4 minute read

Exness raw spread account review: Pros and Cons

When it comes to professional trading accounts, the Exness Raw Spread Account is one of the most popular choices among scalpers, day traders, and algorithmic traders. With spreads starting from 0.0 pips and a fixed commission structure, it offers a balance between low costs and transparent trading conditions.

In this review, we’ll dive into the features, benefits, drawbacks, and real examples to help you decide whether the Raw Spread account is right for you.

👉 Get started with Exness today:

What is the Exness Raw Spread Account?

The Raw Spread Account is designed for traders who need ultra-tight spreads and low commissions. Unlike Standard accounts, where the broker’s markup is included in the spread, the Raw Spread account provides direct market spreads (sometimes as low as 0.0 pips).

Instead of markup, traders pay a commission per trade, ensuring transparent and predictable costs.

Key Features of the Raw Spread Account

Spreads: From 0.0 pips on major pairs.

Commission: From $3.50 per side per lot (round turn = $7).

Execution: Market execution with ultra-fast order processing.

Leverage: Up to unlimited leverage (depending on region and conditions).

Instruments: Forex, metals, indices, cryptocurrencies, energies, and stocks.

Platforms: MetaTrader 4, MetaTrader 5, Exness Web Terminal, Mobile App.

👉 Open a Raw Spread account now: Sign Up Here

Pros of the Raw Spread Account

✅ 1. Tightest Spreads Available

Spreads can go as low as 0.0 pips, especially during high-liquidity times. This is excellent for scalpers who trade multiple times daily.

✅ 2. Transparent Commissions

Instead of hidden markups, commissions are fixed and predictable, making it easy to calculate trading costs.

✅ 3. Suitable for All Trading Styles

Great for scalping, day trading, swing trading, and algorithmic trading (EA/robot).

✅ 4. Institutional-Like Conditions

Professional traders get direct market pricing with no hidden fees.

✅ 5. Wide Range of Instruments

From forex to crypto, all available with low spreads and commissions.

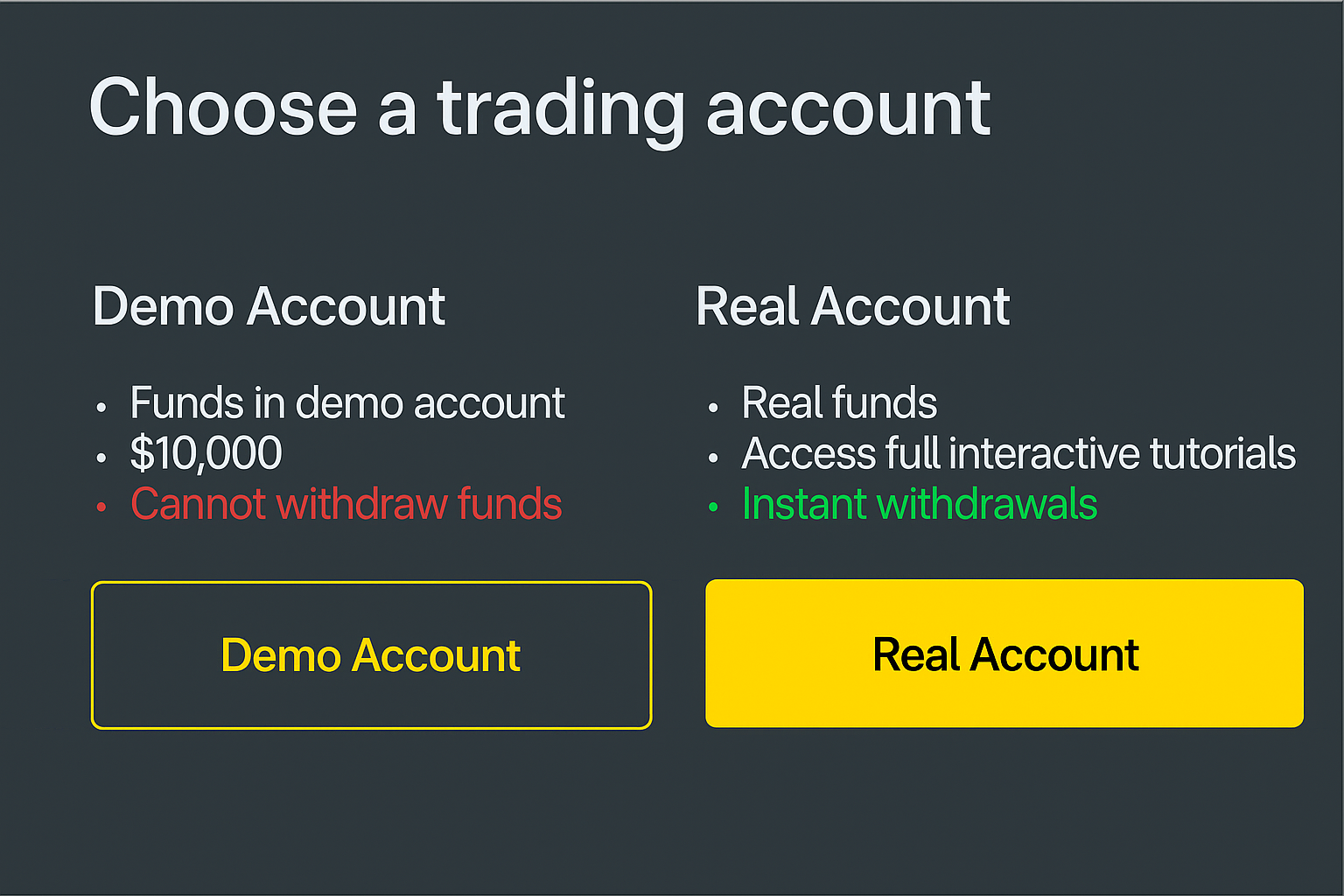

how to create account in exness

Cons of the Raw Spread Account

❌ 1. Commissions Per Trade

Traders must pay a fixed commission per lot, which may be costly for small accounts.

❌ 2. Higher Minimum Deposit

Compared to Standard Cent or Standard accounts, Raw Spread may require a higher minimum deposit (around $200).

❌ 3. Not Always 0.0 Pips

During high volatility or low liquidity, spreads may widen.

❌ 4. Best for Experienced Traders

Beginners may struggle to manage commission-based trading.

Example: Raw Spread vs Standard Account

Standard Account

Spread on EUR/USD = ~1 pip

Trade size = 1 lot

Cost = $10 (spread cost)

Raw Spread Account

Spread on EUR/USD = 0.0 pips

Commission = $7 round turn

Cost = $7

👉 Result: Raw Spread is more cost-efficient, especially for frequent or large trades.

Who Should Use the Raw Spread Account?

Scalpers who need ultra-tight spreads.

Day traders looking for predictable costs.

Swing traders who trade with bigger positions.

Algorithmic/EA traders requiring consistent execution.

Professional traders seeking near-institutional conditions.

If you’re a beginner with small capital, the Standard Cent Account is a better starting point before upgrading.

Conclusion

The Exness Raw Spread Account is an excellent choice for professional traders seeking low spreads, predictable commissions, and institutional-grade trading conditions. With 0.0 pip spreads on major pairs, fast execution, and unlimited leverage options, it’s designed for traders who prioritize efficiency and cost savings.

For beginners, however, the commission structure and minimum deposit may be a barrier. In such cases, starting with Exness Standard or Cent Accounts might be more practical before transitioning to Raw Spread.

👉 Ready to try Raw Spread Account?

FAQs – Exness Raw Spread Account

1. What is the minimum deposit for the Raw Spread account?Typically $200, but it may vary depending on payment method and region.

2. Does the Raw Spread account have 0.0 pips all the time?No, spreads may widen during volatile market conditions, but remain much tighter than Standard accounts.

3. What commission does Exness charge on Raw Spread?A fixed commission starting from $3.50 per side per lot.

4. Can I use Raw Spread for scalping?Yes, it is highly recommended for scalping and high-frequency trading.

5. Is Raw Spread better than Zero Spread?Both are professional accounts. Raw Spread has slightly lower commissions, while Zero Spread offers stable 0.0 pips but with different commission costs.

6. Can beginners use Raw Spread?Yes, but it’s recommended for traders with more experience and larger balances.

See more: