4 minute read

Exness zero spread account review: Pros and Cons

For traders who want to maximize profits by reducing trading costs, the Zero Spread Account from Exness is one of the most attractive choices. This account type is designed for scalpers, day traders, and high-frequency traders who rely on tight spreads to execute multiple trades efficiently.

But is the Zero Spread account really worth it? In this review, we’ll break down its features, advantages, disadvantages, and ideal use cases, so you can decide if it’s the right fit for your trading strategy.

👉 Try Exness Zero Spread Account today:

What is the Exness Zero Spread Account?

The Exness Zero Spread Account is a professional-type trading account where spreads can start from 0.0 pips on major forex pairs during most trading hours. Instead of spreads, traders pay a fixed commission per lot.

This structure makes it transparent, predictable, and suitable for those who need ultra-low spreads and high execution speed.

Key Features of the Zero Spread Account

Spreads from 0.0 pips (especially on major forex pairs like EUR/USD).

Fixed commission per trade (from $0.2 per side per lot depending on instrument).

Unlimited leverage (under specific conditions).

Order execution: Market execution with very low latency.

Available platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), Exness Terminal, Mobile App.

👉 Open your Zero Spread account here: Sign Up

Pros of the Zero Spread Account

✅ 1. Extremely Tight Spreads

Perfect for scalpers and day traders who rely on small price movements. Example: On EUR/USD, spread can be 0.0 pips during peak hours.

✅ 2. Predictable Trading Costs

Instead of worrying about spread fluctuations, you know exactly what commission you will pay.

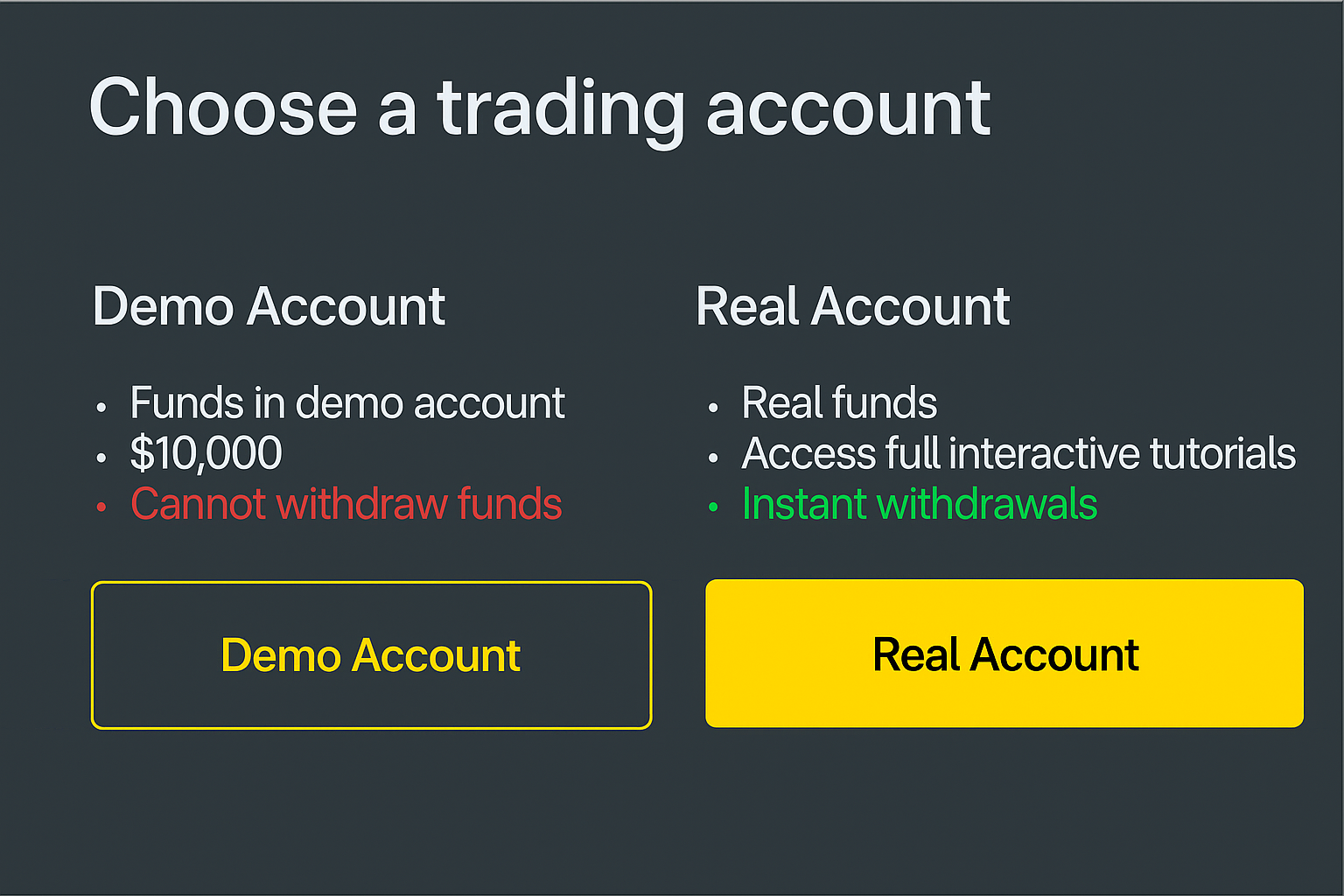

how to create Exness Real Account

✅ 3. Great for High-Frequency Trading

The low spreads and fast execution make this account ideal for algorithmic traders and robots (EAs).

✅ 4. Access to All Instruments

Forex, crypto, metals, energies, indices, and stocks are all available with low spreads.

✅ 5. Professional Trading Conditions

Traders can enjoy unlimited leverage, deep liquidity, and stability, similar to institutional environments.

Cons of the Zero Spread Account

❌ 1. Commission-Based Model

While spreads are nearly zero, commissions per lot are charged. For some traders, this might increase costs compared to Standard accounts.

❌ 2. Requires Higher Skill

This account is best suited for experienced traders who understand how commissions affect total costs. Beginners may find it confusing.

❌ 3. Not Always 0.0 Pips

Although spreads can be 0.0 pips, during volatile news events, spreads may widen.

❌ 4. Minimum Deposit

A higher minimum deposit might be required compared to a Standard Cent account, making it less beginner-friendly.

Example: Zero Spread vs Standard Account

Standard Account:

Spread on EUR/USD = ~1 pip

Lot size = 1 lot

Cost = $10 (spread cost)

Zero Spread Account:

Spread = 0.0 pip

Commission = $7 round-turn

Cost = $7

👉 For active traders, the Zero Spread Account saves costs compared to Standard.

Who Should Use the Zero Spread Account?

Scalpers who trade multiple times a day.

Day traders who need precise entries and exits.

Algorithmic traders/EA users requiring consistent conditions.

Professional traders managing larger accounts.

If you’re a beginner with a very small balance, the Standard Cent Account may be more suitable before upgrading to Zero Spread.

EXNESS FOREX Broker Review 2025: Pros and Cons

Conclusion

The Exness Zero Spread Account is one of the best choices for professional traders looking for low-cost, high-precision trading conditions. With spreads from 0.0 pips, transparent commissions, and unlimited leverage, it is designed for those who take trading seriously.

However, beginners may find commissions and professional conditions overwhelming, so starting with a Standard Account might be wiser.

👉 Ready to try Exness Zero Spread Account?

FAQs – Exness Zero Spread Account

1. What is the minimum deposit for a Zero Spread account?The minimum deposit usually starts at $200, but it may vary depending on payment method and region.

2. Is the Zero Spread account good for scalping?Yes, it’s one of the best choices for scalpers due to 0.0 pip spreads and fast execution.

3. Does Exness Zero Spread account have swap-free (Islamic) options?Yes, Muslim traders can request a swap-free Islamic account.

4. What instruments can I trade with a Zero Spread account?Forex, crypto, metals, indices, stocks, and commodities.

5. Are spreads always 0.0 pips?No, spreads can widen during low liquidity or major news events.

6. Is the Zero Spread account better than Standard?For professionals, yes. It lowers costs per trade. But beginners may prefer Standard accounts due to simplicity.

See more:

Which Exness account is best for scalping