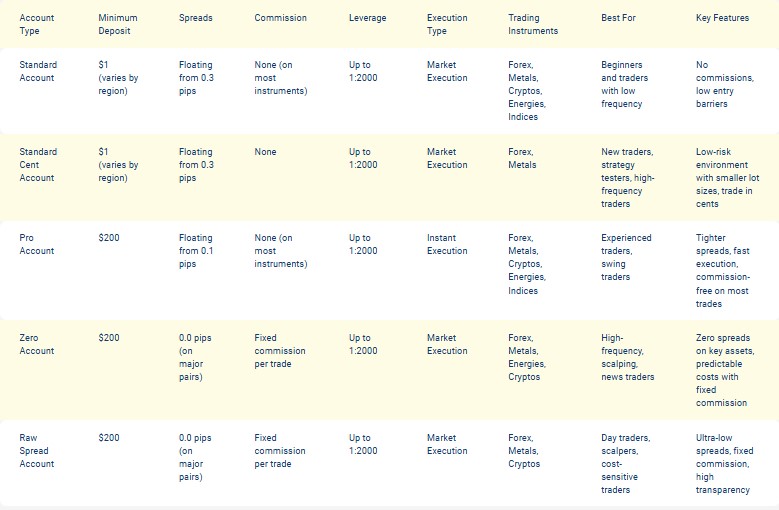

When considering the various trading accounts offered by Exness, one may find themselves asking, which exness account is best: Standard, Raw Spread, Zero, or Pro? Each account type has its unique characteristics and caters to different trading styles and preferences. Understanding these distinctions can significantly impact your trading success and overall experience with the platform.

Comparison of Exness Account Types: Standard, Raw Spread, Zero, Pro

Exness is a reputable forex broker that offers several types of trading accounts to cater to the needs of different traders. The four primary accounts—Standard, Raw Spread, Zero, and Pro—are designed to provide varying levels of accessibility, costs, and features. This section will delve into each account type, highlighting their key differences and helping you understand which might be the most suitable for your trading strategies.

Start Exness Trade: Open Exness Account and Visit site

Overview of Exness Account Types

Each account type at Exness comes with distinct trading conditions, spreads, commissions, leverage options, and minimum deposits. While they all allow access to the same trading instruments, the specific settings will dictate how effectively you can trade according to your personal strategy.

The Standard account is often favored by beginners due to its straightforward nature and user-friendly environment. On the other hand, more experienced traders may opt for the Raw Spread or Pro accounts, which offer tighter spreads and lower commissions, conducive for high-frequency trading and scalping strategies. The Zero account, as the name suggests, offers zero spread but may come with a commission on trades, making it appealing to those looking for cost-effective trading options.

Key Features of Each Account Type

Standard Accounts:

Ideal for beginners, characterized by no commissions.

Competitive spreads, usually starting from 0.3 pips.

Leverage can go up to 1:2000 depending on the regulatory entity and client verification level.

Designed for advanced traders aiming for precision in trade execution.

Spreads are very tight, often starting at 0 pips, but there is a commission per trade.

Suitable for scalpers and day traders who rely on small price movements.

Offers true zero spreads; however, this comes at a cost of higher commissions.

Beneficial for frequent traders who require efficient entry and exit points.

Allows for trading with larger volume sizes while keeping transaction costs down.

Tailored for high-volume professionals with significant capital.

Offers the lowest spreads among all account types, along with additional benefits such as dedicated support.

Greater flexibility regarding leverage based on the trader's experience and account status.

Start Exness Trade: Open Exness Account and Visit site

Understanding these features provides an essential foundation for determining which Exness account is best suited for your trading needs.

Which Exness Account is Best for Beginners?

For many aspiring traders, stepping into the world of Forex can feel overwhelming. With several account types available, it's crucial to ascertain which account best aligns with a beginner’s requirements, learning curve, and risk appetite.

Importance of User-Friendly Platforms

Beginners often seek simplicity and ease of use when selecting a trading account, making the Standard account a popular choice.

With no commissions and decent spreads, newcomers can focus on learning the intricacies of trading without incurring excessive costs. The platform also supports demo trading, allowing users to practice strategies in a risk-free environment before venturing into live trading.

Additionally, educational resources offered by Exness can support beginners in mastering fundamental concepts of forex trading, market analysis, and risk management. This holistic approach ensures that new traders are equipped with the necessary skills and knowledge to navigate the complexities of the trading world.

Risk Management Considerations

Another critical factor for beginners is risk management. The Standard account offers a manageable risk level, allowing novices to make smaller trades without overexposing their capital.

This controlled environment encourages responsible trading practices and enables beginners to develop better money management skills. As they gain confidence and knowledge, they can eventually explore other accounts, like the Raw Spread or Pro accounts, which may present greater opportunities but also heightened risks.

Support and Resources

The availability of customer support and learning materials is another vital consideration for beginners. Exness provides extensive support through tutorials, webinars, and 24/7 customer service.

This support infrastructure serves as a safety net for new traders, ensuring that they have access to assistance whenever needed. The comprehensive educational content further enhances the learning process, making the Standard account an apt choice for anyone just starting their trading journey.

Raw Spread vs Standard Account: Which is Right for You?

As you delve deeper into the world of forex, understanding the distinctions between the Raw Spread and Standard accounts becomes paramount. Both accounts have their merits, and choosing the right one depends largely on your trading style and objectives.

Exploring the Raw Spread Account

The Raw Spread account is tailored for those who engage in high-frequency trading strategies, including scalping and day trading.

With ultra-tight spreads that can start from 0 pips, this account is ideal for traders seeking to capitalize on minor price fluctuations. However, it is essential to note that this advantage comes with a commission per trade, which may offset some of the savings gained from lower spreads.

Moreover, the Raw Spread account allows traders to take advantage of advanced trading platforms and tools, enabling them to analyze market trends, execute trades swiftly, and optimize their profitability.

See more:

How to Open a Pro Account in Exness

How to Open a Raw Spread Account in Exness

How to Open a Zero Account in Exness

Weighing the Benefits of the Standard Account

Conversely, the Standard account appeals to those who prefer a straightforward and less complex trading environment.

With competitive spreads starting from 0.3 pips and no commissions, this account type enables traders to enter and exit positions without worrying about additional fees. This feature can be particularly attractive for those who wish to avoid the intricacies of commission-based trading.

Furthermore, the Standard account is perfect for those who might engage in swing trading or long-term strategies, where the cost associated with wider spreads is not as impactful on overall profitability. As a result, beginners and intermediate traders may find this account more favorable when balancing risk and potential reward.

Assessing Your Trading Style

Deciding between the Raw Spread and Standard accounts requires an introspective look at your trading approach. If you thrive on quick trades and are comfortable with commission structures, the Raw Spread account could align with your needs.

In contrast, if you prefer a calmer trading experience with a focus on longer timeframes and minimal costs, the Standard account would likely suit you better. Ultimately, both options have their unique advantages, and understanding your personal trading style is crucial in making the right decision.

Understanding Exness Pro Accounts: Features and Benefits

The Exness Pro account stands out as a premium offering aimed at professional traders seeking optimal trading conditions. This section will explore the defining features and numerous benefits associated with the Pro account.

Premium Trading Conditions

One of the primary benefits of the Exness Pro account is its exceptional trading conditions. With spreads that are often lower than those of other account types, traders can maximize their profits on every trade.

The Pro account also allows for larger trading volumes and higher leverage options, accommodating the needs of experienced traders who manage substantial portfolios. This flexibility empowers professional traders to fine-tune their strategies and execute trades efficiently.

Start Exness Trade: Open Exness Account and Visit site

Enhanced Customer Support

Professional traders often require robust support systems to handle their trading activities seamlessly. Exness caters to this need by providing dedicated account managers for Pro account holders.

These managers offer personalized assistance, ensuring that all queries and concerns are addressed promptly. The availability of enhanced support services elevates the overall trading experience, making the Pro account an attractive option for serious traders.

Access to Advanced Tools

The Exness Pro account grants access to sophisticated trading tools and resources that empower traders to make informed decisions. This includes advanced charting capabilities, technical indicators, and expert insights.

By leveraging these tools, traders can conduct in-depth analyses, identify profitable opportunities, and develop well-informed strategies. This additional layer of sophistication can significantly enhance trading outcomes and foster a more confident trading approach.

Zero Spread Accounts Explained: Pros and Cons

The Zero Spread account is designed for traders who prioritize low trading costs and tight market conditions. However, like any account type, it comes with its own set of pros and cons that should be carefully examined.

Advantages of Zero Spread Accounts

The principal appeal of the Zero Spread account is the opportunity to execute trades at precisely the market price without the burden of spread costs. For many active traders, this can translate to considerable savings, especially when making multiple trades throughout the day.

Moreover, a Zero Spread account typically involves lower overall transaction costs, making it suitable for scalping and day trading strategies that depend on minimal price movement. This account type can also serve as a powerful tool for traders using automated strategies, where precision is pivotal.

Disadvantages of Zero Spread Accounts

Despite the clear advantages, the Zero Spread account is not without its drawbacks. The most notable downside is the commission per trade, which can vary depending on the trading volume and instrument.

Traders must carefully calculate whether the savings achieved through zero spreads outweigh the costs incurred from commissions. For those who engage in infrequent trading or prefer longer positions, the added commission may diminish the overall benefits of this account type.

Additionally, some traders may find that the Zero Spread account has restrictions on certain trading instruments or strategies. It is vital to delve into the specifics of the account to ensure compatibility with your trading objectives.

Analyzing the Best Exness Account for Forex Trading

When evaluating the best Exness account for forex trading, one must consider various factors that play a crucial role in successful trading. This analysis delves into aspects such as trading goals, risk tolerance, and personal preferences.

Aligning Account Features with Trading Goals

Understanding your trading goals is fundamental in determining which Exness account aligns best with your aspirations.

For instance, if you aim to engage in short-term trading with high volume and minimal costs, the Raw Spread or Zero Spread accounts would be more appropriate. Alternatively, if your strategy focuses on delivering long-term results with less frequent trades, the Standard account may be a better fit.

By assessing your trading goals and aligning them with the features offered by each account type, you can arrive at a decision that supports your journey toward achieving success in forex trading.

Balancing Costs and Profits

The financial aspect of trading cannot be overlooked. Each account type comes with its own cost structure, which can influence your overall profitability. To determine which Exness account is best, it’s crucial to evaluate how spreads and commissions interact with your trading frequency.

If you trade frequently, the Raw Spread or Zero Spread account might yield better results despite the associated costs. However, for occasional traders, the Standard account may prove more economical in the long run, given its absence of commissions.

Start Exness Trade: Open Exness Account and Visit site

Personal Preferences and Trading Experience

Lastly, personal preferences and prior trading experience heavily impact which Exness account is deemed the best for forex trading. New traders may favor the straightforward approach of the Standard account, while seasoned professionals might lean toward the Raw Spread or Pro accounts for precision and lower costs.

Ultimately, it’s essential to reflect on your unique trading preferences and experiences when deciding on the account that aligns best with your needs.

Key Differences Between Exness Standard and Raw Spread Accounts

The distinction between the Exness Standard and Raw Spread accounts can significantly affect trading outcomes. Understanding these differences can help clarify which account type could be most beneficial for you.

Spread and Commission Structure

The most apparent difference lies in the spread and commission structure. The Standard account typically offers wider spreads that start from around 0.3 pips without any commission charges.

On the contrary, the Raw Spread account boasts tighter spreads that can start from 0 pips, accompanied by a commission per trade. This pricing model reflects the account’s design for high-frequency trading, making it a preferred choice for scalpers and day traders.

Trading Flexibility

Both accounts provide access to a wide range of trading instruments, yet their trading flexibility varies. The Standard account allows traders to engage in various styles, including swing trading and position trading, without incurring additional commission costs.

In contrast, the Raw Spread account is explicitly geared towards fast-paced trading strategies, demanding precise execution and real-time market data. For traders who thrive on such strategies, the Raw Spread account is indispensable for maximizing profitability.

Start Exness Trade: Open Exness Account and Visit site

Suitability Based on Trader Profile

When determining suitability, the Standard account generally appeals to novice and intermediate traders who wish to learn and gradually refine their trading strategies without the pressures of commissions.

Conversely, the Raw Spread account is tailored for experienced traders who possess a solid understanding of market dynamics and can capitalize on small price changes with speed and efficiency. Evaluating your experience level, comfort with commissions, and overall trading ambition will inform your choice between these two accounts.

Choosing the Right Exness Account Based on Trading Style

Trading style plays a pivotal role in determining which Exness account is best suited for individual traders. Different accounts cater to different approaches, making it imperative to align account characteristics with trading strategies.

Scalping and Day Trading Preferences

For traders who favor scalping or day trading, the Raw Spread and Zero Spread accounts emerge as the optimal choices. These accounts boast tight spreads and low transaction costs, enabling traders to execute multiple trades efficiently while minimizing expenses.

Scalpers, in particular, require speedy order execution and the ability to react quickly to market changes. The advanced tools and features provided by these accounts enhance their capacity to seize fleeting opportunities, ultimately enhancing profitability.

Swing Trading and Long-Term Strategies

On the other hand, traders who engage in swing trading or longer-term strategies may find that the Standard account meets their requirements more effectively.

With no commissions and reasonably competitive spreads, the Standard account allows for a more relaxed trading environment, where the focus can shift from constant monitoring to analyzing broader market trends. This approach is particularly advantageous for those who prefer not to be glued to their screens throughout the day.

Flexibility and Adaptability

Lastly, it’s crucial to recognize that trading styles can evolve over time. A trader may start with a Standard account and later transition to a Raw Spread account as they gain experience and confidence.

Being aware of how your trading style may change allows you to select an Exness account that accommodates both your current needs and future ambitions. Staying adaptable and open to exploring different account types can lead to enhanced trading performance over time.

Expert Insights on Selecting the Best Exness Account

When it comes to selecting the best Exness account, obtaining expert insights can provide valuable guidance throughout the decision-making process. Industry professionals often emphasize several key considerations.

Thorough Research and Analysis

Before committing to any account type, conducting thorough research is essential. Trade reviews, comparisons, and testimonials from other traders can offer useful perspectives on the strengths and weaknesses of each account.

See more:

EXNESS best indicator - Top 10 trading indicators

EXNESS cent account review 2025: Is a Cent Account profitable?

EXNESS standard vs standard cent account: What is the difference between standard and standard Cent Account?

Online forums, social media groups, and specialized trading websites can also provide valuable information and feedback from traders across different skill levels. Engaging with the broader trading community can equip you with knowledge that informs your account selection process.

Assessing Personal Goals and Risk Tolerance

Expert advisors often stress the importance of aligning your account choice with your unique goals and risk tolerance.

Assess whether your main objective is to generate steady income, achieve consistent growth, or engage in aggressive trading tactics. Understanding your risk appetite will assist in identifying which Exness account fits your profile best. For example, risk-taking traders may gravitate toward the Raw Spread or Pro accounts, while cautious individuals may prefer the reliability of the Standard account.

Seeking Professional Guidance

If uncertainty persists, consider reaching out to a financial advisor or trading mentor. Their insights can guide you in selecting the Exness account that aligns with your trading style and objectives.

Additionally, brokers like Exness often provide educational resources that can aid in refining your trading approach and understanding the nuances of different account types. Leveraging these resources enhances your capability to make informed decisions in your trading journey.

Is the Exness Pro Account Worth It? A Detailed Review

The Exness Pro account often garners attention from professional traders, prompting the question: is it really worth the investment? This review will analyze the pros and cons associated with the Pro account to help you decide if it's the right fit for your trading endeavors.

👉 Start your trading journey today:

Advantages of the Pro Account

The Pro account offers several advantages that can significantly enhance a trader’s experience. Among these is the unparalleled access to low spreads and superior execution speeds, which are critical for traders operating with large volumes and requiring precision.

Additionally, the dedicated customer support available to Pro account holders can prove invaluable, offering insights and assistance customized to individual trading needs. Traders can benefit from personalized support that can address issues promptly and effectively, ensuring seamless trading operations.

Considerations Before Committing

However, it’s essential to weigh these benefits against potential downsides. One consideration is the higher minimum deposit required to open a Pro account compared to other account types.

Traders must assess whether the benefits justify the initial investment, especially if they are still developing their trading skills. Moreover, while the Pro account is tailored for experienced traders, those who have recently transitioned to the forex market may find it overwhelming compared to other more straightforward account types.

Conclusion on Value Proposition

In conclusion, the Exness Pro account presents a compelling value proposition for seasoned traders, offering lower costs and advanced features. However, it may not be the ideal choice for everyone, particularly those still gaining traction in their trading journey.

Assessing your experience, financial commitment, and trading goals will help determine whether the Pro account aligns with your overall objectives.

Conclusion

Choosing the right Exness account is a critical step in establishing your success as a trader. With a variety of options available—Standard, Raw Spread, Zero, and Pro—an understanding of each account type's features, benefits, and limitations is essential.

Whether you are a novice just beginning your trading journey or a seasoned professional seeking to optimize your strategies, careful consideration of your trading goals, style, and personal preferences will ultimately guide you to the best account type for your needs.

See more: